Inside Day at Highs. Semiconductors Coiled

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 21, 2025

Market Action

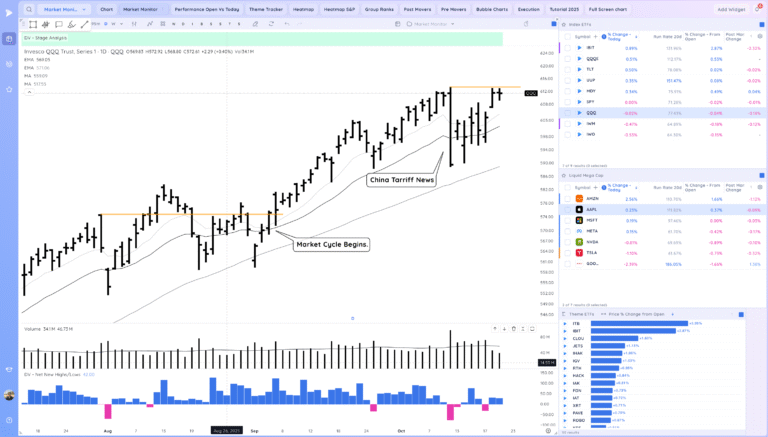

QQQ – Inside day as we consolidate right below the key level of the friday reversal highs. This will be a level that everyone is watching and positioning against. The last 2 days have been on lower volume. The overall environment is still choppy.

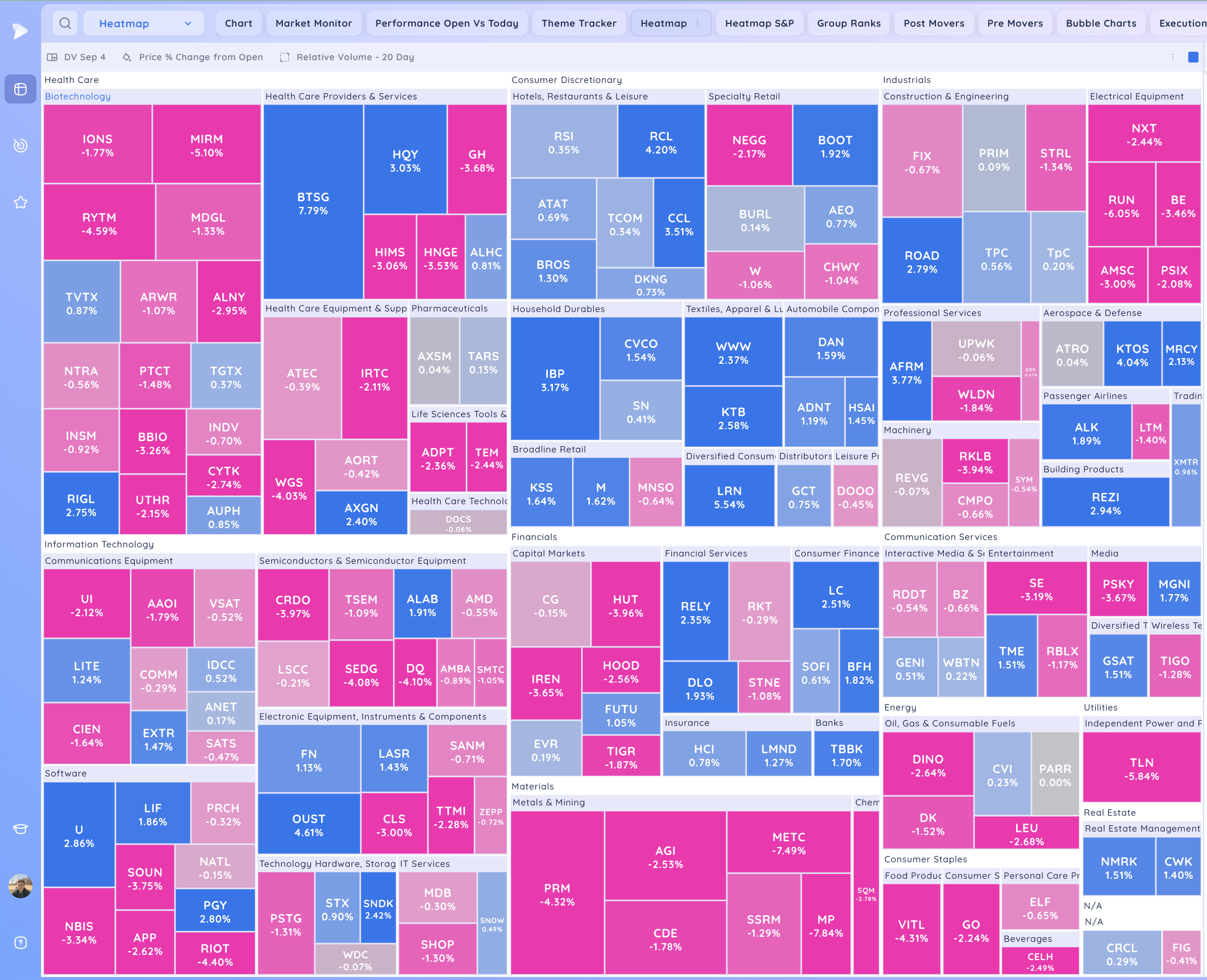

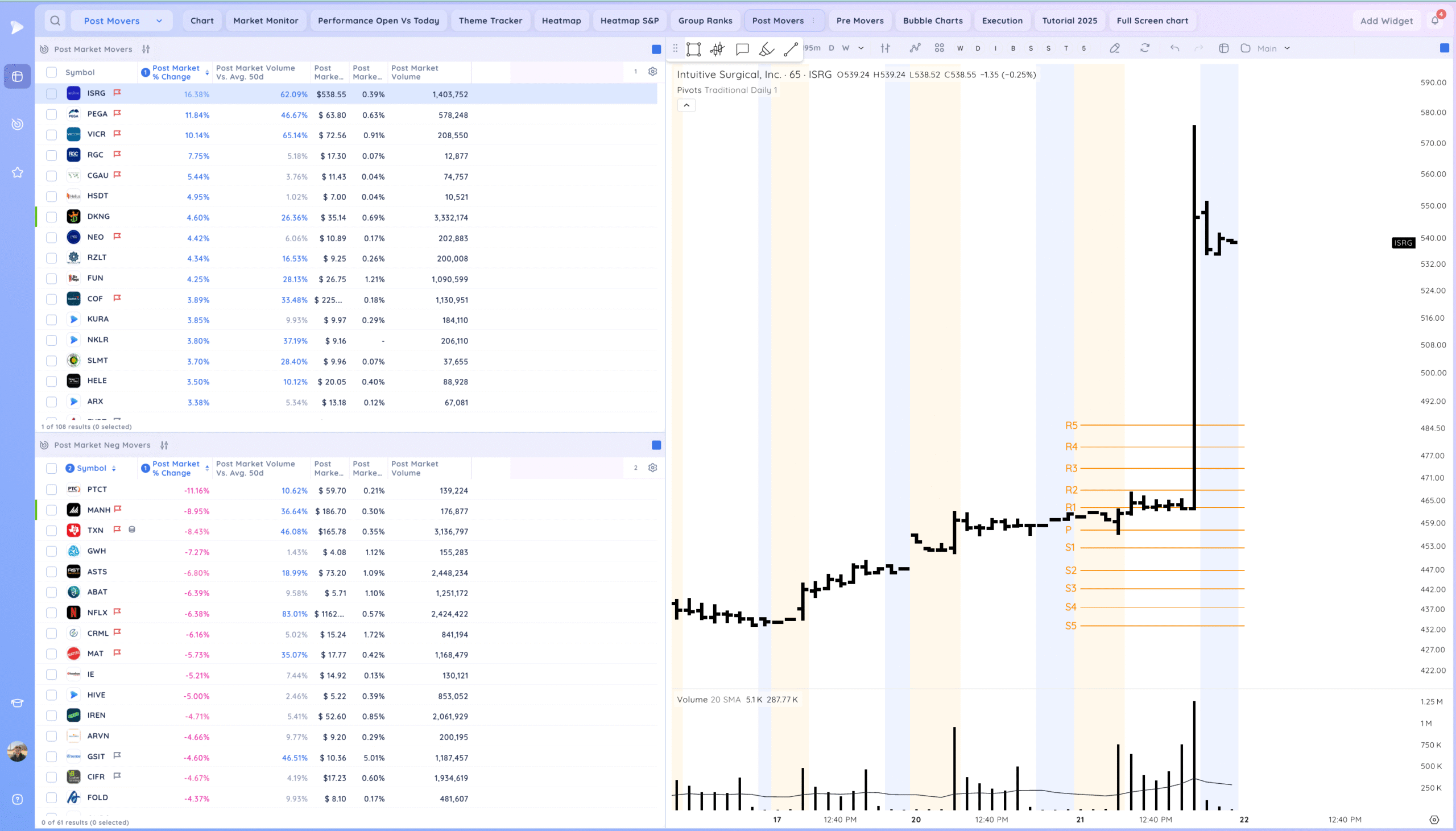

Earnings season is upon us. I’ve included my Deepvue post market movers dashboard below after the heatmaps. Earnings moves provide great insight inot the risk appetite of institutions. It’s not just about the initial gap, but also if those gaps are followed by follow on strength or weakness.

Bulls want to see us follow through higher and break above that reversal high

Bears want to see us reverse down, and see more earnings gap downs than gap ups from key growth names.

Daily Chart of the QQQ.

