Downside Reversals

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 7, 2025

Market Action

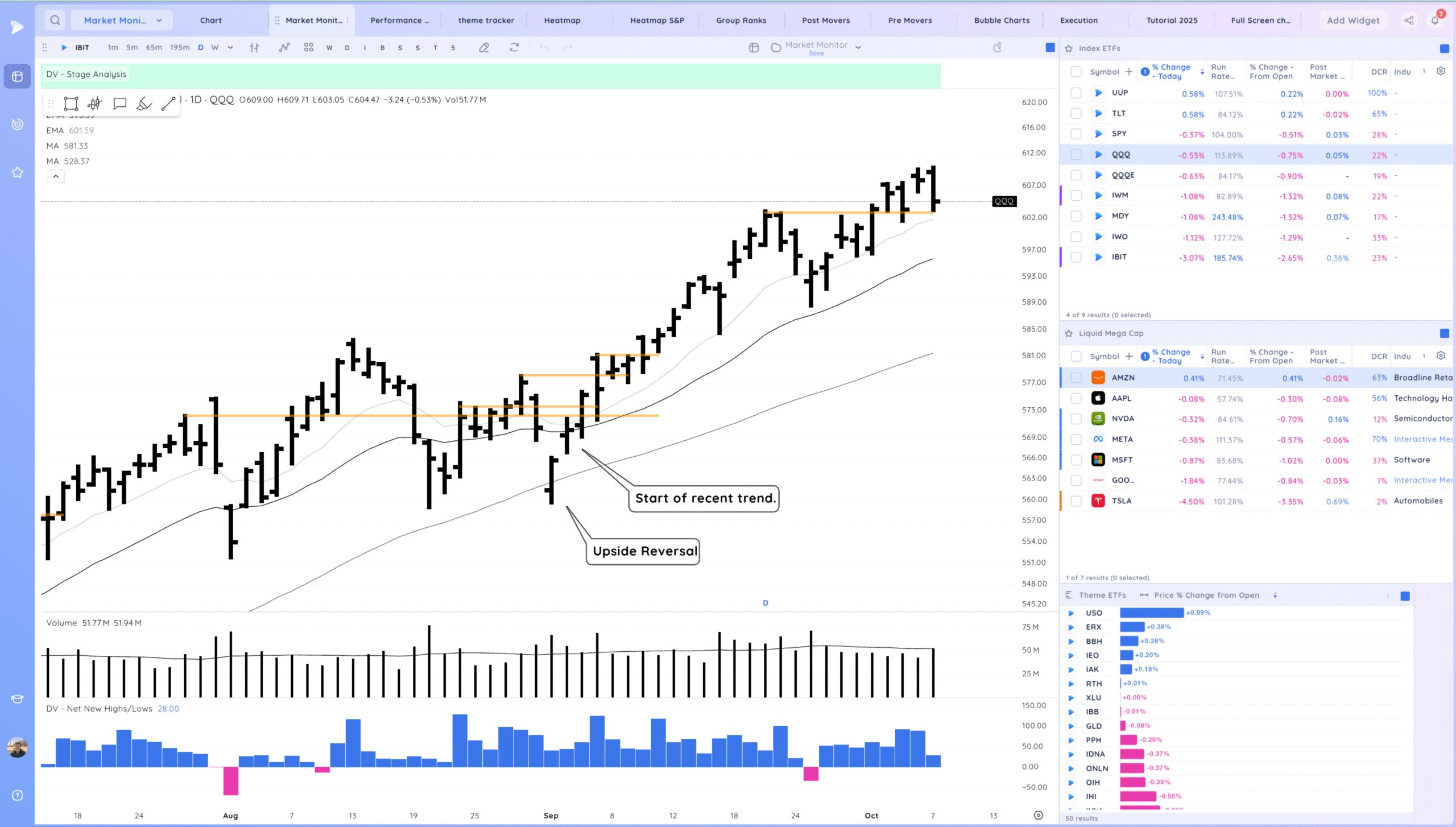

QQQ – Downside reversal today and a bit of a stress test. We are pulling back into the prior pivot. We continue to trend above rising moving averages.

Many key names also had downside reversals

Sharp follow through below the 10ema area would make me more cautious.

Bulls want to see us hold the pivot area and continue to trend

Bears want to see a sharp drop below the 10ema.

Daily Chart of the QQQ.

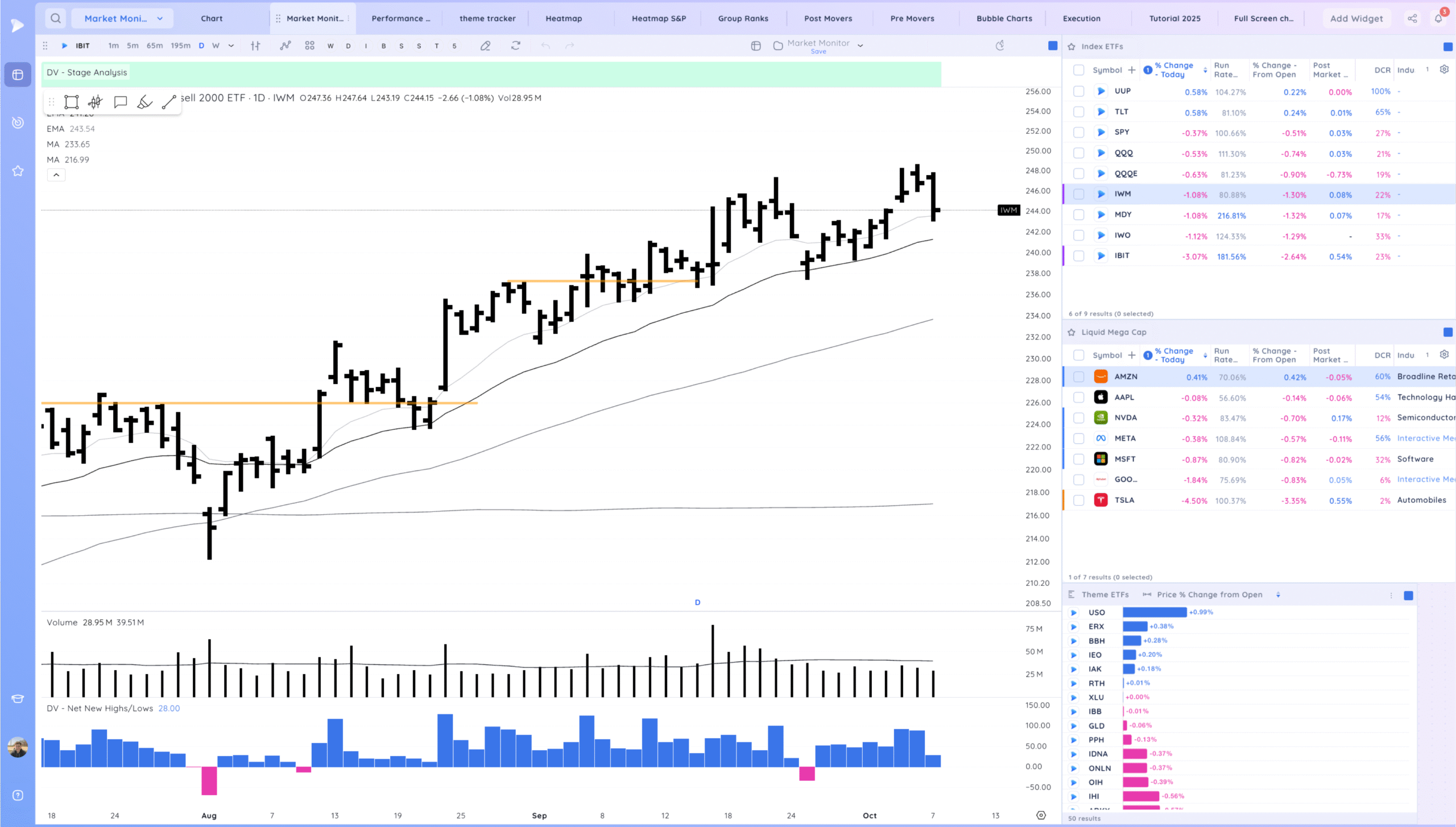

IWM – Sharp pullback, pulling into the 10ema

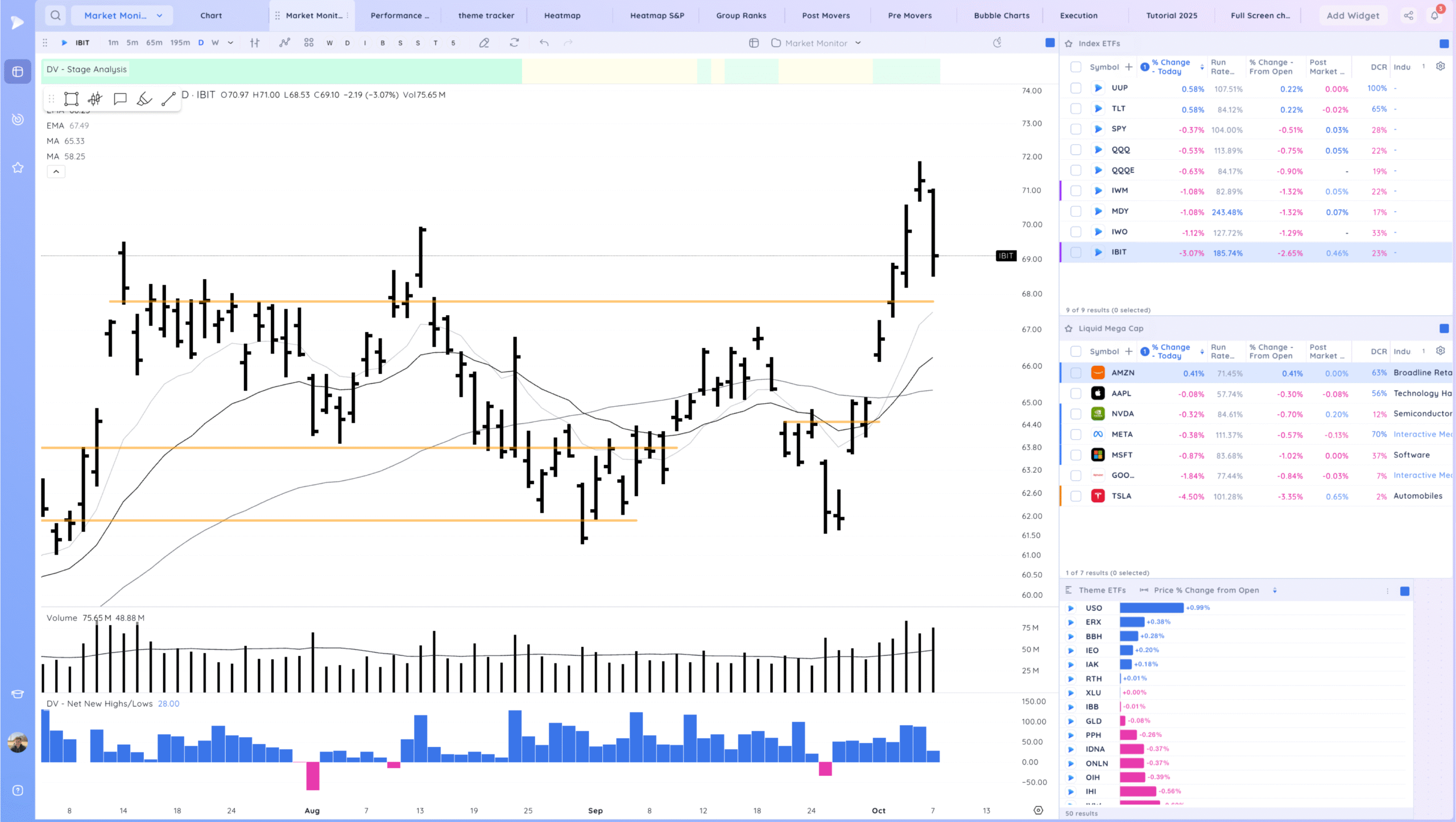

IBIT – Sharp pull in. Normal given the strong move higher. Now watching for a range to build.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

