TML Report November 12, 2025

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

November 12, 2025

Market Overview

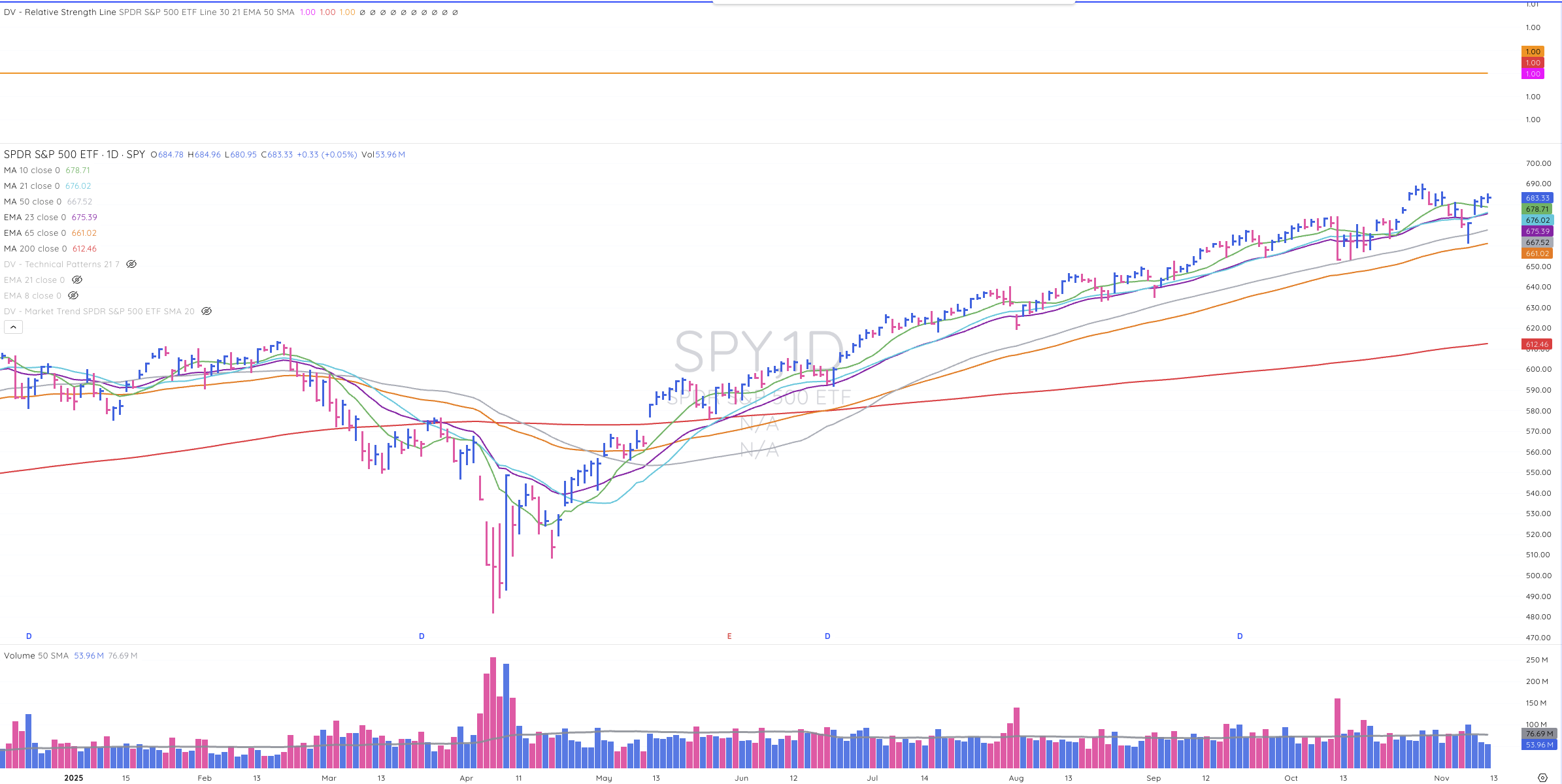

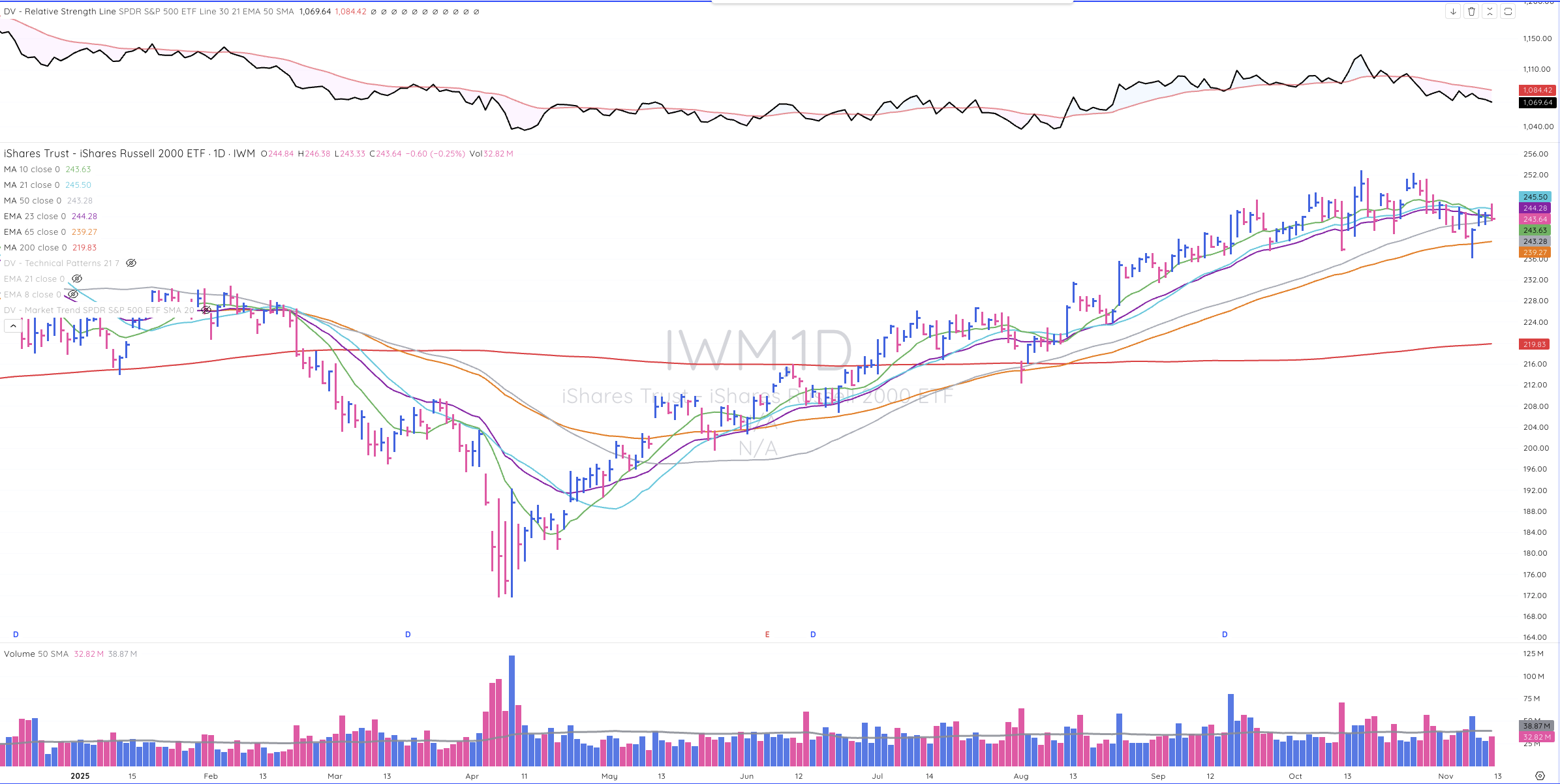

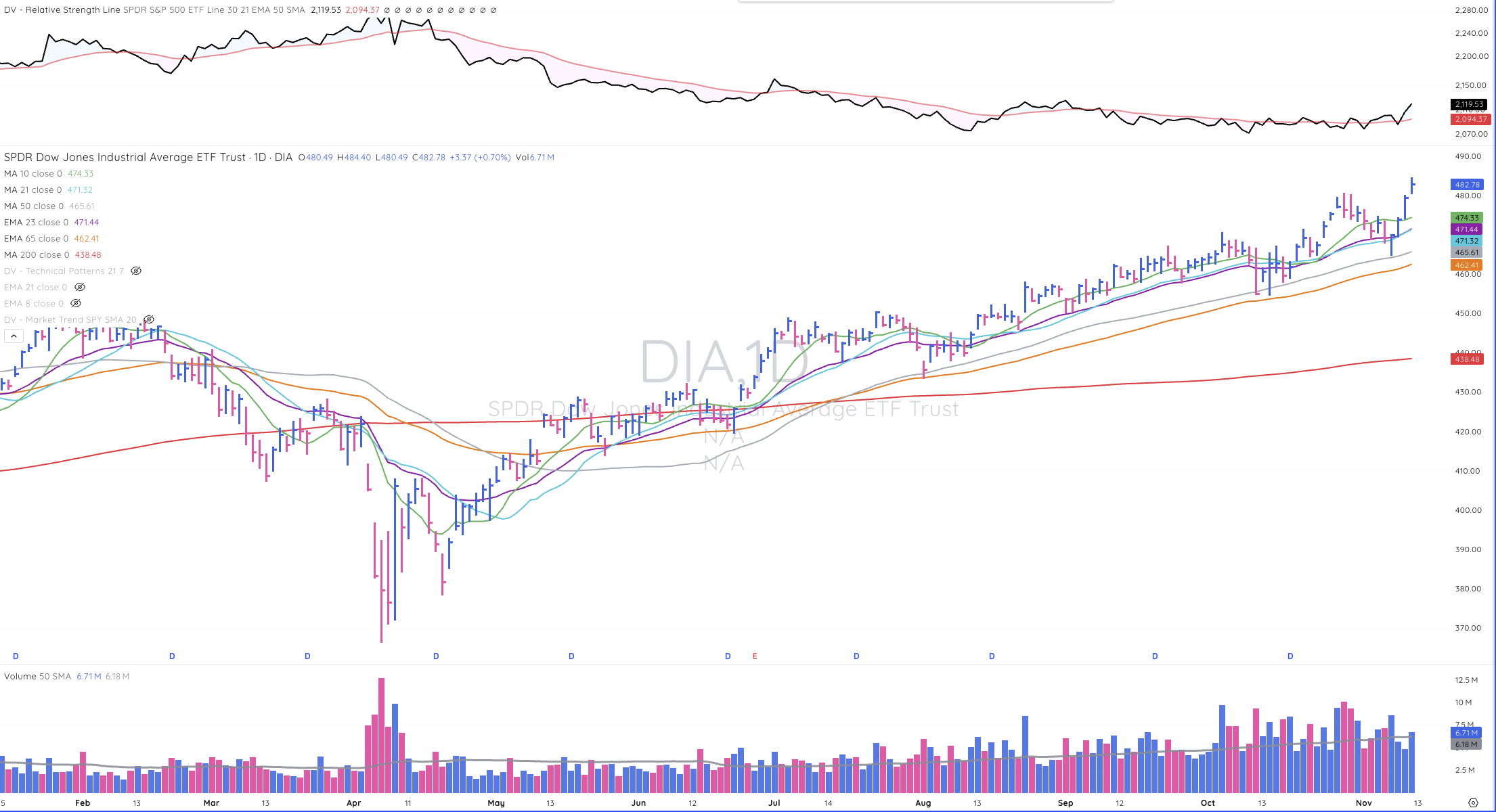

Last week’s sharp selloff ended on Friday, with all of the major indexes bouncing at logical support levels. The NASDAQ, S&P 500, and DOW all shook out to, or below, their key 50-day SMAs, while the Russell ultimately shook out below its 65-day EMA. The DOW finished the session at a new all-time high, the S&P 500 finished above its 10-day SMA for the third day in a row, the NASDAQ has found support at its 21-day SMA, while the small-cap index is resting above its 50-day SMA.

The market’s leadership is undergoing intense rotation. Some of the stocks that have led the way since April are still showing major weakness after massive moves over a very short period, while others continue to ride up their short-term 10-day SMAs, ignoring all weakness in the general market. Many are currently testing key moving averages.

At the end of the day, my Long Watch list shrank notably, with no apparent signs of where rotation is headed. Based on my assessment of the market’s leadership today, versus a few weeks ago, I am surprised at how well the major indexes have continued to hold up on a relative basis. It was noticeably harder to find stocks worth discussing out today.

Today’s list is what’s continuing to hold up, much more than potential actionable setups. There are still quite a few big leaders like SNDK, WDC, STX, CIEN, etc that remain in powerful channels to the upside. We will discuss these on Friday.

