Negative Expectation Breaker. Nasdaq 100 falls 1.3%. Leaders Hit

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 19, 2025

Market Action

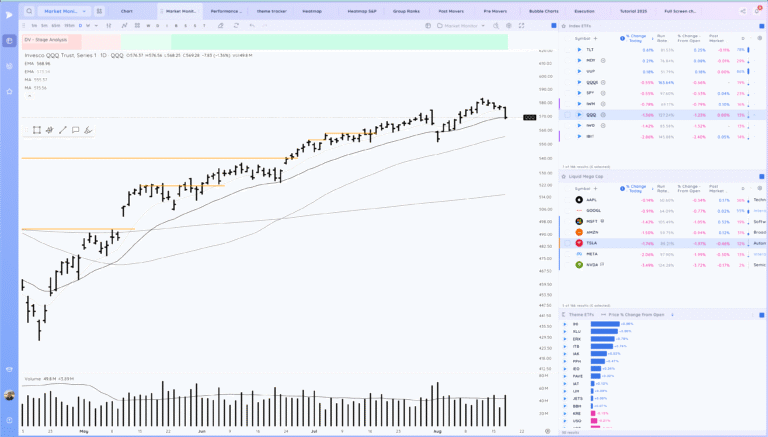

QQQ – The expectation after the recent action of the 10ema pullback was to push higher and continue to trend above the moving average. Instead today we broke lower on the QQQ and many of the key leaders as well closed near lows. This suggests at least short term caution. It may end up being like what we had a few weeks ago where we broker the 21ema and quickly snapped back higher and continue to higher or it may finally start more of a consolidation period.

What will be key is what follows and how we act the next few days particularly in the leaders. For now remain above the 21ema so the uptrend is intact.

Bulls want to see us hold near the 21ema and snack back higher

Bears want to see us follow through lower below the 21ema

Daily Chart of the QQQ.

