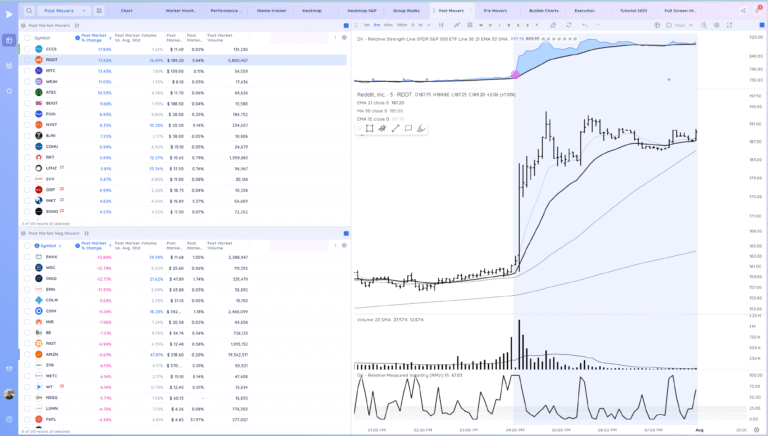

Gap Reversal Warnings. RDDT Gap

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

August 1, 2025

Market Action

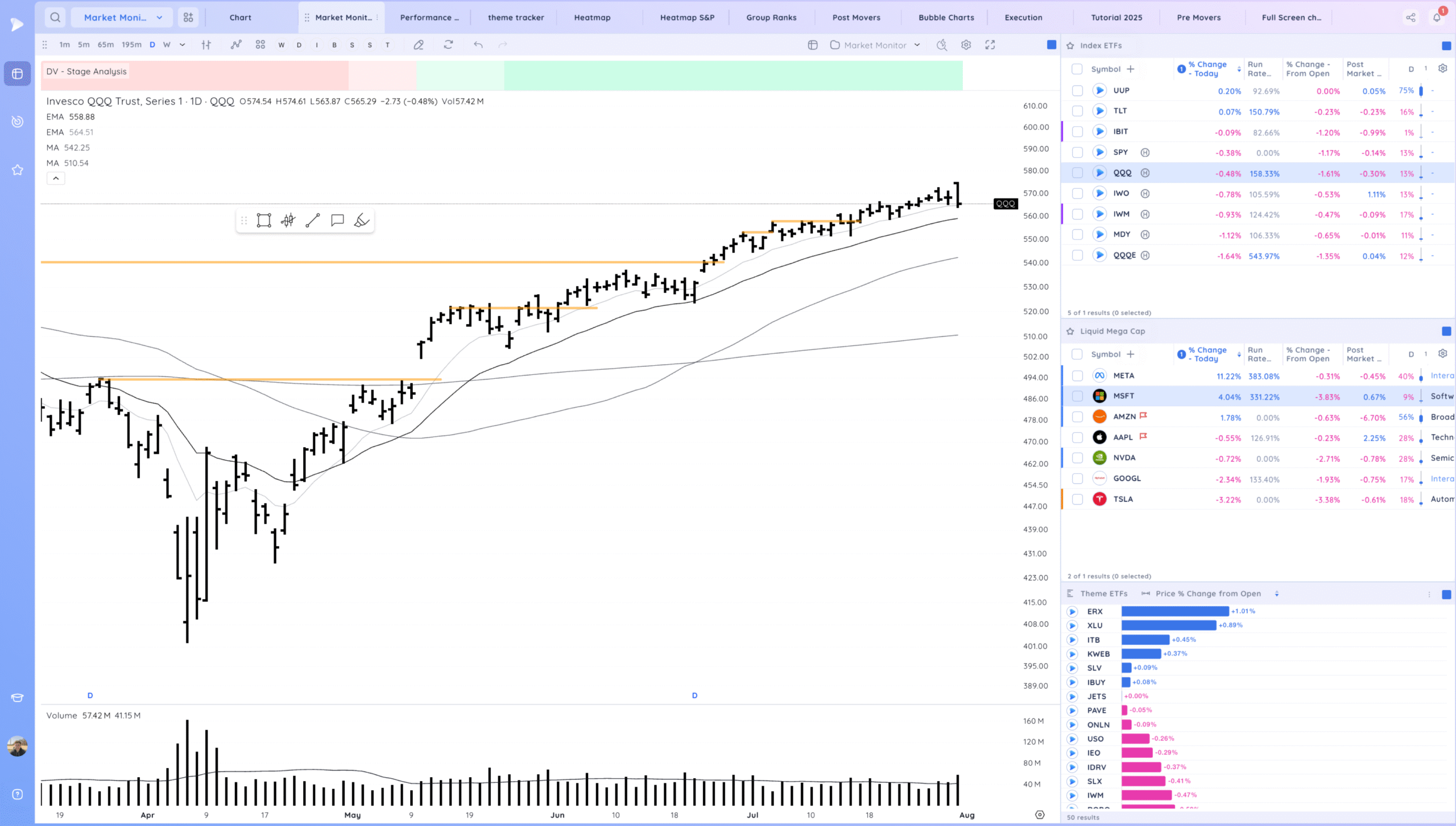

QQQ – The gap up was sold into. Large reversal. Potential for a trend change if we follow through down and break the 10 and 21 emas.

Bulls want to see us hold the 10ema area and continue to ride the MAs higher. A strong upside reversal to end the week would be ideal

Bears want to see follow through down breaking below the 10ema and testing the 21

Daily Chart of the QQQ.

