Choppy Inside Week.

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 17, 2025

Market Action

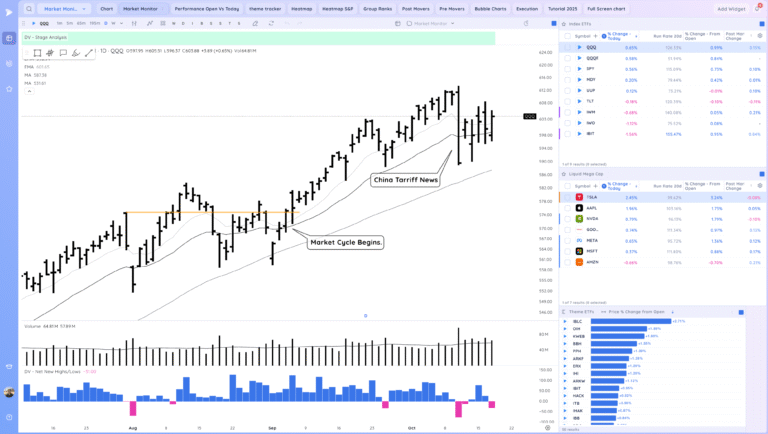

QQQ – Overall a choppy inside week contained in the sell off bar’s range. Short term direction to be decided. Good inside day with a high closing range above the 21ema to end the week,

Bulls want to see us hold above the 21ema and continue trending

Bears want to see us reconfirm down, likely with additional negative news catalysts.

Daily Chart of the QQQ.

