Trade Opportunity Case Study of the Week: PL Gapper – | Dec 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 14, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

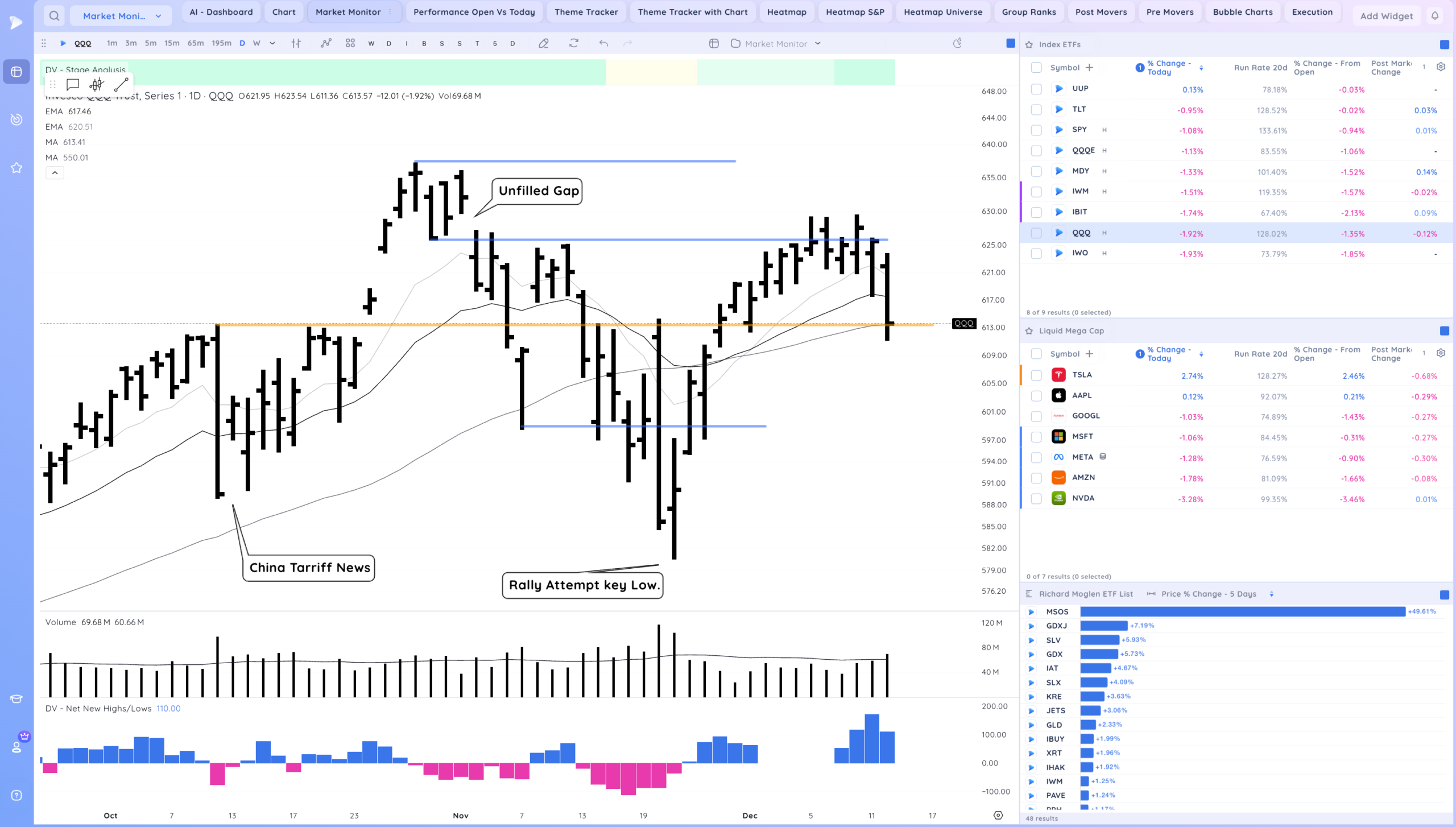

To add market context, the QQQ formed a range and then broke lower below the 21ema

The best opportunities this week were in areas outside of traditional growth stocks in biotechs, miners, and select catalyst based moves.

EGO and other miners range breakouts.

WVE Weight loss drug trial episodic pivot

WRBY AI Glasses partnership with GOOG new developments and timeline catalyst move

Marijuana stocks took off on policy change catalyst Friday. See MSOS Below

For this week, we will be focusing on PL. An earnings catalyst gap.

