Negative Expectation Breaker as the Market Falls 3%

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 3, 2024

Market Action

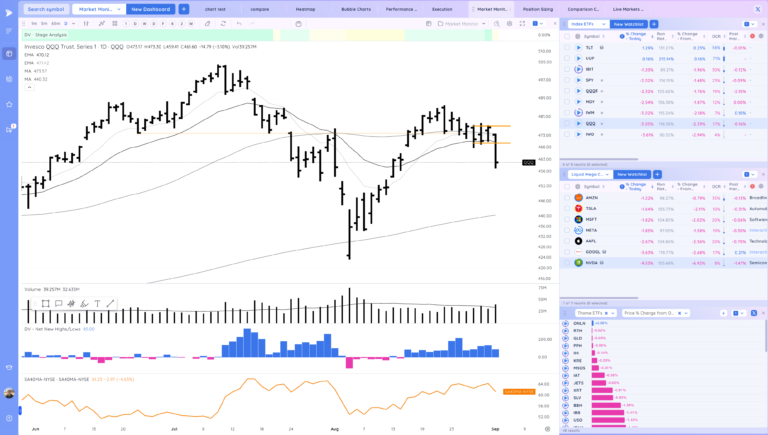

QQQ – going into the weekend I mentioned in my market outlook that overall I thought the pattern looked constructive and we would have to see which way we pushed out of the range.

We’ll the benefit of having an expectation is that when it is broken you get immediate feedback.

Instead of breaking up out of the range we gapped down and trended down, breaking the range lows, 21ema, and closing negatively.

This looks like a potential turning point. Some potential support levels and key areas to watch is the gap set Aug 13 and the 200 day. We are right at the AVWAP from the correction low. Looks like more time is needed for this base.

