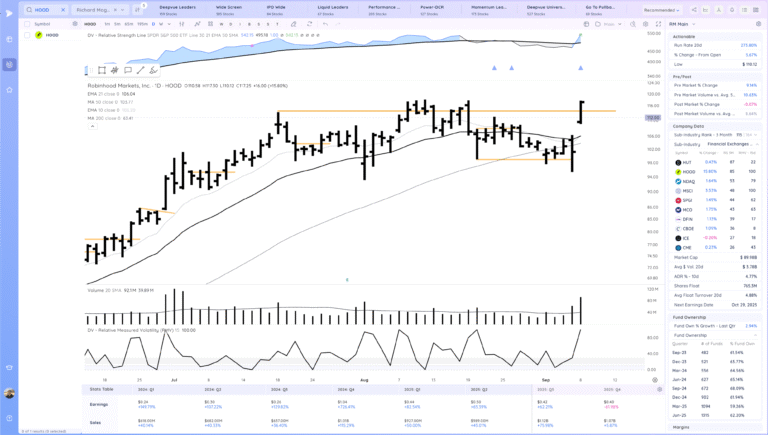

HOOD Gap and Go. Some Downside Reversals

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 8, 2025

Market Action

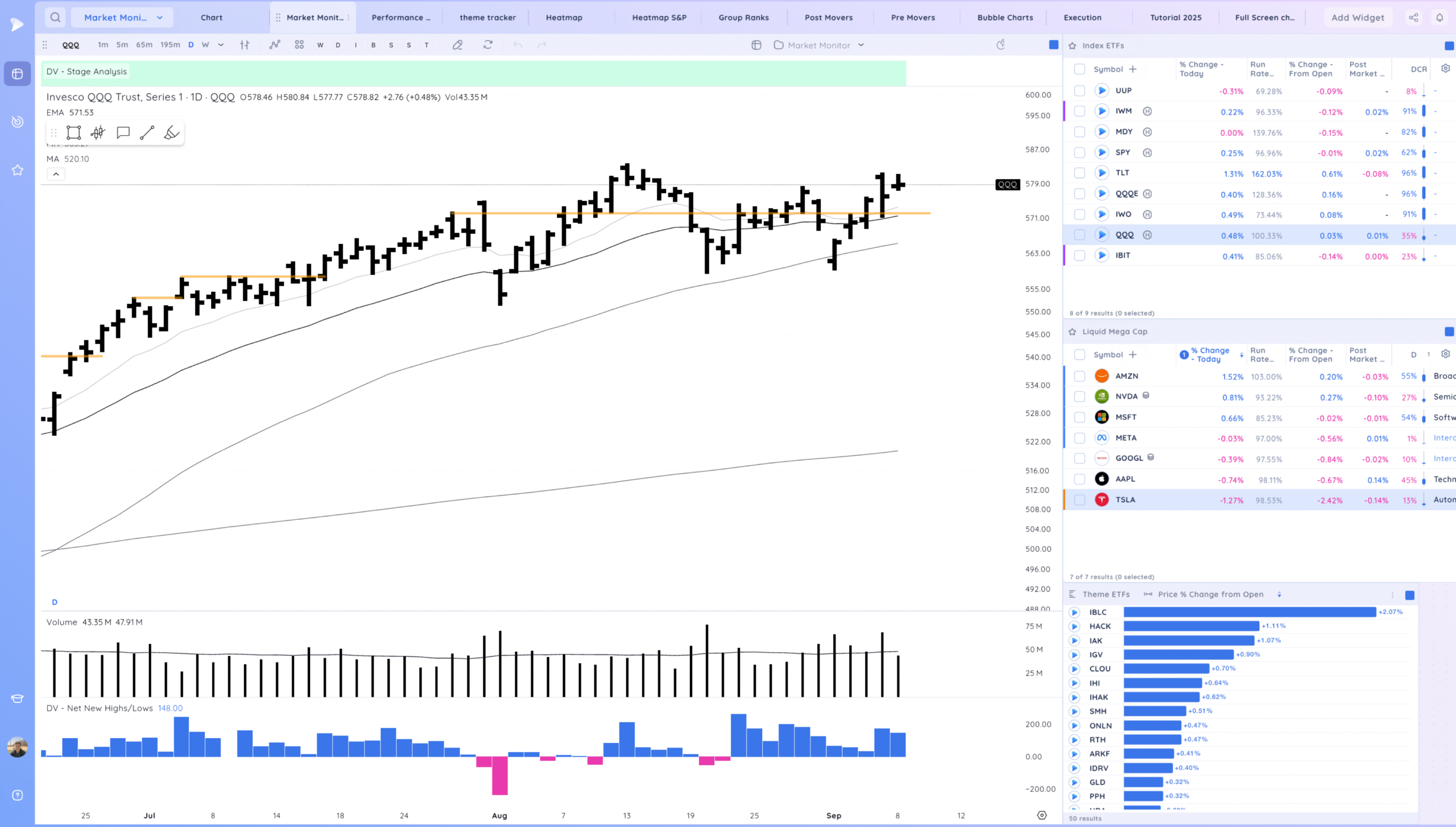

QQQ – Inside day within the range of Friday’s close and high.

Bulls want to see a continued trend higher or constructive range sideways

Bears want to see a reversal lower breaking back below the 21ema

Daily Chart of the QQQ.

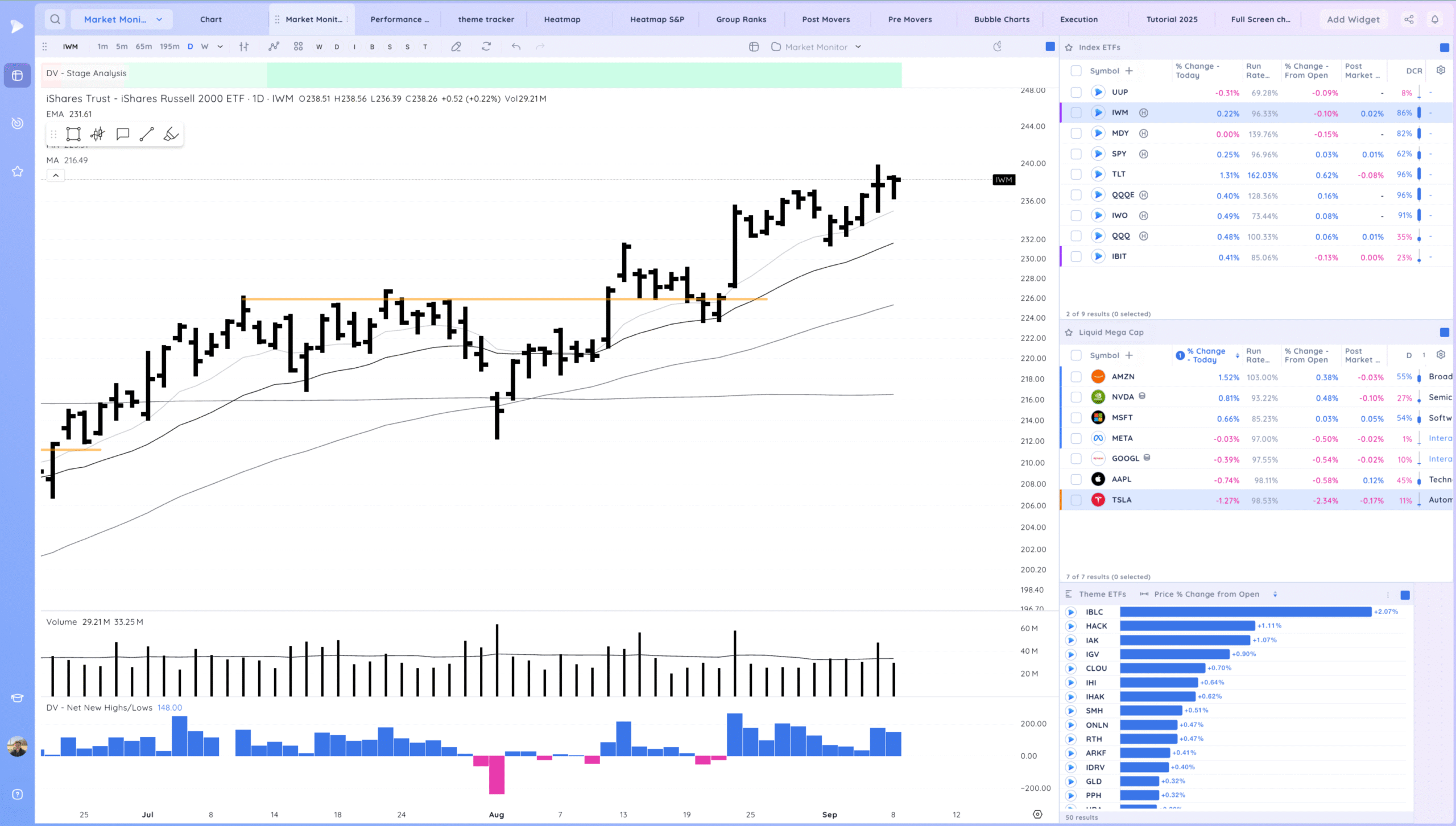

IWM – Inside day with a good closing range

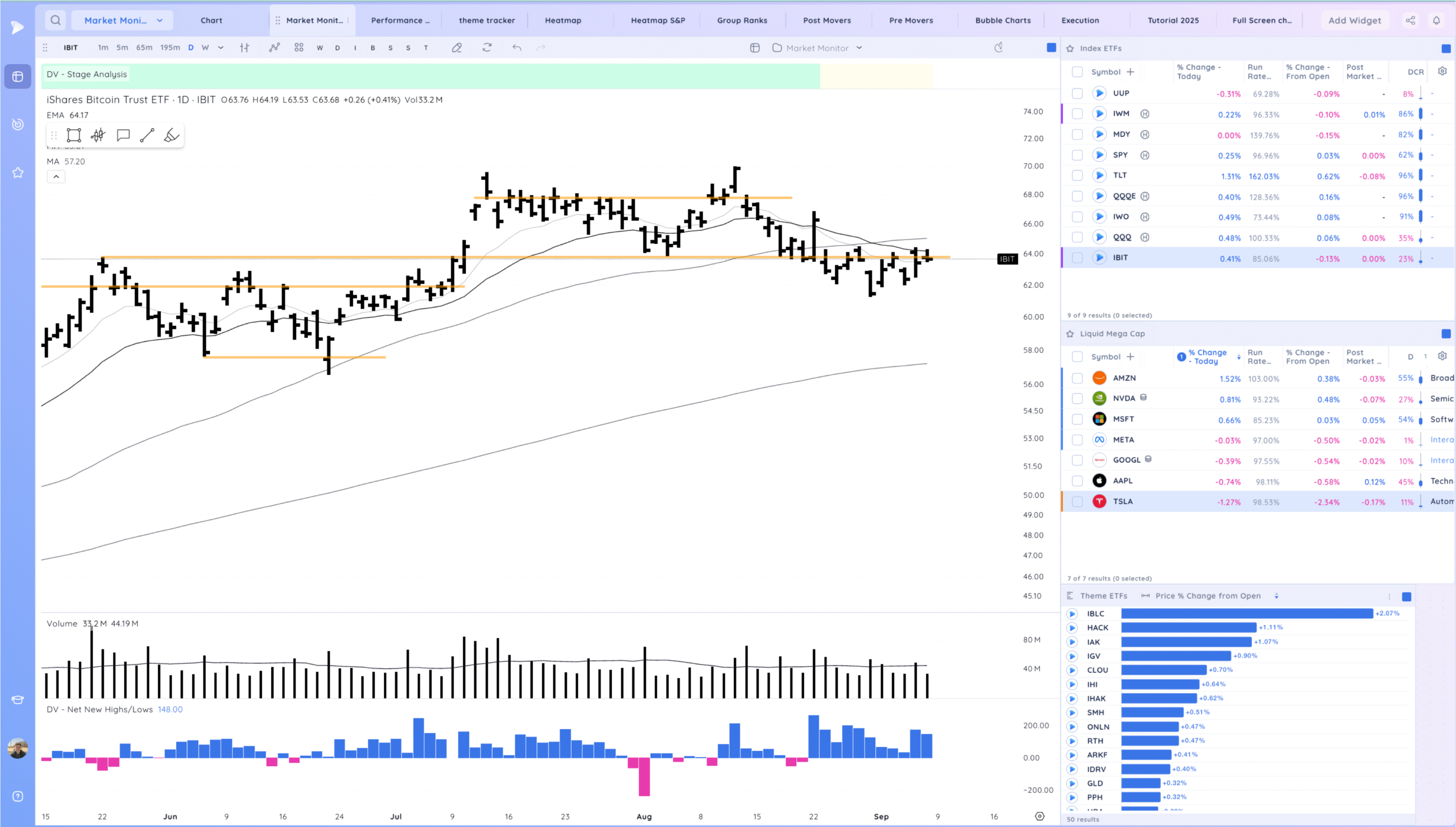

IBIT – Inside day right at a key level. Expecting expansion. This is a make or break spot.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

