Fed Volatility – Upside Reversal

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 17, 2025

Market Action

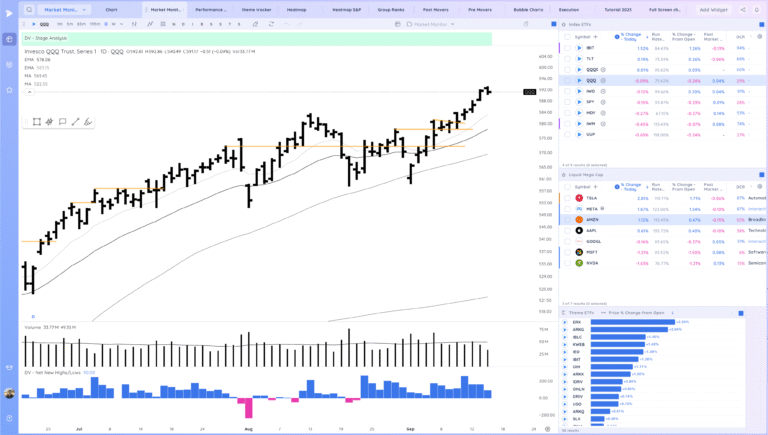

QQQ – Stress test today that so far we’ve passed. Volatile upside reversal day pushing off the 10ema. We continue to trend above the moving averages.

The Fed cut 25 bps, signaled more cuts in the future

Bulls want to see continued progress above the MAs or constructive tightening/range building

Bears want to see a leak lower and undercut of today’s lows

Daily Chart of the QQQ.

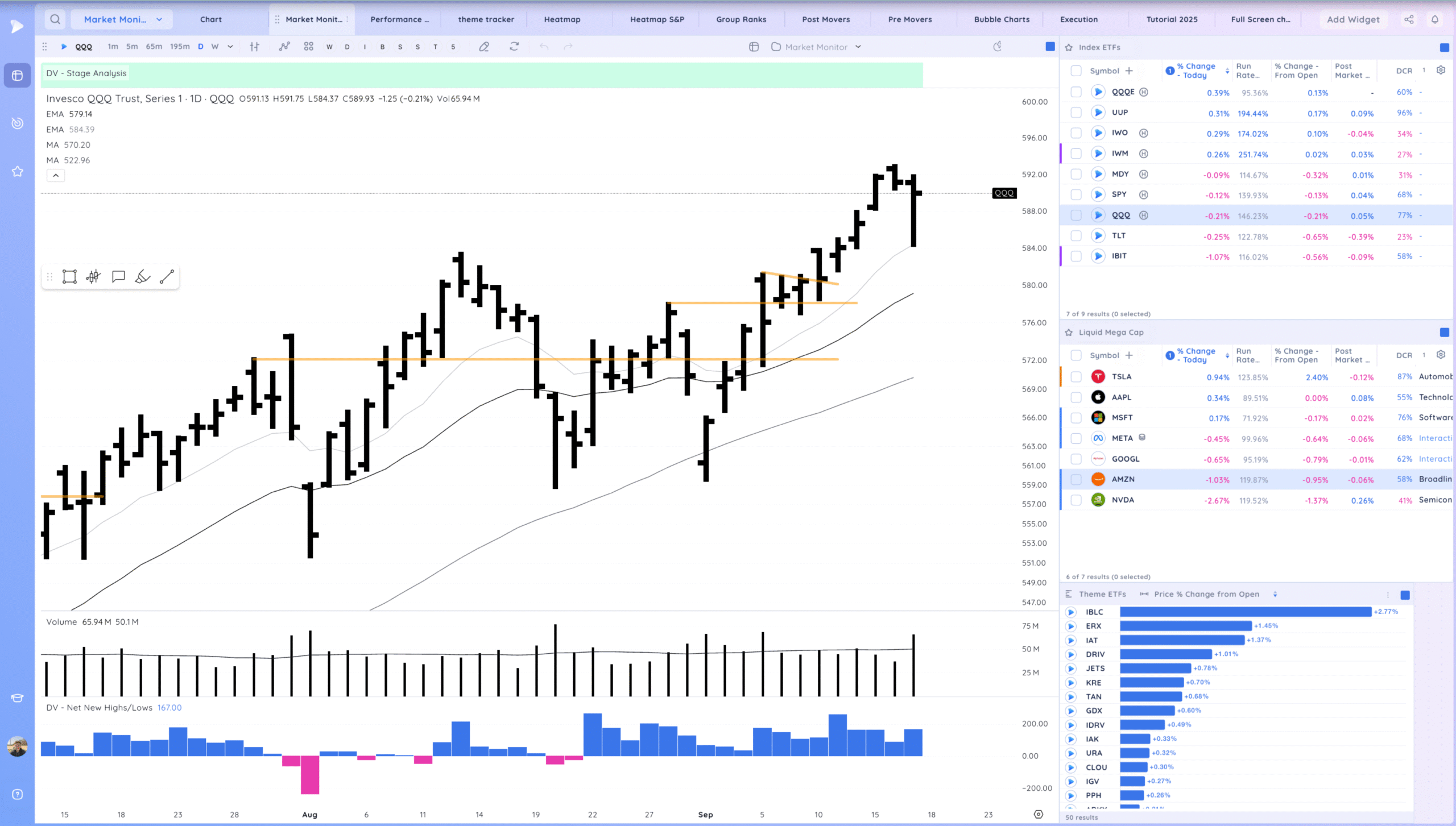

IWM – Big fade off highs. back in the range

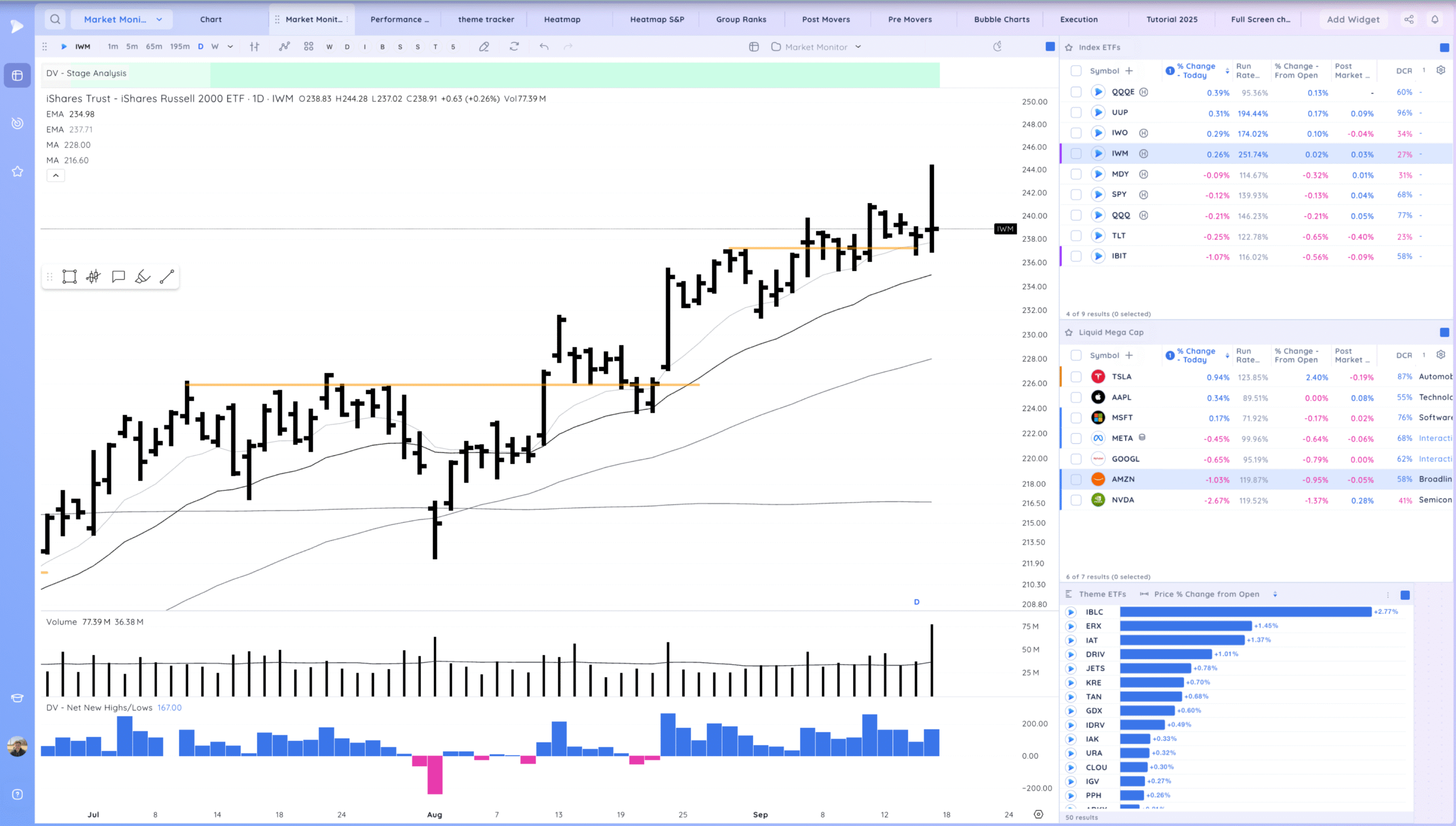

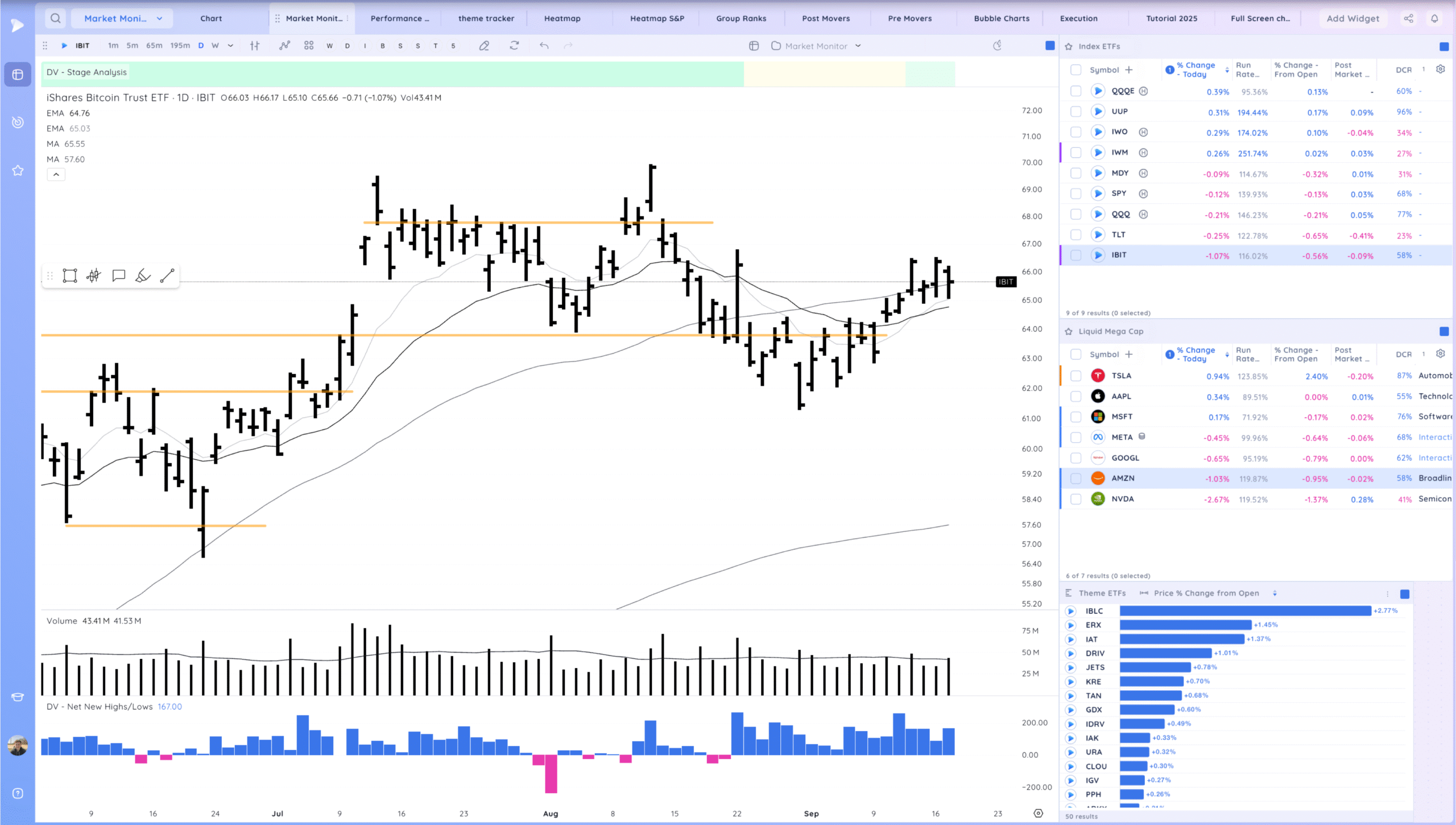

IBIT – Tightening against the moving averages up the right side.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

