Downside Reversal. Some Areas of Interest

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

January 3, 2026

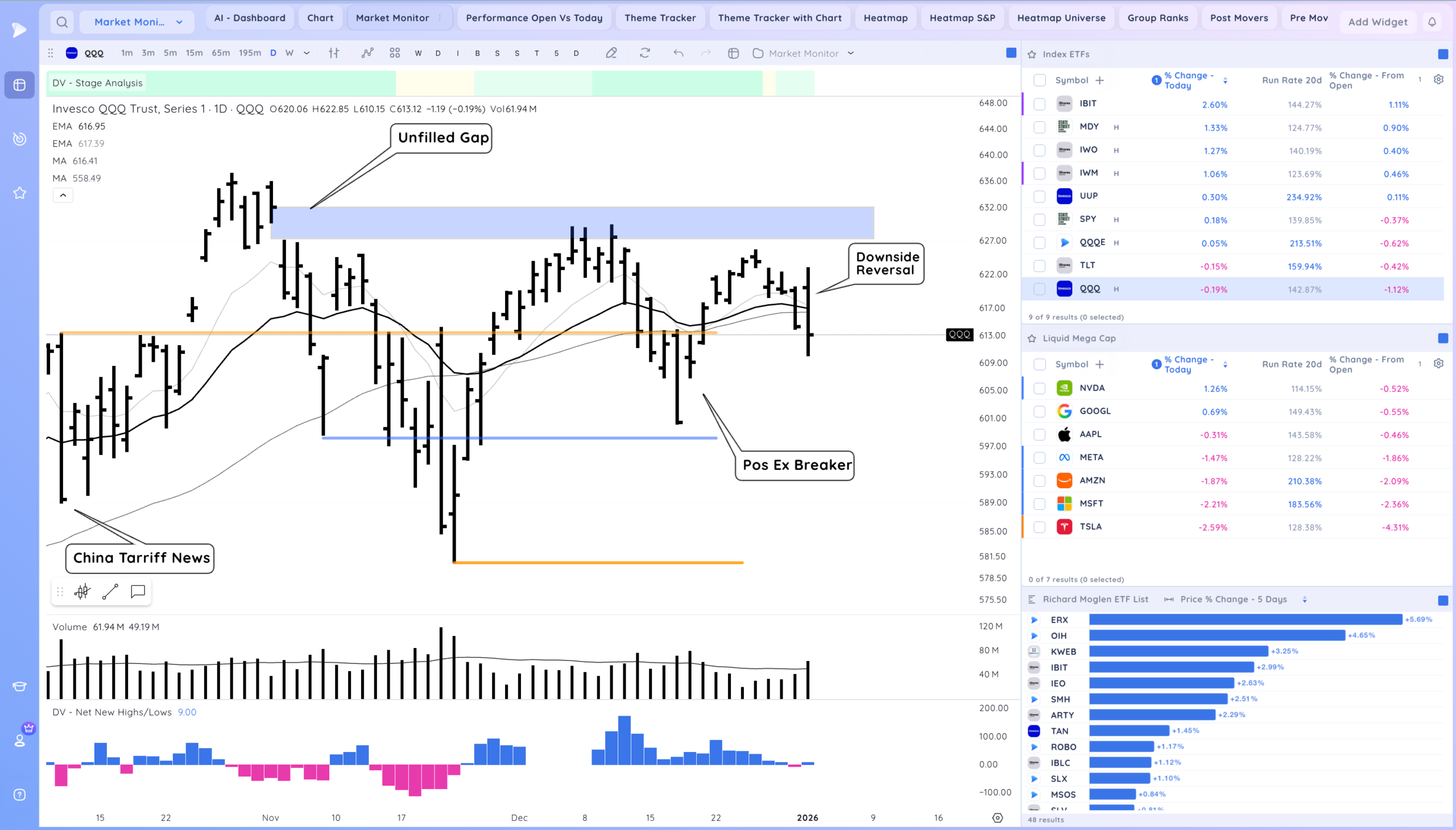

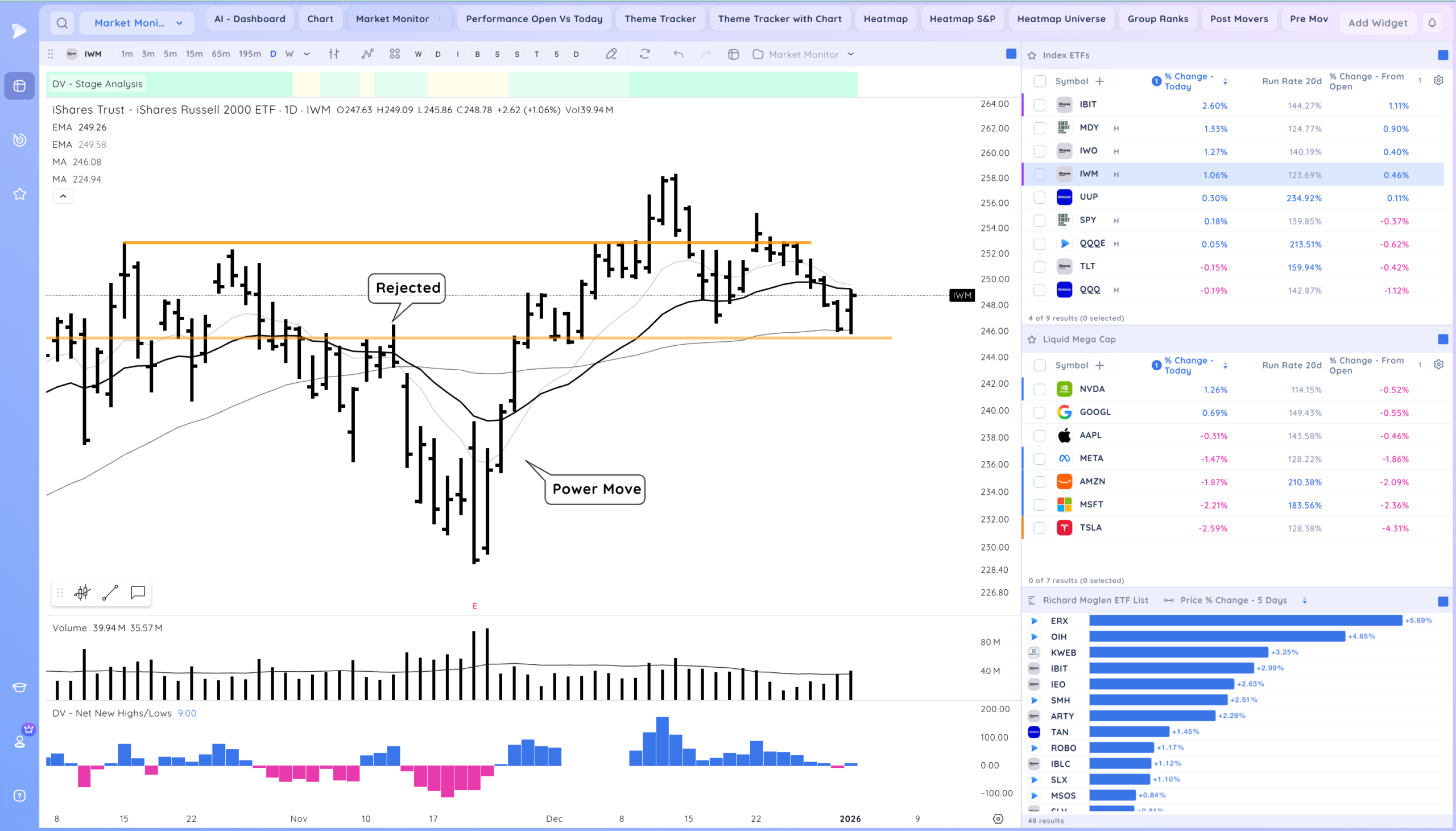