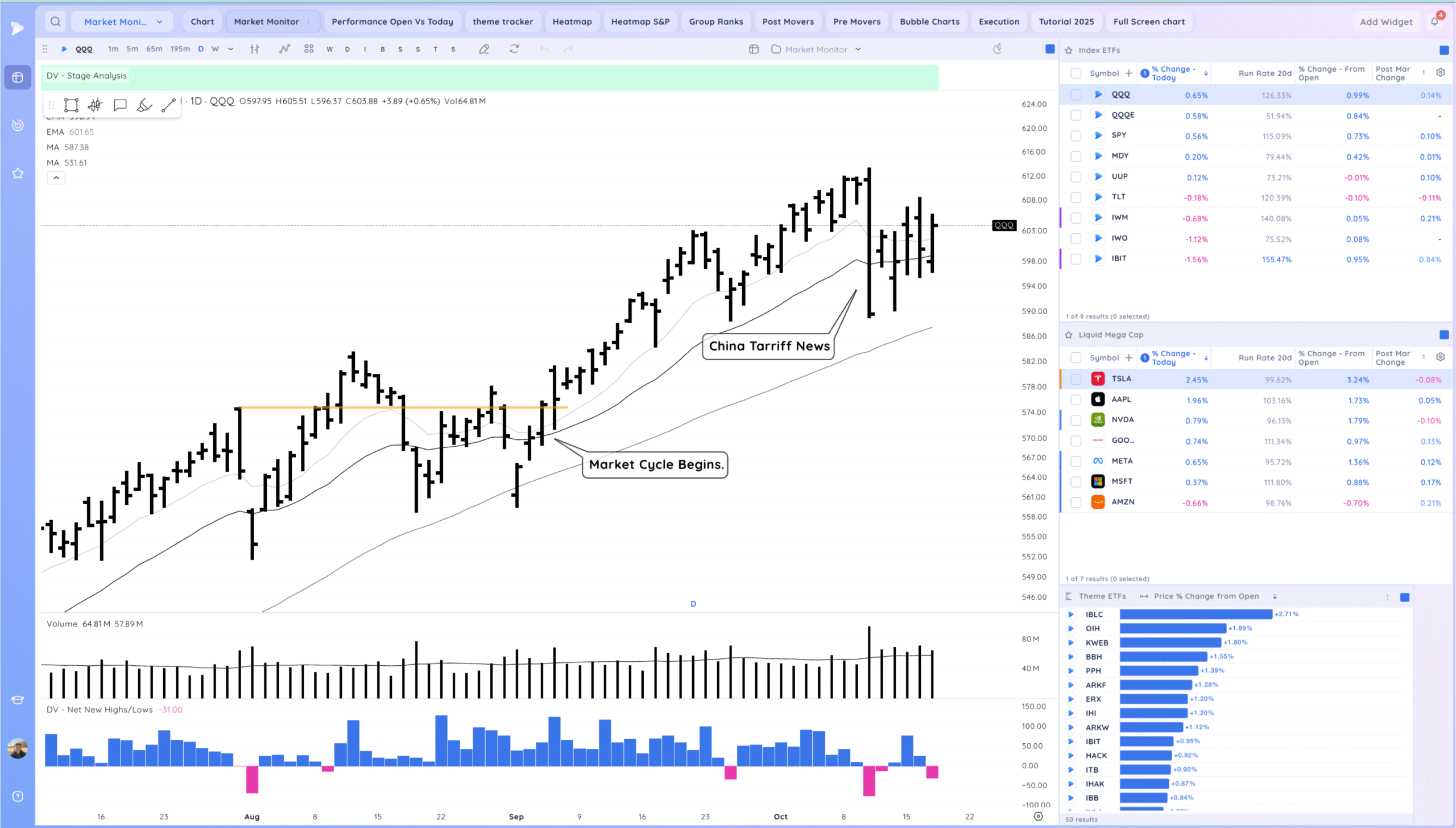

IWM – Reversal down below the pivot. Failed breakout for now

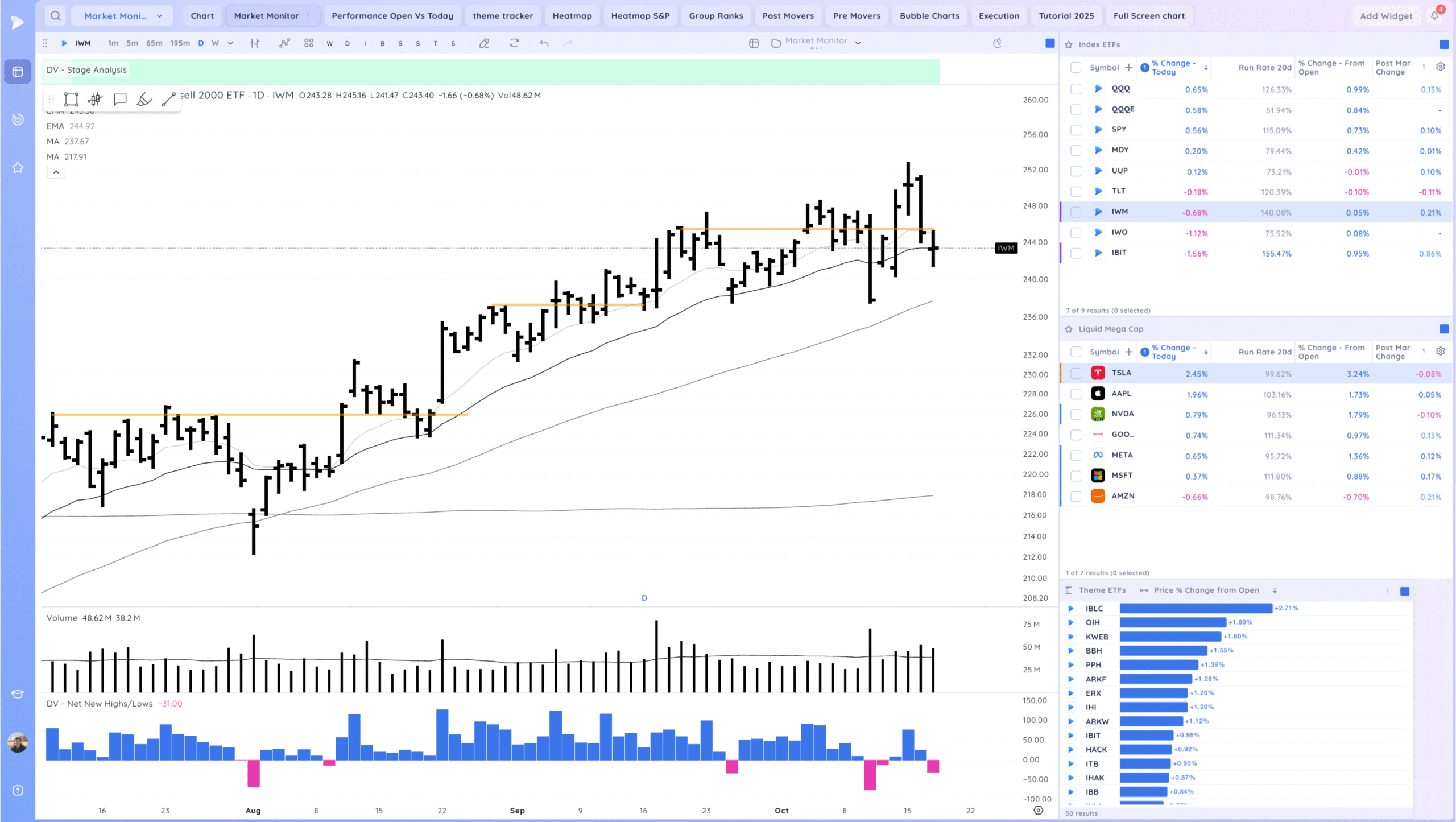

IBIT – Reconfirmation down from the inside day

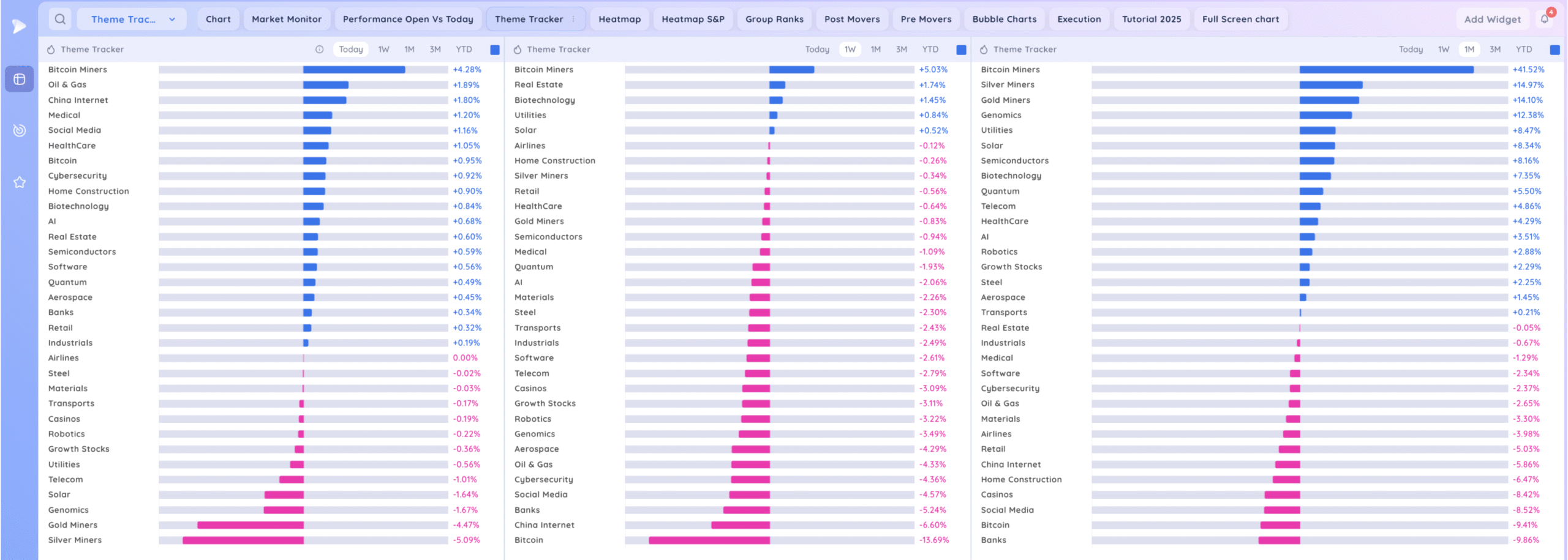

Trends (3/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

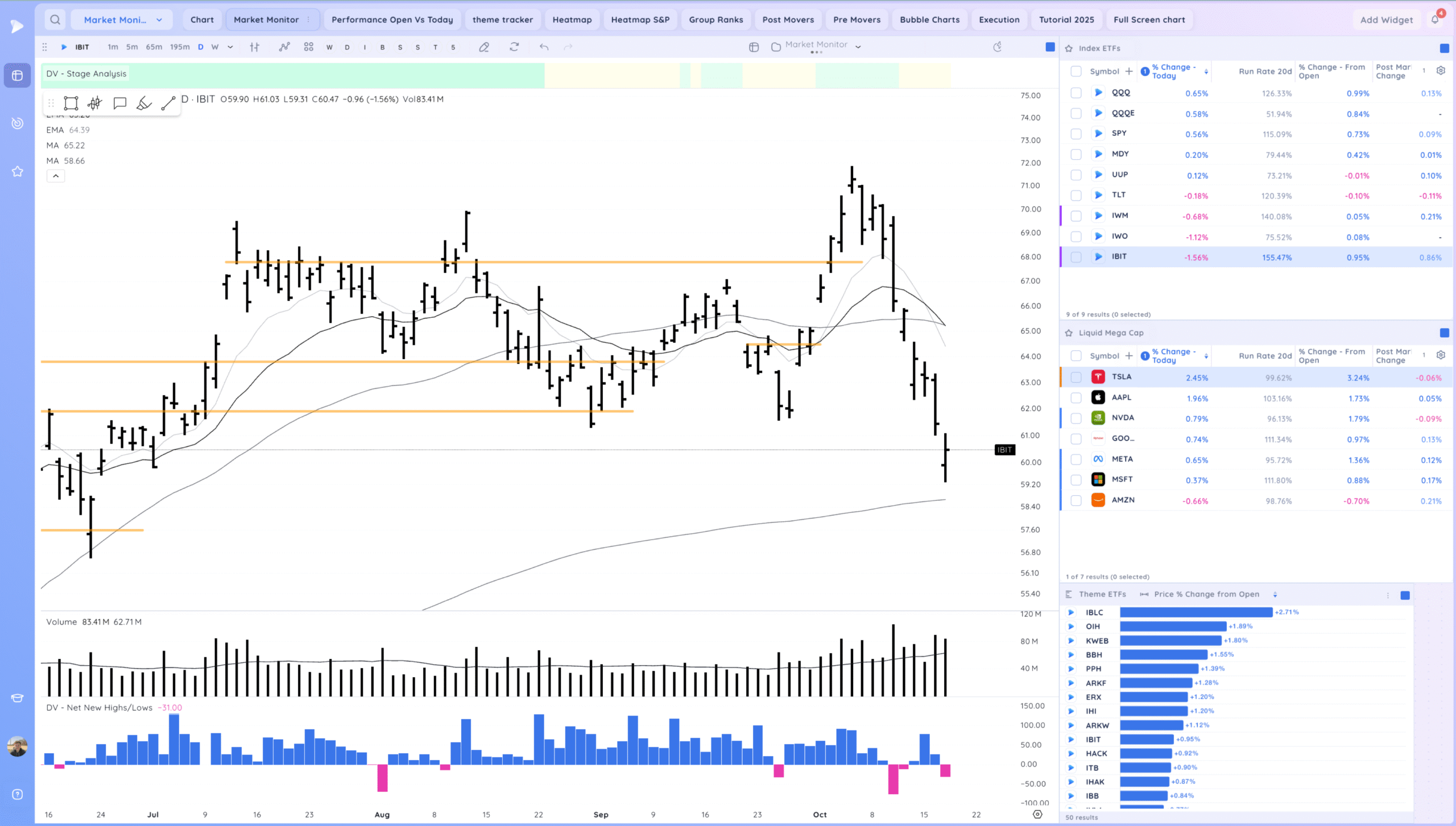

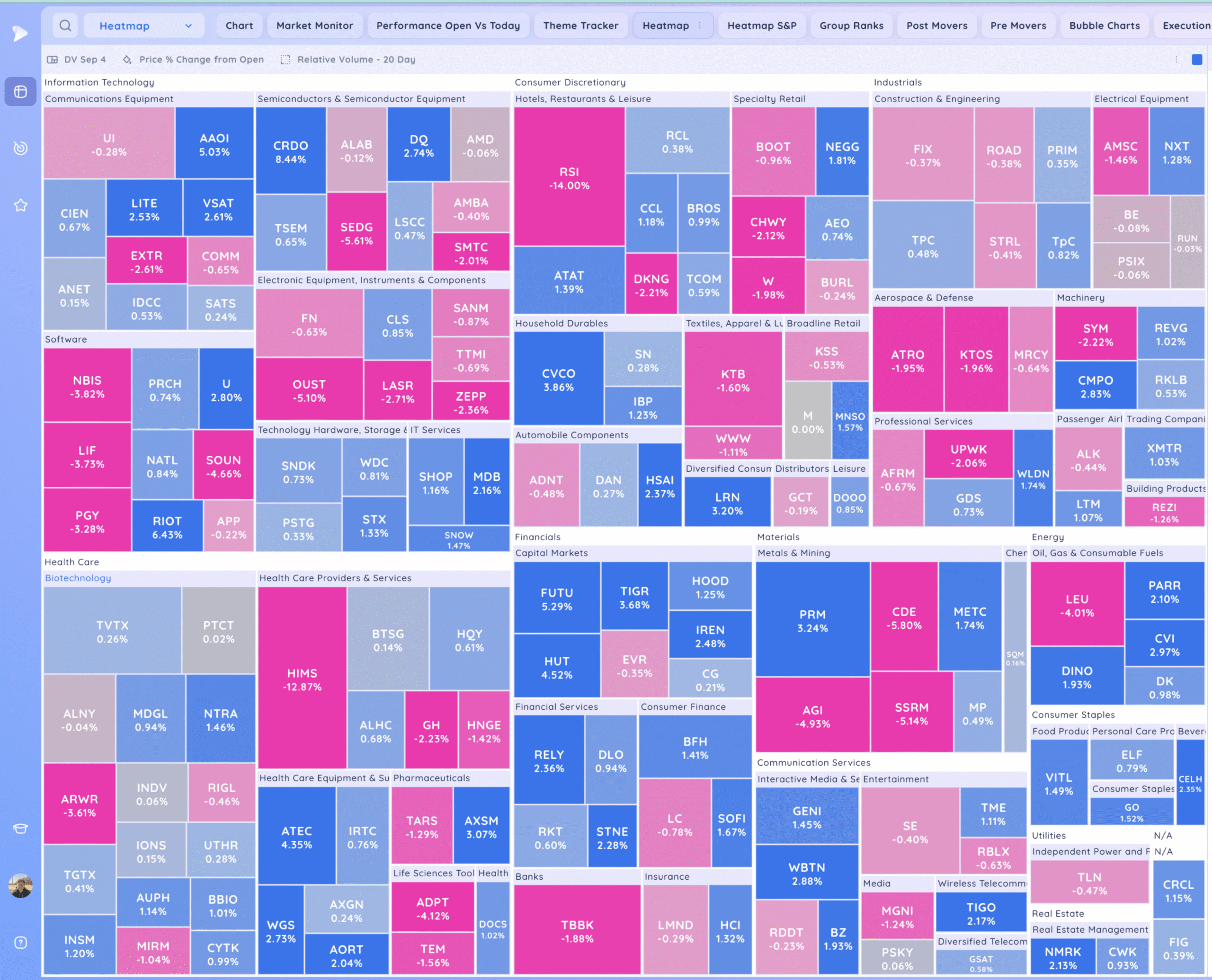

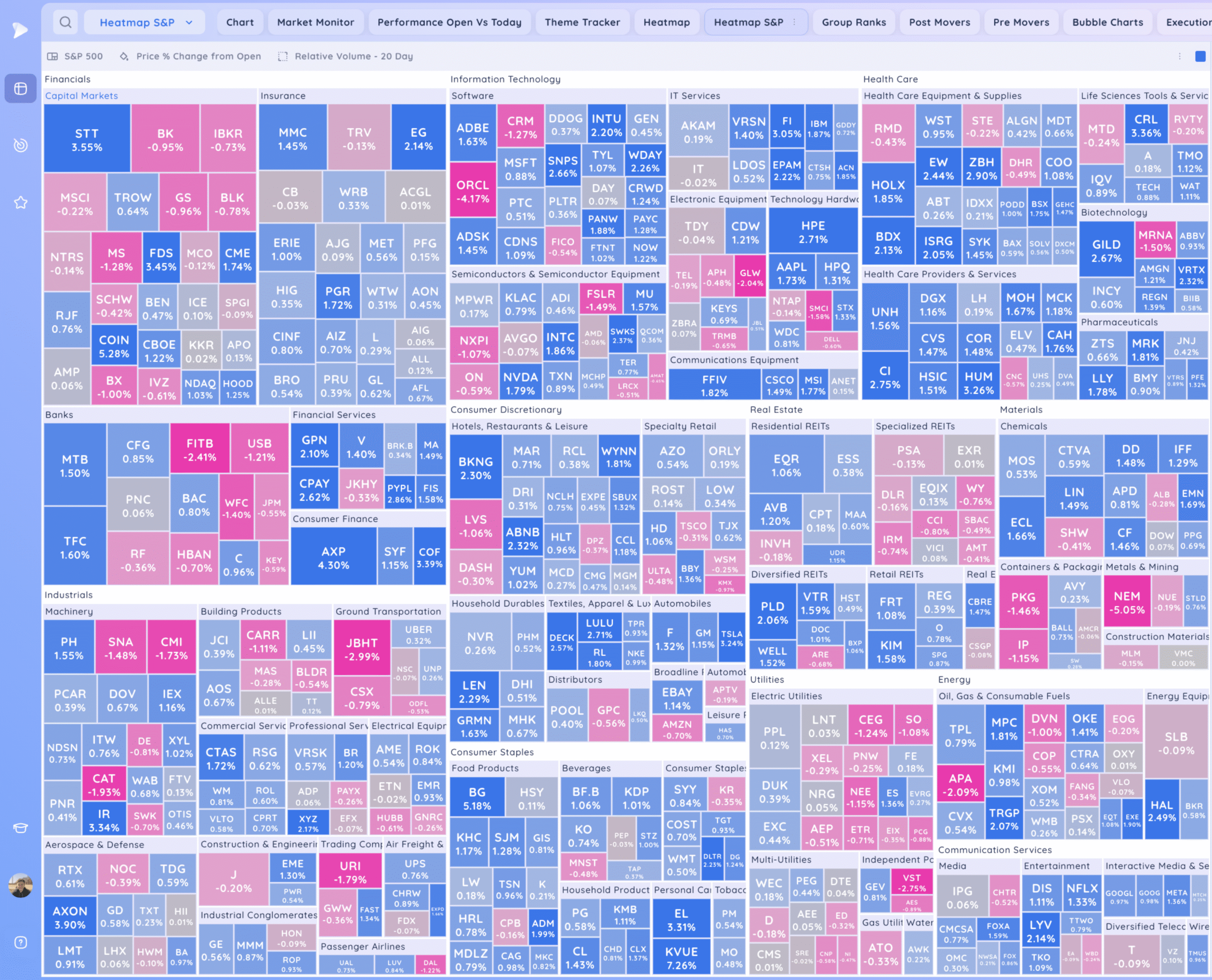

Groups/Sectors

Deepvue Theme Tracker

Deepvue Leaders

S&P 500.

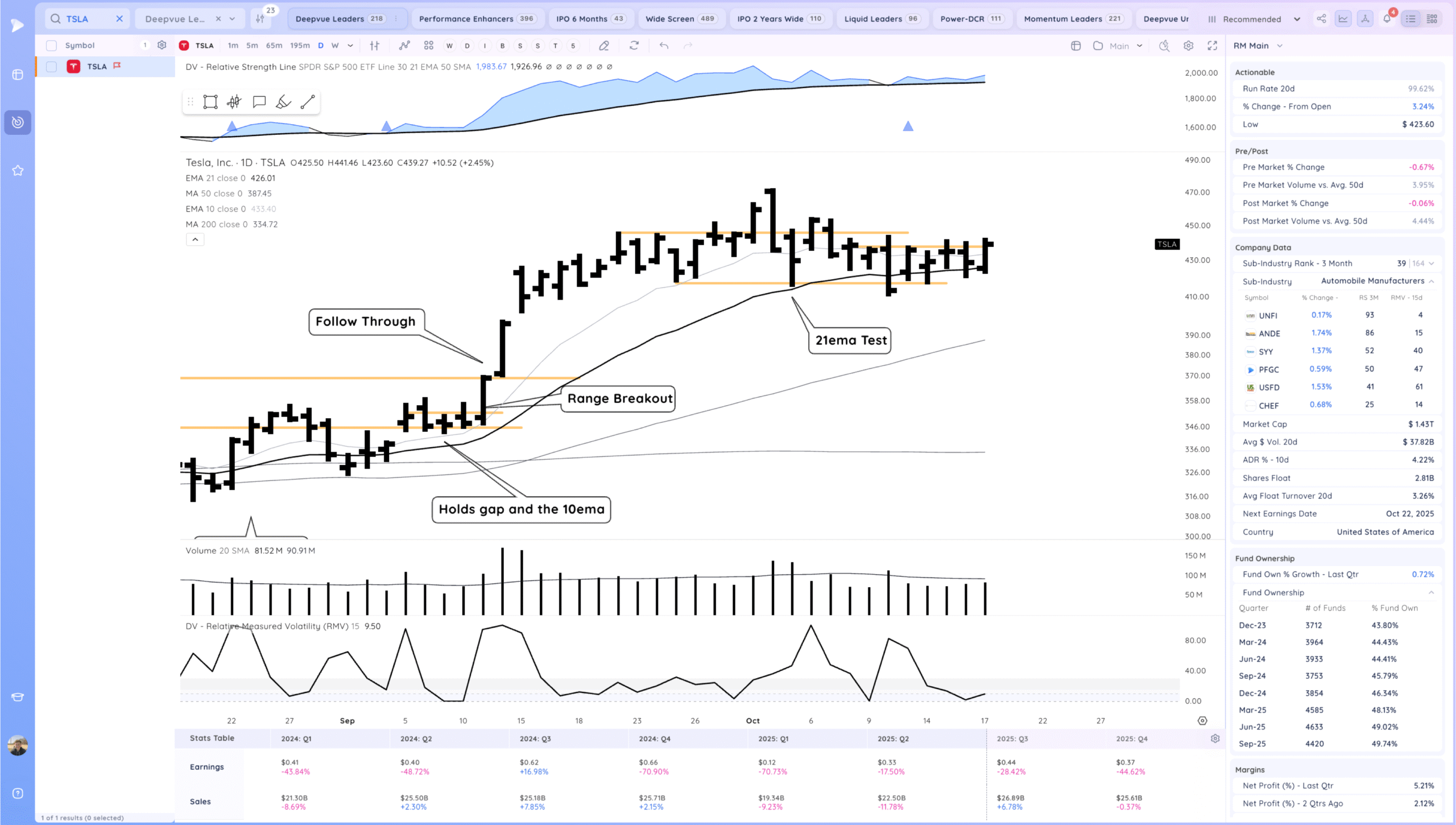

Leadership Stocks & Analysis

TSLA – Strong push off the 21ema to the top of the range. Actionable with at stop a todays/prior day’s lows as it moved up. Watching for follow through next week.

