Market Reversal. Earnings Gaps. HOOD reports tomorrow

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

July 29, 2025

Market Action

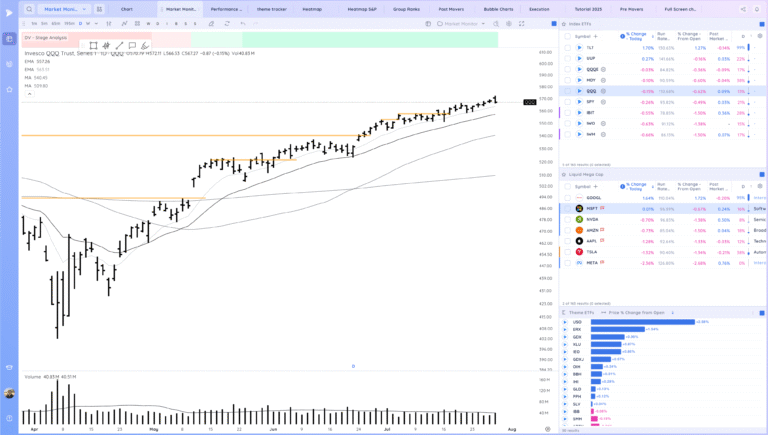

QQQ – Downside reversal after the gap up. We remain in a trend above all the moving averages. On watch for further weakness and a break below the 10ema. That would be the first sign that we may consolidate. Until then we remain in an uptrend.

Summer markets are choppier, we are more extended in this uptrend, and earnings season is upon us. Reasons for me to pick my spots more carefully.

The markets reactions to earnings is an important gauge of risk appetite. Are more names gapping up and following through? Or selling off and/or lack of follow through

Bulls want to see us hold the 10ema area and continue to ride the MAs higher

Bears want to see follow through down breaking below the 10ema

Daily Chart of the QQQ.

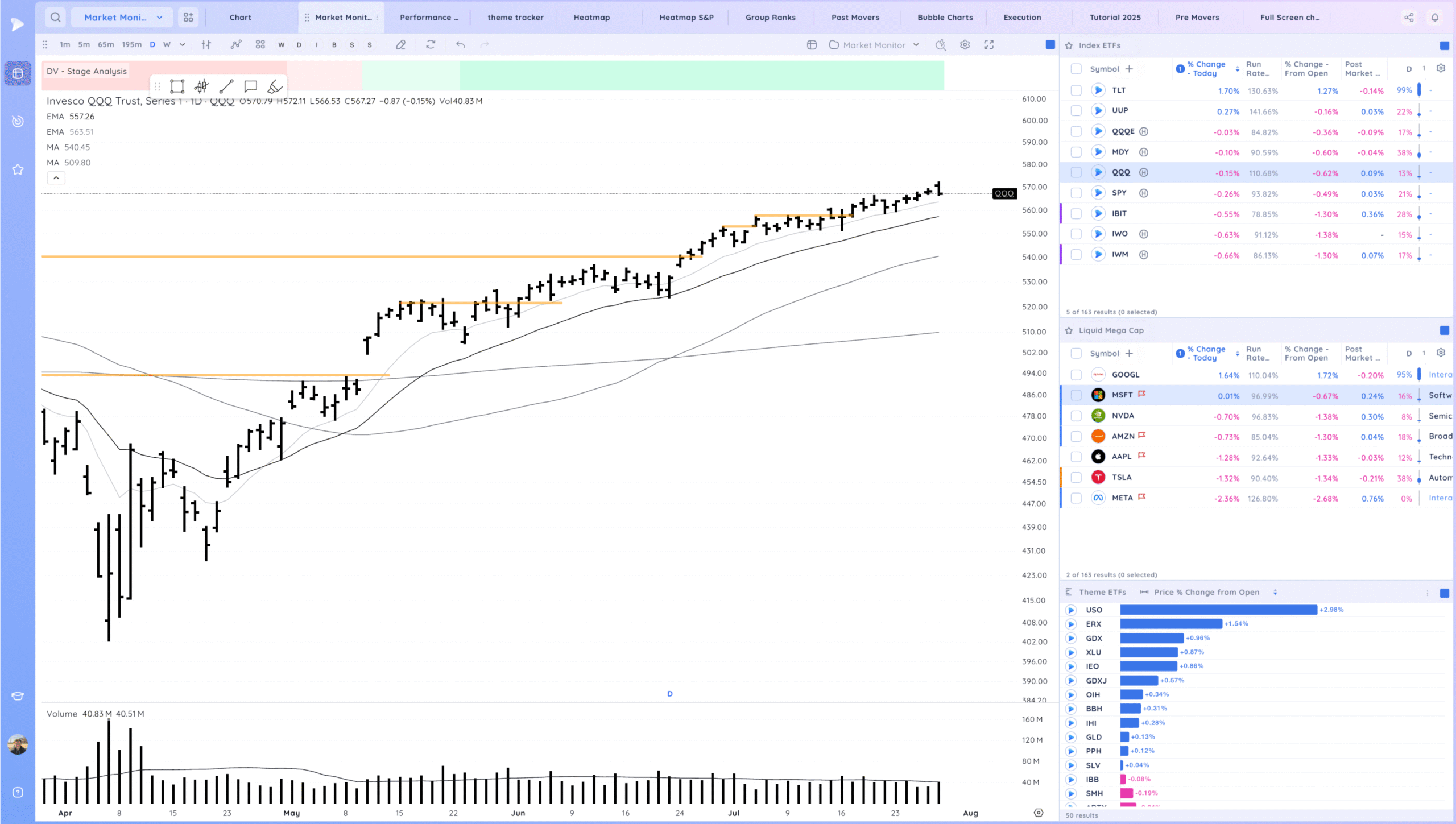

IWM – downside reversal at the consolidation pivot. on watch for follow through down

