Good Action After CPI – TSLA Robotaxi on Deck

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 10, 2024

Market Action

QQQ – consolidation day, good action off the open

Short Term Expectation based on the close is consolidation or continuation higher

Bulls want to see continuation up towards highs

Bears want to see us reverse down and close the week negatively

IWM weaker still but good close after a reversal down

Trends (4/4 Up)

Shortest – 10 Day EMA – Above Rising

Short-term – 21 ema – Above Rising

Intermediate term – 50 sma – Above Flat

Longterm – 200 sma – Up – Above Rising

Never miss a post from Richard Moglen!

Stay in the loop by subscribing.

Powered by Deepvue

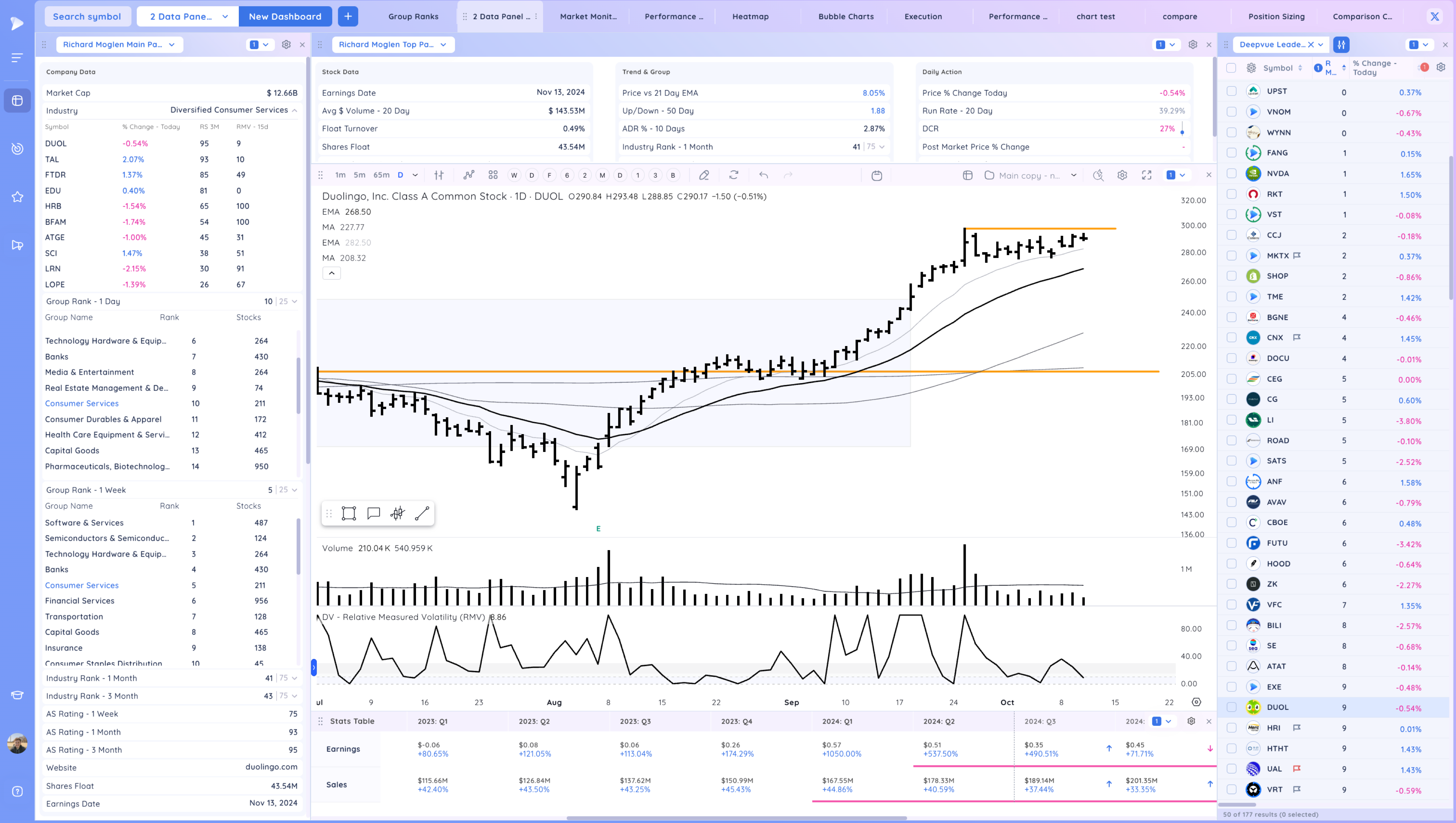

We just added a new key feature to the platform. You can now add Data panels to your dashboard to make a fully customizable layout based on the most important information for you. You can analyze technicals and fundamentals all together along with visualizing markets in a whole new way with real time bubble charts, heatmaps, and performance charts.

Not a Deepvue subscriber yet? – Try 2 Months for only $39 here

Groups/Sectors – % Change

From yesterday’s close on the left, from today’s open on the right

Performance Charts from Deepvue

S&P 500 % Change from Open vs Relative Volume

Deepvue Leaders Heatmap

Key Stocks in Deepvue

NVDA progressing higher. Forming a bit of a range above the pivot

TSLA upside reversal below the 21ema. Robotaxi even tomorrow, could be in play tomorrow

META into the 10ema again

ALAB great action through the HVC and intraday spots – Daily chart

ALAB 15 minute chart, actionable while managing risk versus the lows first 30 or so minutes

NET still stage 1 but strong breakout. Cyber theme has been strong

RBRK continued expansion. low risk entry was from inside day near the 21ema

CRWD push through 200 day

IOT breakout

KVYO push, not huge volume

BEKE pullback to base pivot. China related names can gap either way

CORT 10 ema flag

UPST in this base

VST sharp pullback to the 10ema

CEG on the AVWAP

HOOD good action near the pivot

SE tight day in range

DUOL in this stubby flag

Market Thoughts

Good action after CPI, see how we close the week.

Day by Day – Managing risk along the way