Market Overview

The NASDAQ and S&P 500 continued to rise over Friday’s shortened session due to the Thanksgiving holiday, leaving them above their key moving averages.

Small-cap shares continued to exhibit the most relative strength, despite the Russell 2000 being the weakest index of the four over the last couple of months.

Now that he major indexes have pushed back through key resistance, we need to see constructive action continue as rotation among the leaders continues.

Healthcare names continued to lead, consumer discretionary stocks are showing more strength, and select names across techland have begun to recover convincingly.

If the major indexes can hold above their key moving averages and setups continue to evolve, that would be enough for me to start adding back exposure.

Indexes

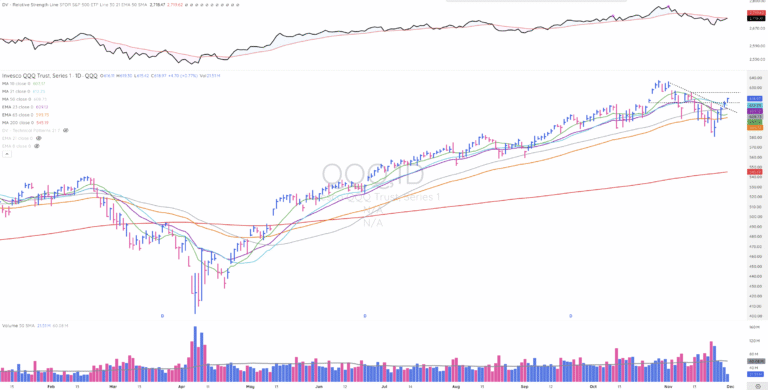

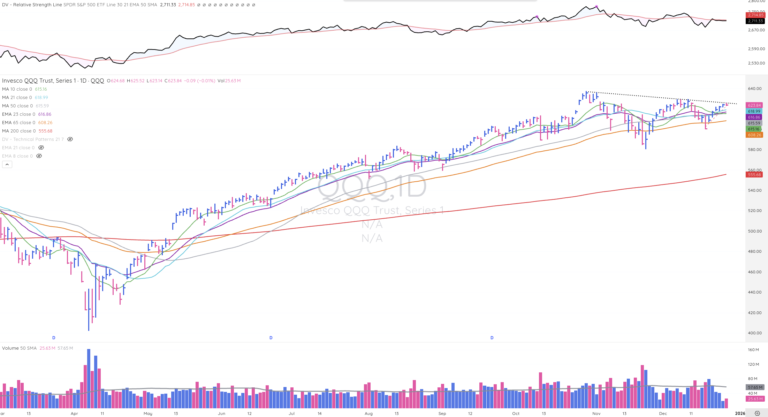

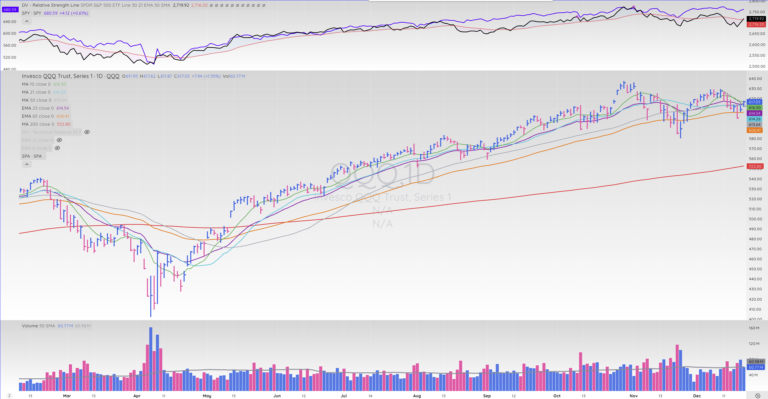

QQQ

The NASDAQ closed above its KMAs to end the week, although it has rallied for the last five consecutive days on light and declining volume, so next weeks action will be telling.

