INTC Gap Up On Earnings. TSLA Recovery

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 23, 2025

Market Action

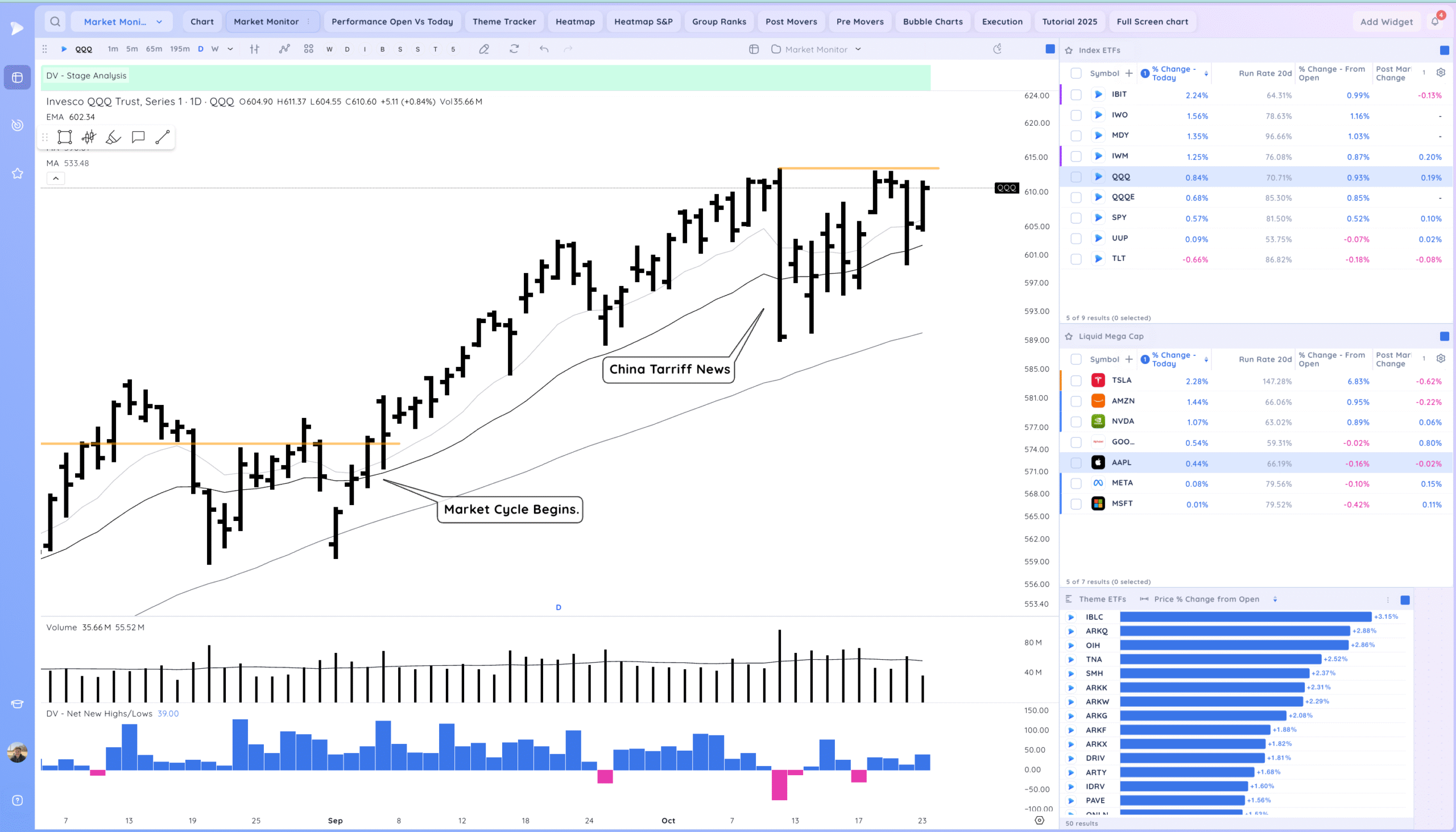

QQQ – Strong day as we close near highs and once again approach the friday reversal high

Bulls want to see us take out the reversal high and trend

Bears want to see us reverse down, and see more earnings gap downs than gap ups from key growth names.

Daily Chart of the QQQ.

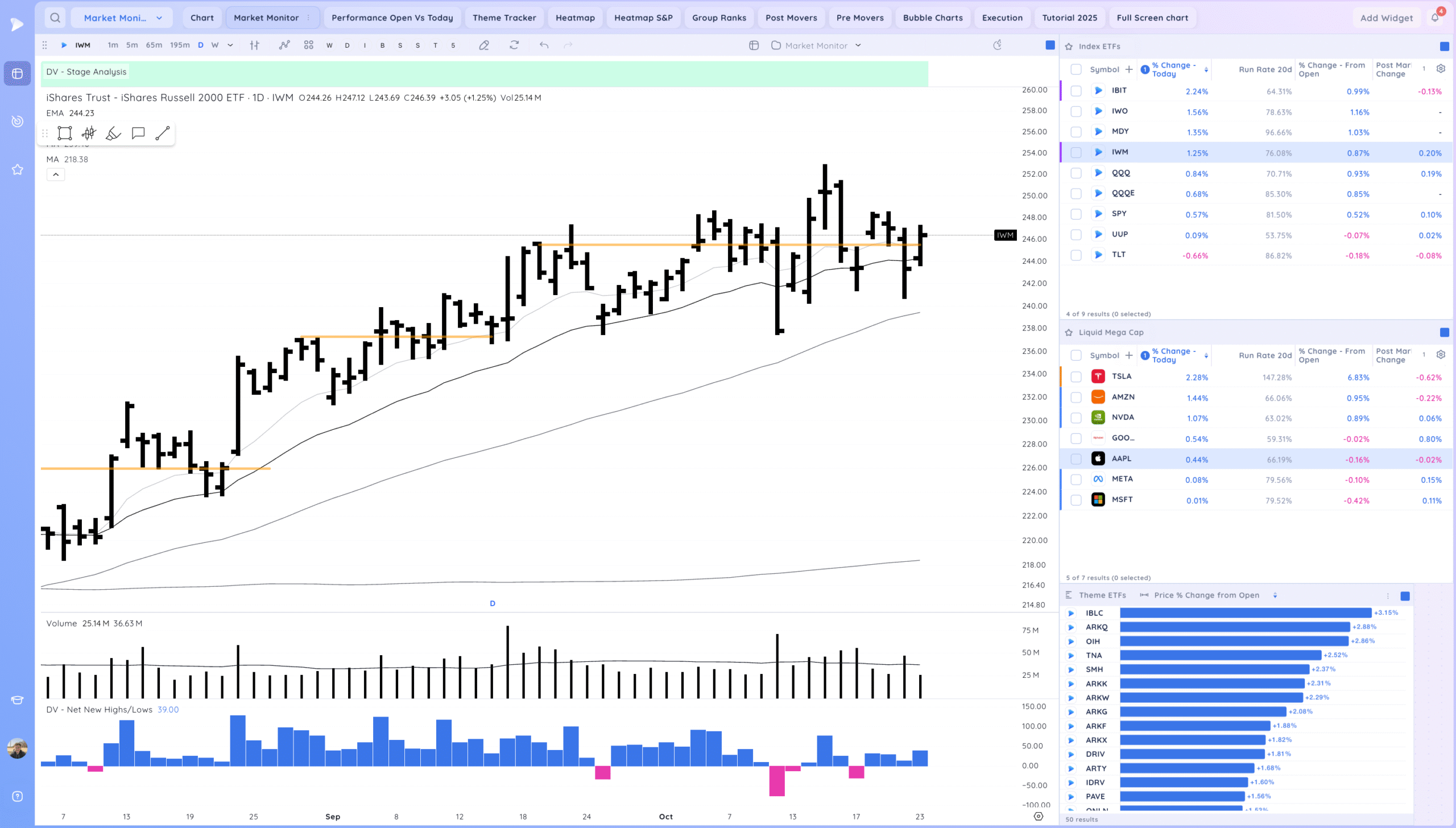

IWM – still chopping around this level, strong day today.

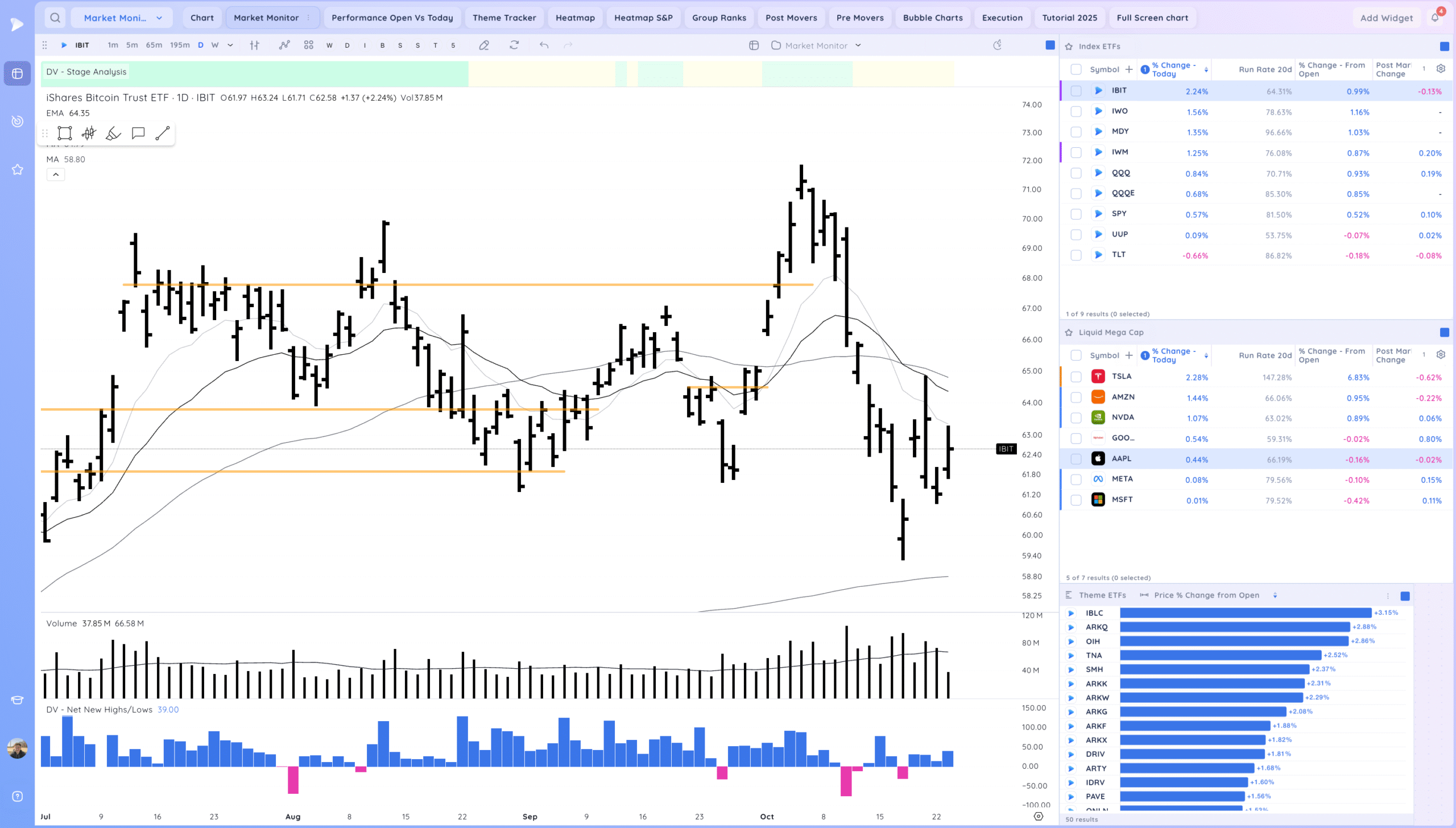

IBIT – Positive expectation breaker. Potential higher low yesterday. However still below the moving averages

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

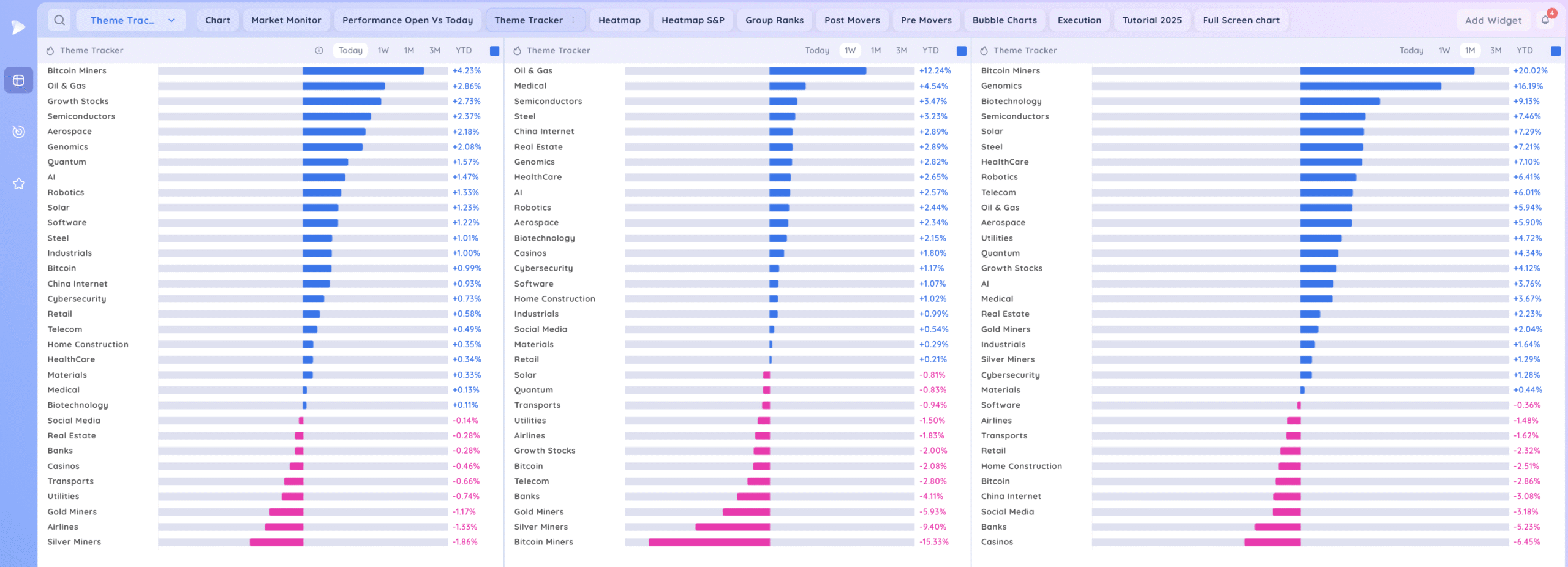

Groups/Sectors

Deepvue Theme Tracker.