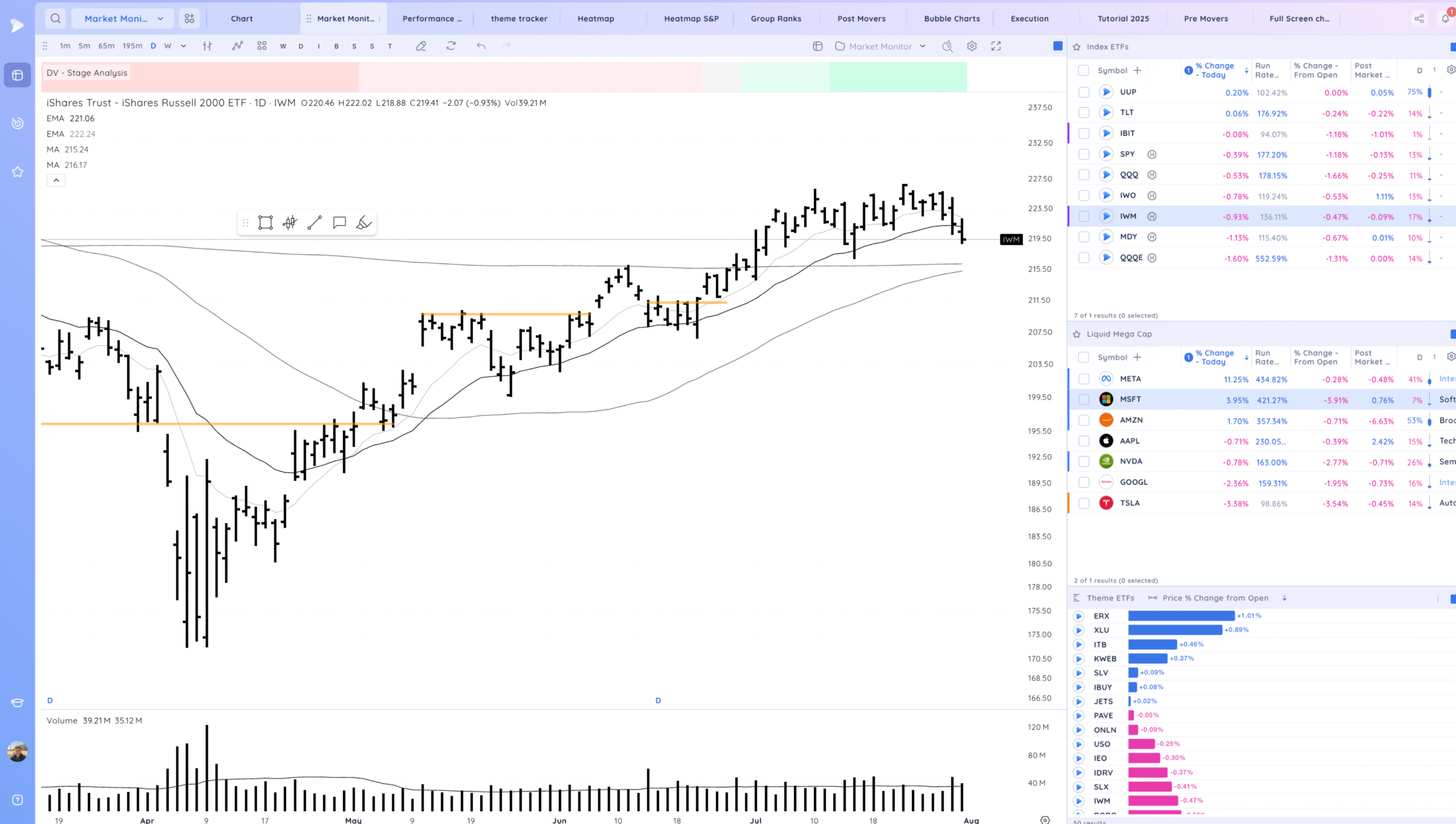

IWM – closing below the 21ema

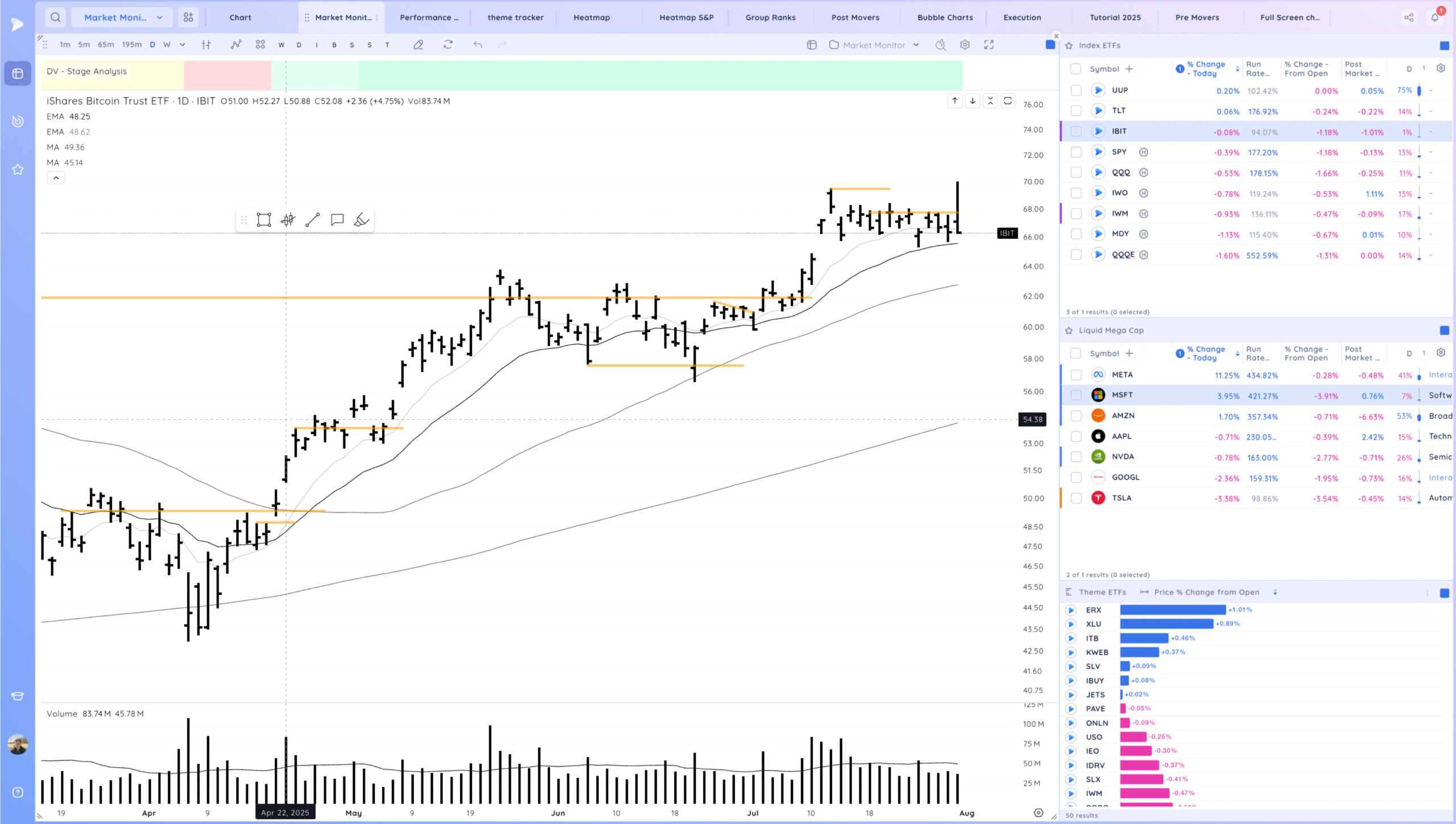

IBIT – Weird print. HOD is 67.5. Still a fade at the pivot

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