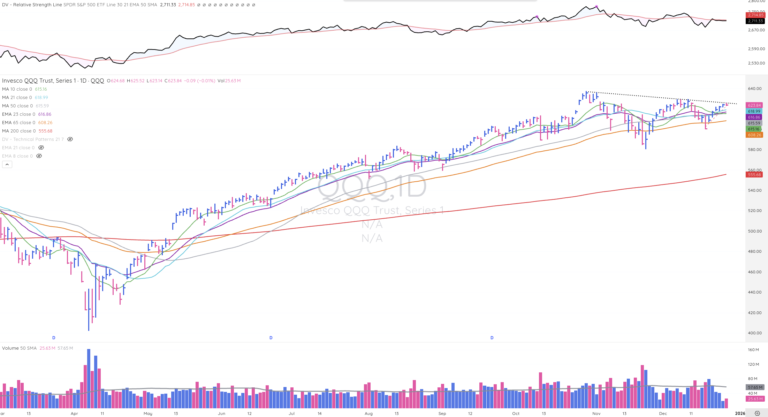

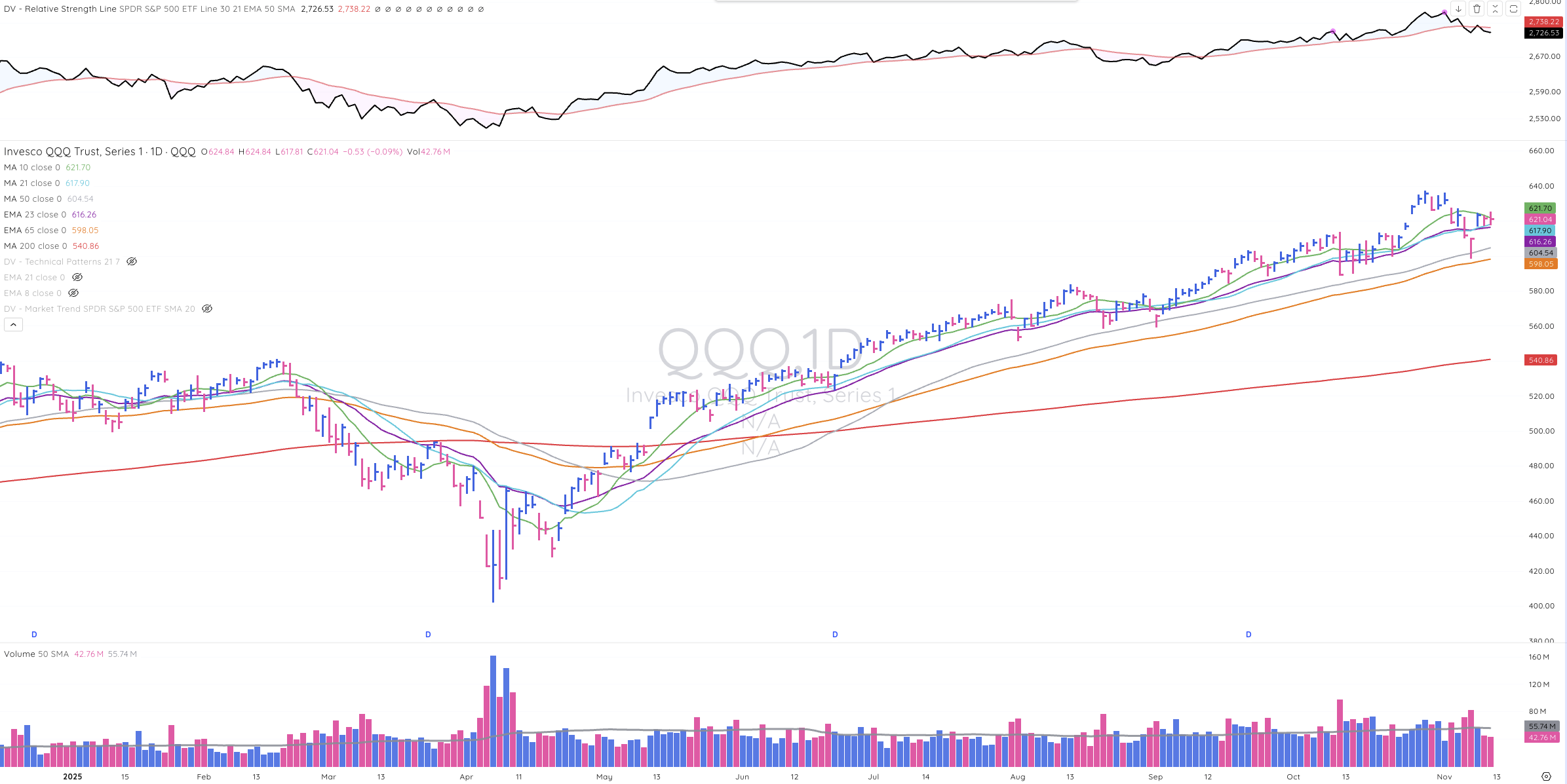

QQQ

The NASDAQ is looking healthy and constructive despite last week’s sharp sell-off. Last Friday’s shakeout below the 50-DMA was exactly how you want to see it, and this week’s rally back above the 21-day SMA and then holding tight is incredibly sound action, despite all the volatility in the NASDAQ’s leadership.

Continue Reading This Week’s TML Report

Get expert CANSLIM analysis from Ross Haber, former William O’Neil portfolio manager, plus live Friday sessions and curated watchlists