Making It Impossible NOT To Be Consistently Profitable Trader

Fred Saffore (Lone Stock Trader)

Fred Saffore is a self-taught trader who turned years of hard lessons and a 90% portfolio loss into a consistent, profitable trading career.

Published: April 12, 2025

There is a simple mathematical fact in trading, which, although well-known, most traders immensely underestimate.

Understanding the implication of such a fact can be of tremendous help in turning you into a consistently profitable trader, and helping you stay in that small circle.

The 3 Numbers You Must Know About Your Trading

If you have been following me and my blog, you probably already know what those numbers are.

But they are so important, IMHO, that I’ll remind them to you anyway.

Those three variables will determine whether your trading strategy has a positive expectancy—in other words, whether you are actually making or losing money over time.

1. Your Win Rate

The “win rate” (a.k.a. “batting average”) is your percentage of winning trades over a certain number of trades.

E.g.: If you had 80 winning trades over the last 200 trades, your win rate is 40%.

Most trading strategies have a win rate between 40% and 60%. Some strategies have a much higher win rate (which can go up to 80% for short periods), but they are usually very short‑term (e.g.: scalping), the average loss is much bigger than the average profit, and the win rate fluctuates a lot—meaning that the expectancy of the system can quickly turn into a losing one since it relies so much on a high win rate.

Since most profitable trading strategies are right between 40% and 60% of the time, how do profitable traders actually make money in the markets?

They do so by focusing on the two other variables of the expectancy of a system: the average profit and the average loss.

2. Your Average $ Loss

As traders, we do not have real control over our win rate. Indeed, the market gives us the opportunities. We don’t take from the market. We are slaves to it.

But although we don’t really have control over our win rate, we do have control over our average loss. This is done by using a stop loss—the level at which we’ll get out at a loss if the trade goes against us.

The word “average” is key. The fact that some trades will result in losses larger than your average loss—for instance, in the case of a gap down—doesn’t matter in trading. Trading is not about one trade. Trading is about a series of trades—hundreds or even thousands of trades. If your average loss over the last 200 trades is $500, one trade that results in a $1,000 or even a $2,000 loss will not have much impact on your average loss over those 200 trades.

3. Your Average $ Profit

So, since the average loss can be kept in check, the only variable left is the average profit. Basically, this variable will determine how easy it will be for you to make money over time.

Making It Impossible NOT To Be Consistently Profitable

As a reminder, the $‑expectancy of your strategy (i.e., the amount you can expect to make per trade, over time, on average) can be calculated as follows:

$ Expectancy per trade = (Win Rate × Avg $ Profit) – (Loss Rate × Avg $ Loss)(Note: the “Loss Rate” simply is 1 – Win Rate.)

