Gap up, Chop

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 15, 2025

Market Action

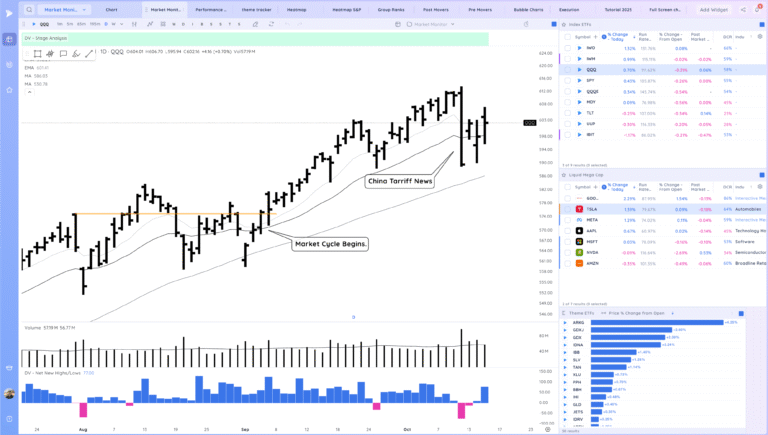

QQQ – Gap up and volatile day but with a decent close. The sell bar last Friday still gives me pause. Bars like that typically precede choppy/corrective periods. However we reclaimed the 21ema.

Bulls want to see us hold above the 21ema at week end and continue trending

Bears want to see us reconfirm down, likely with additional negative news catalysts.

Daily Chart of the QQQ.

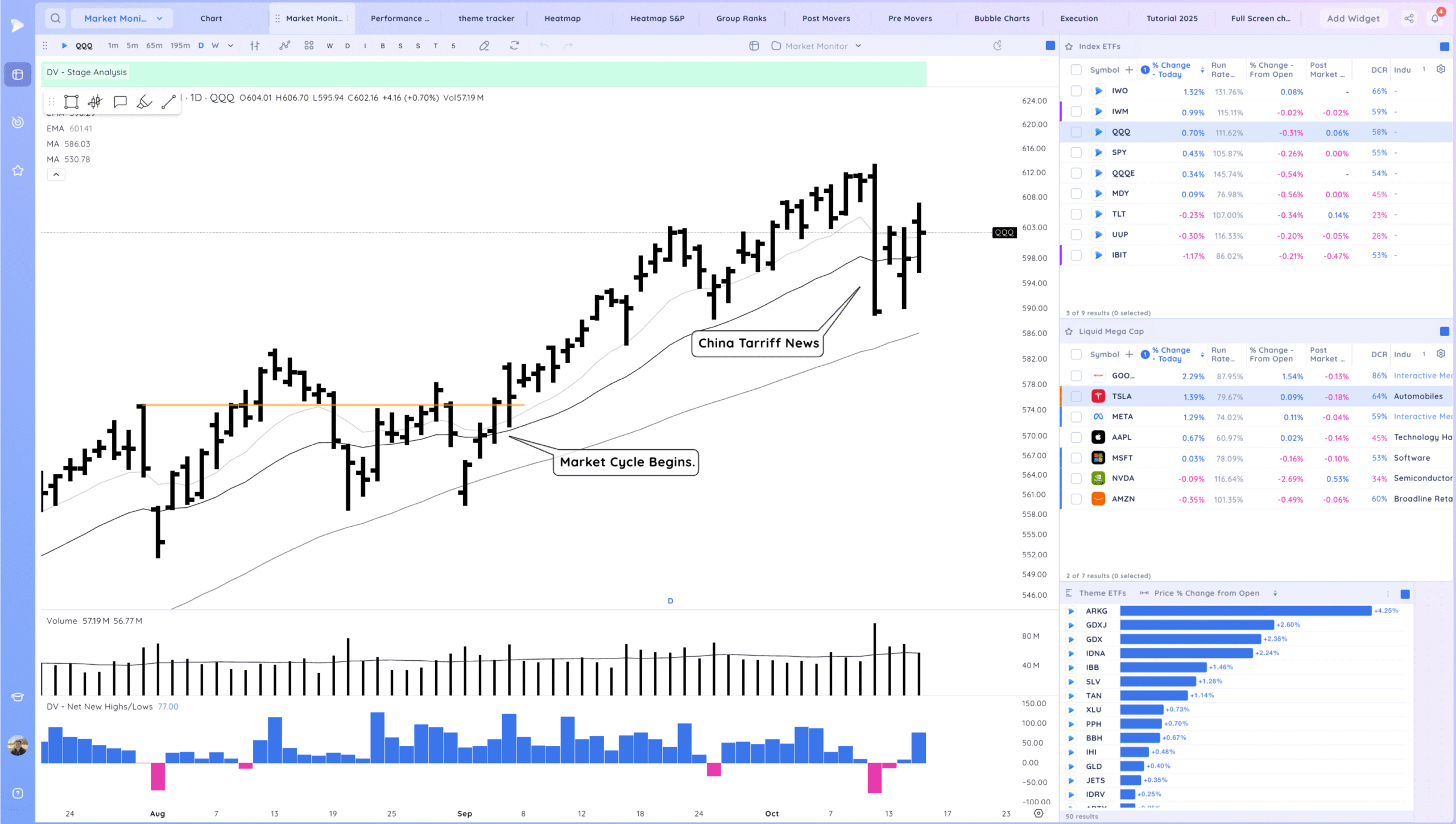

IWM – Follow through higher

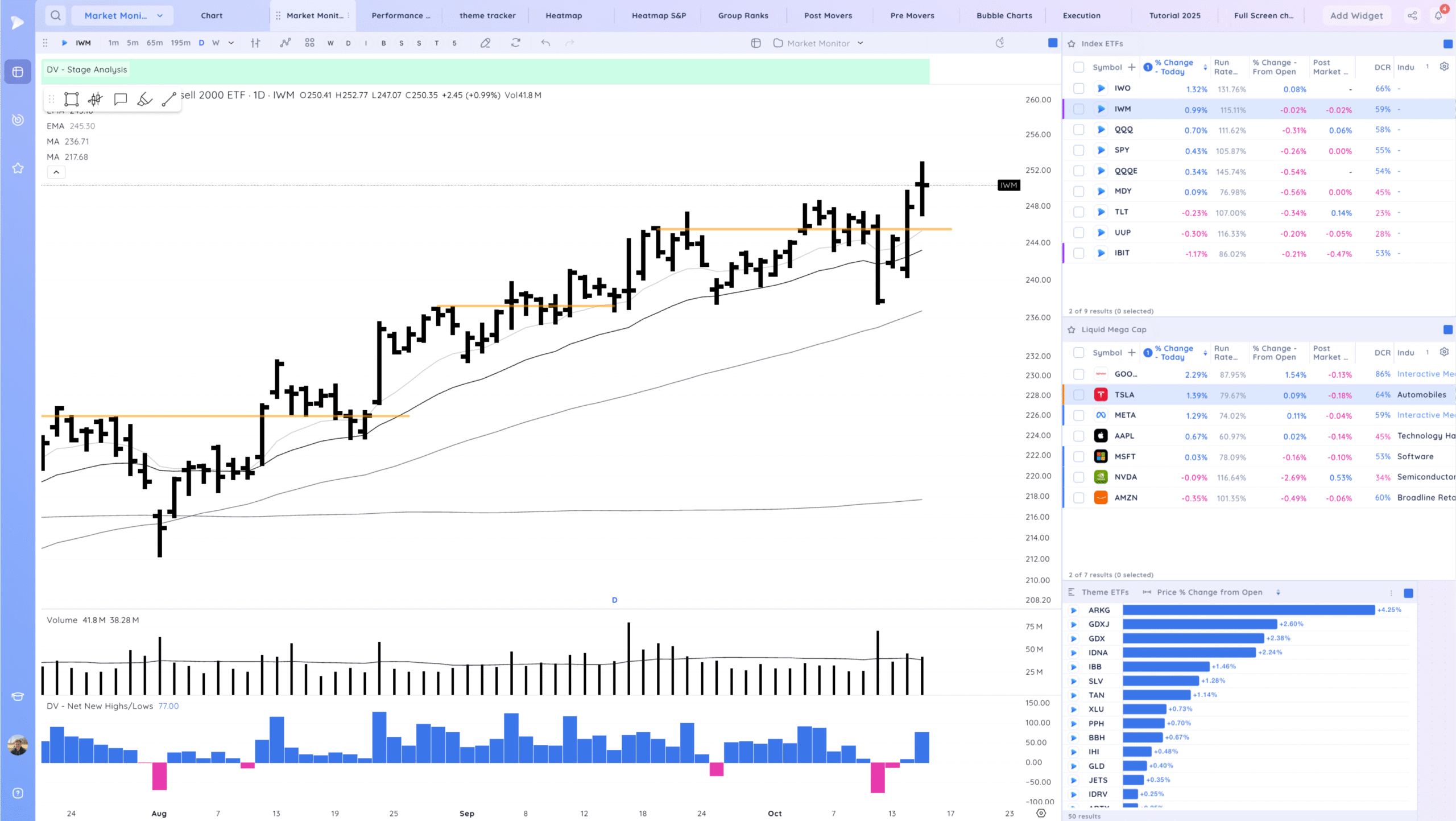

IBIT – Inside day. Still in this sharp drop.