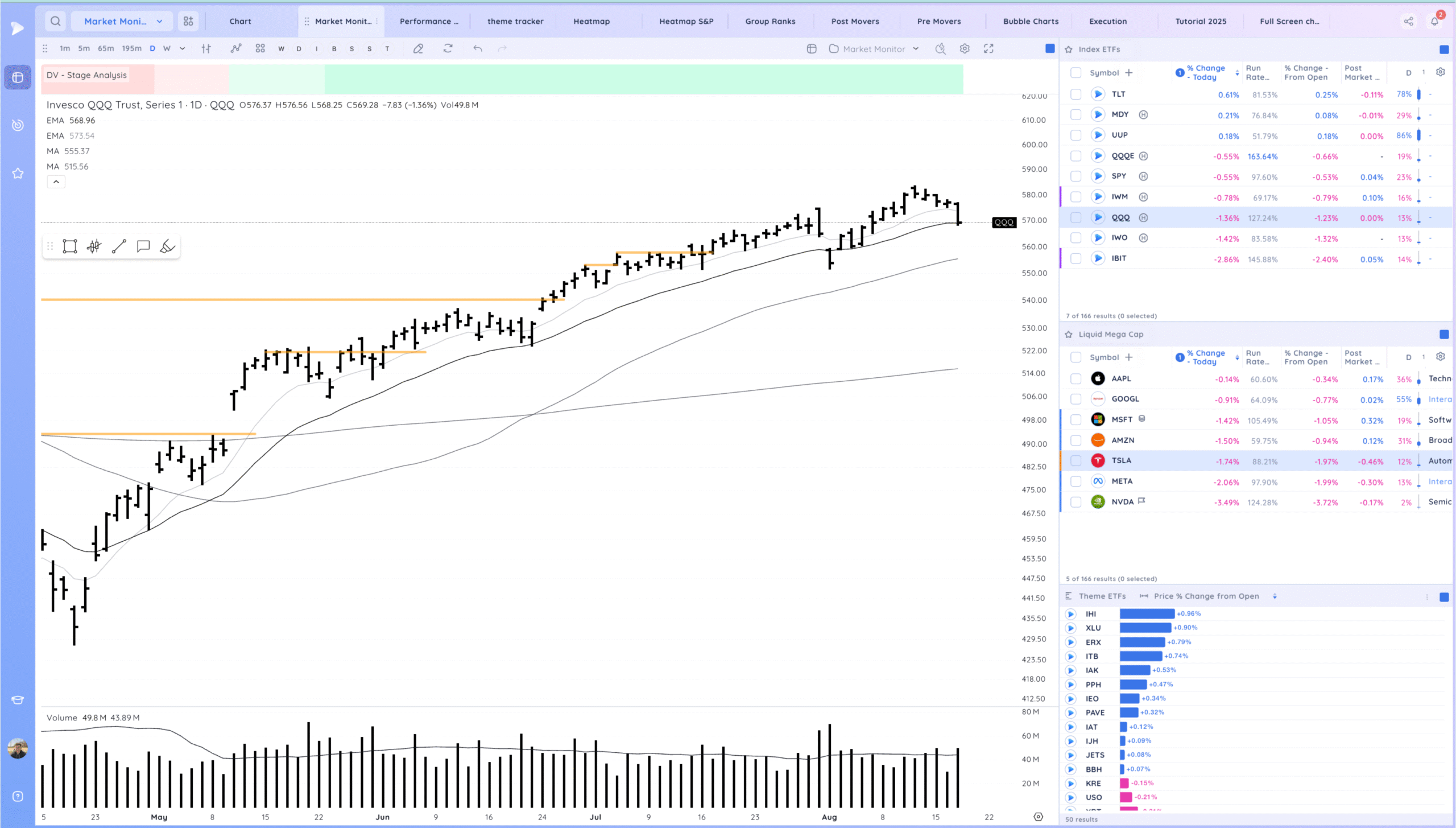

IWM – Downside reversal and testing the 10ema

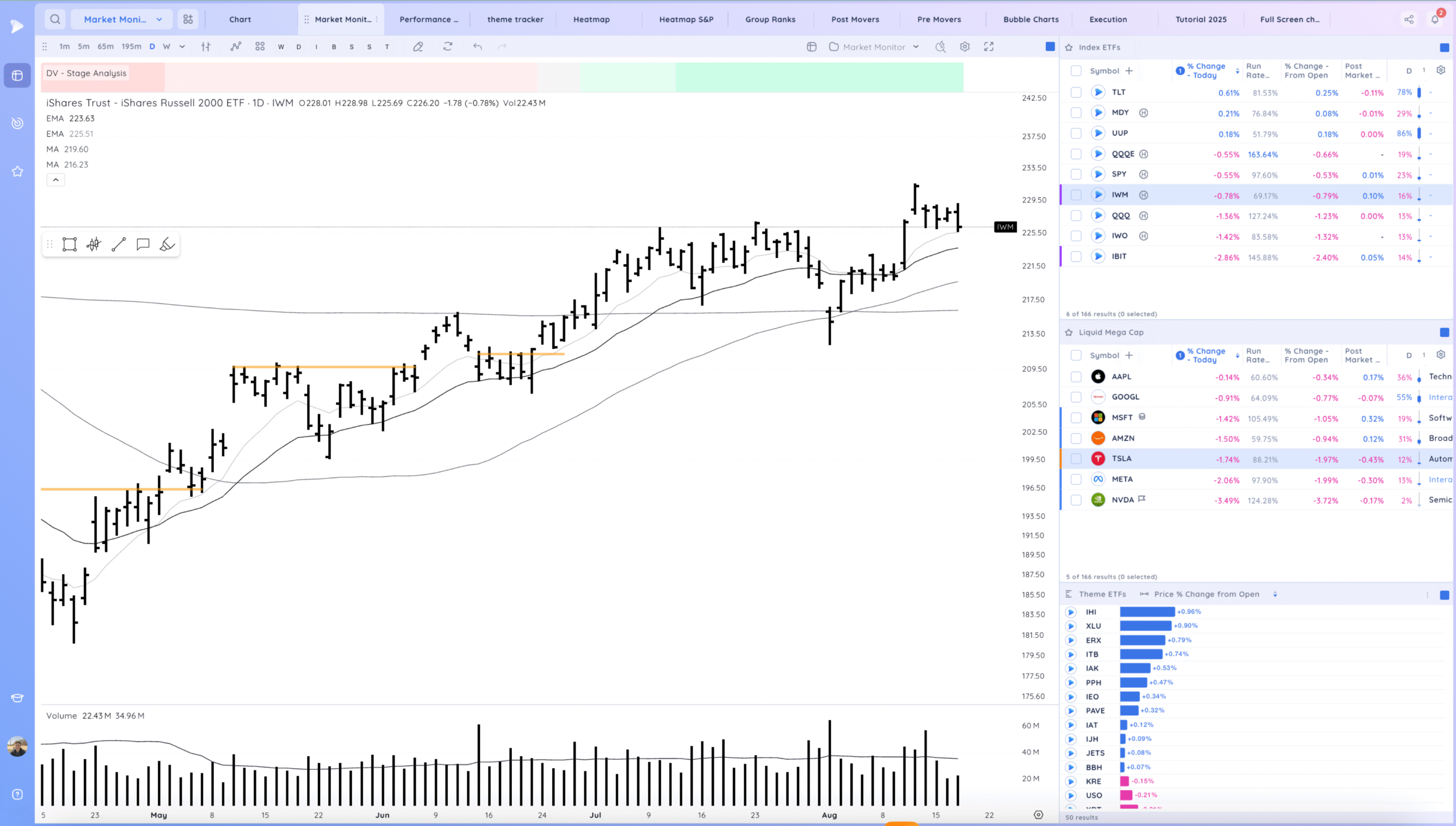

IBIT – follow through lower

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

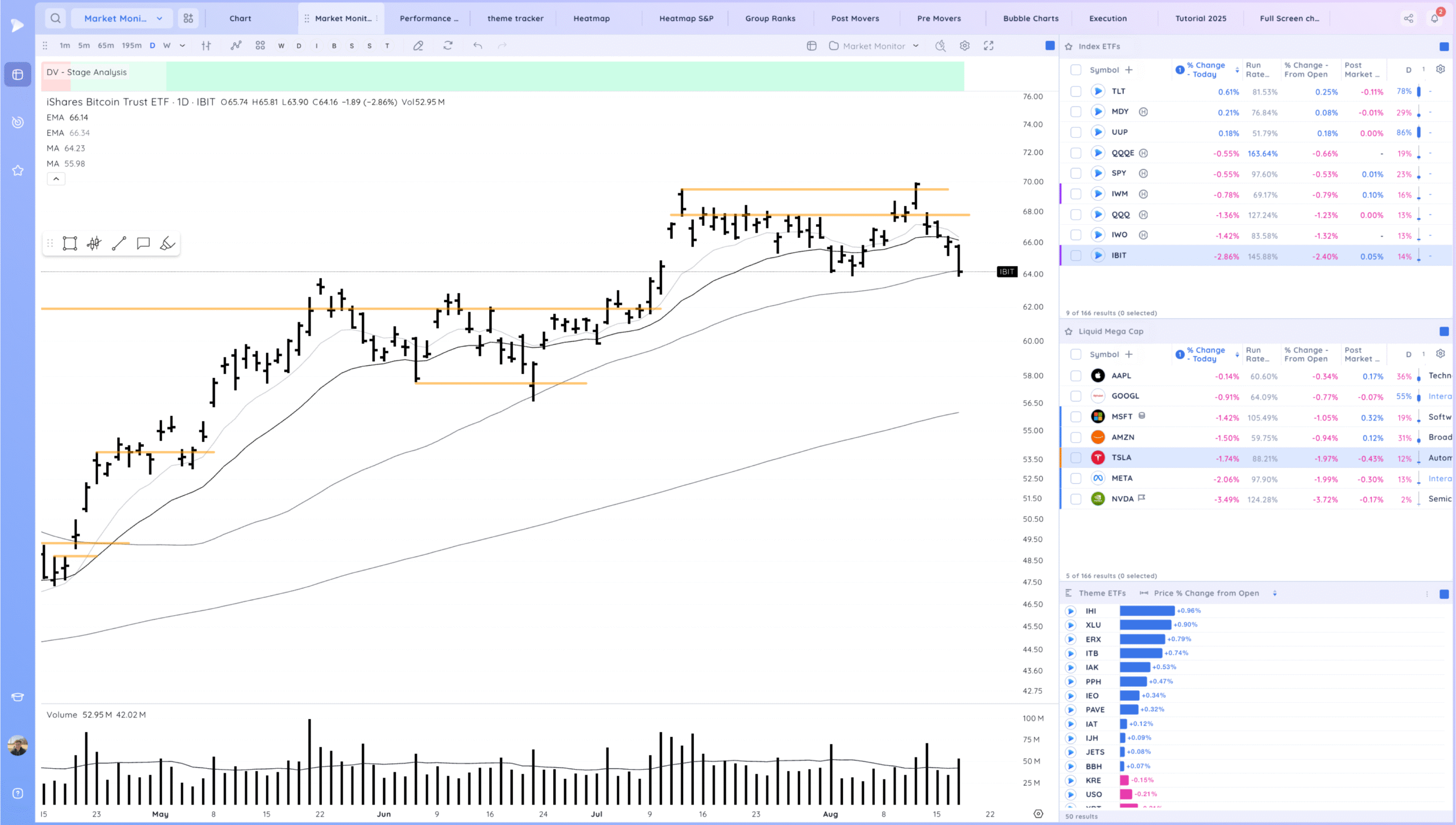

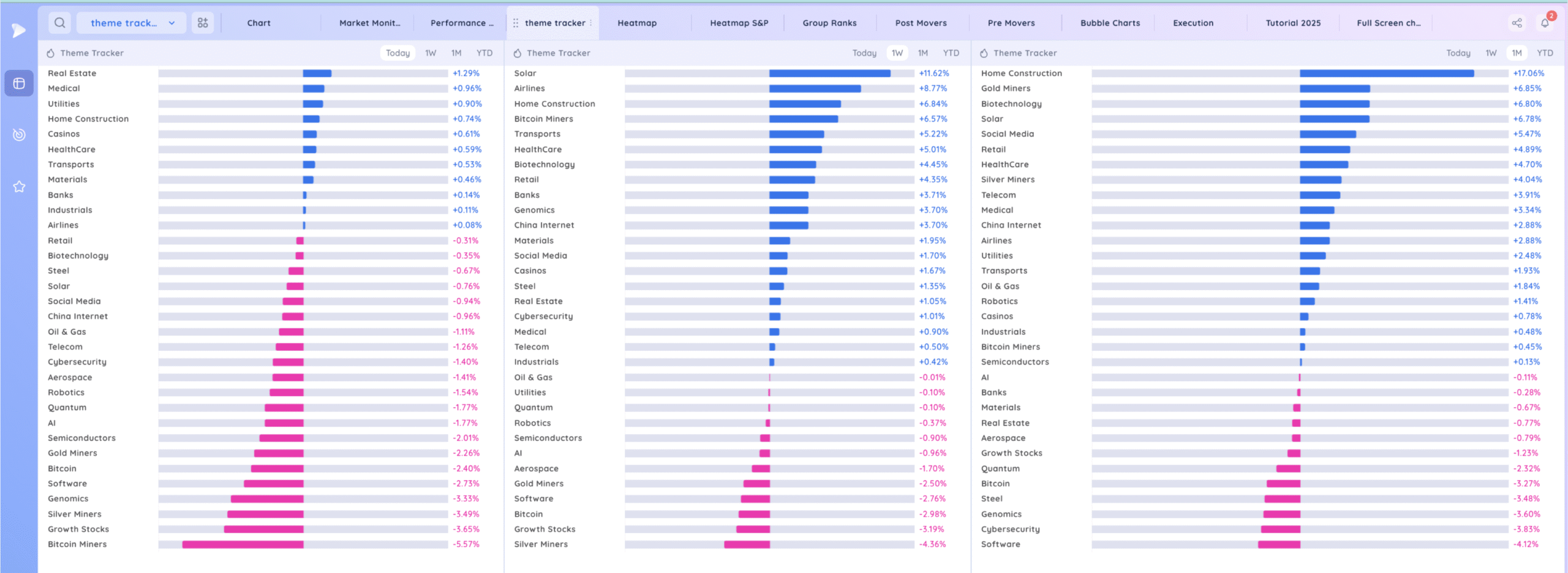

Groups/Sectors

Deepvue Theme Tracker

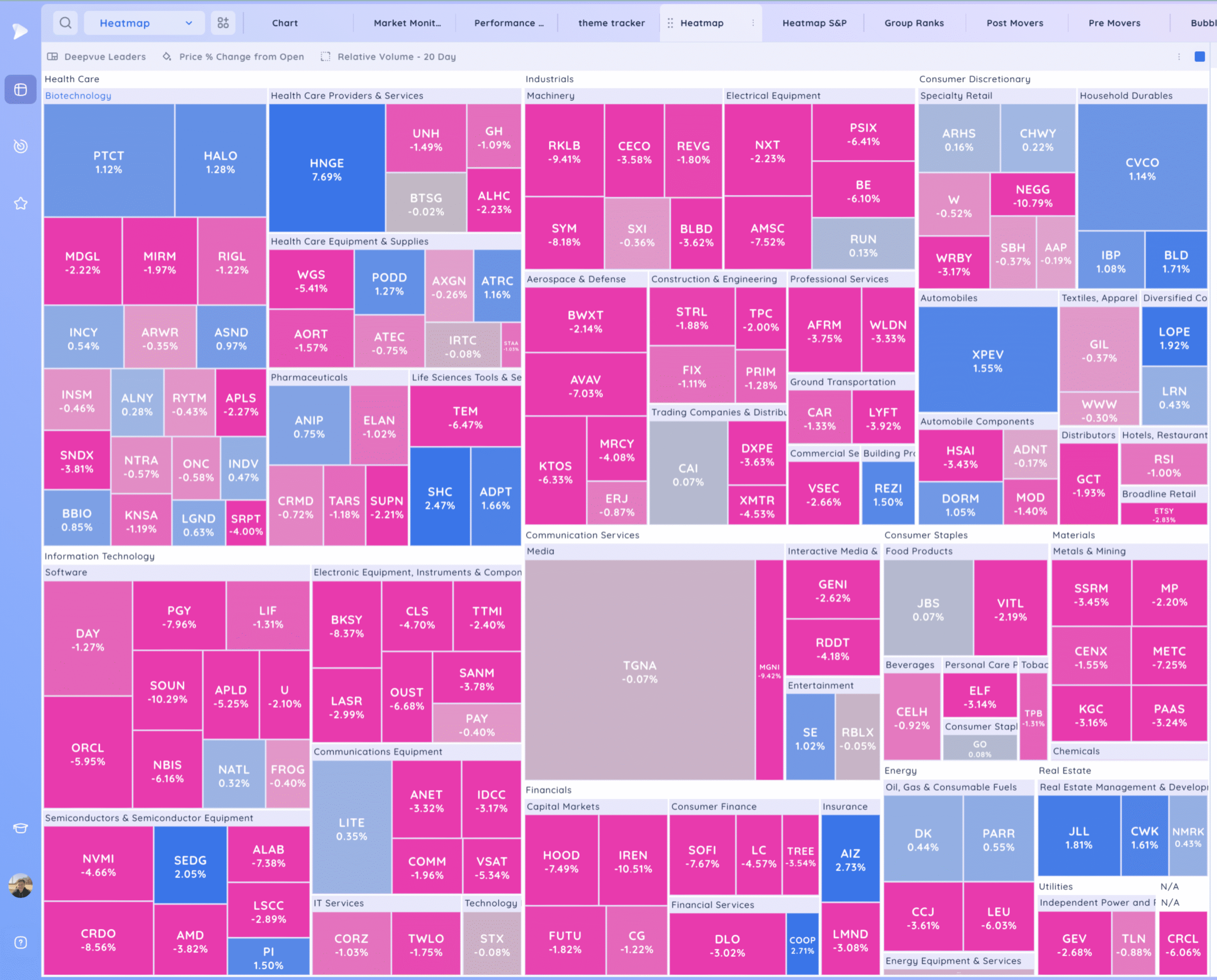

Deepvue Leaders Heatmap

S&P 500.

