What 3 Leading Stocks Would William O’Neil Buy Today?

Published: December 5, 2025

The William O’Neil Philosophy: Buying Strength, Not Weakness

William O’Neil’s legendary CAN SLIM methodology has guided generations of growth investors to market-beating returns. Today, we examine which stocks align with his proven criteria and would likely capture his attention in the current market environment.

William O’Neil’s approach fundamentally differs from traditional value investing. While most investors seek stocks trading near their lows, O’Neil’s research revealed that the biggest winners break out to new highs before making major price advances. This counterintuitive insight forms the foundation of growth investing.

O’Neil’s Core Principles:

- Buy stocks breaking out of proper base patterns with volume

- Focus on leading stocks in leading industry groups

- Cut all losses quickly at 7-8% below the purchase price

- Let winners run, but have clear profit-taking rules

- Invest only when the overall market is in a confirmed uptrend

Decoding CAN SLIM: Seven Factors for Stock Selection

O’Neil’s CAN SLIM system combines fundamental analysis with technical pattern recognition to identify stocks positioned for major price moves. Each letter represents a critical factor that, when present together, significantly increases the probability of success.

Current Quarterly Earnings

The most predictive factor O’Neil discovered. Look for earnings per share growth of at least 25% year-over-year in the most recent quarter. Even more powerful are stocks showing earnings acceleration – where the growth rate itself is increasing quarter after quarter. This demonstrates sustainable momentum rather than a one-time spike.

Annual Earnings Growth

Seek companies with annual EPS growth of 25% or more over the past three years. This demonstrates consistent performance beyond quarterly fluctuations. Companies meeting this threshold have proven business models with sustainable competitive advantages. The five-year average earnings growth rate should ideally exceed 25% annually.

New Products, Management, or Highs

Something new drives institutional interest and stock price momentum. This could be innovative products or services that solve significant problems, new leadership bringing fresh strategic direction, or the stock making new 52-week highs. These catalysts attract market attention and create the conditions for substantial price appreciation.

Supply and Demand

This critical factor measures genuine buying interest through volume analysis. When a stock breaks out from a proper base pattern, volume should spike to at least 50% above its average daily level – this confirms institutional accumulation is occurring. Heavy volume on up days combined with light volume on down days signals strong demand overwhelming available supply.

O’Neil called this “the footprints of big money” – large institutions leaving unmistakable traces of their buying activity. Without volume confirmation, even perfect chart patterns often fail.

Leader or Laggard

Only buy the number one or two stocks in a leading industry group. O’Neil measures this through Relative Strength Rating – a comparison of a stock’s price performance over the past 12 months against all other stocks. Seek RS ratings of 87 or higher, meaning the stock outperformed 87% of all other stocks. Leaders keep leading while laggards rarely catch up.

Institutional Sponsorship

Winning stocks need increasing institutional ownership from top-performing mutual funds, pension funds, and other large investors. However, excessive institutional ownership can limit upside potential. Look for a reasonable number of quality institutions buying the stock in recent quarters – this provides the buying power needed for sustained price advances.

Market Direction

Perhaps the most critical factor. O’Neil estimates that 75% of stocks follow the general market direction. Only buy stocks when major indices like the S&P 500 and NASDAQ are in confirmed uptrends. During market corrections, even the best stocks with perfect fundamentals will decline.

Successful timing requires aligning individual stock purchases with favorable market conditions.

Cup with Handle: William O’Neil’s Signature Pattern

Beyond fundamental analysis, William O’Neil pioneered specific technical patterns that identify optimal buying opportunities. The cup with handle pattern has proven remarkably effective across market cycles and remains one of the most reliable bullish continuation patterns for identifying stocks about to make major moves.

Prior Uptrend – Foundation of Strength:

The pattern must form after a significant rally of at least 30%. This establishes the stock as a leader attracting institutional interest. Without this foundation, the pattern lacks the momentum needed for continuation.

