Pradeep Bonde: Episodic Pivots Delayed Reactions

Pradeep Bonde

Pradeep Bonde is a seasoned trader known for his expertise in momentum-based strategies and identifying Episodic Pivots, helping thousands of traders enhance their performance through his time-tested approach.

Published: March 28, 2025

Achieve Episodic Pivot Mastery 👇

Learn Pradeep’s method designed to capture rapid stock moves by significant catalysts.

What Are Episodic Pivots?

Episodic Pivots (EPs) are big price swings in a stock caused by major events like earnings surprises, game-changing product launches, regulatory approvals, or industry-shifting news. These events spark a surge in trading volume, driving the stock sharply up or down.

When an EP happens, the stock often breaks out of its usual range and starts a strong trend, usually upward. Traders and investors watch for these moments because they can create high-reward opportunities when trading with the new momentum.

Jumping straight into a stock after a large gap-up can be very risky. Waiting for a lower-risk entry on the other hand can help help minimize loss.

Earnings breakouts can lead to explosive stock moves, but what happens next? The delayed reaction entry method helps traders enter strong stocks at logical support levels after the initial spike.

Why Stocks Stall After Earnings Breakouts

Earnings reports often trigger massive stock surges, but these breakouts don’t always keep running. Many traders expect non-stop momentum, only to see the stock stall, pull back, or trade sideways.

Short-term traders that are holding stock before a big move are quick to take profits after an episodic pivot making it harder for stocks to keep climbing. Large investors also take profits, causing temporary slowdowns.

Understanding this behavior can help traders position themselves in a low-risk area to avoid the frustration of chasing extended stocks. Learn the strategies to enter episodic pivots that lead to rapid price movements.

When a stock sees a large gap-up it is sometimes too risky to buy a stock at extreme levels of extension. Instead, wait for a brief pullback into support that provides a lower-risk entry with a clear stop loss.

How Earnings Moves Play Out

Most earnings breakouts follow a four-stage pattern:

- Big Gap Up: The stock surges immediately after earnings.

- Short-Term Rally: It may continue rising for a day or two.

- Stagnation or Pullback: The stock stops moving up or even drops.

- Delayed Reaction: After days, weeks, and even months, a second strong move may occur.

This delayed reaction is a key opportunity for traders looking for a better risk-reward setup. Understanding this cycle can help traders time their entries better and avoid getting caught in weak breakouts.

EP Delayed Reaction: A Tradeable Setup

A delayed reaction occurs when a stock initially moves on earnings but fails to sustain momentum. Instead of chasing the initial breakout, traders can watch for a secondary setup.

After DOCS gapped up the price moved sideways for five days before offering a more ideal entry. Almost three weeks later an even better low-risk entry appeared.