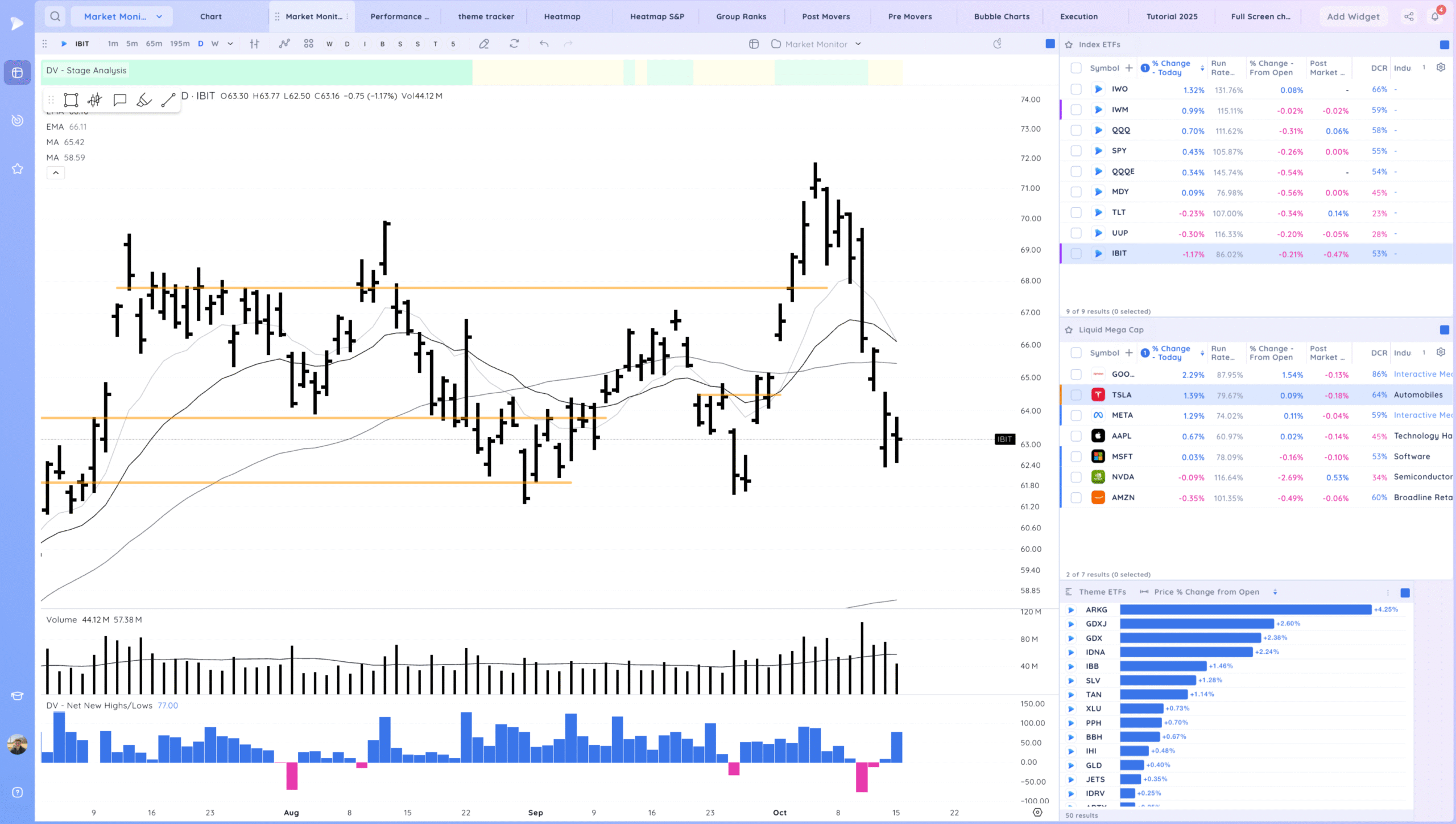

Trends (3/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

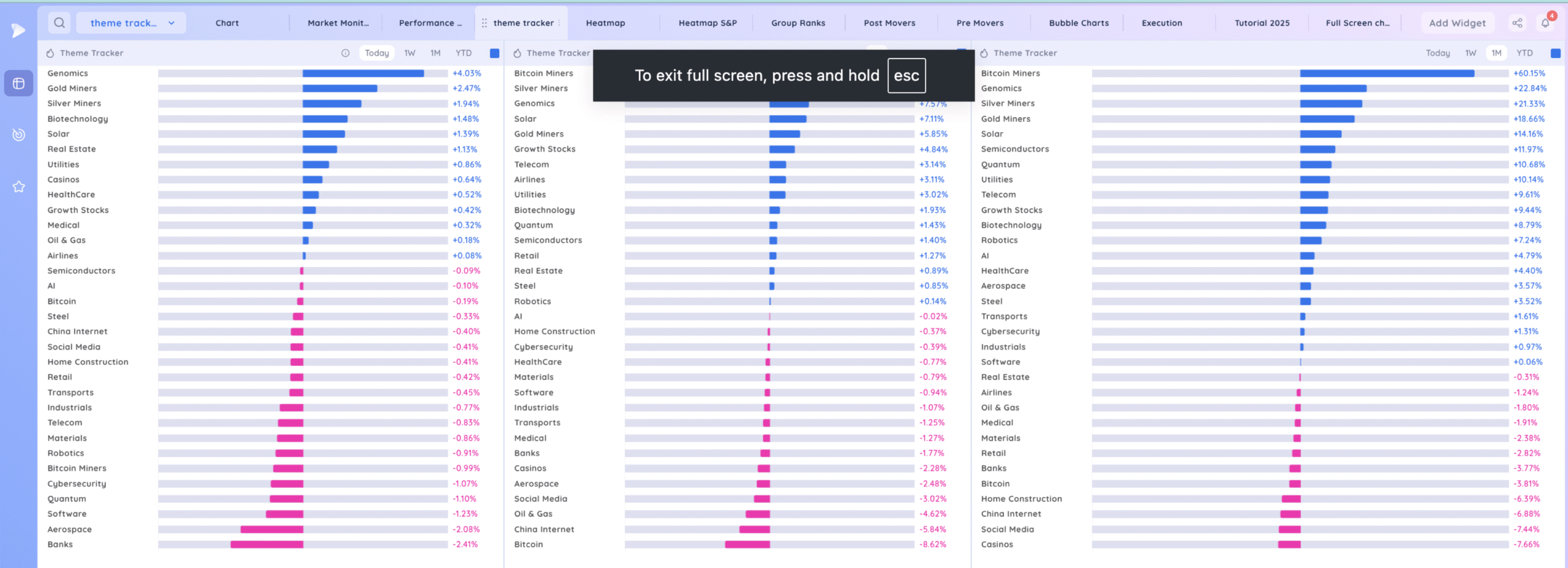

