Market Coiled? Setups into Next Week

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 16, 2025

Market Action

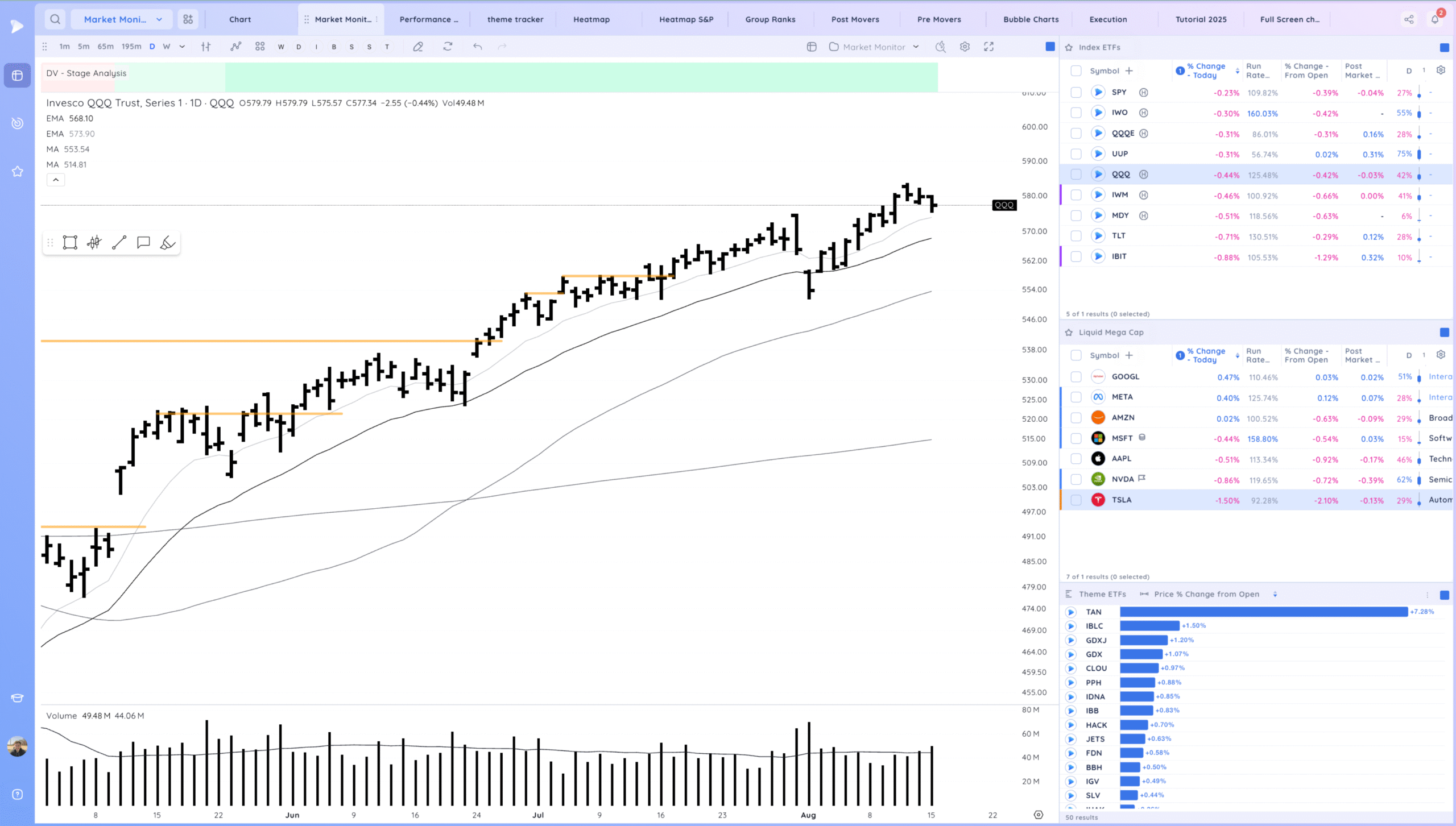

QQQ – Pulling back into the 10ema area but overall trending above the moving averages.

Bulls want to see us respect and continue to trend above the 10ema

Bears want to see us break lower or experience a large downside reversal

Daily Chart of the QQQ.

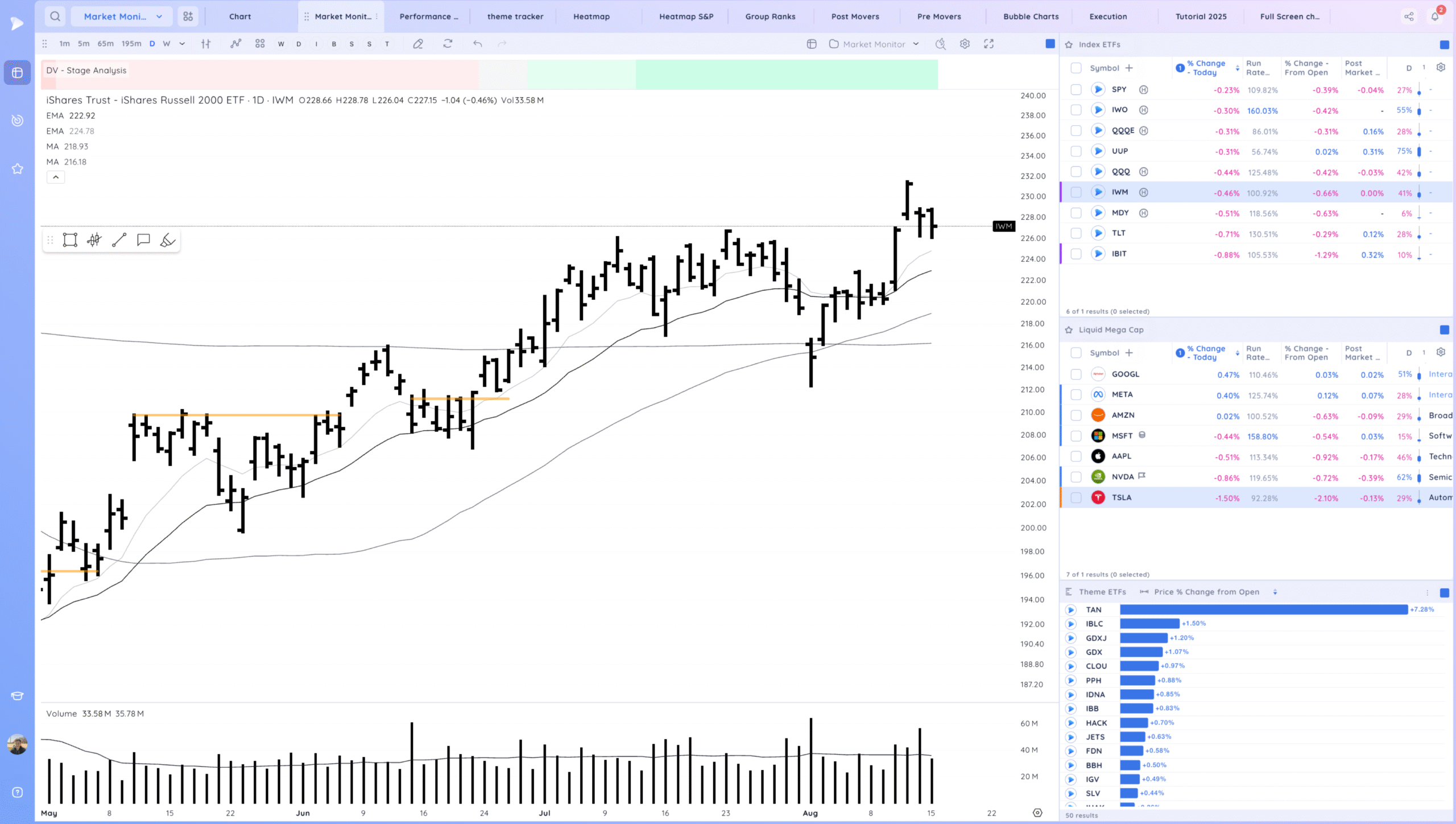

IWM – Has been powerful since the Aug 1 upside reversal. consolidating the past 2 days