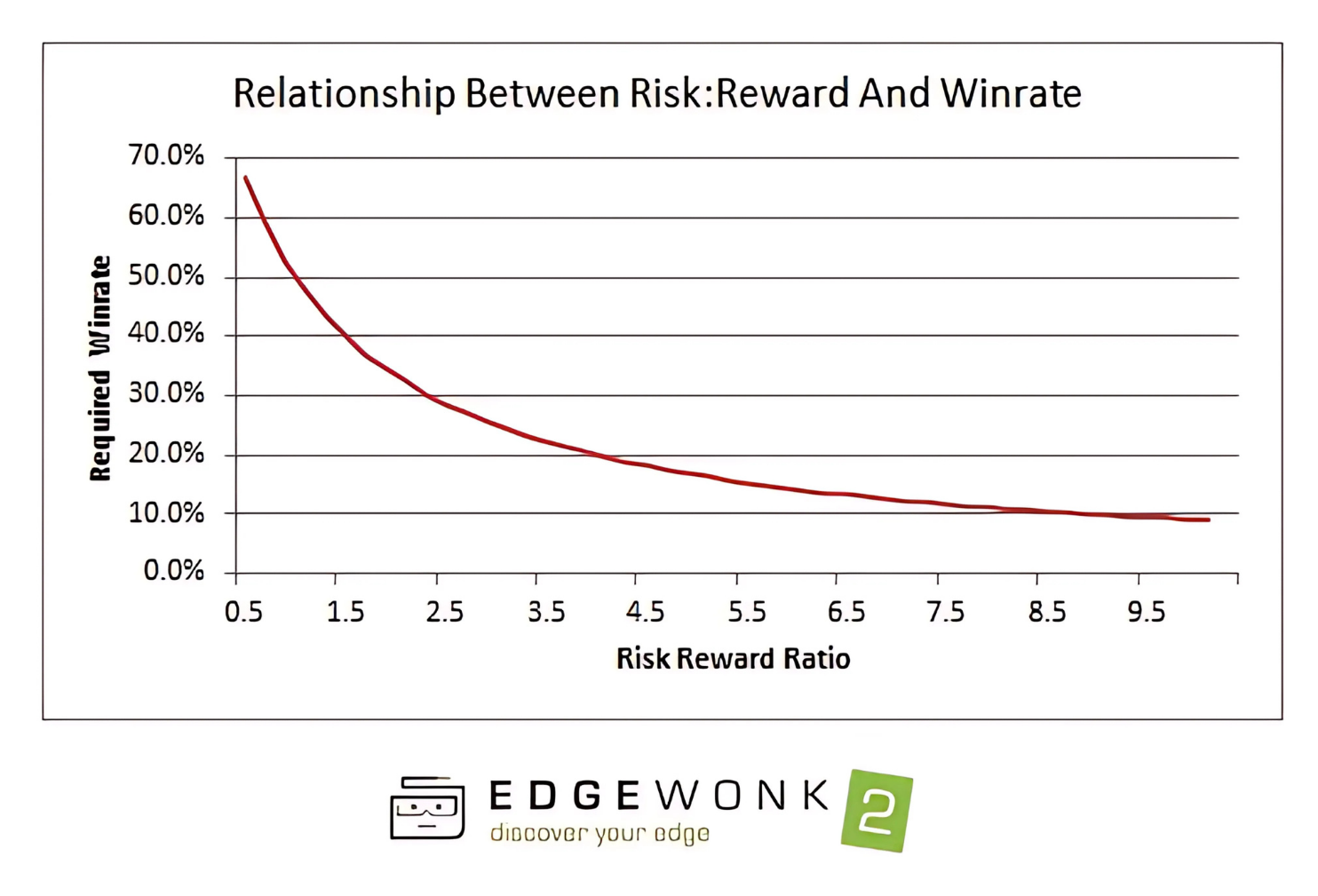

For example, if your strategy produces an average profit that is three times bigger than the average loss, you only need to be right more than 25% of the time in order to generate profits consistently over a certain number of trades.

Now think about it. In the market, it is quite difficult to be right more than 50% of the time. But the good news is that it is equally difficult to be wrong more than 50% of the time. Indeed, if you were consistently wrong 75% of the time, you’d just have to reverse your strategy in order to be right 75% of the time.

What are the implications of that? Well, if you can get your average profit three times bigger than your average loss, it will be very difficult NOT to make money over time, since you would need to be wrong more than 75% of the time.

If you can get your average profit three times bigger than your average loss, it will be difficult NOT to make money over time.

And even if your average profit is only twice as big as your average loss, you only have to be right more than 34% of the time in order to make money consistently in the markets. In that case, you can be wrong 65% of the time and still make money.

So the “magic” here is that the bigger your average profit is compared to your average loss, the more difficult (if not downright impossible) it will be to NOT be consistently profitable in the markets.

Then Why So Few Traders Make Money Consistently?

1. We Are “Programmed” To Do The Opposite of What Should Be Done

Our human nature makes it extremely difficult to cut our losses short (keep our losses as small as possible) and let our winners run (stay in a trade as long as it goes up). In fact, we are even “programmed” to do the opposite—cut our winners short and let our losers run.

To learn more about this tendency, see [Loss Aversion].

2. Most New Traders Take Over‑sized Positions

Many fail despite a positive‑expectancy strategy because they use position sizes that are too large—betting too big. Even if your strategy wins 80% of the time, betting 100% of your capital on any trade will eventually blow your account.

Rule of thumb: Risk no more than 1% of your trading capital on any one trade. This reduces your risk of ruin to nearly zero.

3. Aiming For The Bare Minimum

Blindly aiming for a 2:1 reward‑to‑risk ratio often leaves your average profit much less than twice your average loss. Aim instead for trades with a minimum reward‑to‑risk ratio of 3:1 or more.

In my own trading, year to date, my average profit is 2.77 times bigger than my average loss.

4. Most Traders F*ck Their Expectancy Up When Things Get Tough

When losing streaks hit, many widen their stops to avoid whipsaws—thereby increasing their average loss and destroying their profit/loss ratio. The correct response is to tighten stops to preserve your favorable expectancy.

5. Most Strategies’ Win Rate Will Go Down When Aiming At Larger Reward/Risk Trades

Win rate and reward/risk ratio are negatively correlated: larger targets often mean a lower win rate. Your goal is to build a strategy that offers both a high profit/loss ratio and a decent win rate.

Four Pillars of a Robust Strategy

- Large profit potential — good odds of landing a big winner

- Optimal entry — highest chance of starting in profit

- Tight stops — keep average loss in check

- Mindset & rules — let winners run

You now have the principles for developing a robust system. But of course, no one said it was going to be easy 🙂