TML Report – November 18, 2025 – Waiting on NVDA Earnings Tomorrow

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

November 18, 2025

Market Overview

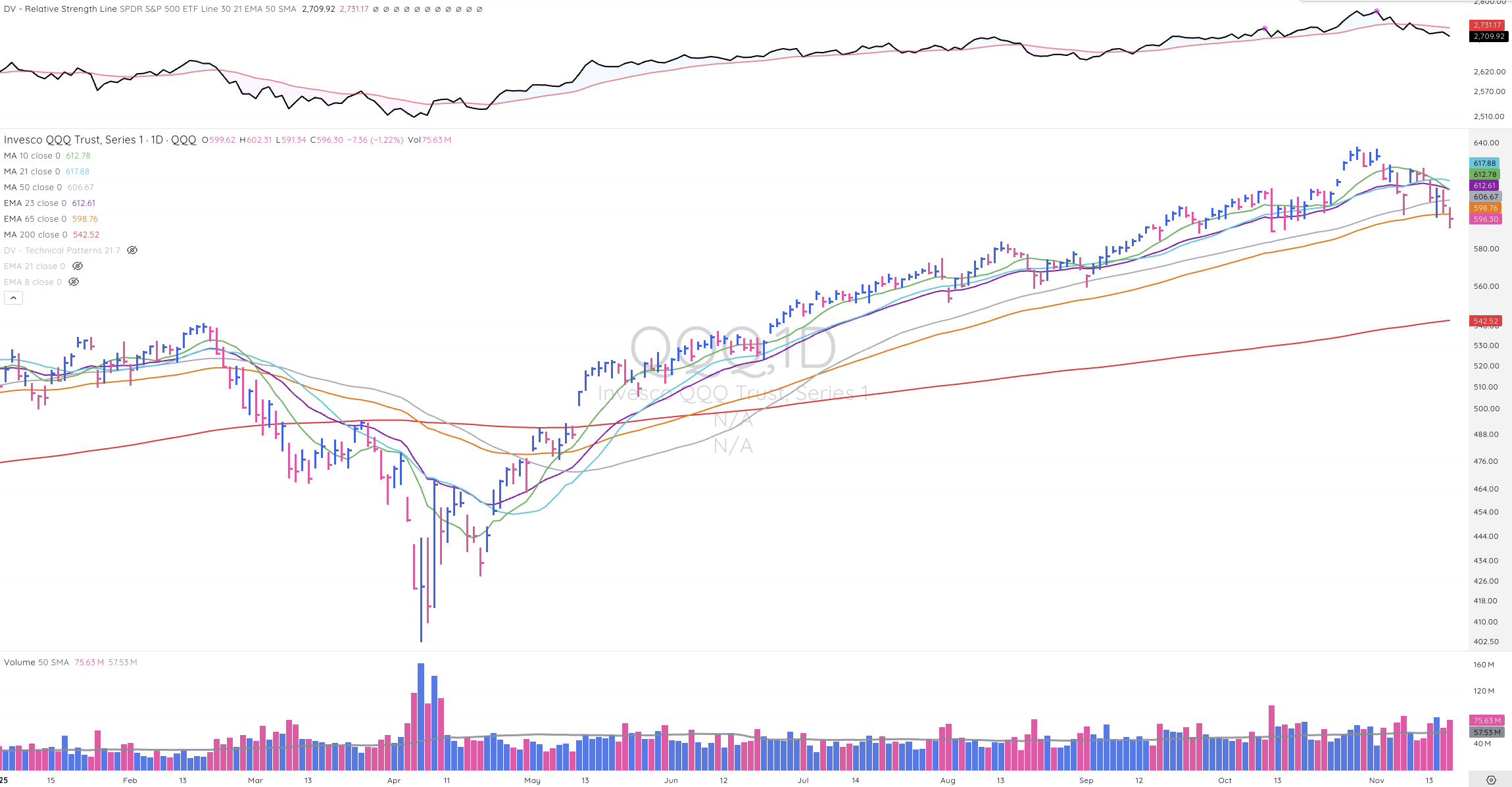

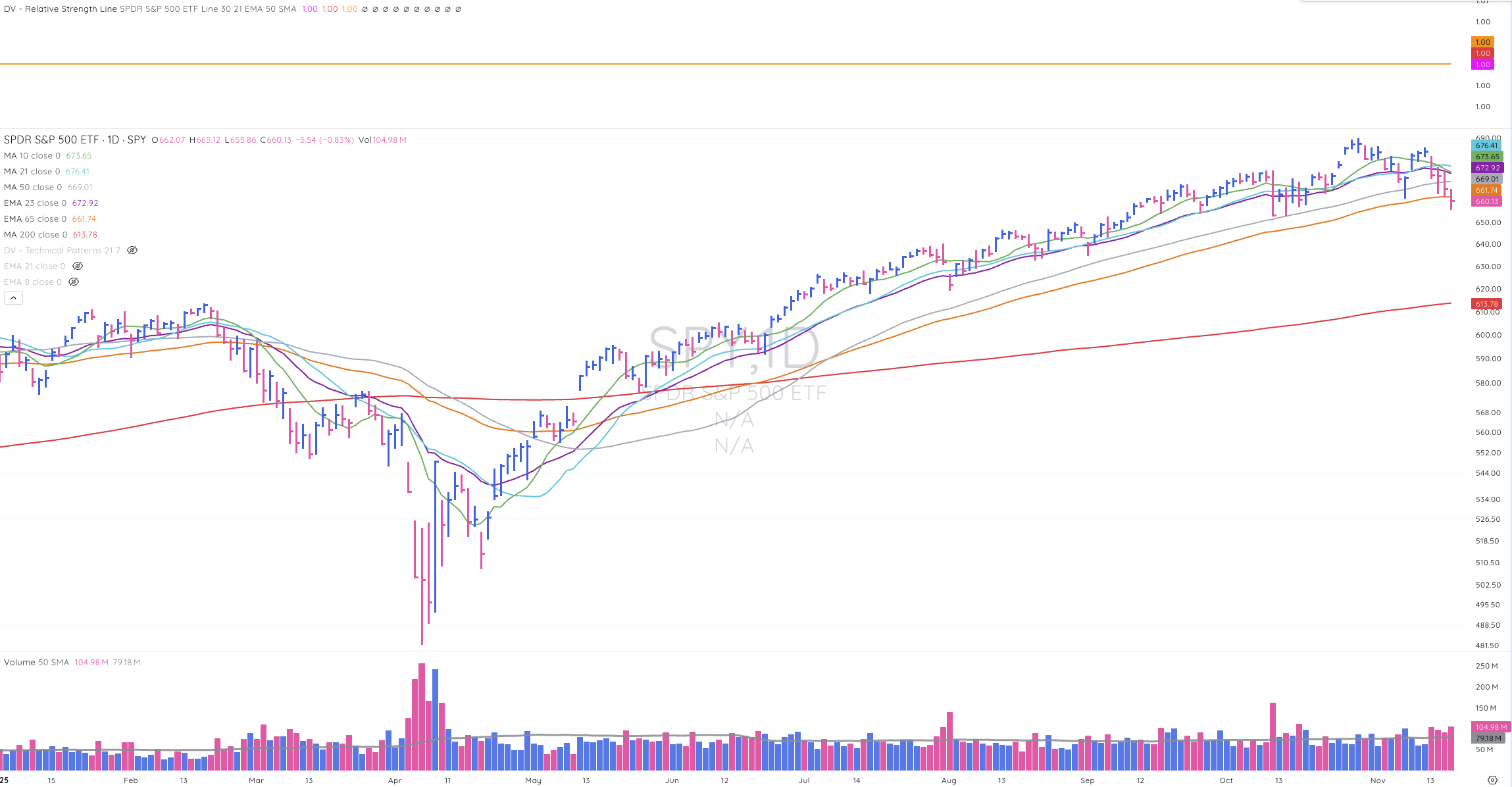