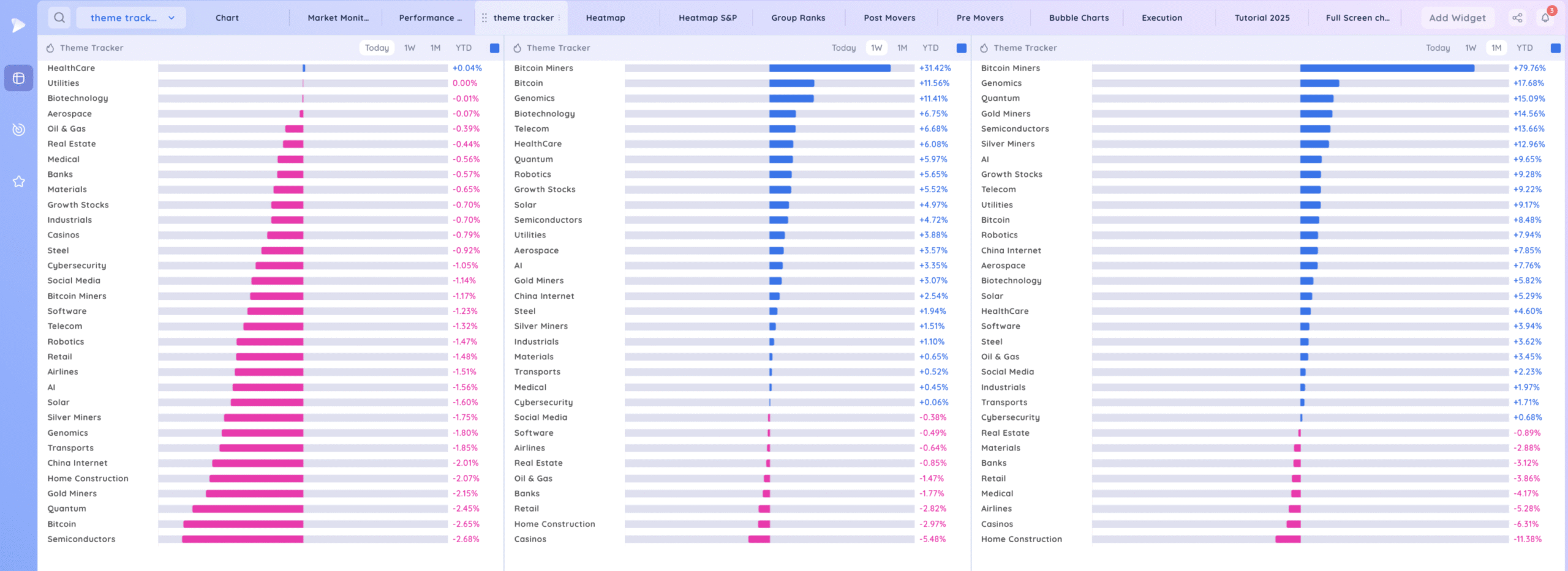

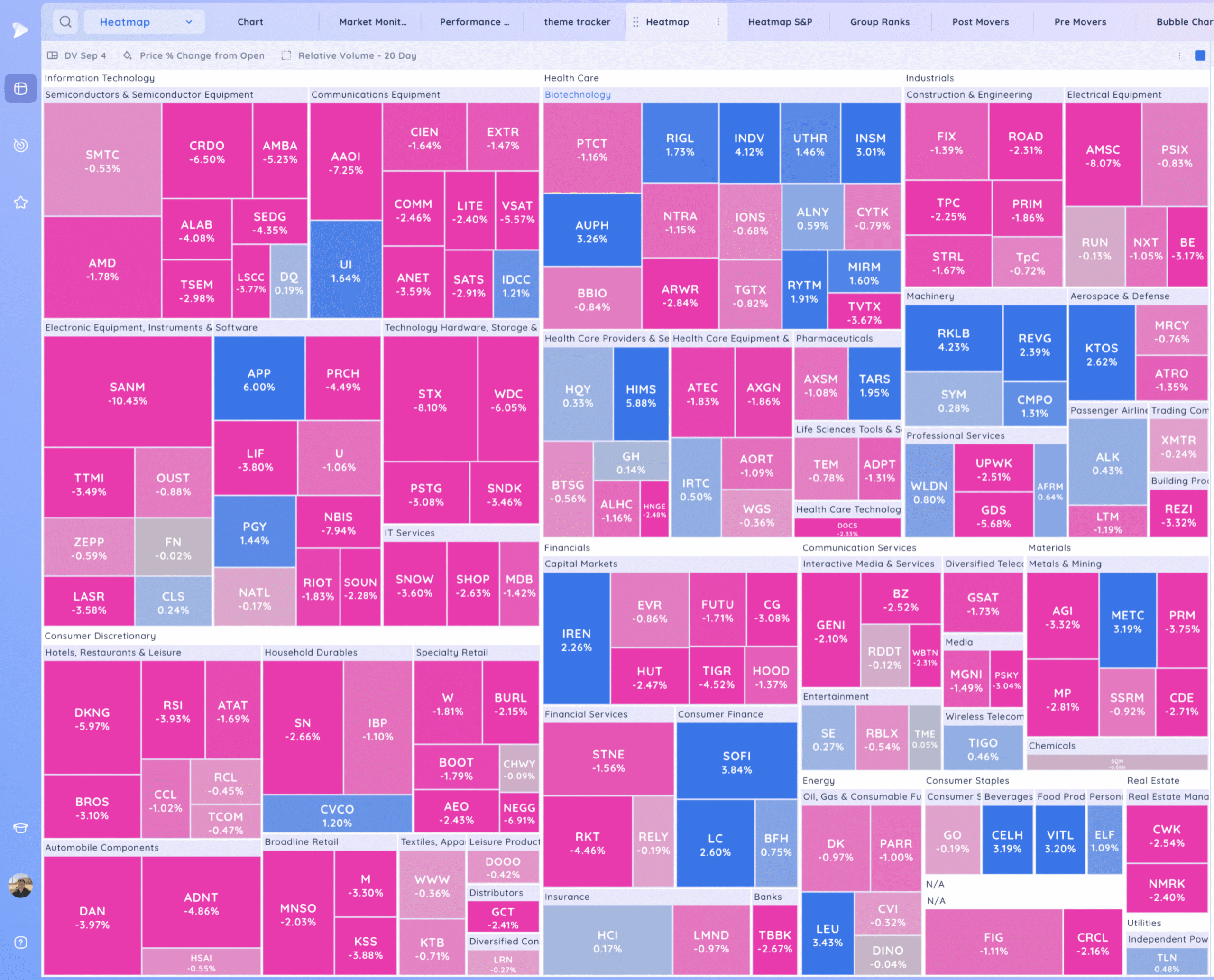

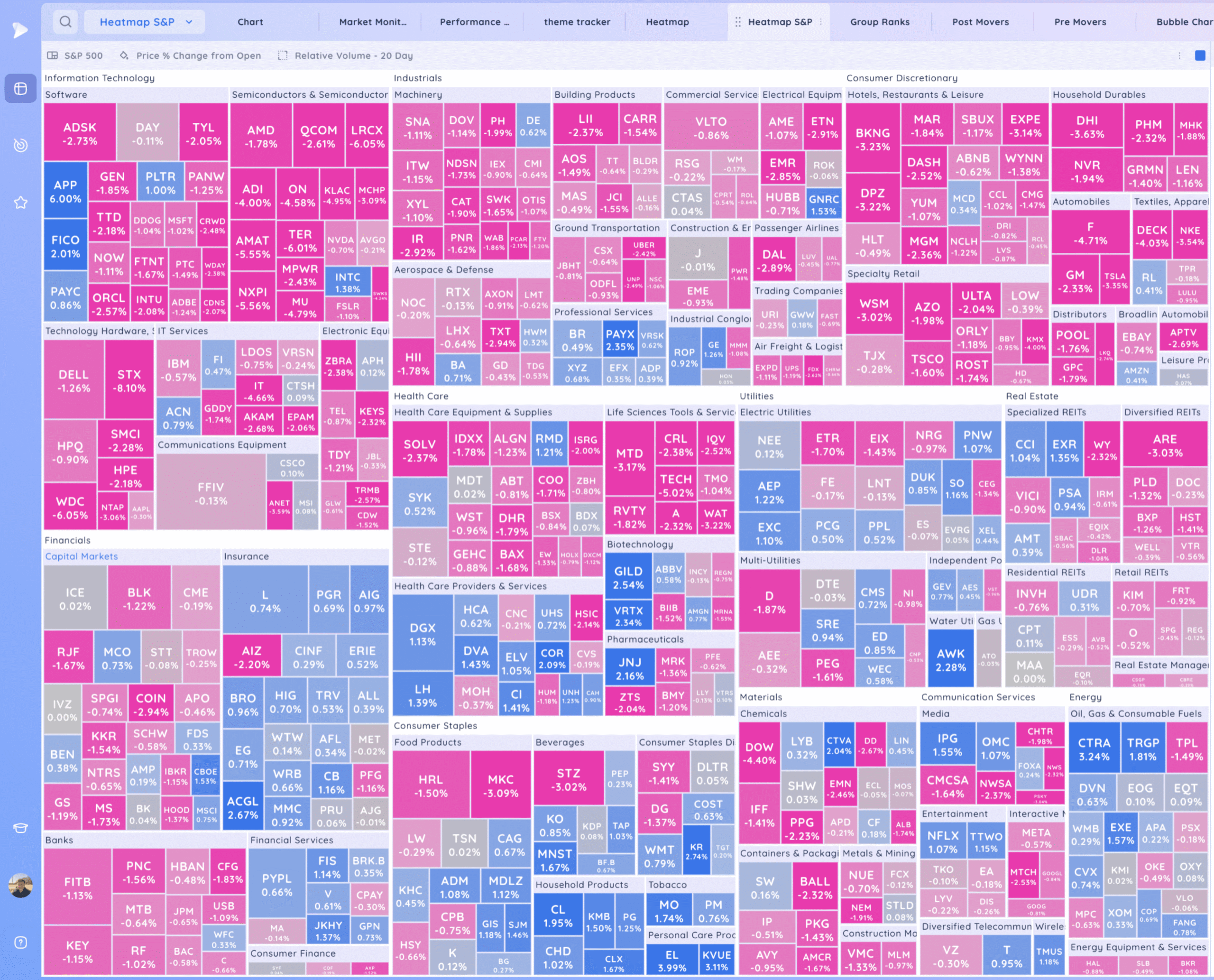

Groups/Sectors

Deepvue Theme Tracker

Deepvue Leaders

S&P 500.

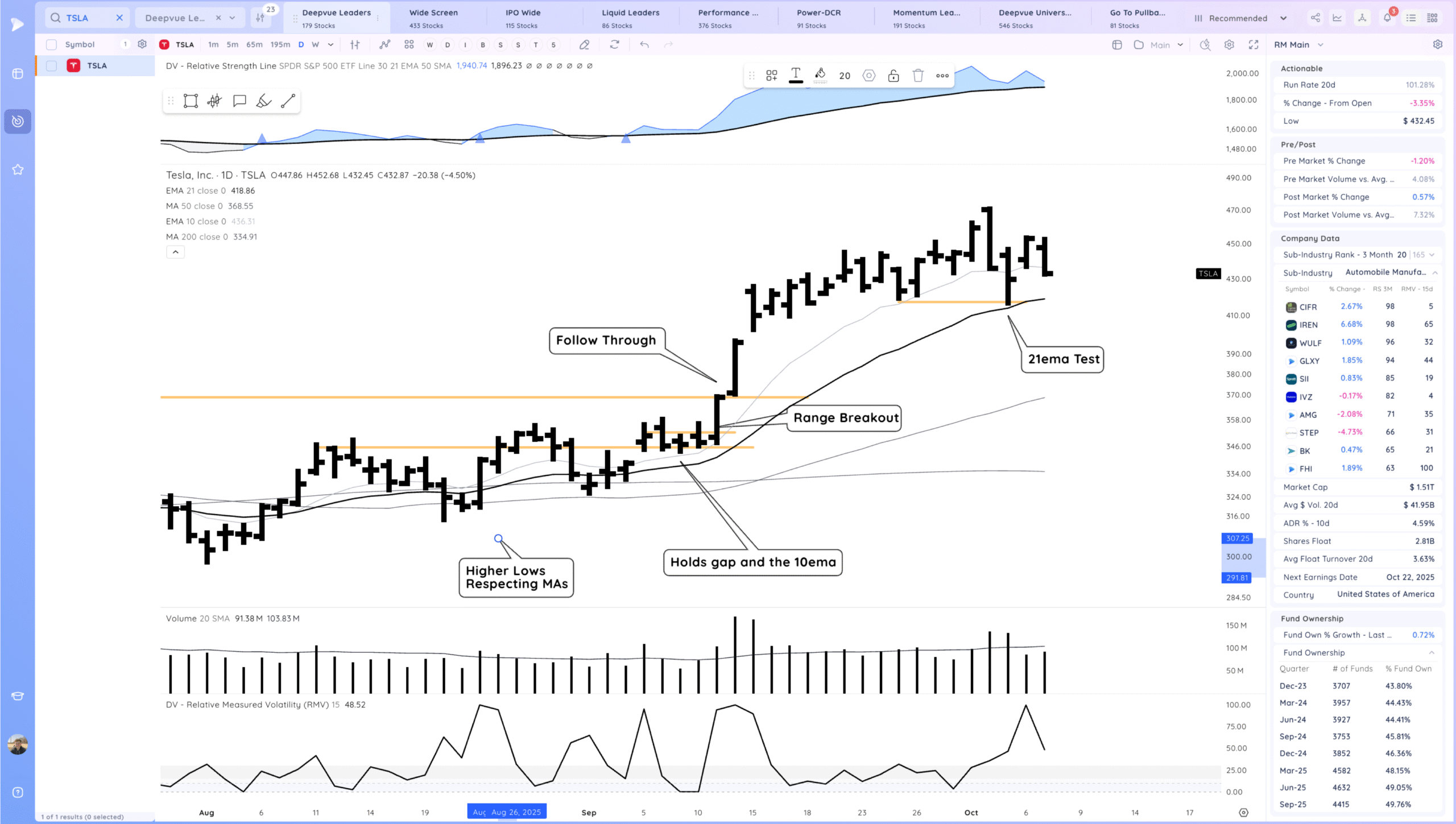

Leadership Stocks & Analysis

TSLA – Was holding up well today but closed poorly. Overall watching for it to build out a consolidation here.