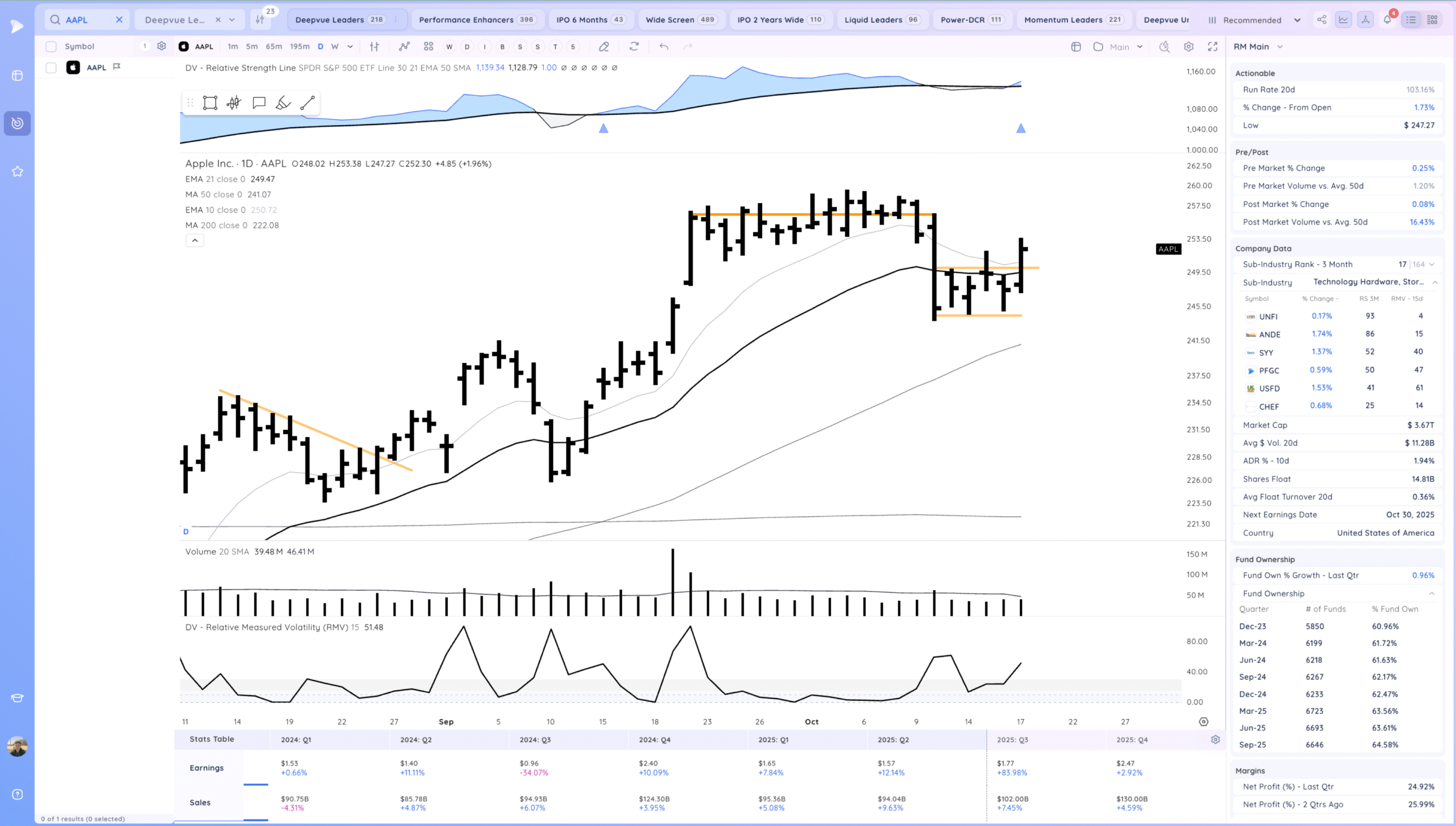

AAPL Expansion higher following through. retaking the 21ema.

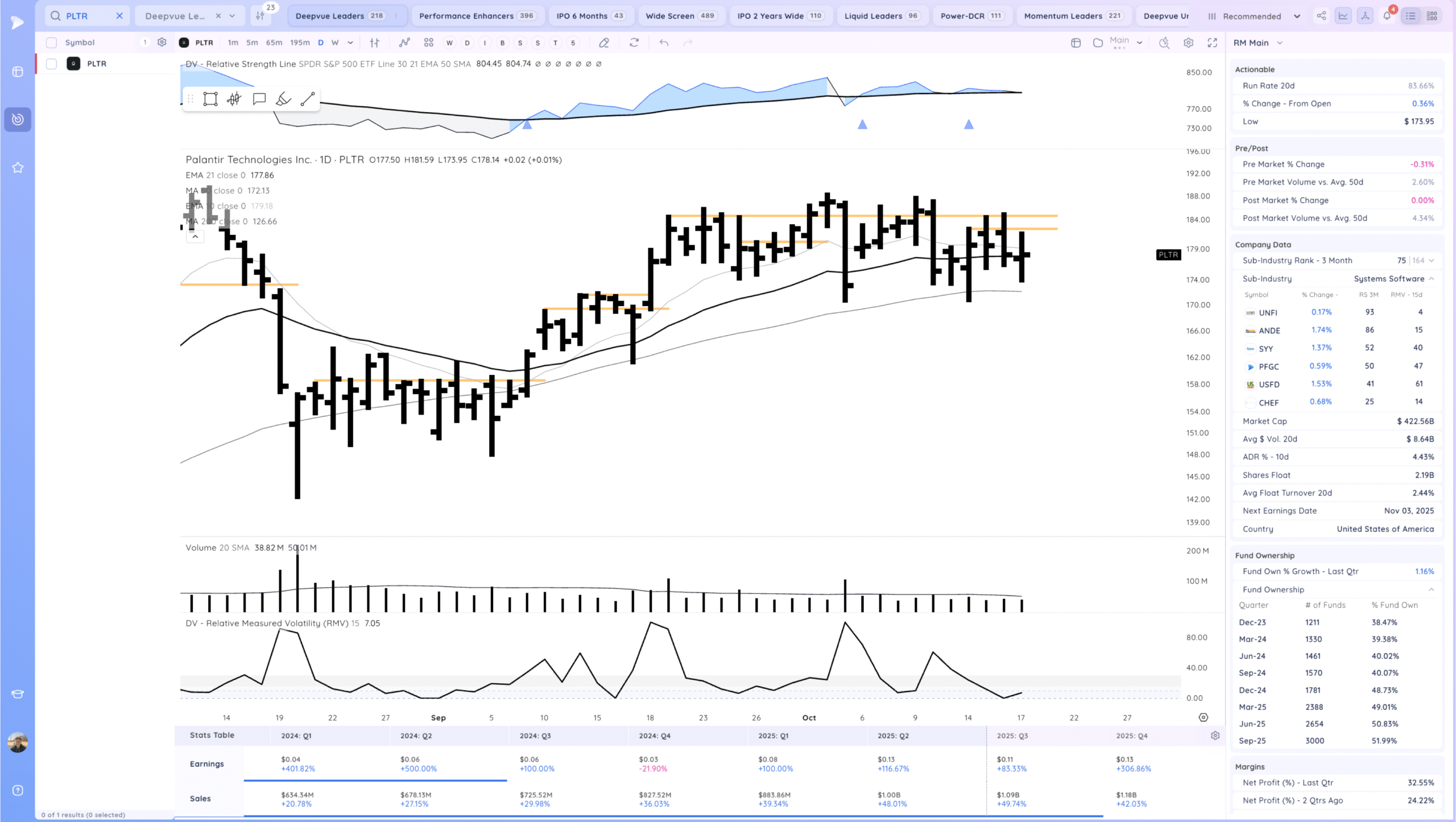

PLTR choppy but tightening a bit right at the 21ema. Expecting expansion next week

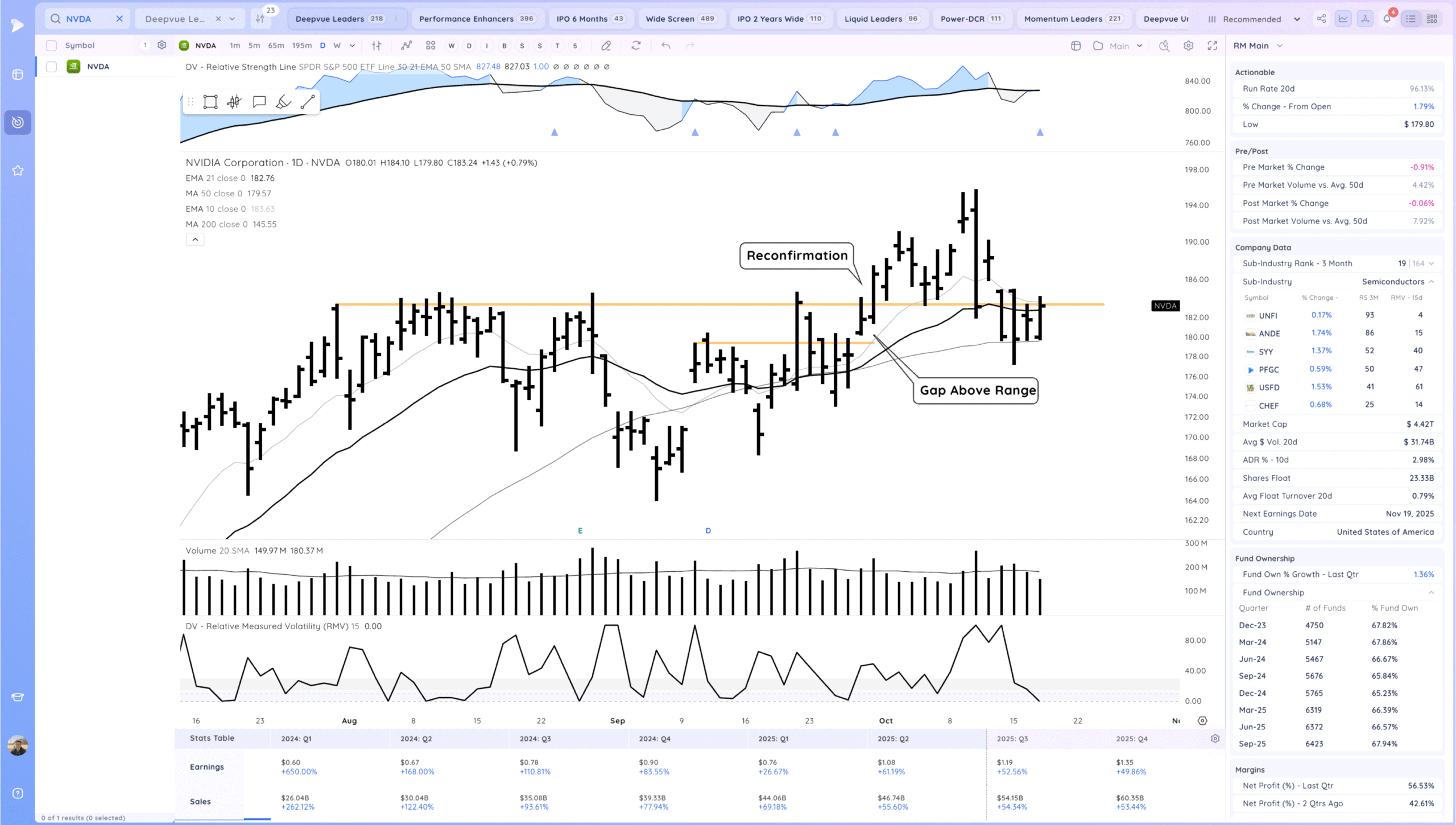

NVDA Push off the 50 sma after the gap down. Just under the base pivot.

