AI, Nuclear Stocks Strong Week.

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 19, 2025

Market Action

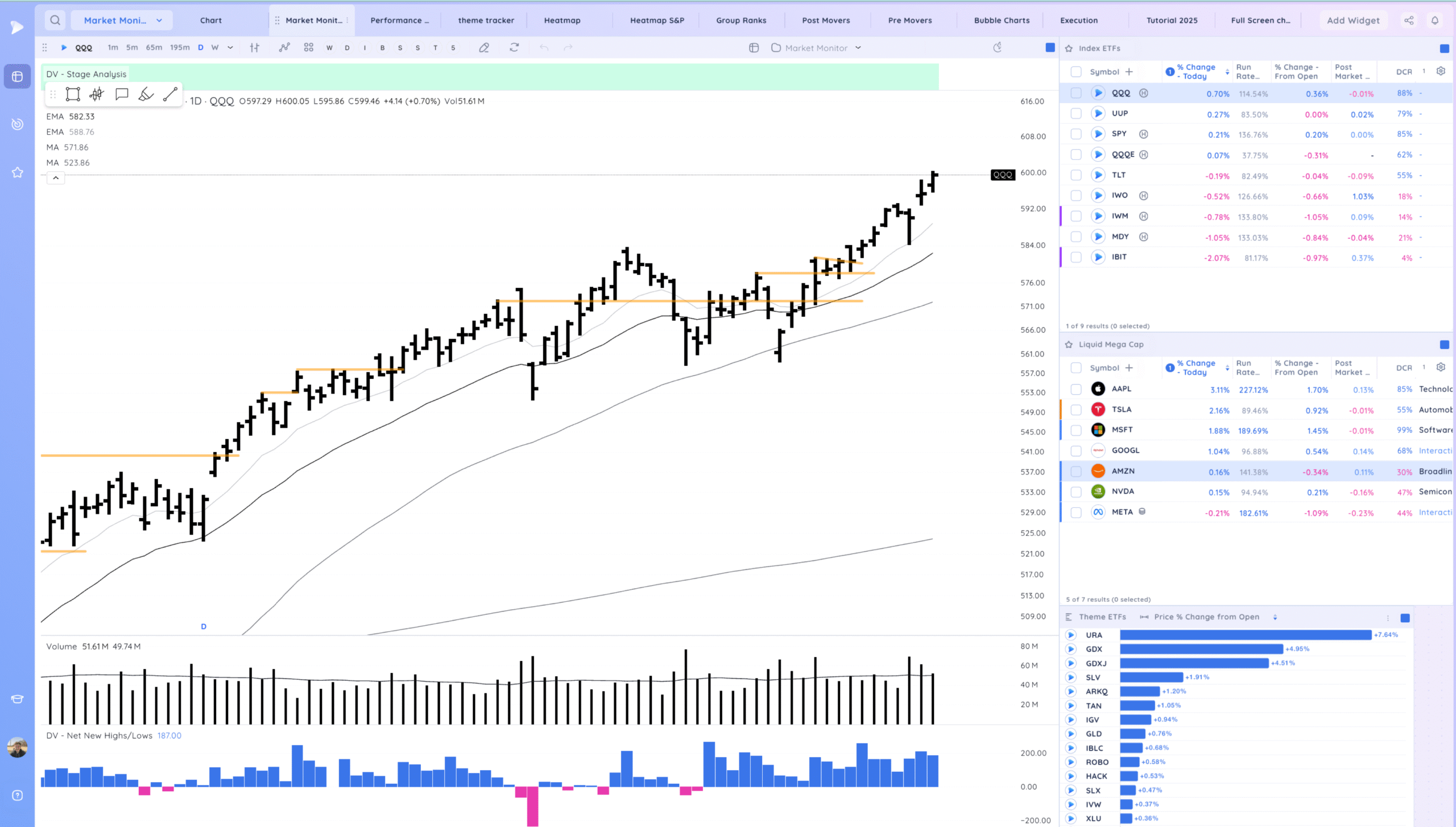

QQQ – Trending higher. A pause would be constructive. We are up most of the last 15 days. Mentally prepared for some consolidation/chop

Bulls want to see continued progress above the MAs or constructive tightening/range building

Bears want to see a sharp break lower closing at lows

Daily Chart of the QQQ.

