Trending

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 9, 2025

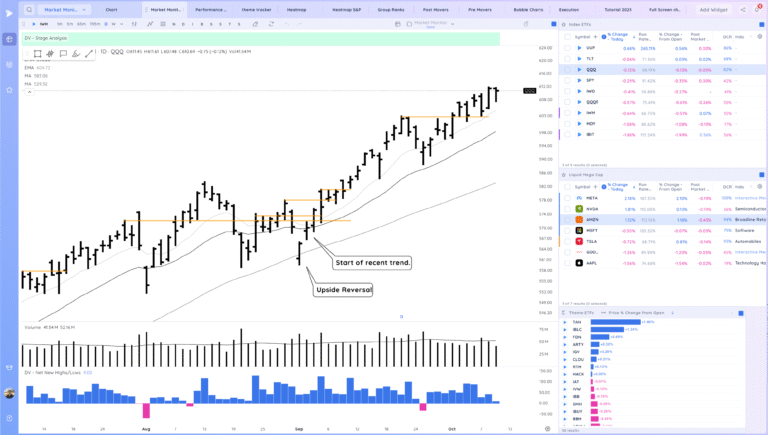

Market Action

QQQ – Inside day and a strong close as we continue to trend above the moving averages.

Bulls want to see us continue to trend above the 10ema

Bears want to see a sharp reversal closing below the 10ema

Daily Chart of the QQQ.

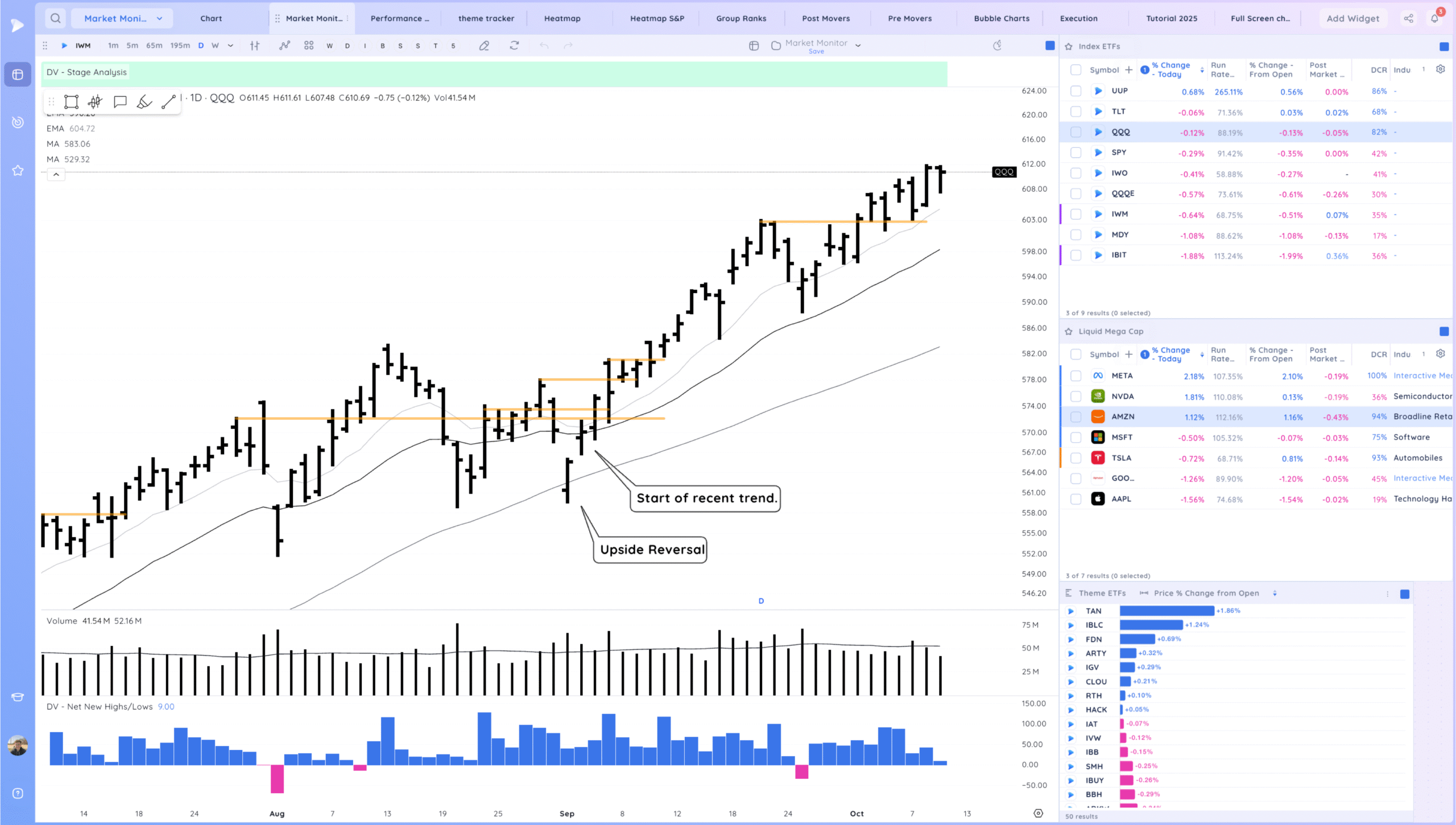

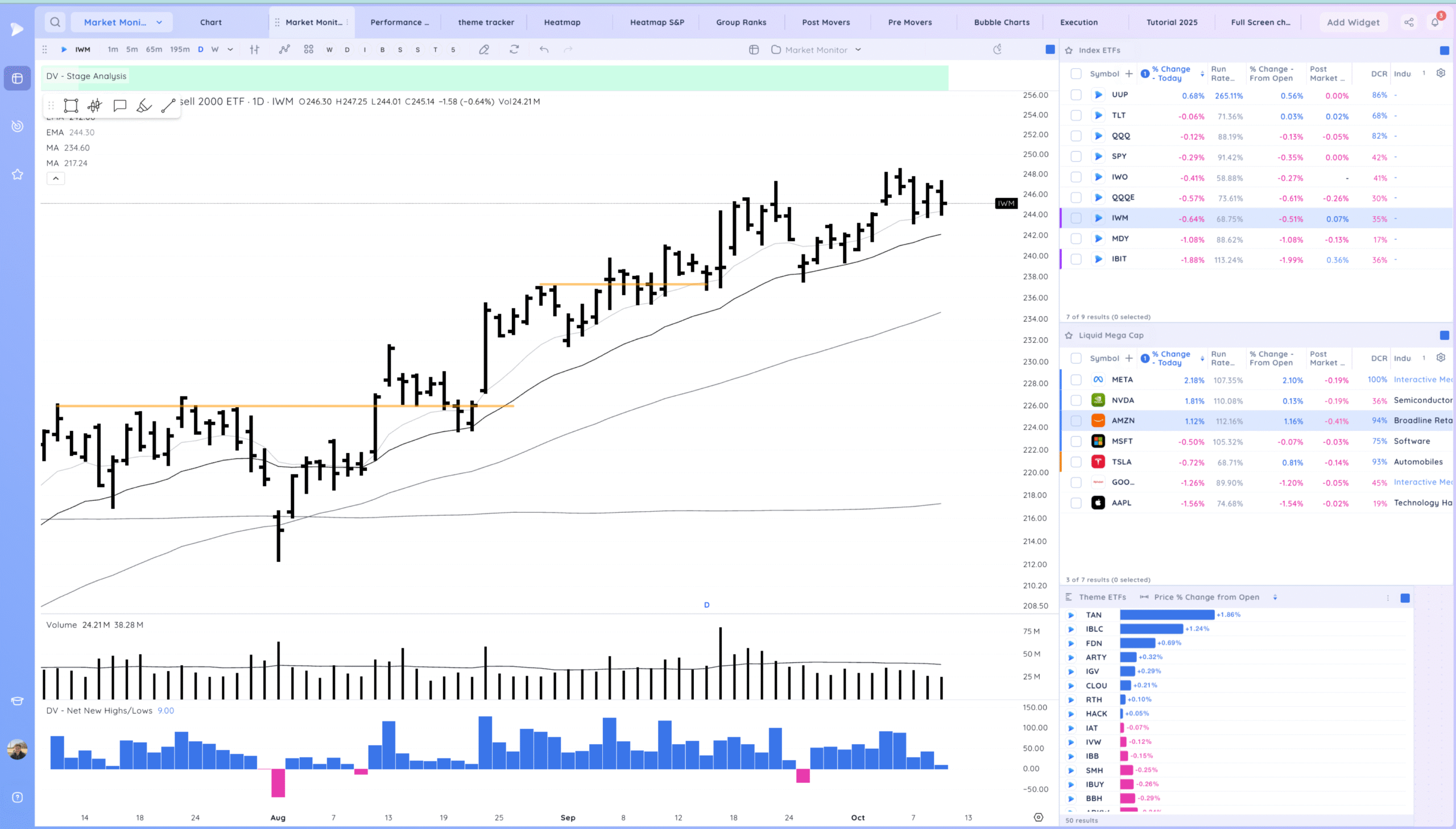

IWM – Consolidation Day. Trending above the MAs

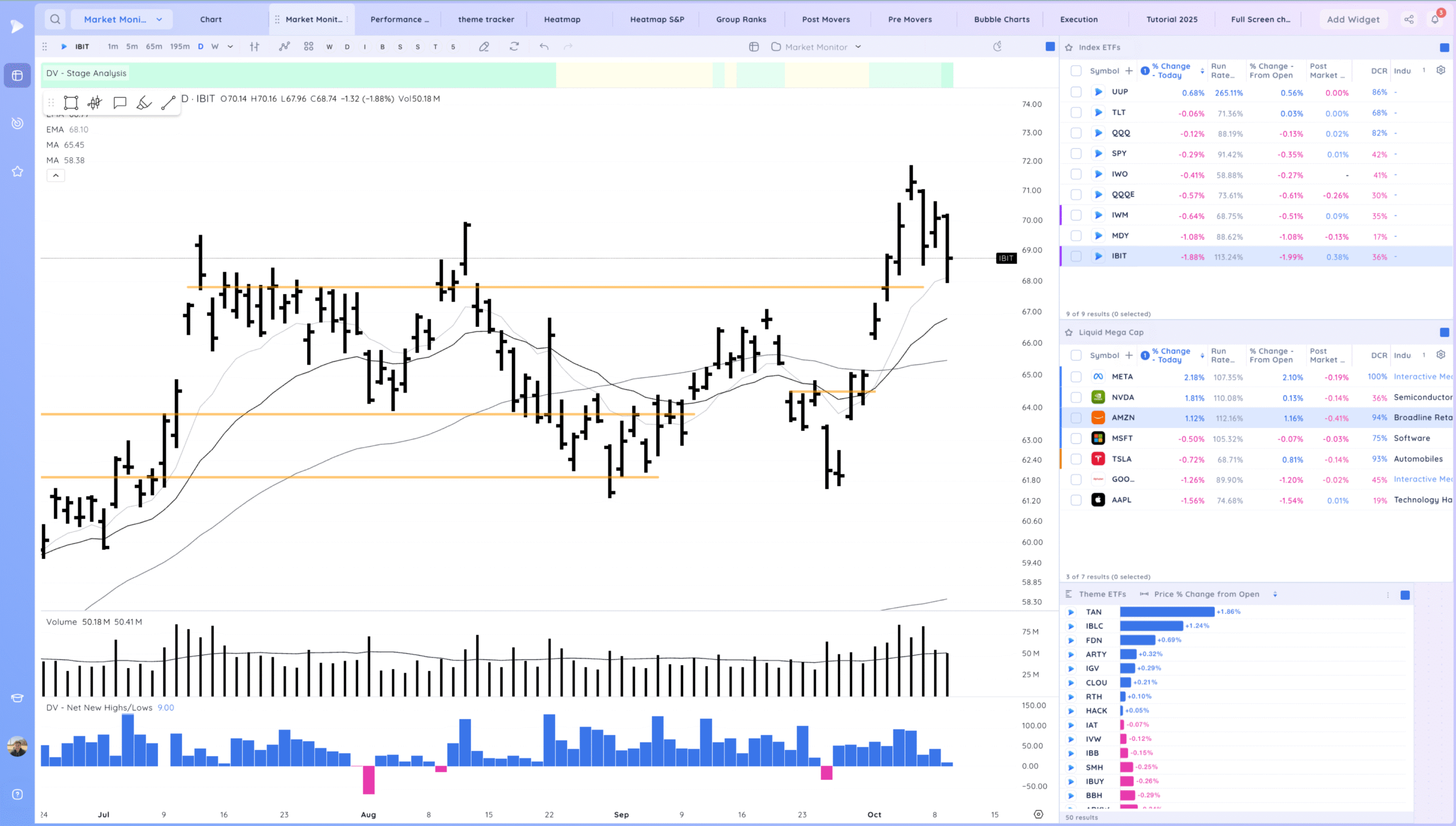

IBIT – Continuing to pullback but bounce off lows. Watching for a pivot to form now