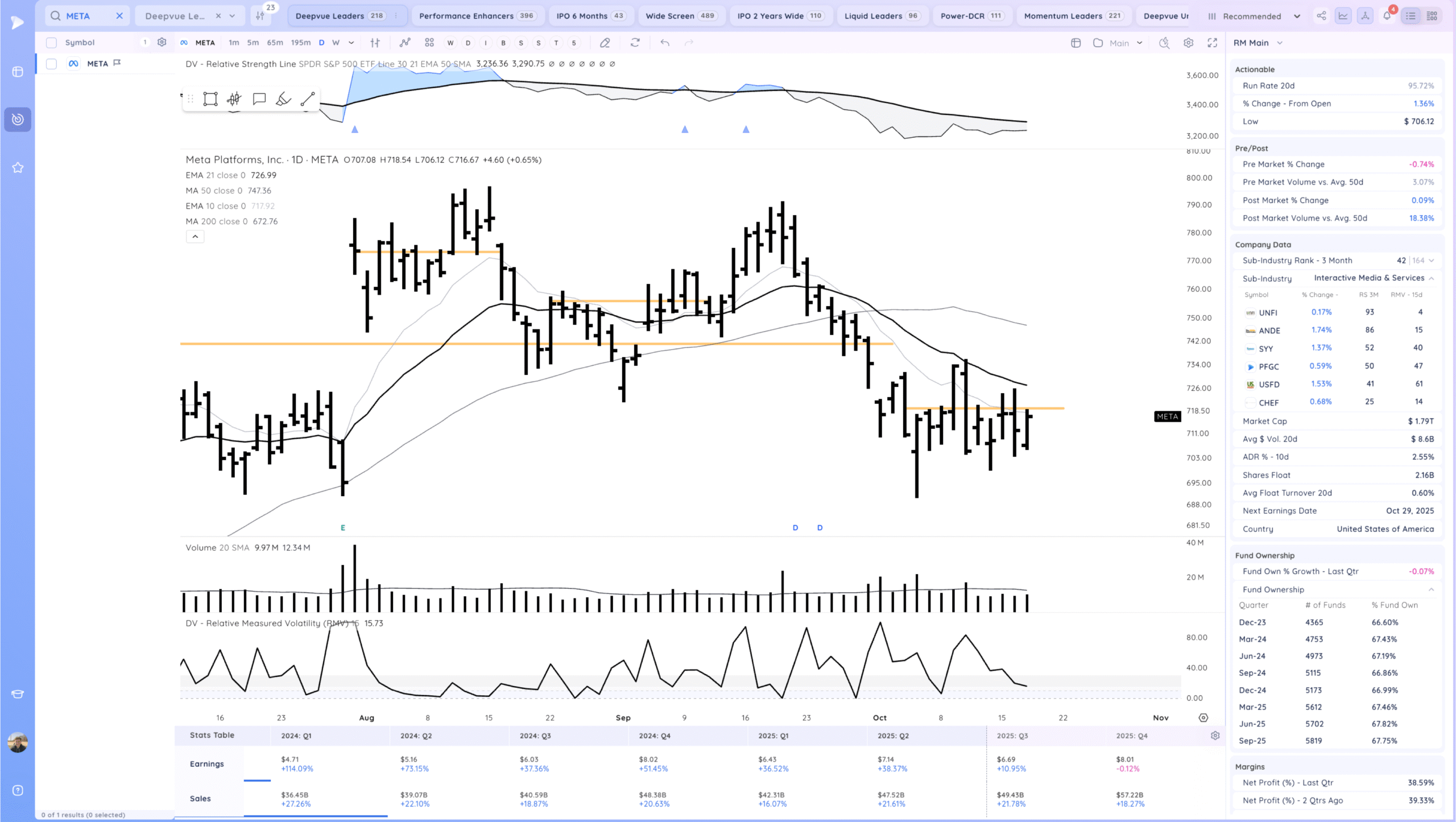

META inside bar and still in this range

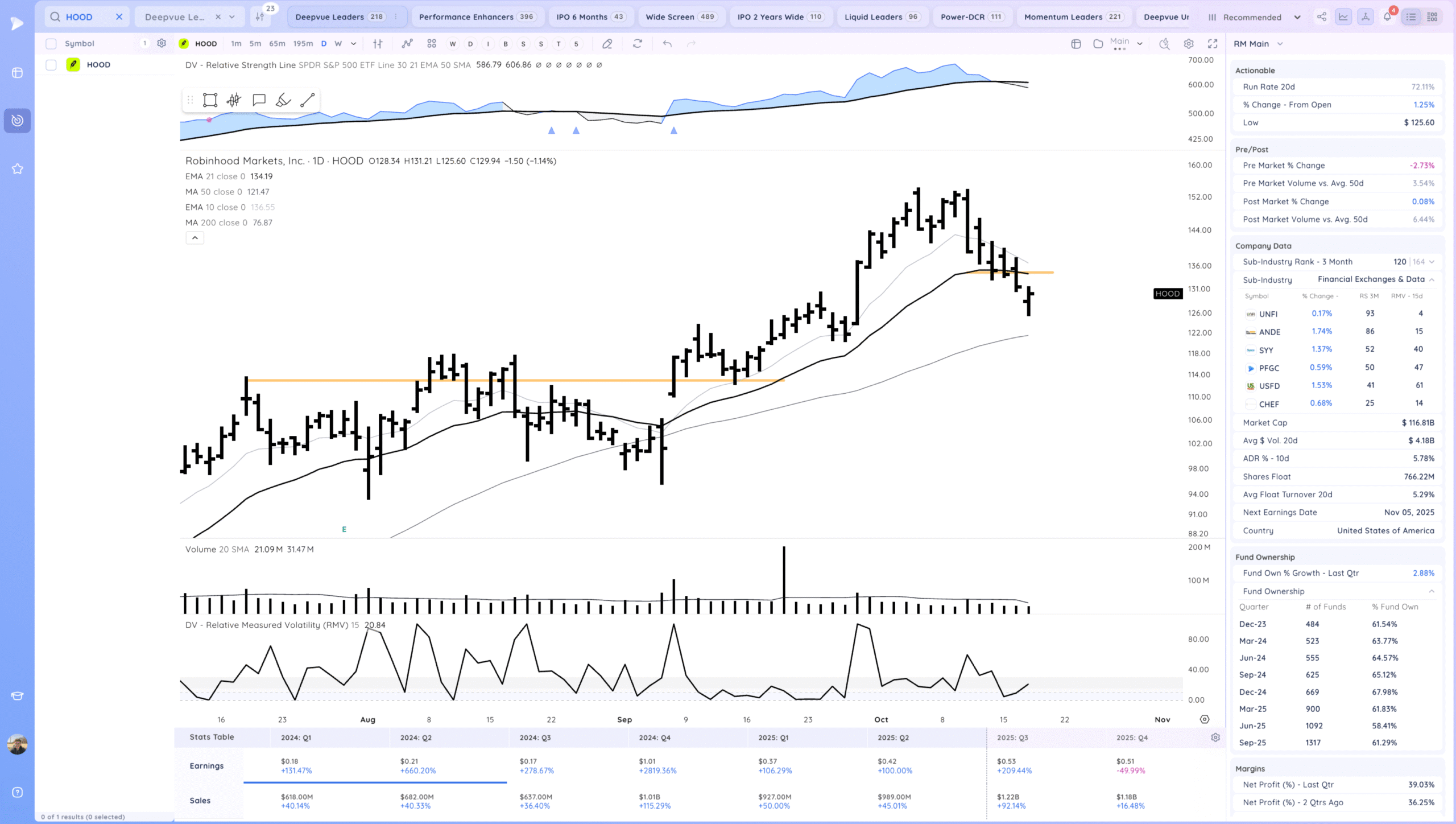

HOOD Gap down but upside reversal. Below the 21ema

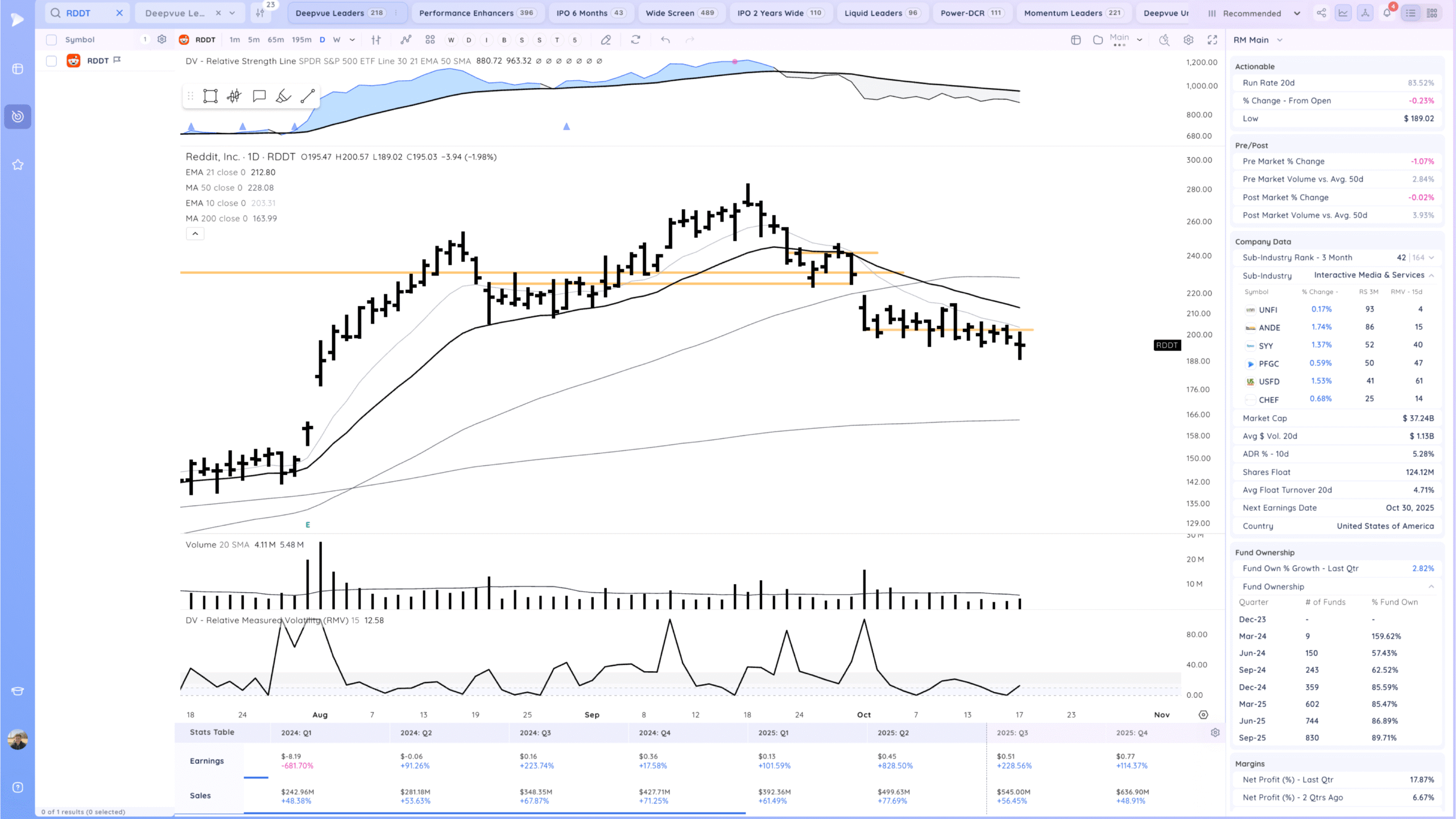

RDDT Move lower but closing off lows. Still in this range. below the 10 and 21ema

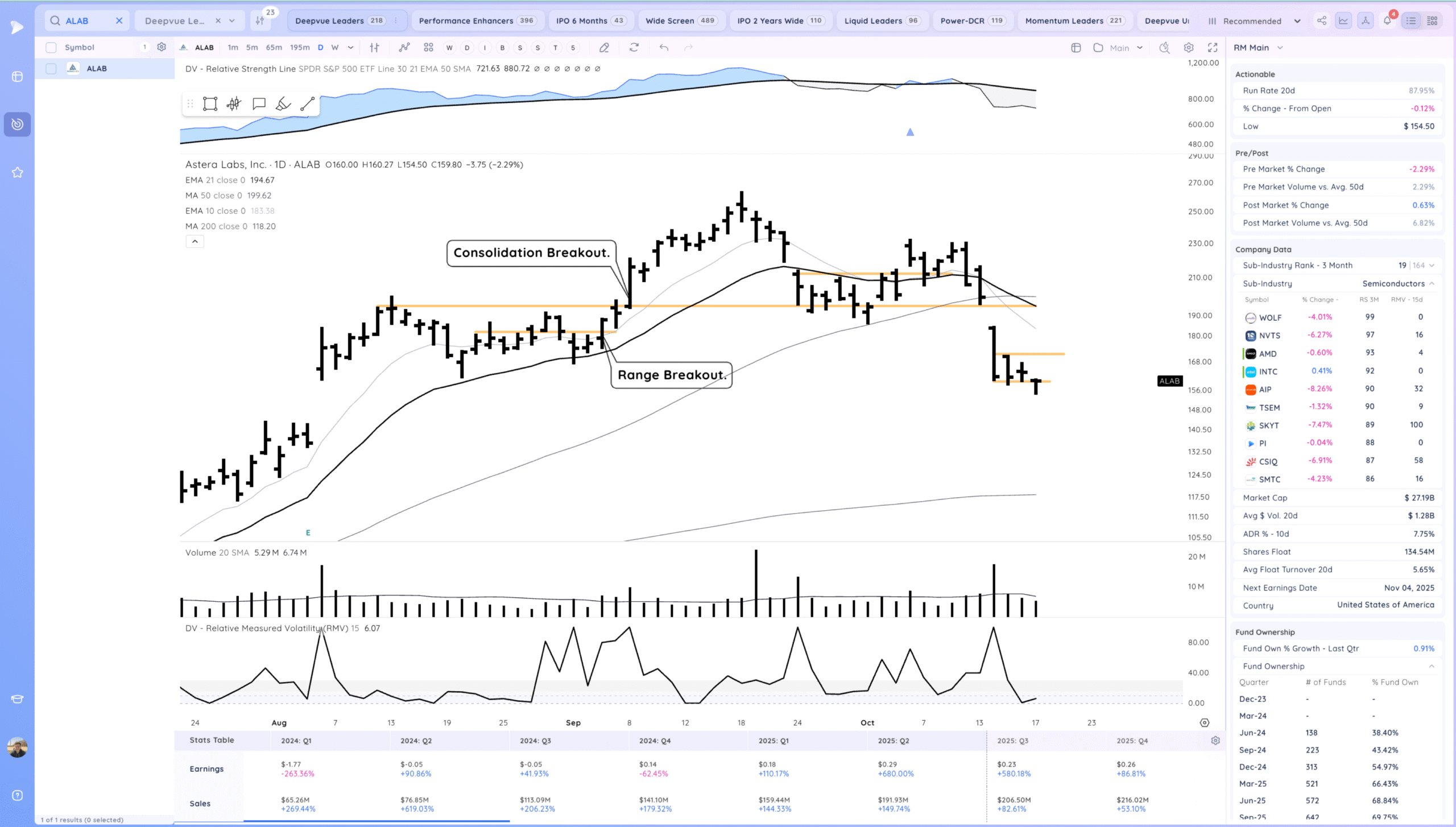

ALAB upside reversal and still in this range below the MAs

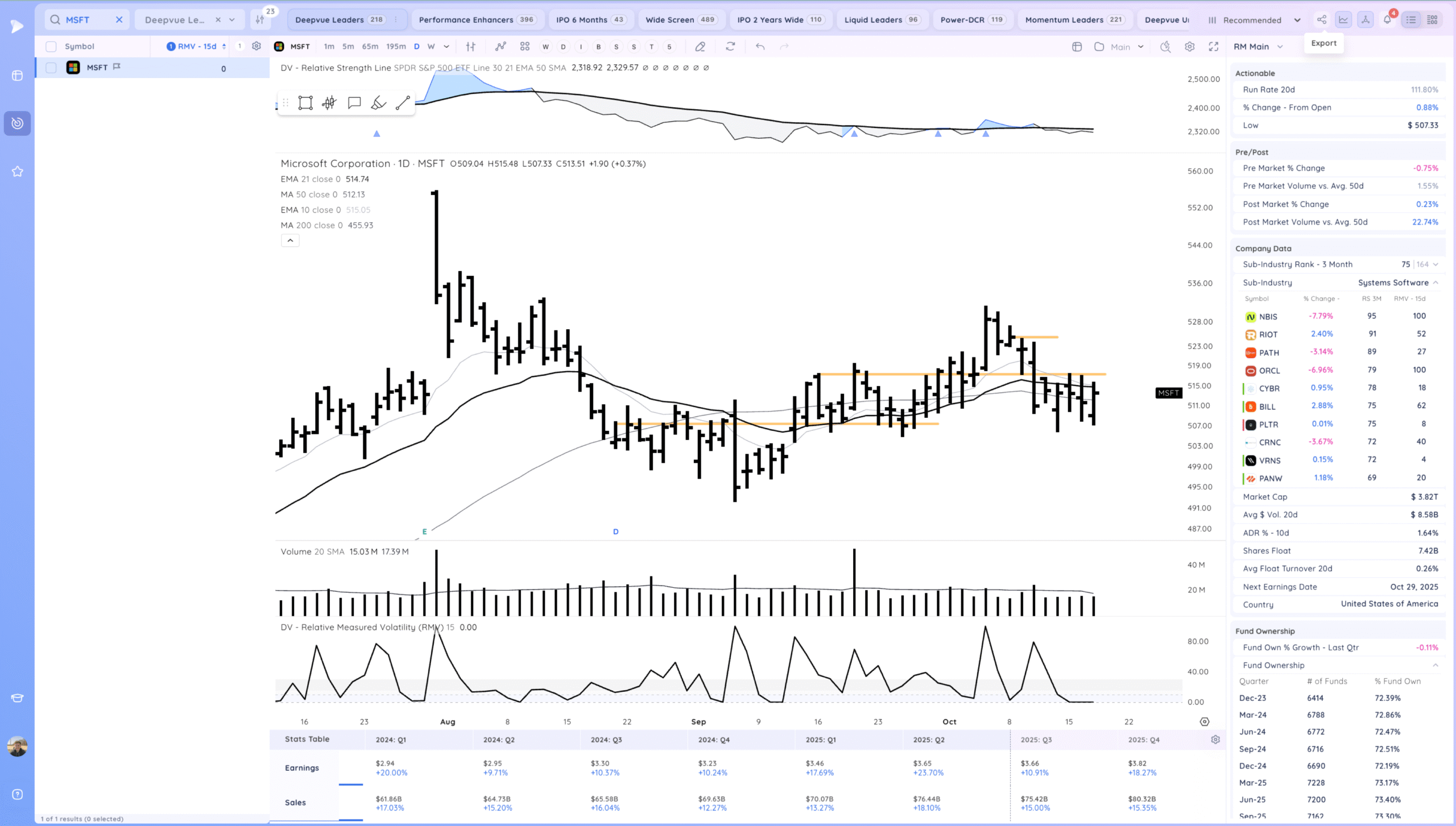

MSFT Still a choppy range here below the pivot. So far has failed to move up the right side. Upside reversal today