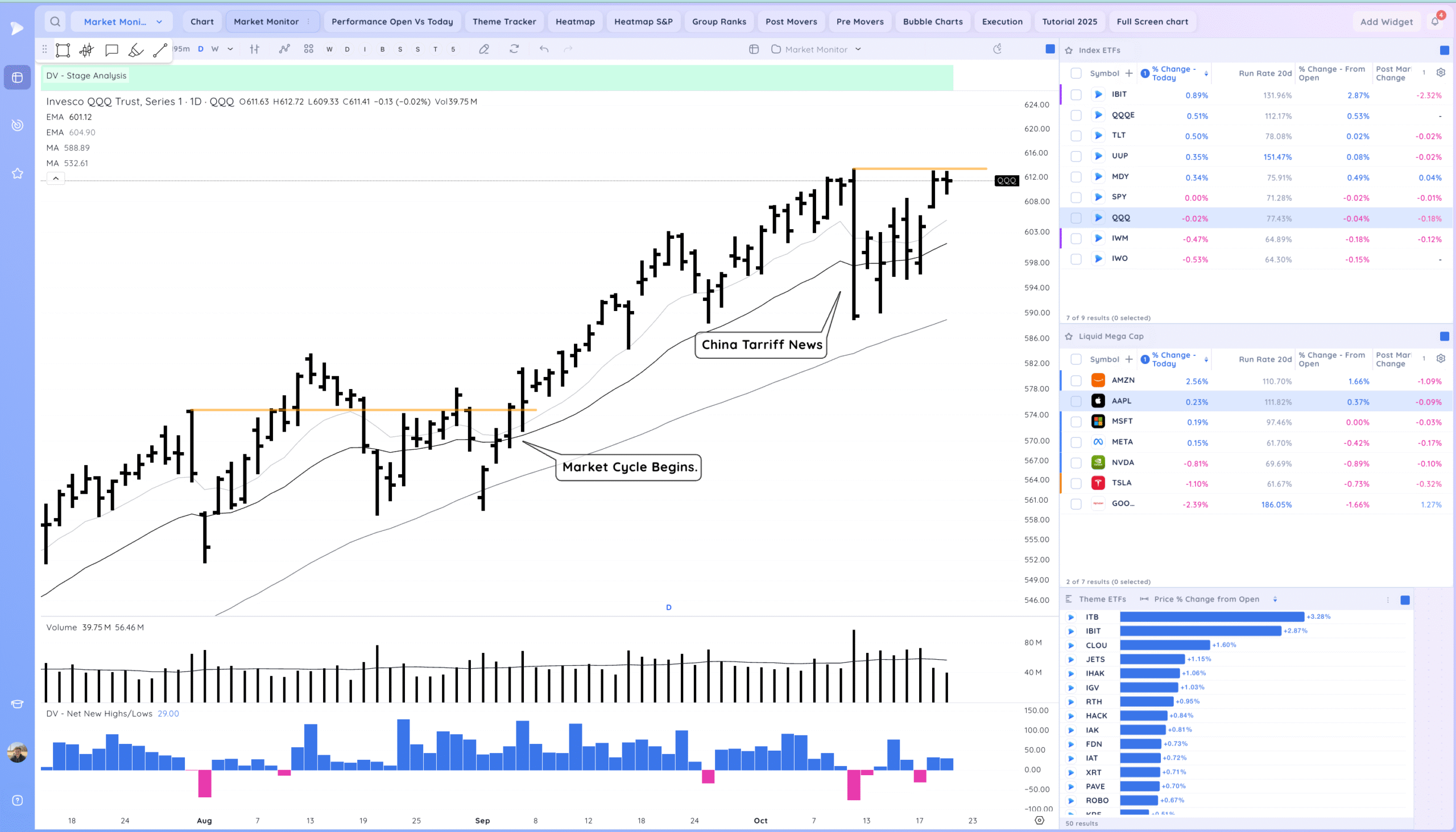

IWM – Tight day resting on the pivot. Constructive

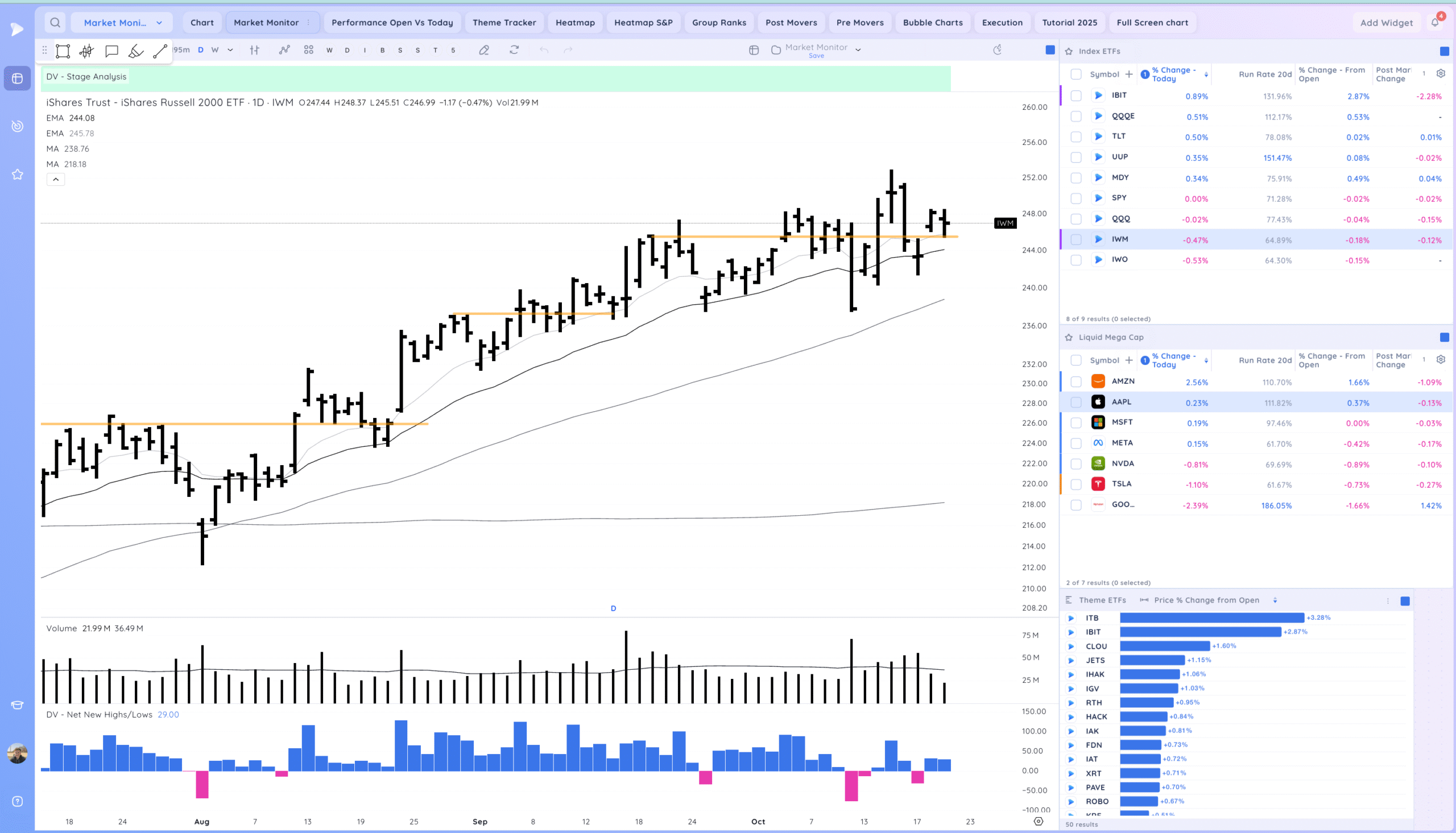

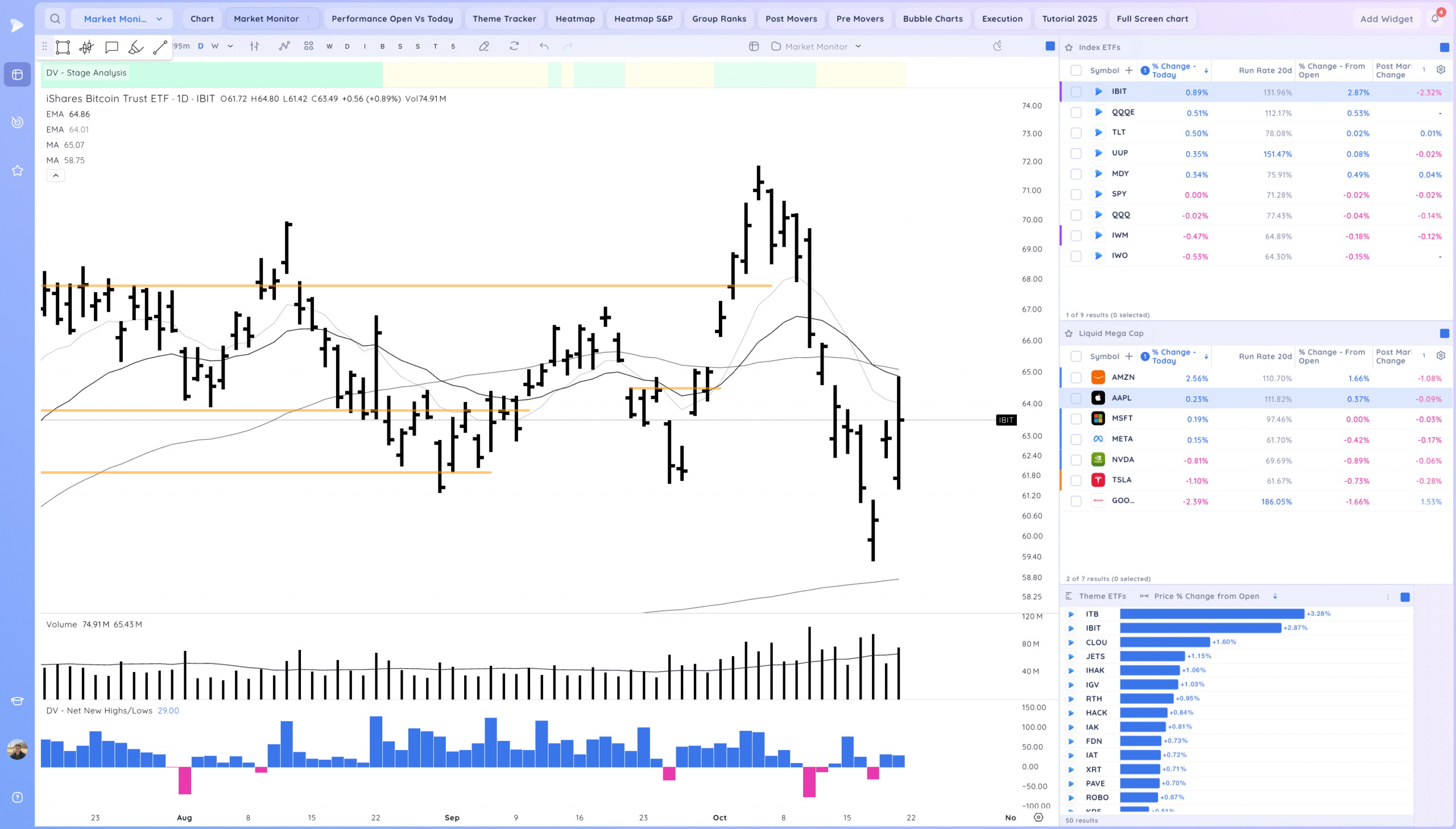

IBIT – Wide range but positive bar. Remains volatile and below the MAs

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

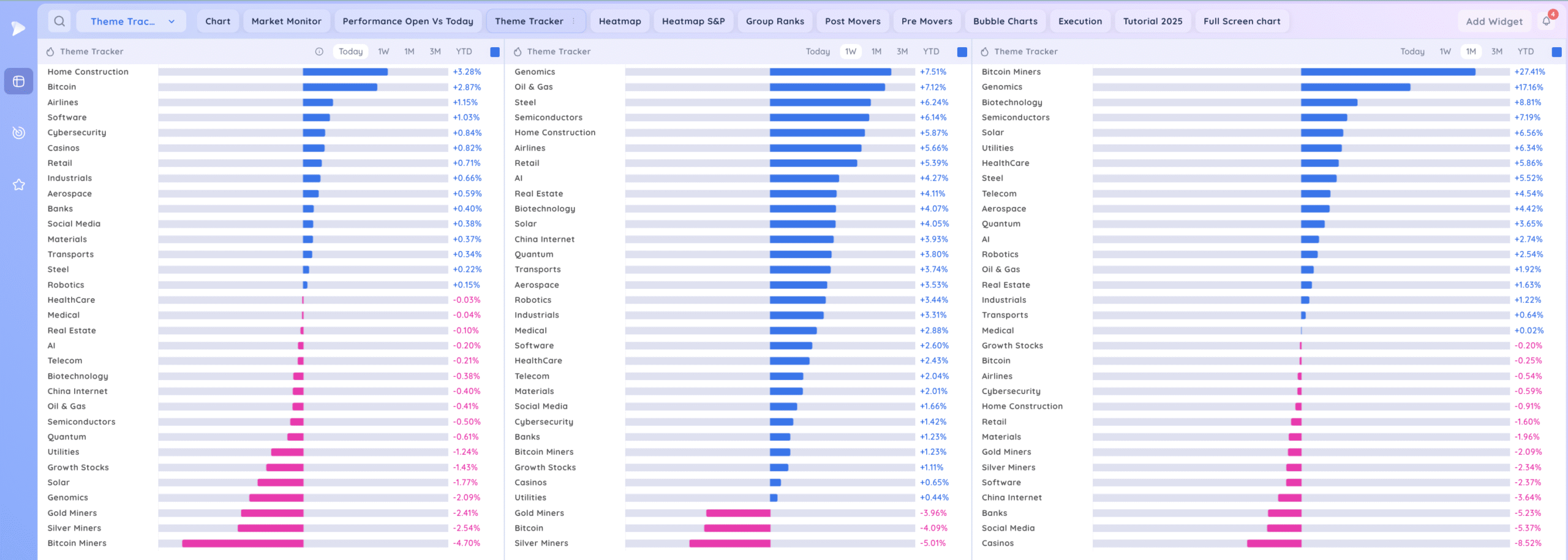

Deepvue Theme Tracker. Home construction leading today

Deepvue Leaders. Gold miners pulling in

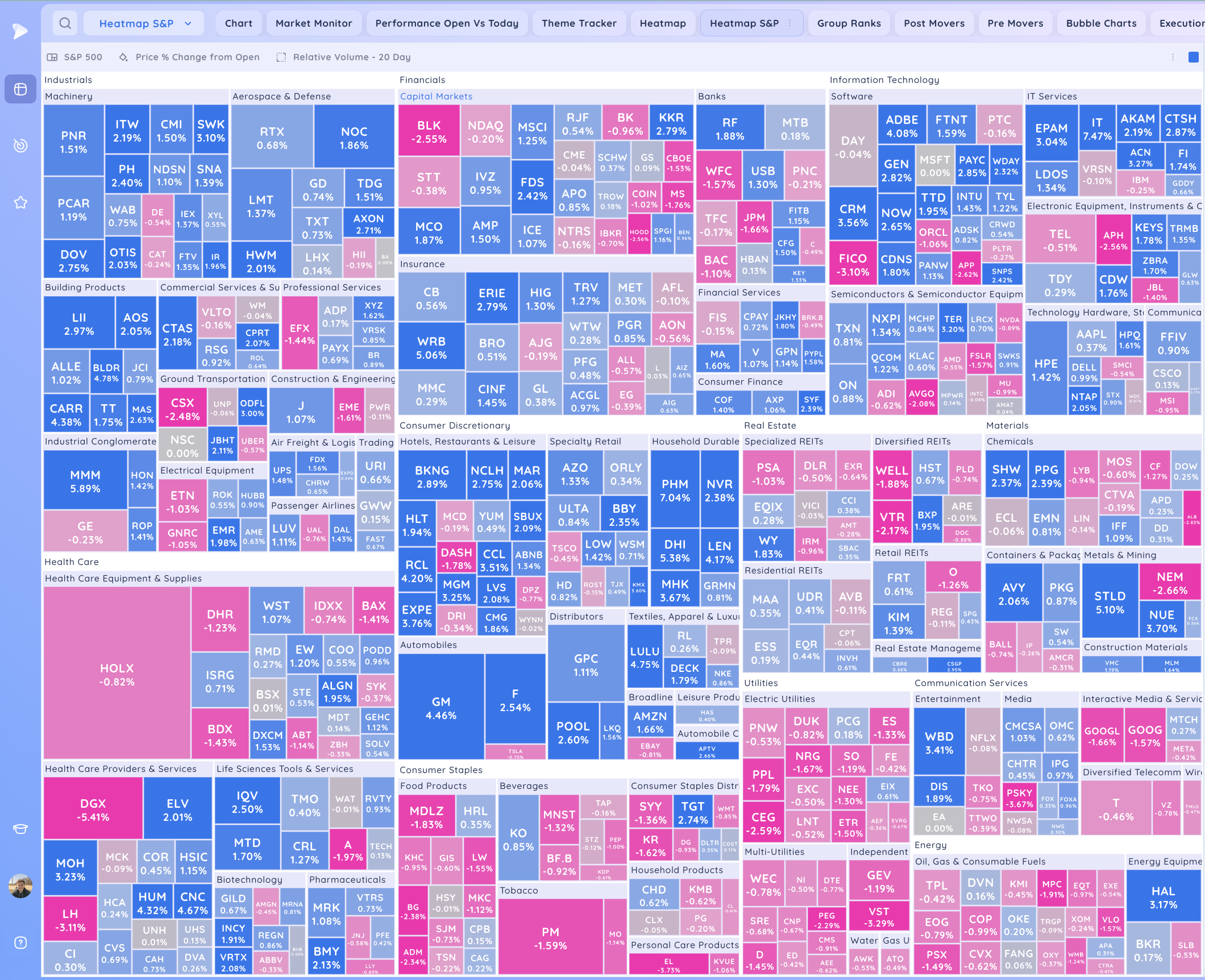

S&P 500.