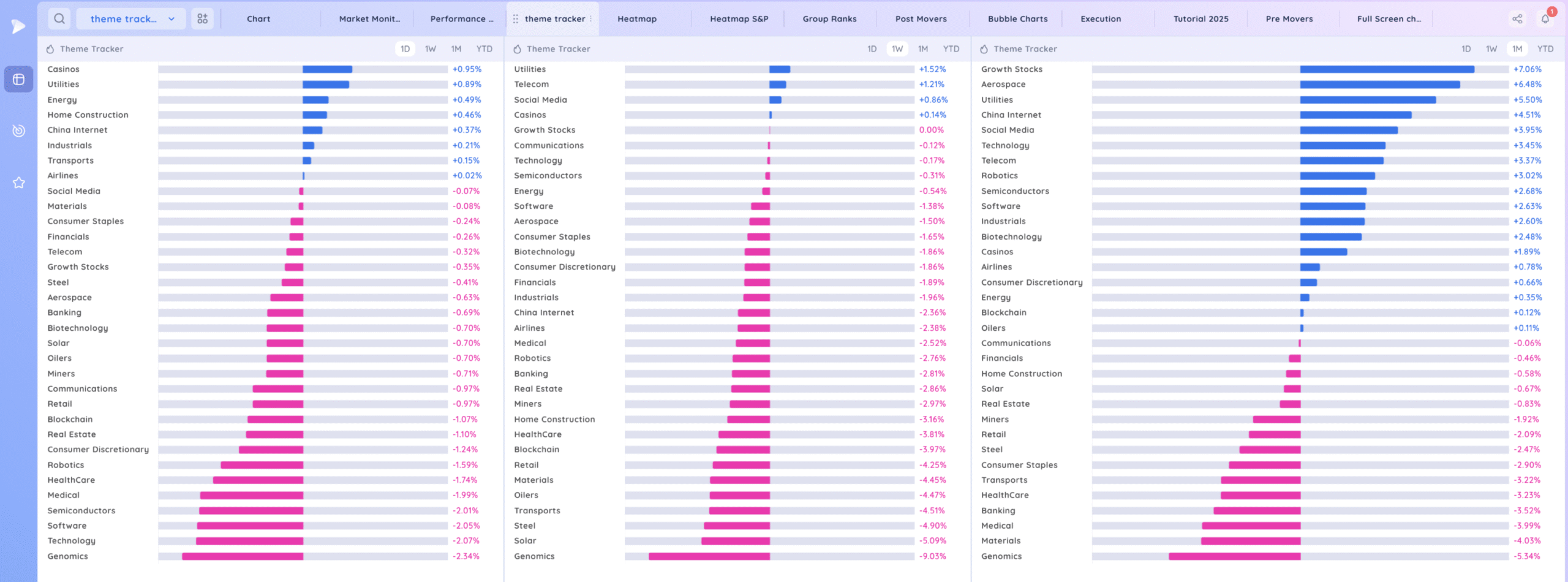

Deepvue Theme Tracker

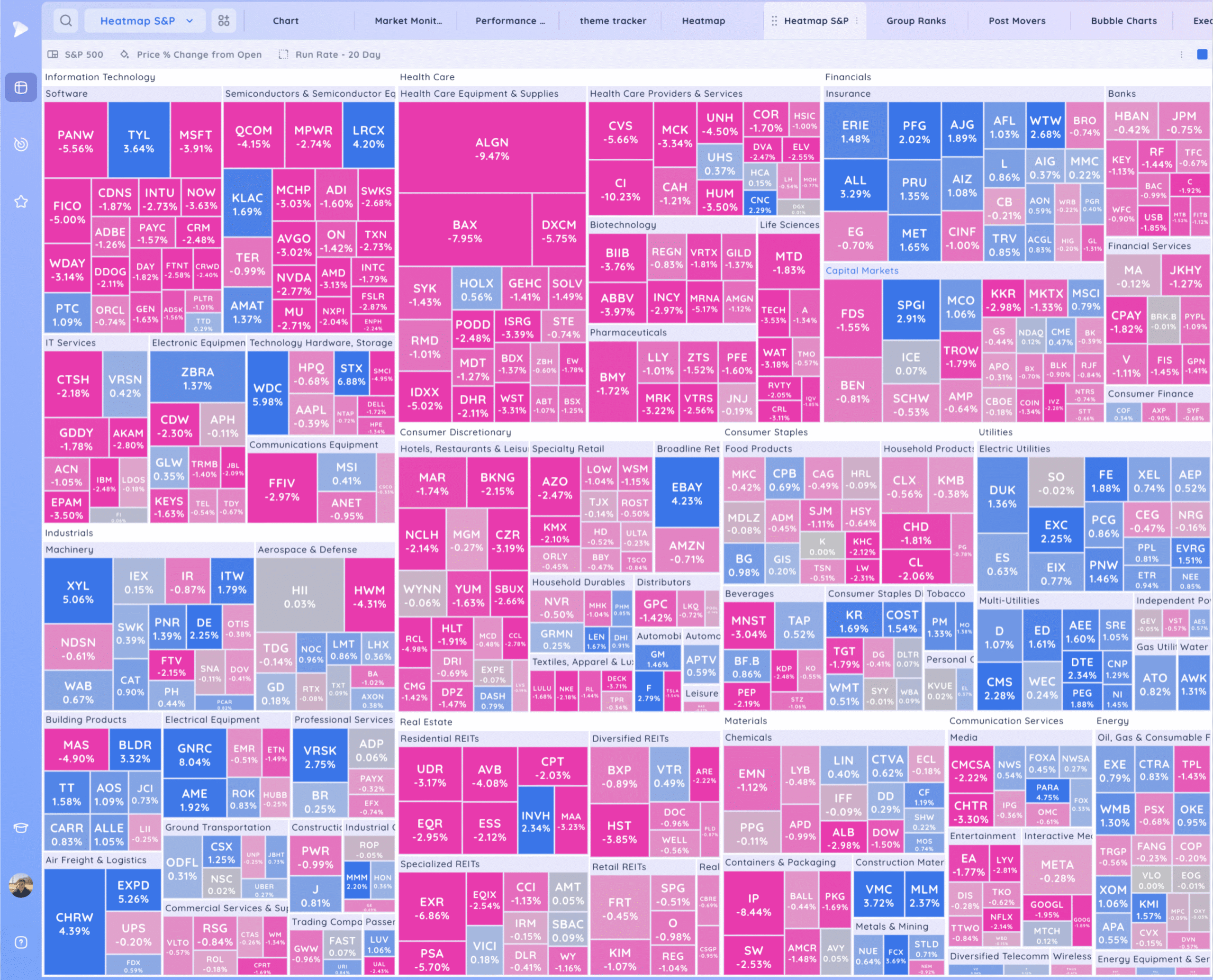

Deepvue Leaders Heatmap

S&P 500.

Leadership

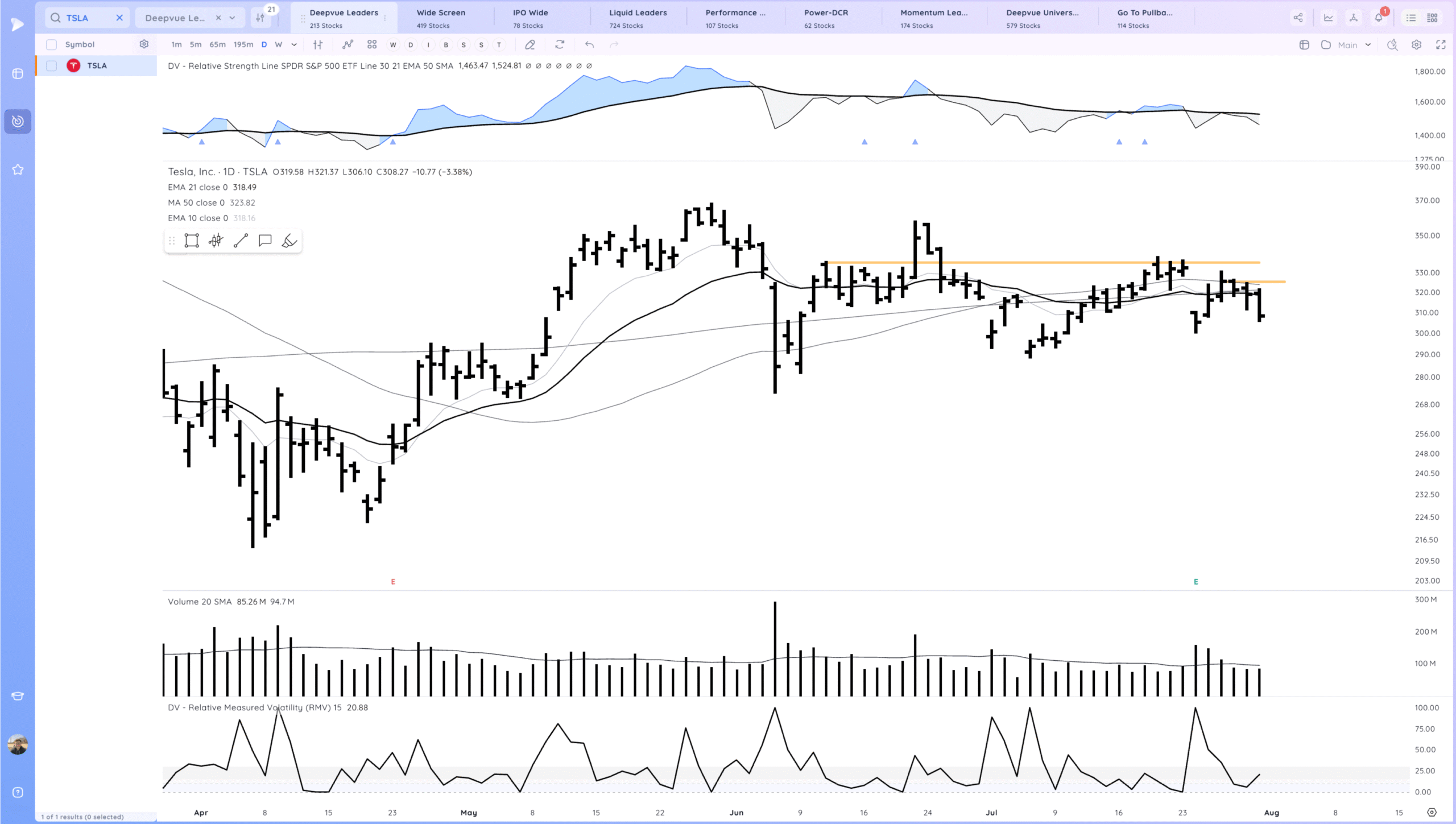

TSLA no follow through up, closing below the 21ema.