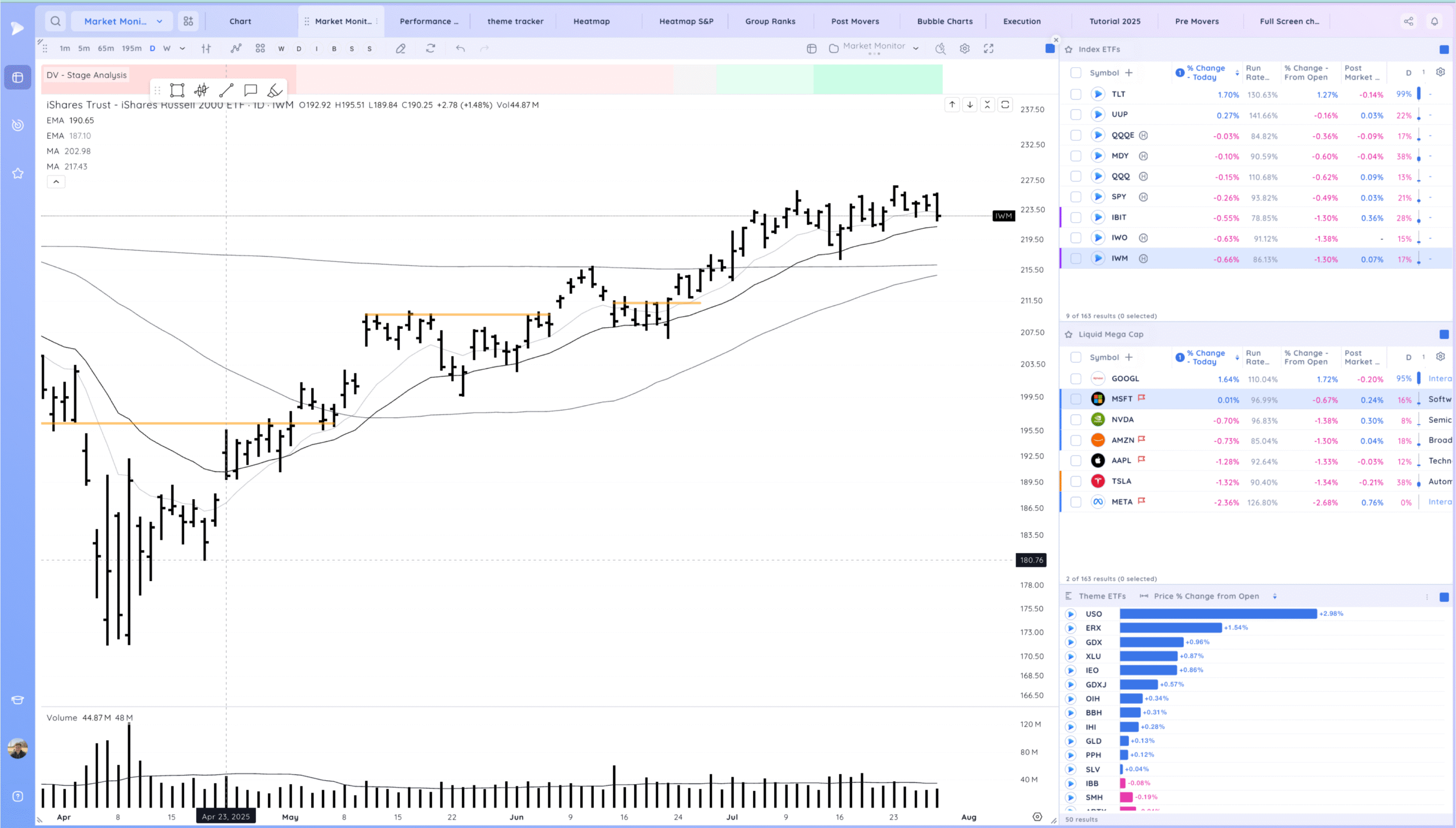

IBIT – could not take the pivot and closed near lows. still in the consolidation

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

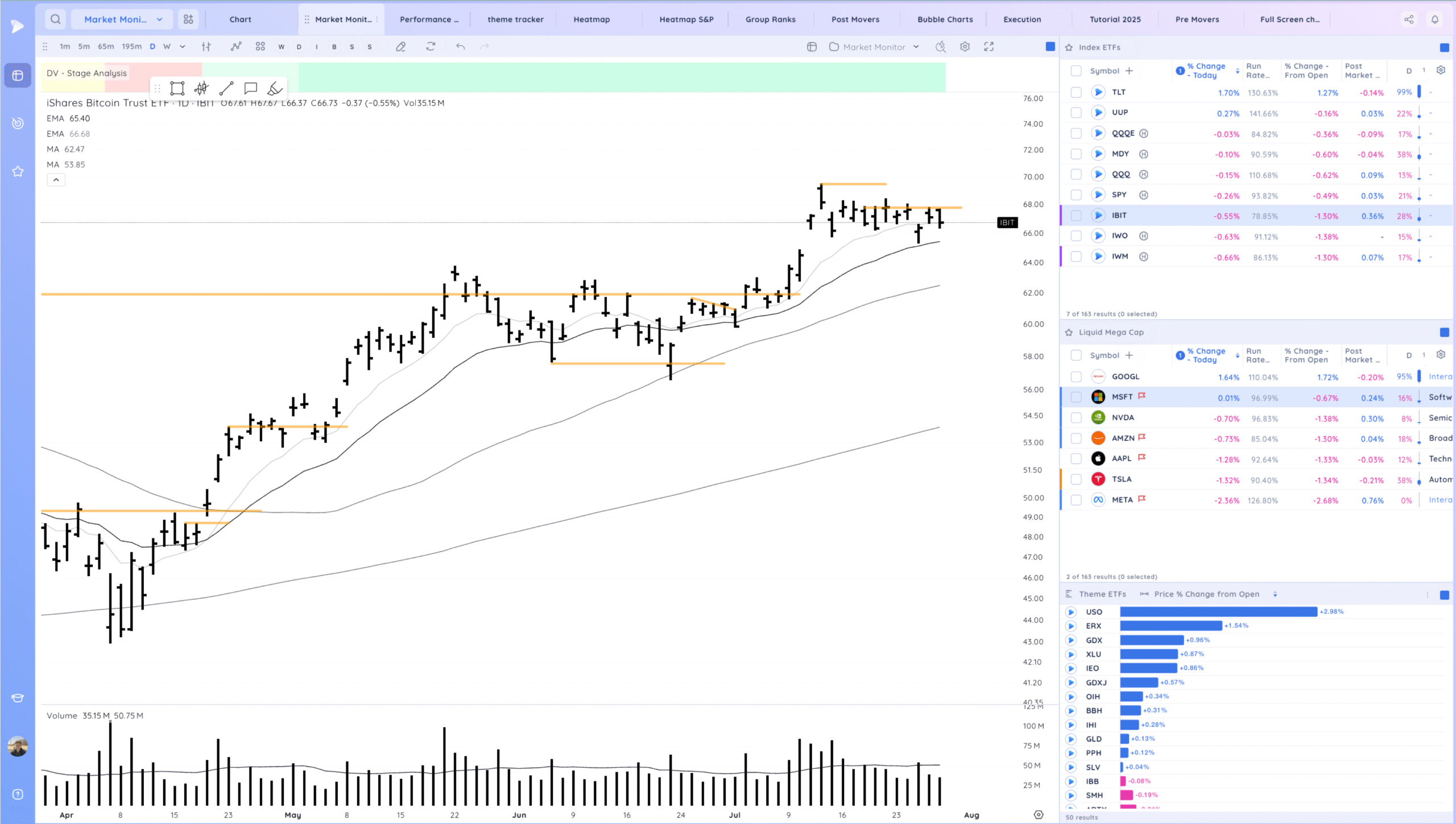

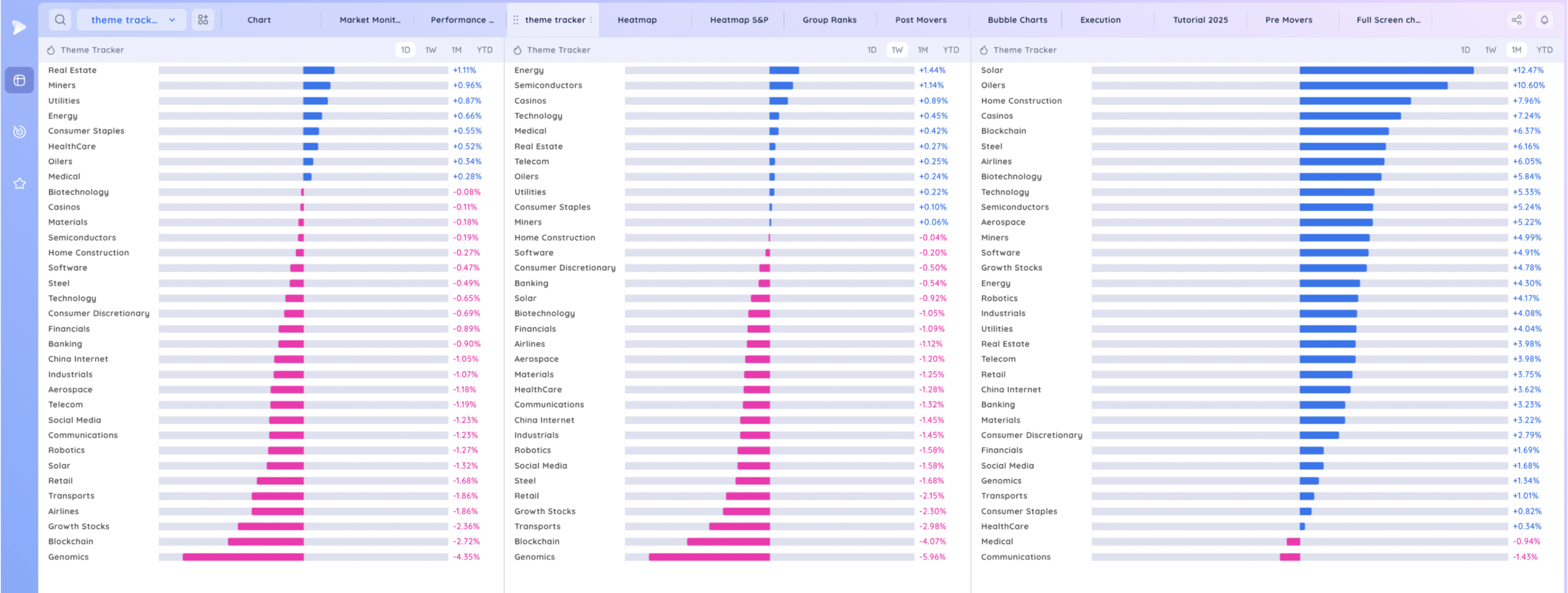

Groups/Sectors

Deepvue Theme Tracker

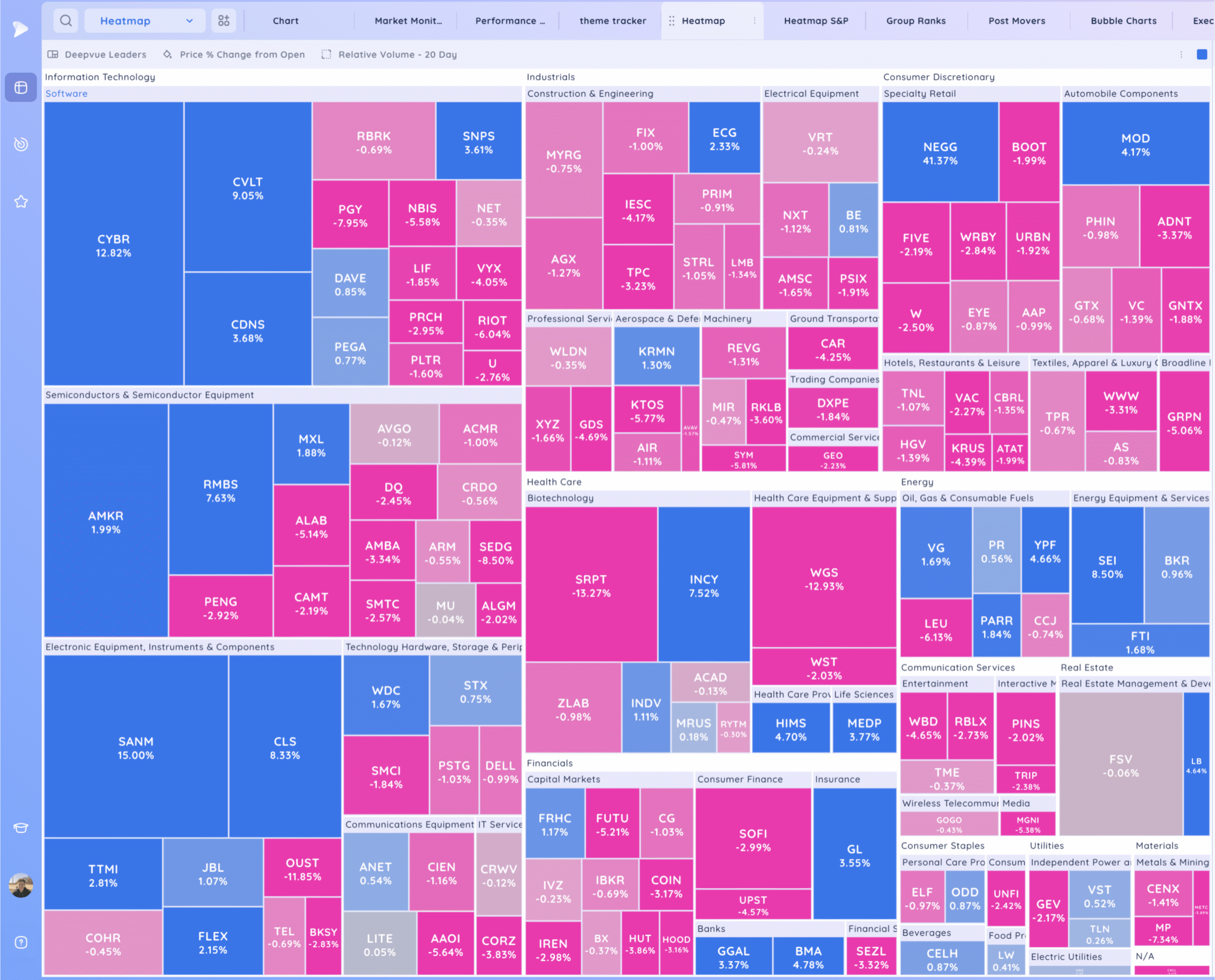

Deepvue Leaders Heatmap

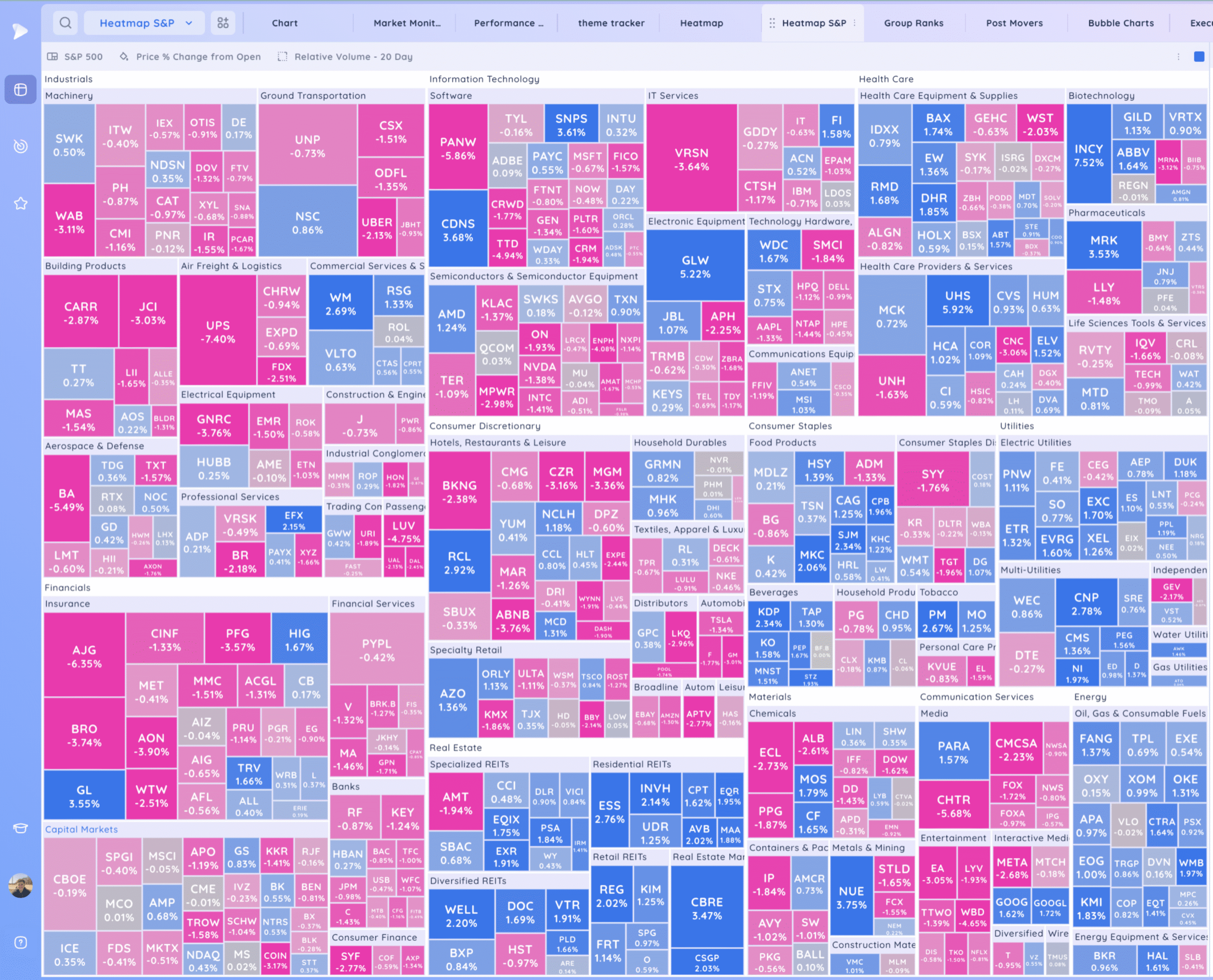

S&P 500. Rotation into reits and oil & gas

Leadership