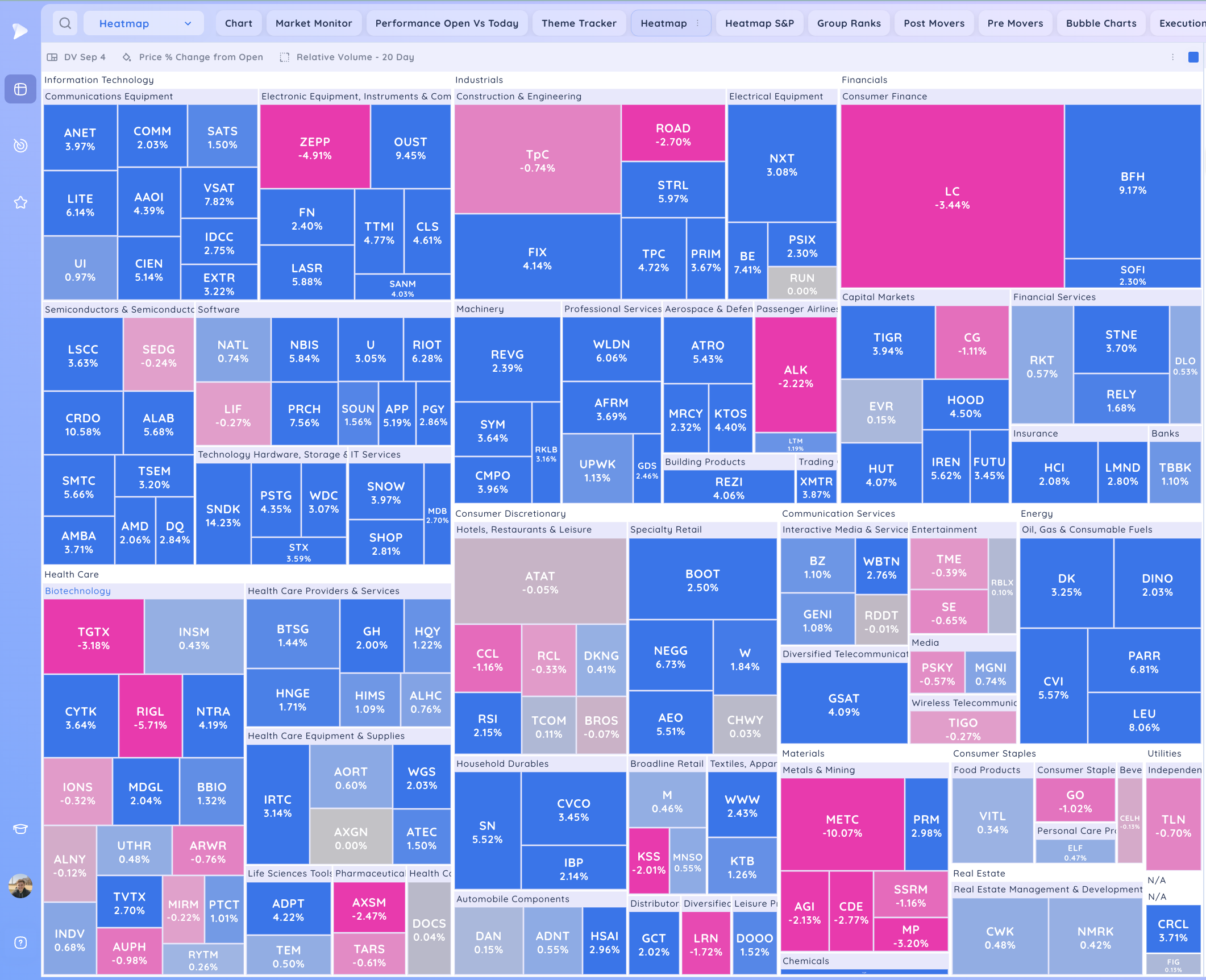

Deepvue Leaders.

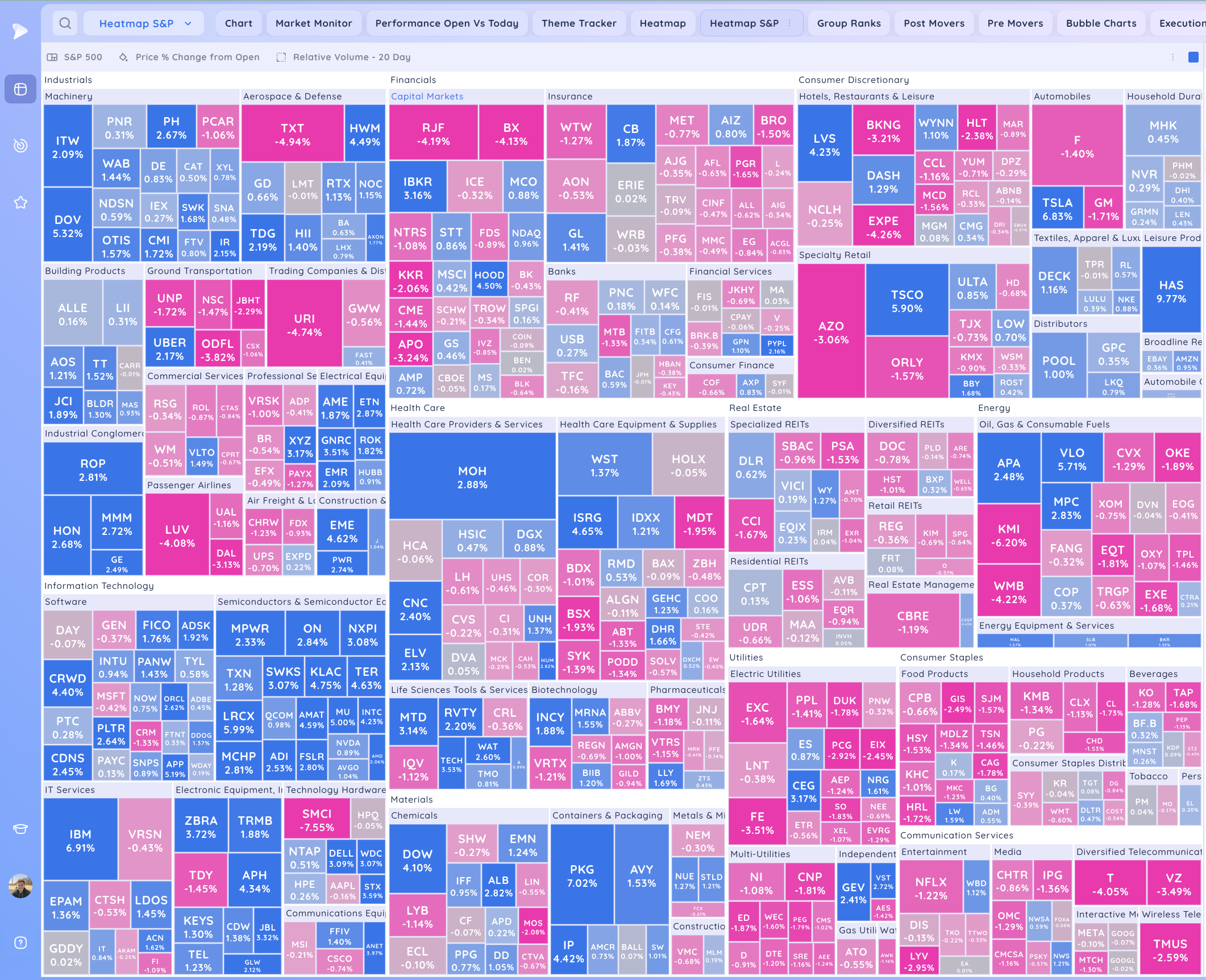

S&P 500.

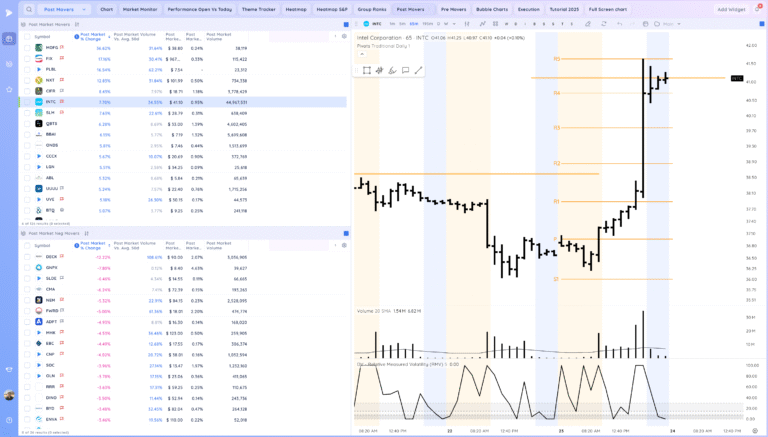

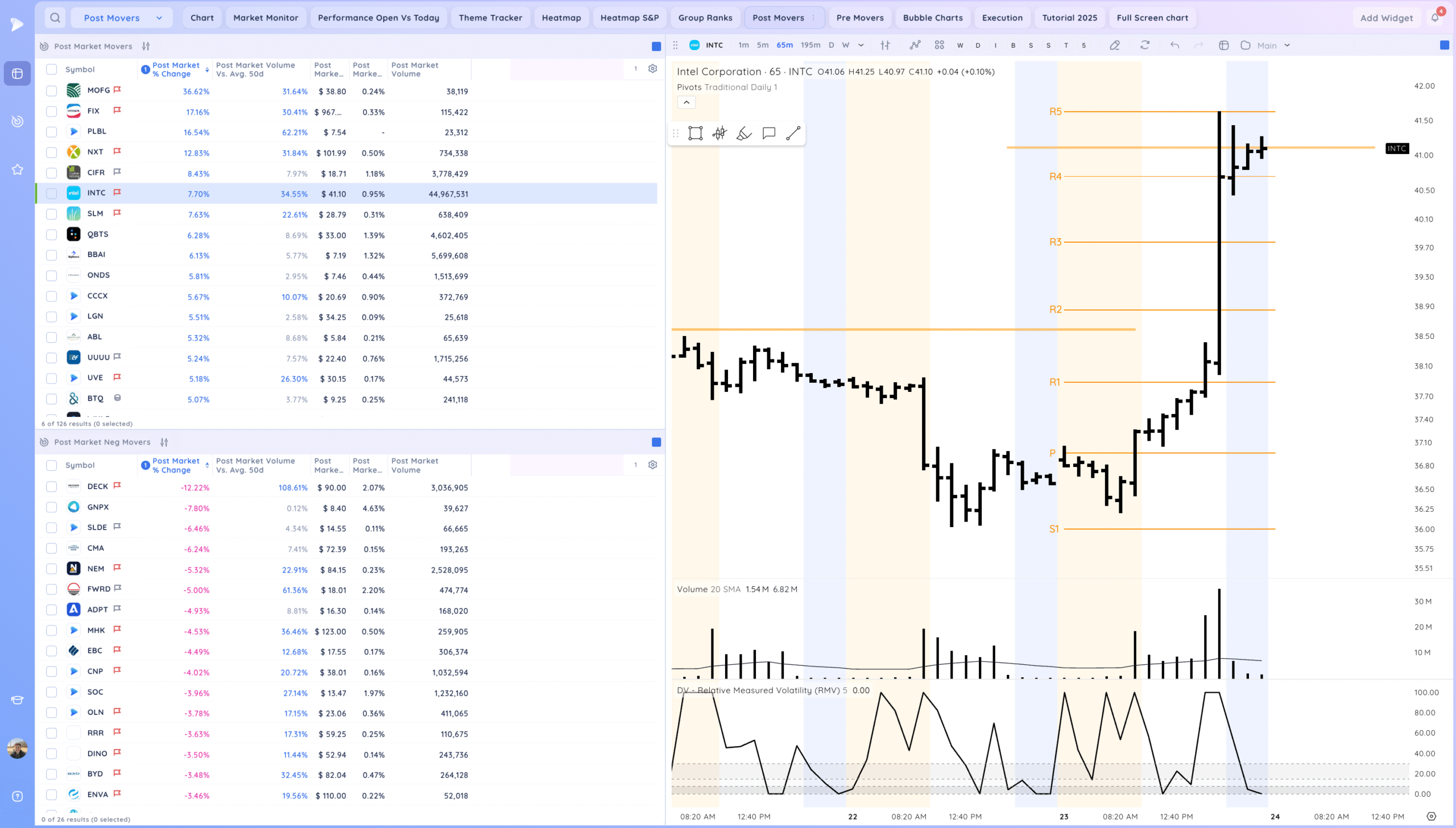

Post Market Movers. INTC NXT Gapping up

Leadership Stocks & Analysis

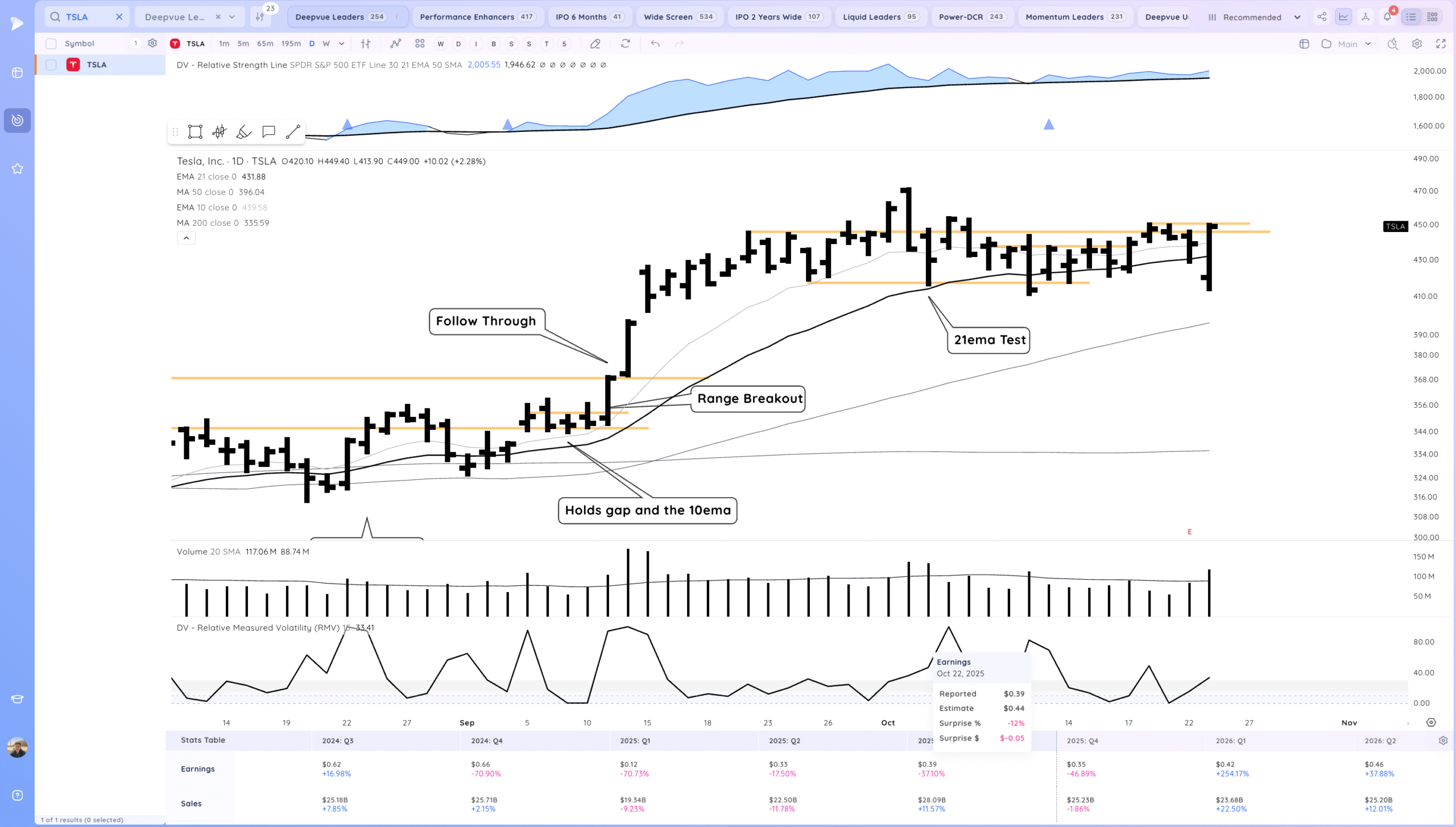

TSLA – Strong Oops reversal after the earnings gap down. Expecting follow through tomorrow. Low risk entries in the AM

