NIO MarkUp – July 2020

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: December 25, 2020

NIO – July 2020

This Mark Up covers the NIO trade in detail. Below I journal my thoughts in addition to the detailed chart mark up.

Never miss a post from Rai!

Sign up to get instant notifications when I publish a new post.

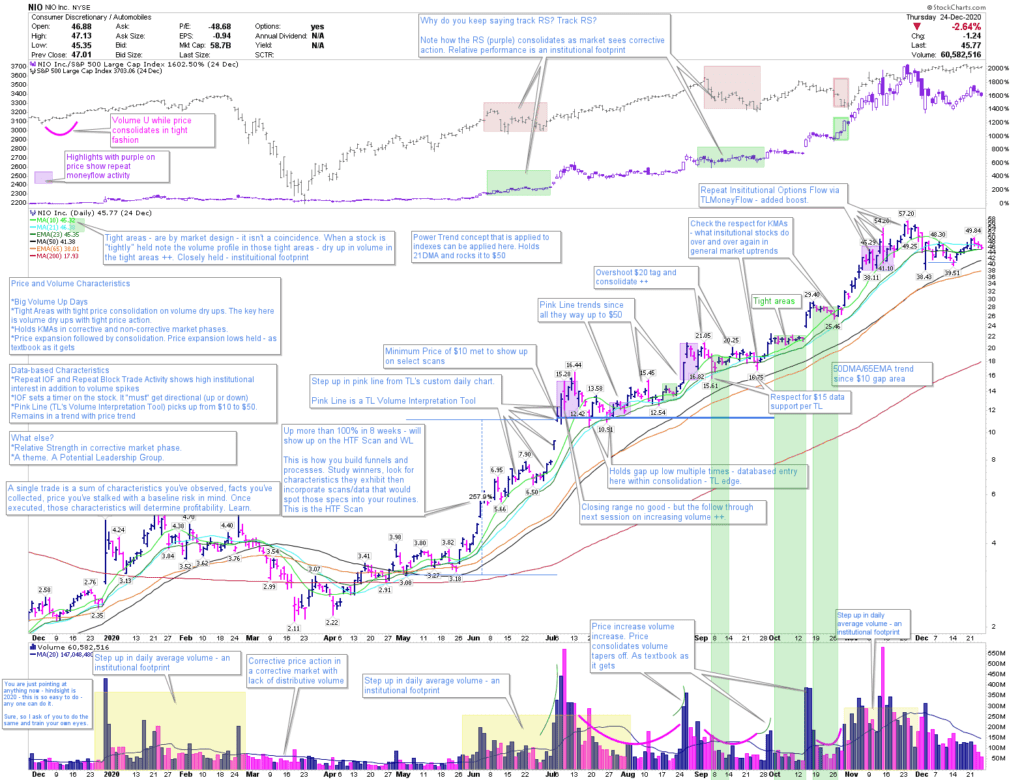

Price and Volume Characteristics

*Big Volume Up Days – Low Volume Down Days

*Tight Areas with tight price consolidation on volume dry ups. The key here is volume dry ups with tight price action. The Volume U’s as price consolidates.

*Holds KMAs in corrective and non-corrective market phases

*Price expansion followed by consolidation. Price expansion lows held – as textbook as it gets in the stock market.

*Relative Strength in a corrective market phase – 2x.

*A theme. In 2020 EVs (Electrical Vehicle) stocks were trending and part of Potential Leadership Groups (PLG). TSLA the other.

Data-based Characteristics

*Repeat IOF (Institutional Options Flow) and Repeat IBT (Institutional Block Trades) = high institutional activity / interest.

*IOF sets a timer on the price to get directional (up/down).

*Pink Line (TL’s Volume Interpretation Tool) – trends higher from teens to 50s – added conviction.

Process

*Picked up through the HTF Scan after moving up 100% in 8 weeks

*Large Volume on Gap Up – with low closing range, however follow up with full closing range the next day on increasing volume ++

*IOF+IBT+Pink Line+PLG added to conviction.