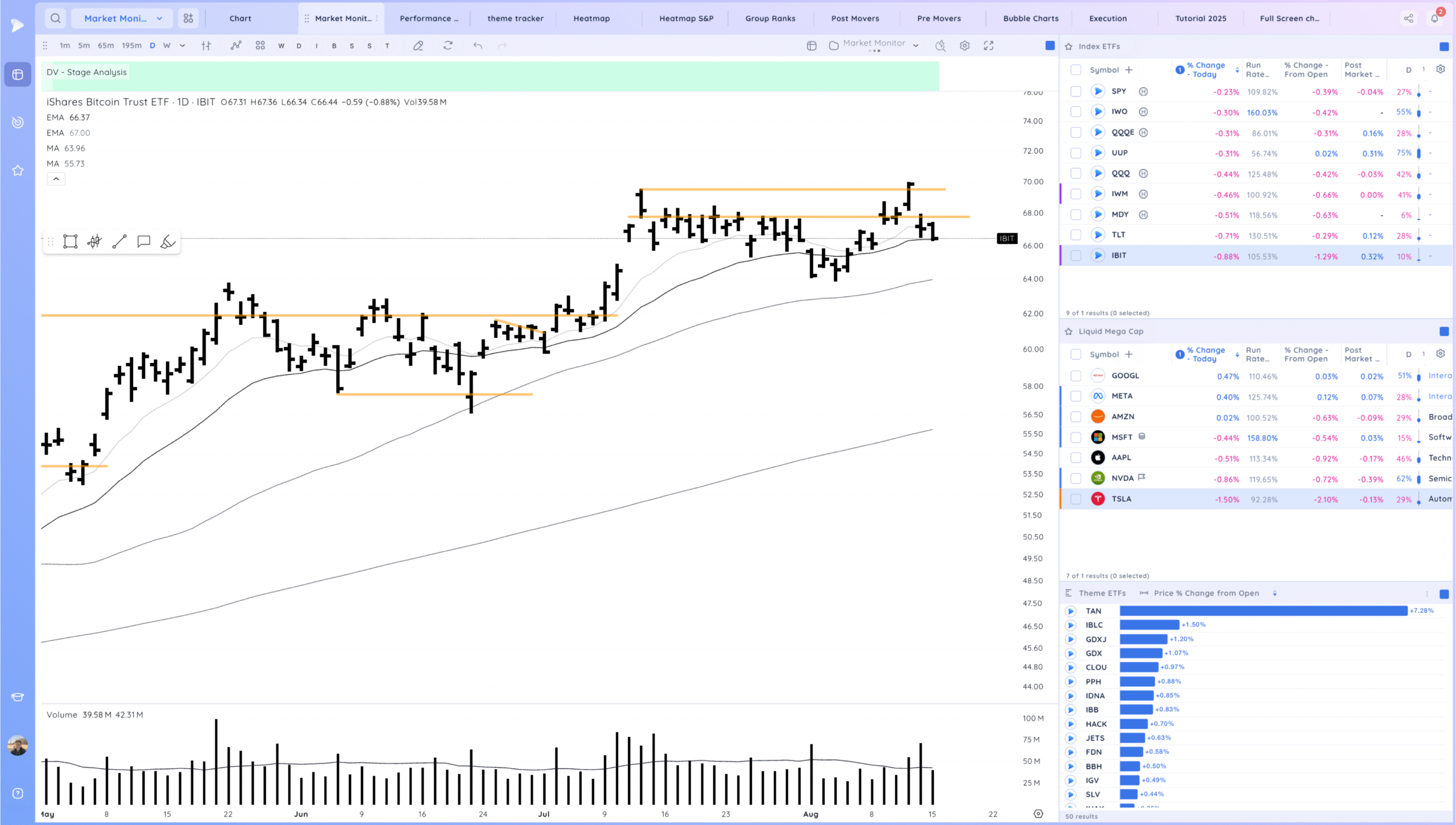

IBIT – negative expectation breaker with the gap down Thursday. Now testing the 21ema. Want to see this hold and build more of the right side of this consolidation

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

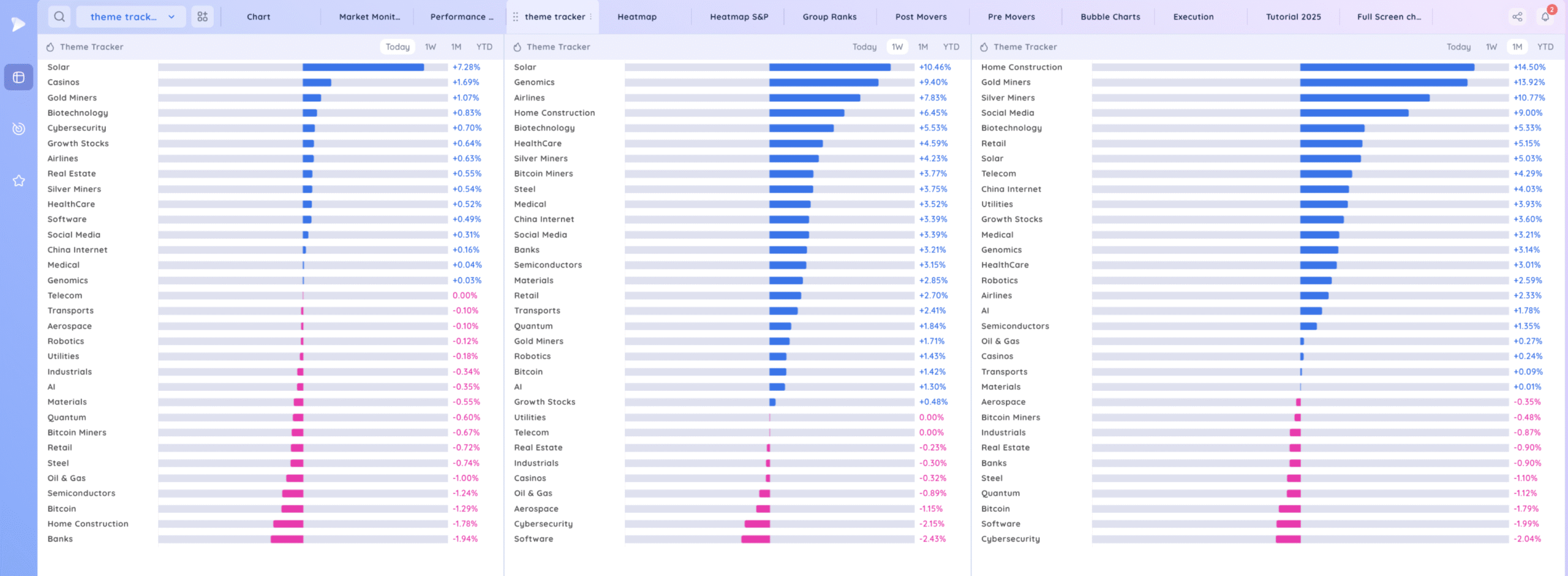

Groups/Sectors

Deepvue Theme Tracker

Deepvue Leaders Heatmap

S&P 500.

Leadership

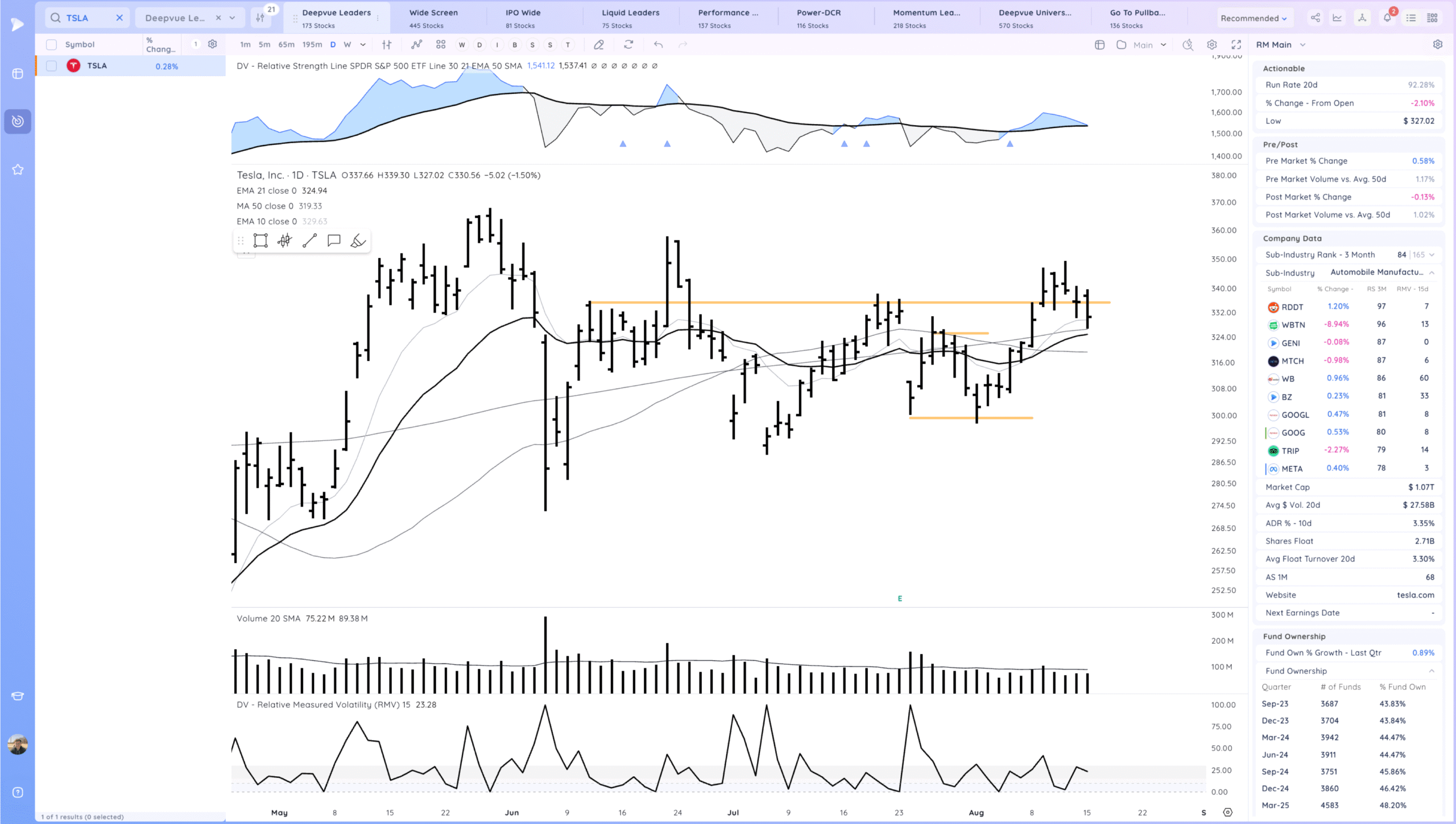

TSLA pulling in over the past week. Want to see it respect the 21ema area and resume higher