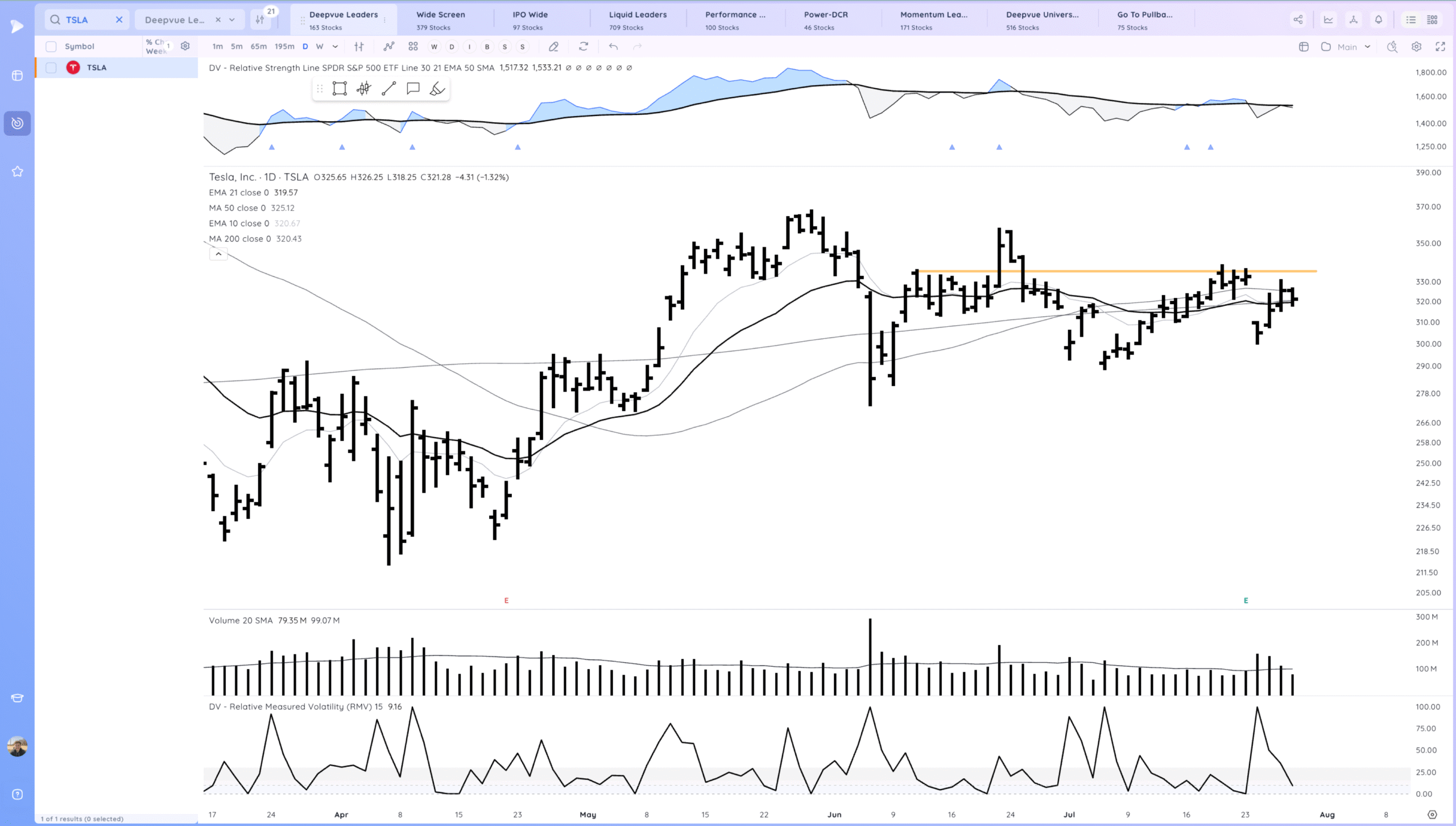

TSLA inside day. no clear direction yet but like how it has handled the gap down. This could be bottoming action. TSLA has obviously lagged the market and most growth names for quite some time.

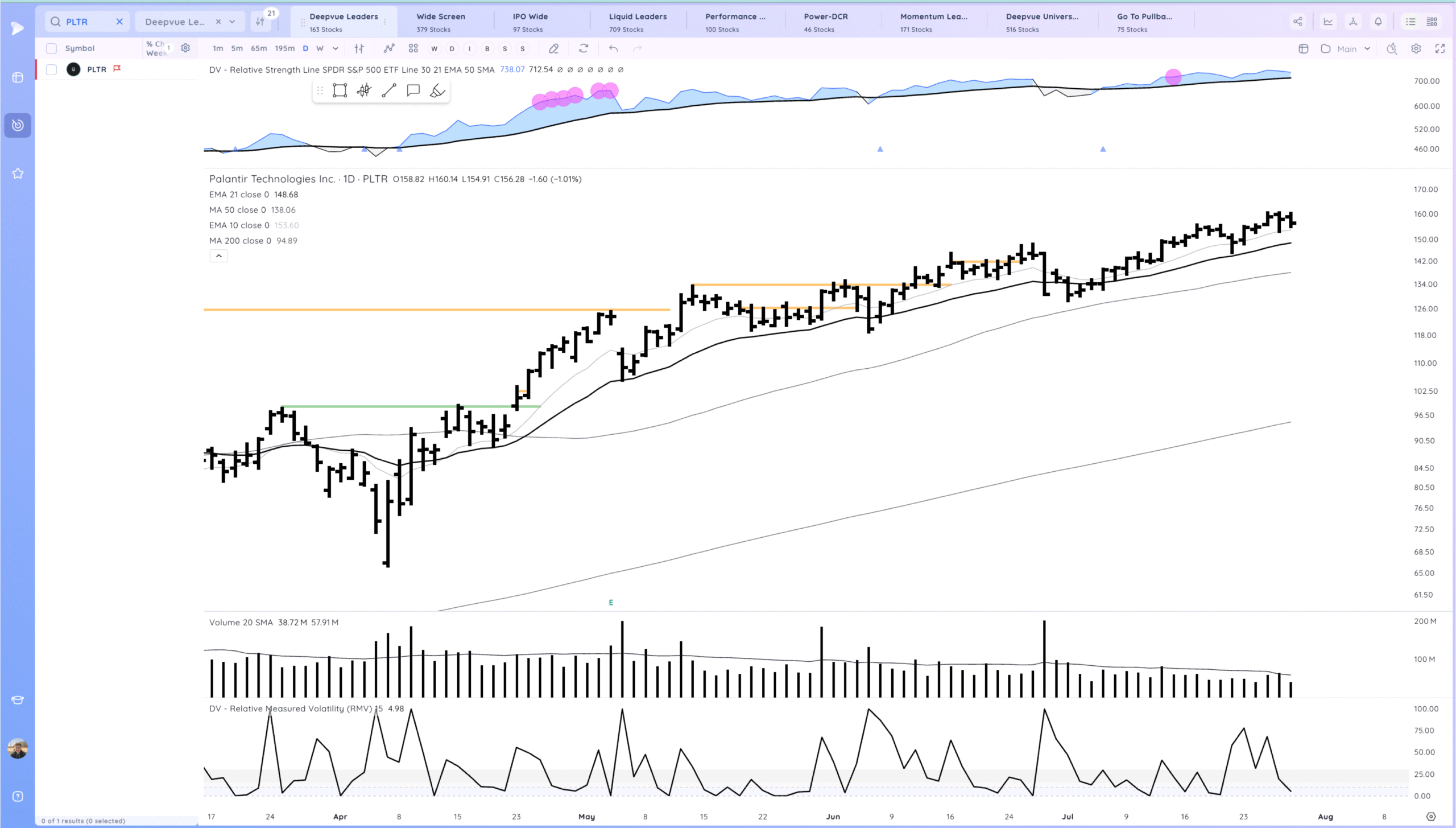

PLTR consolidation day, trending. if you own it not much to do. if you don’t there is no fresh setup. We are pulling back into the 10ema and consolidation pivot but later in the trend.