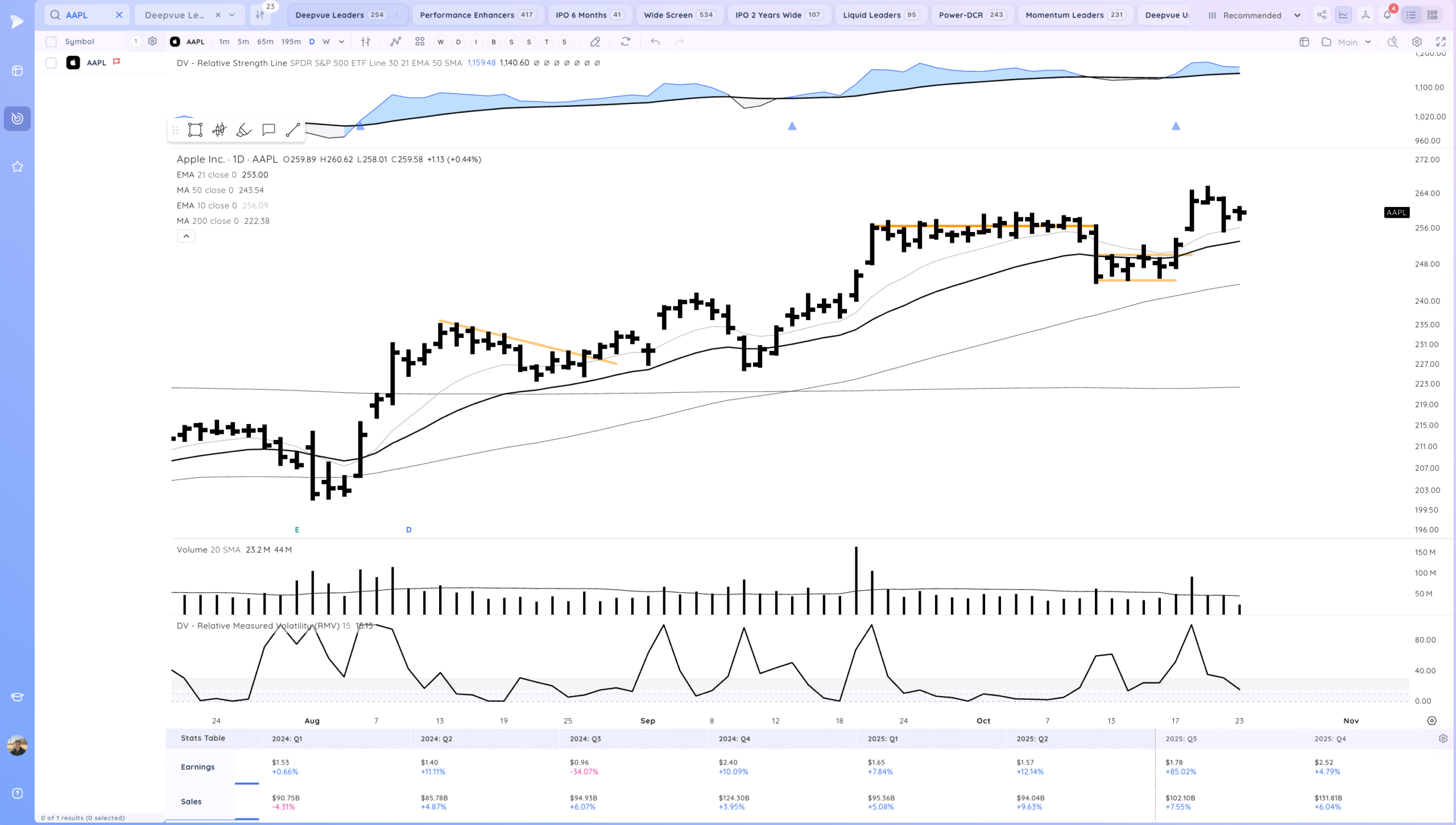

AAPL Tight inside day

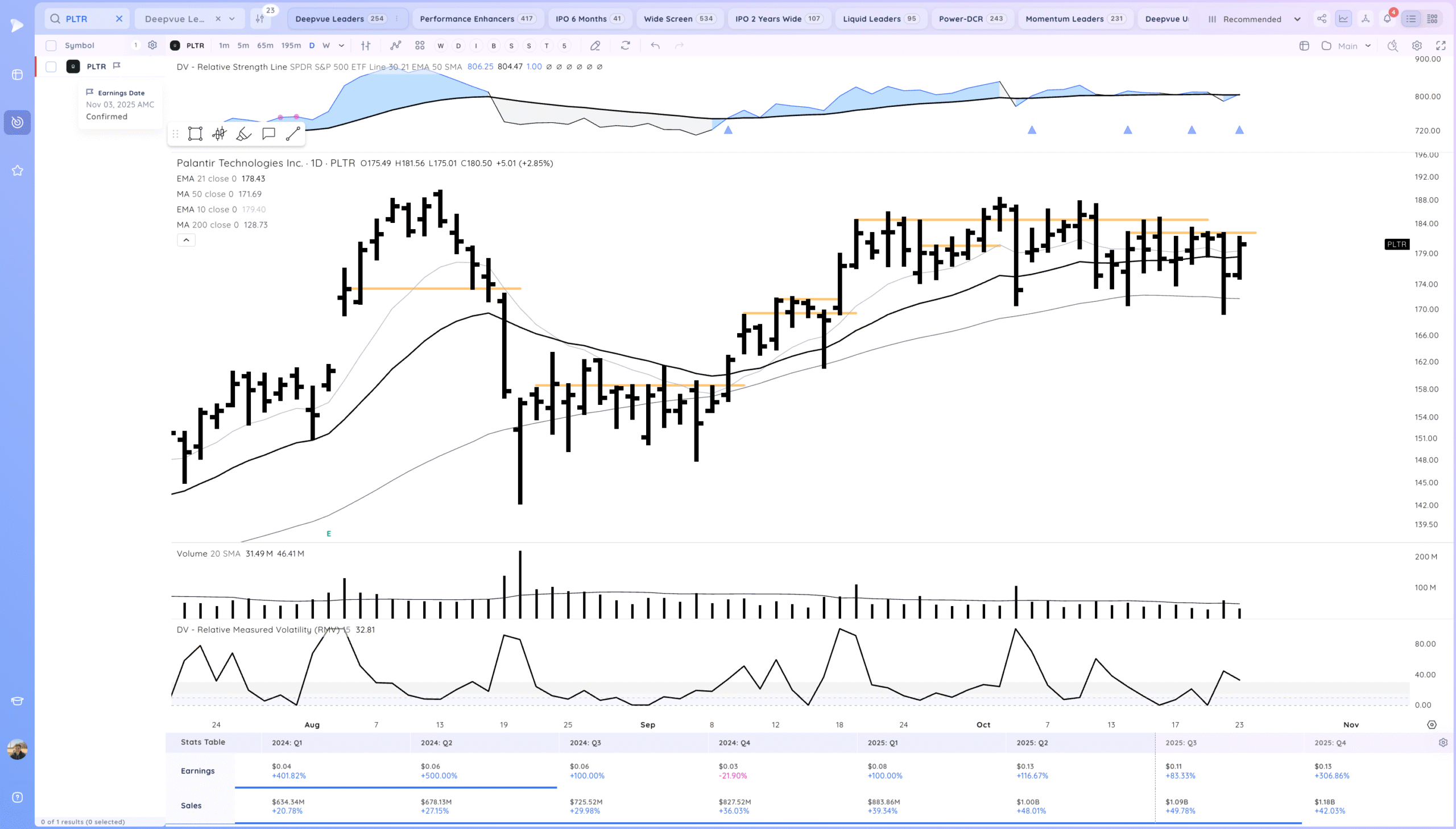

PLTR Inside day, watching for a range breakout

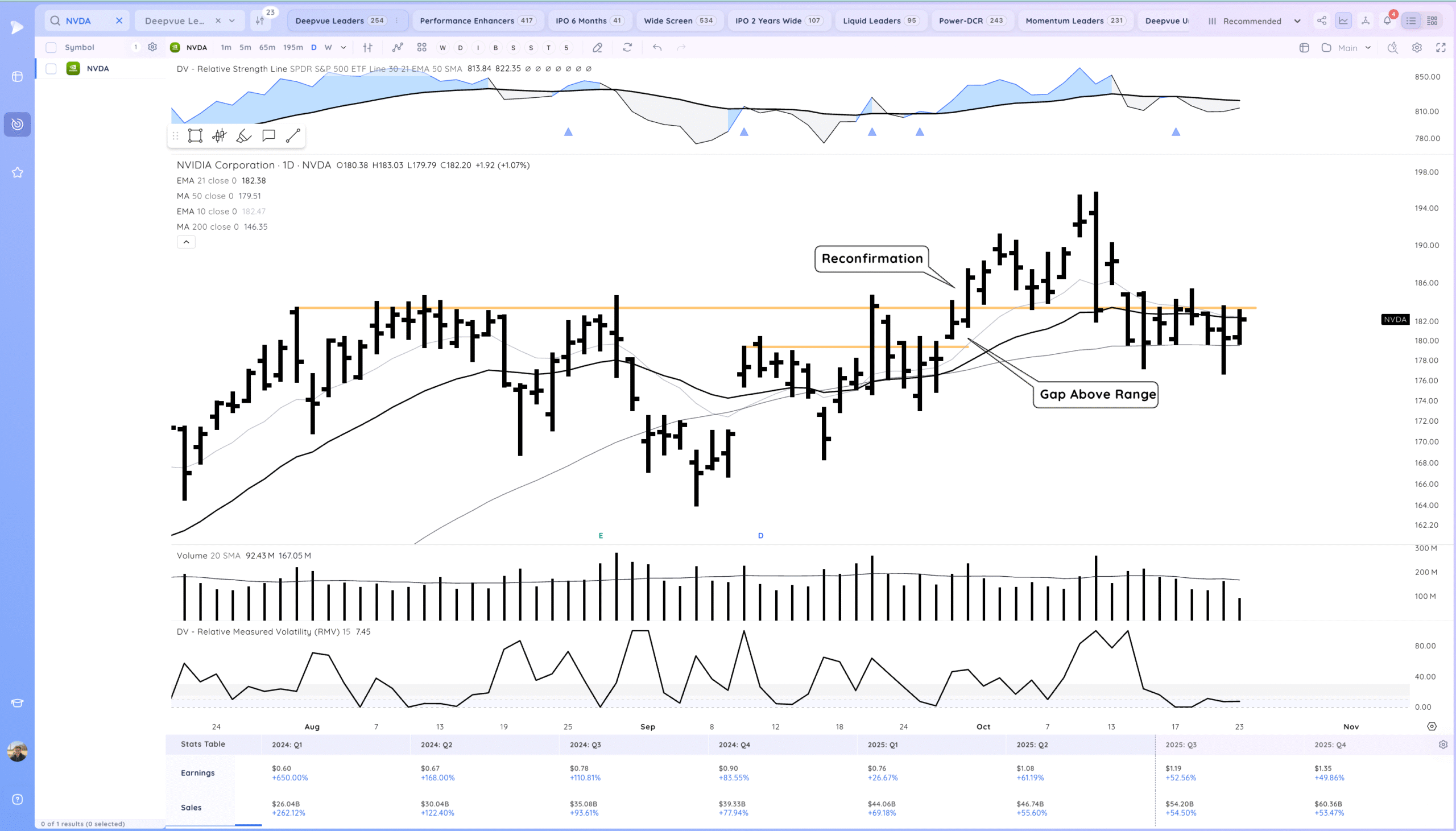

NVDA tight below the pivot and 50sma, watching for a range breakout

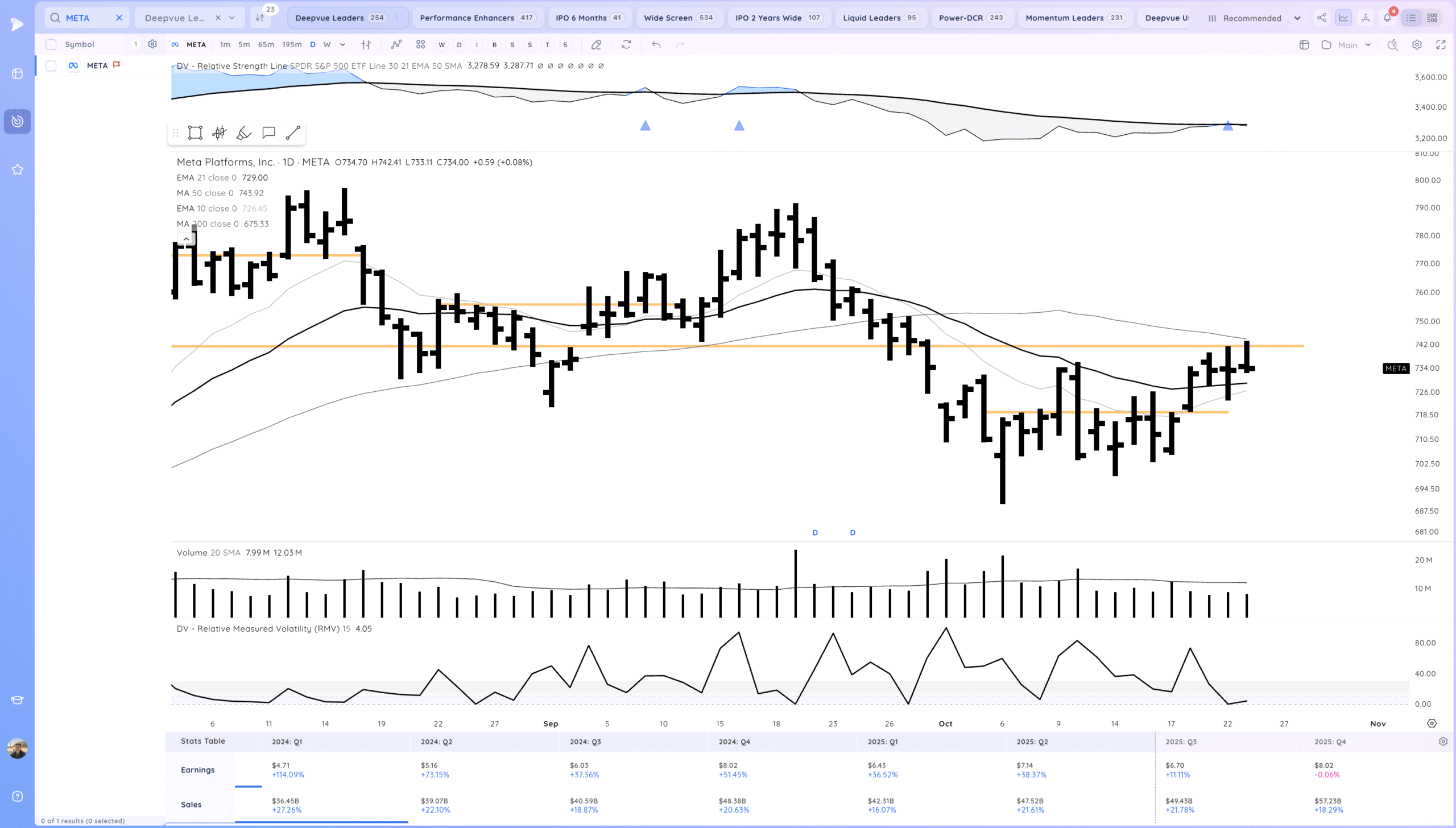

META Tight closes below this level, watching for a pop above