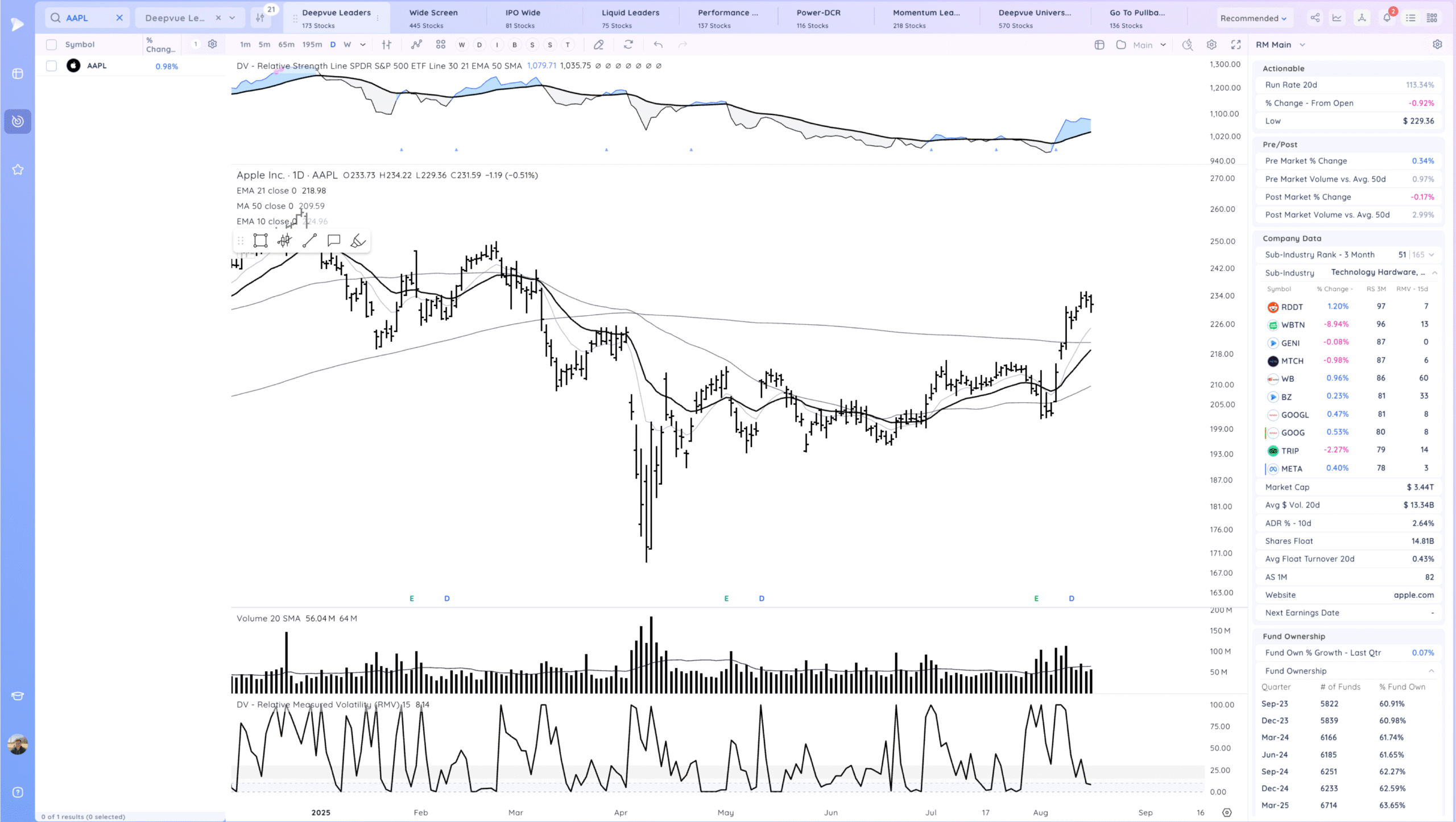

AAPL back above the 200sma and moving up the right side of a larger structure

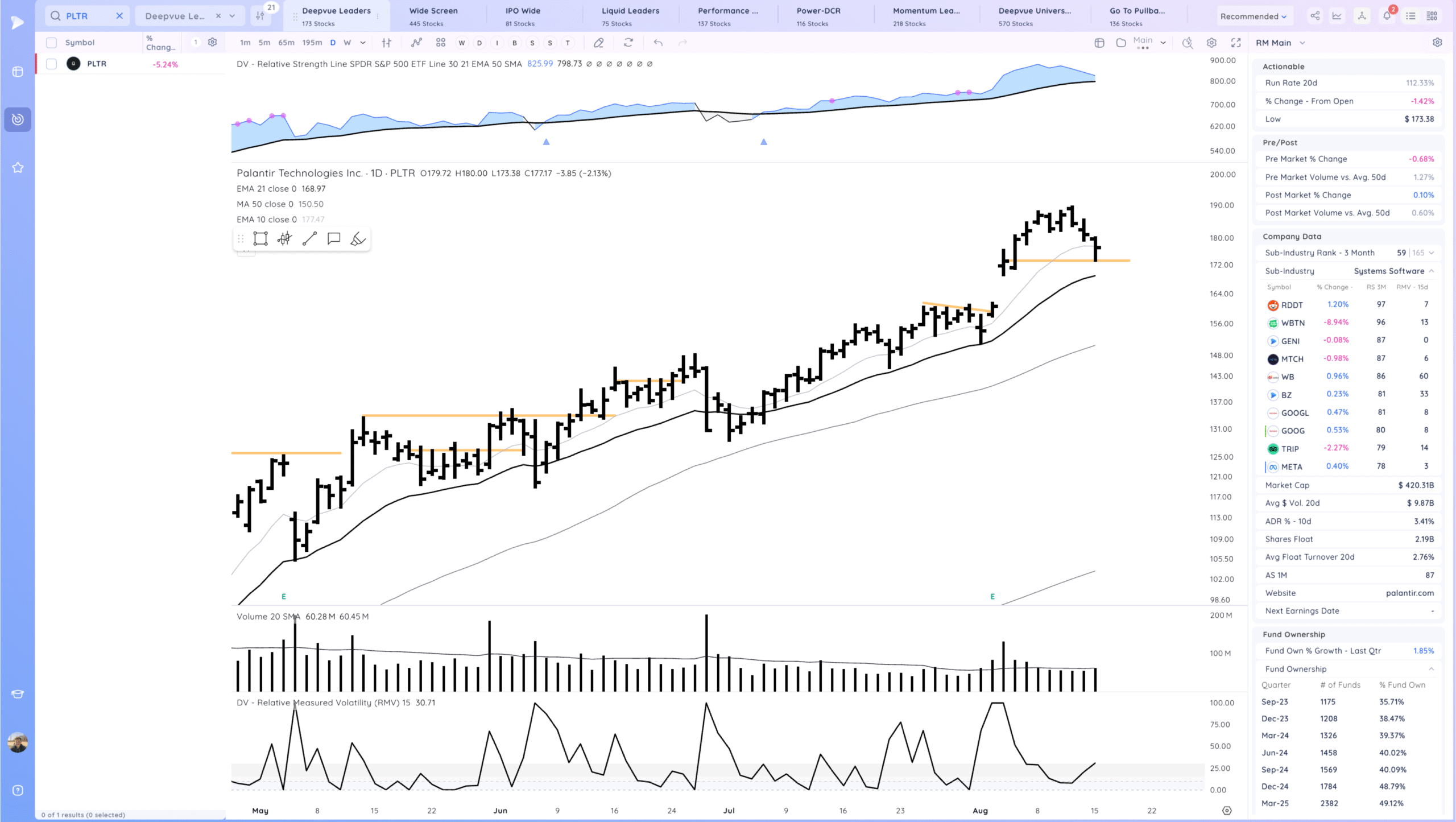

PLTR Want to see it hold the HVC area. Longer term uptrend

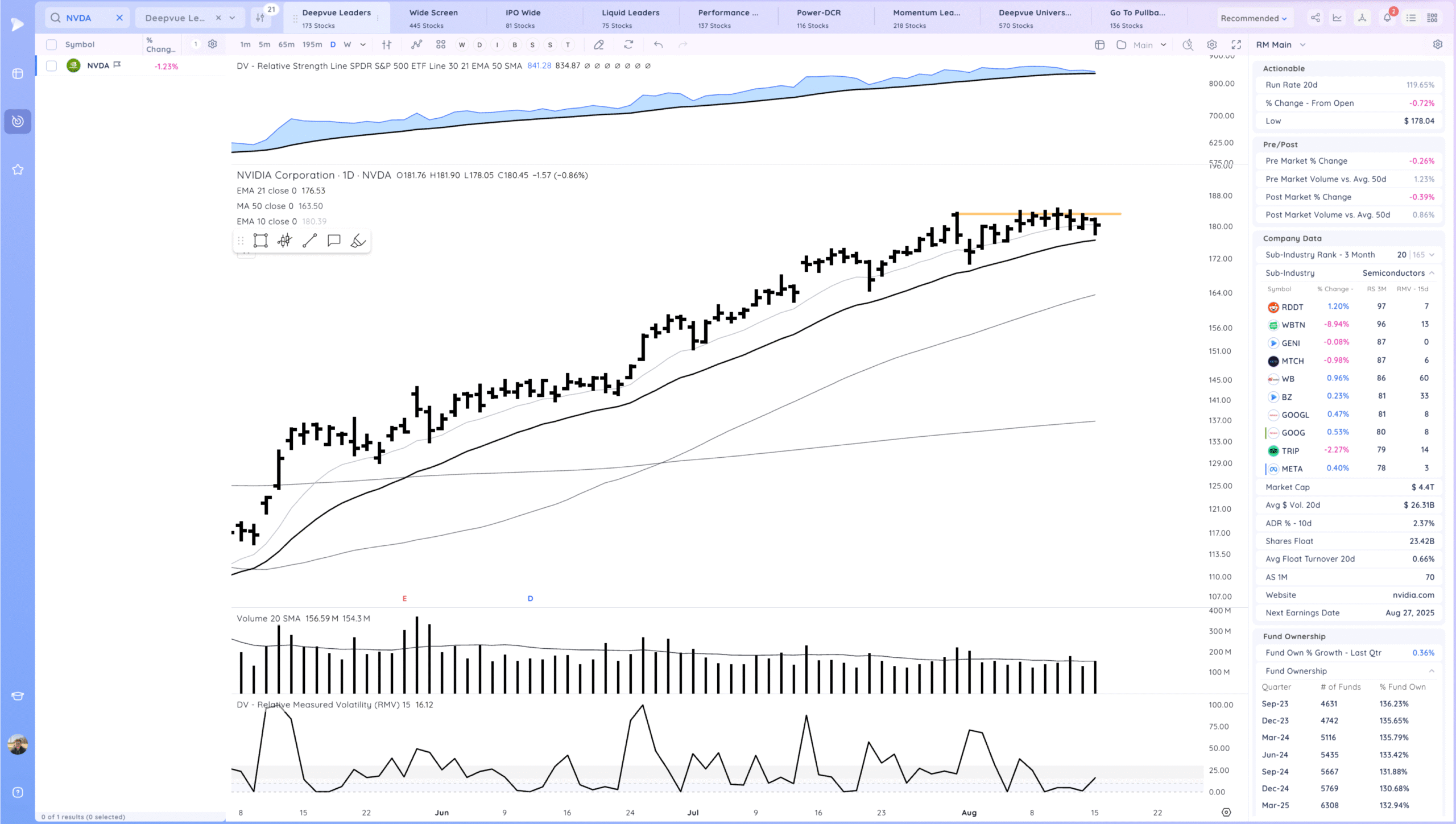

NVDA tightening against the 10 and 21 emas

META acting well since the gap up. Downside reversal friday