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

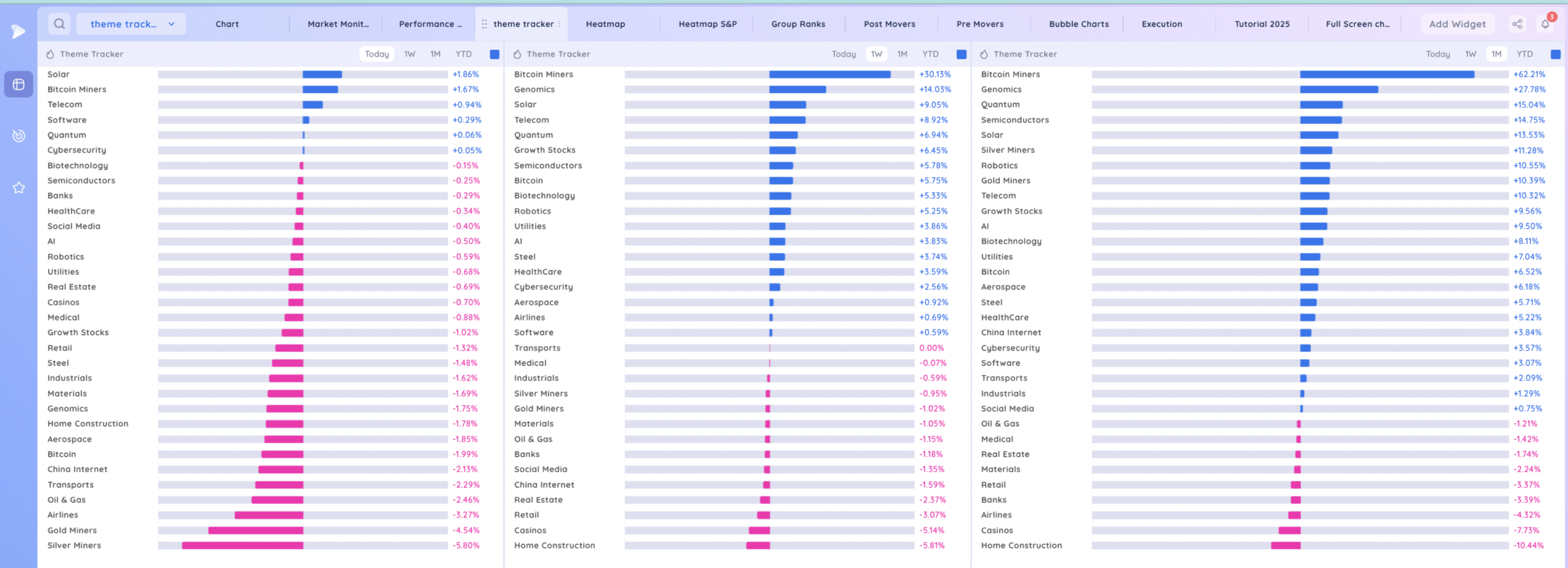

Deepvue Theme Tracker

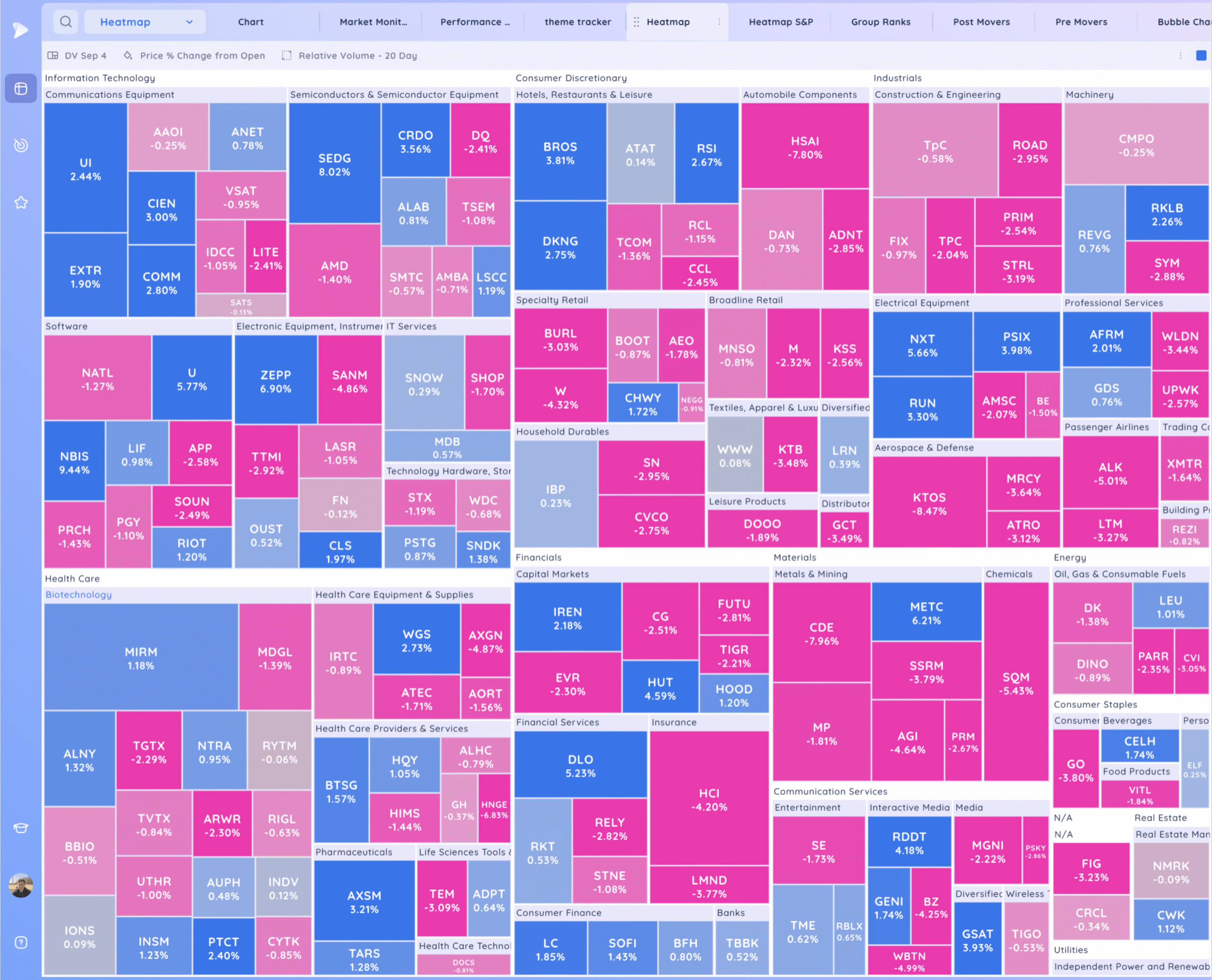

Deepvue Leaders

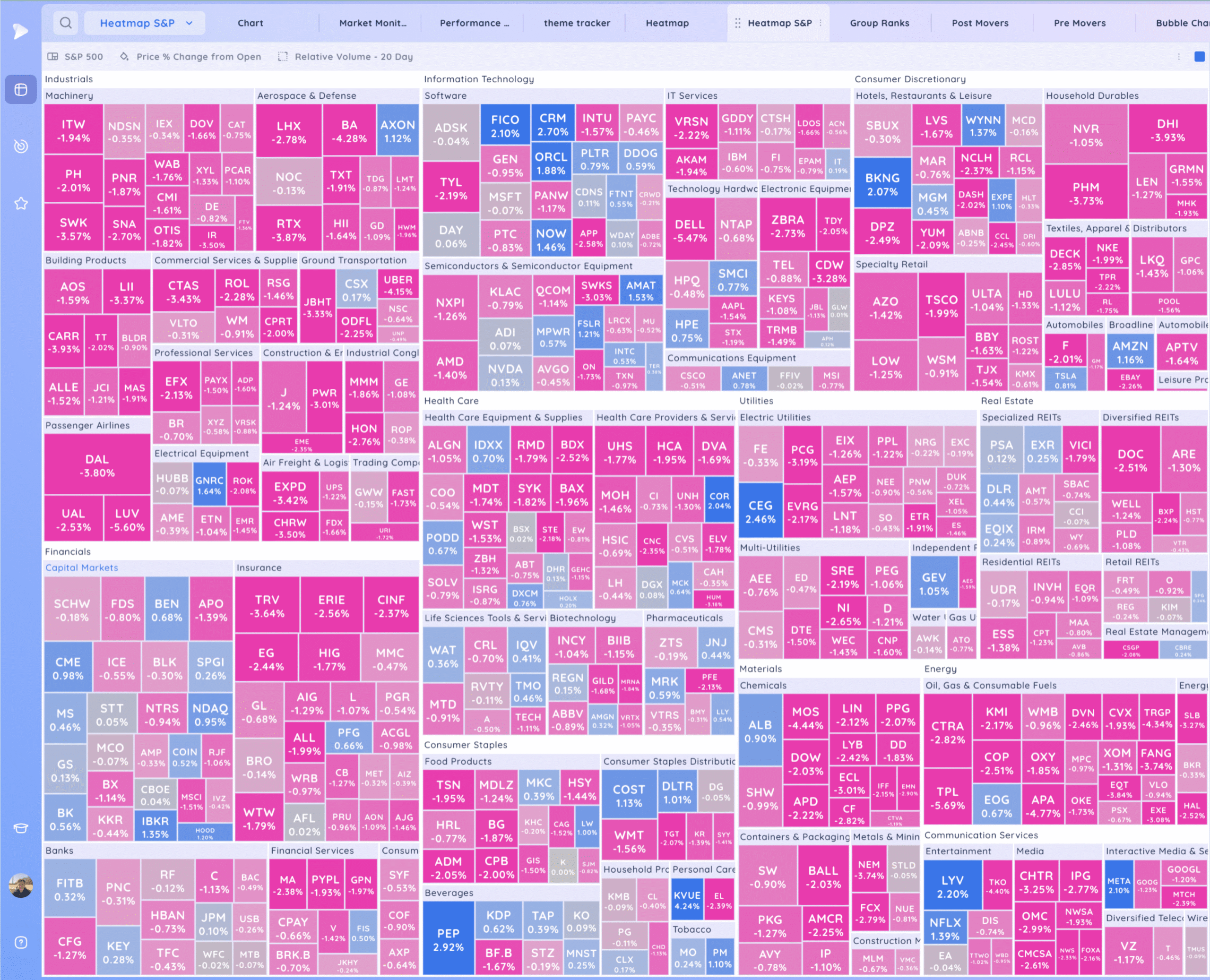

S&P 500.