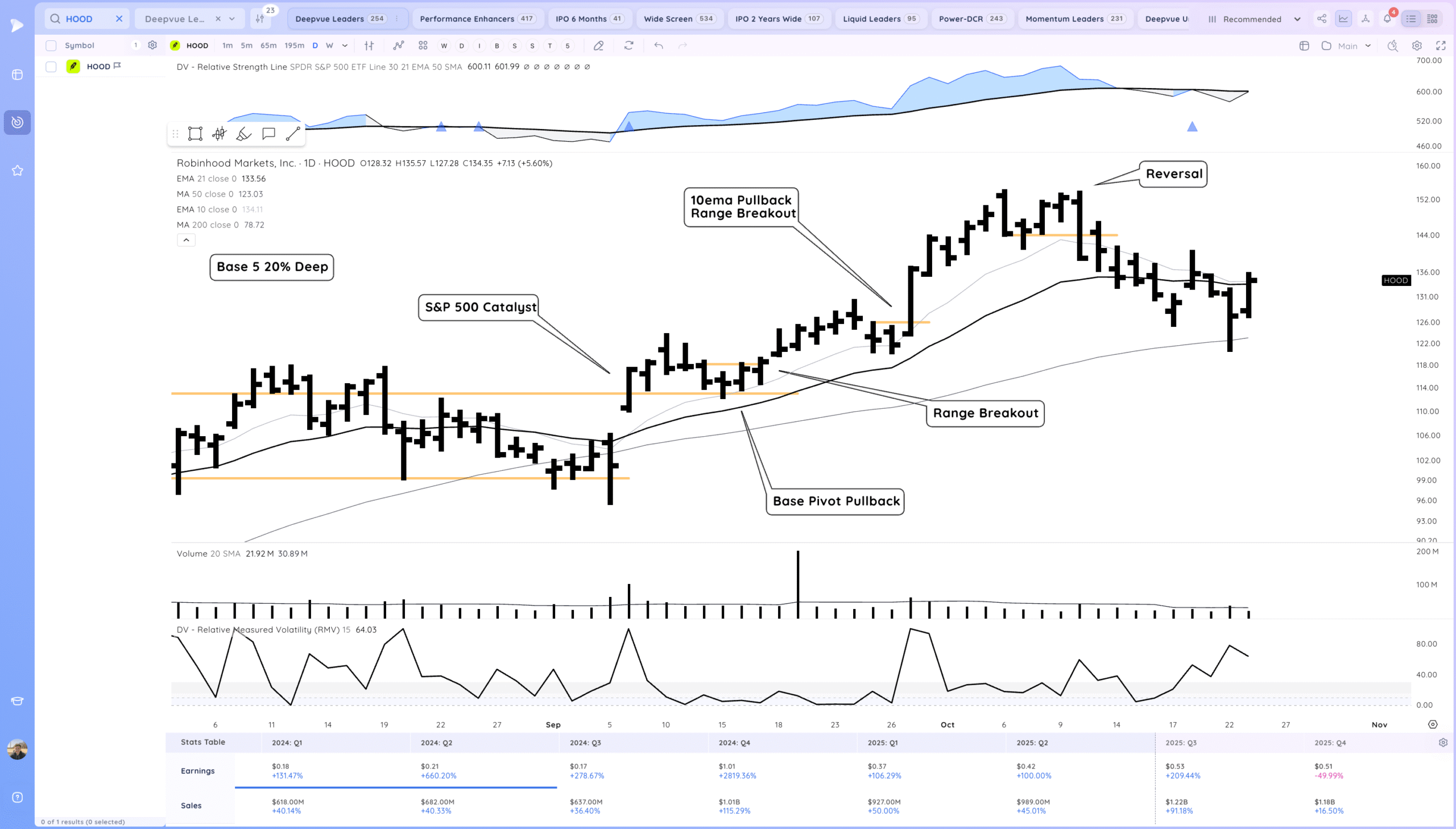

HOOD Slight follow through up after the upside reversal off the 50sma yesterday

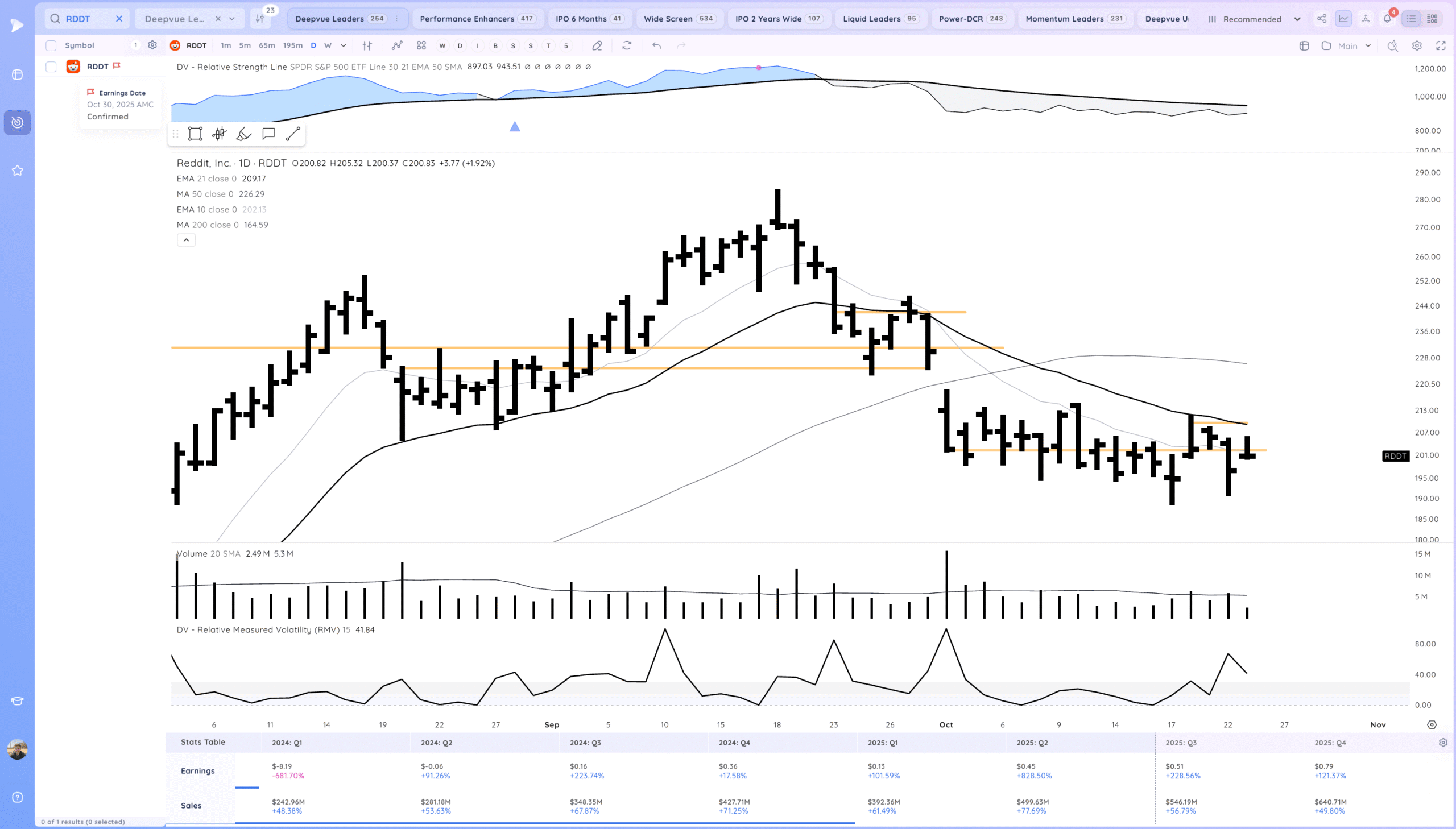

RDDT Tight day, in this range. Earnings upcoming

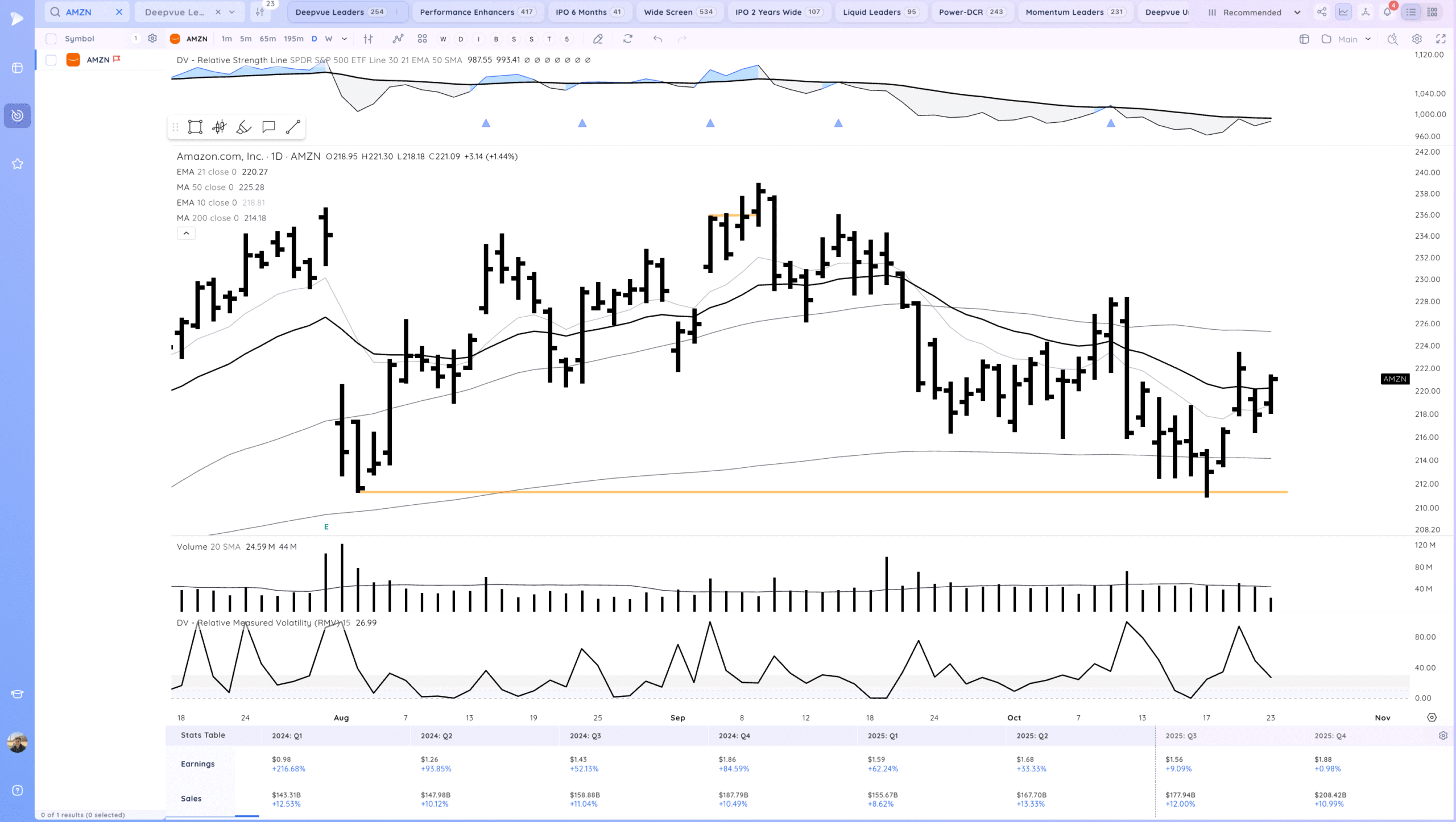

AMZN 21ema reclaim, potential higher low yesterday

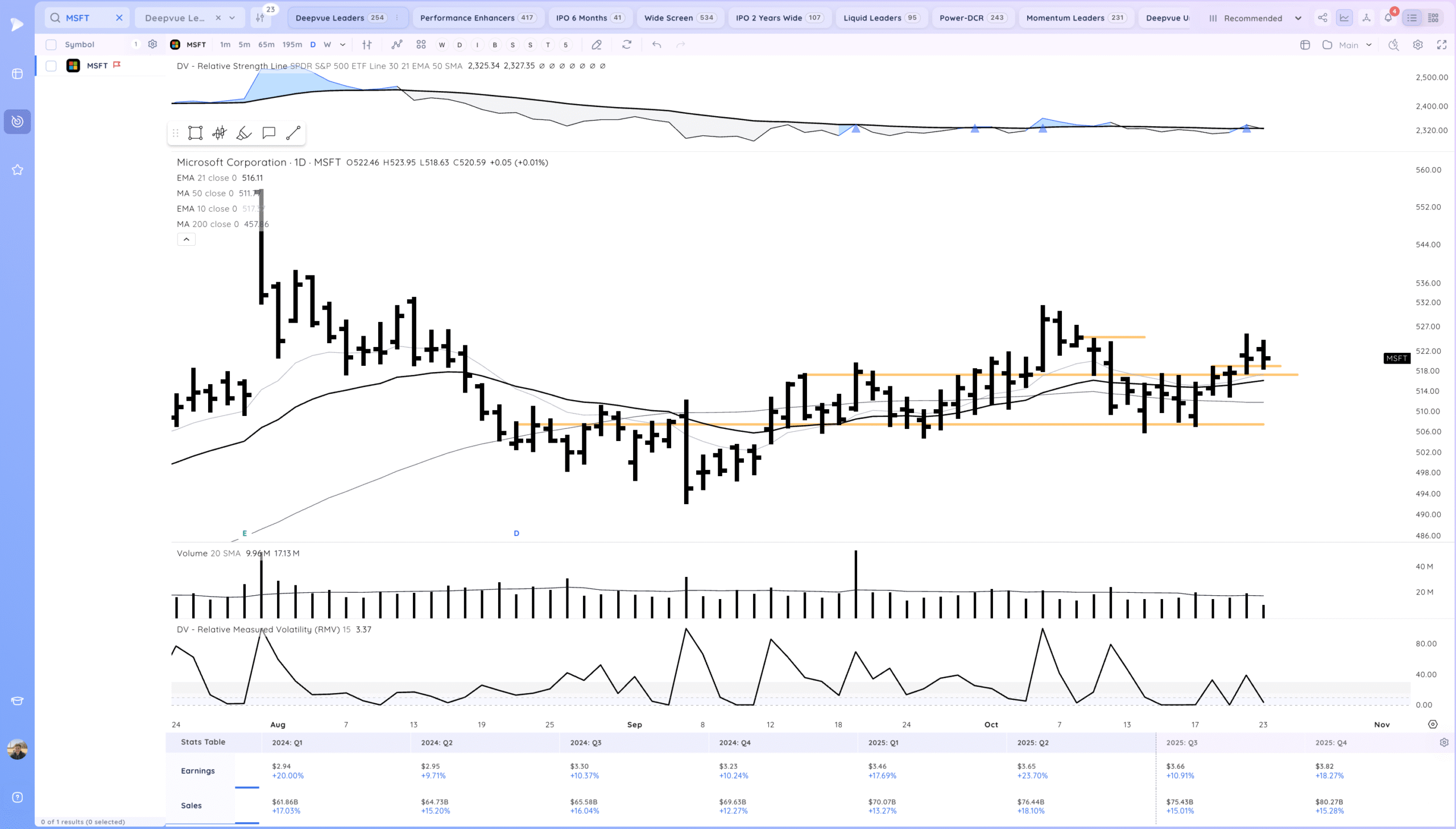

MSFT Inside day above the pivots.

