Gap Up and Follow through Down

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 15, 2025

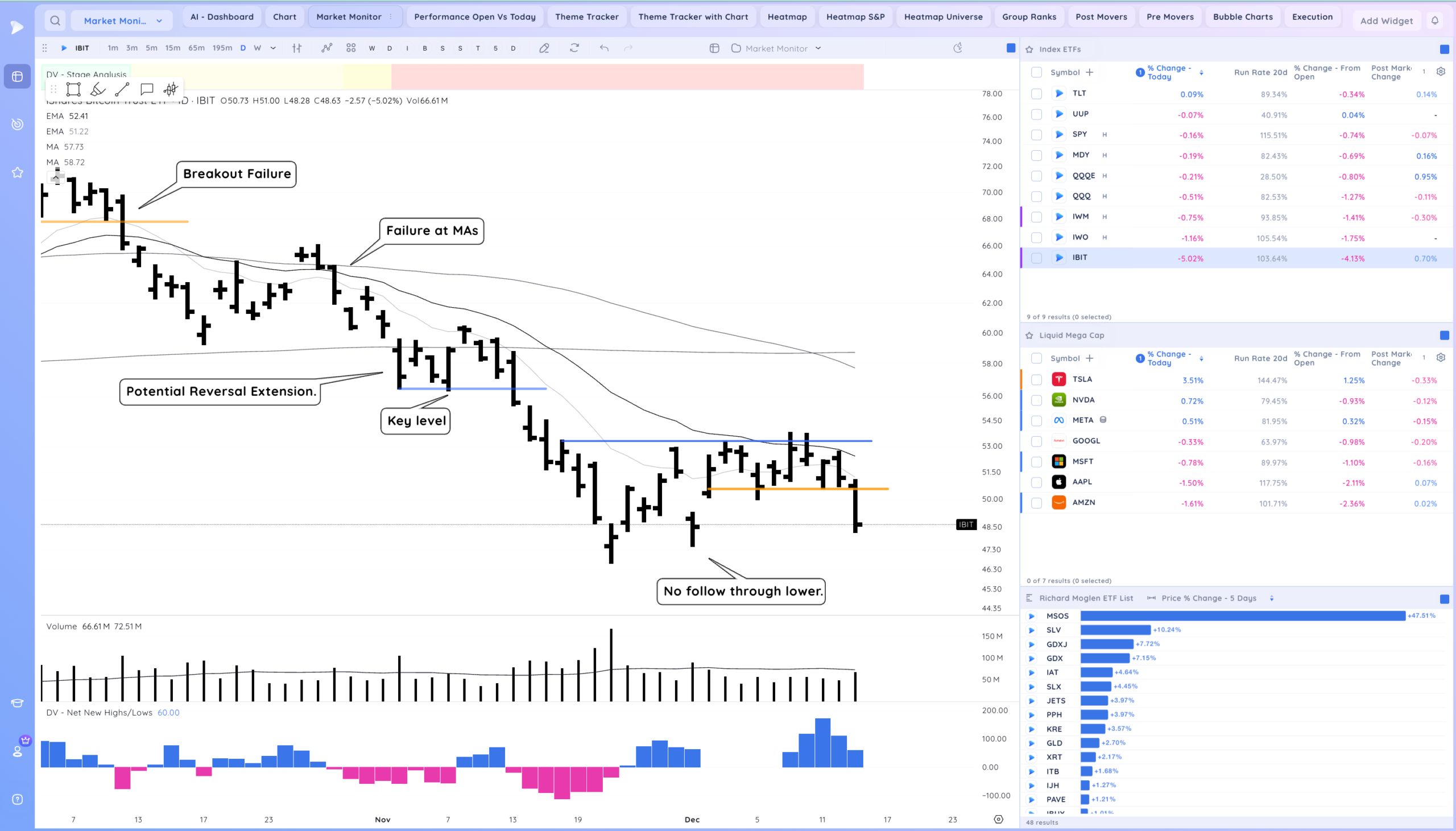

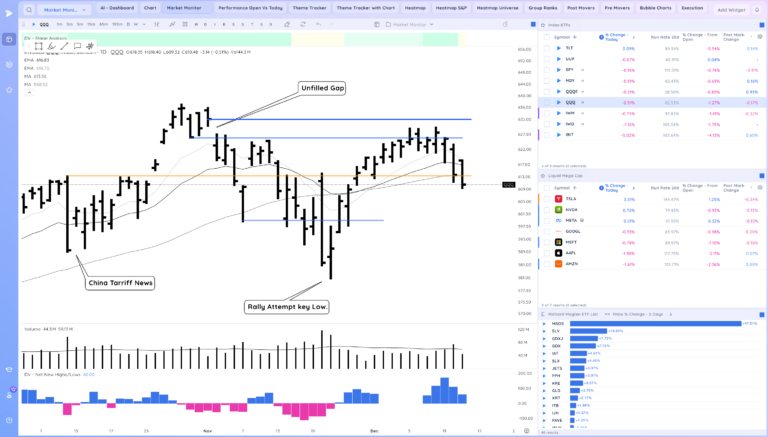

Market Action