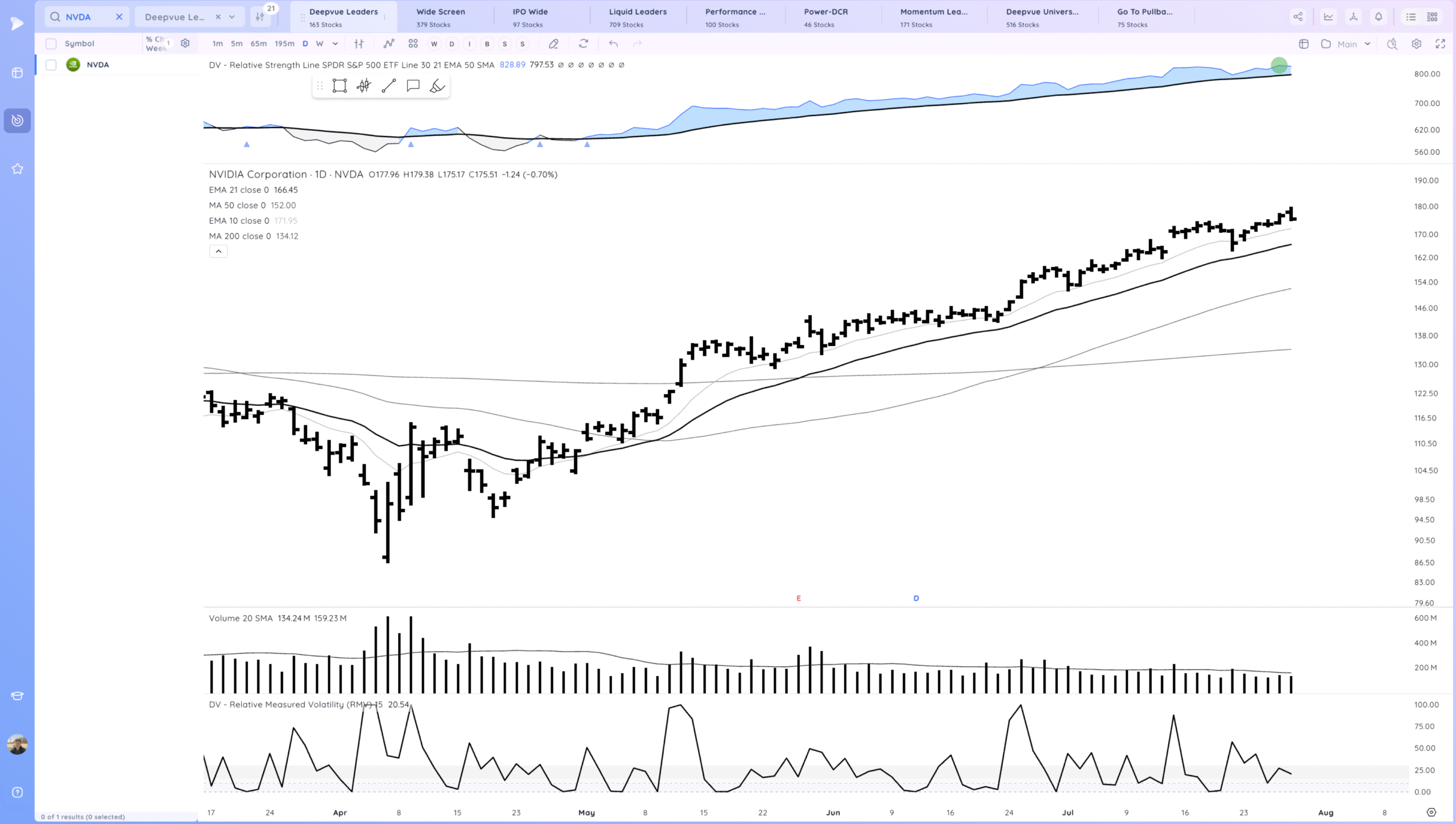

NVDA downside reversal. Trending above the MAs

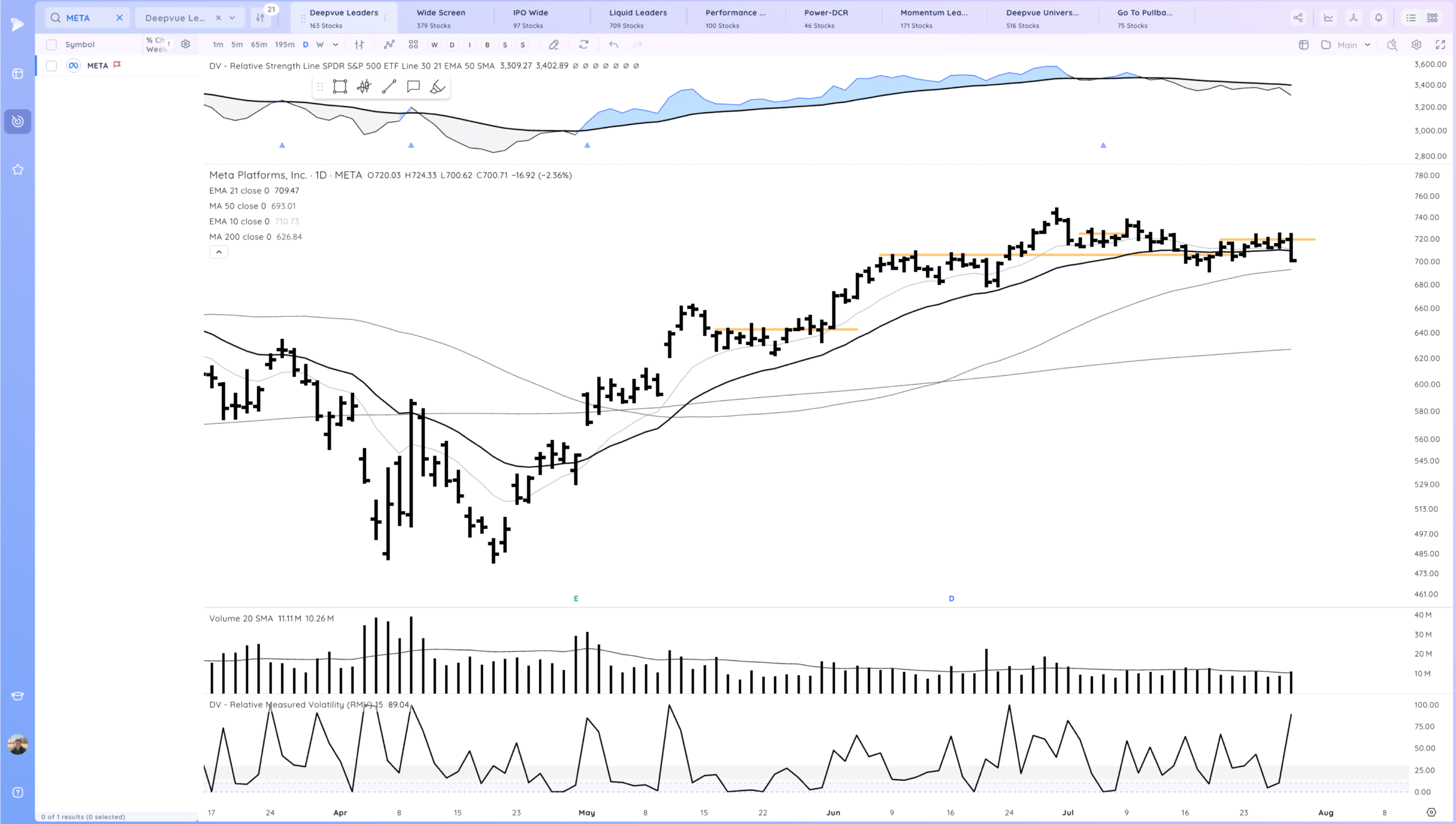

META 21 ema failure. First close below. watching how it acts versus the 50 day area

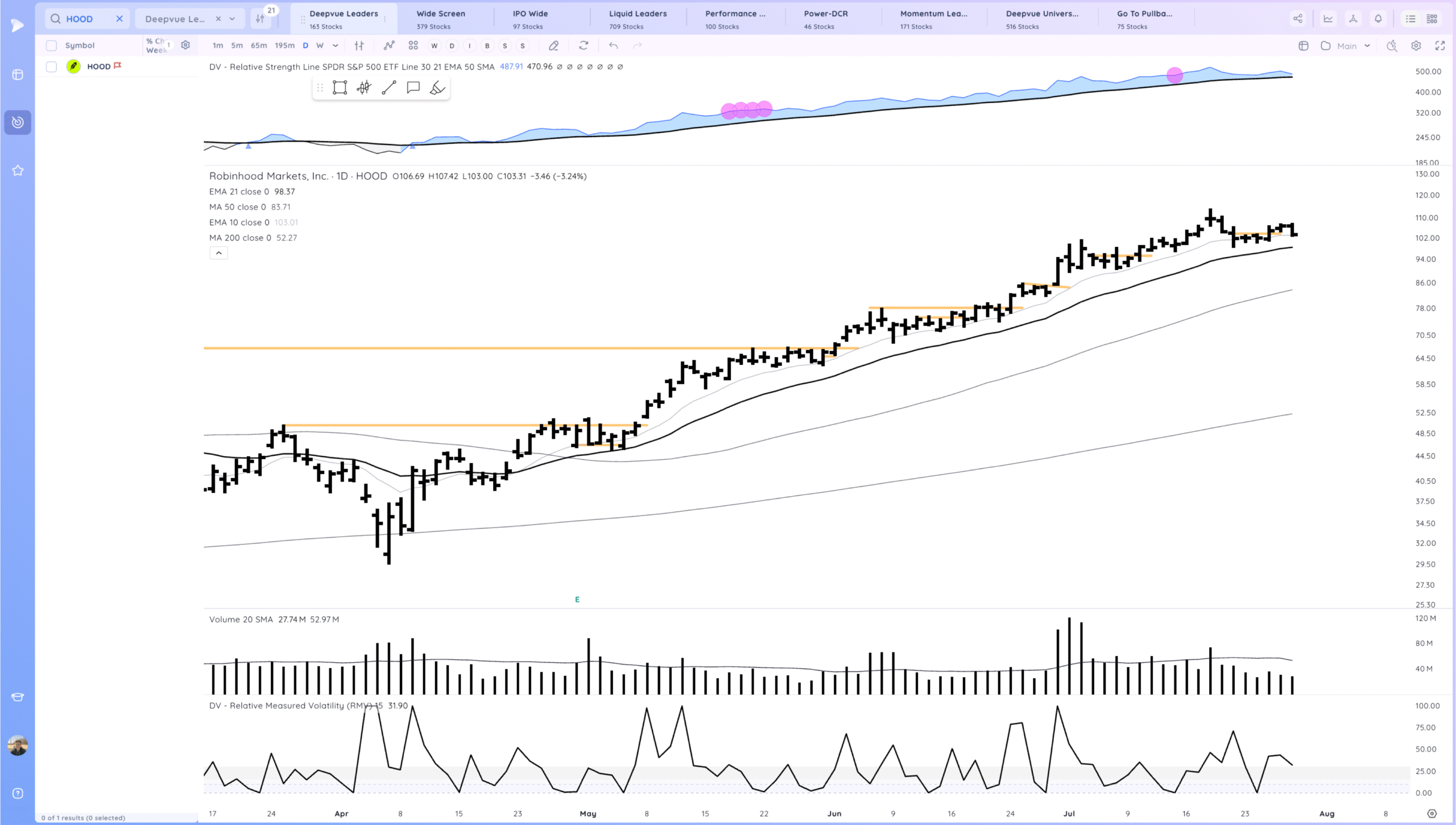

HOOD trending. move lower but no volume in it yet. Earnings tomorrow!

