Market Overview

The NASDAQ and S&P 500 sold 1.81% and 1.16% respectively. Volume rose across the board. The S&P 500 closed below the 50-day SMA and near its low for the day. The NASDAQ finished in even worse shape, below both its 50-day SMA and 65-day EMA.

The health and breadth of the market’s traditional growth leaders deteriorated considerably throughout today’s session.

Tonight’s Focus List below is a mish-mosh of what’s left standing. Rotation was primarily out of tech and healthcare and into retail, silver & gold, consumer staples, and steel. Biotech stocks continue to show the strongest gains, though many have started to break.

Until we see considerable improvement in the market’s leadership, minimal exposure is your best bet right now, including going to 100% cash, unless the stops on your current positions remain valid.

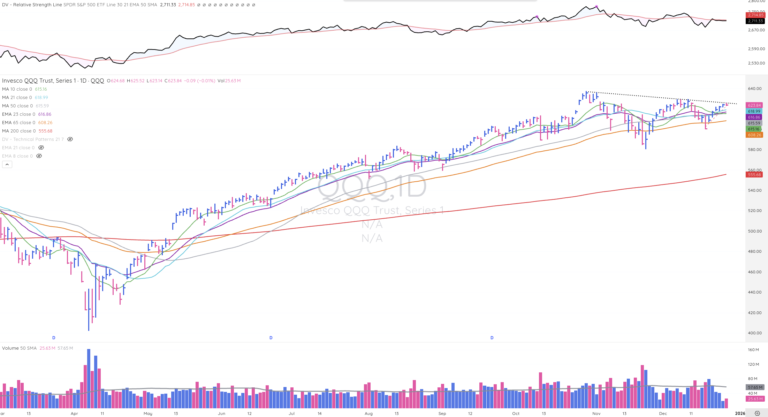

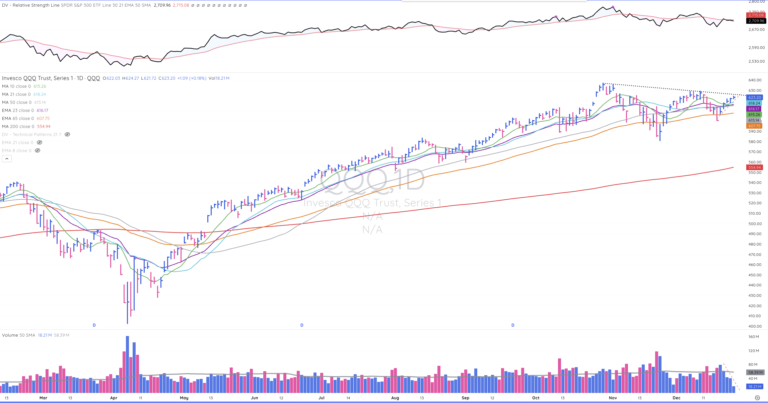

Indexes

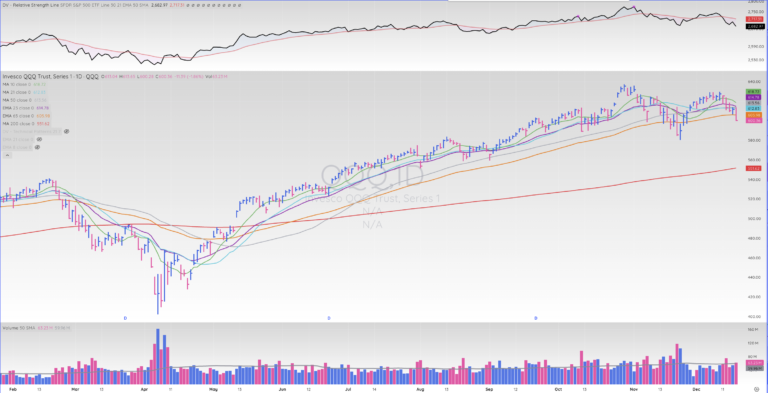

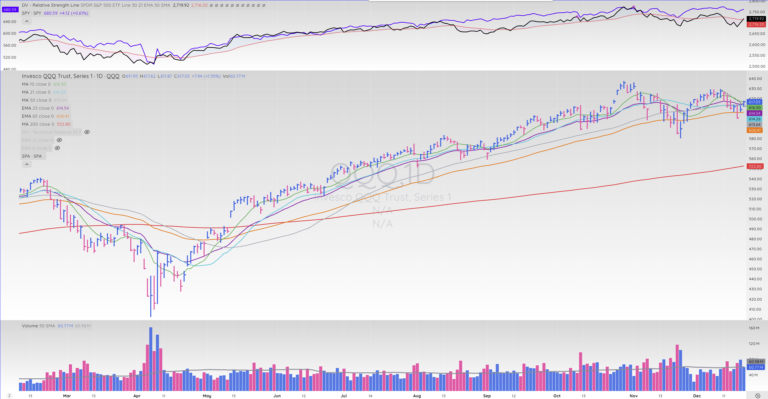

QQQ

The NASDAQ broke sharply below its key 50-day SMA and 65-day EMA on heavier volume, which doesn't portend well for a Santa Clause rally this year.