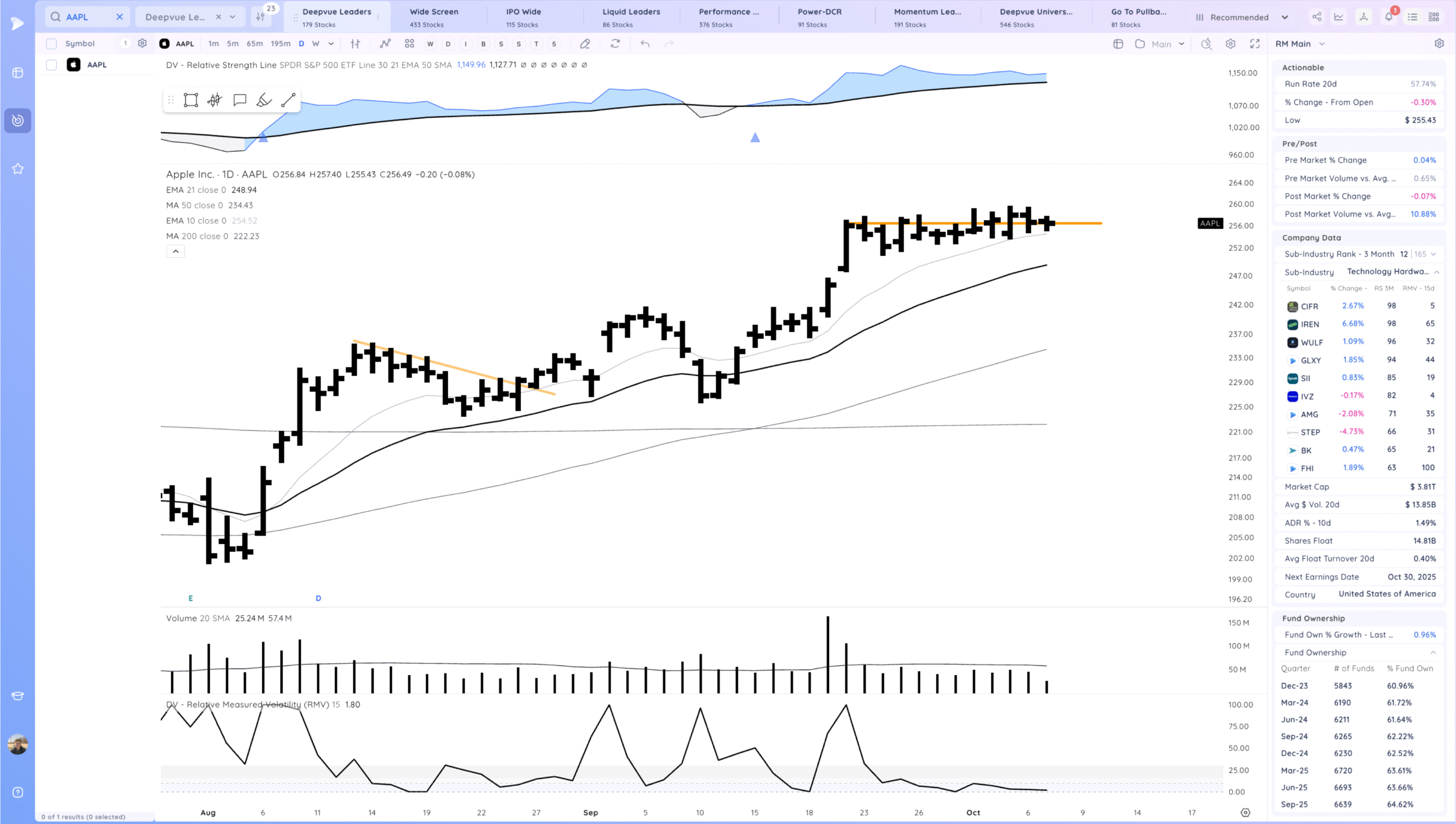

AAPL very tight in this flag. Expecting expansion tomorrow

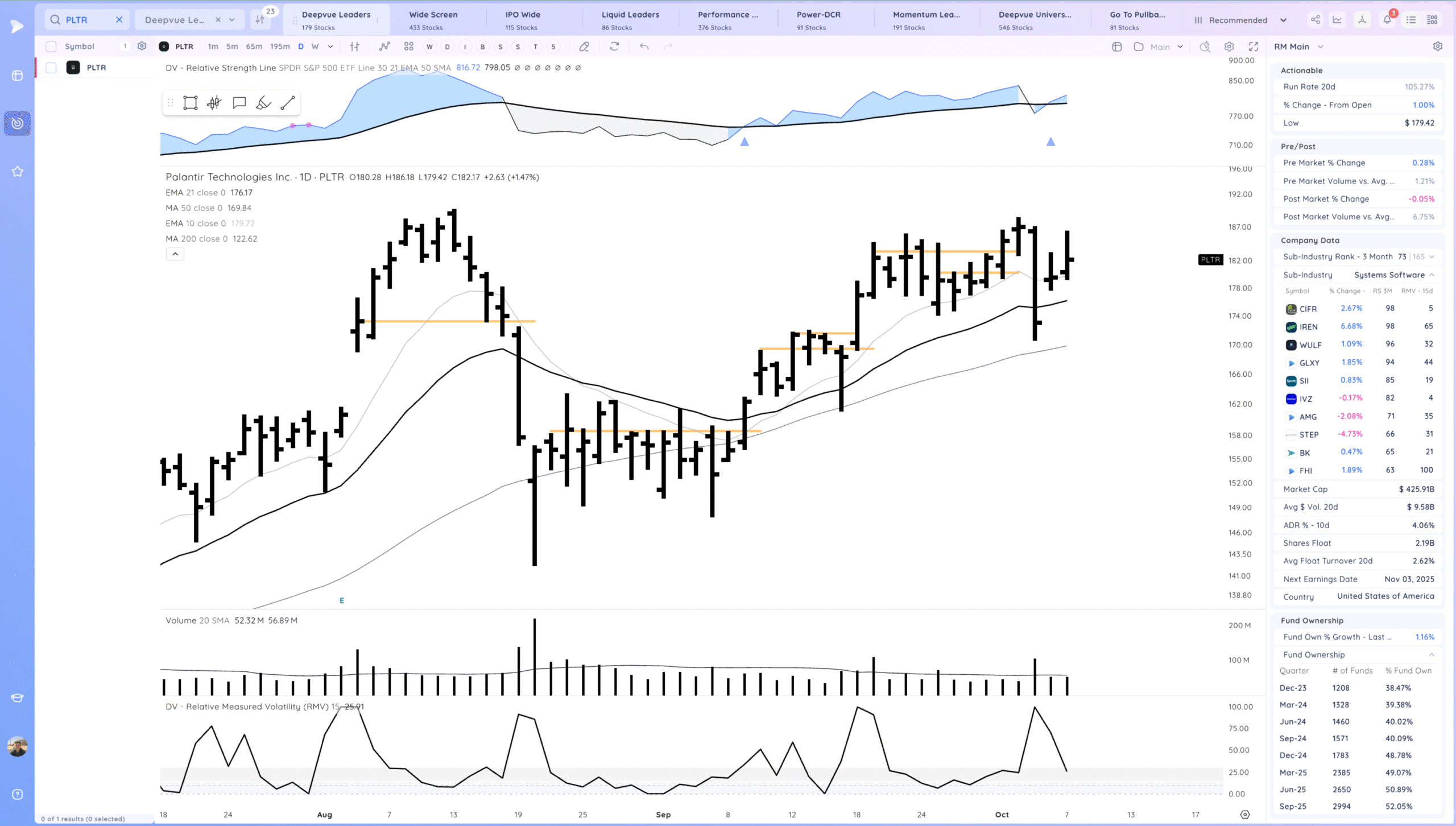

PLTR some fade off highs but holding up better than most today

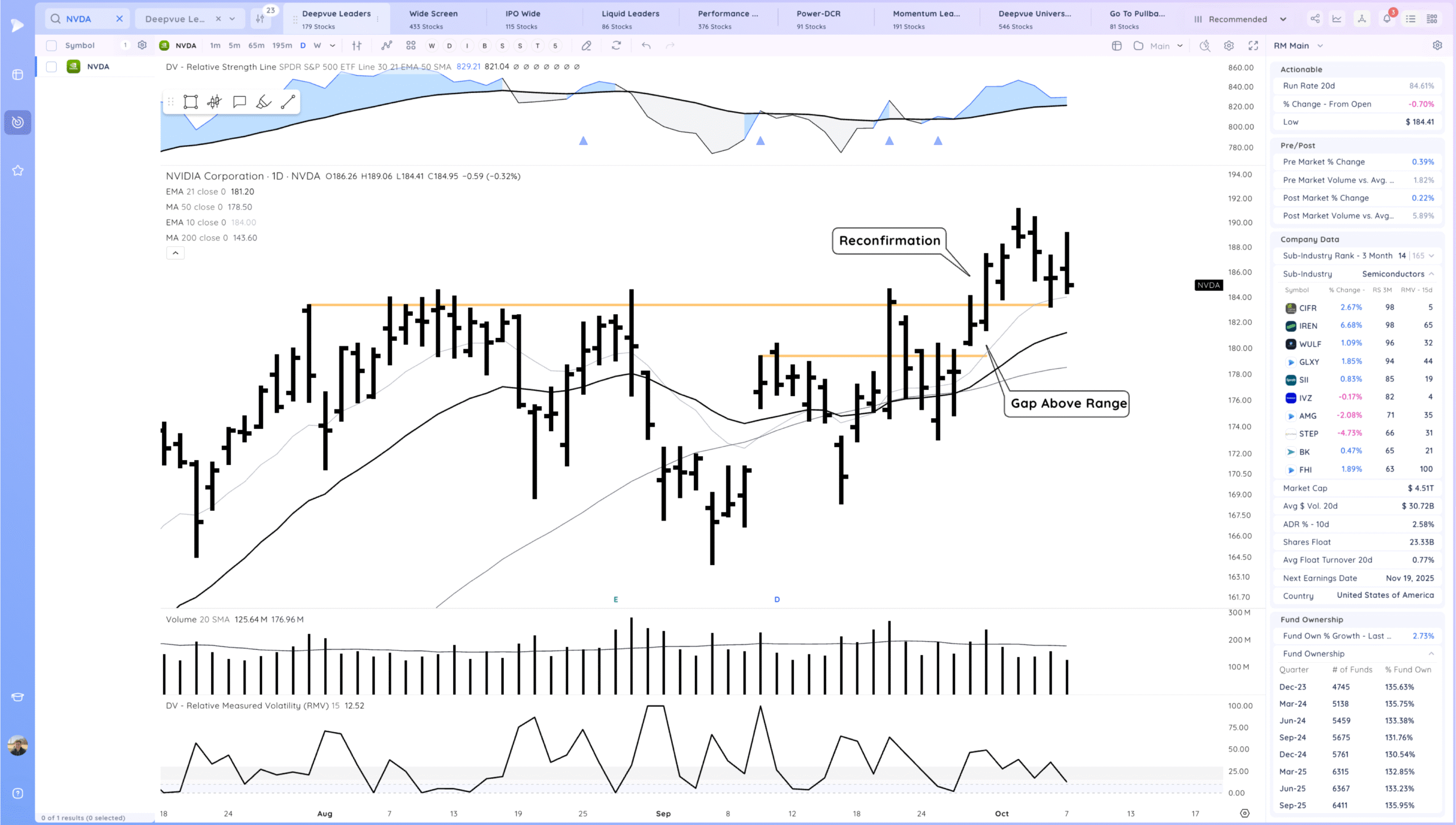

NVDA Looked to follow through up but instead formed a downside reversal. On watch now for continued downside. The base pivot is a key level