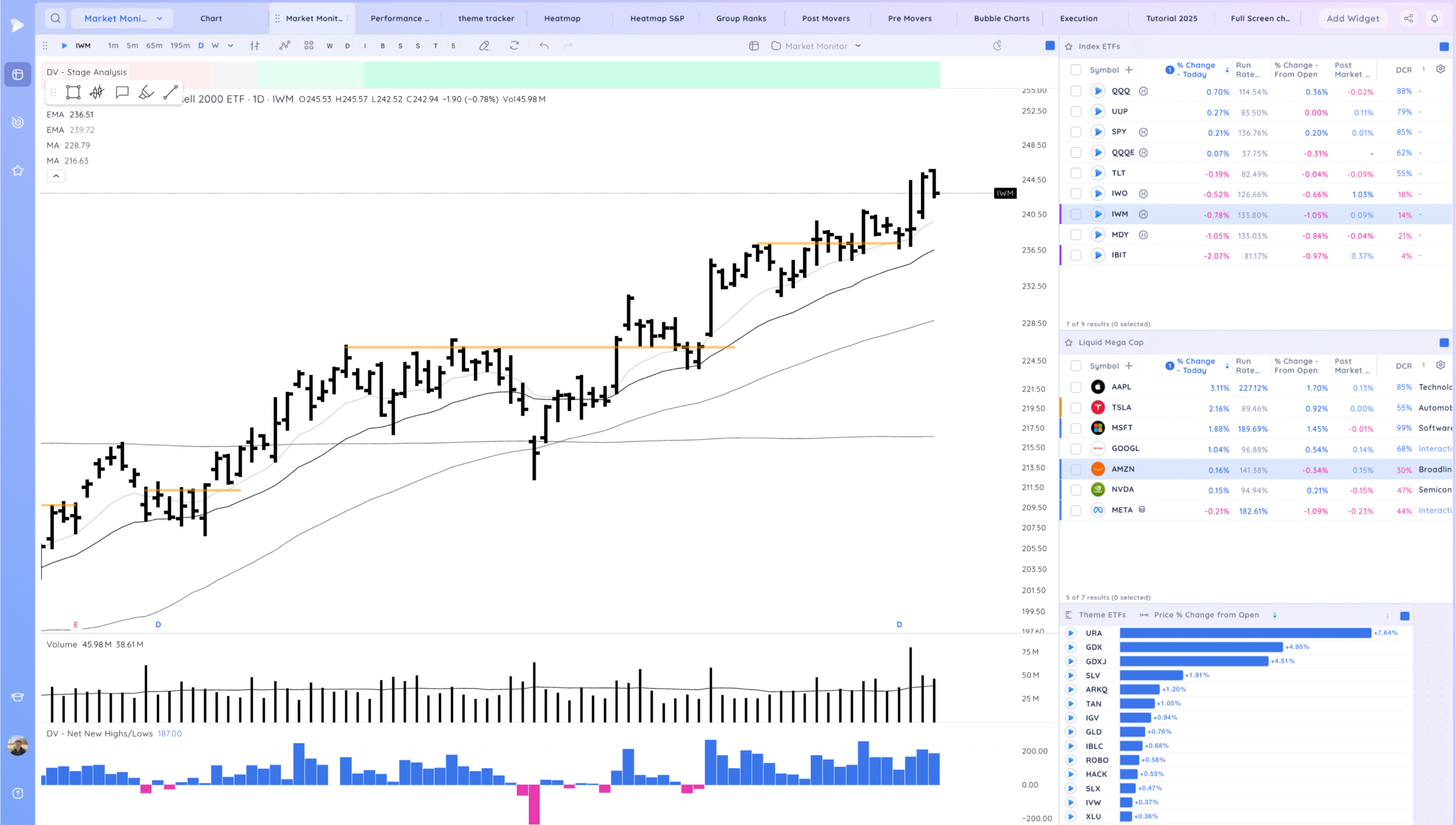

IWM – New highs but downside reversal

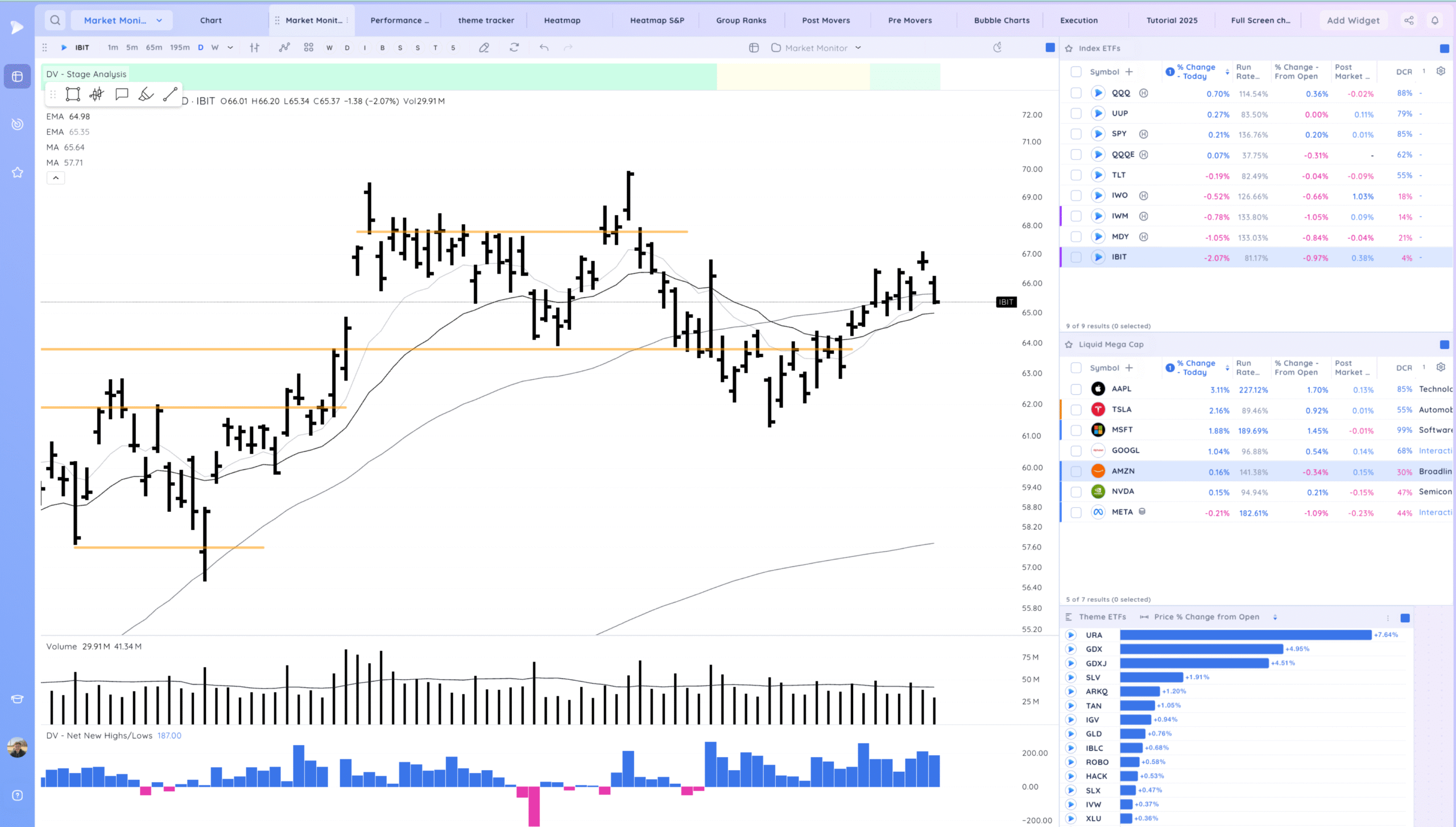

IBIT – Gap down back into the range

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

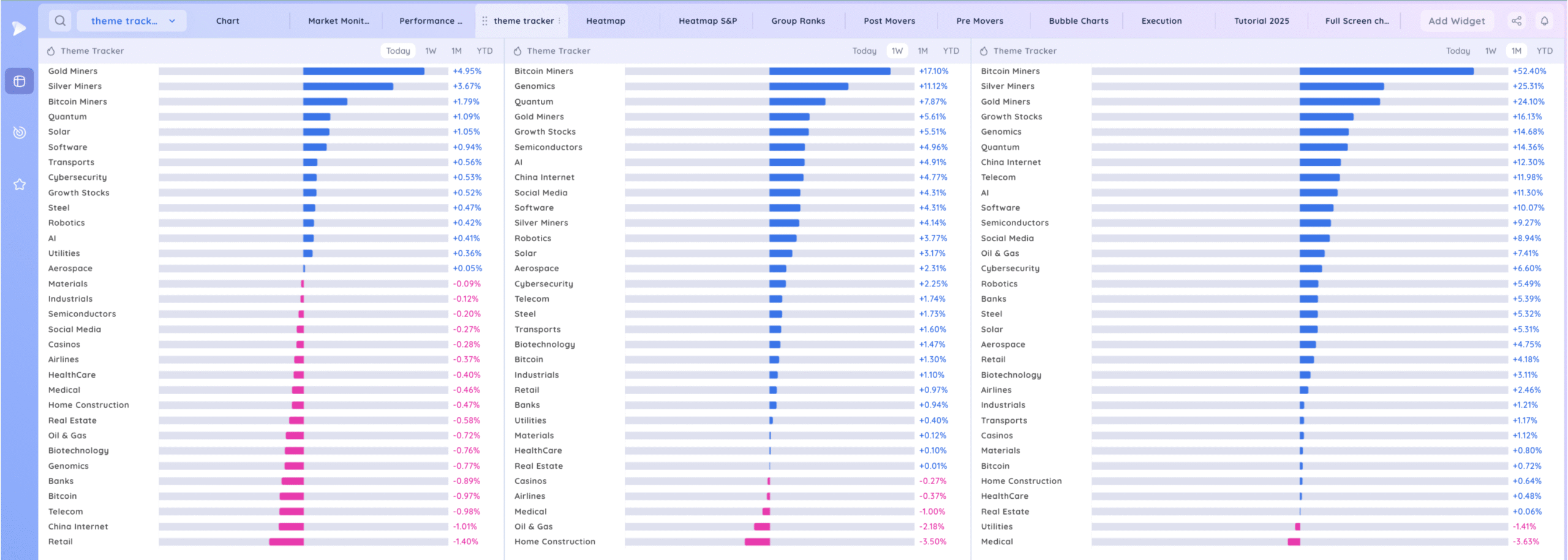

Deepvue Theme Tracker

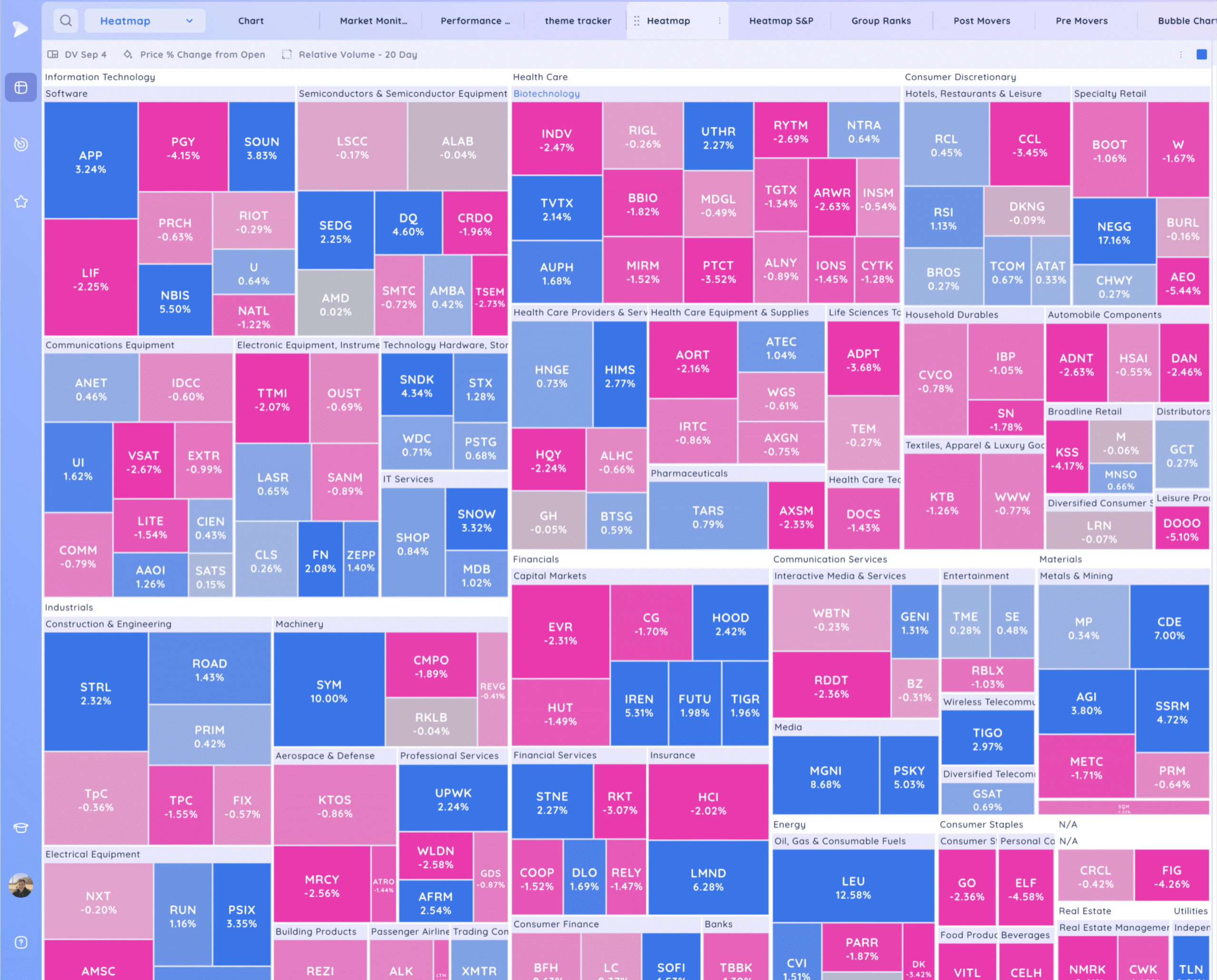

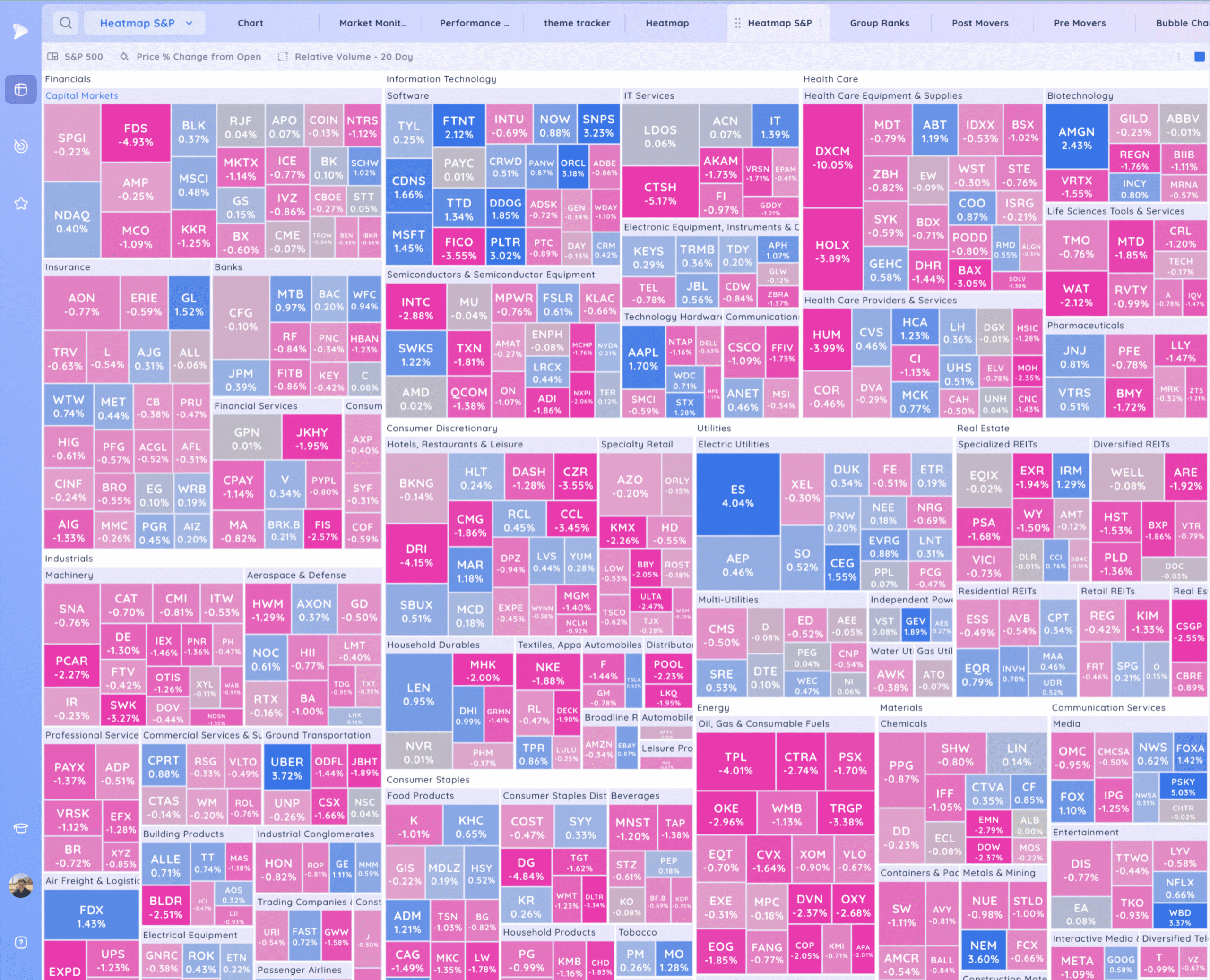

Deepvue Leaders

S&P 500.