Cup Formation – Healthy Consolidation:

The rounded bottom shows controlled selling rather than panic. Volume should decrease during the decline and base formation, indicating that selling pressure has dried up. The right side of the cup should reach within 15% of the left side high, demonstrating buyers remain eager despite the pullback.

Handle Formation – Final Shakeout:

Lasting one to six weeks, the handle forms in the upper half of the cup pattern. This brief pullback of 10-15% creates one final opportunity for weak hands to exit before the breakout. Volume should contract significantly during handle formation, showing minimal selling interest.

Breakout Point – The Buy Signal:

The ideal entry occurs when the stock closes above the highest point of the handle on volume at least 50% above average. Some of the most powerful breakouts show volume surging 100-200% or more above normal levels. This volume surge is non-negotiable – it proves institutions are aggressively buying and validates the entire pattern.

O’Neil recommends never buying more than 5% above the precise pivot point to manage risk effectively. A breakout on weak volume is suspect and often fails.

Critical Rule: Cup with handle patterns have approximately a 95% success rate when properly identified and entered at the correct pivot point with appropriate volume confirmation, in ideal market conditions.

Today’s CAN SLIM Leaders: November 2025

Based on William O’Neil’s criteria and current market conditions, several stocks demonstrate the characteristics he seeks. With the market in a confirmed uptrend through 2025 and AI infrastructure driving sustained demand, specific sectors show particularly strong alignment with CAN SLIM principles.