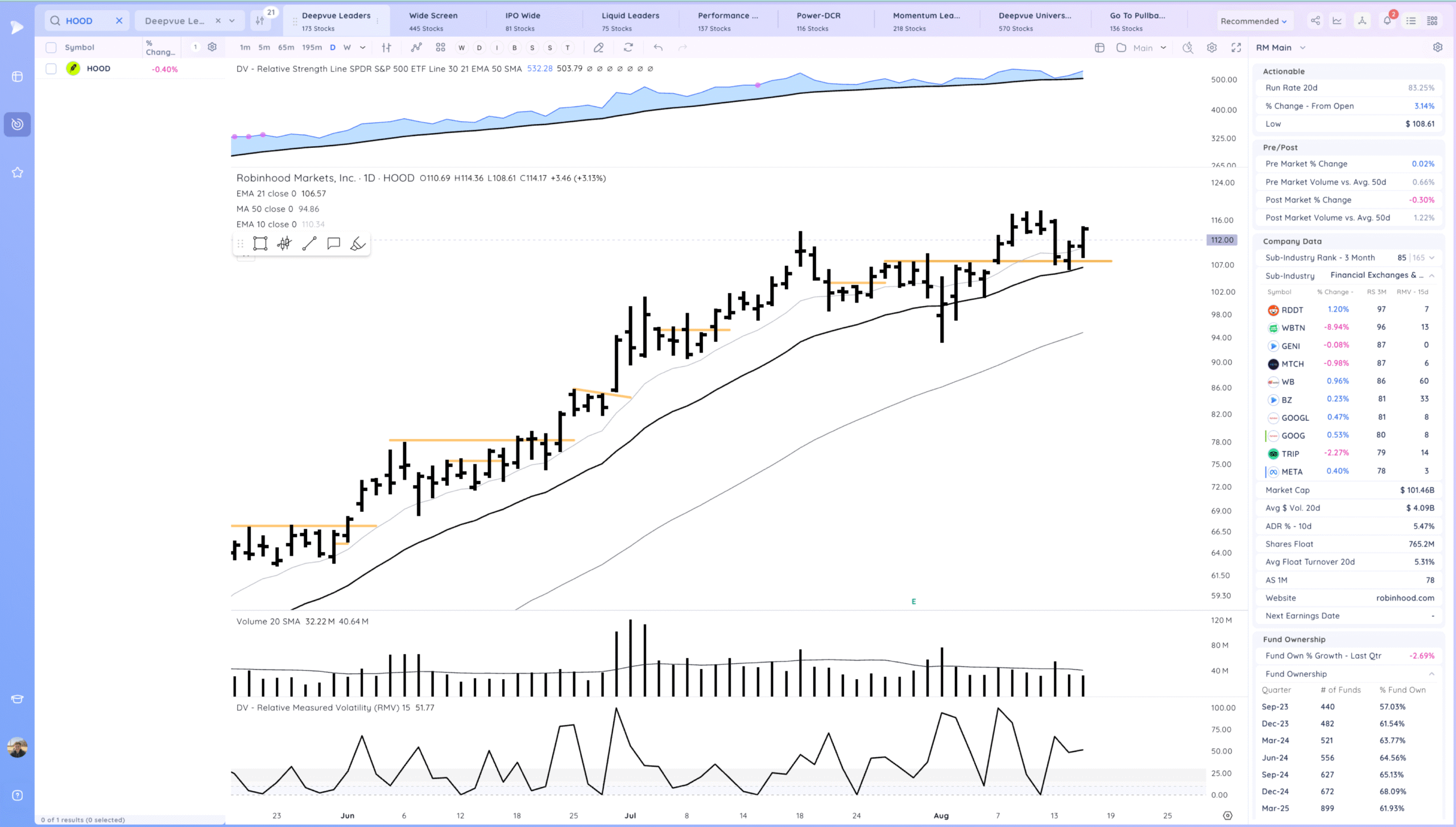

HOOD respect for the 21ema a day ago. Trending

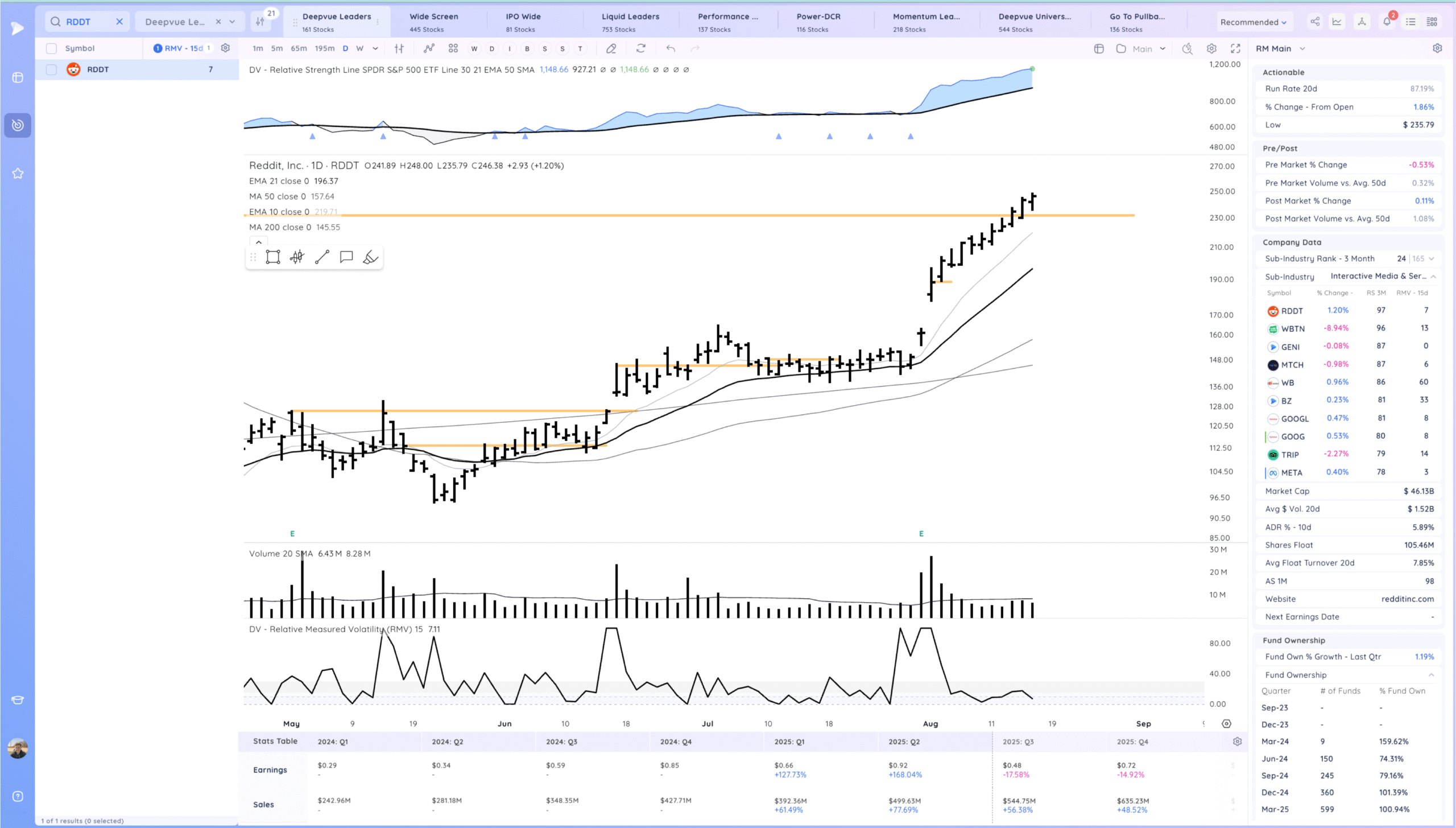

RDDT strong trend since the eps gap. New highs

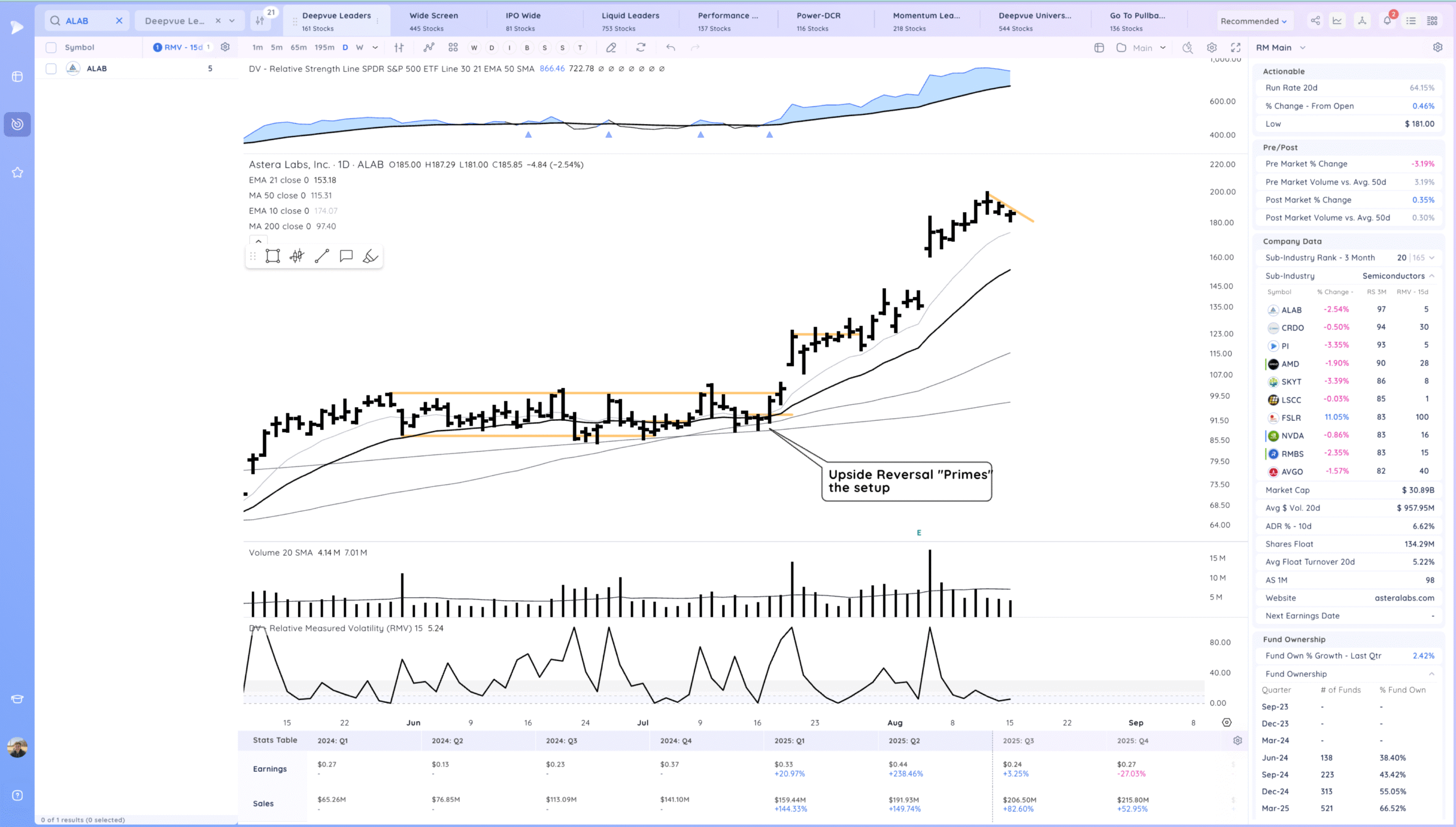

ALAB trending. Short term flag. Could pull in more and still be healthy. 10ema is the moving average of note for now.