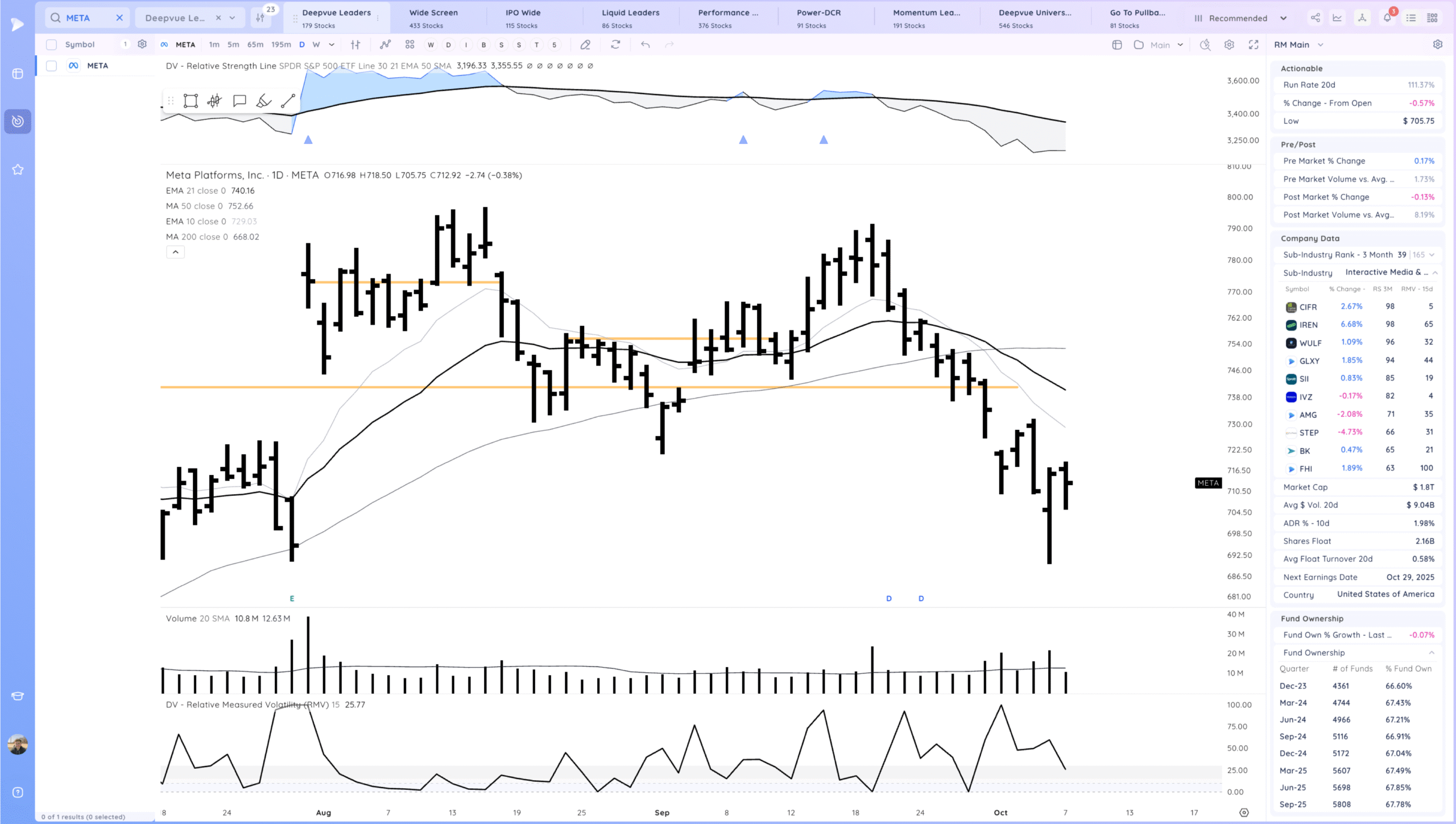

META Tight consolidation after the potential reversal extension. Still below declining MAs