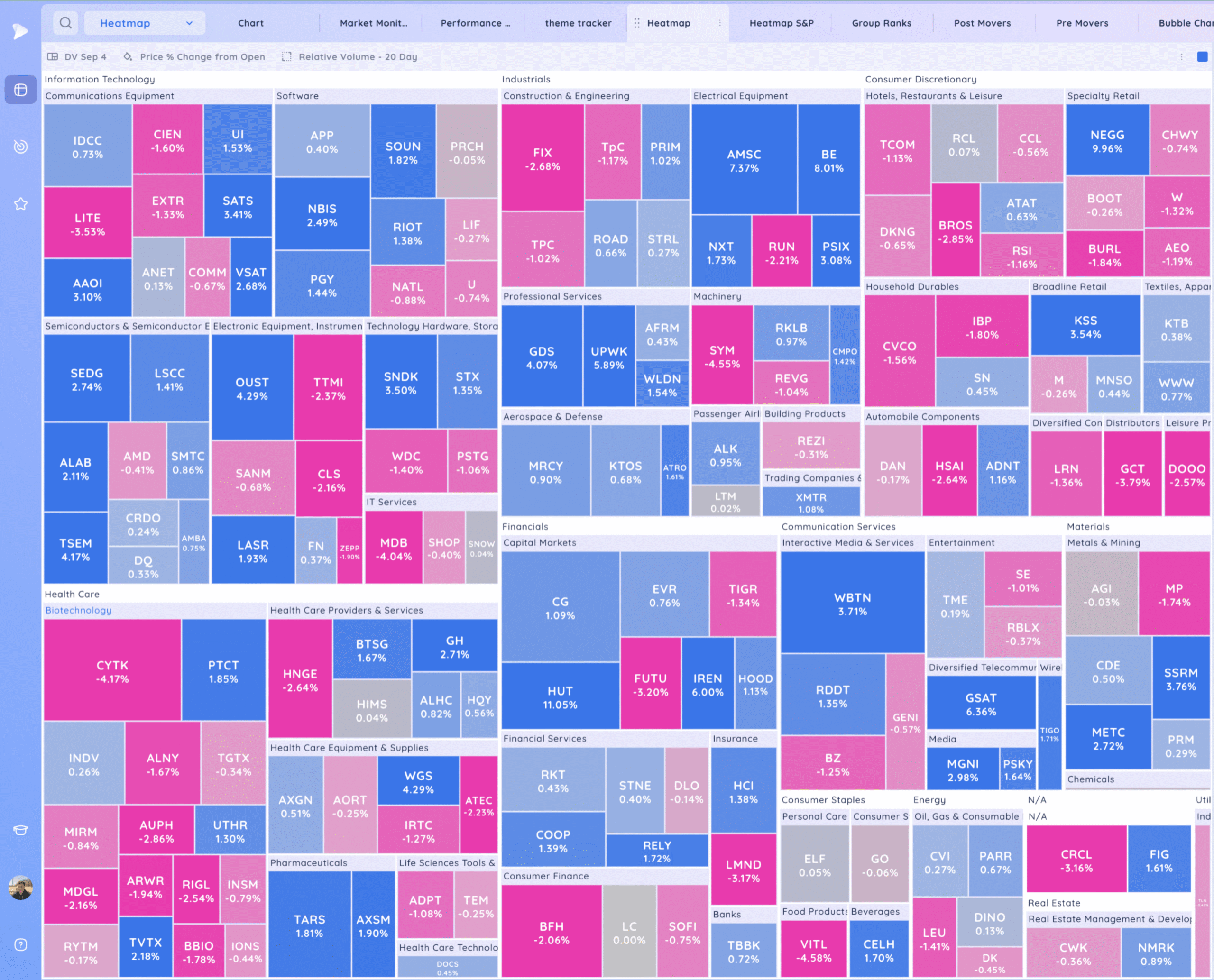

Groups/Sectors

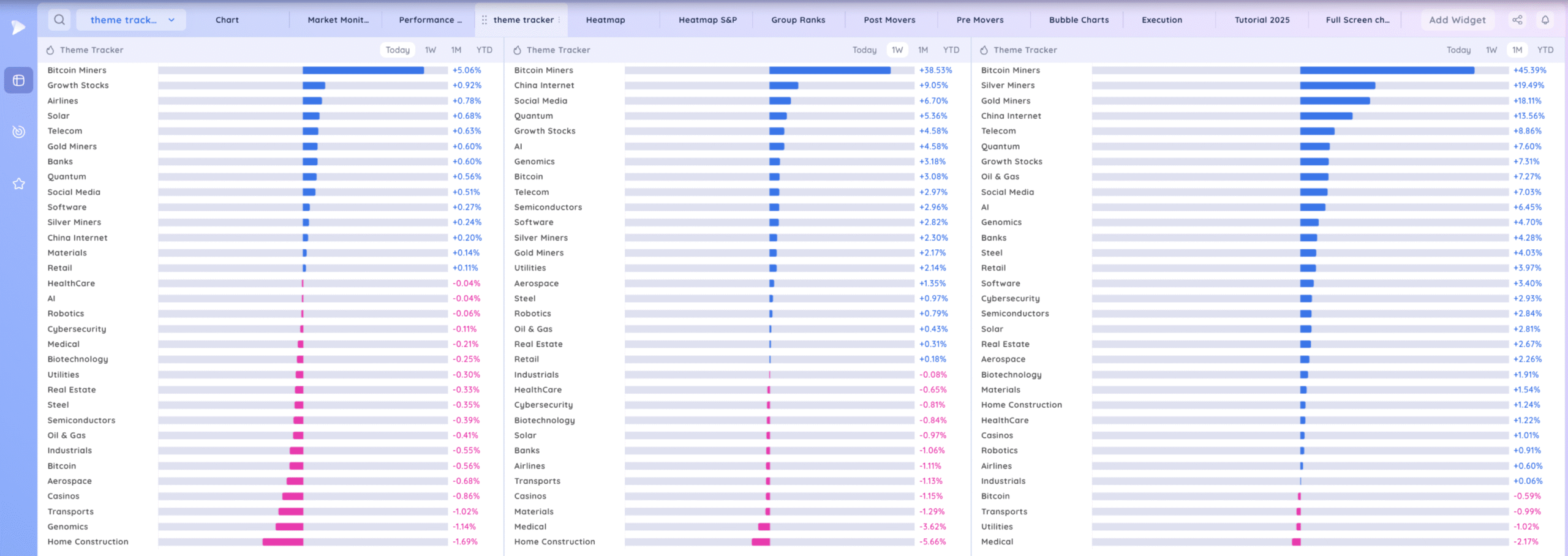

Deepvue Theme Tracker

Deepvue Leaders

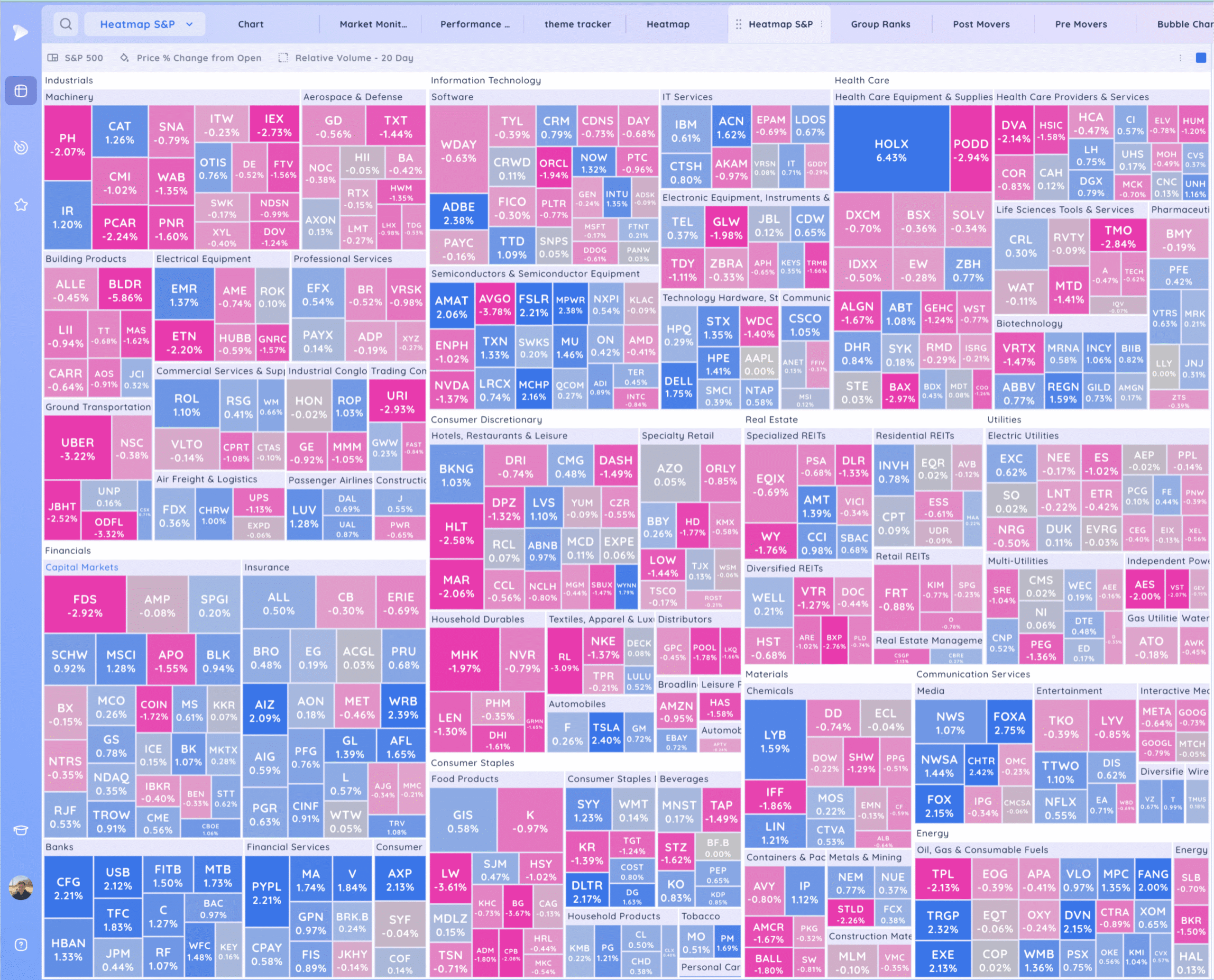

S&P 500.

Leadership Stocks & Analysis

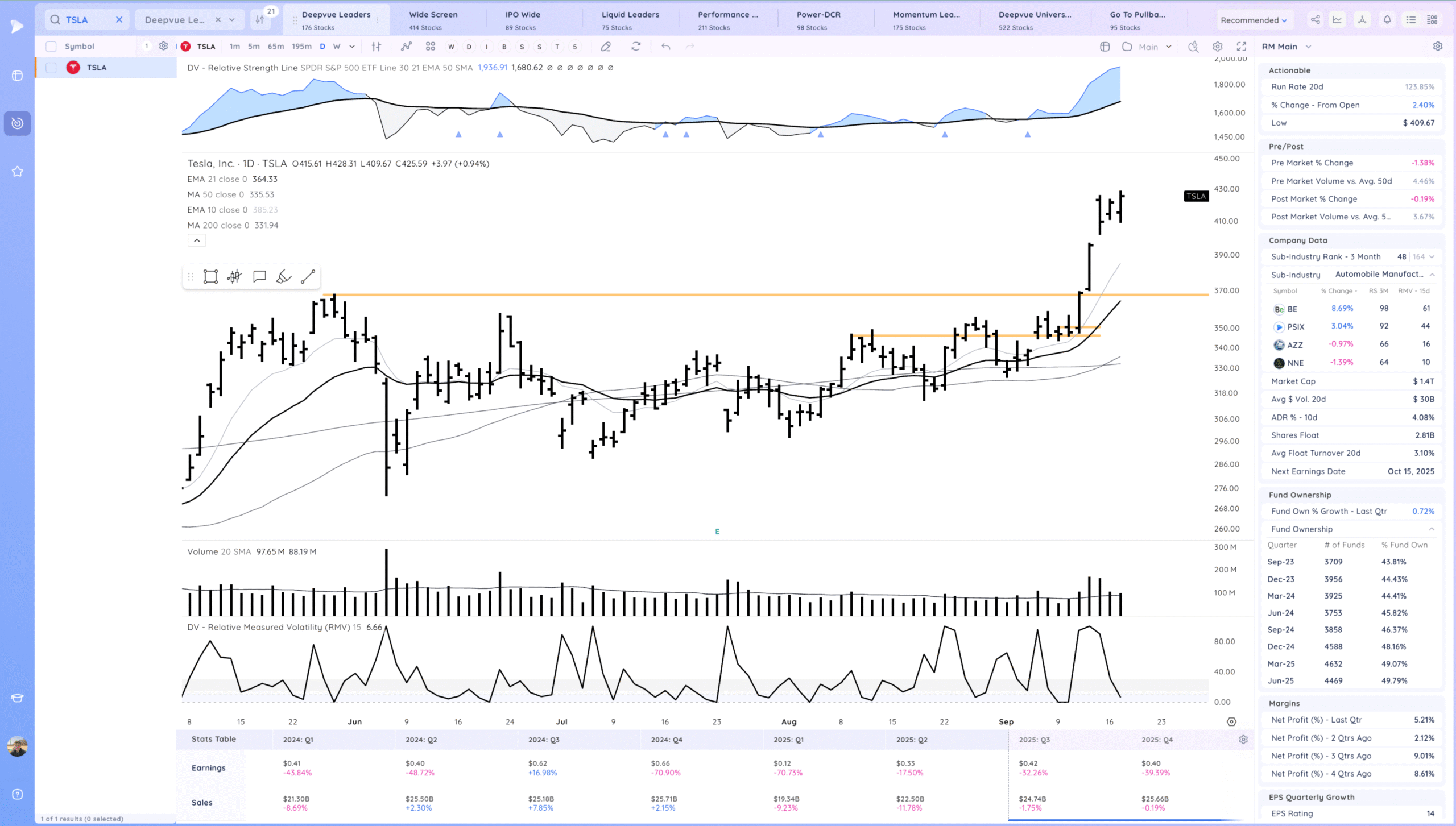

TSLA – A+ action since the range and base breakout so far. Positive outside day. Expecting this to trend abvoe the 10ema