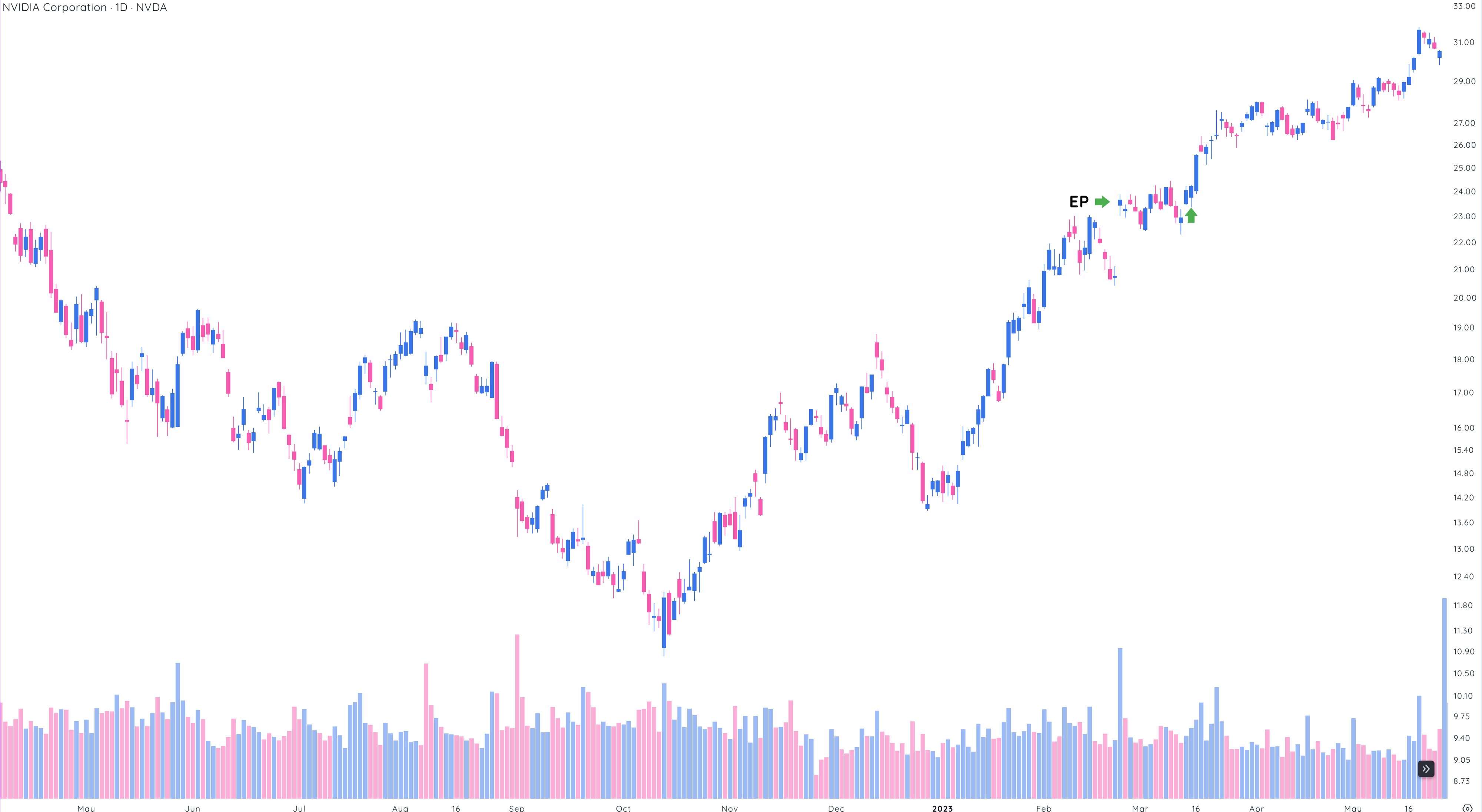

NVDA failed to hold a new high for three weeks after its episodic pivot, which started a 500% move. Once a new high was confirmed, the price continuously reached new highs.

How to Trade the Delayed Reaction Episodic Pivot

Analyze the price reaction after the episodic pivot and wait for a low-risk entry point. Be sure to understand general market conditions and the stock’s character.

What to Look for After an Episodic Pivot

Two-Part Strategy to Enter Episodic Pivots

Episodic Pivots are powerful setups but require a two-phase approach:

- Trade the Initial Move: This is a high-momentum move but can be risky. Trade the breakout for a quick profit.

- Wait for the Delayed Entry: After the stock consolidates, re-enter when it confirms a new move.

This approach reduces risk and increases the probability of catching the stock’s next leg higher (or lower for shorts).

Achieve Episodic Pivot Mastery 👇

Learn Pradeep’s method designed to capture rapid stock moves by significant catalysts.

Final Thoughts: Reducing Risk with Episodic Pivots

Not every earnings breakout leads to an immediate rally. Understanding episodic pivots with delayed reactions can help traders improve their timing and avoid getting stuck in high-risk trades. Instead of chasing the first move, track stocks post-earnings and wait for the low-risk entry.

By being patient and strategic, traders can reduce risk to increase their chances of riding the next big wave.