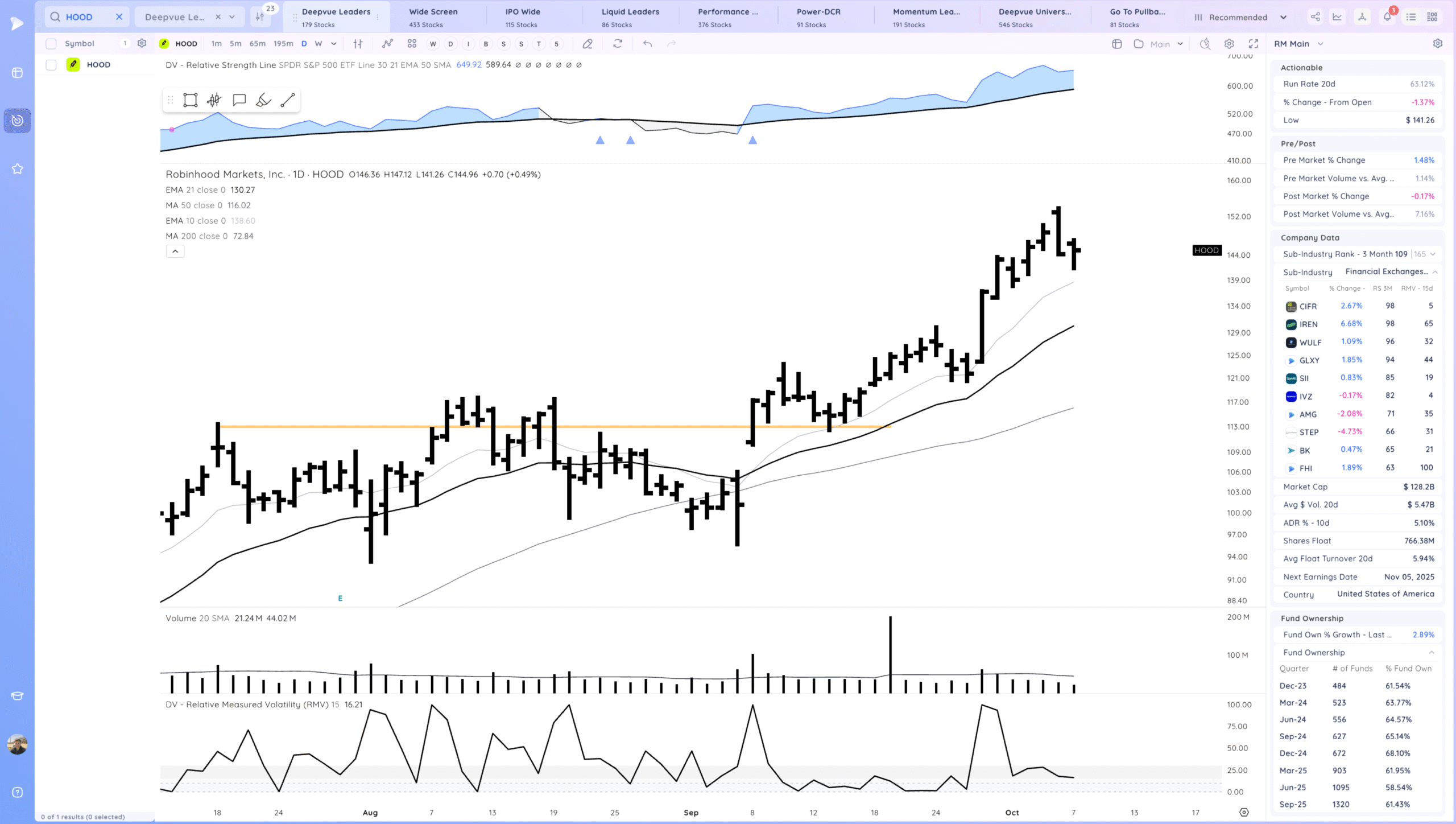

HOOD Some follow through down but good close. Trending above the MAs

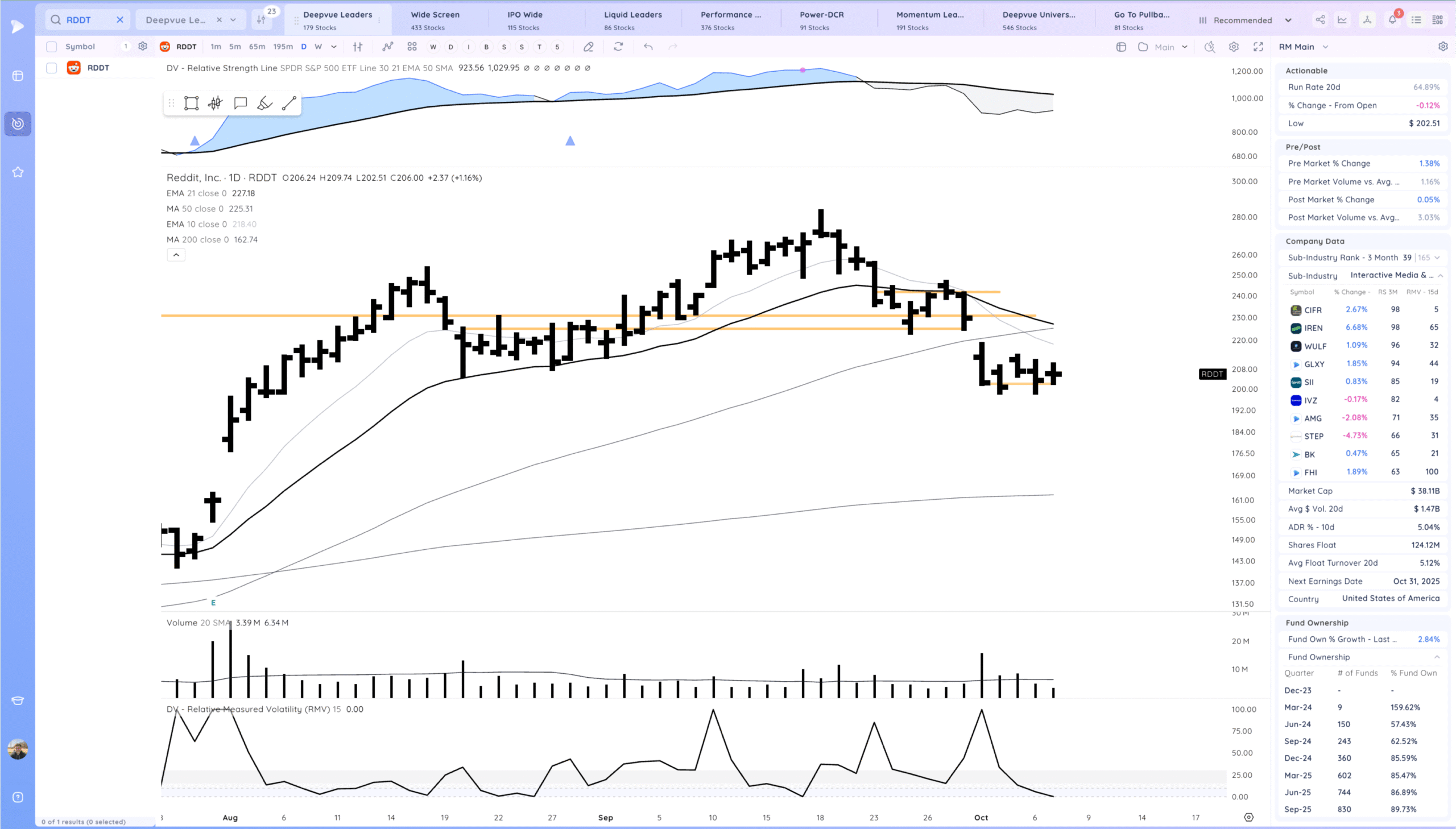

RDDT Tight range here. Bulls want to see a gap up and good close near the 50sma

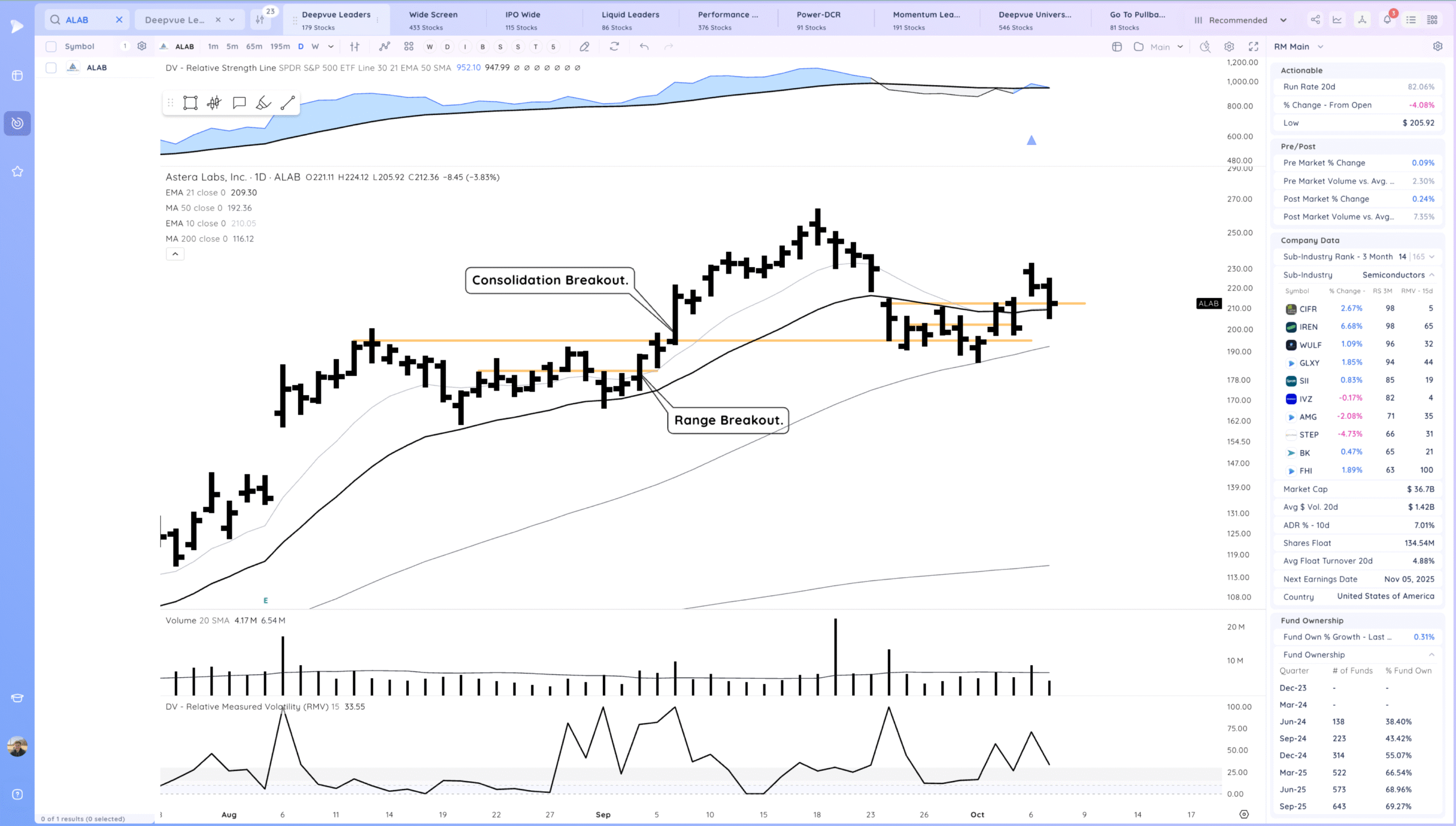

ALAB Pulled back into the prior range pivot and 21ema area

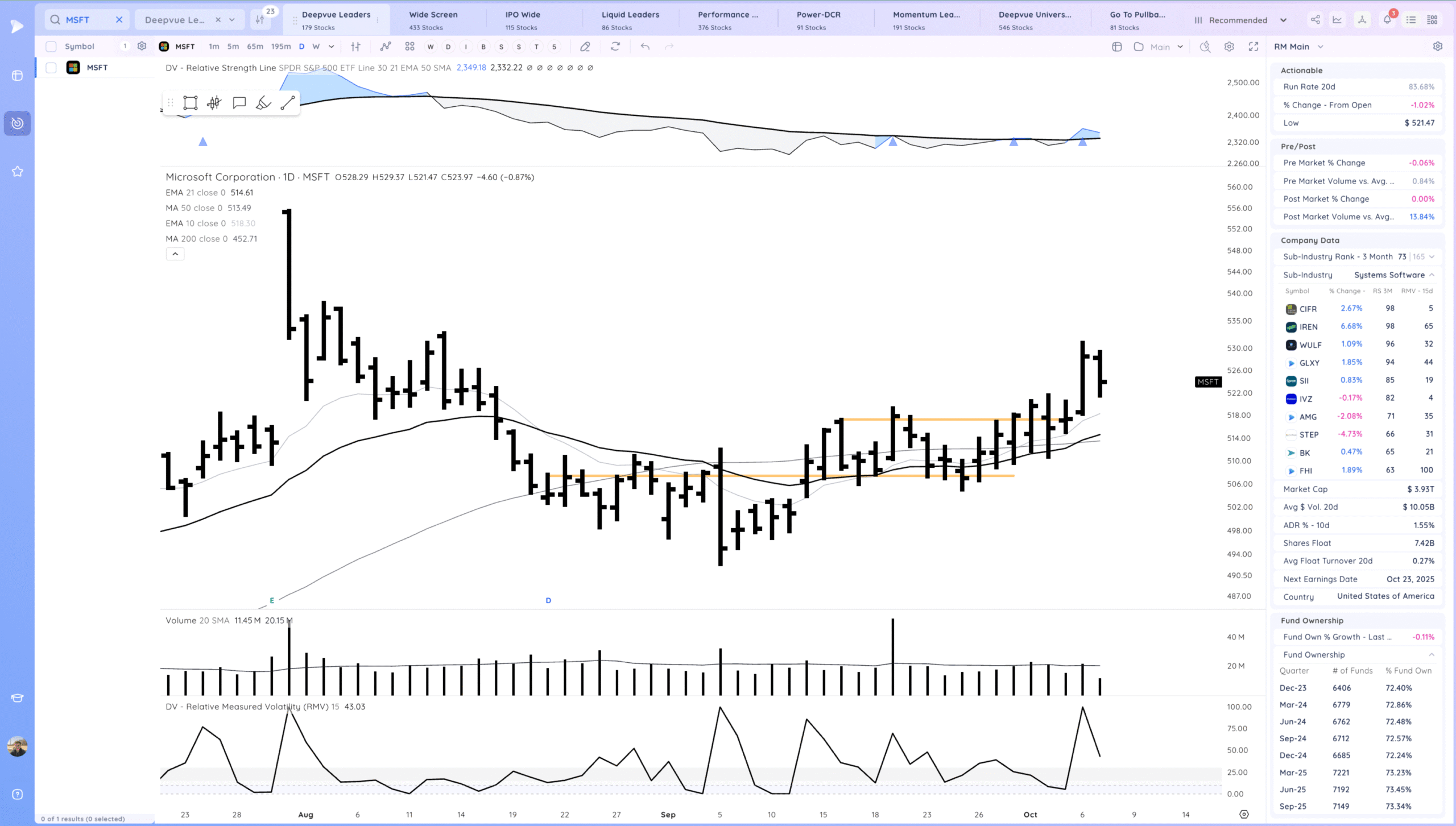

MSFT Inside day after the breakout

Key Moves

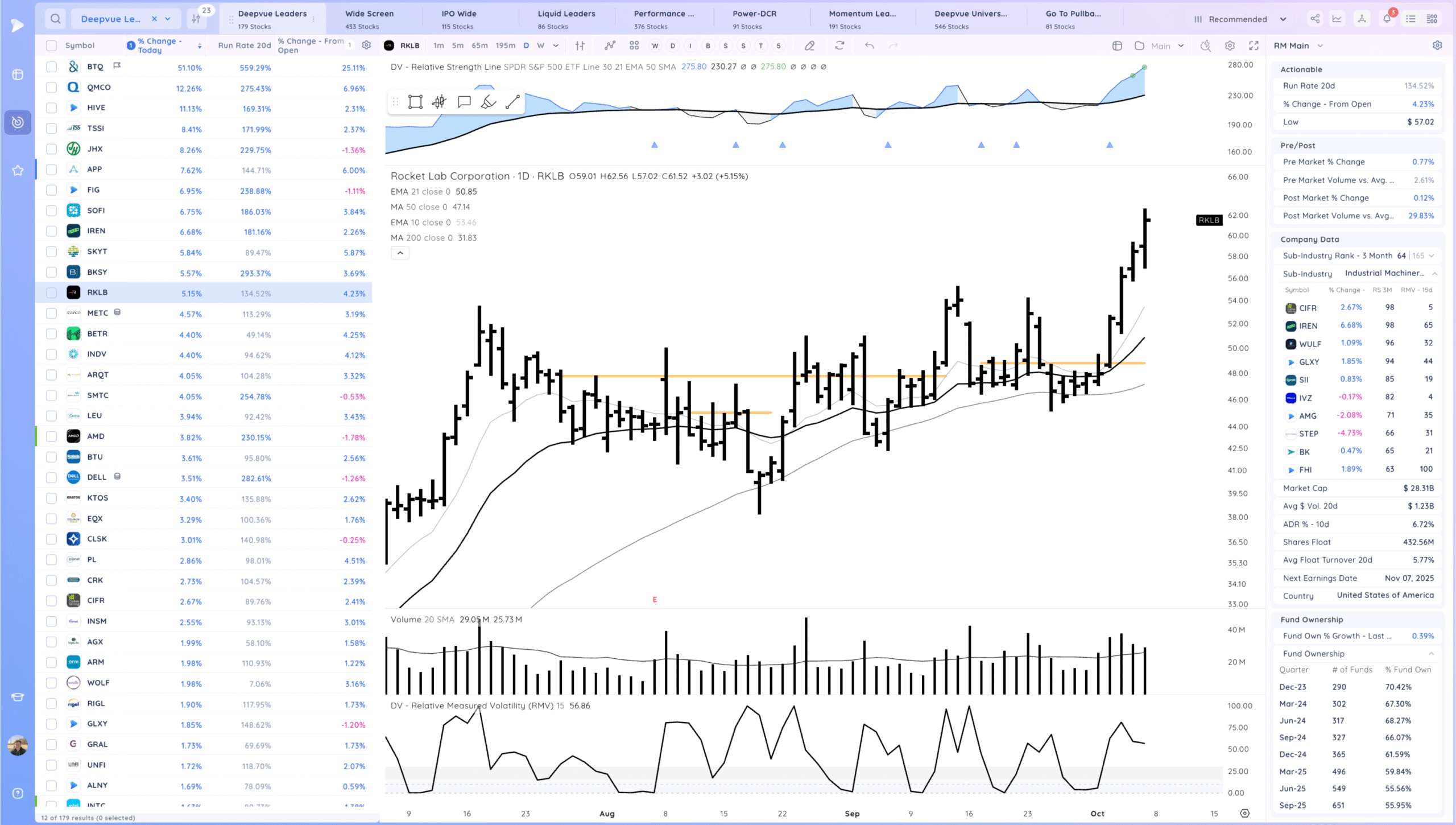

RKLB continuing to follow through. Short term extended now.