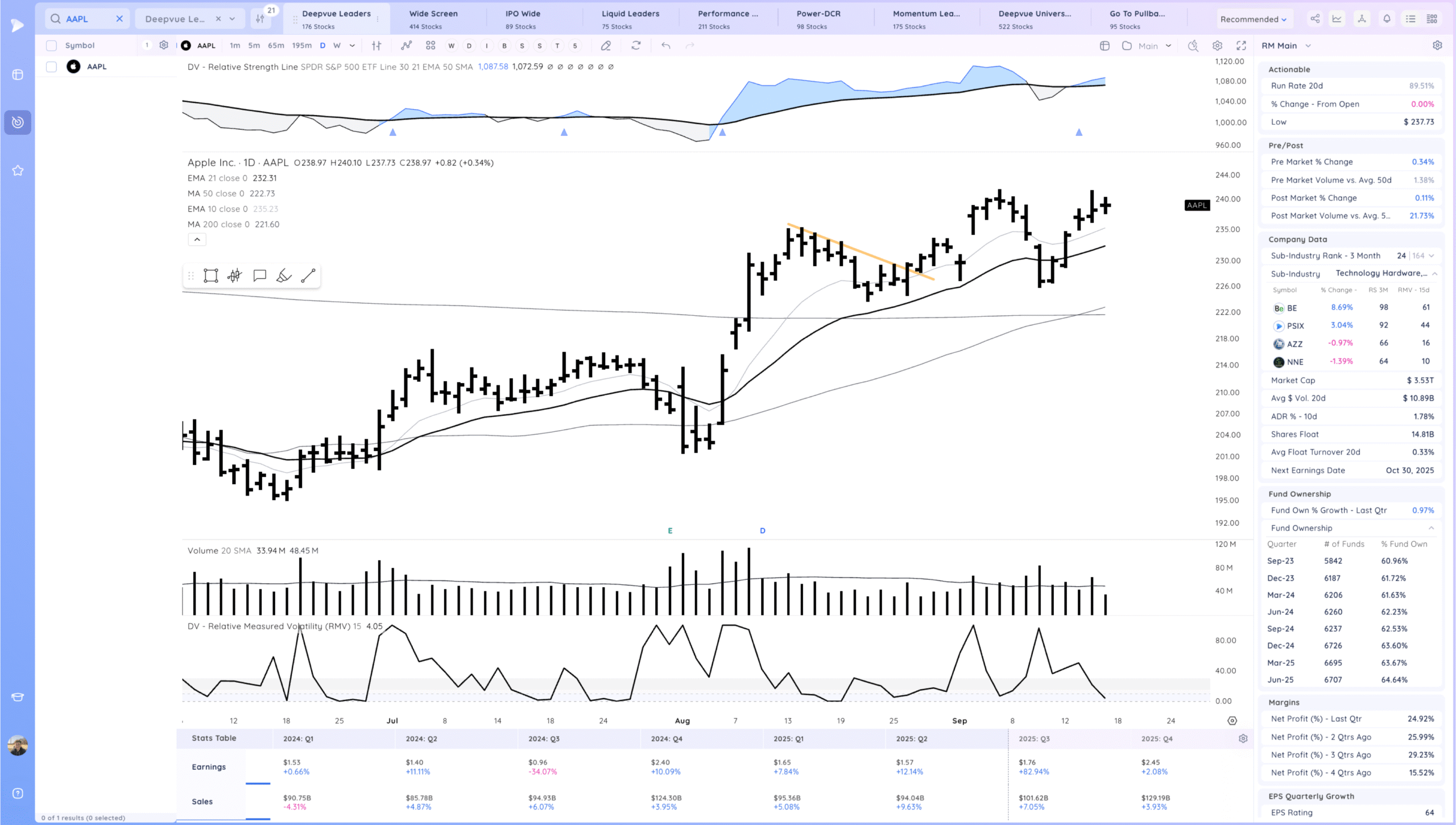

AAPL inside day close to recent highs

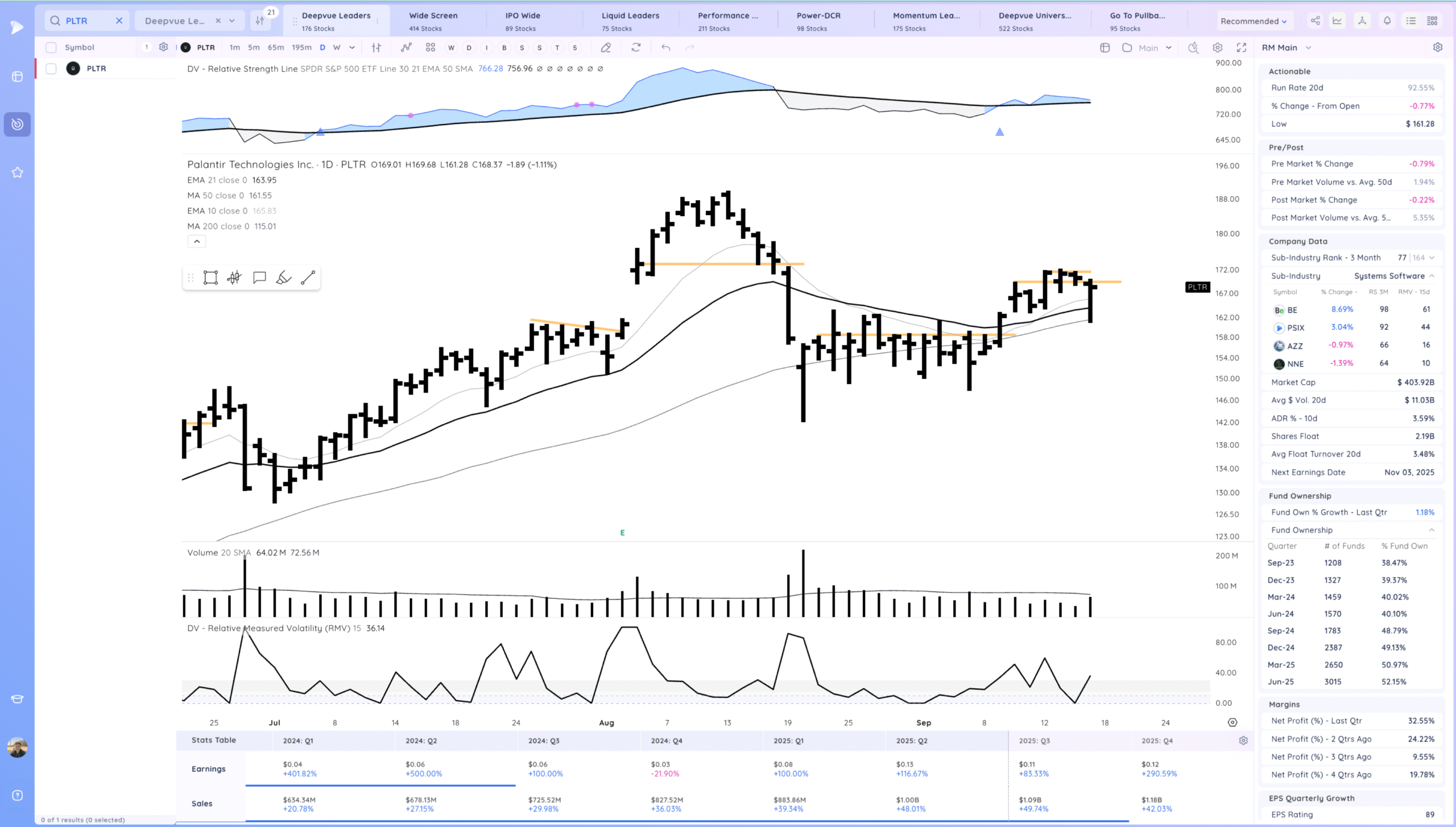

PLTR Big shakeout type move undercuttign the recent ranges and closing strong. Watching for continuation

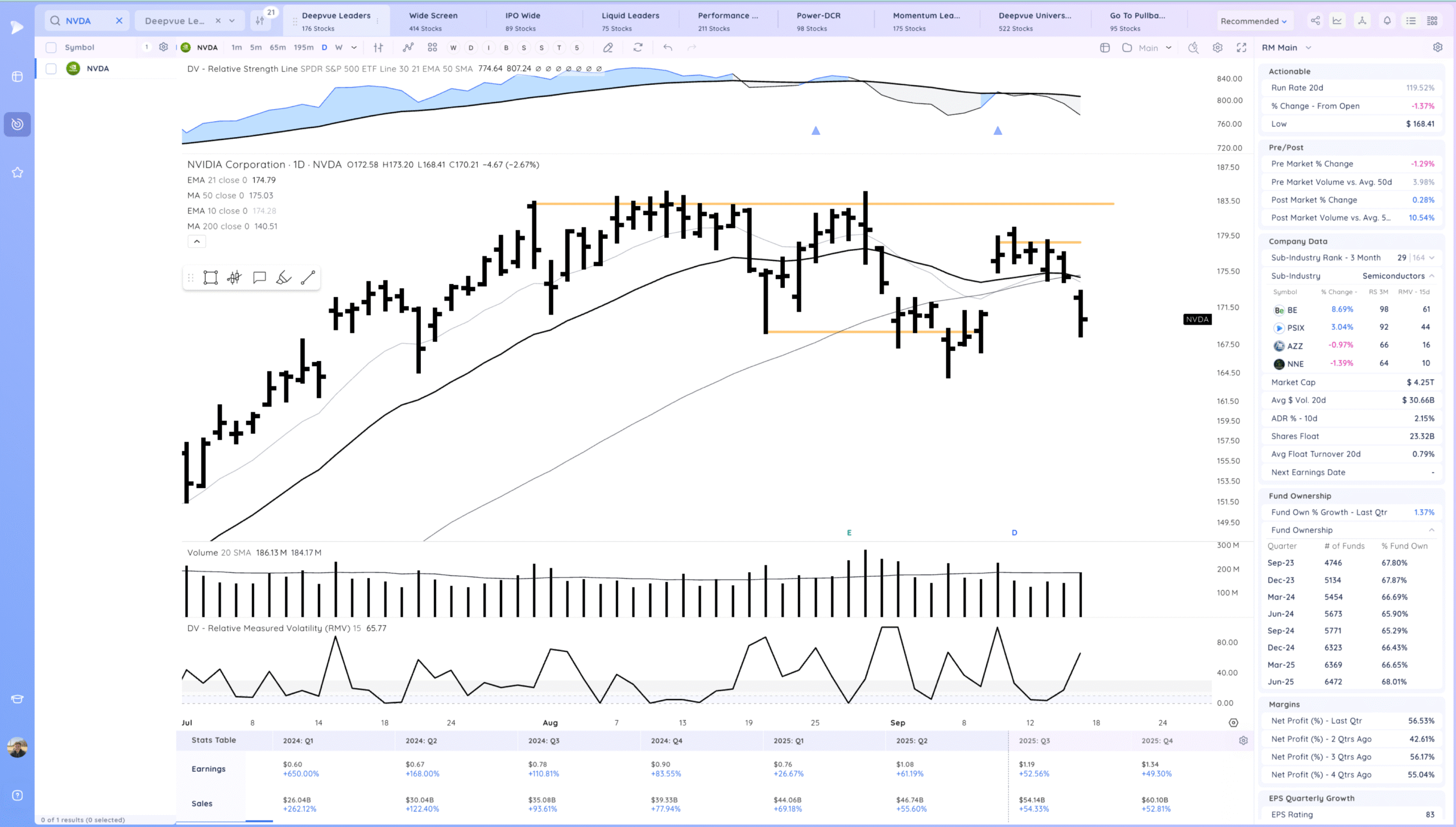

NVDA Weakness with the gap down. Will be watching for a sharp reversal back up or else this may need more time. Keep it on your watchlist

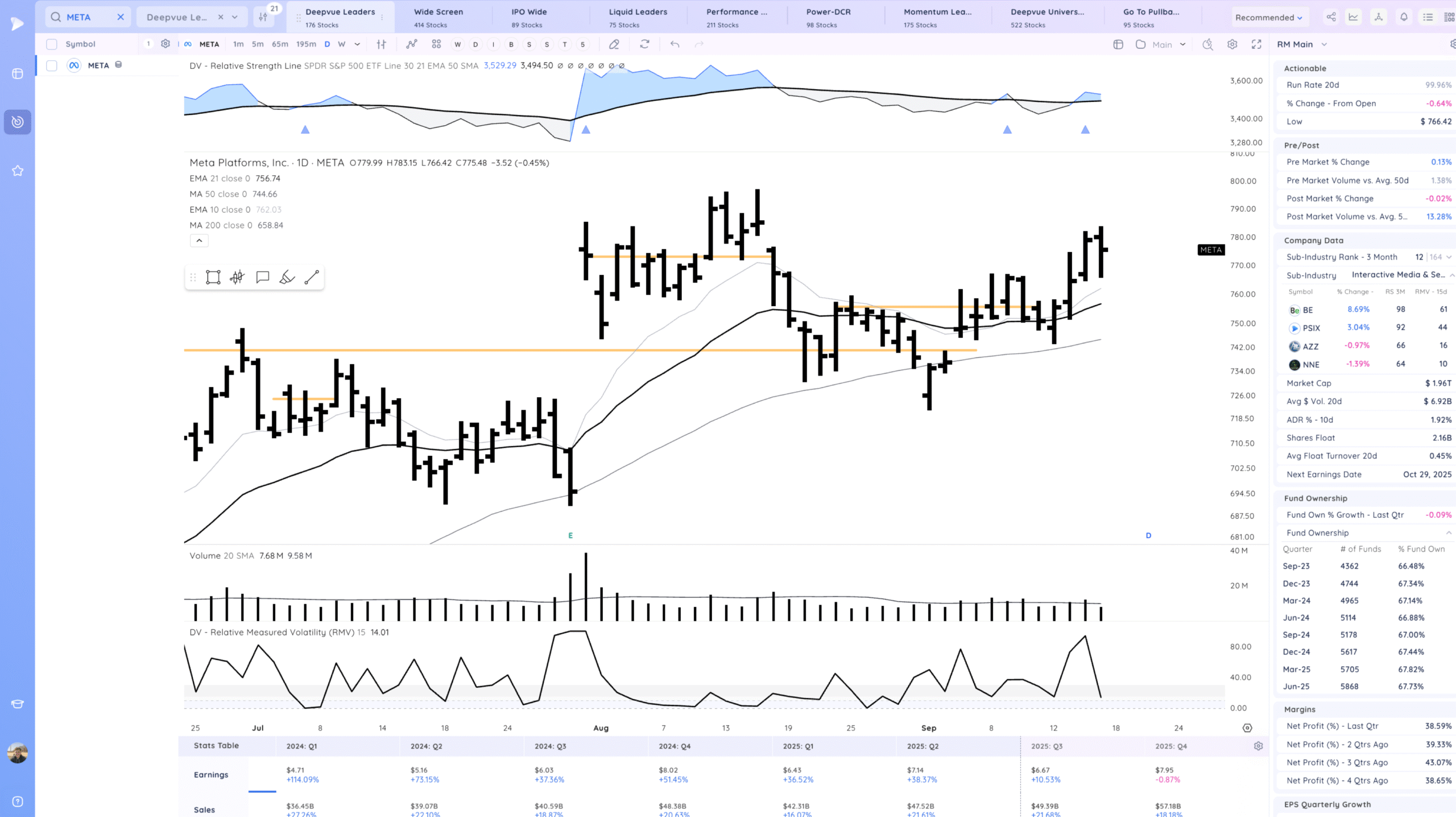

META large range day.

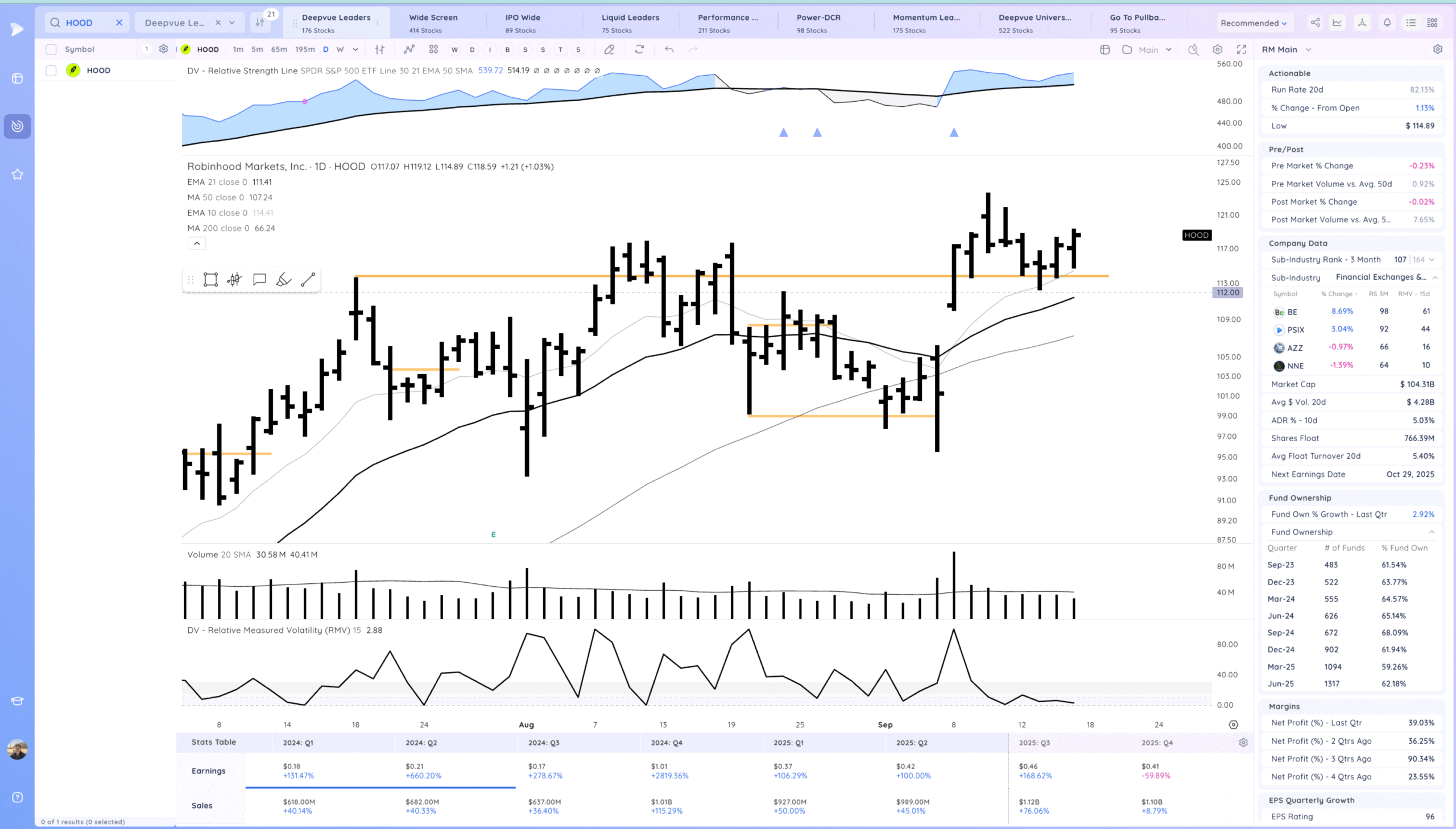

HOOD So far it has bounced off the pivot but not with vigor. Ideally sets up a tight day, one more pullback, and then reconfirms

