Google Gaps Up on Earnings, META, MSFT Down.

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 29, 2025

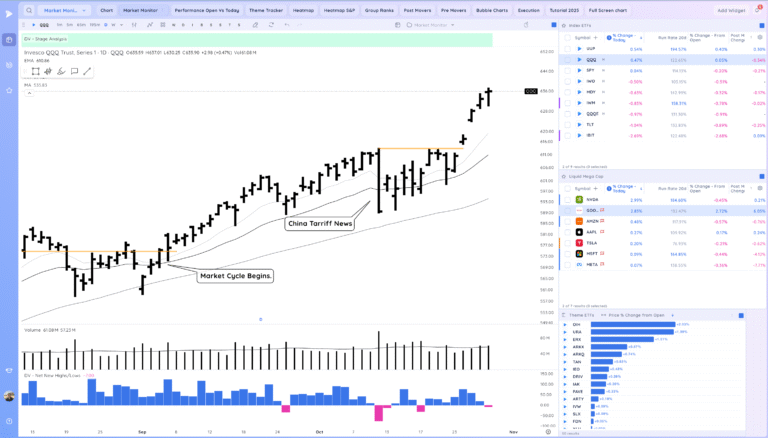

Market Action

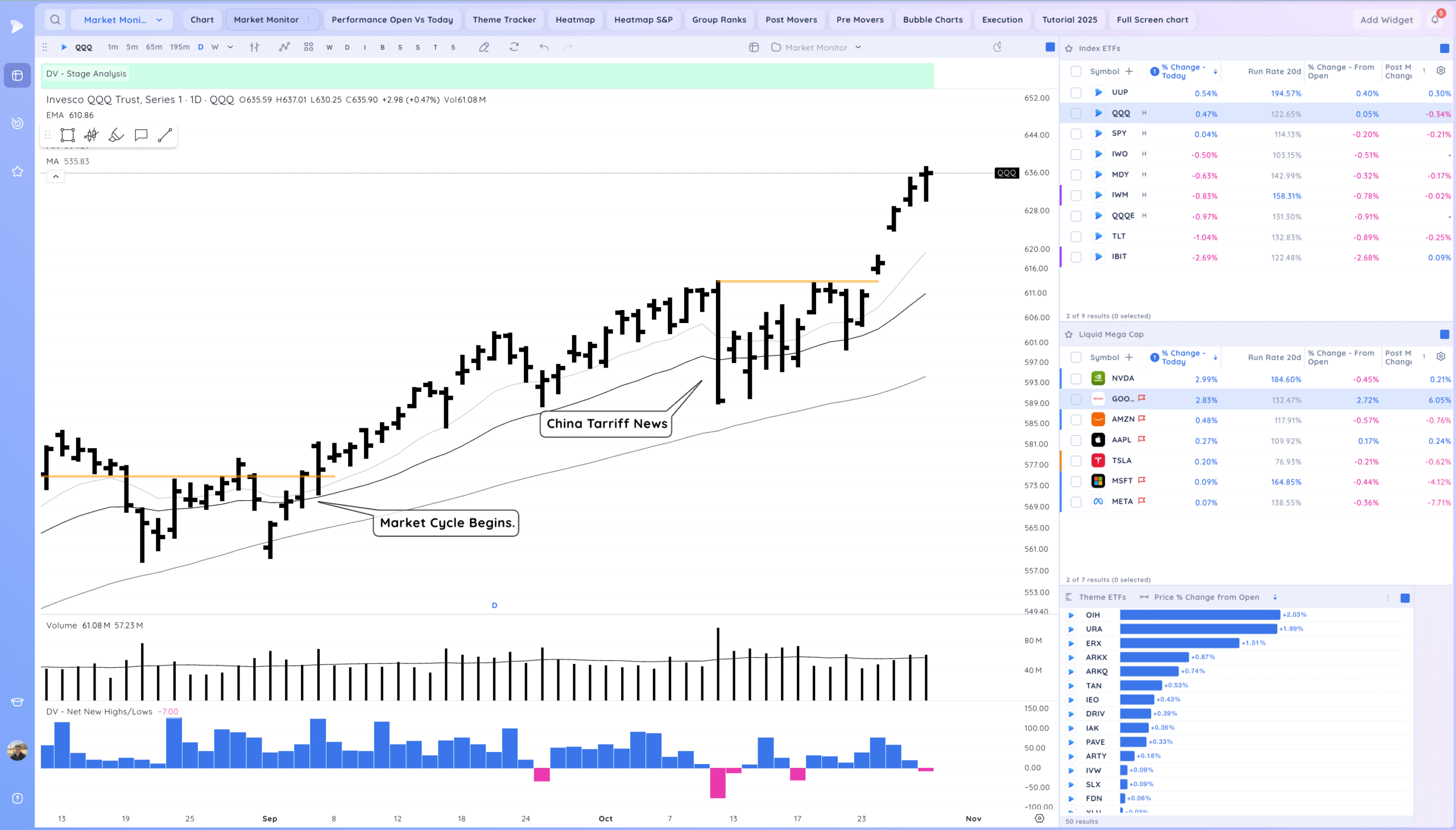

QQQ – Volatile Day with FOCM but overall continued higher. We are still short term stretched, trending above all the MAs.

FOMC 25 bp cut. Quantitative Tightening ends Dec 1, Powell said another cut is “not a foregone conclusion.”

Bulls want to see us either consolidate calmly or continue trending

Bears want to see a sharp reversal down with big earnings names selling off.

Daily Chart of the QQQ.

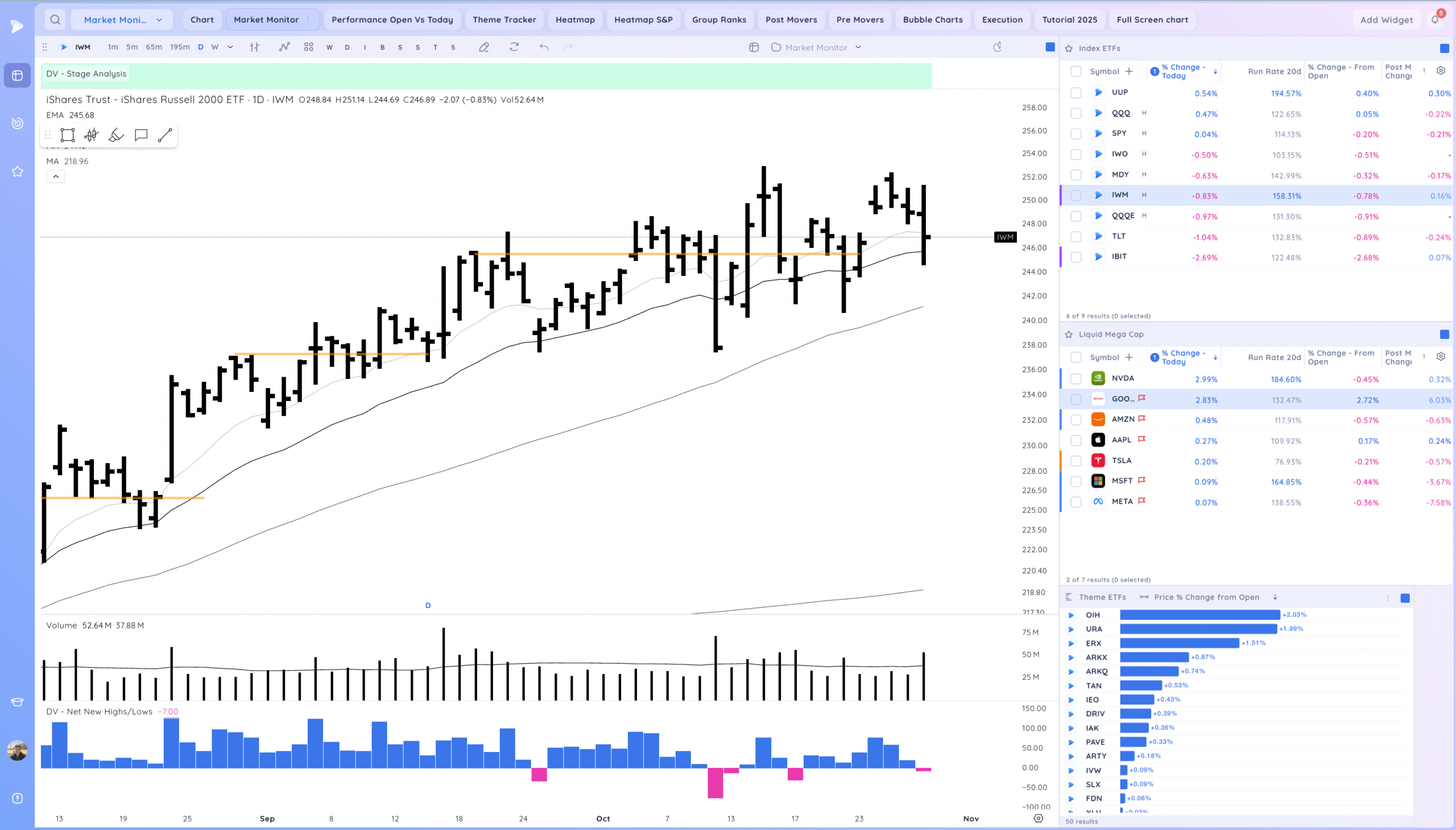

IWM – Still much weaker than the QQQ. test of the 21ema and former pivot.

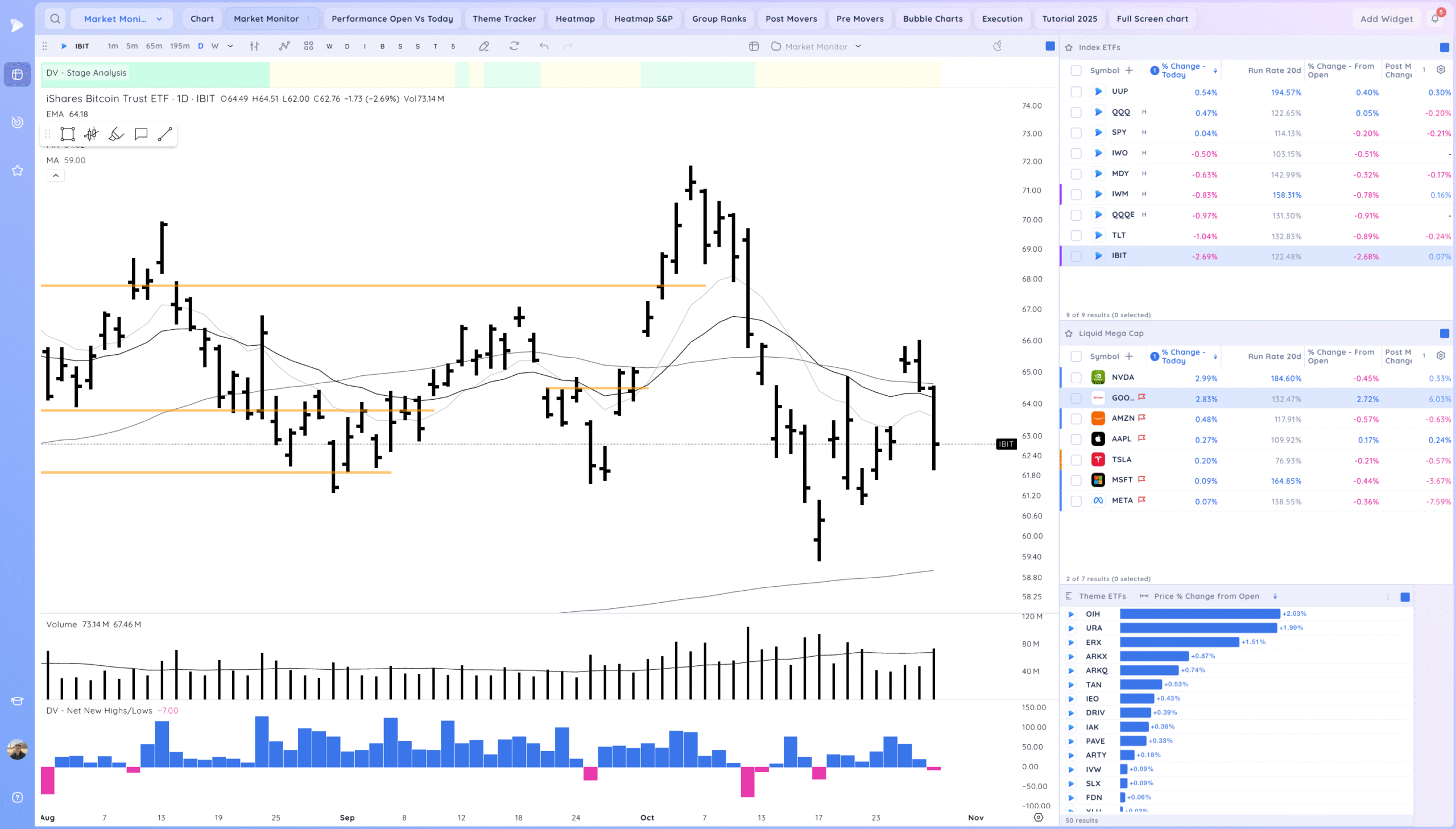

IBIT – Downside reversal back into the moving averages.