Leadership Stocks & Analysis

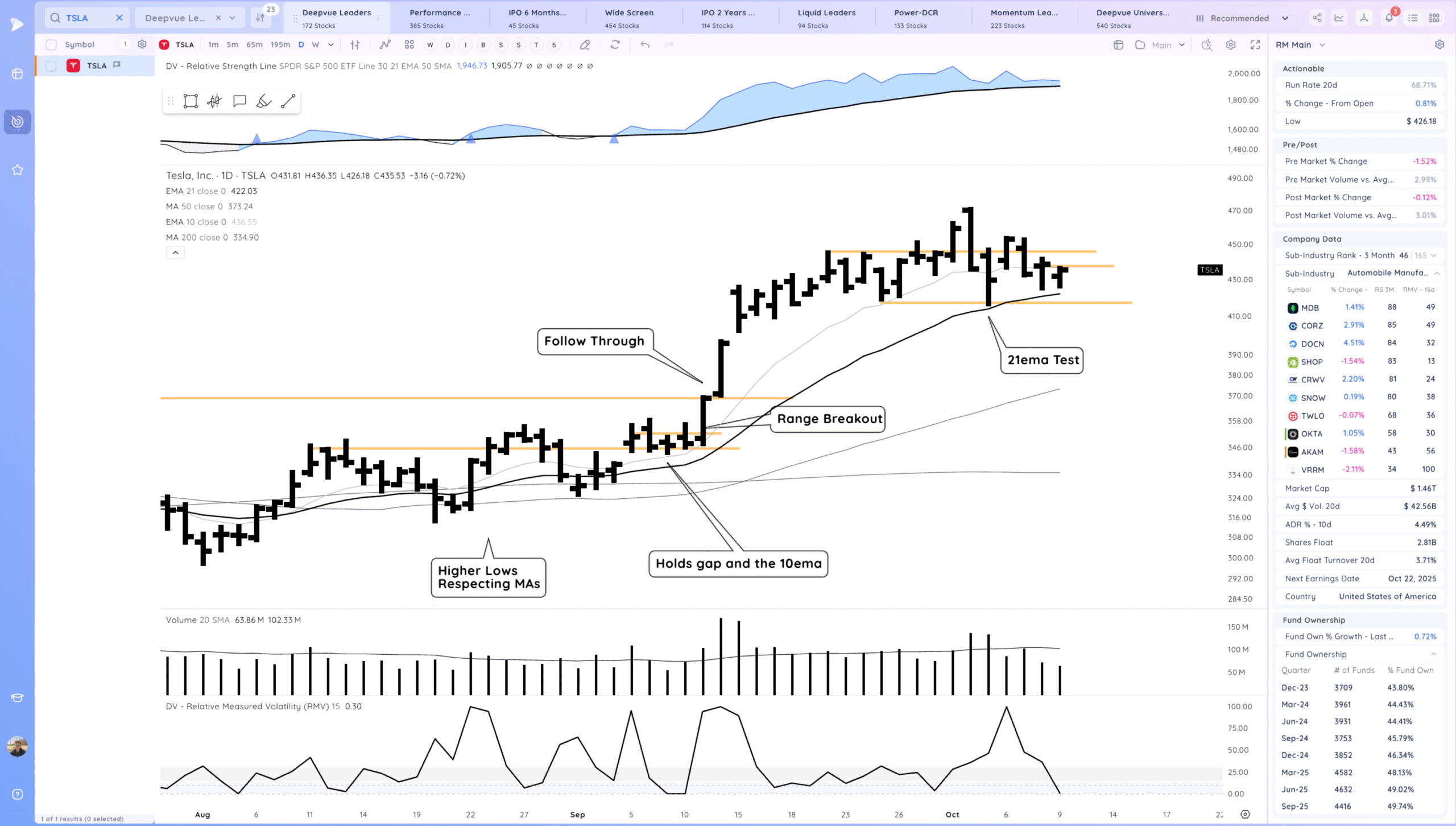

TSLA – inside day on the 21ema. Watching for a range breakout higher

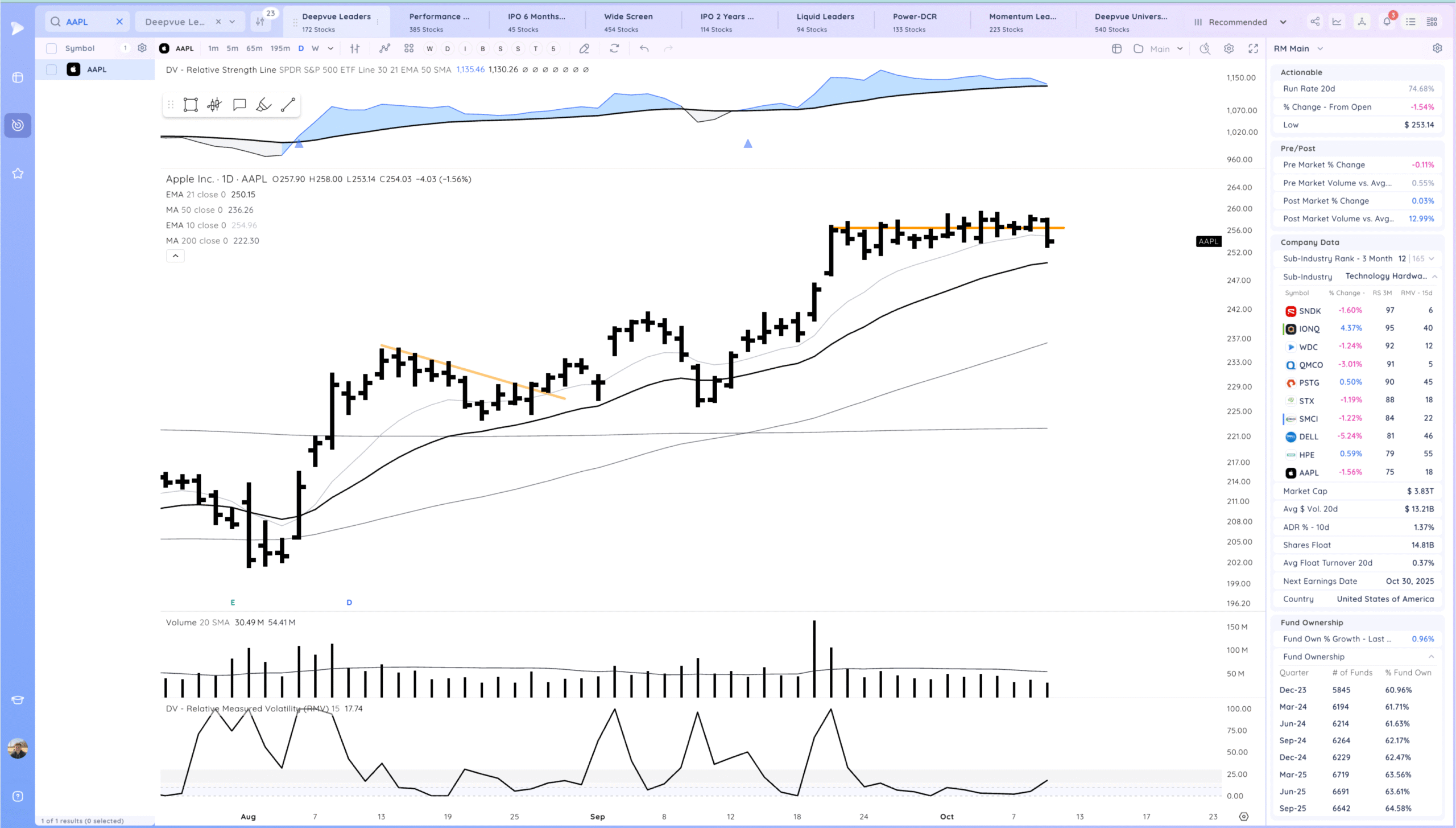

AAPL Break lower from the tight range. Ideally reclaims quickly

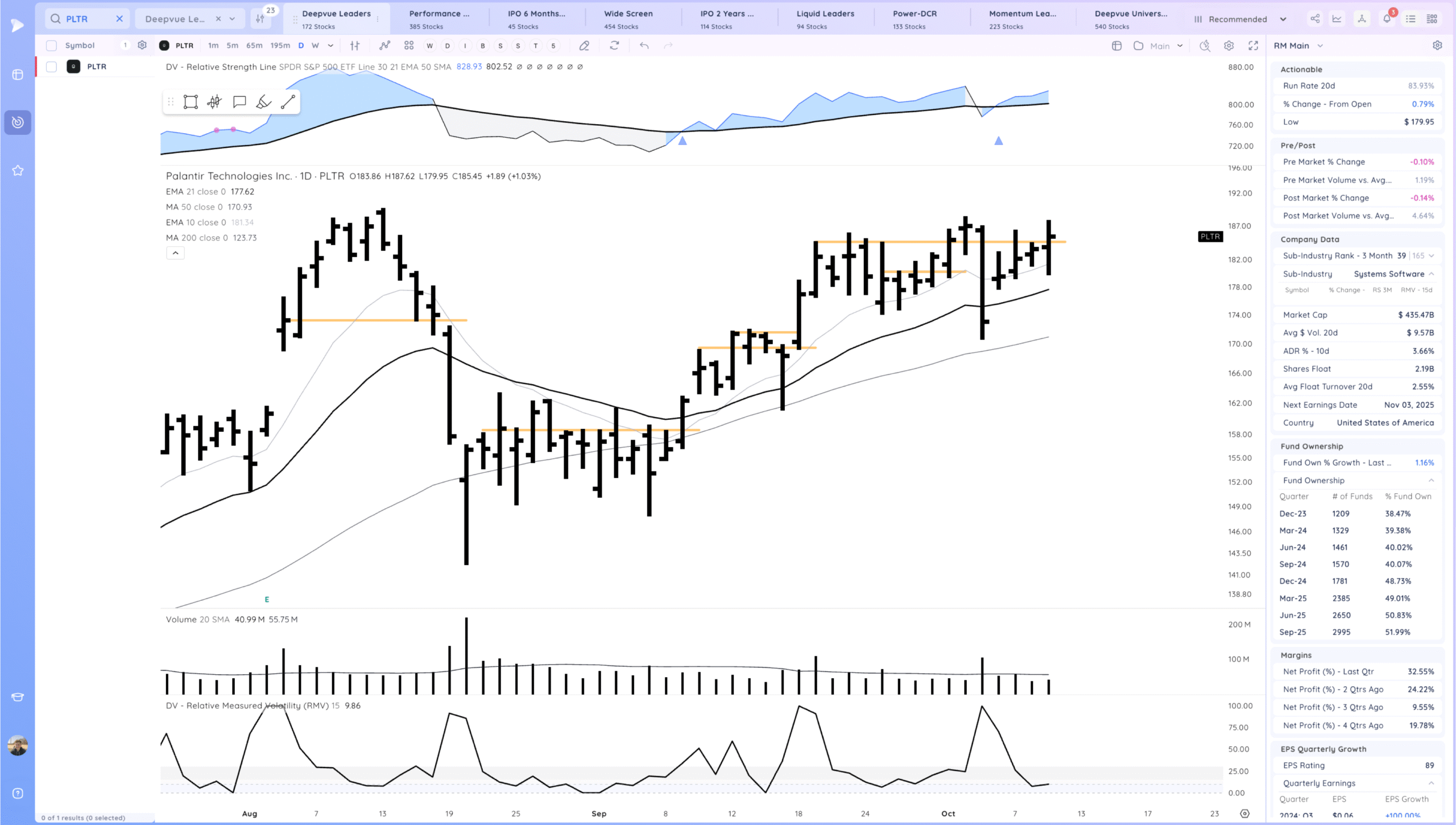

PLTR Volatile day but overall positive outside day within this handle. Watching for follow through up

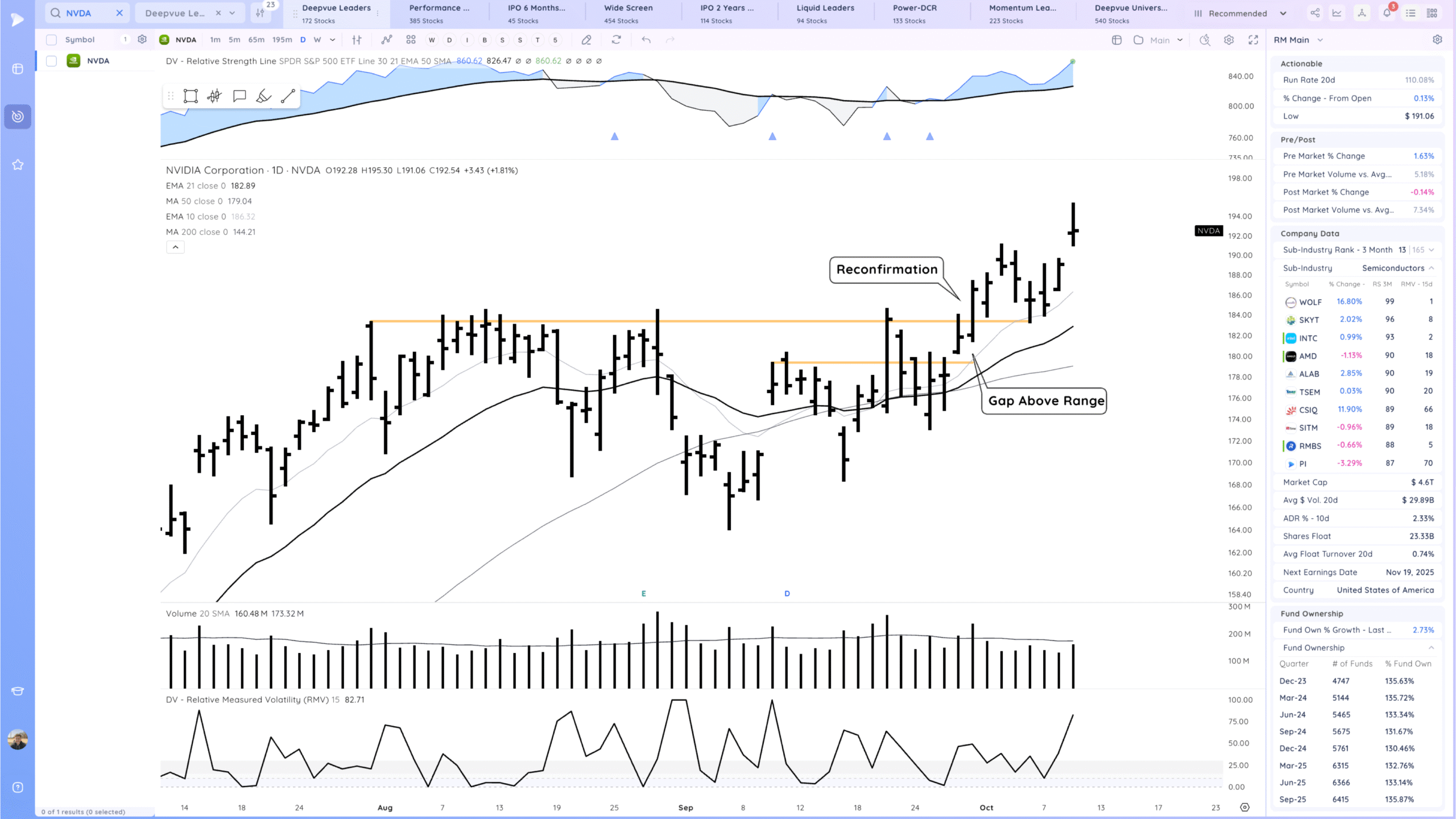

NVDA Gap higher but a fade off highs. Trending above the MAs. 21ema almost equal with the base pivot

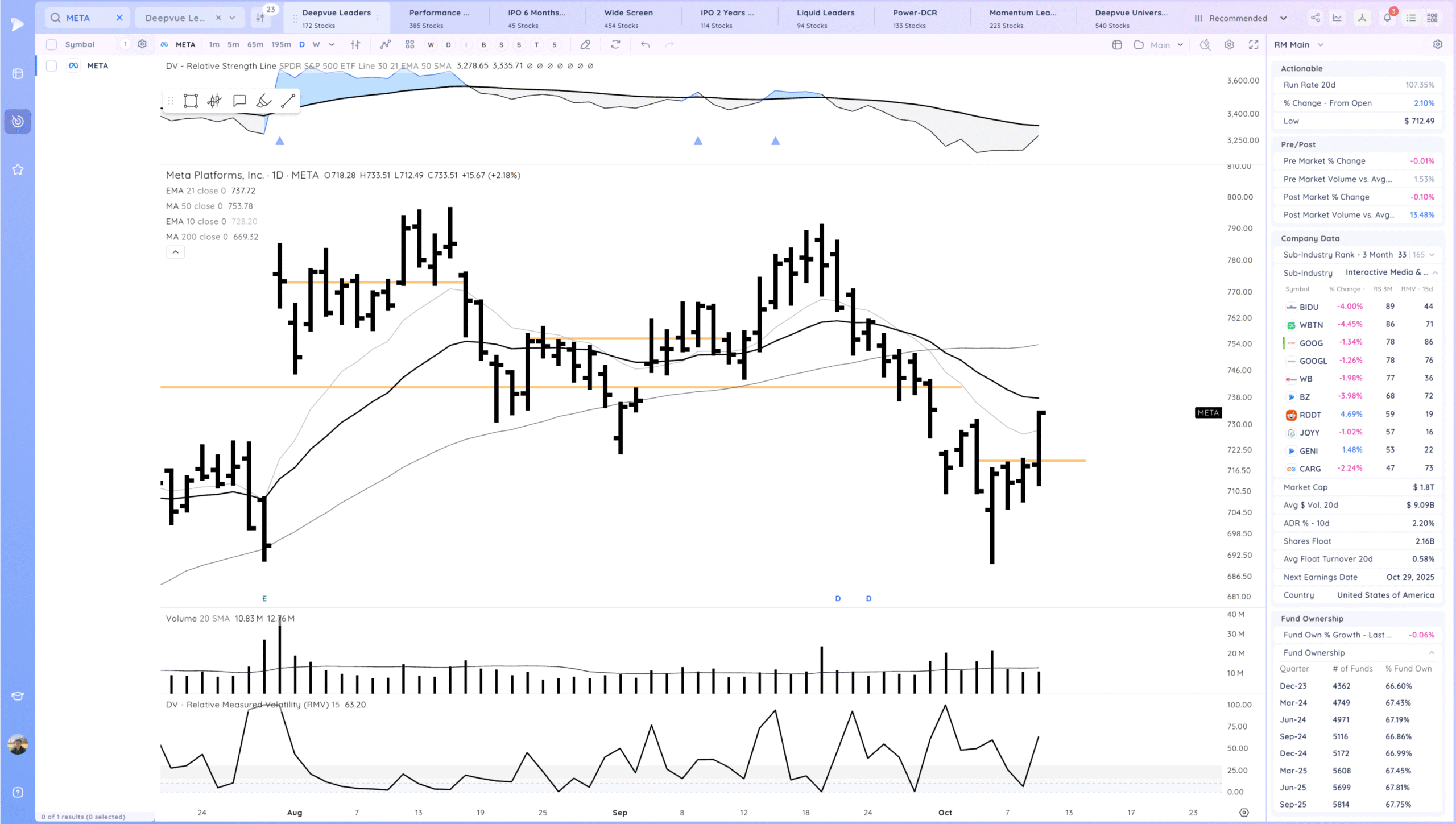

META Strong follow though up from the bottoming range. Expecting some pause near the 21ema area