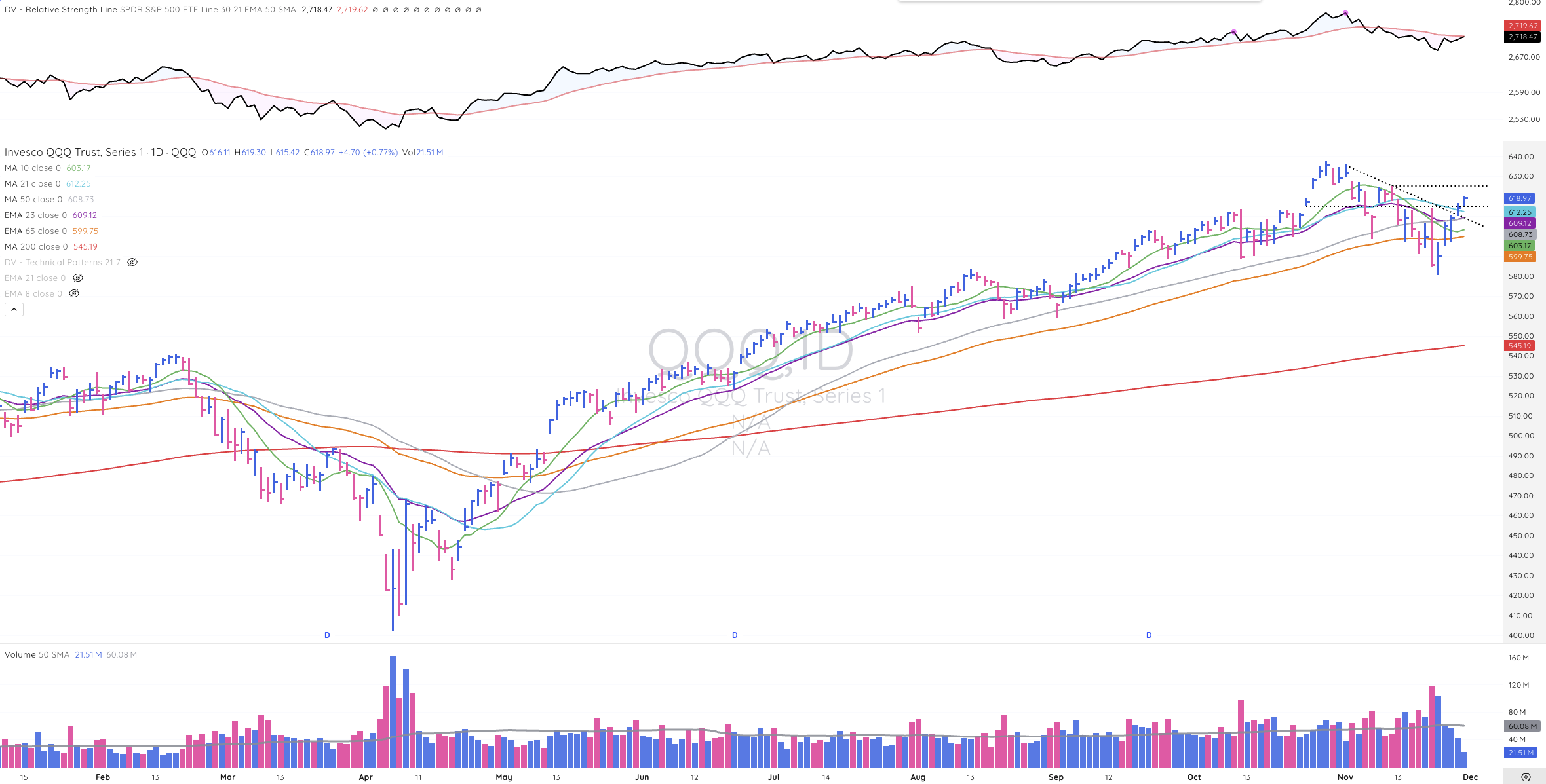

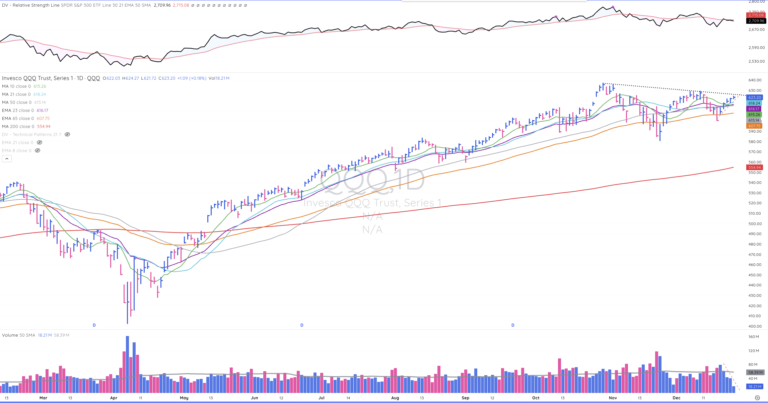

SPY

Just like the NASDAQ, the S&P 500 closed above its KMAs to finish the week, although it has rallied for the last five consecutive days on light and declining volume, so next weeks action will be telling.