Key Moves

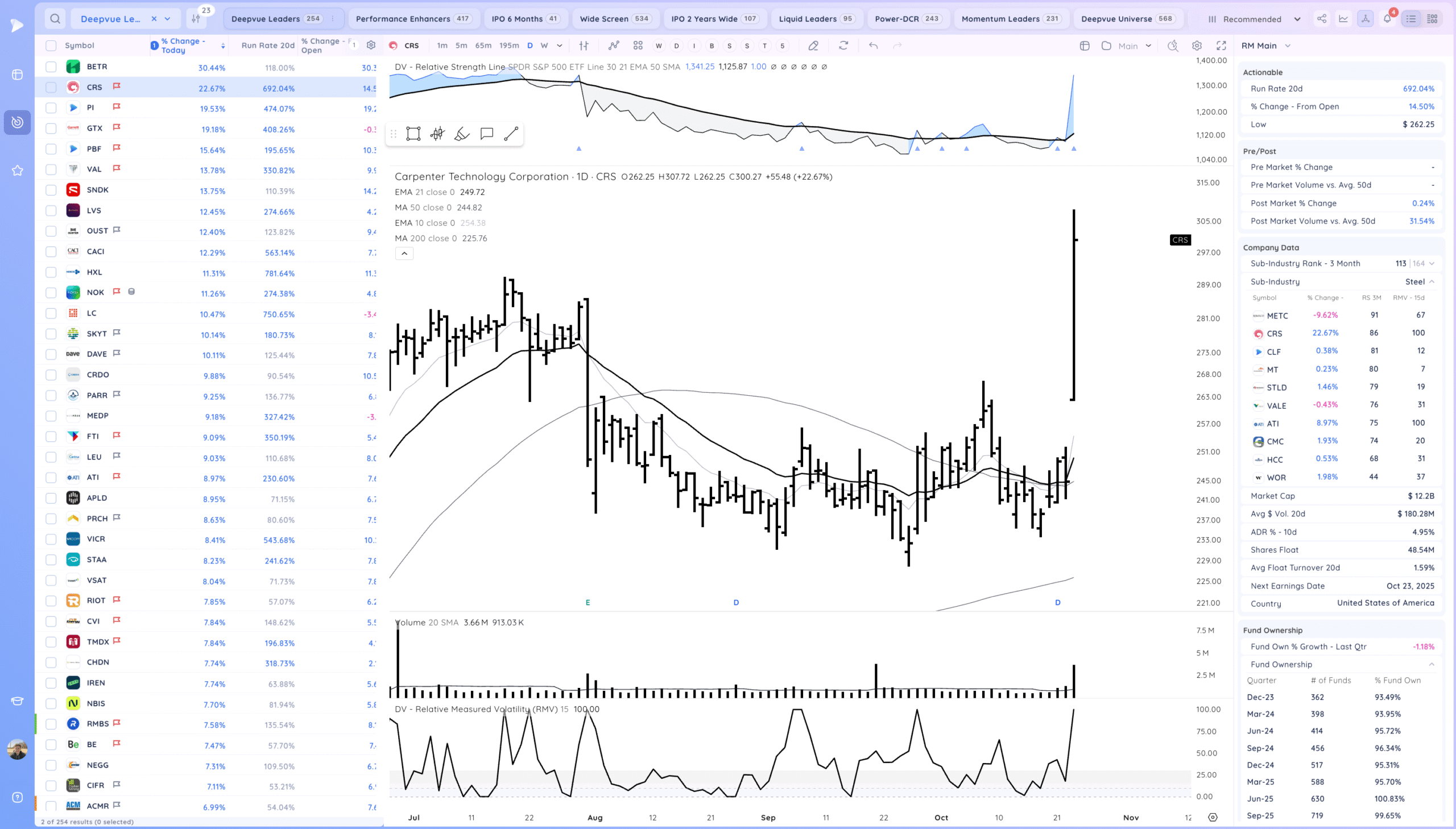

CRS strong move on earnings

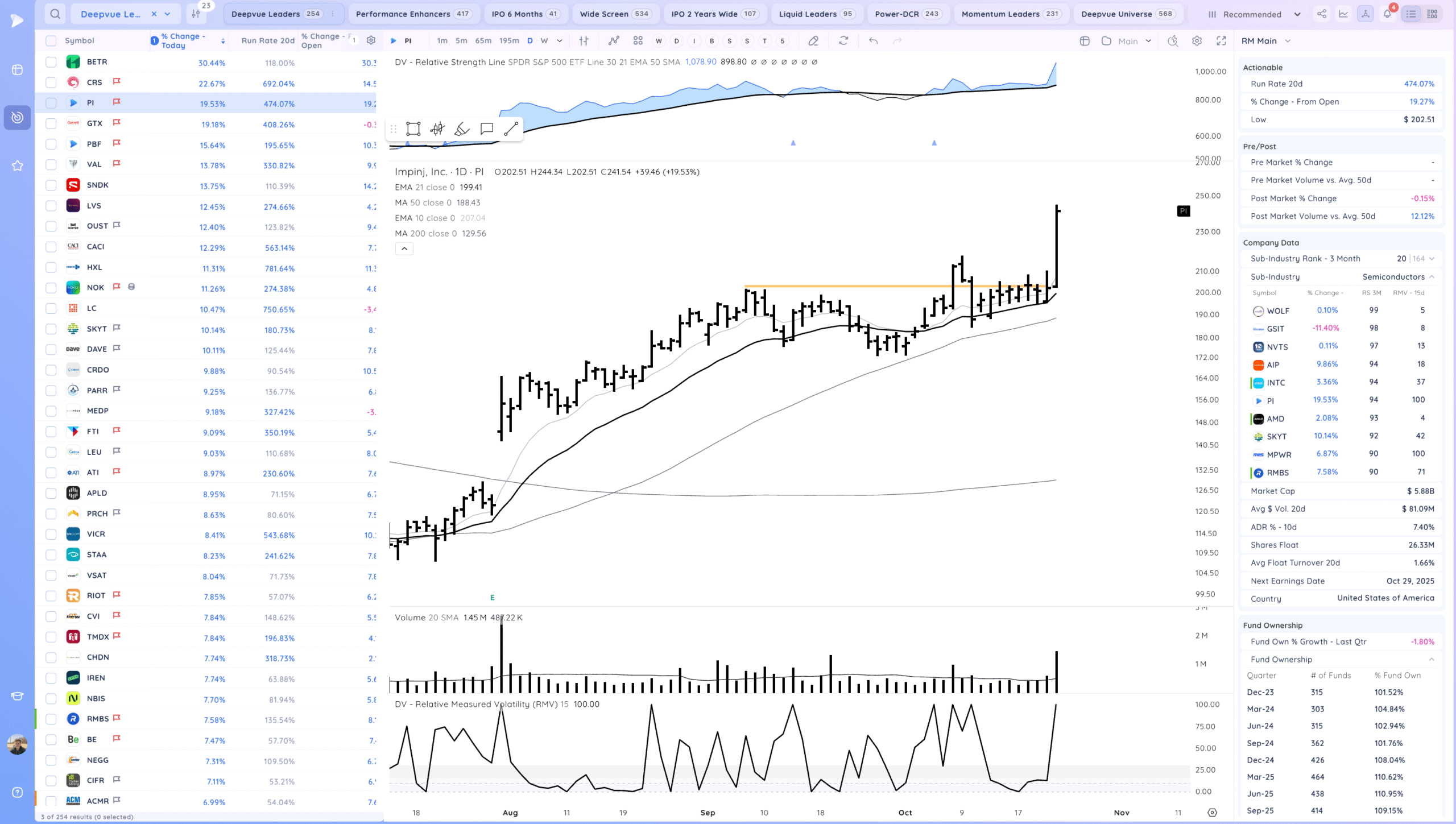

PI from the watchlist strong range breakout

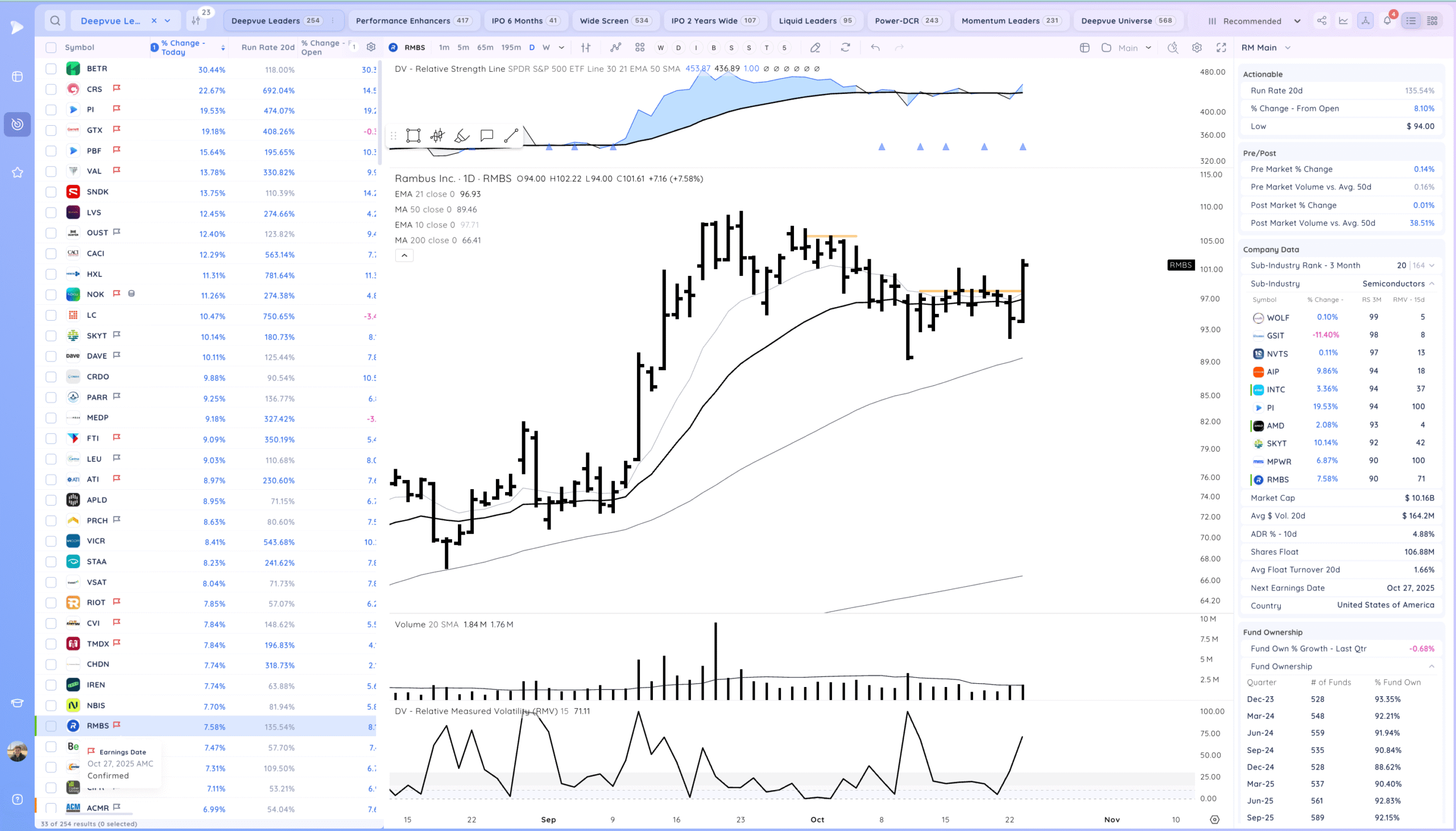

RMBS strong range breakout

Setups and Watchlist

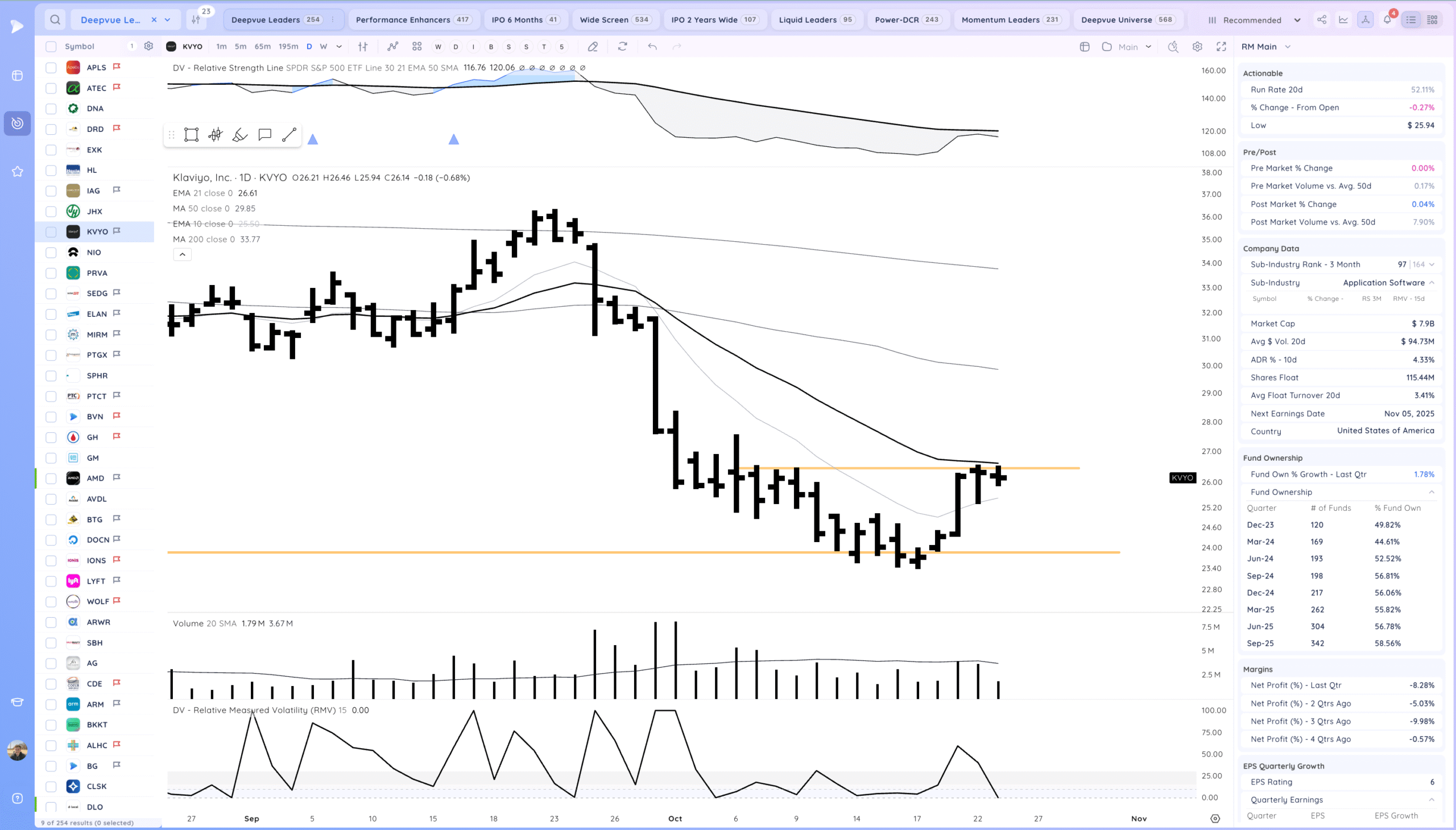

KVYO watching for a bottoming base breakout

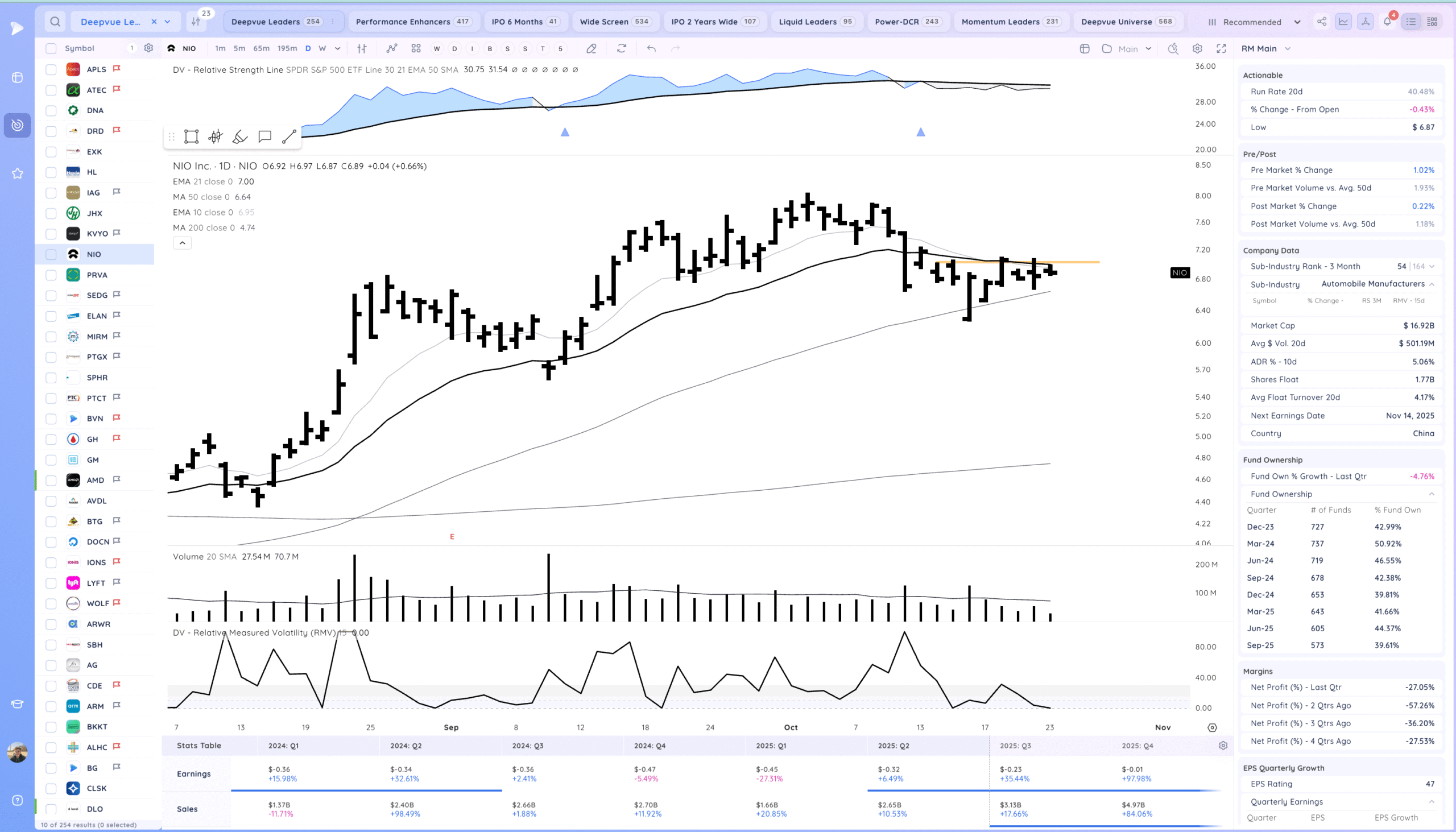

NIO haven’t traded this in a long time but watching for a range breakout through the 21ema. China name so added risk.