Leadership Stocks & Analysis

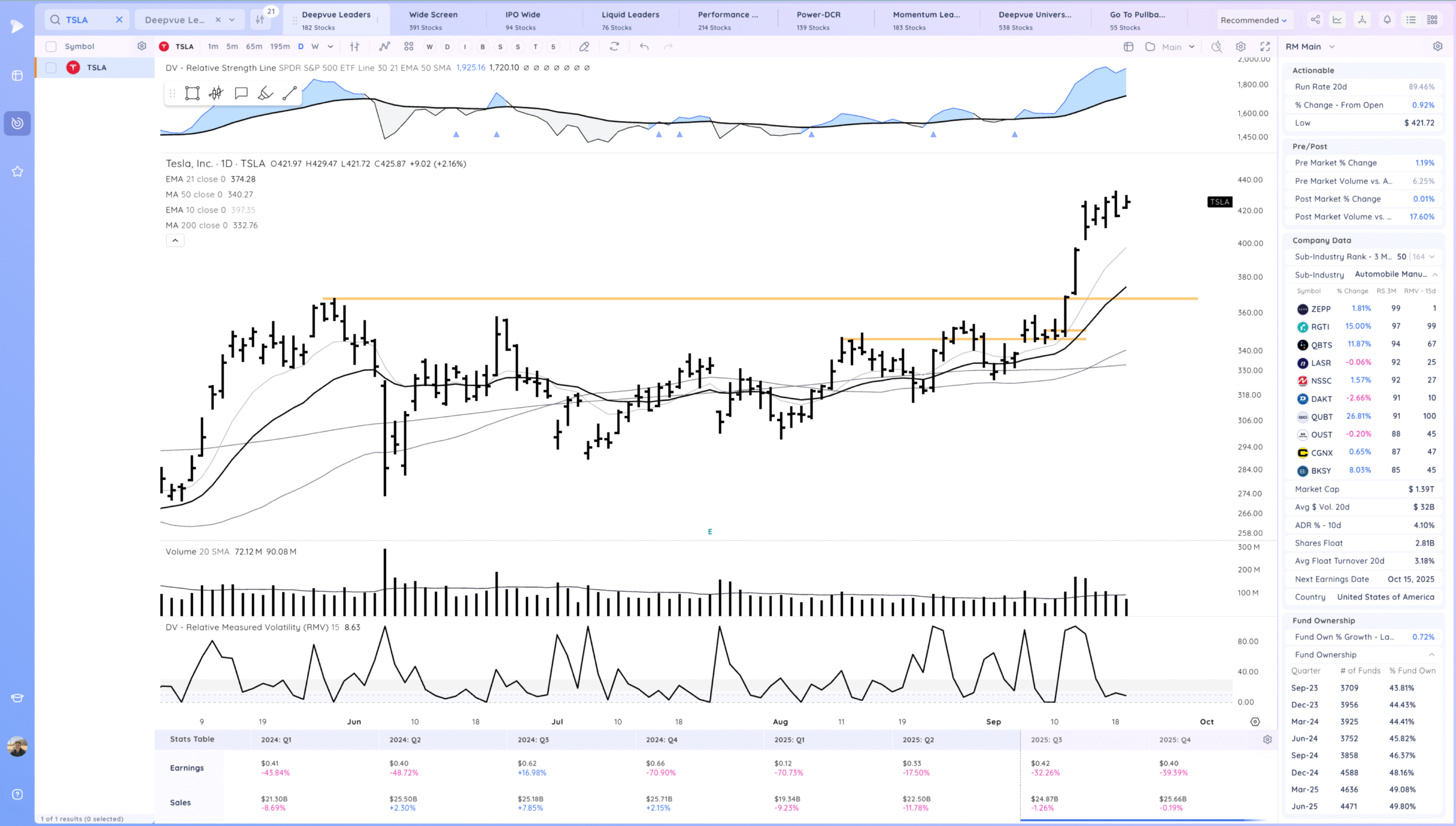

TSLA – Forming a flag. 10ema catching up. Slight wedging action

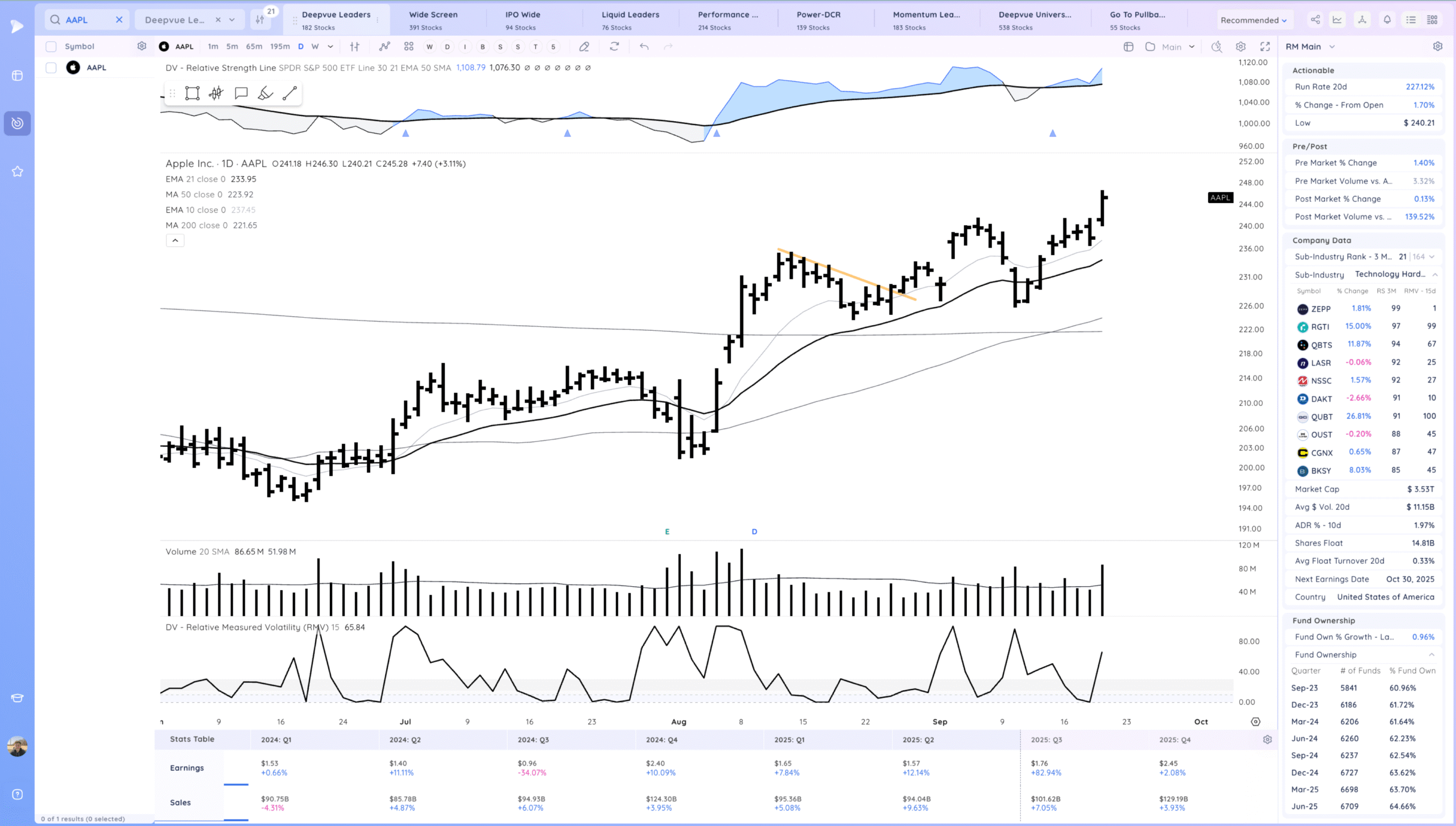

AAPL positive expectation breaker. New recent highs.