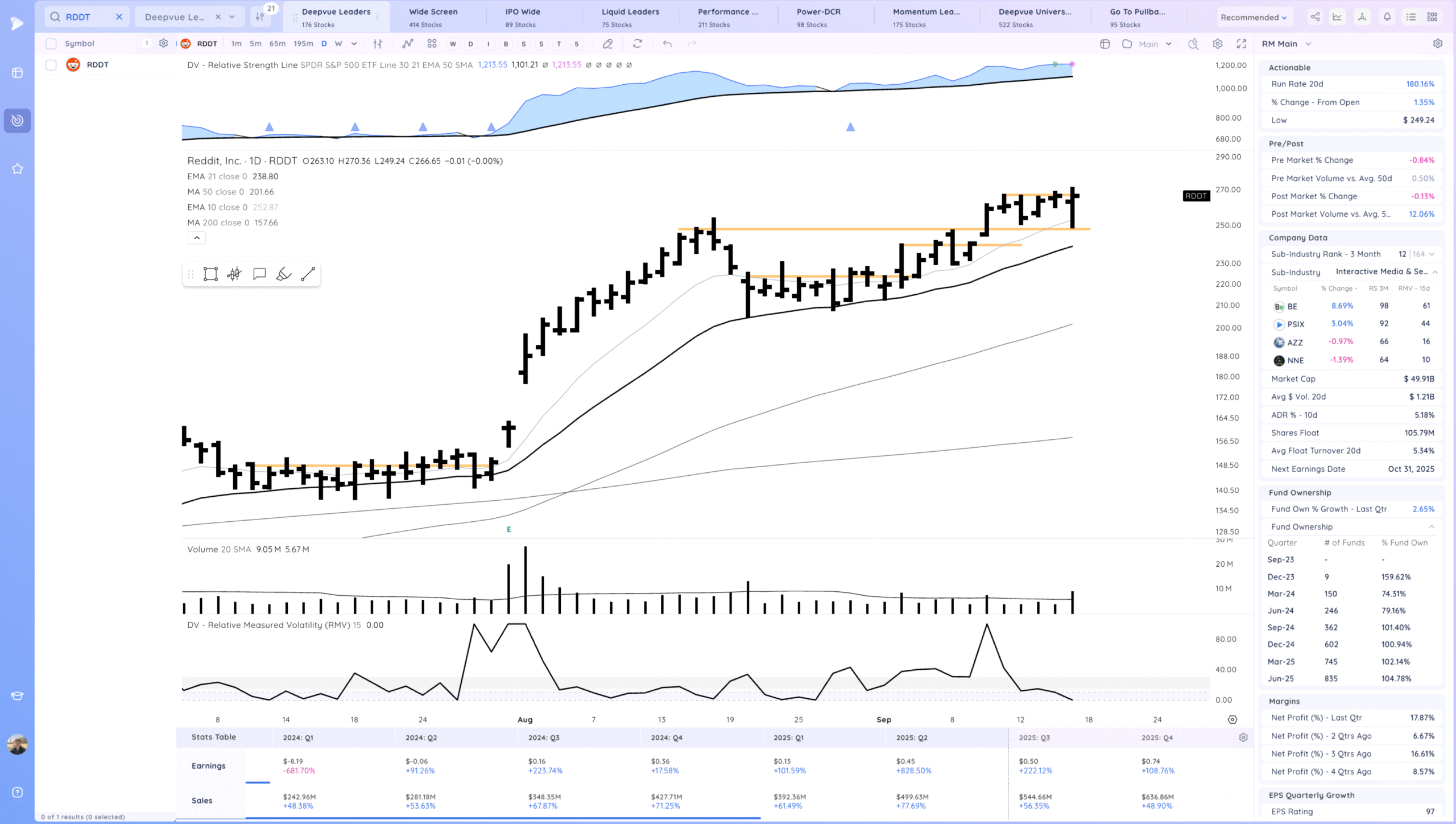

RDDT upside reversal off the pivot. Some news catalyst with google. One to watch for a range breakout

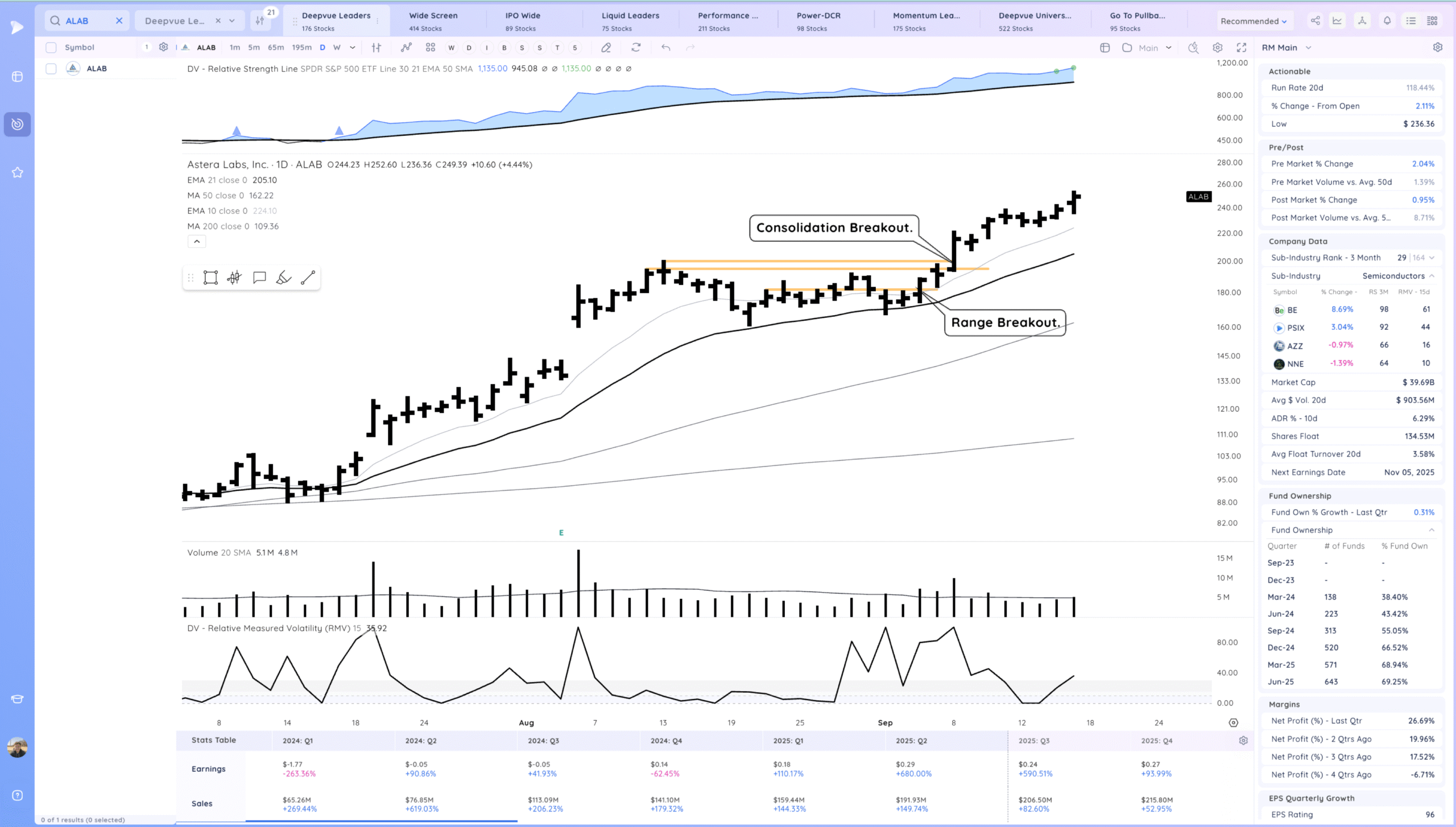

ALAB Trending.