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

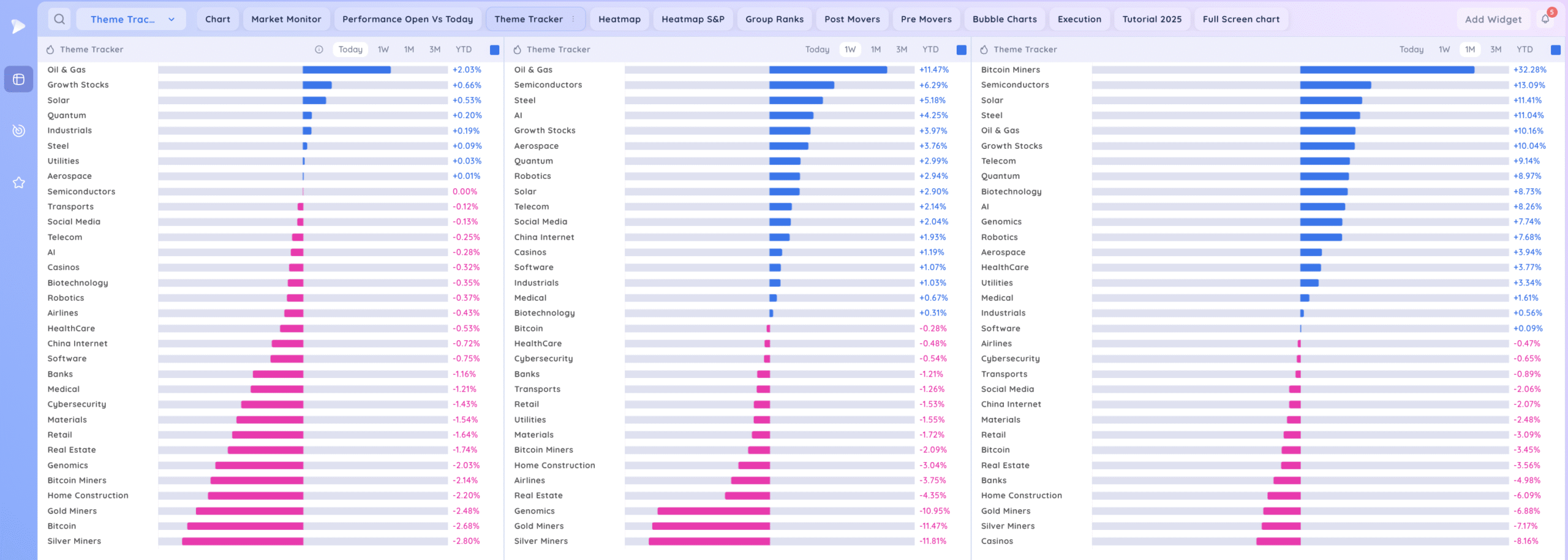

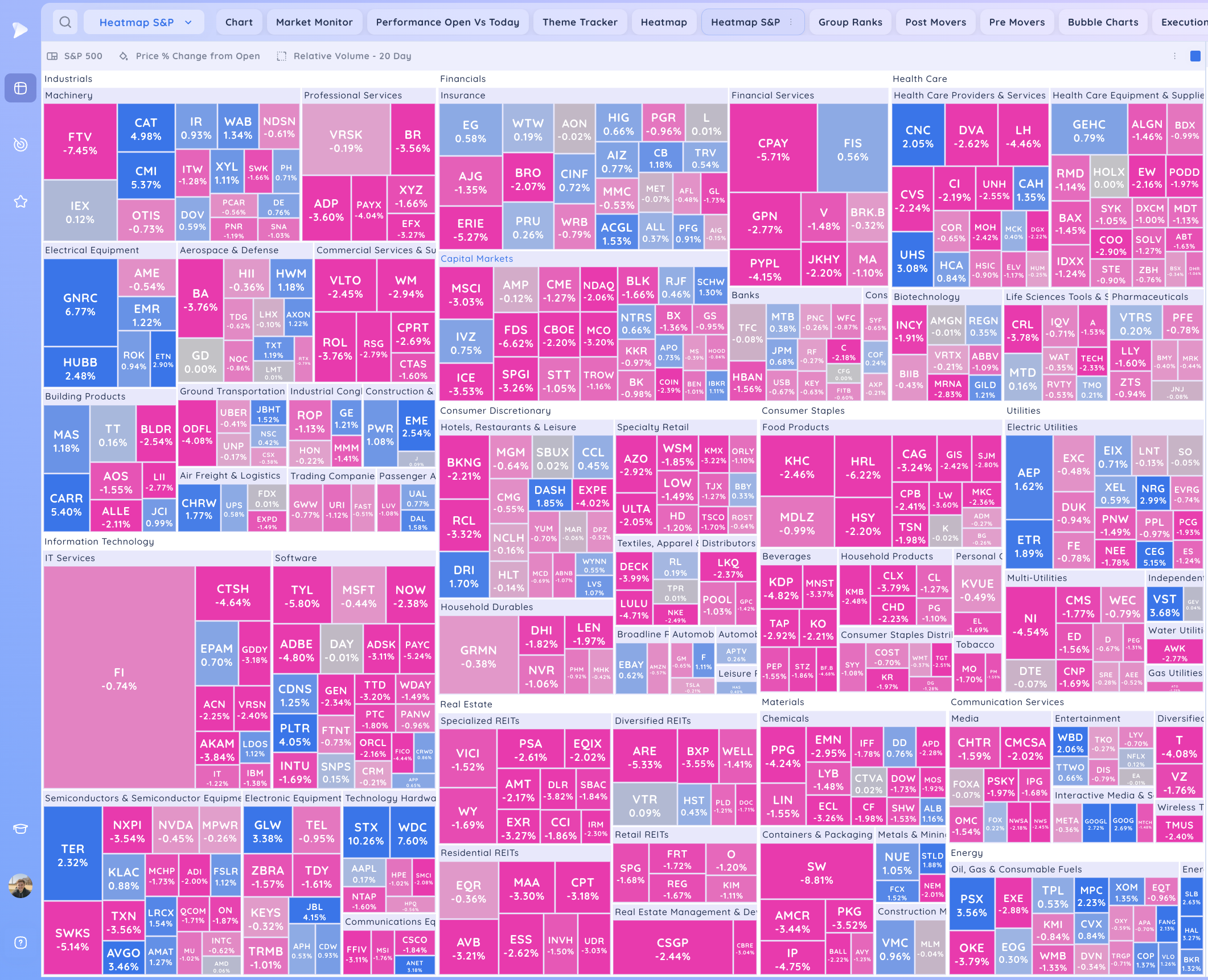

Groups/Sectors

Deepvue Theme Tracker.

Deepvue Leaders.

S&P 500.

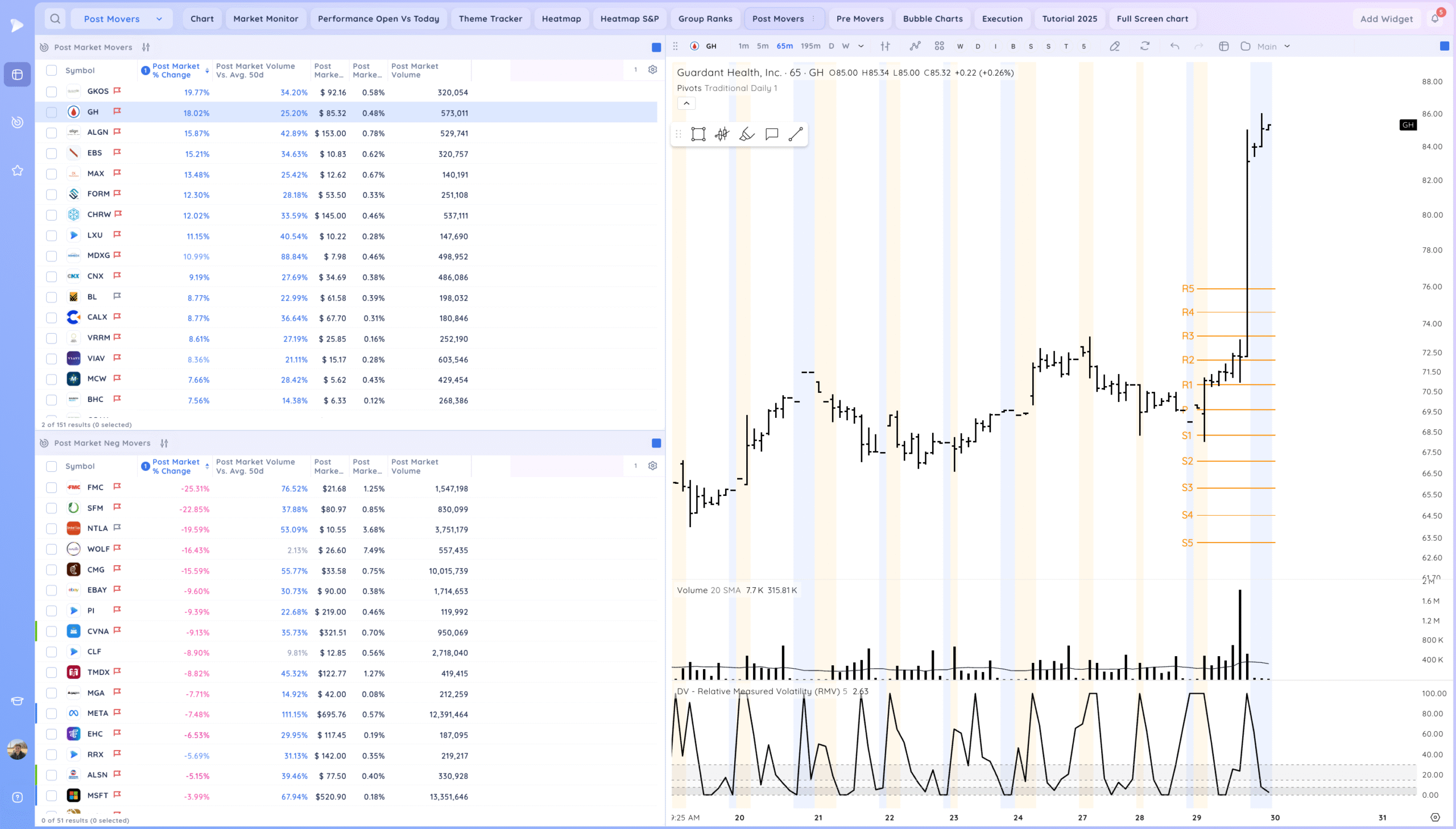

Post Market Movers.

Leadership Stocks & Analysis

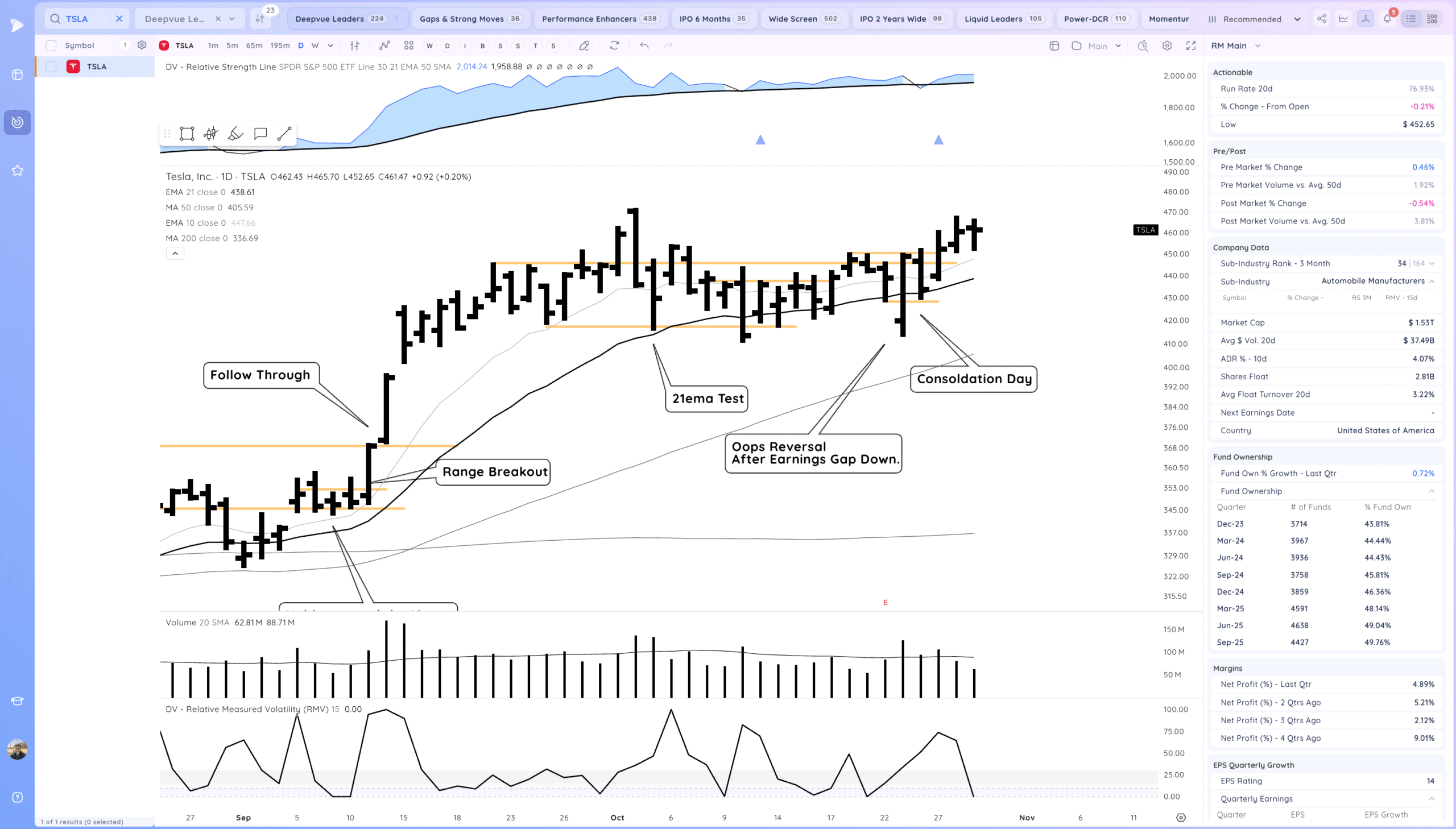

TSLA – Tight, expecting expansion tomorrow.