PL operates the world’s largest fleet of ~200 earth-imaging satellites, capturing daily imagery of Earth’s entire landmass to deliver high-frequency geospatial data, analytics, and insights via a web platform (Planet Insights Platform).

Serves agriculture, mapping, energy, forestry, finance, insurance, plus civil/commercial government customers. For monitoring crops, deforestation, assets, or national security.

Discovery – PL Gapper

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

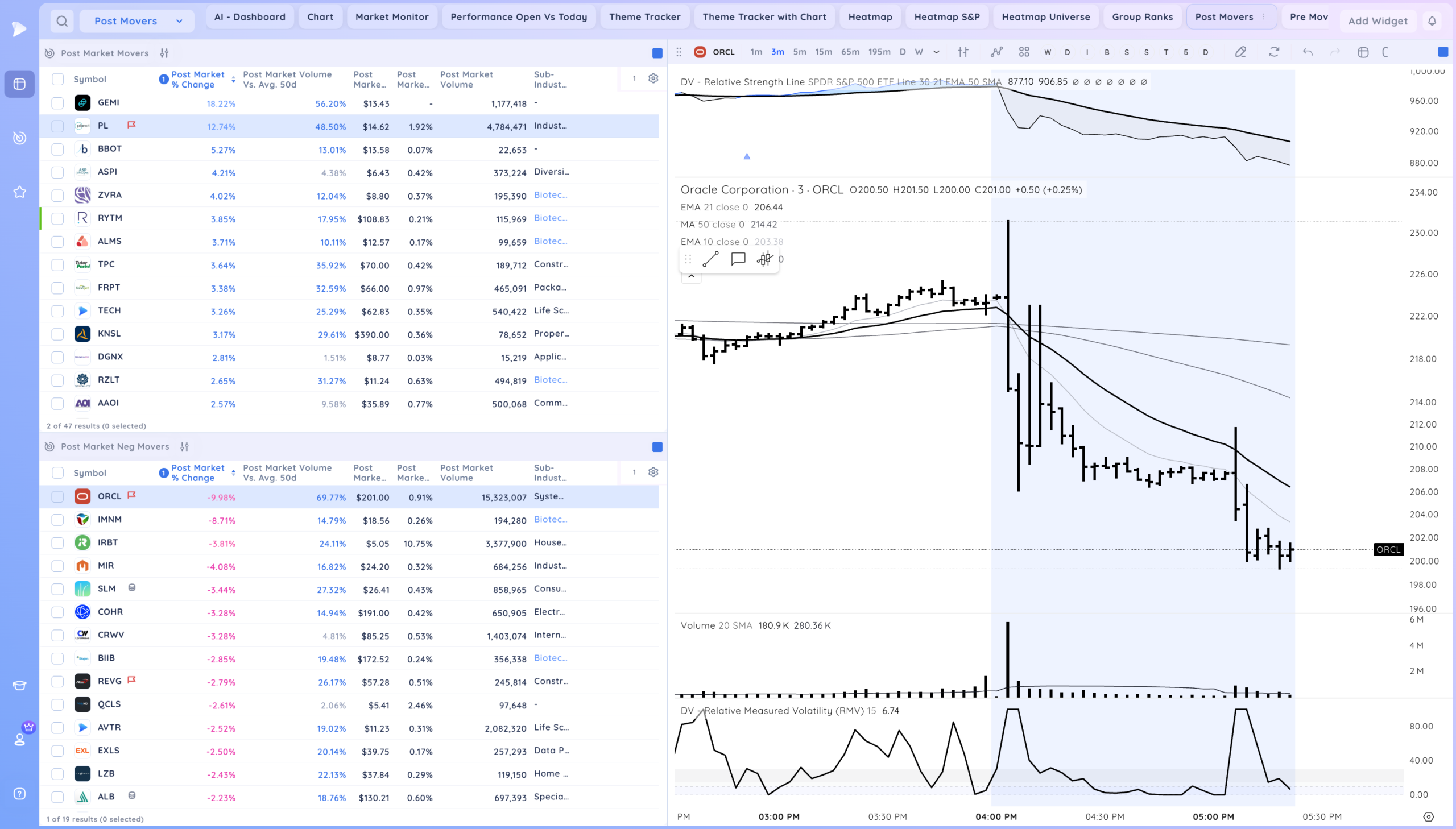

To catch catalyst gaps you need to review pre & post market movers.

I have a dashboard set up in Deepvue to make this easy.