PLTR still coiled in a tight range, likely won’t make a meaningful move before earnings.

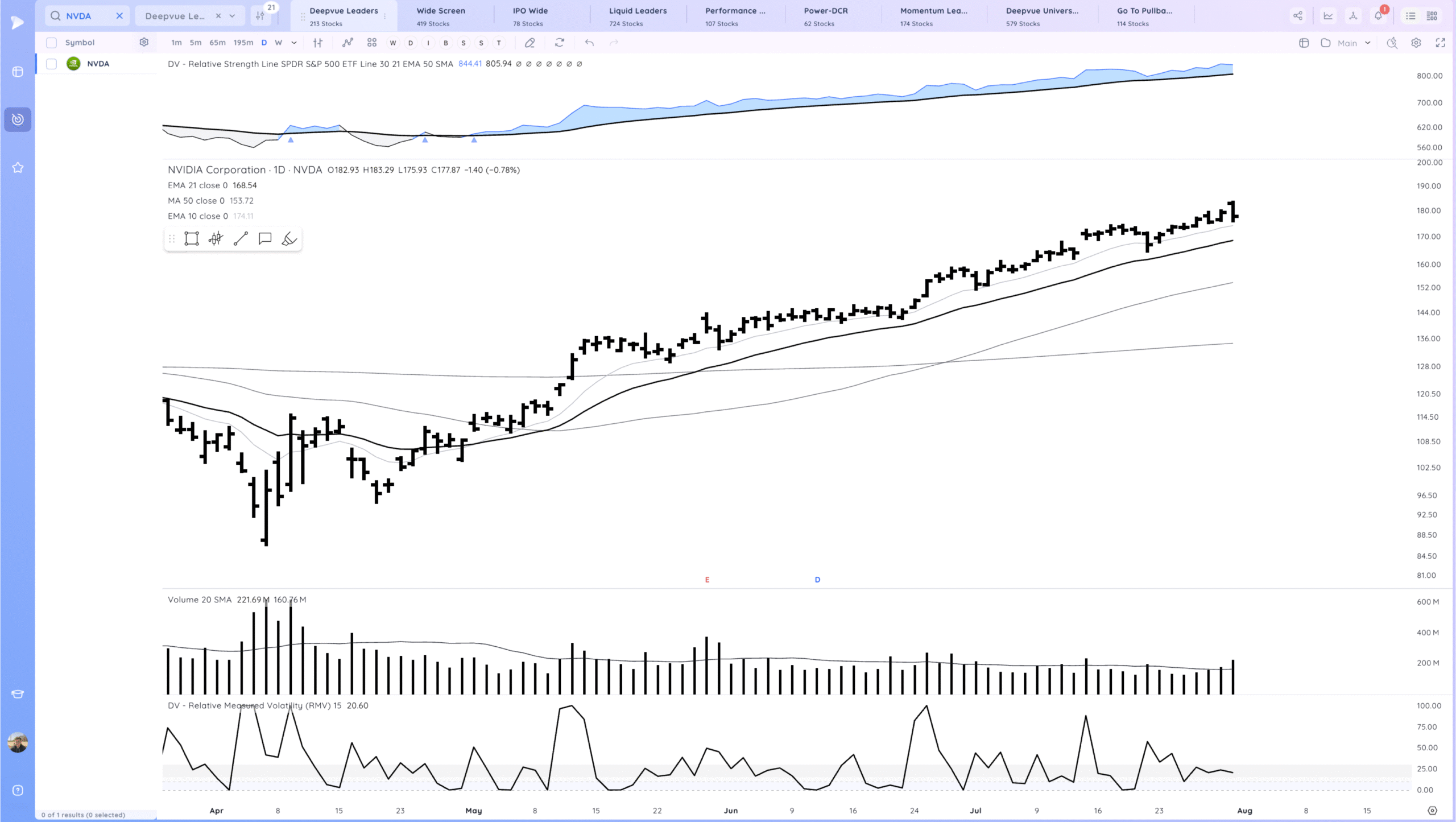

NVDA downside reversal. trending above the MAs. potentially the start of a consolidation

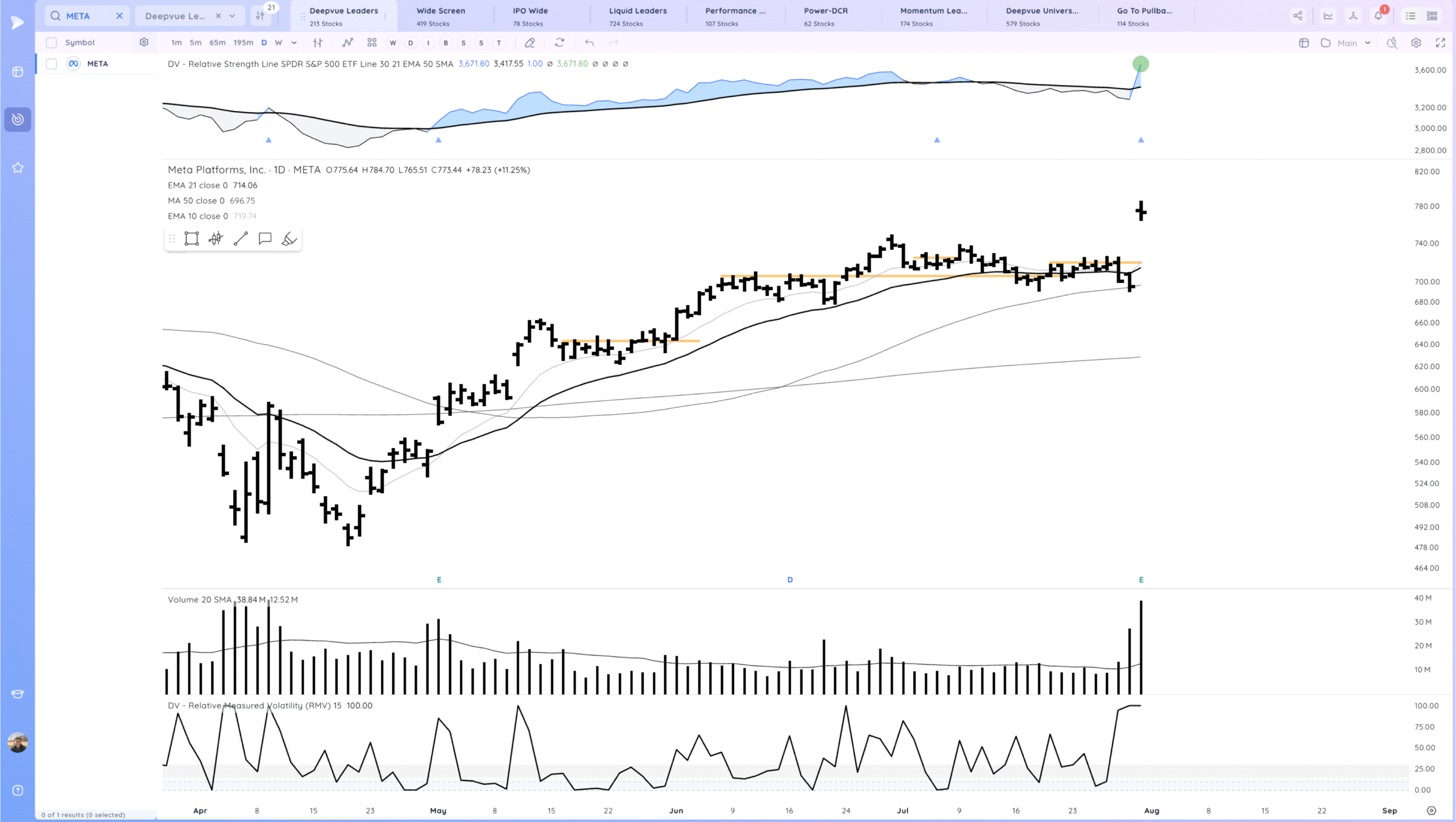

META Gap up, middle close.