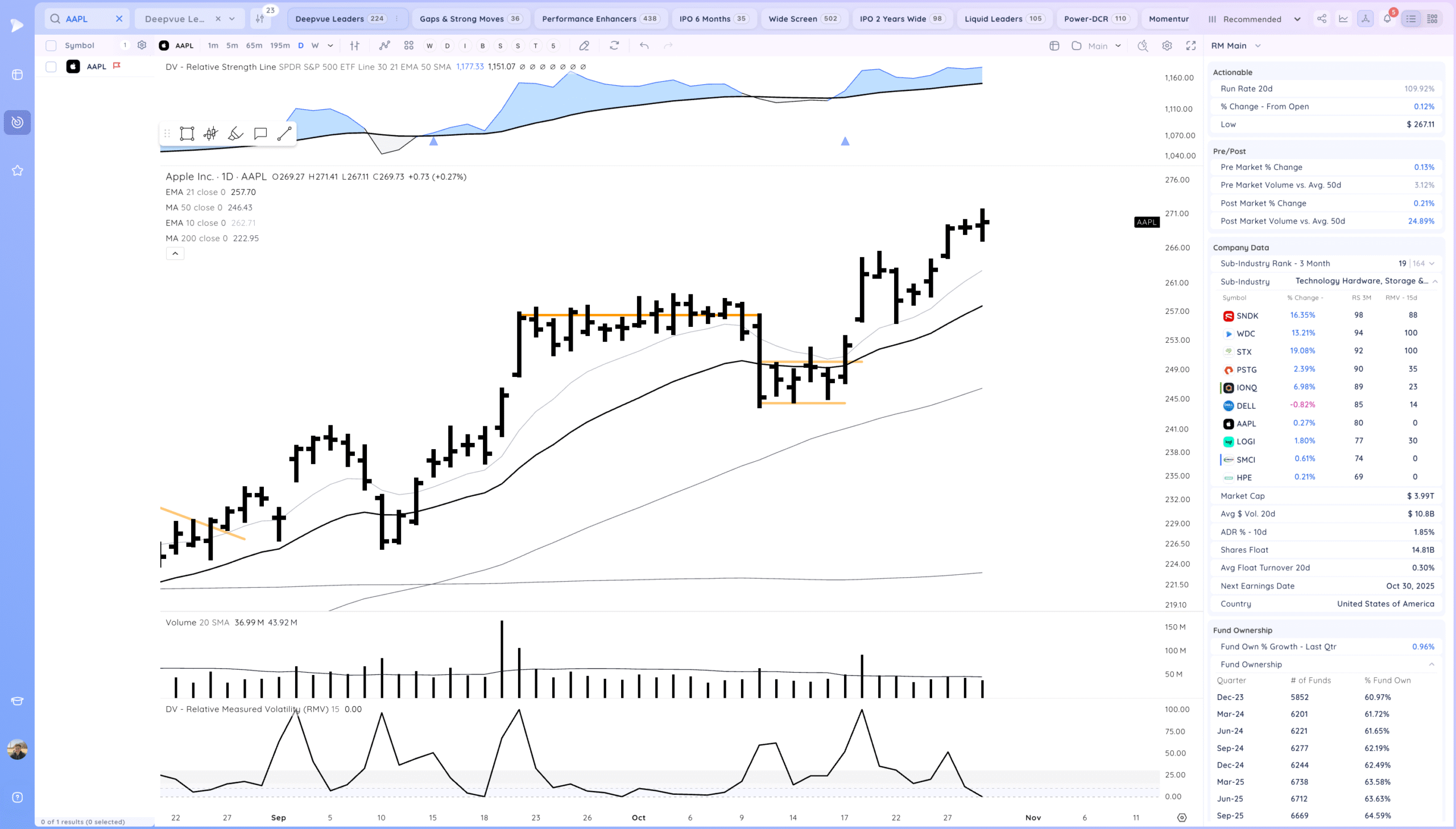

AAPL Trending above the moving averages

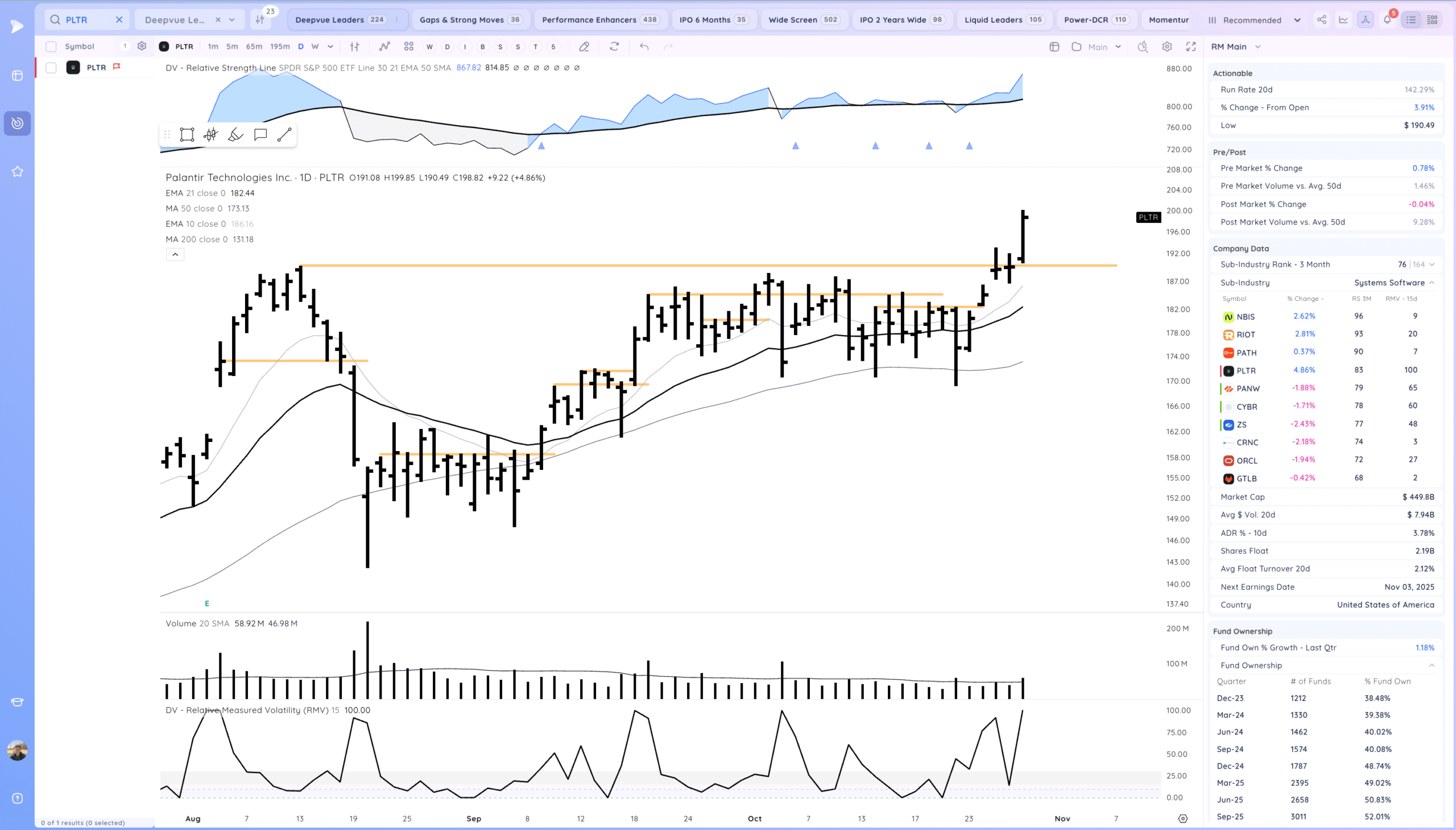

PLTR’s day to shine, expansion from the 2 tight days at the pivot

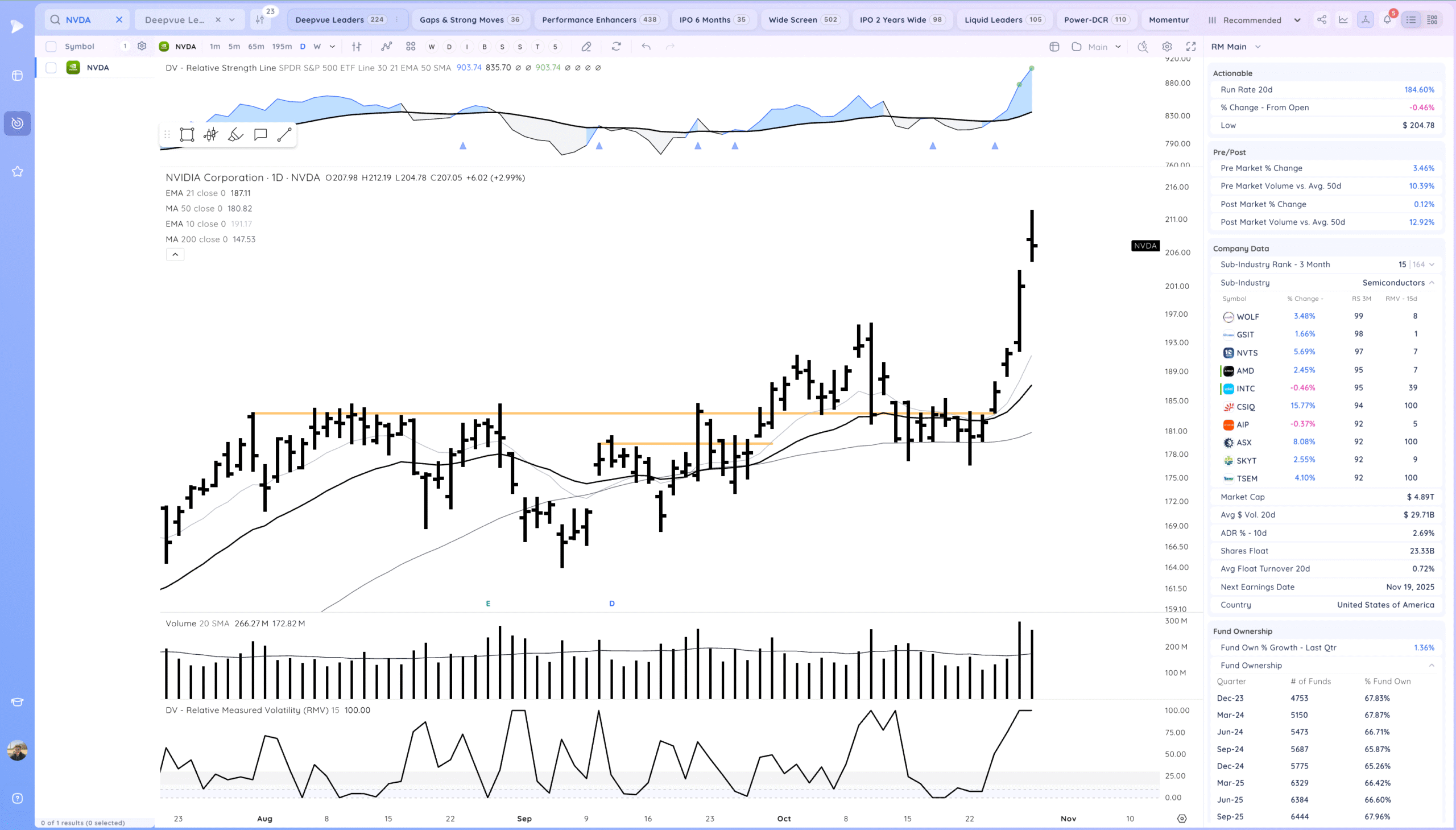

NVDA Continued expansion up, indecisive daily action. Getting stretched short term but a strong breakout move into highs.

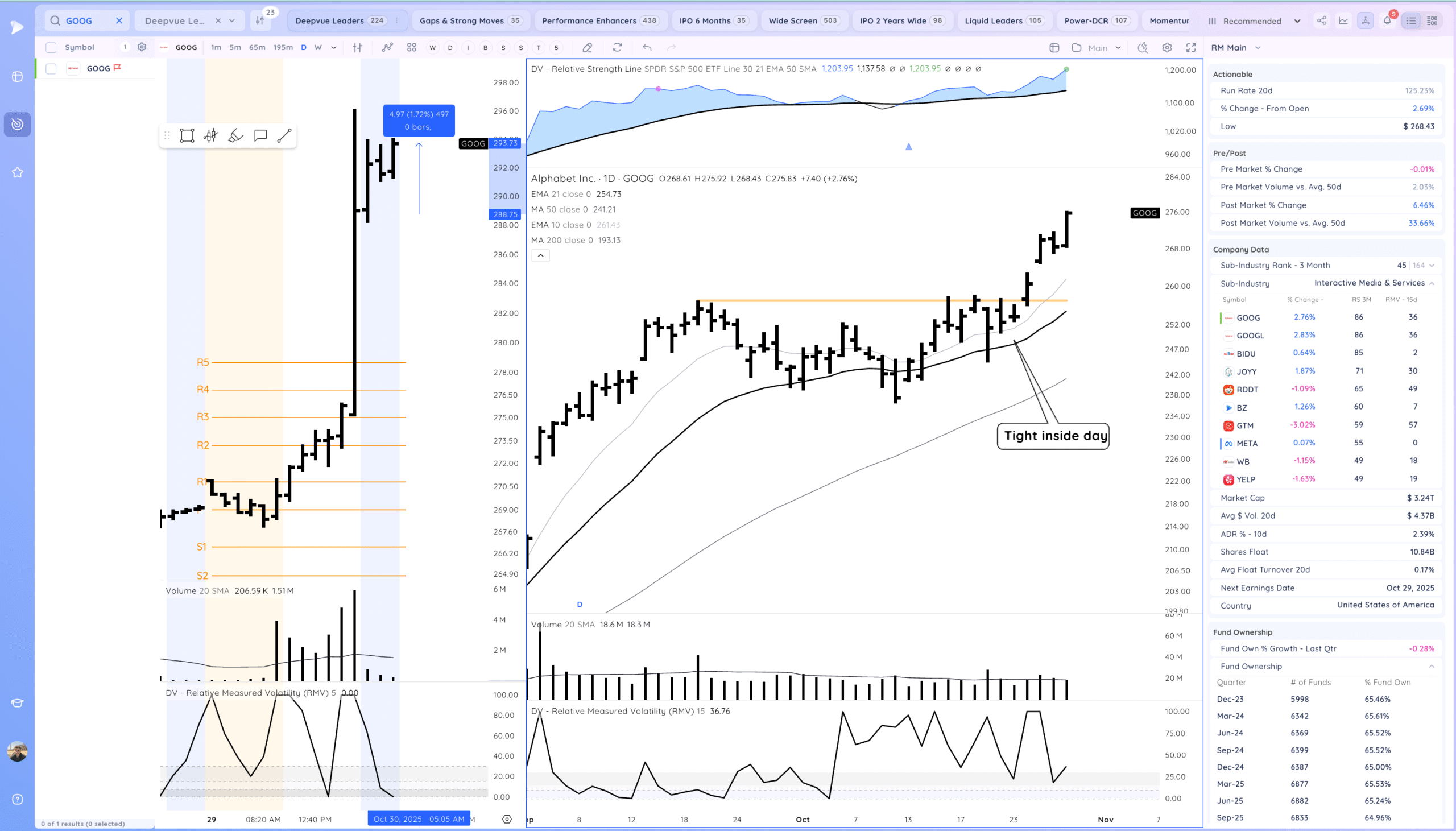

GOOG follow through higher. And slightly higher after hours.

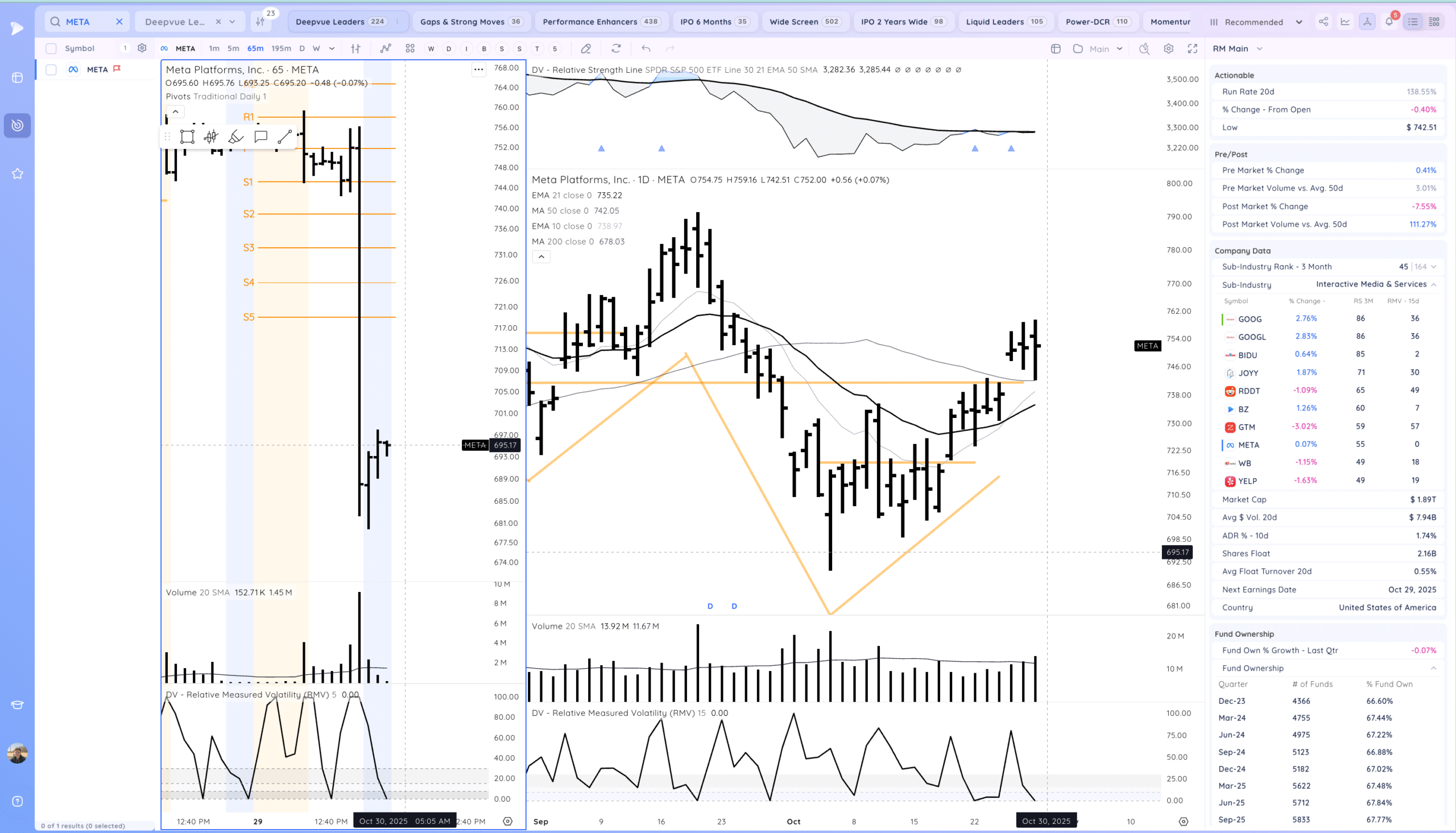

META Down 7.5% on earnings.