Leadership

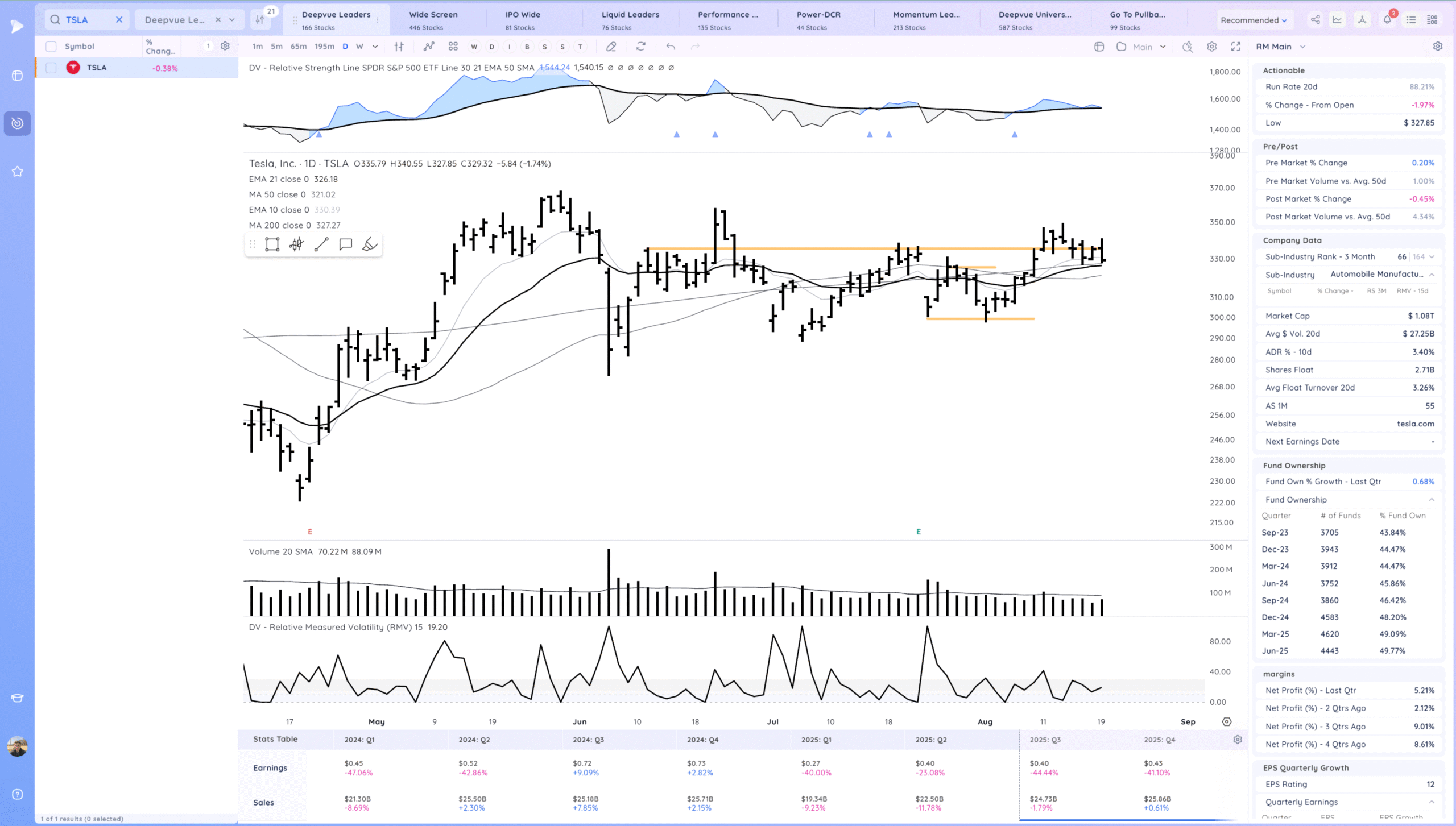

TSLA downside reversal. The 21ema is the key level

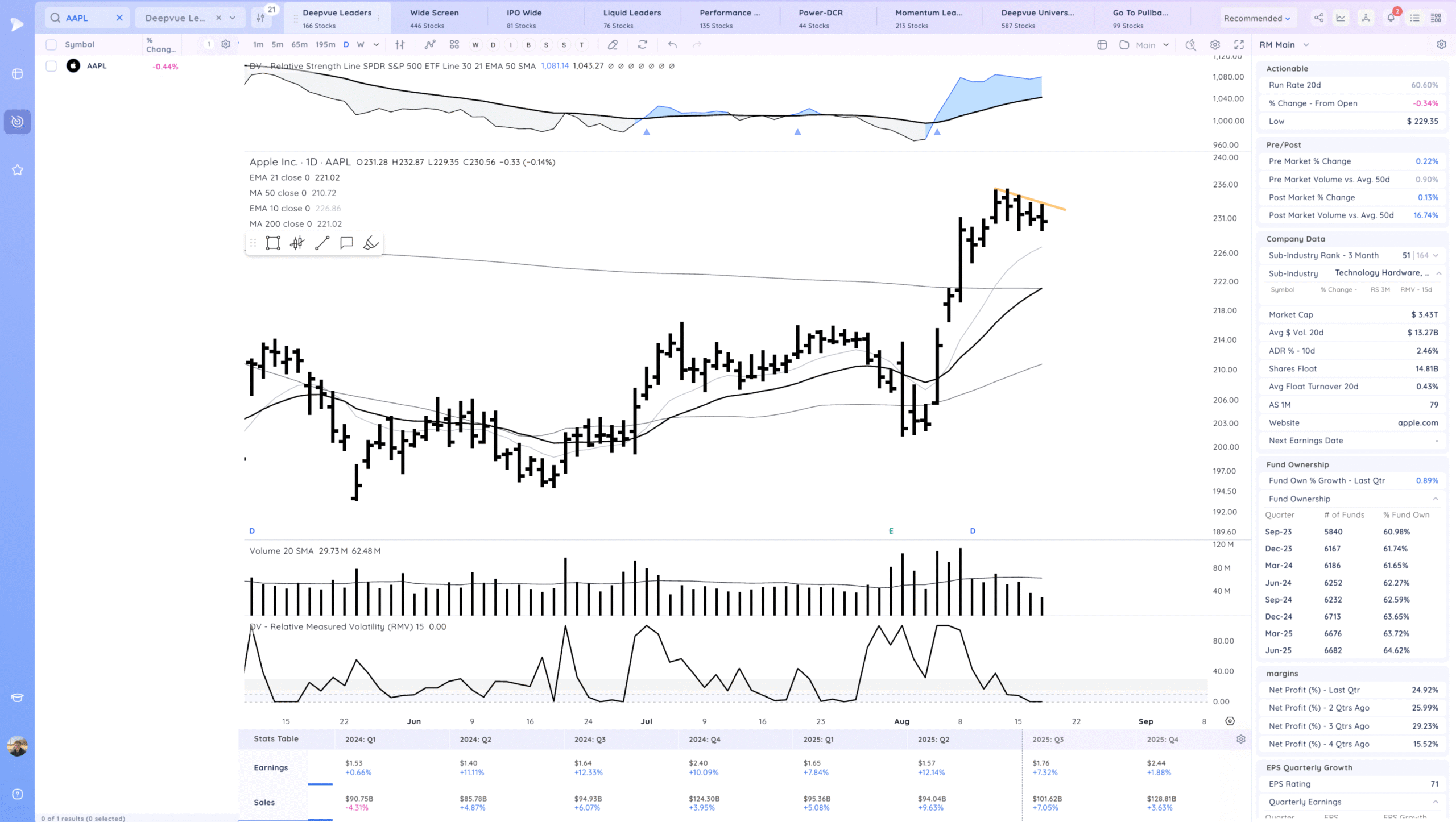

AAPL Still acting constructively

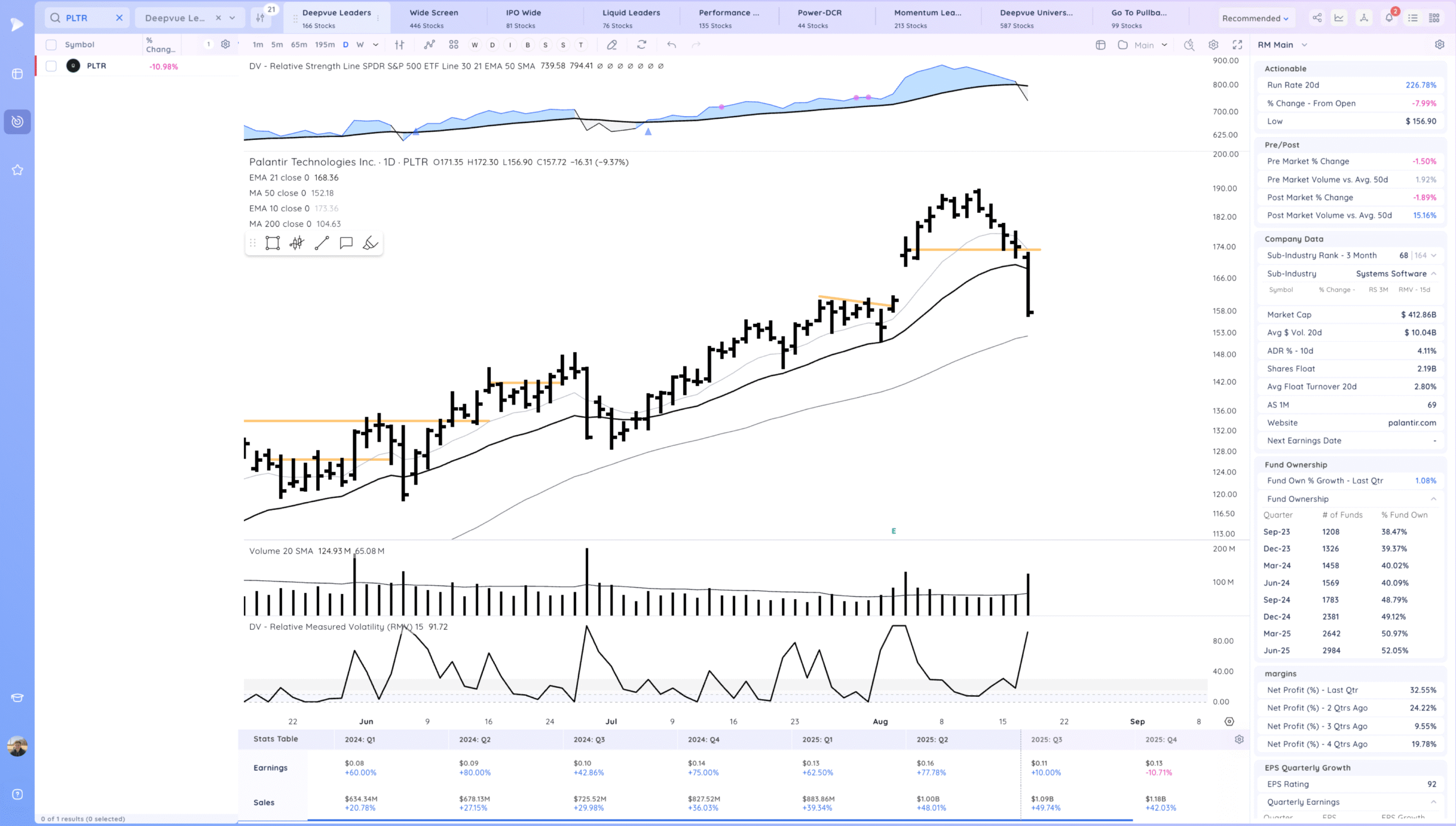