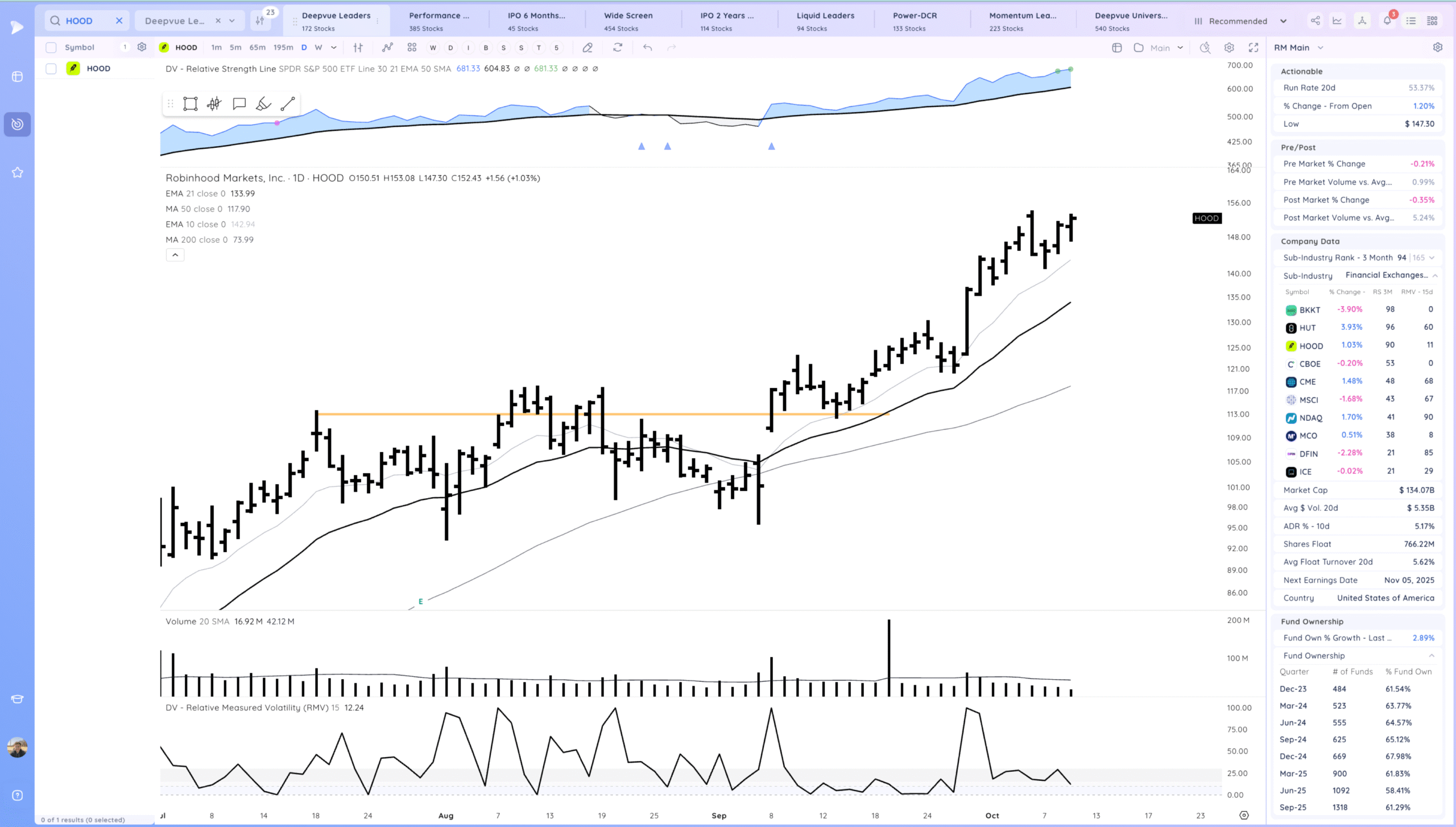

HOOD Trending above the MAs

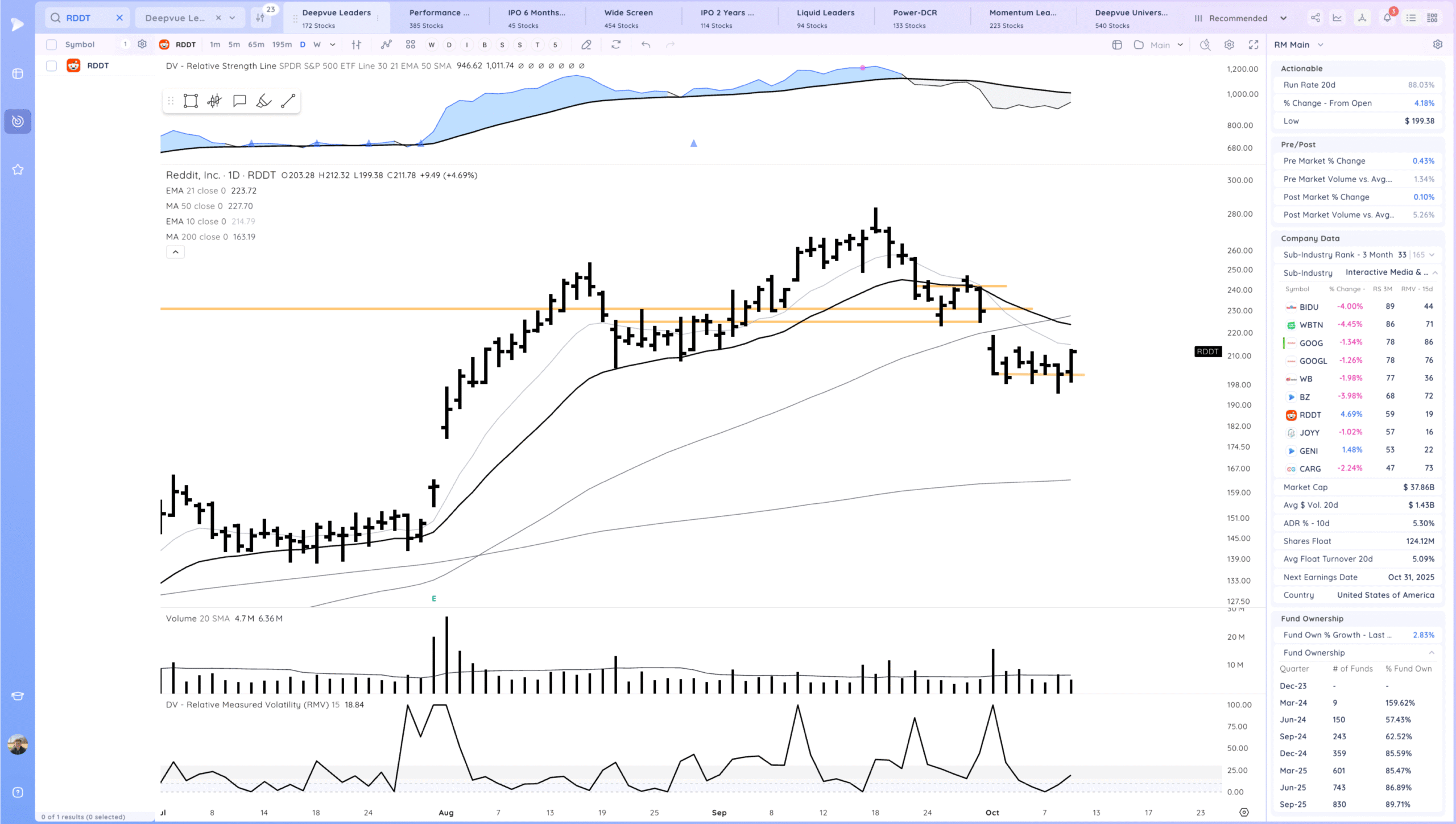

RDDT Starting to push up from the bottoming range

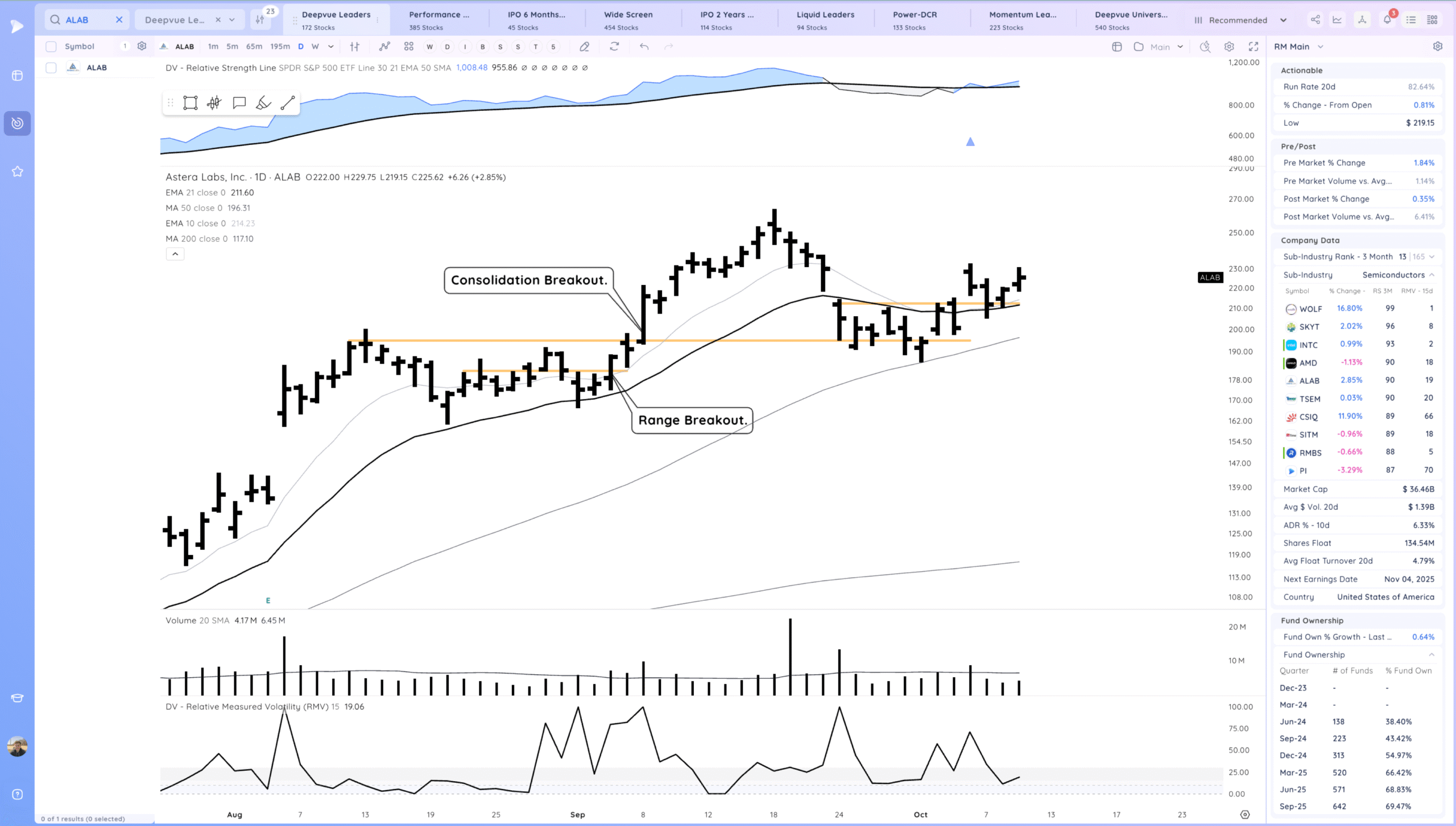

ALAB Slight move higher from the inside day. watching for tightening

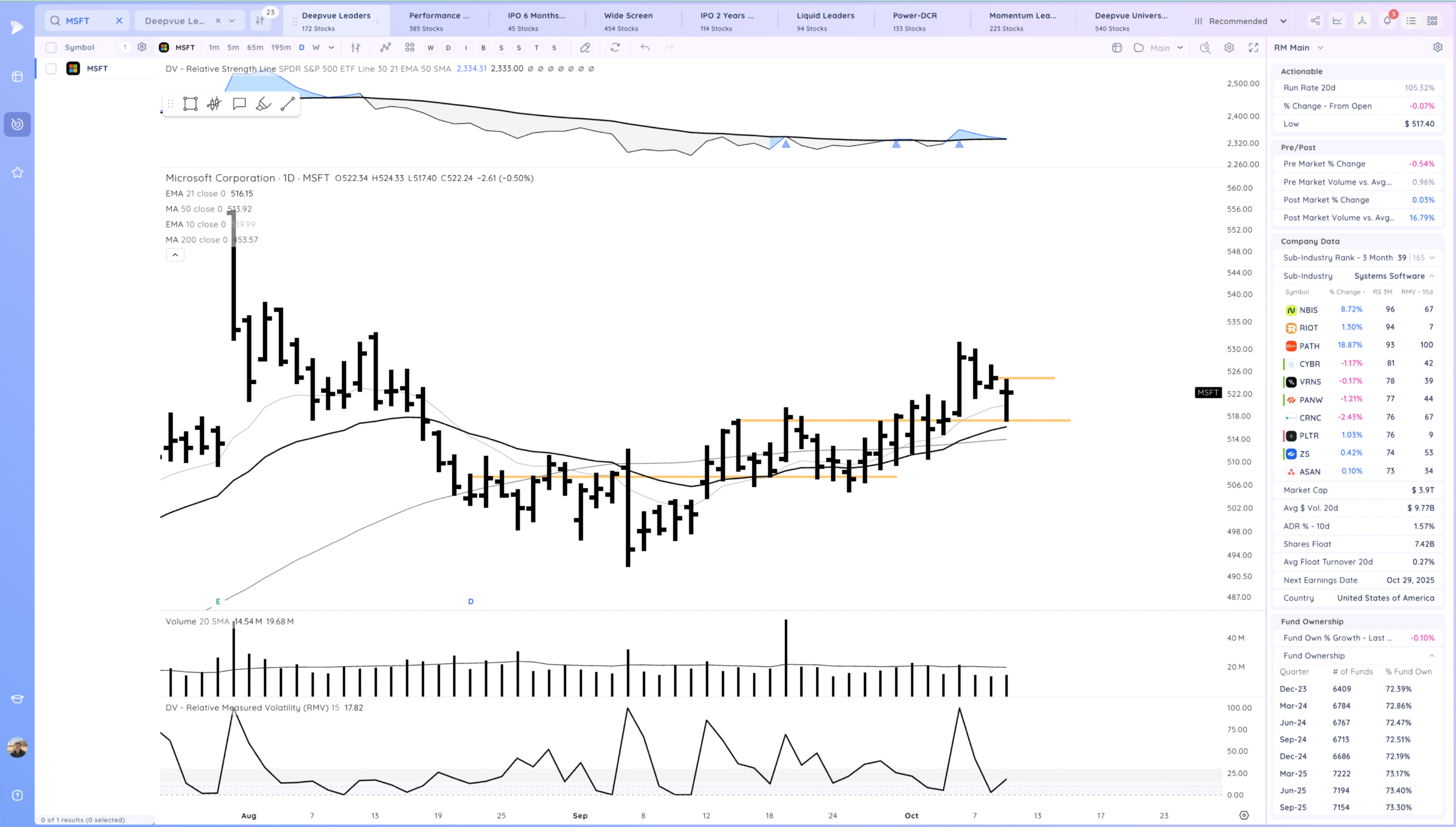