Post Market Movers. NFLX Down ISRG Up

Leadership Stocks & Analysis

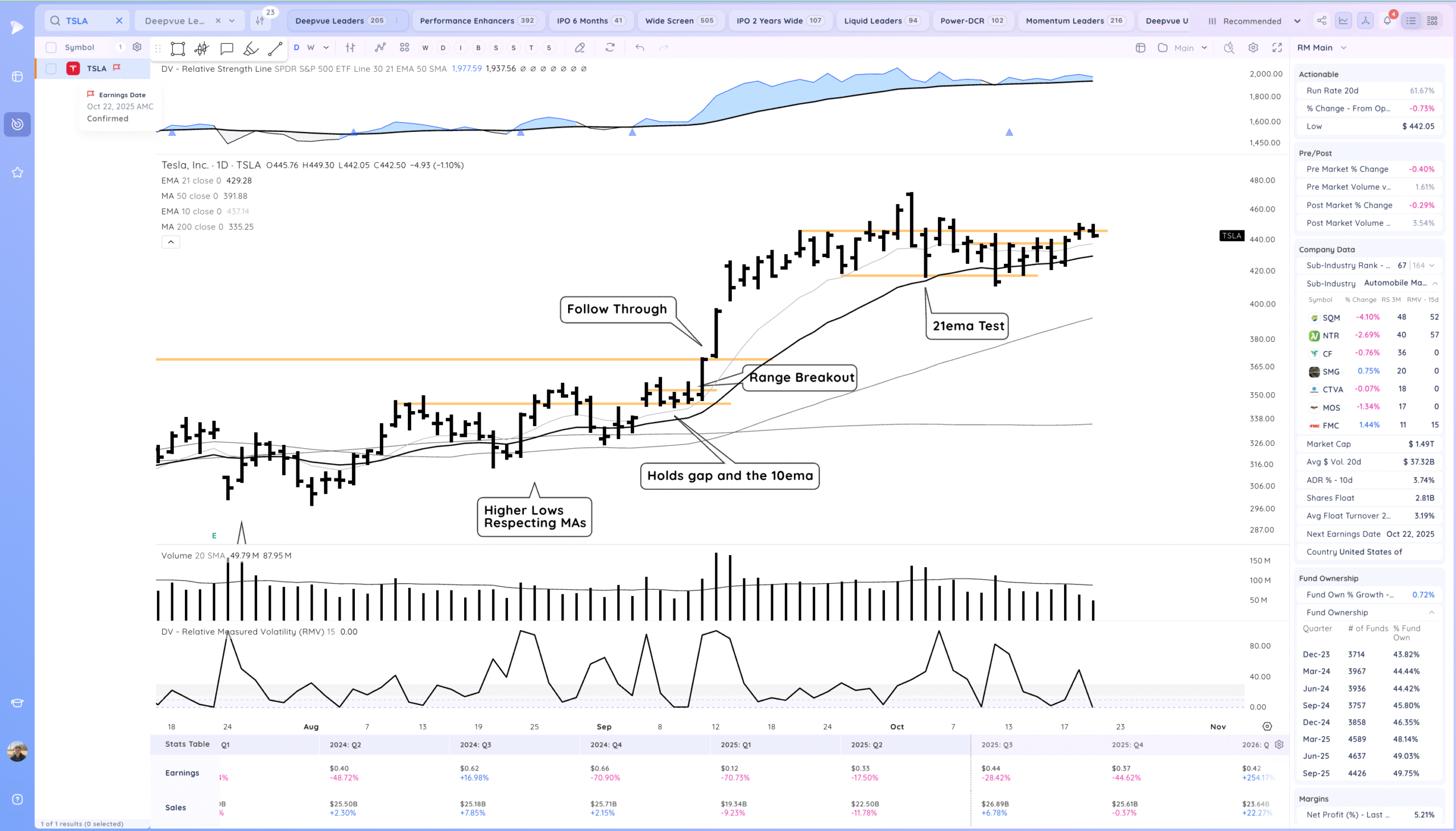

TSLA – Overall tight near the top of this range heading into earnings. Tomorrow AMC. Can expect some volatility tomorrow.