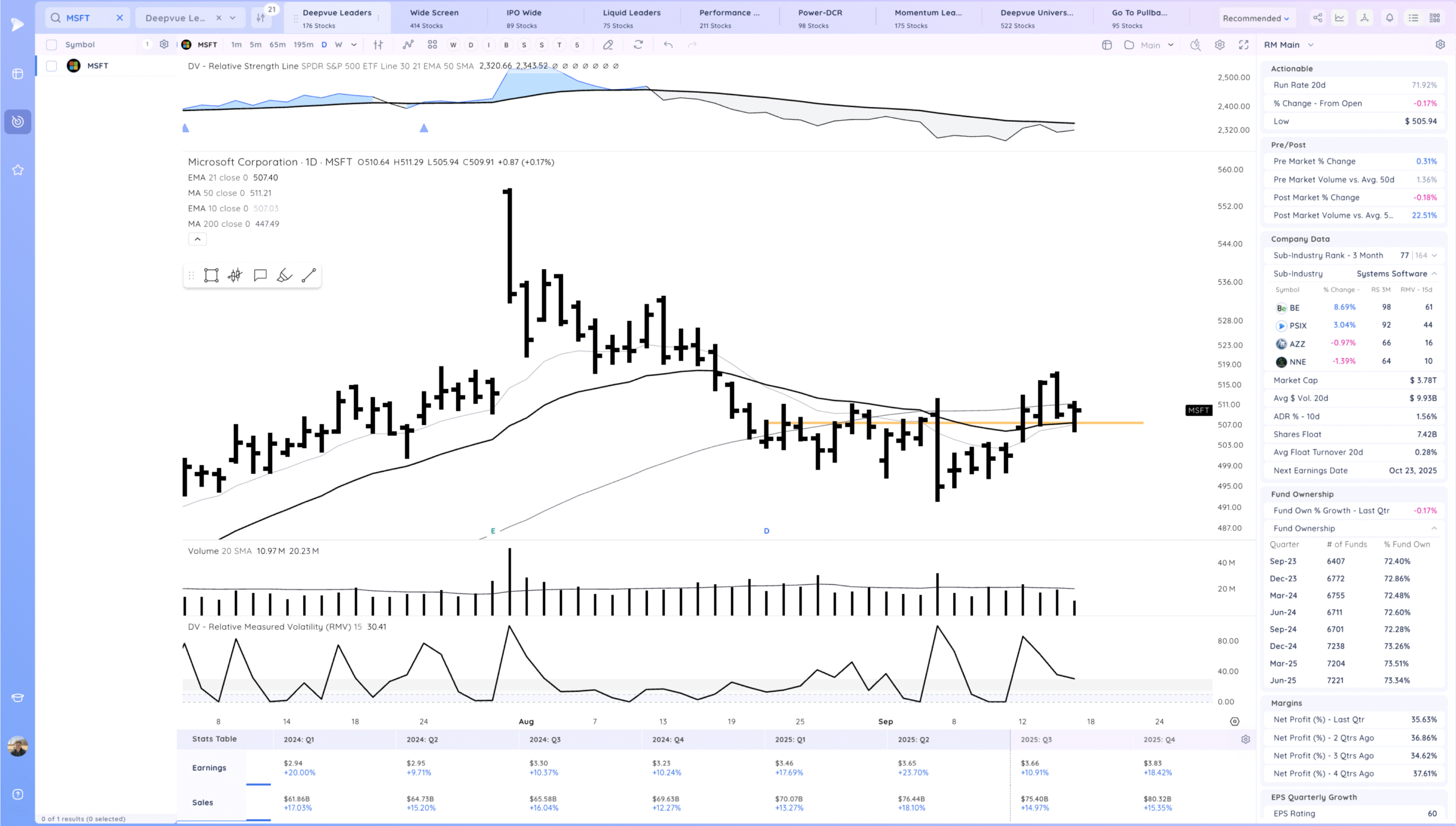

MSFT Upside reversal at the MAs, watching for a push higher now

Key Moves

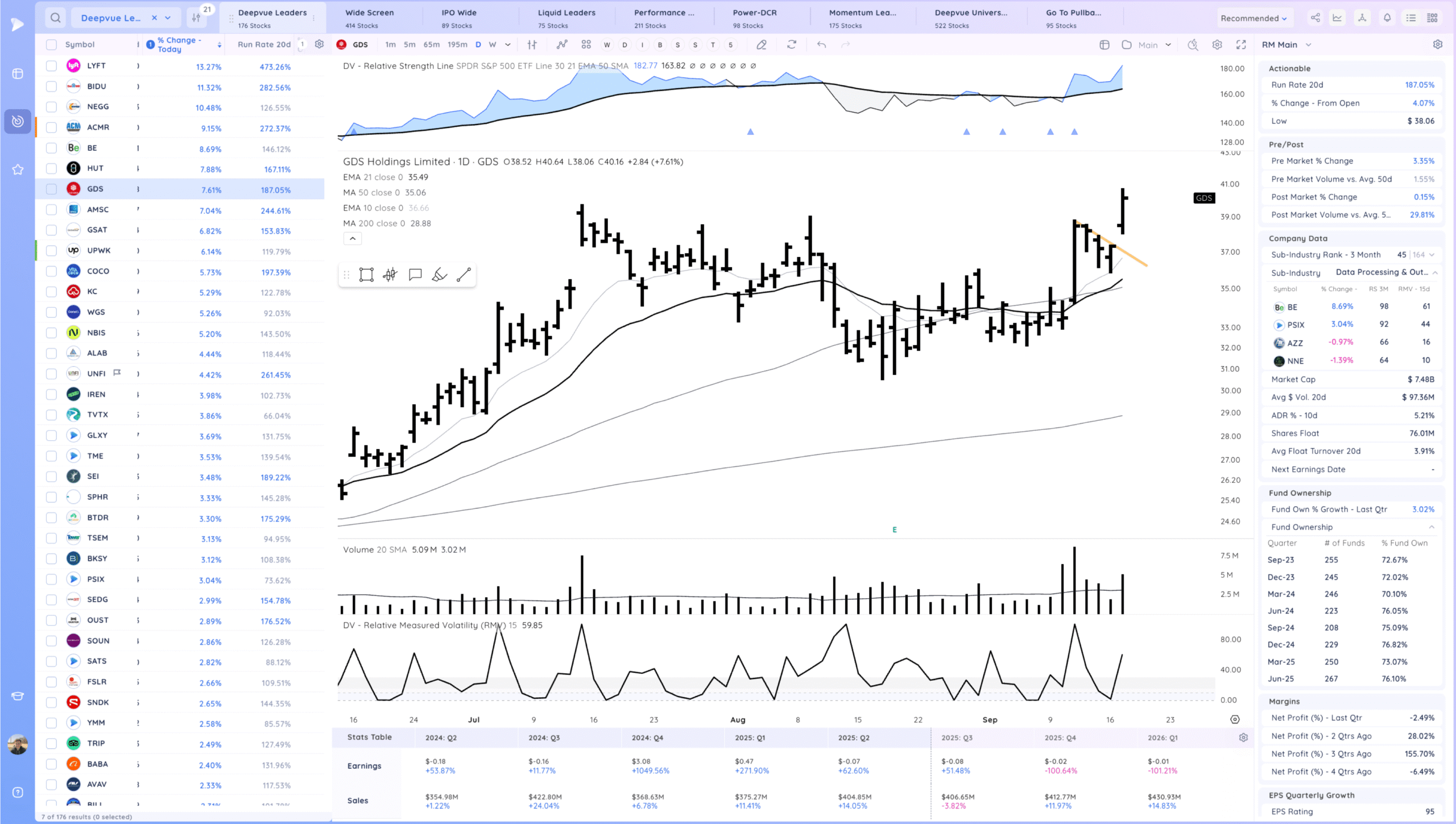

GDS gap and go

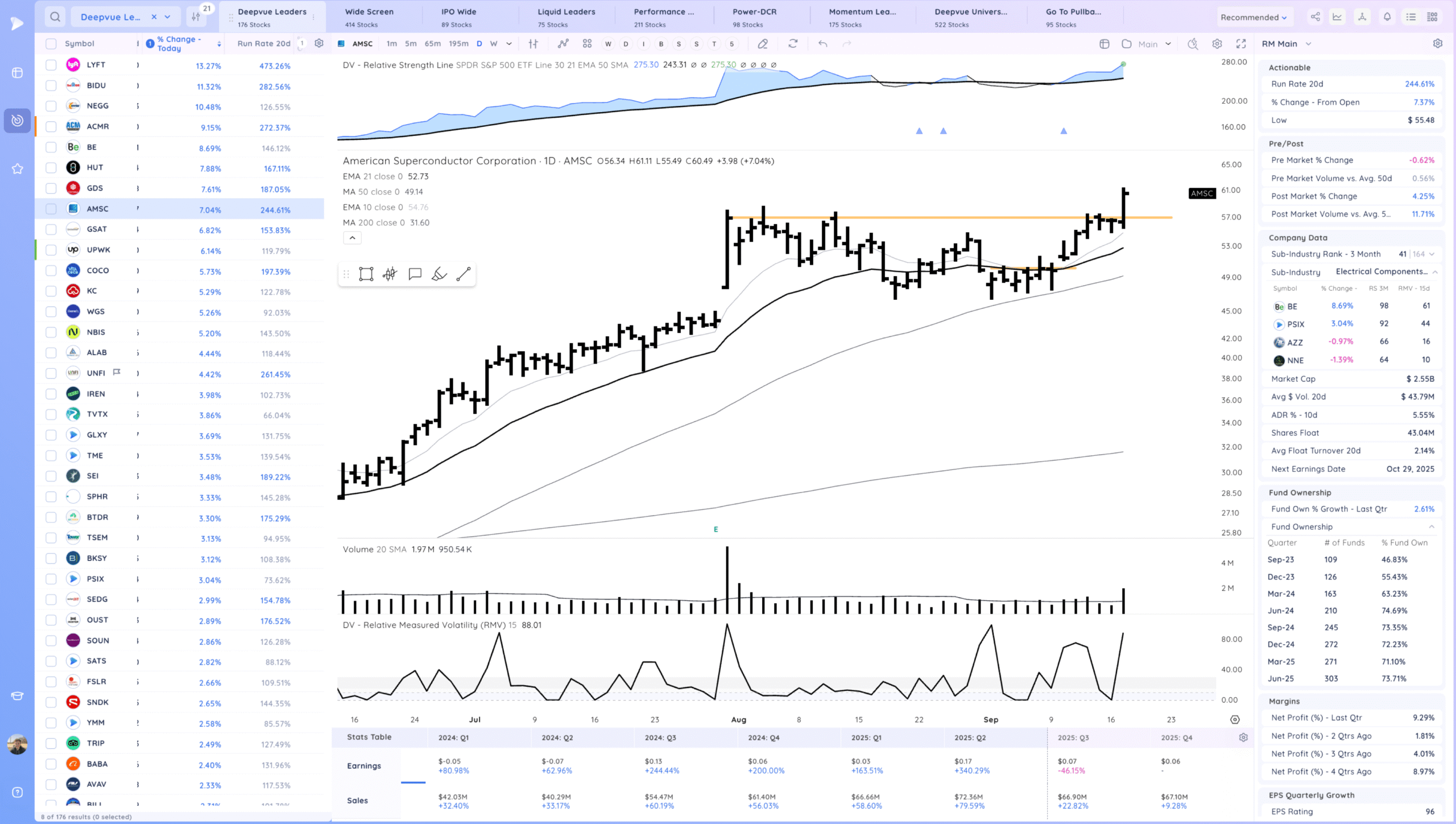

AMSC strong breakout, watching for follow through

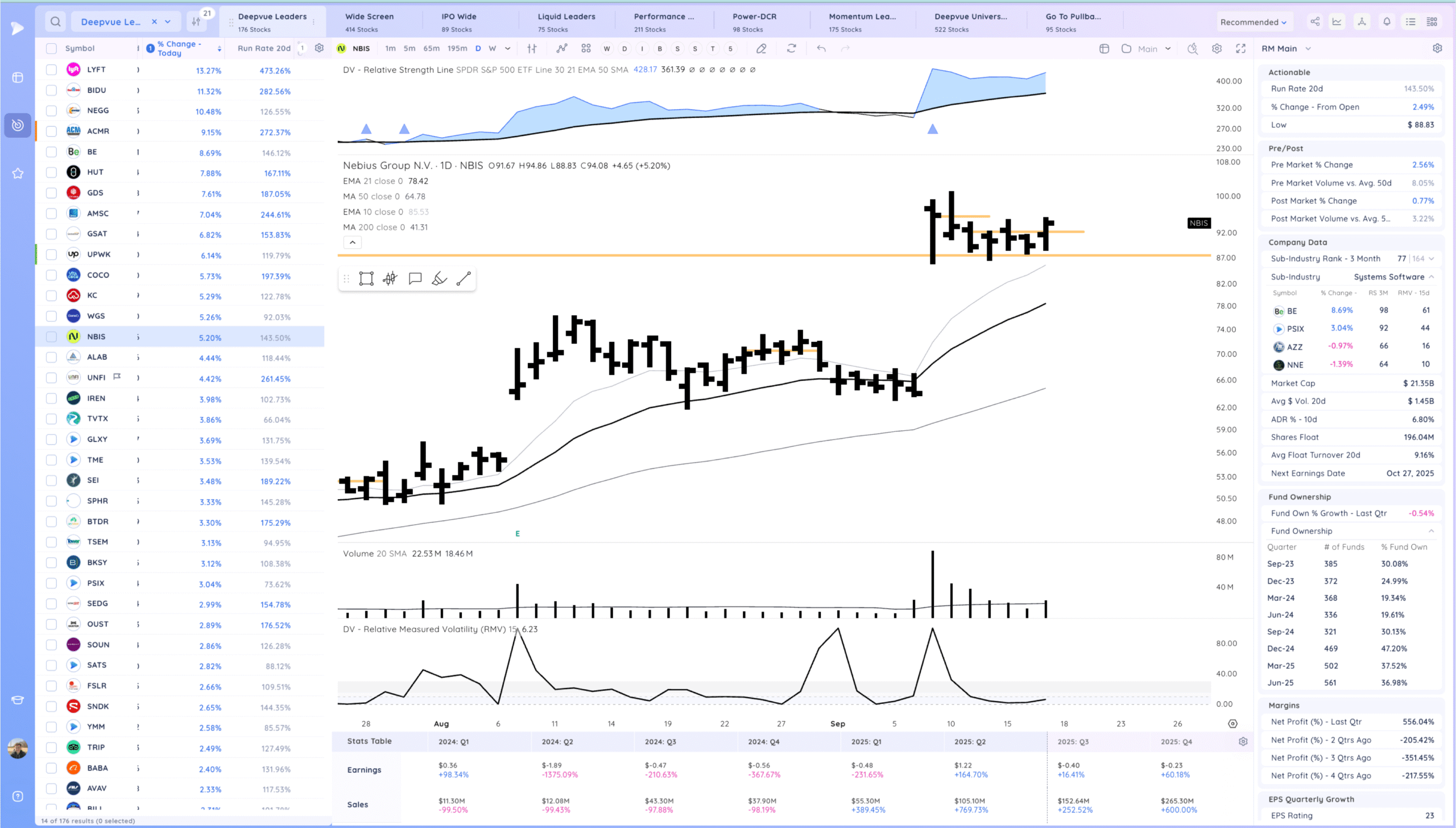

NBIS range breakout

Setups and Watchlist

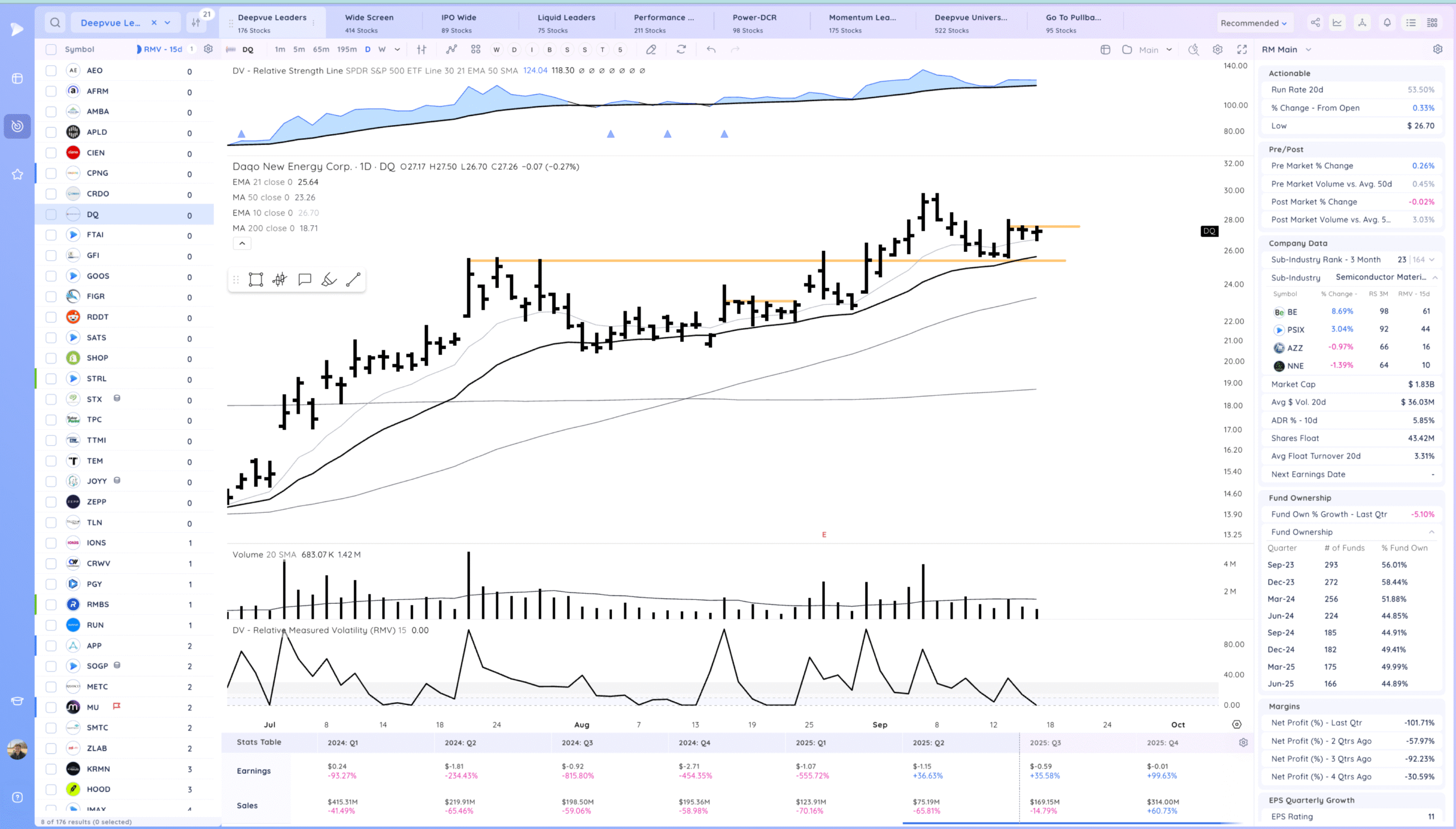

DQ watching for a range breakout. Swing trade type name

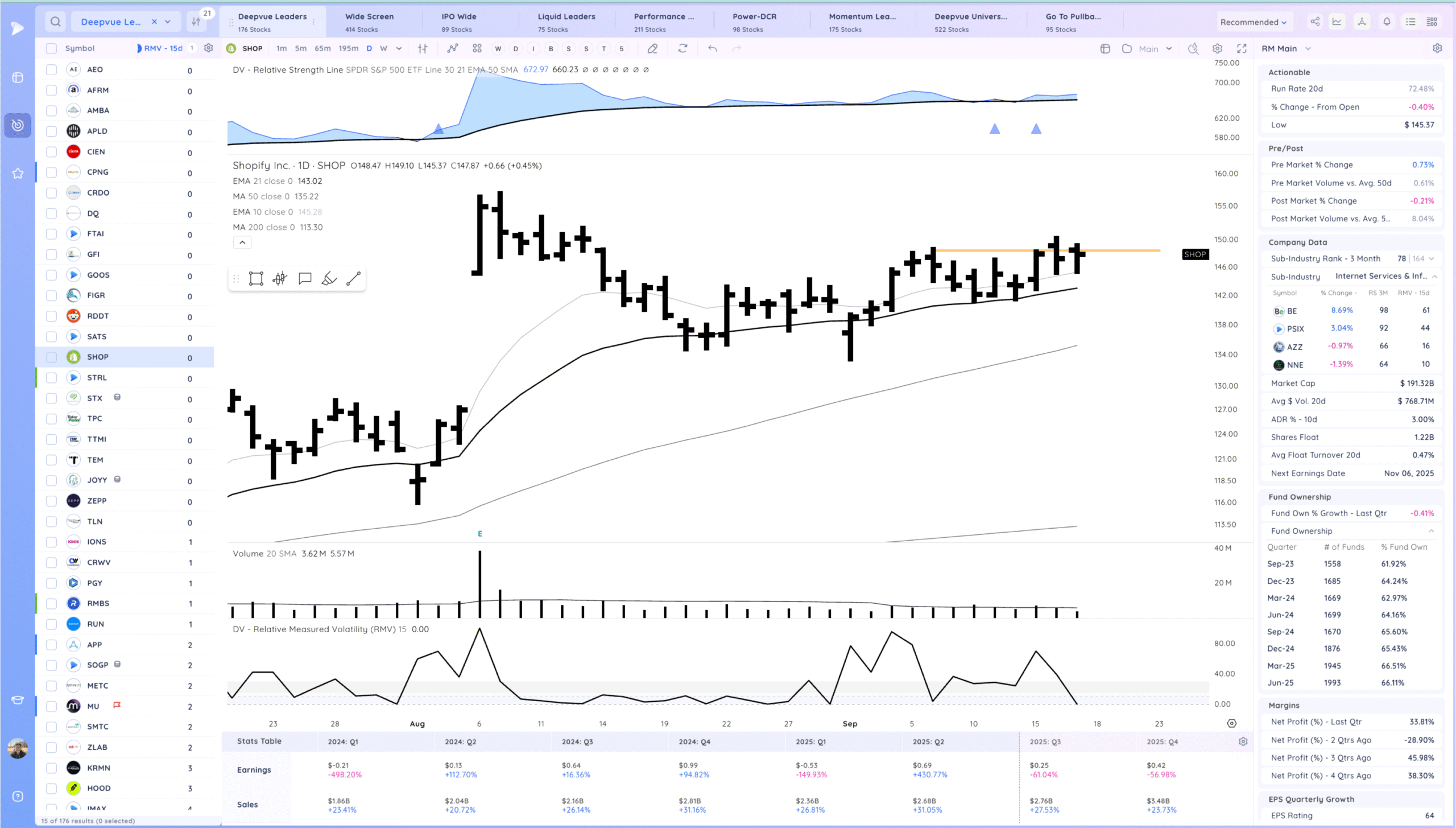

SHOP watching for a range breakout.