MSFT Shake lower off the pivot. watching for follow through up

Key Moves

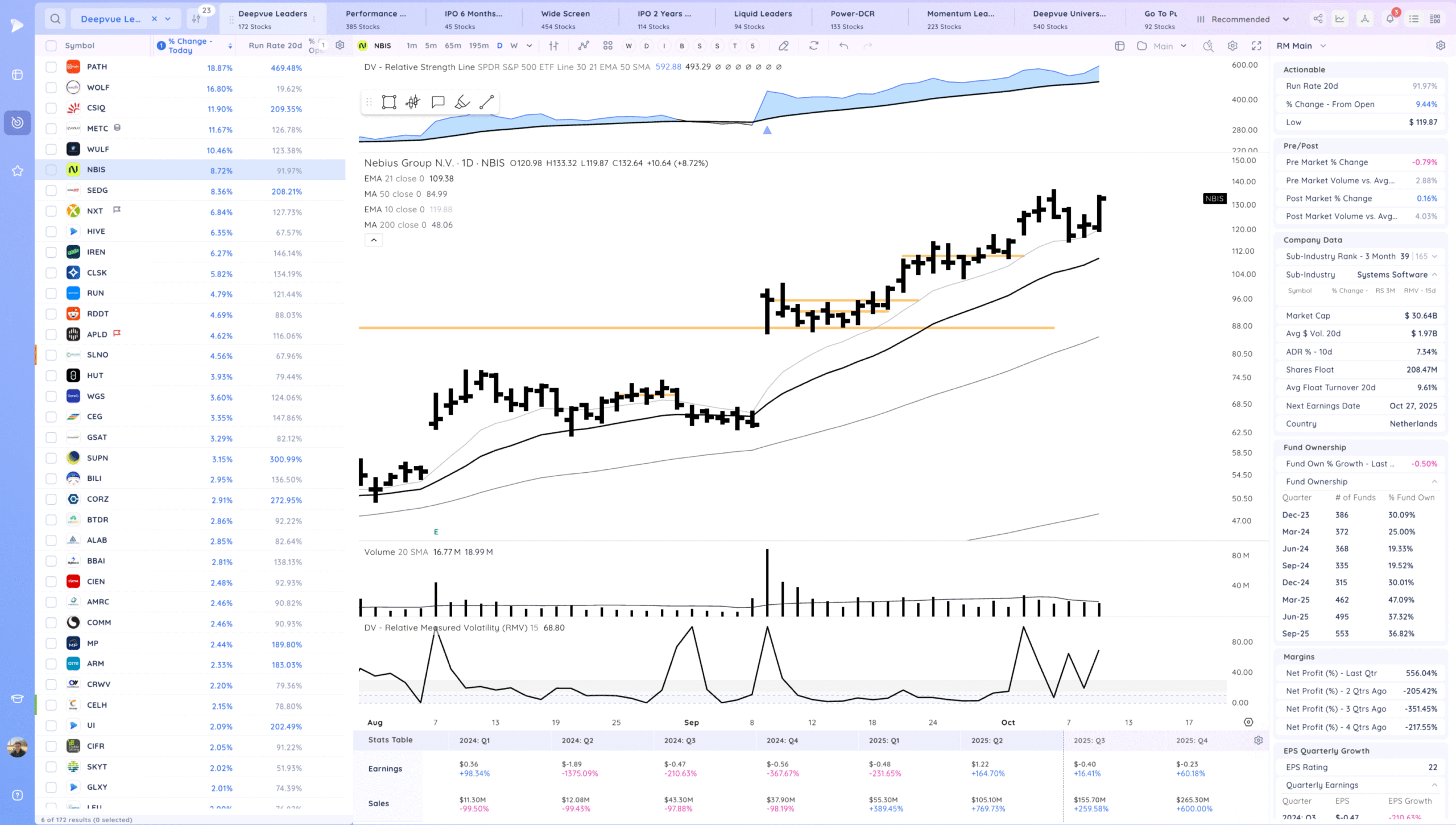

NBIS continuing to trend

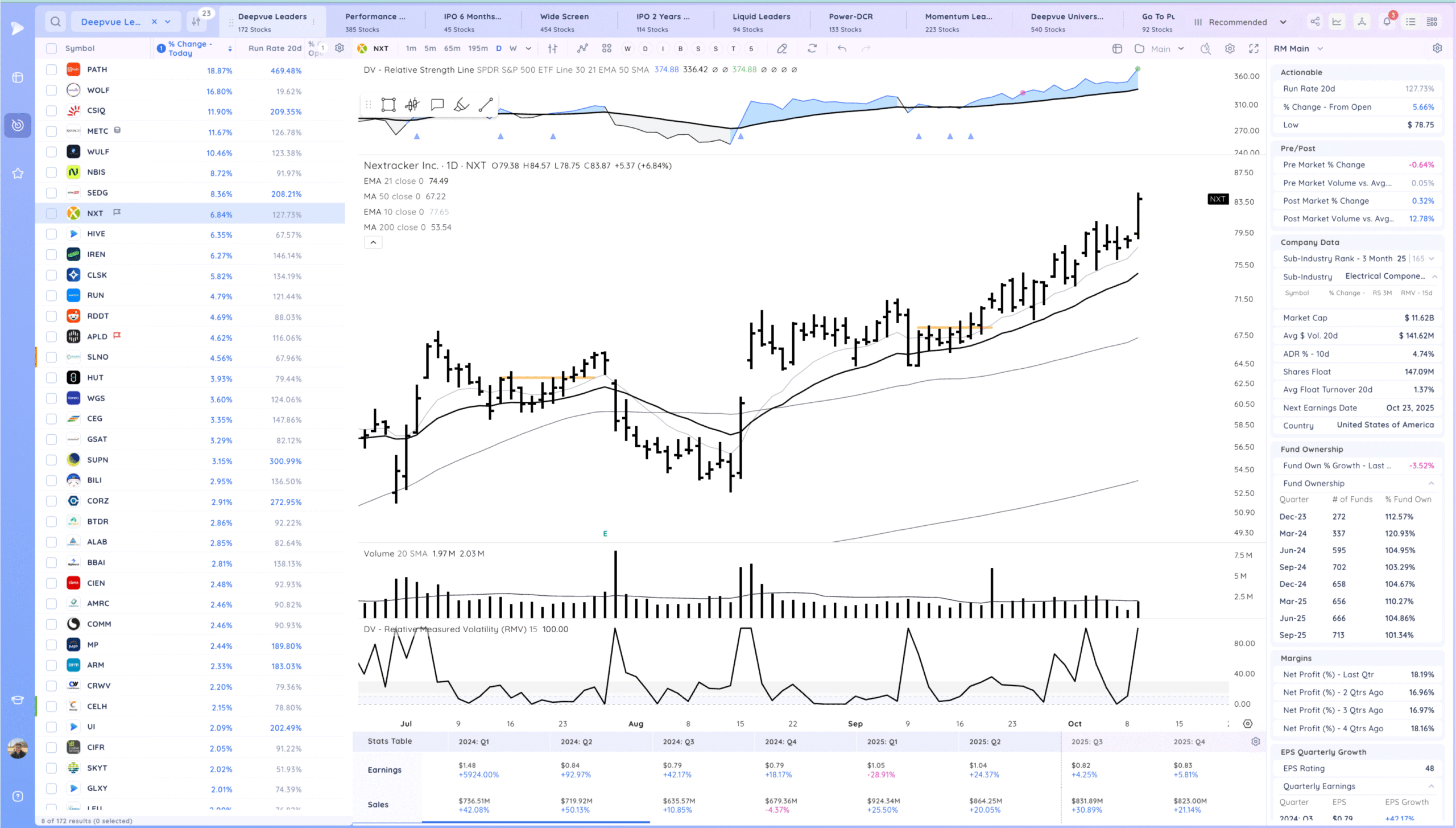

NXT and solar strong moves

Setups and Watchlist

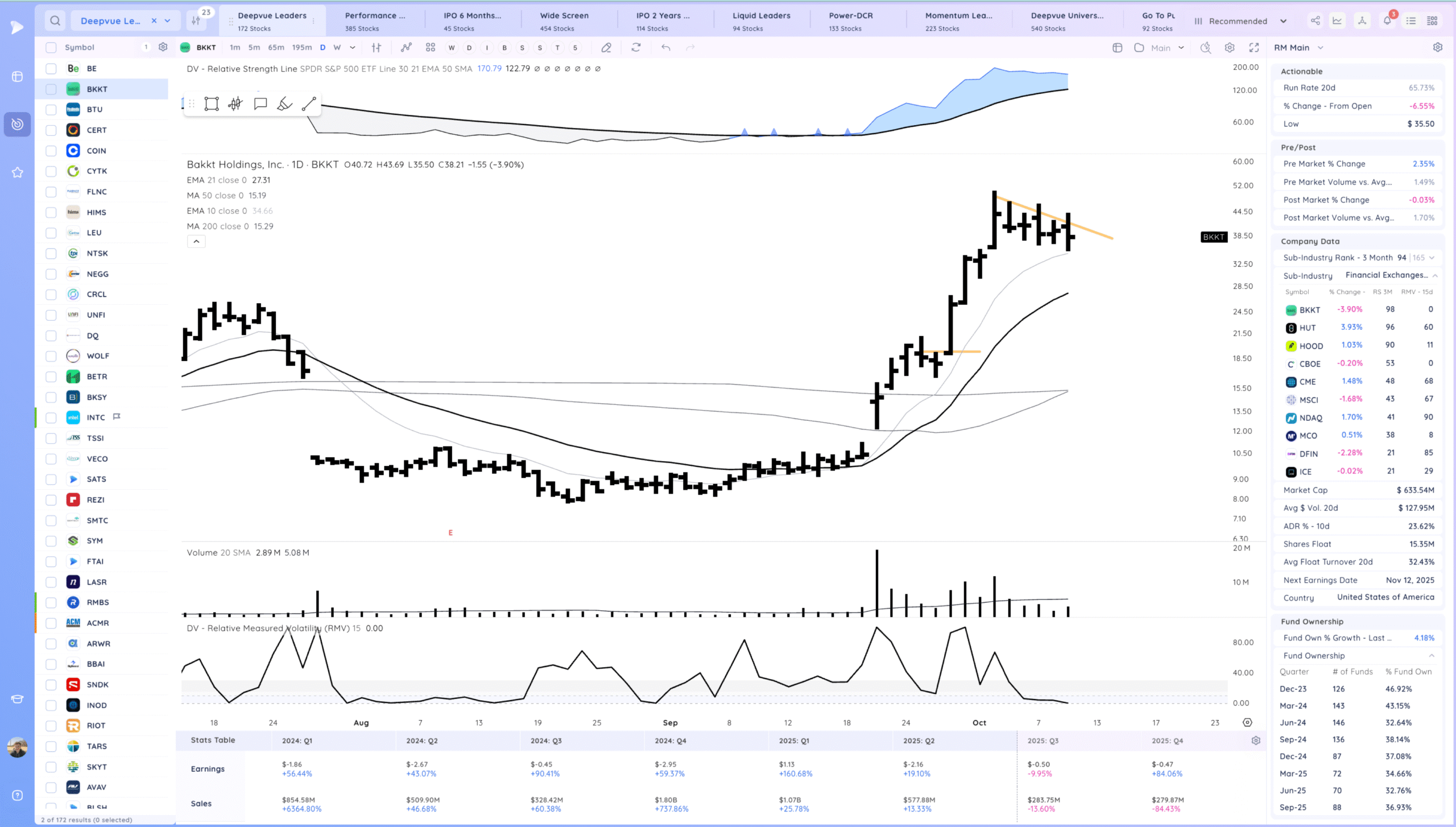

BKKT flag into the 10ema, ideally tightens further