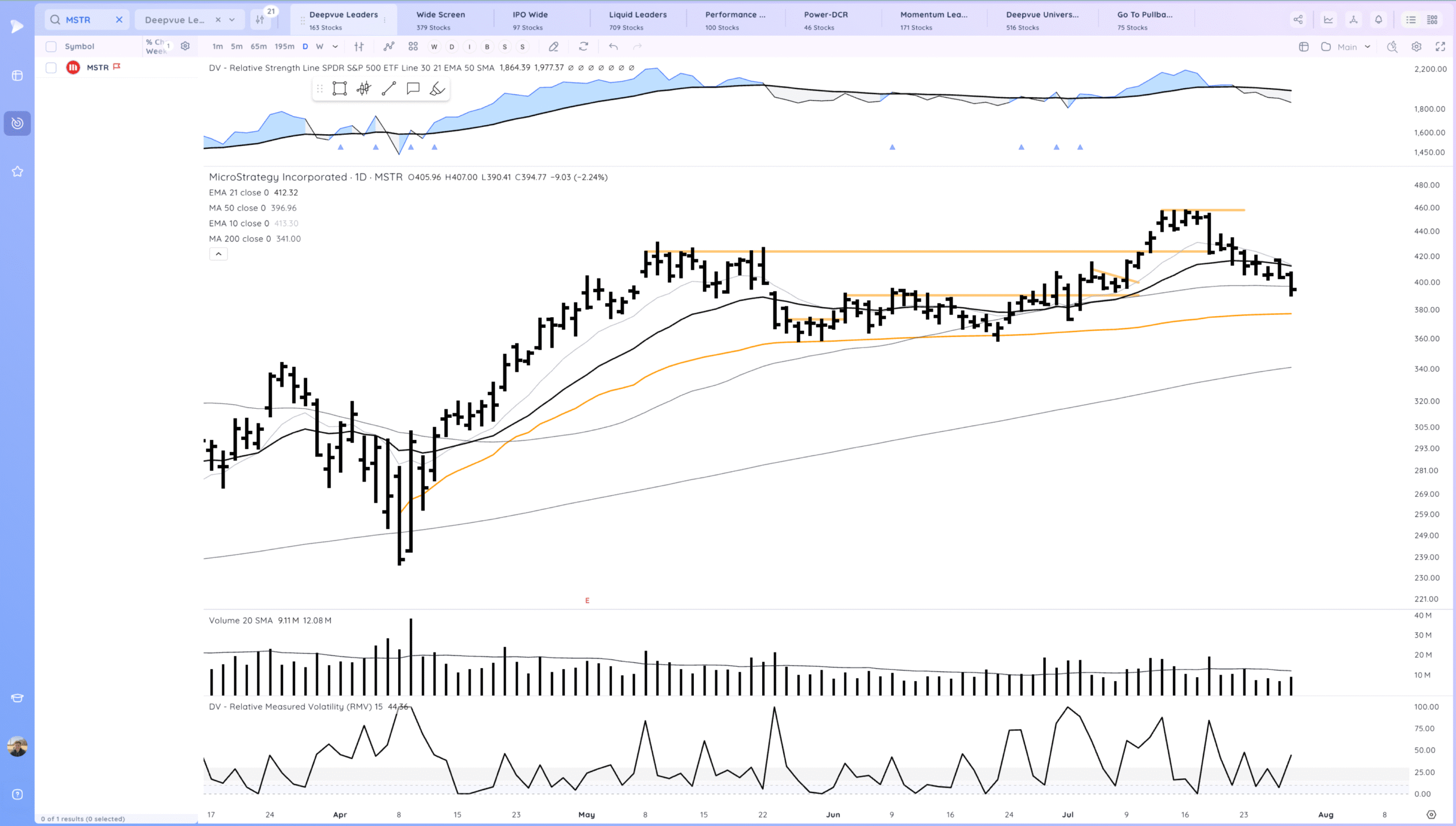

MSTR follow through lower

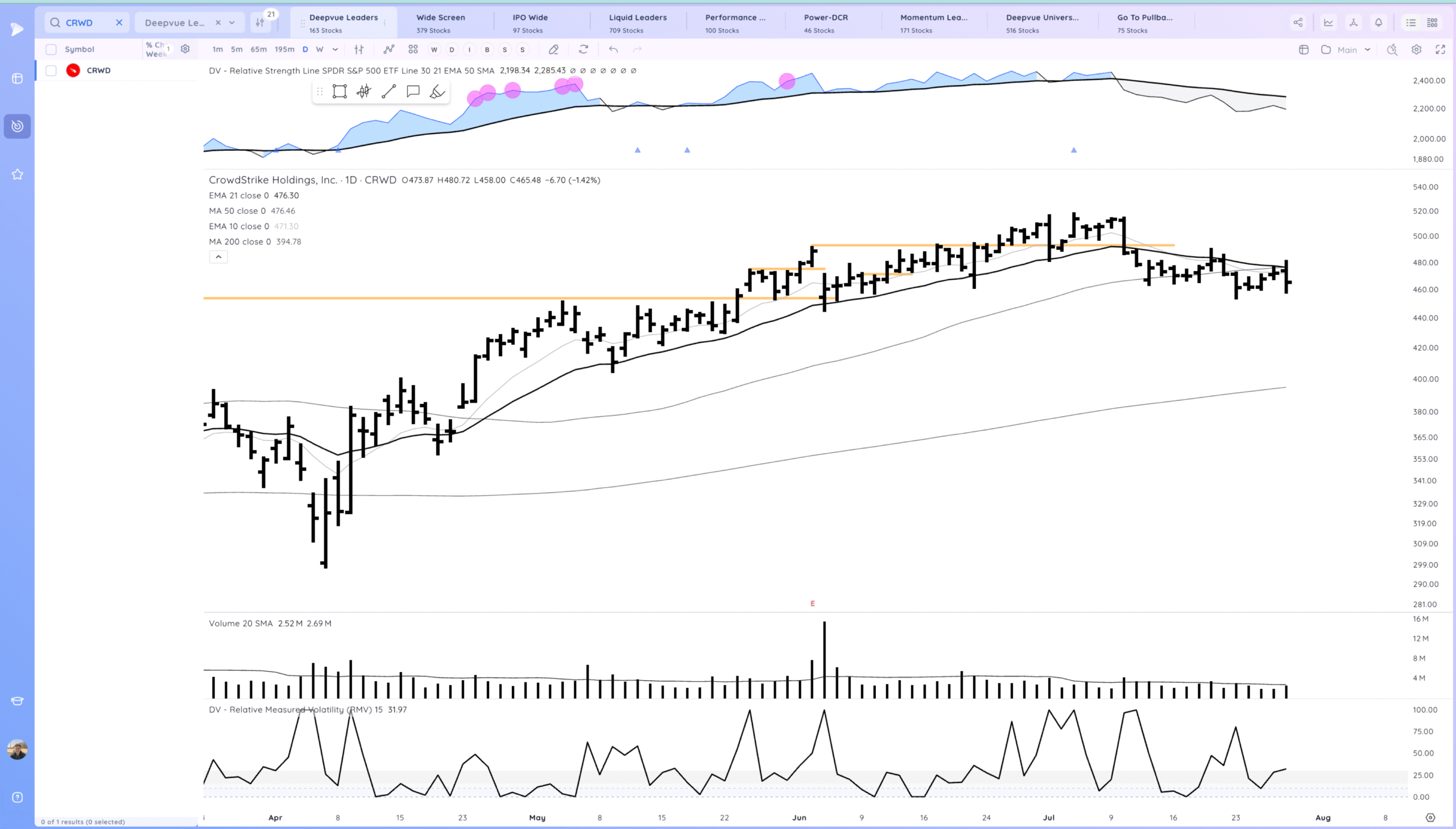

CRWD downside reversal and 2nd lower high at the 21ema

Key Moves

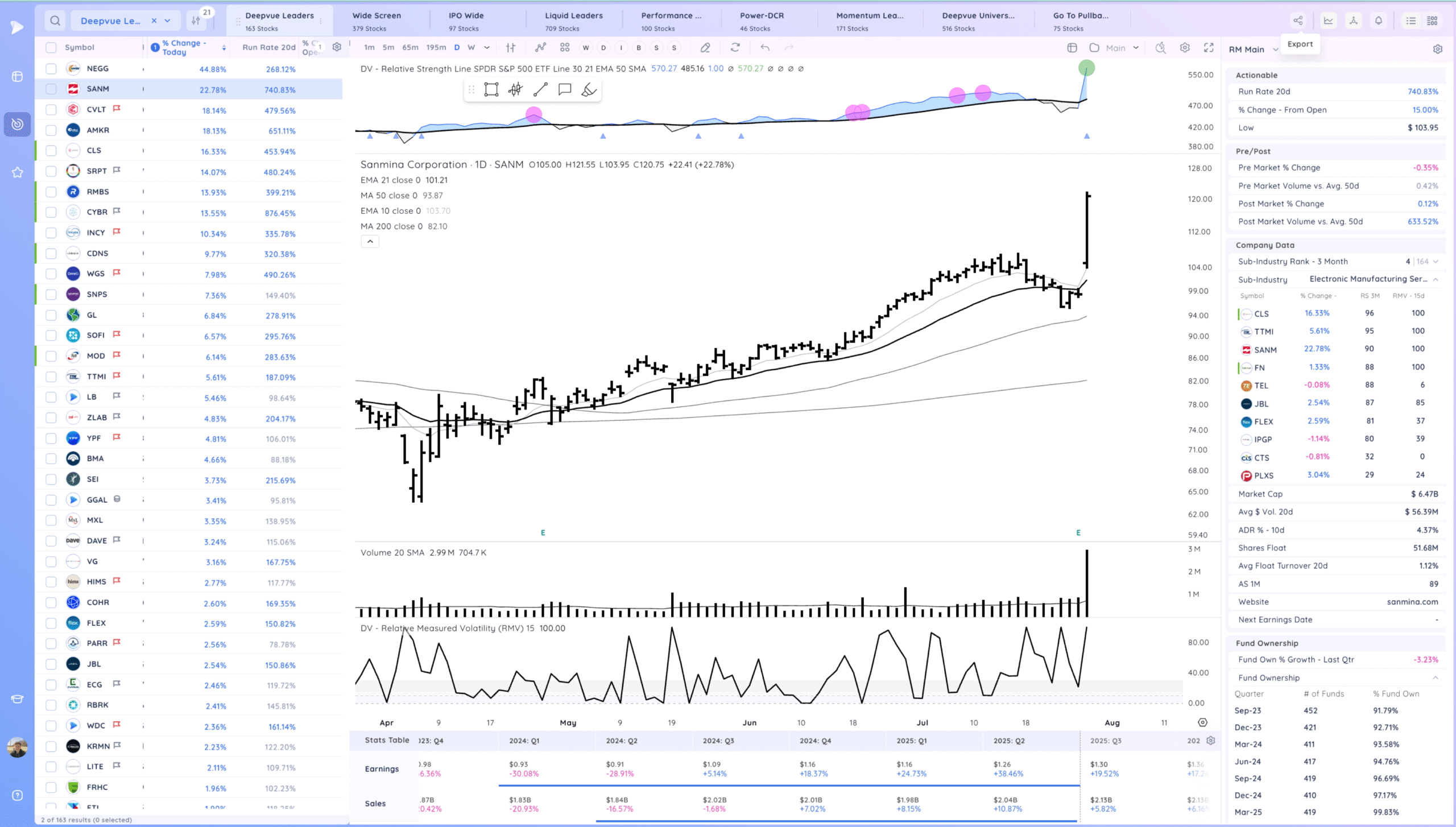

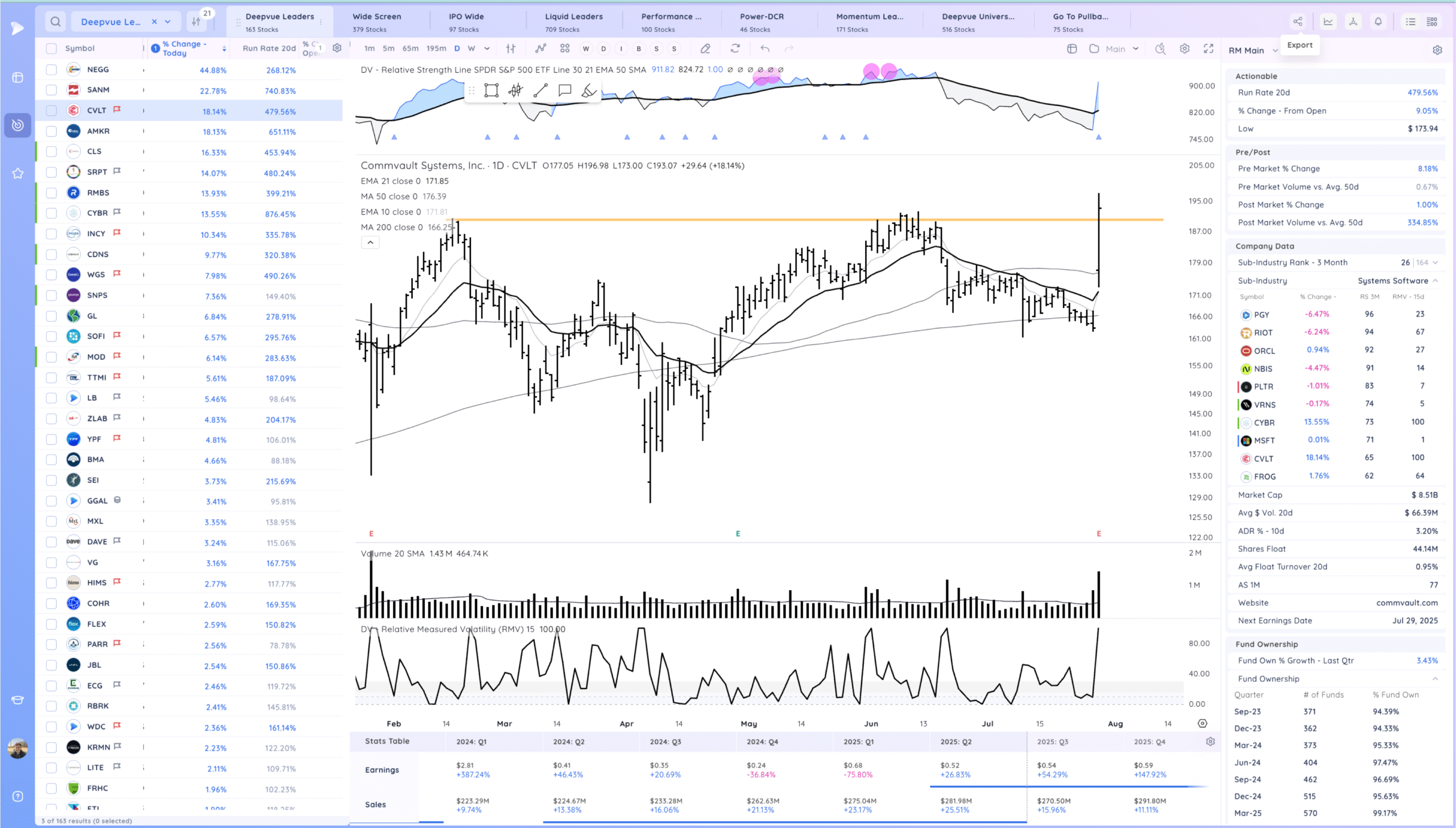

SANM significant earnings move can watch for follow on points. CLS also strong same industry