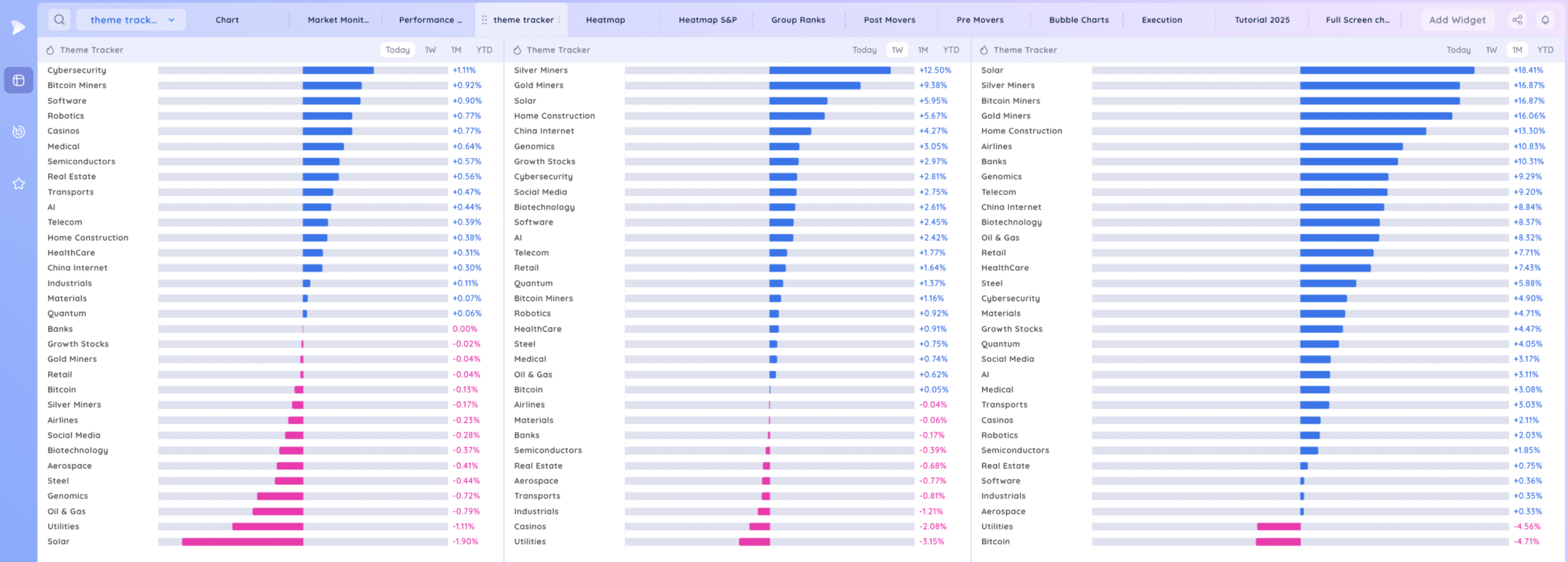

Deepvue Theme Tracker

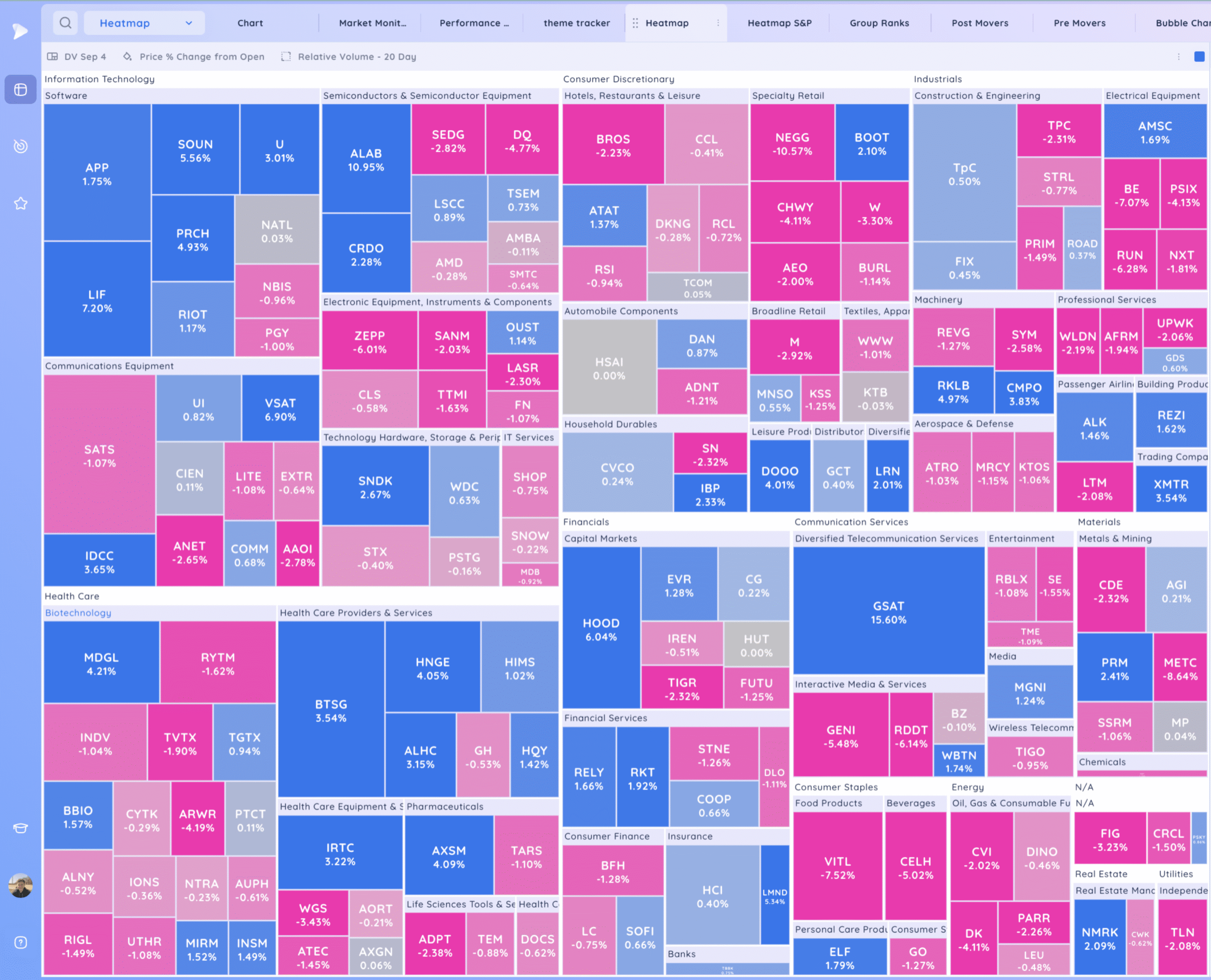

Deepvue Leaders

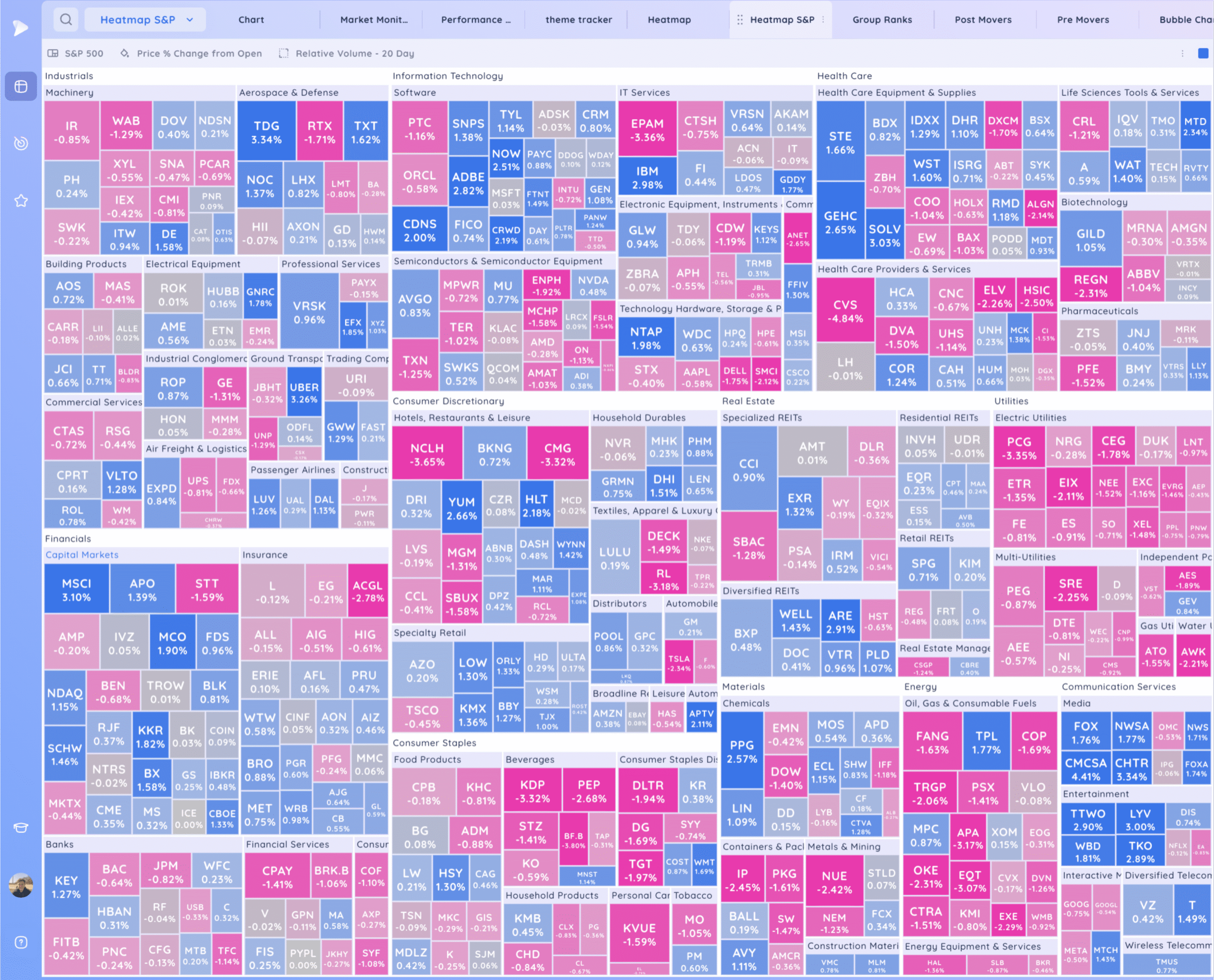

S&P 500.

Leadership

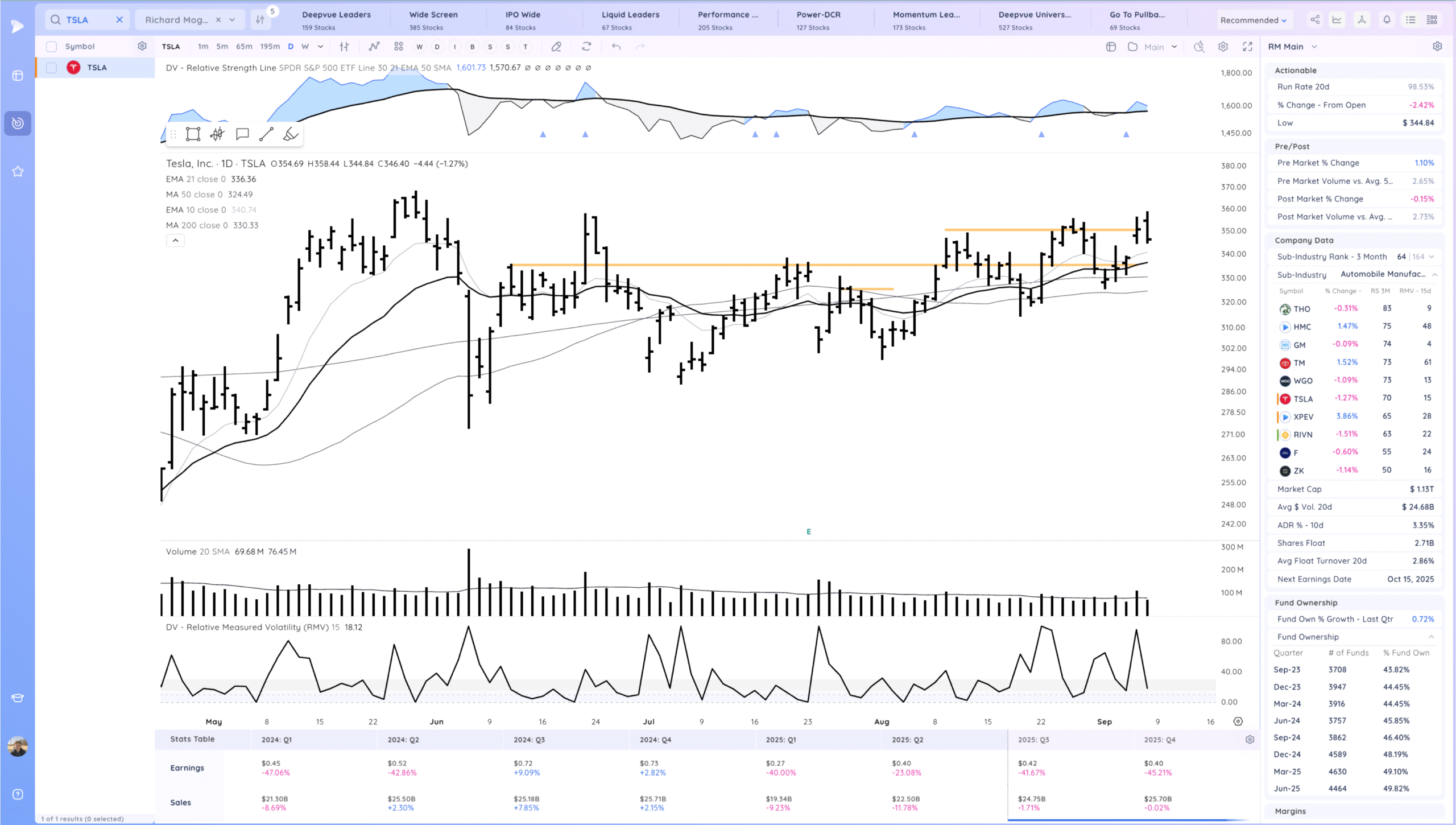

TSLA downside reversal closing near lows. A key tell will be if we can hold this gap and the 10ema. Bulls want to see this hold here and reverse higher tomorrow