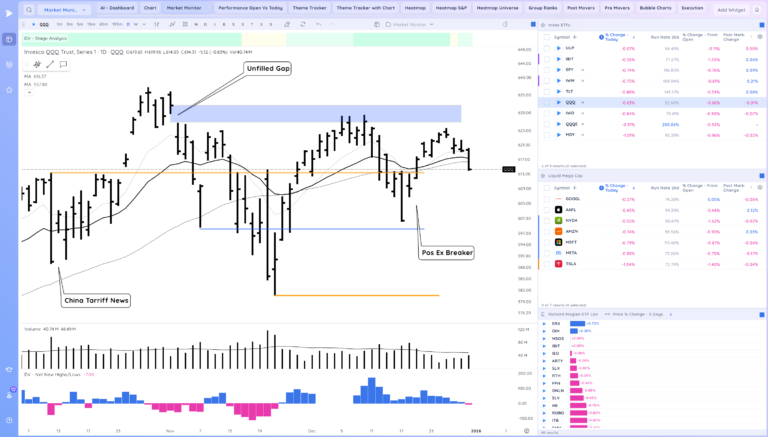

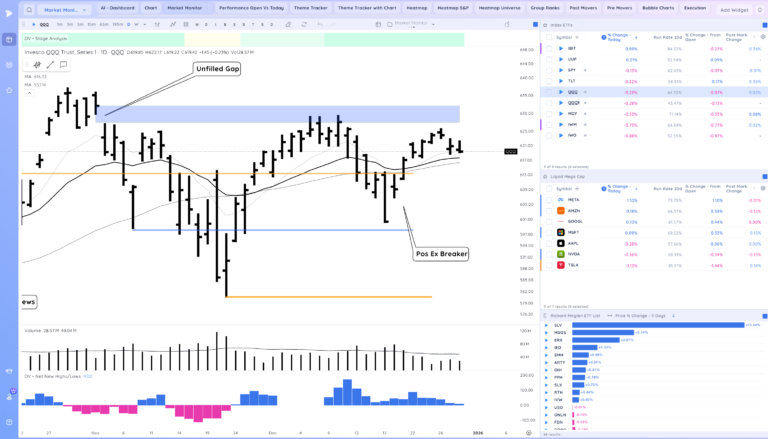

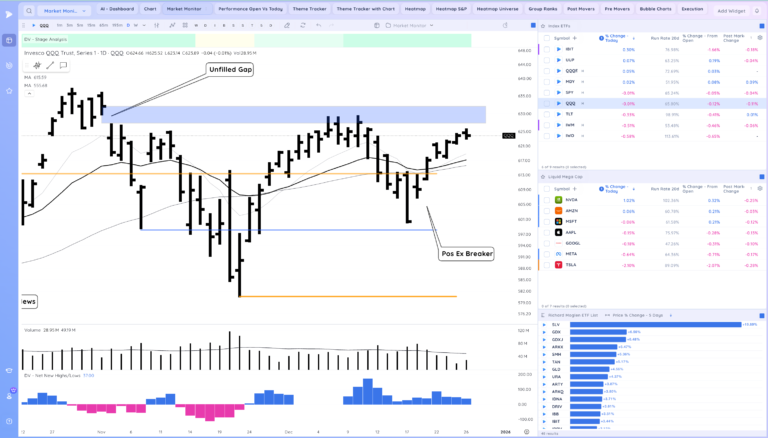

Market Action

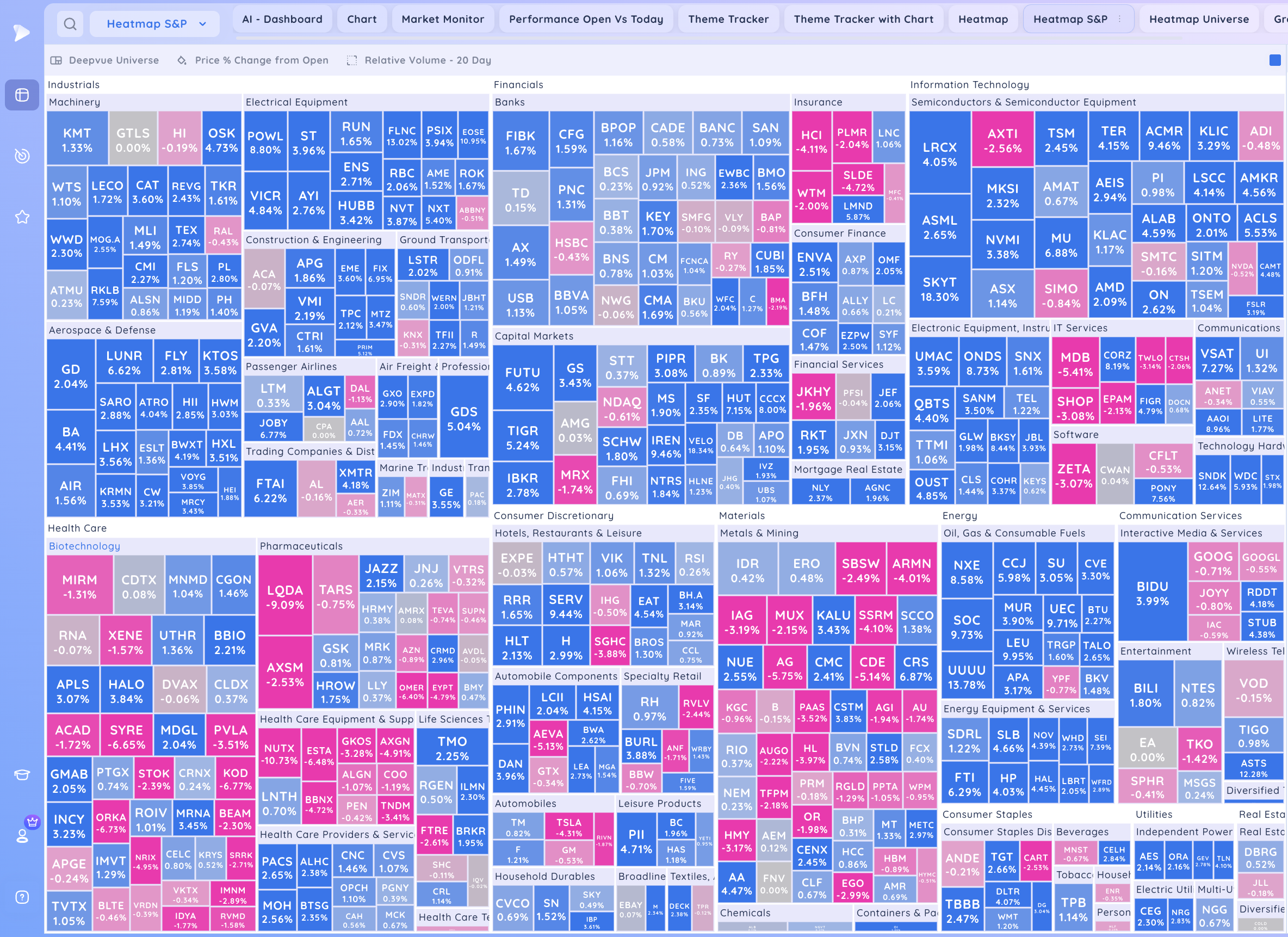

