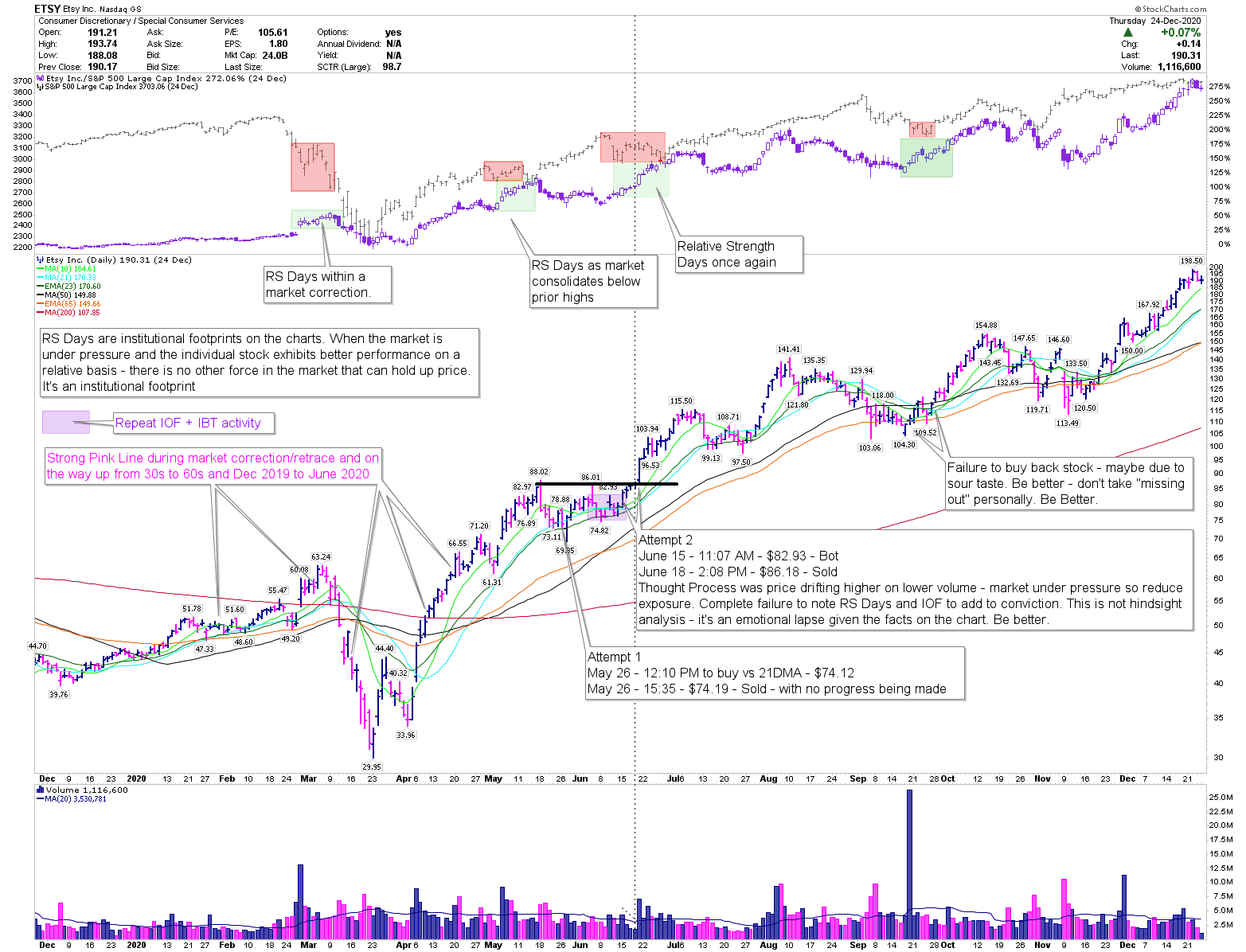

ETSY MarkUp – June 2020

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: December 25, 2020

This Mark Up covers the ETSY trade in detail. Below I journal my thoughts in addition to the detailed chart mark up.

Price and Volume Characteristics

*Relative Strength Days with price trading above 21DMA, while market consolidates its gains.

*Multiple Phases of prior Relative Strength with Institutional Footprints on the charts in a corrective market.

Data-based Characteristics

*Repeat IOF (Institutional Options Flow) and Repeat IBT (Institutional Block Trades) = high institutional activity/interest.

*IOF sets a timer on the price to get directional (up/down).

*Pink Line (TL’s Volume Interpretation Tool) – trends higher from the 30s to 60s and from December 2019 to June 2020.

Process

*Noting Relative Strength

*Considered a leader in its own space. Prior cycle winner. Traded multiple times in prior years.

*IOF+IBT+Pink Line+PLG all pressent.

*Failure to spot RS Days and hang on to stock. Conviction should have been higher as IOF+IBT+Pink Line+RS Days where all present. Sold for pennies when dollars should be the mindset. Should be okay with giving up 3.5 points and let it hit stops even. Lapse in judgement, thought process.

Never miss a post from Rai!

Sign up to get instant notifications when I publish a new post.