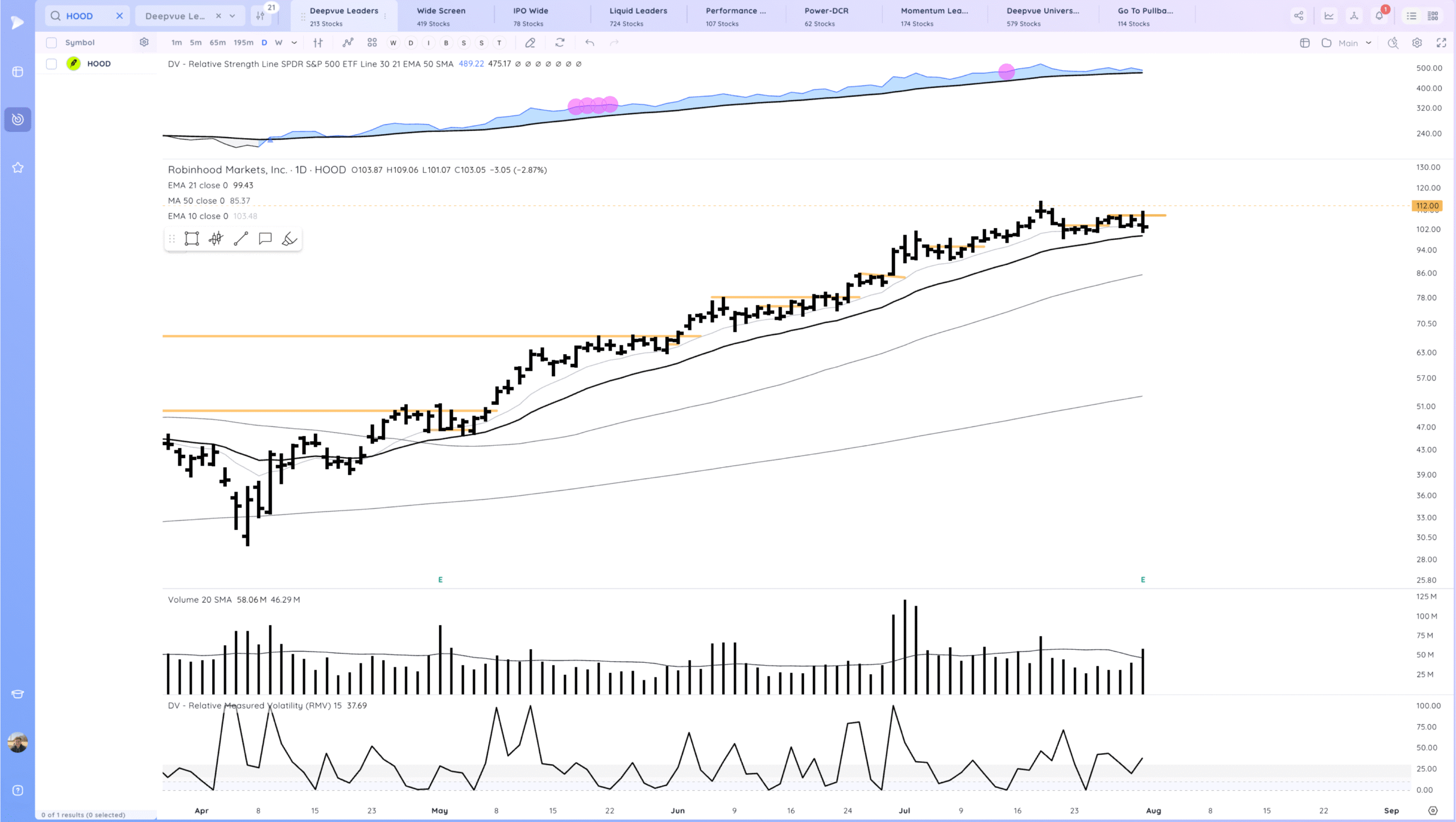

HOOD fade off highs. Mixed reaction after earnings. Holding above the 21ema

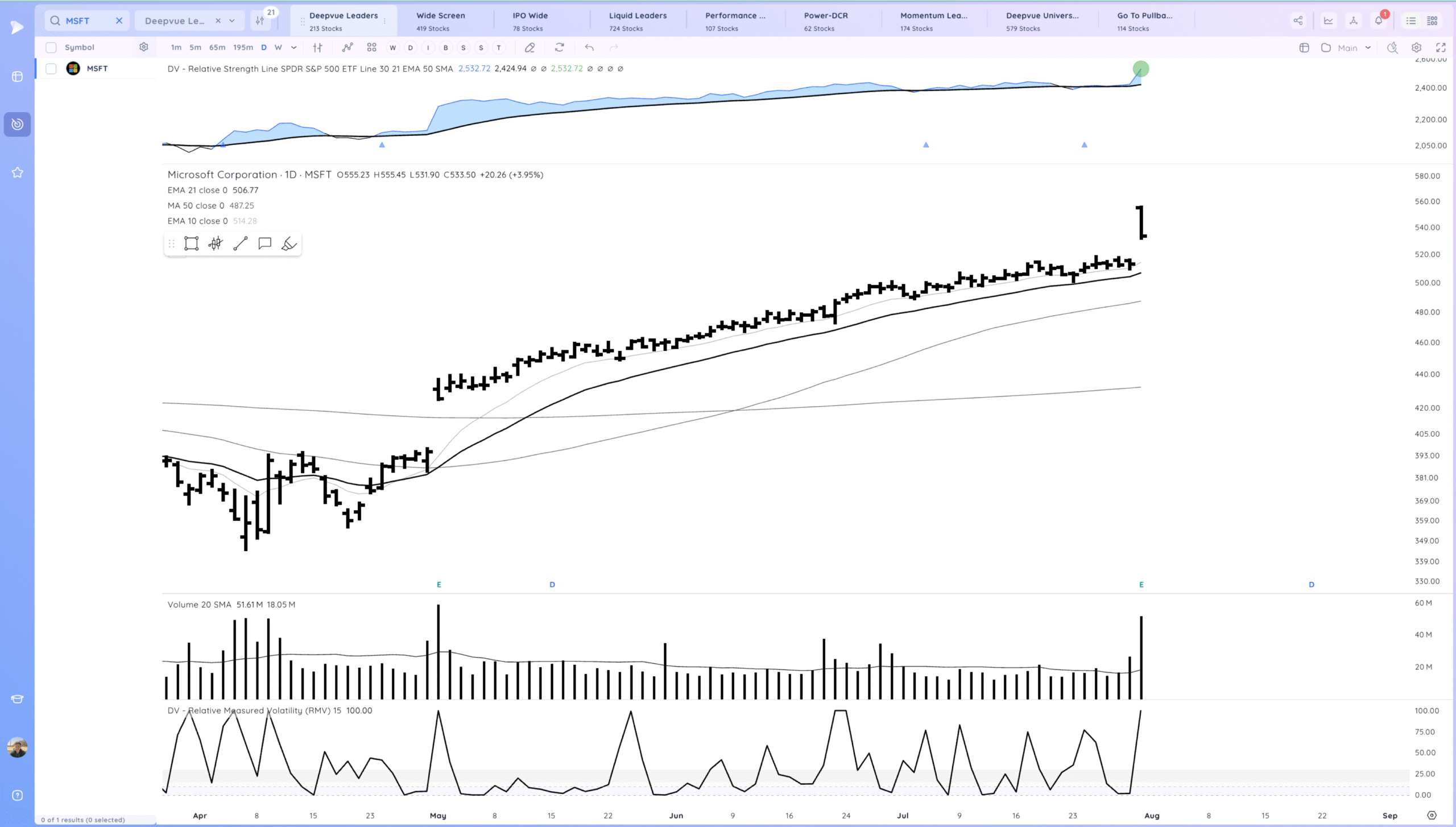

MSFT close at lows after the gap up

MSTR fade off the 21ema

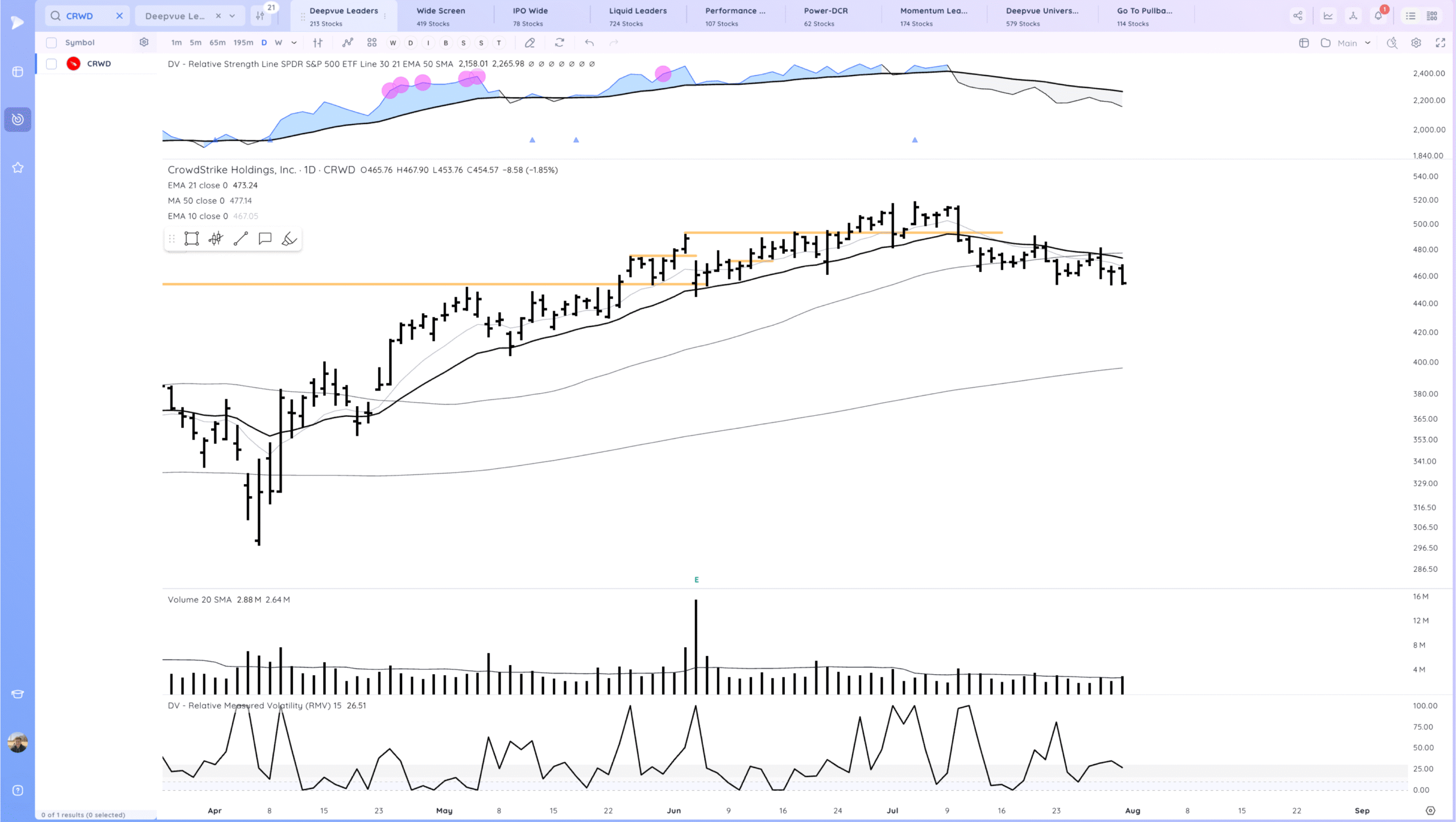

CRWD near range lows, needs to make a stand