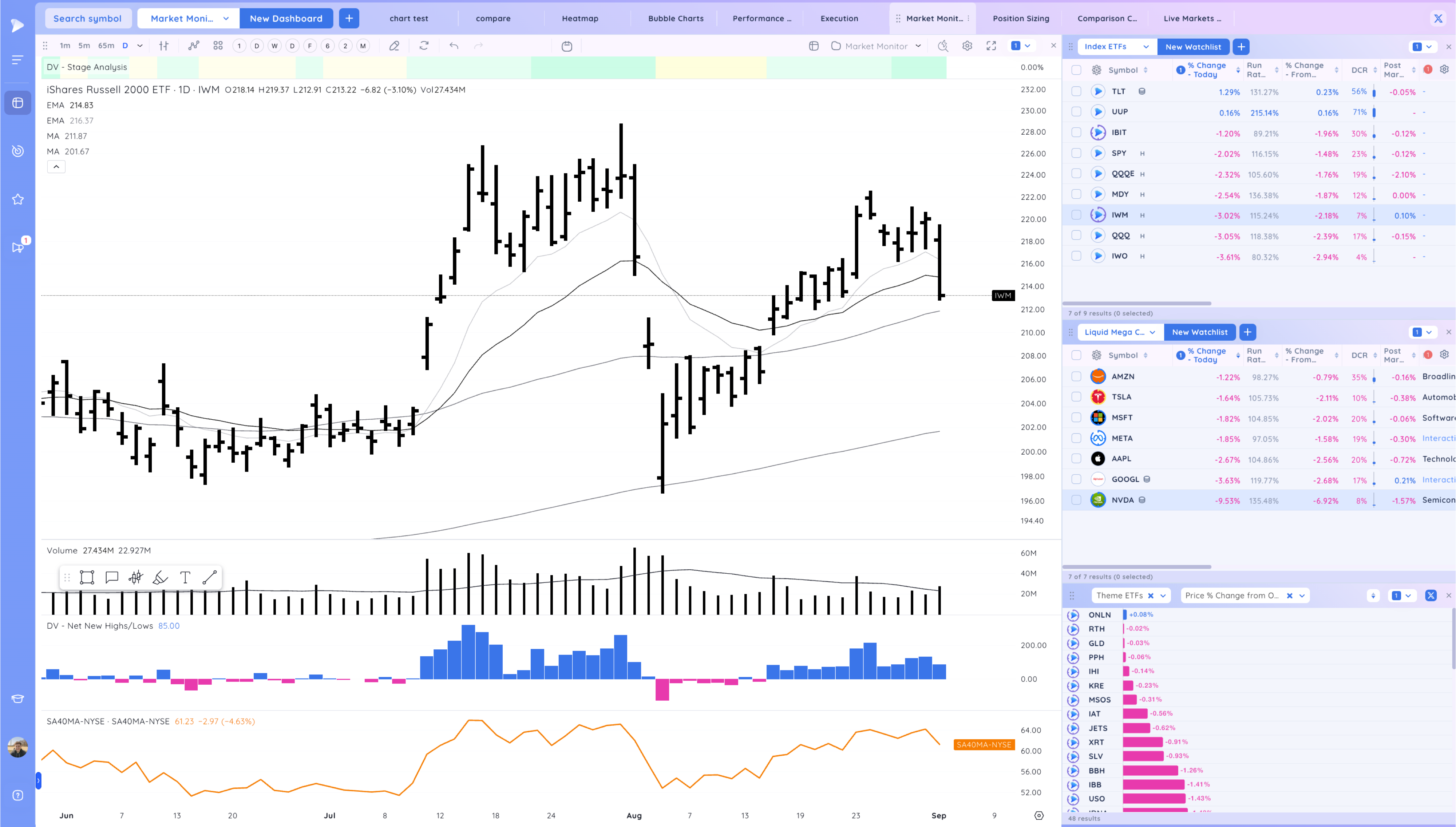

IWM – losing the 10ema and similar bad break

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

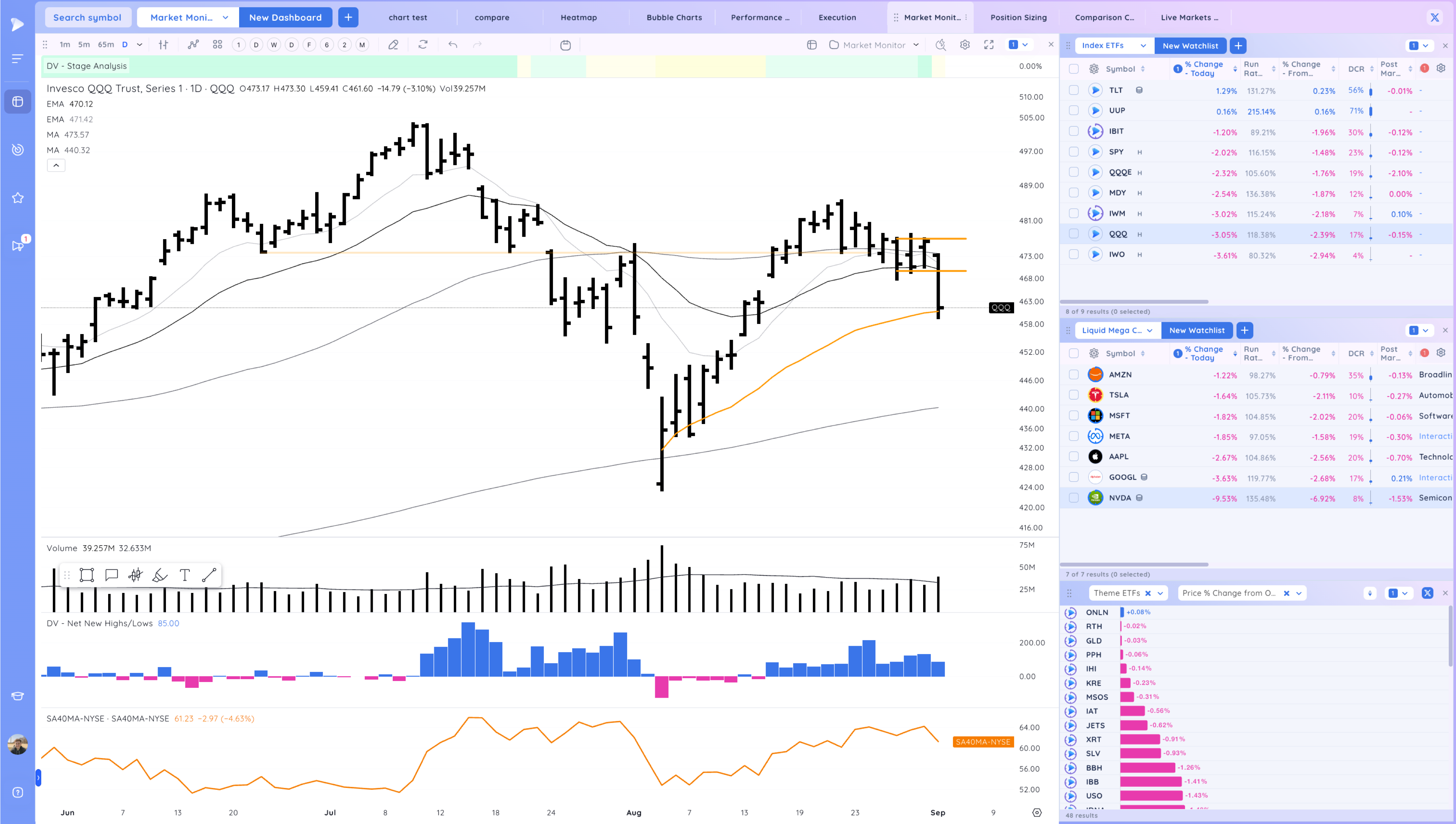

Trends (1/4 Up)

