8 Life Lessons I Learned From Becoming a Trader

Fred Saffore (Lone Stock Trader)

Fred Saffore is a self-taught trader who turned years of hard lessons and a 90% portfolio loss into a consistent, profitable trading career.

Published: April 25, 2025

Although I’ve only been involved in the markets for about 10 years now, looking back, becoming a trader had a huge impact on me. It profoundly changed me—it reshaped my way of thinking, challenged many of my previous beliefs, and ultimately transformed part of my personality. These changes also had ripple effects in many other areas of my life.

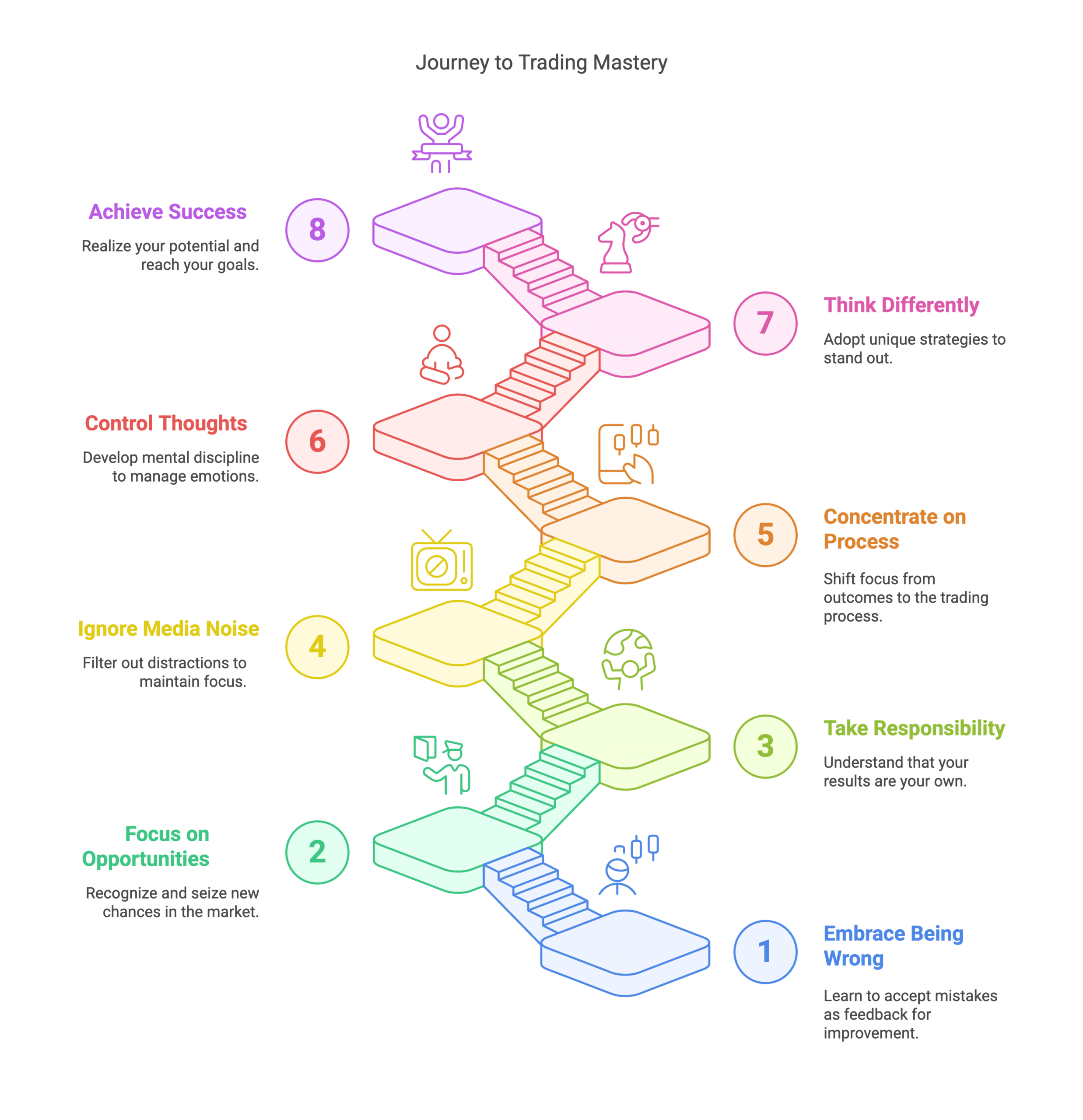

I’d like to share a few life lessons I’ve learned from trading:

1. Being Wrong Is OK

We’ve been taught since we were kids that being right is good and being wrong is bad. It makes it very difficult for us to admit when we are wrong.

