AMZN Gap Up but Closes at Lows

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 31, 2025

Market Action

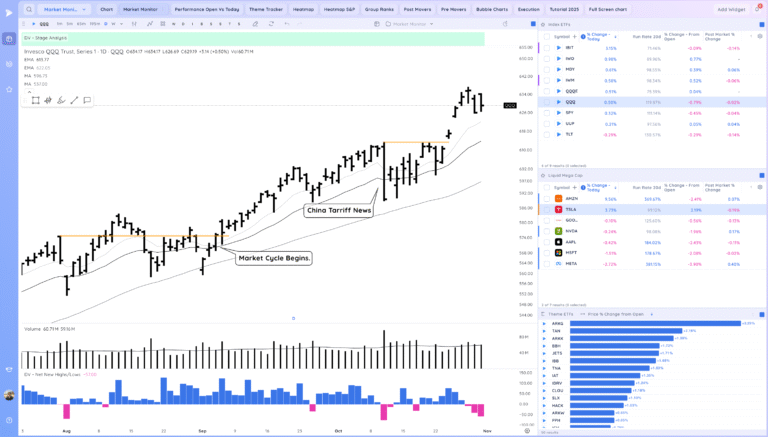

QQQ – Some selloff after the gap up. Overall consolidating the last 4 days. The 10ema is rising.

A range forming here letting the MAs catch up would be A+. Mega caps have been driving the market, ideally they hold up build flags and more names continue working.

Bulls want to see us either consolidate calmly or continue trending

Bears want to see a sharp reversal down with big earnings names selling off.

Daily Chart of the QQQ.

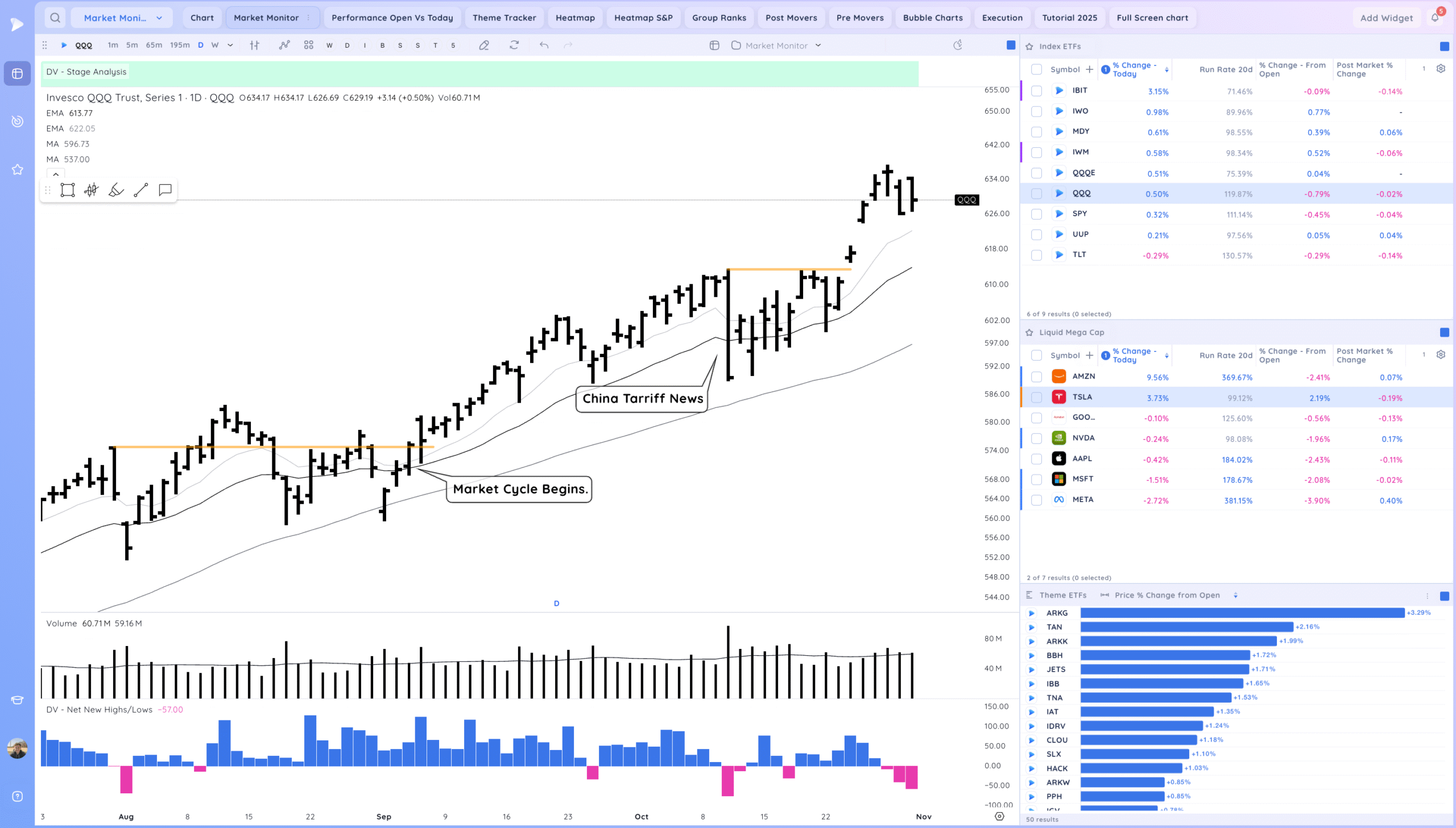

IWM – Upside reversal and reclaiming this level and the 21ema. Ideally pushed next week as large caps rest.

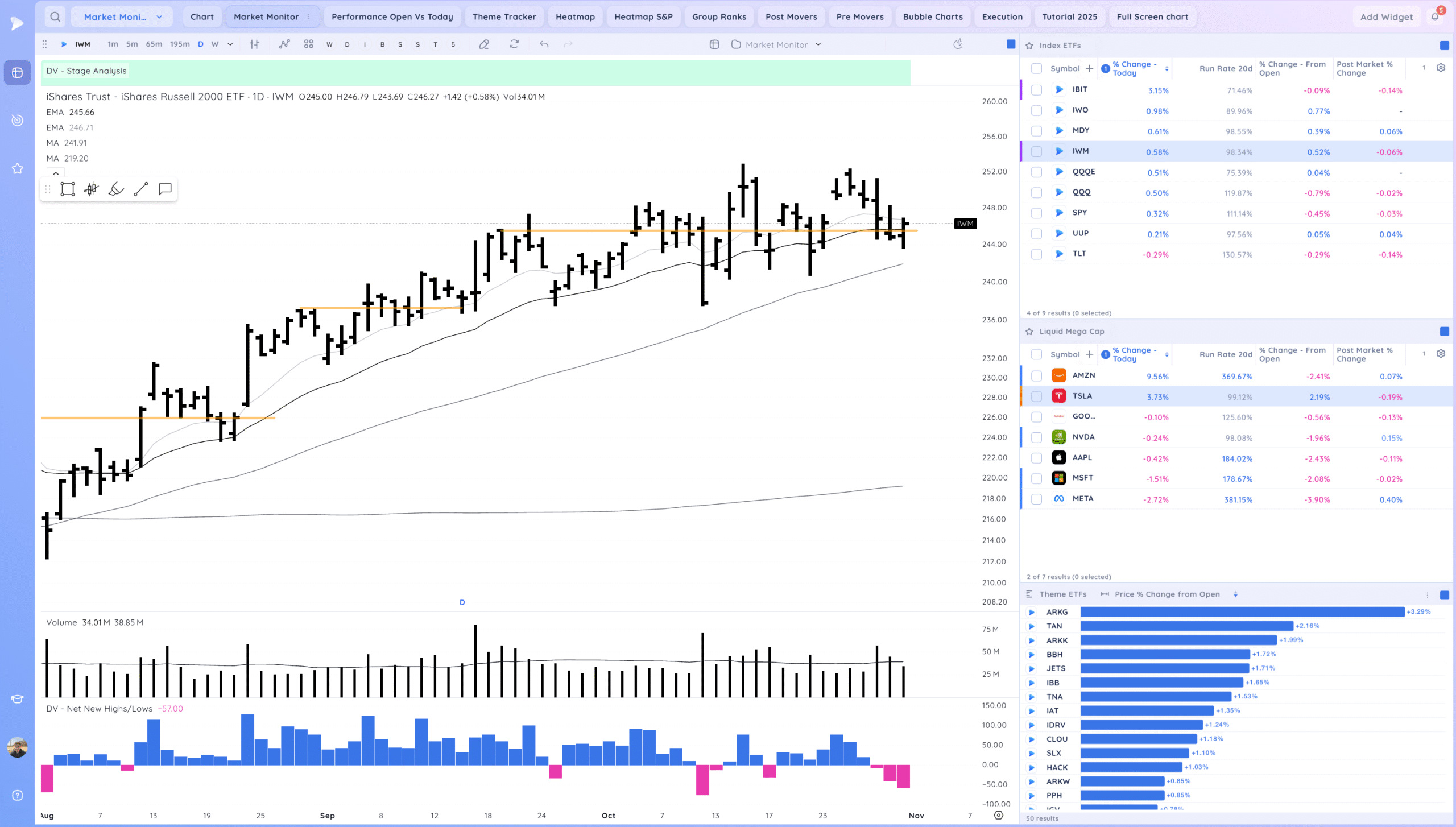

IBIT – Gap up and tight open to close. Direction undecided. Below the moving averages