CVLT breaking out of a base after earnings

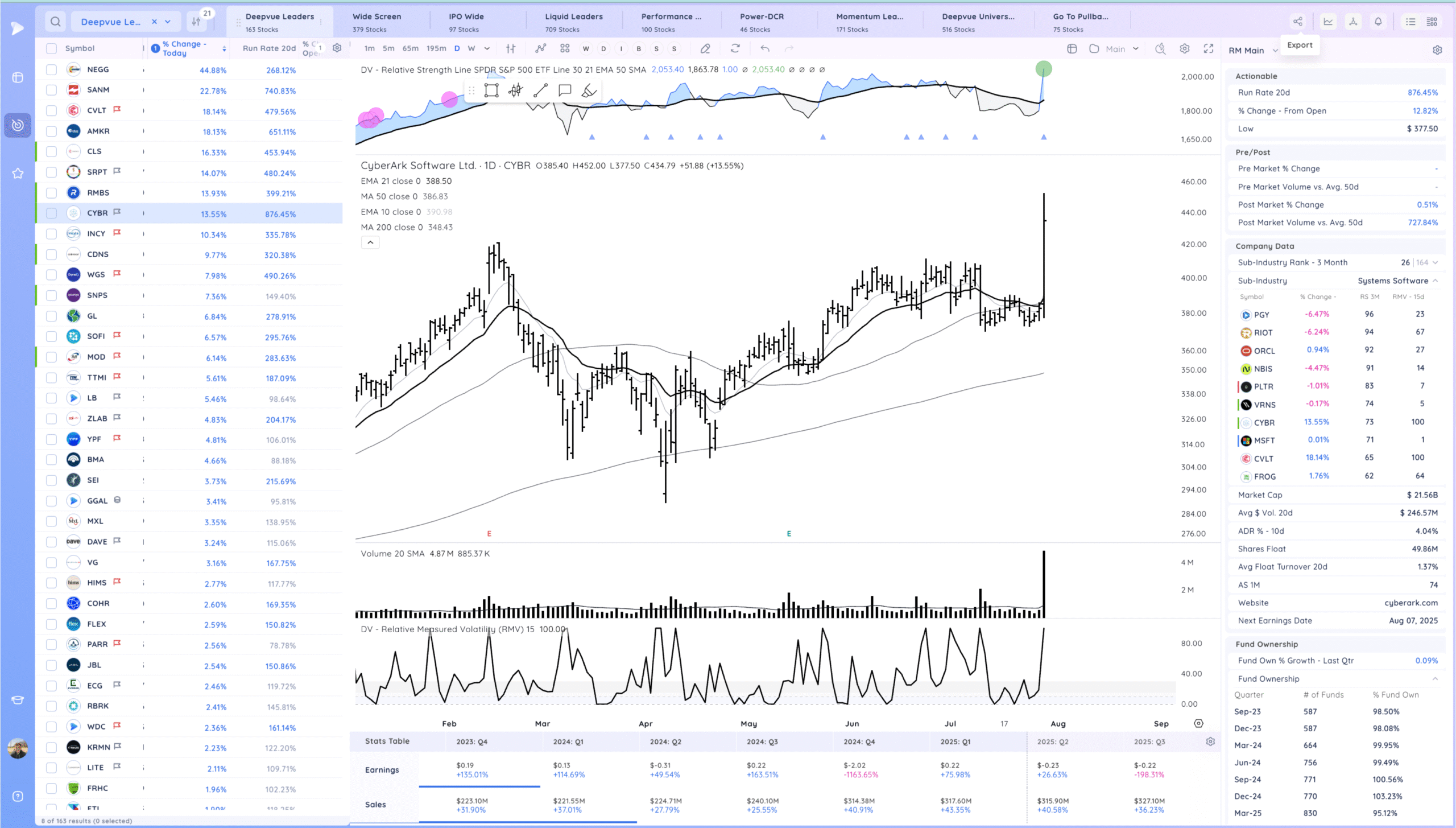

CYBR breakout on HV1

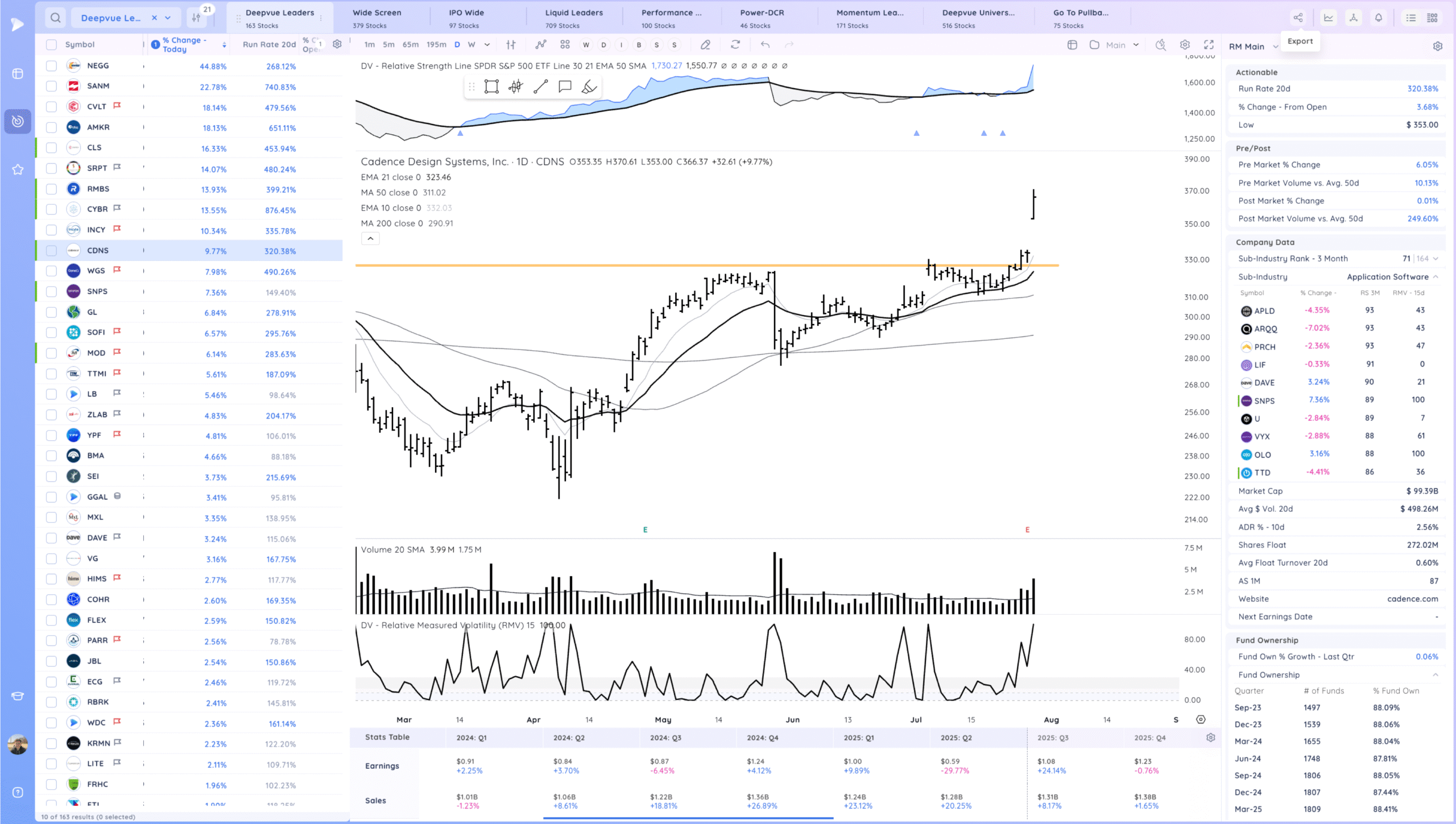

CDNS base breakout after earnings

Setups and Watchlist

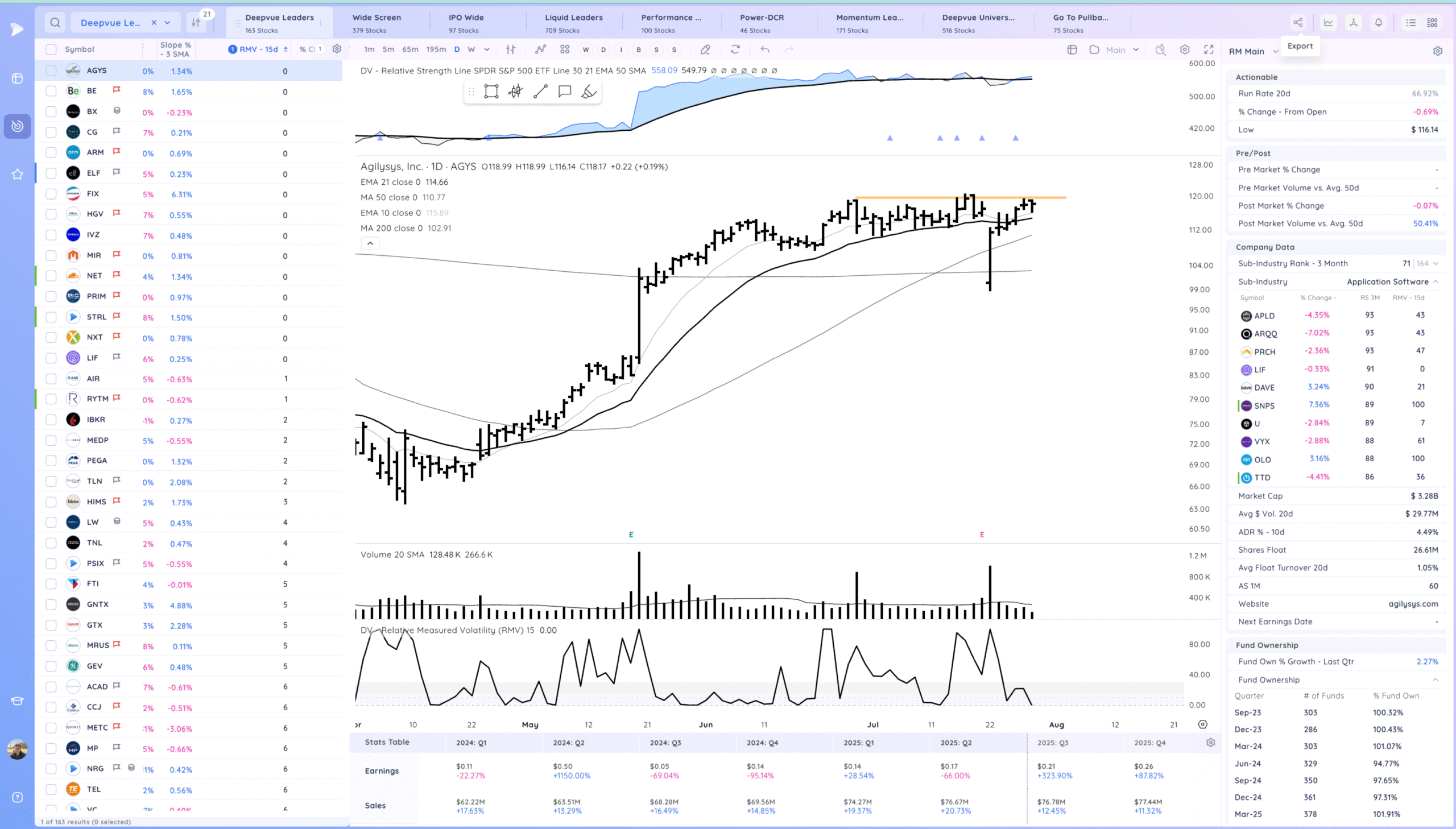

AGYS watching for a base breakout

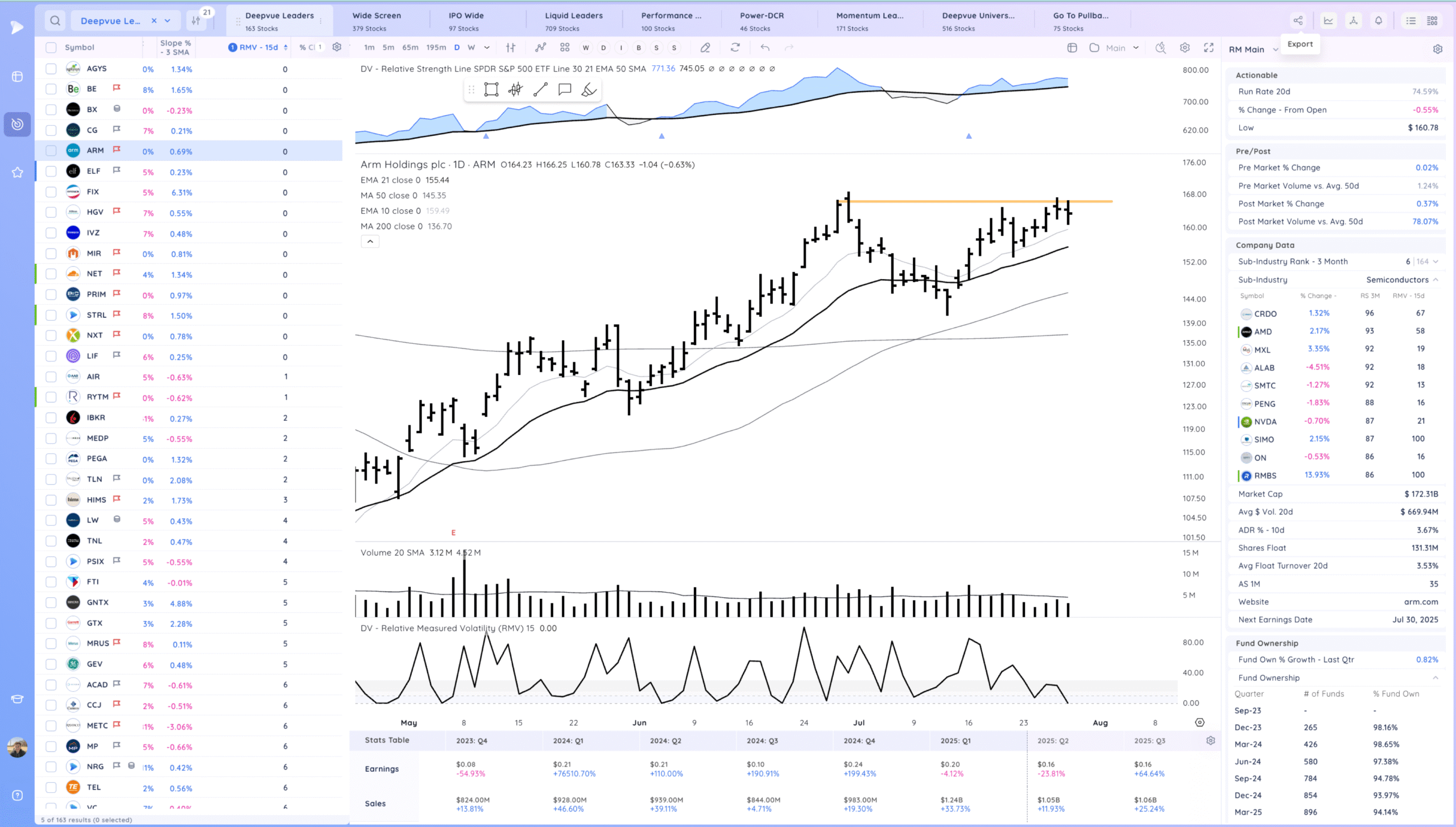

ARM watching for a consolidation breakout/ earnings move.