Key Moves

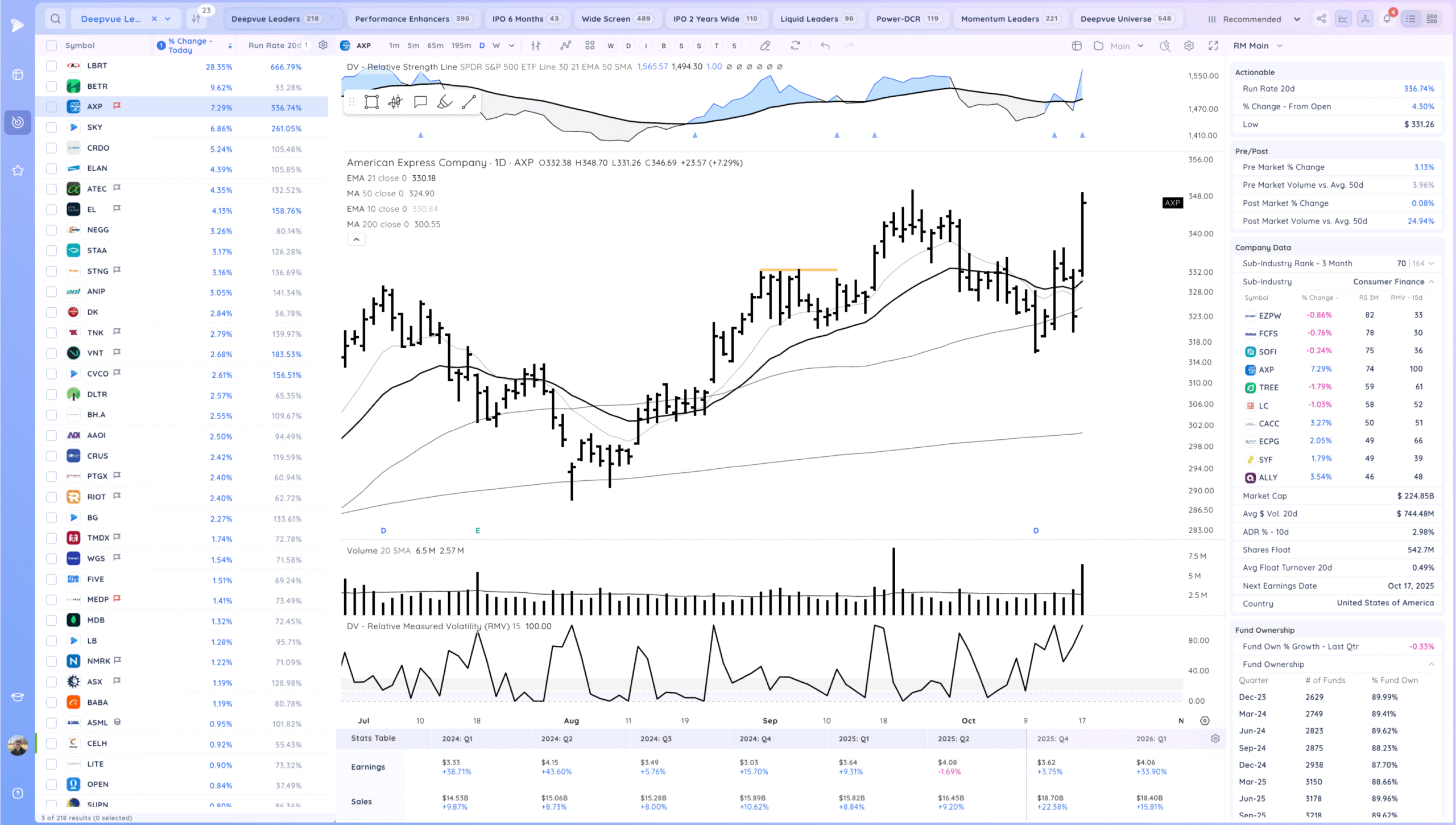

AXP strong move on earnings close to highs.