PLTR Broke lower significantly. Unless it snaps back likely needs a new base

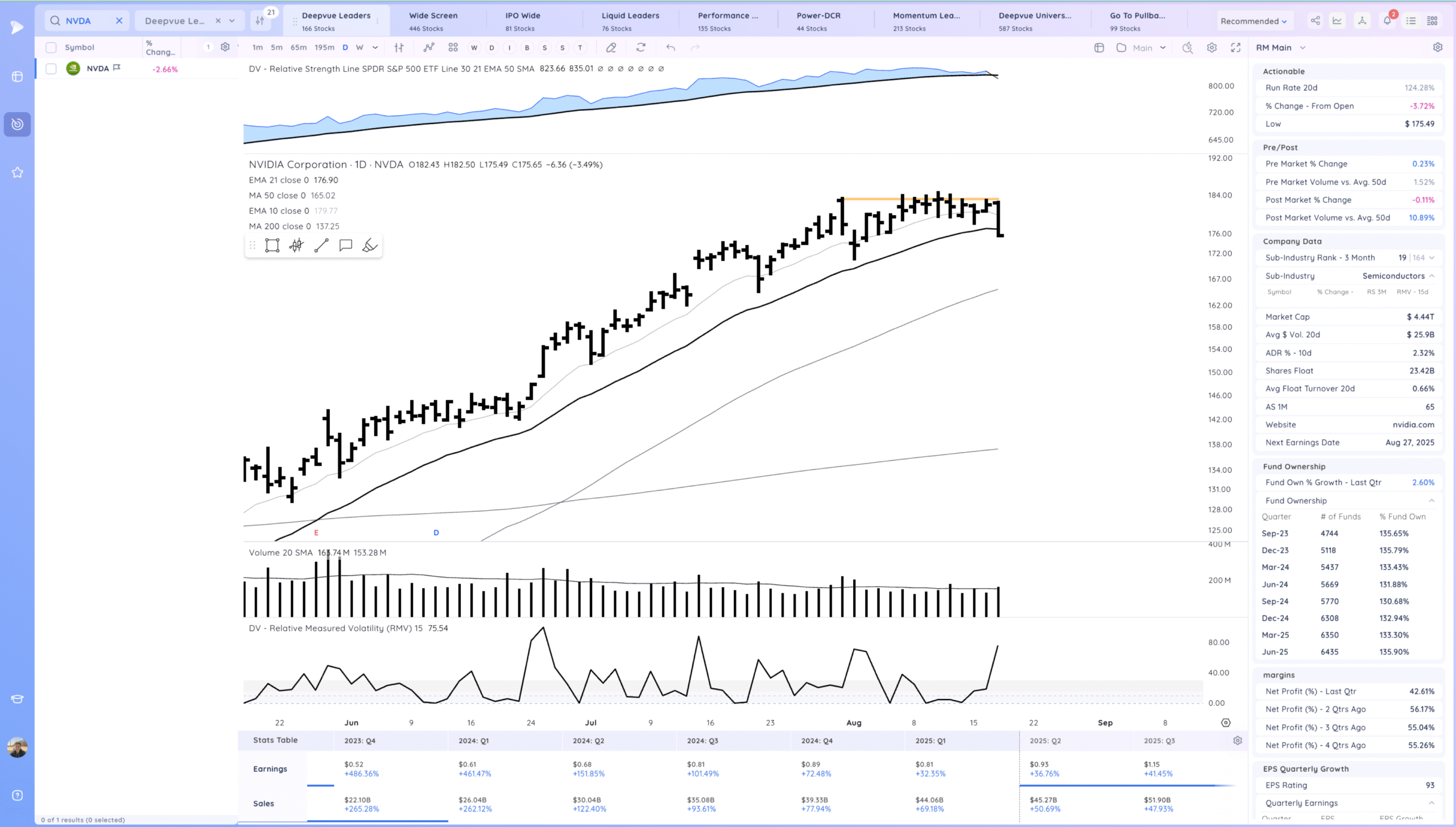

NVDA broke lower from the tight area. Below the 21ema

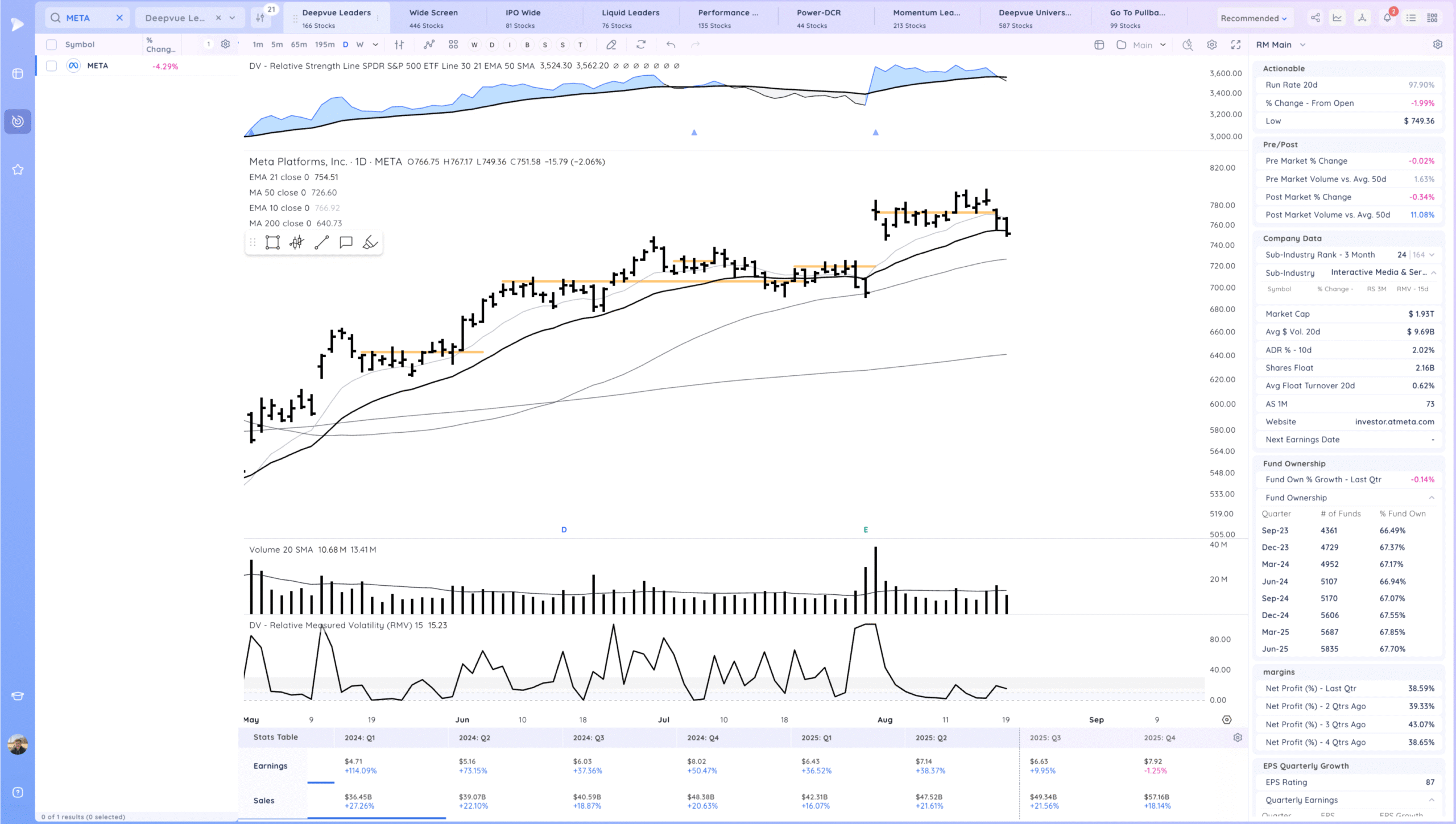

META Closed below the 21ema