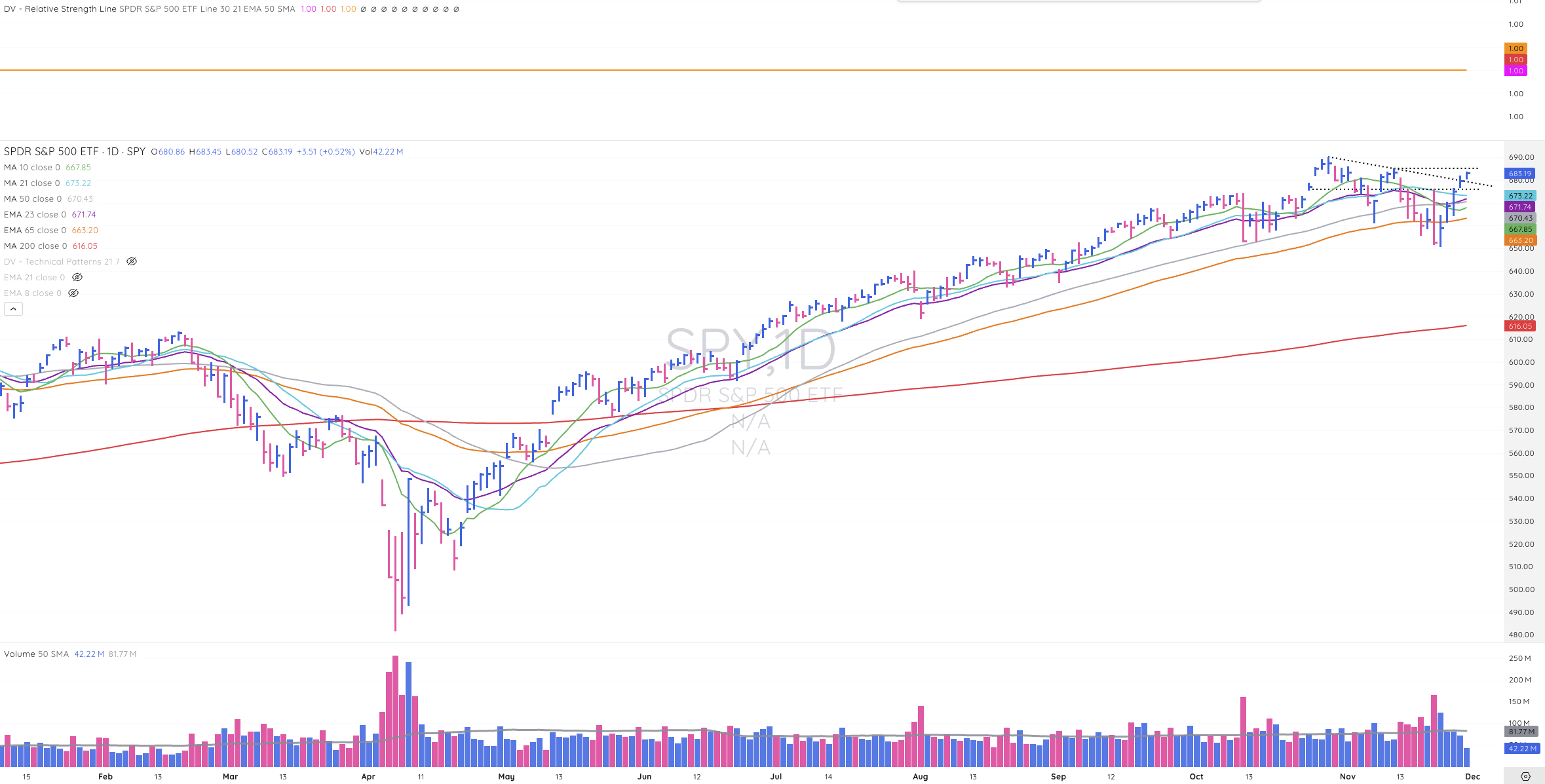

IWM

The Russell 2000 continued to exhibit the most strength of the four major indexes on Friday, despite its relative weakness over the last couple months.