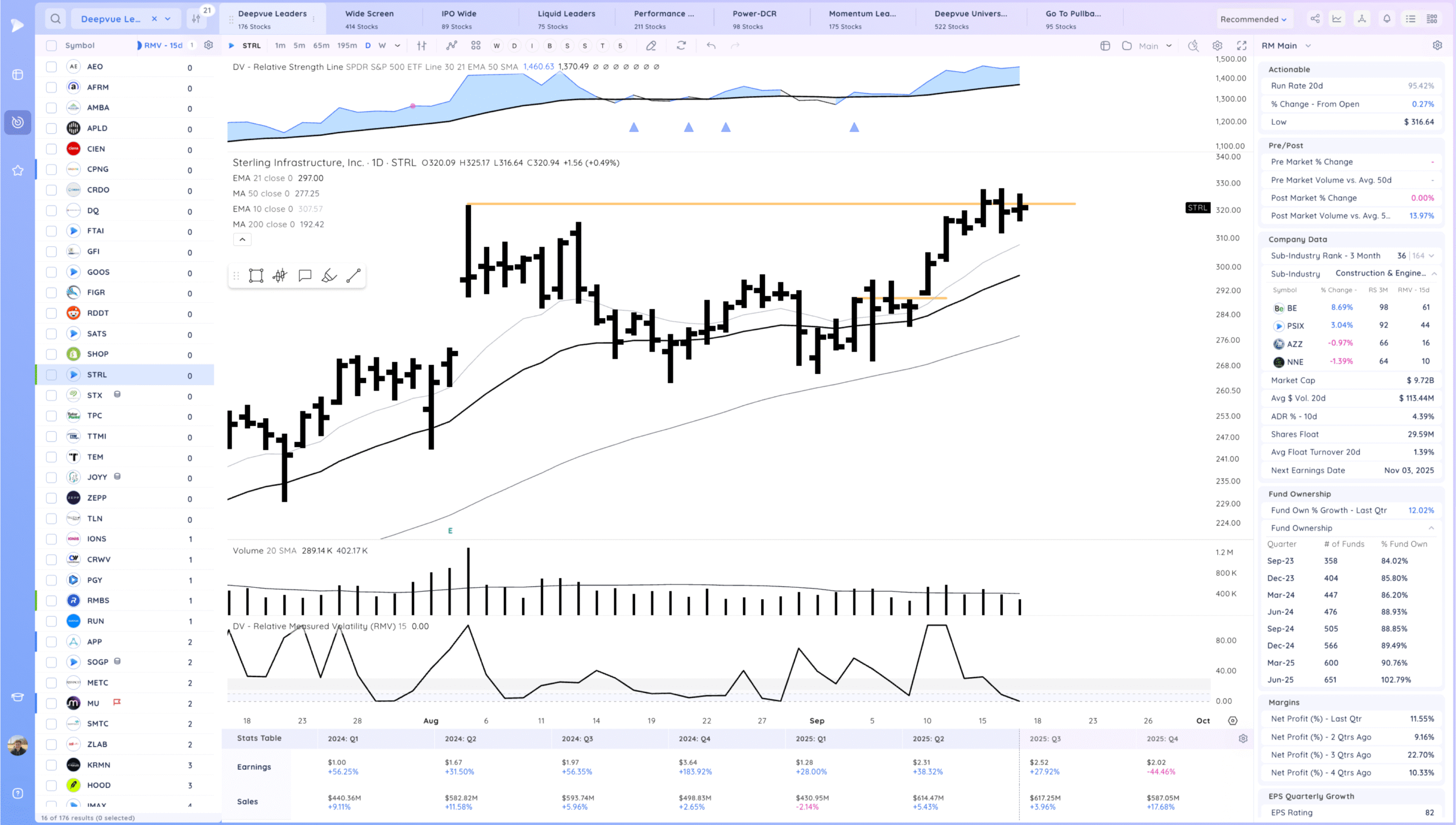

STRL watching for a consolidation breakout

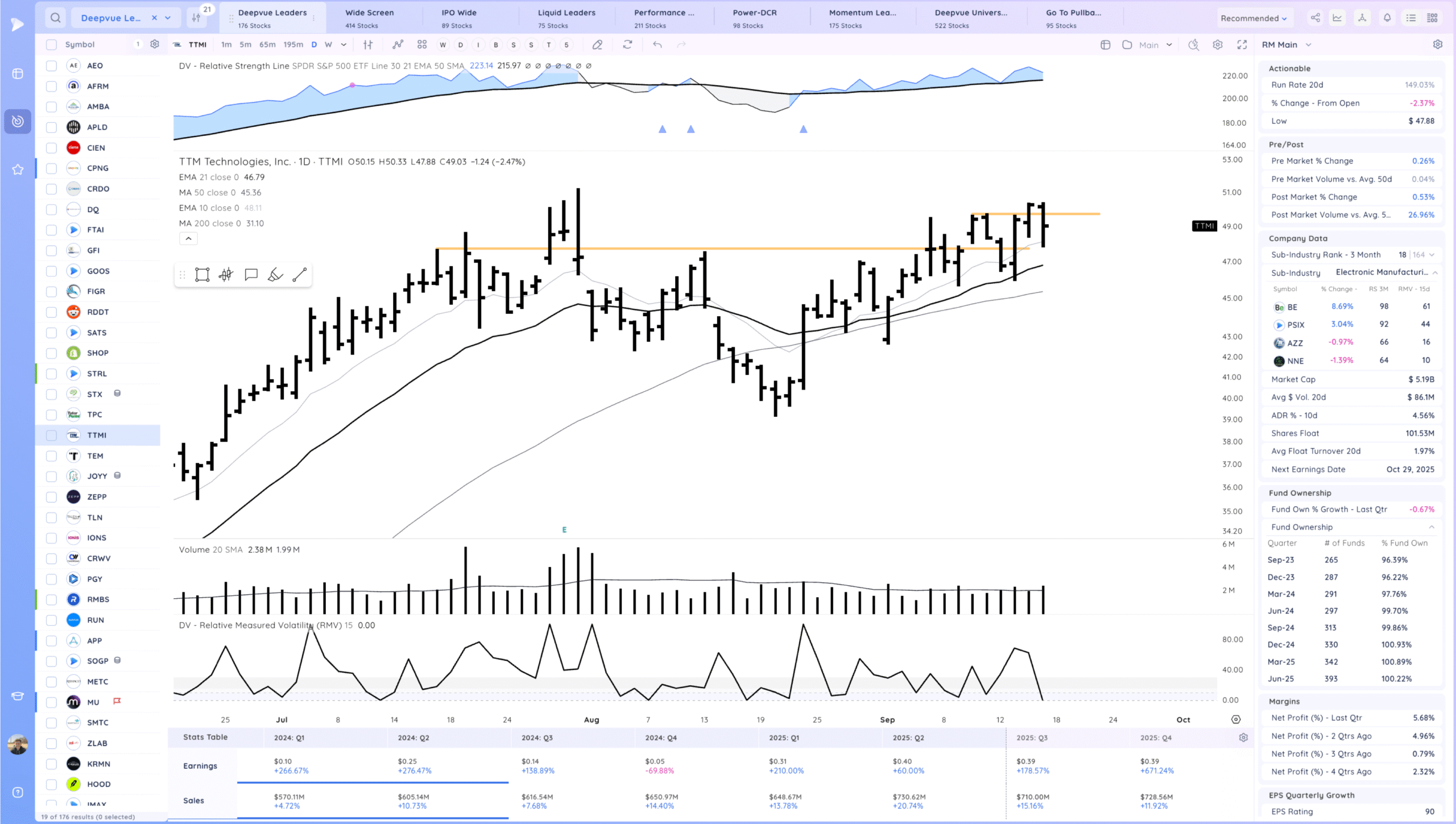

TTMI watching for a range re-breakout

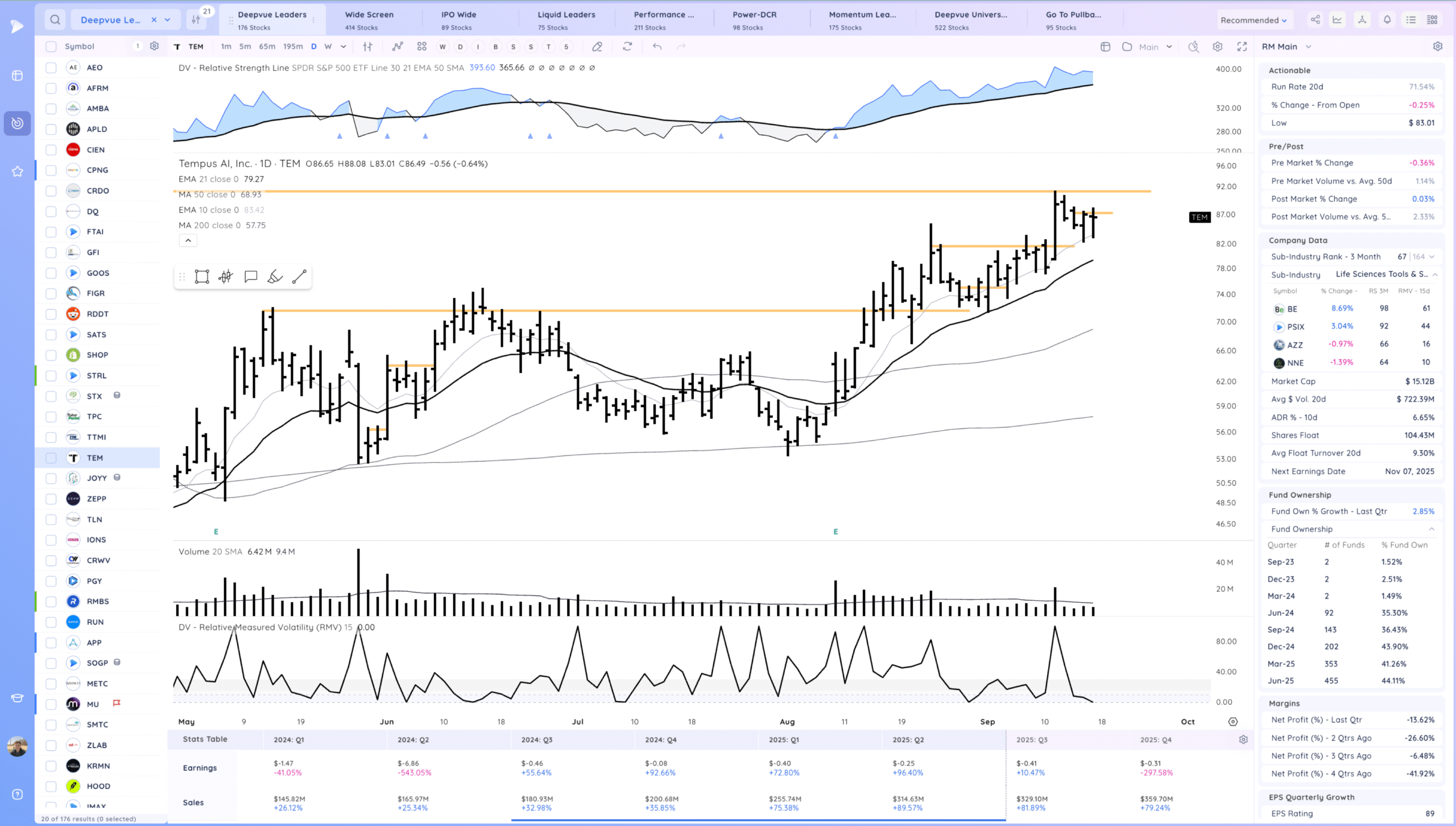

TEM watching for a range breakout.