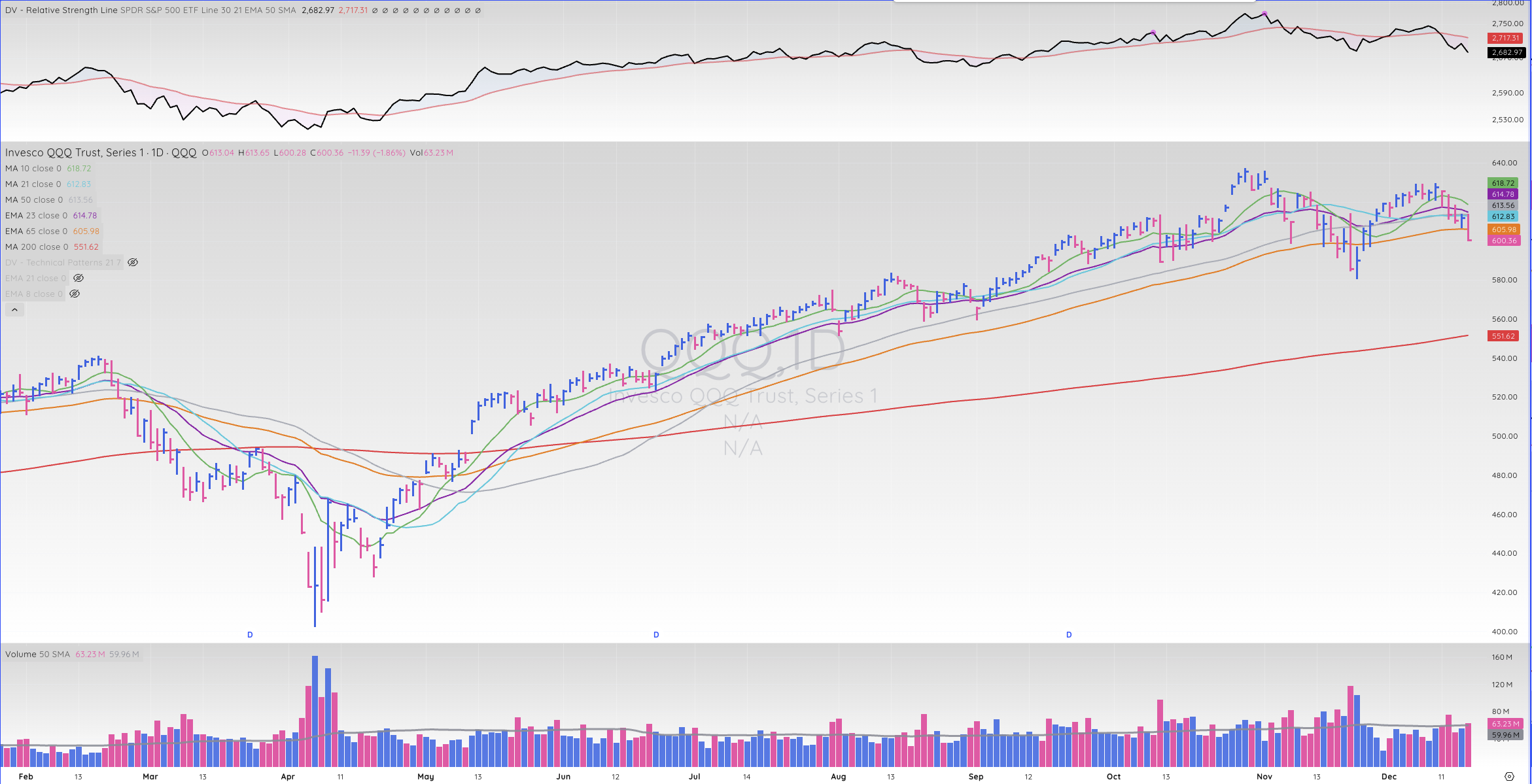

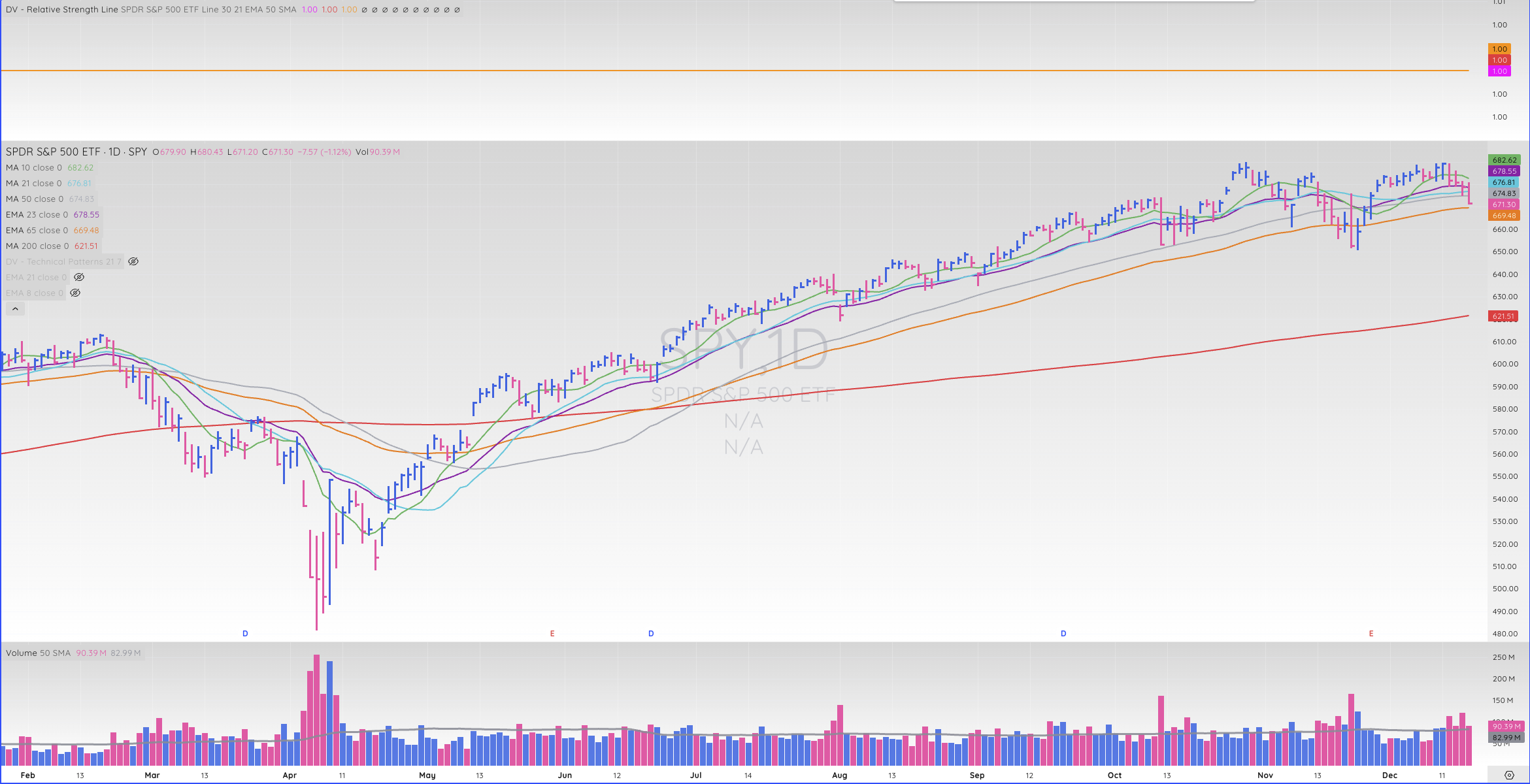

SPY

The S&P 500 wasn't far behind the NASDAQ today. It help up better on a percentage basis and closed above its 65-day EMA, although it melted straight through its 50-day SMA, just like the tech-heavy NASDAQ

IWM

The Russell 2000 closed above its 21-day and 50-day SMAs and its 65-day EMA, as the small-cap index continued to exhibit more strength than the NASDAQ or S&p 500.

DIA

The DOW held up the best of the four major indexes today, which makes sense given the rotation into "relative safety" we've seen over the last few days

Focus List

TSLA

TSLA fell 4.64%, but held up well above its 10-day SMA and near its prior highs, showing much more strength than the general market.