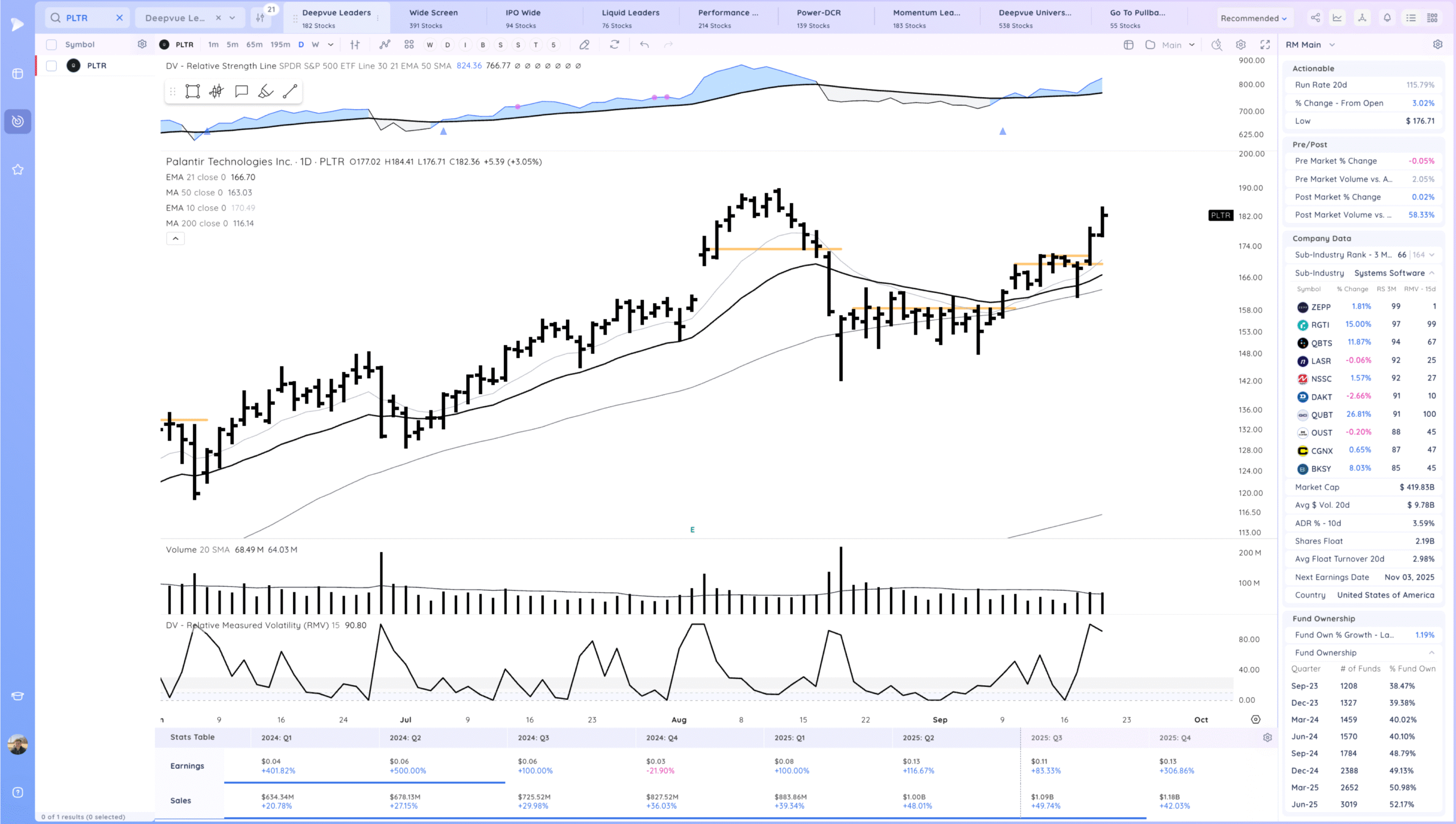

PLTR Follow through Up

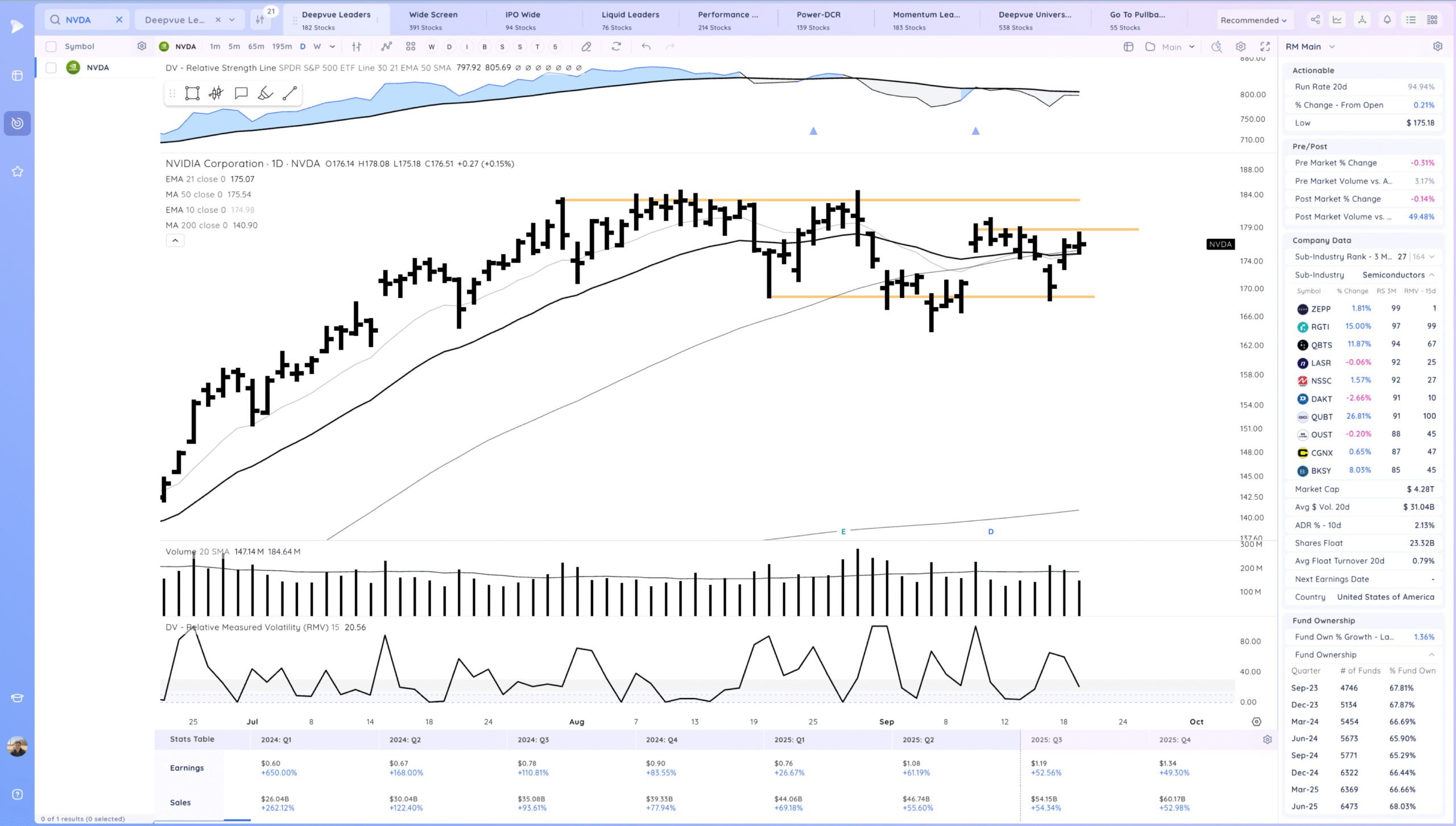

NVDA Tightening above the 21ema

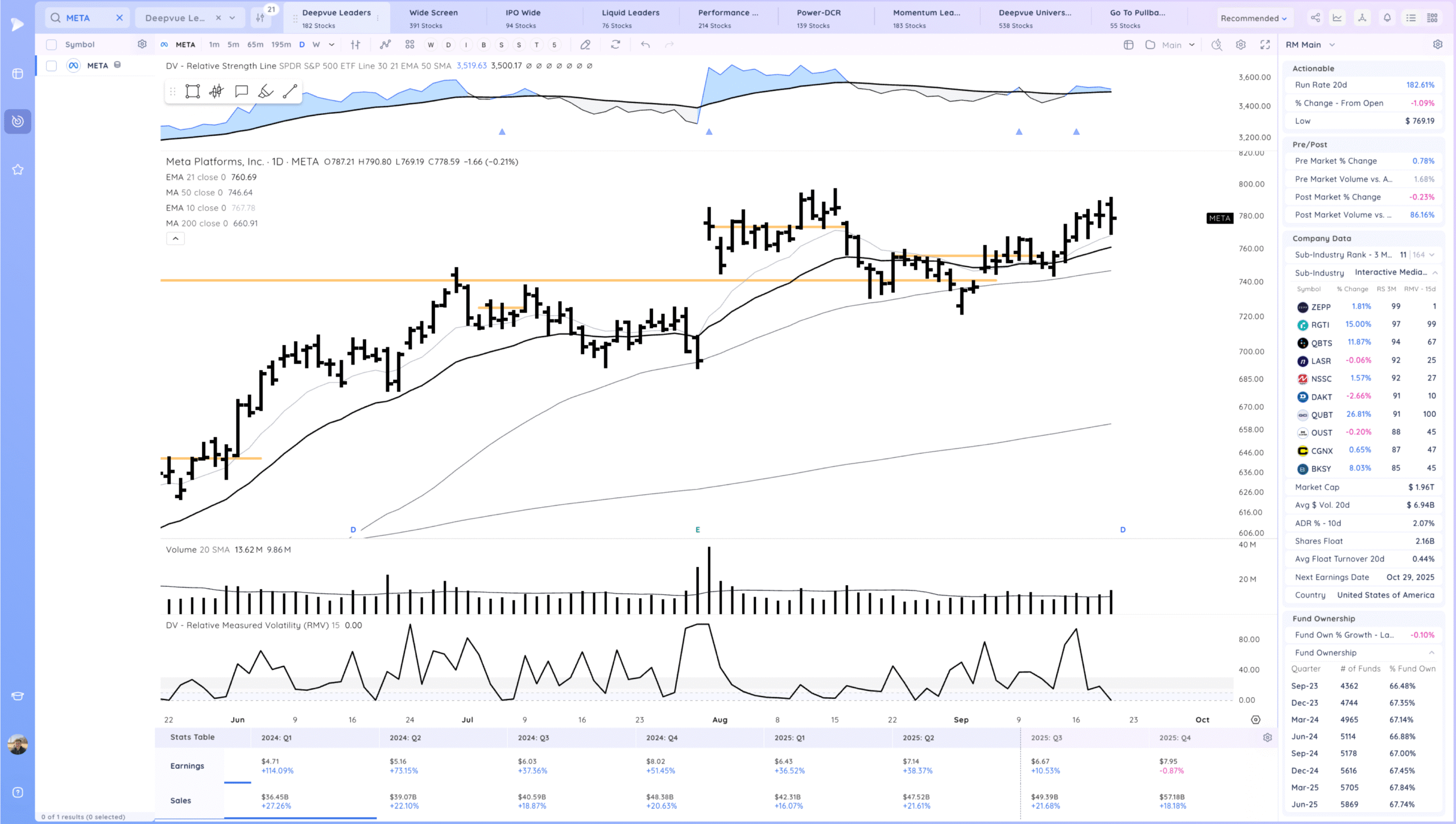

META slight down side reversal but nice move off lows

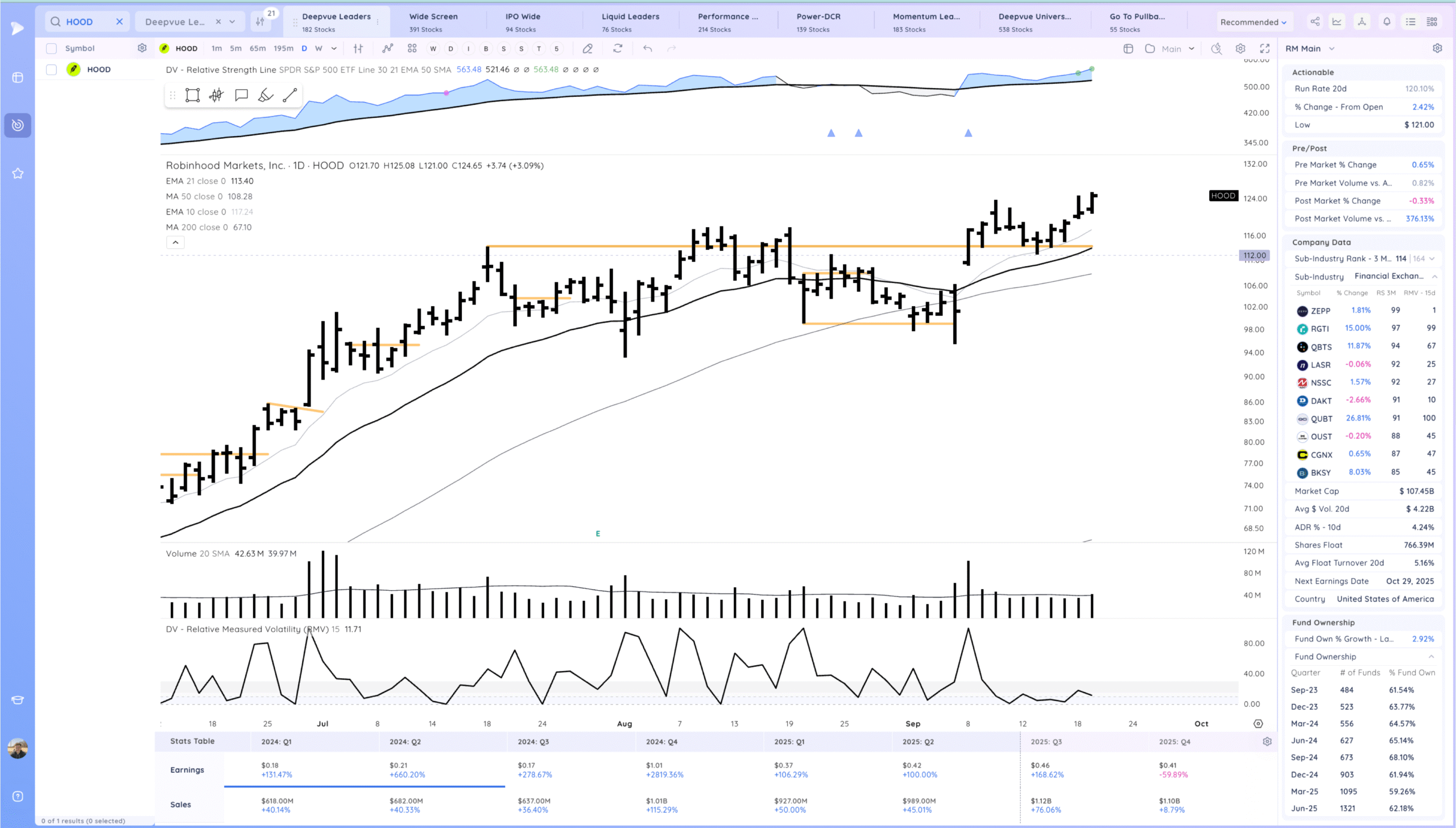

HOOD Good push off the base pivot this week