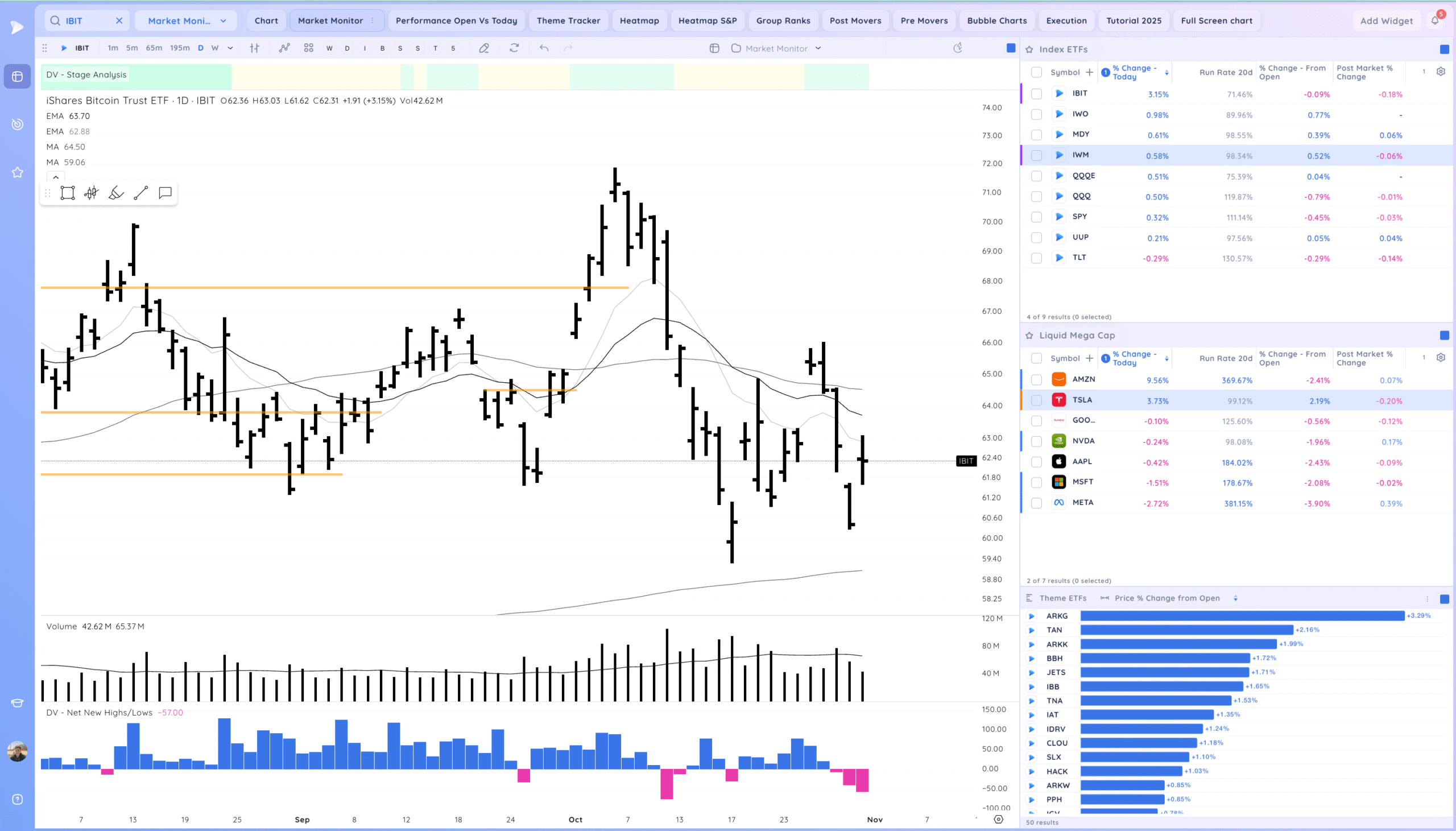

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

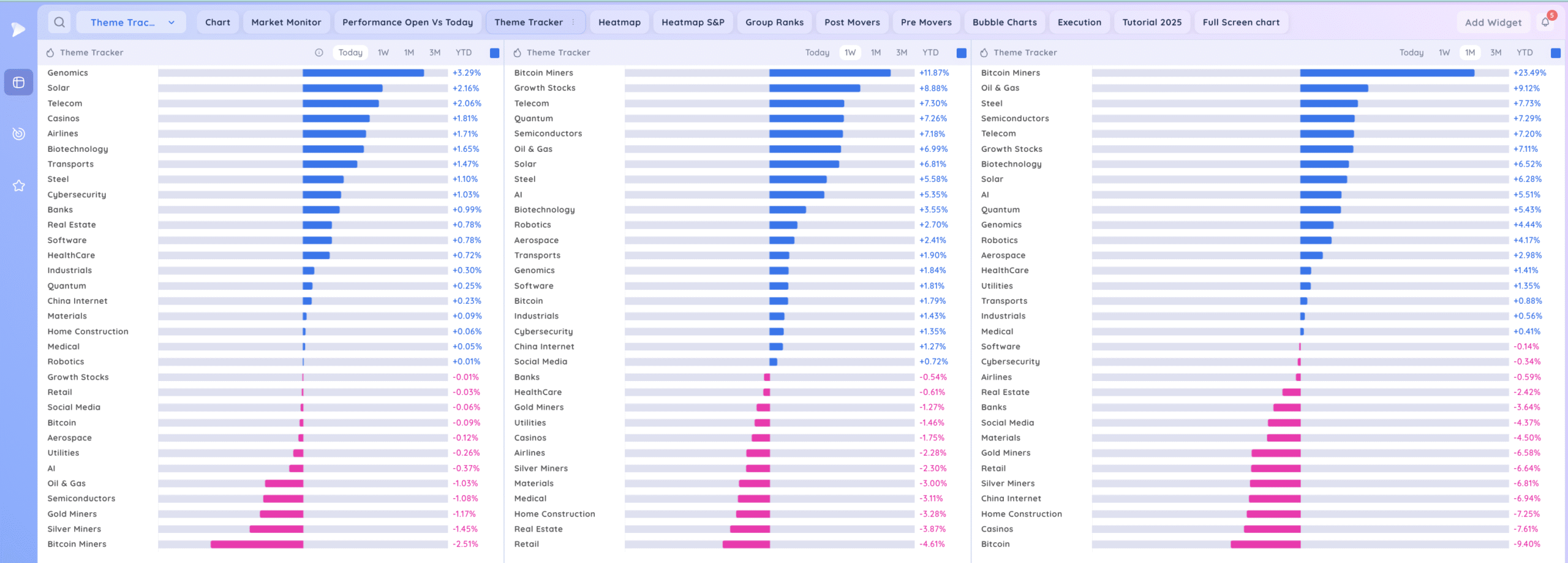

Deepvue Theme Tracker.

Deepvue Leaders.

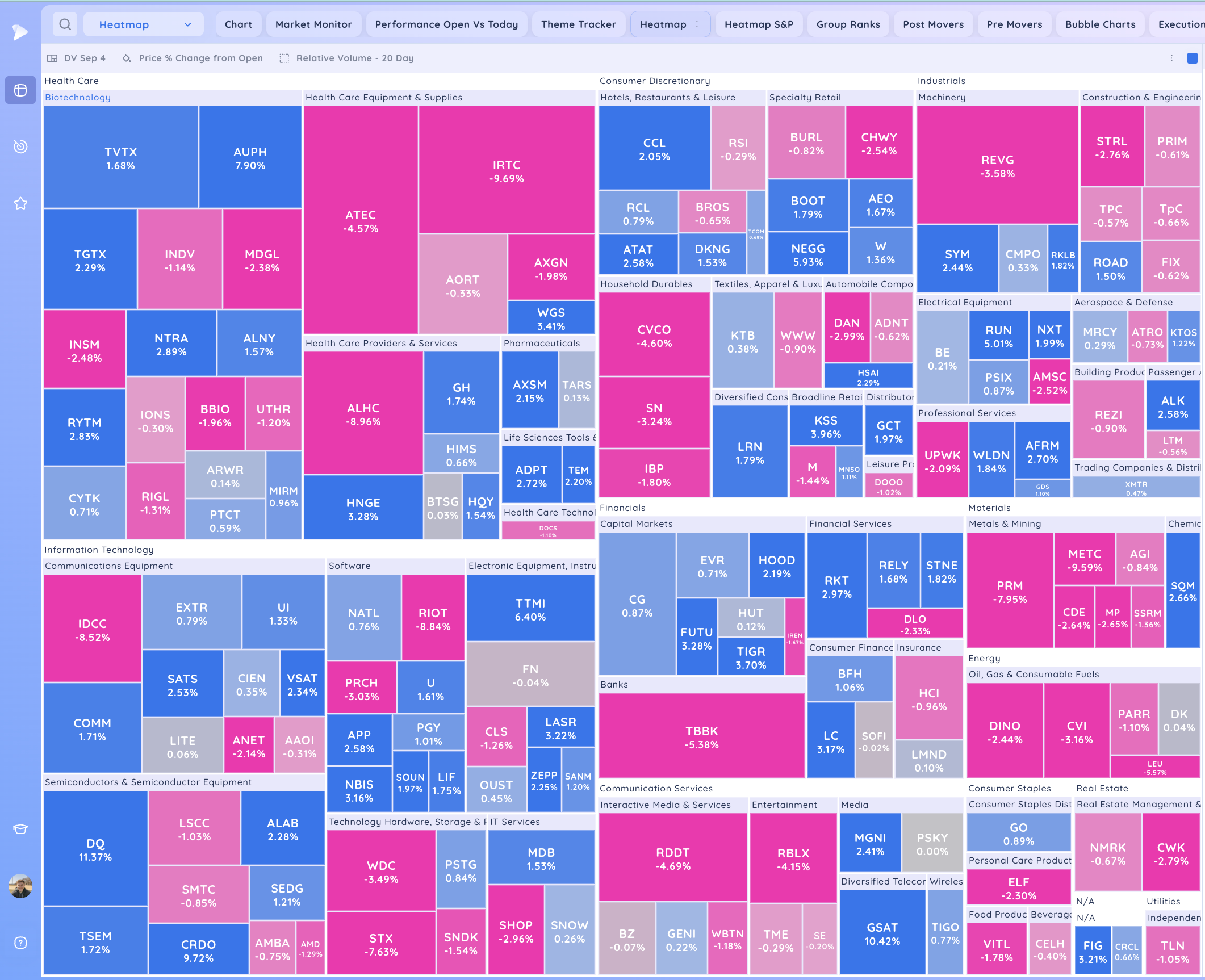

Quick note! I got some questions about how to I use the heatmaps. I use it broadly to see how themes are acting, If there are some groups standing out in terms of being all down big or up big from the open.

It gives me a feel for today’s rotation. I also look back on past reports to see when theme trends started.

S&P 500.