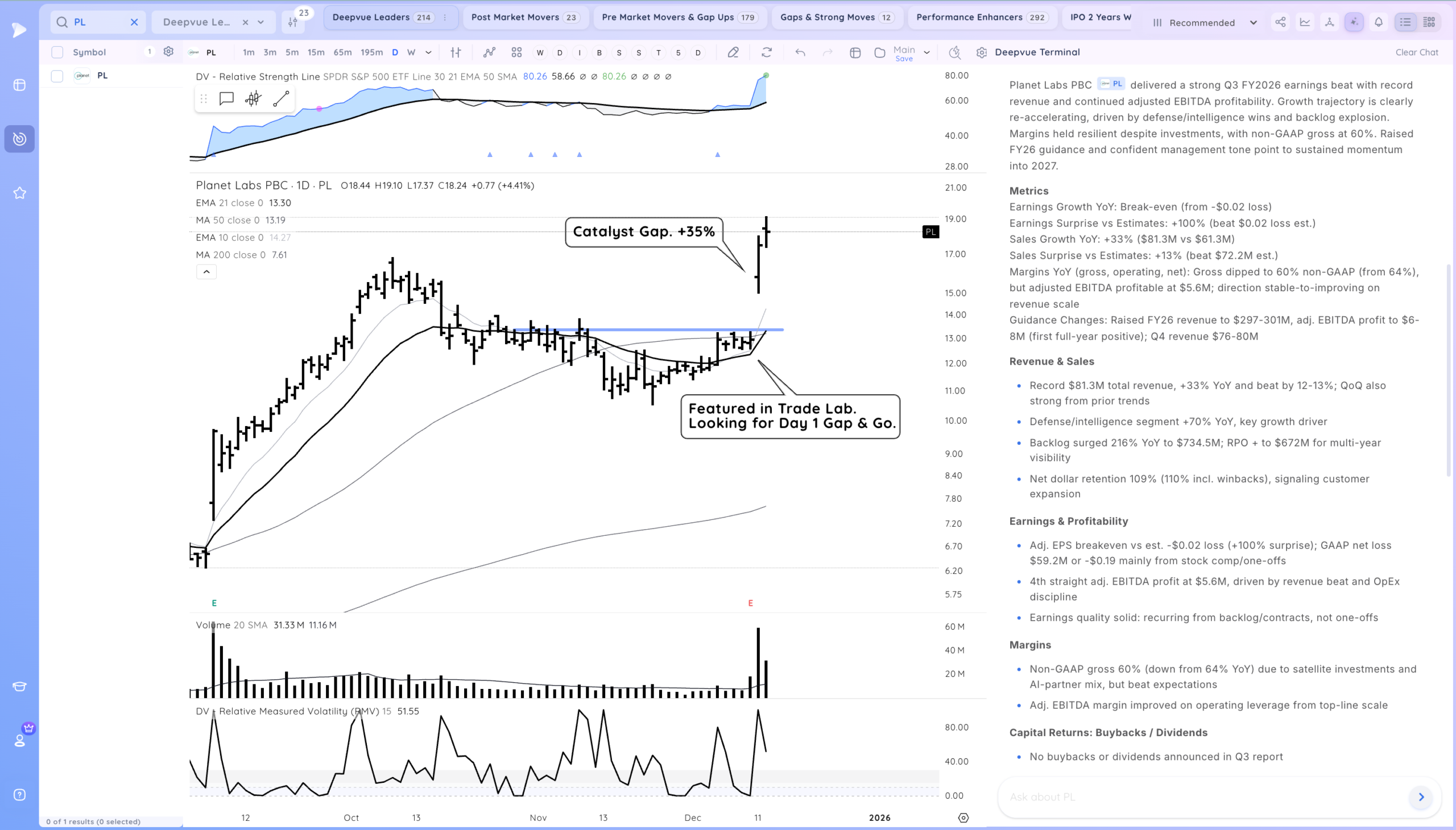

On December 10th. PL was one of the Gappers standing out.

Note how the post market volume versus average was nearly 50% – that’s huge interest.

Once you notice that a stock is gapping up on big volume, you want to dive deeper into the catalyst.

I use a Deepvue prompt that breaks down earnings reports looking for significant updates. I’m looking for earnings and sales surprises, strong growth, guidance raises, margins improvements, game changing developments, and share buy backs if possible

Here is the output:

PL delivered a strong Q3 FY2026 earnings beat with record revenue and continued adjusted EBITDA profitability. Growth trajectory is clearly re-accelerating, driven by defense/intelligence wins and backlog explosion. Margins held resilient despite investments, with non-GAAP gross at 60%. Raised FY26 guidance and confident management tone point to sustained momentum into 2027.