Deepvue Theme Tracker

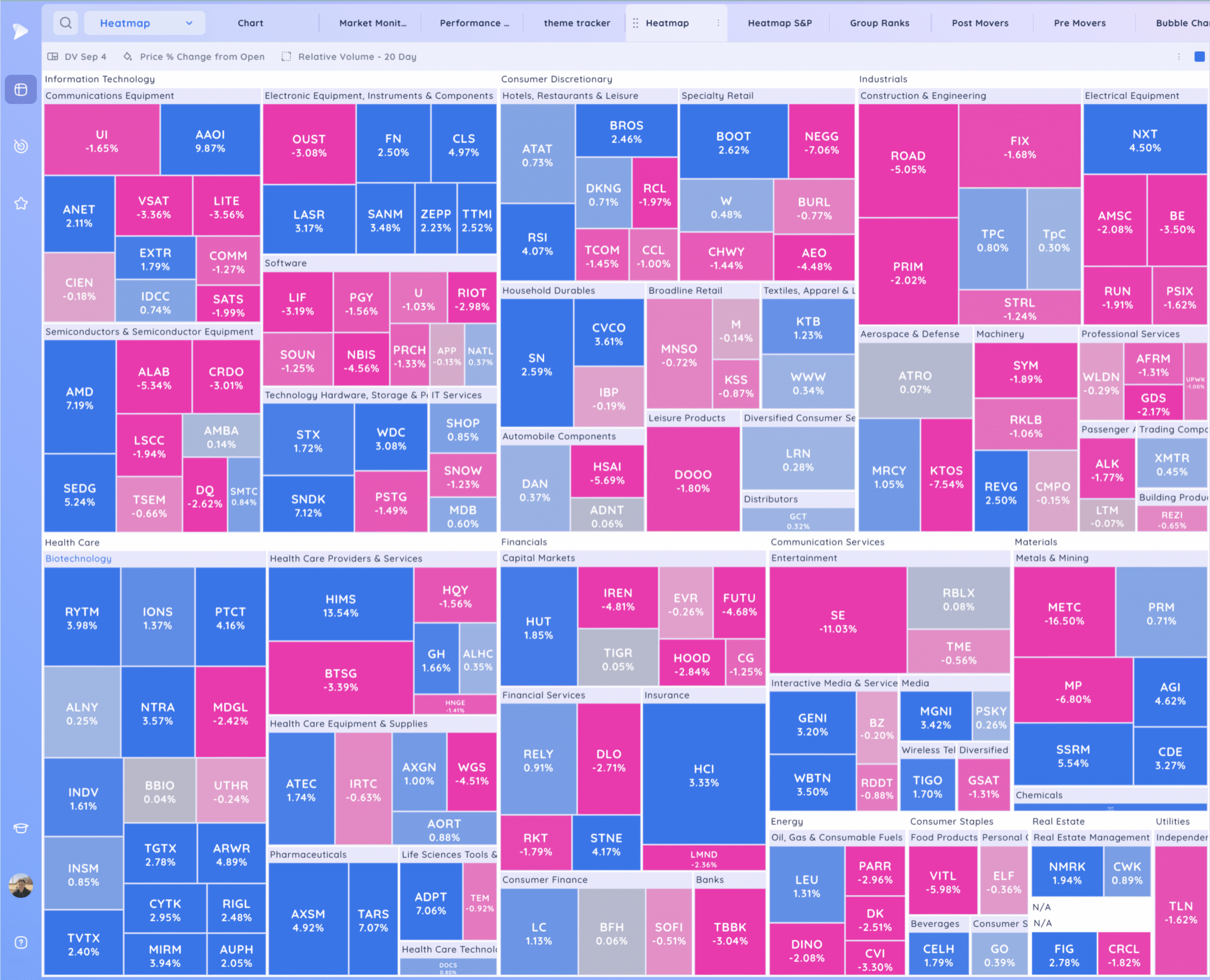

Deepvue Leaders

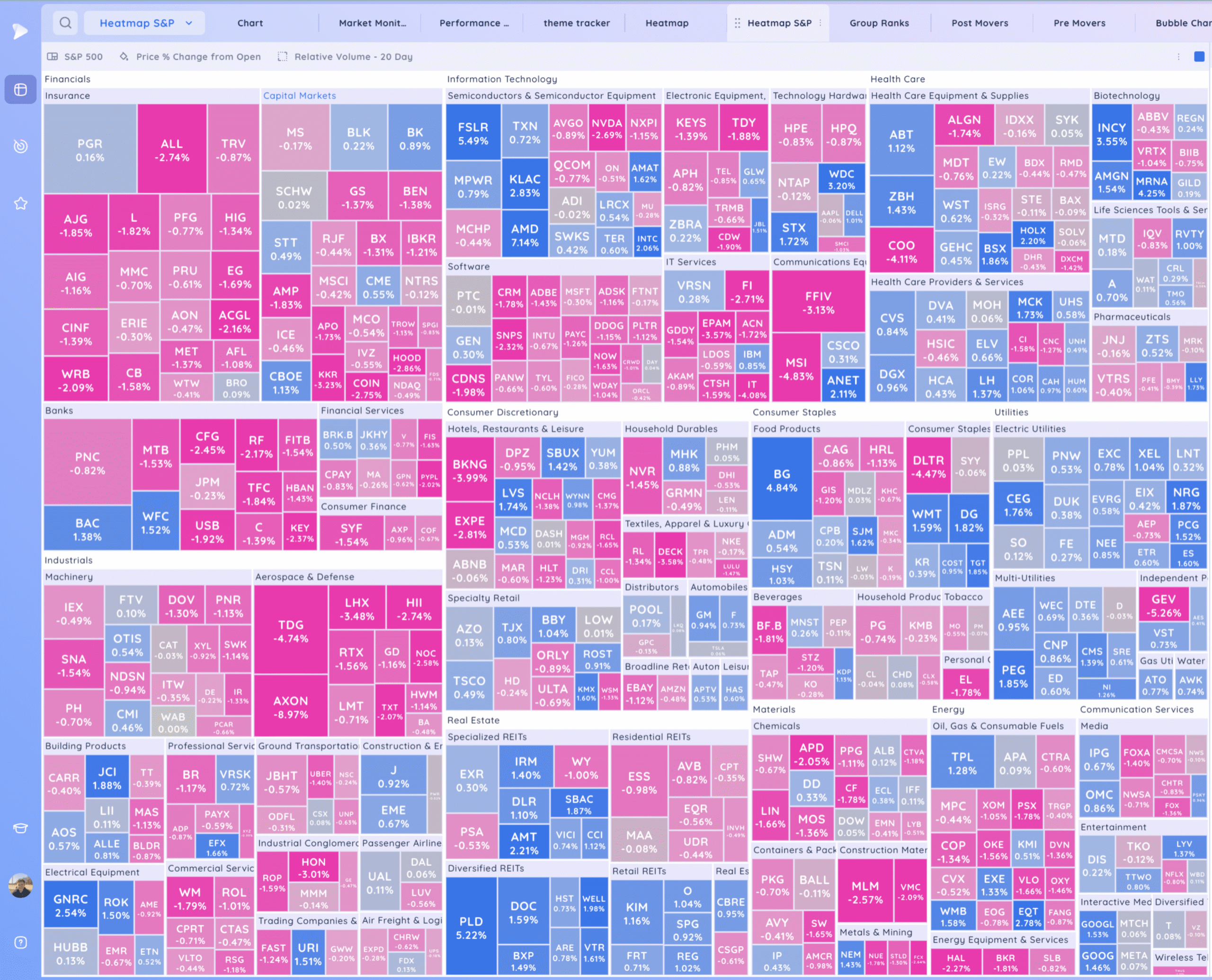

S&P 500.