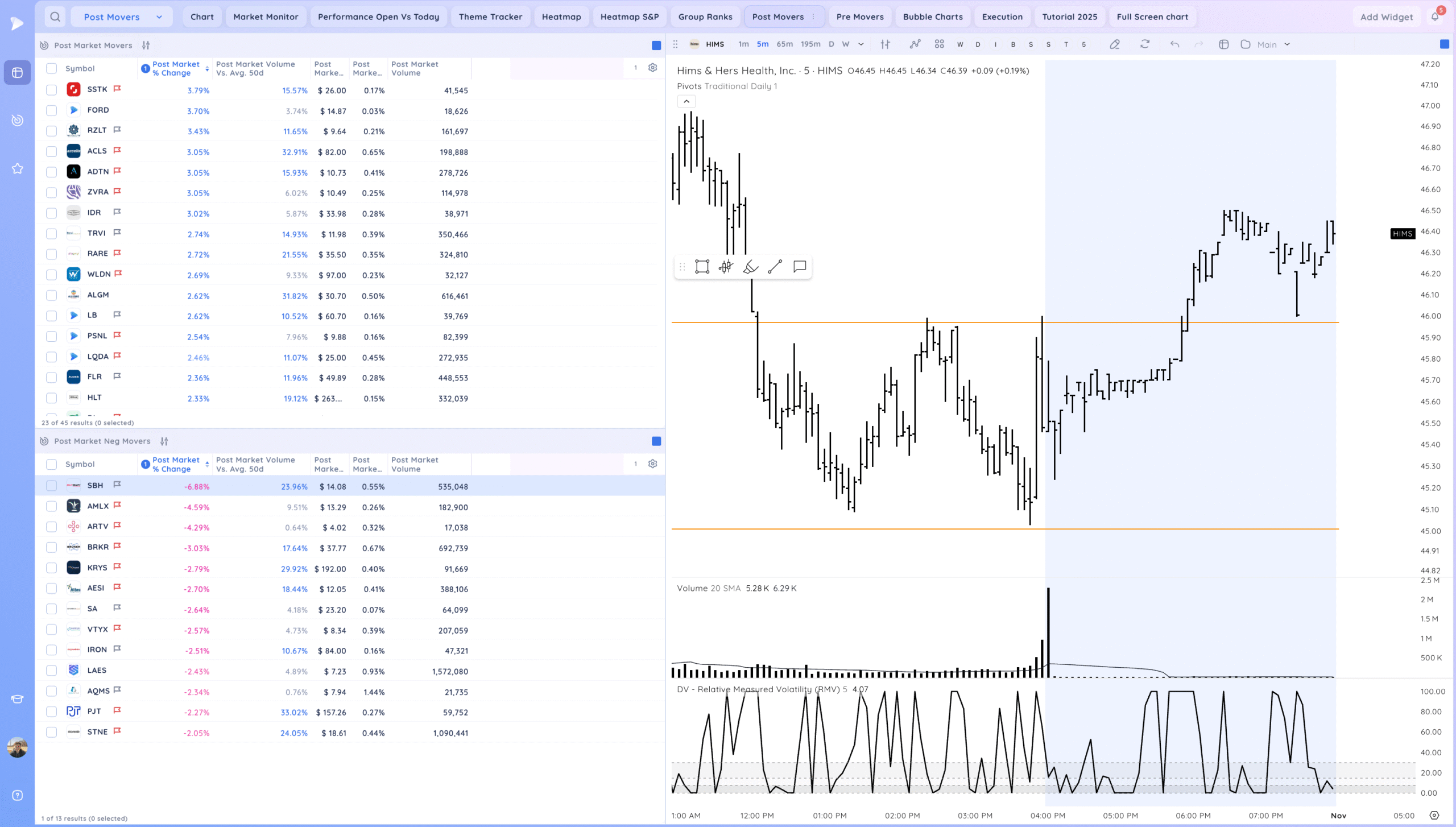

Post Market Movers. Not much action

Leadership Stocks & Analysis

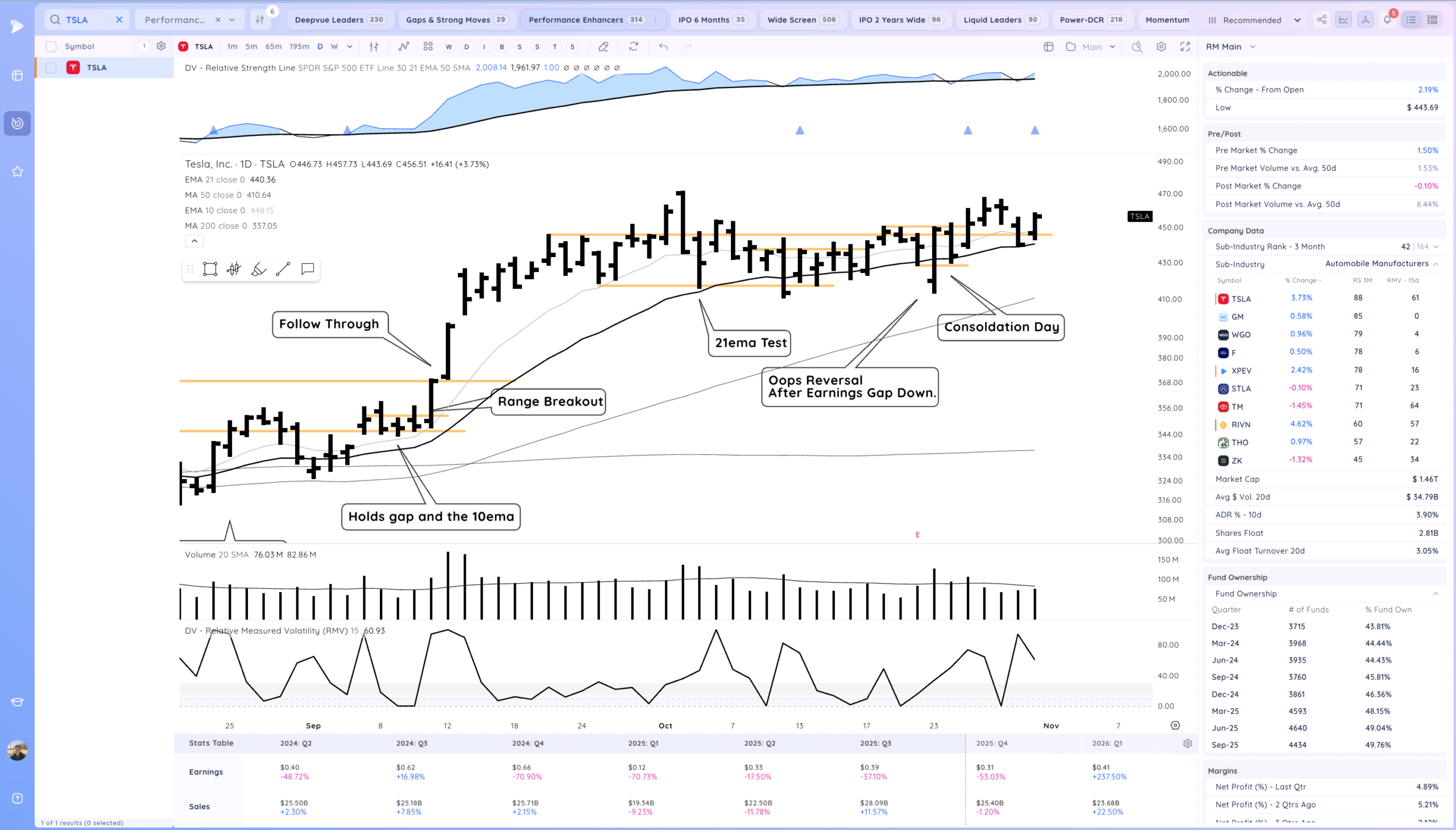

TSLA – Held the key 21ema and with a pop higher setting up for higher next week

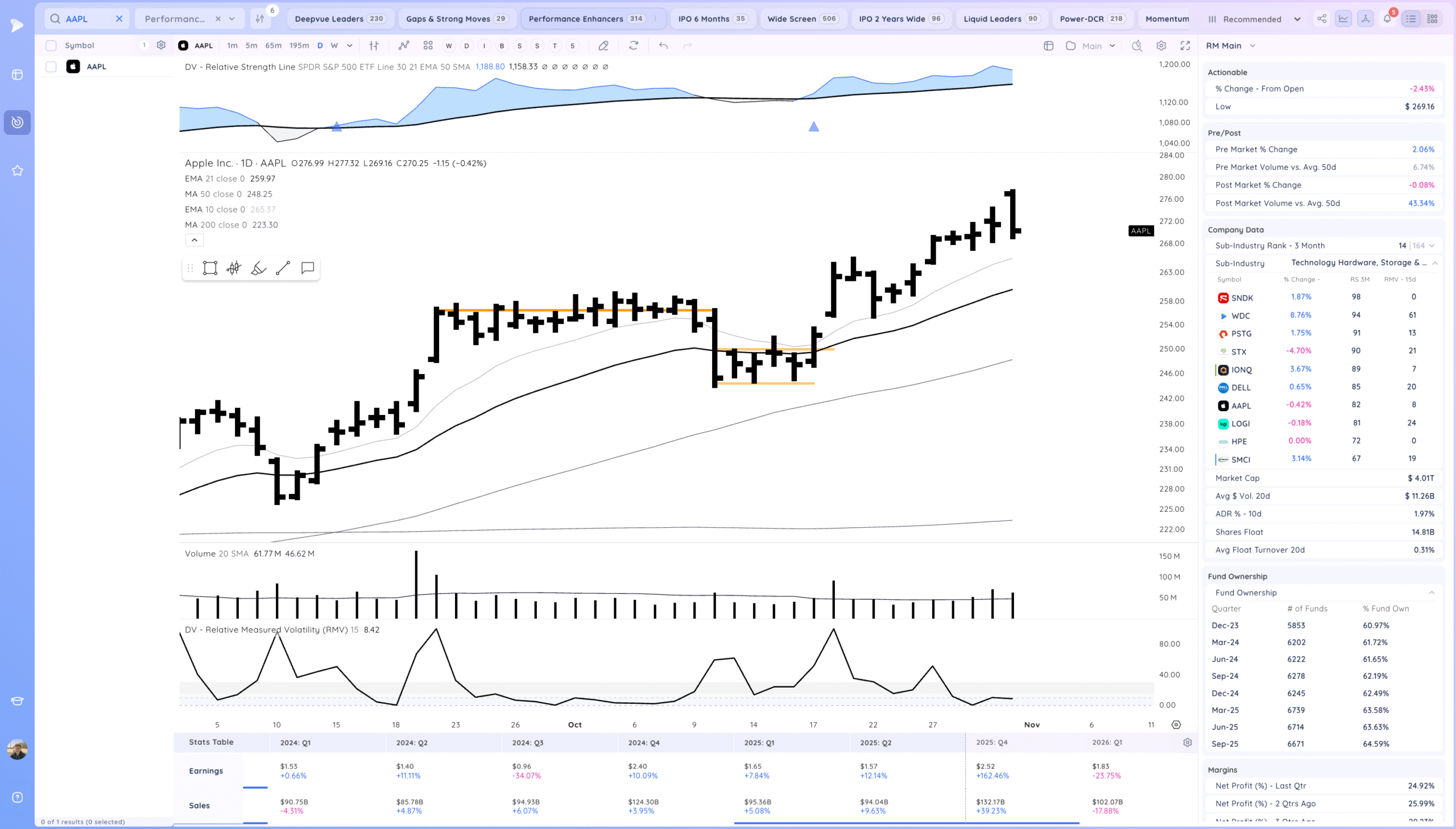

AAPL Downside reversal after the slight earnings gap

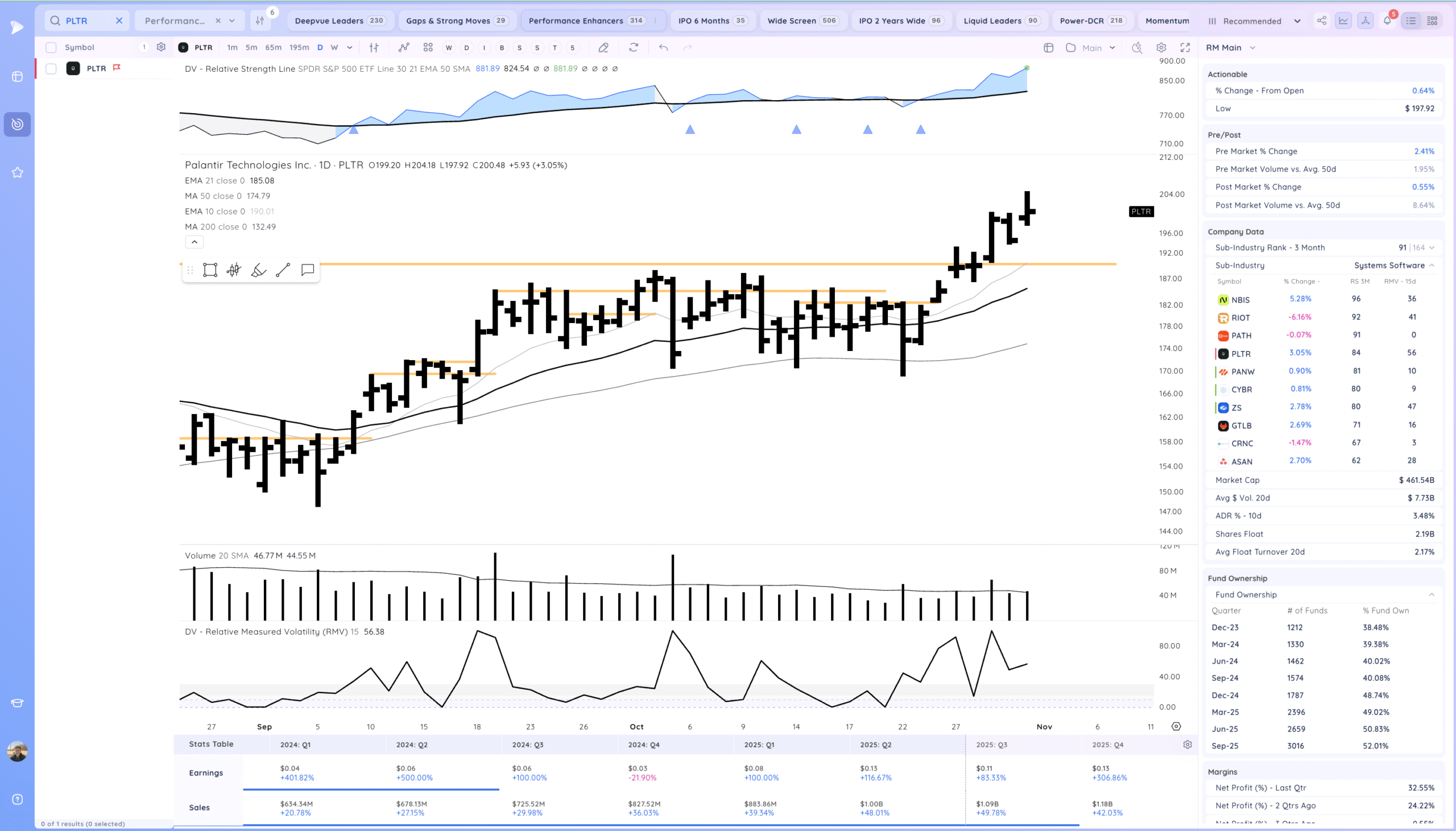

PLTR’s Gap up but fade off highs. trending

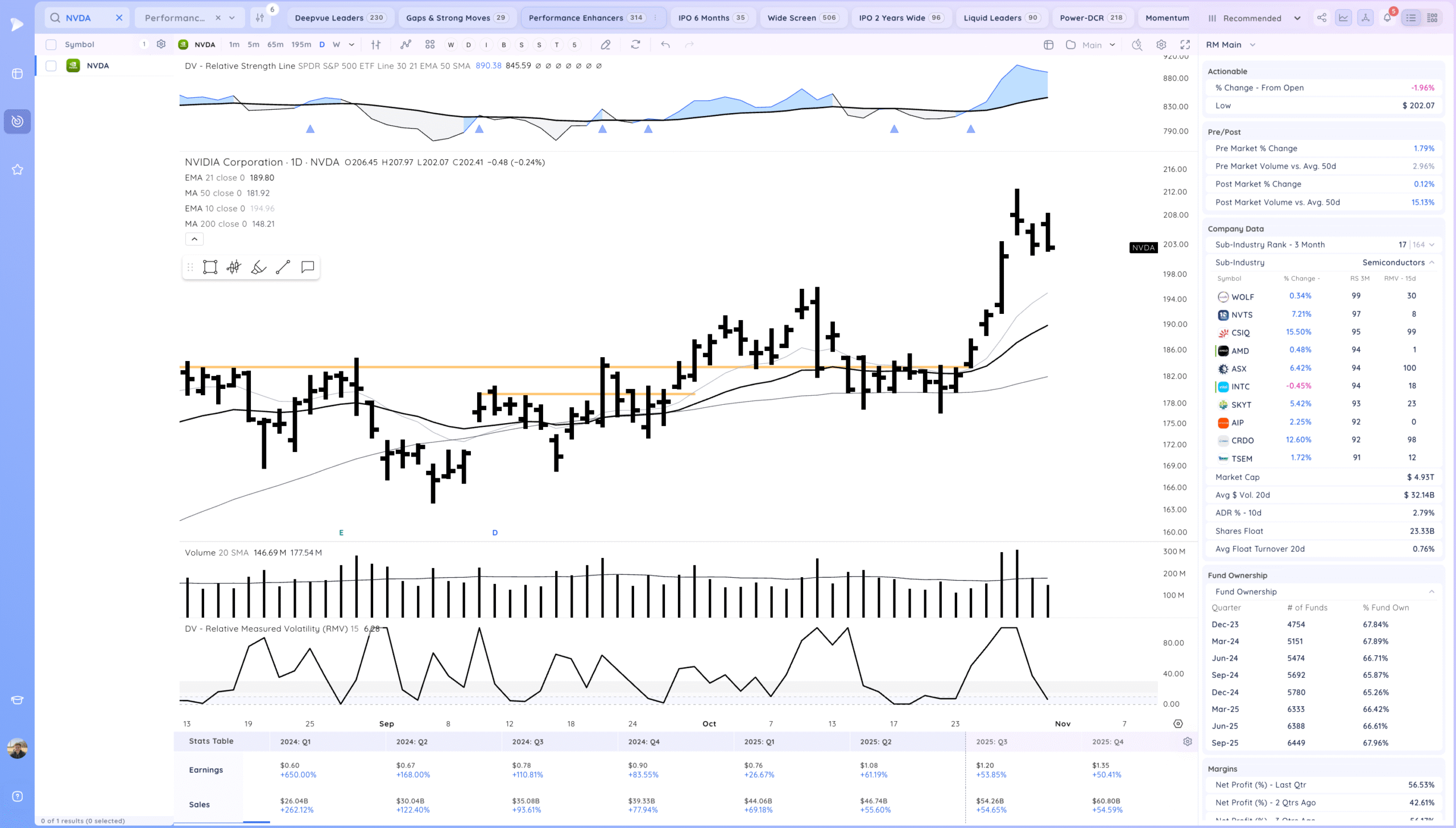

NVDA gap up but downside reversal, room to pullback to the rising 10ema