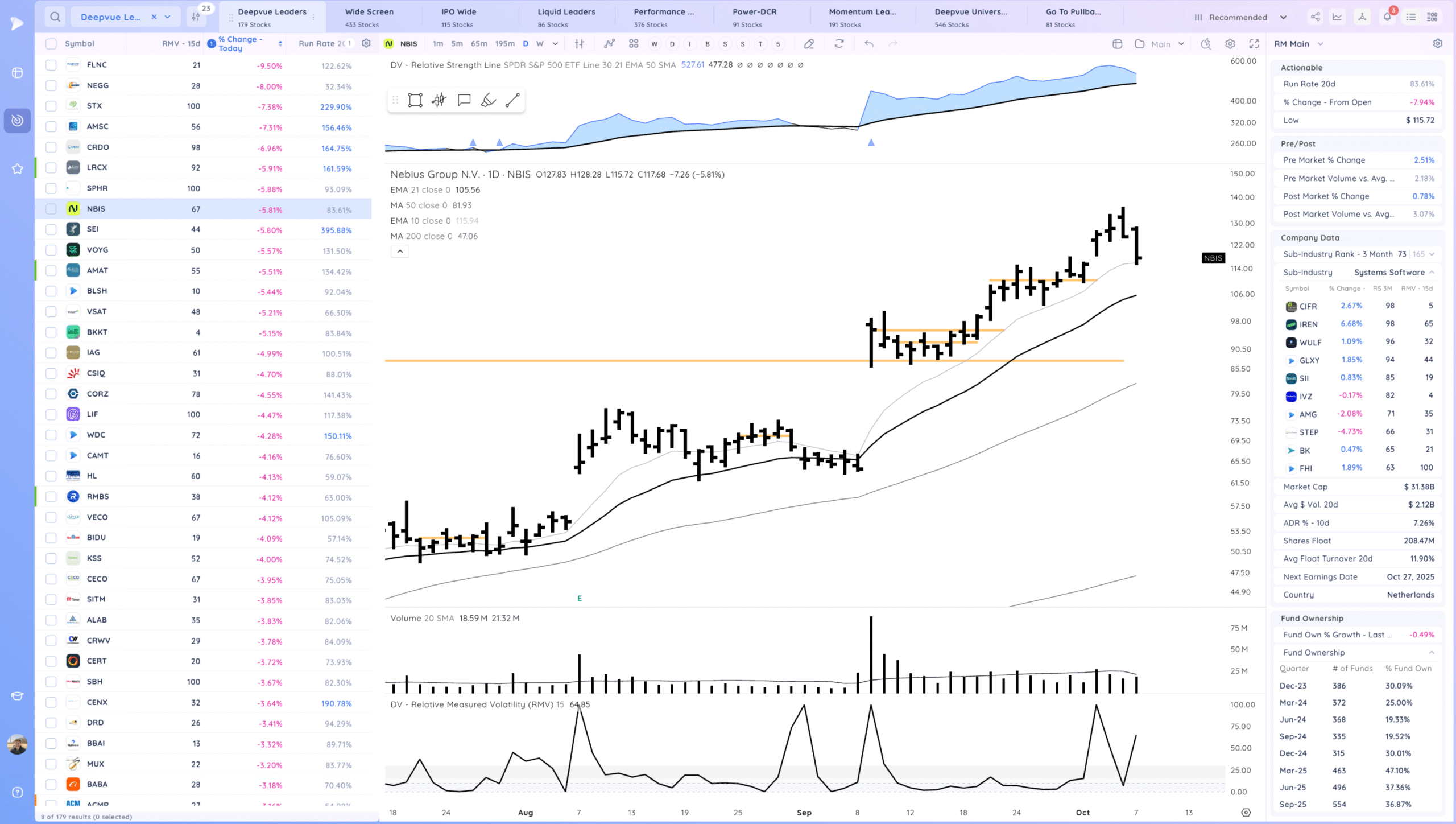

NBIS sharp pull into the 10ema

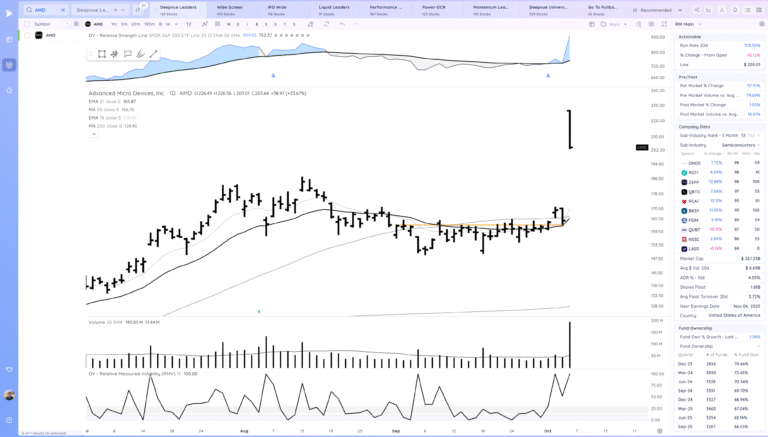

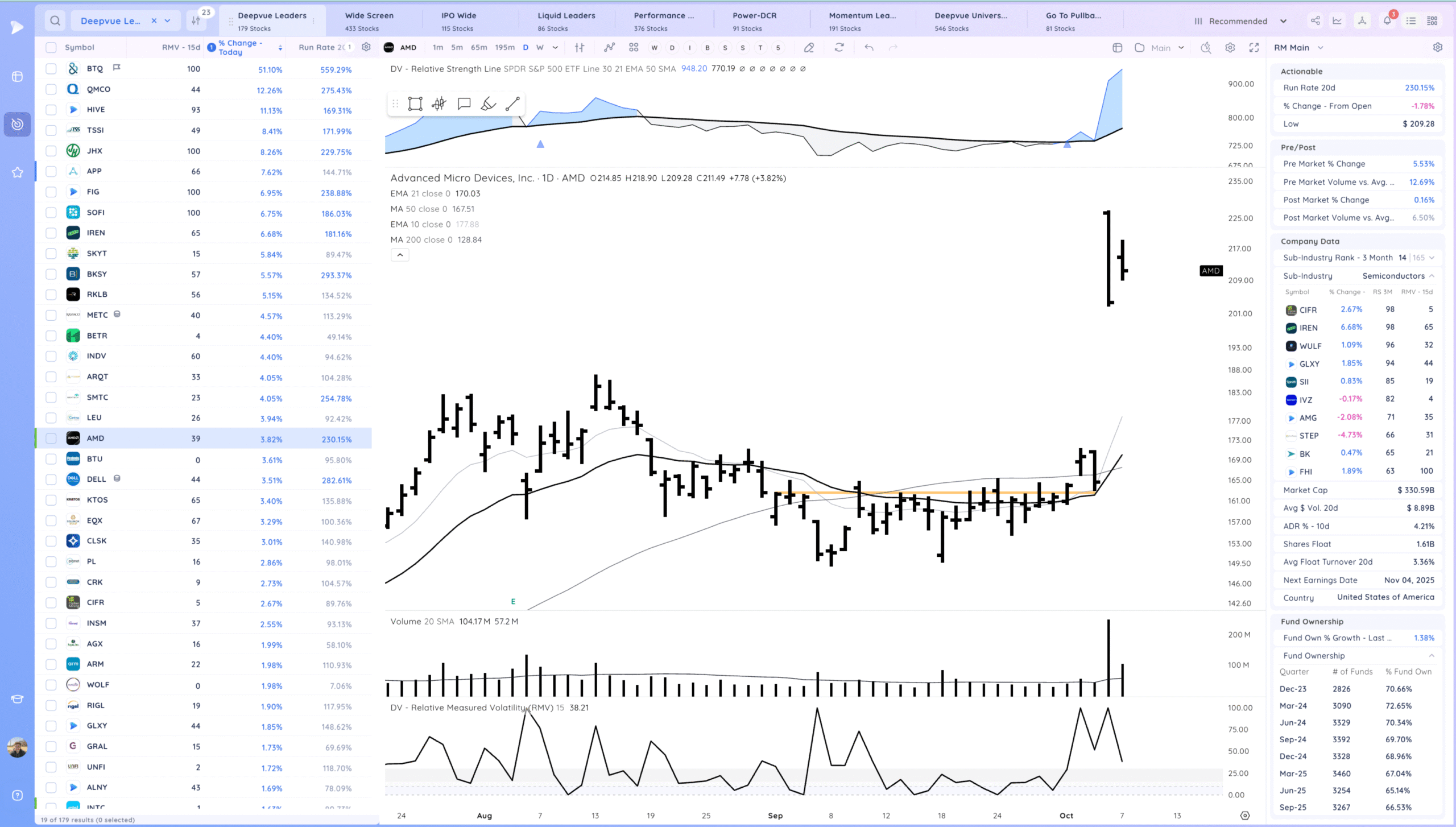

AMD gap and hold. After such a large gap I would look for more consolidation here

Setups and Watchlist

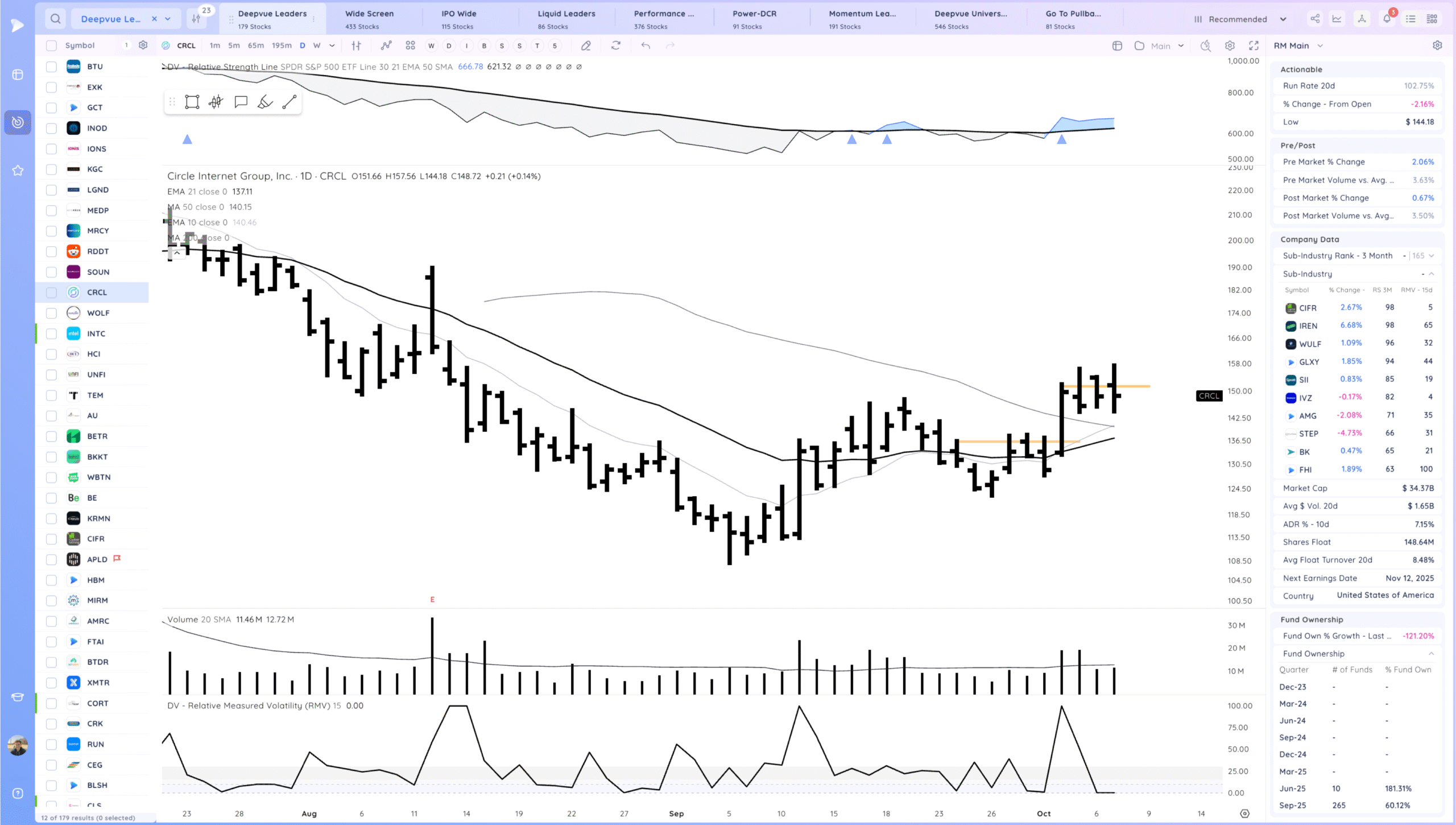

CRCL sitting on the pivot. Watching for a push higher off this level.