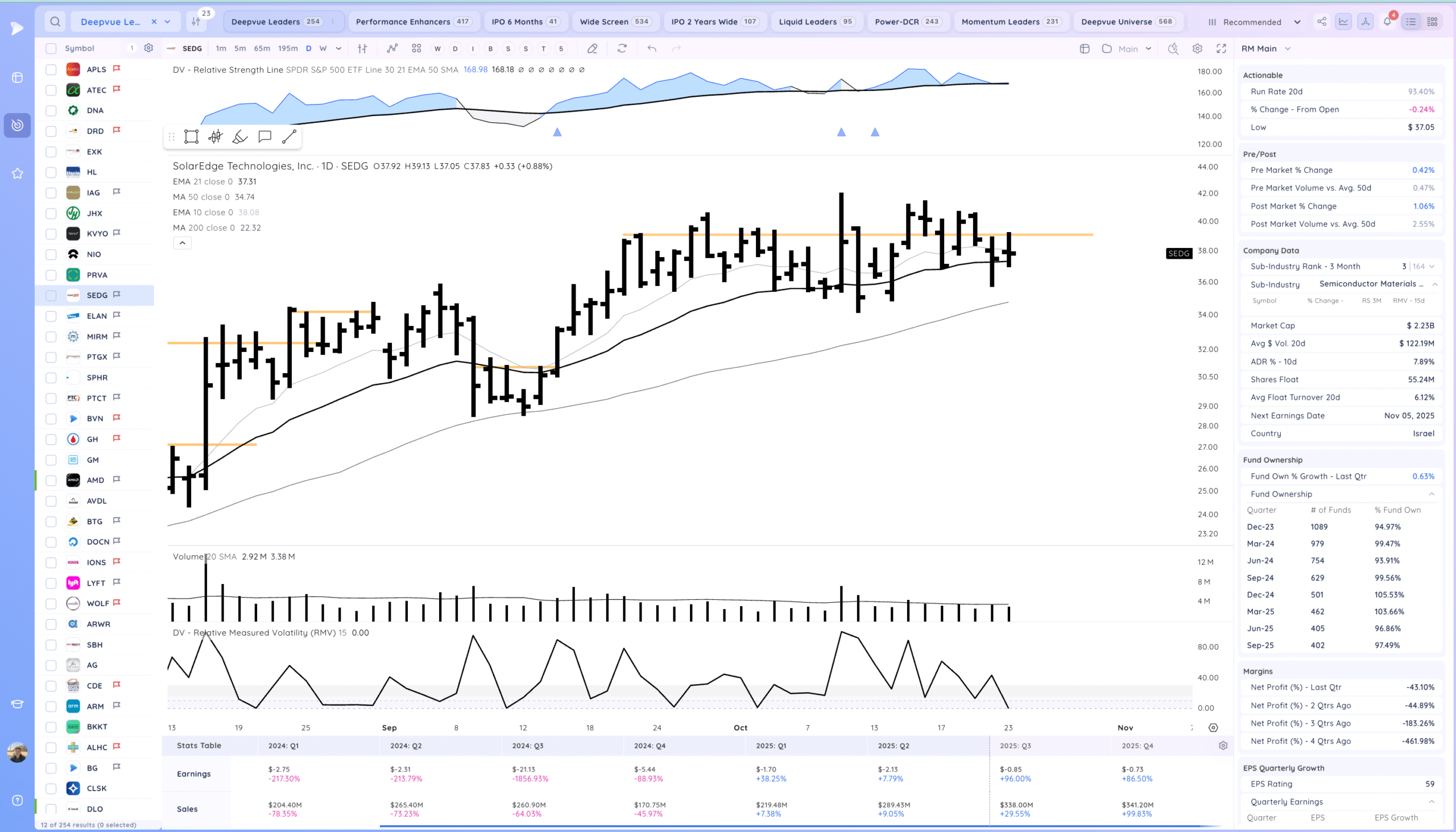

SEDG watching for a range breakout. NXT strong action in theme

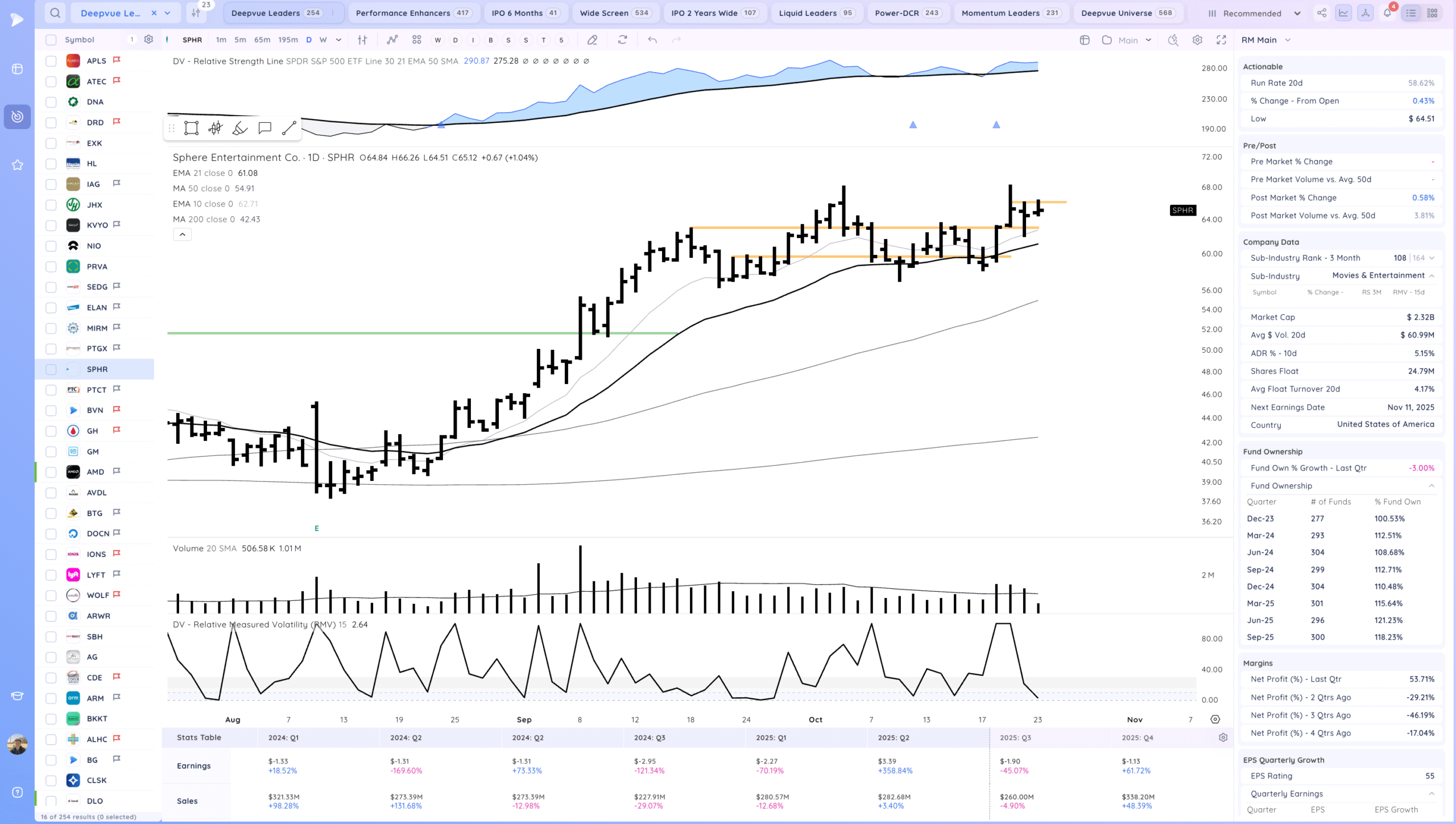

SPHR watching for a range breakout. Ideally tightens more

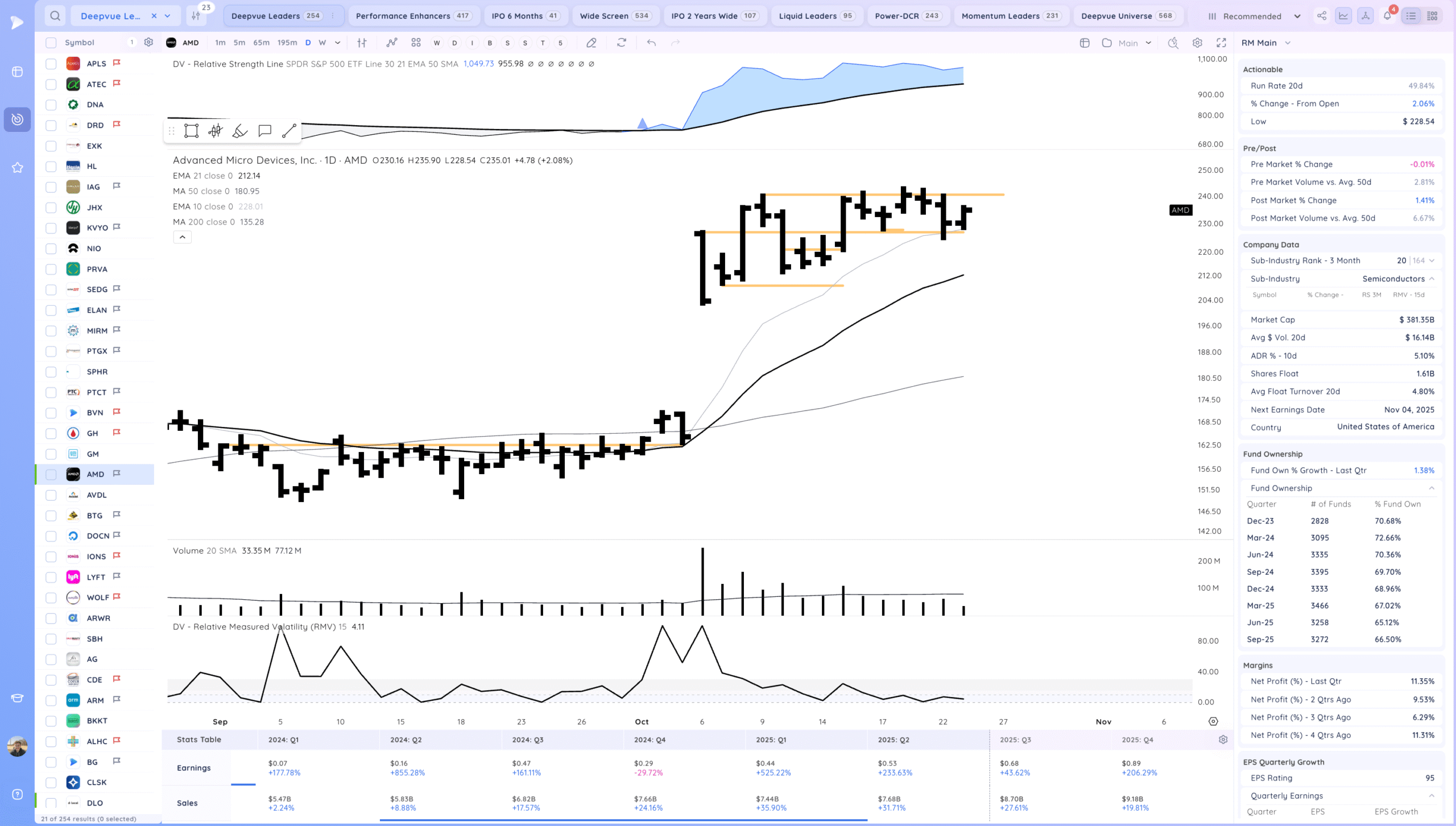

AMD watching for a range breakout

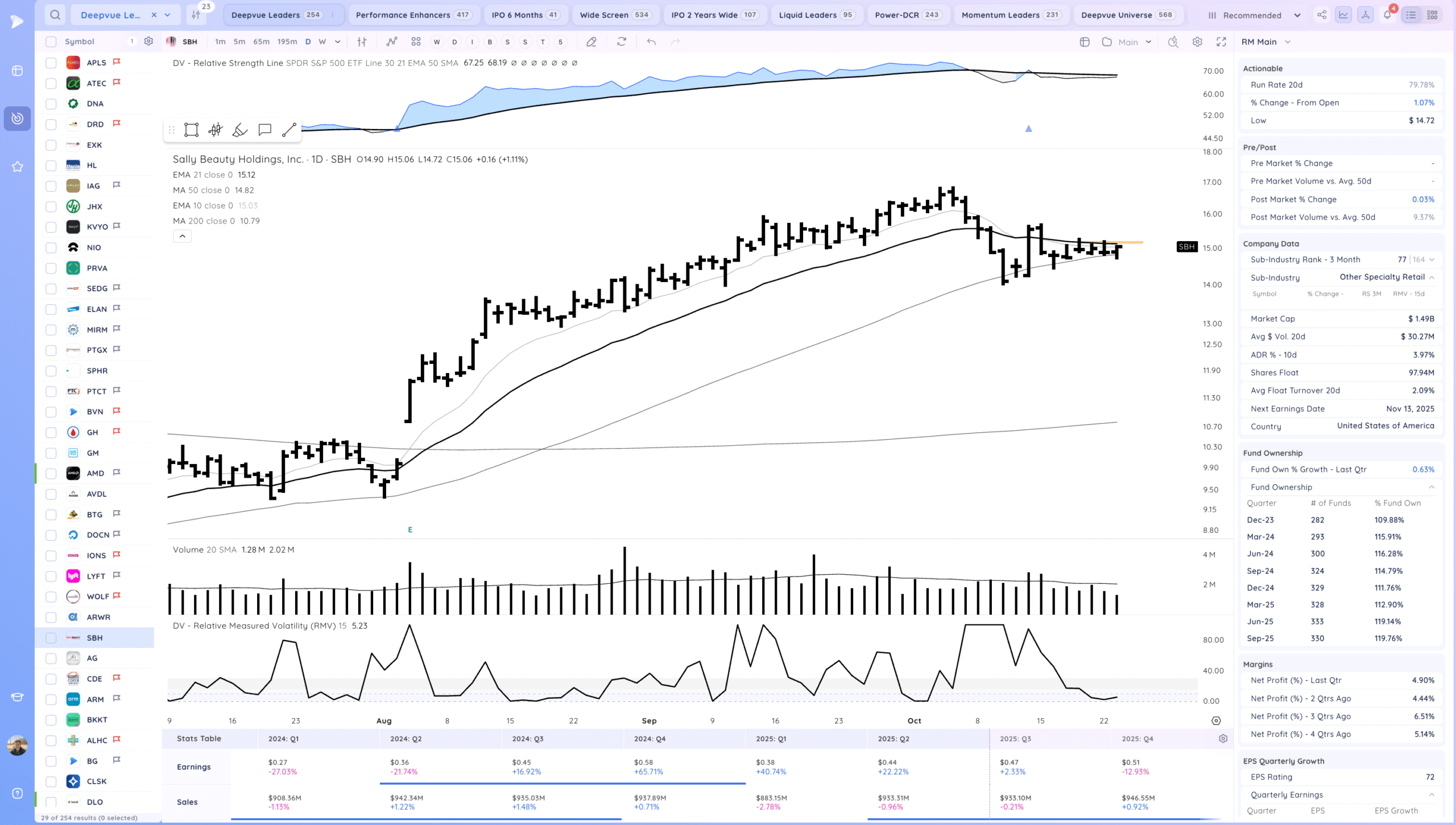