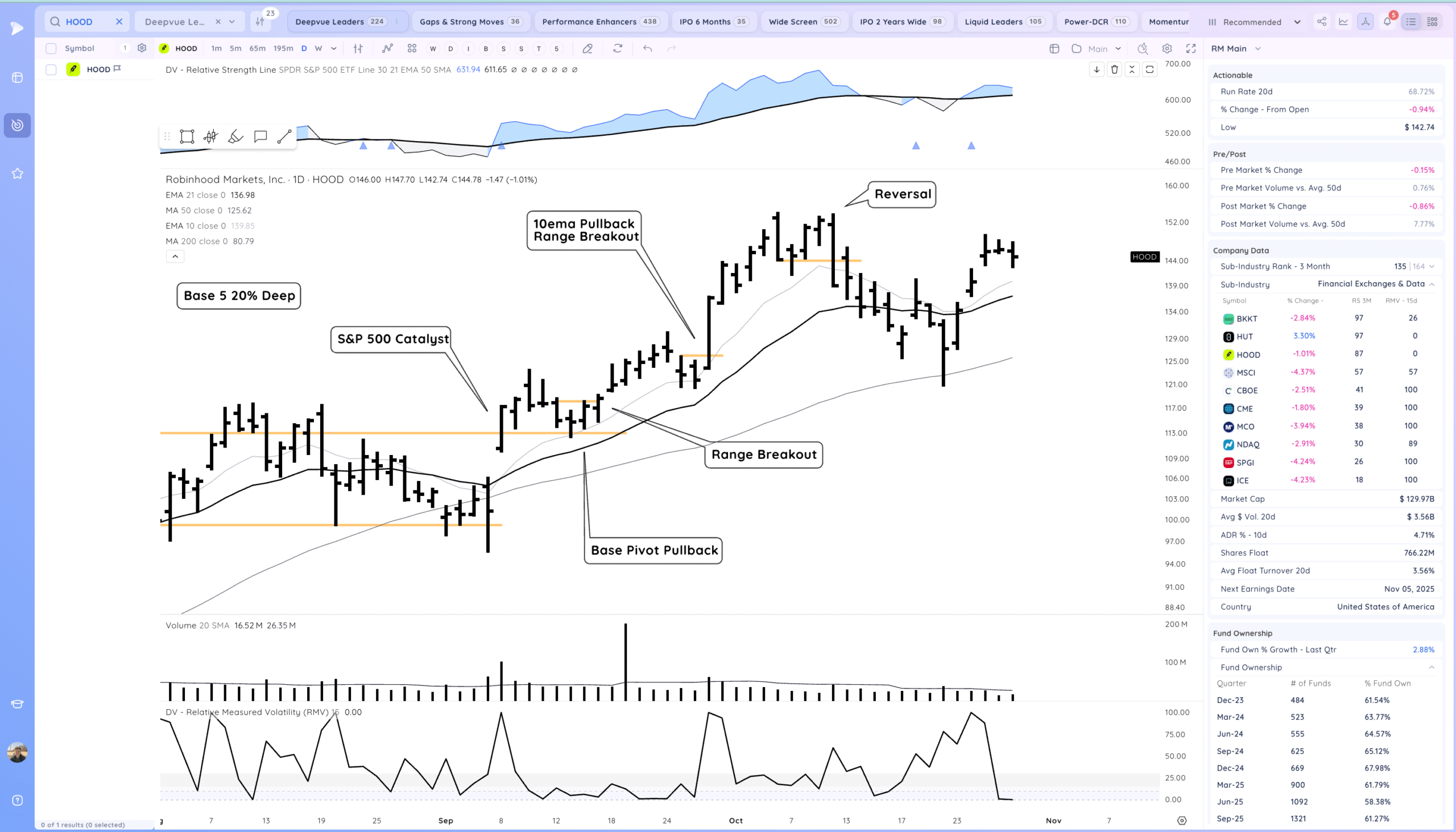

HOOD Tightening here, expecting expansion. I prefer tight ranges near the 21ema. This base is a bit stubby currently.

