Weekly Digest – Edition 19

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: December 6, 2025

Weekly Subscriber Digest

Summary & Outlook

Summary: Big change in character over the past two weeks. Multiple breadth thrust days, stocks leading, and constructive action throughout. Built full positions in $TSLA and $ASML, half position in $GEV. Exposure went from 20% to 75% by week’s end. Bad news (job numbers) met with strong price action which is opposite of what we’ve had. So far a shift in character.

Outlook: The environment feels similar to early may when stuff felt easier, there was a wind at our back, and new trades worked more frequently. I don’t know how long it continues but the positive feedback so far and “easier” feeling is something to lean into while its here instead of question after a period where it was the opposite. $TSLA and $GEV both showed standout action Friday. Looking to add $GEV to full size on a higher low or breakout above $650. Staying positioned and letting winners work.

Key Trading Insights

Tight quiet ranges near highs = compression and the stock is likely going to get directional.

Stocks that have built long consolidation patterns over years create powerful setups. The longer the base the bigger the trend that usually develops if it breaks out.

Sometimes the best trades feel uncomfortable in the moment. What matters is following your process when the setup is there.

When everybody expects the same thing it often doesn’t happen.

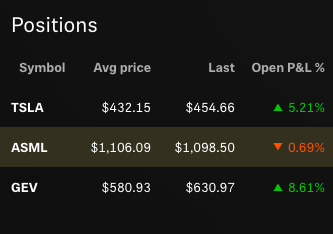

Current Holdings

3 positions • 75% total exposure

| Ticker | Status & Notes |

|---|---|

| $TSLA | 30% of portfolio – Full position. Very nice action Thursday and Friday. 7% from all-time high. |

| $ASML | 30% of portfolio – Full position. Focus list. I bought on strength after a big move because it was at my planned entry level and last time this same thing happened and it never stopped. I have hard stops 1055 but may reduce size or exit and revisit before that. |

| $GEV | 15% of portfolio – Half position, looking to add. Standout action Thursday, getting close to completing its base around $650. Average entry $580. Will add the rest either on weakness next week if we see a higher low or thebreakout. |

Trade Activity

6 trades this week • Scaling into focus names across multiple days

| Ticker | Trade Notes |

|---|---|

| $TSLA |

Bought

Started 15% position Monday. Added Tuesday near $430. Filled to 30% Wednesday as it

approached $440 resistance—forced to buy strength after waiting for pullback that never

came in September.

Tue add → · Wed fill → |

| $ASML |

Bought

Initiated 15% Tuesday as it pushed through 2024 pivot. Added Wednesday to 30% full

position. Took it on strength after missing the September move by waiting for a

pullback.

Tue initiate → · Wed full position → |

| $GEV |

Bought

Started 5% Monday, treating it like $TSLA with slow accumulation. Added on Wednesday

morning weakness to 15%. Average around $580. Looking to complete position on higher low

or breakout above $650.

Mon start → · Wed add → |

Day to Day Thought Process

| Day | Key Observations |

|---|---|

| Monday | Gap down open—better than a Monday gap up. Started $TSLA and $GEV. Slow accumulation approach since neither in ideal sizing spots. Nice action overall but not like the breadth days from prior week. |

| Tuesday | Gap up open. $PLTR, $GEV, $ASML standing out with relative strength. Added $TSLA and initiated $ASML. Mixed day with some fades. $TSLA still struggling above $430 level. Many want a pullback which may mean like April/May it doesn’t come so continuing to slowly add as stuff works. |

| Wednesday | Flat open. Added $GEV on morning weakness. Filled $TSLA near $440 as it hit top of buy range. Added $ASML. Internals improved to 70% stocks up. Bad job numbers released but market closed strong—potential character change. Breadth thrust day. Now at full positions in $TSLA and $ASML. |

| Thursday | Good constructive day. No breadth thrust but most stocks moved higher. Genomics, growth, aerospace, robotics leading first hour. $GEV standout action. Getting close to completing its base. Wednesday morning weakness was a gift so far. $TSLA very nice action and close. |

| Friday | Rest day for positions and most names. Great week from $TSLA and $GEV. |