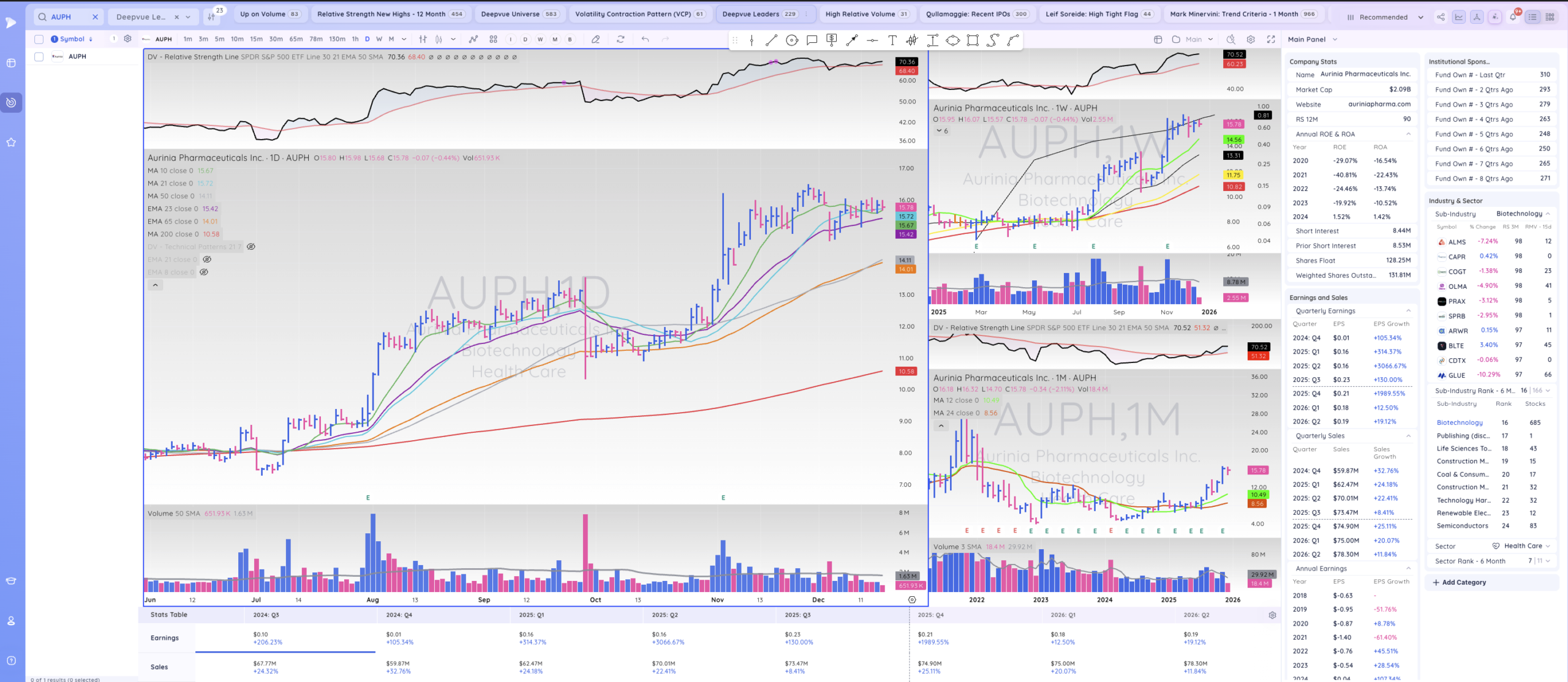

AUPH

AUPH is a smaller biotech stock that continues to tighten up constructively as it moves sideways, and appeas to be setting up to break higher.