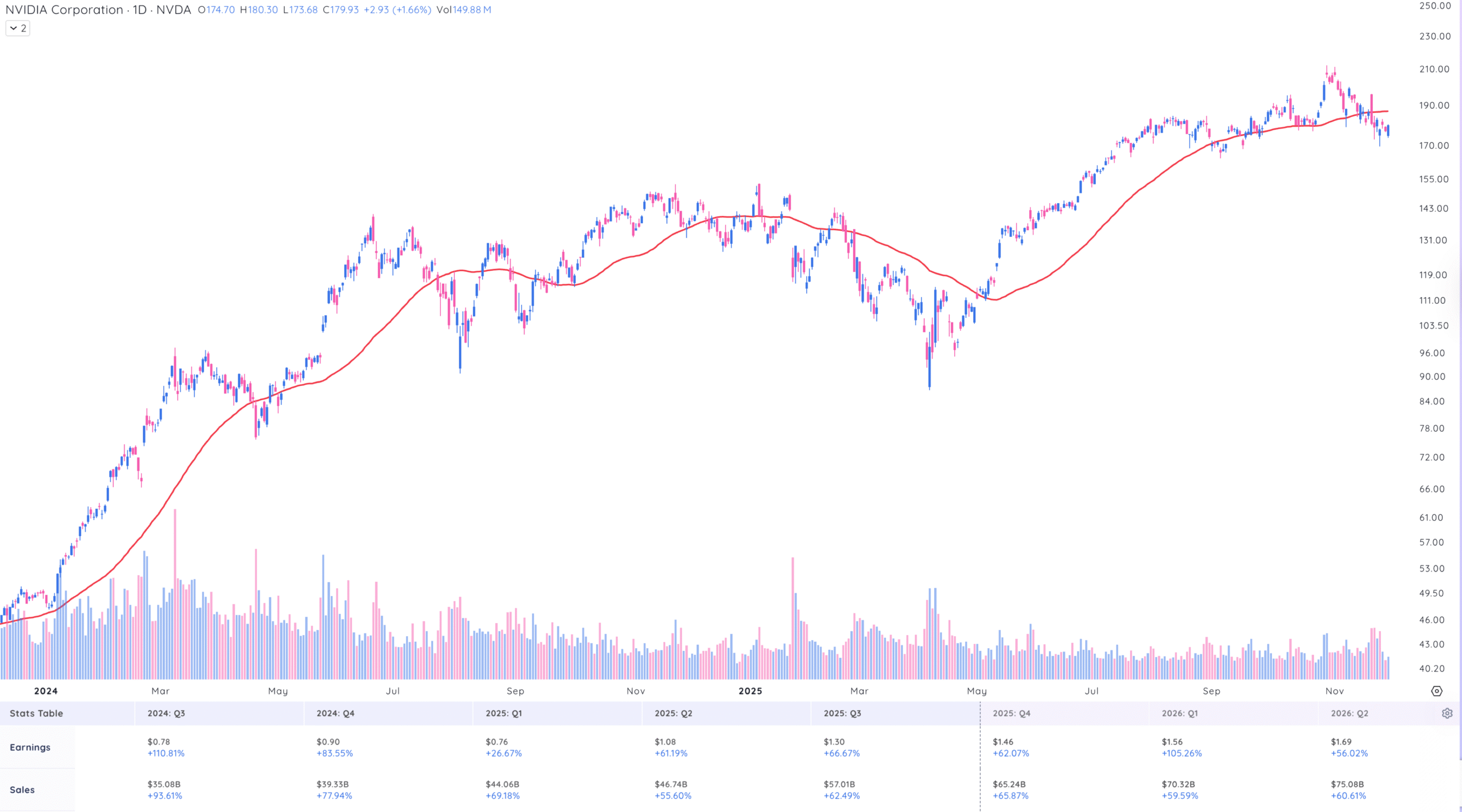

NVIDIA Corporation (NVDA)

Fundamentals: NVIDIA exemplifies O’Neil’s criteria with explosive earnings growth driven by its dominance in AI chips. The company reported data center revenue growth exceeding expectations quarter after quarter, with gross margins above 70% demonstrating pricing power and operational excellence. Annual earnings have grown substantially above the 25% threshold O’Neil requires.

Technicals: The stock has formed multiple consolidation patterns throughout 2025, breaking out to new highs on volume. Its Relative Strength Rating remains in the top tier of all stocks. While the valuation appears elevated at first glance, earnings growth justifies the premium – trading at approximately 28 times forward fiscal 2027 earnings.

Institutional Support: Major institutional investors continue accumulating shares, with strong ownership from top-performing growth funds. The company’s products remain essential infrastructure for AI development, providing a sustainable competitive advantage.