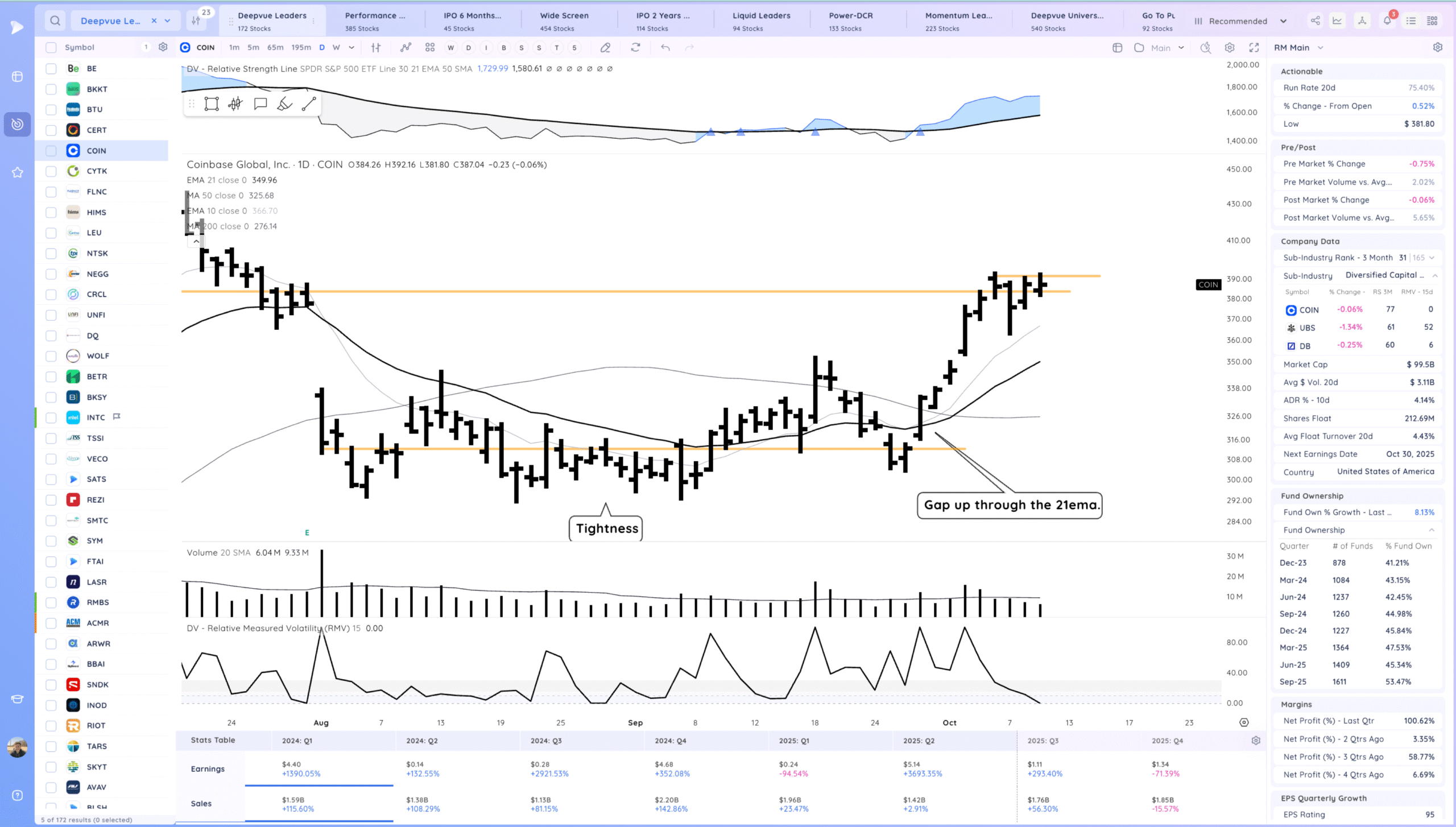

COIN watching for a range breakout. Biotech

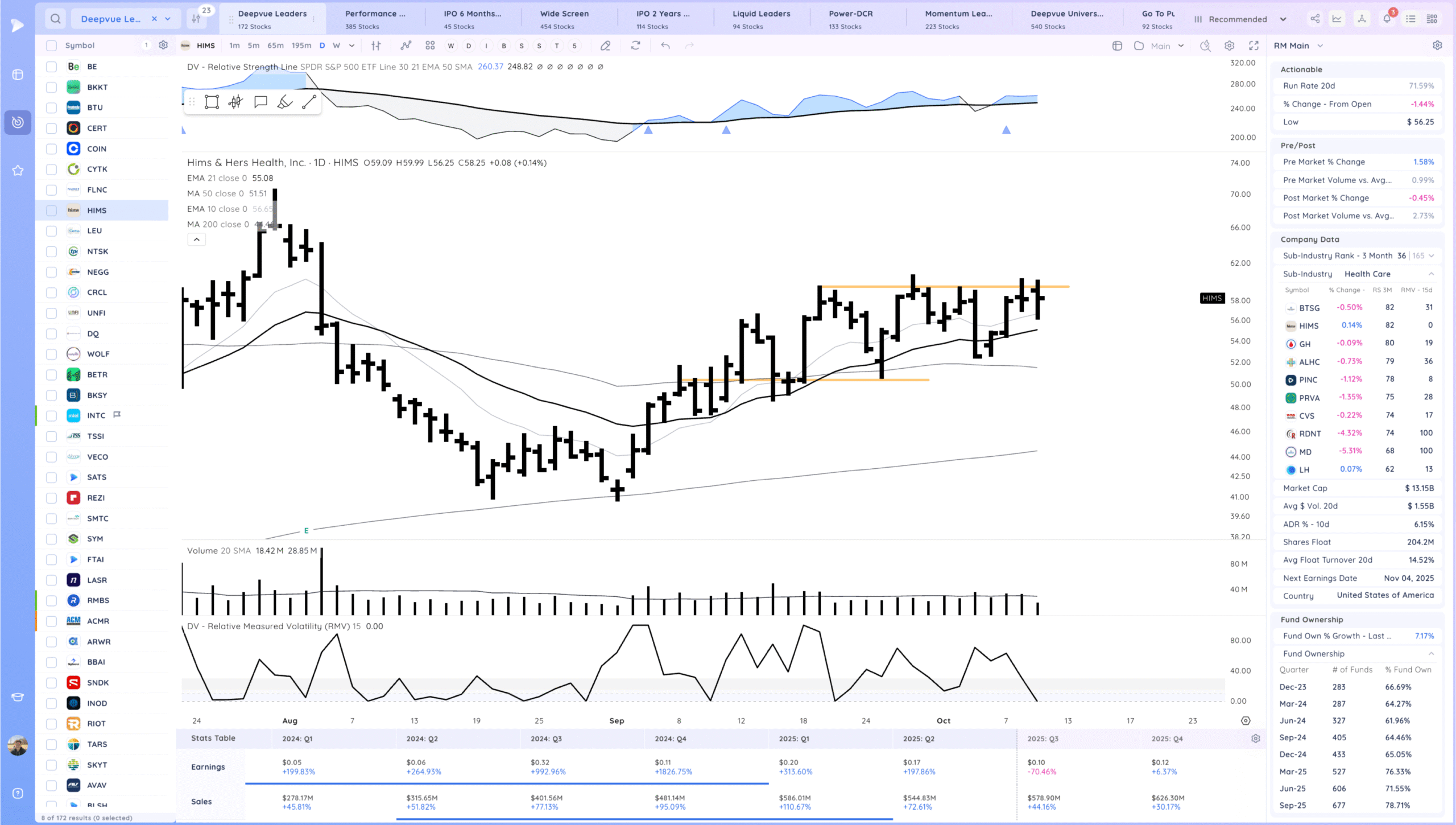

HIMS watching for a range breakout

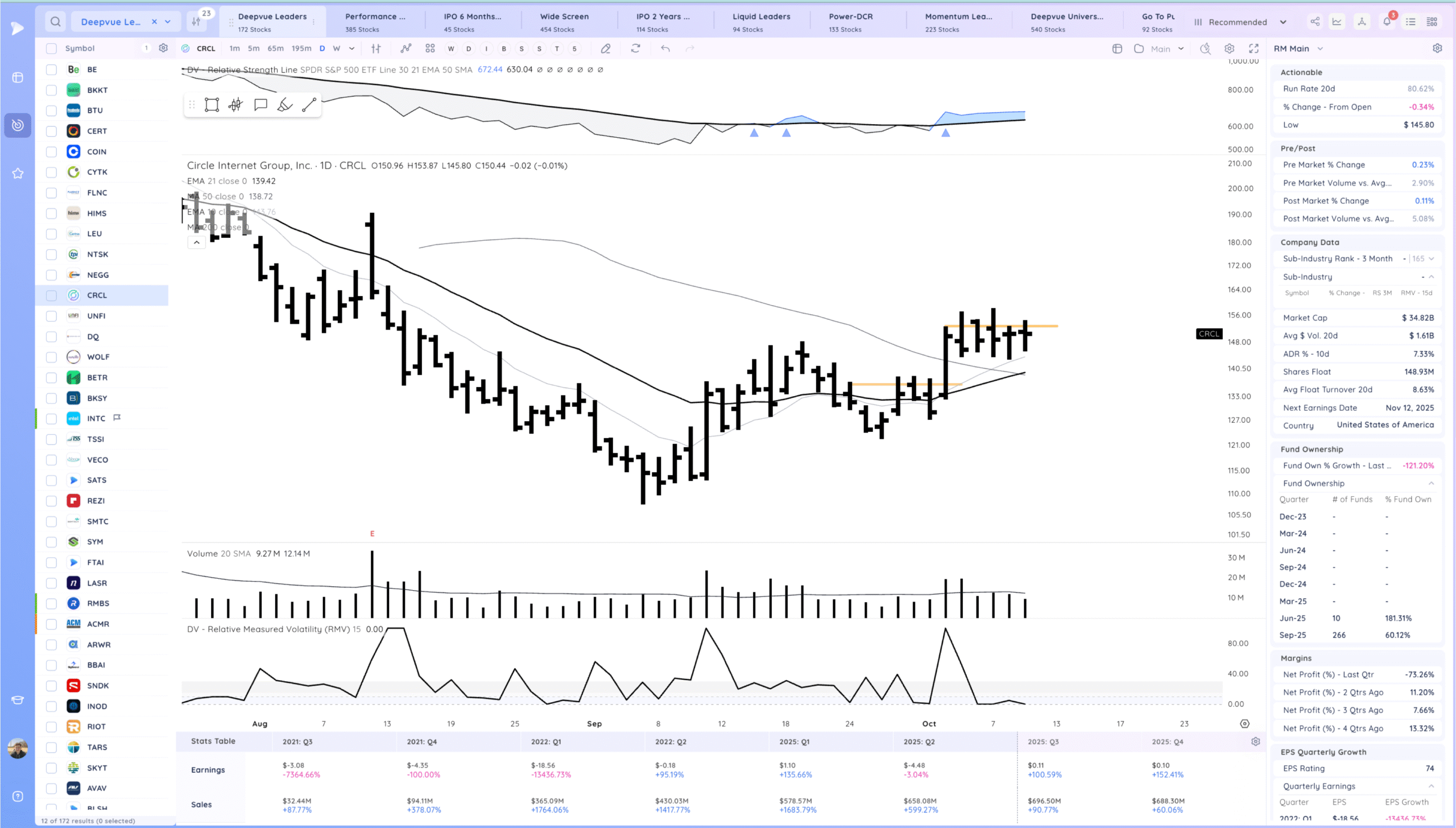

CRCL. watching for a range breakout. fast name

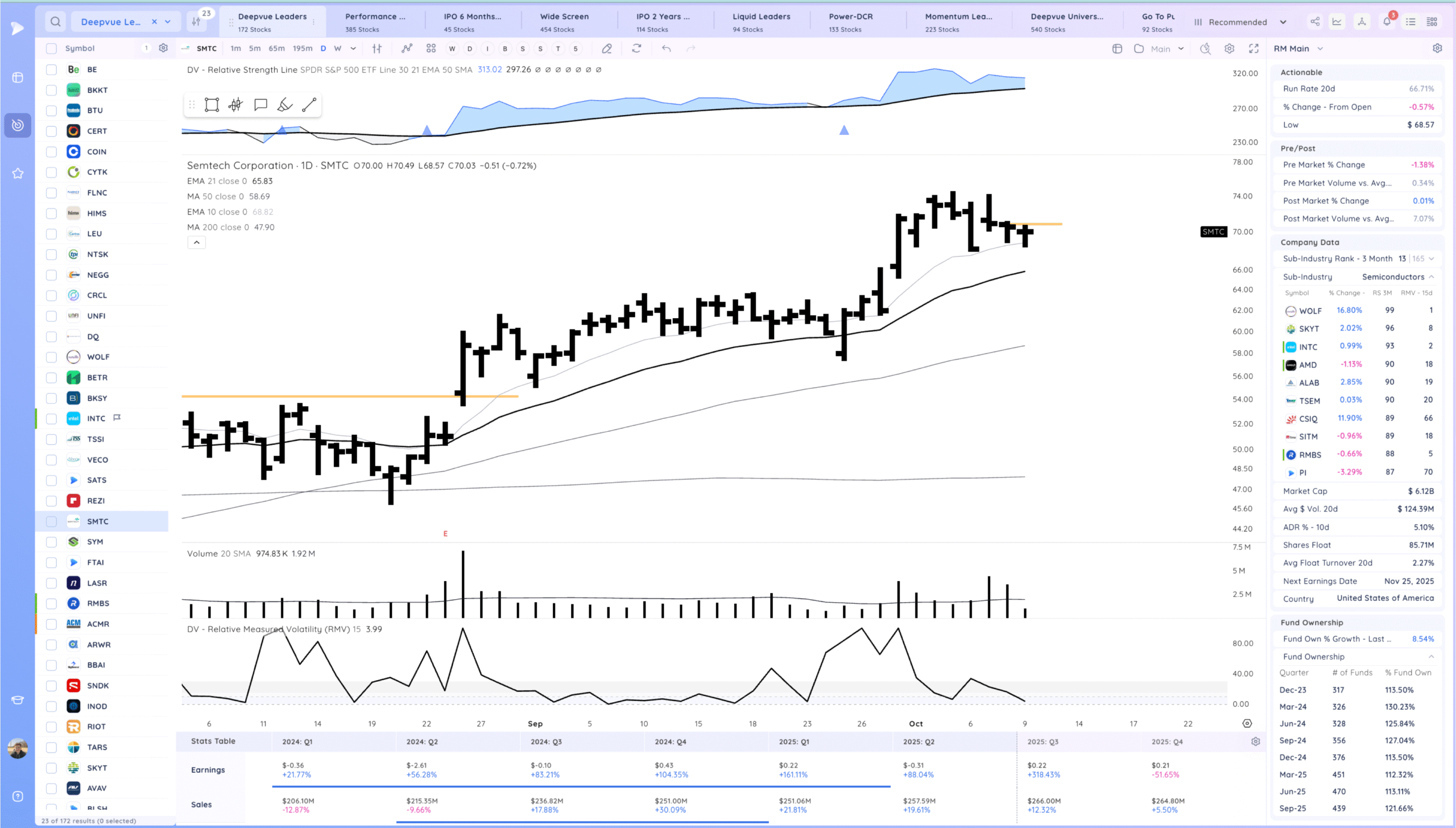

SMTC 10ema pullback, watching for a push higher. Swing trade idea