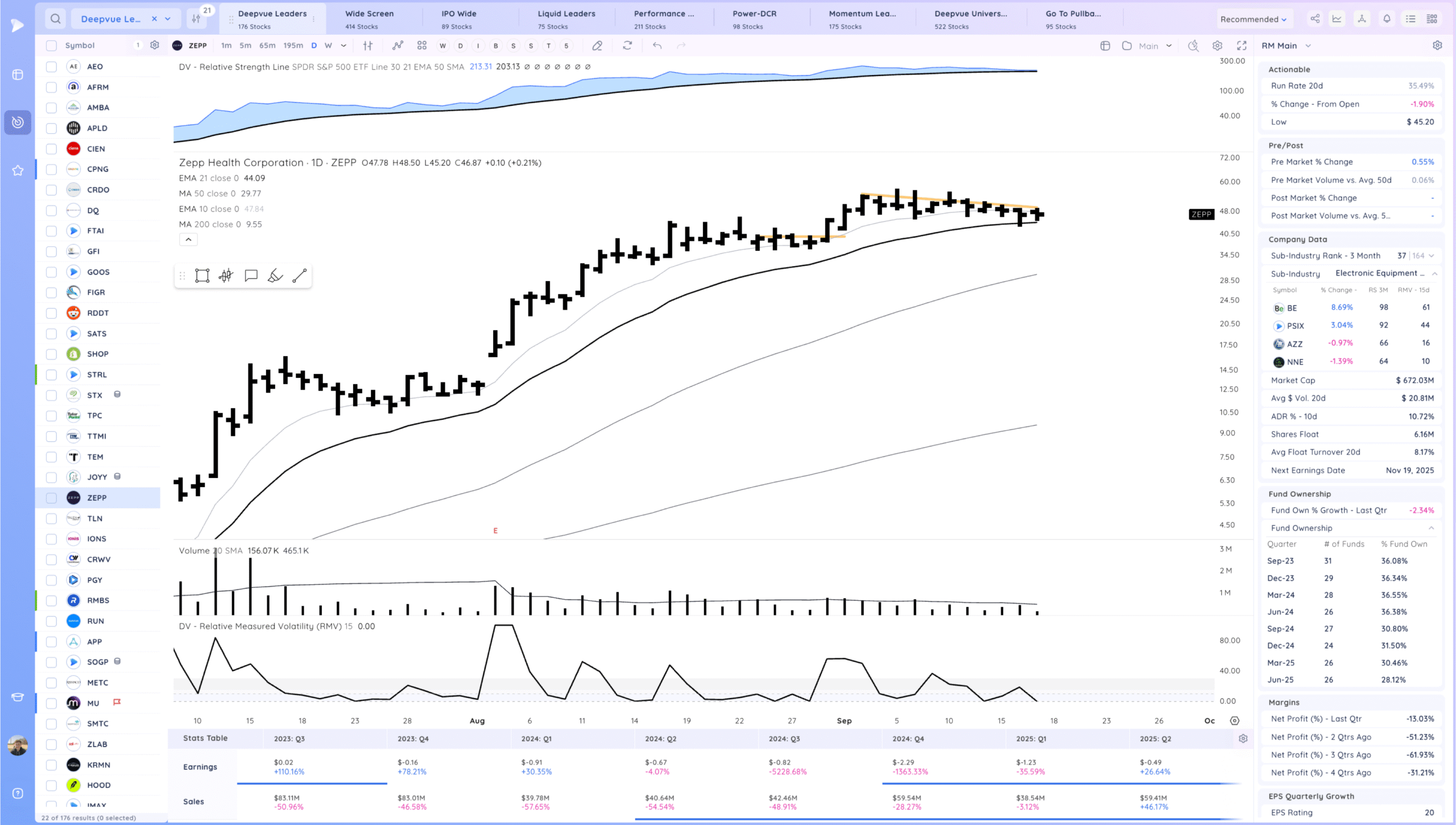

ZEPP watching for a flag breakout. Fast mover

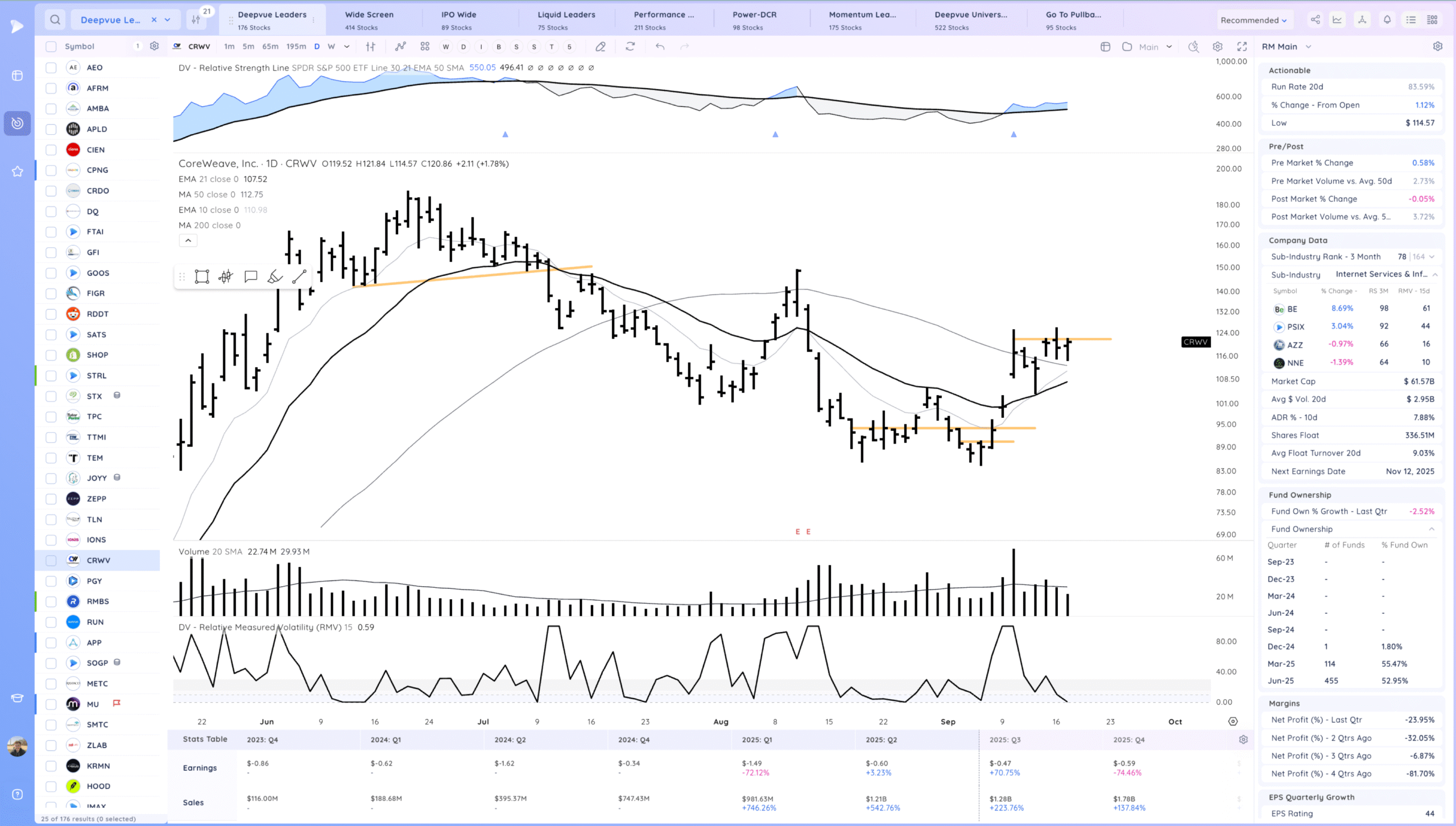

CRWV watching for a range breakout, could mature this range a bit.

