Market Sets New Highs – Crypto Set Up for Higher?

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 14, 2024

Market Action

QQQ – good close to the week as we make new highs. Trending above all the moving averages

Short Term Expectation based on the close is consolidation or higher

Bulls want to see us continue to trend higher or flag sideways

Bears want to see us reverse down sharply and break below the 10ema

IWM – still below the 21ema. Coming towards the 50

Bulls would want to see us build a range here and rebound higher

Bears want to see us follow through lower on increasing volume

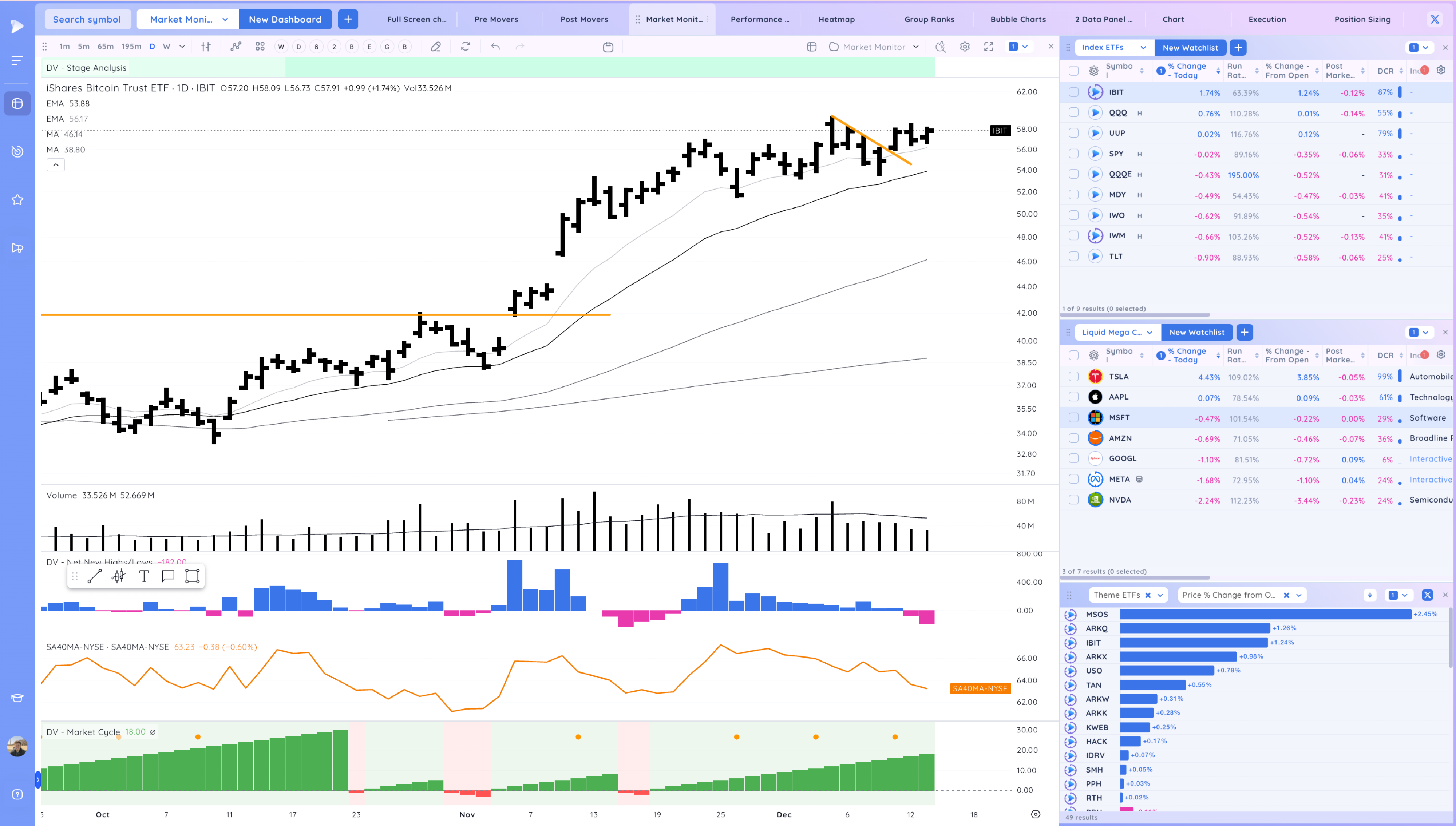

IBIT- building a range here sideways above the 10ema

Bulls want to see us reconfirm higher

Bears want to see us break lower below the range and 10ema

Trends (4/4 Up)