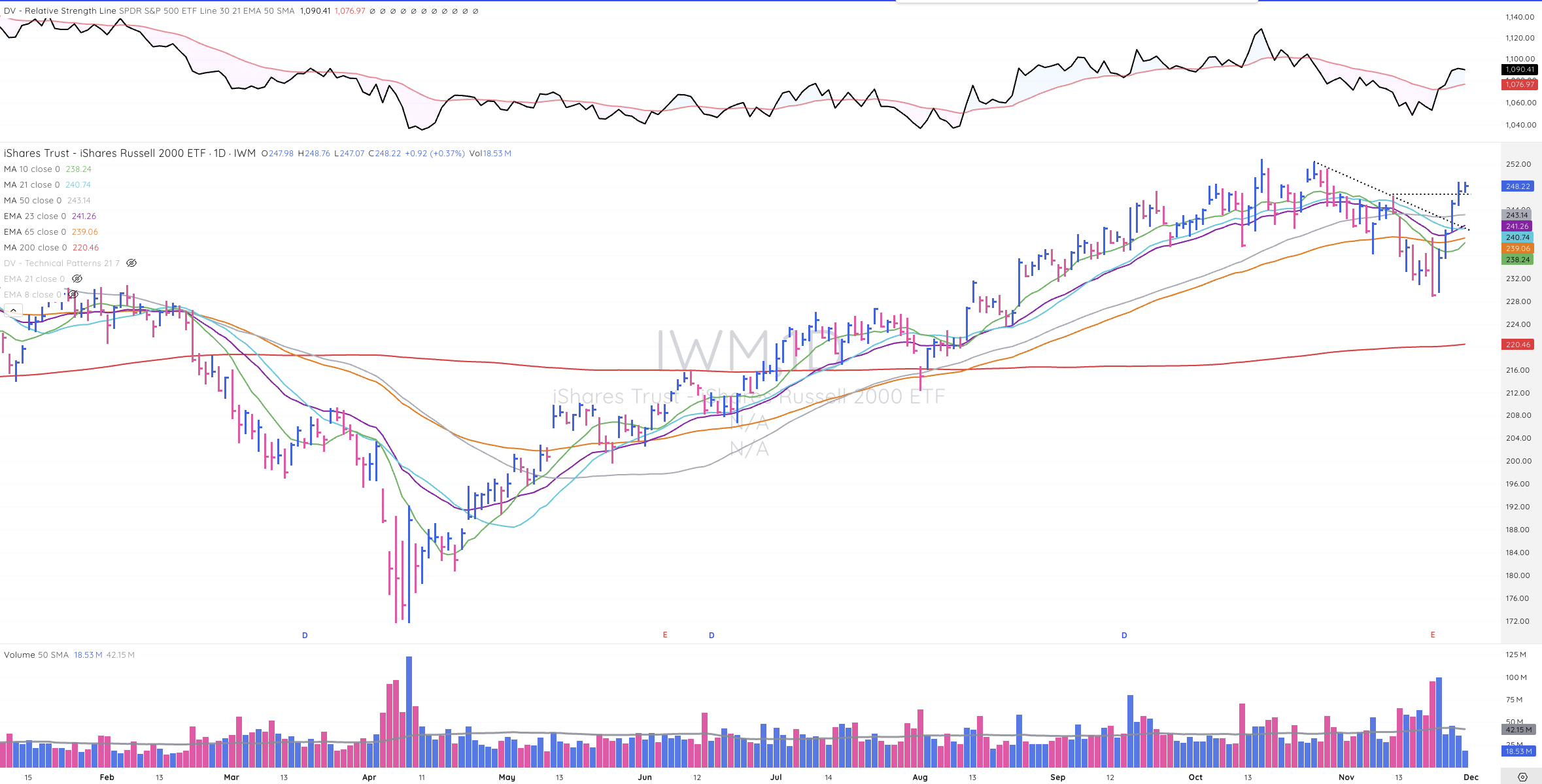

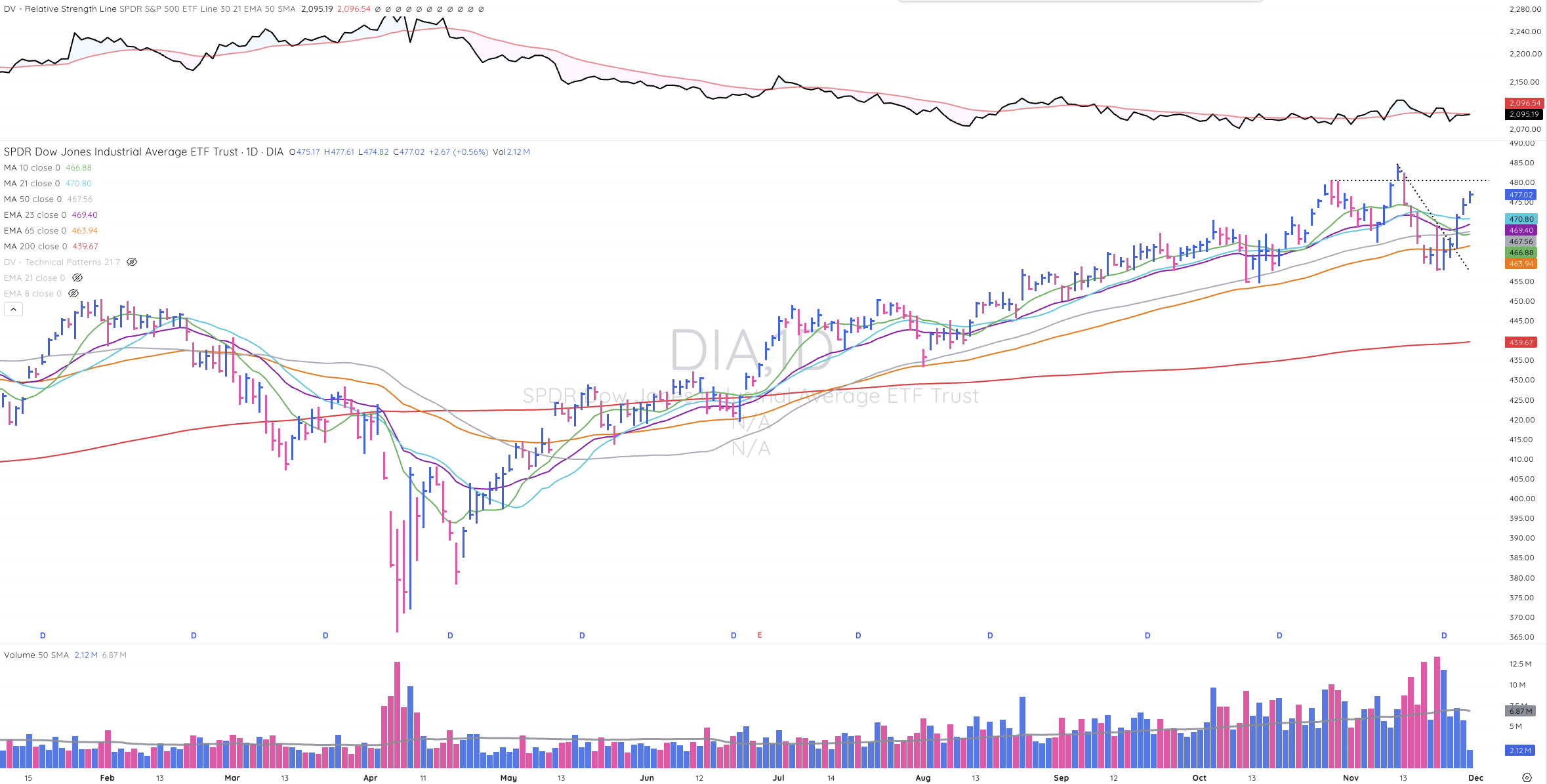

DIA

The DOW followed the other major indexes higher last week and finished back above its KMAs and not too far below its prior all-time high.