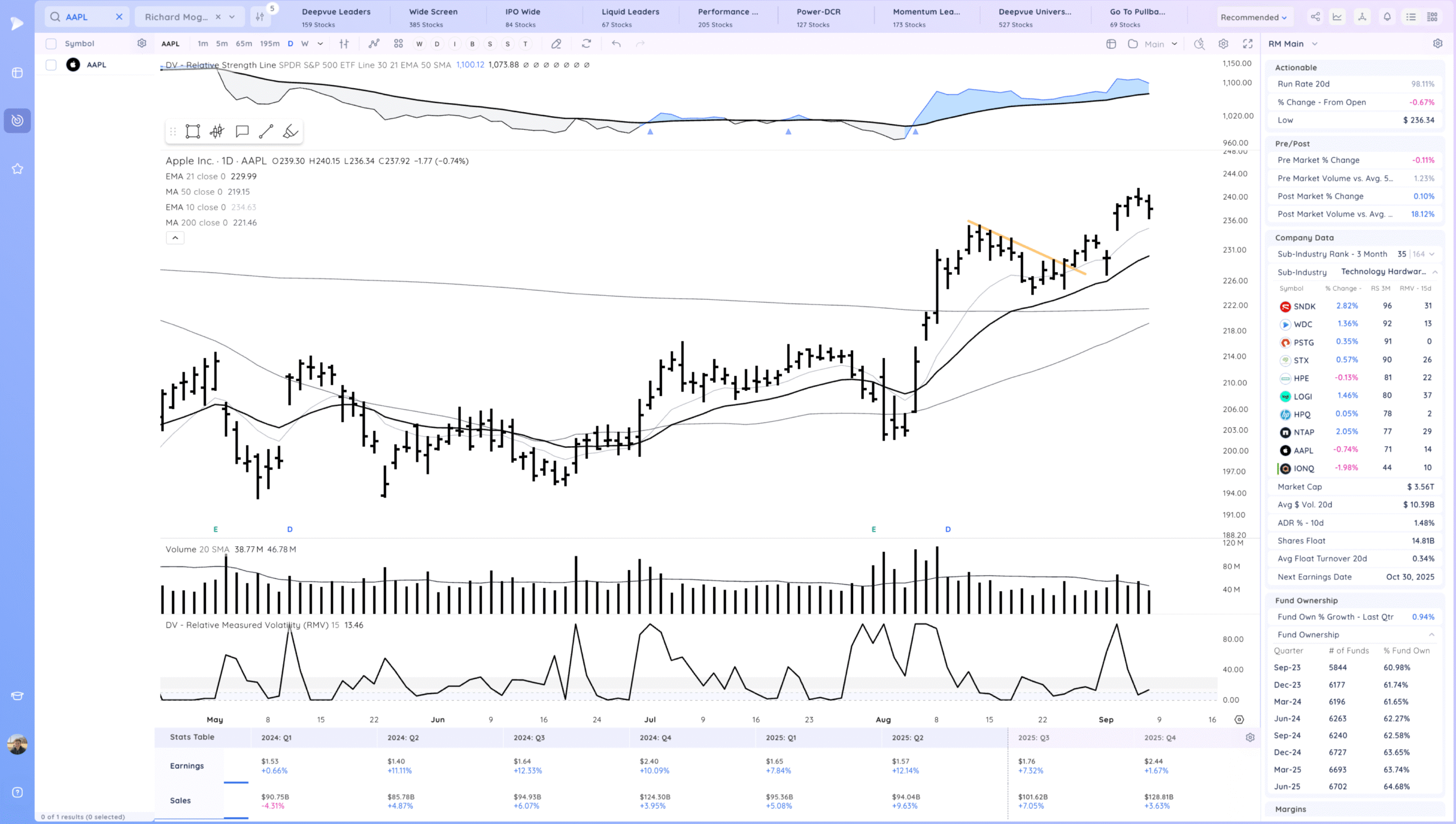

AAPL slight pullback, moving averages rising

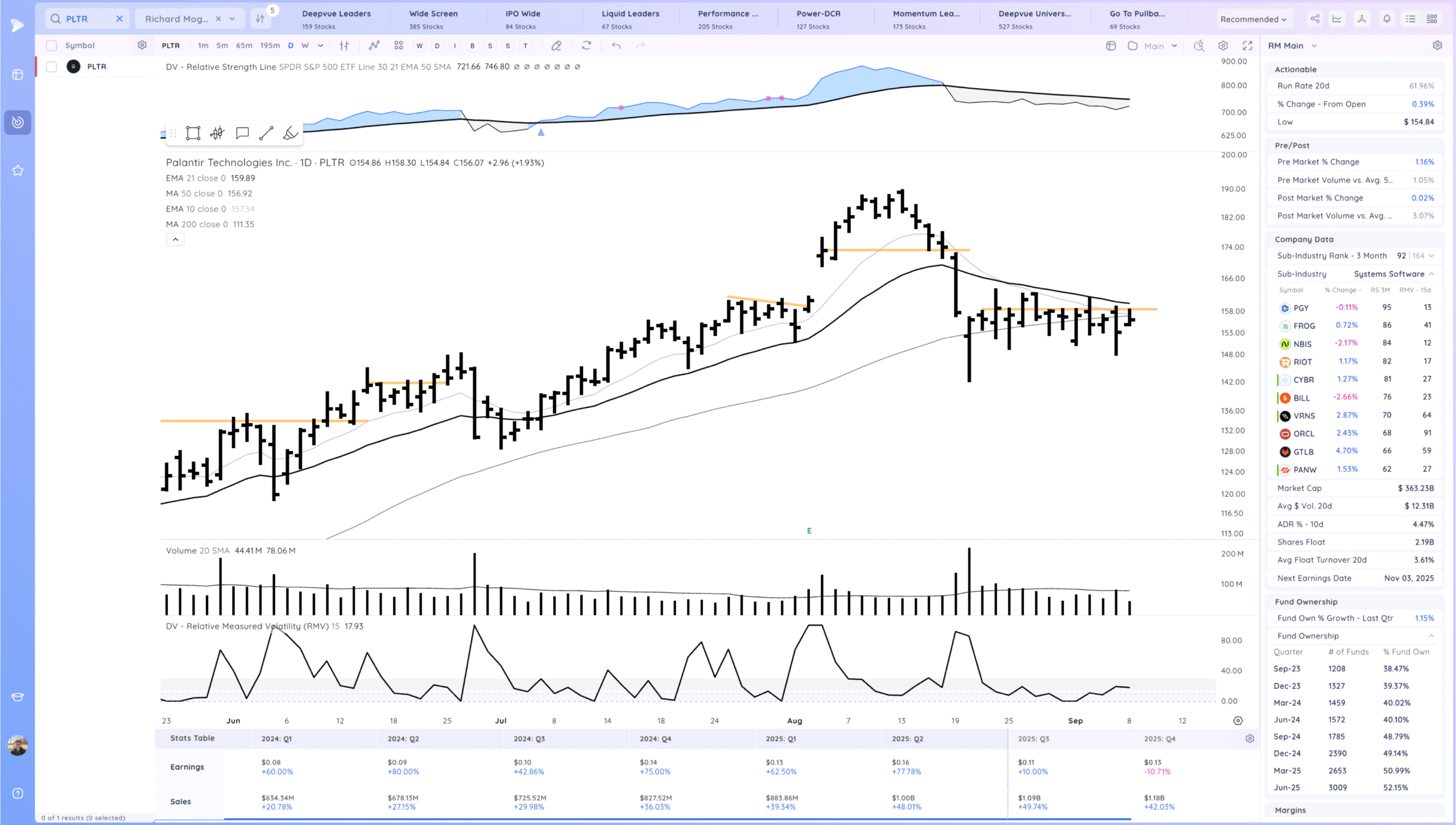

PLTR Very tight day. Expecting expansion tomorrow

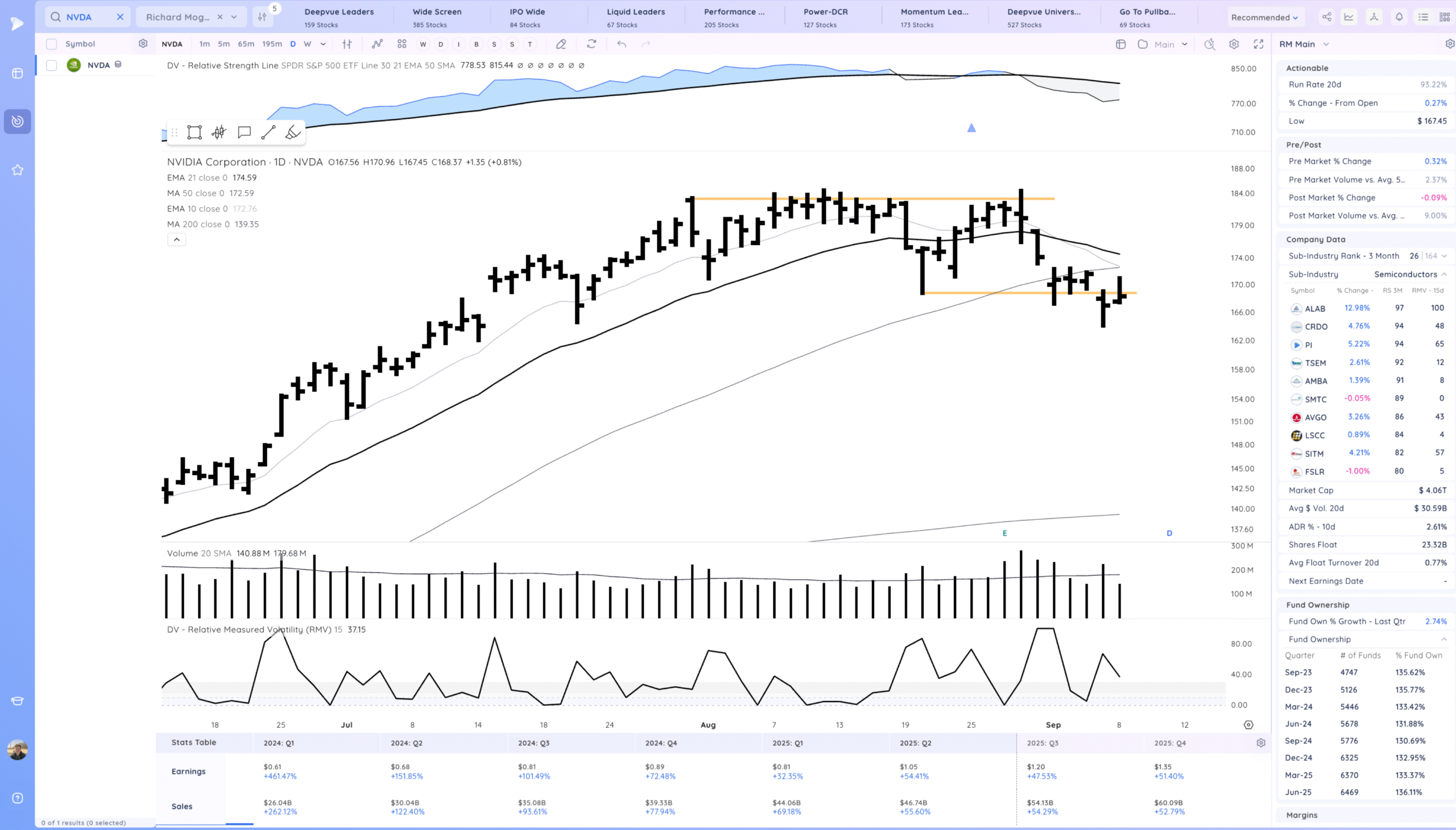

NVDA Fade off highs and closing below the undercut and rally level. Below the moving averages.