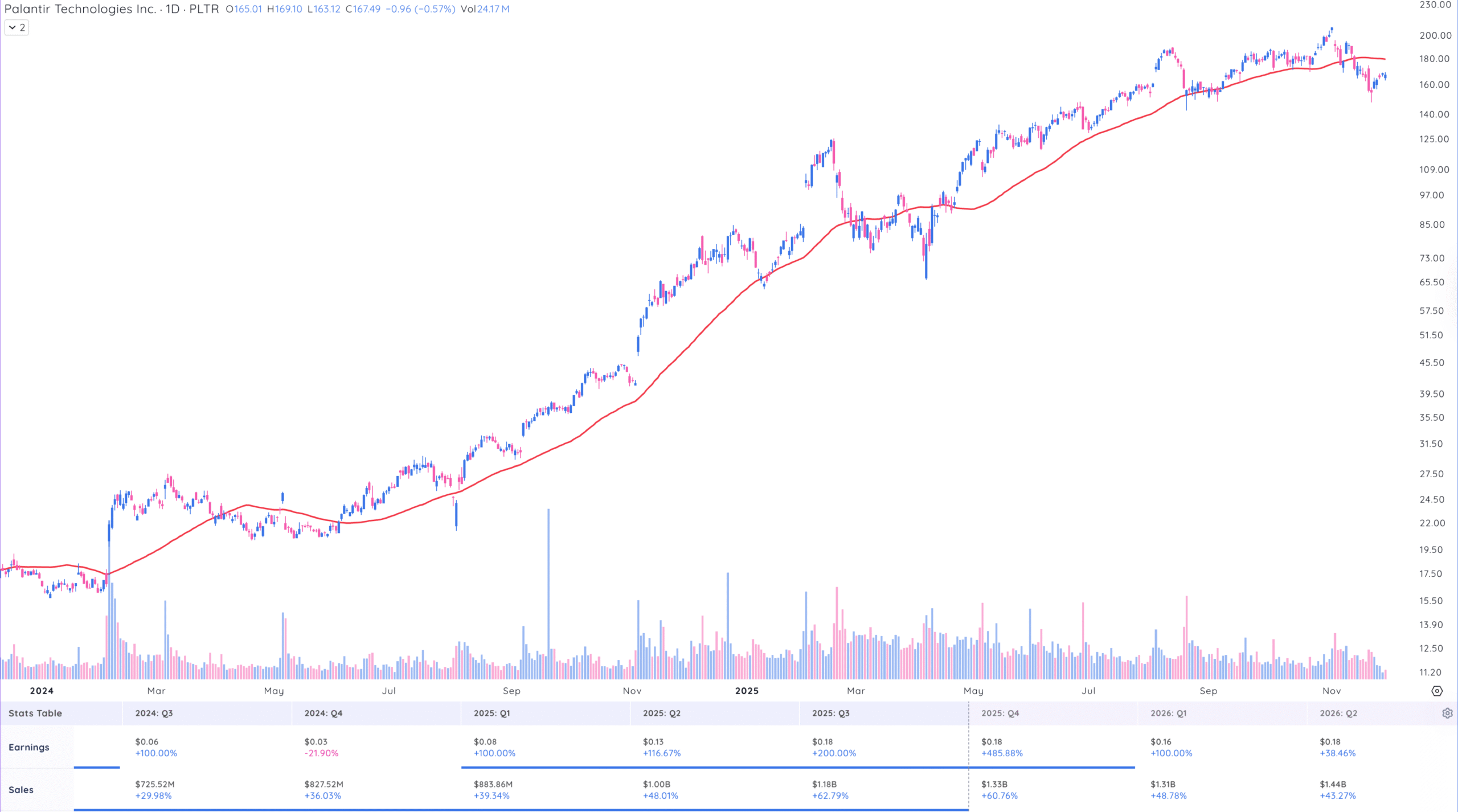

Palantir Technologies (PLTR)

Fundamentals: Palantir demonstrates exceptional earnings acceleration with revenue growing 30% year-over-year and 7% sequentially. U.S. commercial revenue specifically jumped 93%, while U.S. government revenue increased 53% – both well above O’Neil’s 25% threshold. The company has achieved consistent profitability with strong free cash flow generation.

New Products: Palantir’s AI platform and Artificial Intelligence Platform (AIP) represent genuine innovation, attracting enterprise customers. The “N” factor is clearly present with new AI capabilities driving customer adoption and revenue expansion.

Valuation Considerations: The stock trades at premium valuations that reflect high growth expectations. Analysts project 36% EPS growth with 22% revenue growth upcoming. While expensive by traditional metrics, free cash flow generation supports the current price for long-term holders.