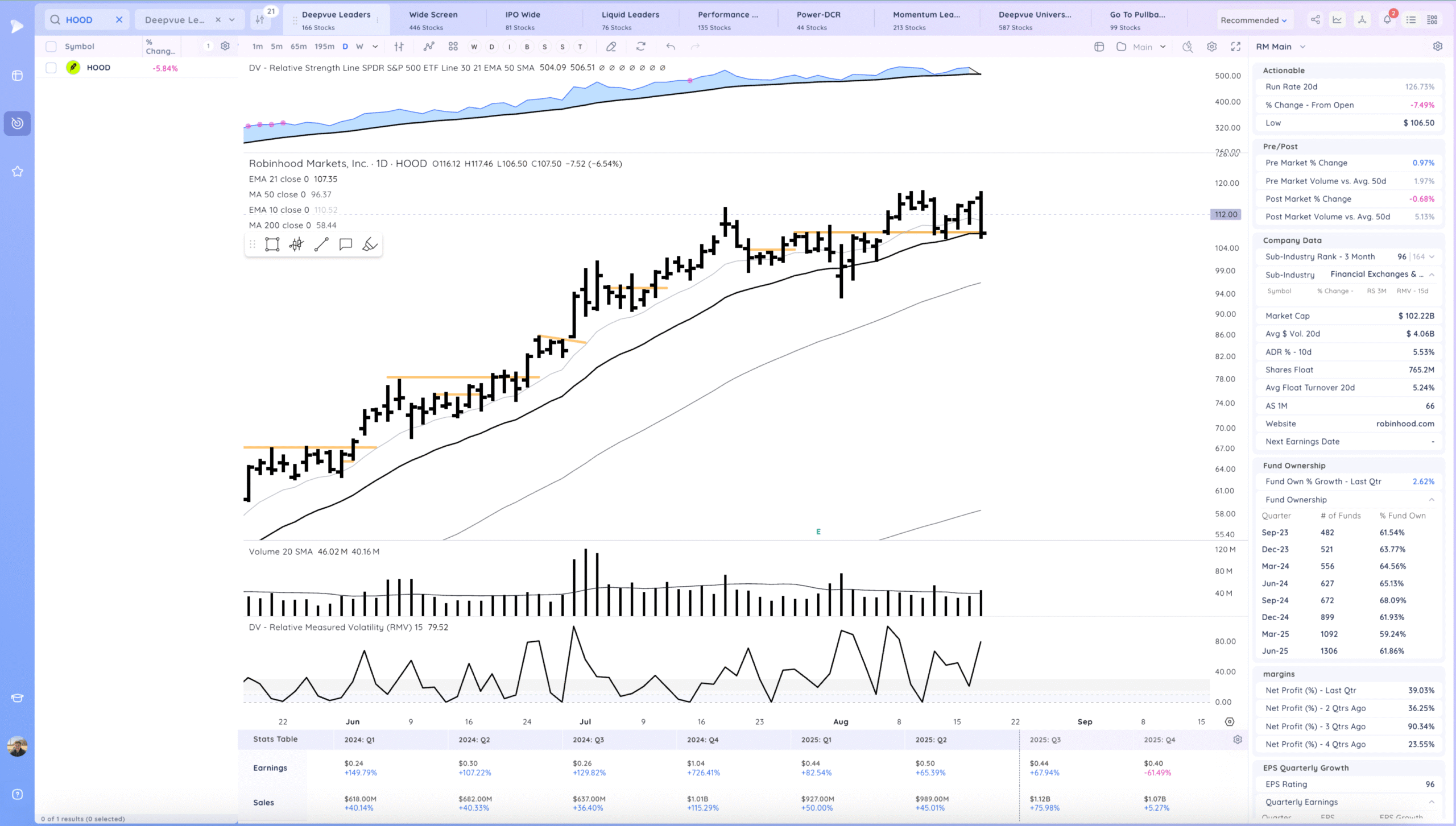

HOOD large downside reversal

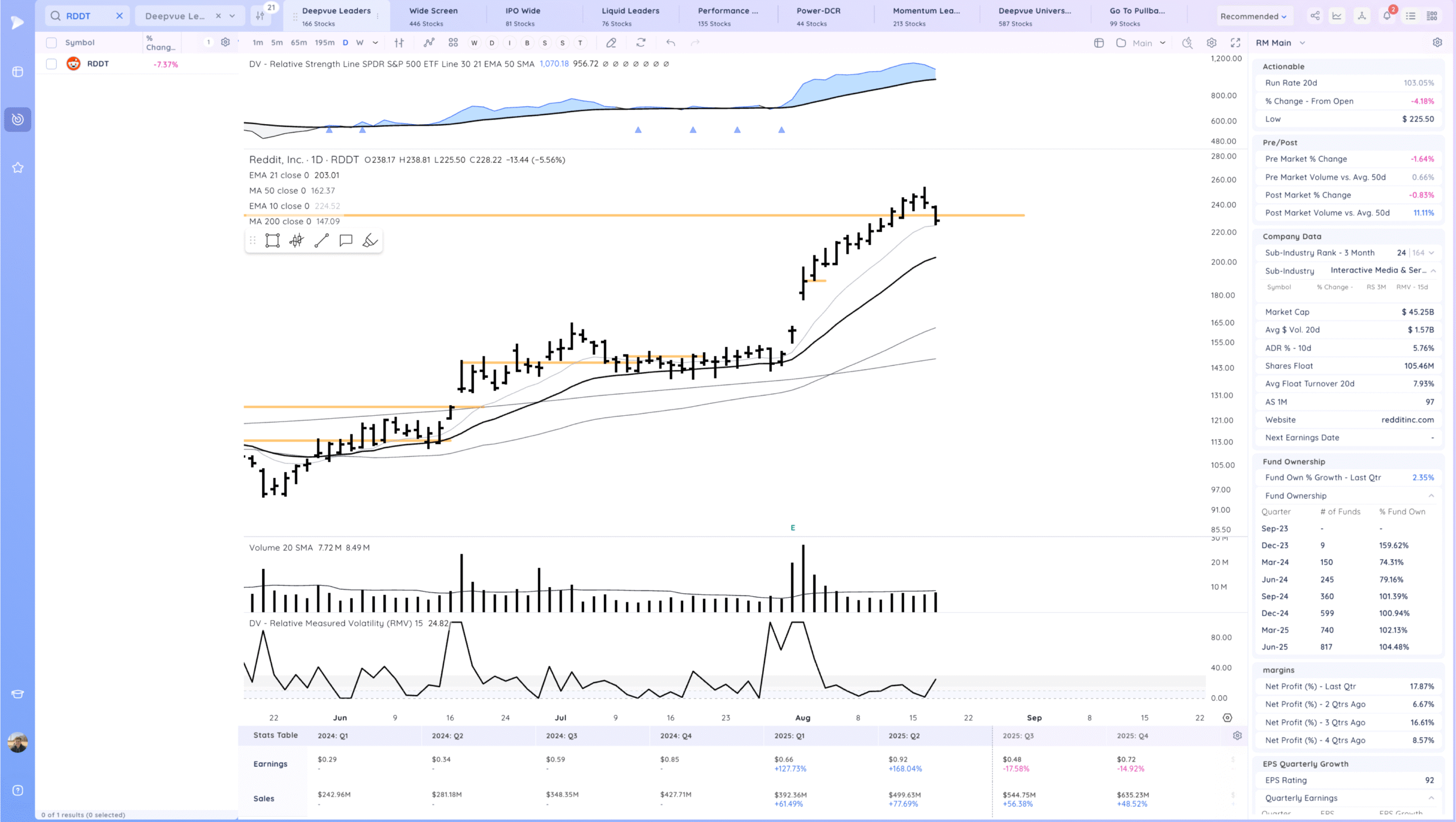

RDDT Closed back below the ATH pivot. Ideally forms a base here

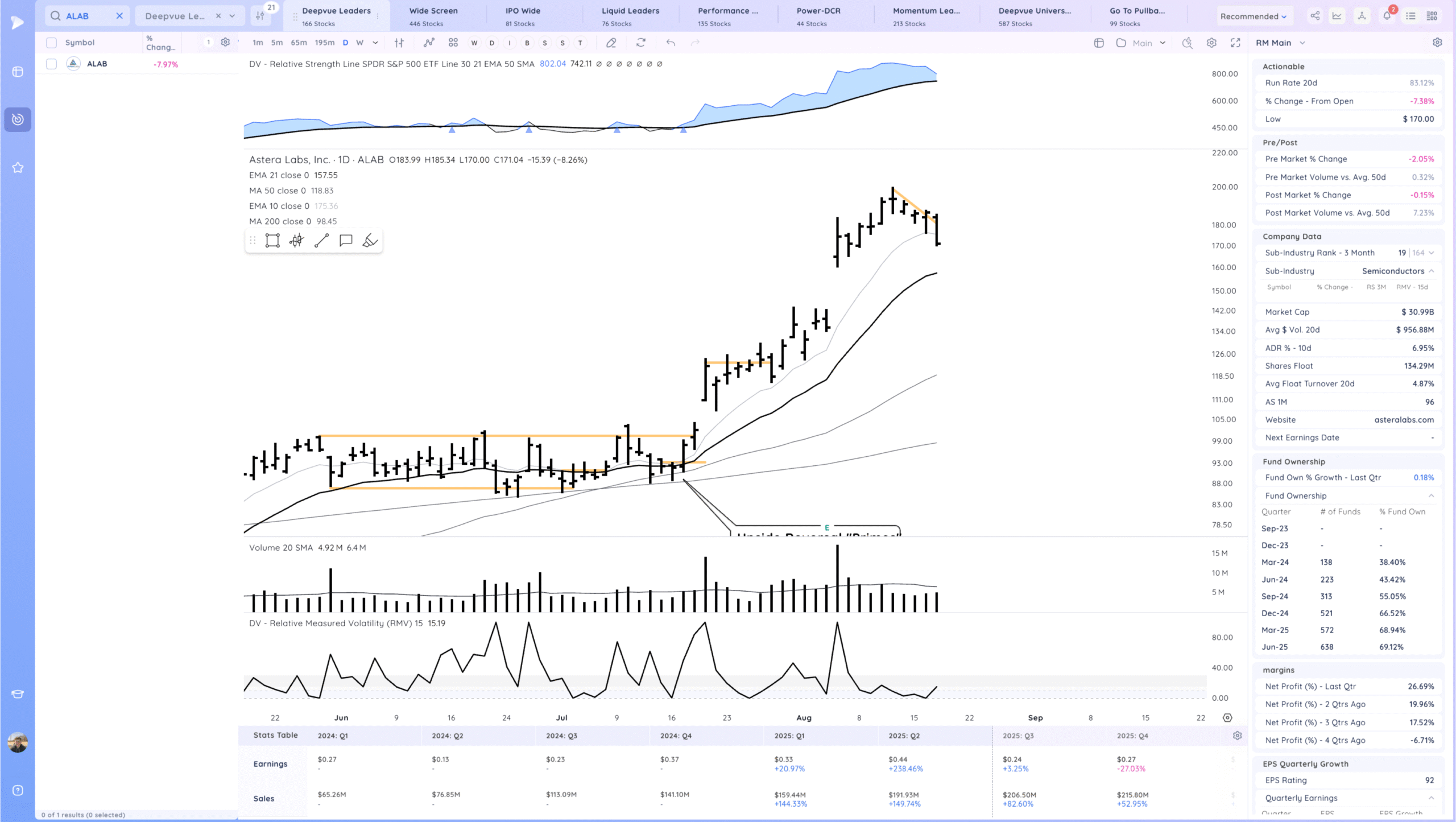