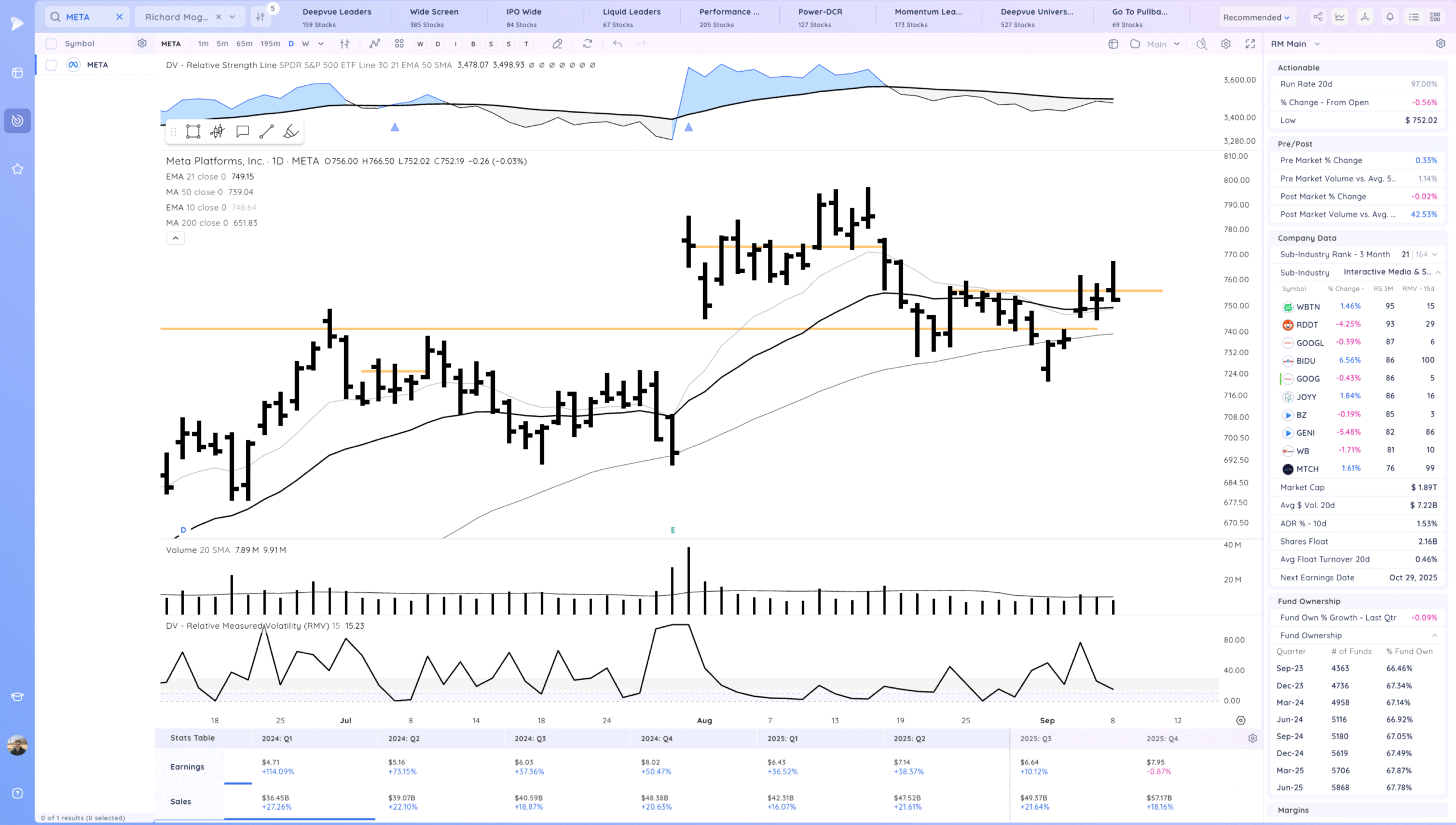

META Downside reversal, needs to hold here. On watch for follow through down

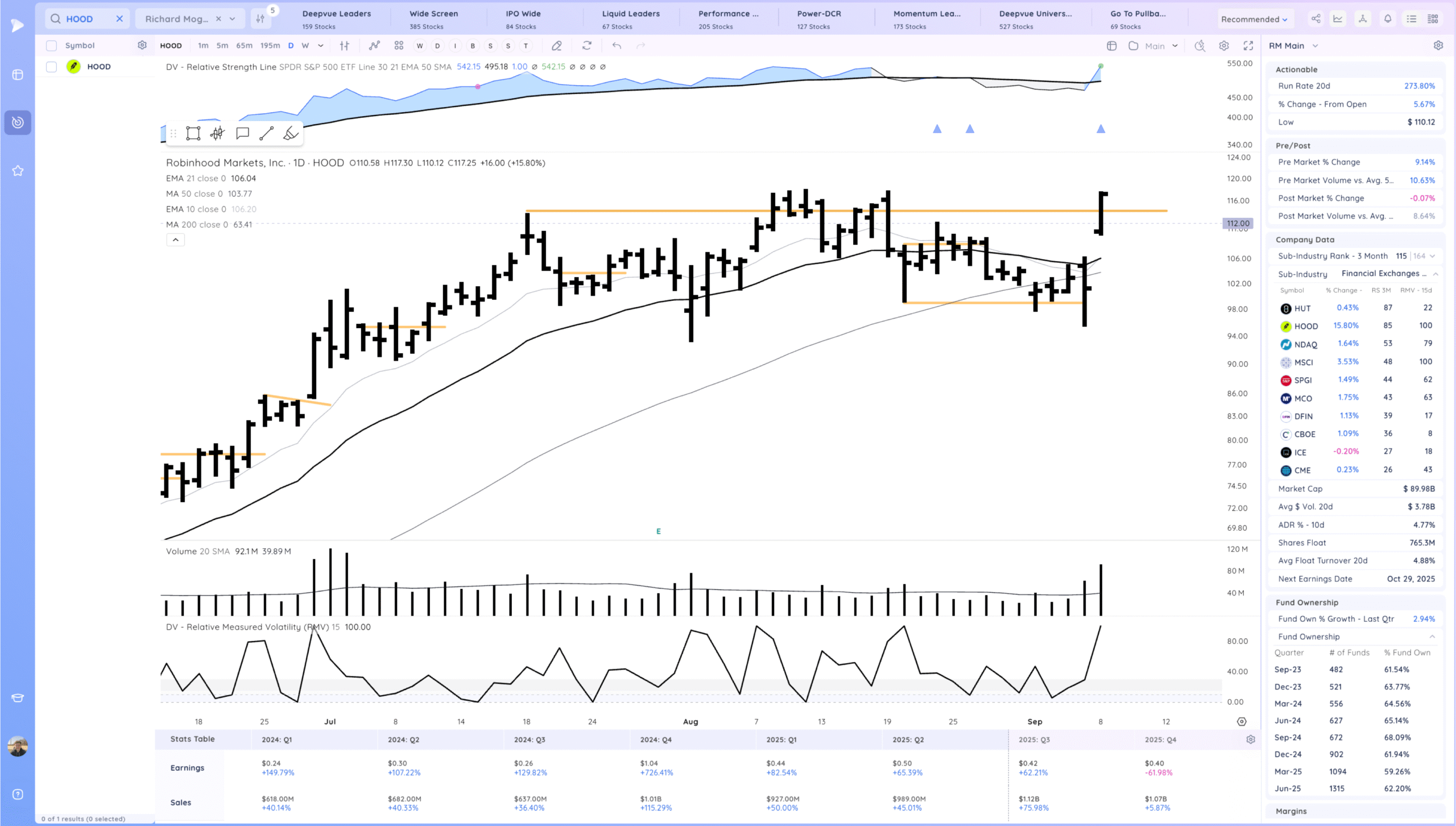

HOOD Strong gap and go move with a close near highs. Actionable on AVWAP reclaim a few minutes after the open. Ideally follows through to new highs tomorrow