Leadership Stocks & Analysis

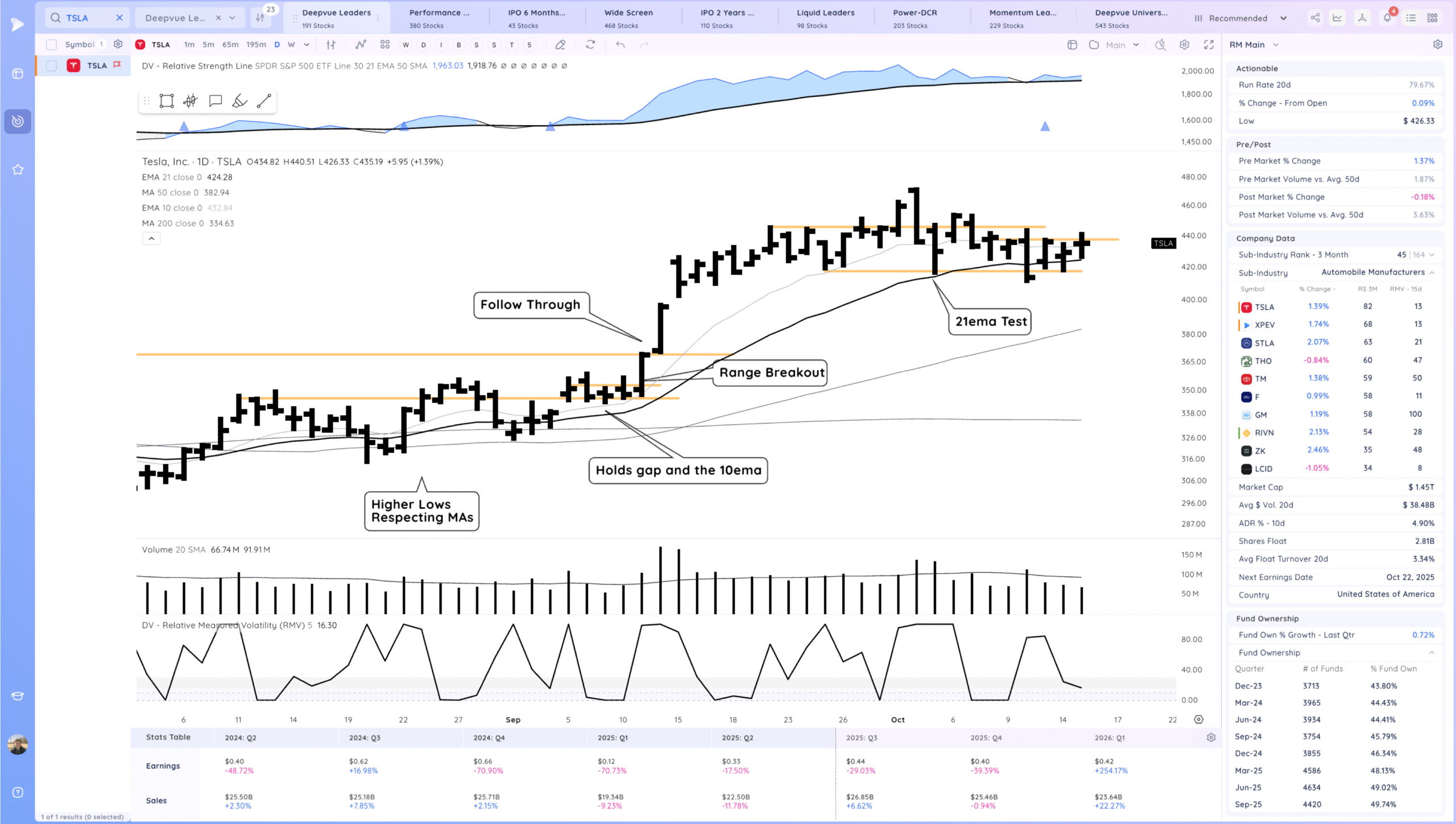

TSLA – tight upside reversal at the range pivot. Watching for a range breakout

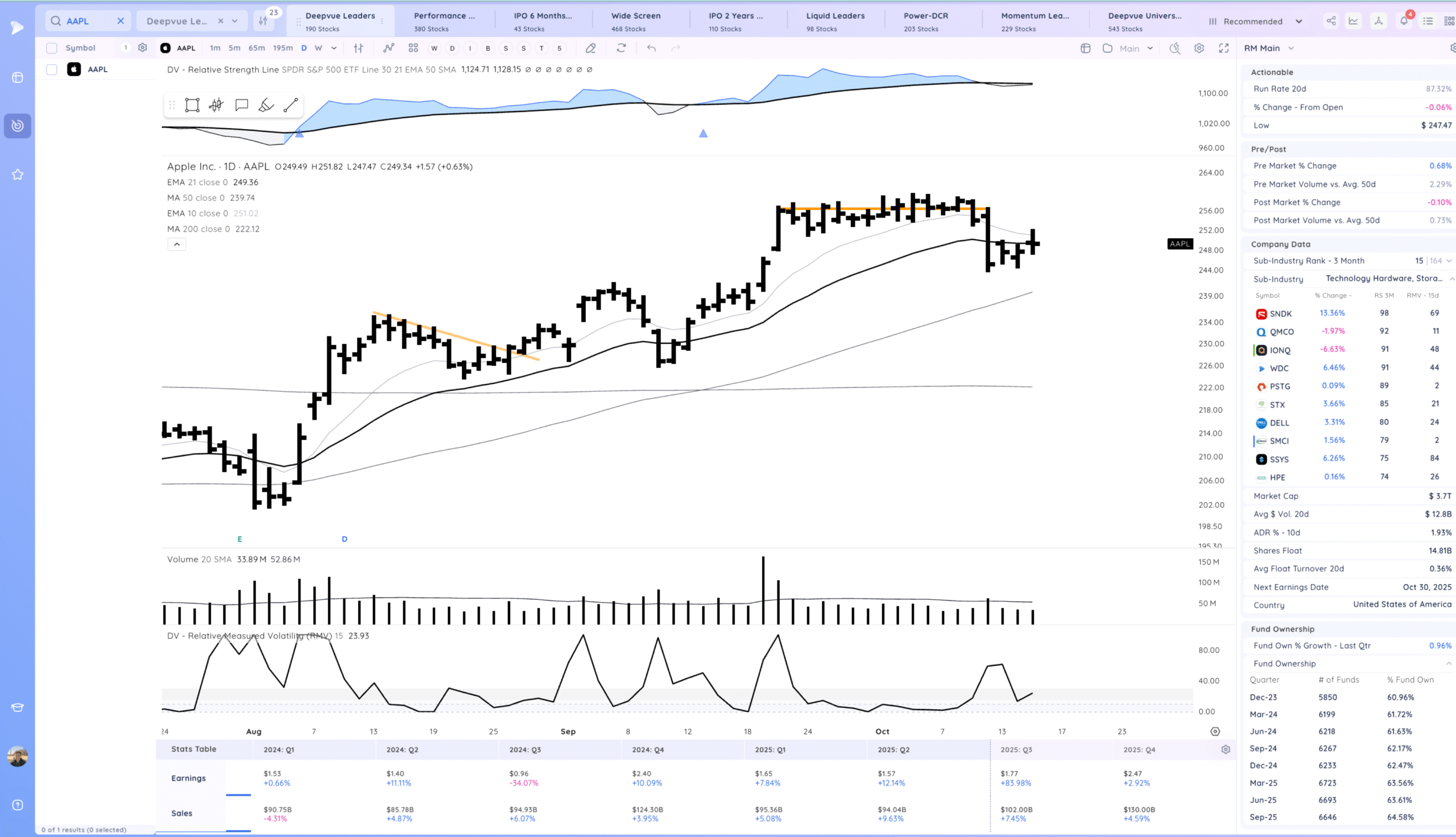

AAPL slight fade at the MAs

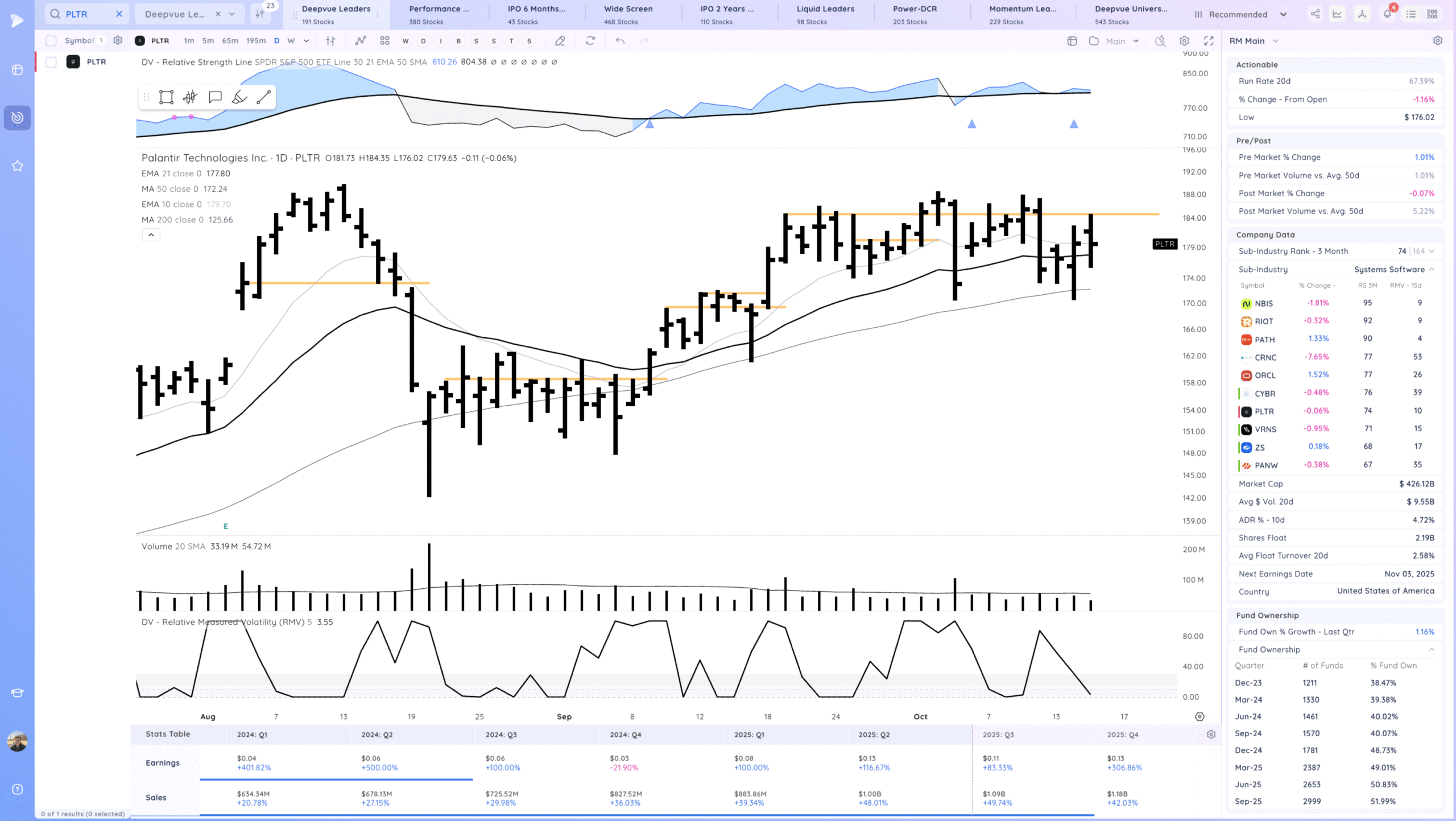