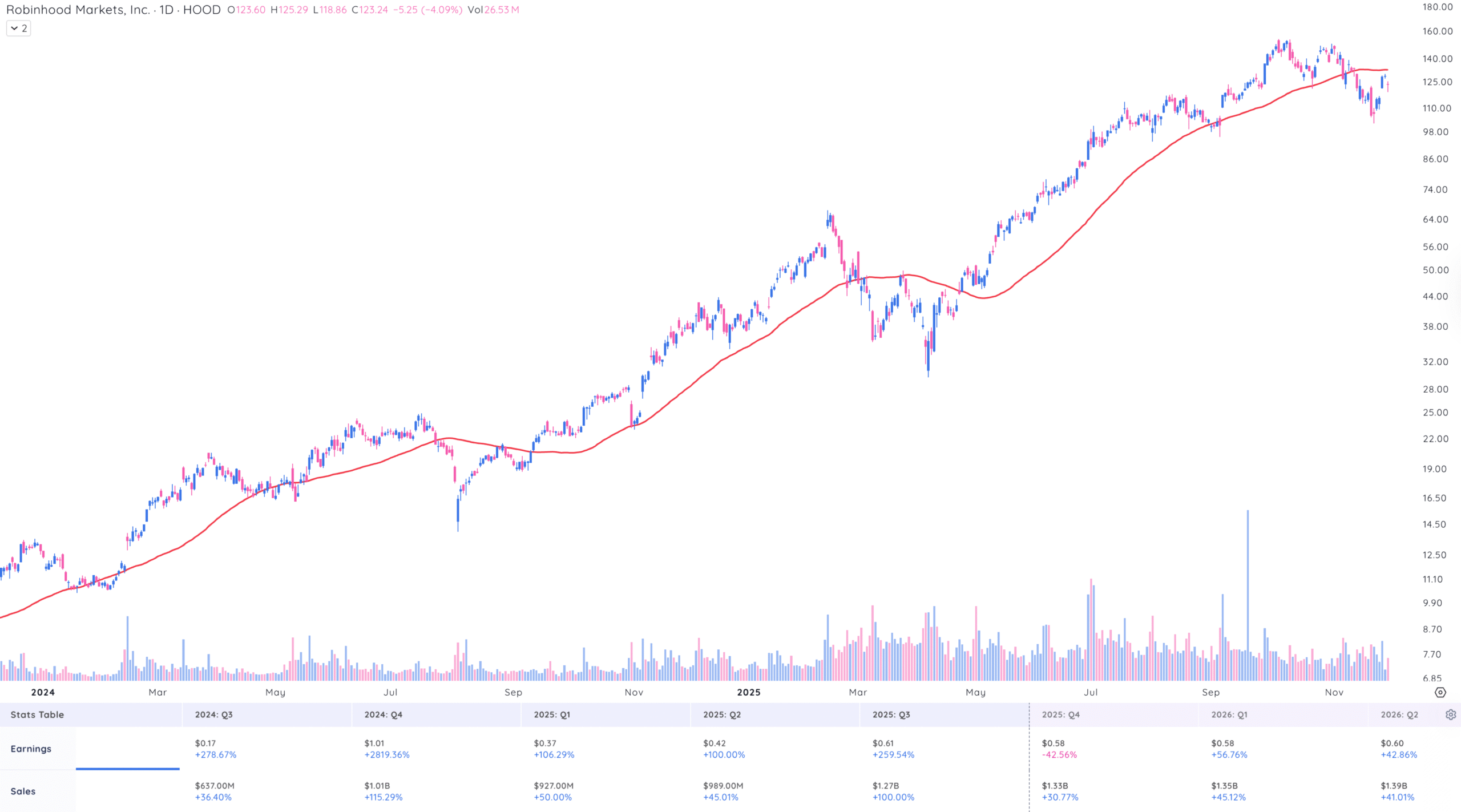

Robinhood Markets (HOOD)

Fundamentals: Robinhood exemplifies explosive growth with revenue surging 45% year-over-year to nearly $1 billion in Q2 2025. More impressively, EPS doubled compared to the previous year, demonstrating operational leverage. For Q3, analysts expect $0.51 EPS versus $0.17 a year ago – representing 200% growth that far exceeds O’Neil’s 25% threshold. Revenue is projected at $1.21 billion, up 91% year-over-year.

New Products (N Factor): Robinhood scores exceptionally high on innovation. The company launched prediction markets (event contracts), which generated nearly 1 billion contracts in Q2 alone – a completely new revenue stream most analysts didn’t anticipate. Index options volumes grew 60% quarter-over-quarter. The company is rolling out Robinhood Banking, expanding internationally through Bitstamp acquisition, and pioneering stock tokenization for 24/7 trading outside the U.S.

Technicals: HOOD has skyrocketed approximately 250% year-to-date through 2025, breaking out from $50 to peak near $154 before consolidating. The stock has formed multiple bullish continuation patterns throughout its ascent. The current price, around $130-145, represents a pullback from all-time highs, potentially forming a handle pattern. Trading volume remains robust with institutional participation evident.