ALAB downside reversal and now below the 10ema

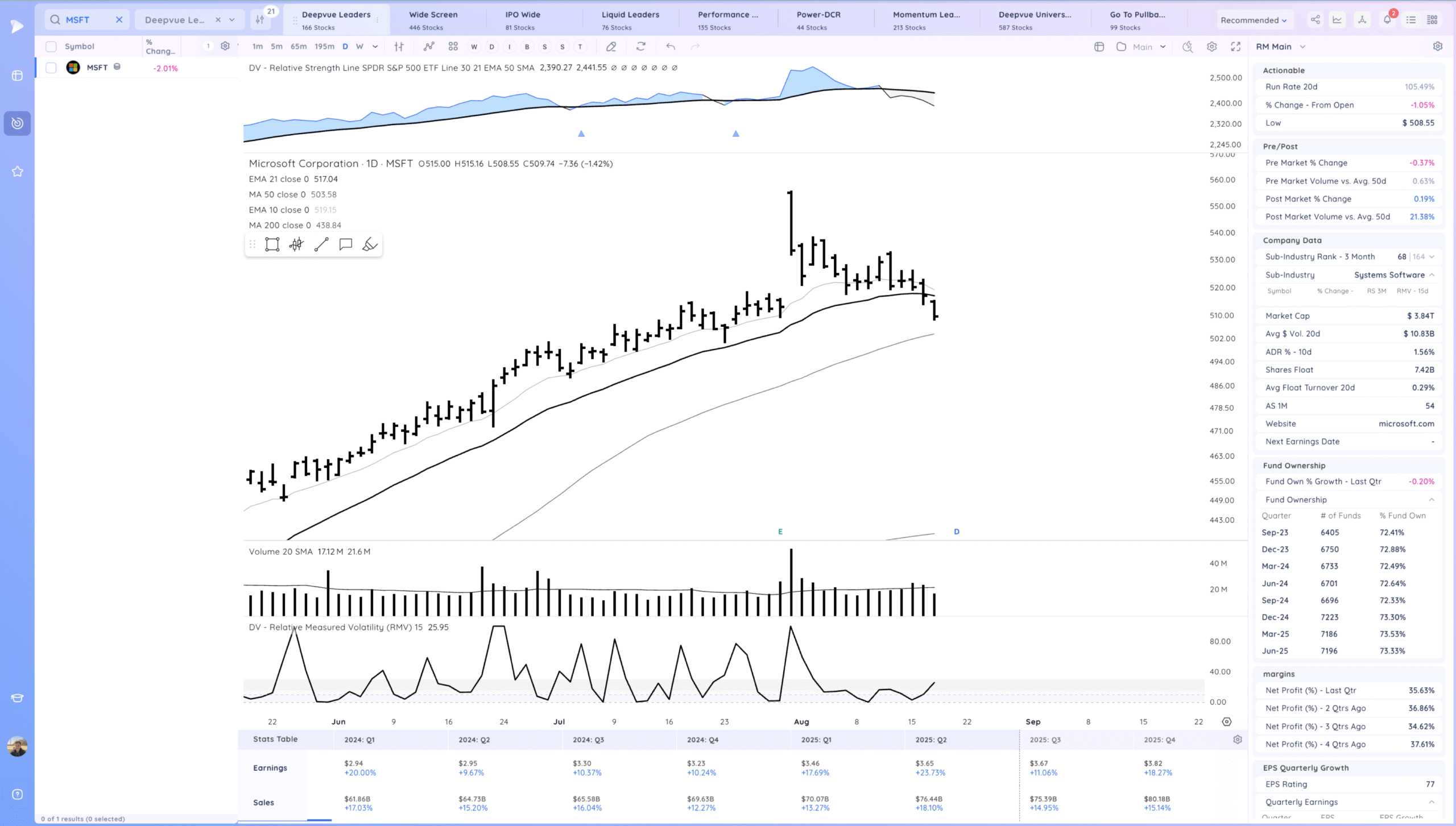

MSFT closing below the 21ema again

Setups and Watchlist

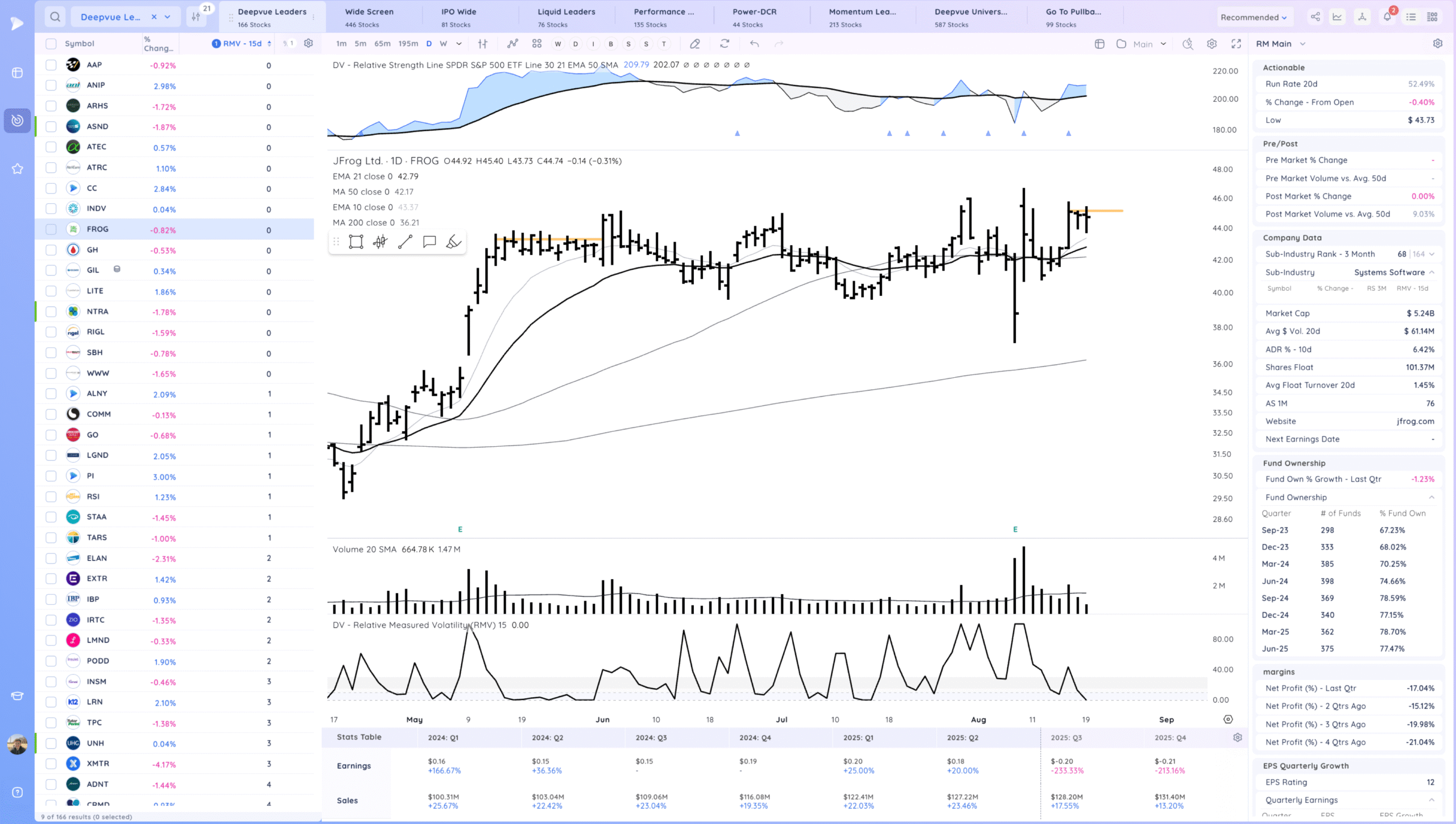

FROG watching for a range breakout.