Focus List

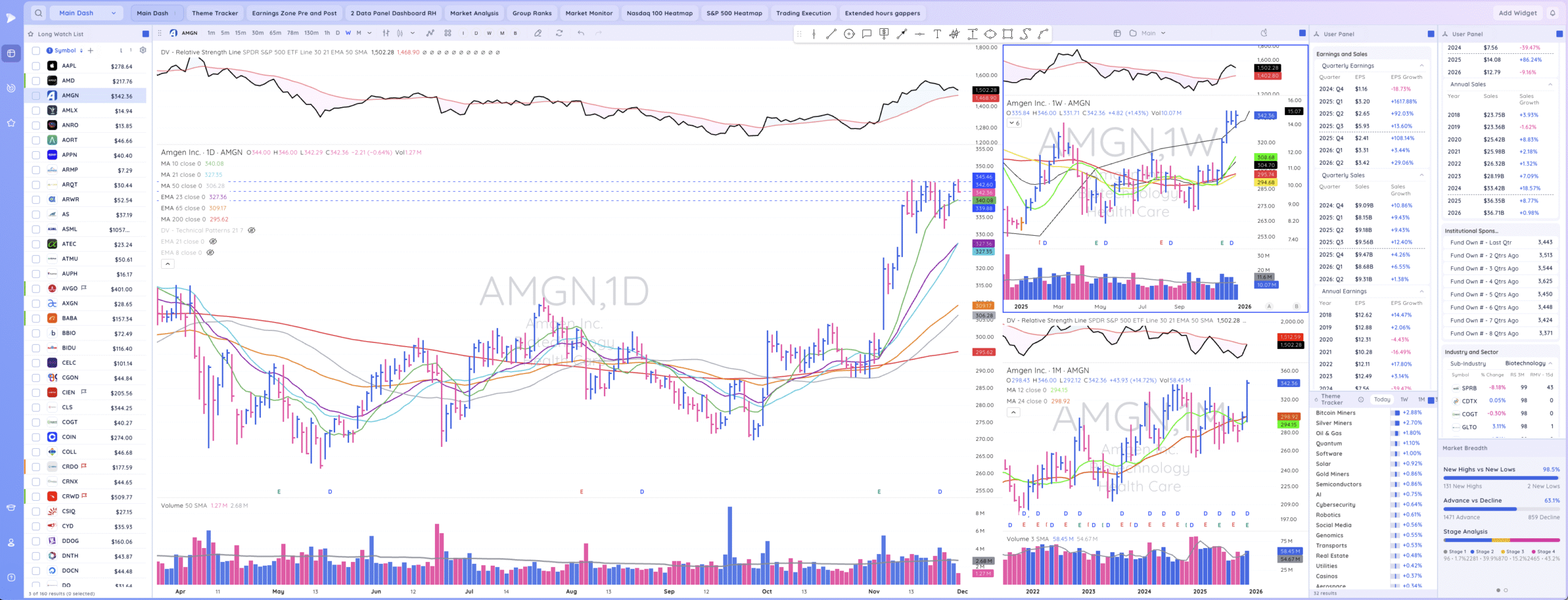

AMGN

AMGN has formed a bull flag pattern just slightly below its prior all-time high.

PRAX

PRAX is working on week seven of a flat base on the heels of a powerful gap up in the middle of October.

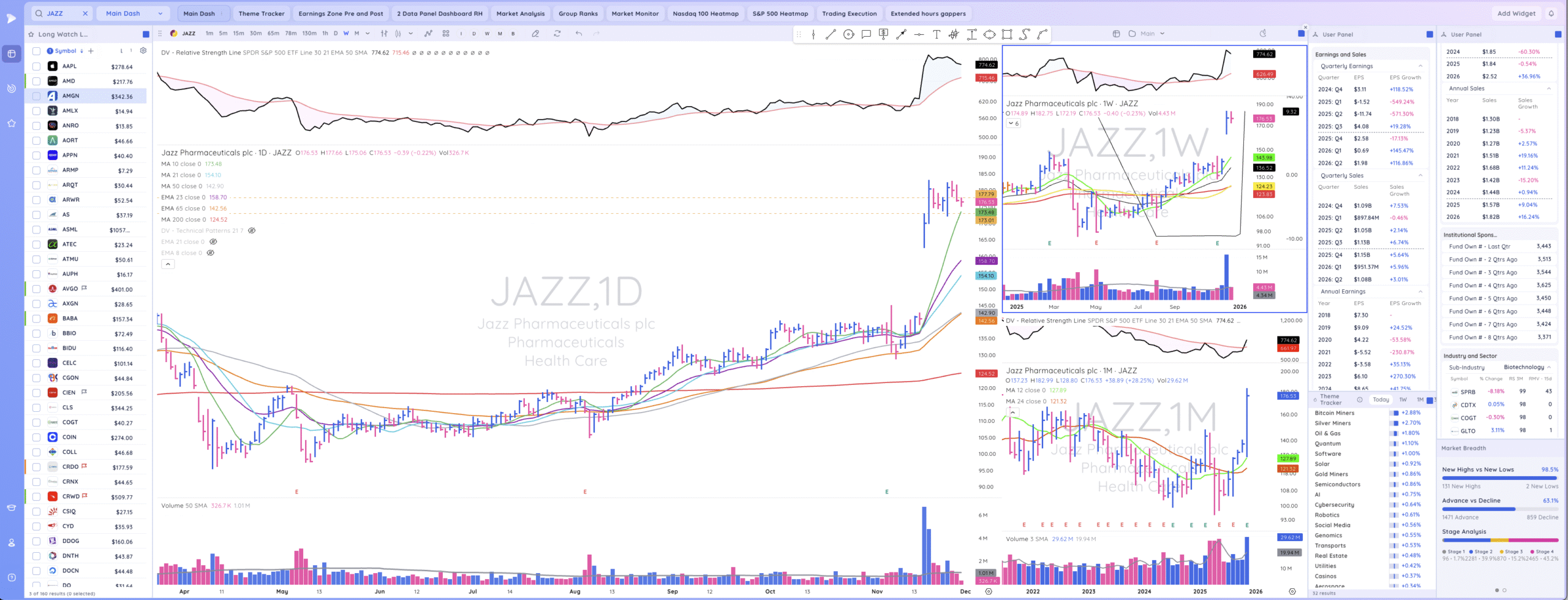

JAZZ

JAZZ is a leading pharmaceutical name forming a bull flag on the heels of a powerful gap up.