Key Moves

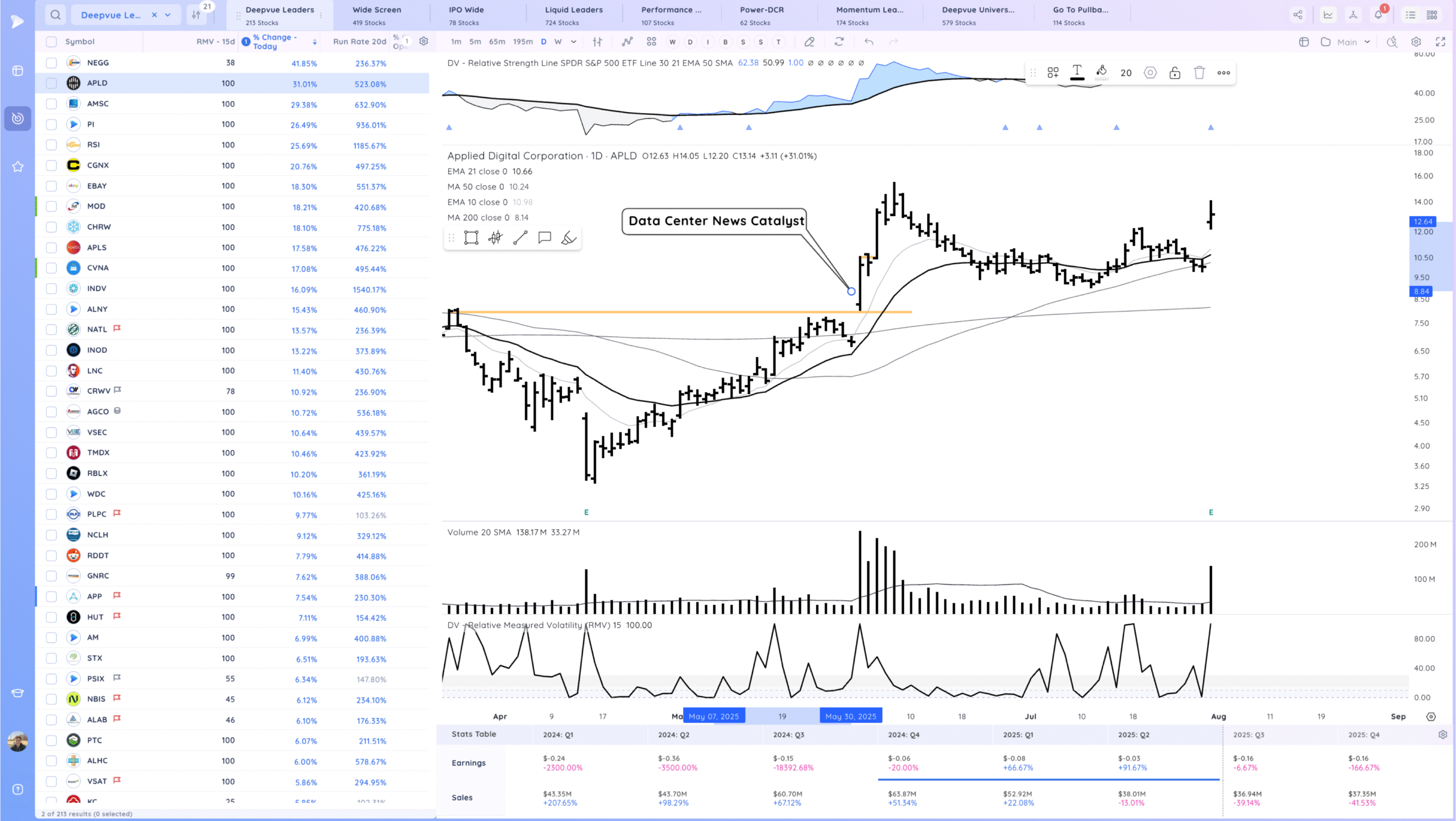

APLD gap up on earnings

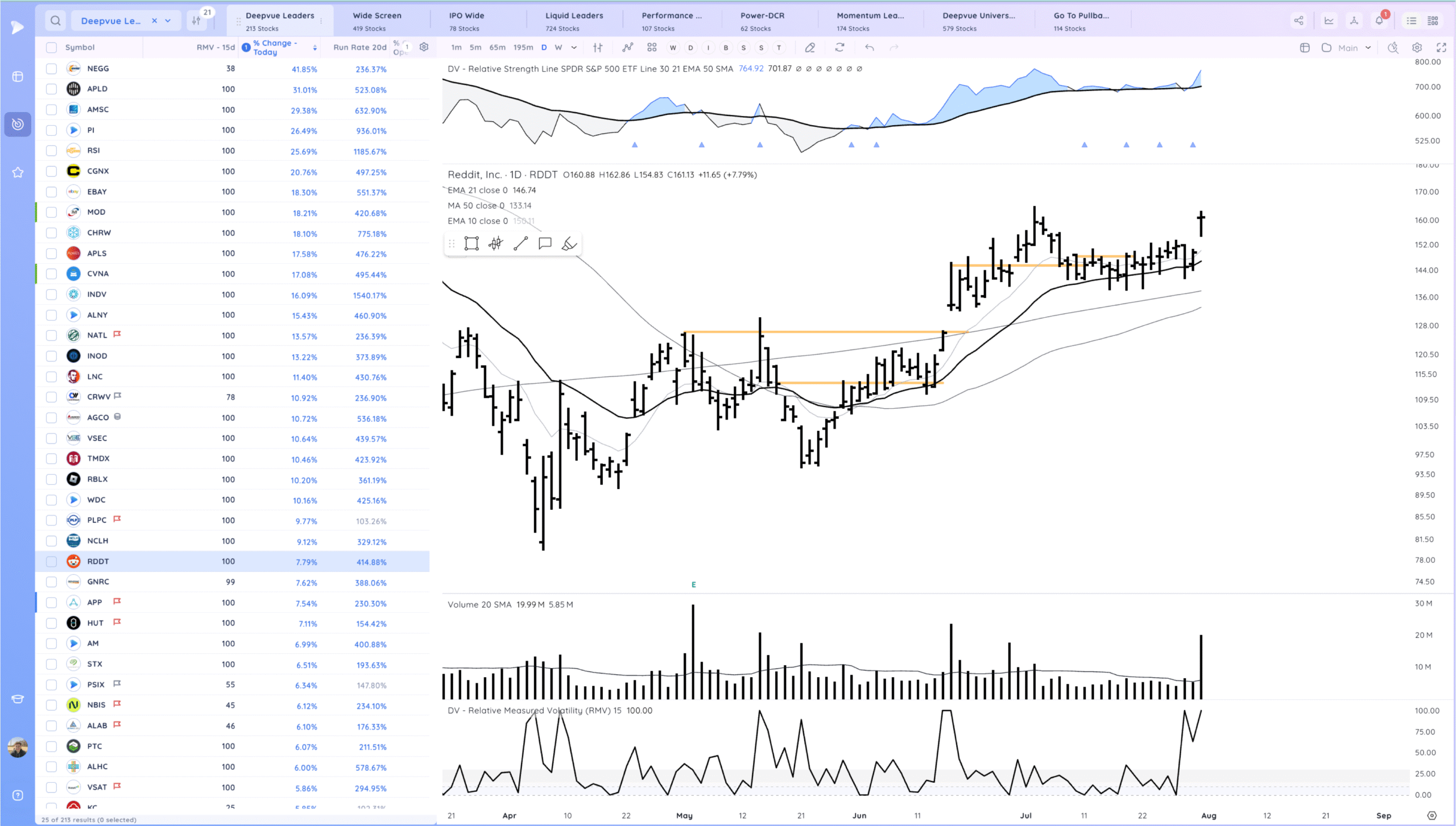

RDDT good close. Gapping up after hours on beat

Post Market Movers

Setups and Watchlist

AVAV watching for a range breakout

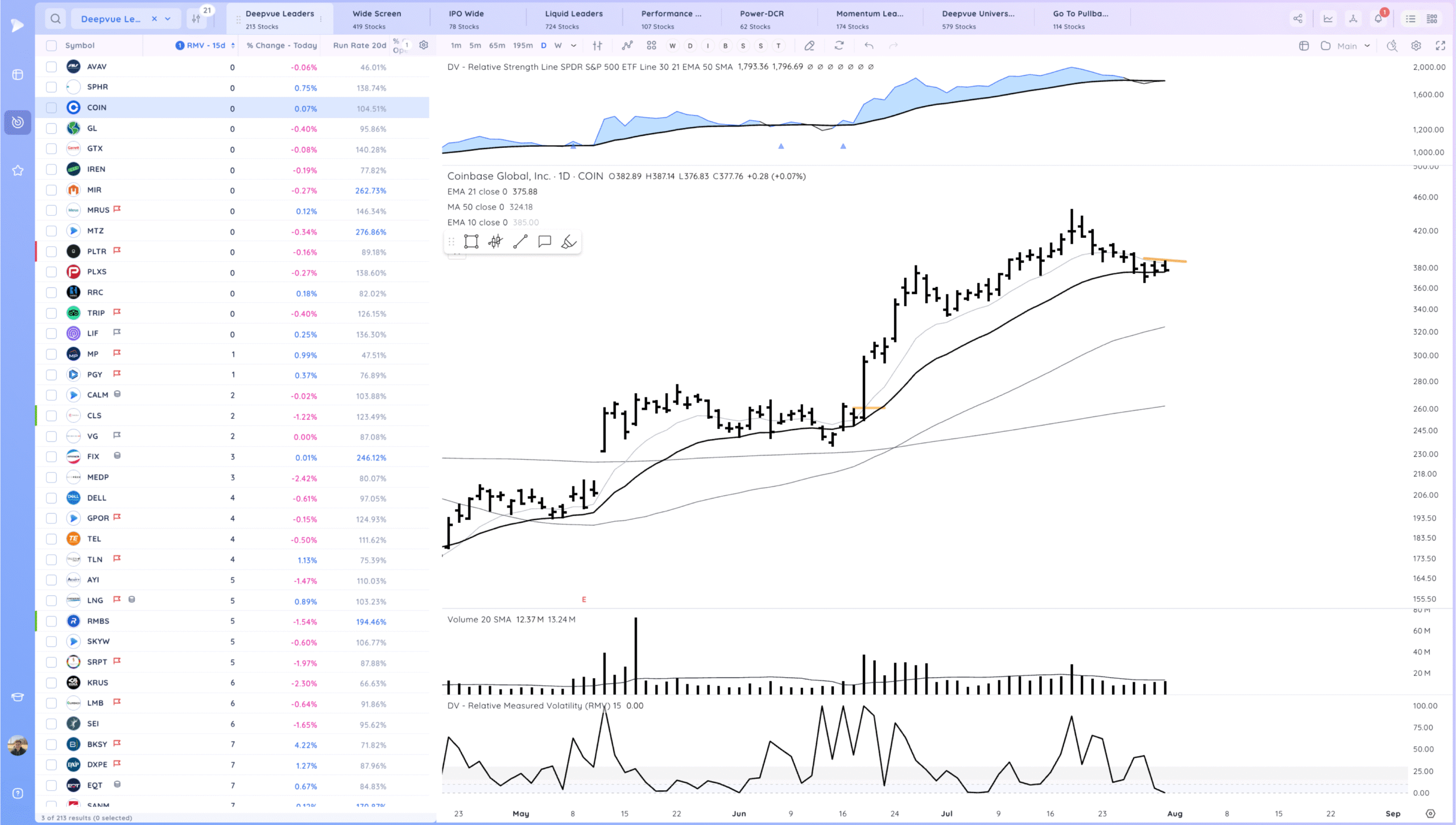

COIN watching for a range breakout