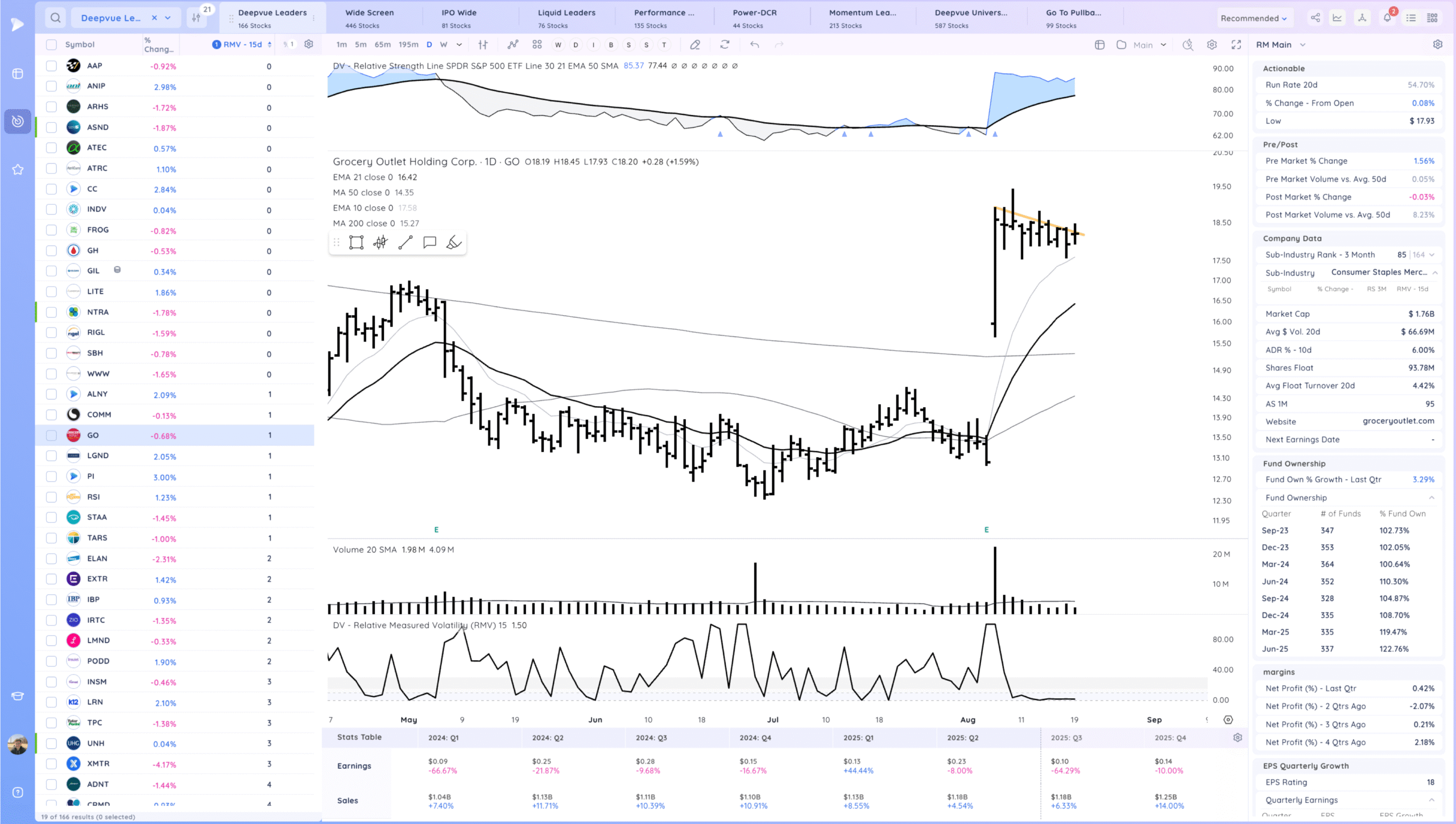

GO watching for a range breakout. consolidation day

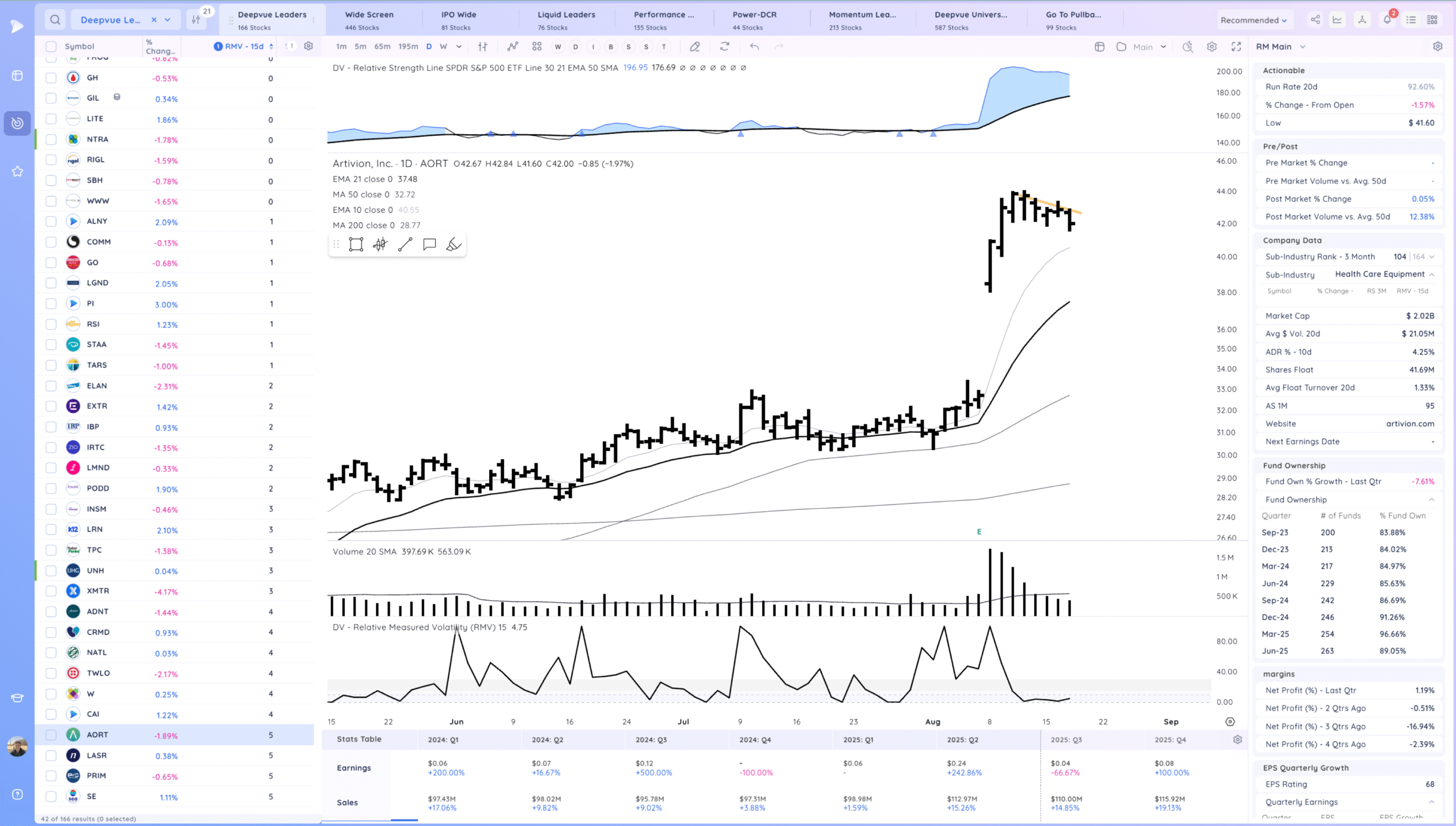

AORT watching for a range breakout

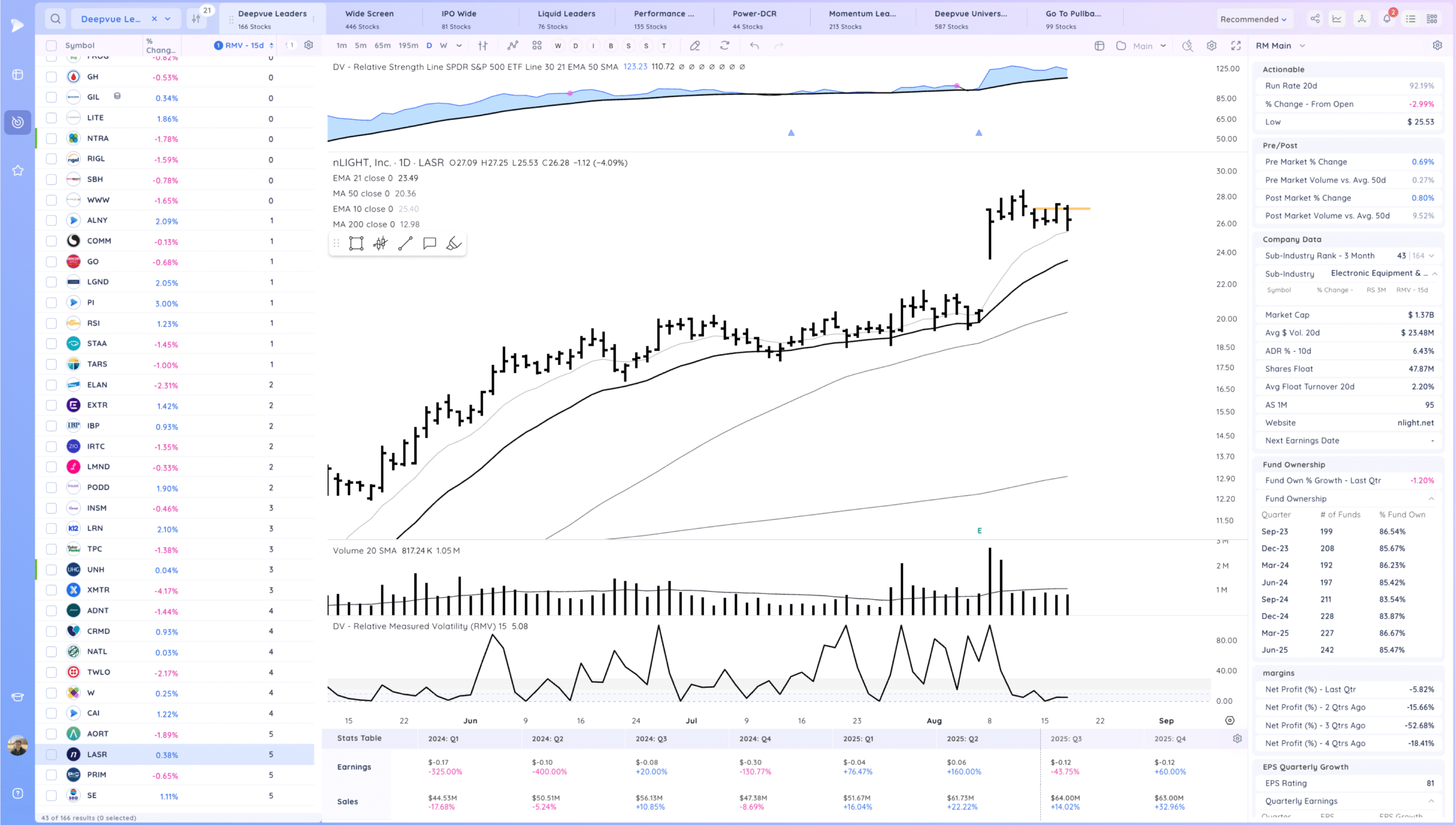

LASR watching for a range breakout

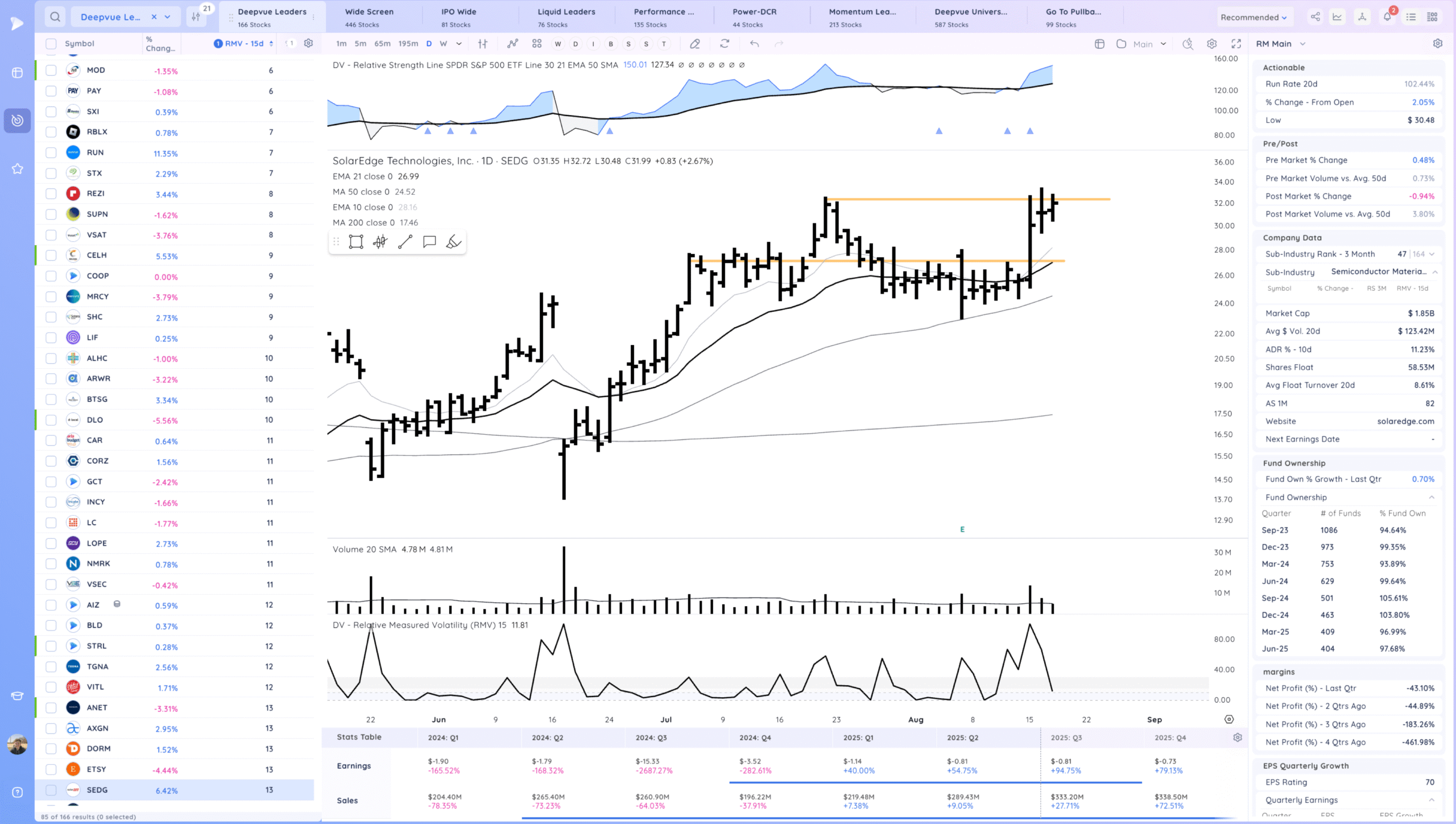

SEDG watching for a range breakout. Slightly extended. Solar has been holding up well so far.

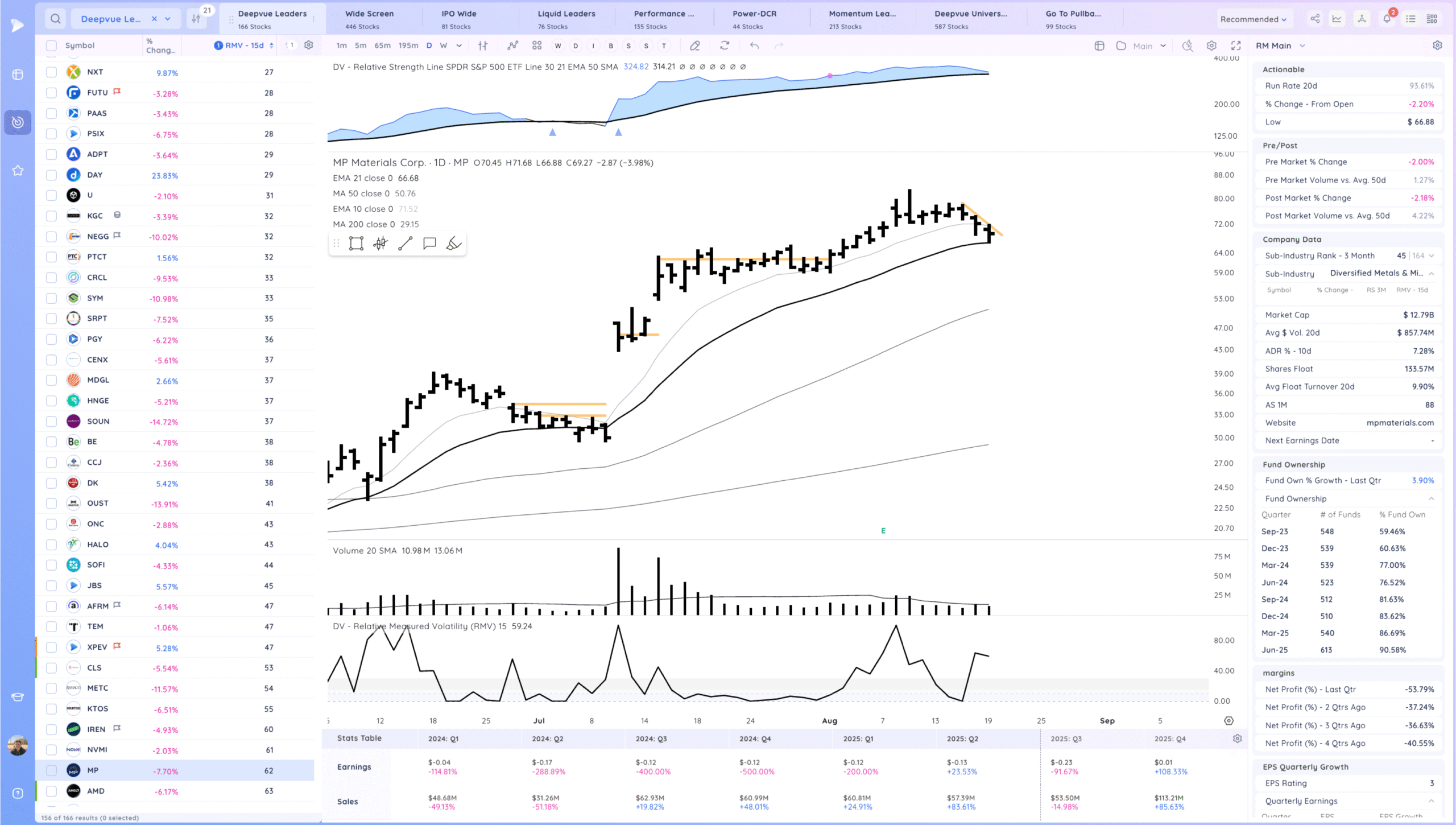

MP watching for a 21ema bounce

Today’s Watchlist in List form

Focus List Names

FROG GO AORT LASR SEDG MP

Focus:

GO MP

Themes

Strongest Themes: Software, Cyber, Nuclear Power, Semis, Miners

Market Thoughts & Focus

Today was a sharp down day with tech in particular getting hit. Longer term trends intact but for me caution warranted unless we get a quick snap back.

Anything can happen, Day by Day – Managing risk along the way