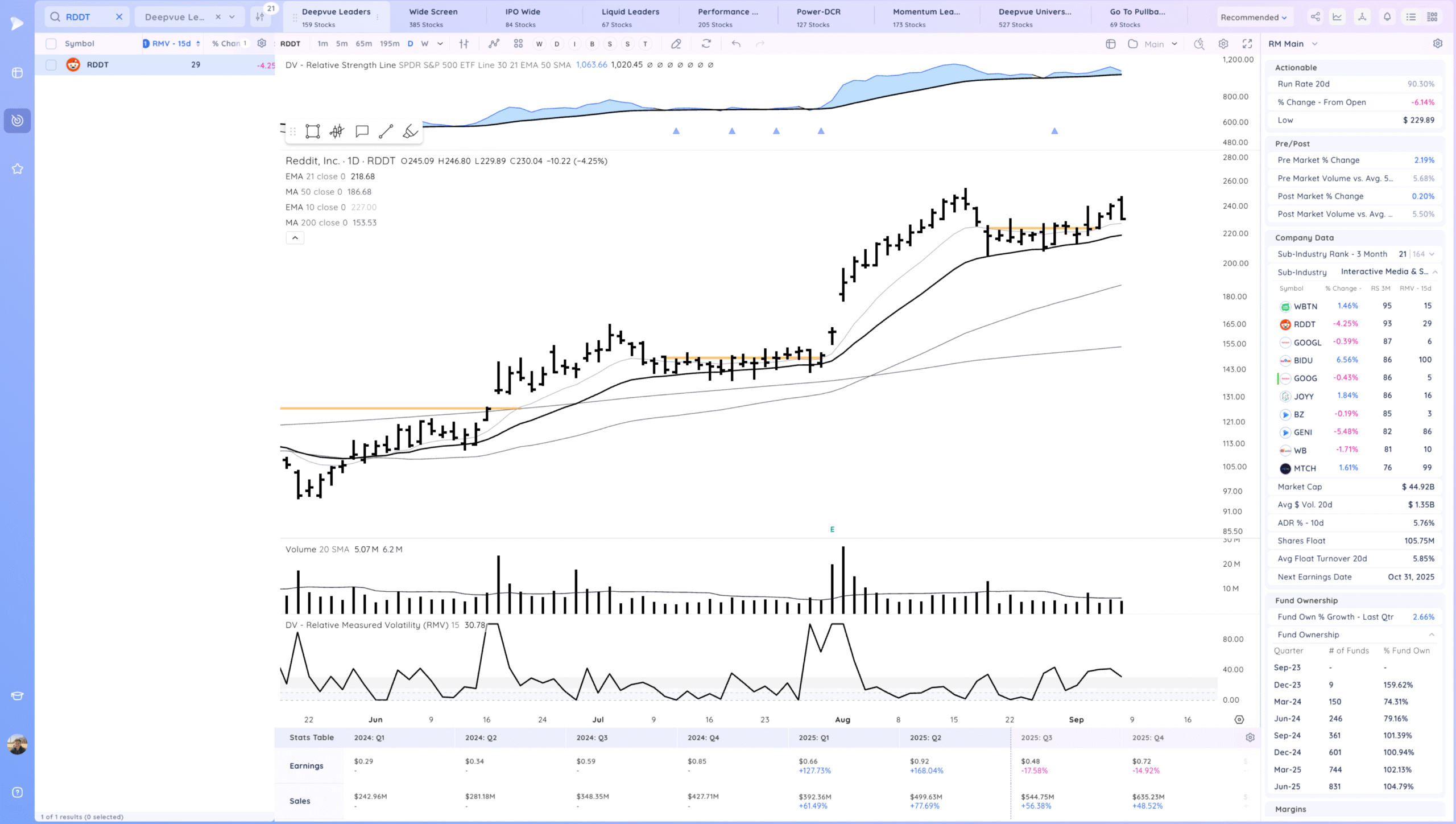

RDDT Downside reversal, back into the 10ema. Ideally rebounds off that level

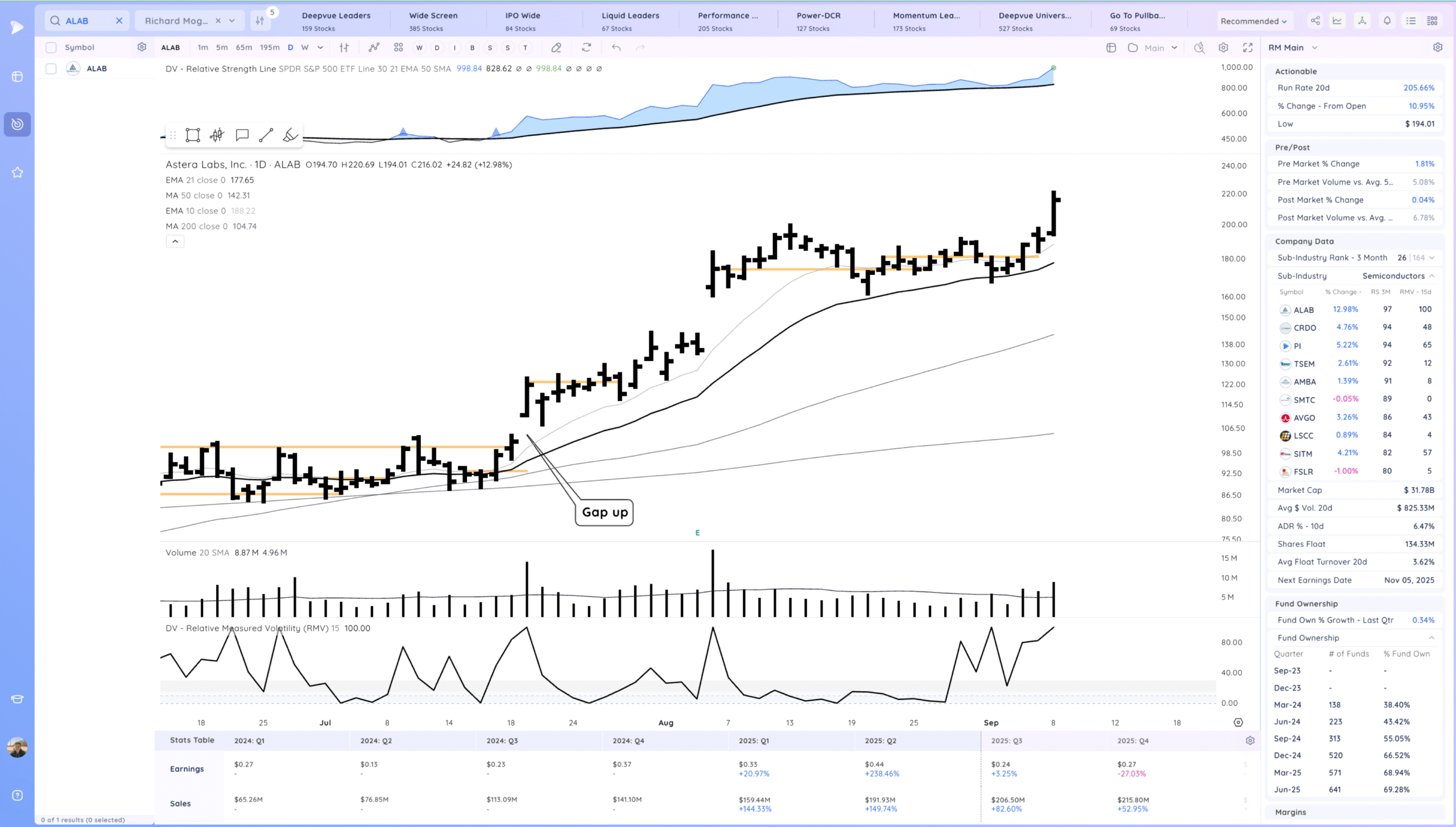

ALAB Strong expansion higher breaking out of the consolidation. Best buy point was on the range breakout near the 21ema

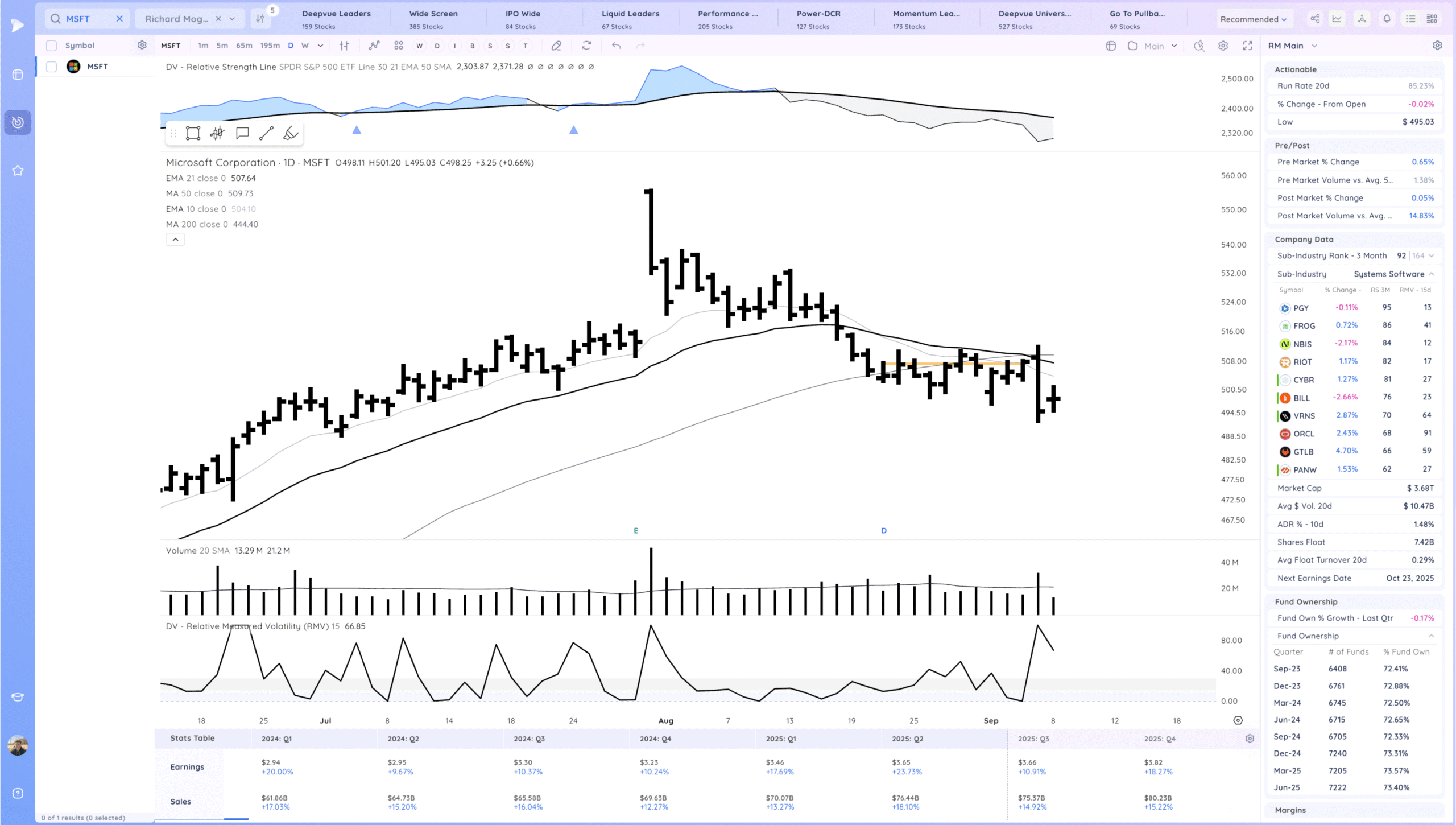

MSFT Very tight day after the negative bar. Below the moving averages

Key Moves

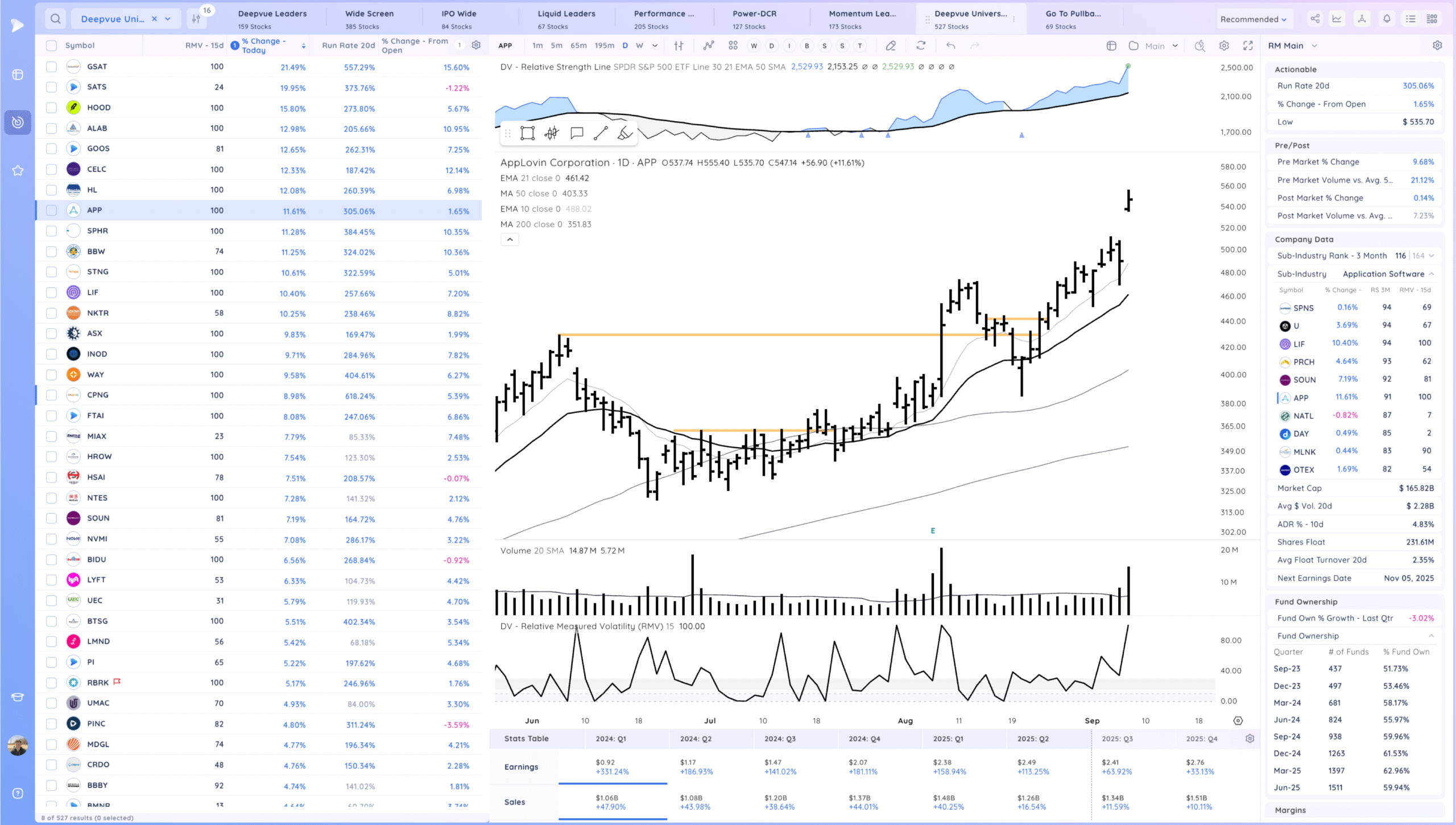

APP gap on the S&P inclusion as well. Already in a trend and feels short term extended now