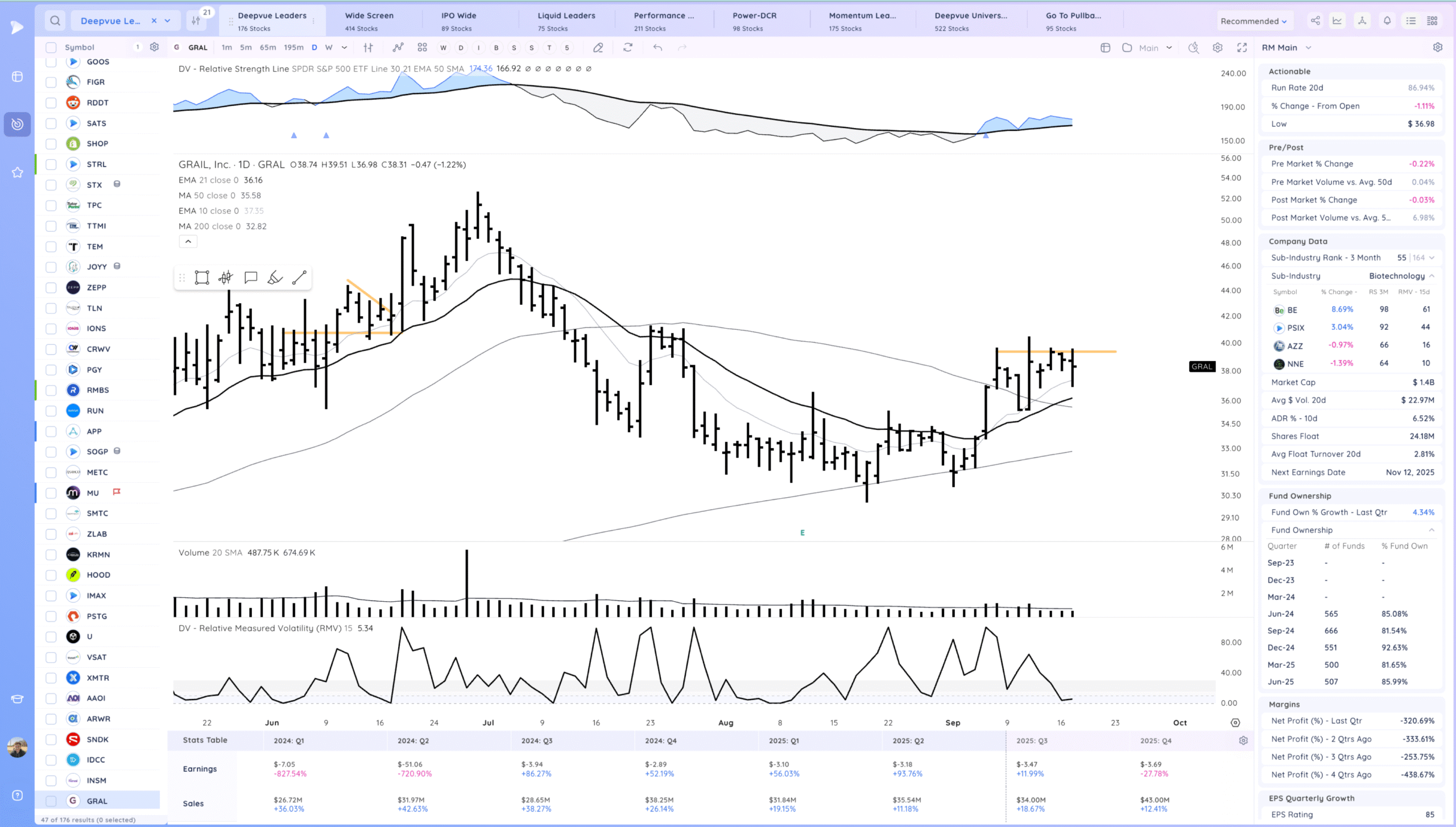

GRAL watching for a range breakout

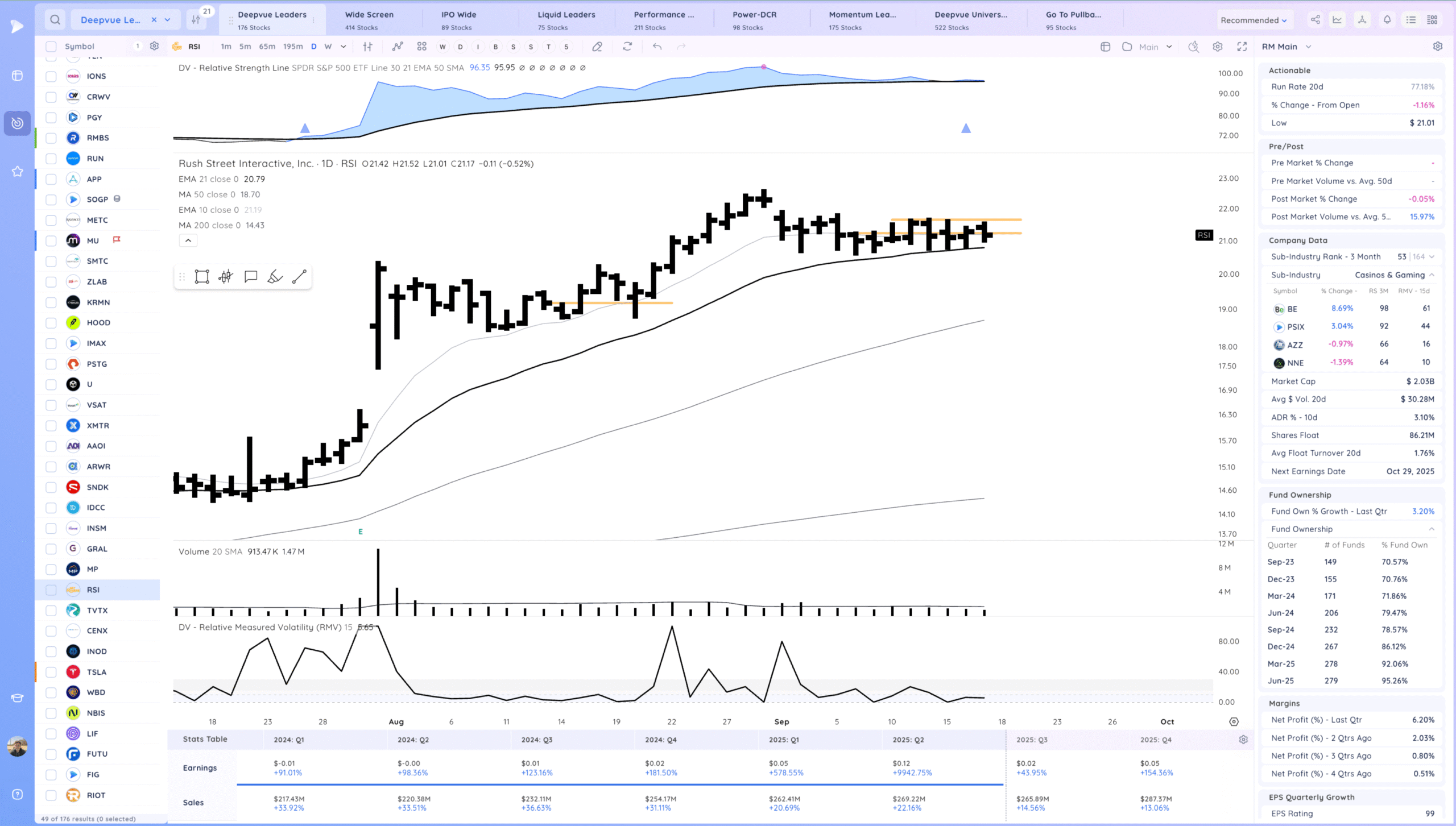

RSI. watching for a range breakout

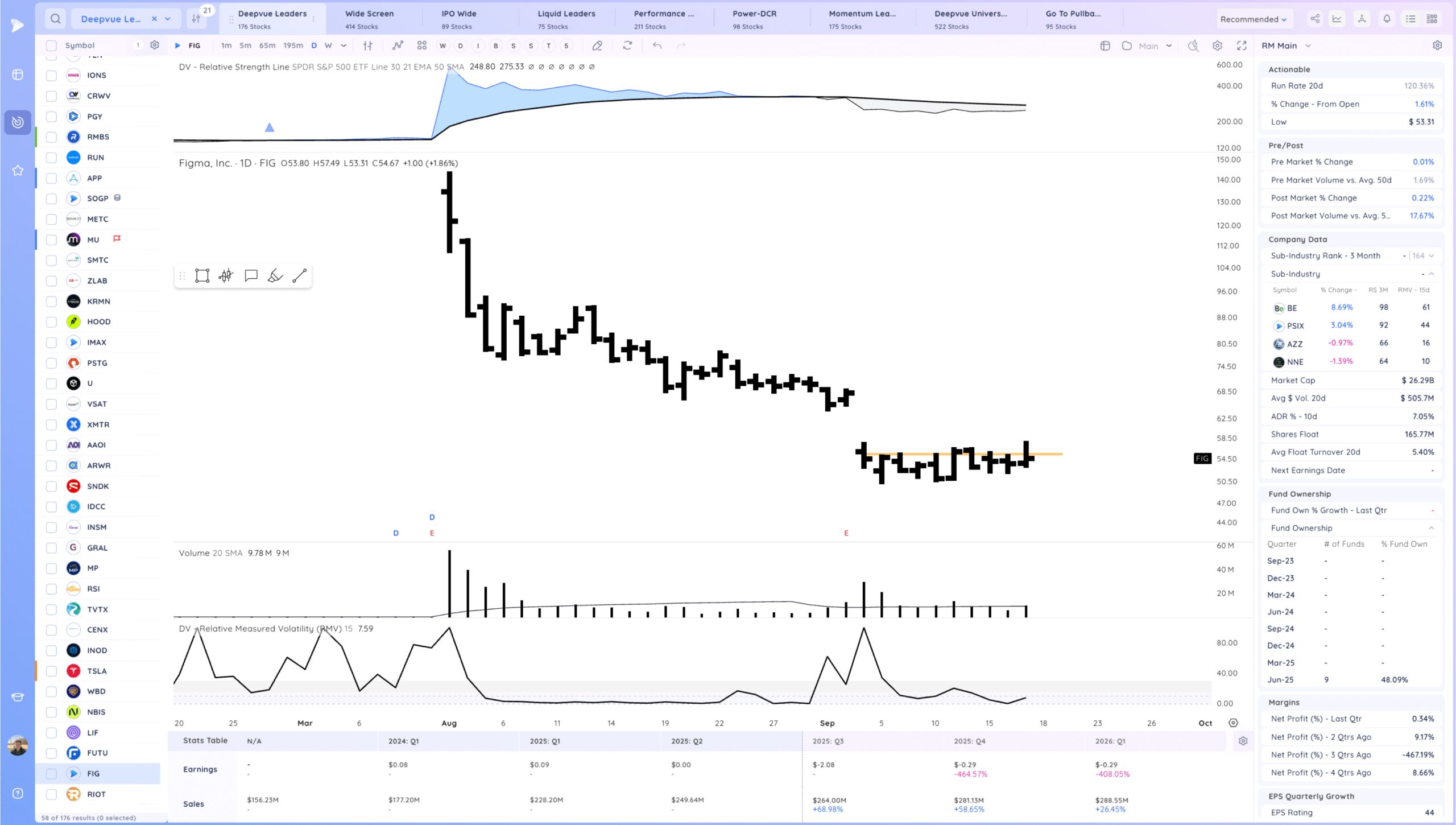

FIG watching for re-breakout

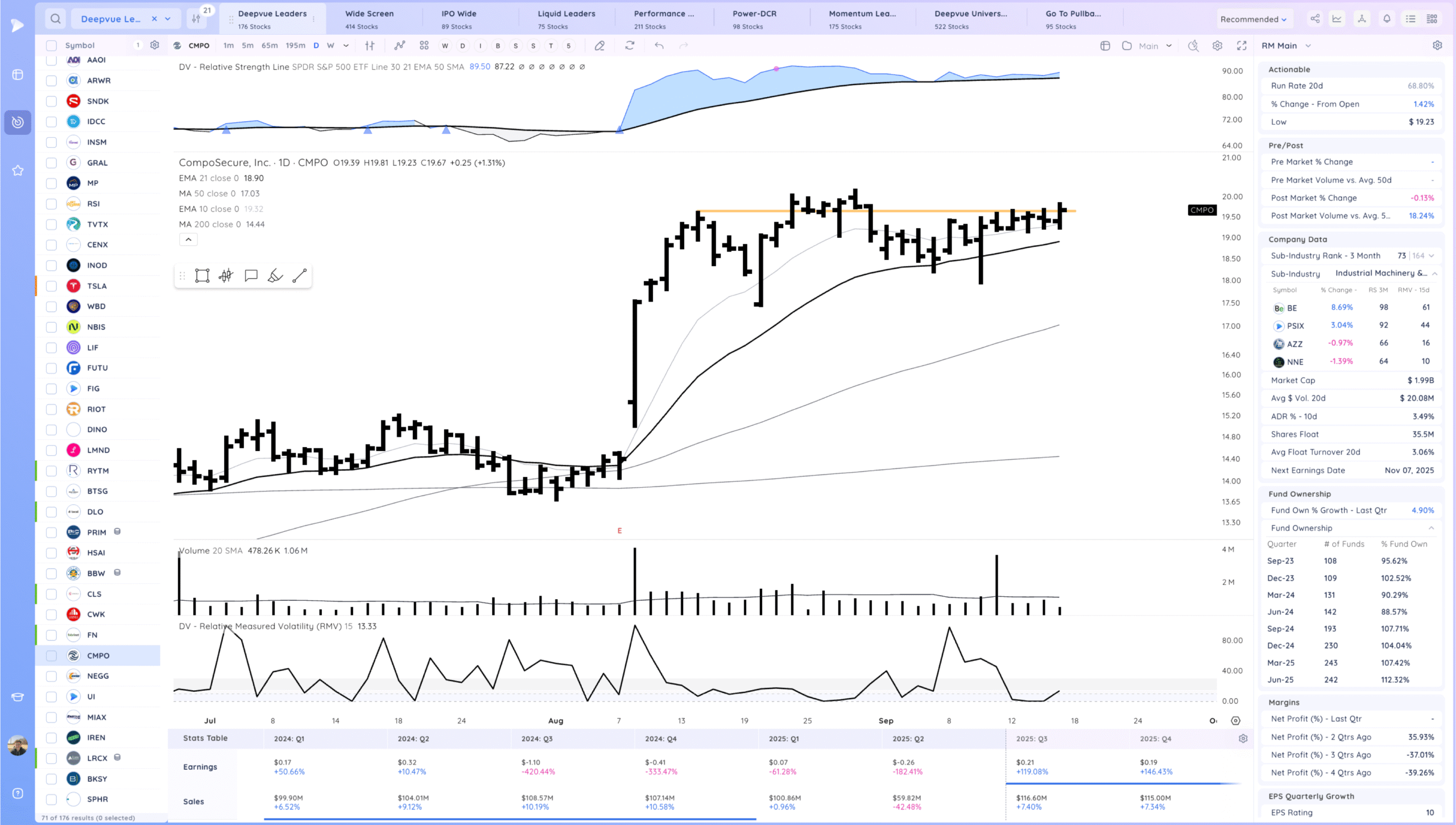

CMPO watching for a range breakout

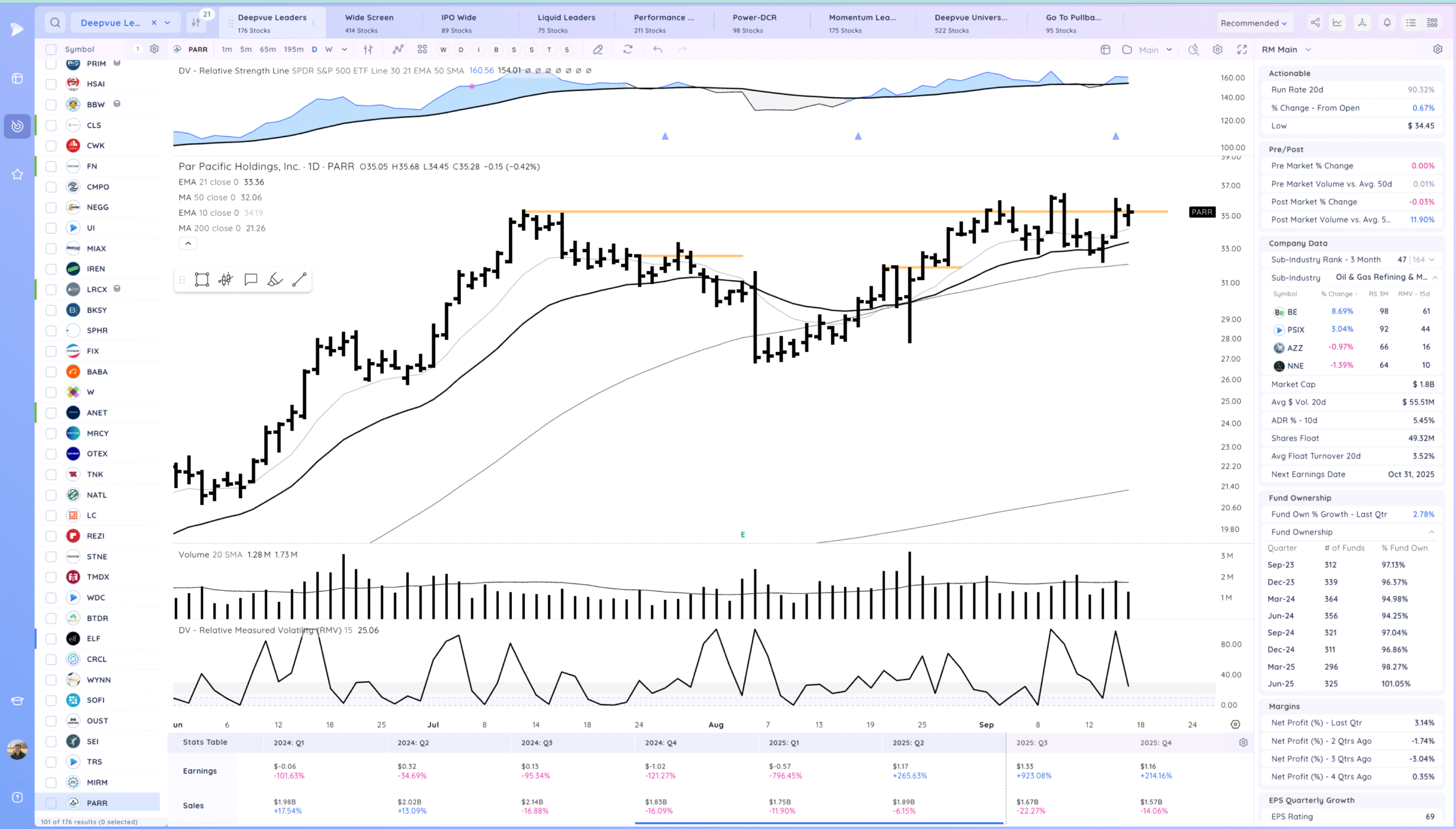

PARR watching for the base breakout. Inside day

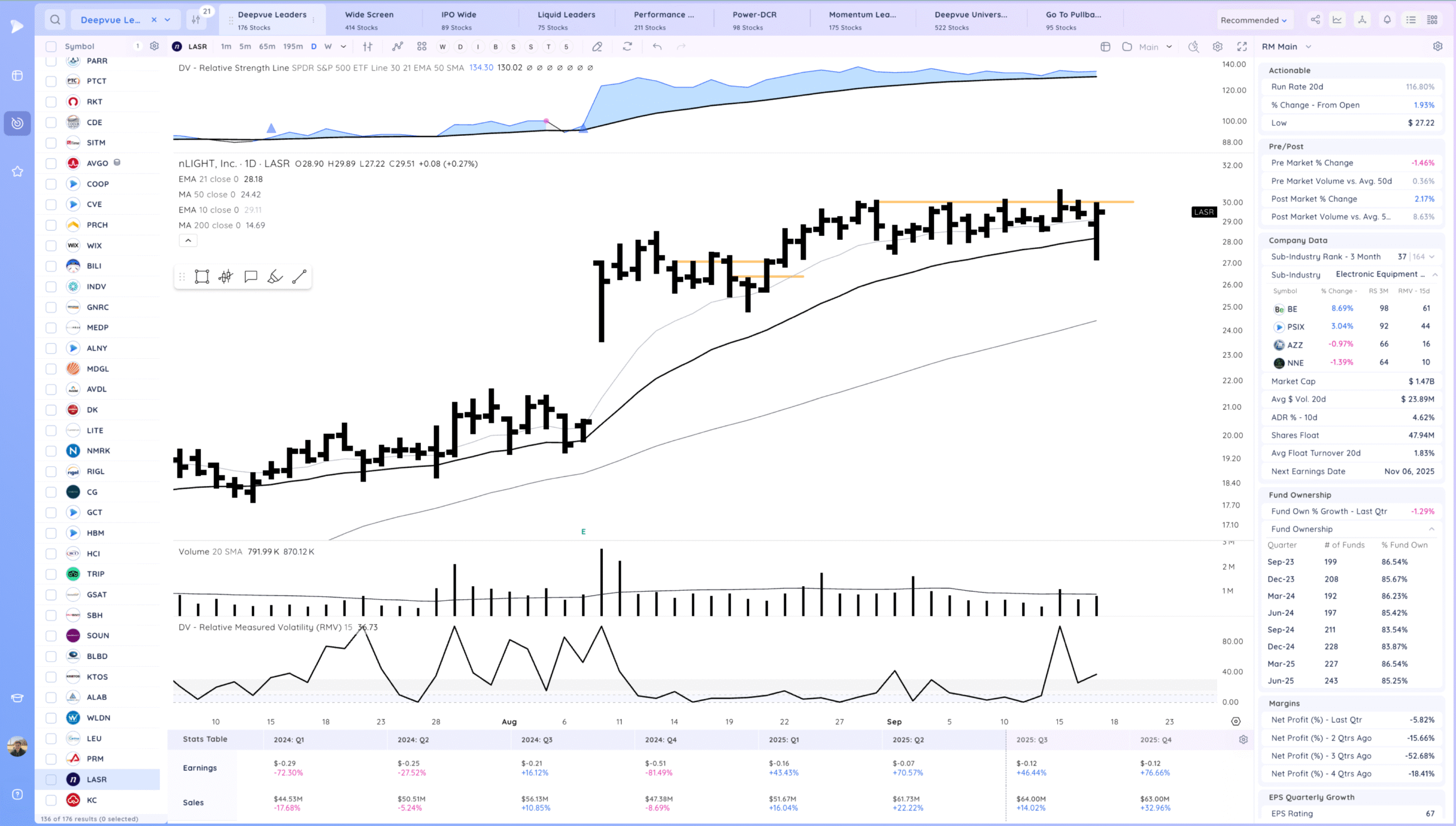

LASR watching for a breakout

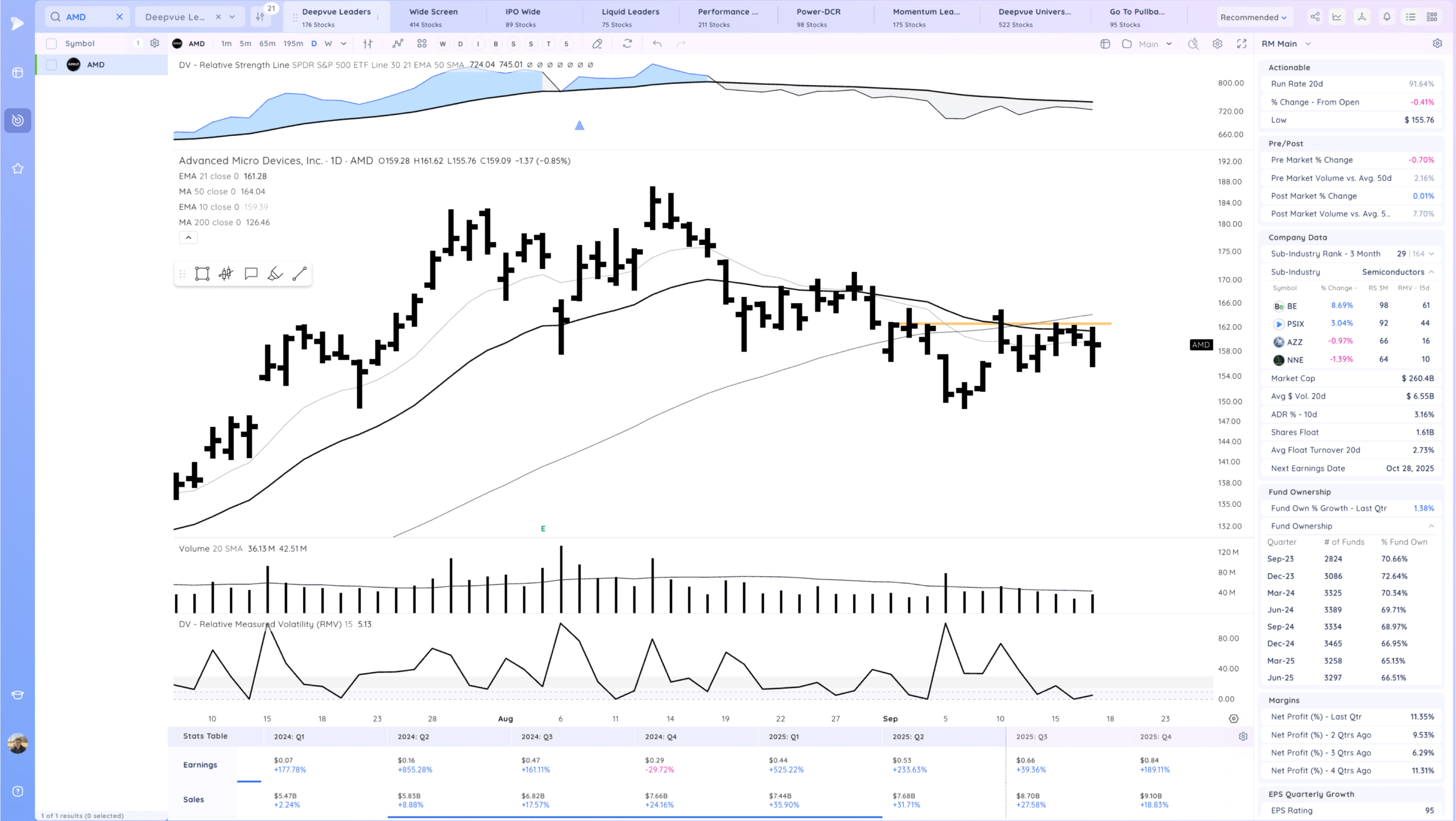

AMD watching for a breakout through the 21

Today’s Watchlist in List form

Focus List Names

DQ SHOP STRL TTMI TEM ZEPP CRWV GRAL RSI FIG CMPO PARR LASR RDDT NVDA AMD PLTR

Focus:

RDDT PLTR NVDA

Themes

Strongest Themes: AI, Metals/Miners, Software, Energy, Crypto Miners

Market Thoughts & Focus

Good action after the stress test, How we act through the end of the week will be key. Ideally the indexes pause as names continue to work

Anything can happen, Day by Day – Managing risk along the way