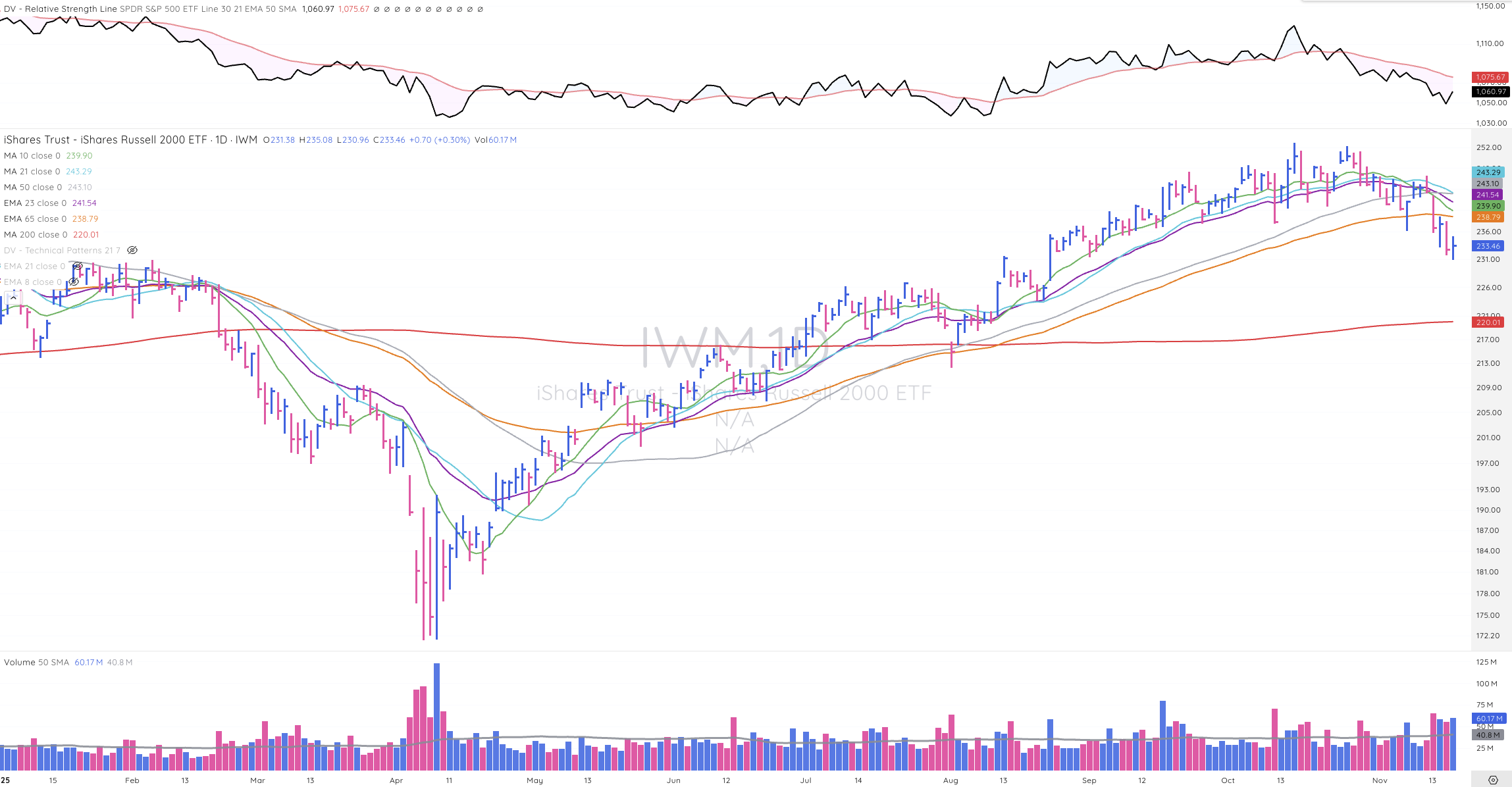

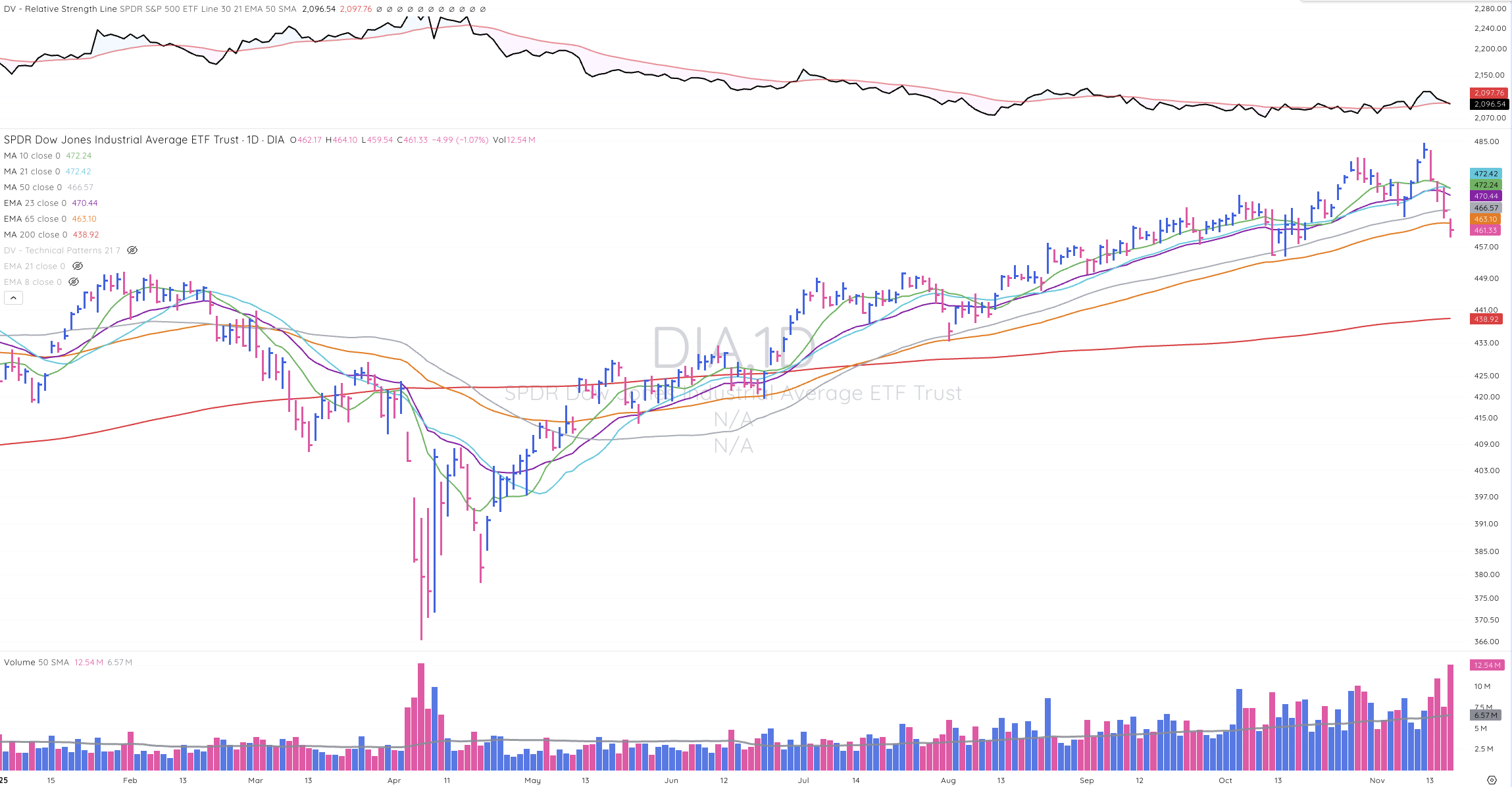

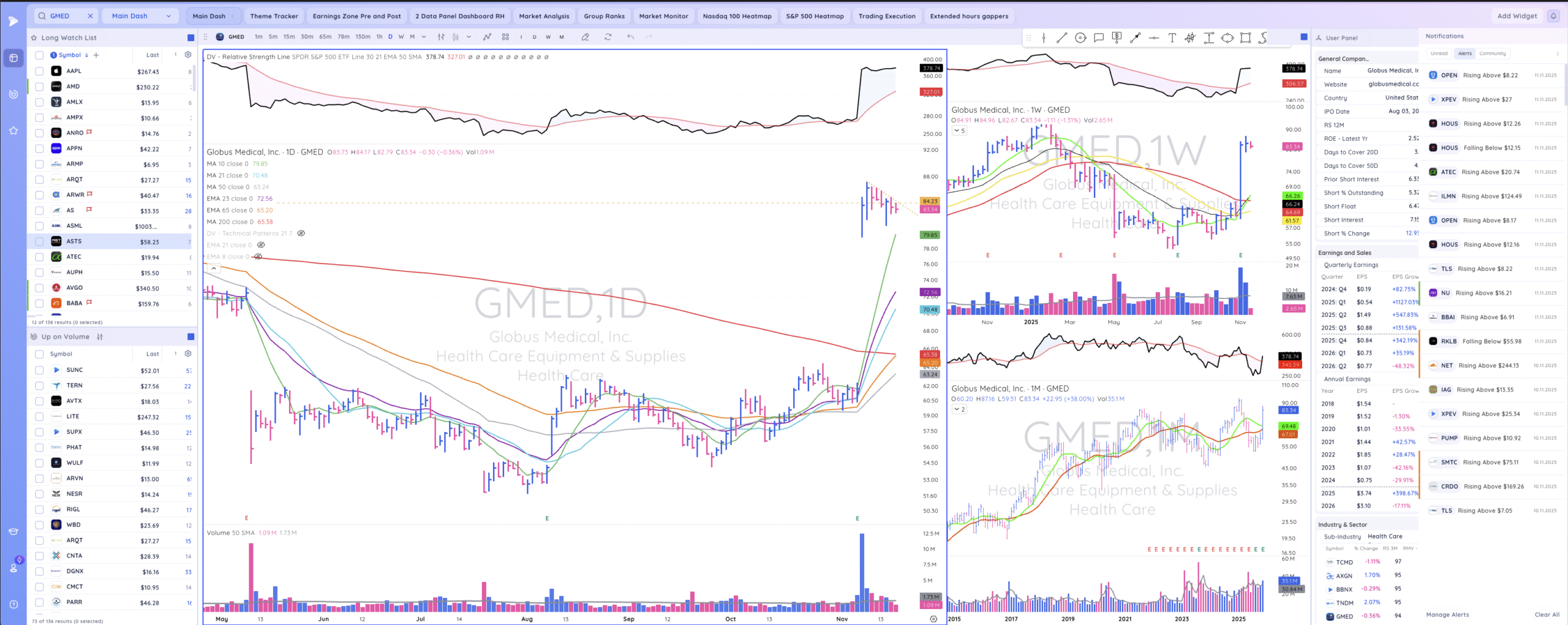

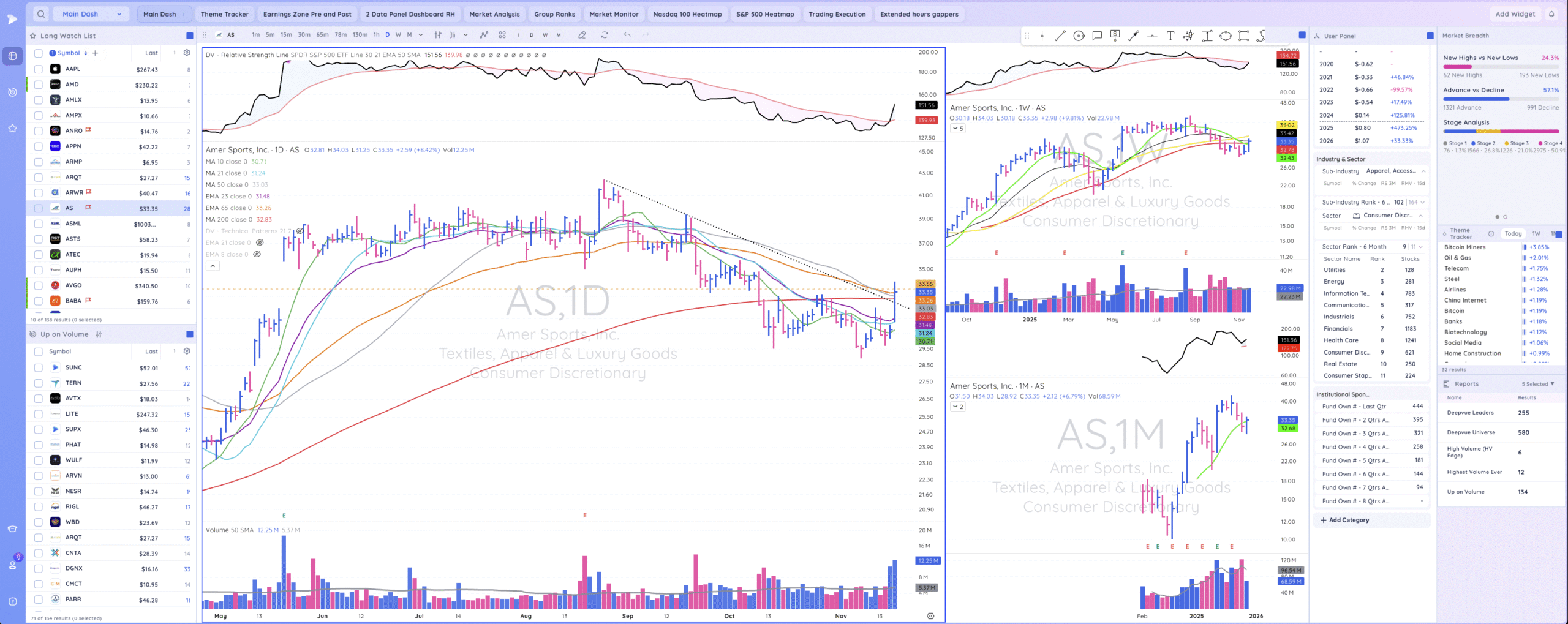

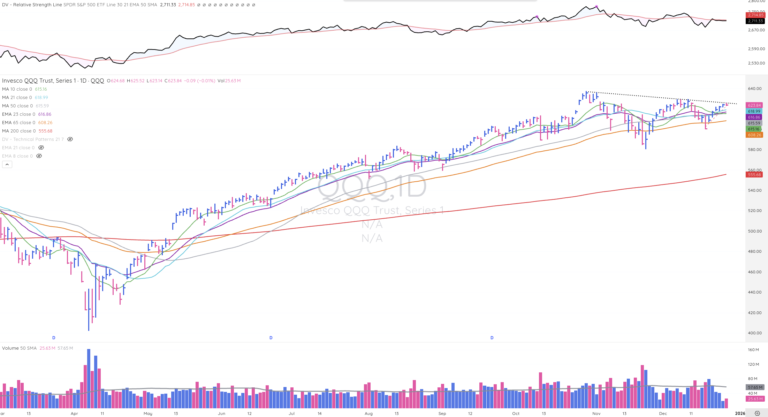