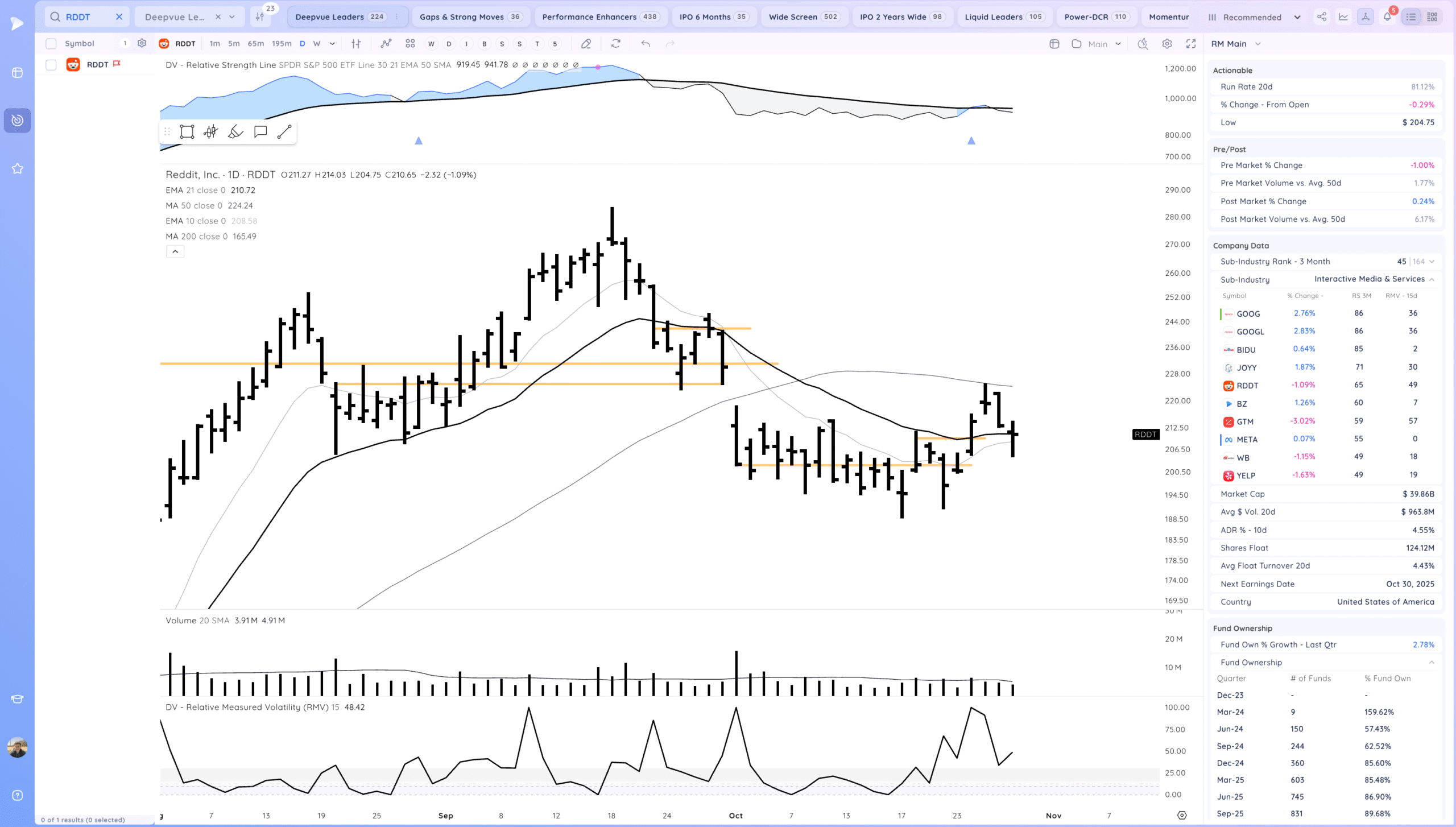

RDDT Earnings tomorrow. Near base lows

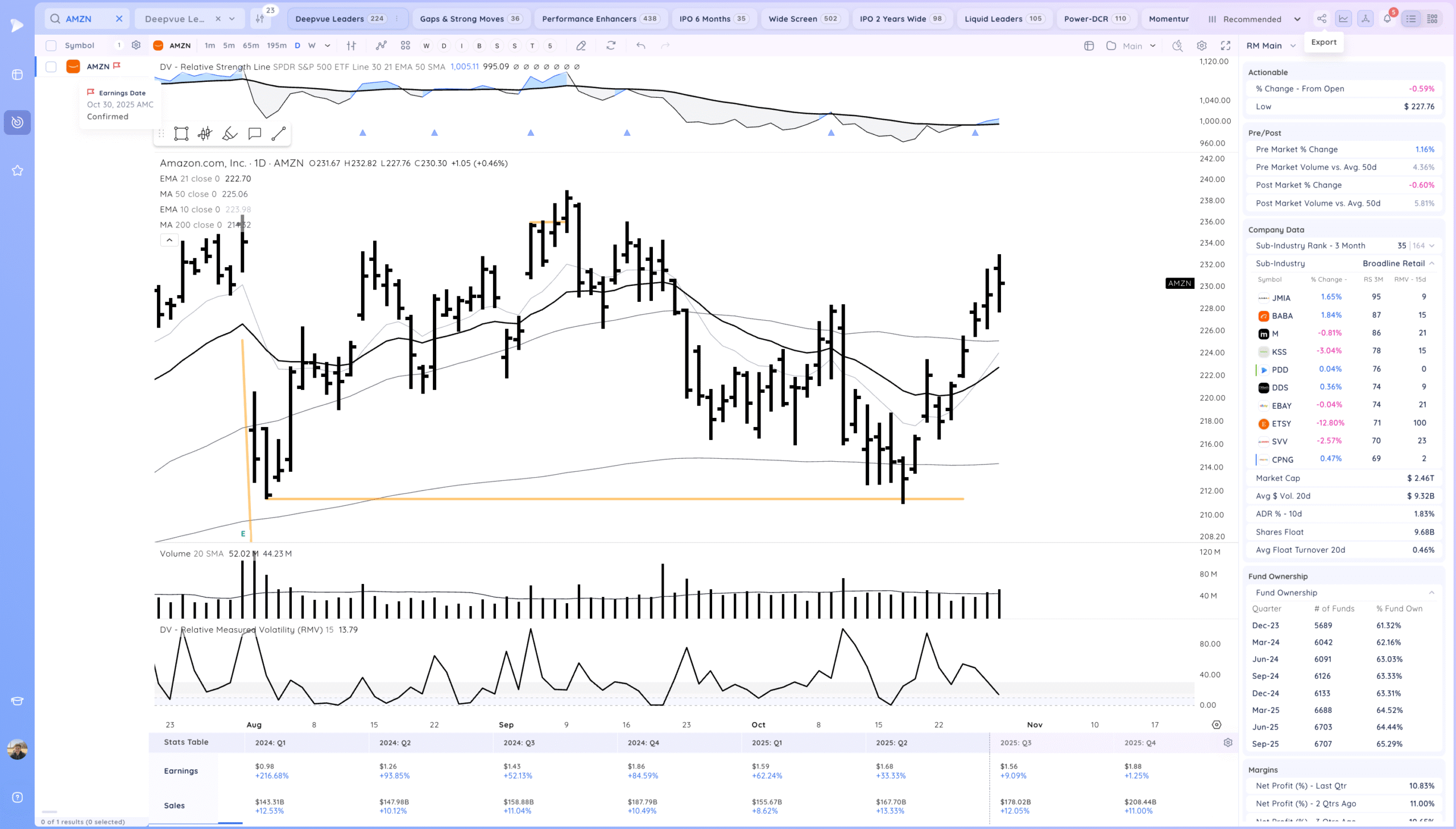

AMZN Holding above the 50sma, Earnings tomorrow

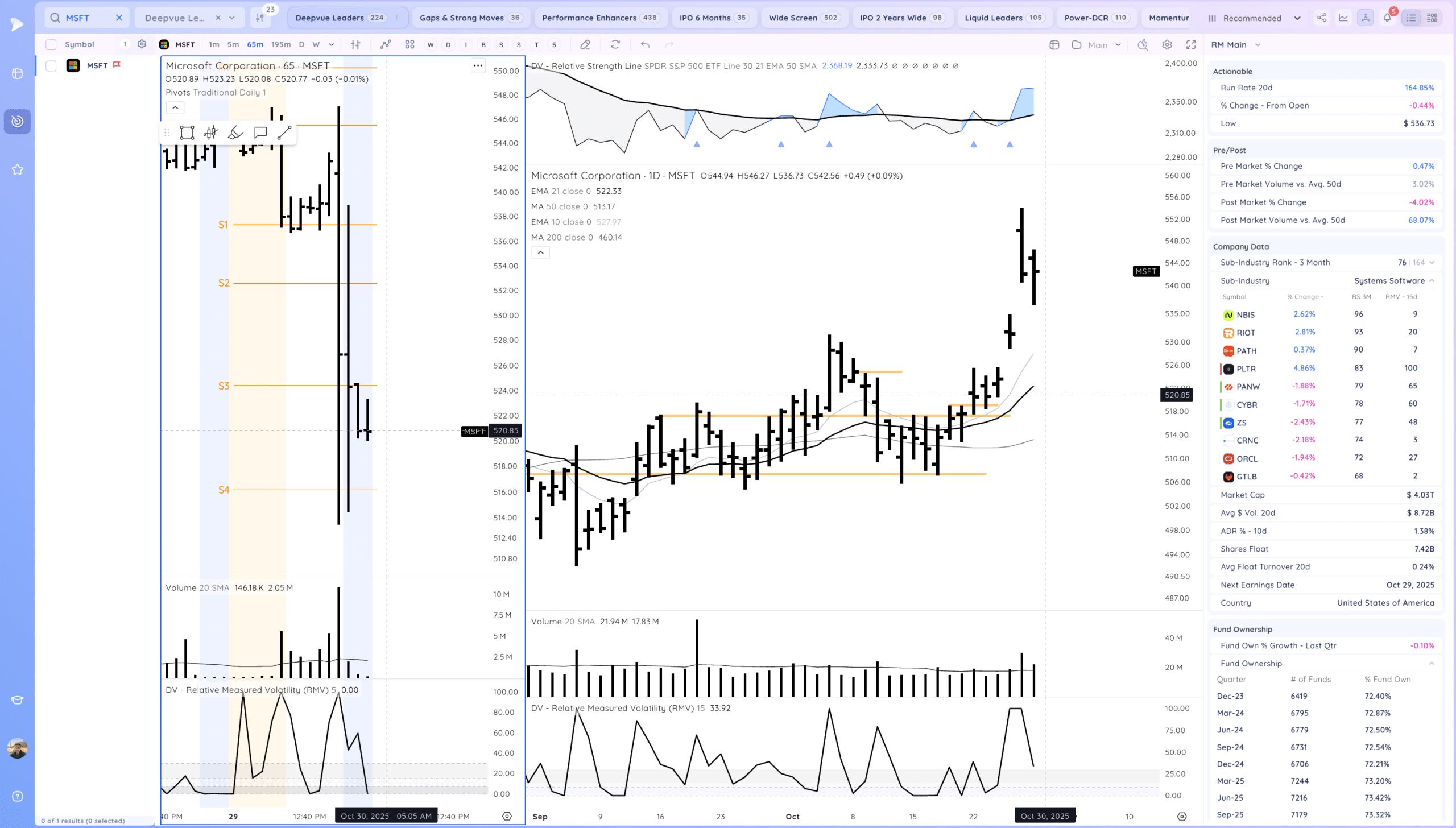

MSFT Down 4% on earnings

Key Moves

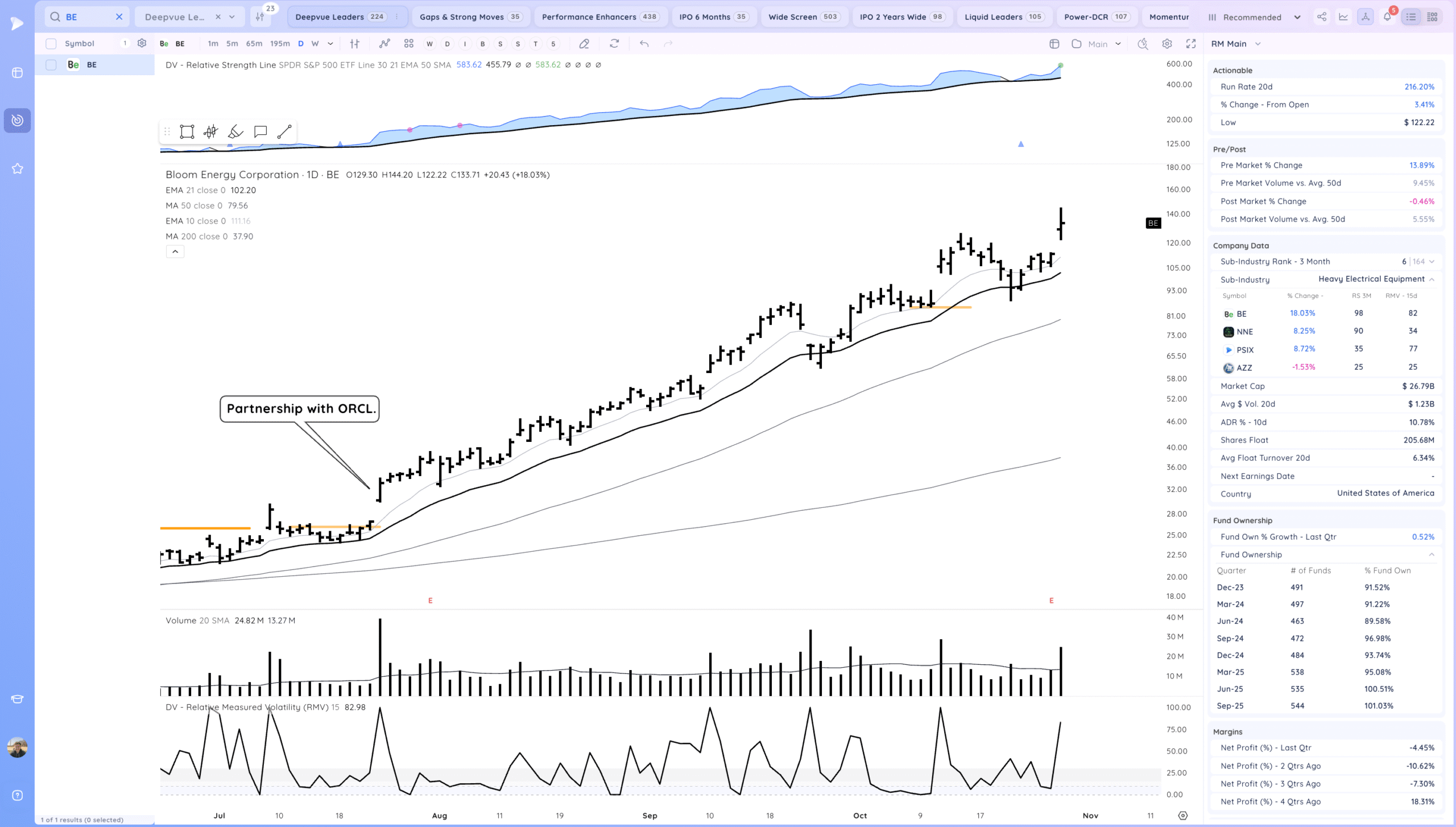

BE strong earnings gap, continues to trend

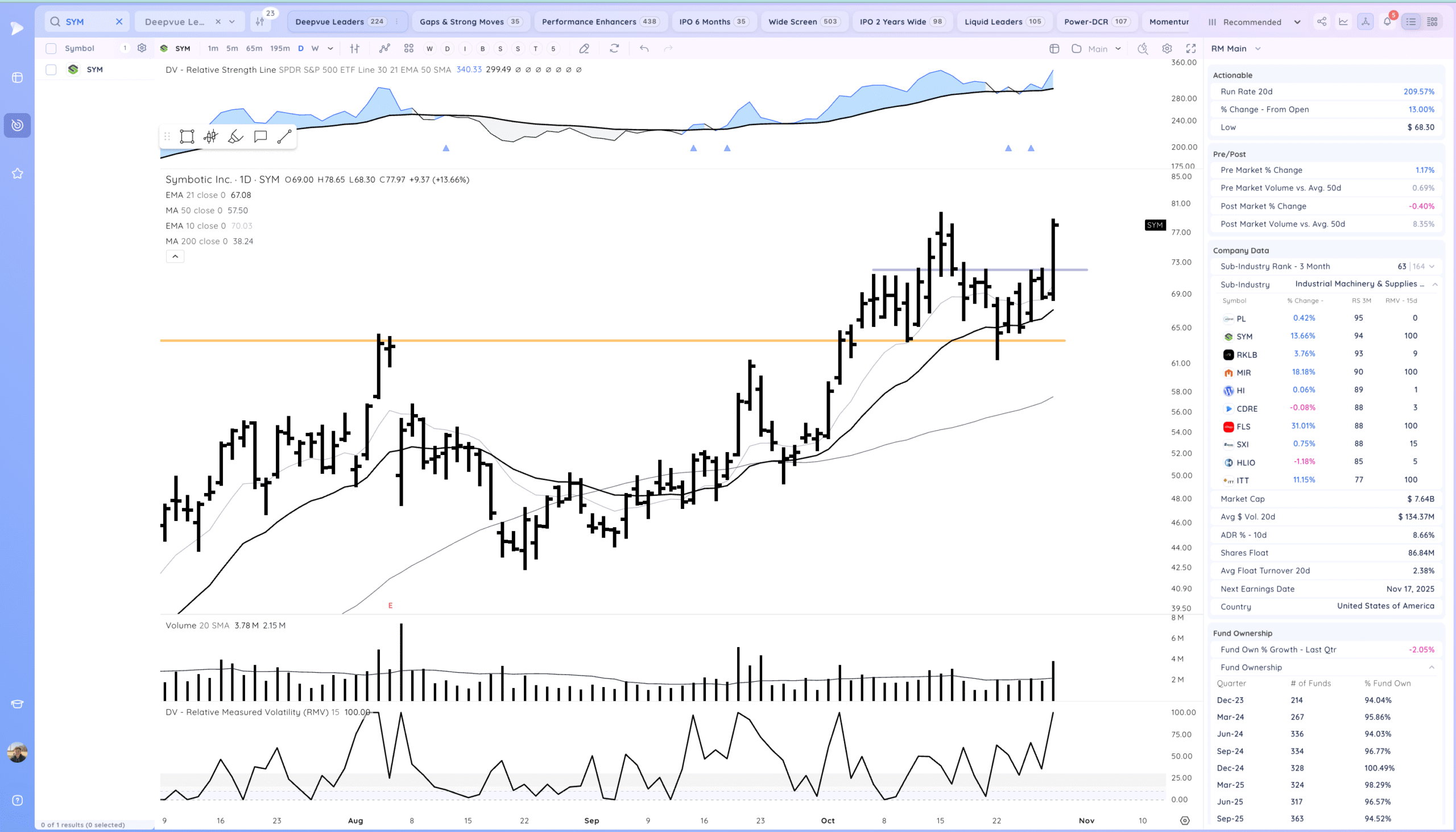

SYM range breakout