Metrics:

Earnings Growth YoY: Break-even (from -$0.02 loss)

Earnings Surprise vs Estimates: +100% (beat $0.02 loss est.)

Sales Growth YoY: +33% ($81.3M vs $61.3M)

Sales Surprise vs Estimates: +13% (beat $72.2M est.)

Margins YoY (gross, operating, net): Gross dipped to 60% non-GAAP (from 64%), but adjusted EBITDA profitable at $5.6M; direction stable-to-improving on revenue scale

Guidance Changes: Raised FY26 revenue to $297-301M, adj. EBITDA profit to $6-8M (first full-year positive); Q4 revenue $76-80M

Revenue & Sales

- Record $81.3M total revenue, +33% YoY and beat by 12-13%; QoQ also strong from prior trends

- Defense/intelligence segment +70% YoY, key growth driver

- Backlog surged 216% YoY to $734.5M; RPO + to $672M for multi-year visibility

- Net dollar retention 109% (110% incl. winbacks), signaling customer expansion

Earnings & Profitability

- Adj. EPS breakeven vs est. -$0.02 loss (+100% surprise); GAAP net loss $59.2M or -$0.19 mainly from stock comp/one-offs

- 4th straight adj. EBITDA profit at $5.6M, driven by revenue beat and OpEx discipline

- Earnings quality solid: recurring from backlog/contracts, not one-offs

Margins

- Non-GAAP gross 60% (down from 64% YoY) due to satellite investments and AI-partner mix, but beat expectations

- Adj. EBITDA margin improved on operating leverage from top-line scale

Capital Returns: Buybacks / Dividends

- No buybacks or dividends announced in Q3 report

- Sept 2025: Raised $460M convertible debt (net ~$406M after capped call); cash pile at $677M signals growth focus over returns

New Products, Developments & Strategic Moves

- AI-enabled partner solutions and satellite services fueling contract mix

- Defense wins expanding competitive edge in geospatial intel over 1-3 years

Guidance & Management Tone

- FY26 raise vs prior/consensus: revenue +~10% higher range, adj. EBITDA now profitable $6-8M; Q4 guides growth continuation

- Reiterated FY26 FCF positive; backlog supports 2027 momentum

- Tone confident on demand, no macro/competition concerns flagged

Big Picture Takeaways for Investors/Traders

- Positives: Re-accel growth, backlog visibility, profitability streak, guidance raise

- Risks: GAAP losses persist, capex $28M in Q3 (FY26 guide $81-85M) ties to satellite buildout

- Strengthens bull case: Execution proves scalable model in high-demand defense/geospatial, with multi-year tailwinds intact