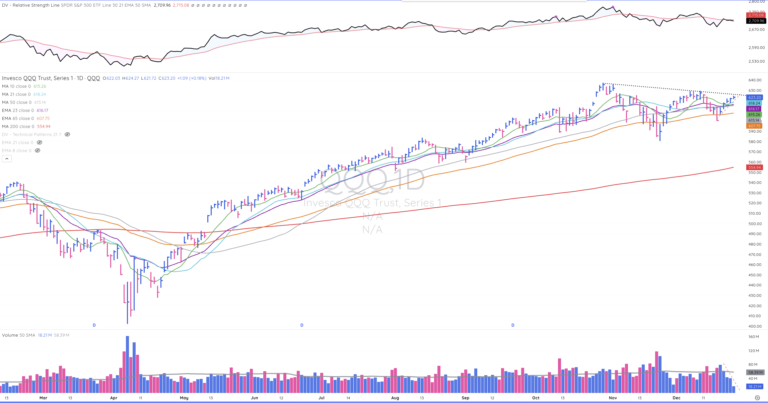

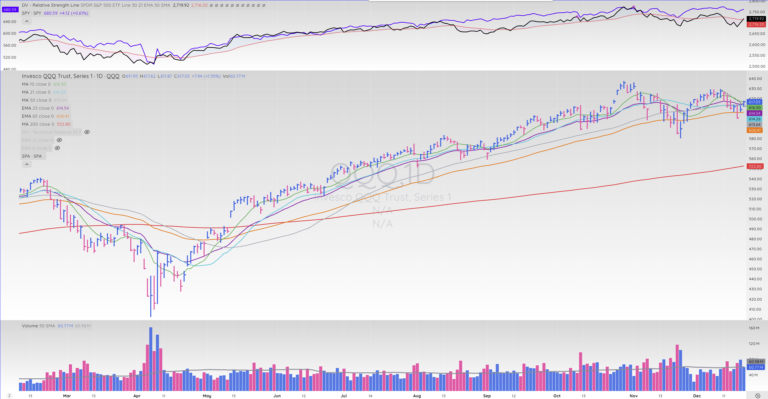

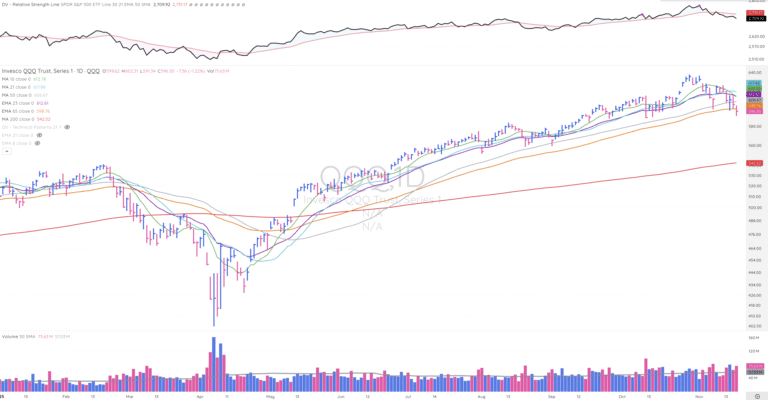

As of the last report, the major indexes were holding up incredibly well relative to the market’s leadership, but that all changed this week. Many of the market’s traditional, high-growth leaders continued to weaken and break down further this week, and the major indexes have begun to follow.

The NASDAQ and S&P 500 are trading below their key 50-day SMAs as the market waits on NVDA’s earnings tomorrow after the close. NVDA accounts for a large share of the NASDAQ Composite Index, so the reaction to its earnings tomorrow will have a significant impact on the index’s direction.