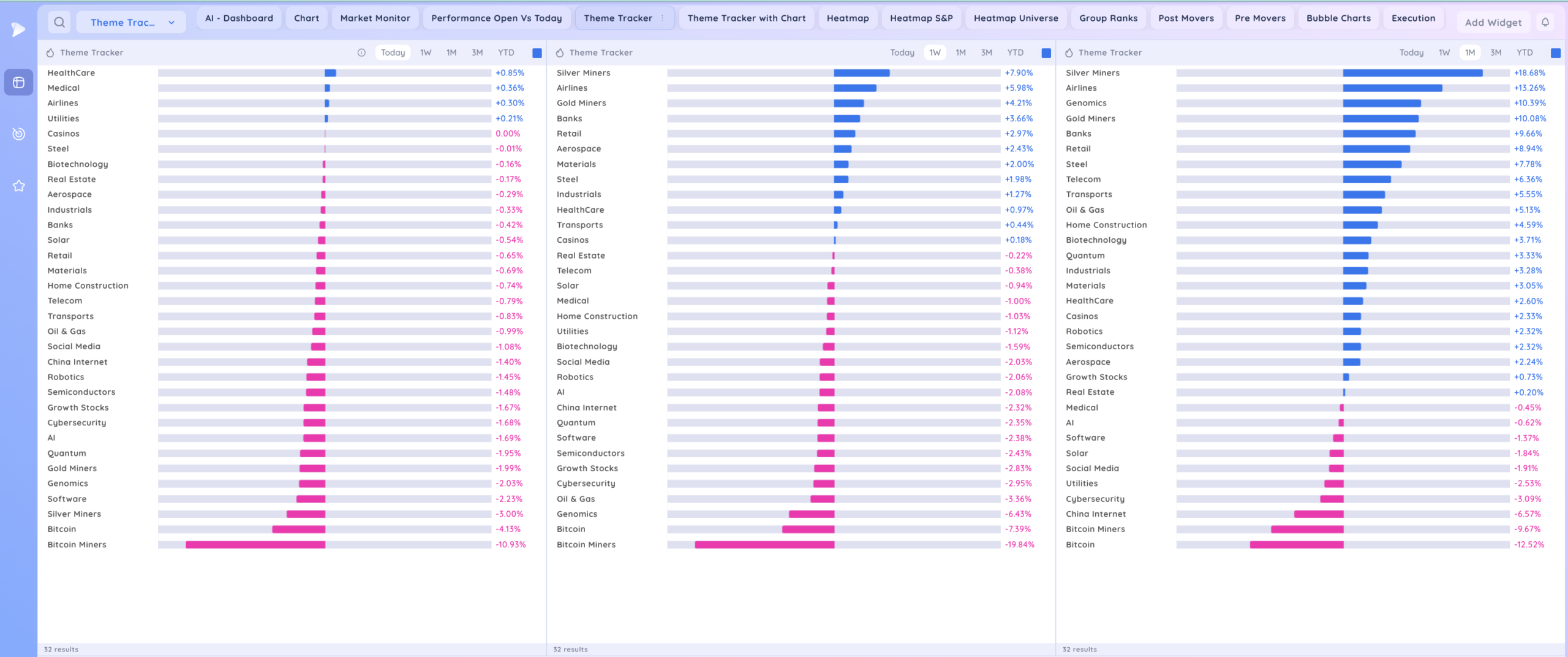

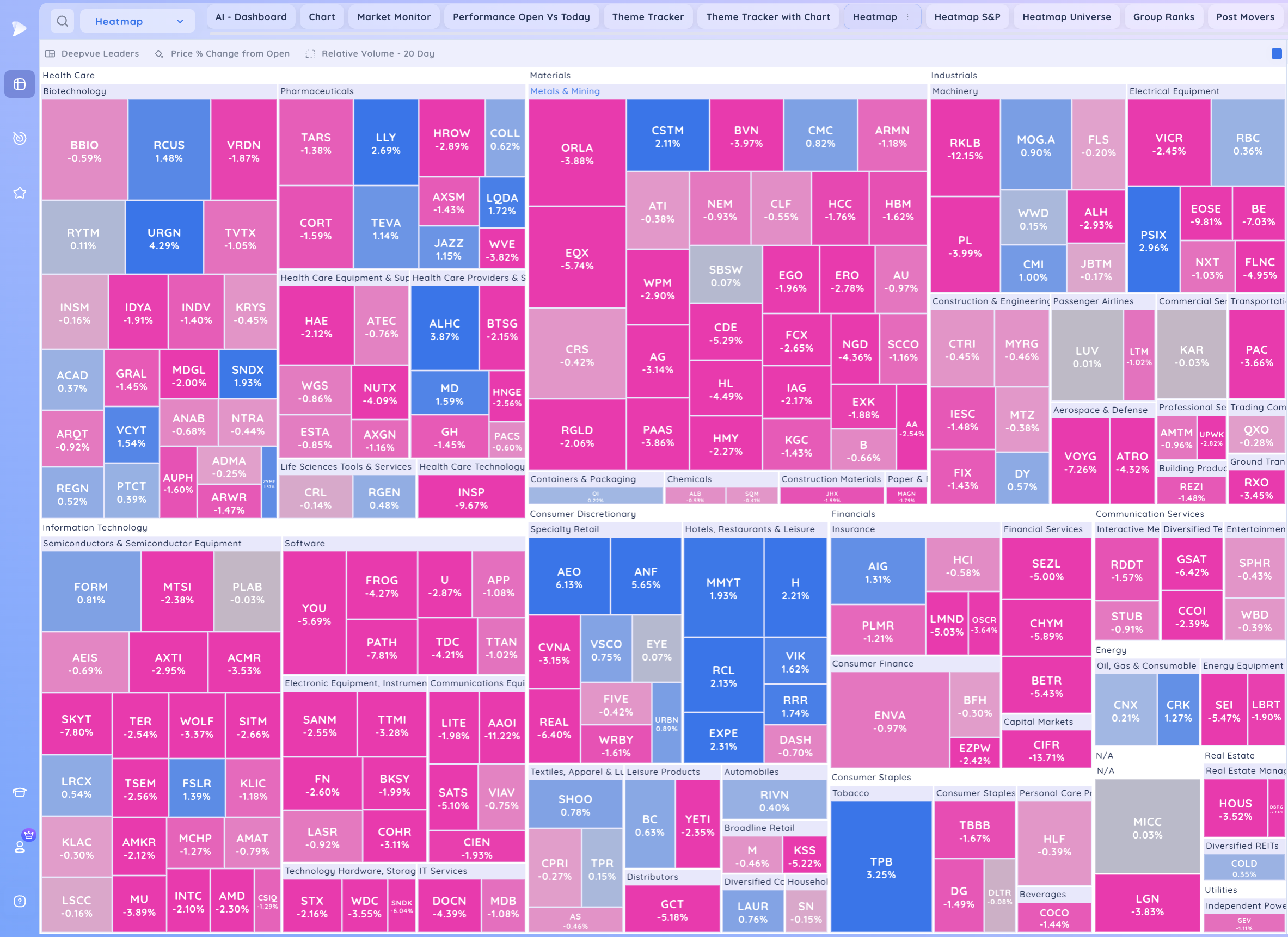

Gap up and then some follow through lower. The best thing to do now is to build RS lists and identify themes holding up the best. Retail and Biotech are the current leading themes.

Look for stocks ignoring the market weakness, holding above MAs, pivots.

Remember, the market and stocks can shape up a lot faster than we think so stay optimistic and do the homework.