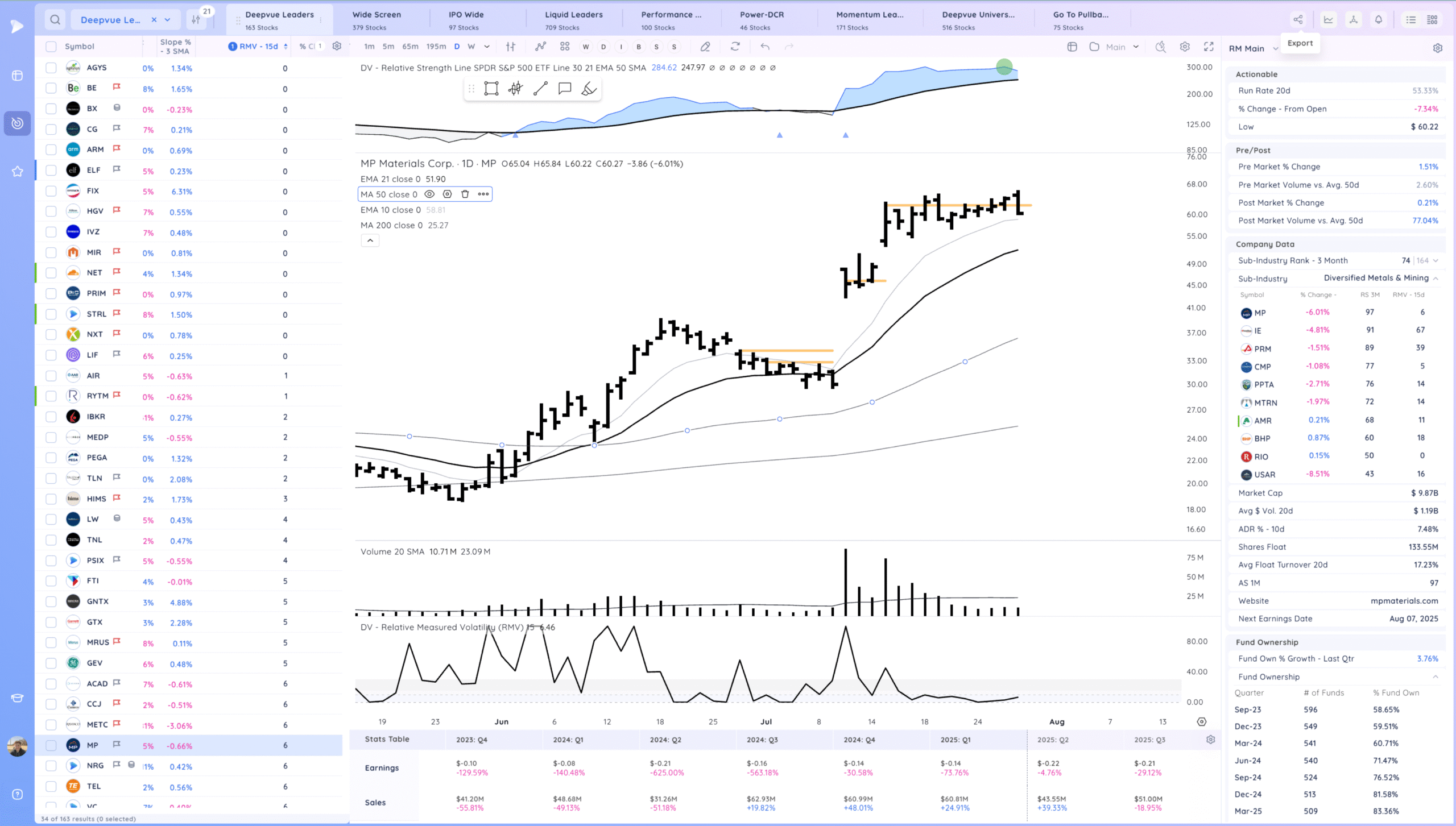

MP watching for an undercut and rally of the 10ema

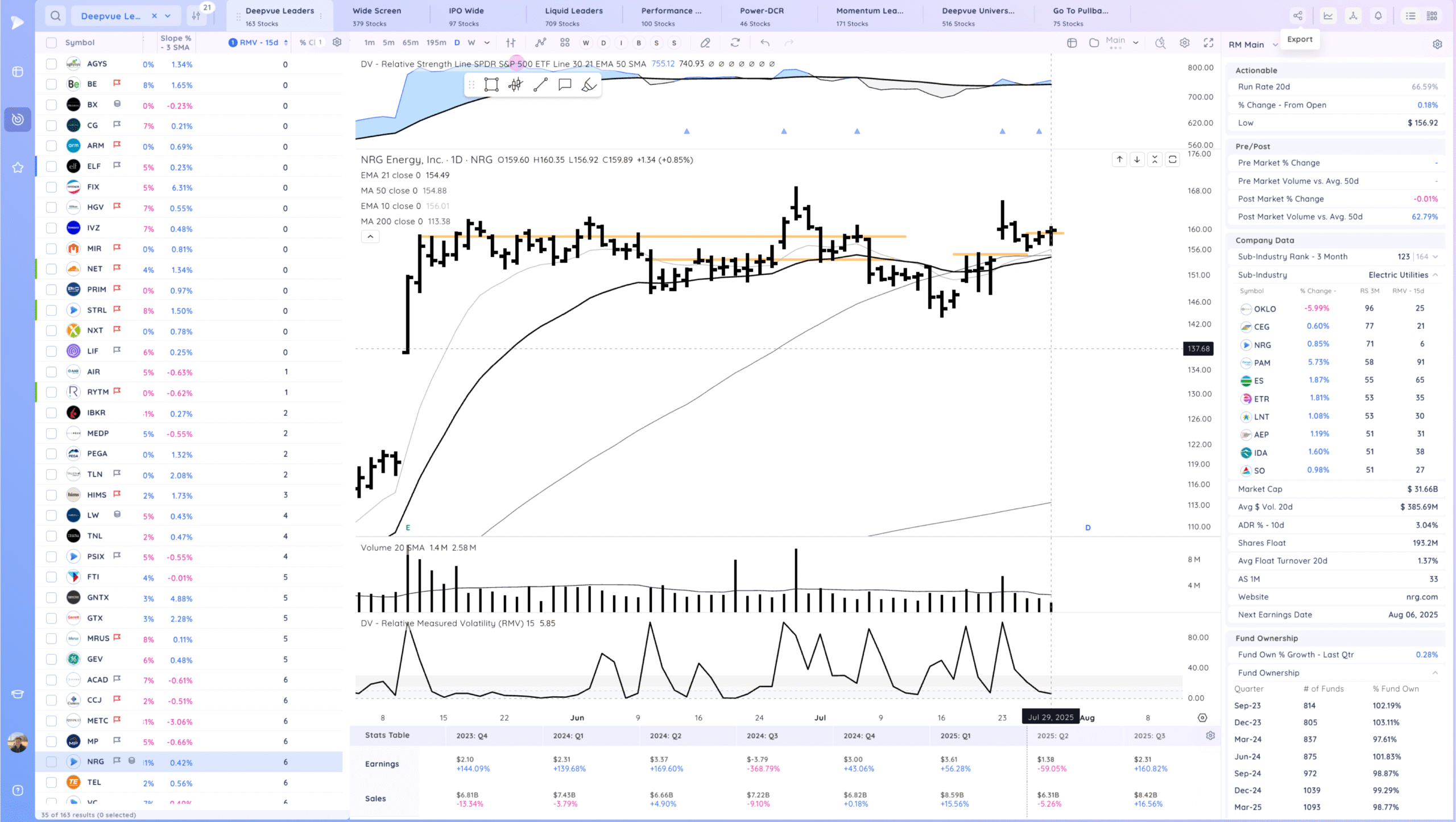

NRG watching for follow through up

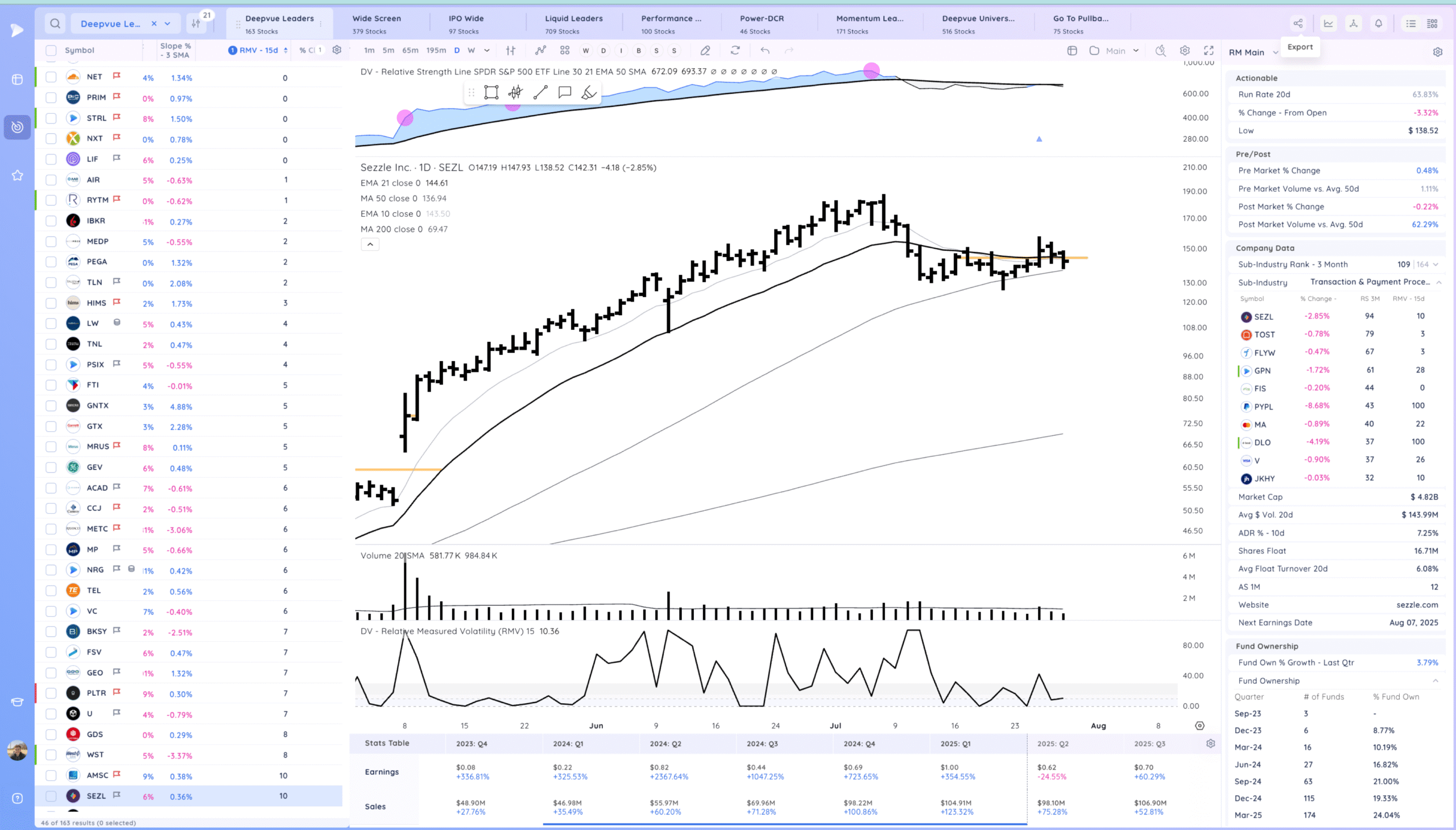

SEZL watching for a 21ema pop

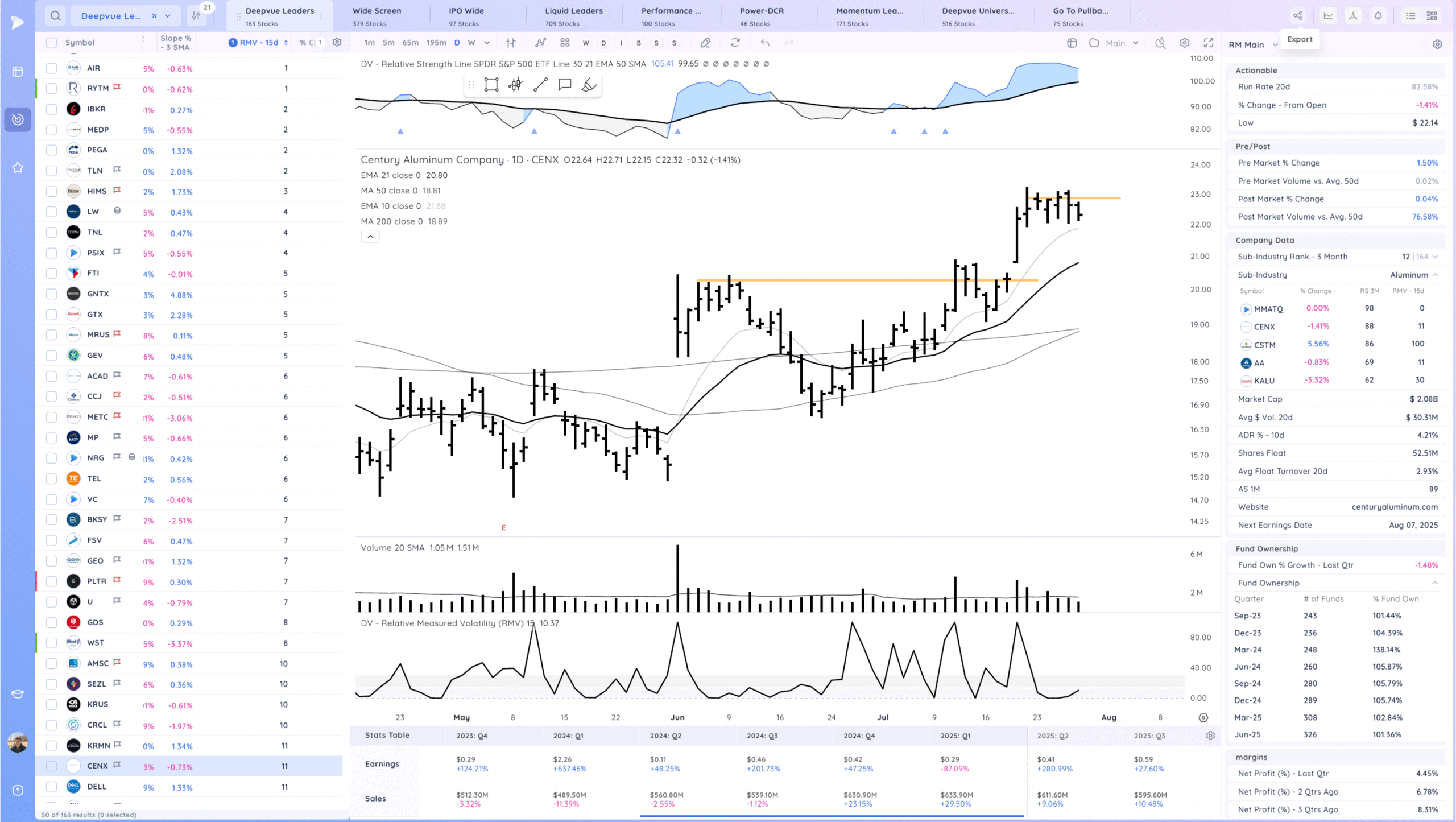

CENX watching for a range breakout

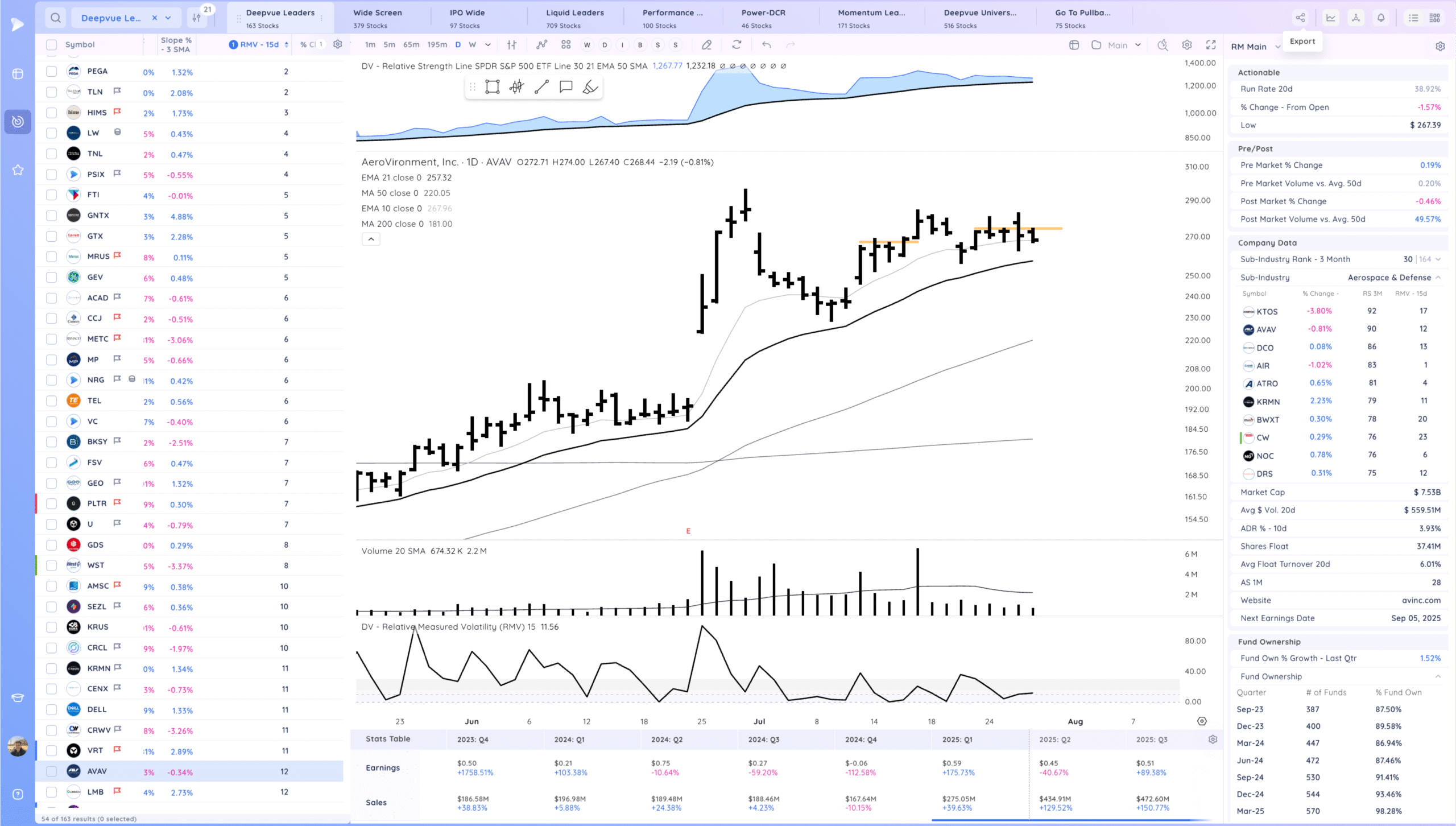

AVAV watching for a range re-breakout