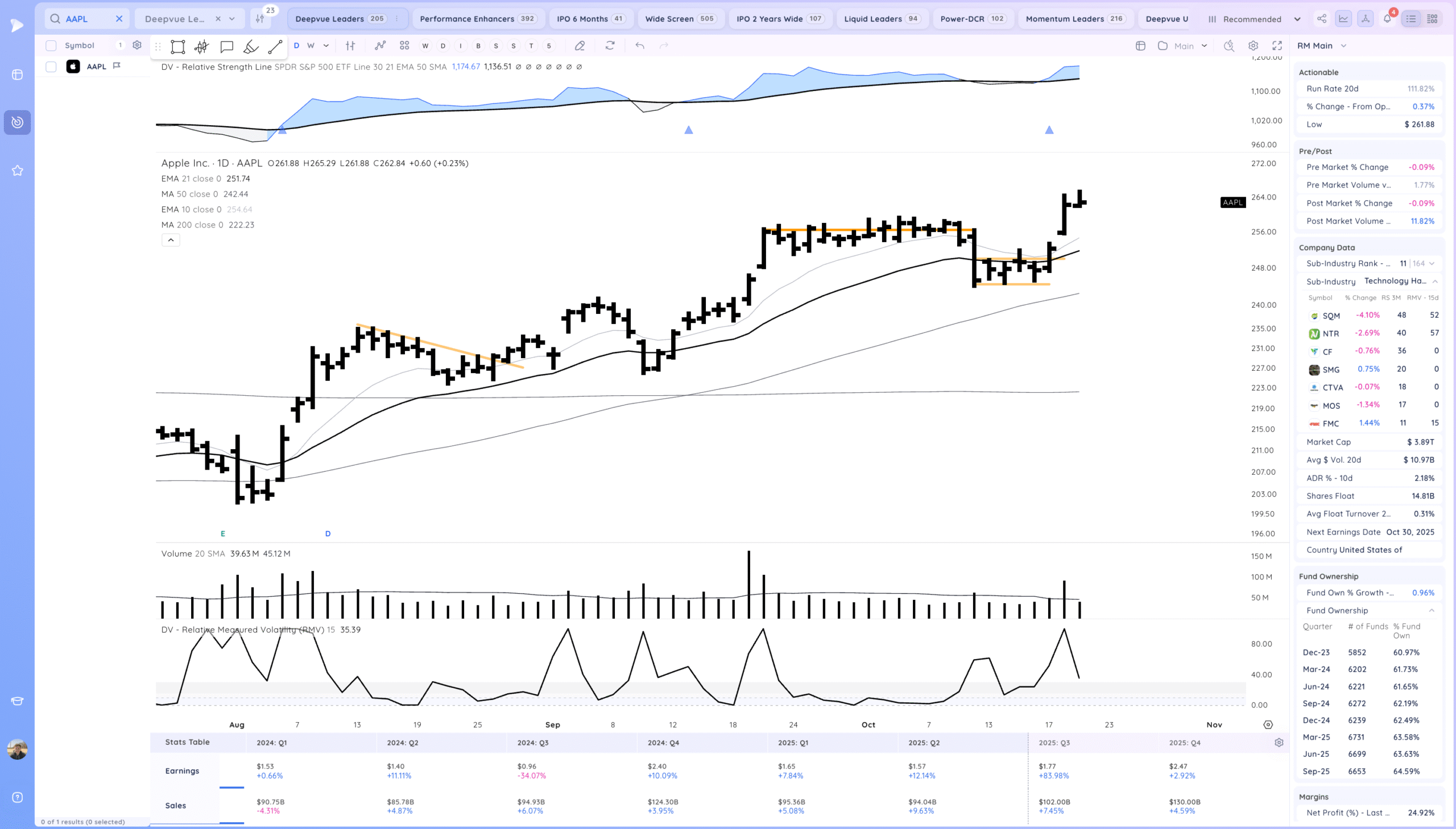

AAPL tight day after the recent expansion

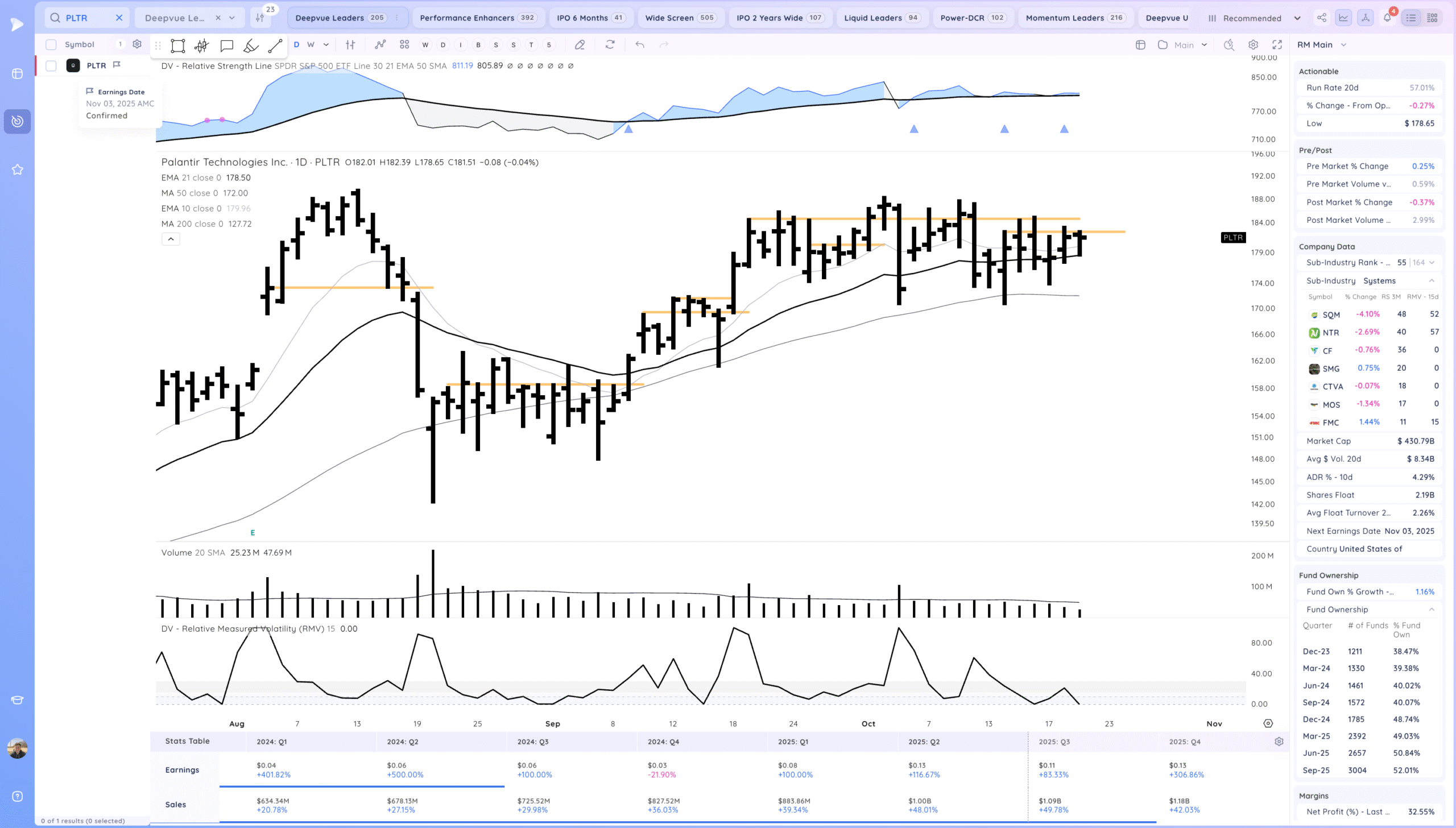

PLTR Very tight. Right above the 21ema. Watching for a range breakout

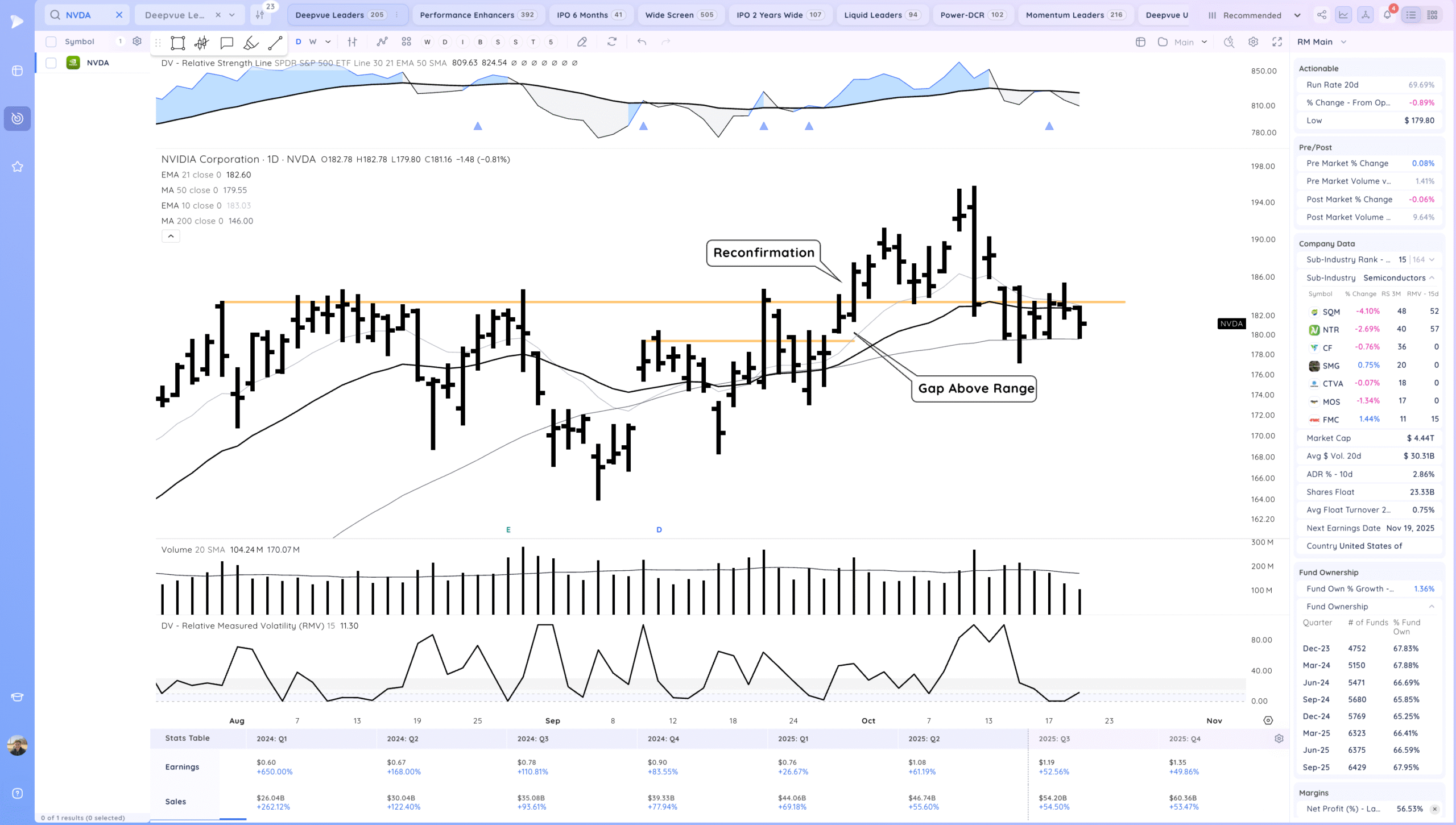

NVDA chopping between the base pivot and 50sma. Will be tough for semis to make a meaningful move unless this begins trending

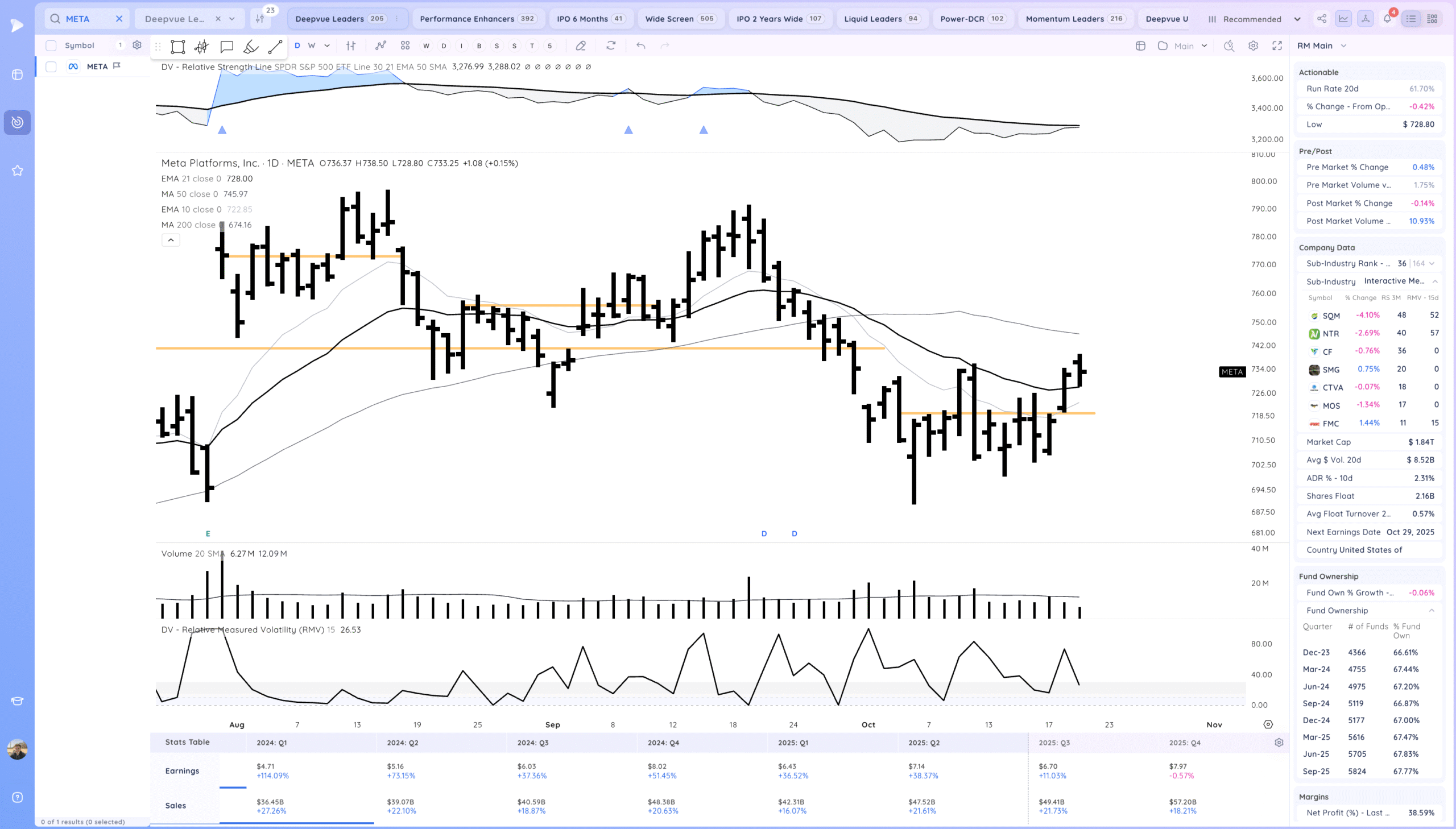

META Holding above the 21ema

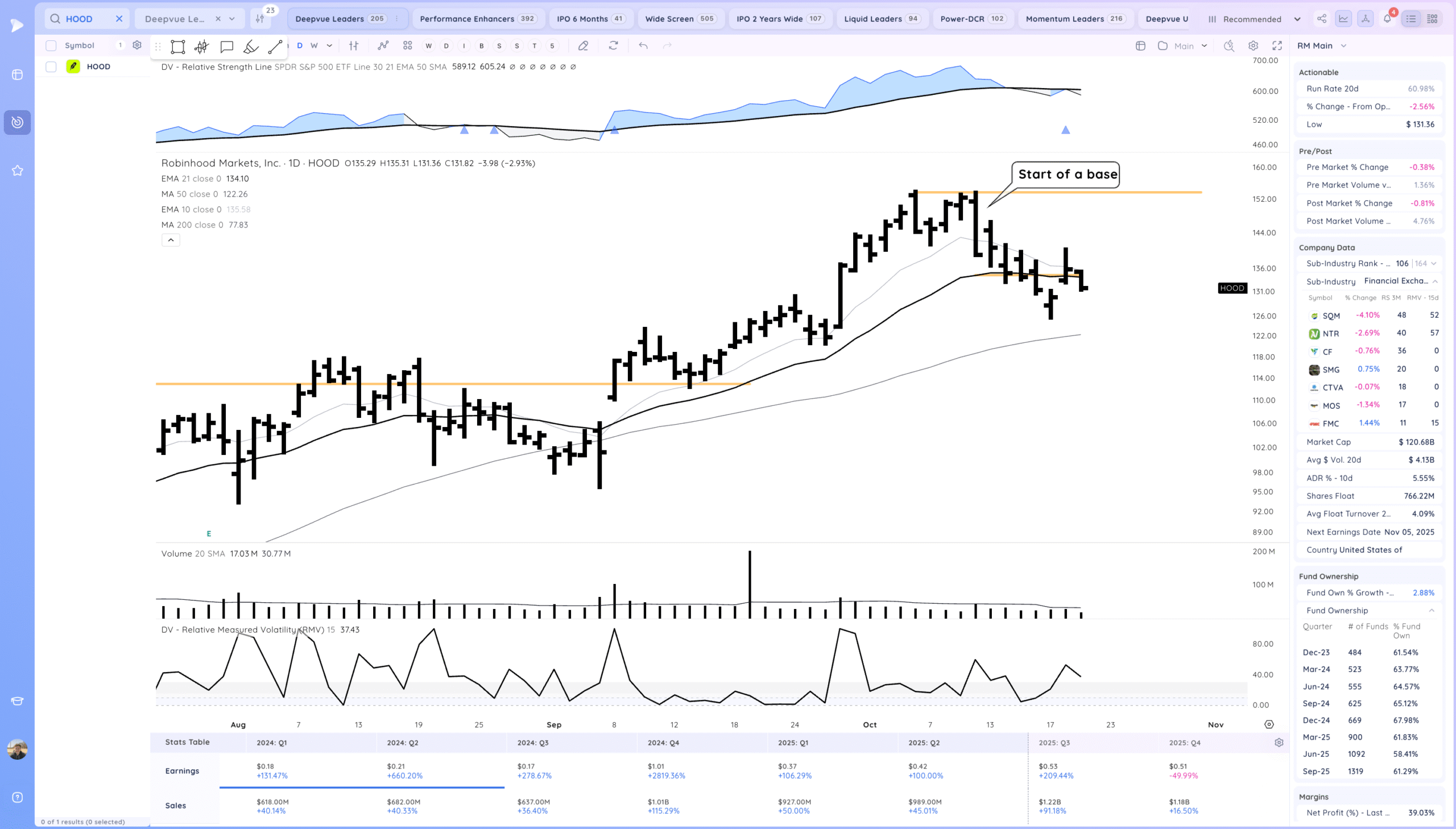

HOOD slight follow through down testing the gap. Ideally this builds a base on base here.