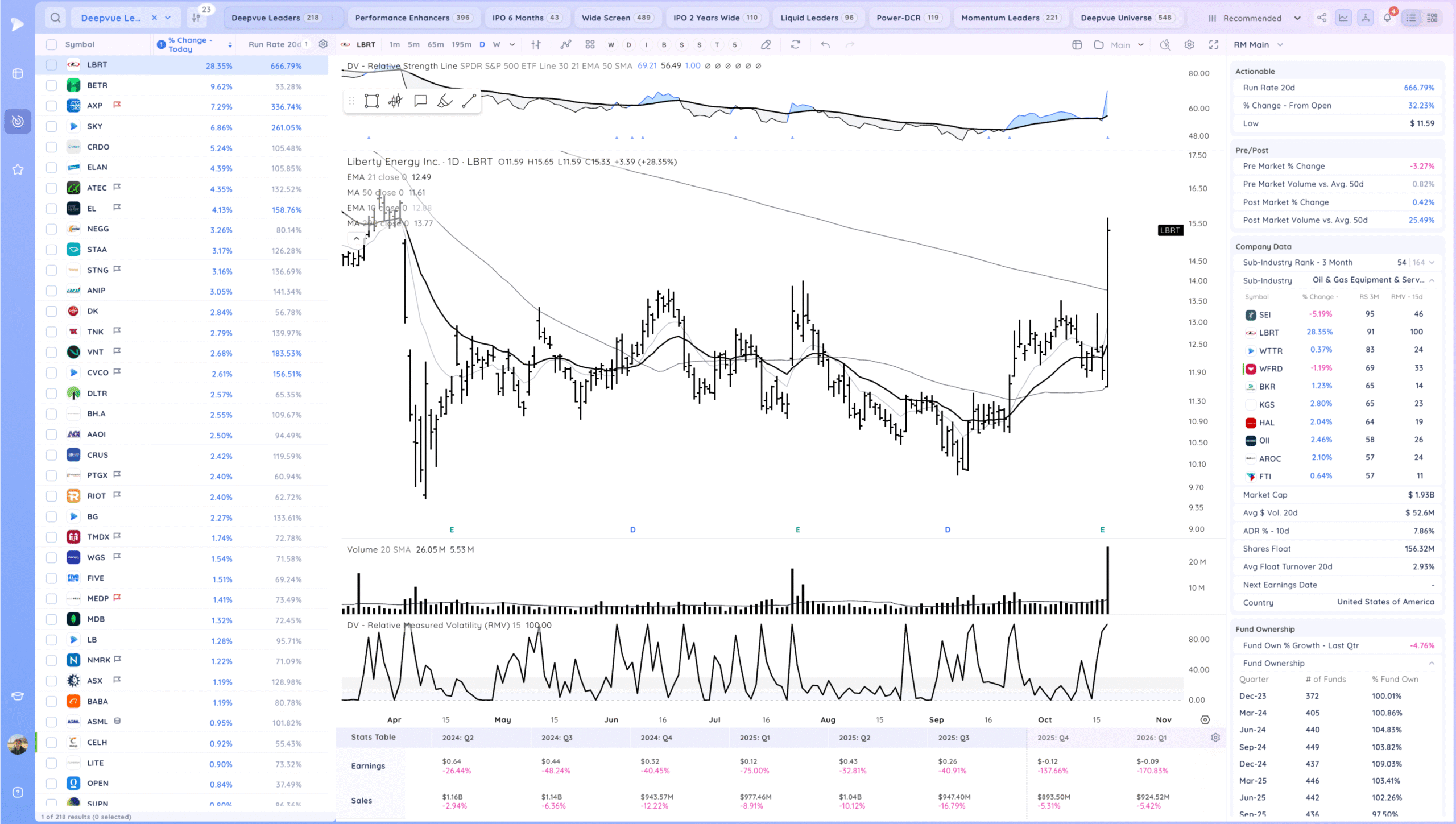

LBRT huge earnings move. Bottoming base

Setups and Watchlist

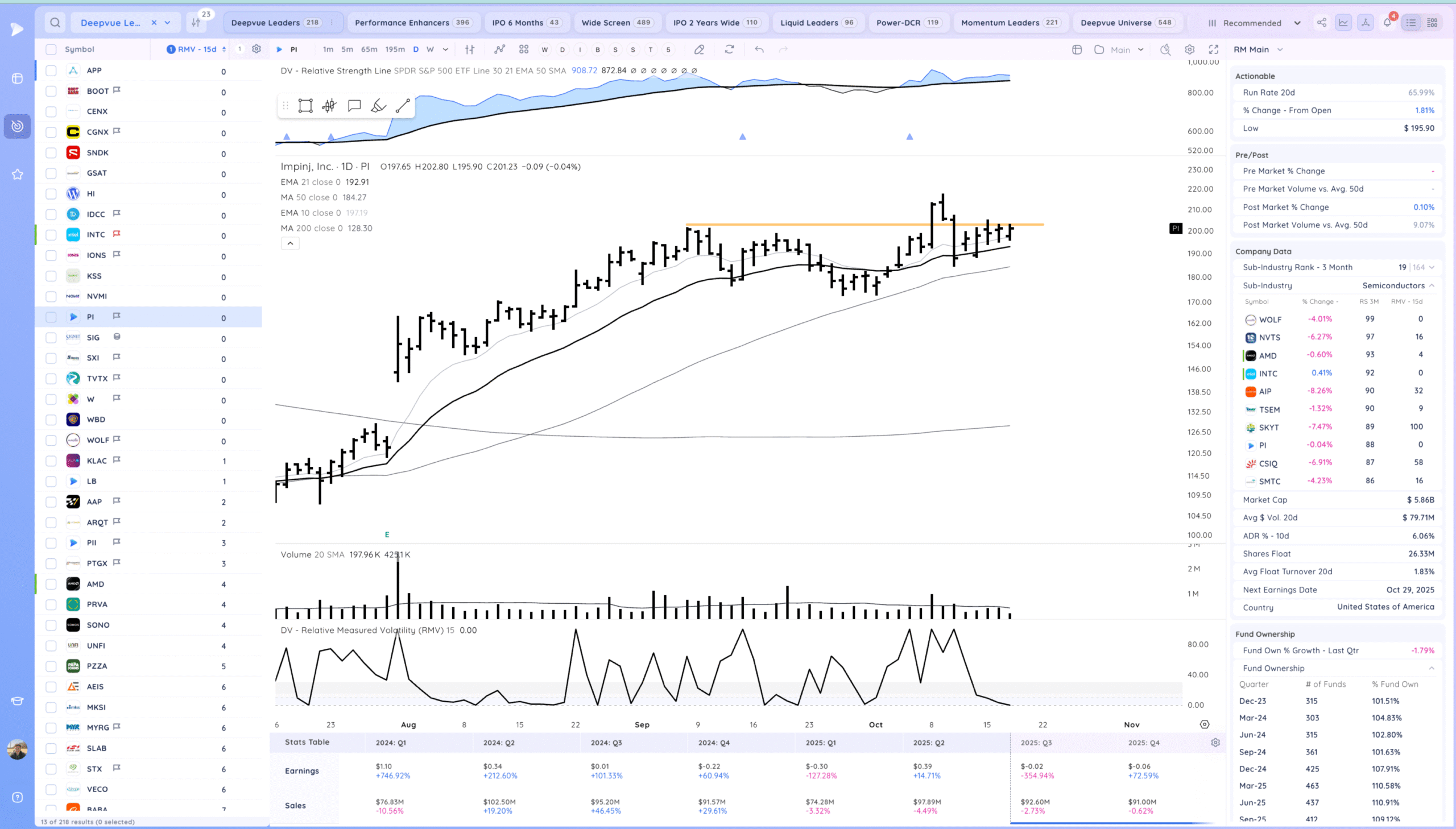

PI watching for a base breakout

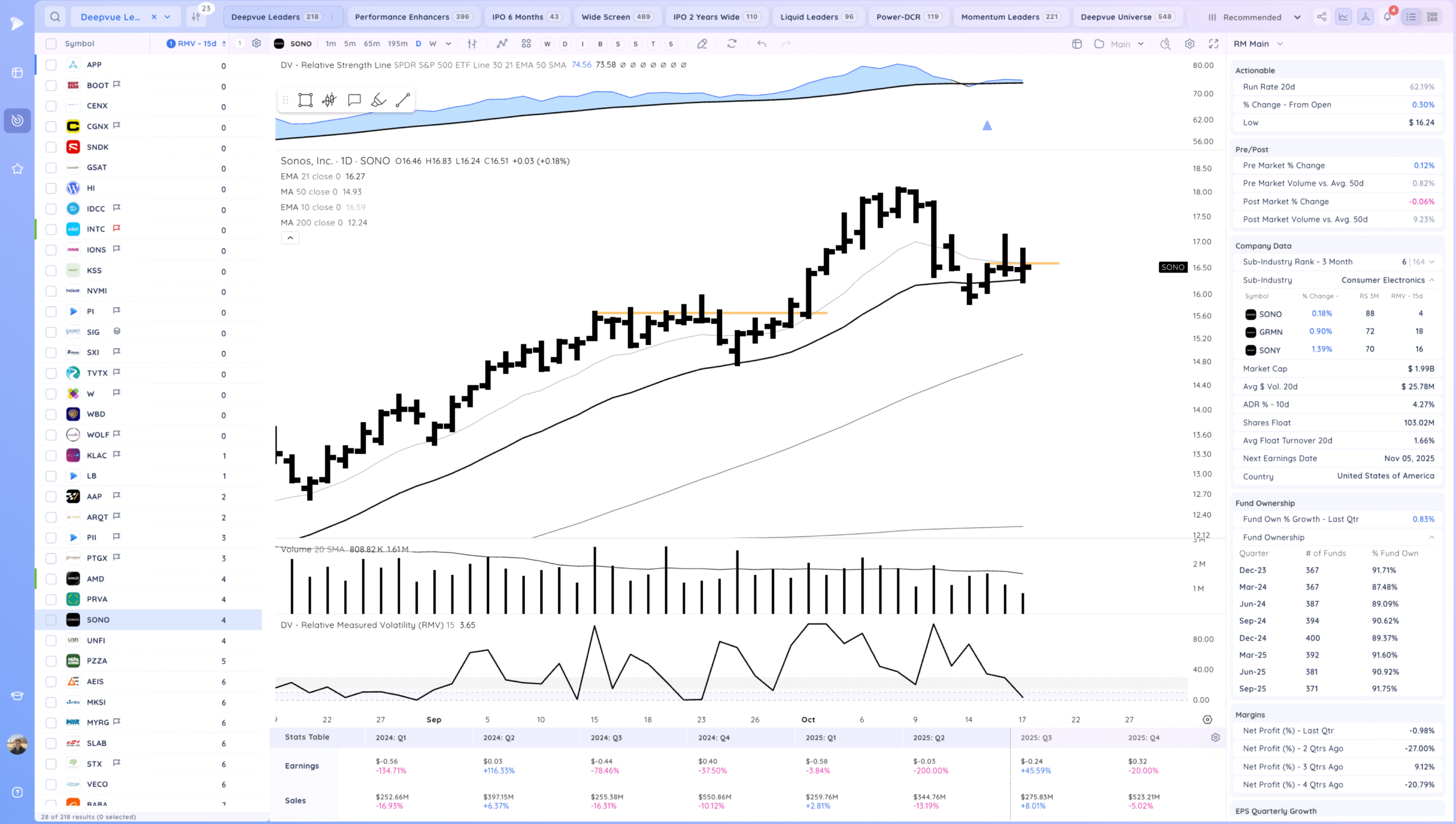

SONO watching for a range breakout. Fast mover

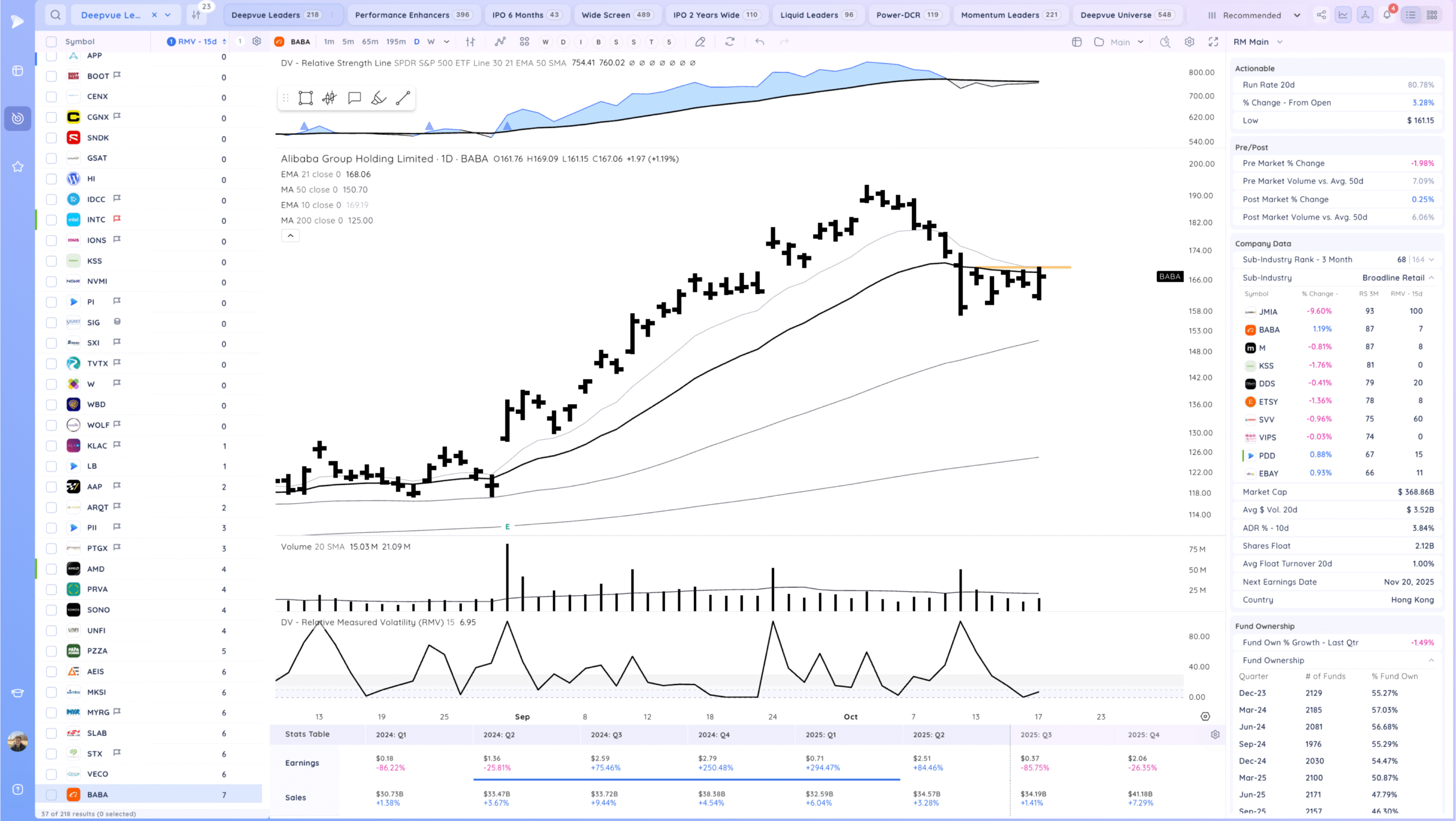

BABA oops reversal, watching for a range breakout. China theme

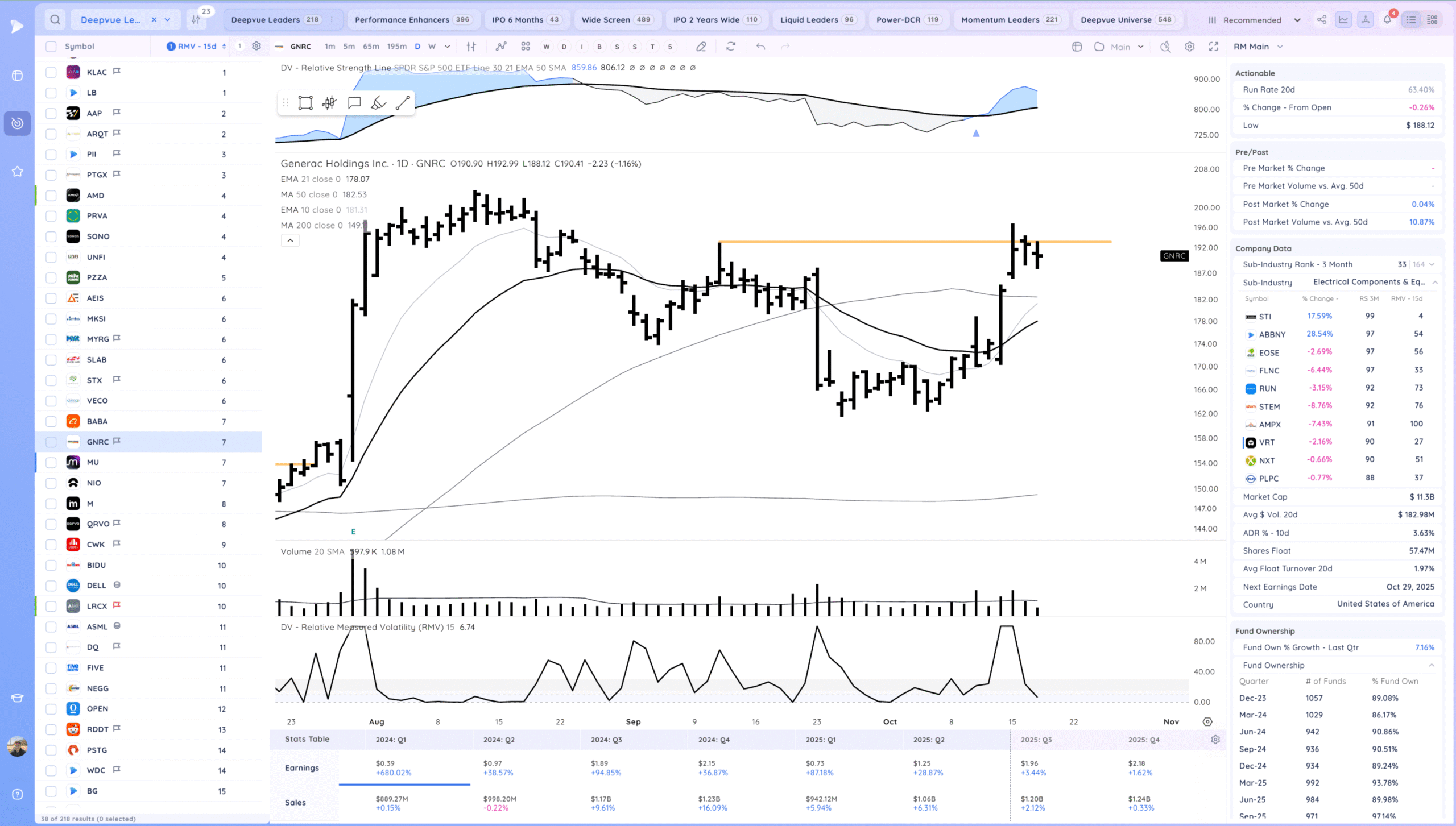

GNRC watching for a range breakout

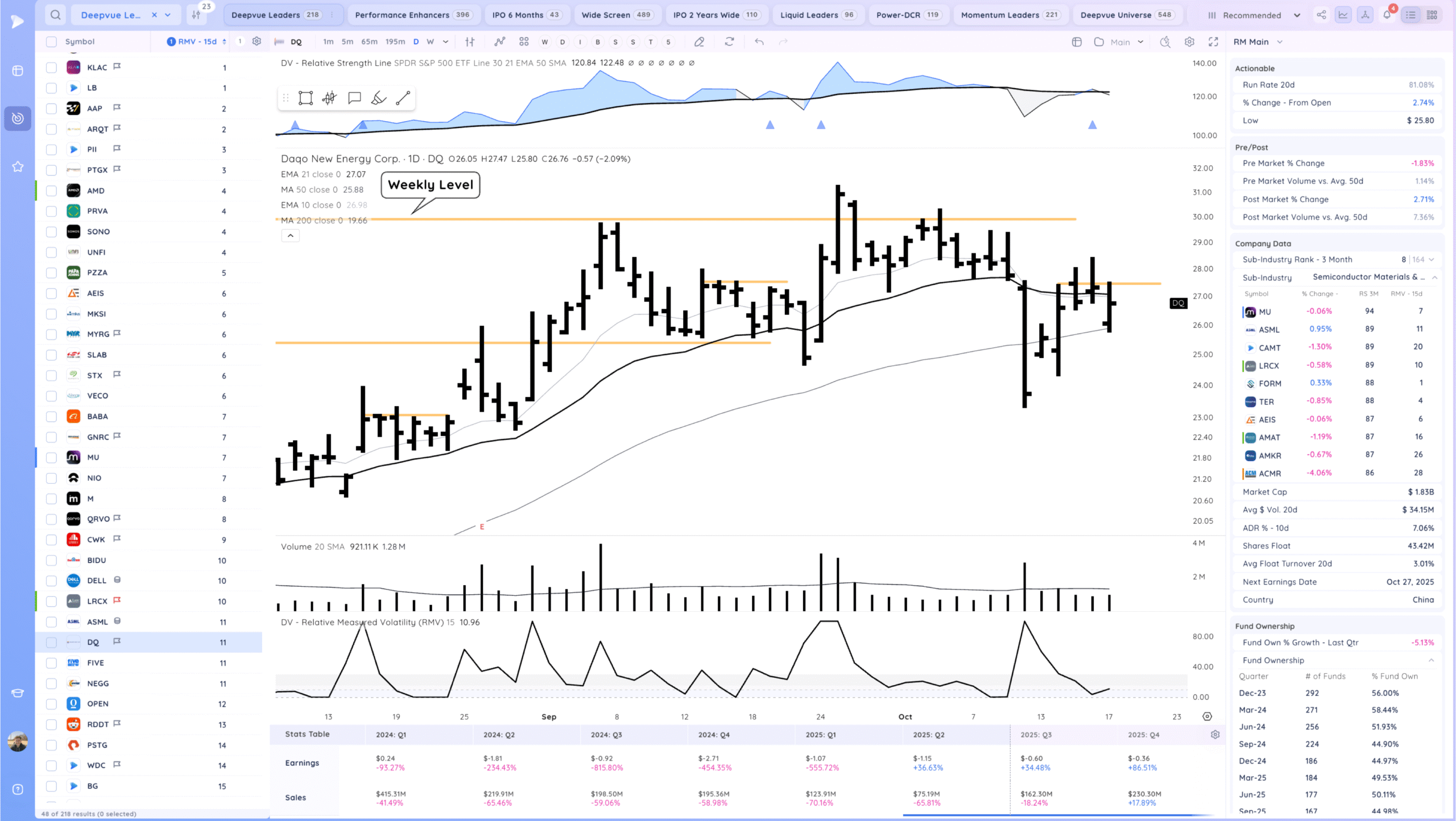

DQ watching for a range breakout, could tighten more. base near a weekly level.