Shortest – 10 Day EMA – Up Above Rising

Short-term – 21 ema – Up Above Rising

Intermediate term – 50 sma -Up Above Rising

Longterm – 200 sma – Up – Above Rising

Deepvue Special Offer – Try 2 Months for only $39

Try out the best platform for CANSLIM Swing and Position Traders – Top Trader Screens, Unique Indicators – Streamlined Routines

Groups/Sectors

Performance Today on the Left, Performance over the past 20 days on the right.

Performance Charts from Deepvue

Deepvue Leaders Heatmap

S&P 500

Group Ranks: 1 Day, 1 Week, 1 Month, 3 Month from left to right. This is now a preset for Deepvue Members

Post Market Movers.

Key Stocks and Moves in Deepvue

NVDA still acting weak, lower high in place and below the MAs

TSLA trending strongly, above all the MAs

META solving down from the inside day and testing the 10ema

AMZN flagging sideways, would love a 10ema pullback

MSTR setting up a spot here from this range

COIN also has a clear pivot

ALAB strongest leader in the market

RDDT holding up well

AVGO earnings gap and one to watch. News on new chip tech

SOUN rmv tight signal yesterday, from contraction comes expansion

Stocks Setting Up

APP forming a tight range at the 21ema. A swing trade name at this point, later in the overall move. May need a much bigger base if it breaks lower form here

BNTX setting up the right side, swing trade type name and biotech

CVNA upside reversal at the 21ema, watching for follow through up

EQT watching for reconfirmation up, would prefer a few more days sideways or an upside reversal to prime this

ML tight but microcap

MSTR watching for a push on this range

VST range on top of the base pivot

AFRM still in this range, would prefer an inside or upside reversal to prime the setup

QMCO tightest day in a while, current theme/story

SOFI watching for breakout higher

ASAN watching for a push higher

COIN watching for a break above the range

HIMS volatile but 21ema pullback, watching for follow through up from the upside reversal

GEO pulling into the 21ema area, watching for a push from the range

BE watching for a push from this inside day

NNE spec, watching for a push through the DTL

SHOP watching for a breakout and reclaim of the pivot off the 10ema

BILL looking for respect and bounce form the 21ema

GEV has been choppy, watching for a push from the inside day

WGS watching for follow through up

Themes and Leaders

Key Themes

Crypto, Fintech, Software, AI, Semis, Alt Energy

These names have the top RS, growth stories

TSLA PLTR HOOD MSTR COIN RDDT APP ALAB DUOL NVDA AXON FTNT DASH SHOP GEV VST VRT

Recent Earnings gaps and powerful moves

These names are good to watch for pullback spots

AAOI APP AXON BROS COIN GEO IONQ UPST TEM BILL DOCS FRSH LUMN ALAB PLTR SOUN LYFT TSLA HOOD POWL Z AX AMSC LUNR PLNT TOST CRDO COHR RDDT RKLB TRMB VST WVE CEIX LMND MSTR SOFI VRT FTNT MCK DFS MLI CADE HIMS MARA HUT ROOT CRS FHN HQY PODD UPWK GEV OKLO NTNX DOCU FN DUOL GDS FOUR SHOP RKLB SNOW ESTC SMTC PSTG OKTA MRVL GAP NVCR RBRK ASAN DOCU AVGO

Market Thoughts & Focus

Market still trending.

Of the names set up, I’m focused most on AVGO, IBIT/MSTR, AFRM, ASAN, BE

Anything can happen, Day by Day – Managing risk along the way