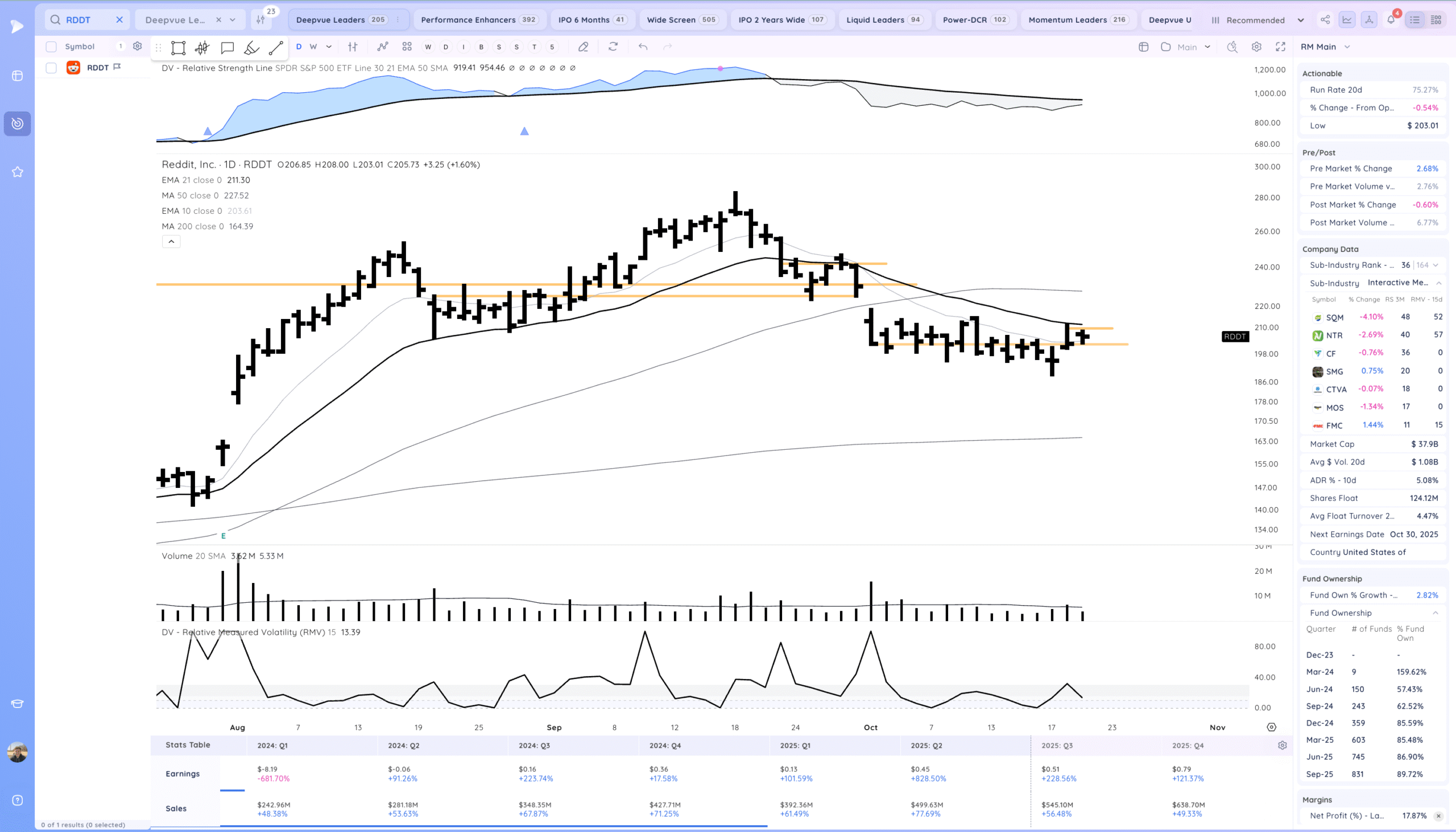

RDDT very tight day. watching for a pop through the 21ema

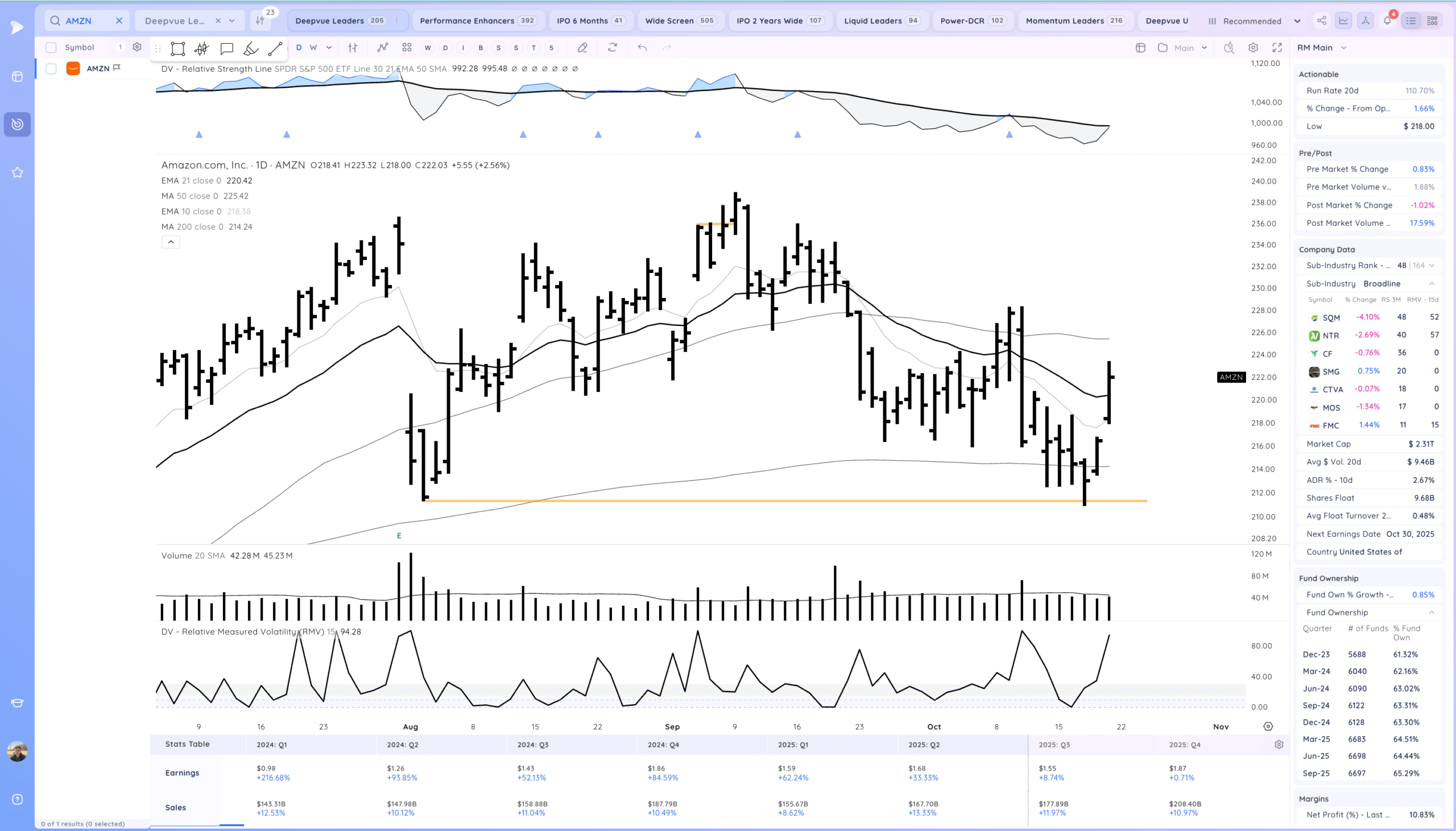

AMZN strong follow through up reclaiming the 21ema

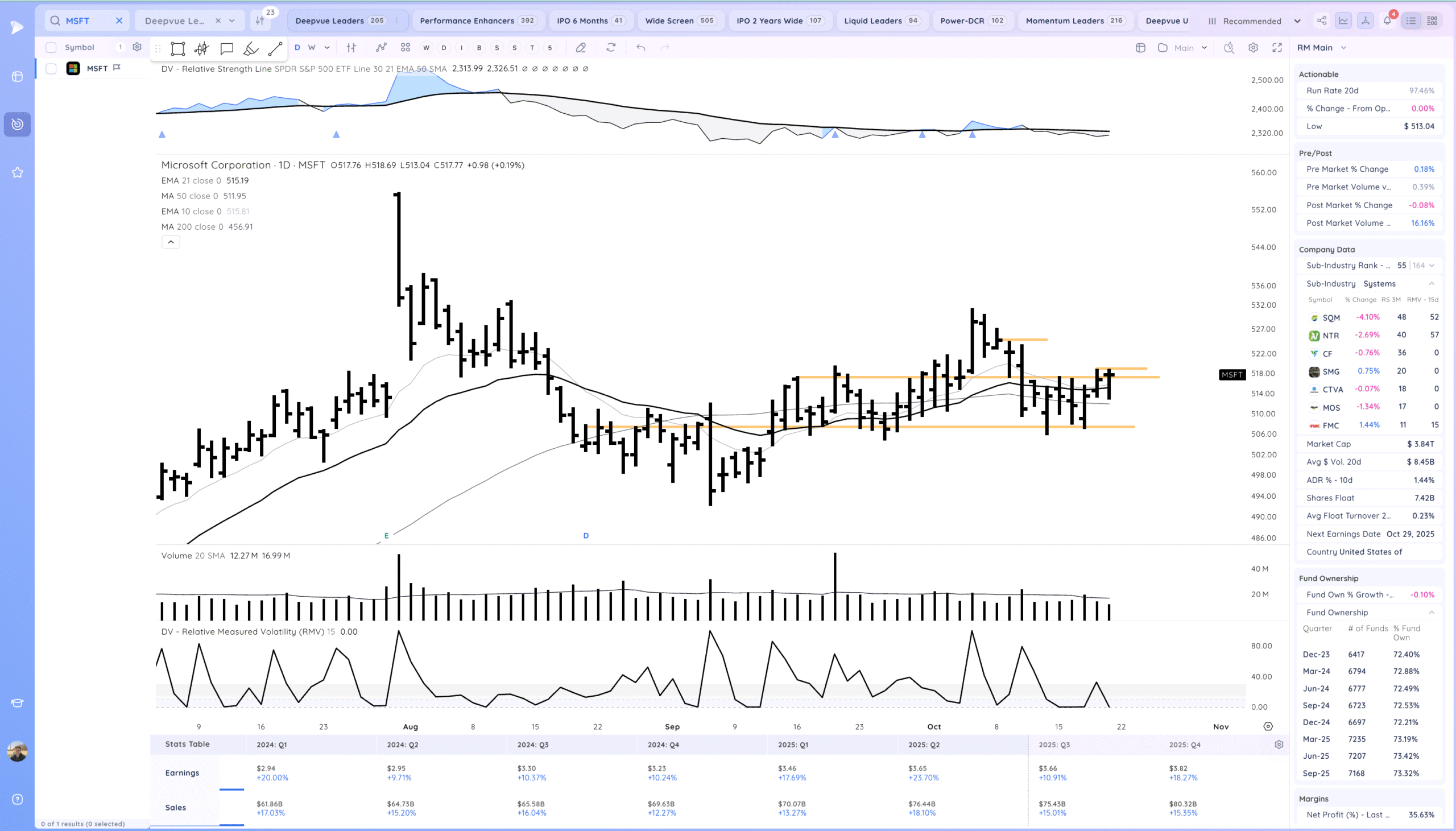

MSFT strong upside reversal at the range pivot. Watching for a breakout

Key Moves

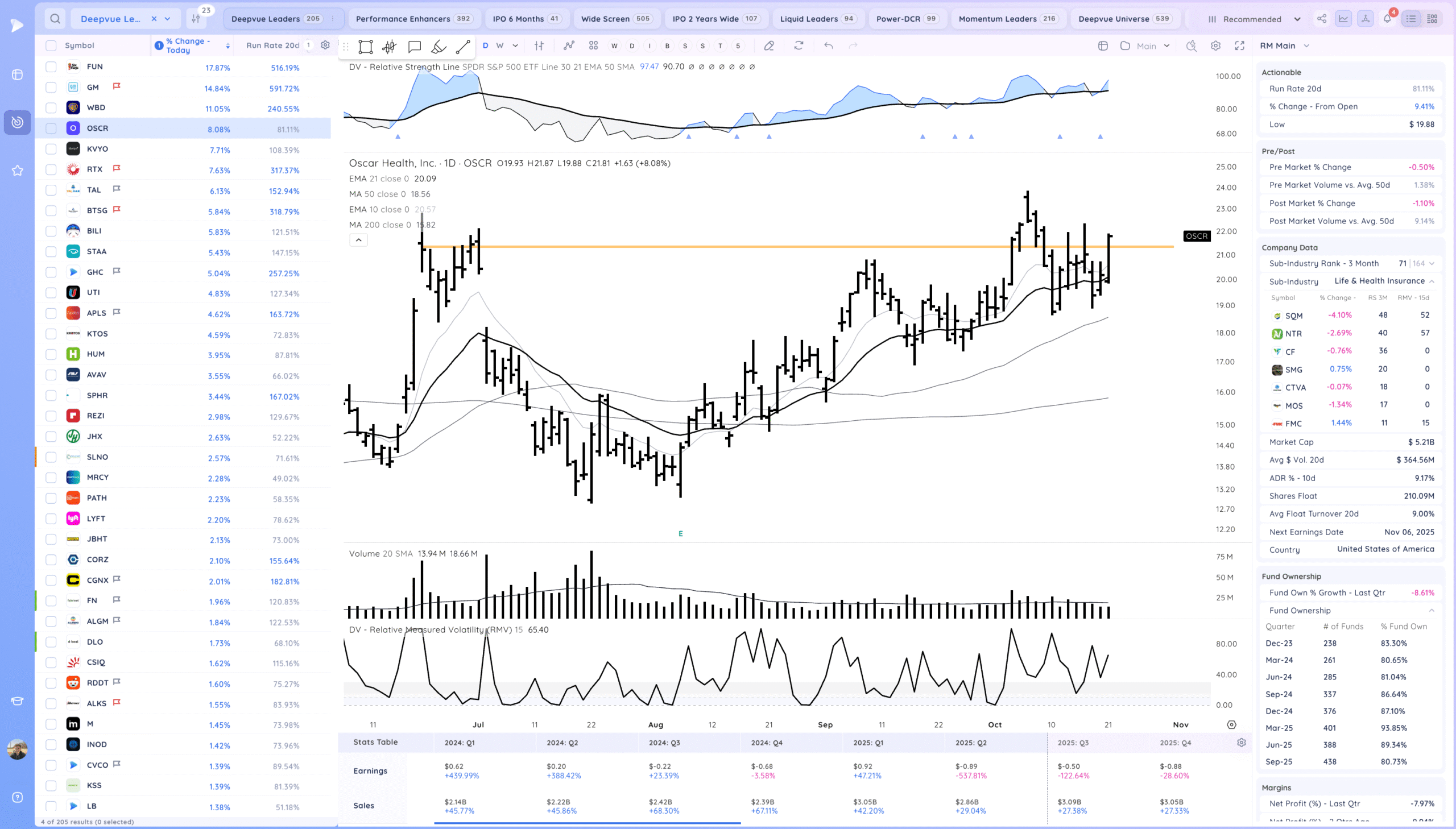

OSCR range and base breakout move