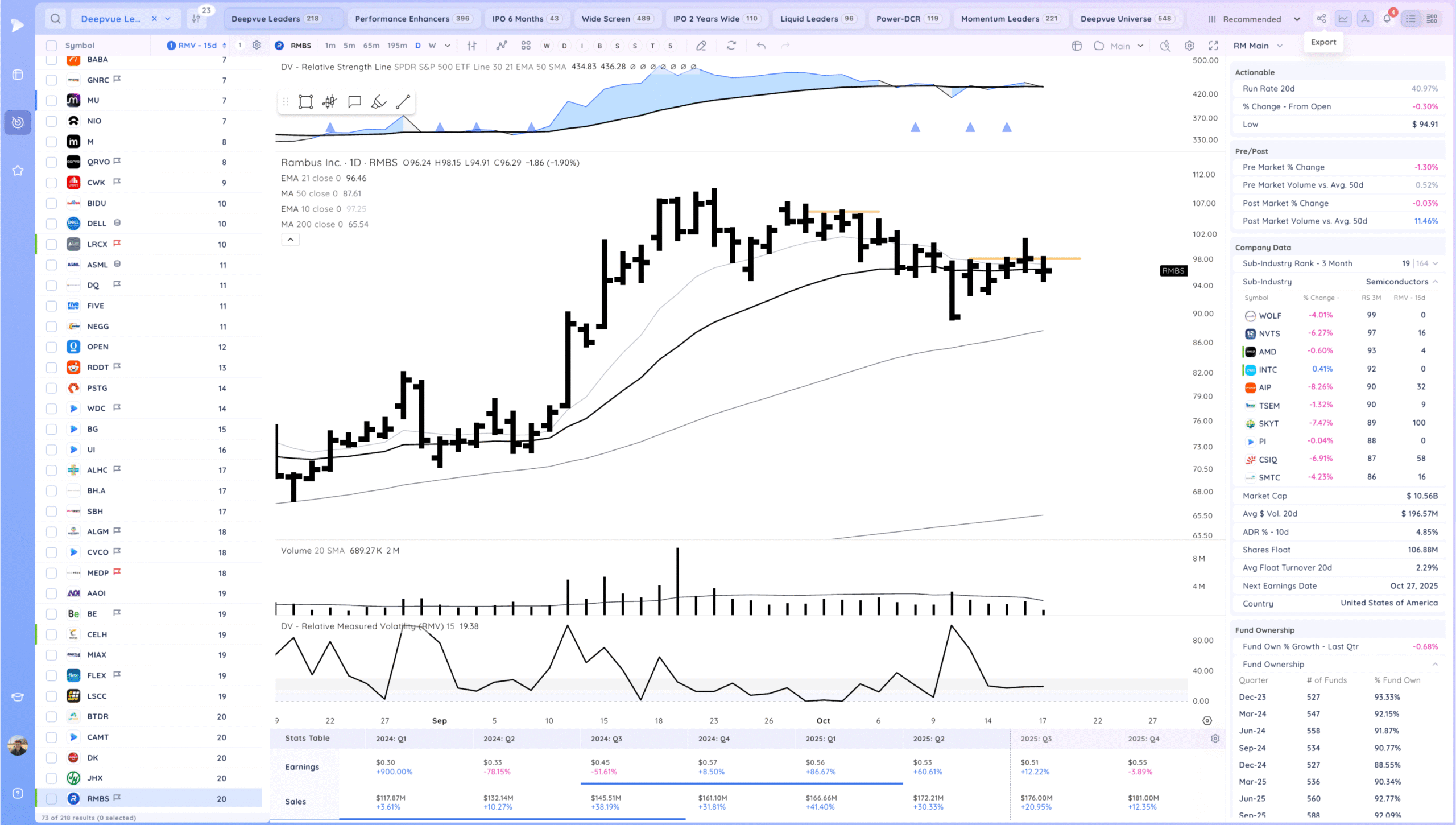

RMBS watching for a range breakout

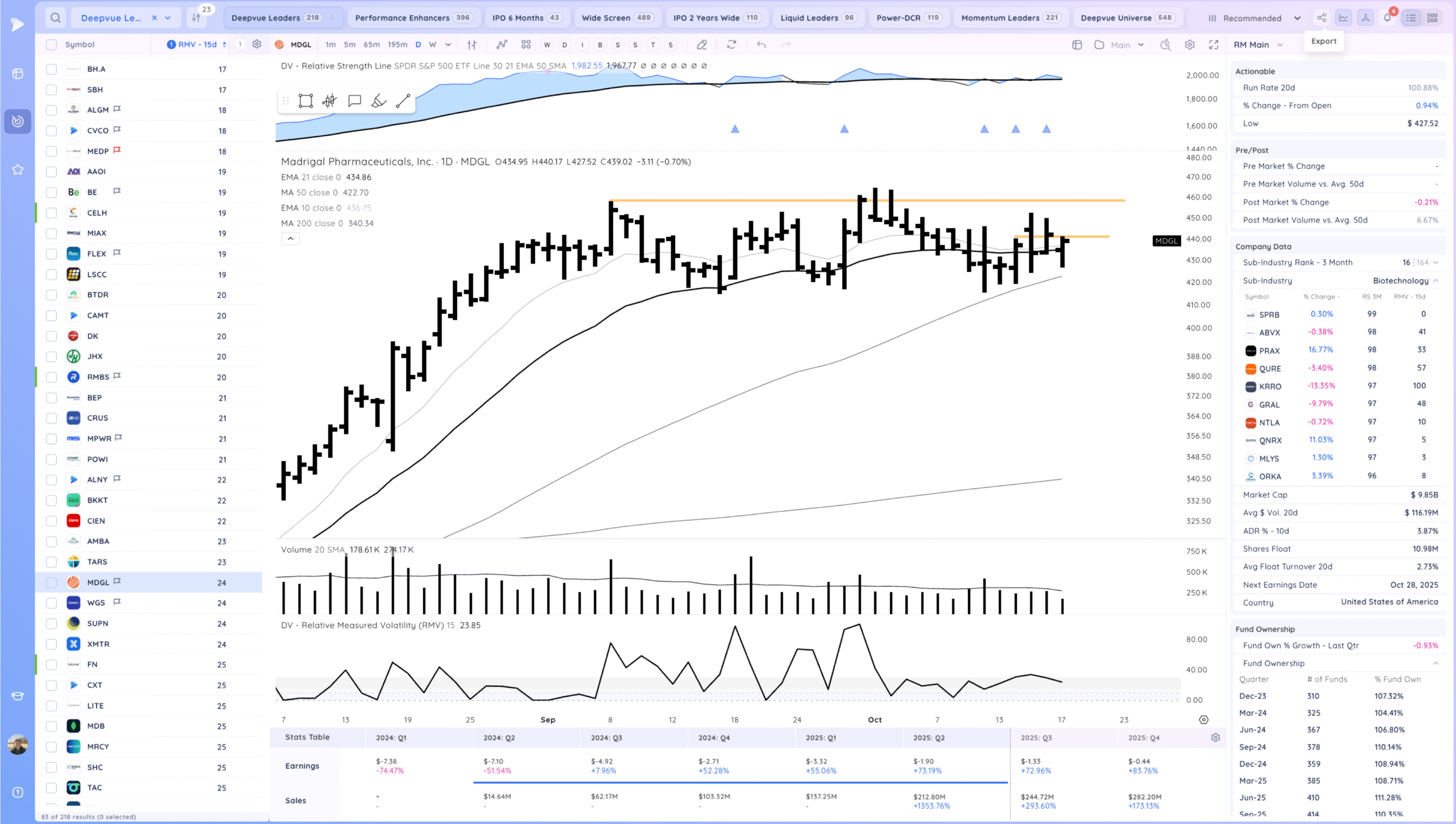

MDGL watching for a range breakout. Biotech

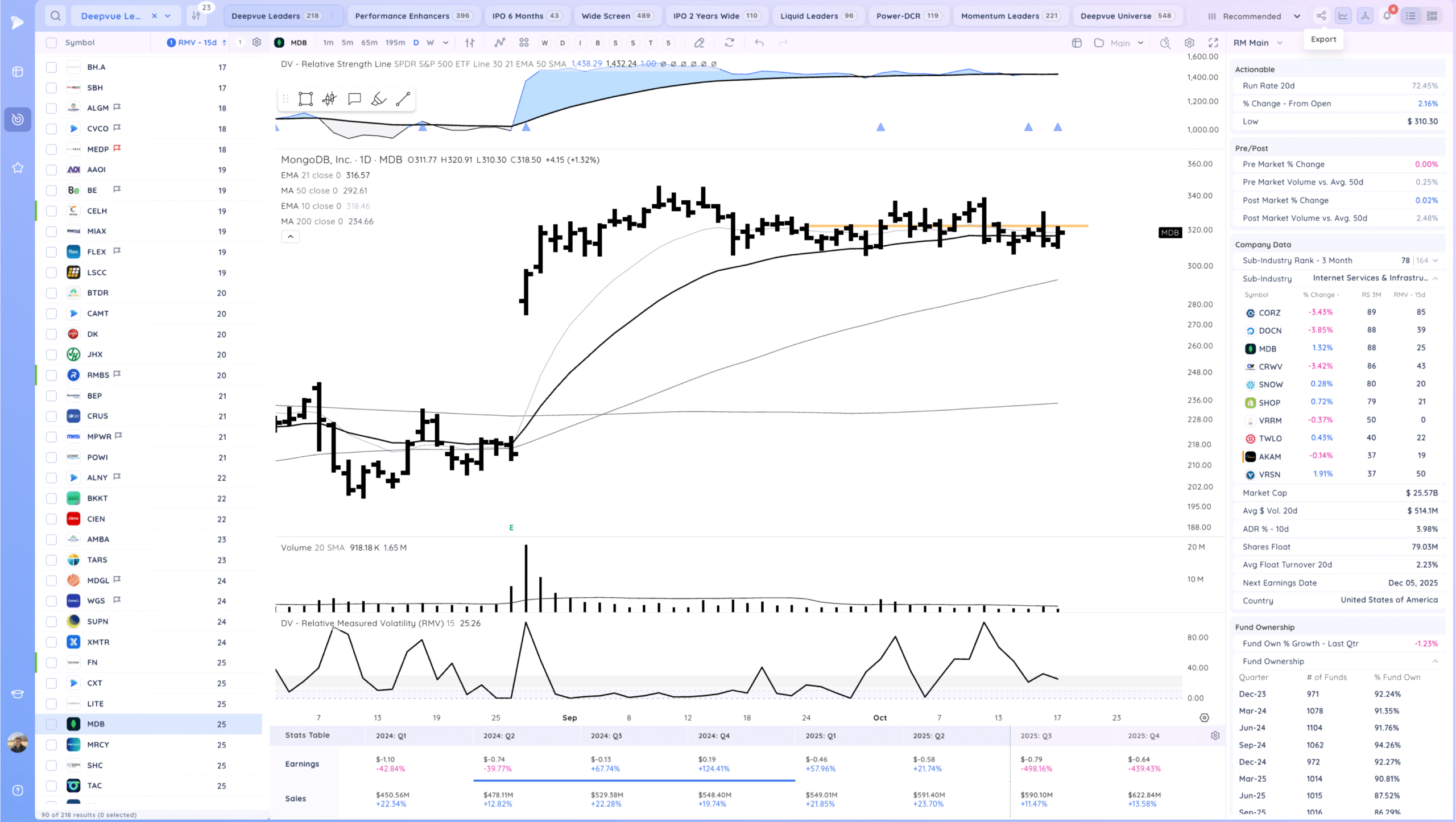

MDB watching for a range breakout

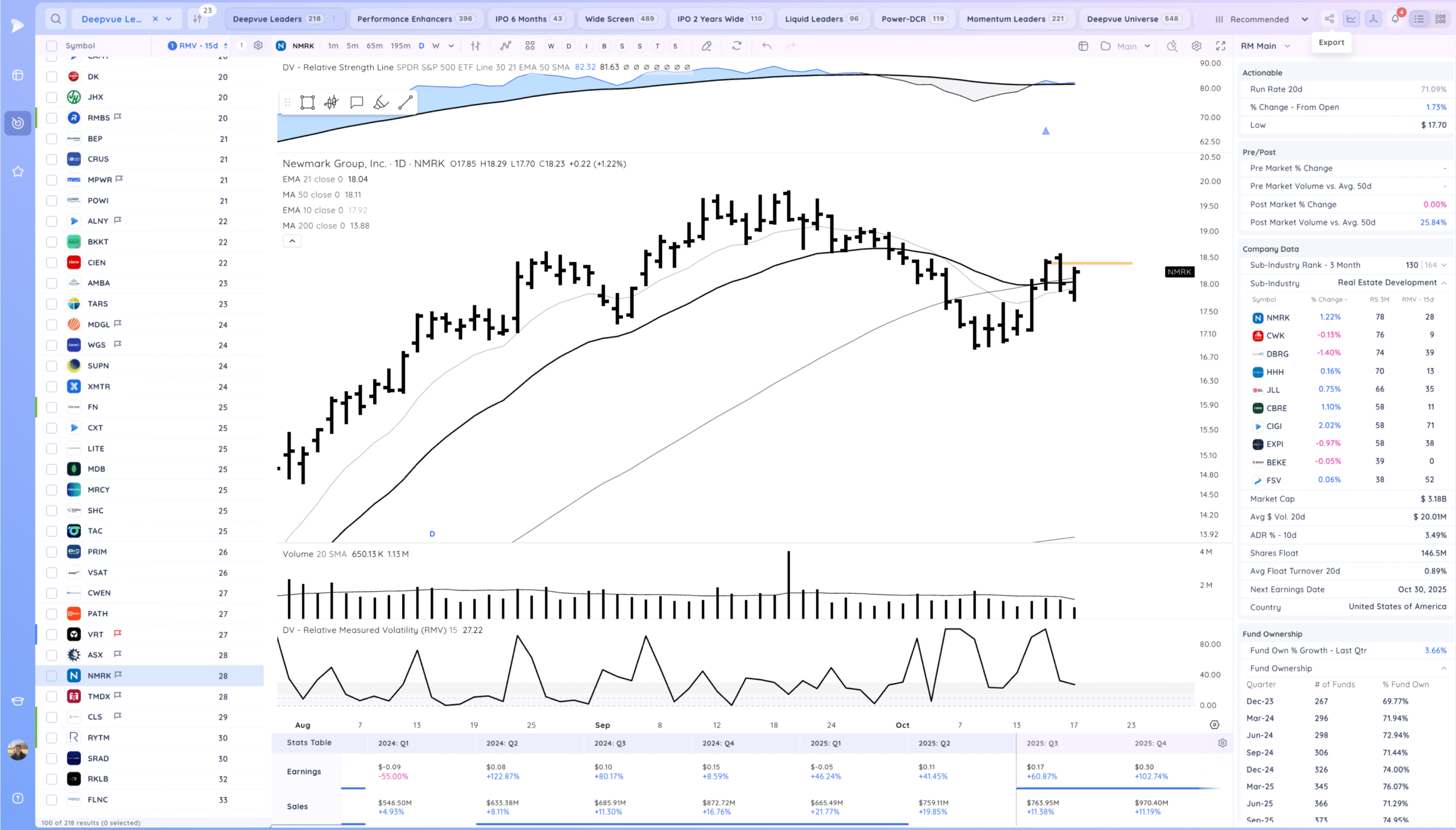

NMRK watching for a range breakout. Real estate theme

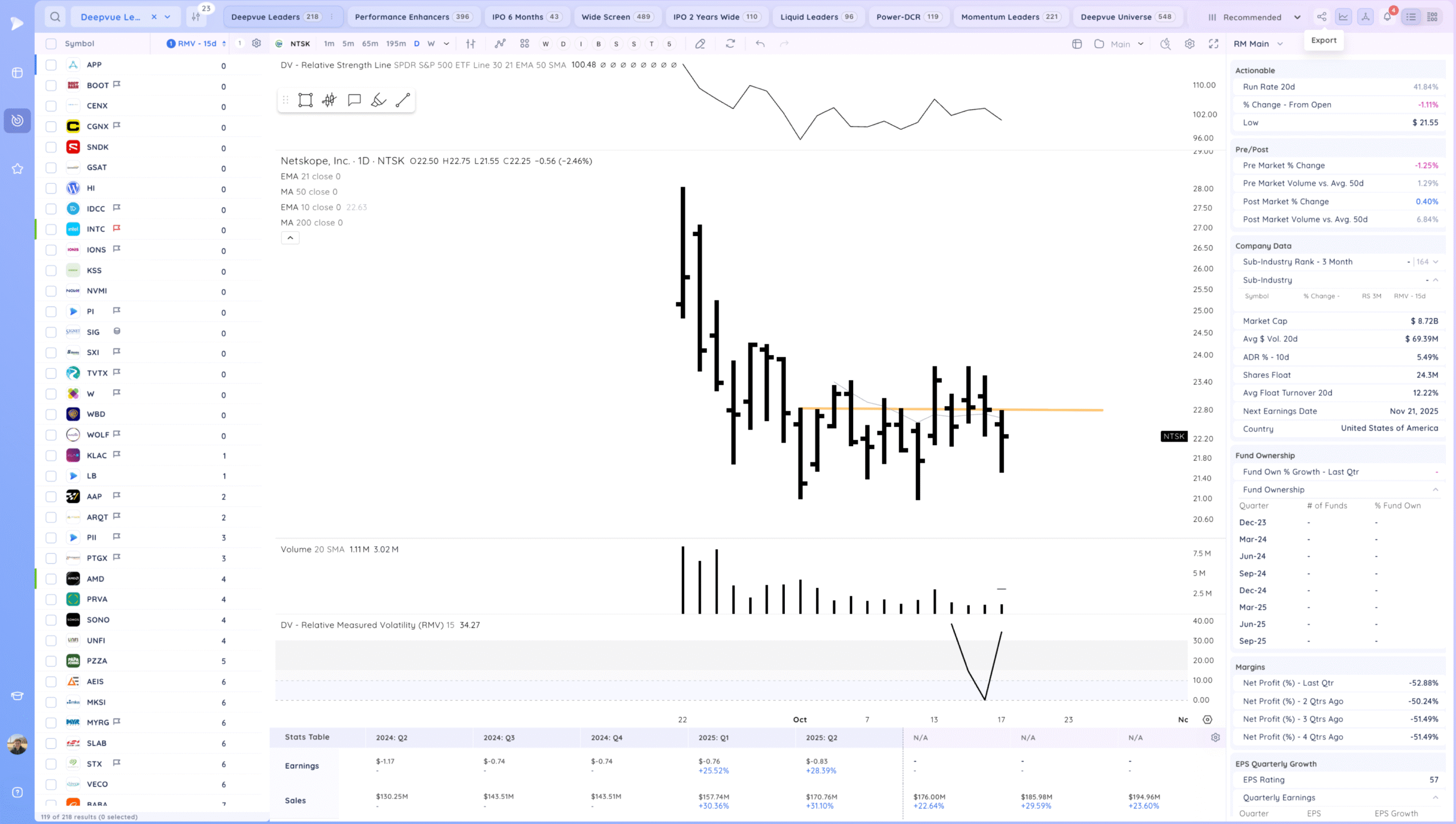

NTSK watching for follow through up

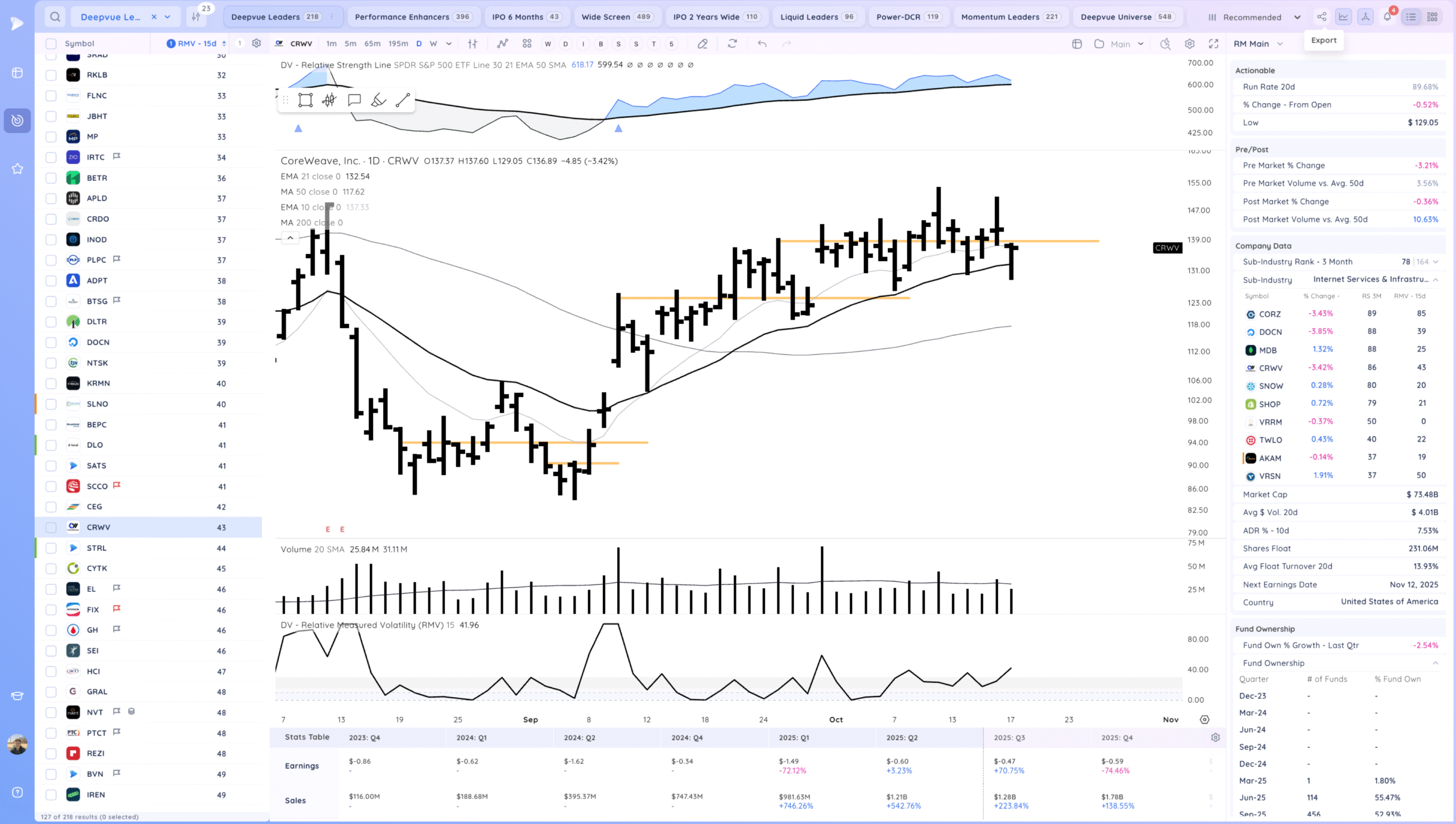

CRWV has been choppy. Watching for follow through up

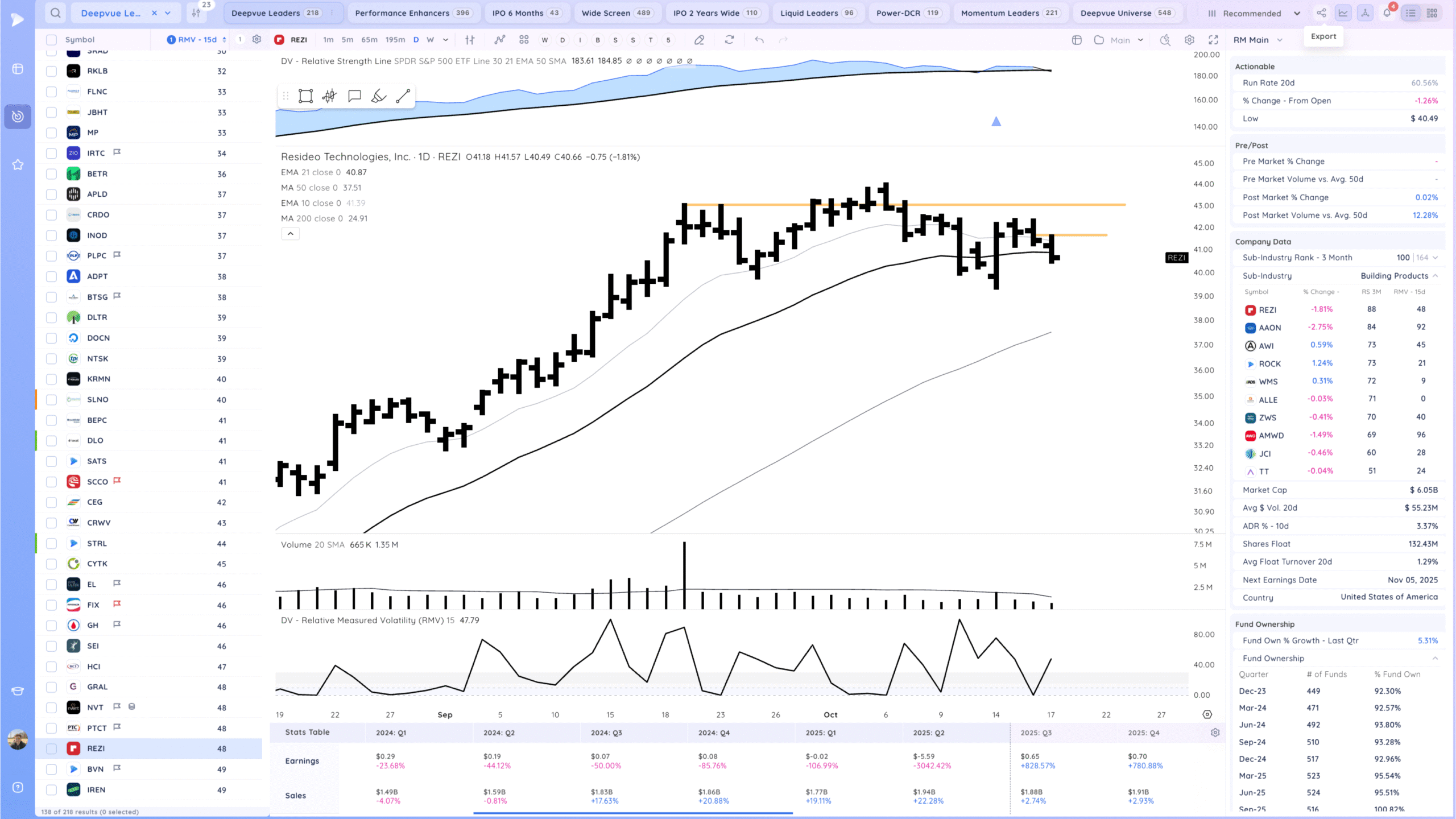

REZI watching for a 21ema reclaim and range breakout

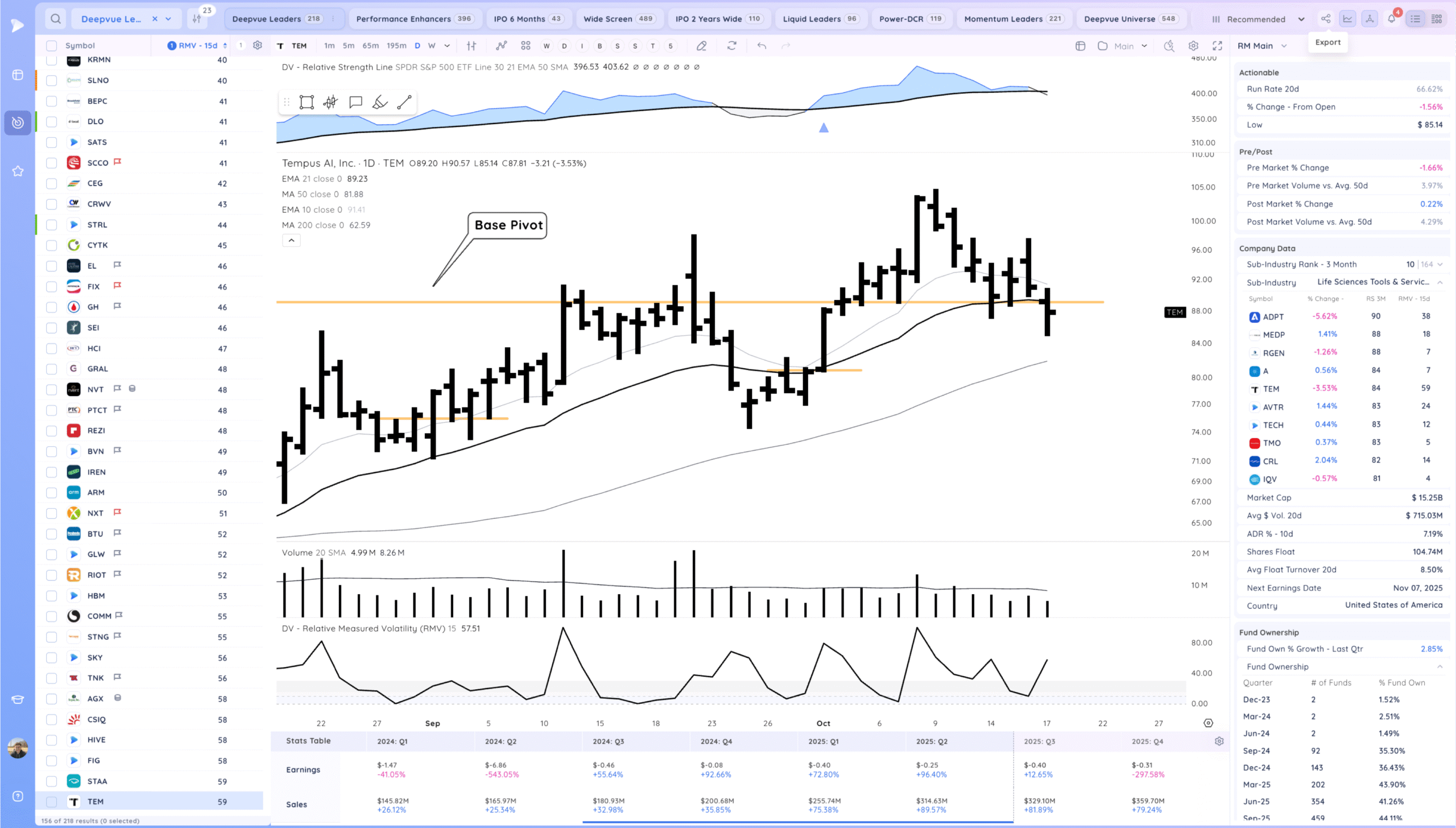

TEM watching for a base pivot reclaim. this name you want to more buy on pullbacks and weakness.

Today’s Watchlist in List form

Focus List Names

PI SONO BABA GNRC DQ RMBS MDGL MDB NMRK NTSK CRWV REZI TEM TSLA NVDA PLTR

Focus:

TSLA NVDA NMRK PLTR

Themes

AI, AI Energy, rare metals, biotech. Gold names took a hit today especially with GLD reversal

Additional Thoughts

Inside week and and inside day to end it. Expecting short term direction to be revealed next week. Earnings season is upon us which can ignite new themes and momentum, or if we see a lot of gaps downs, reveal the risk appetite. If the market resumes higher there are more names than I expected to focus on early next week.

Anything can happen, Day by Day – Managing risk along the way