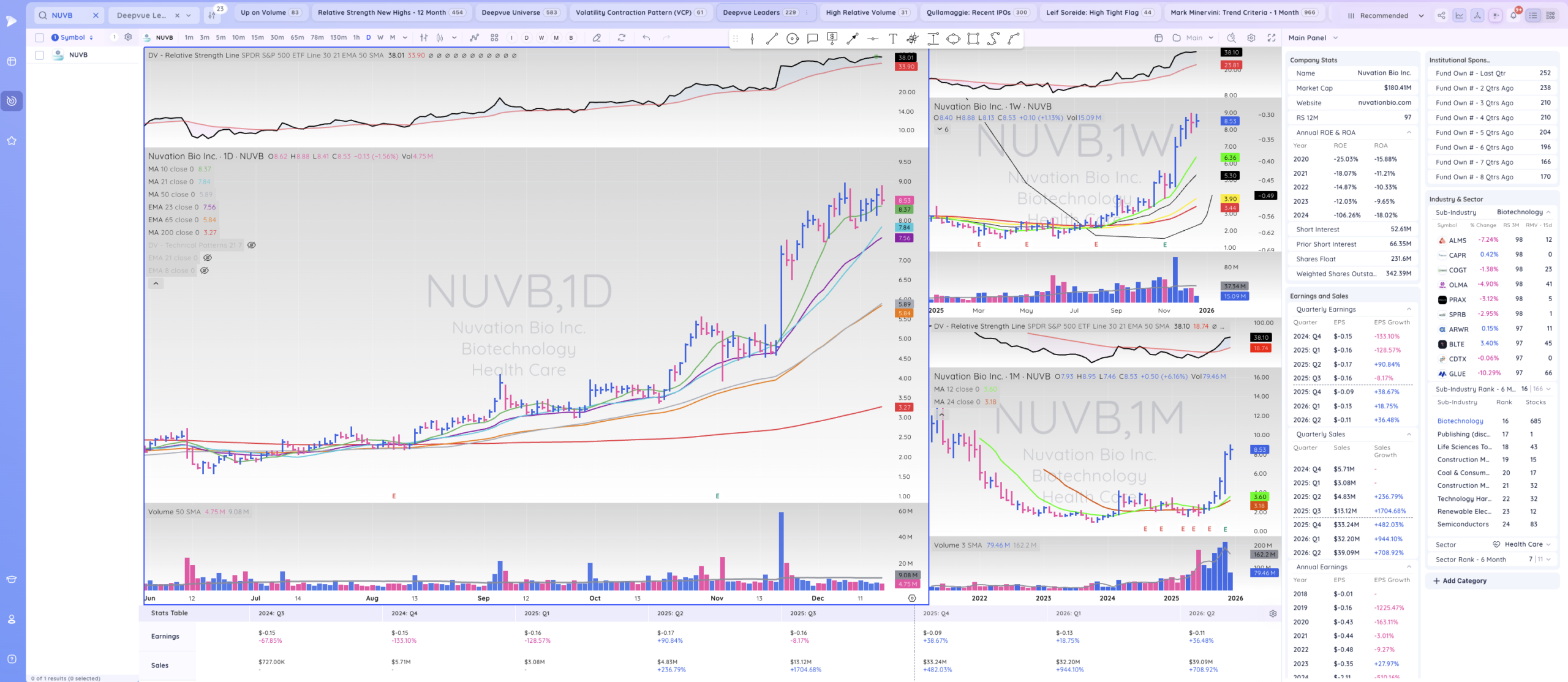

NUVB

NUVB is another smaller biotech name, which is forming a high tight flag and also appears to be setting up for higher prices.