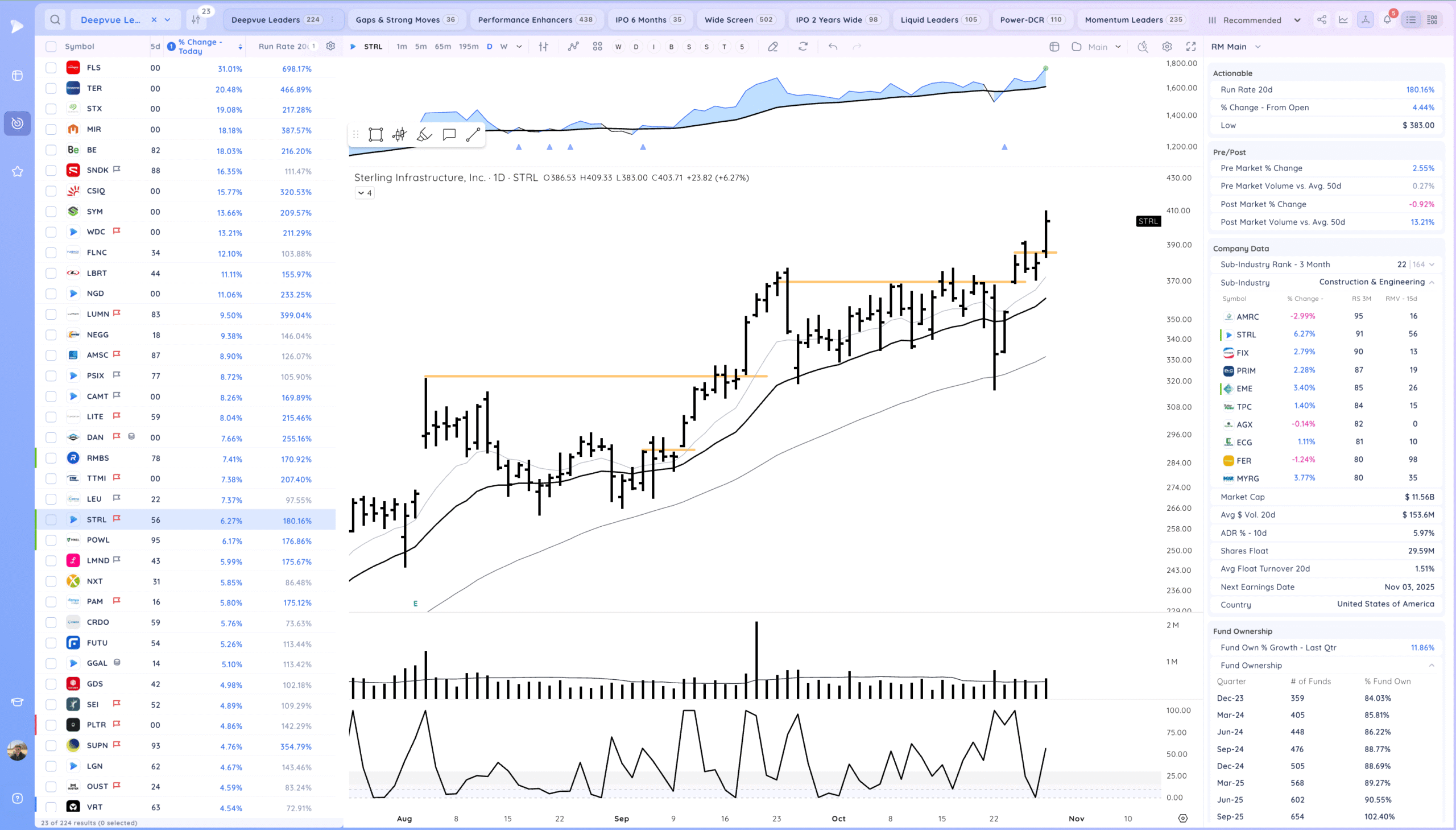

STRL reconfirmation

Setups and Watchlist

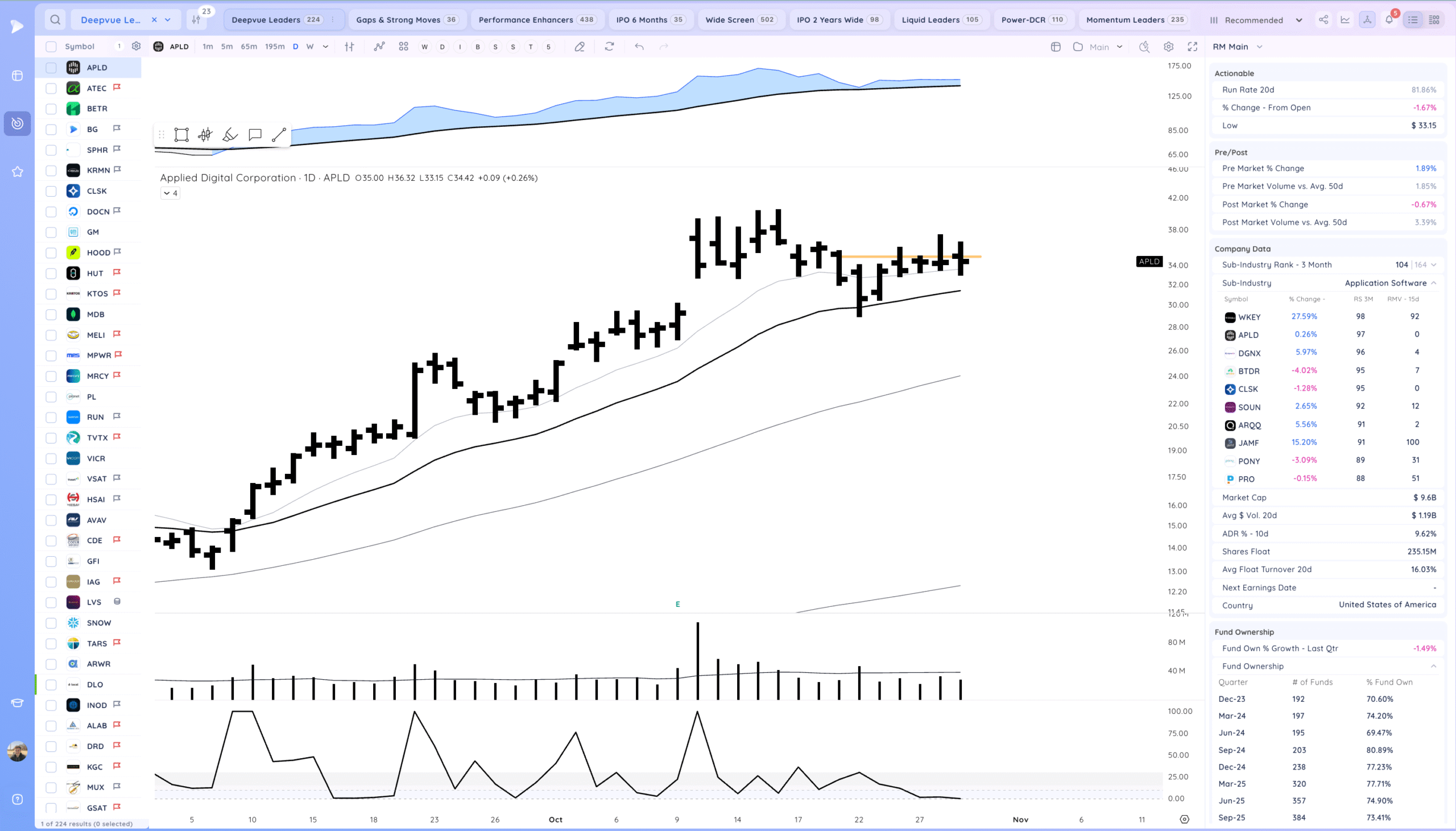

APLD watching for a range breakout

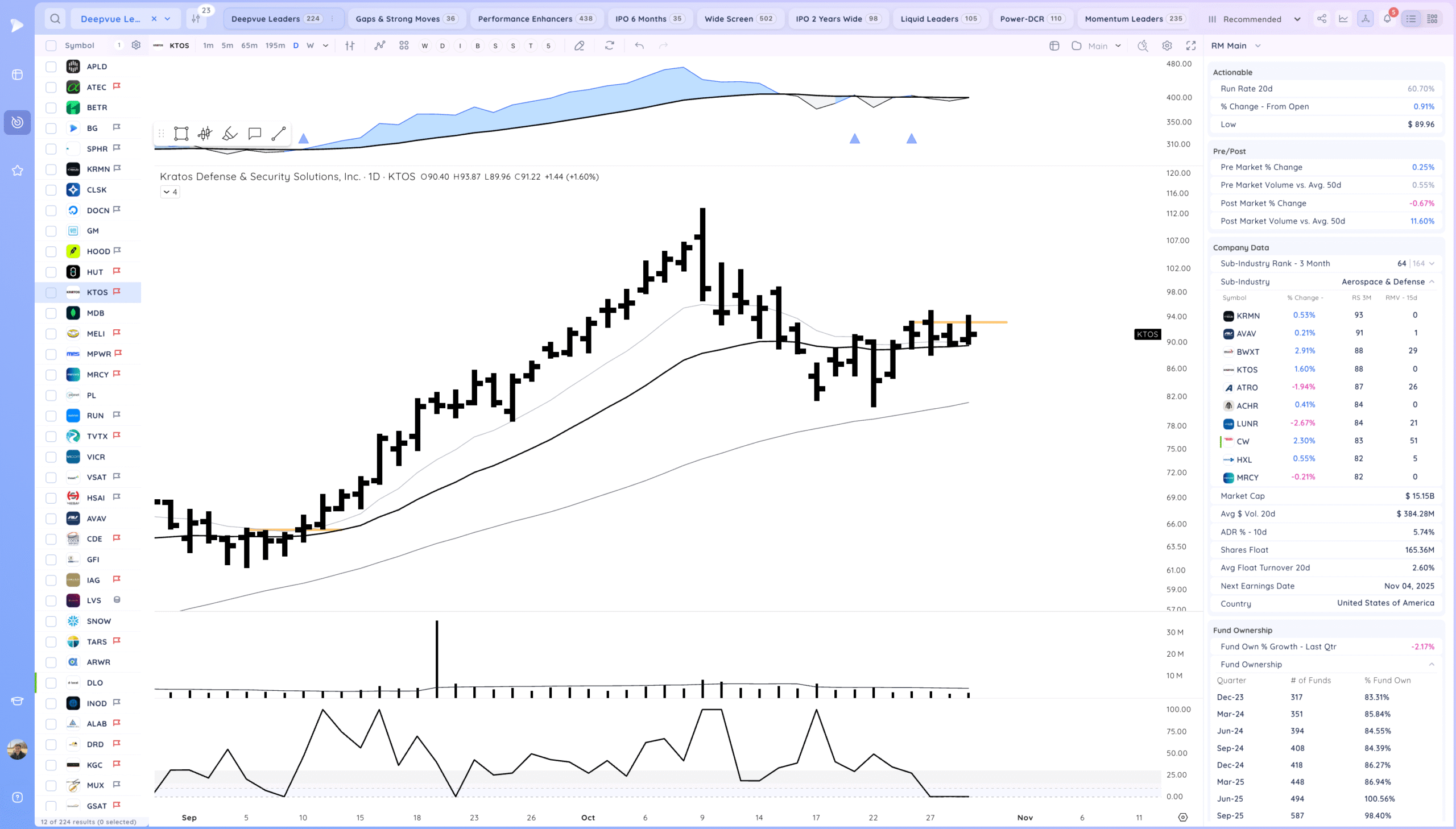

KTOS watching for a range breakout

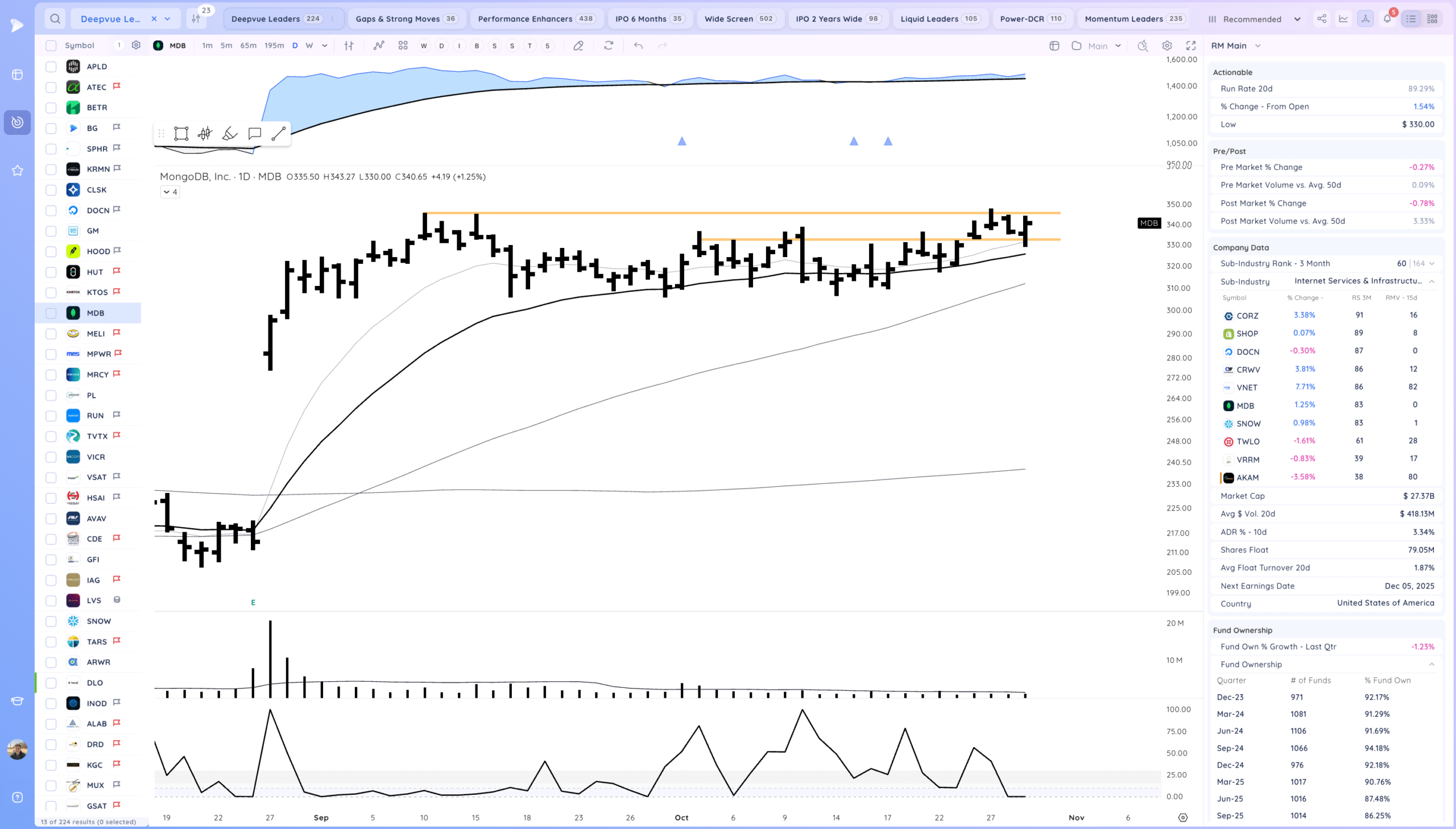

MDB watching for a base breakout

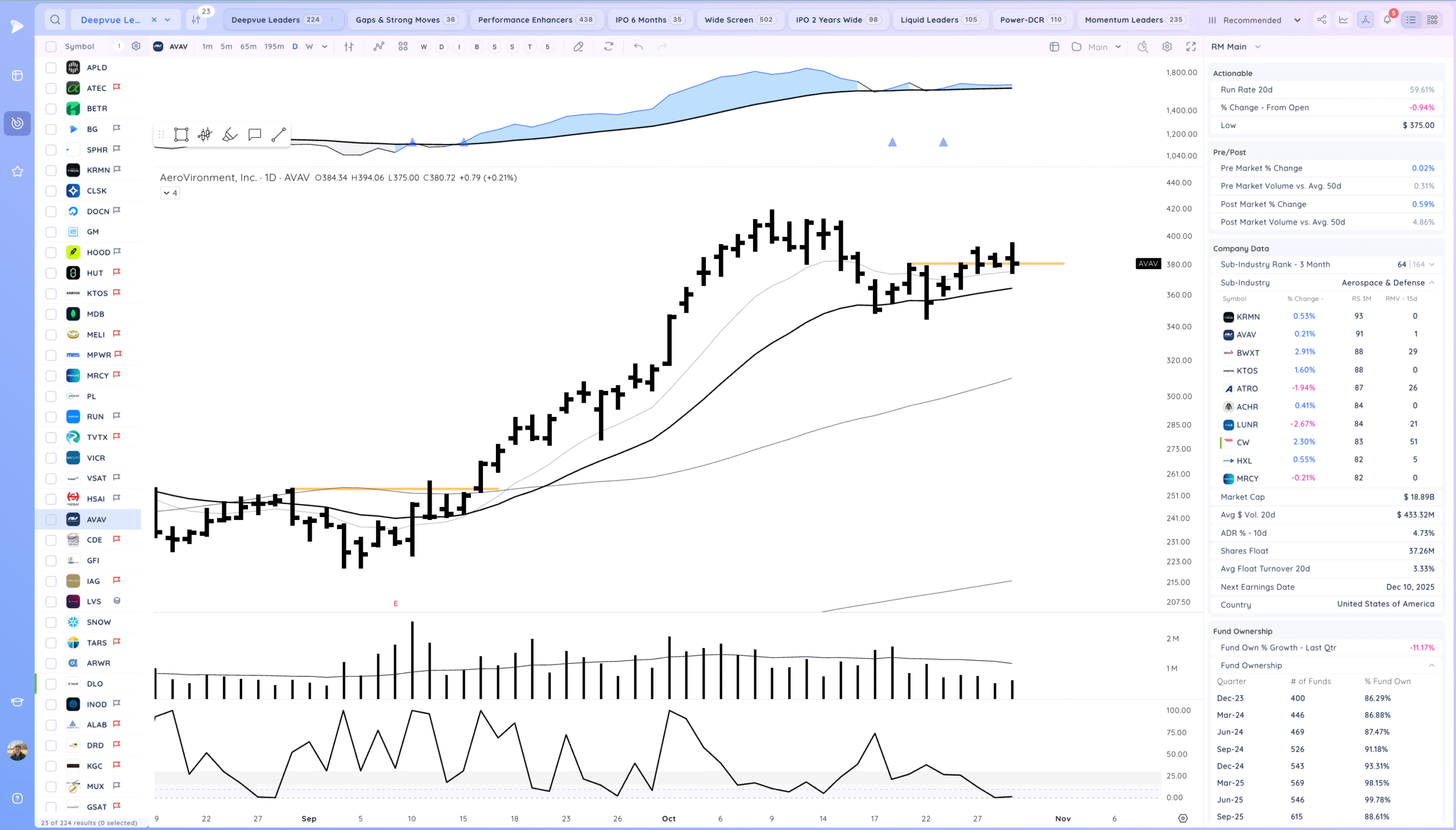

AVAV watching for a bounce off the prior pivot