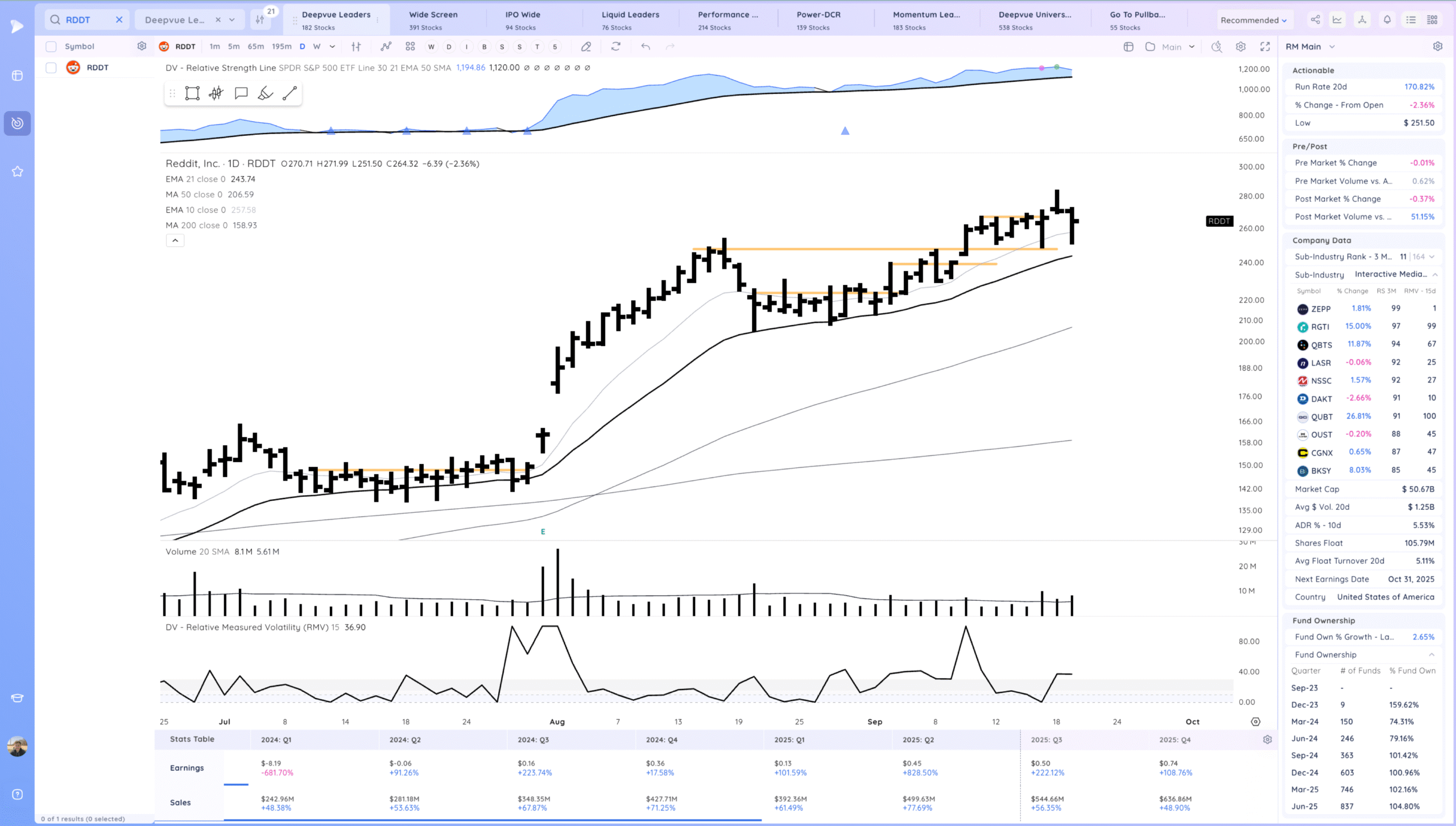

RDDT follow through down but then a nice move off the short base pivot area

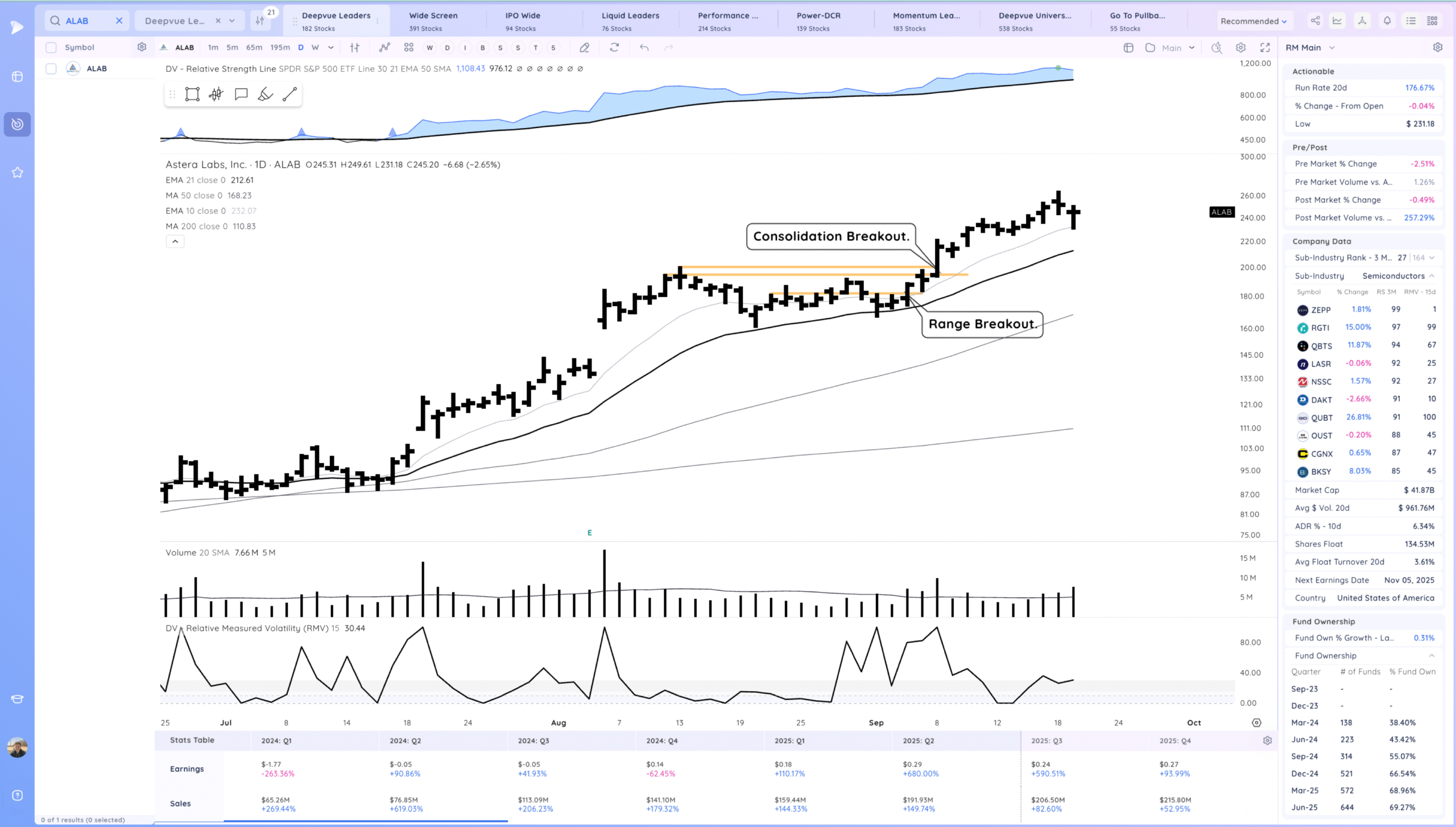

ALAB Trending. Upside reversal off the 10ema

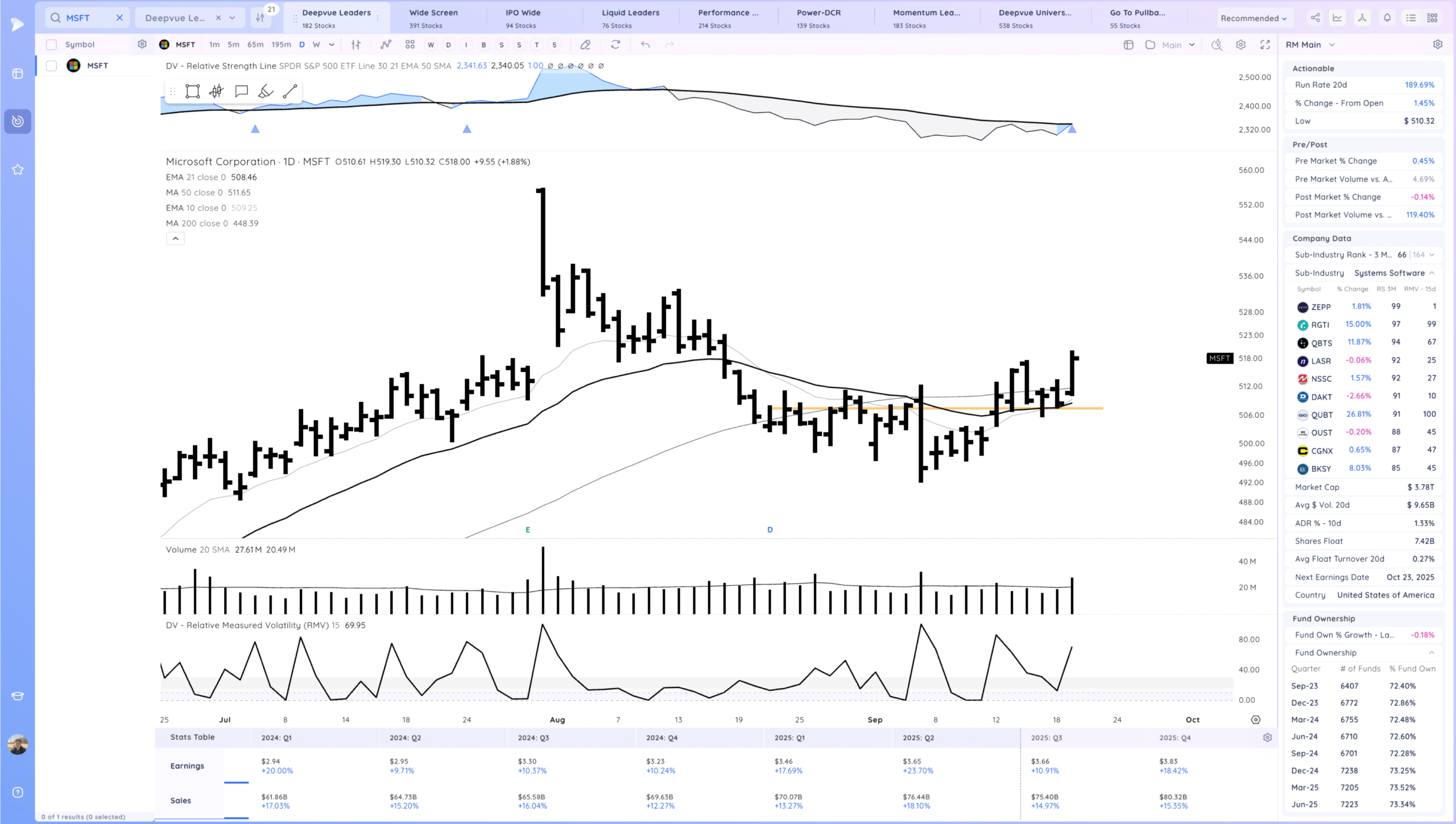

MSFT Strong positive expectation breaker off the pivot