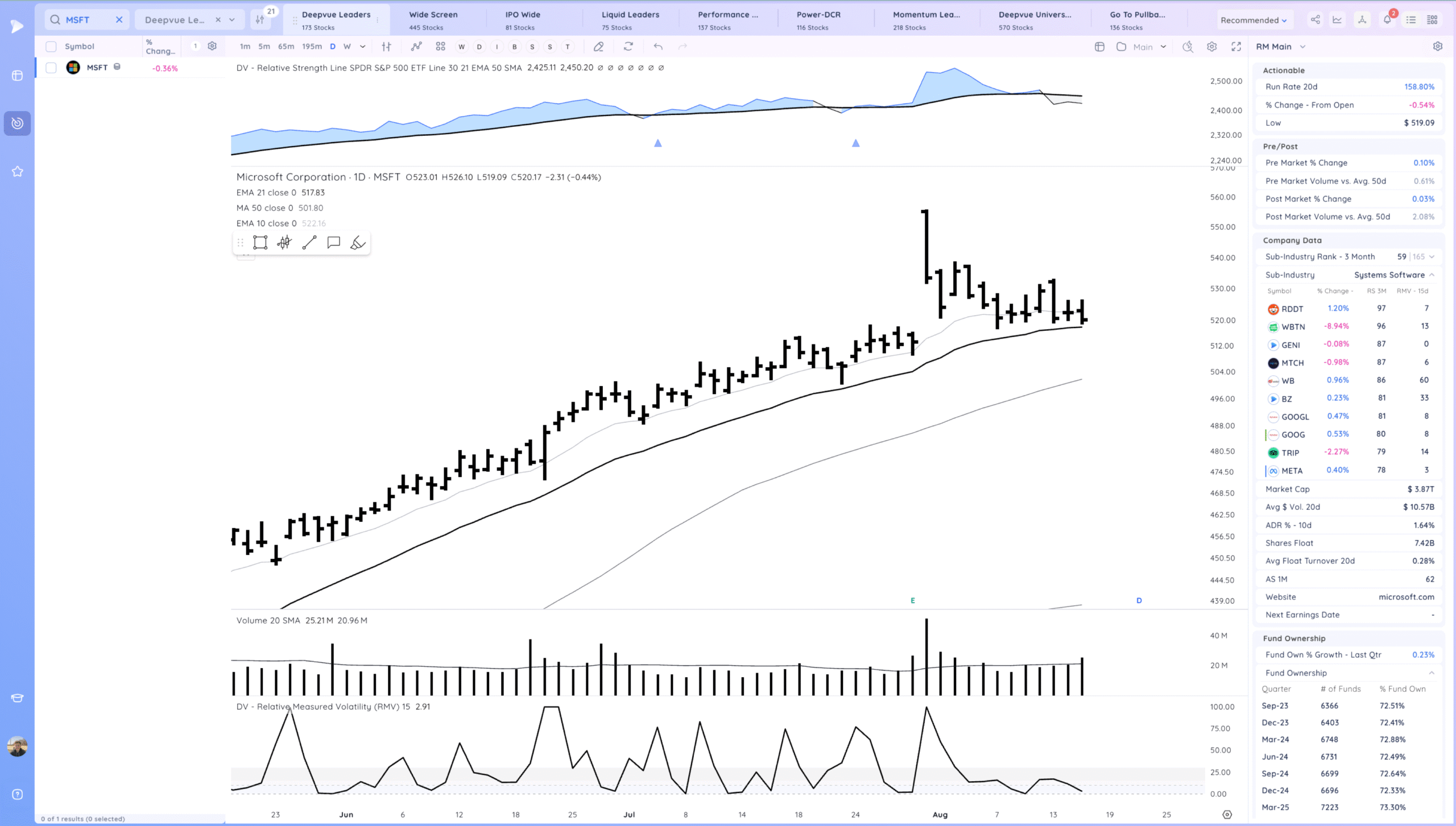

MSFT has pulled back since the earnings reversal lower but holding the 21ema

Key Moves

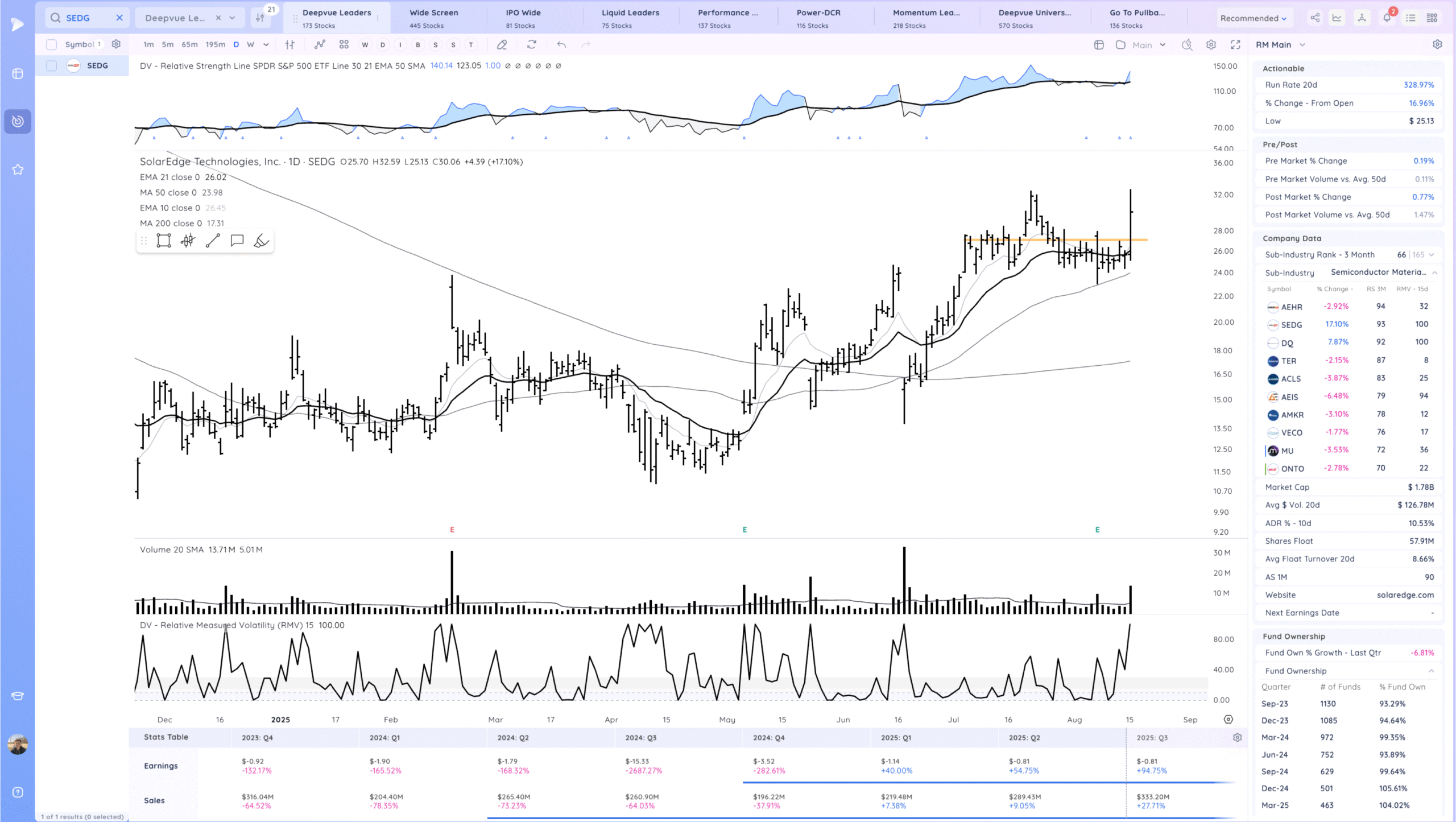

SEDG strong push on volume with Solar Theme. Overall this is still forming a bottom of a trend