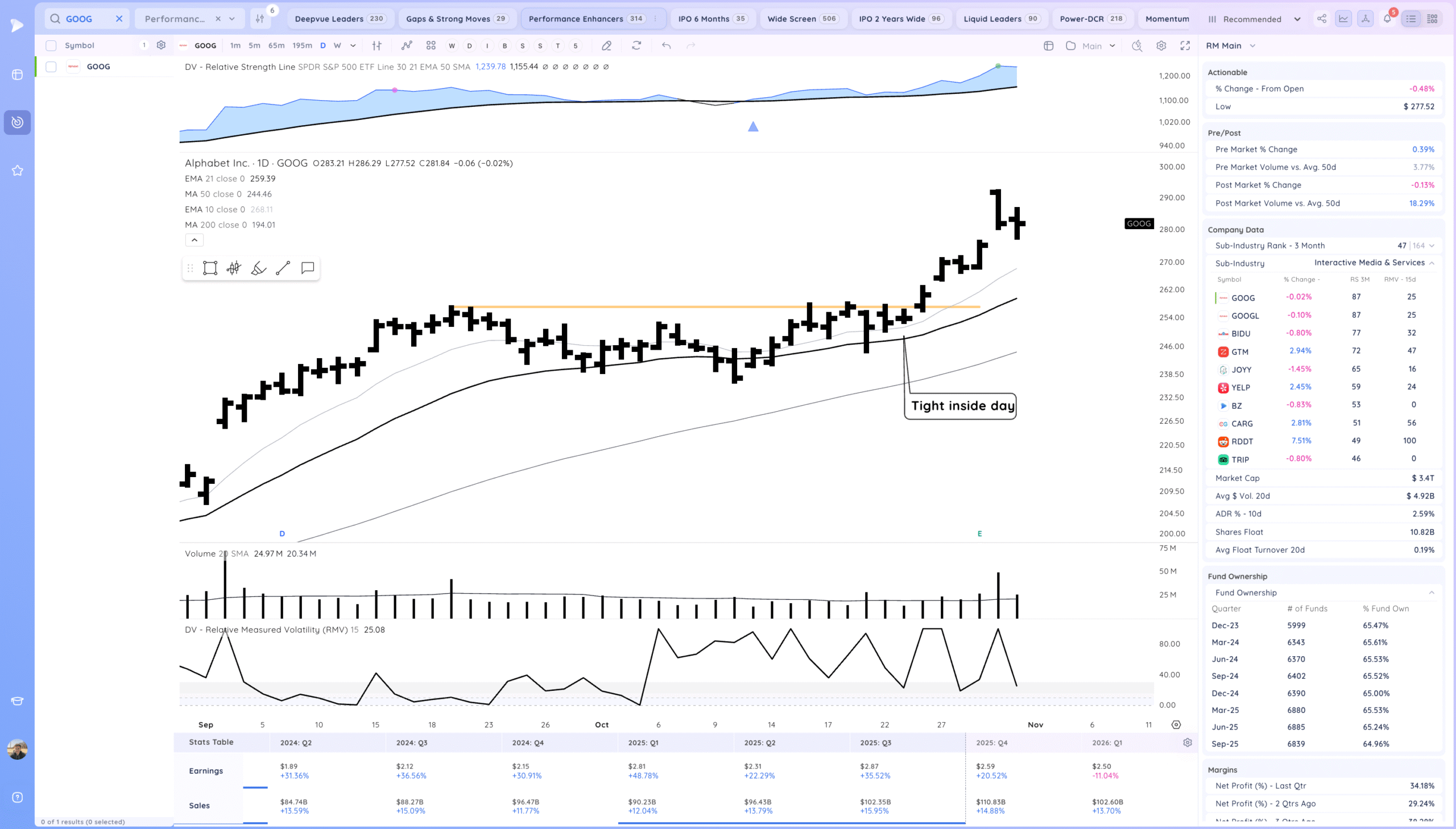

GOOG tight day, trending

META Not a good bar. However if it does not follow through down that will be a tell

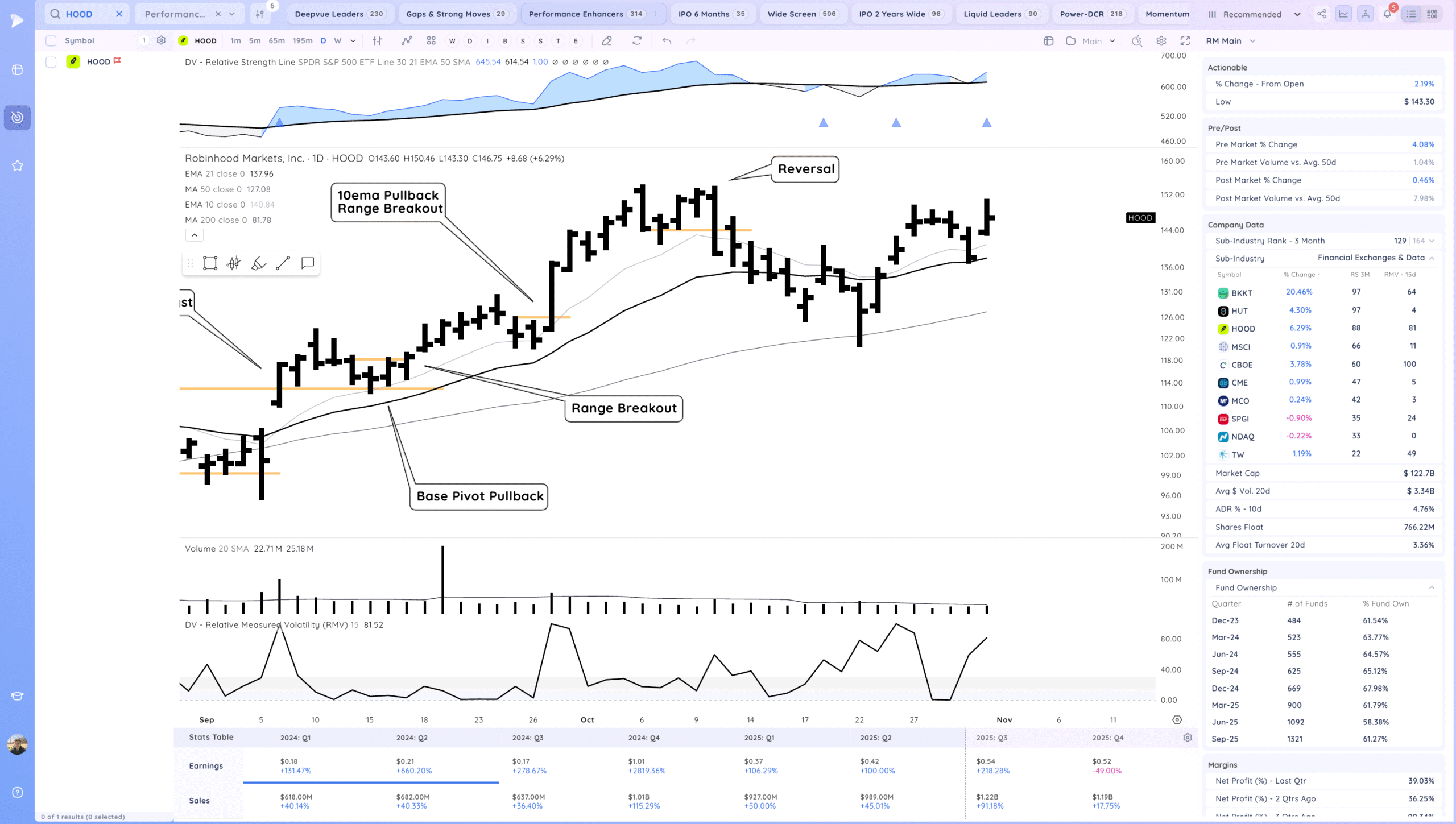

HOOD Positive expectation breaker. Some fade off highs. Ideally tighens along the 10ema

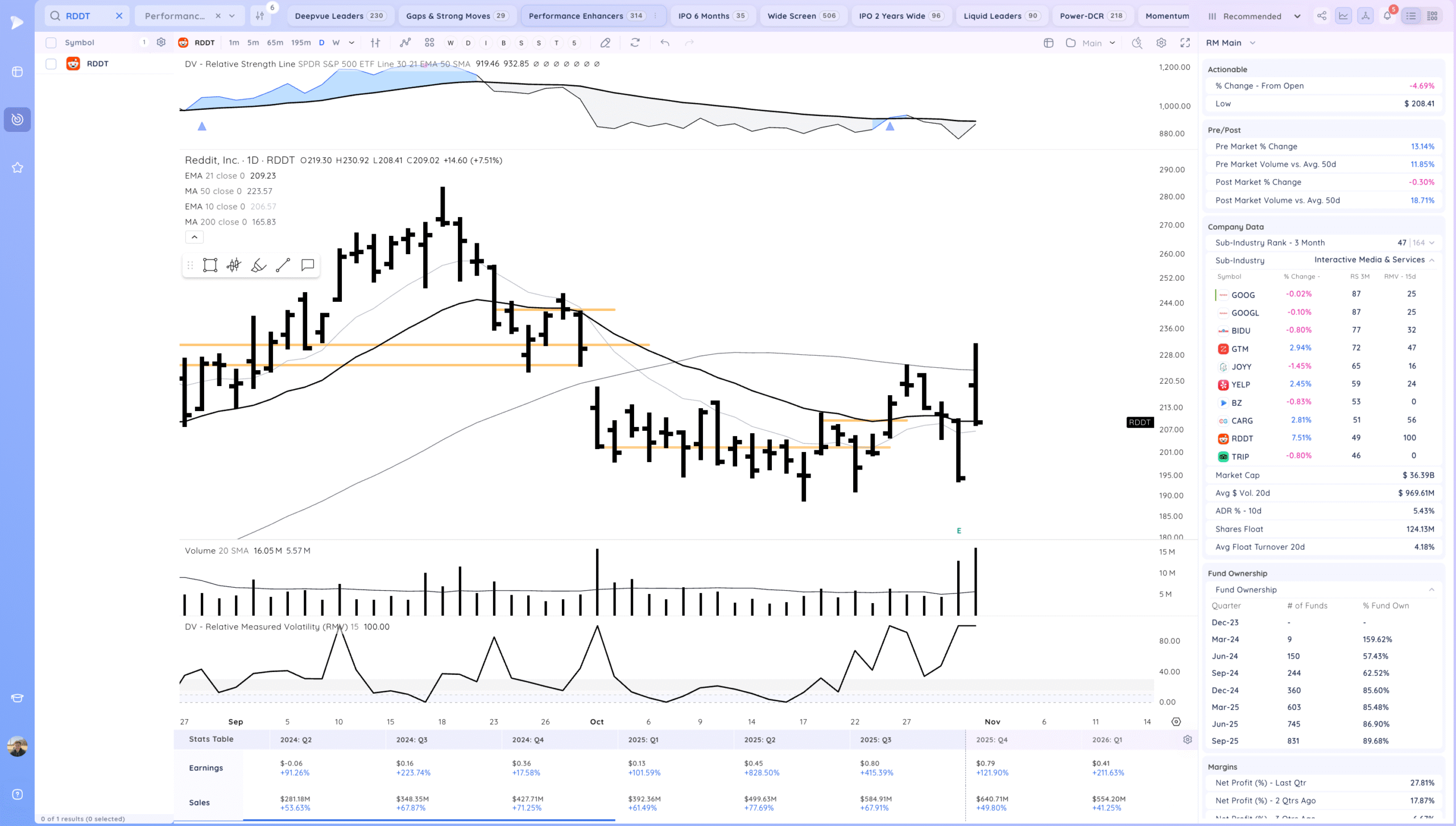

RDDT Strong earnings but sold off. see how it acts next week. Again when there is a very negative bar, how it reacts after gives us information