Key Moves

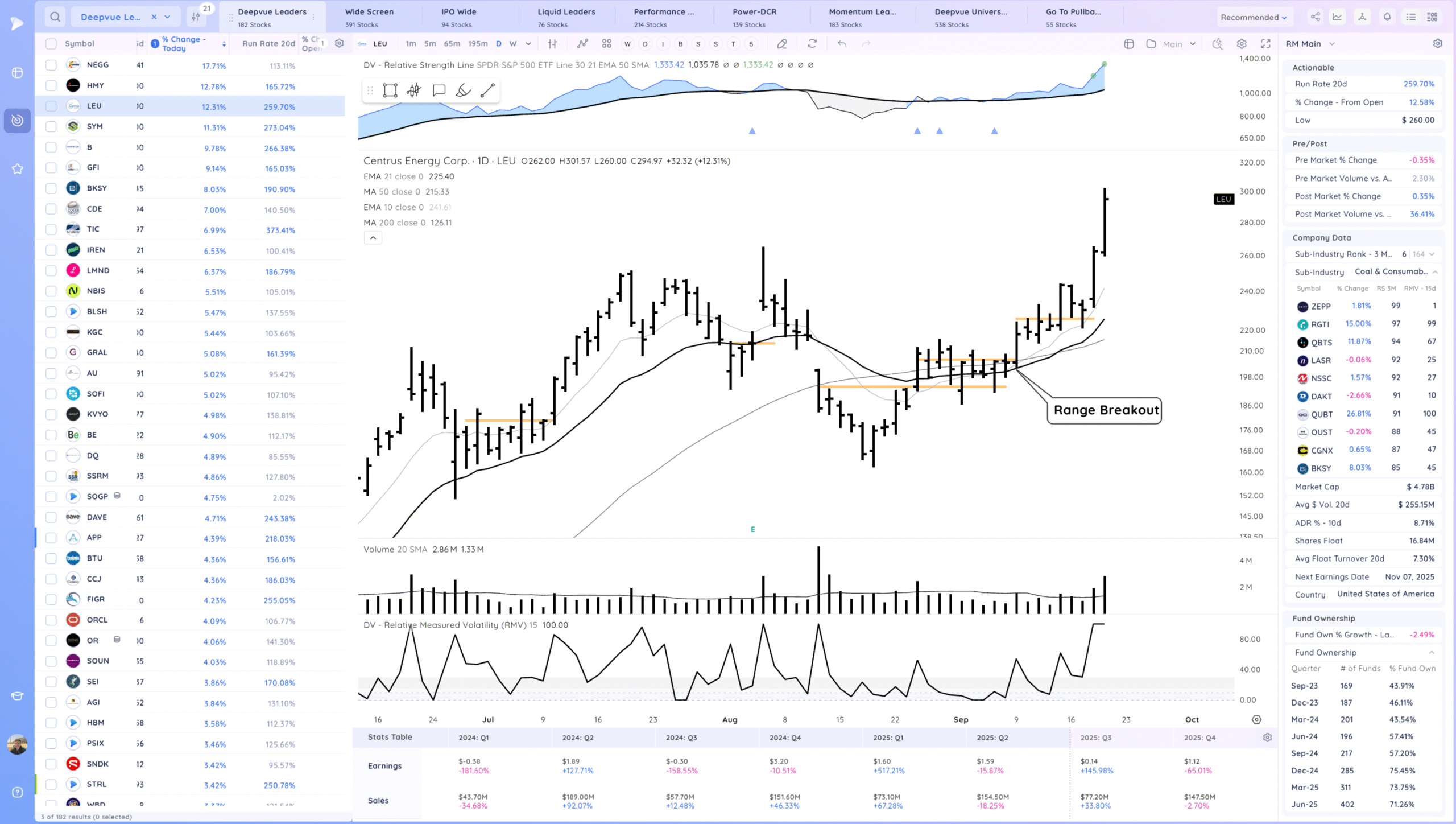

LEU textbook action from the range breakout entry 2 weeks ago

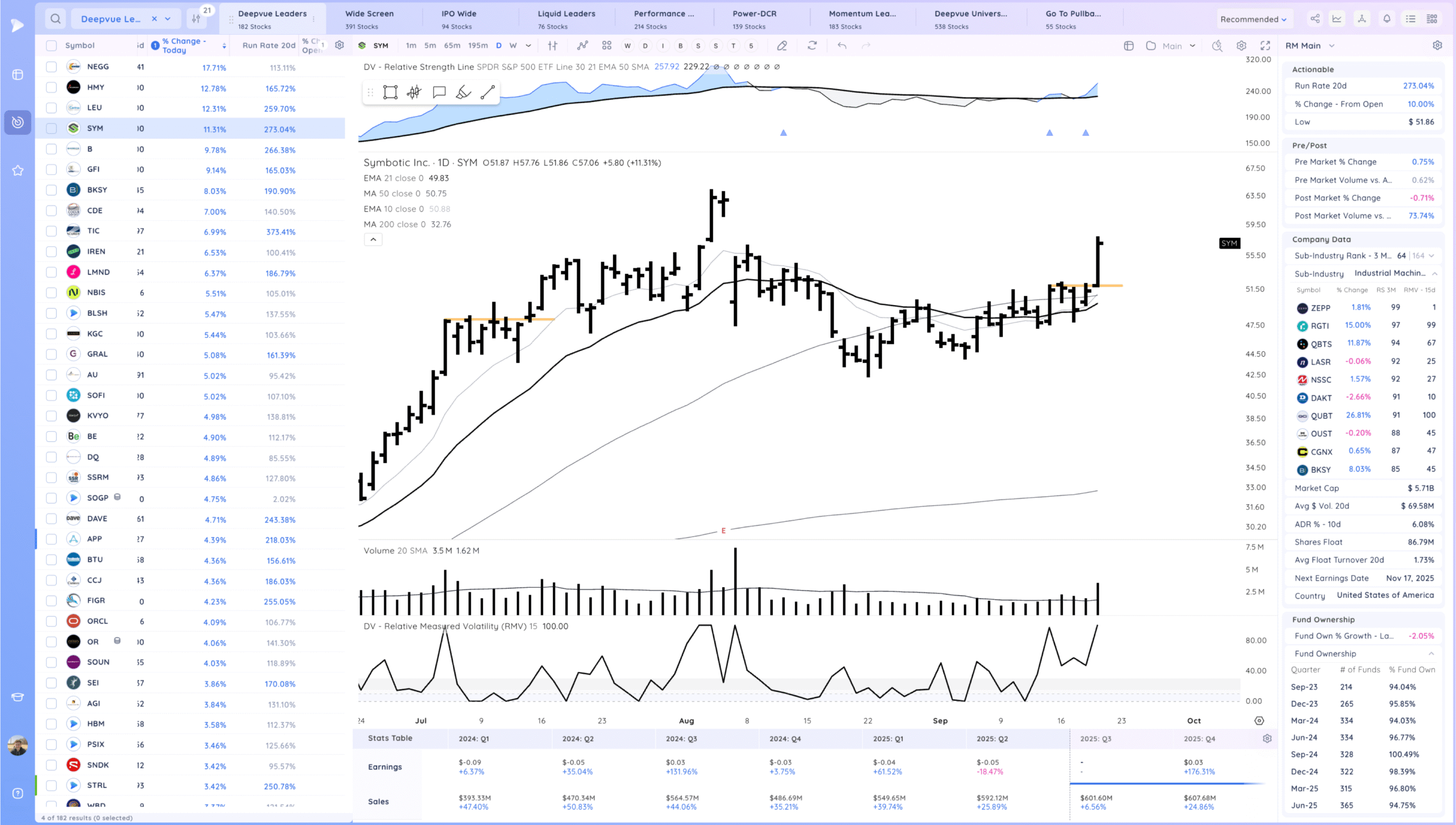

SYM from the watchlist, Range Breakout

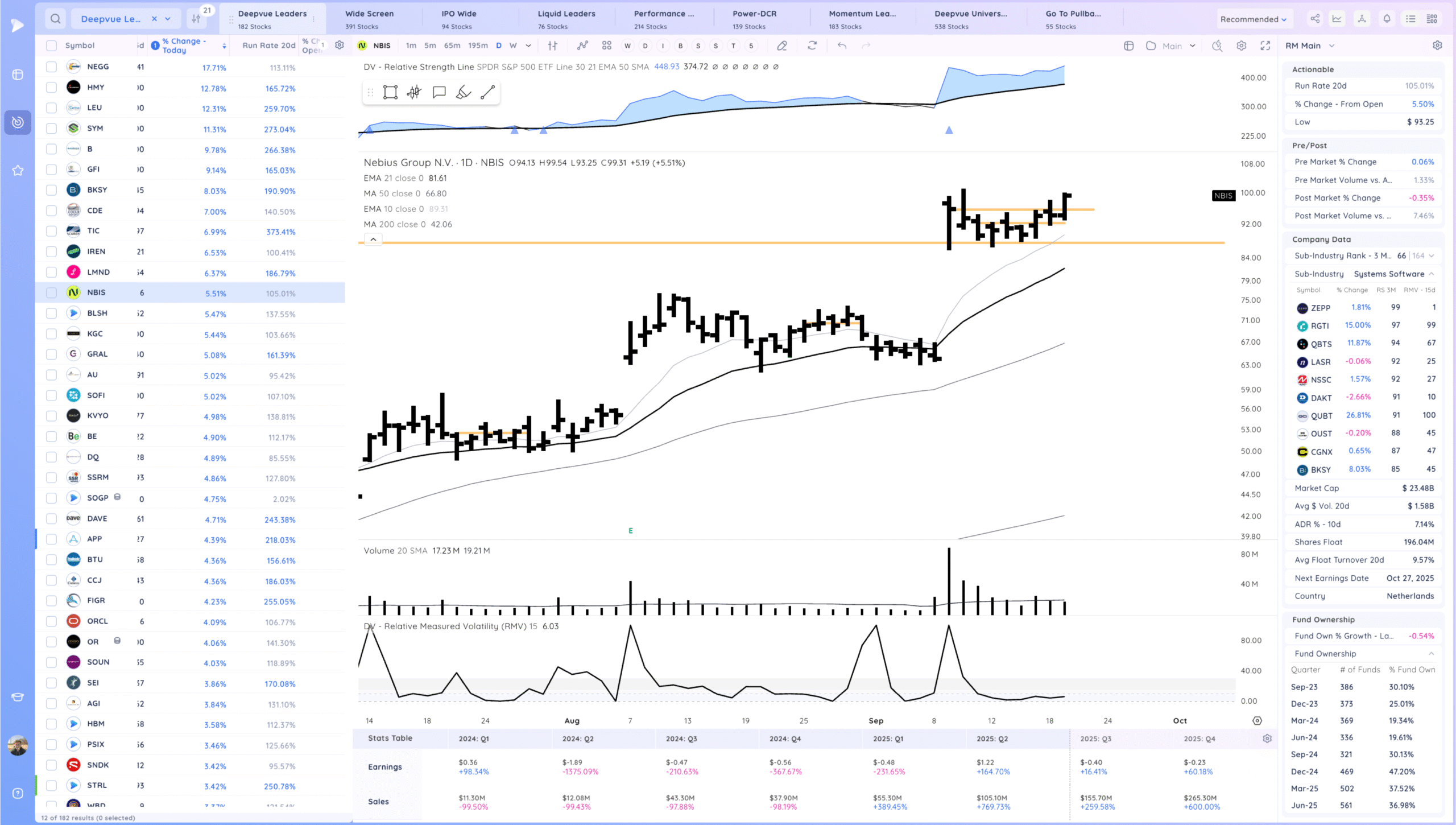

NBIS through the HVC

Setups and Watchlist