PLTR still choppy here in this consolidation. Watching for a breakout.

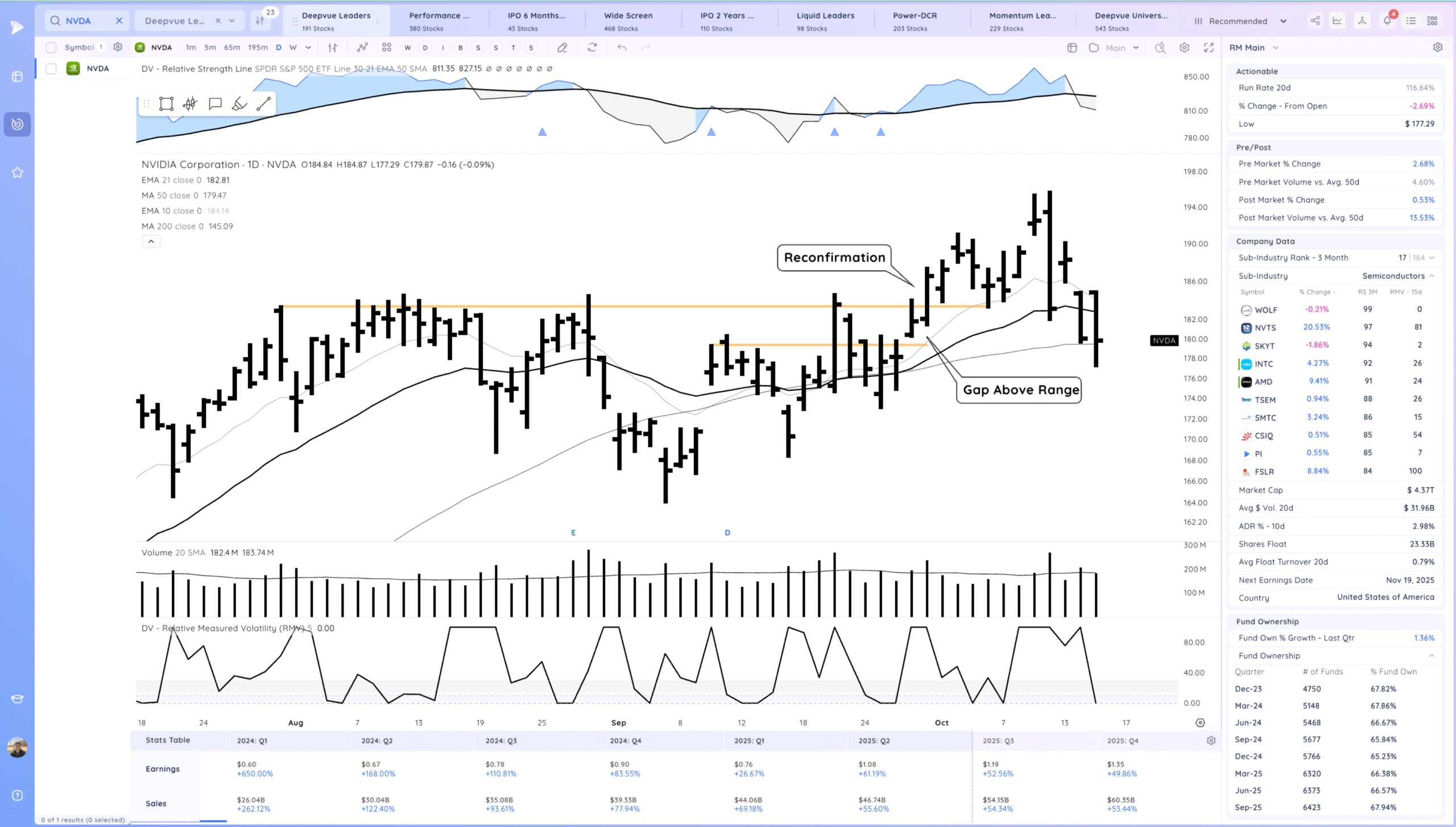

NVDA Negative action after the gap up. However if it can’t follow through down under the 50sma that will be a positive tell.