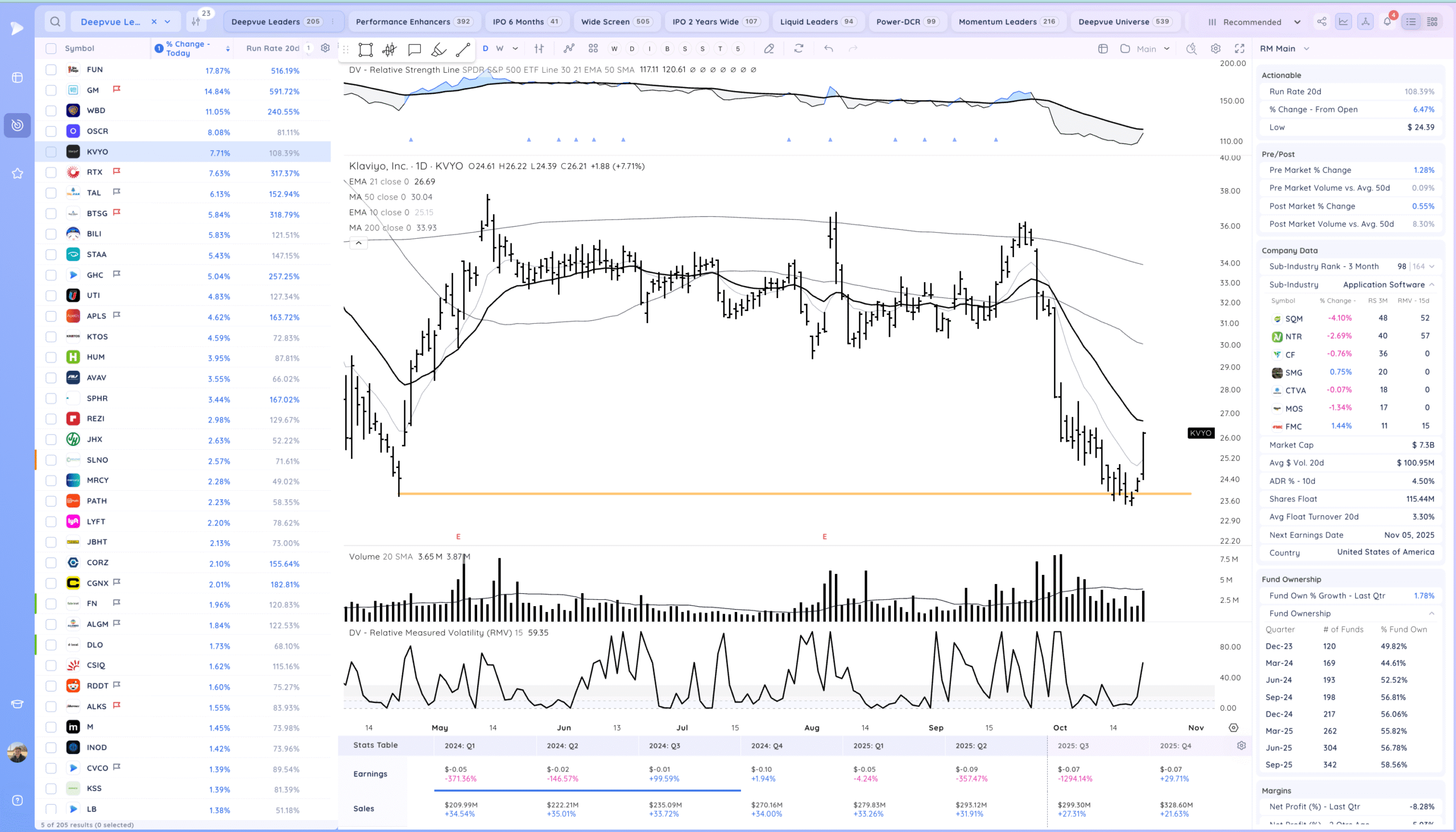

KVYO one to watch in coming months for a trend change

Setups and Watchlist

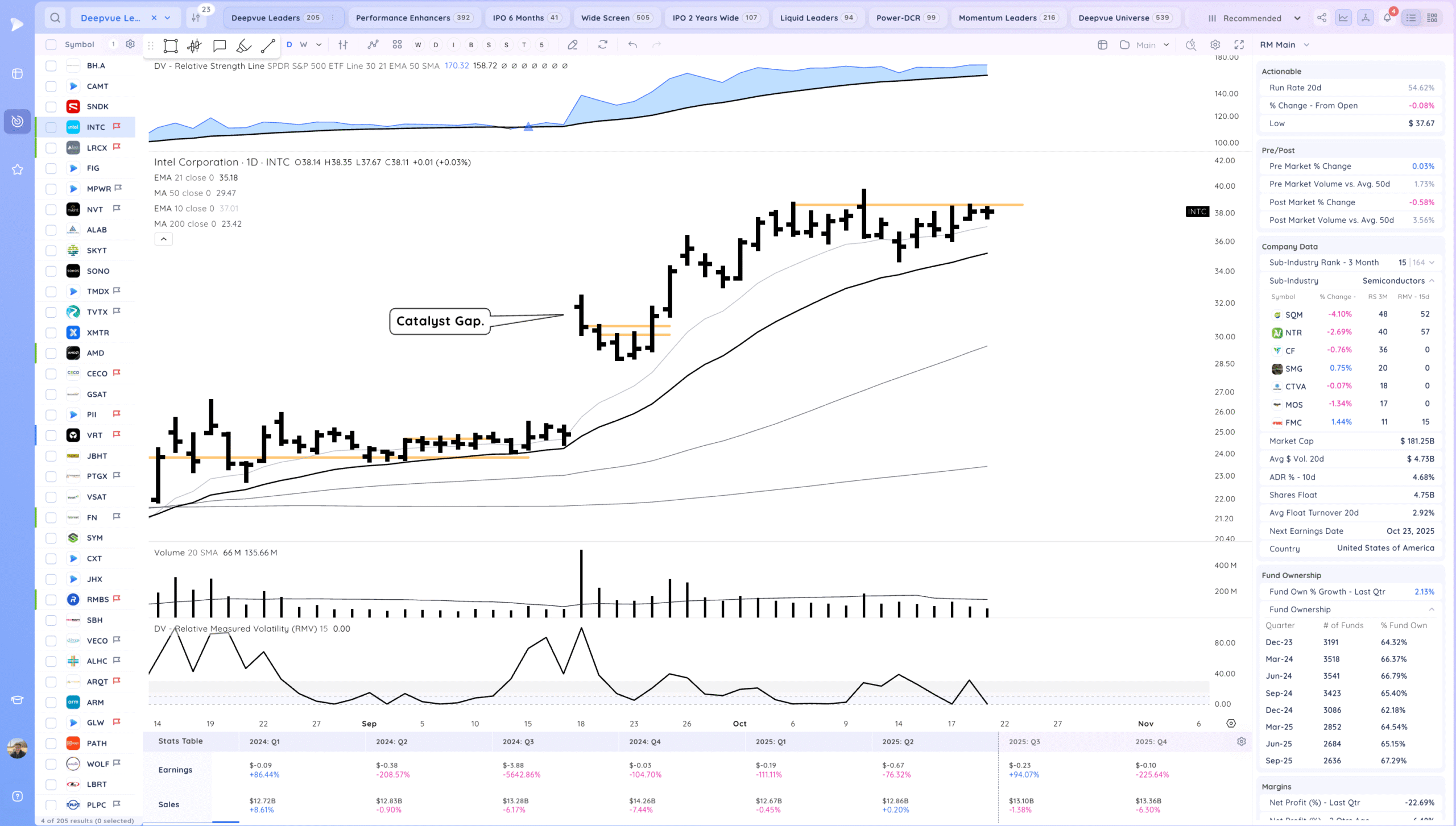

INTC watching for a range breakout. EPS upcoming

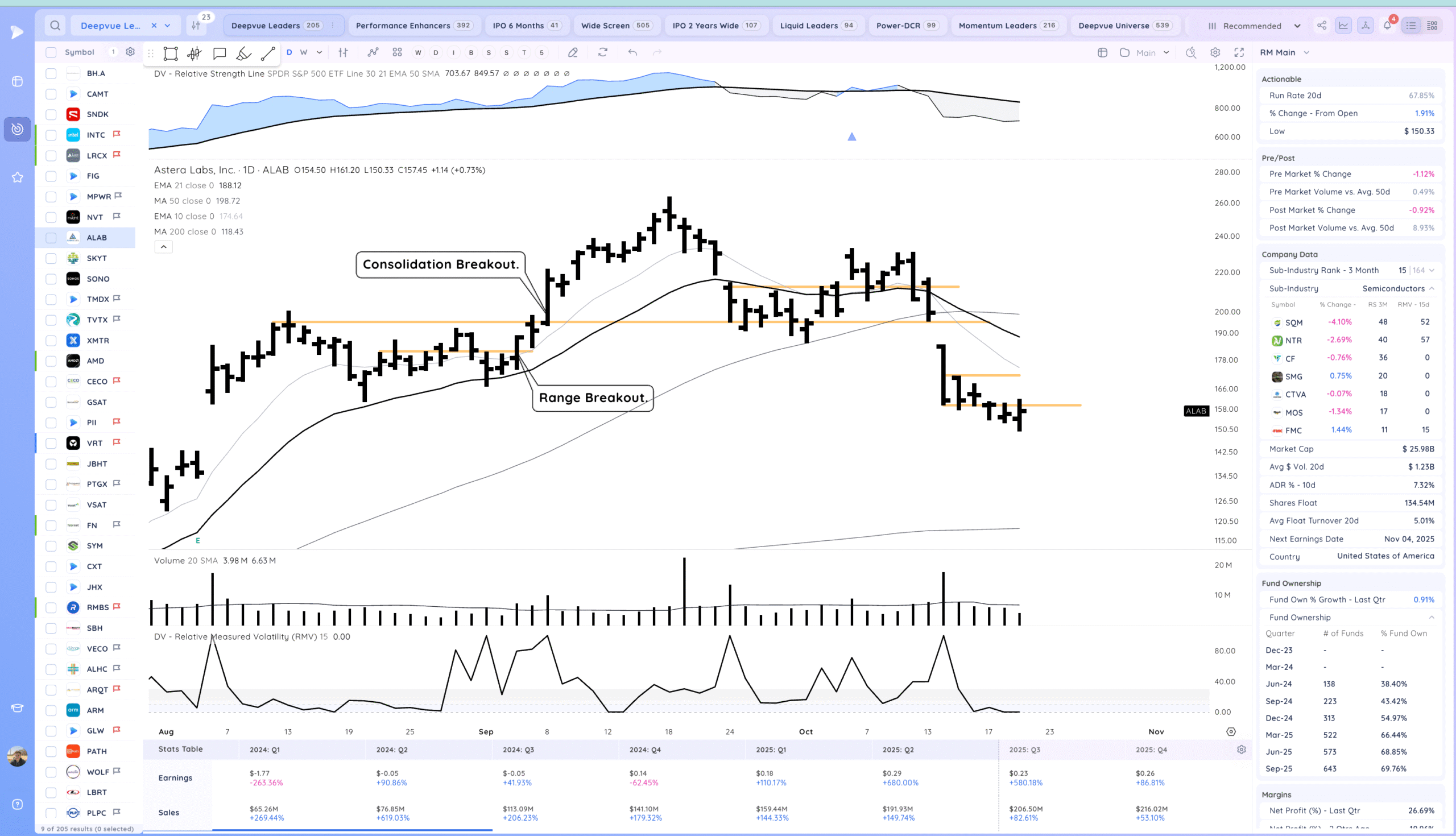

ALAB watching for a range breakout.

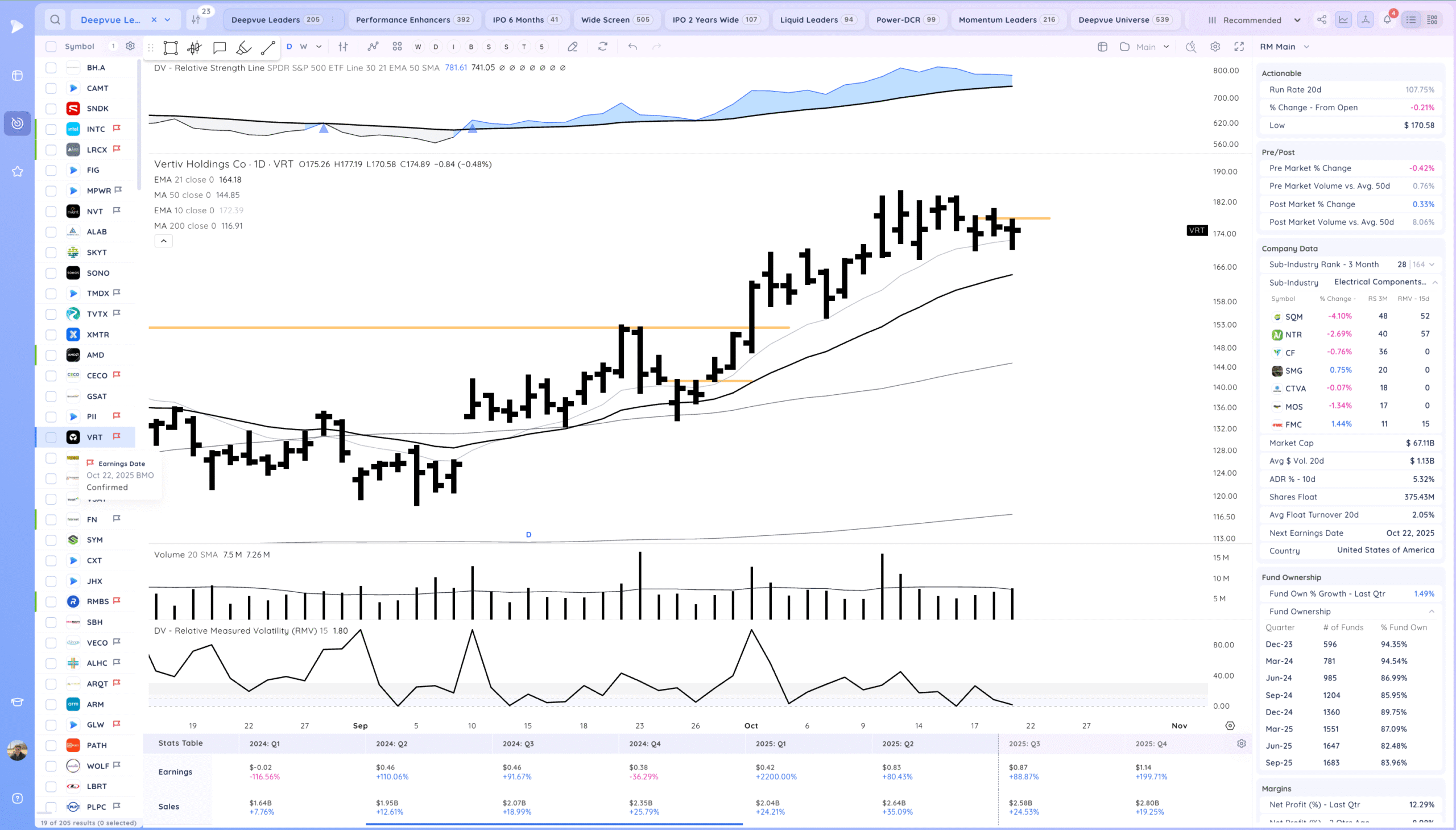

VRT watching for a range breakout and earnings move.