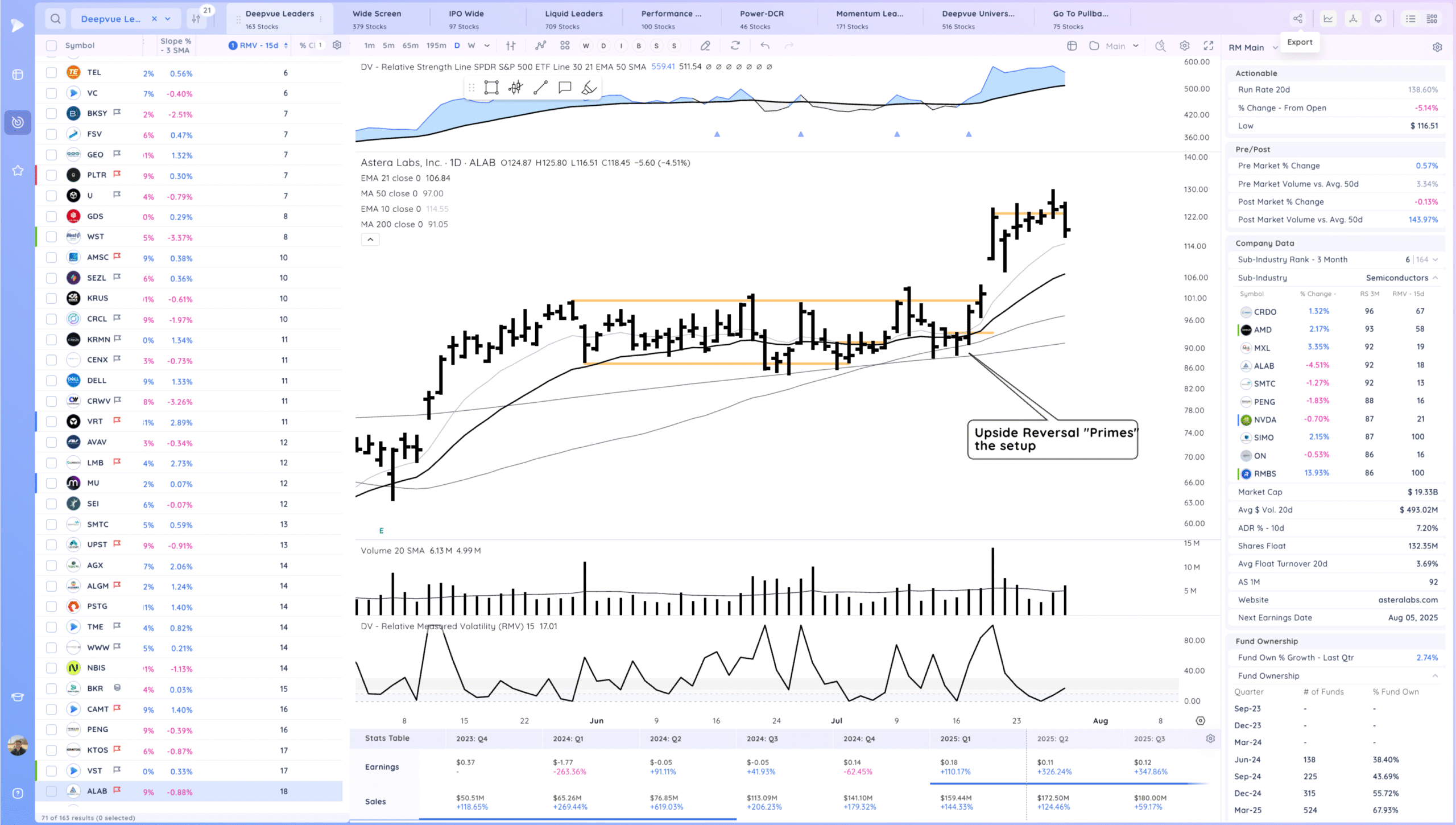

ALAB watching for an undercut and rally of the 10ema

Today’s Watchlist in List form

Focus List Names

AGYS ARM MP NRG SEZL CENX AVAV ALAB

Focus:

HOOD (Earnings) ARM MP ALAB

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

HOOD the key leader with earnings tomorrow. Will be a great gauge of risk appetite.

Anything can happen, Day by Day – Managing risk along the way