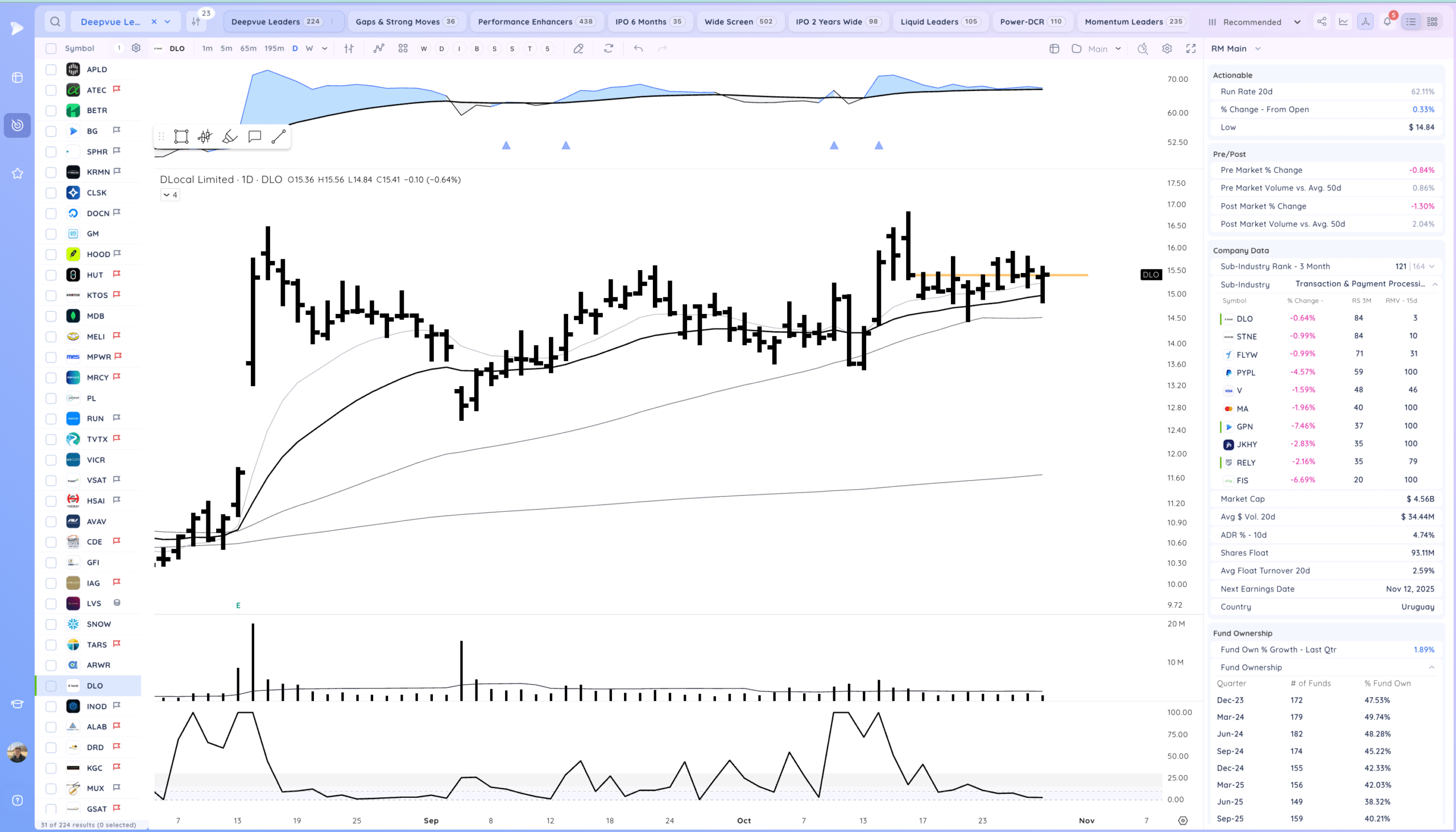

DLO watching for a range breakout. Strong upside reversal

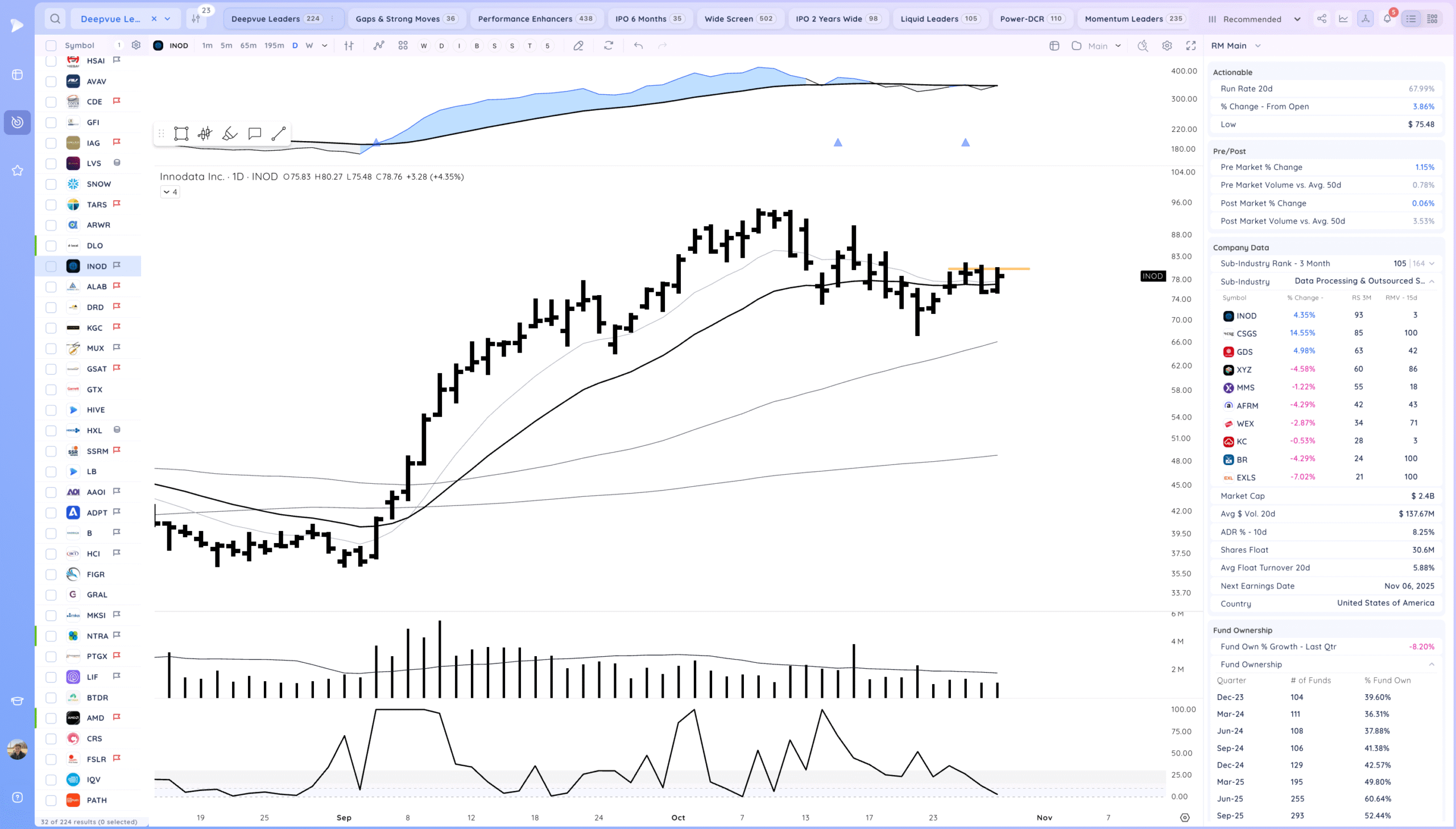

INOD watching for a range breakout

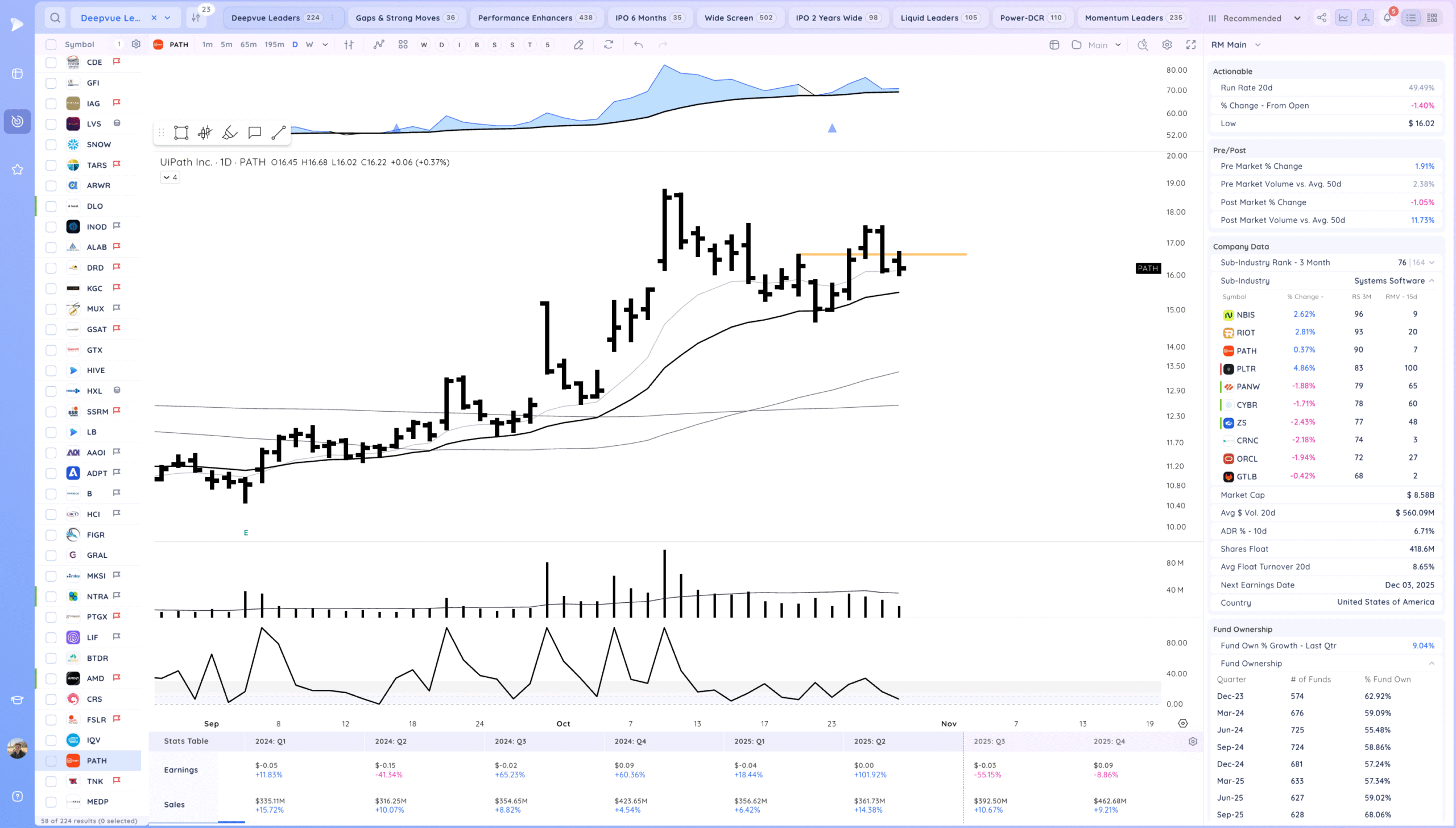

PATH tight day after the mov lower yesterday, watching for a range re-breakout. Fast mover

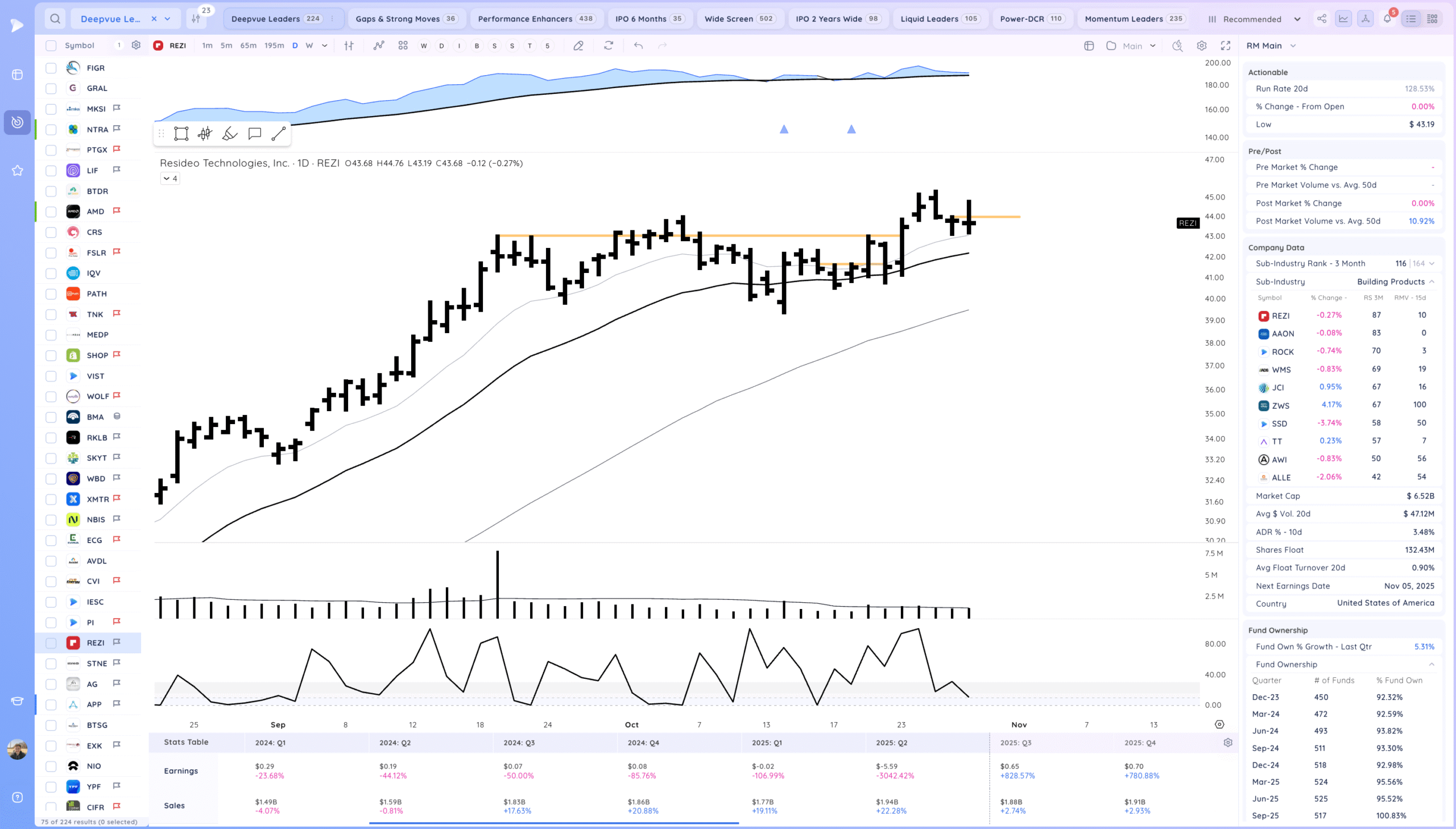

REZI watching for a range re-breakout.