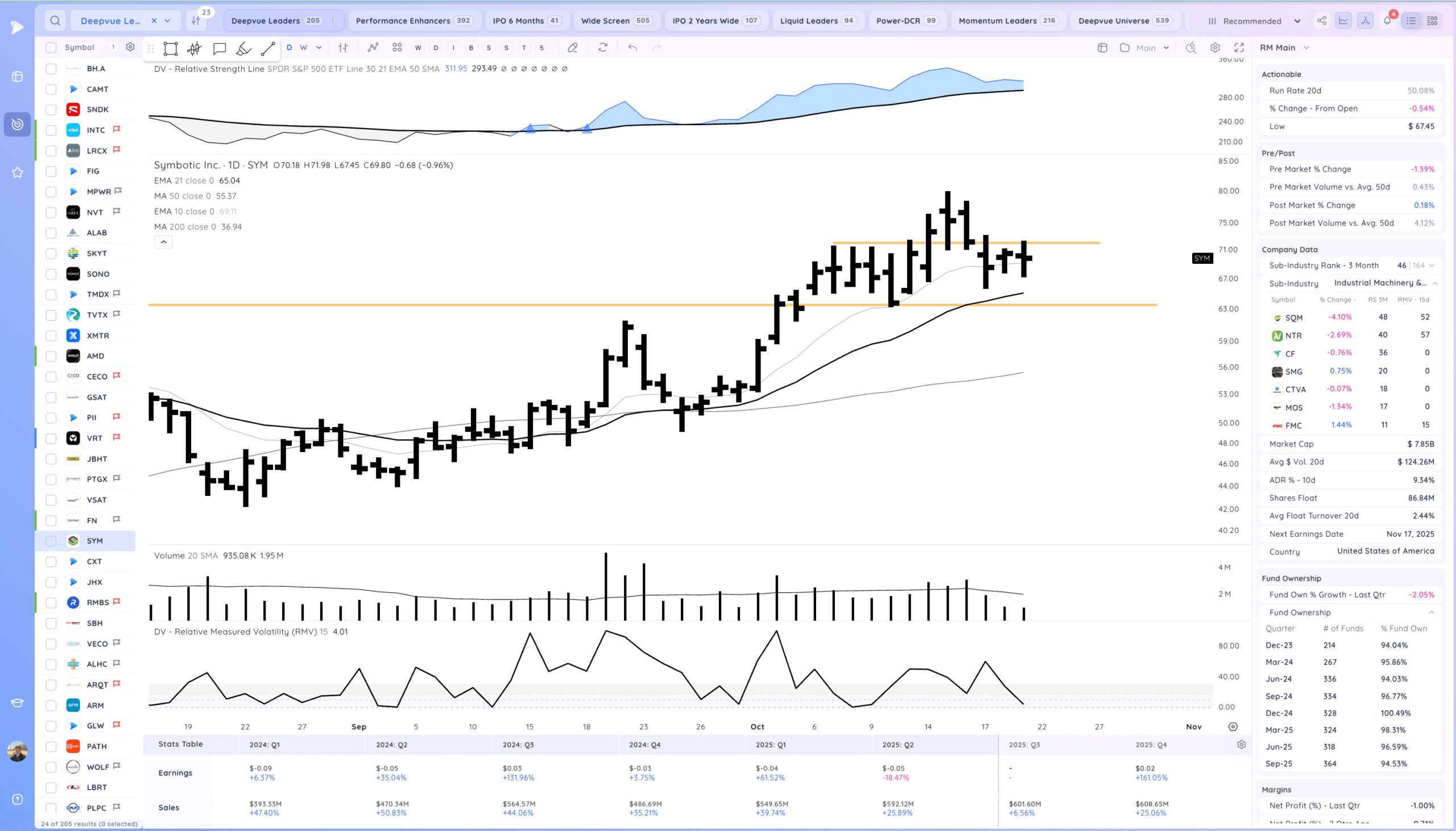

SYM watching for a range breakout.

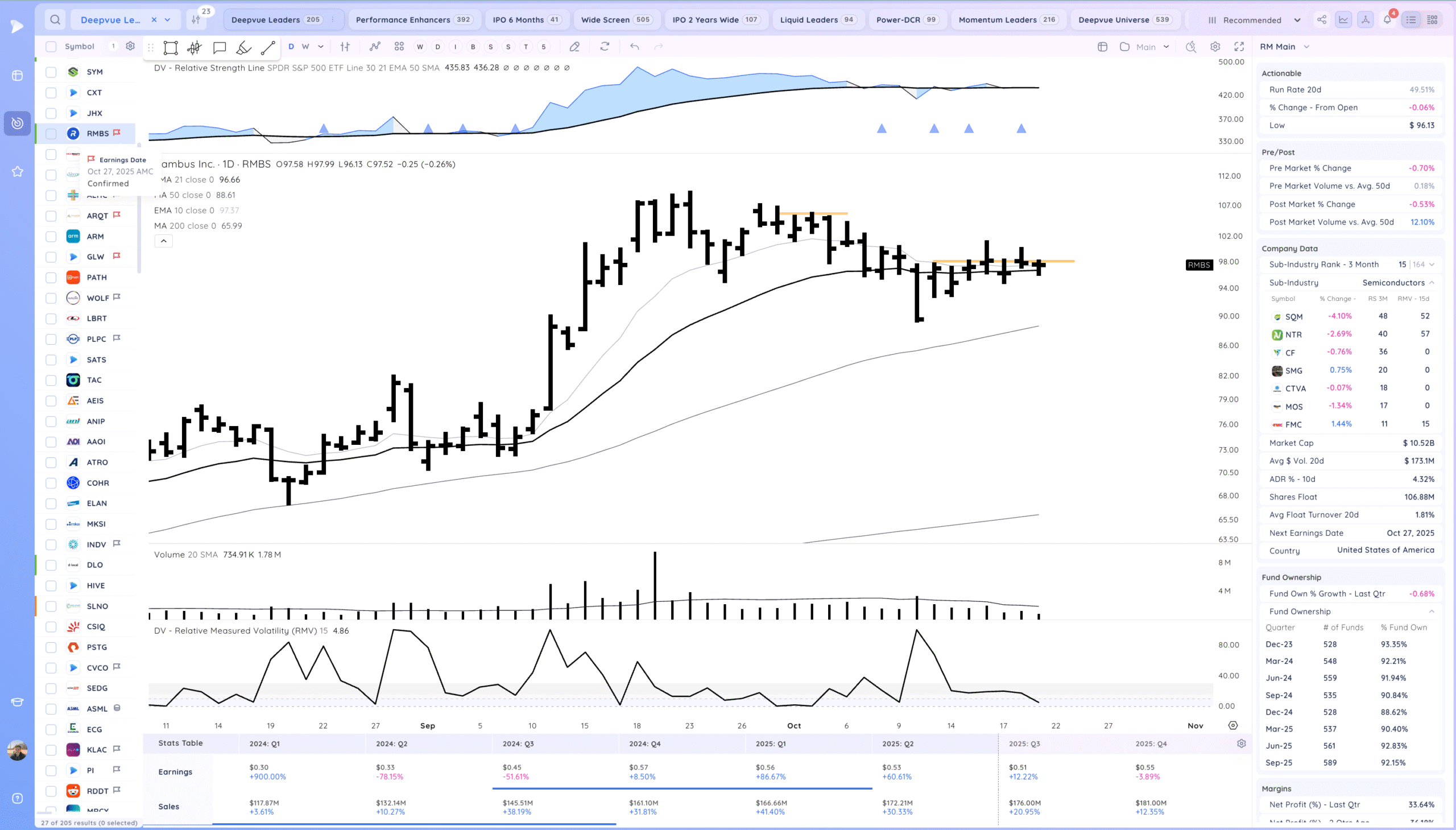

RMBS watching for a range breakout and earnings move

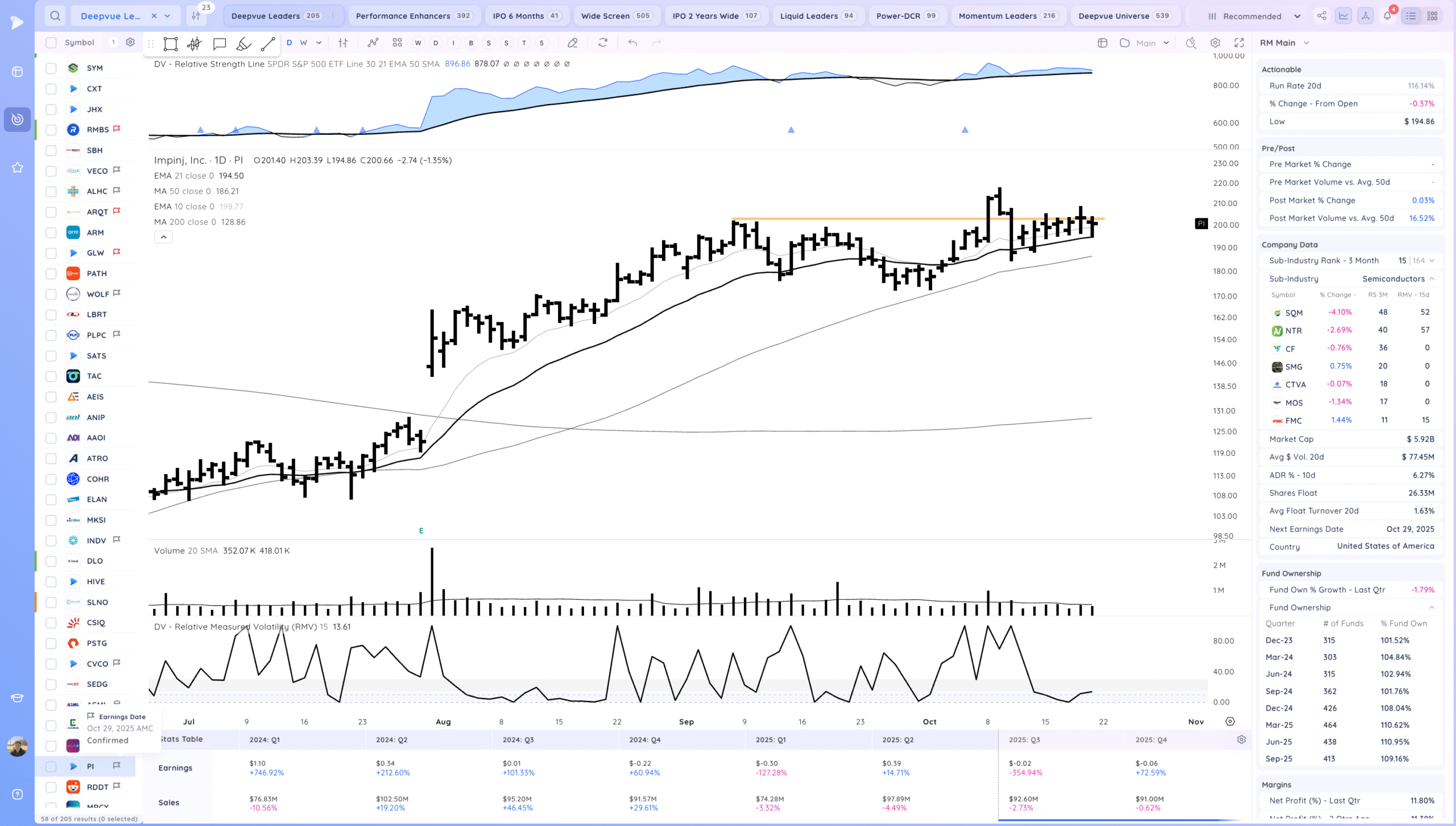

PI watching for a range breakout

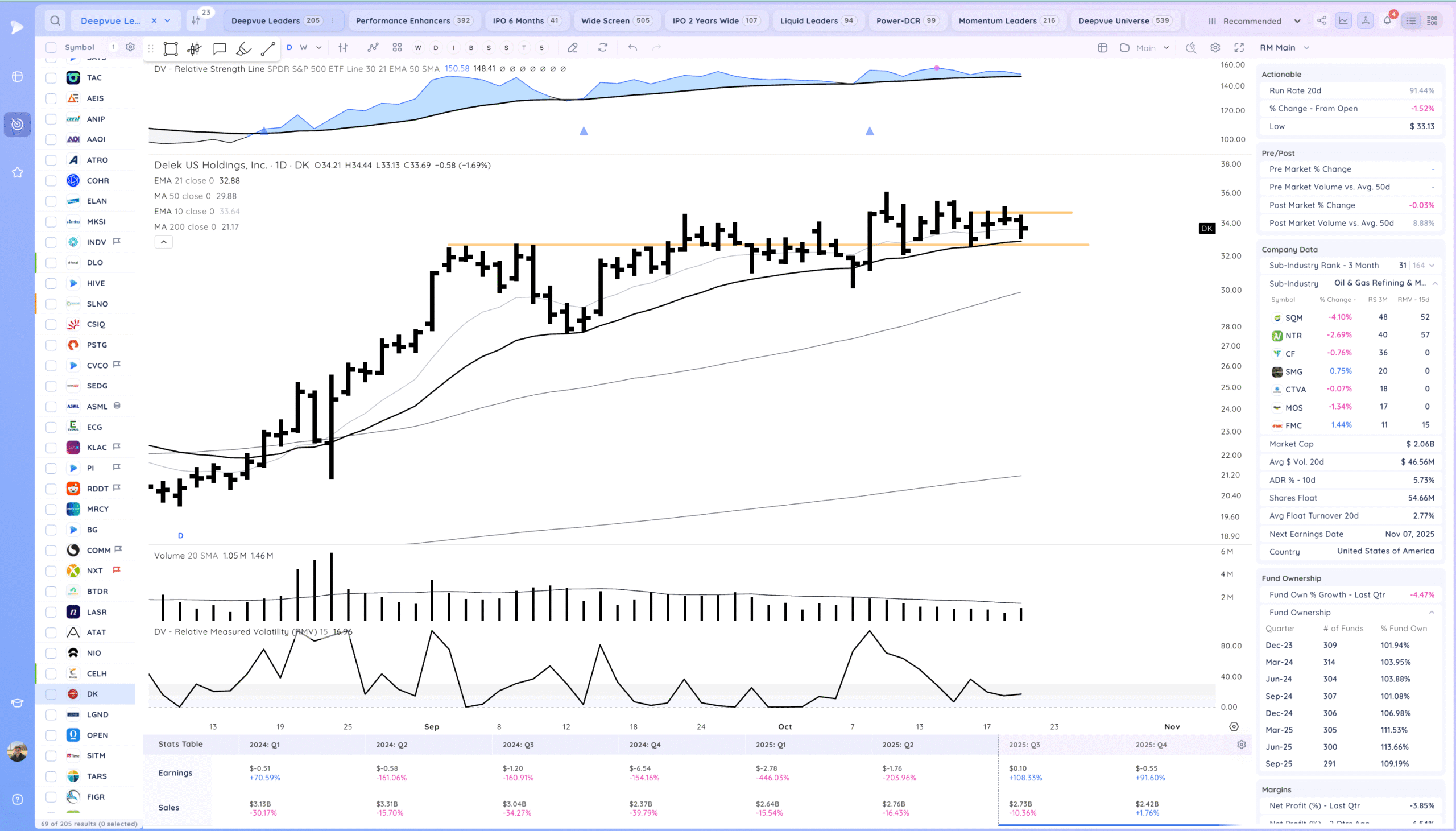

DK watching for a range breakout. Oil and gas name but it can trend. Near big weekly level