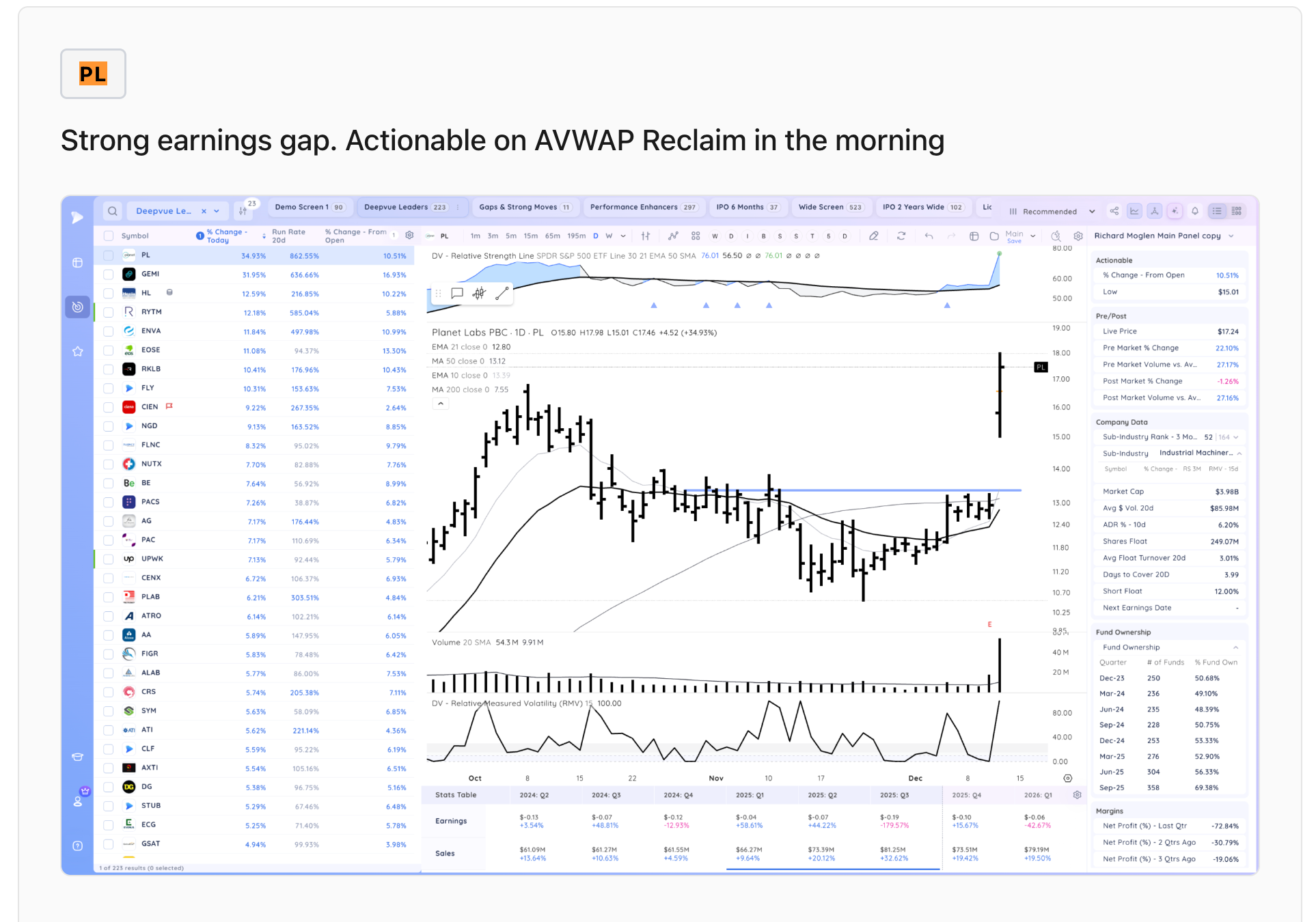

This was sufficient to look for a gap and go move on day 1 after the report. I featured it in the Dec 10 report:

Setup and Execution

For earnings gap’s I’m most often looking to enter very shortly off the open using these potential entry tactics

- Opening Range Breakout (1 or 5 Minute)

- Daily AVWAP Undercut and Rally

- Intraday Range/Base Breakout

My preferred entry happens in the first 10 minutes of the trading day, the stock forms a short intraday pullback, undercuts the AVWAP and then reclaims it. In the strong names the stock then breaks out of the opening range and never looks back, trending above the daily AVWAP and intraday moving averages and closing strong.

Gapper Day 1 entries are the only time I’m looking at sub 5 minute charts and I quickly get off them once the stock is trending.

