The Market Sells Off

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

December 12, 2025

Market Action

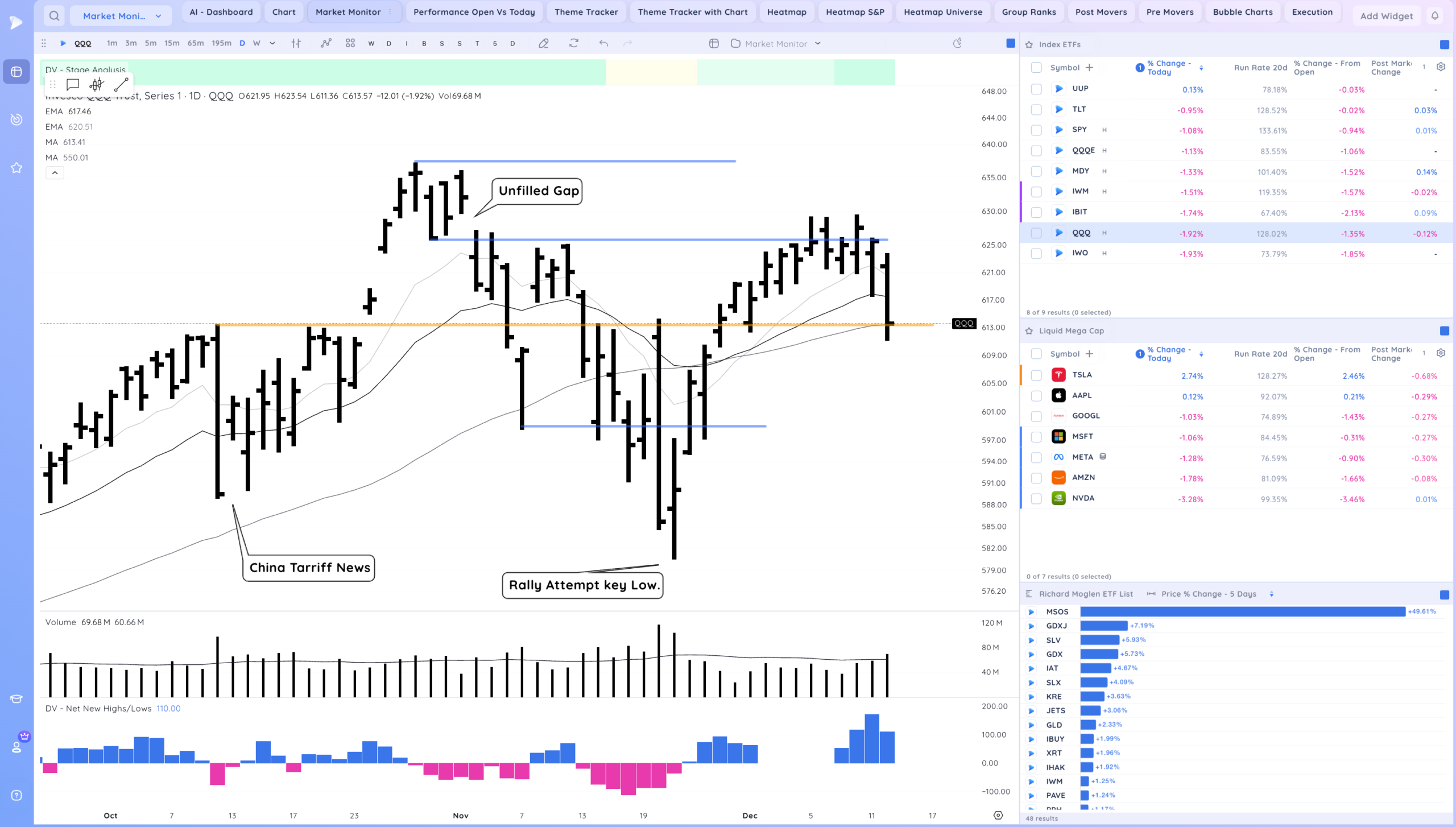

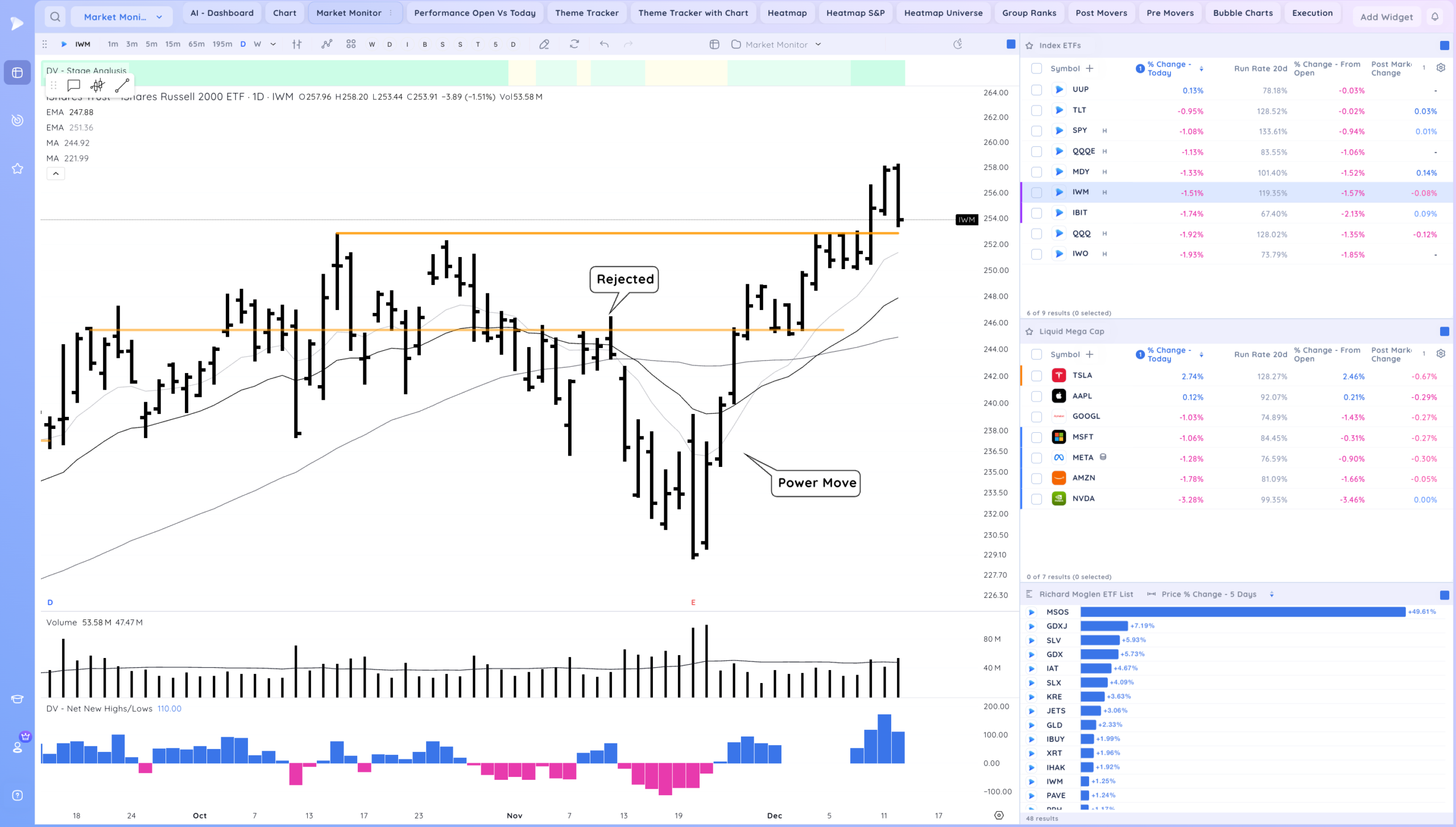

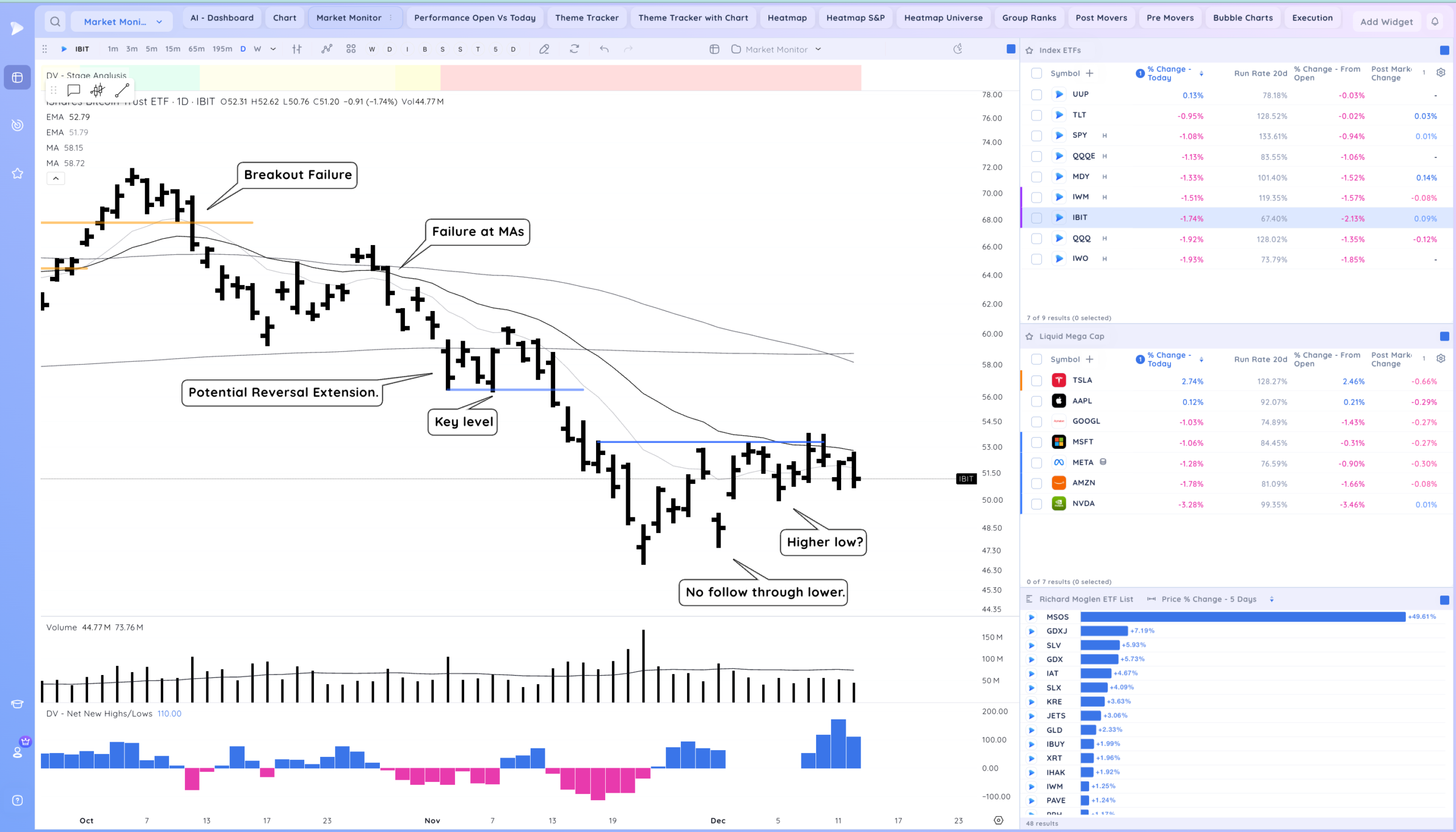

A lot can change in a day… We were watching for follow through higher, for the market to show it’s strength and that institutions were adding exposure after the fed catalyst. Instead we got a gap down and a sell off. Leaders took bigger hits especially in the AI space. This is a negative.

We were in a developing uptrend but now that is under pressure with the QQQ being under the 21ema.

Biotechs still coiled but in the growth space there is not much. I’ve included my RS list below.

Less is more for growth trading until leaders shape up. Unless we see a very strong snapback early next week.

The QQQ is testing a key level and the 50sma, key spots to watch early next week for respect.