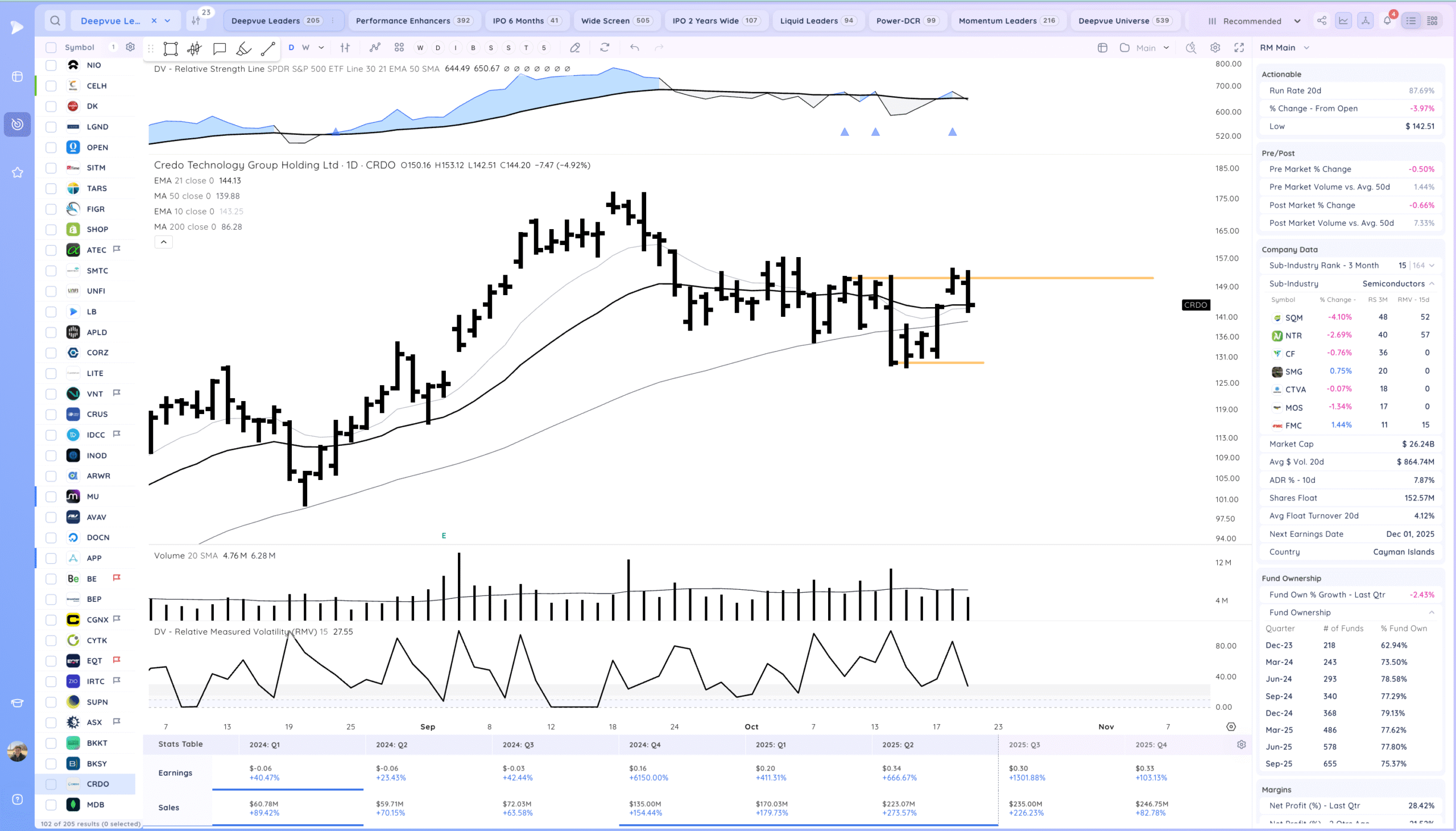

CRDO watching for a push off the 21ema/ positive expectation breaker

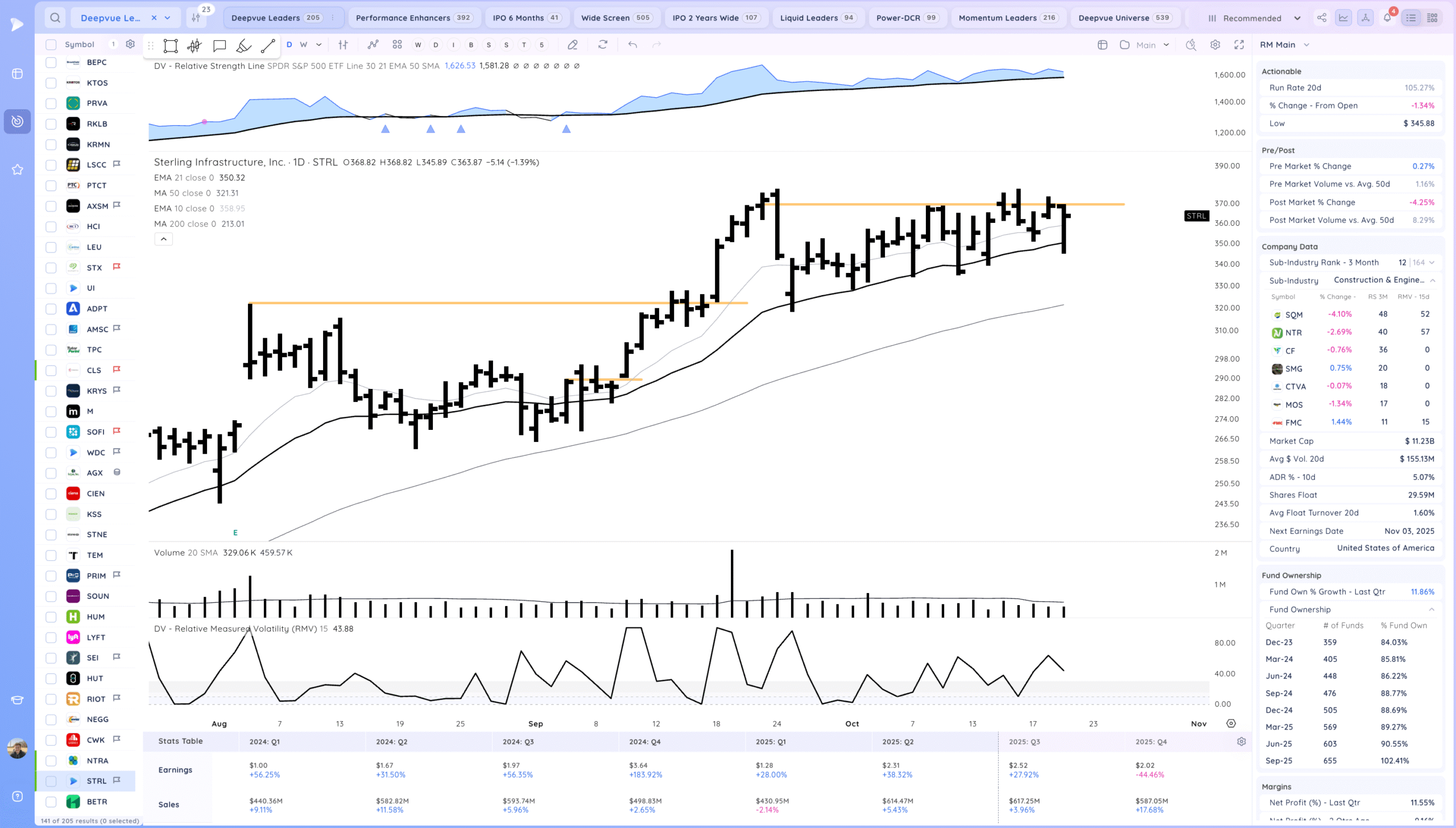

STRL watching for a range breakout.

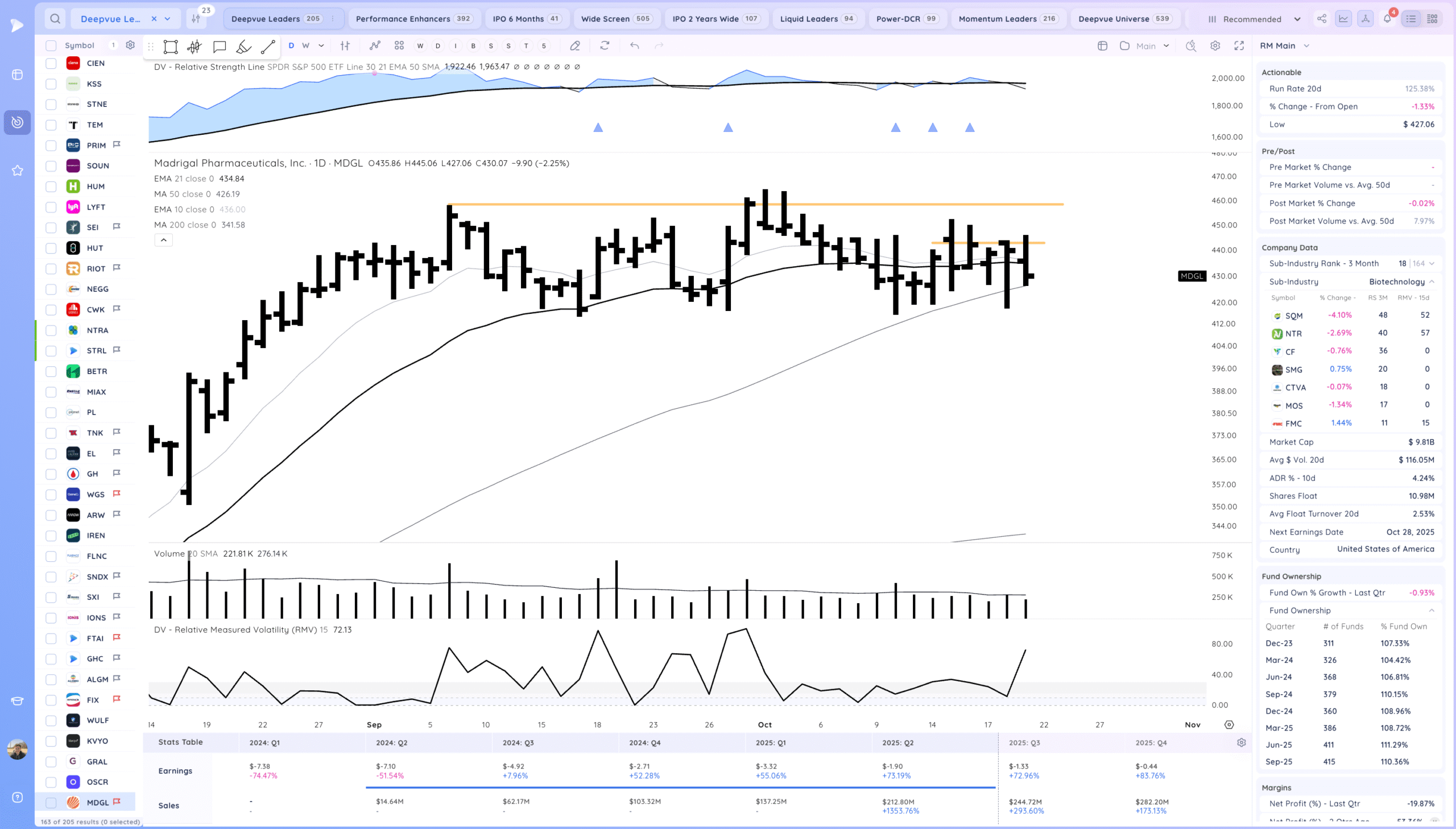

MDGL watching for a range breakout. Biotech

Today’s Watchlist in List form

Focus List Names

INTC ALAB VRT SYM RMBS PI DK CRDO STRL MDGL PLTR TSLA NVDA RDDT

Focus:

TSLA PLTR

Themes

AI, AI Energy, rare metals, biotech. Gold/miners more distribution

Additional Thoughts

Semiconductor names look primed for a significant move in coming days. TSLA earnings tomorrow will be a key gauge of market health and sentiment. Know your plan with your holdings.

Anything can happen, Day by Day – Managing risk along the way