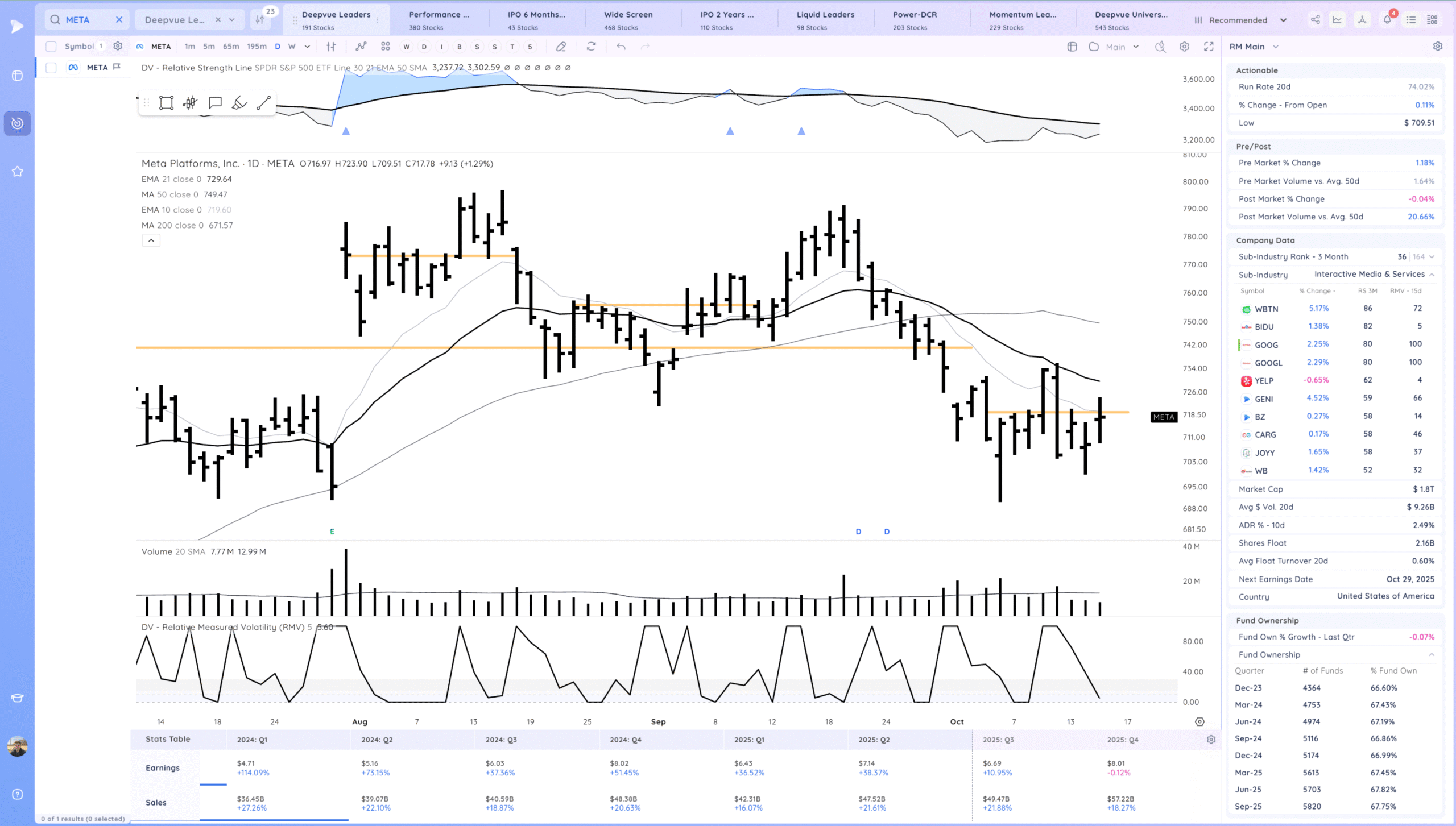

META Make it or break it moment for meta.

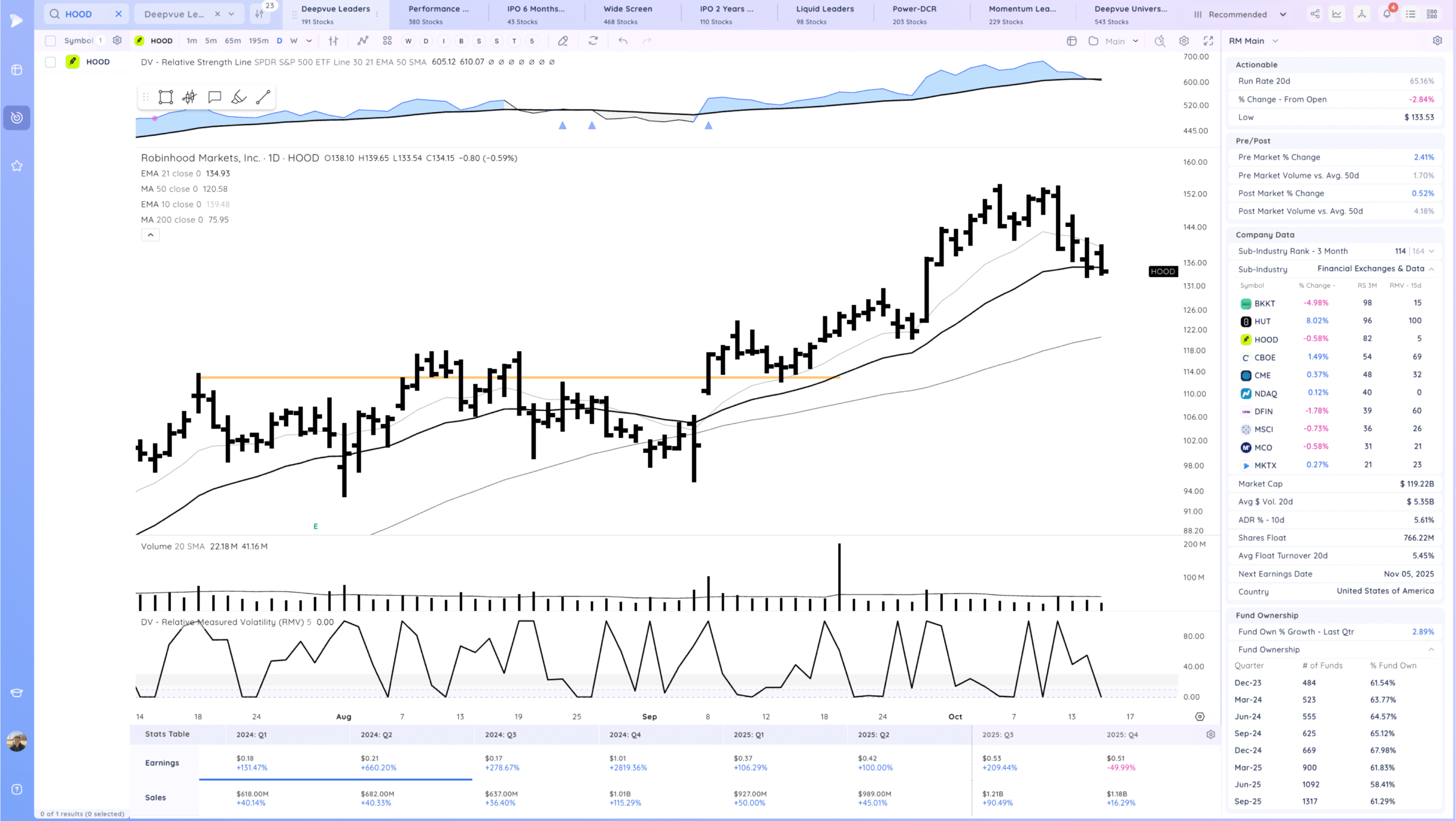

HOOD inside day but with a poor close on the 21ema. Key level

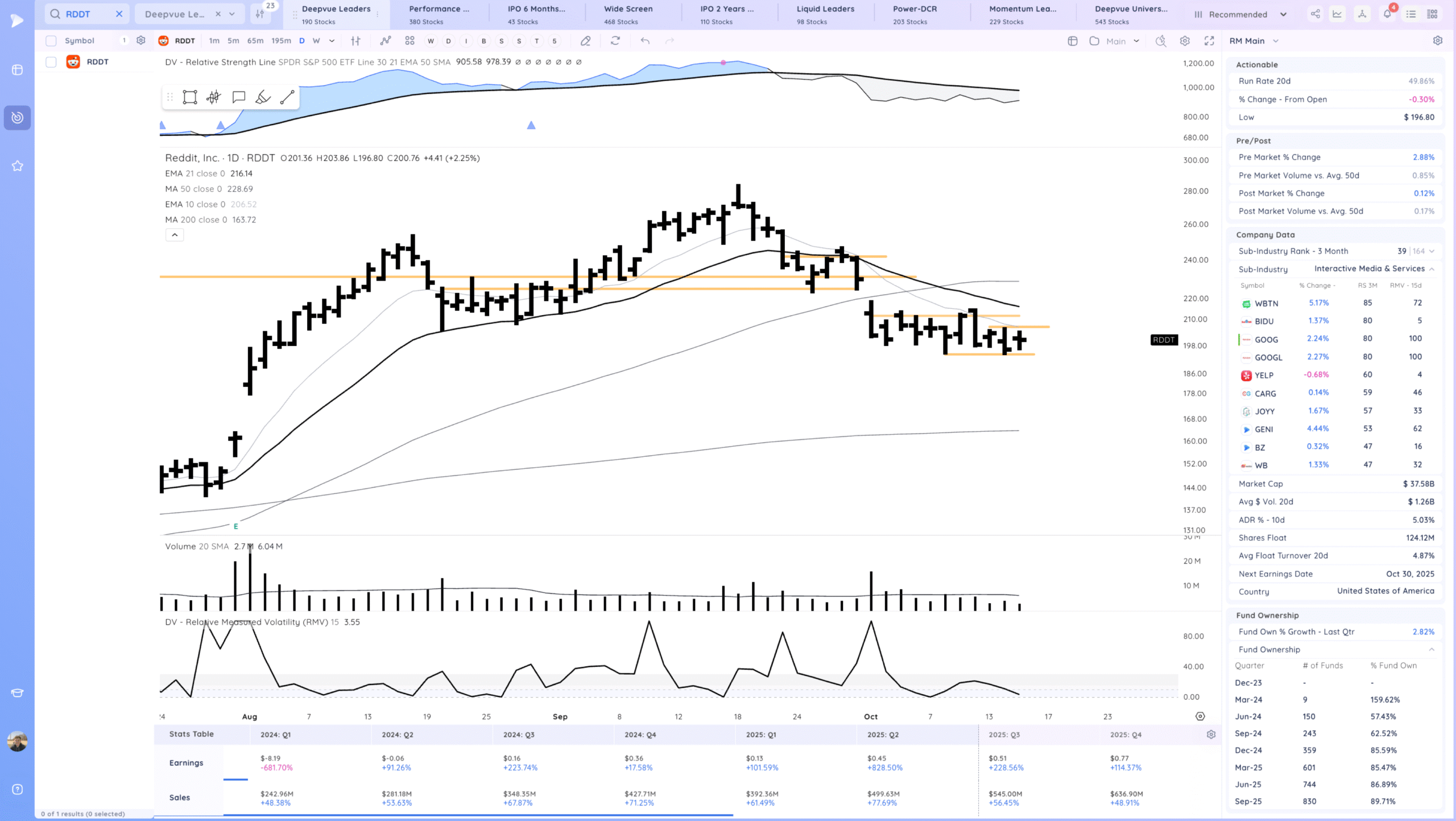

RDDT still in this range but looking vulnerable unless it can hold here. Unfilled gap above and in a downcycle. Expecting expansion tomorrow