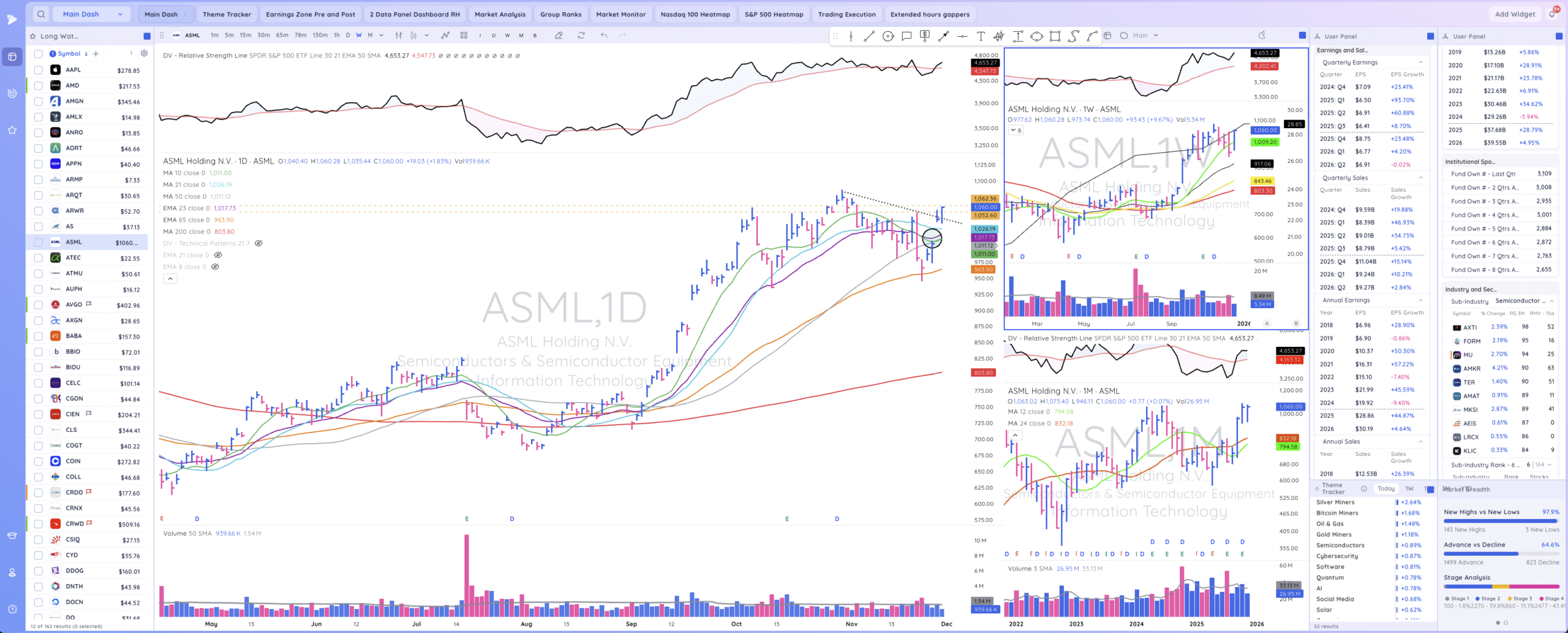

ASML

ASML recovered quickly last week and appears to be setting up to head higher from here.