SBH watching for a range breakout. I

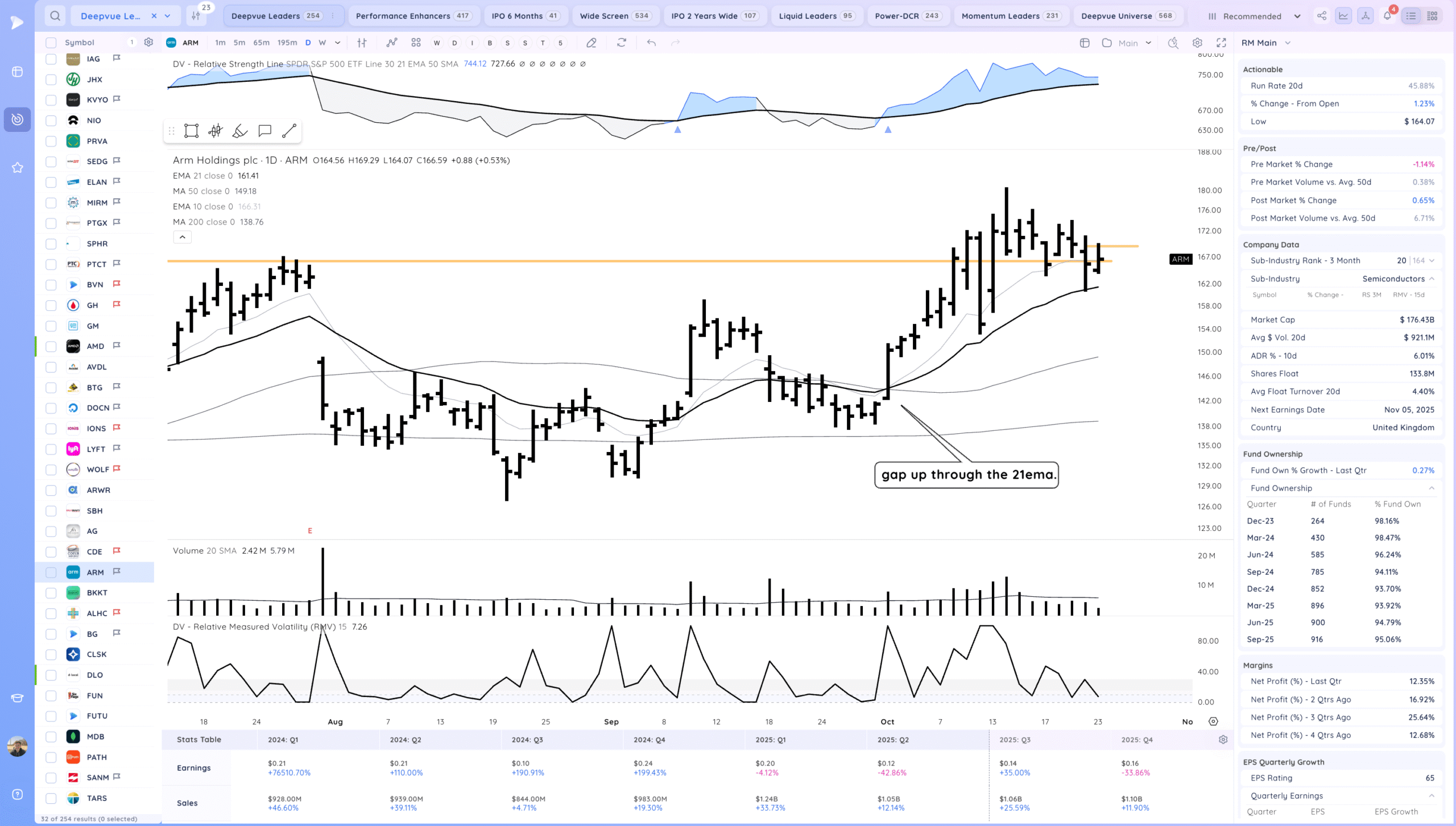

ARM watching for a range breakout from the inside day

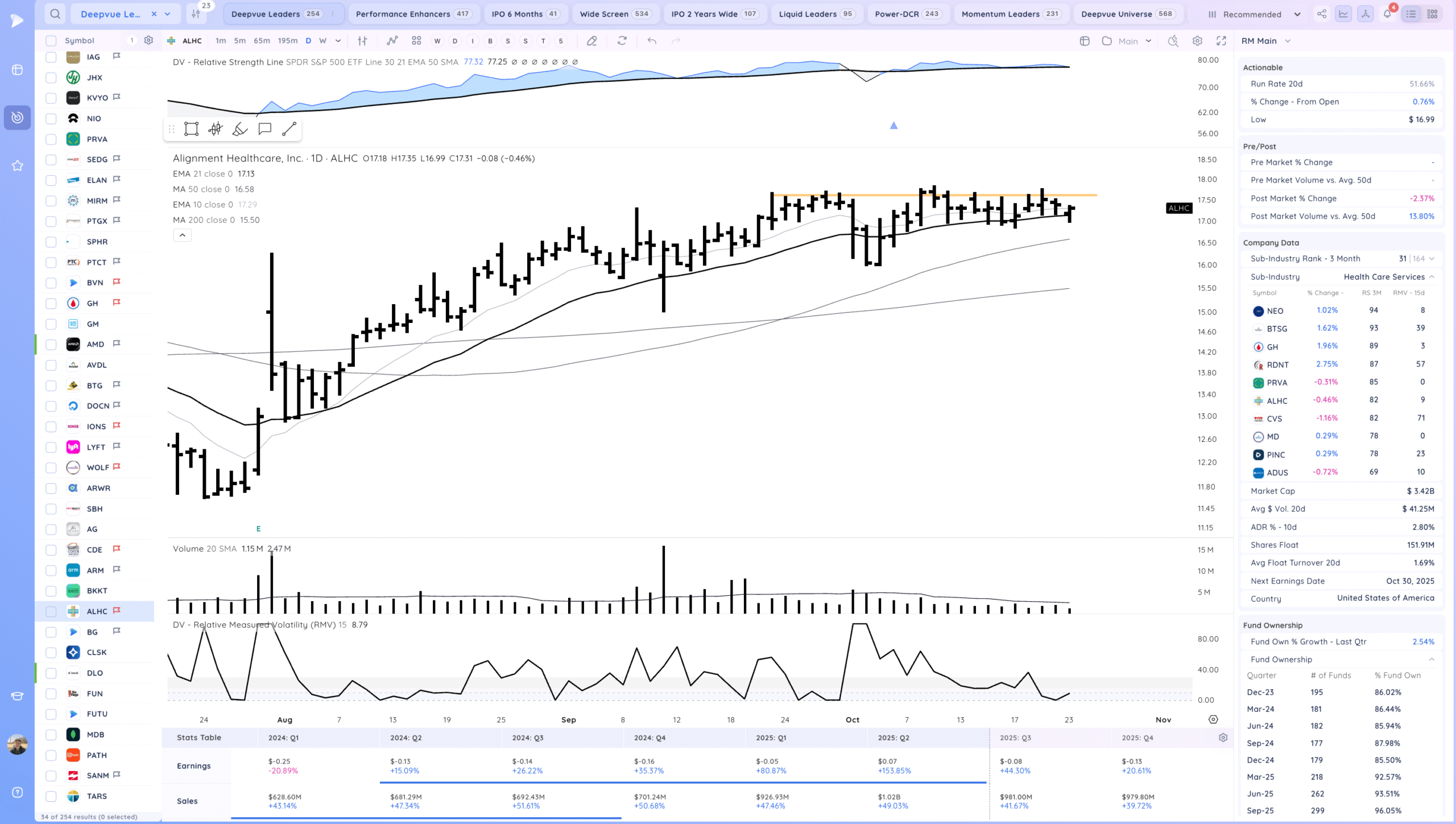

ALHC watching for a base breakout. Earnings the 30th

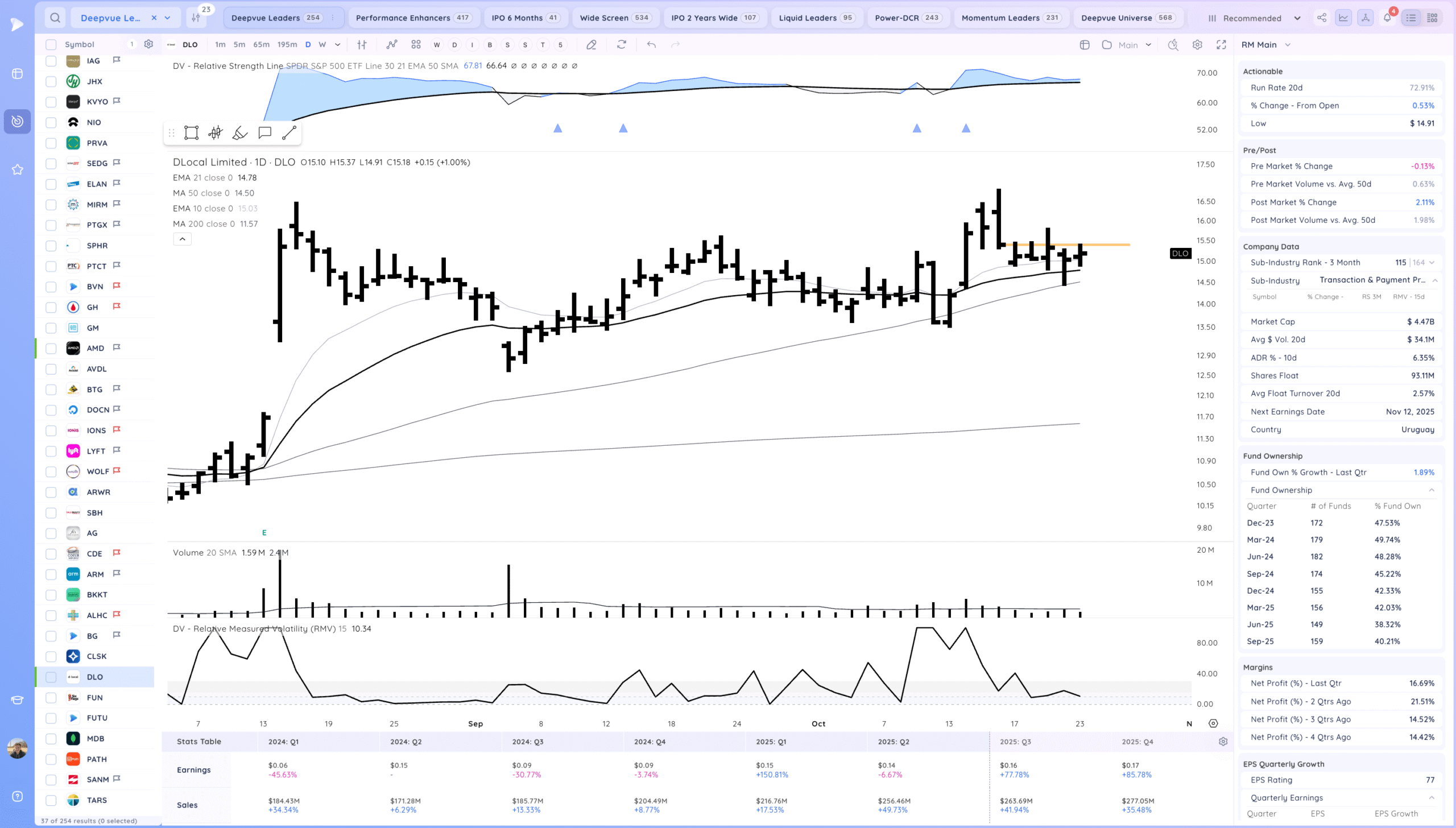

DLO watching for a range breakout.