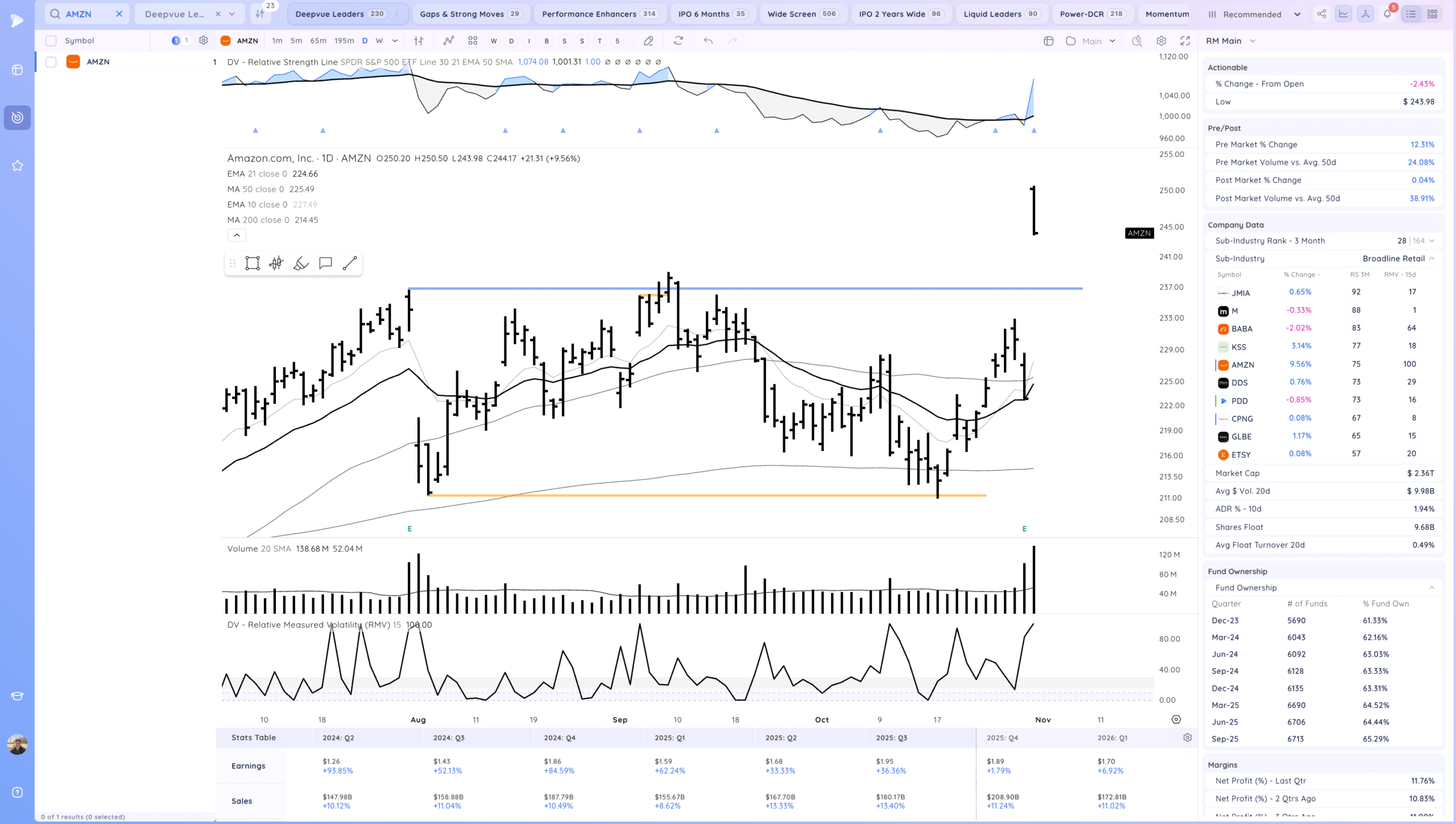

AMZN Strong gap but close at lows. Ideally forms a tight range

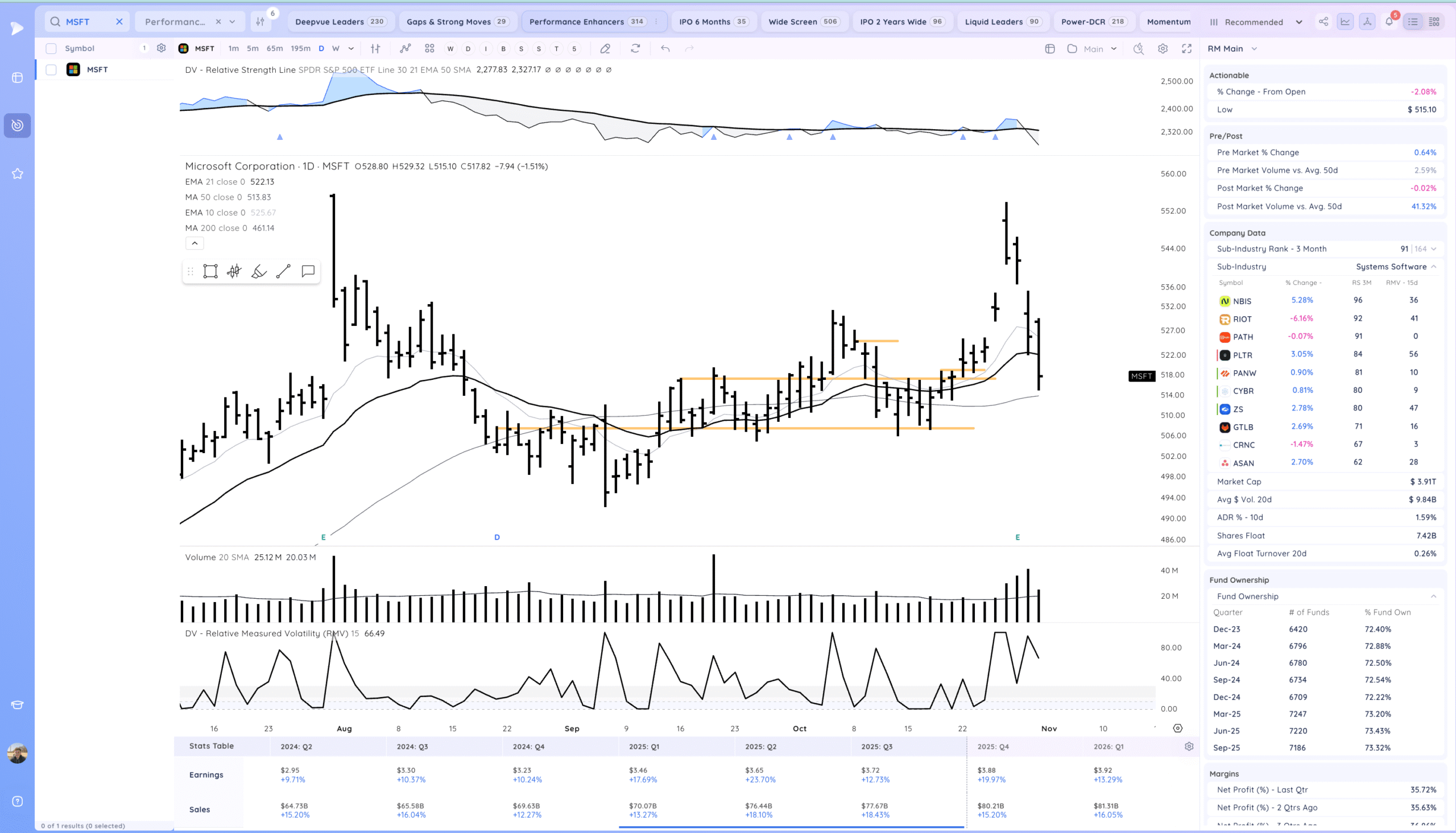

MSFT More follow through lower. Testing the 50sma

Key Moves

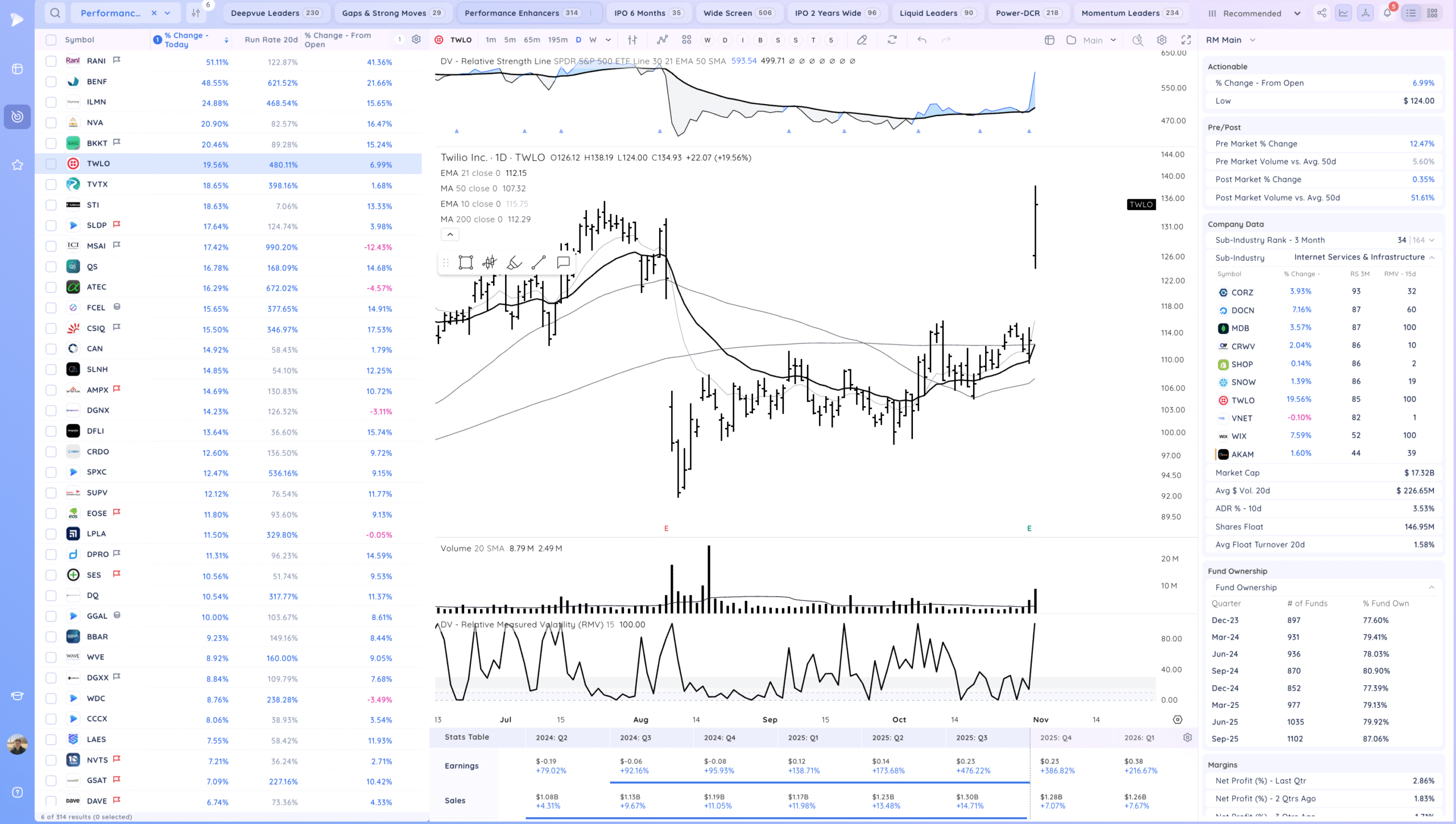

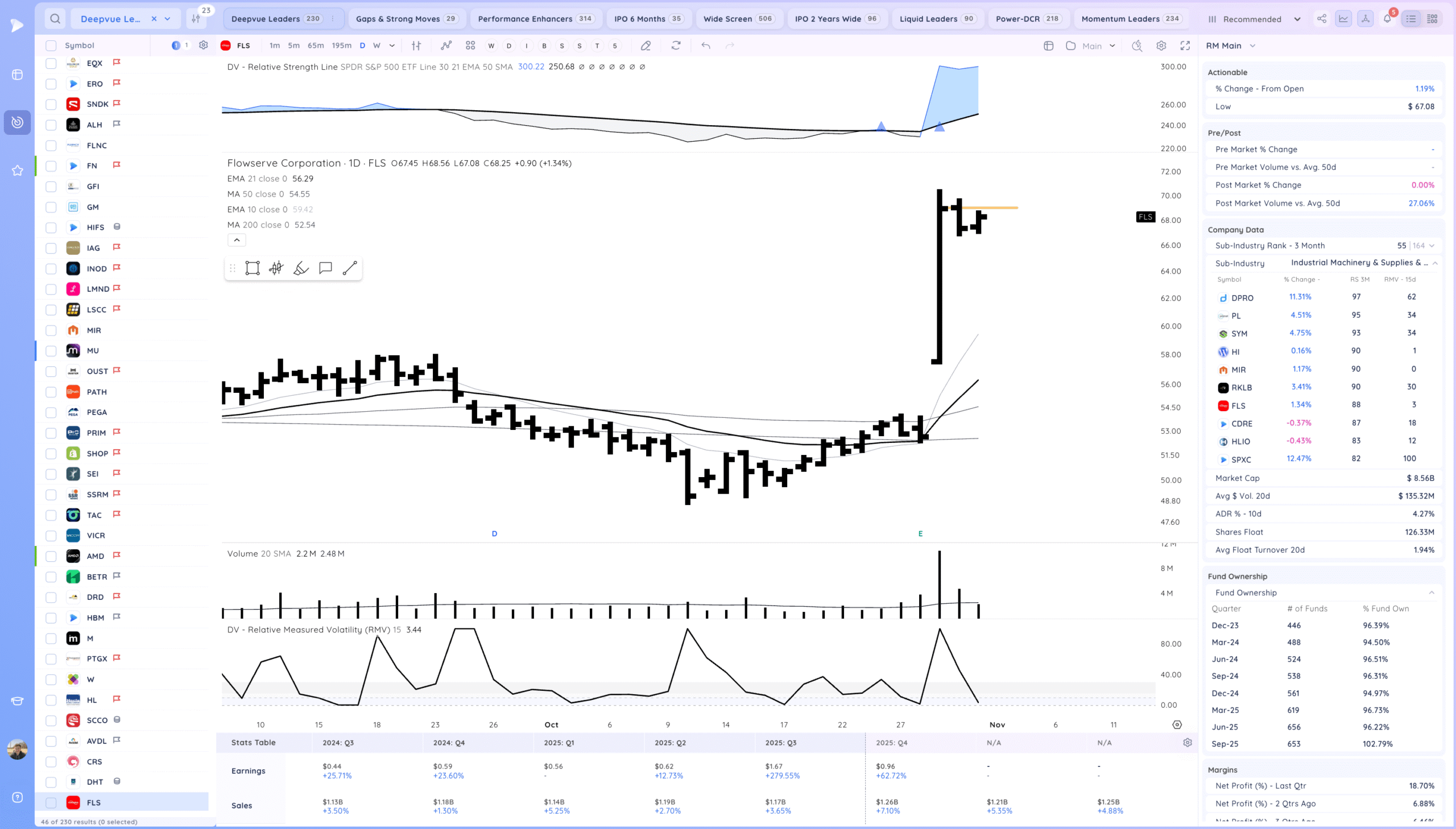

TWLO 19% move on an earnings gap. Not huge volume

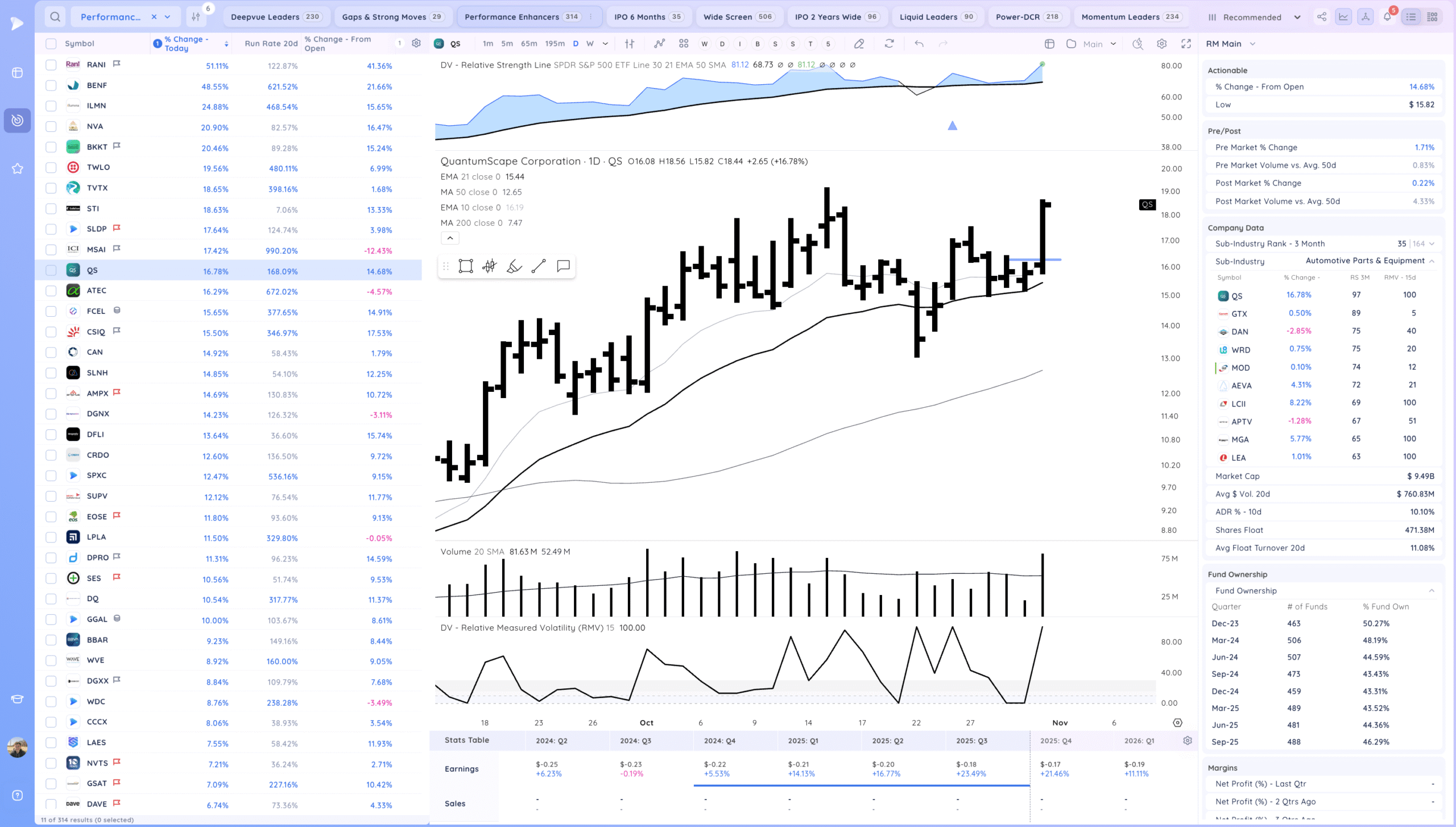

QS electric car theme with a range breakout

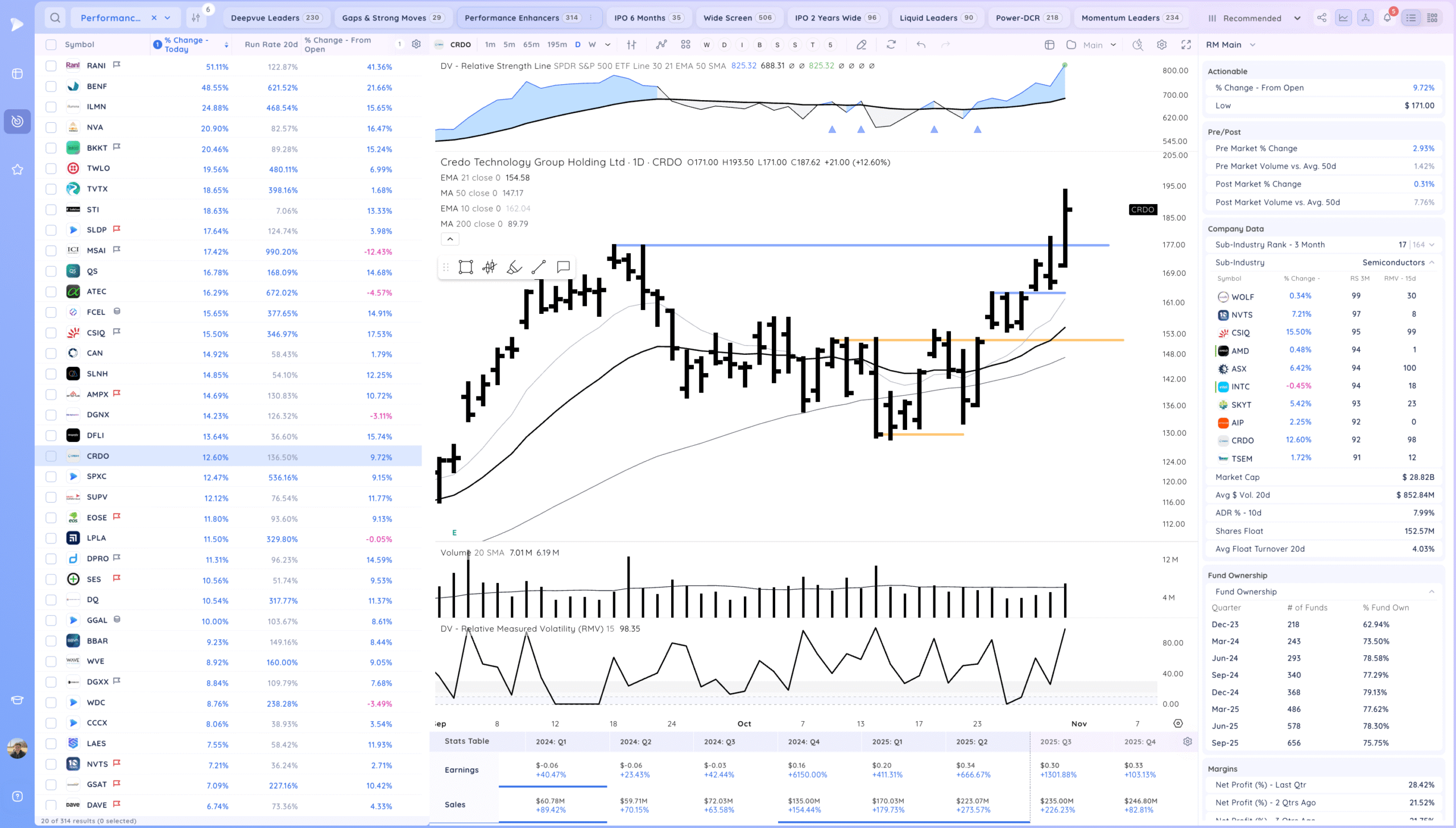

CRDO base breakout

NET Breakout to new all time highs