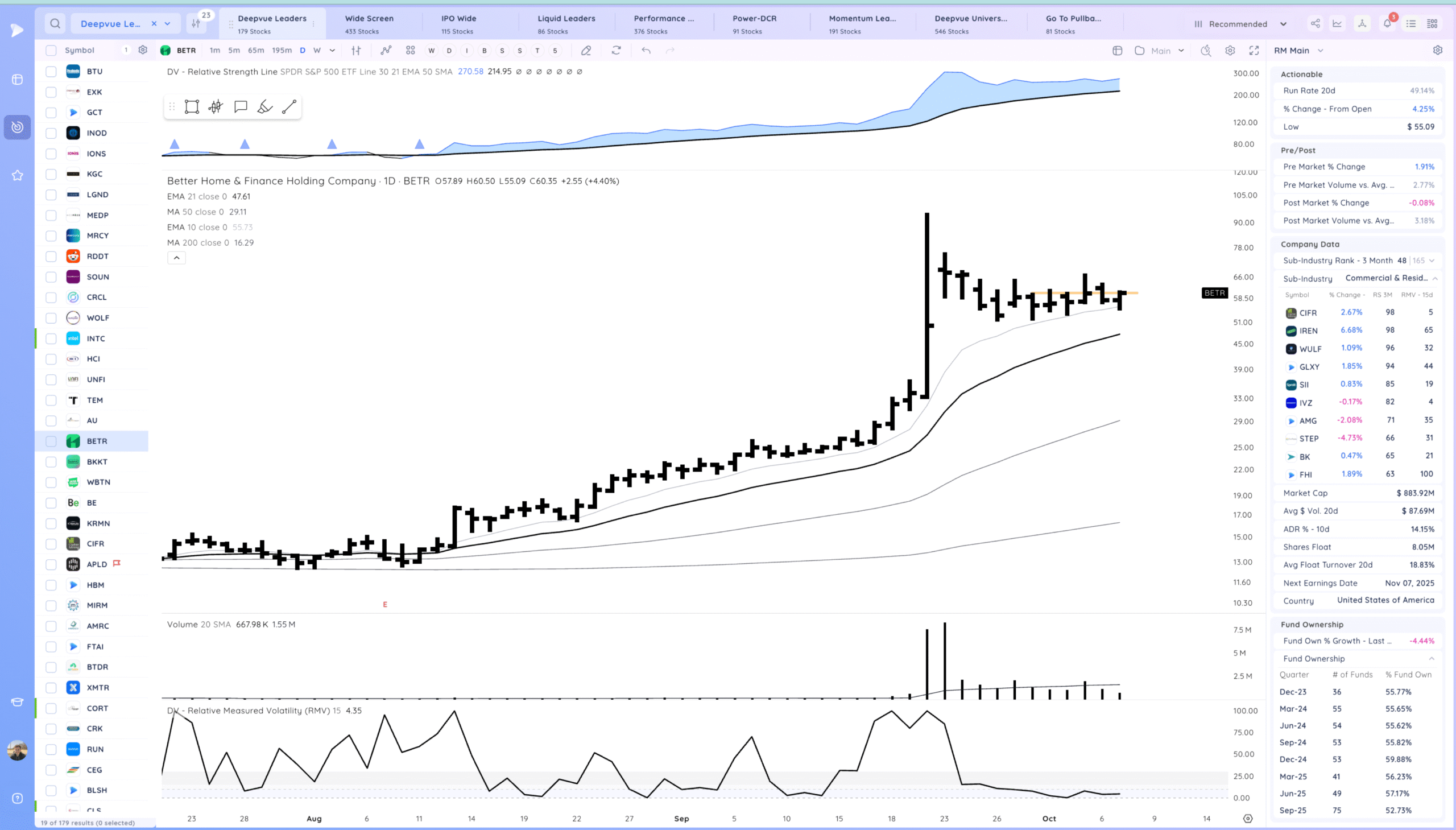

BETR very fast mover. Upside reversal. Watching for a range breakout

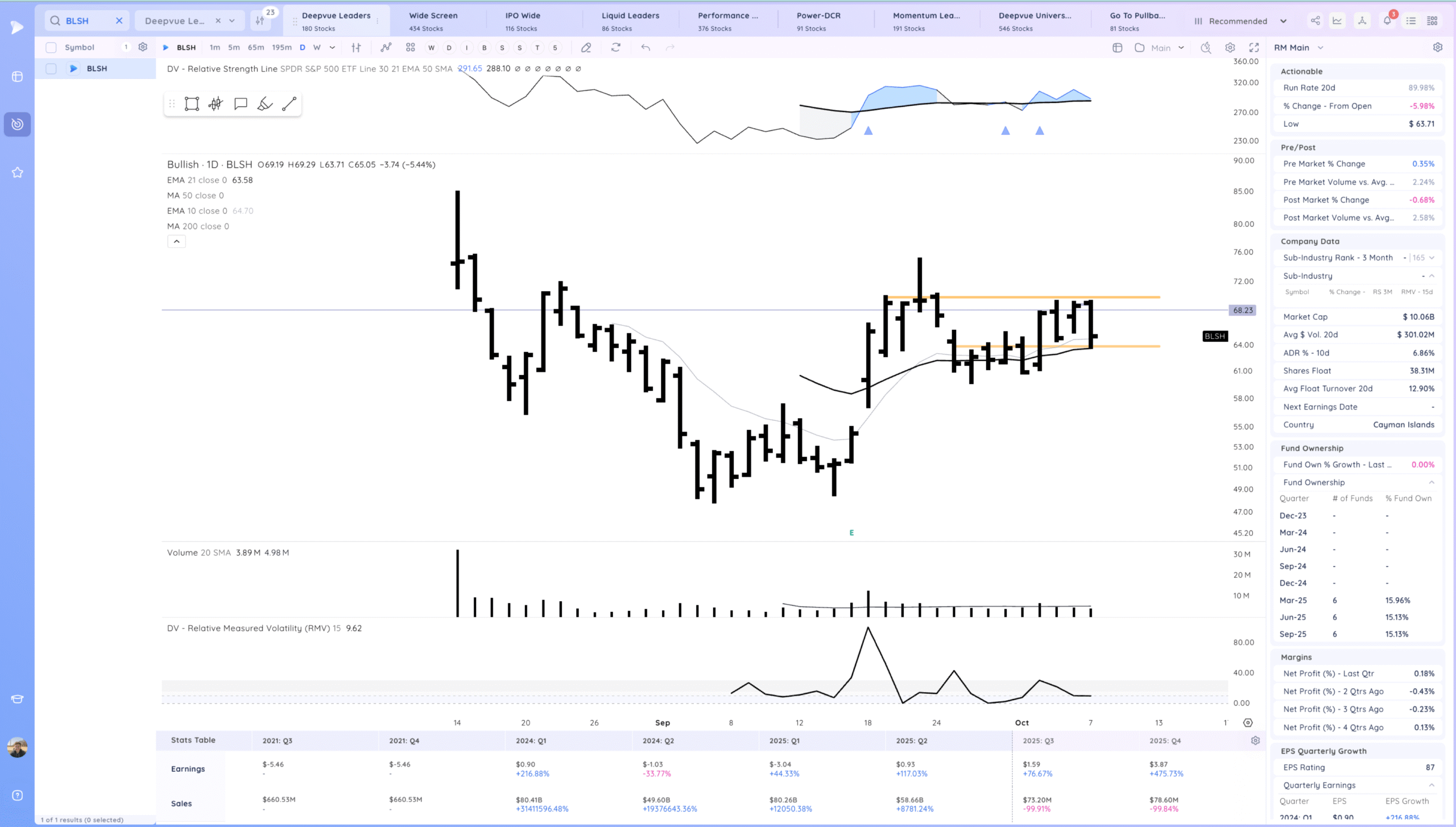

BLSH weak today but pulling into the 21ema and prior range. Recent listing worth watching. Crypto theme. Watching for a range breakout

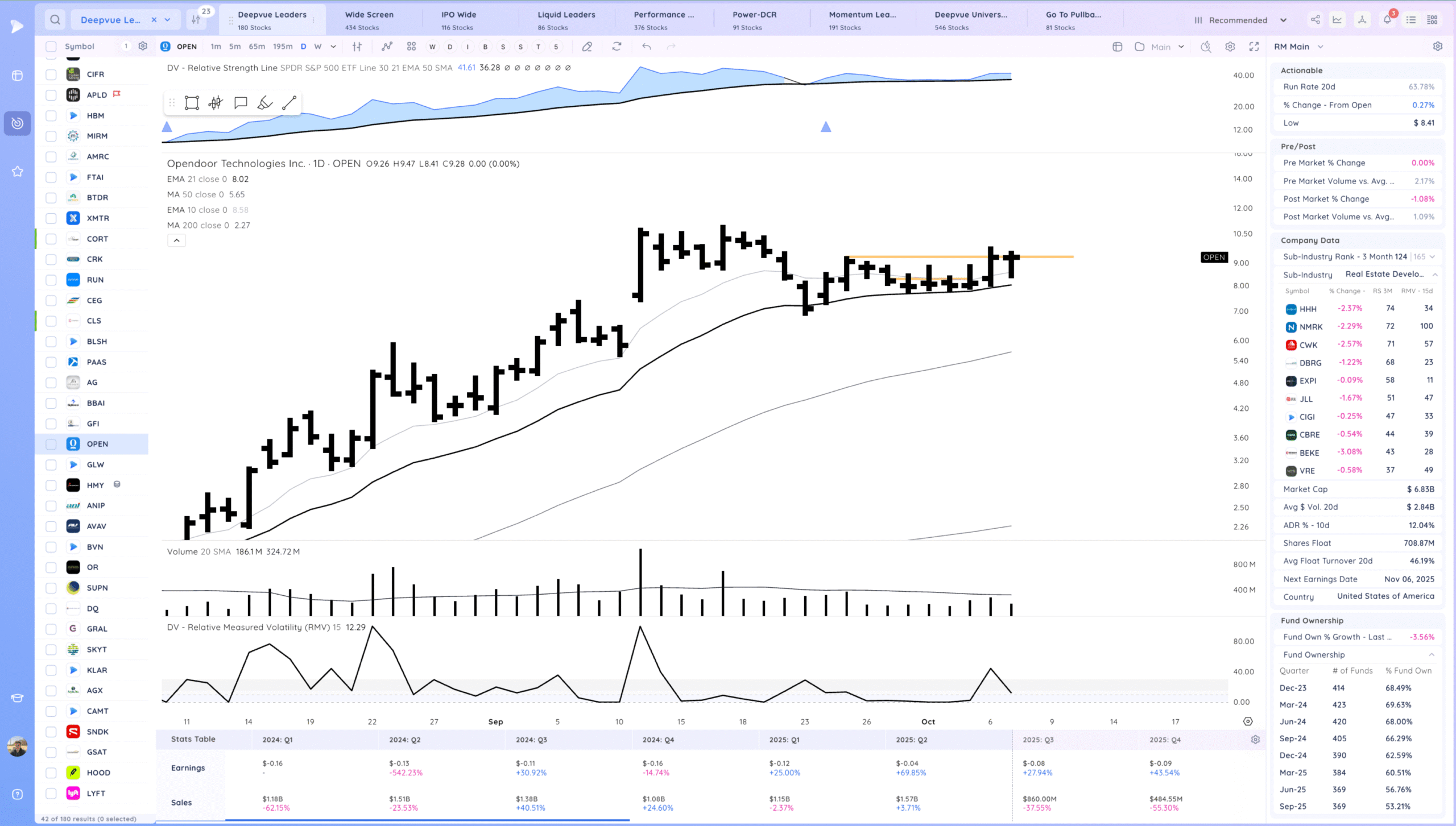

OPEN watching for a range breakout. Inside day. fast name

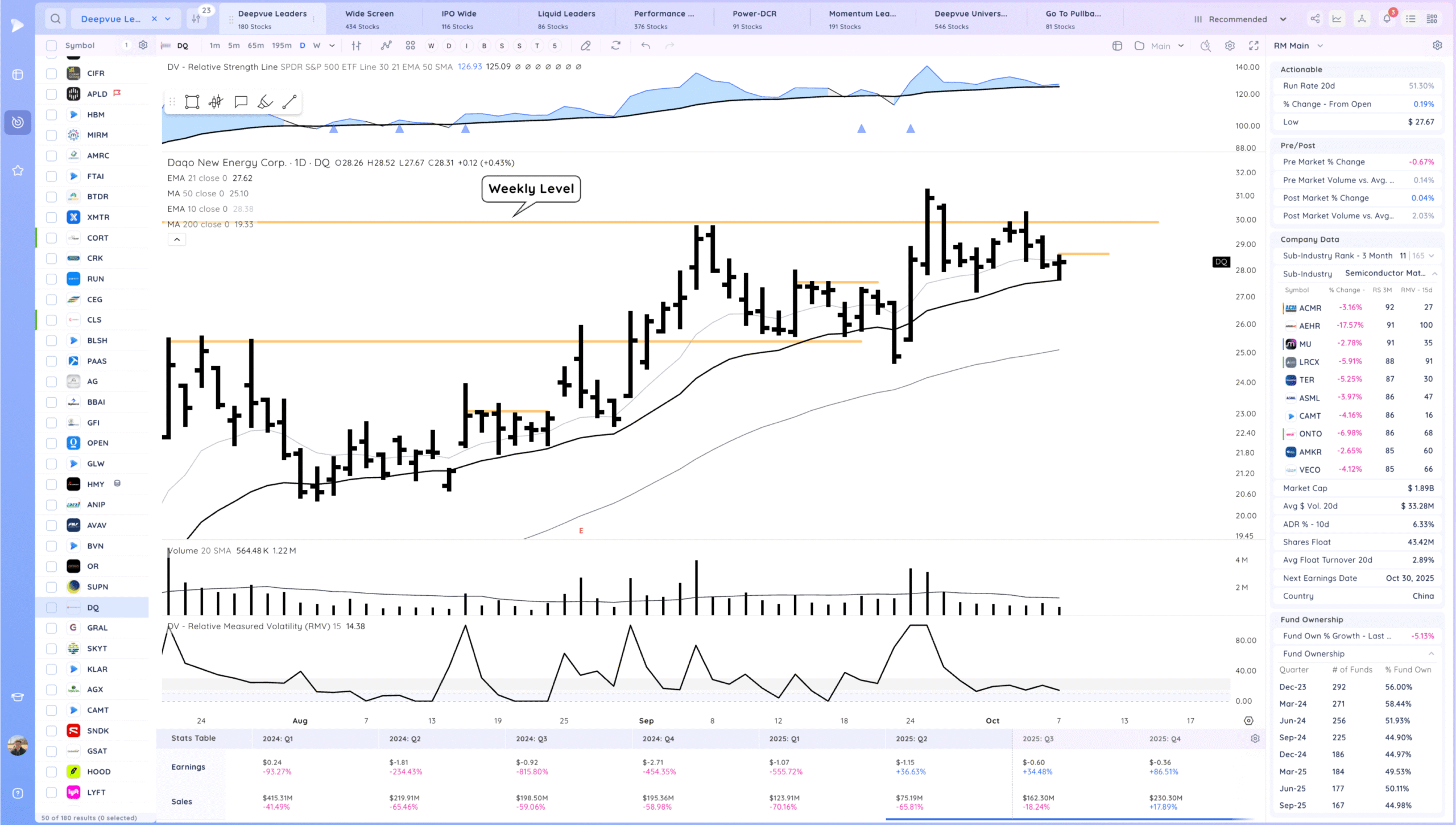

DQ watching for follow through up. Near big weekly level.