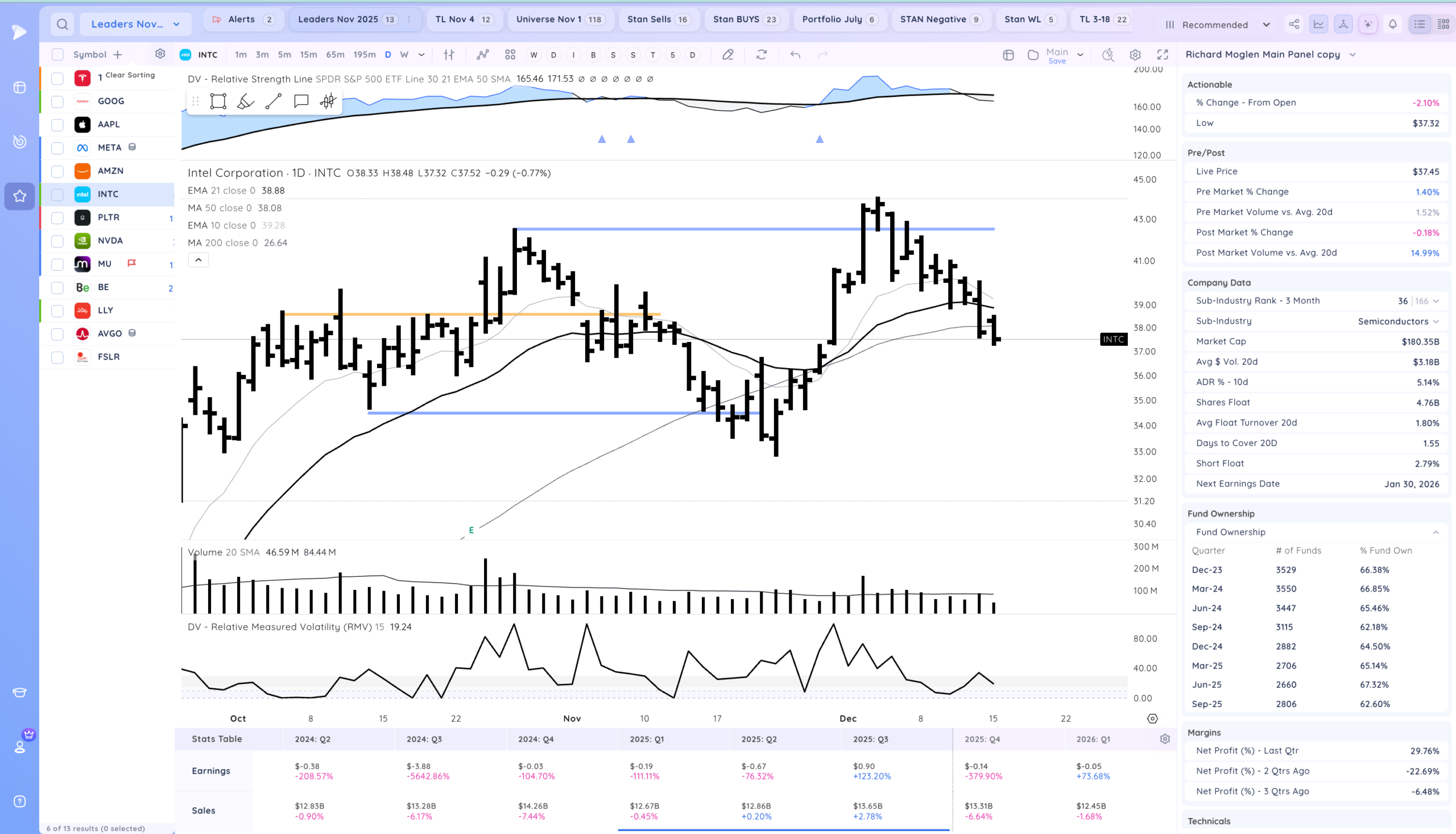

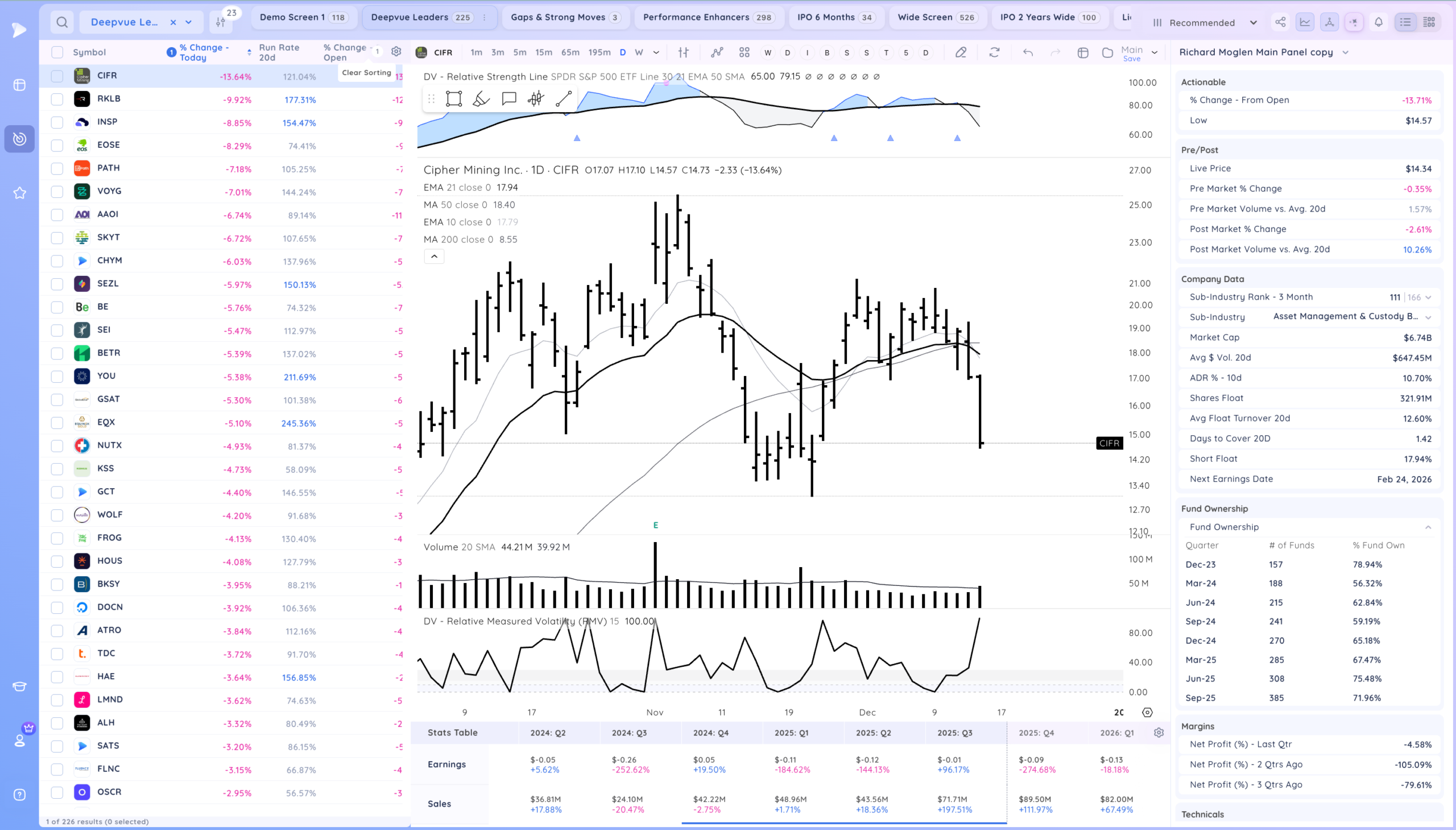

My watchlist/RS list is below.

Trends 2/4 Up – based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Below

Intermediate term – 50 sma – Above

Longterm – 200 sma – Up – Above Rising

Current View: Developing Uptrend (Under Pressure)

Groups/Sectors

Leadership Stocks & Analysis

Key Moves

Setups and Watchlist

Watchlist & Themes

Larger Watchlist/RS List

Highest Focus among RS List

Universe List

Recent Gaps

Additional Thoughts

We’ll see how this week closes. Not too much follow through down today but stocks need to shape up. TSLA a clear market gauge if it can hold near the base pivot that’s a good sign.