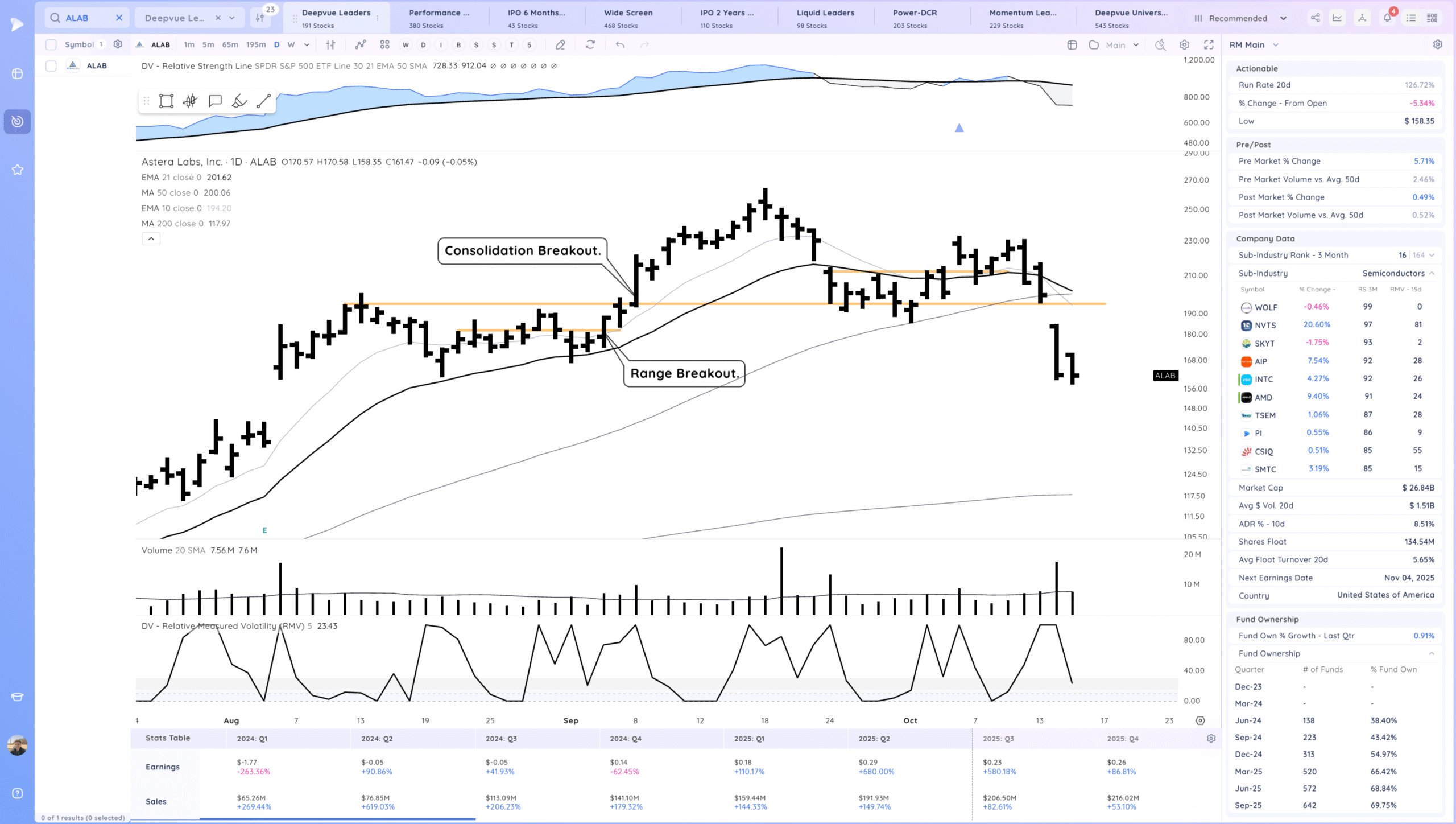

ALAB gap up but sold. So far not much progress down versus yesterday. Below all the MAs and in a downcycle for now.

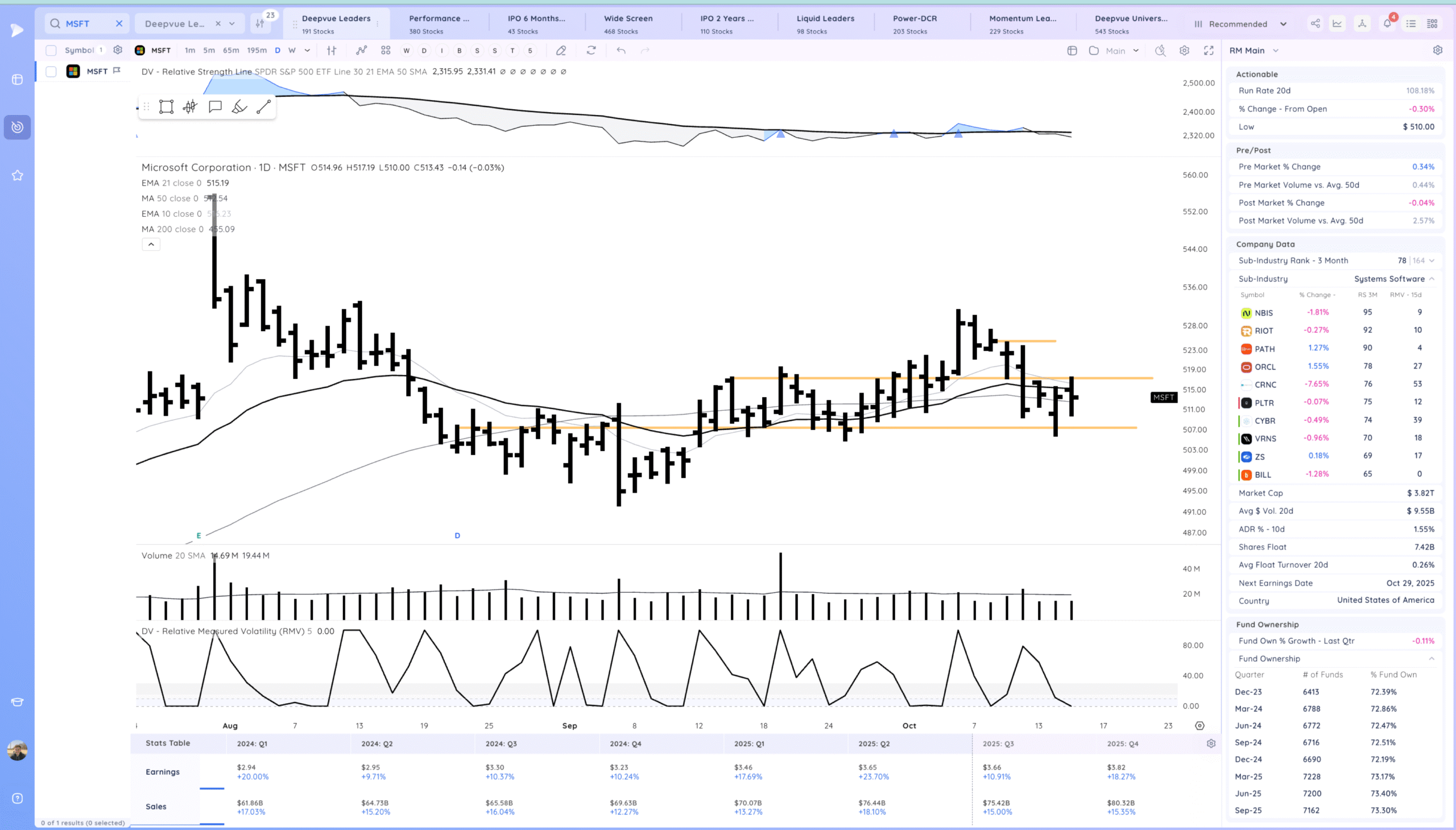

MSFT tight range here below the pivot. So far has failed to move up the right side.