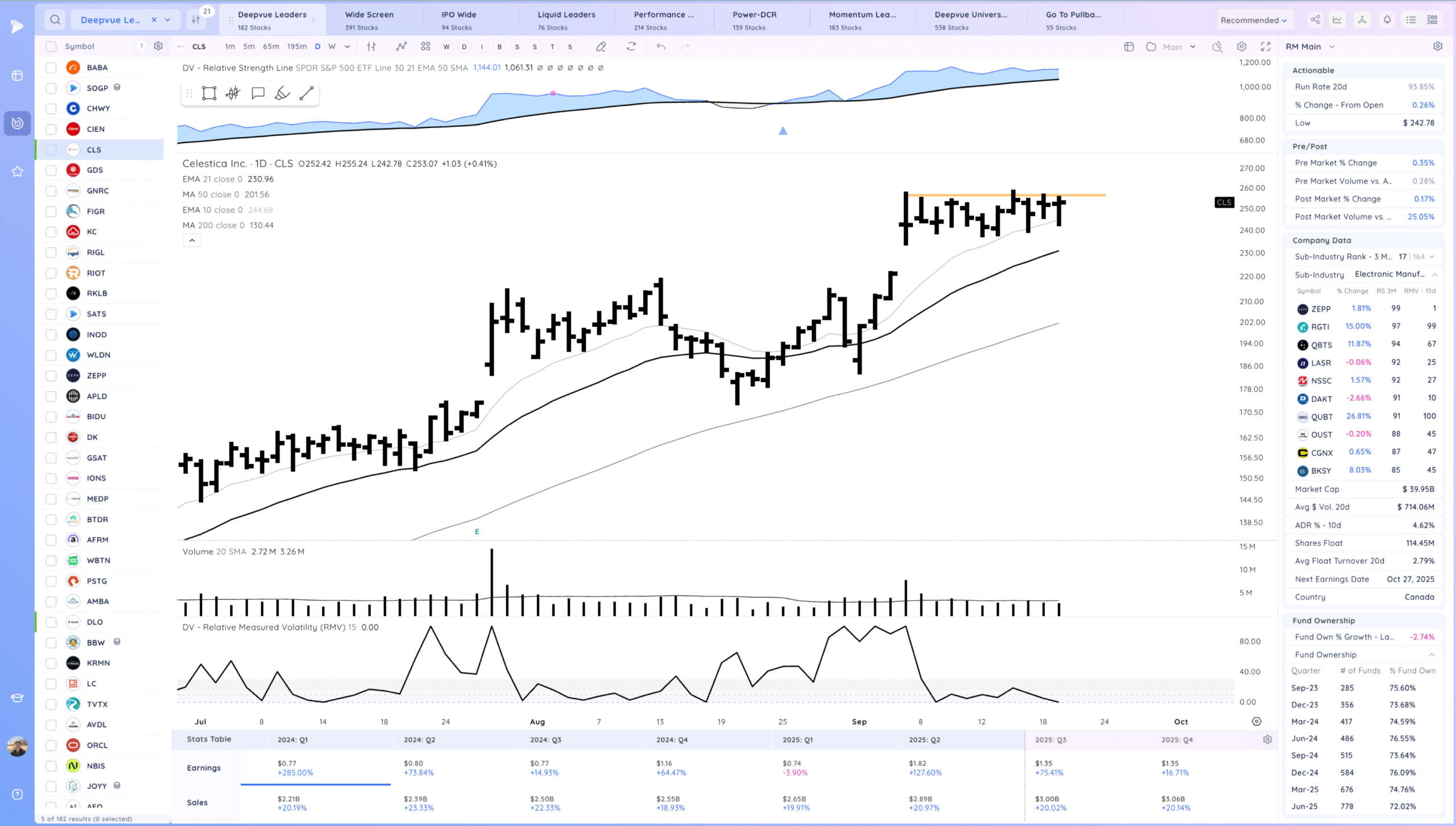

CLS watching for a range breakout. Strong trend

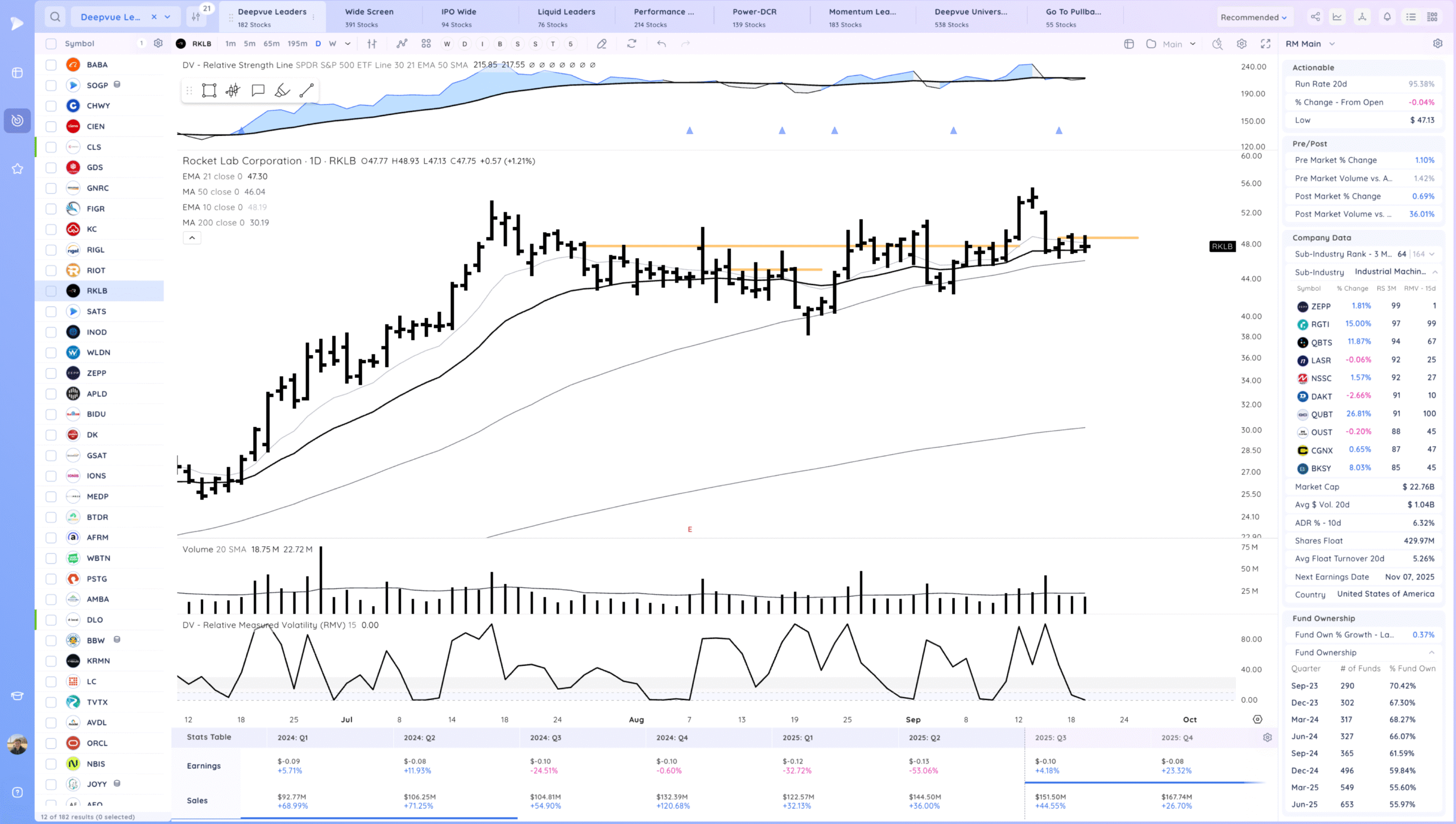

RKLB watching for a range breakout after the 21ema reset

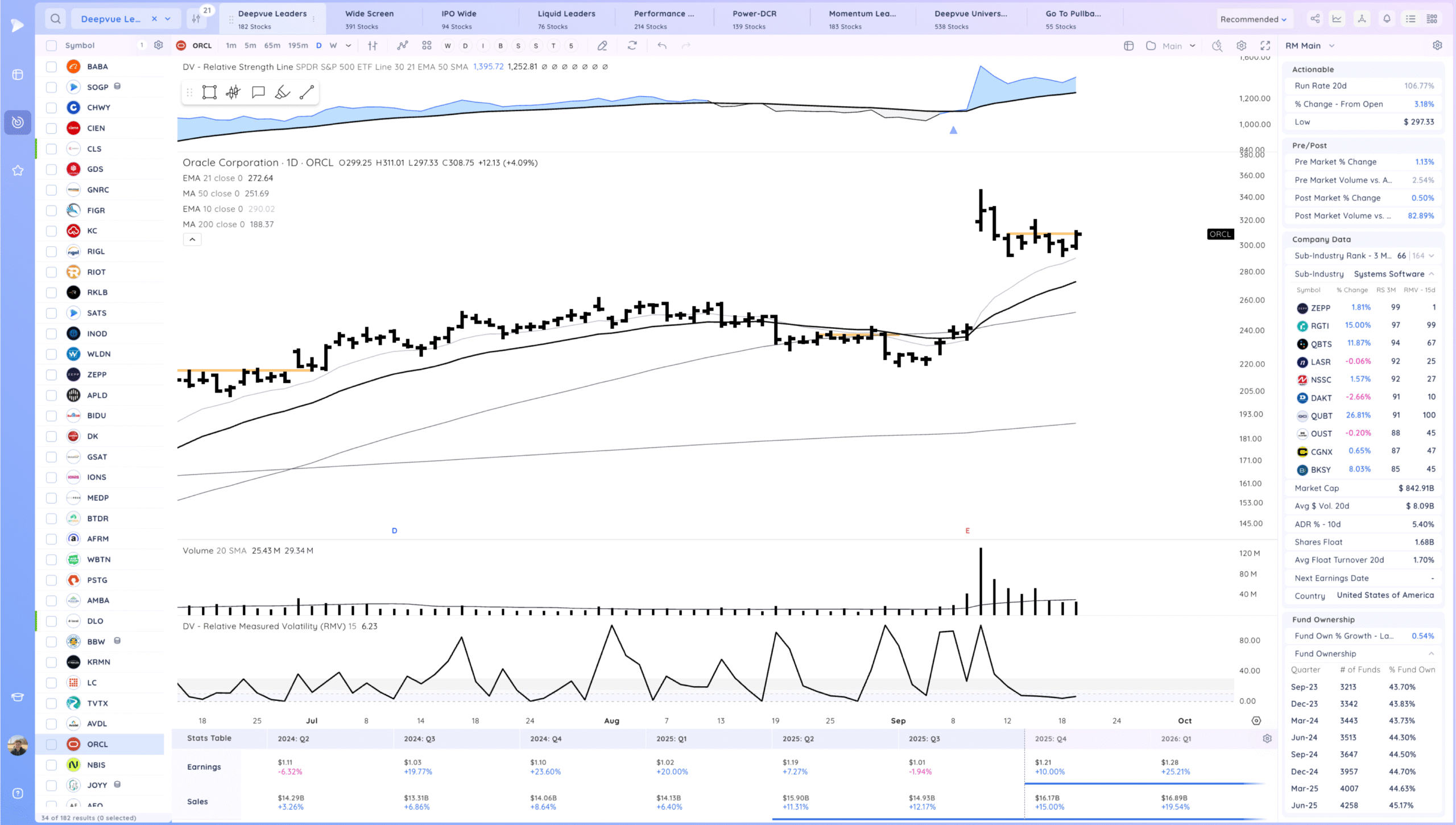

ORCL actionable today through yesterday’s high but watching for a range breakout for the U turn