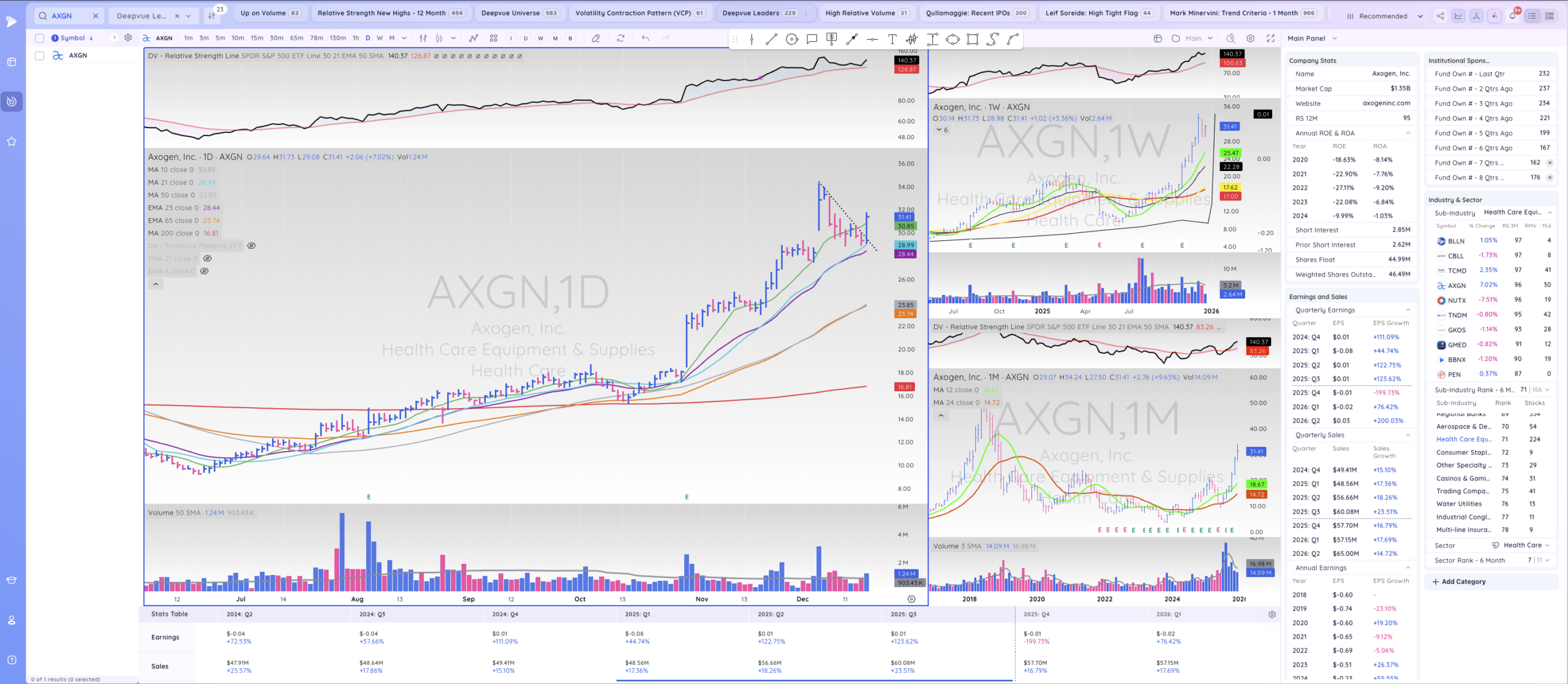

AXGN

AXGN completely ignored the general market today and could have been purchased after it bounced at its 21-day SMA and broke above its declining tops line and 10-day SMA on big volume.

DG

Consumer Staples stock DG is moving vertically like a tech name as money rotates towards relative safety, in a risk-off environement.

ANF

ANF is a high-quality, liquid retail leader that can exhibit extreme power and appears to be setting up to move higher from here.