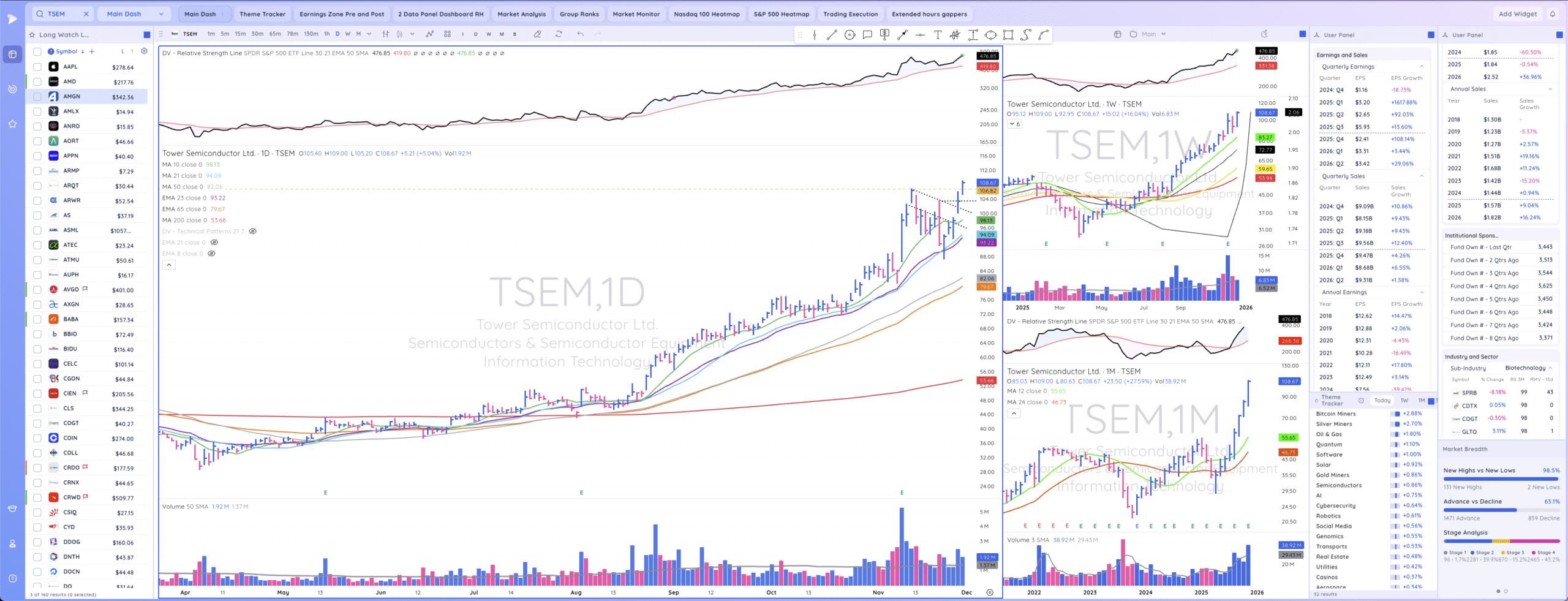

TSEM

Leading semi equipment stock TSEM looks like it may be buyable on constructive weakness next week.

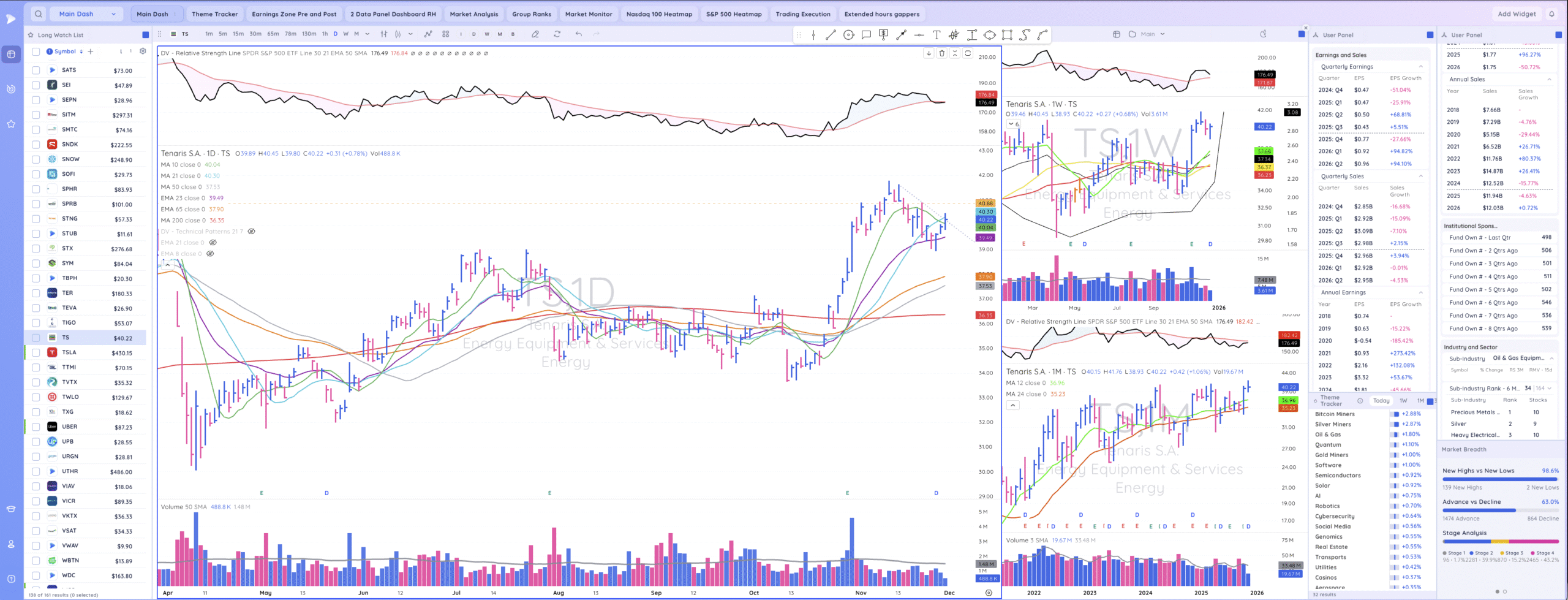

TS

TS is a leading energy equipment name which appears to be setting up to move higher with the rest of the leaders in the group, such as FTI, NOV, and BKR.

SEI

SEI is a leading energy equipment name which appears to be setting up to move higher with the rest of the group.