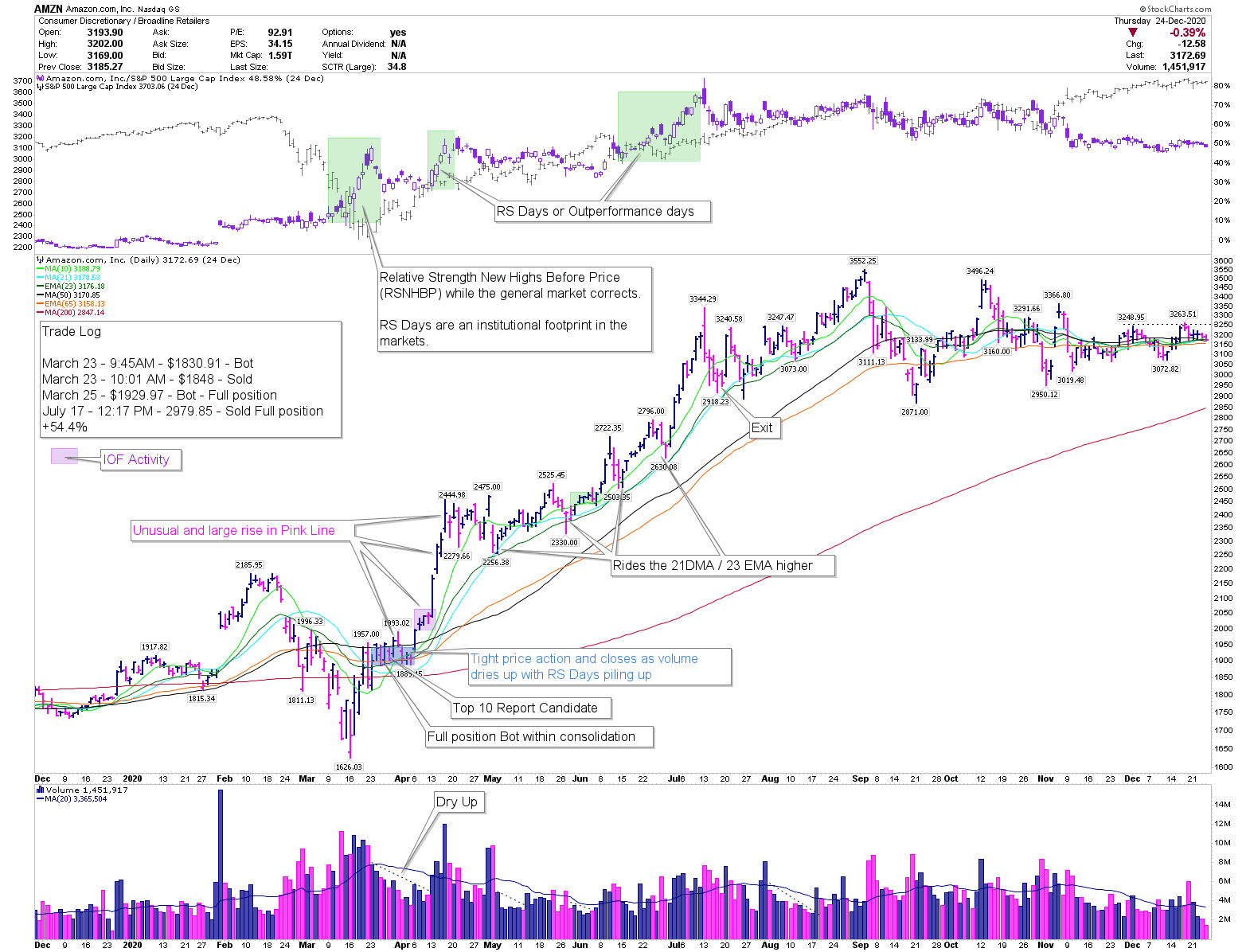

AMZN MarkUp – March 2020

Ameet Rai

Electrical Engineer and Swing Trader focused on achieving super-performance. Through extensive studies of previous super-performance stocks and proprietary data-based research I provide guidance for new traders with an emphasis on building processes and teaching traders how to think and trade for themselves.

Published: December 26, 2020

This Mark Up covers the AMZN trade in detail. Below I journal my thoughts in addition to the detailed chart mark up.

Price and Volume Characteristics

*Relative Strength New Highs Before Price (RSNHBP) characteristic on display. This means that AMZN on a relative basis to the general markets acted much stronger while the market was in a correction. A key characteristic that liquid, big cap, institutional darlings exhibit during corrective market action.

*Tight consolidation above its 65EMA into early April 2020.

*Dry Up in volume while price consolidates tightly. Resistance to market pressure observed at the same time which resulted in AMZN being a Top 10 Report candidate.

Data-based Characteristics

*IOF activity right before its large movement, near the $2000 mark.

*Pink Line (TL’s Volume Interpretation Tool) – trends higher from the 1950s to 2440s and from Late March 2020 to mid-April 2020.

Process

*Noting Relative Strength, Relative Strength New Highs Before Price.

*Considered a leader in its own space. Prior cycle winner. Traded multiple times in prior years.

*IOF+Pink Line+PLG all present.

*Multiple RS Days and Phases where AMZN outperformed the general markets. Trend above 21DMA – could’ve been held as a little longer into September 2020. A+++ trade, with the full position being held from initiation to exit – rare.

Never miss a post from Rai!

Sign up to get instant notifications when I publish a new post.