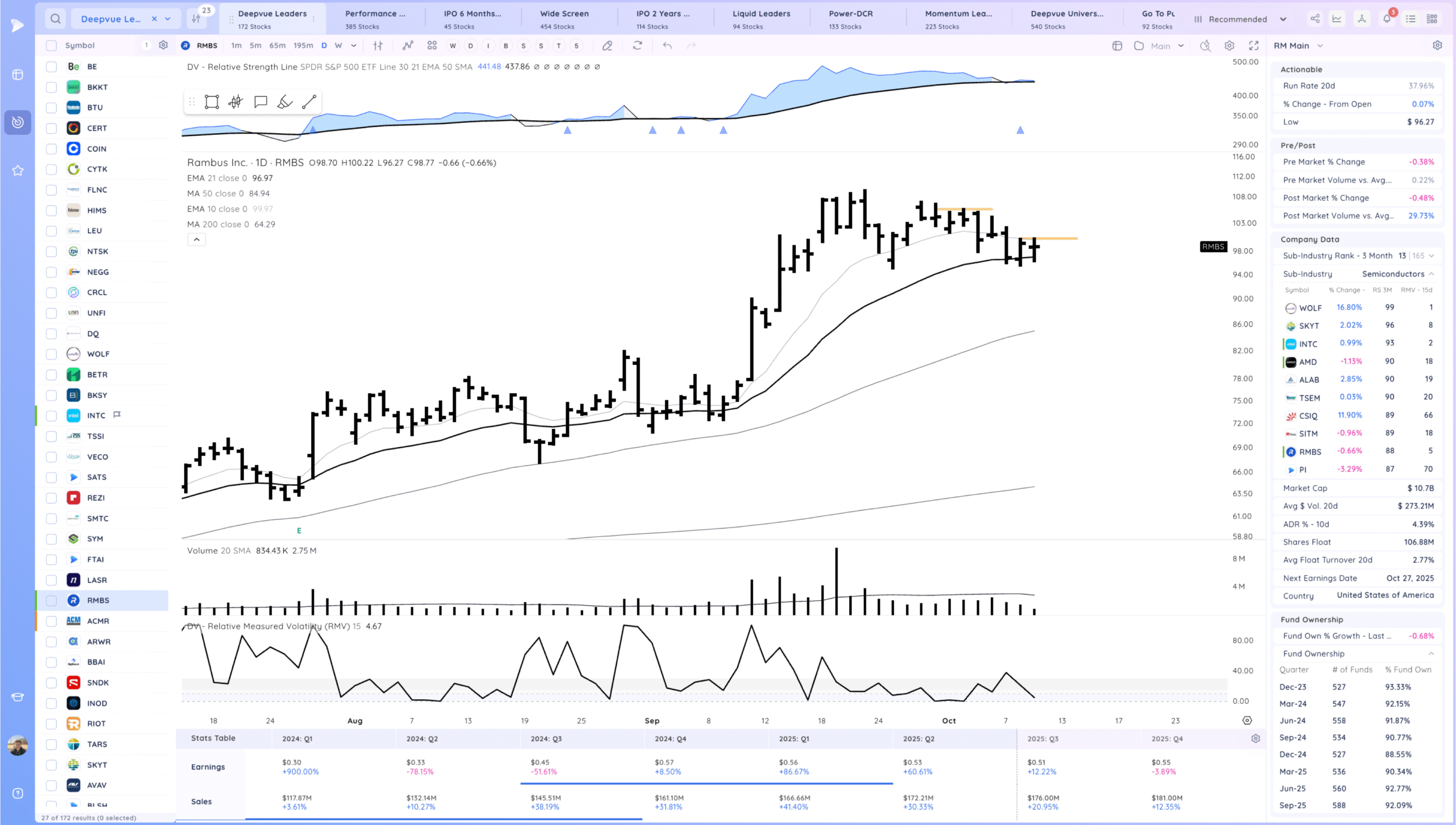

RMBS Watching for a range breakout.

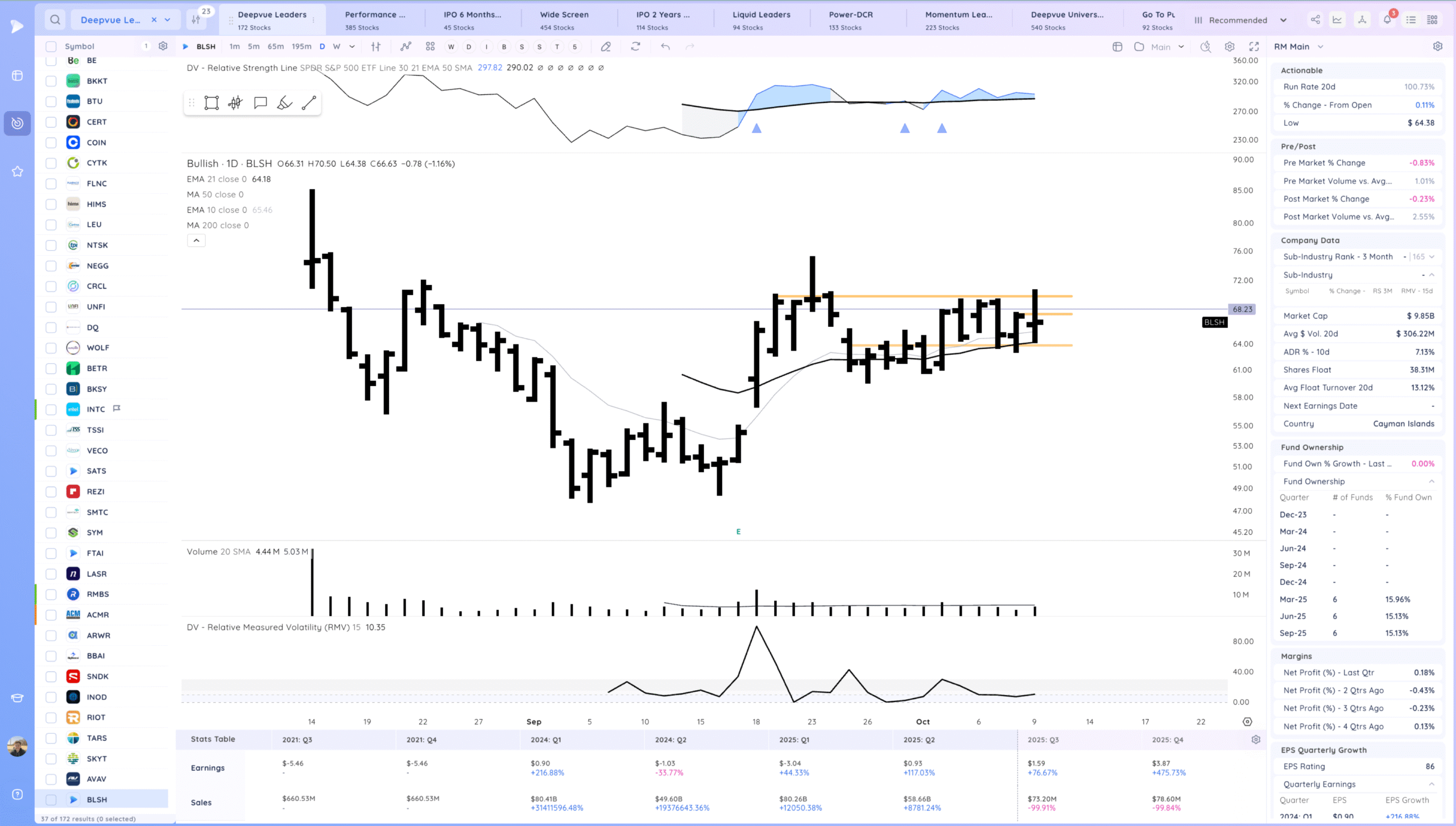

BLSH watching for a range re-breakout

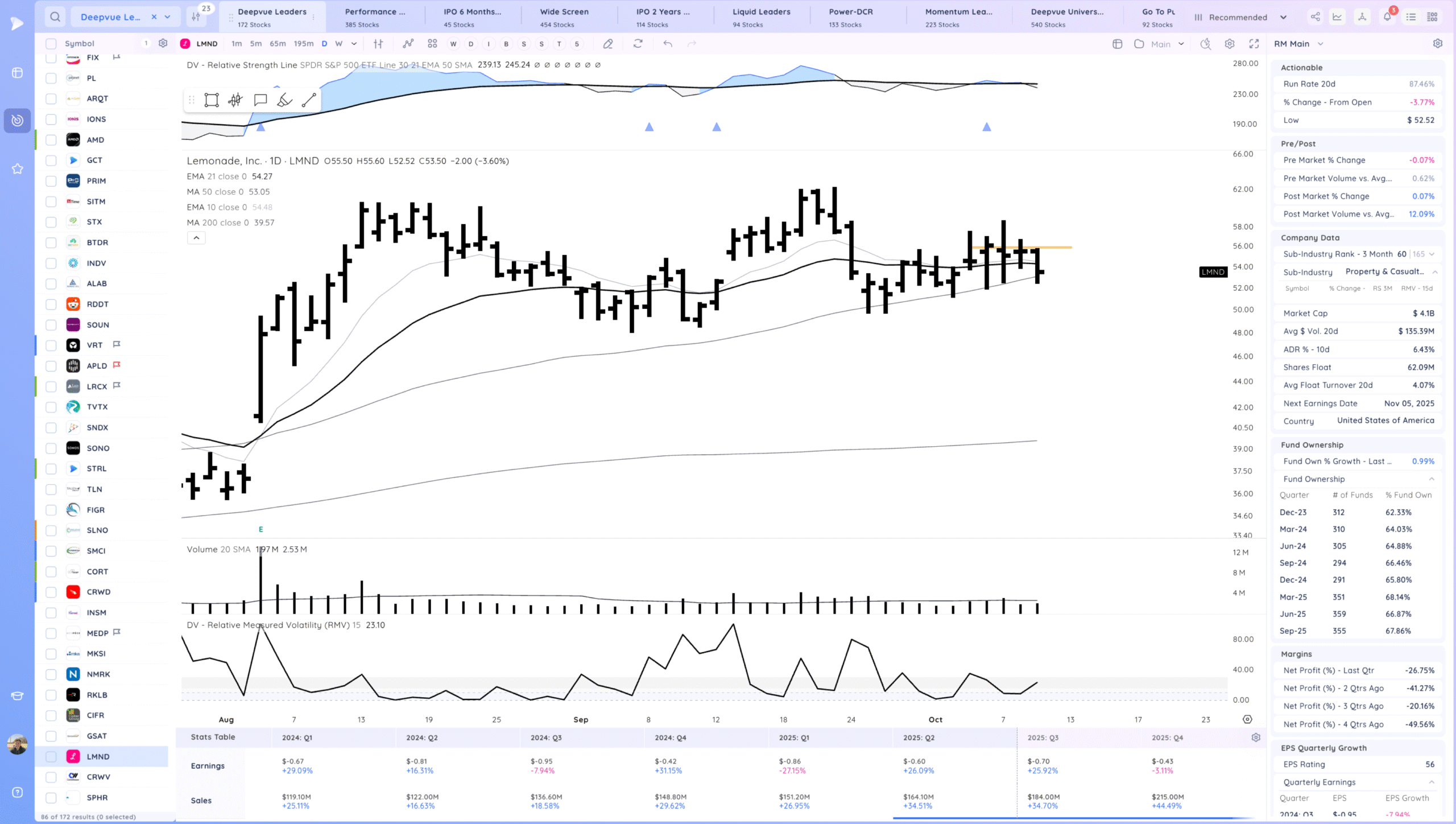

LMND watching for a recovery up and range breakout. pullback today to the 50sma. Needs to hold here