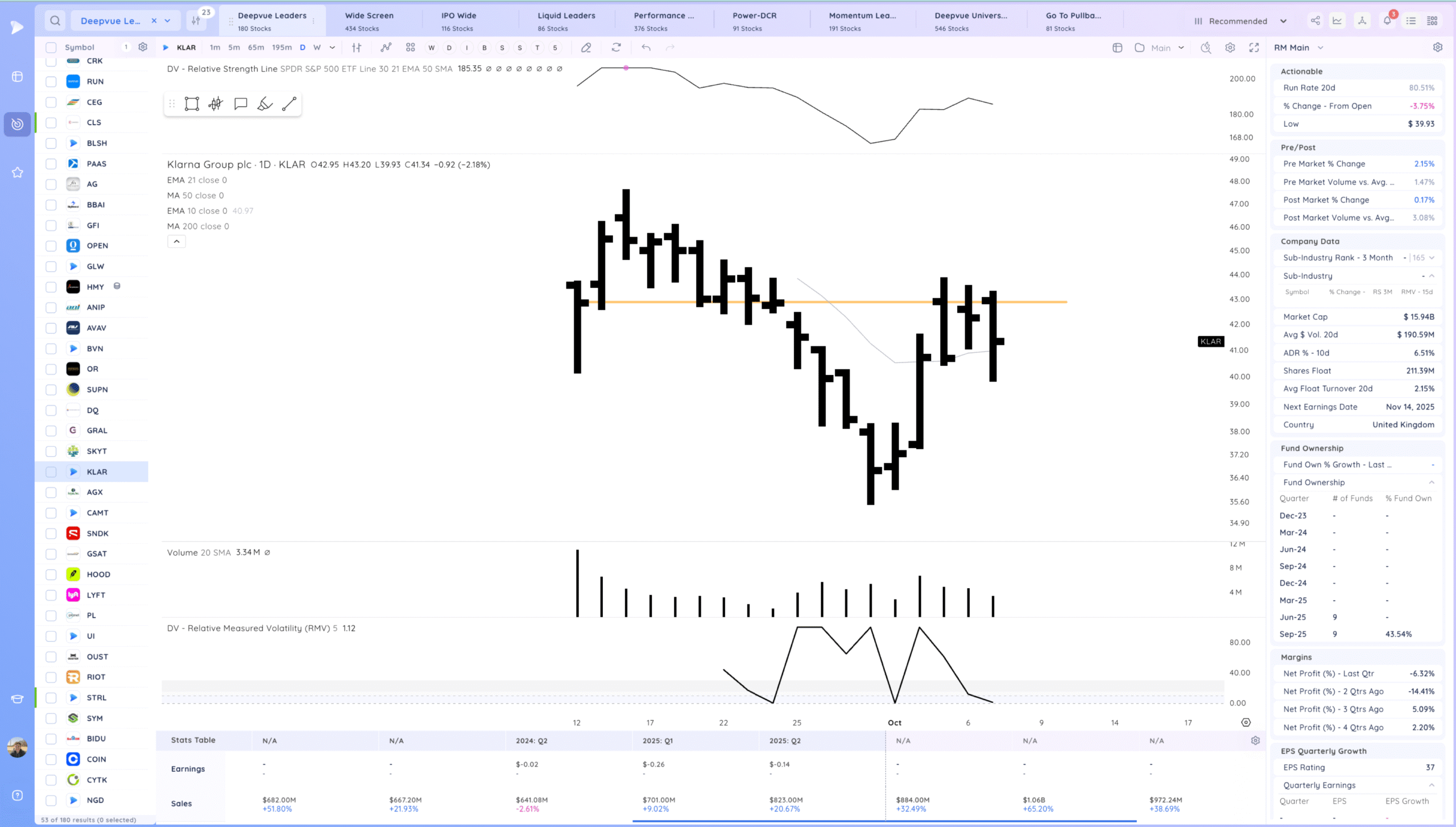

KLAR recent listing. Watching for a range breakout

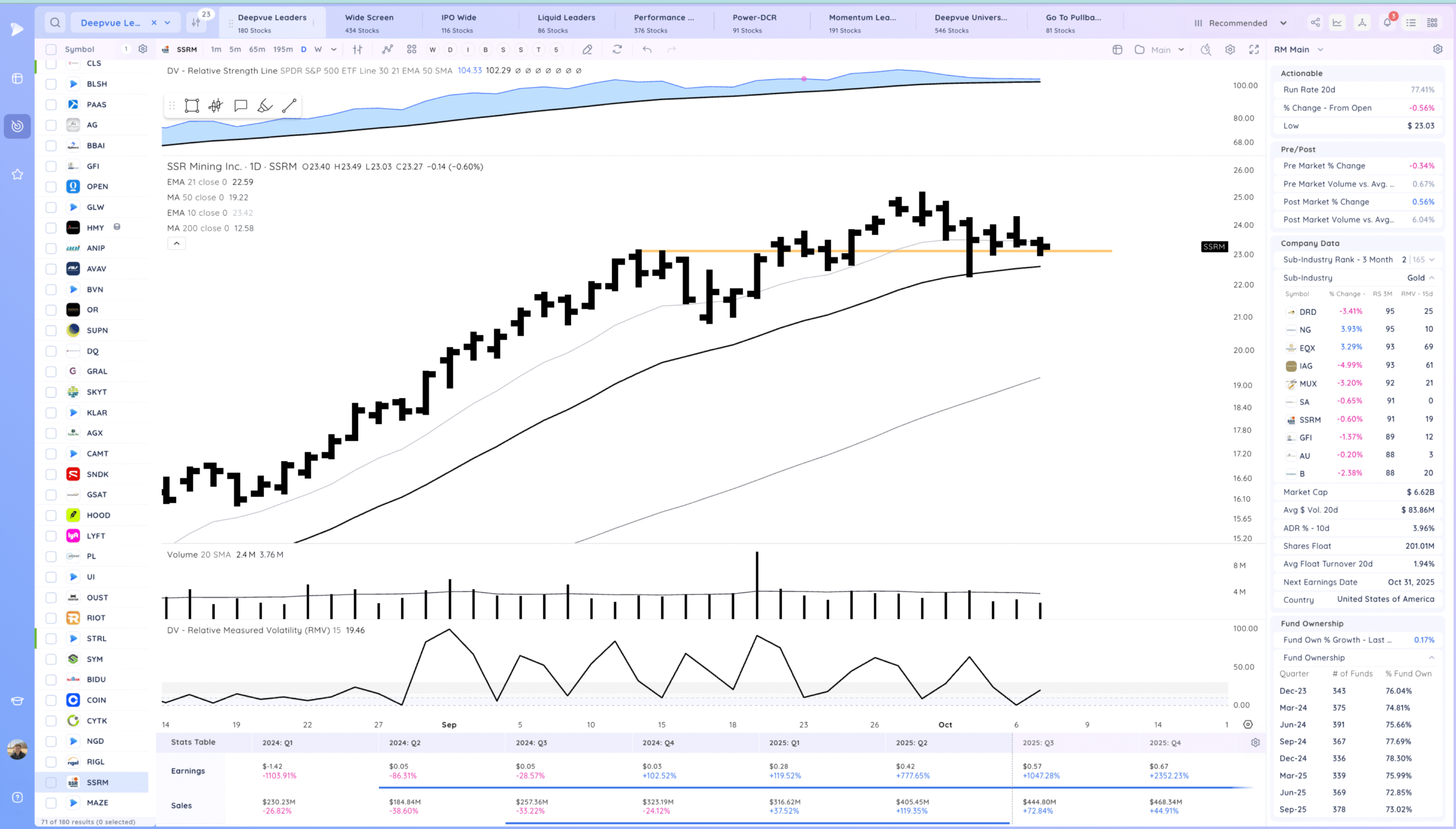

SSRM watching for a push off the consolidation pivot.

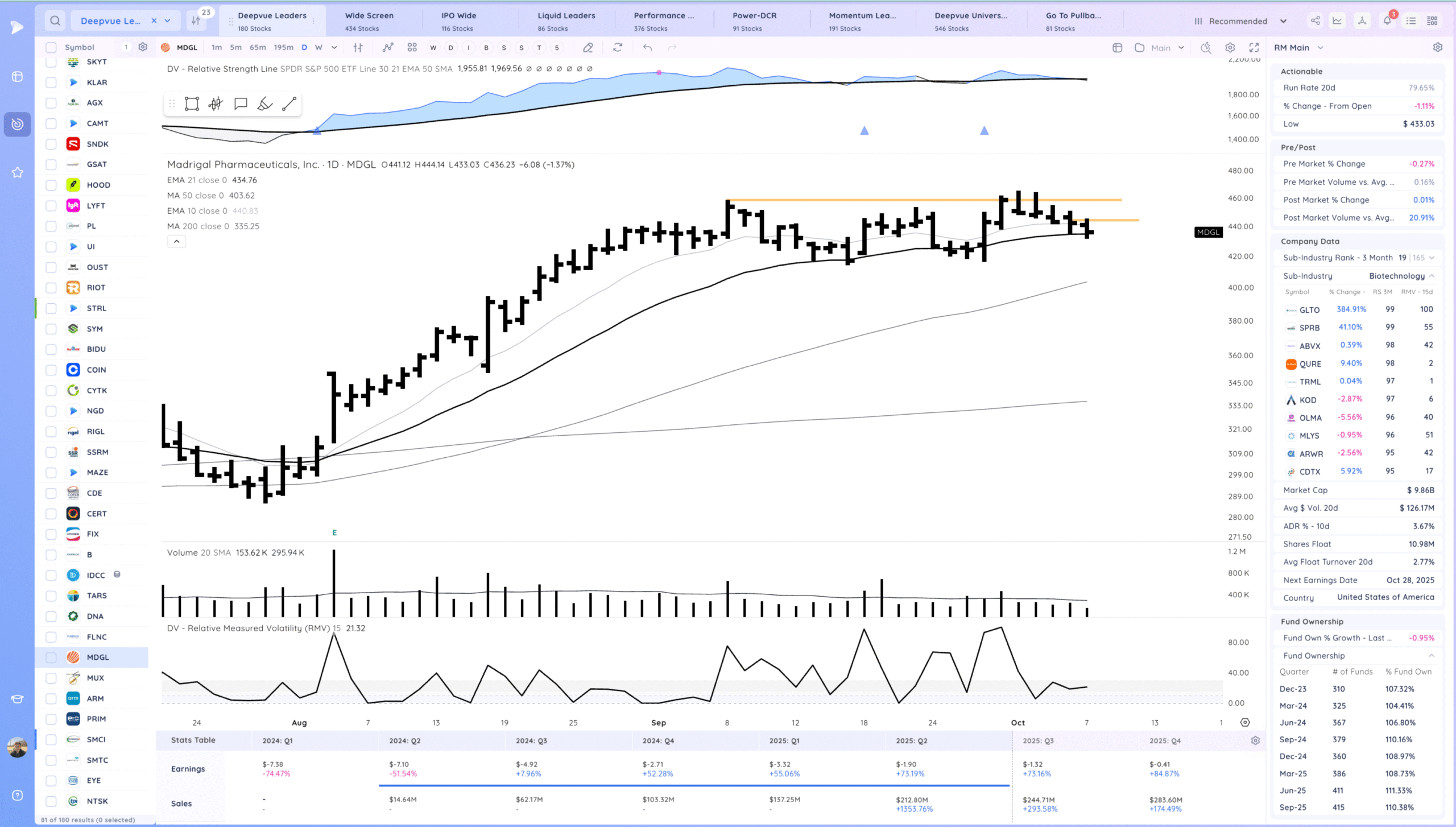

MDGL watching for a push off the 21ema. Biotech

Today’s Watchlist in List form

Focus List Names

CRCL BETR BLSH OPEN DQ KLAR SSRM MDGL ALAB

Focus:

OPEN ALAB SSRM CRCL

Themes

Strongest Themes: AI, Metals/Miners, Energy, Crypto

Market Thoughts

Didn’t like the action today given how we were looking strong but that transitioned to many downside reversals. Each day gives us clues about the health of the market. Yesterday was also something to note with the semi names not acting too well. The AI theme may need a pause to recoup strength.

That being said we are in an uptrend above all the moving averages. Manage positions versus those.

Anything can happen, Day by Day – Managing risk along the way