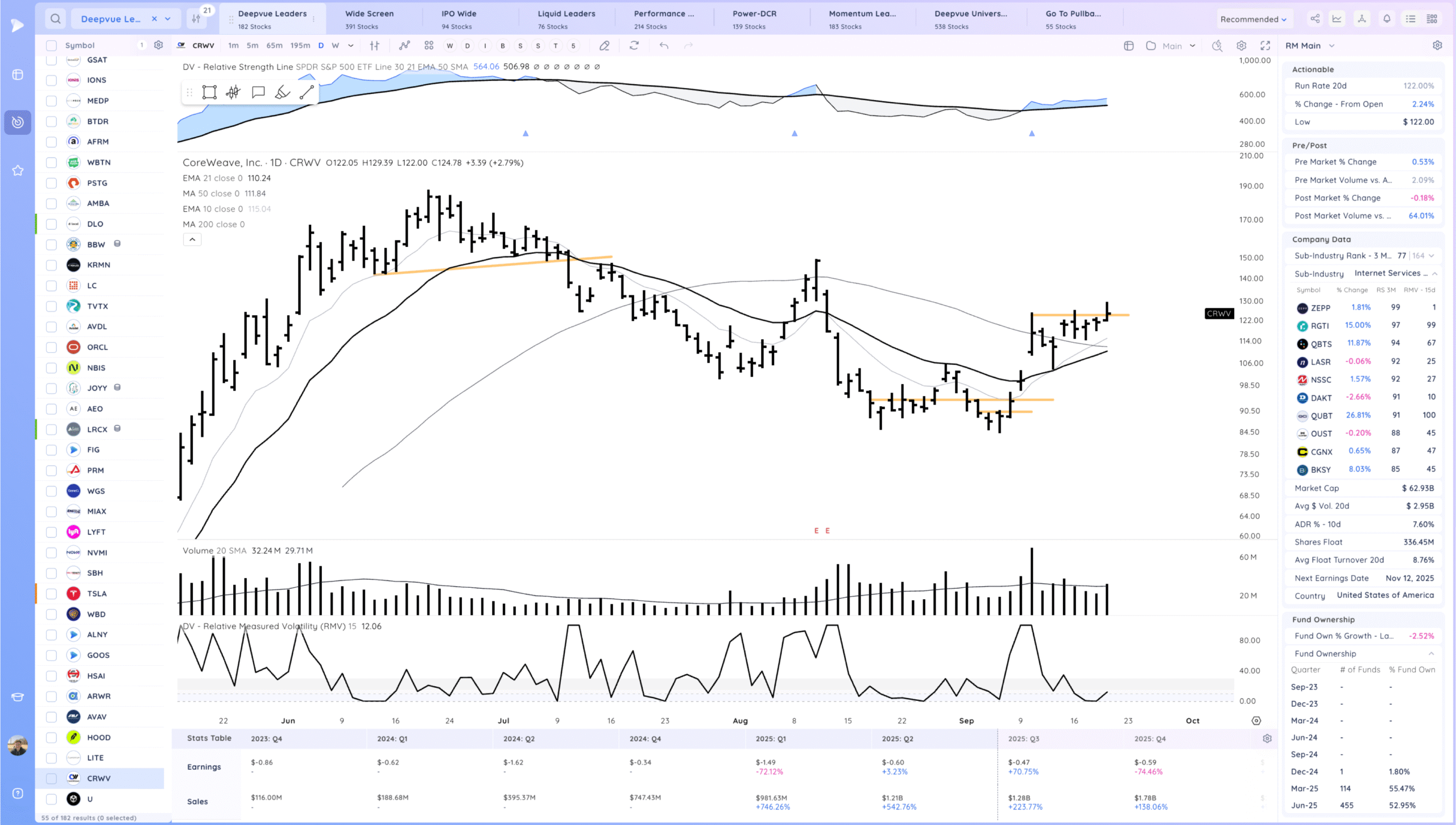

CRWV fade today but watching for a range re-breakout

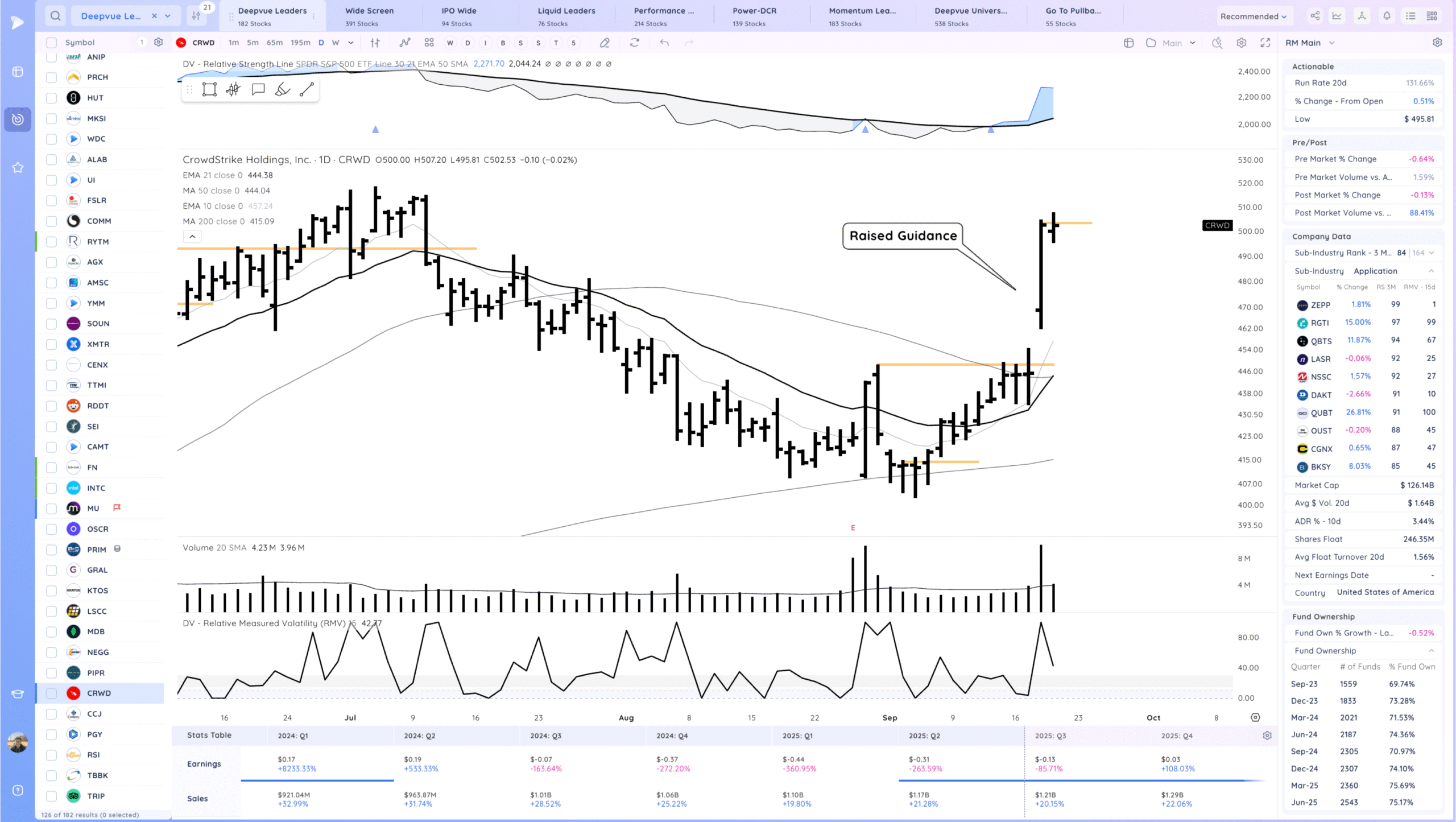

CRWD watching for an breakout from the tight day. Ideally this flags out more and forms a range

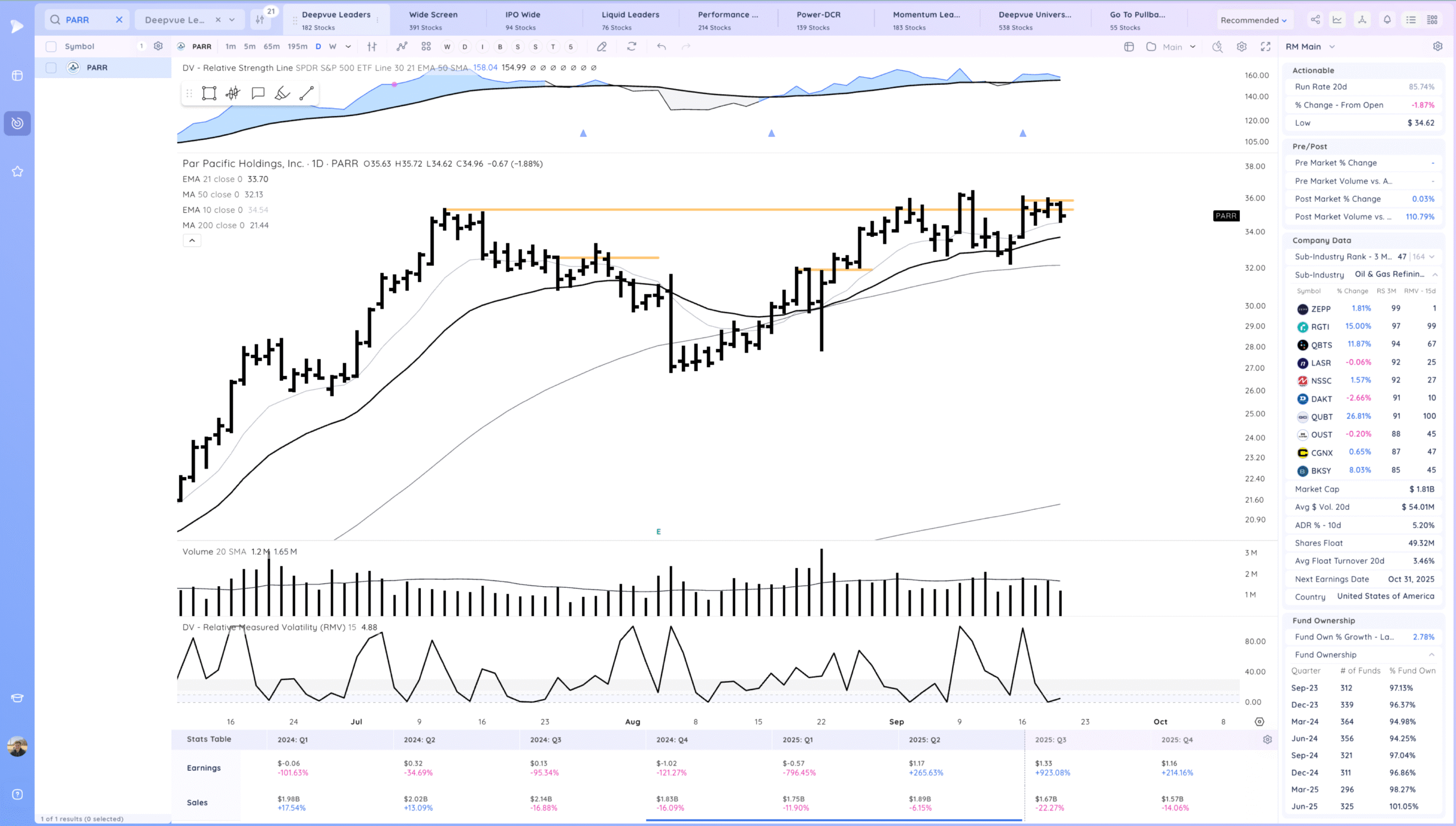

PARR watching for the range breakout.

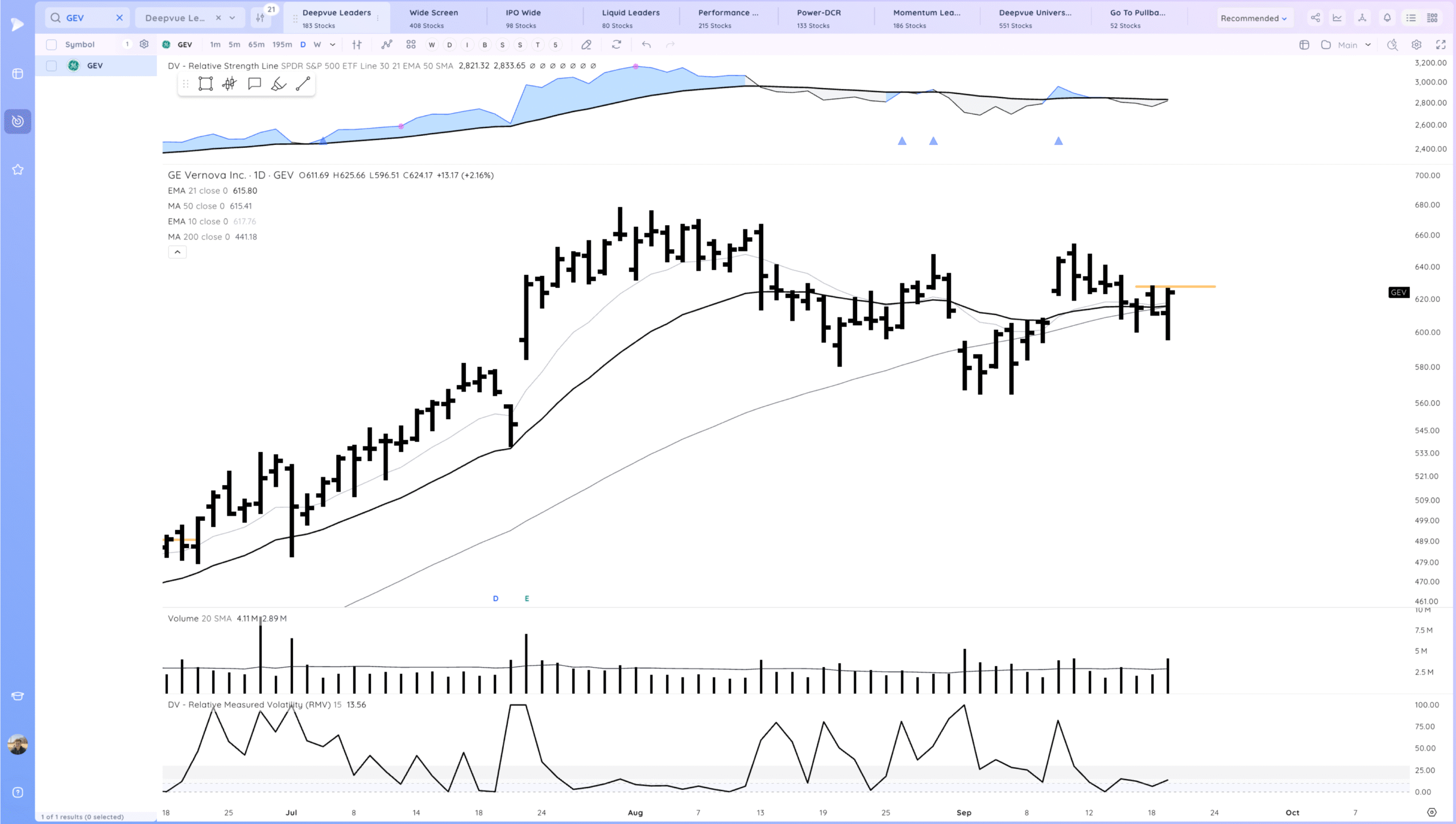

GEV watching for follow through

Today’s Watchlist in List form

Focus List Names

PARR CRWD CRWV ORCL CLS RKLB NVDA GEV

Focus:

NVDA GEV

Themes

Strongest Themes: AI, Metals/Miners, Software, Energy, Crypto Miners

Market Thoughts & Focus

Strong action from the portfolio and watchlists this week. Mentally prepared for some chop/consolidation/pullback if it comes. Lots of positive sentiment on X and we are up many days in a row. Don’t see too many fresh setups.

Anything can happen, Day by Day – Managing risk along the way