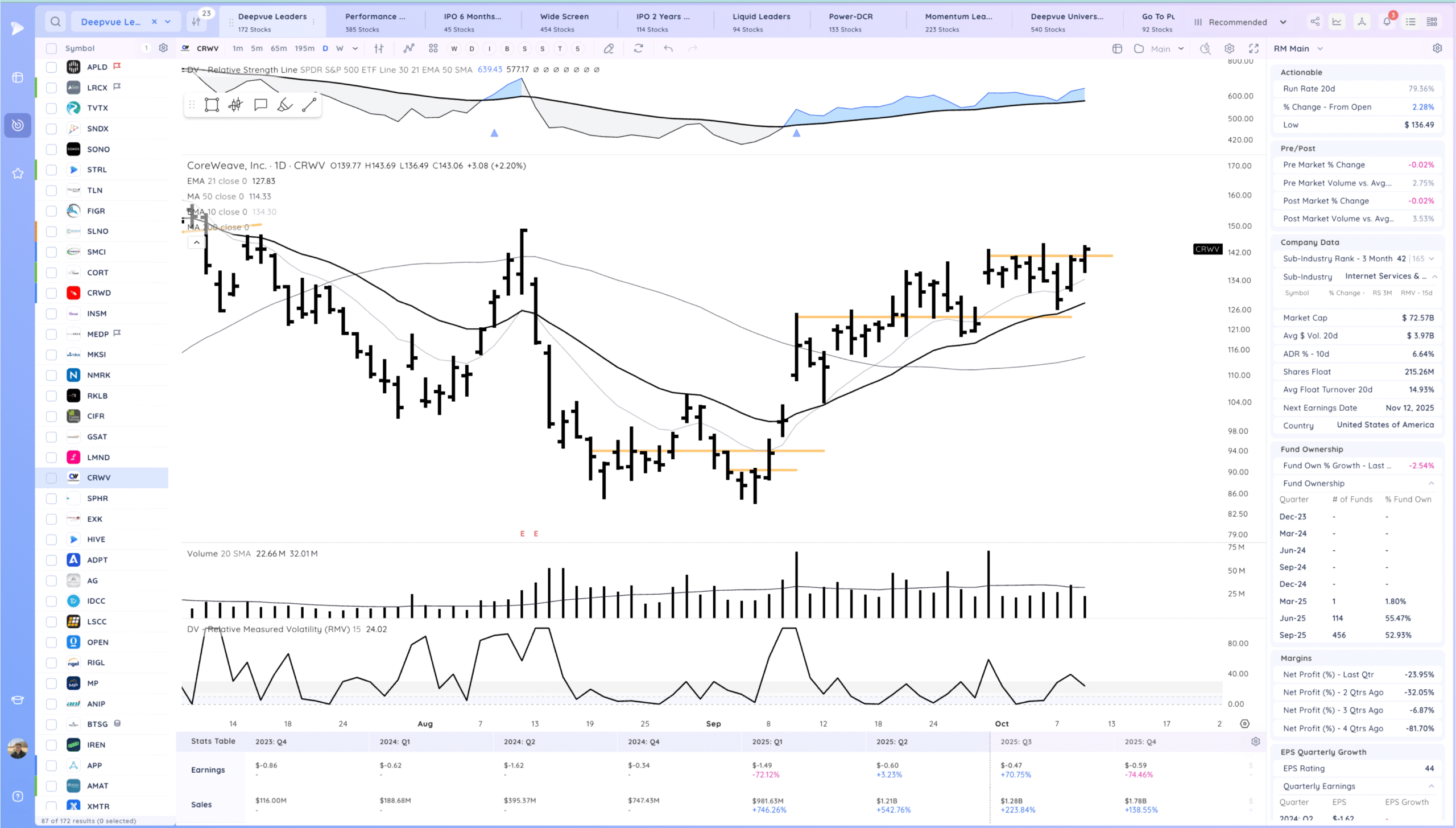

CRWV Watching for follow through and range breakout

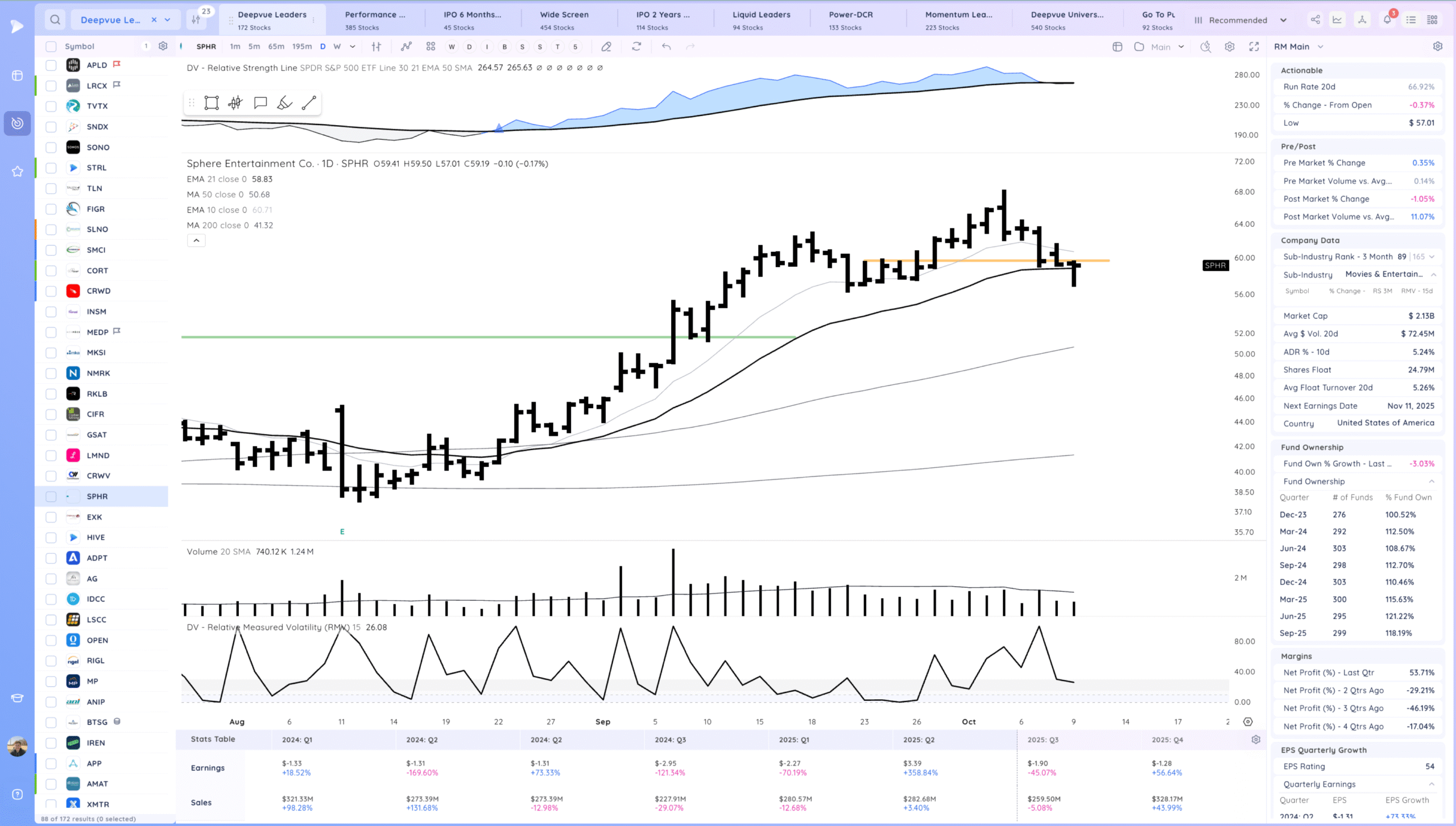

SPHR watching for follow through up

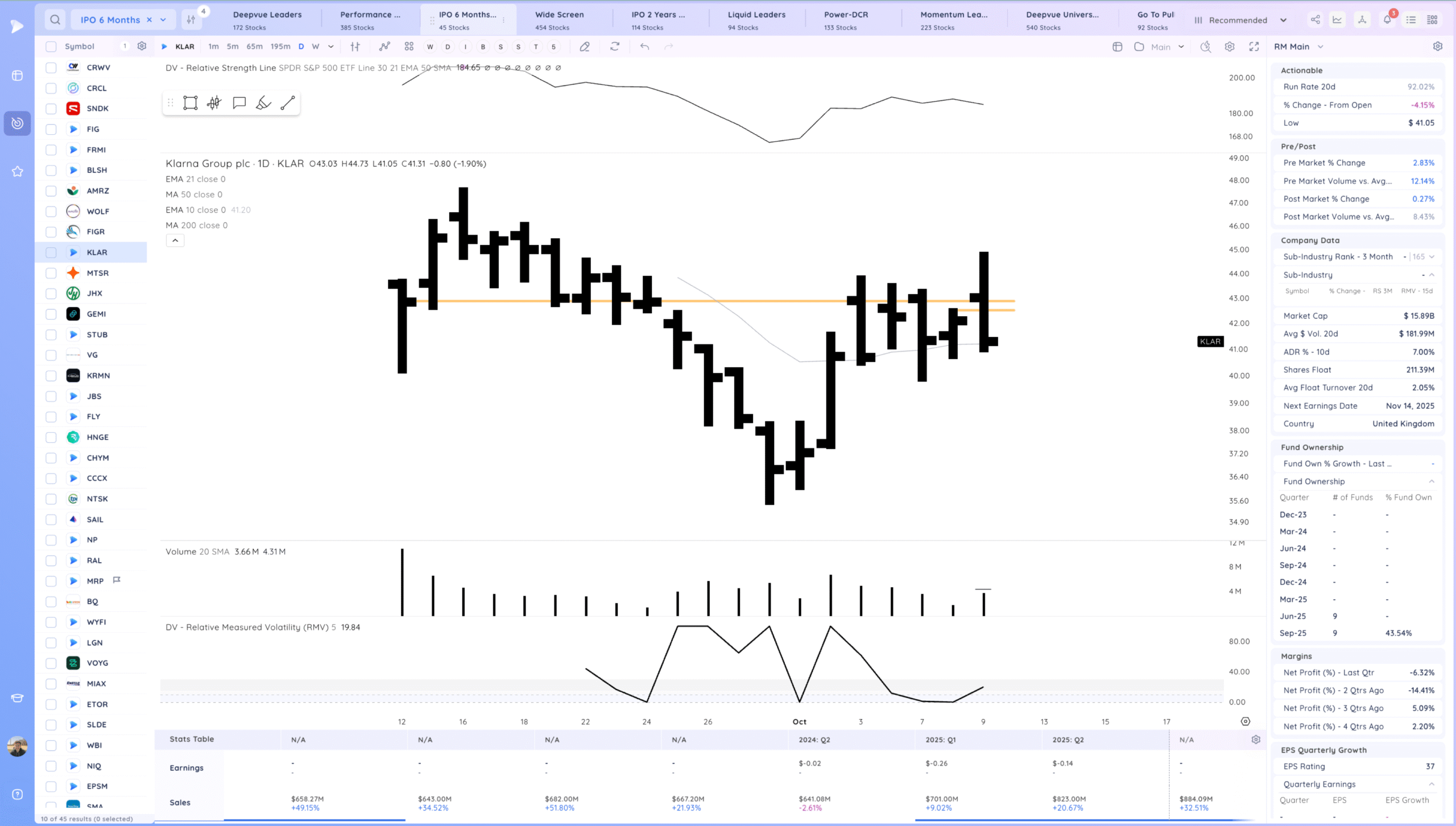

KLAR watching for positive expectation breaker and range breakout

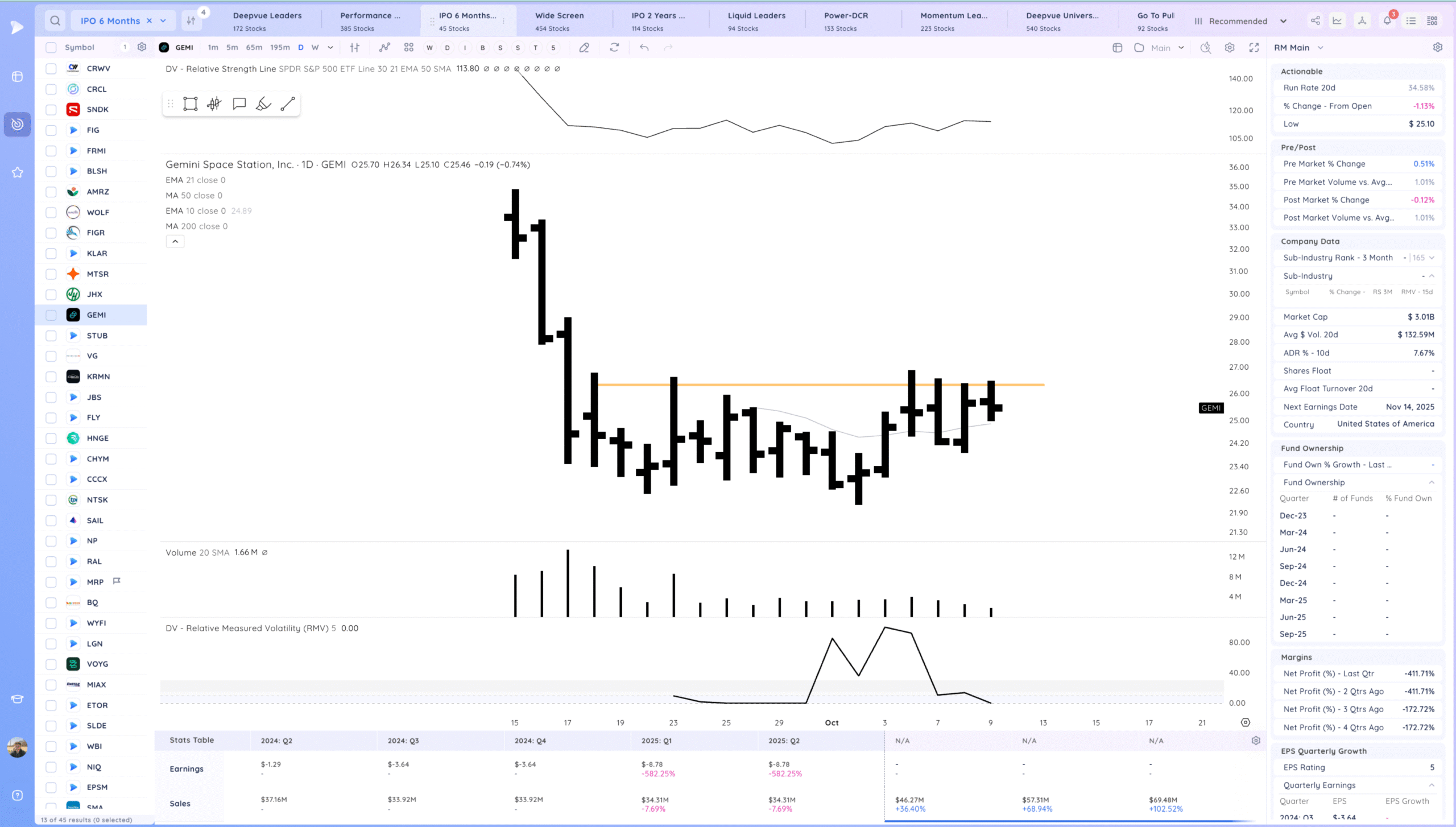

GEMI watching for a range breakout

Today’s Watchlist in List form

Focus List Names

BKKT COIN HIMS CRCL SMTC RMBS BLSH CRWV LMND SPHR KLAR GEMI TSLA ALAB PLTR

Focus:

COIN GEMI TSLA CRCL

Themes

Strongest Themes: AI, Metals/Miners, Energy, Crypto

Market Thoughts

We continue to trend strongly. Seeing more setups today which is a positive. Semi names which pushed strongly pulling back into key MAs and levels. Good gauge for the market. Crypto name is compelling.

Anything can happen, Day by Day – Managing risk along the way