Trends 2/4 Up – based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Below

Intermediate term – 50 sma – Above

Longterm – 200 sma – Up – Above Rising

Current View: Developing Uptrend (Under Pressure)

Groups/Sectors

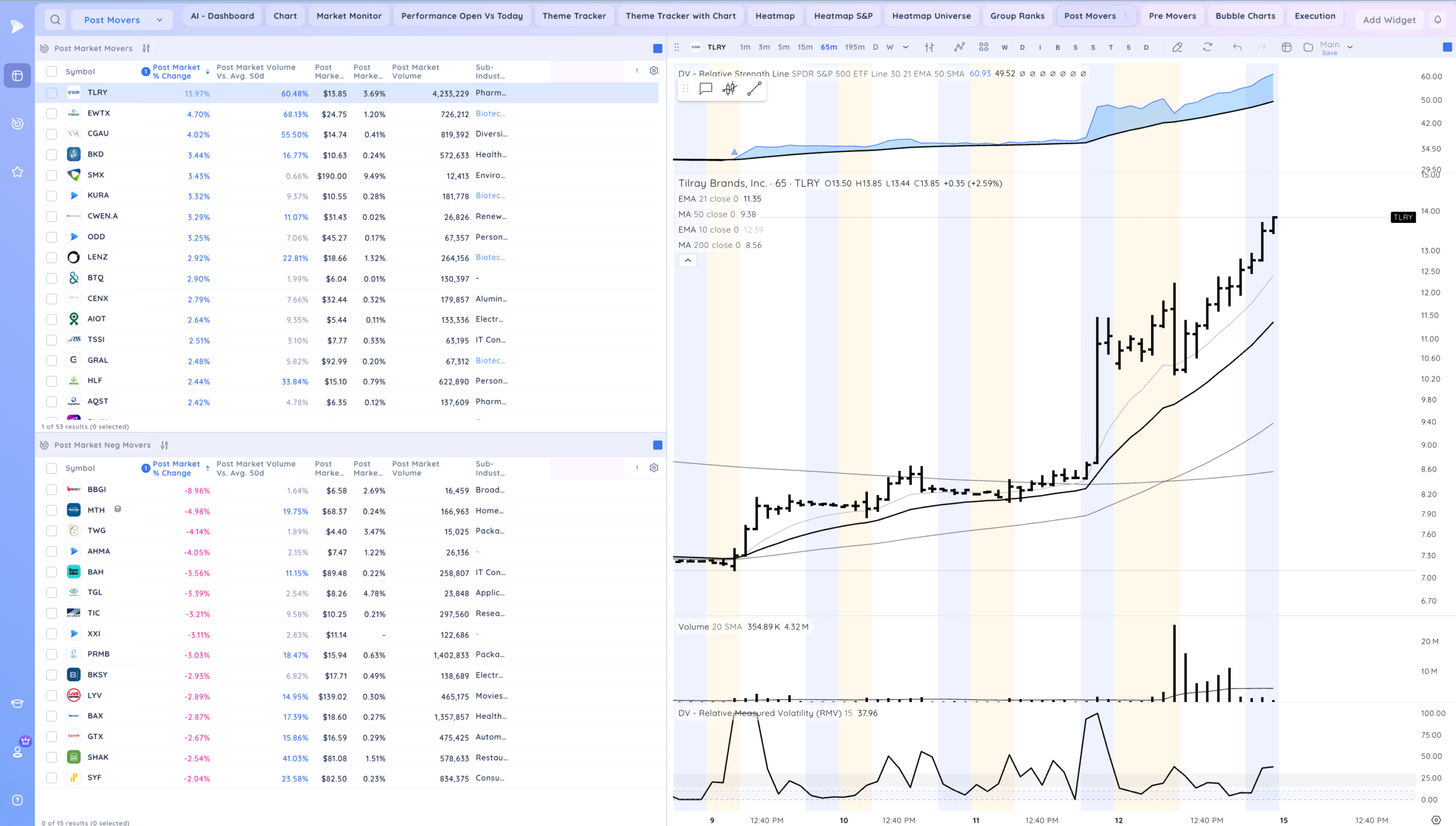

Leadership Stocks & Analysis

Key Moves

Setups and Watchlist

Watchlist & Themes

Larger Watchlist

Relative Strength List (Growth type names sticking out)

Universe List

Recent Gaps

Additional Thoughts

In the semi, AI, growth space not much is going on outside of TSLA and isolated charts. Biotech still holding up. As mentioned before less is more until the market proves itself. Early next week should provide more info.