3 Sectors for Big Moves in Episodic Pivot Trading

Pradeep Bonde

Pradeep Bonde is a seasoned trader known for his expertise in momentum-based strategies and identifying Episodic Pivots, helping thousands of traders enhance their performance through his time-tested approach.

Published: April 18, 2025

Achieve Episodic Pivot Mastery 👇

Learn Pradeep’s method designed to capture rapid stock moves by significant catalysts.

What Sectors Work Best for Episodic Pivots?

If you’re trying to make real money trading episodic pivots (EP), you need to focus on the right sectors. While an EP can technically come from anywhere, the biggest, most consistent moves come from just a few places.

In this post, we’ll break down the three sectors that deliver the best EP setups: biotech, technology, and cyclical industries. We’ll also touch on thematic EPs, which can offer short-lived but powerful opportunities when certain narratives take hold.

1. Biotech and Healthcare

Why Biotech Moves Big

Biotech stocks often make massive moves based on clear catalysts like:

- Positive drug trial results (phase I, II, or III)

- FDA approvals

- Licensing deals or partnerships with larger companies

These catalysts can push a stock up 100%, 200%, or even more—in a single day. That’s what makes this sector the number one place to look for EP setups.

How to Trade Biotech EPs

Biotech trades well with a two-stage strategy:

- Initial move: Buy the stock on the news and ride the first day or two of momentum.

- Delayed reaction: Wait for a pullback and look for a second breakout once the market digests the news and any secondary offerings.

Risk Management

Biotech comes with higher risk. Stocks often give back large gains quickly. Development-stage companies can also dilute with secondaries right after a spike. So size your positions smaller unless the company has real revenue.

2. Technology

Why Tech Stocks Work

Tech stocks move big because innovation drives interest. Whether it’s a new AI tool, cloud breakthrough, or hardware release, traders pile into names that show real earnings growth and a strong narrative.

Advantages of Trading Tech EPs

- More consistent sales and earnings

- Stronger institutional interest

- Themes (like AI or cybersecurity) often last longer

Unlike biotech, you’ll often find more sustainable moves here. You’re not just playing hype—you’re also riding real financial growth.

3. Cyclical Stocks

What Are Cyclical Stocks?

These are companies that follow economic cycles. Think airlines, casinos, auto rentals, or luxury retail. When the economy slows, these businesses suffer. But when things turn around, they bounce back—fast.

Examples of Cyclical EPs

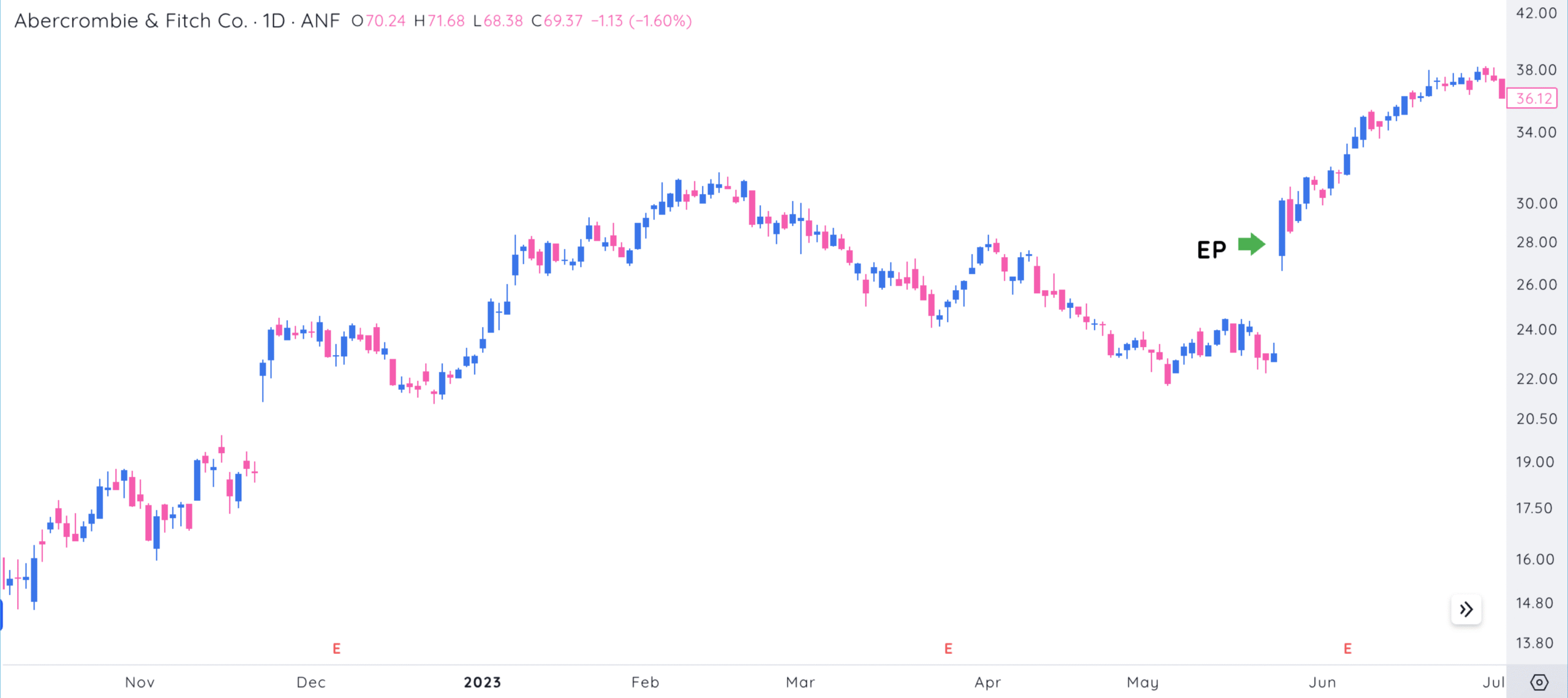

A great example is Abercrombie & Fitch (ANF). It had a major earnings surprise and then kept trending for nearly a year, returning over 400%.

Key Traits

- Earnings surprises drive the initial move

- Turnarounds often lead to multi-month trends

- You’ll find these plays mostly in the consumer discretionary sectors

Bonus: Thematic EPs

Sometimes, it’s not about earnings or data—it’s about narrative. These are thematic EPs, where a stock moves because of a broader story in the market.

Common Themes

- AI: Anything tied to AI gets attention. Stocks mentioning partnerships with Nvidia or AI features can spike hard.

- Crypto: When crypto heats up, stocks like MARA, RIOT, or CLSK can run 100%+ in weeks.

- Marijuana: Rumors of legal reform can ignite sector-wide breakouts.

- China turnaround: Recently, Chinese stocks began popping on hints of economic recovery.

How to Use This

Track current themes. When a hot one shows up, look for strong breakouts in related stocks. Just know these moves can fade fast.

Key Takeaways

If you’re serious about EP trading, go where the action is:

- Biotech: Fast moves, big risk, use a two-phase strategy

- Tech: Real growth and longer-lasting trends

- Cyclical: Economic shifts bring powerful earnings-driven setups

- Themes: Watch for hot narratives like AI, crypto, or marijuana

Don’t spread your focus too thin. Narrow in on these sectors and study them daily. Most of the best EPs each year will fall into one of these categories.