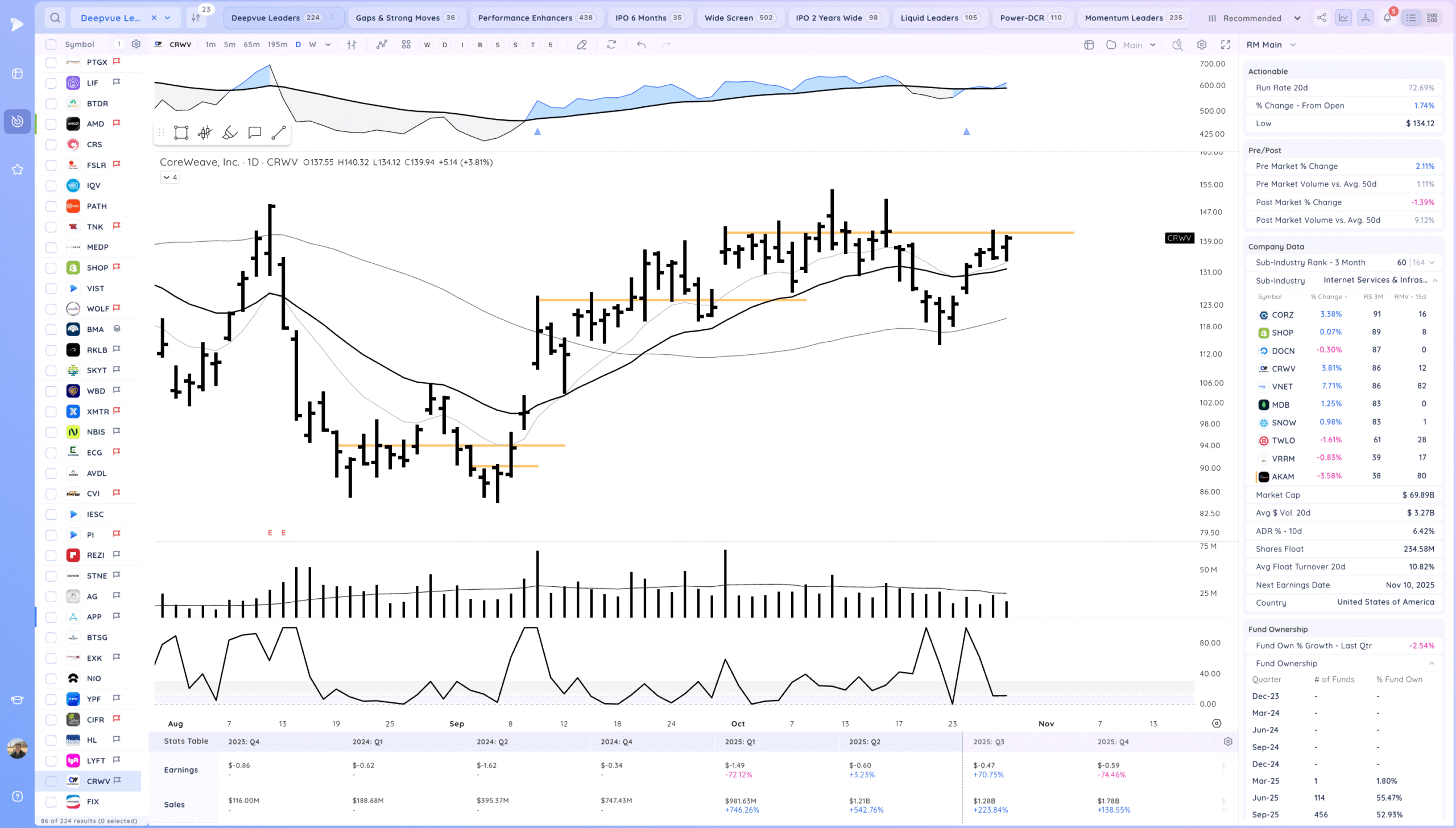

CRWV watching for a consolidation breakout

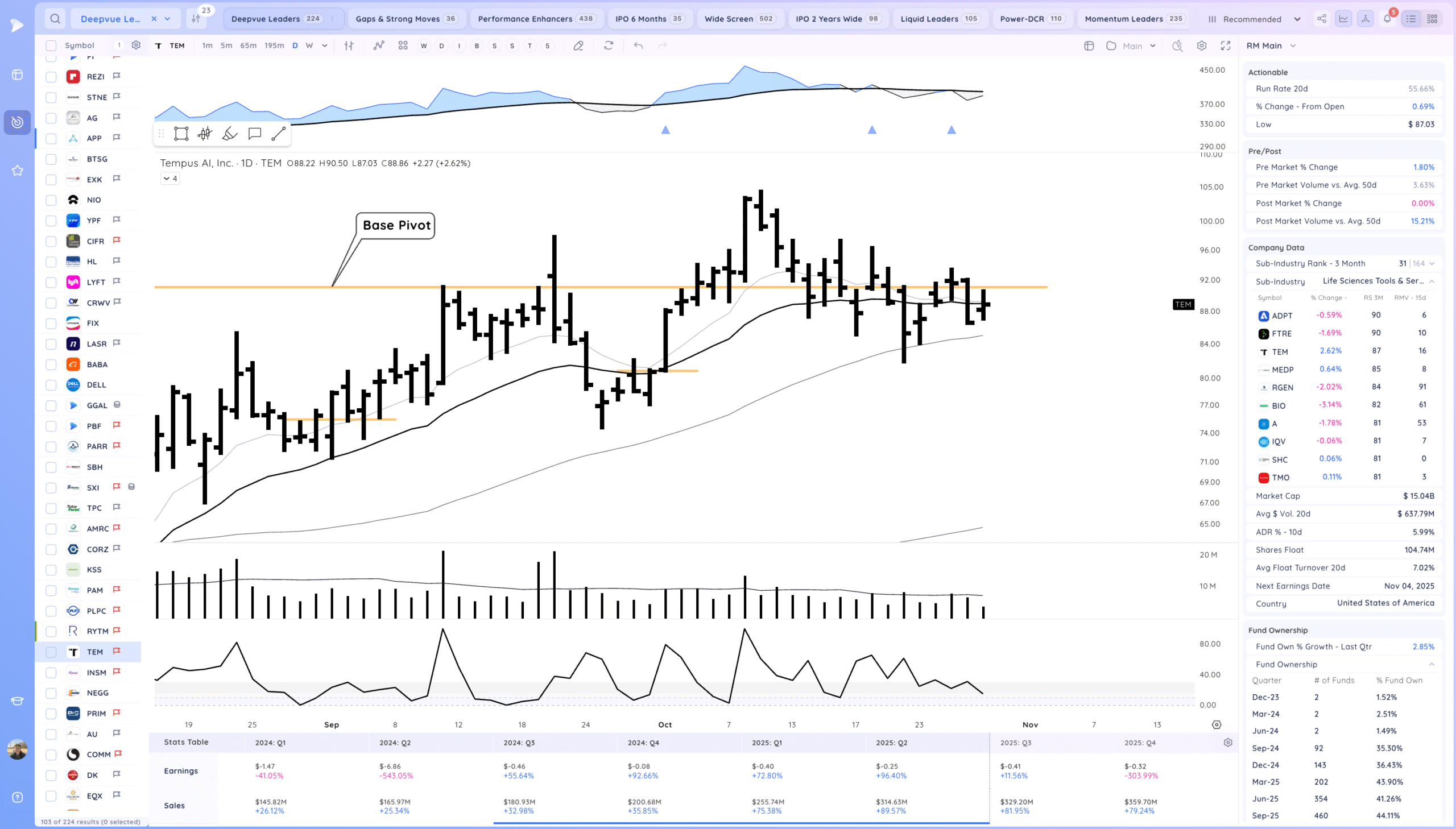

TEM tight day below the key weekly level. Watching for a breakout. Earnings are upcoming early nov

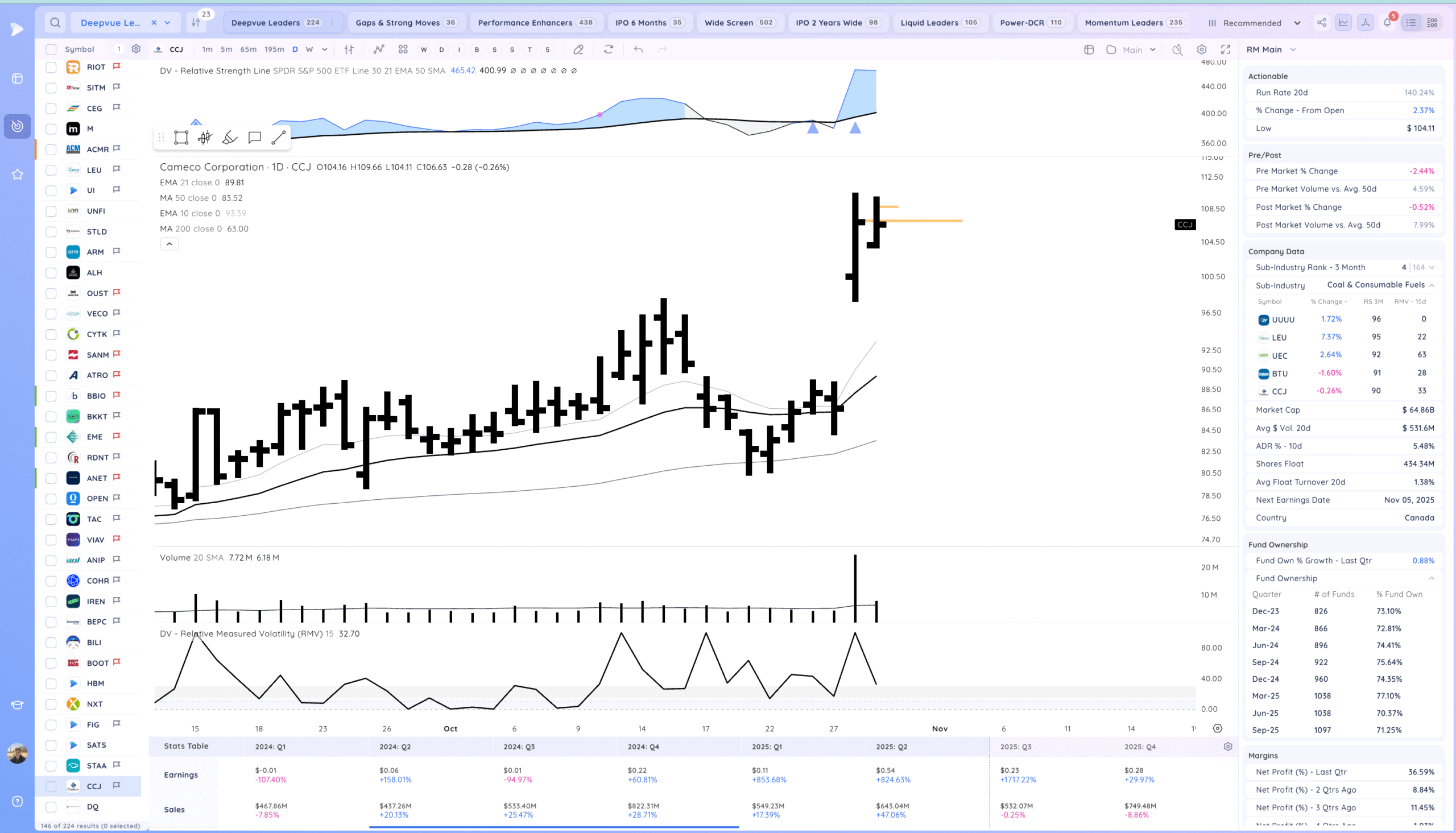

CCJ watching for an HVC re-breakout

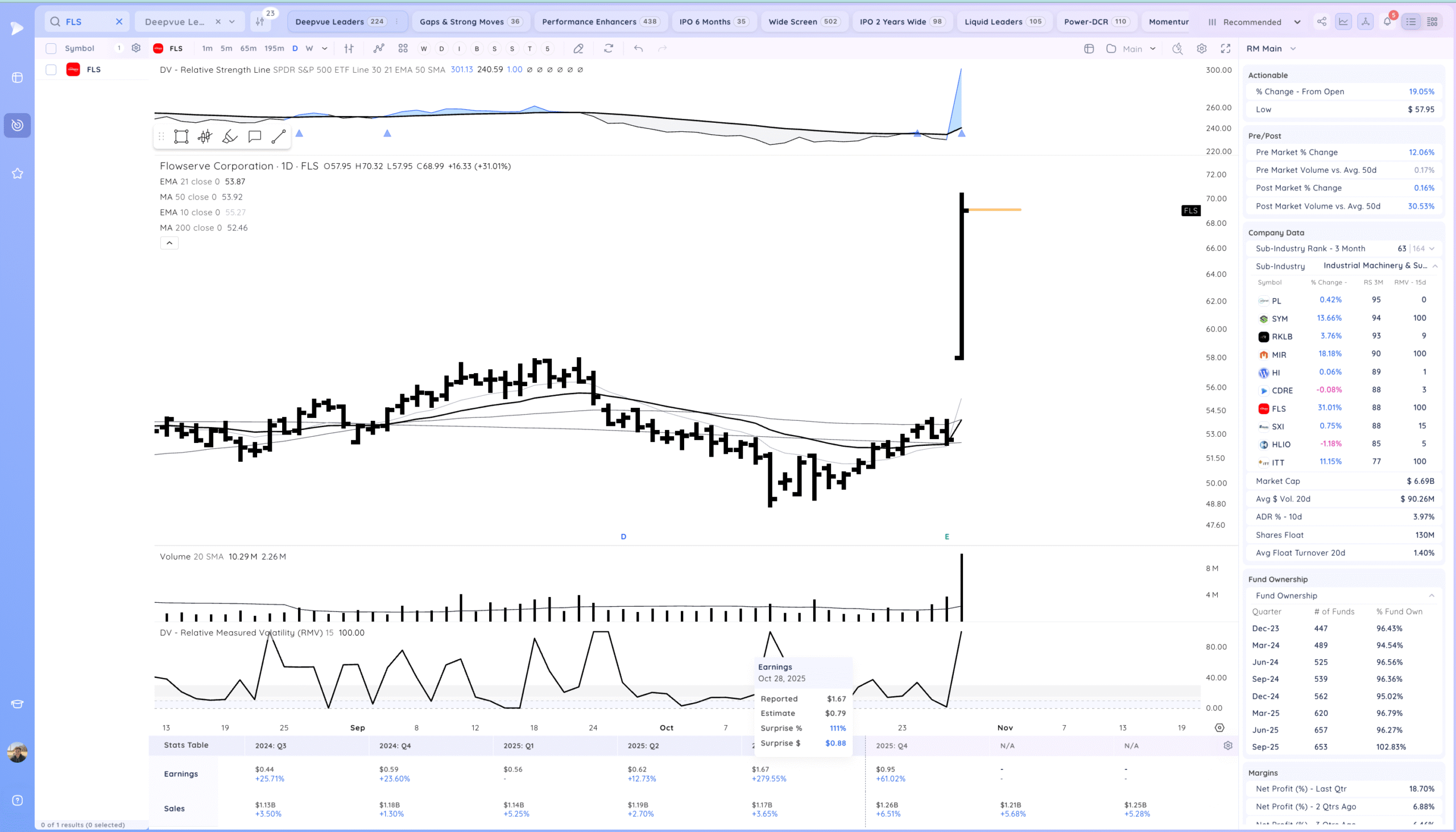

FLS watching for HVC breakout/follow through. or post gap range formation

Margin expansion, earnings growth and surprise. Guidance improvement. Involved in Data center cooling

Recent Gappers to Track

BE FLS YPF GGAL VIST AMD VICR ISRG PEGA INTC CRS PBF GTX LC MEDP QCOM

Today’s Watchlist in List form

Focus List Names

APLD KTOS MDB AVAV DLO INOD PATH REZI CRWV TEM CCJ FLS

Focus:

APLD INOD CCJ FLS

Themes

AI, AI Energy, rare metals, biotech. Oil and Gas, Crypto names recovering, Construction, DATA Center fabrication.

Additional Thoughts

Mix batch from the first megacap earnings. However continuing to see strong action and setups. We get more info tomorrow.

Anything can happen, Day by Day – Managing risk along the way