Setups and Watchlist

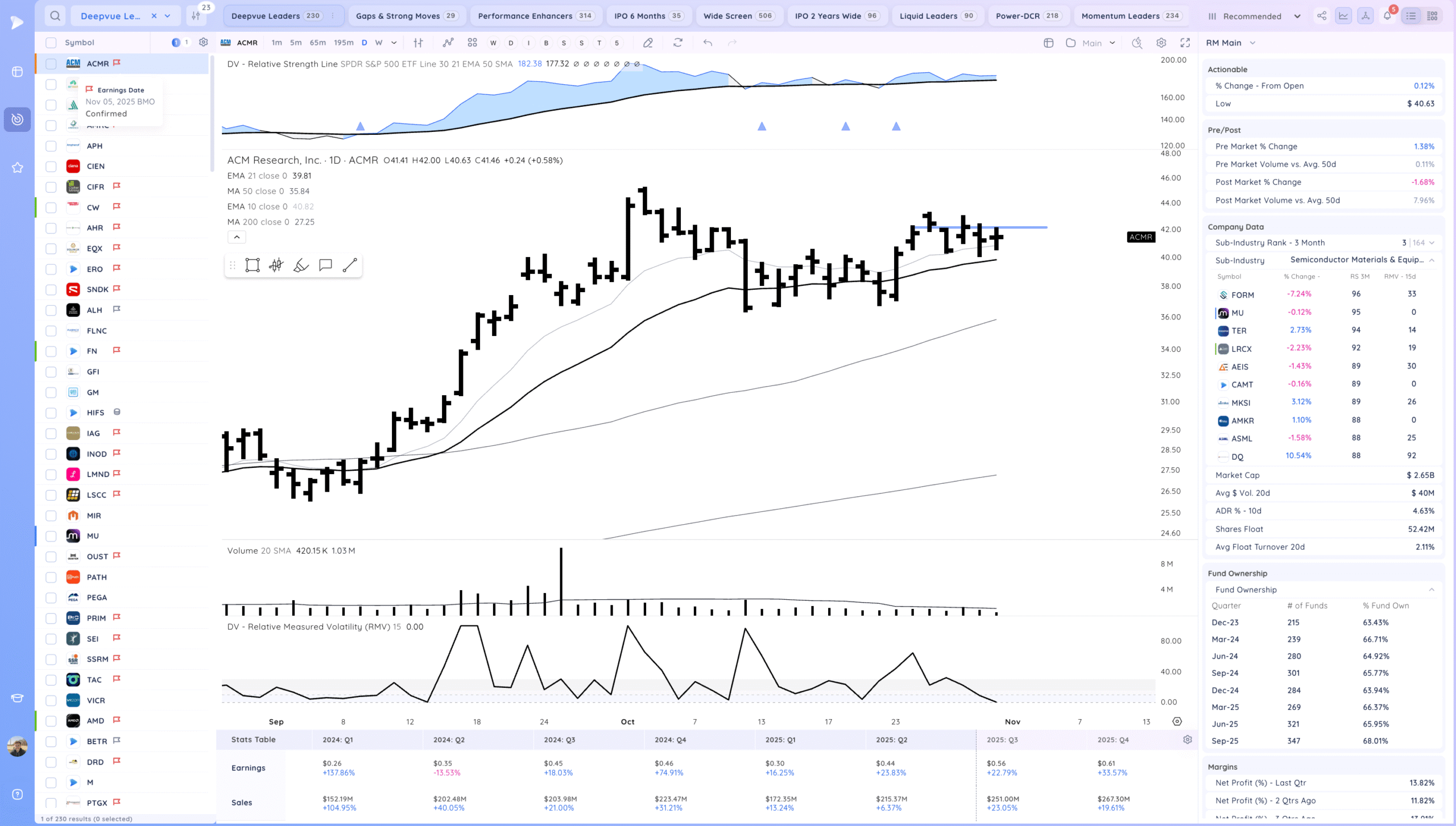

ACMR semi theme watching for a range breakout. Earnings upcoming

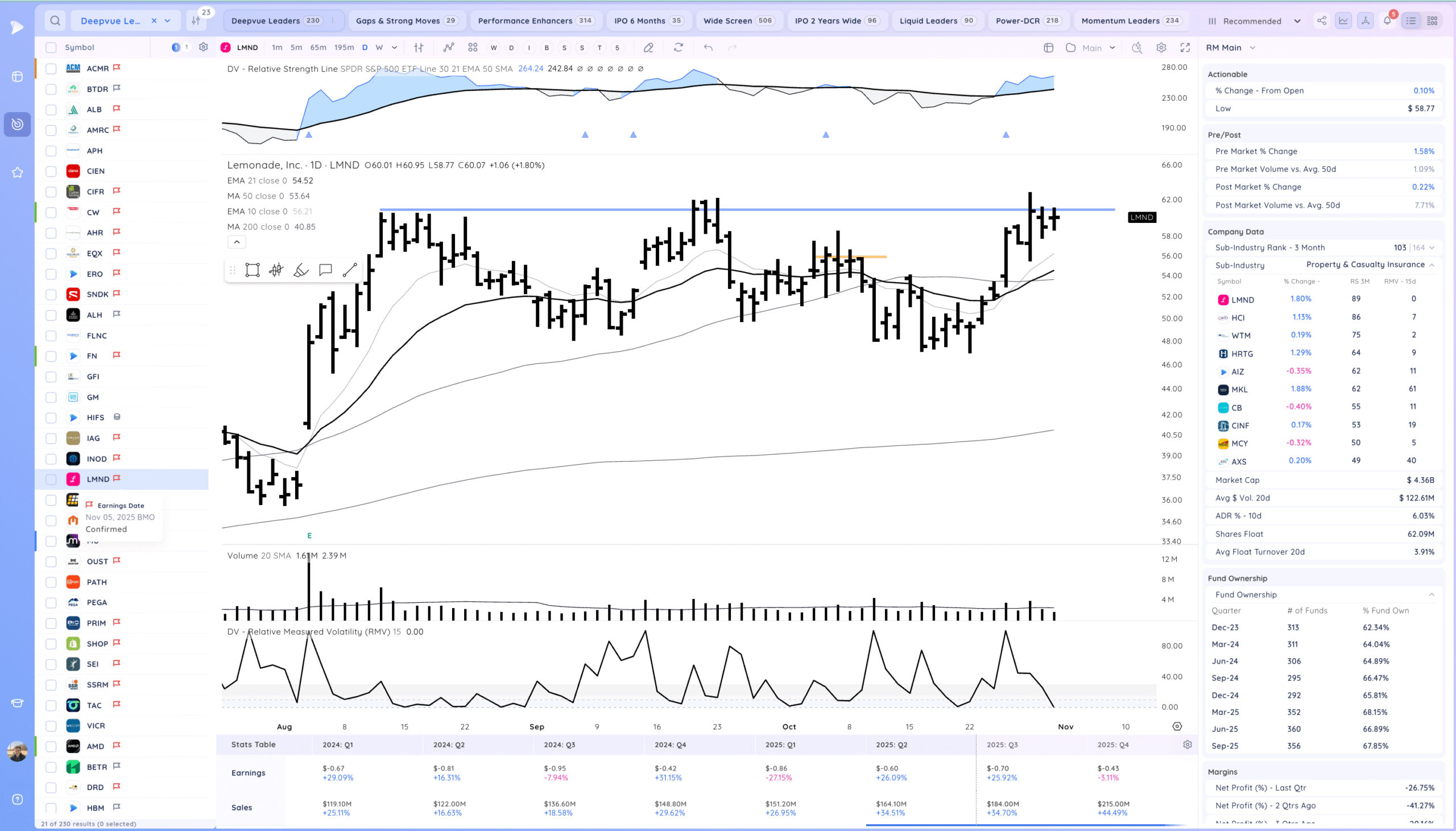

LMND watching for the earnings move

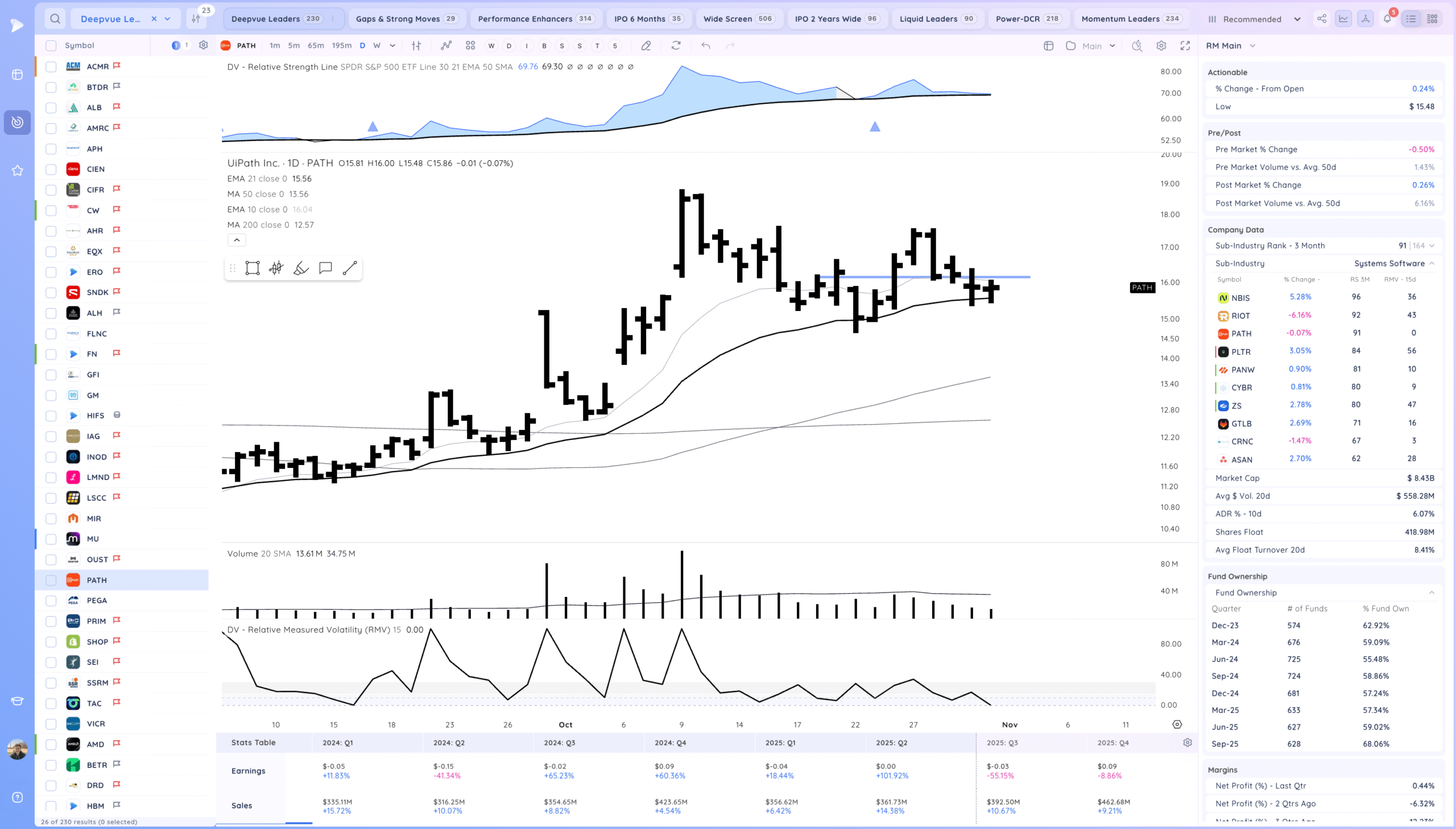

PATH watching for a range breakout off the 21ema

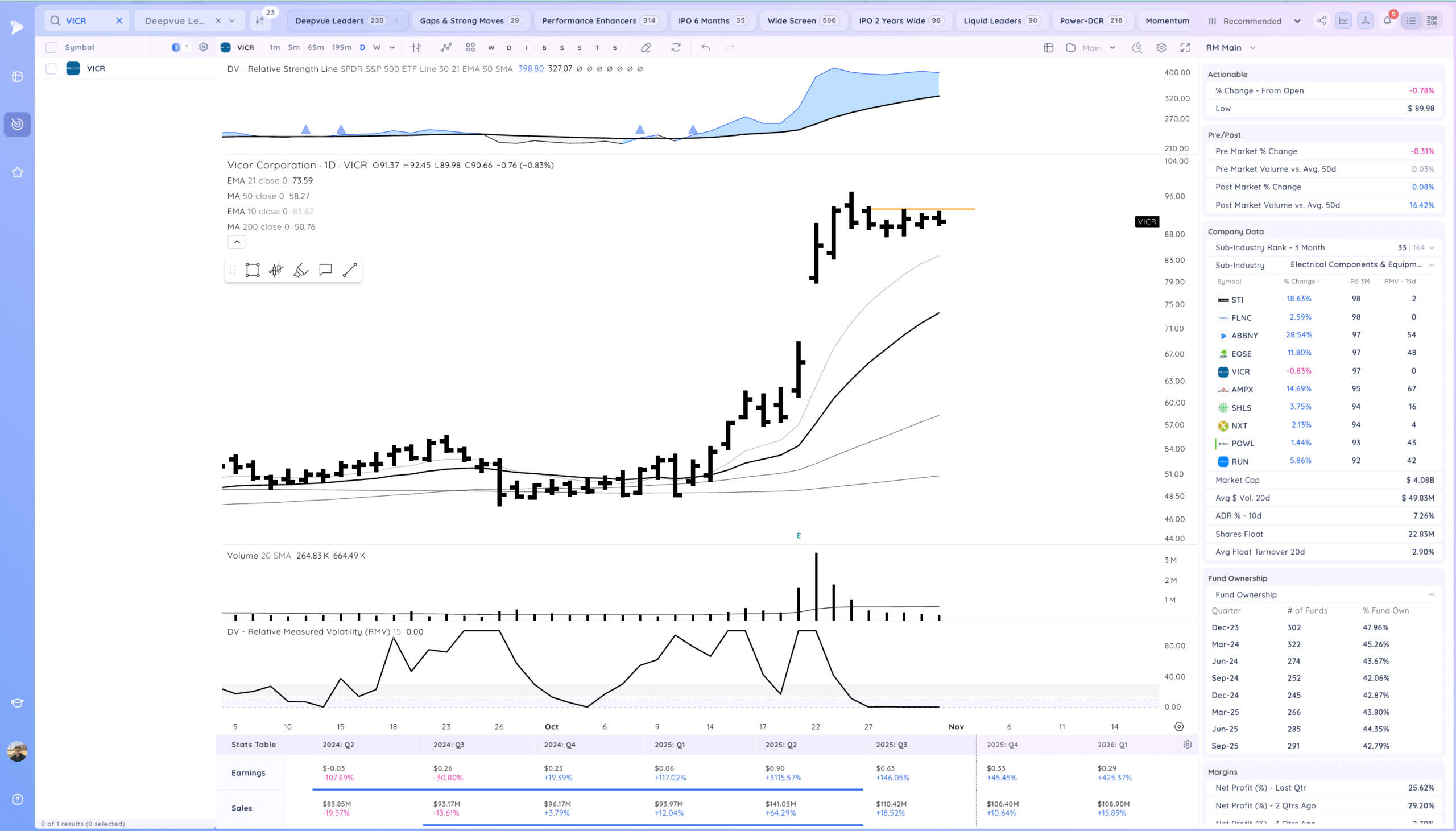

VICR watching for a range breakout. Fast mover

FLS watching for an HVC breakout

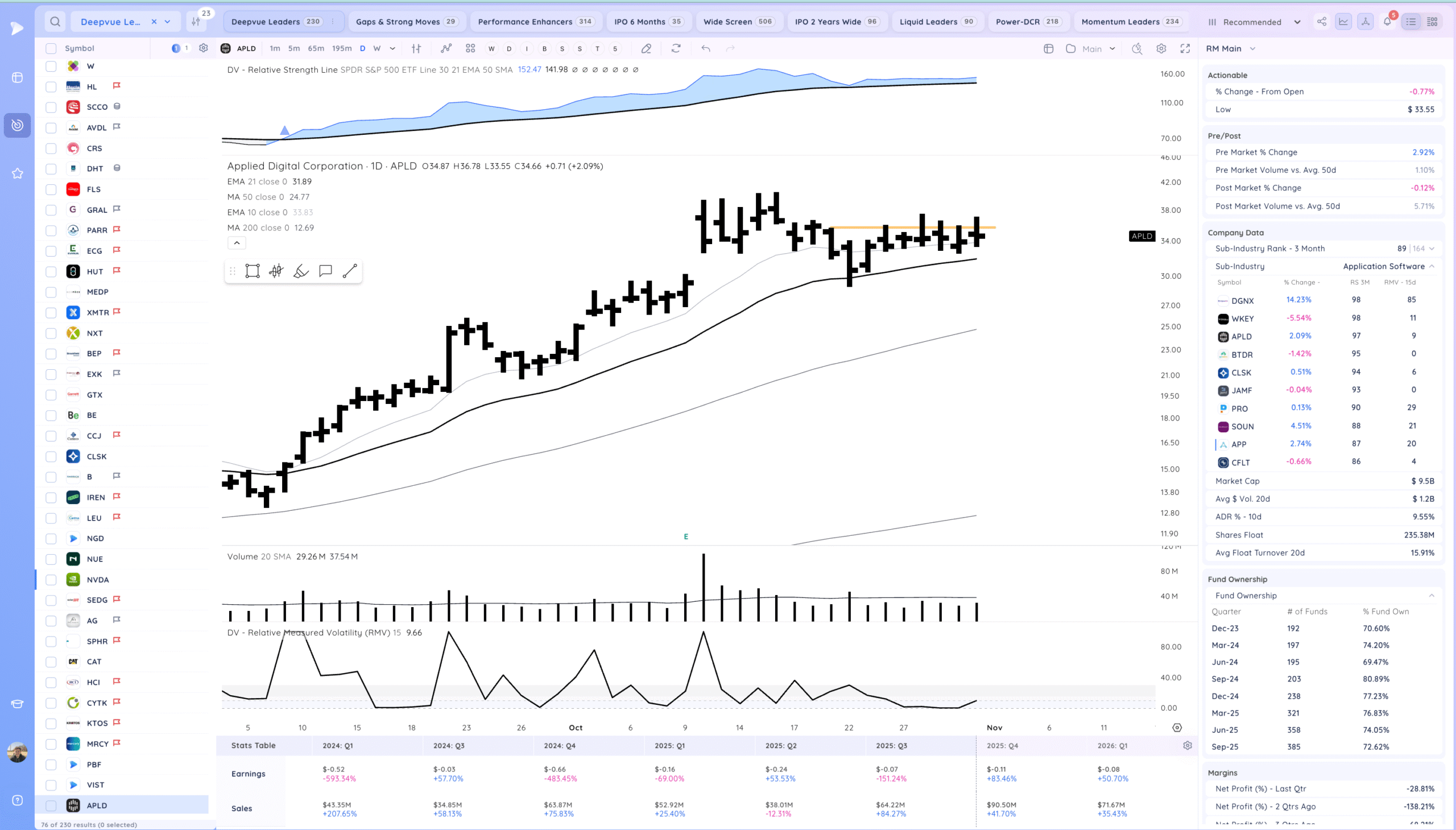

APLD watching for a range breakout. Squat again today