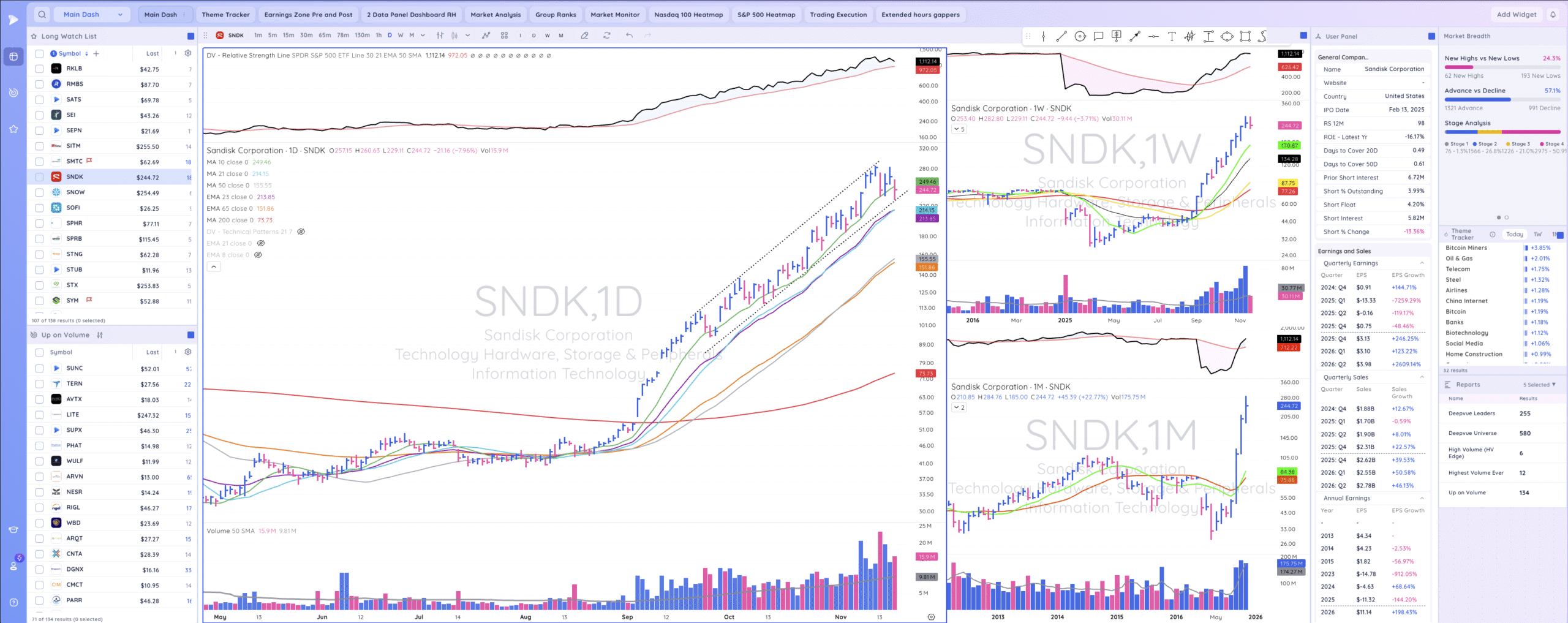

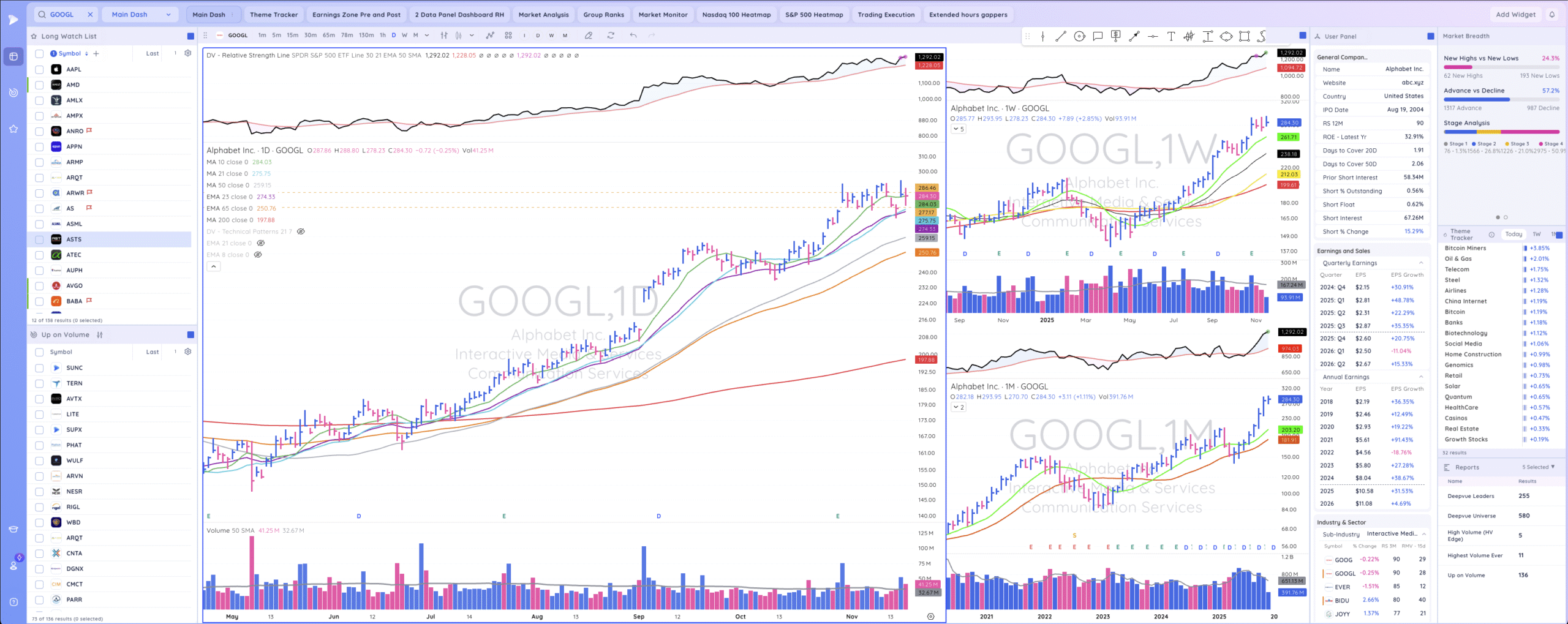

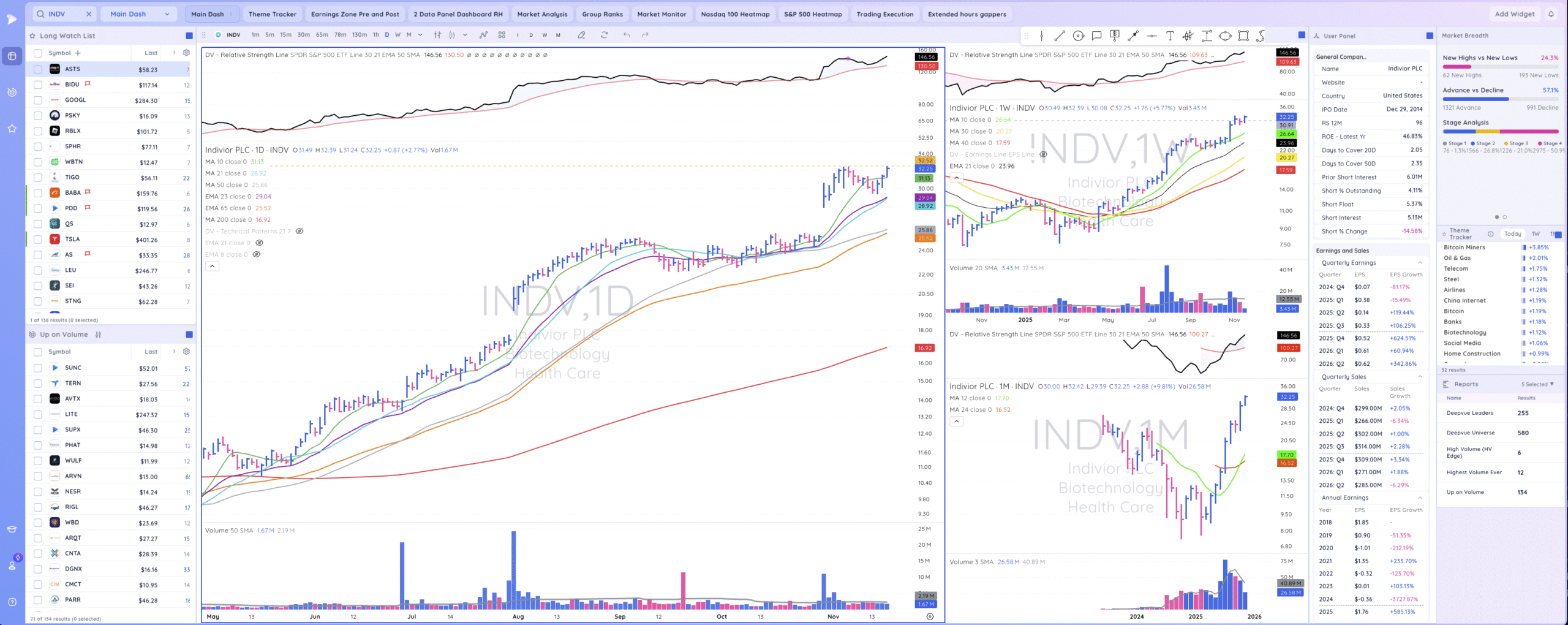

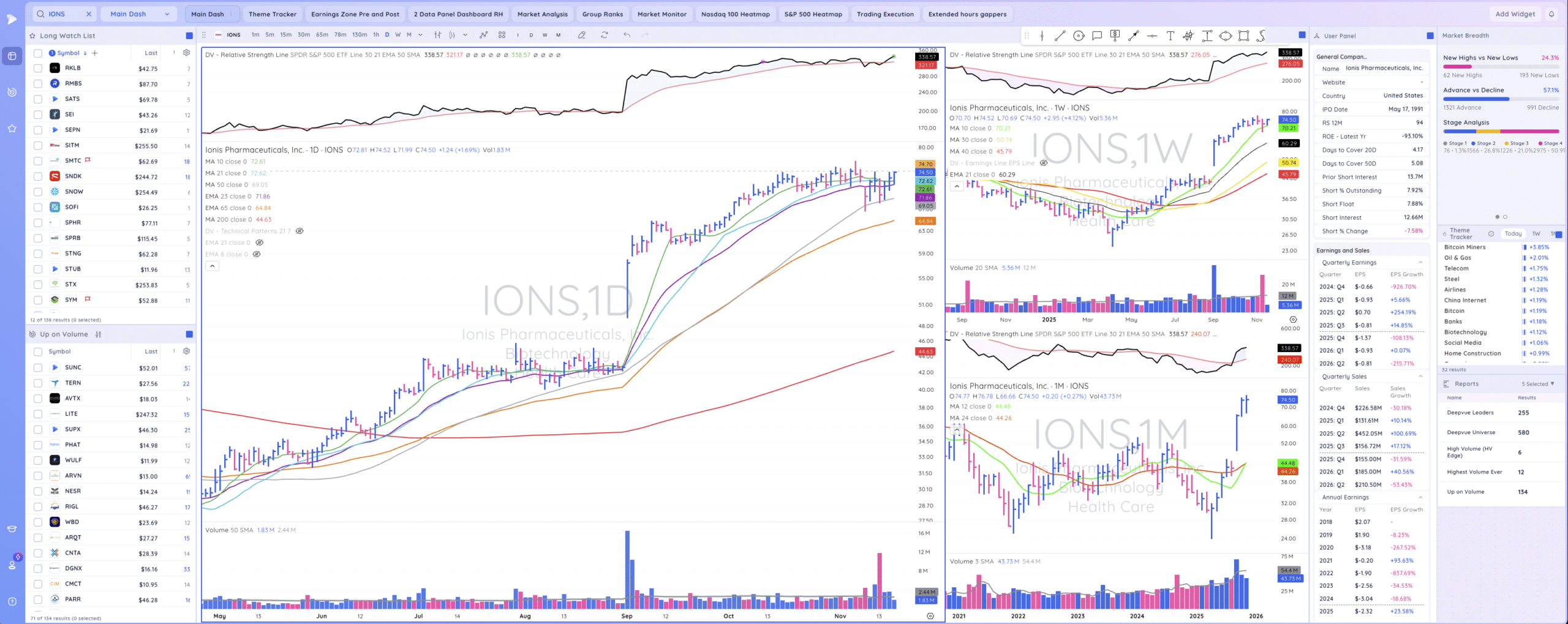

Specific tech names are holding up much better than others, such as GOOGL, SNDK, and CIEN, while most others have sold off to varying degrees over the last couple of weeks. The only real strength I see is in the biotech/pharma and medical equipment names.

As we discussed last Friday, I still see hints of strength in software stocks, such as DDOG, FROG, and APPN, which appear to be under accumulation.

At the end of the day, the market is waiting on NVDA’s earnings tomorrow before making any significant commitments.