Setups and Watchlist

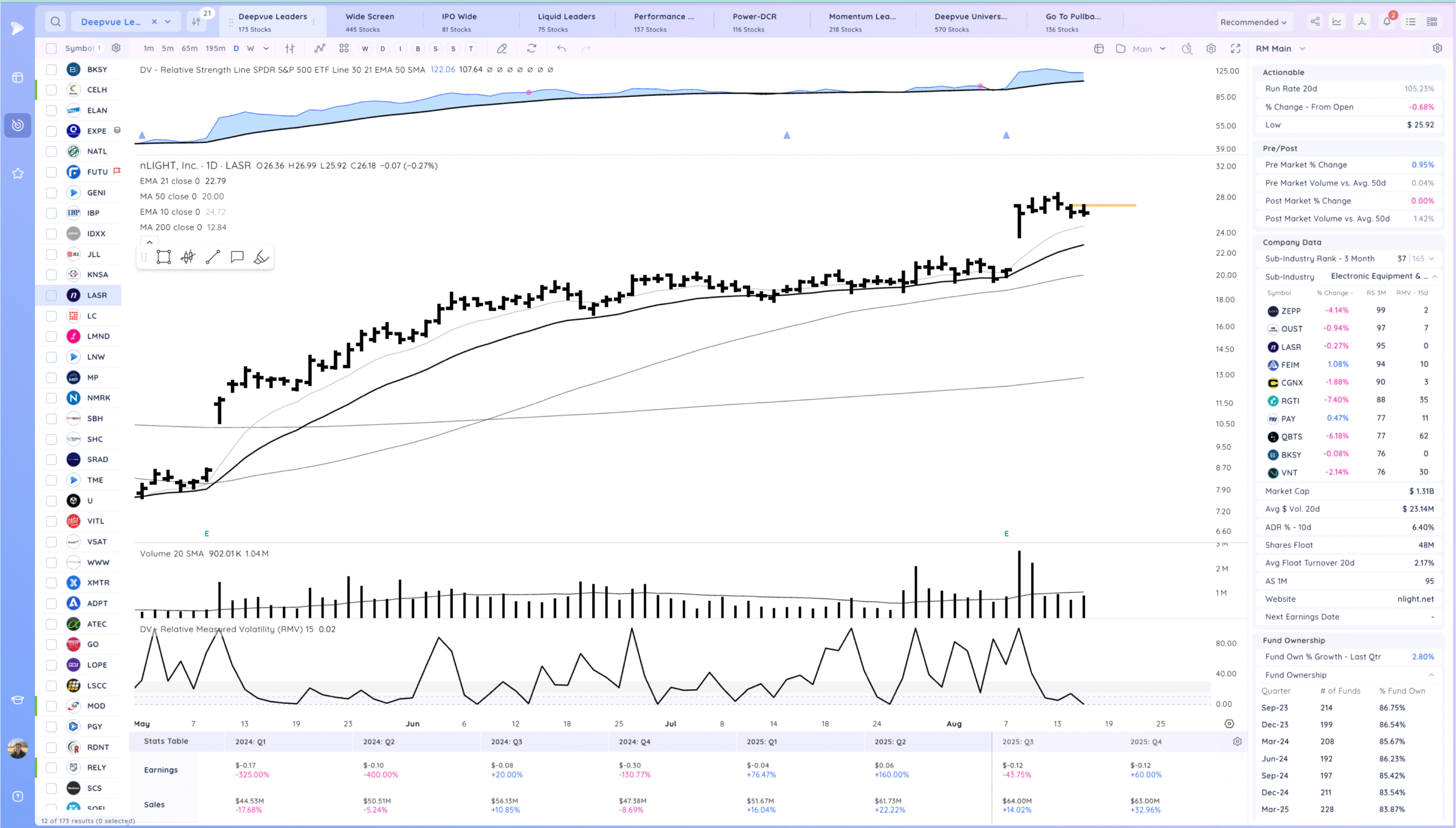

LASR watching for a range breakout. Fast mover

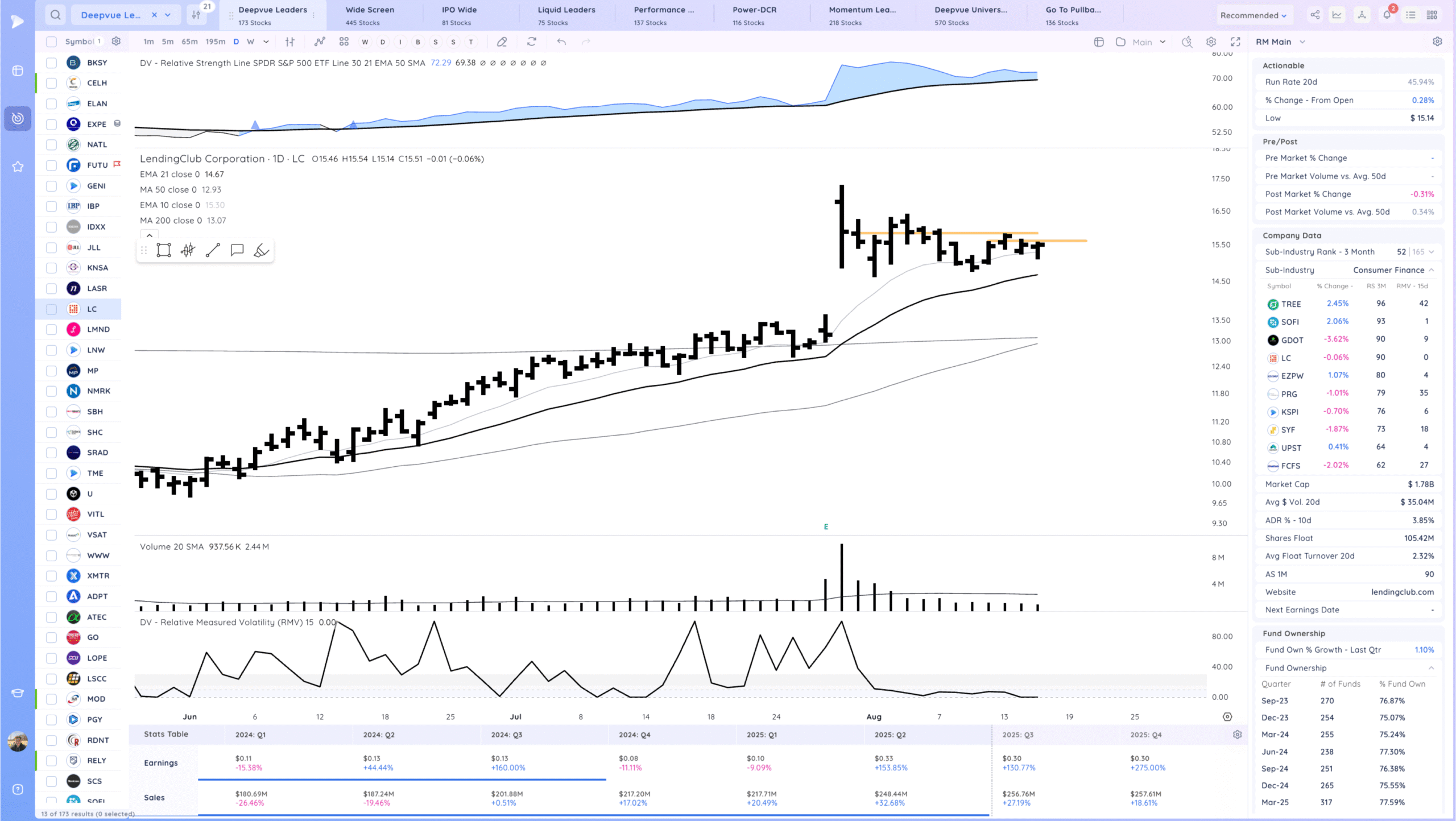

LC watching for a range breakout

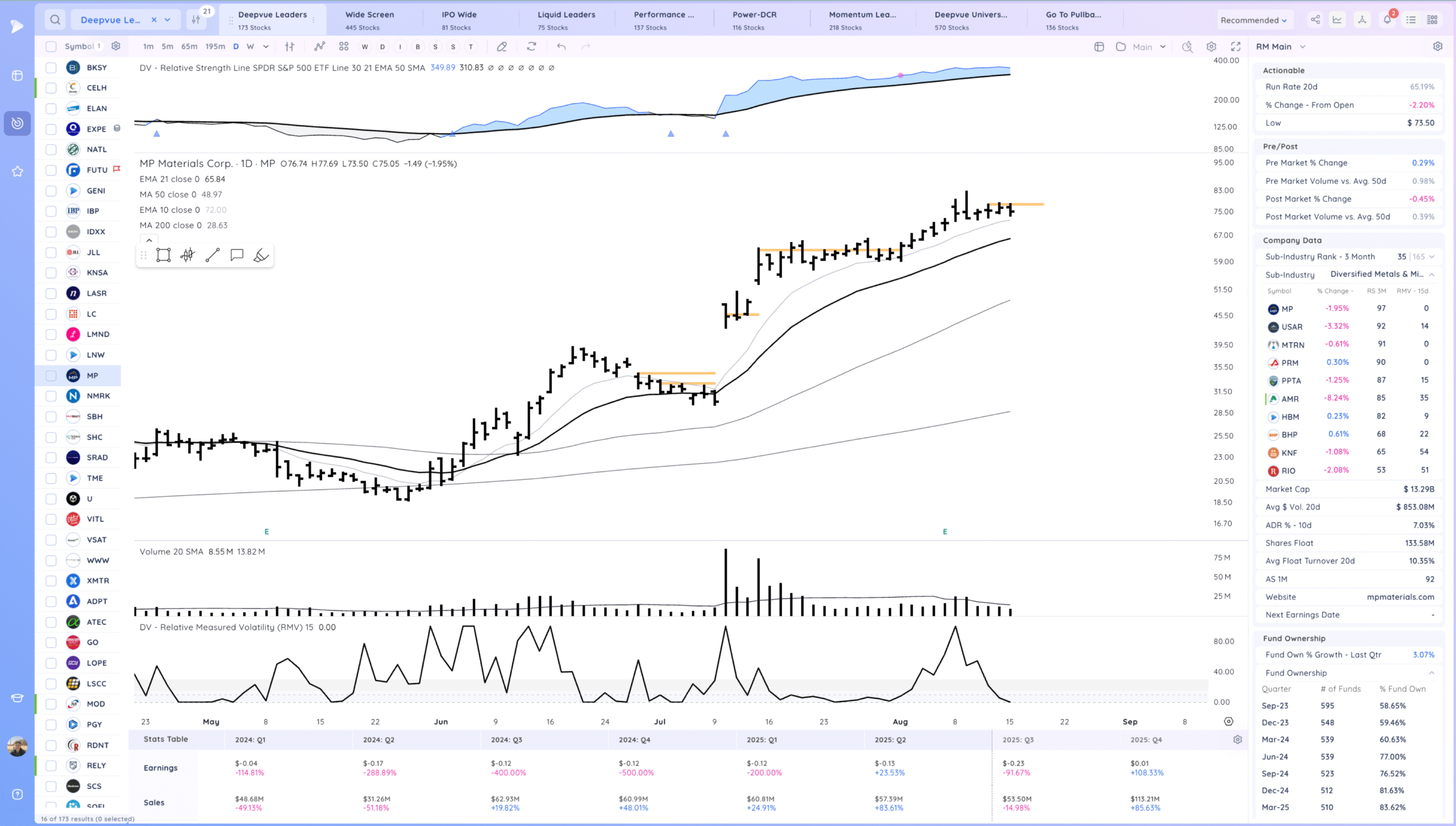

MP tight in the short term but would prefer some pullback or an undercut and rally of the recent range as feels a bit “stretched” in the short term