In trading, we are wrong very often. In fact, even the best traders out there are wrong between 40% to 60% of the time.

If you can’t keep your ego in check and admit quickly when you are wrong, you’re almost sure to lose all the money you have invested in the markets at some point. There is almost no way that you will make it as a trader unless you change your perspective on being wrong.

Being right or wrong is just information, a feedback you use to adjust your actions. When you are wrong, the only thing to do is to stop being wrong by taking the right action.

2. Don’t dwell on missing an opportunity

What is fantastic with trading, is that, just like in real life, there is an endless stream of great opportunities that come our way. We just have to learn how to spot them. Just like trains, if you miss one, just get ready for the next one.

3. You are 100% responsible for your results

In the market despite having no influence whatsoever on the market, we are 100% responsible for our long term results.

The only way to be able to succeed in an environment you can’t control is to focus exclusively on the few variables you actually have control over.

In life, despite not being able to choose where we come from, we have the power to take control of our destiny. We have to focus on what we can impact, what we can change.

Blaming something or someone or the past is a complete waste of your precious time.

For a deeper dive into this mindset, check out 12 Trading Principles from Marios Stamatoudis.

4- Listening to the media often is a waste of time

Before trading, I was a complete sucker for the news and social media. In order to improve my trading I had no choice but to tune out the media noise in order not to be negatively influenced into deviating from my strategy and trading plan.

This made me realize that nothing bad actually happened to me since I stopped watching the news. In fact, my life got much better since then. Media are just money-making machines designed to make us become addicted.

5. What you focus on determines your results

Trading is one of the few endeavors where you have almost no boundaries. You are on your own and what you focus on becomes of utmost importance. I really discovered the importance of focus with trading. What you focus on in trading will literally determine your results.

- If you focus on being right, you’ll probably lose a lot.

- Focus too much on your recent winnings, and you will be prone to overconfidence.

- Focus too much on your recent losses, and you will be scared of taking the next entry signal and more likely to change strategy.

- Focus exclusively on trading while forgetting to analyze your past trades and results, and you will likely repeat the sames mistakes over and over again.

- Focus on listening to others, the news, social media, and you will be influenced by external opinions and prone to disregard your own rules or take trades outside of your strategy.

- Focus on the money and it will be much harder to actually make money.

- Focus on the process and positive expectancy, and money will follow.

6. I don’t have to be a slave to my thoughts

Trading made me discover that I had the power not to be a slave to my thoughts. By observing myself and the thoughts that cross my minds, I have more control over whether to act or not on those thoughts.

This allows me to be calmer in stressful situations, where money is on the line for instance, and act in a more rational manner than I would have if I’d let my thoughts and emotional reactions take over.

7. You have to do things others won’t do in order to get things others don’t have

When we start trading, we are inclined to do what everybody is doing. We learn the same things as everybody else, read the same books, study the same chart patterns, the same indicators, listen to anyone who has an opinion, repeat the same mistakes over and over…

But since it is a well known fact that 90% of traders fail, how can we hope to get different results by doing what the majority does?

In trading, just like in life, we have to think differently and do what others don’t in order to get what other people wish they had.

“To be successful, you must be willing to do the things today others won’t do in order to have the things tomorrow others won’t have” – Les Brown

From my own experience, I discovered that:

- Most traders do not do a thorough post-analysis of their trades and trading results.

- The overwhelming majority of new traders prefer very short time frames.

- They give too much importance to the outcome of a single trade.

- They focus exclusively on finding a way to have a high win rate, often to the detriment of risk/reward.

- They watch the news and get their trading ideas from others…

8. You can succeed at anything you want

Being able to beat the odds and become consistently profitable taught me that with patience, effort, drive, persistence, confidence and adaptability, they are very few things we can’t accomplish.

With those qualities, that fortunately anyone can develop, you can almost be anything you want to be.

Since I became a trader and discovered the limitless potential we all have in us:

- I developed my dream relationship with the woman I love

- I became fluent in 3 languages

- I became a bookworm

- I launched a blog

- I wrote an eBook

- I traveled to many countries

You just have to decide on the few things you really want to accomplish and put all your focus and efforts toward those goals.