Shortest – 10 Day EMA – Below declining

Short-term – 21 ema – Below declining

Intermediate term – 50 sma – Below declining

Longterm – 200 sma – Up – Above Rising

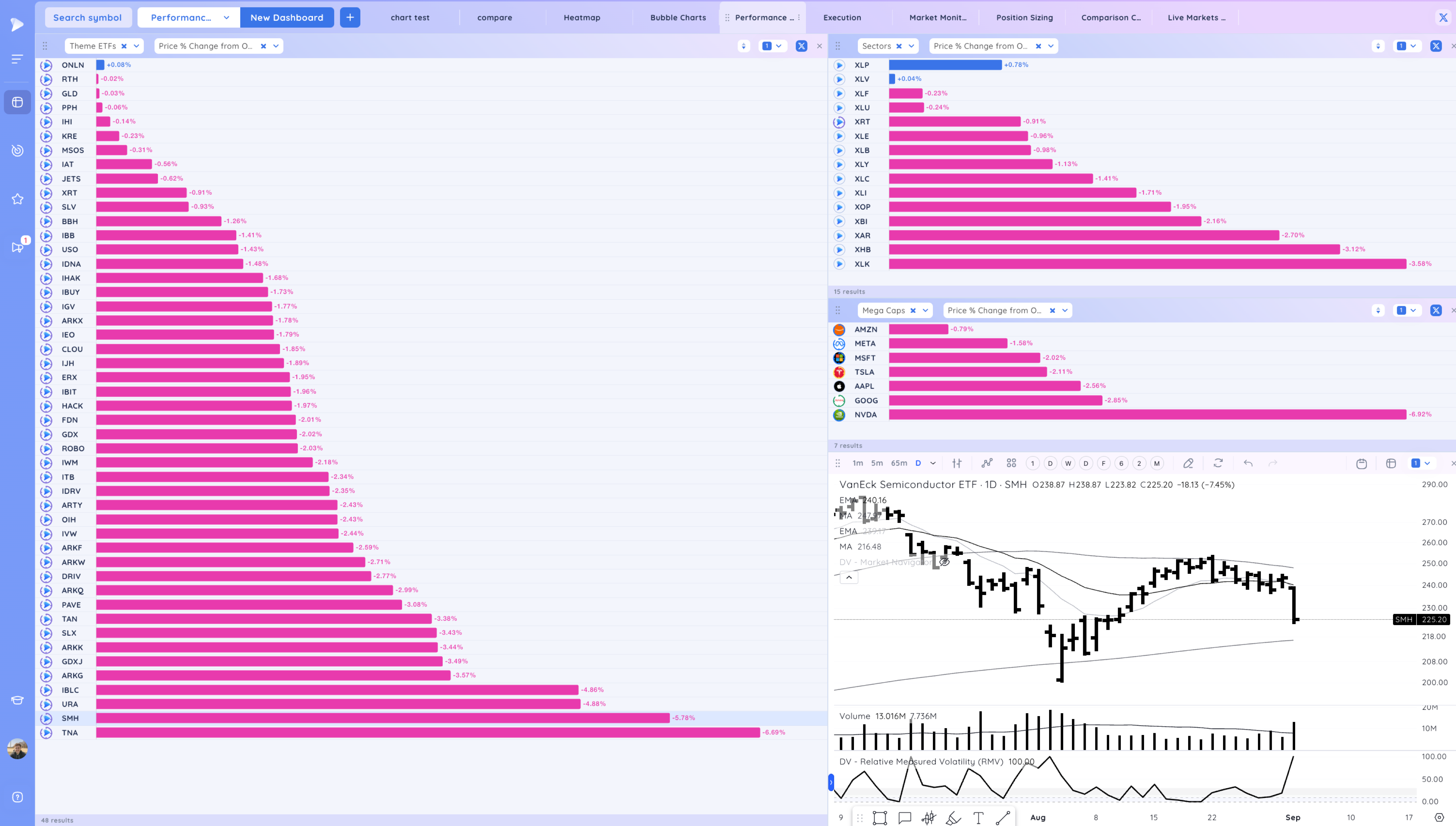

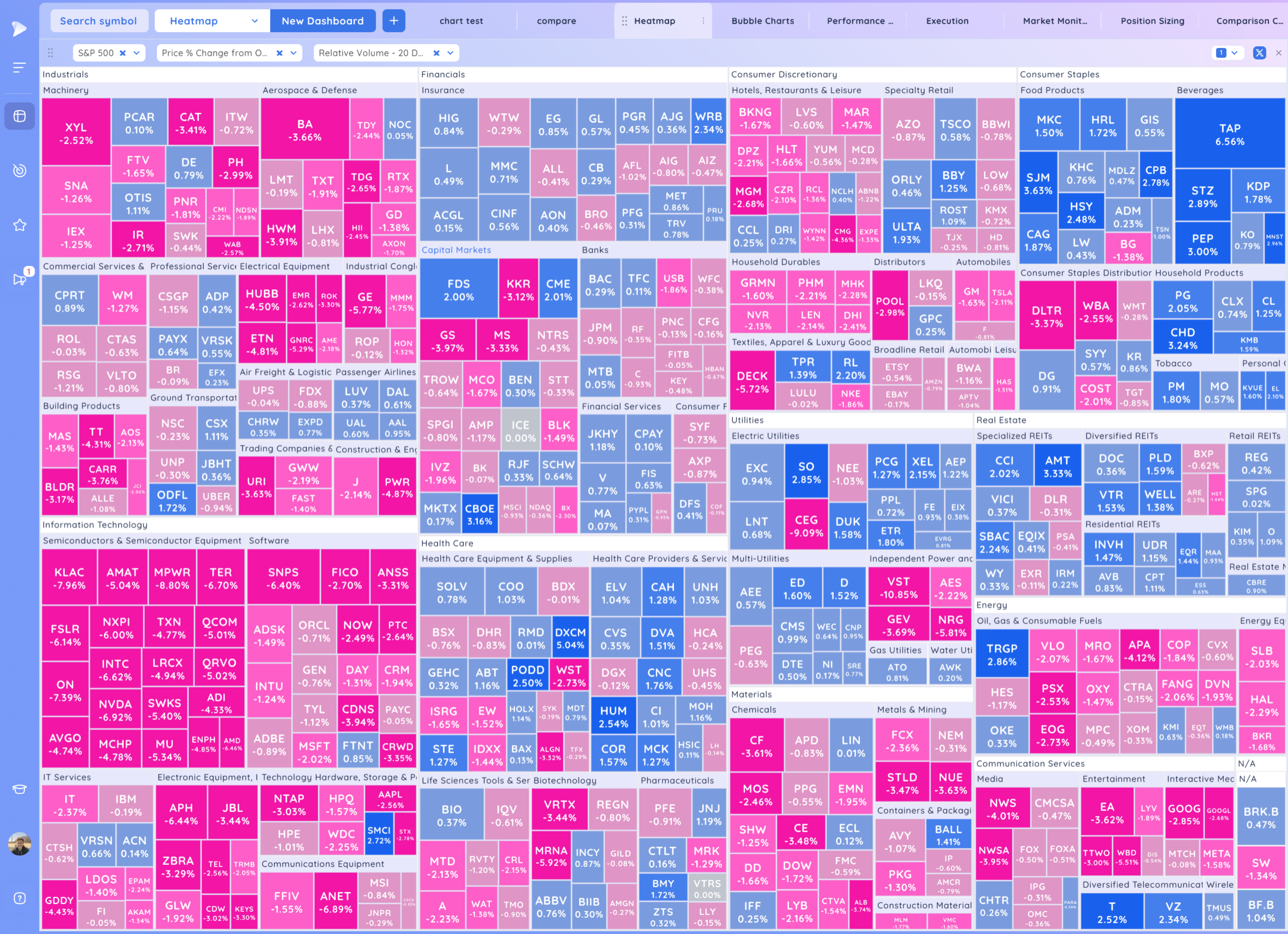

Groups/Sectors – % Change from Open

Performance Charts from Deepvue

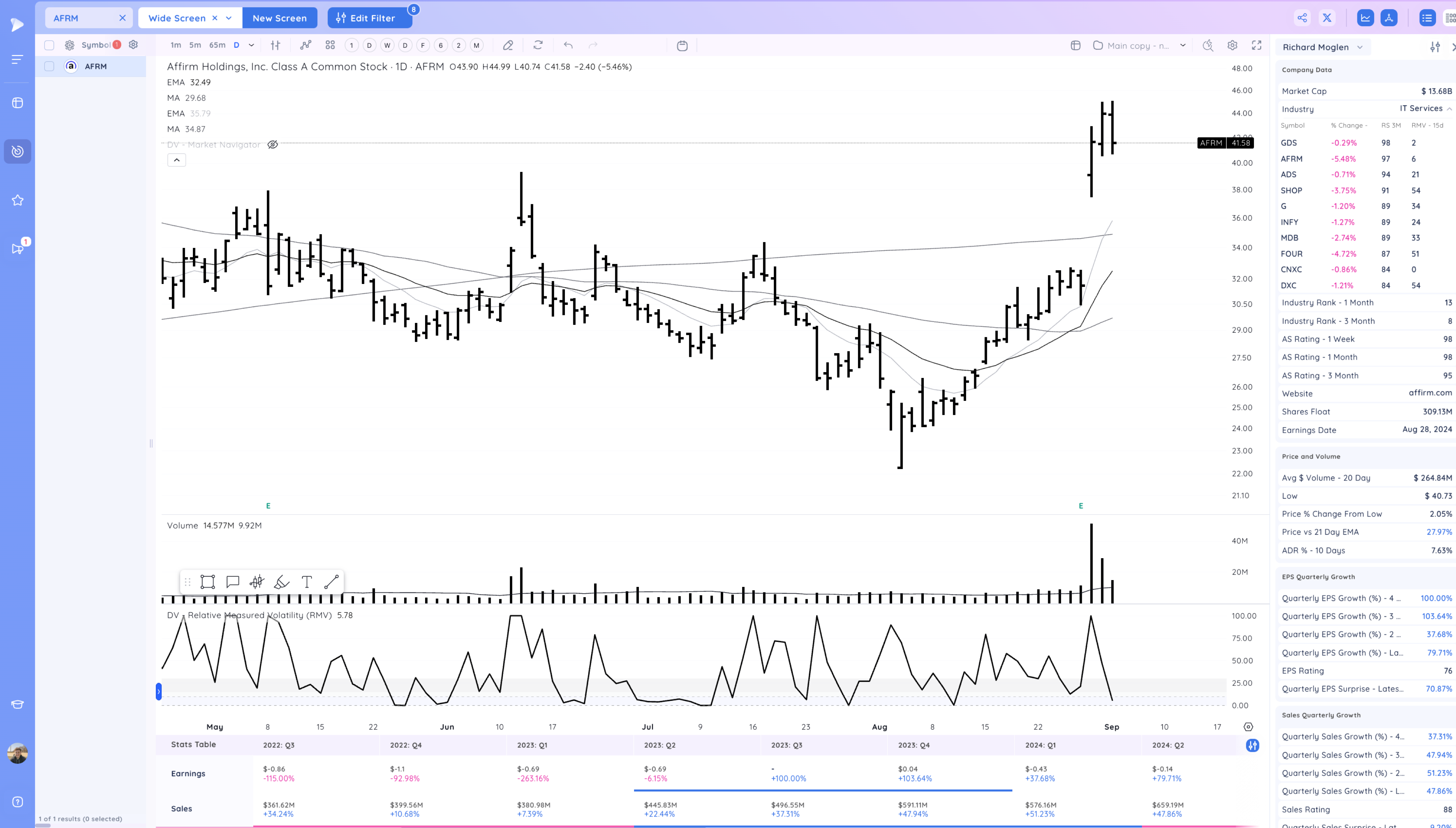

Key Stocks in Deepvue

NVDA sharp continuation down and loss of the handle that had been forming. hit with some extra news after hours.

strong down move over the past 3 days. Could see some bouce up but has started short term downtrend

AFRM retrace yesterday’s move and back at the HVC

MELI failed breakout

Tight range against the 10ema

PCVX big volume gap up on news about a drug trial

AVGO and other semis also broke down from handles

GGAL holding above the pivot for now

CBOE bounce off the 21ema

ASTS tight against the 21ema. wick 2 days ago. Could be a good short if breaks the 21ema and days range. Fast mover

TGTX big reversal just abvoe the 21ema and range lows

LLY another wick, see if there is downside follow through

Market Thoughts

Most of the tight areas and constructive charts I noticed on the weekend resolved down. NVDA the leader is expanding to the downside. We will see how this week closes.

The expectation based on today is more downside but with awareness that we could have a short term bounce.

Day by Day – Managing risk along the way