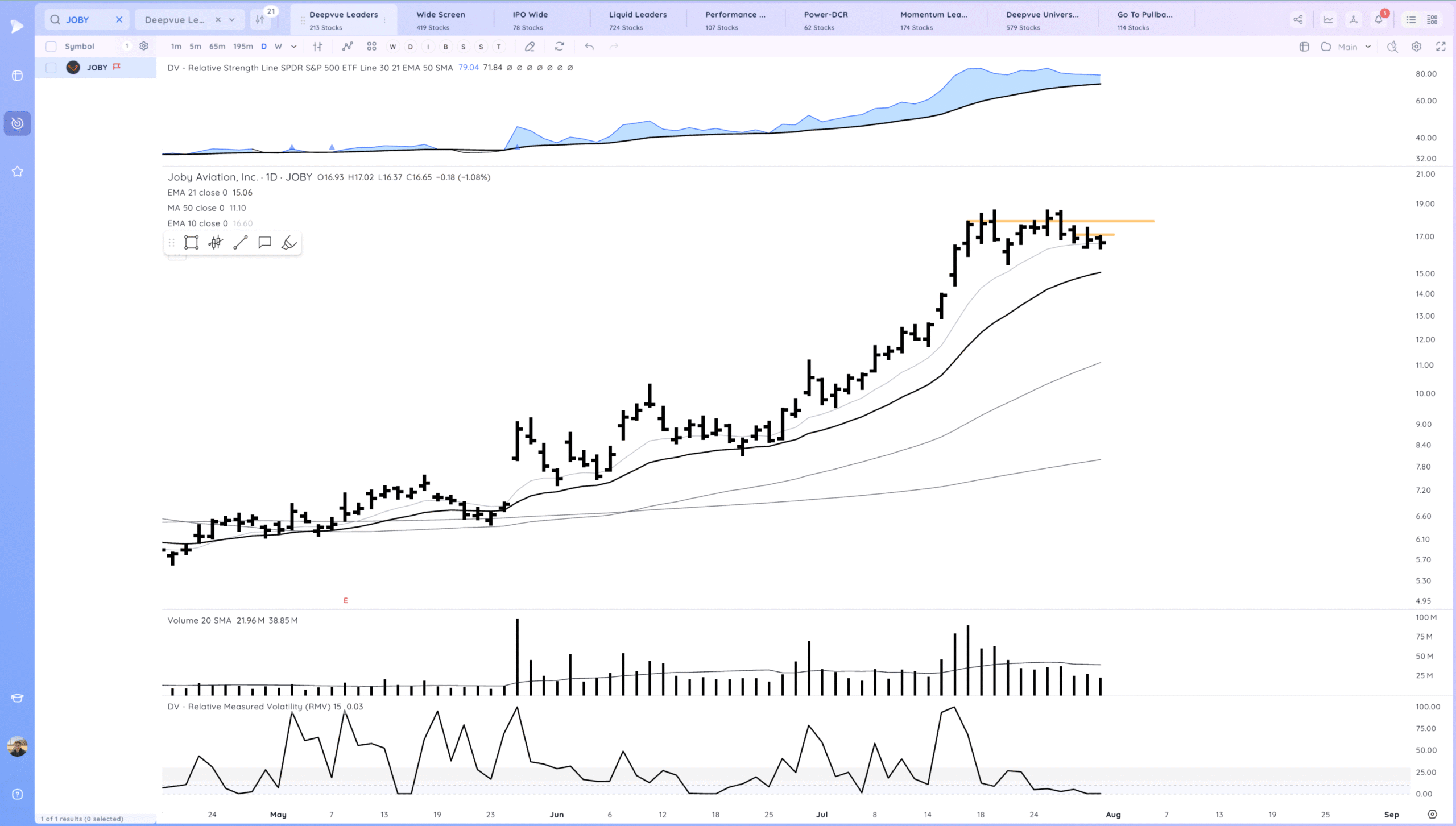

JOBY HTF developing

MP watching for a range breakout

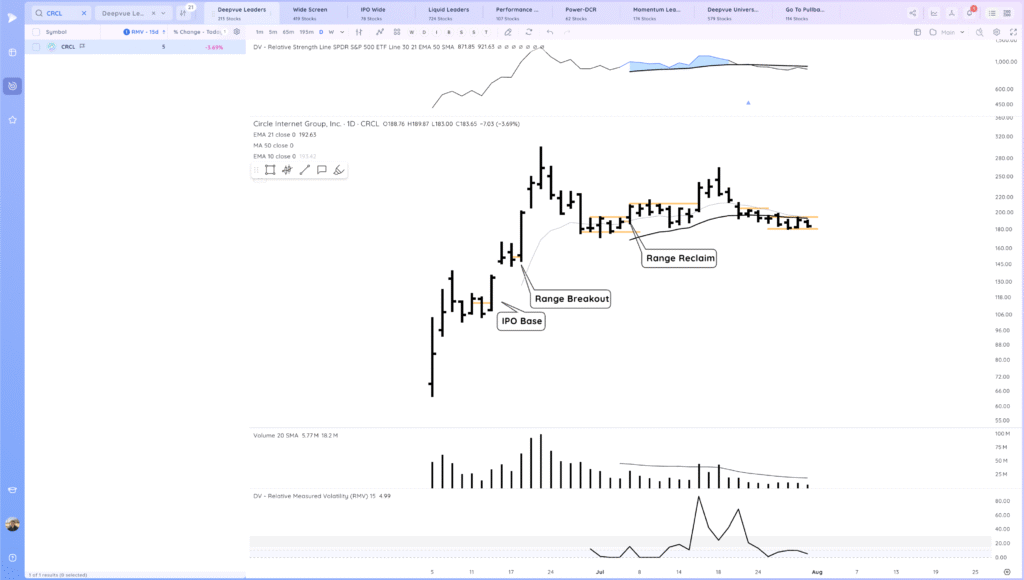

CRCL tight. Ripe for expansion. Watching for a 21ema pop or breakdown

Today’s Watchlist in List form

Focus List Names

AVAV COIN JOBY MP CRCL

Focus:

RDDT COIN

Themes

Strongest Themes: BTC, Miners, Software, Cyber, Nuclear Power

Market Thoughts & Focus

HOOD still a good gauge, see how it ends the week. Going to be picking spots very carefully if getting more involved. Not great seeing MSFT sell off.

Anything can happen, Day by Day – Managing risk along the way