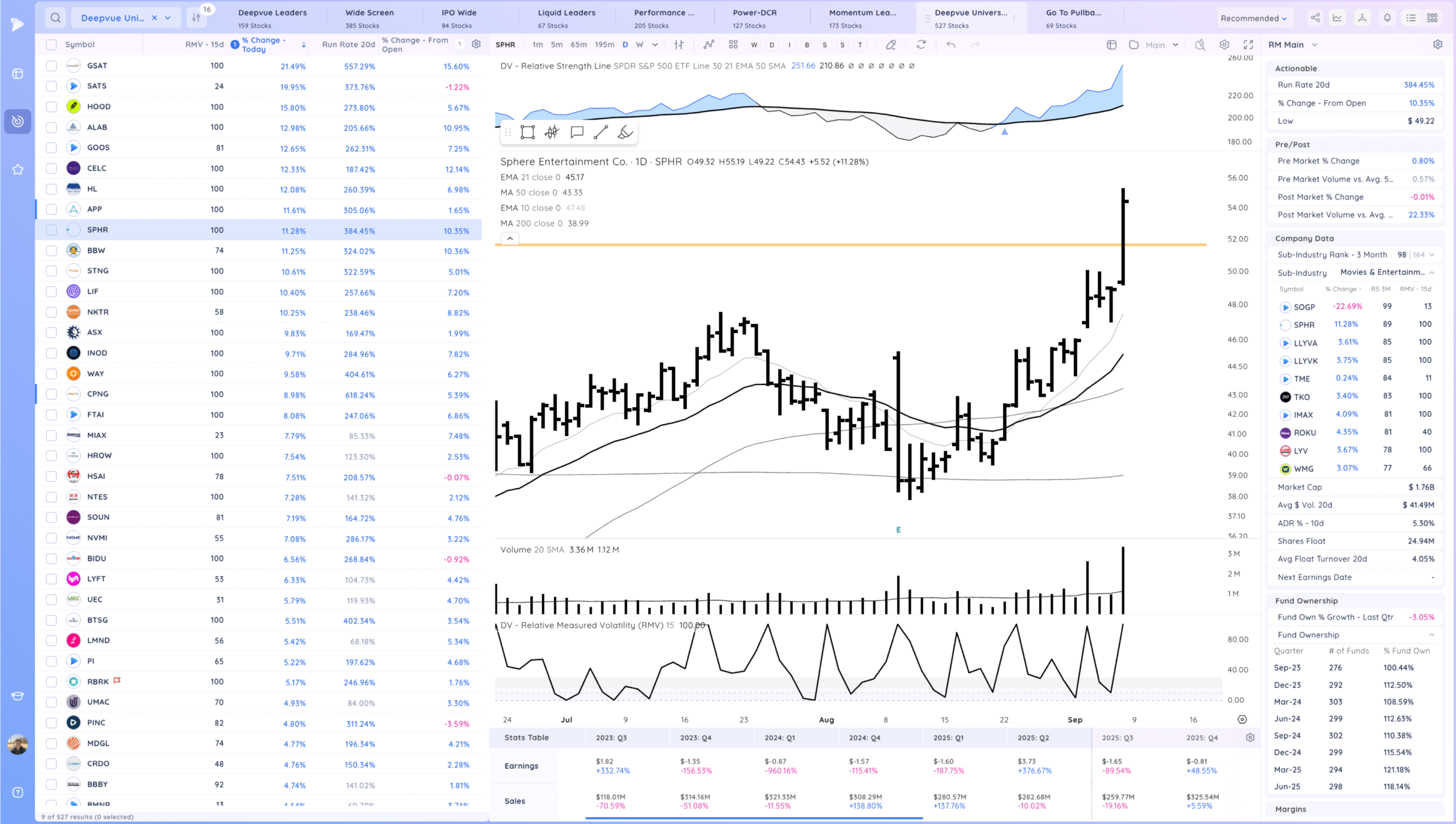

SPHR with a breakout into new all time highs

Setups and Watchlist

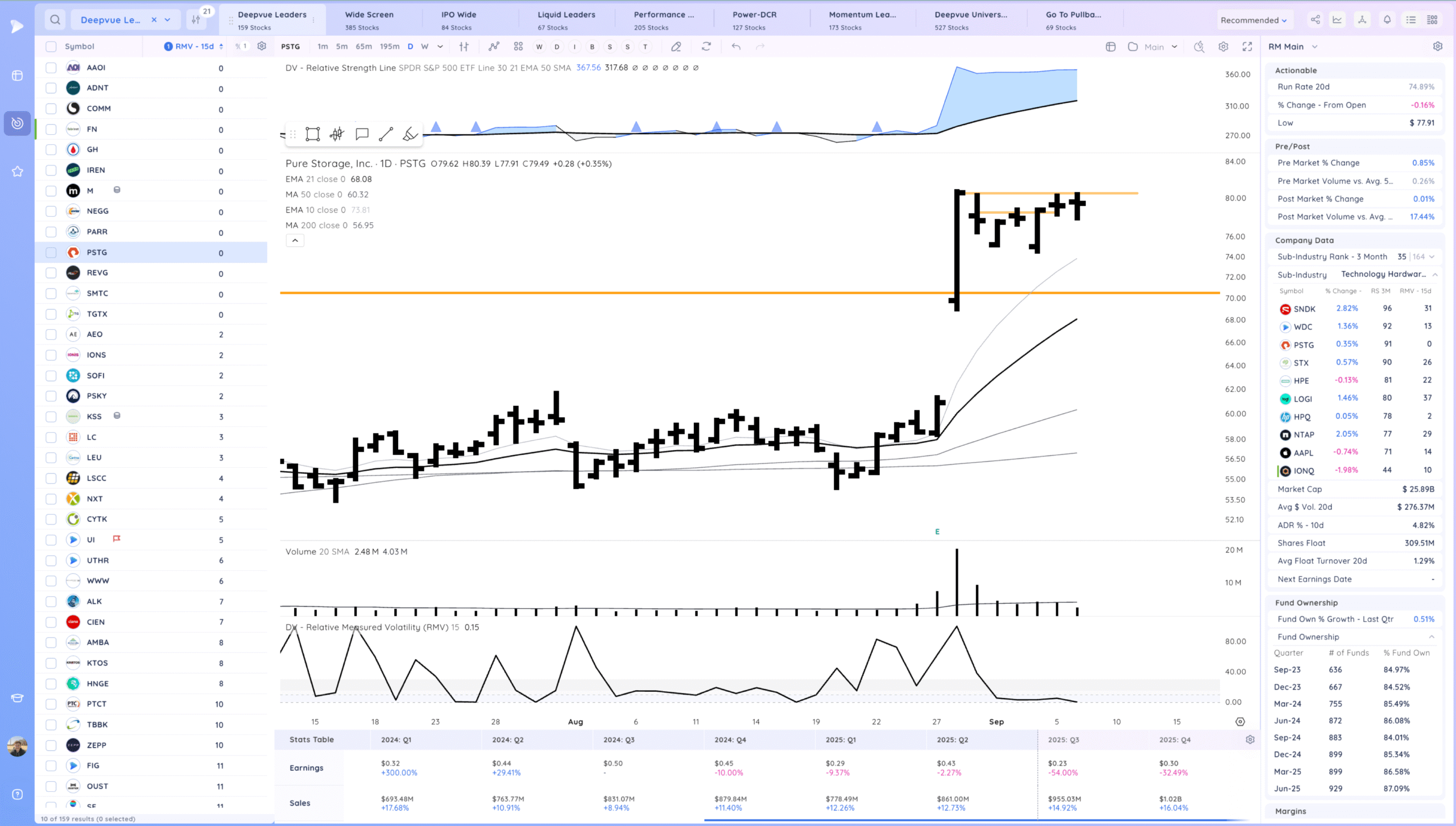

PSTG watching for a range breakout

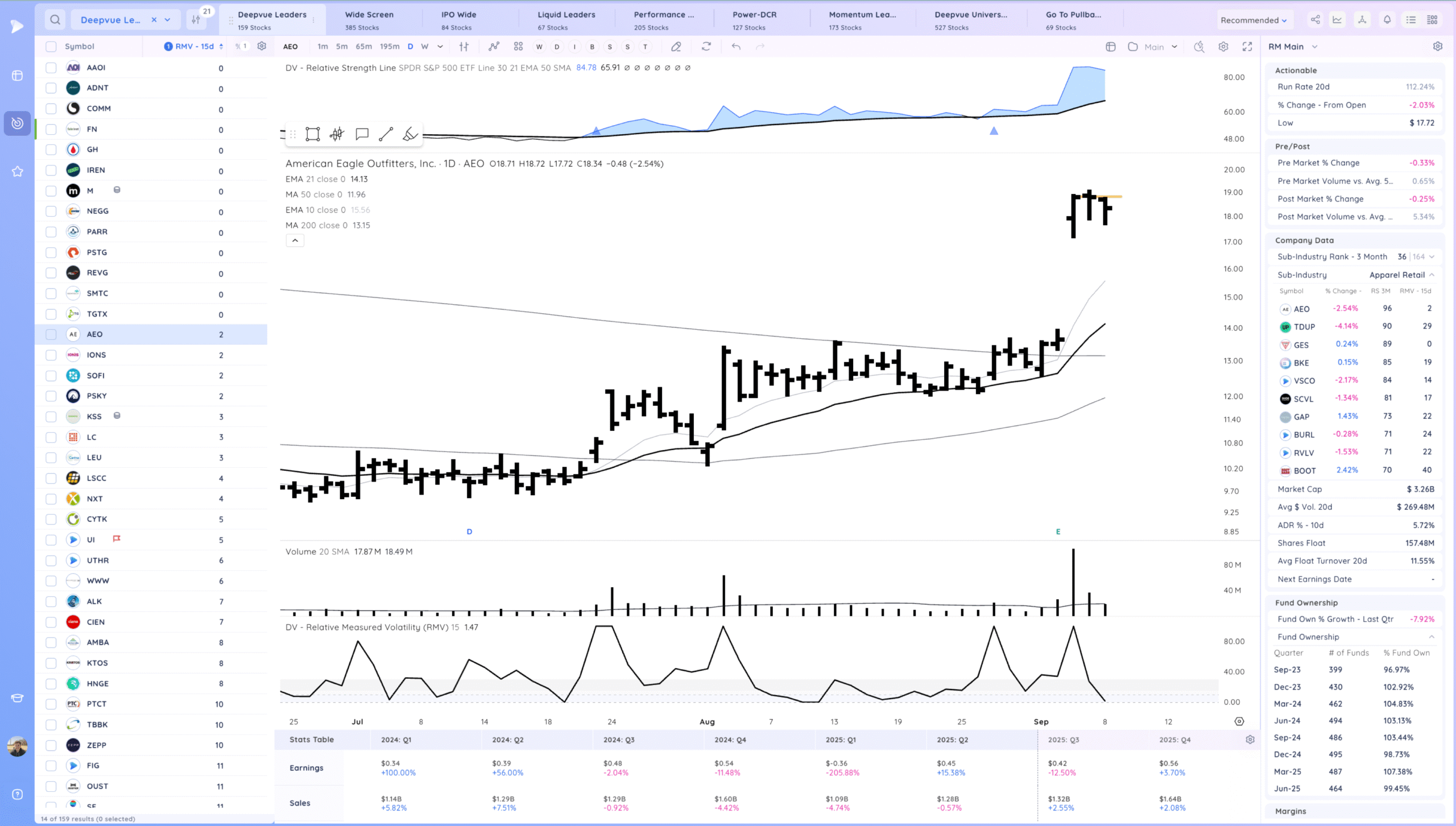

AEO watching for a range breakout.