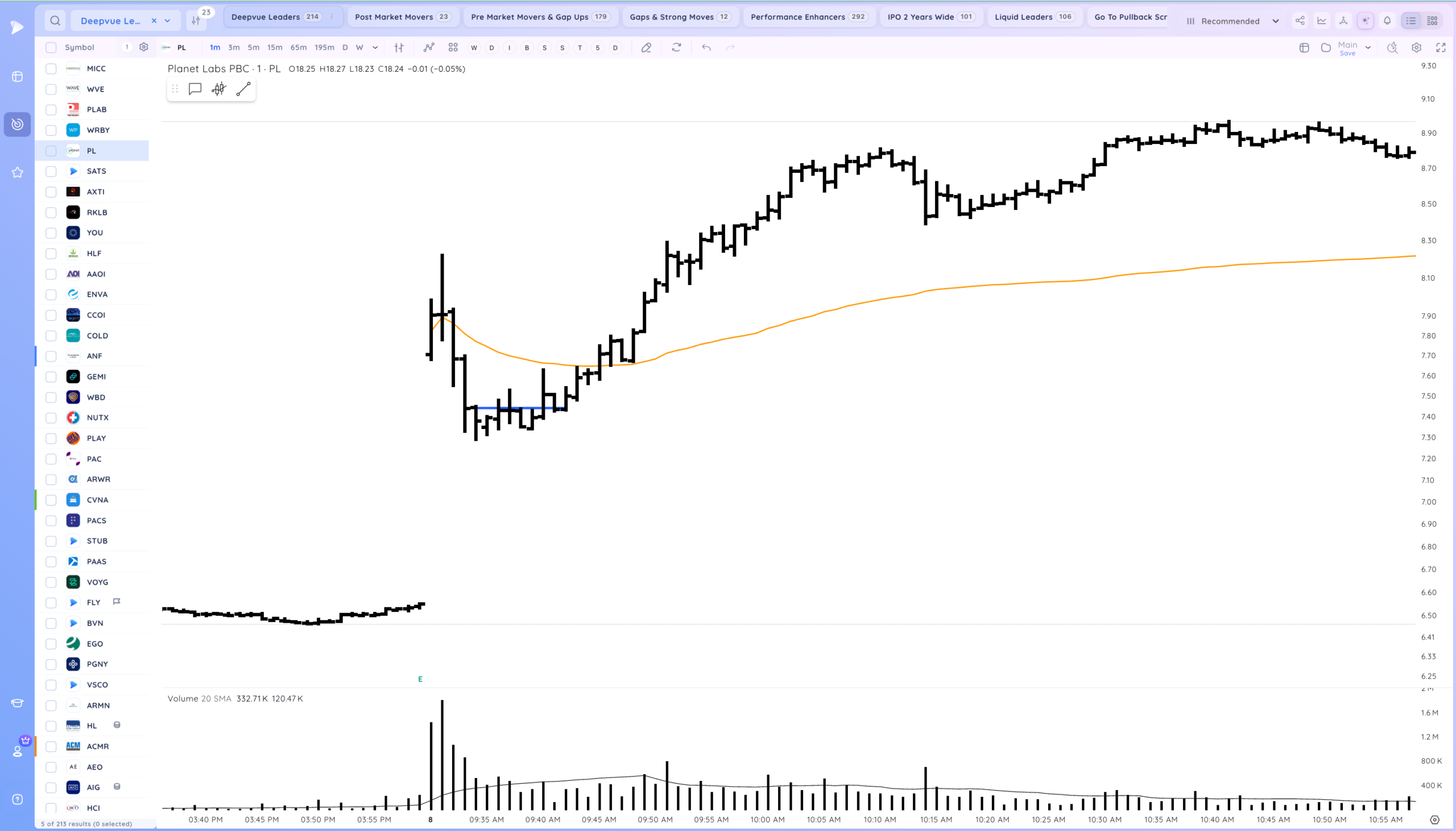

Here is PL on a 1 min

PL pulled back sharply before forming that initial range. Then it pushed higher, reclaiming the daily AVWAP and testing the current high of the day. From there it tightened constructively above the AVWAP and below that high setting up and intraday opening range base. it then broke out and stayed above the AVWAP all day.

With a 5% stop on the AVWAP reclaim entry a position size of 10% is prudent. But as it coiled above the AVWAP in the intraday base you could have put on more size at those entries with tight stops under 3% using the AVWAP level.

With a 3% stop a 20% sized position would be risking 0.6% of your account. A 15% sized position would be risking 0.45%.

Here is the rest of the day 1 action on a 5 minute chart. From the entries annotated above you had at least a 7% cushion at the close. This is enough to hold though to the next day looking for follow through.

Here is how it looked on a daily after the close

The next day we gapped up, then sharply pulled in and tested the HVC level with a slight undercut and bounce. This was a potential add spot.

When we gap up on day 2 and pull in I’m mentally aware that we could undercut these key day 1 levels

- Close

- Day 1 AVWAP

- Day 1 low of an intraday base (if there is one)

It’s a sign of strength how much PL respected the close level even though the intraday base low was so close. It was bought up quickly on weakness and never retested the HVC.

Here is what it looks like after Day 2. Day 1 entries are up 11-17%. Swing traders could have taken profits on 25-50% of their position off into strength.

Given the market weakness. Taking off the full trade may be warranted to protect mental and financial capital.

Future thoughts

Since the gap up PL has acted great, especially given how weak the general market was Friday.

However, gappers are market sensitive, and hard pressed to make meaningful headway unless we are in an uptrend.

If the market continues down I would expect PL to consolidate, retest the HVC and likely undercut it. Basing or pulling back until the market resumes higher.

However if the market snaps back quickly, PL will likely keep trending above the moving averages and make a significant move.

Homework

Study the previous Earnings Gap and move from PL. It gained over 100% in a matter of weeks.

Daily Chart:

1 minute chart of the opening action (notice it also pulled in sharply for this one)

5 Minute chart of Day 1 and 2