XMTR watching for a range breakout

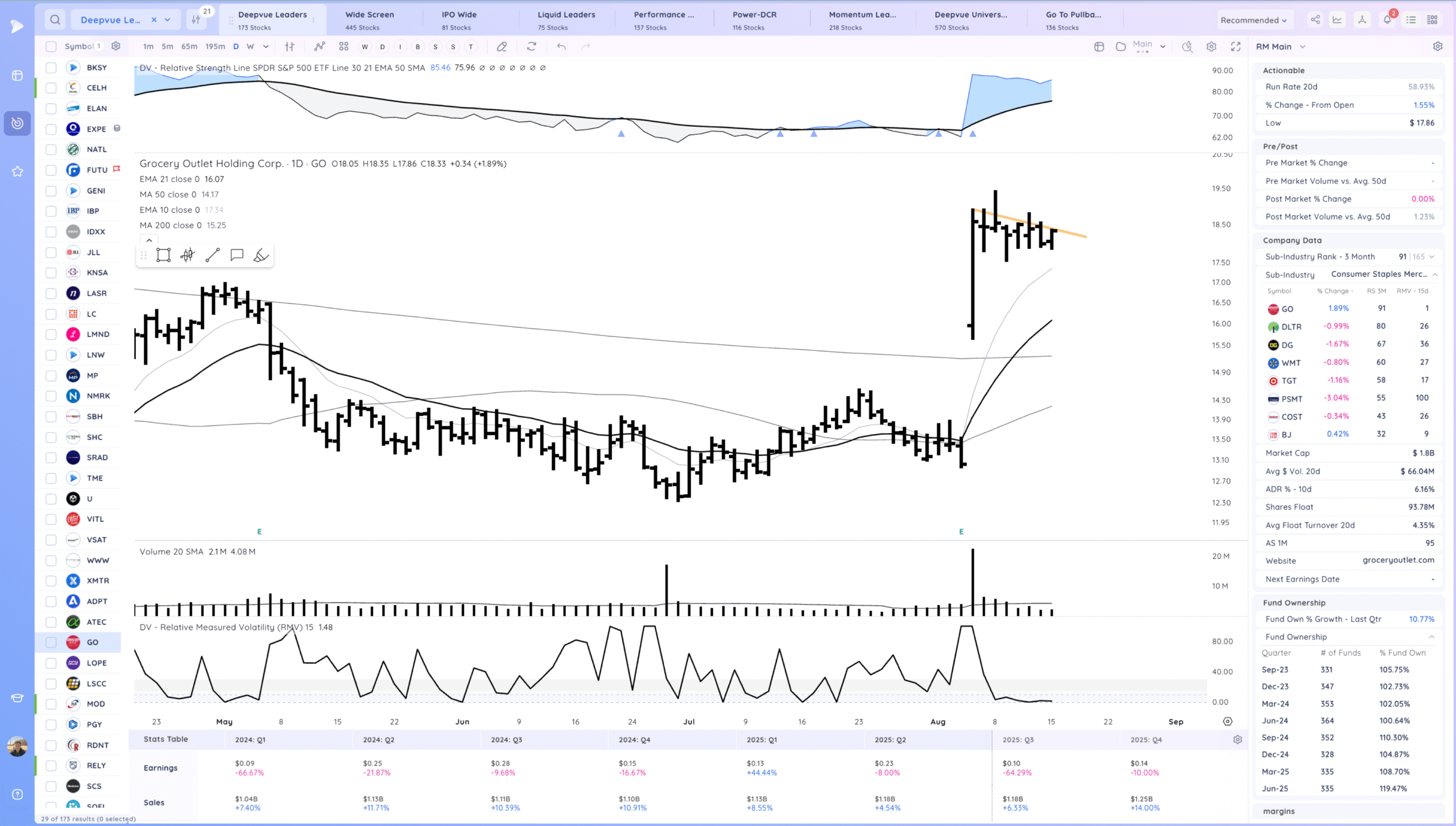

GO watching for a range breakout

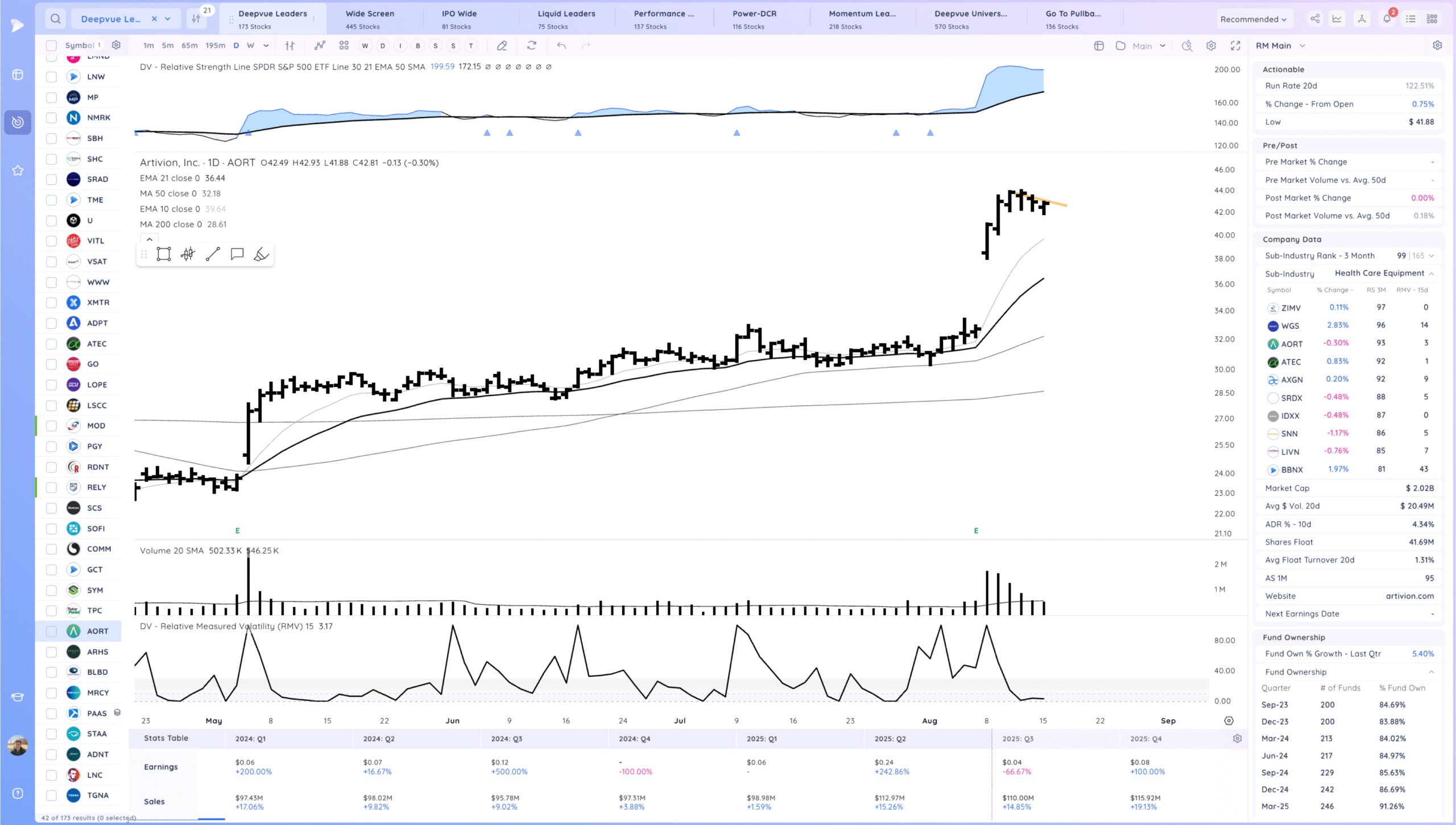

AQRT watching for a range breakout

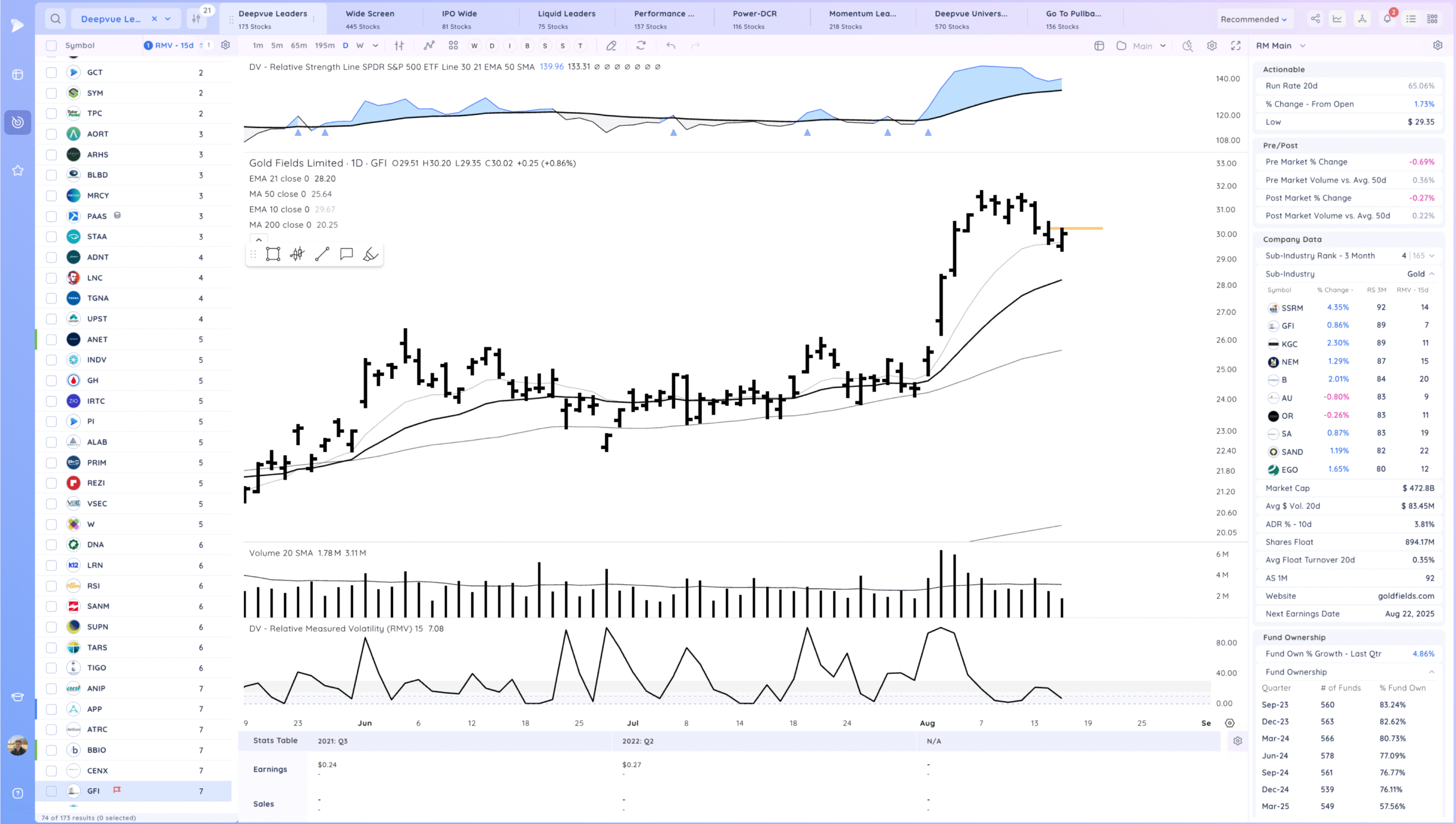

GFI watching for a range breakout after the 10ema pullback

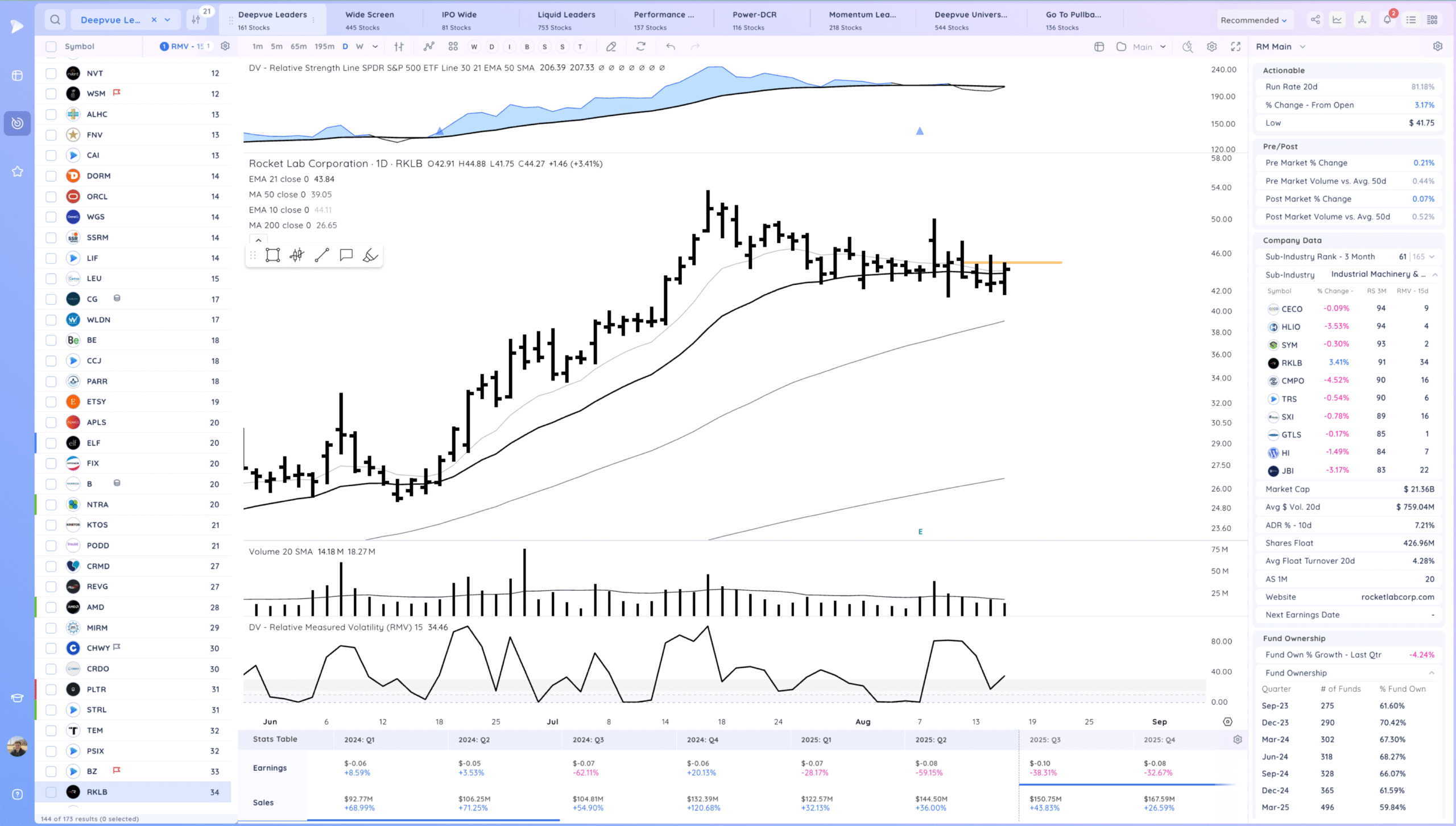

RKLB watching for a range breakout

Today’s Watchlist in List form

Focus List Names

LASR LC MP XMTR GO AQRT GFI RKLB

Focus:

LASR LC RKLB GO

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

Getting back in the swing of things. We continue to stay in an uptrend albeit with rotation.

Anything can happen, Day by Day – Managing risk along the way