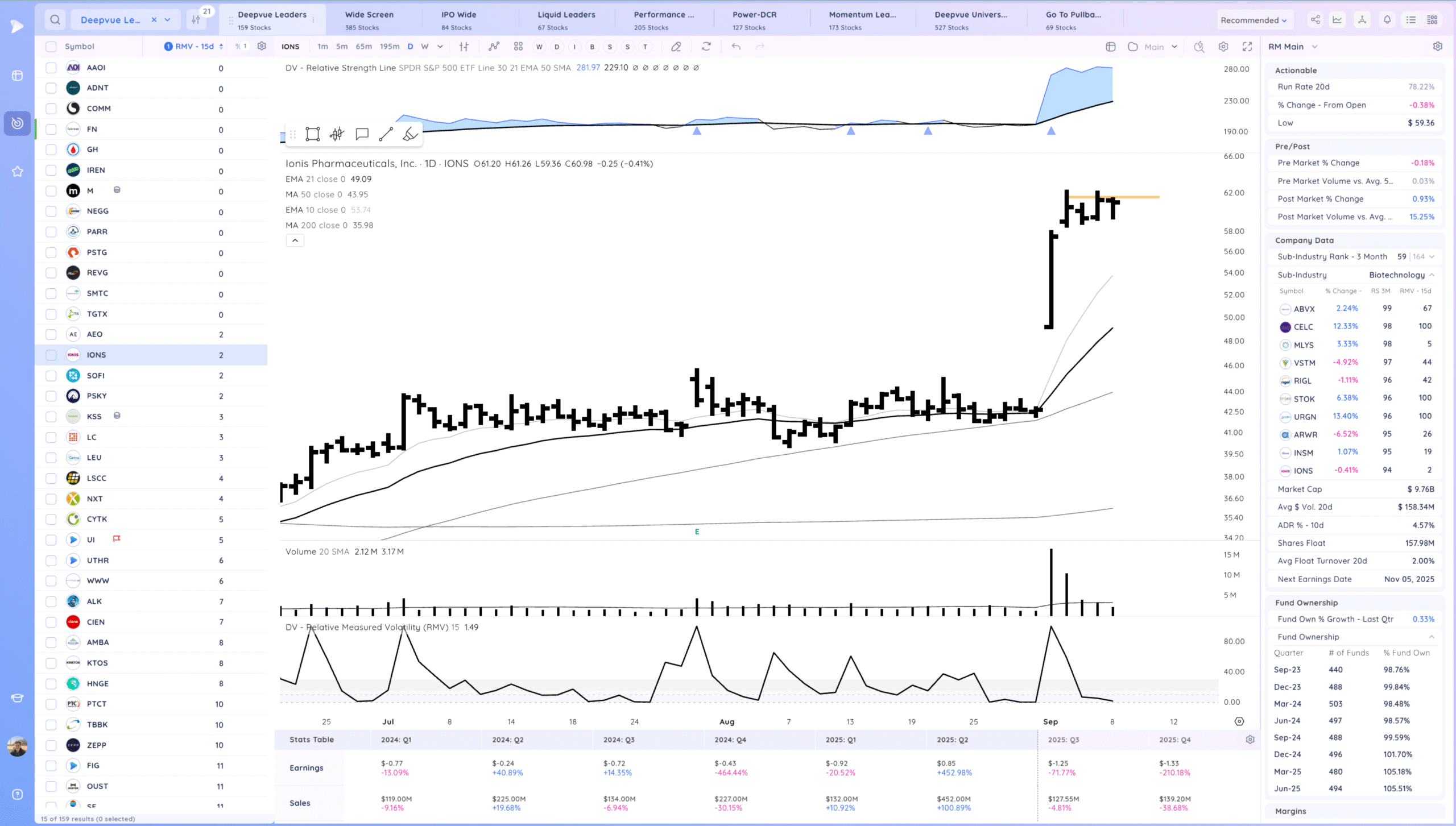

IONS Biotech , watching for a range breakout

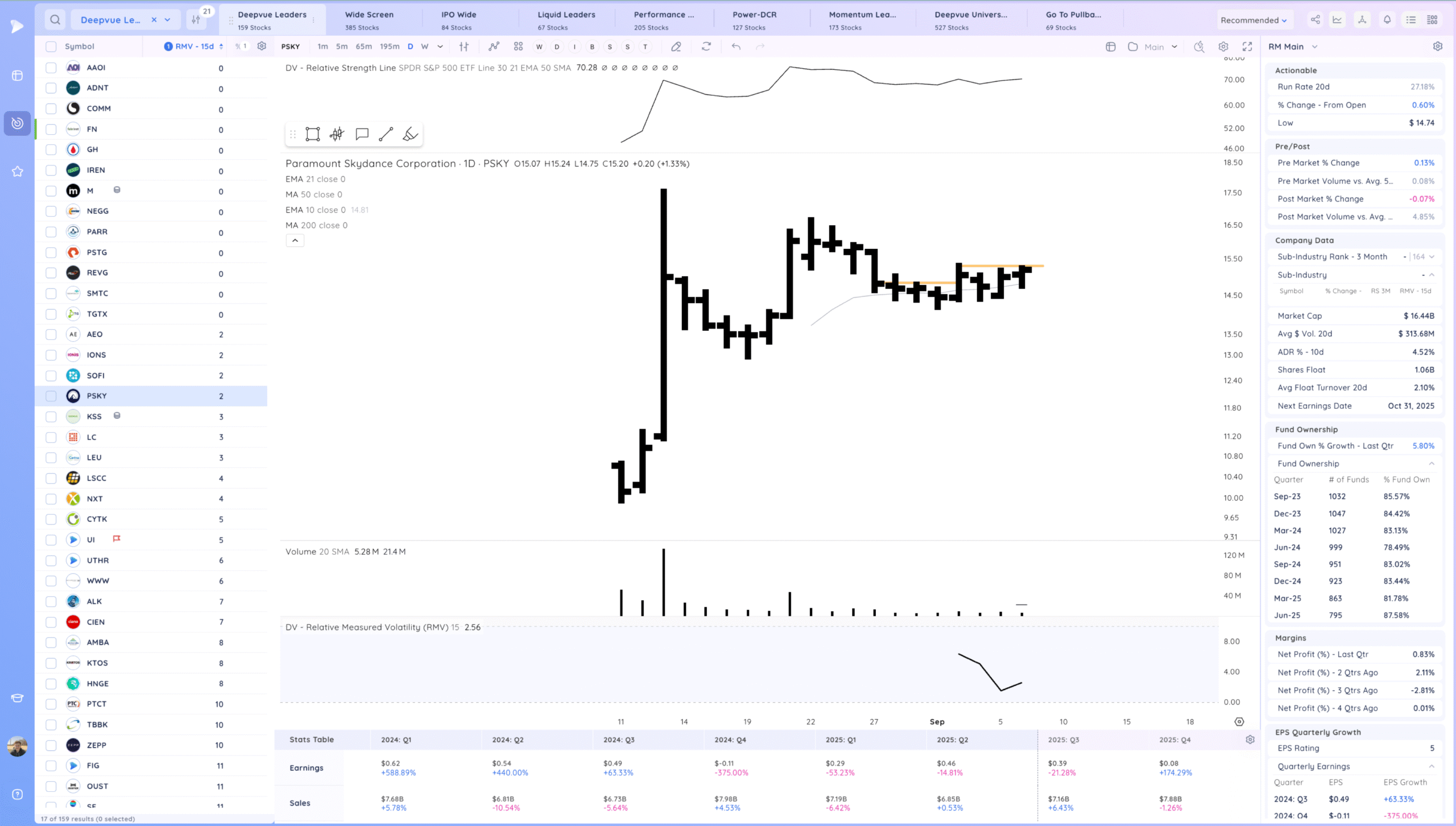

PSKY watching for a range breakout

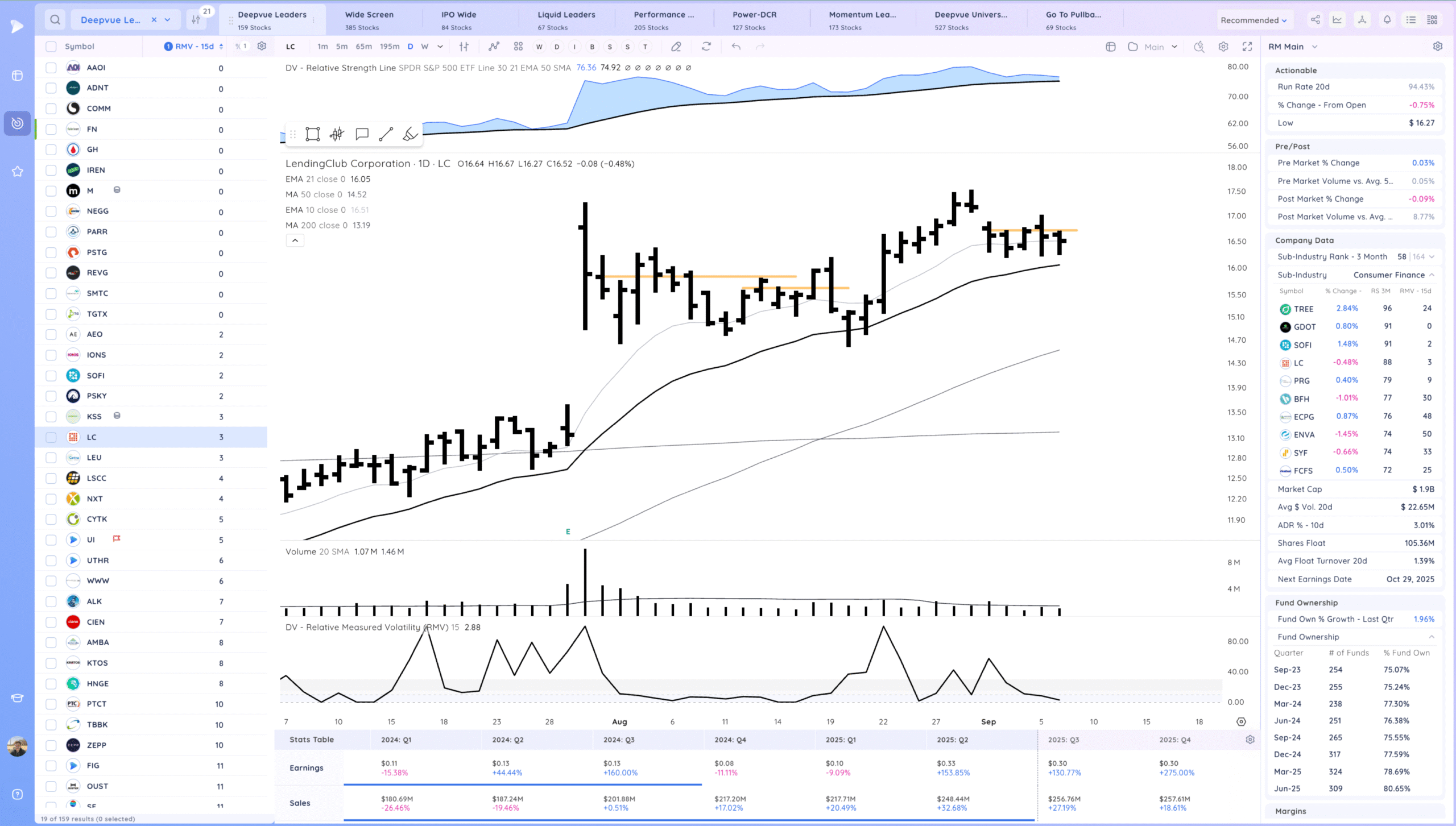

LC watching for a range breakout

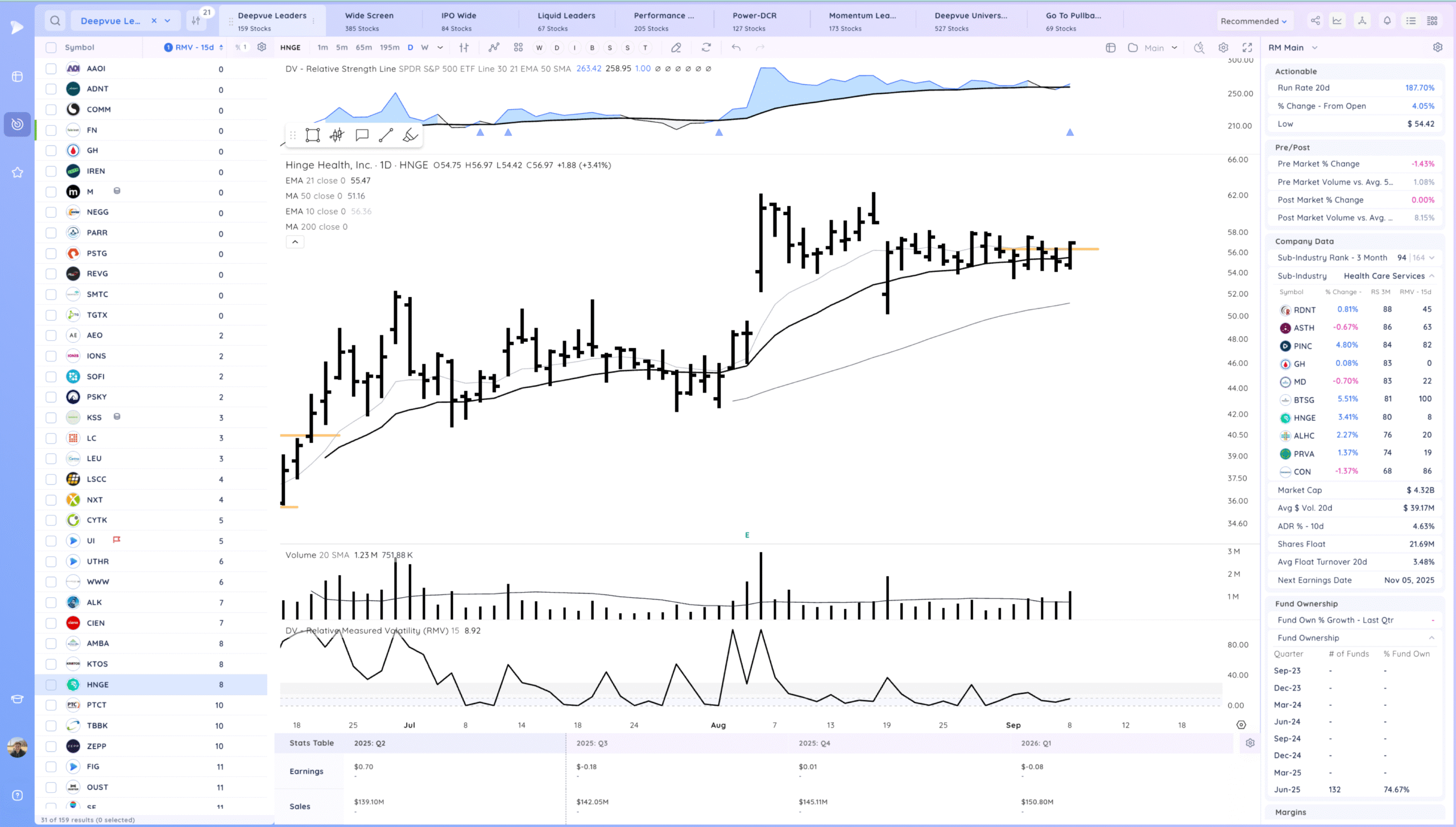

HNGE watching for follow through

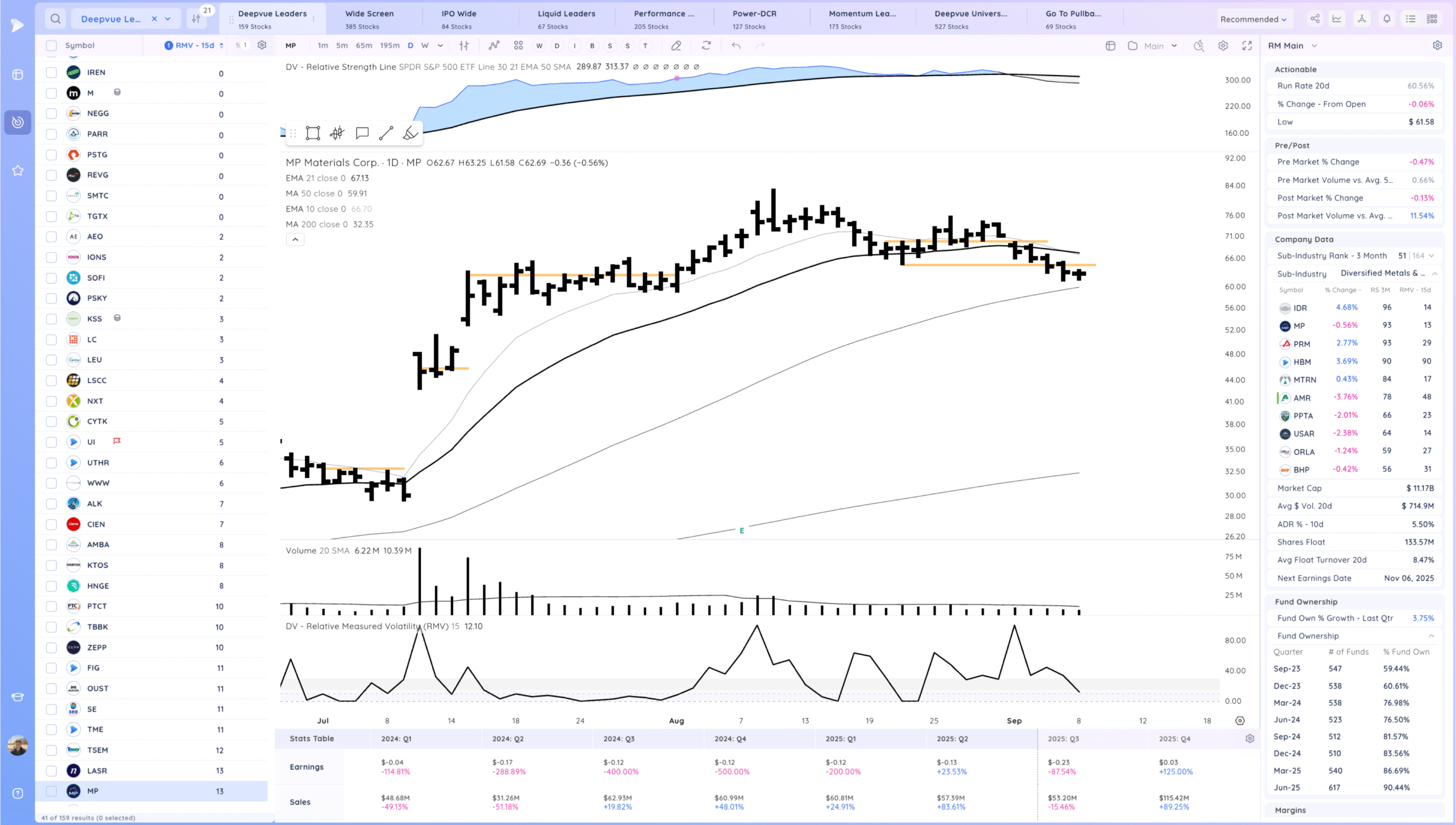

MP tight inside day, watching for the level reclaim

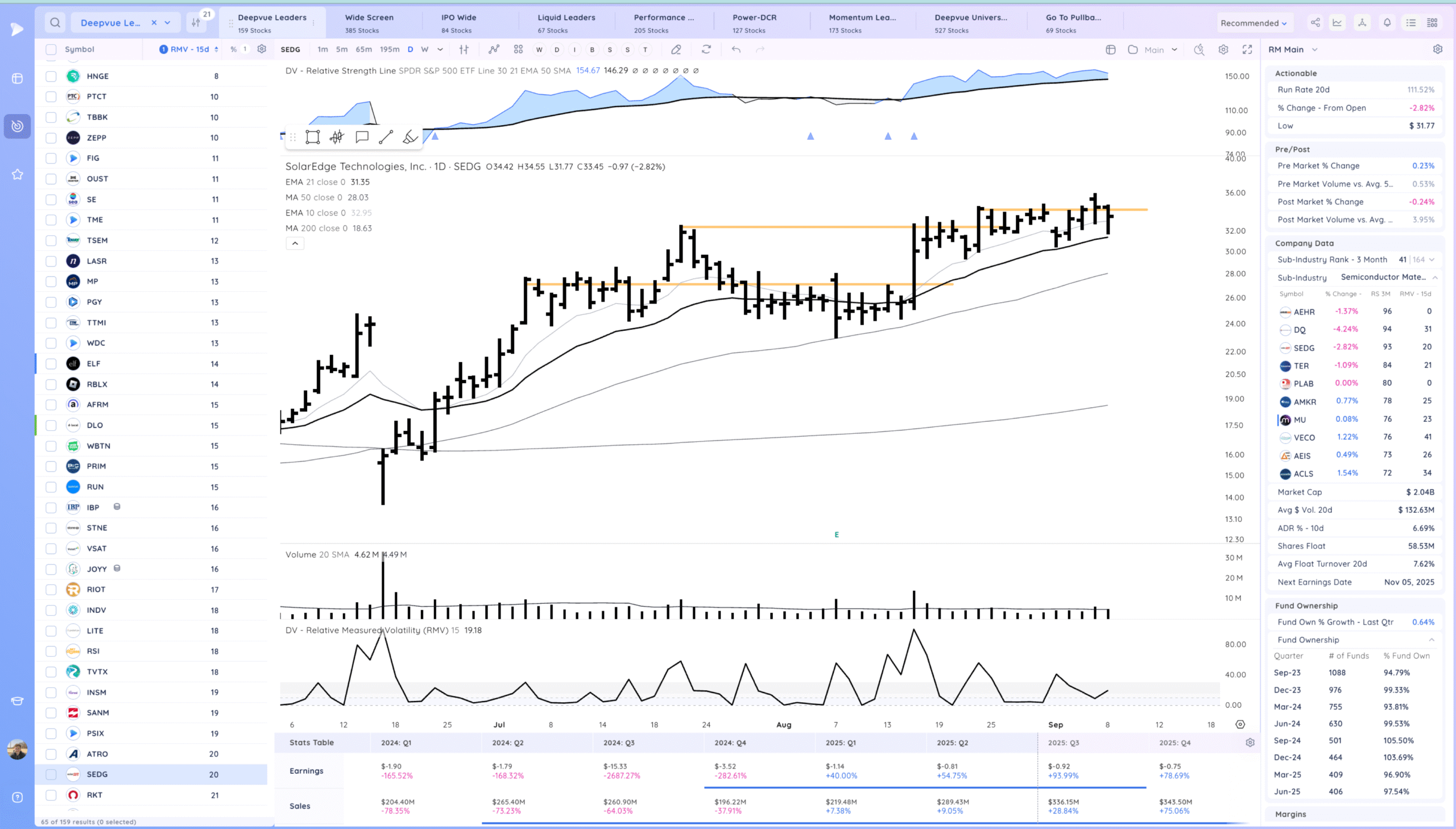

SEDG a bit choppy here but watching for a consolidation breakout

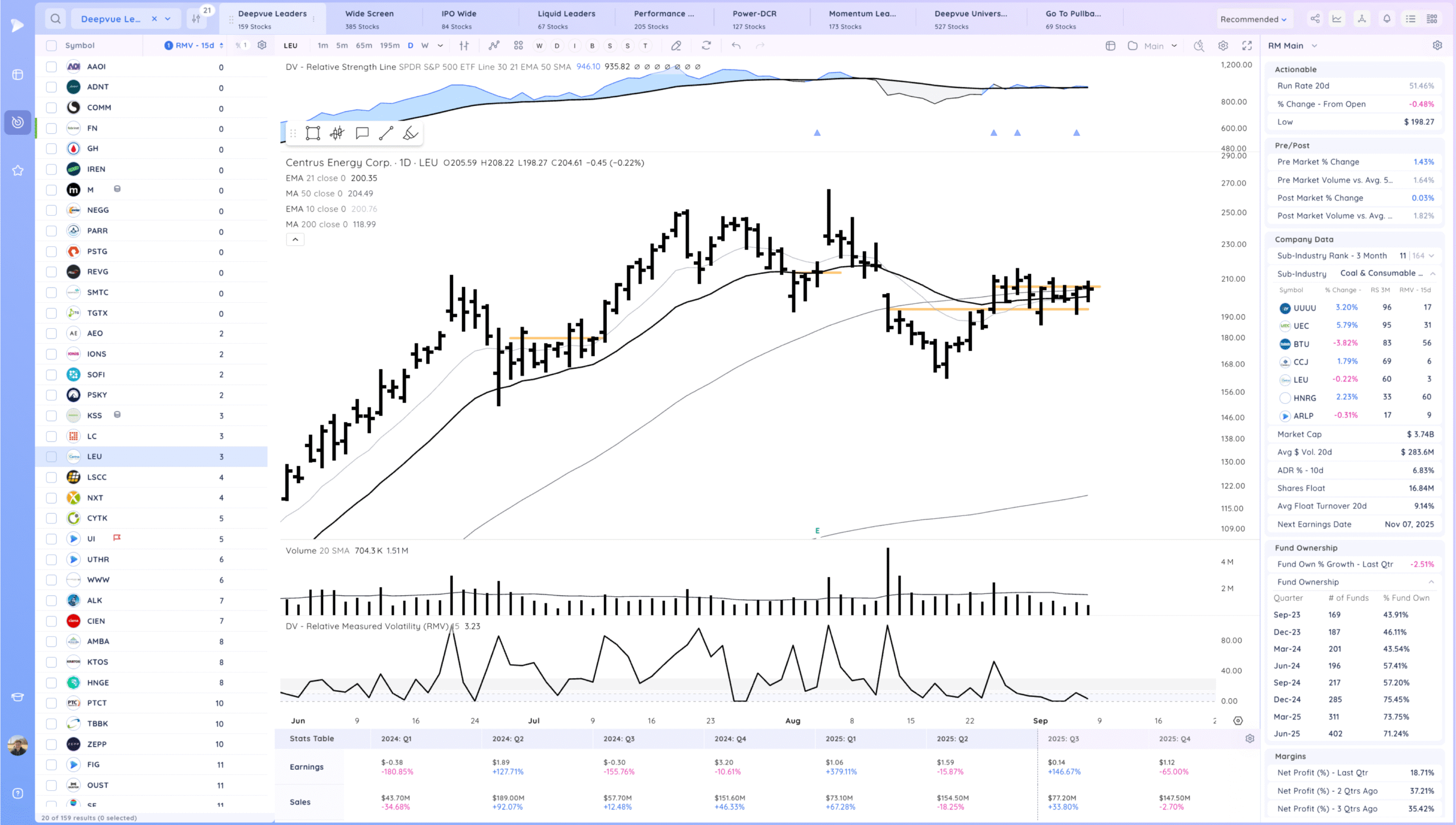