Supply & Demand: Assets under custody exploded 112% year-over-year to over $304 billion by August 2025. Average assets per funded customer surpassed $10,000 for the first time, doubling from the previous year. Net deposits remain strong, putting the company on track to exceed last year’s $50 billion. Record trading volumes across equities, options, and crypto demonstrate genuine demand.

Institutional Support: The stock received multiple analyst upgrades in October 2025, with Compass Point raising its target from $105 to $161, and KeyBanc increasing from $135 to $155. Approximately 60% of analyst ratings are “Buy.” However, the stock carries high beta (~2.4), meaning it’s twice as volatile as the overall market – a characteristic O’Neil actually favored in leading growth stocks.

Key Characteristics of Current Leaders

Earnings Quality – Acceleration Pattern:

Top stocks show not just growth, but accelerating growth rates. Quarter-over-quarter improvements indicate business momentum rather than one-time events. This earnings acceleration typically precedes major stock price advances.

Volume Profile – Institutional Footprints:

Leading stocks demonstrate volume surges on up days exceeding 50% above average – often 100% or more on major breakout days. Meanwhile, volume contracts significantly on down days, sometimes dropping 30-50% below average. This accumulation-distribution pattern reveals smart money positioning ahead of major moves. When volume dries up during pullbacks, it signals that sellers are exhausted. When volume explodes on upward moves, institutions are accumulating aggressively.

Risk Management Reminder: O’Neil’s methodology demands strict discipline. Cut all losses at 7-8% below your purchase price without exception. This single rule prevents small losses from becoming devastating. Even the best stocks occasionally fail – protecting capital allows you to participate when the next winner emerges.

Industry Group Strength: AI & Fintech Megatrends

William O’Neil emphasized buying leaders in leading industry groups. Currently, two sectors demonstrate the strongest group relative strength: AI infrastructure/software and innovative fintech.

With major technology companies expected to invest approximately $4 trillion in AI data center infrastructure by 2030, and with fintech companies capturing market share from traditional finance through superior technology, these secular trends provide multi-year tailwinds for companies positioned correctly.

Supporting Market Conditions

The overall market environment remains favorable for growth stock investing through late 2025. Major indices like the S&P 500 and NASDAQ have established confirmed uptrends, satisfying William O’Neil’s “M” factor.

Growth stocks specifically have outperformed value stocks, with the S&P 500 Growth index gaining approximately 19% through the first nine months of 2025 compared to 8% for the Value index.

This market leadership by growth stocks creates the ideal environment for CAN SLIM investing. When the market favors growth, properly selected stocks with strong fundamentals and technical setups can deliver exceptional returns.

However, investors must remain vigilant for market direction changes – O’Neil’s methodology requires selling when the market enters a correction.

Essential Takeaways: Investing Like O’Neil

William O’Neil’ CAN SLIM methodology endures because it combines objective criteria with proven technical patterns, removing emotion from investment decisions. The system doesn’t predict which stocks will become winners – rather, it identifies stocks demonstrating characteristics that historically preceded major price advances.

- Focus on stocks with accelerating earnings growth above 25% quarterly and annually – this single factor most reliably predicts future price appreciation

- Buy leaders breaking out of proper base patterns on volume at least 50% above average (ideally 100%+), entering within 5% of the pivot point

- Current leaders like NVIDIA, Palantir, and Robinhood demonstrate strong CAN SLIM characteristics with exceptional earnings growth and institutional backing

- Only invest when the overall market is in a confirmed uptrend – 75% of stocks follow market direction regardless of individual fundamentals

- Cut all losses at 7-8% without exception to preserve capital for future opportunities – small losses prevent devastating portfolio damage

- Seek stocks with high relative strength ratings (87+) in leading industry groups showing superior performance versus the overall market

- Watch for volume surges of 50-200% above average on breakout days – this confirms institutional buying and validates the pattern

The principles remain unchanged from William O’Neil’s original research: buy strong companies getting stronger, cut losses quickly, and align individual stock purchases with favorable market conditions.