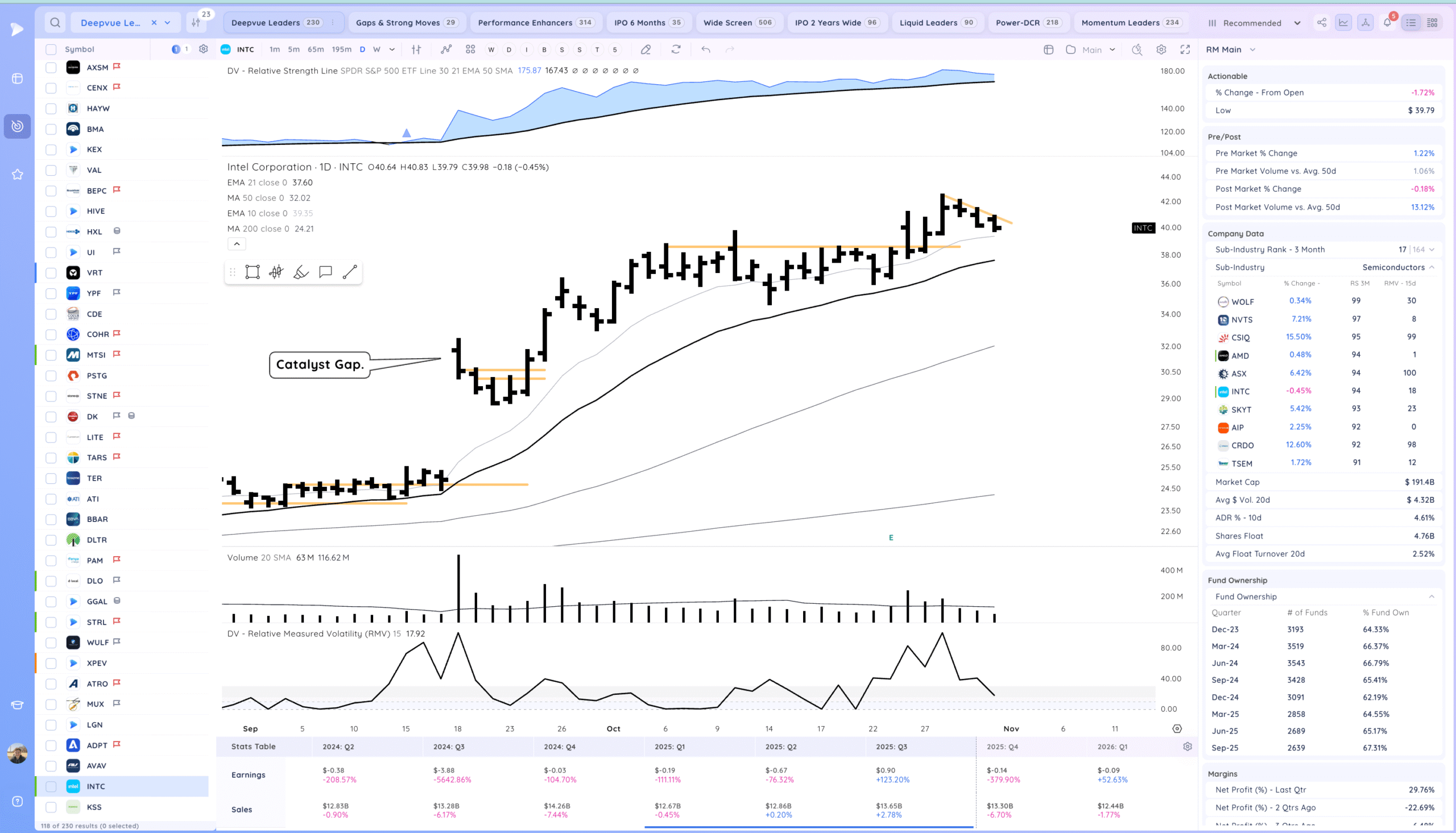

INTC watching for a flag breakout

Recent Gappers to Track

Day 1:

Day 1+: TWLO NET AMZN RDDT SLDP BE FLS YPF GGAL VIST AMD VICR ISRG PEGA INTC CRS PBF GTX LC MEDP QCOM

Today’s Watchlist in List form

Focus List Names

ACMR LMND PATH VICR FLS APLD INTC

Focus:

AMZN FLS APLD CCJ

Themes

AI, AI Energy, rare metals, biotech. Oil and Gas, Crypto names recovering, Construction, DATA Center fabrication.

Universe List

These are names in my wider watchlist that I’m tracking. They could be basing, setting up, or trending. I plan to include this in reports from now on.

AAPL ALAB AMD AMZN APLD APP ARM BABA BE BKKT CCJ CLSK CRDO CRS DELL FIX FLS FSLR GGAL GOOG GOOGL GRAL HOOD HUT INOD INSM INTC LEU LMND MDB MELI META MSFT MU NBIS NET NIO NVDA OPEN PATH PLTR QCOM RGTI RKLB RMBS SHOP SNDK SNOW SOFI SOUN STNG STRL STUB TAC TEM TER TWLO VRT

Additional Thoughts

Choppy end to the week. Gappers so far are not following through in earnest.

Anything can happen, Day by Day – Managing risk along the way