LEU watching for a range breakout

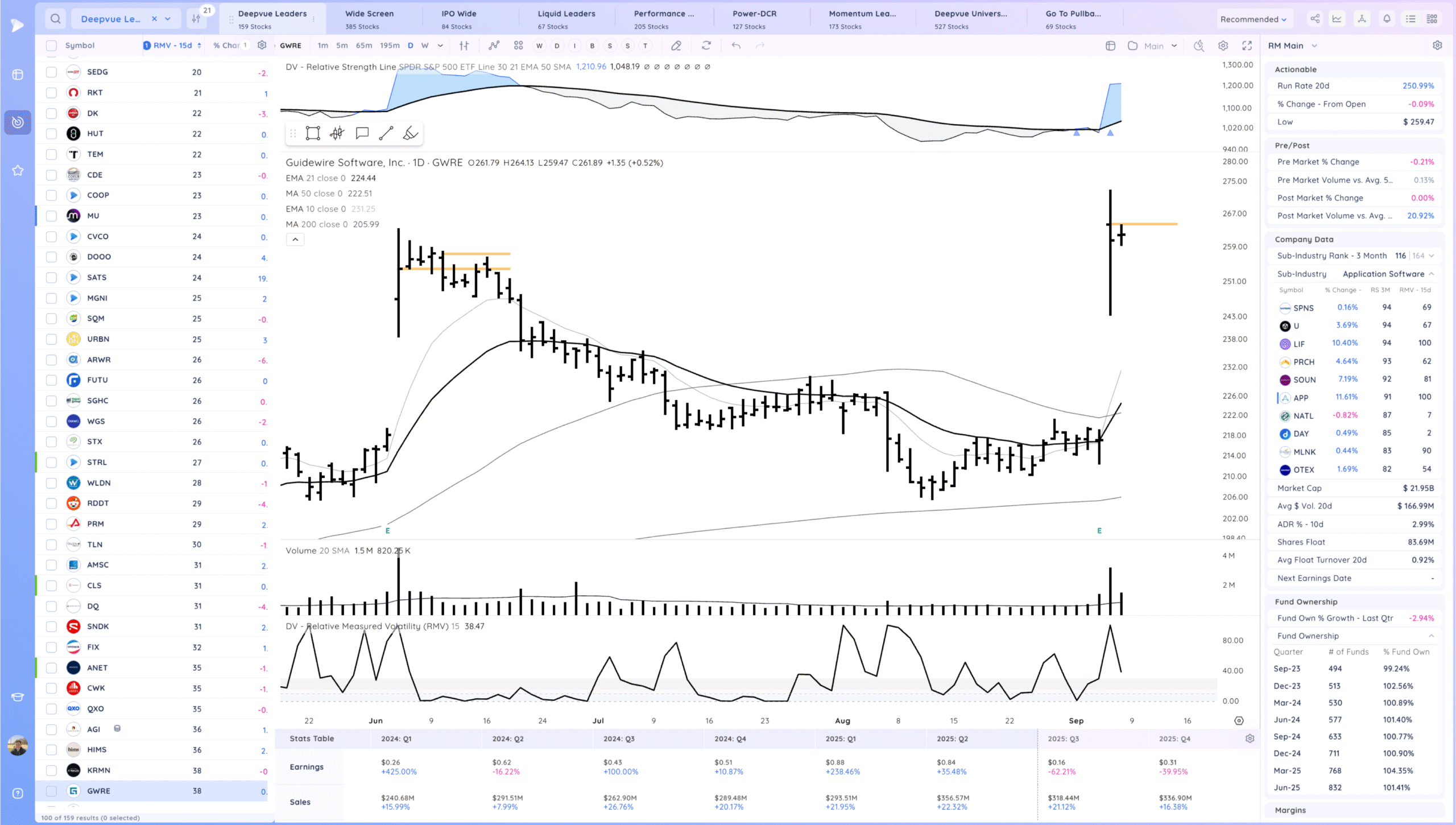

GWRE watching for a range breakout

Today’s Watchlist in List form

Focus List Names

PSTG AEO IONS PSKY LC HNGE MP SEDG LEU GWRE RDDT TSLA HOOD

Focus:

PSTG AEO LEU MP

Themes

Strongest Themes: AI, Miners, Software, Energy

Market Thoughts & Focus

Fair amount of Downside reversals today from some big names. But also leaders HOOD and ALAB acting great. Inside day near highs. Expecting expansion tomorrow.

Anything can happen, Day by Day – Managing risk along the way