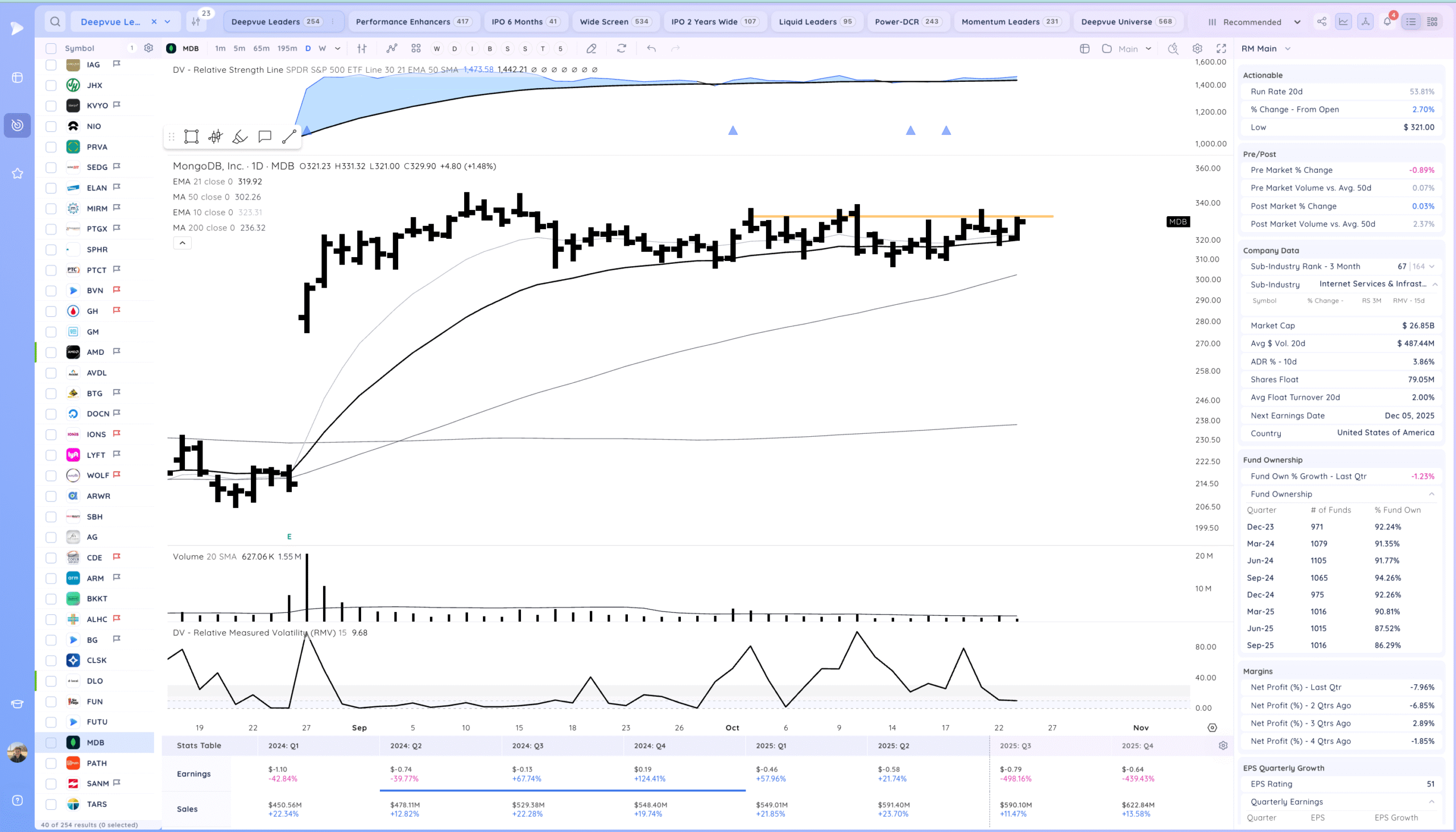

MDB watching for a range breakout

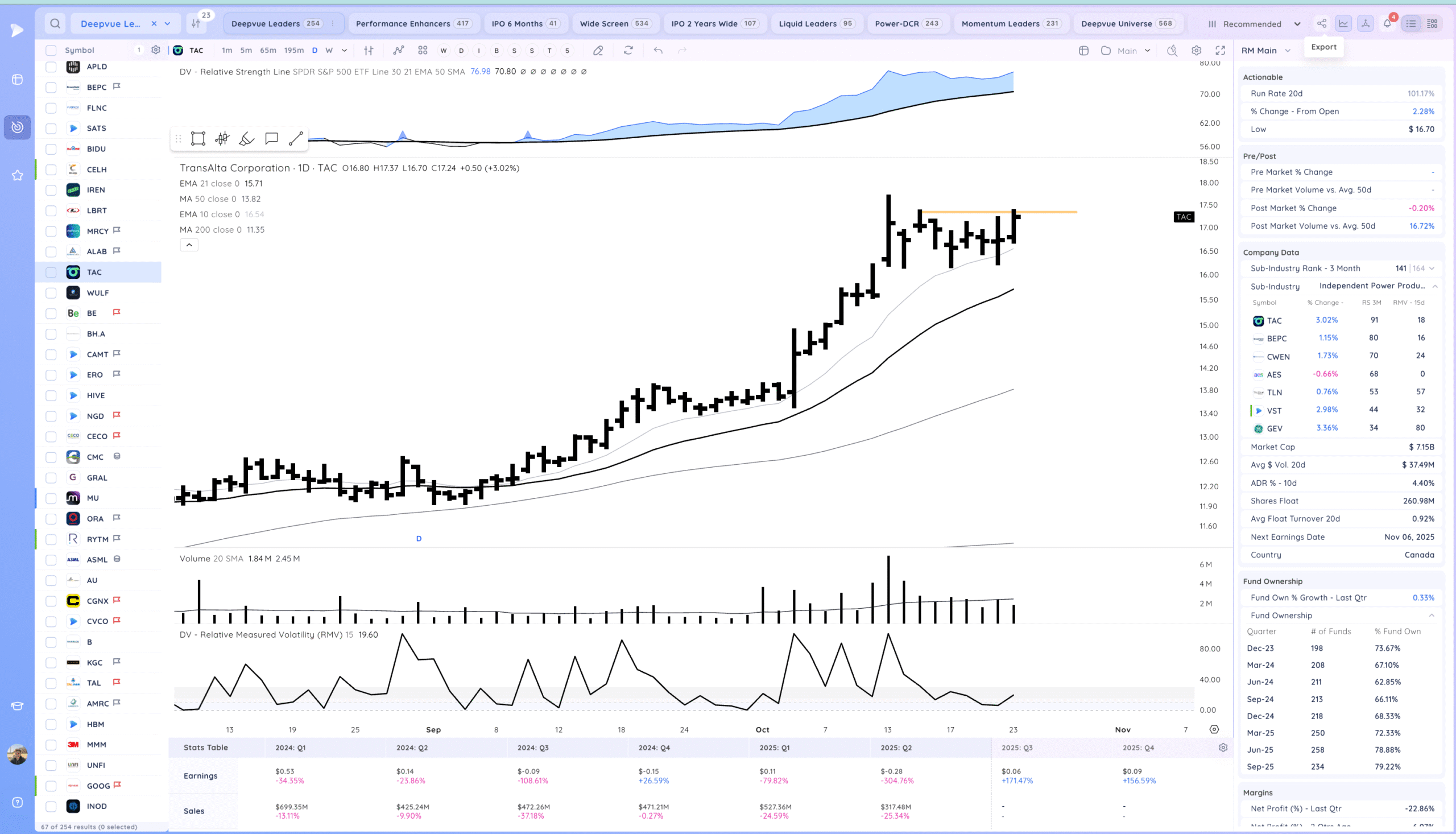

TAC watching for a range breakout.

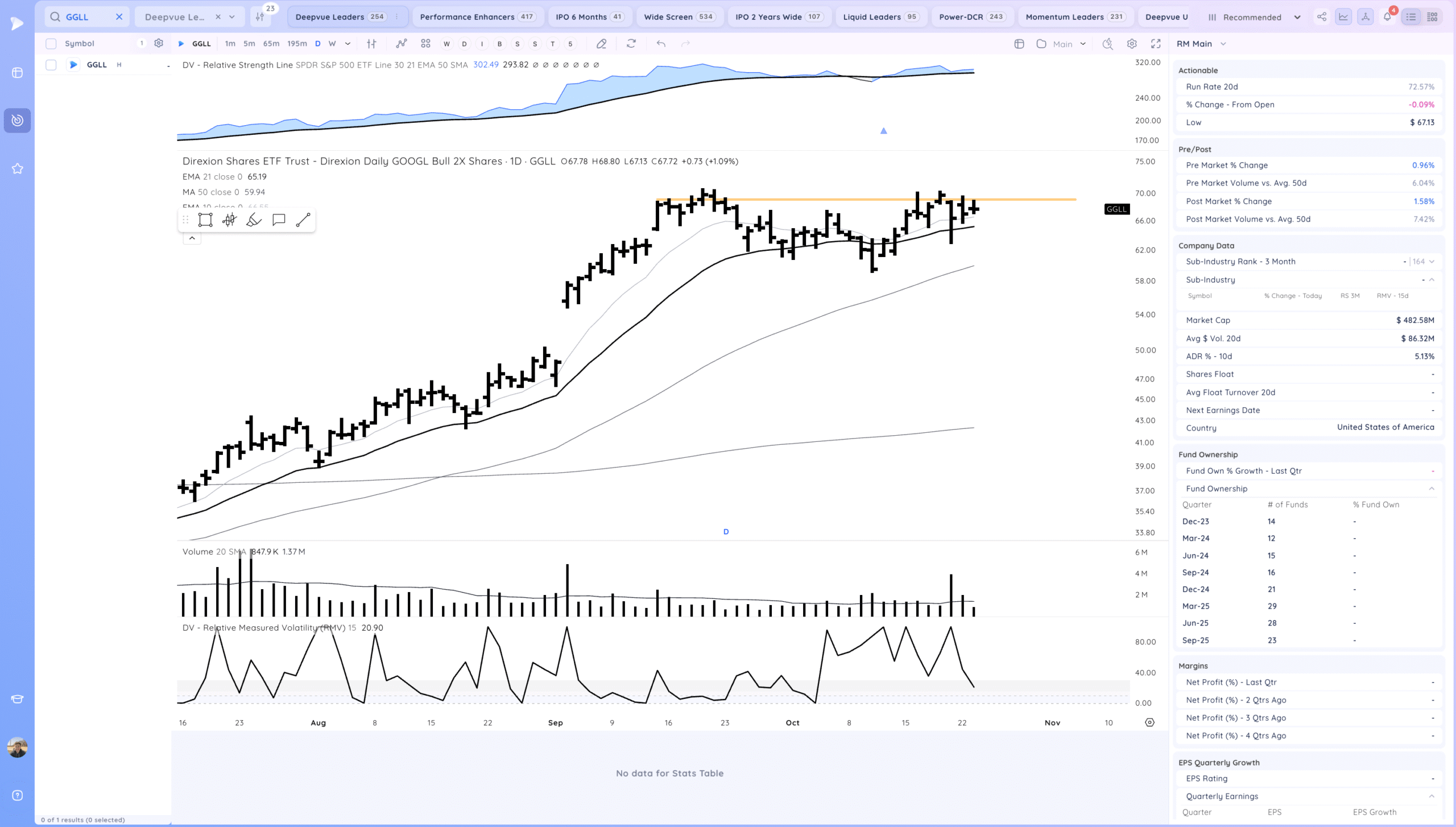

GOOG or a 2X etf like GGLL setting up for a base breakout. Earnings upcoming

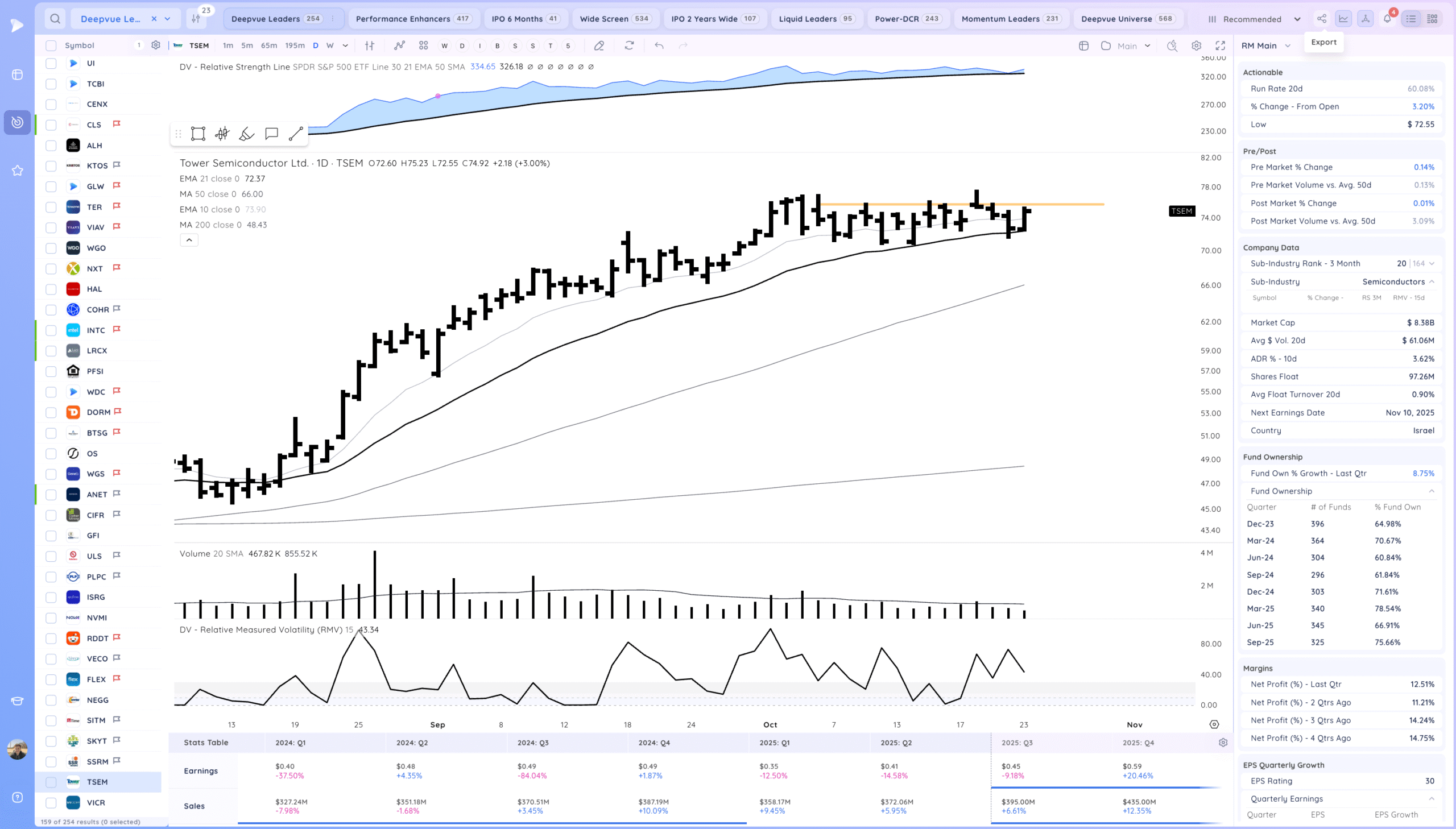

TSEM watching for a range breakout.

Recent Gappers to Track

Day 0 &1

INTC CRS PBF GTX LC MEDP

Day 2+

AMD VICR ISRG PEGA

Today’s Watchlist in List form

Focus List Names

KVYO NIO SEDG SPHR AMD SBH ARM ALHC DLO MDB TAC GOOG/GGLL TSEM INTC PLTR NVDA TSLA

Focus:

TSLA (Add) PLTR NVDA AMD

Themes

AI, AI Energy, rare metals, biotech. Oil and Gas

Additional Thoughts

Strong day after the open and seeing a bunch of setups. Semis a big test tomorrow after INTC earnings see how it closes.

Anything can happen, Day by Day – Managing risk along the way