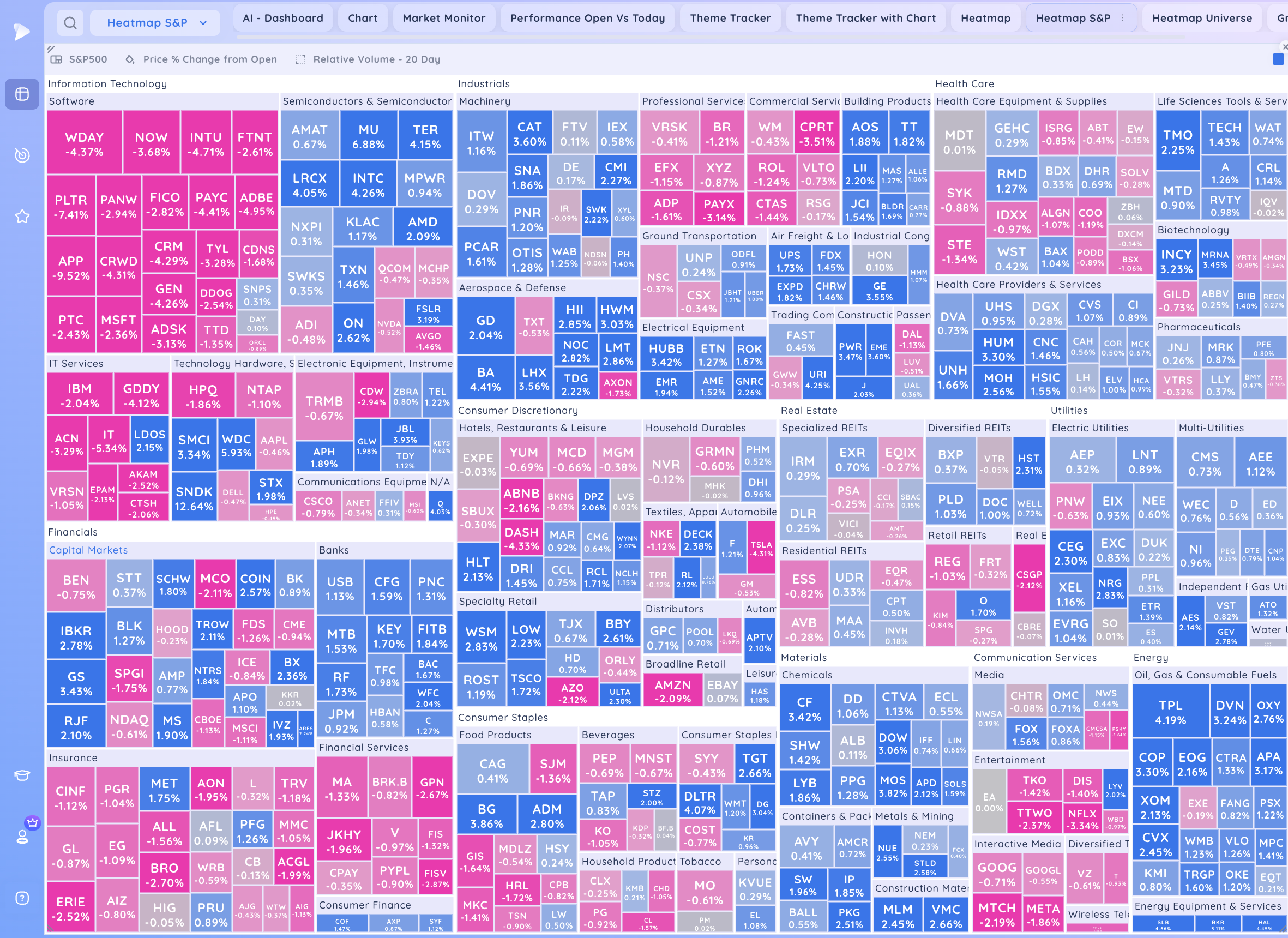

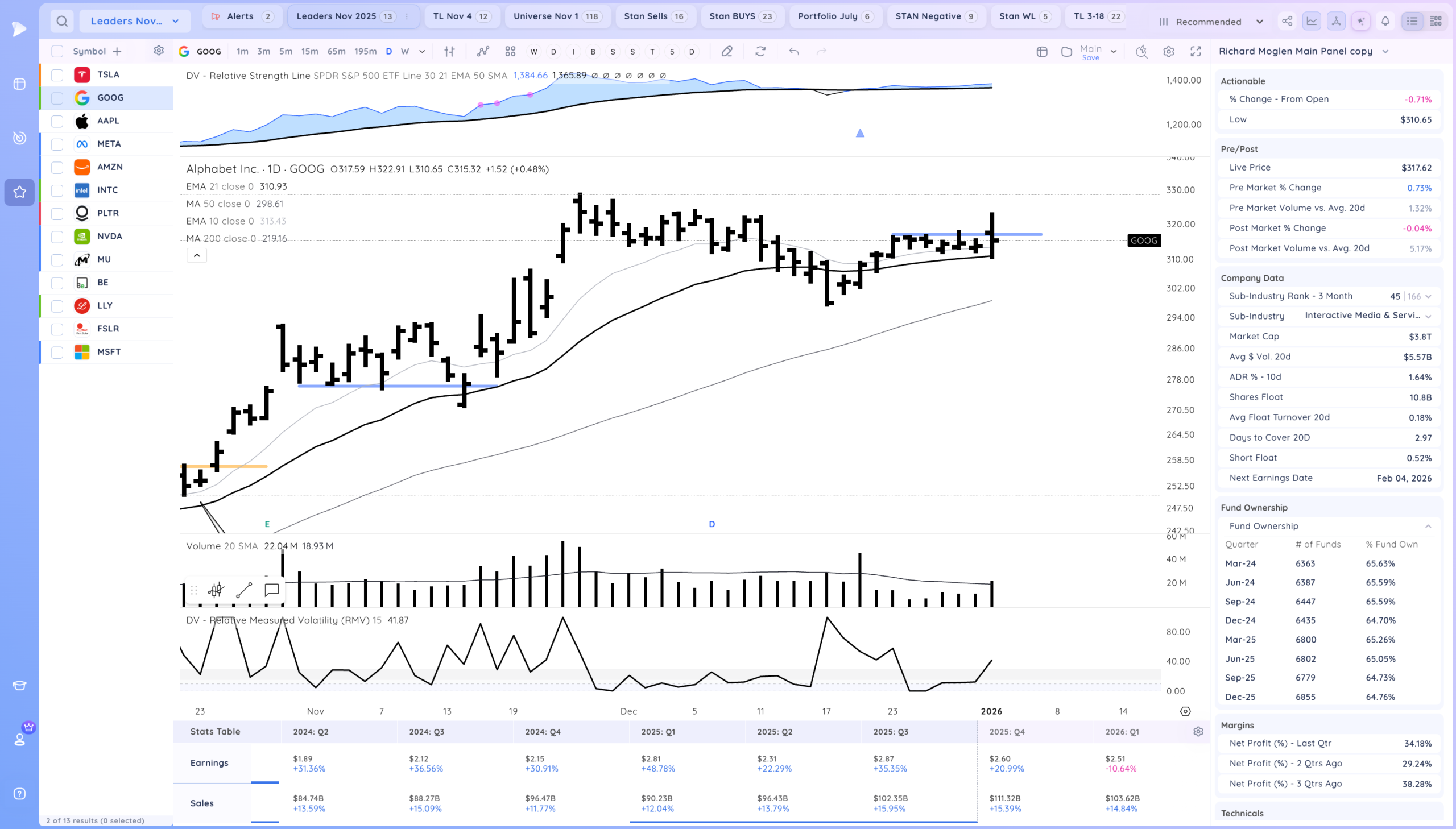

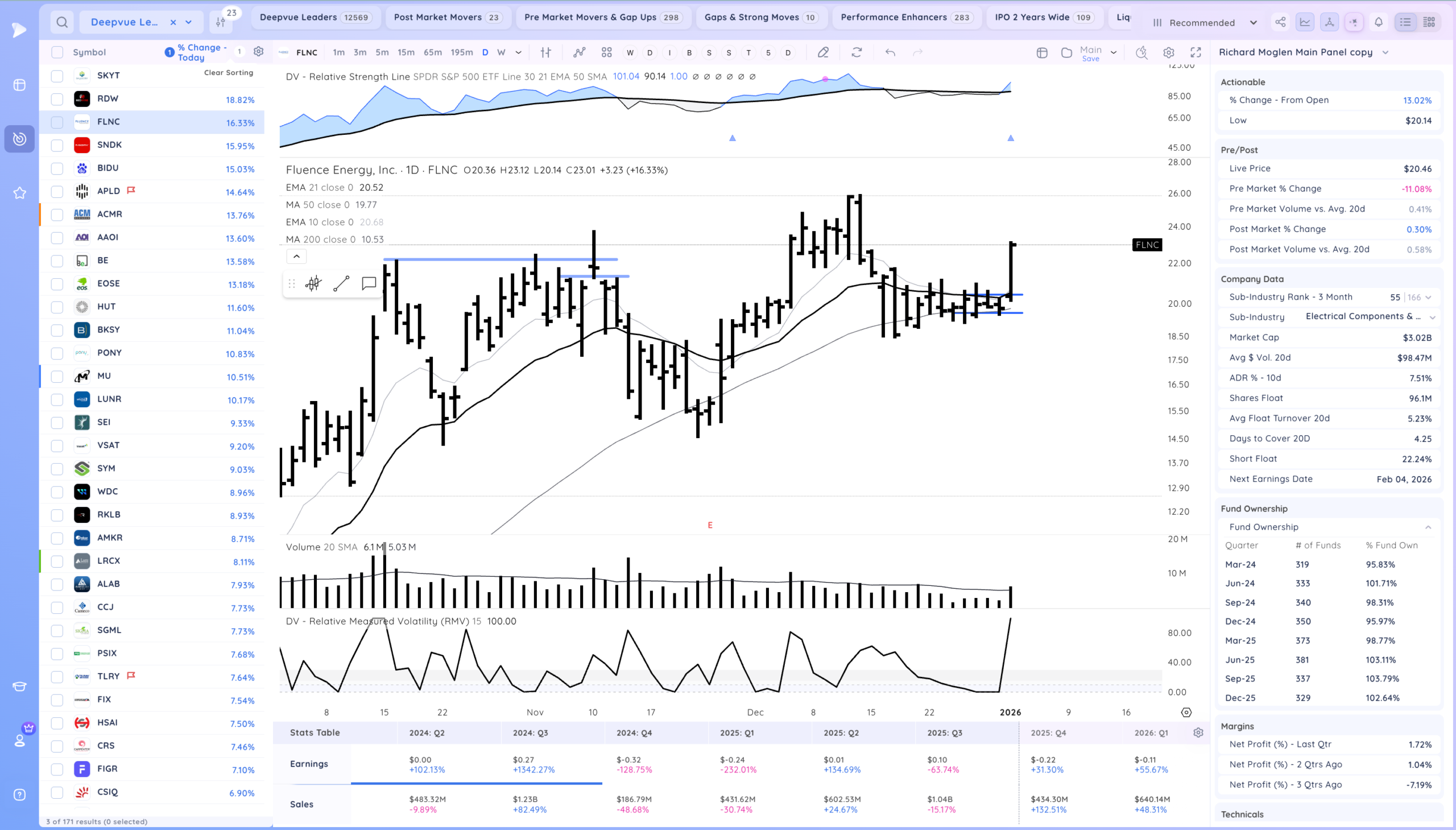

Downside reversal after the gap up. TSLA PLTR GOOG showed weakness/volatility but interestingly some semi names held up much better. Space theme continues to stand out

Bulls want to see a positive expectation breaker Monday that holds and reclaims the 21ema

Bears want to see follow through down

Overall we are in a choppy environment

Trends 1/4 Up – based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Below

Intermediate term – 50 sma – Below

Longterm – 200 sma – Up – Above Rising

Current View: Choppy/Corrective

Groups/Sectors

Leadership Stocks & Analysis

Key Moves

Continue Reading The Full Trade Lab Report

Get instant access to comprehensive market analysis that cuts through the noise and shows you exactly where the opportunities are