Key Moves

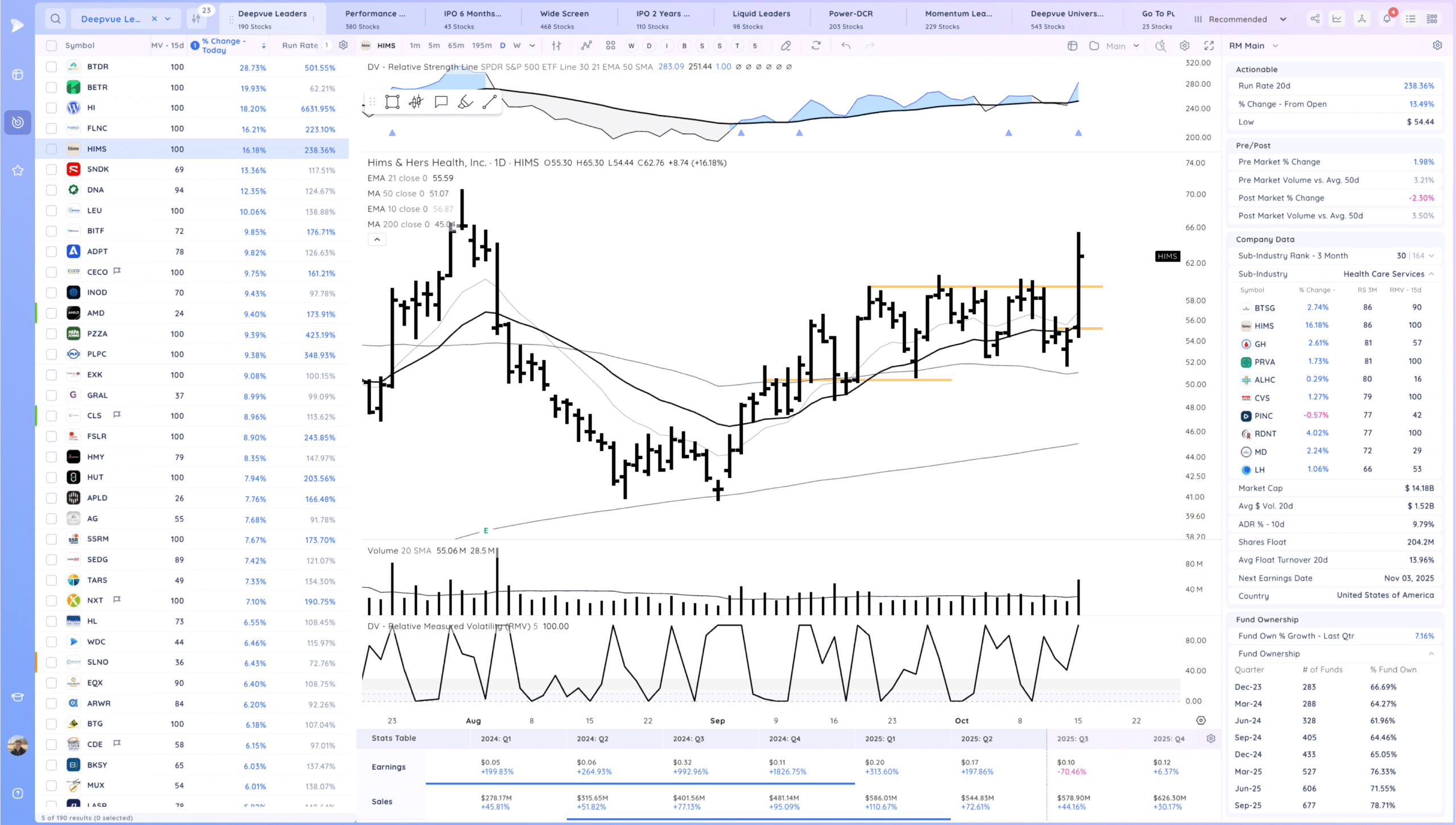

HIMS strong breakout

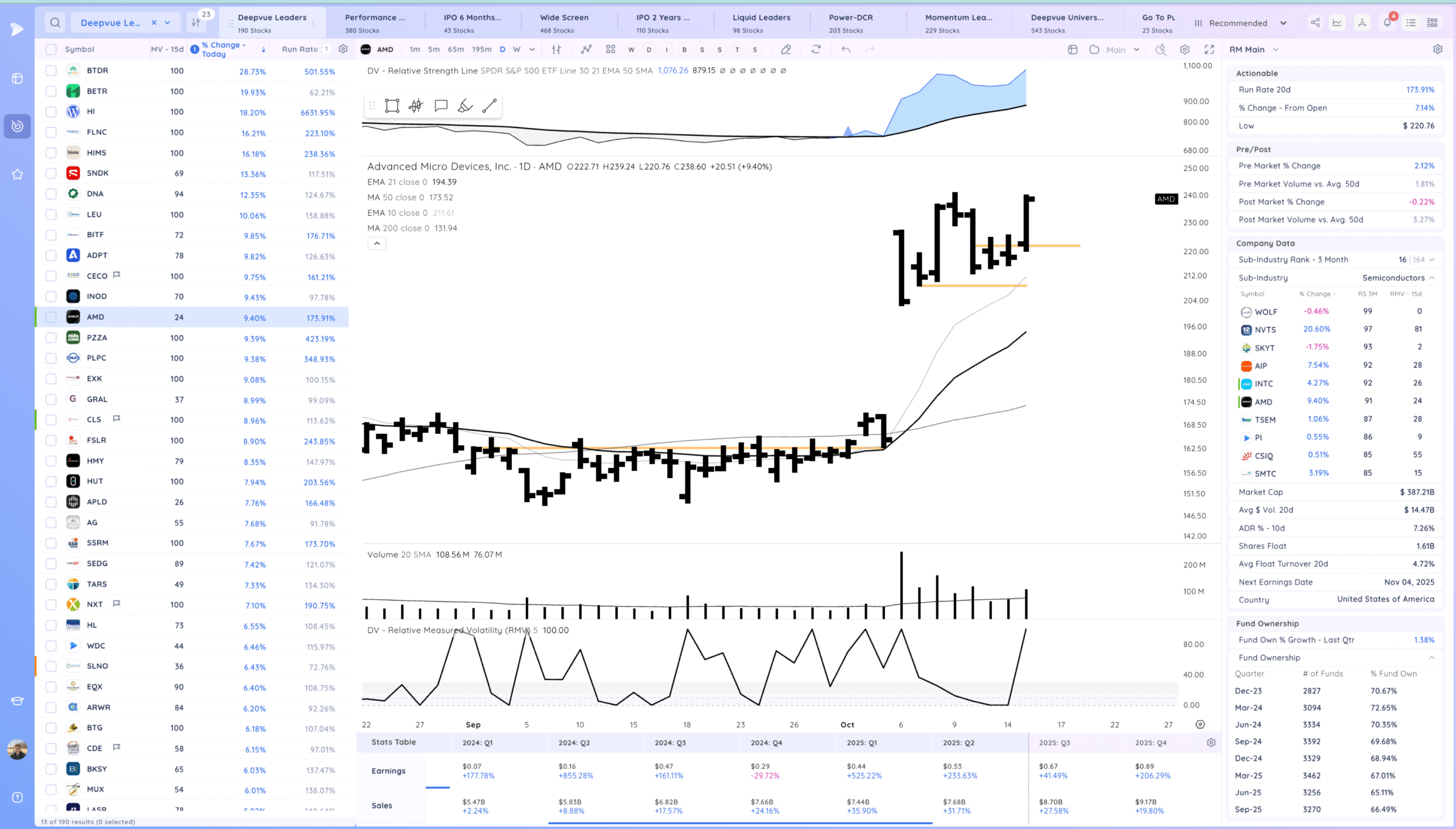

AMD range breakout. SNDK strong as well.

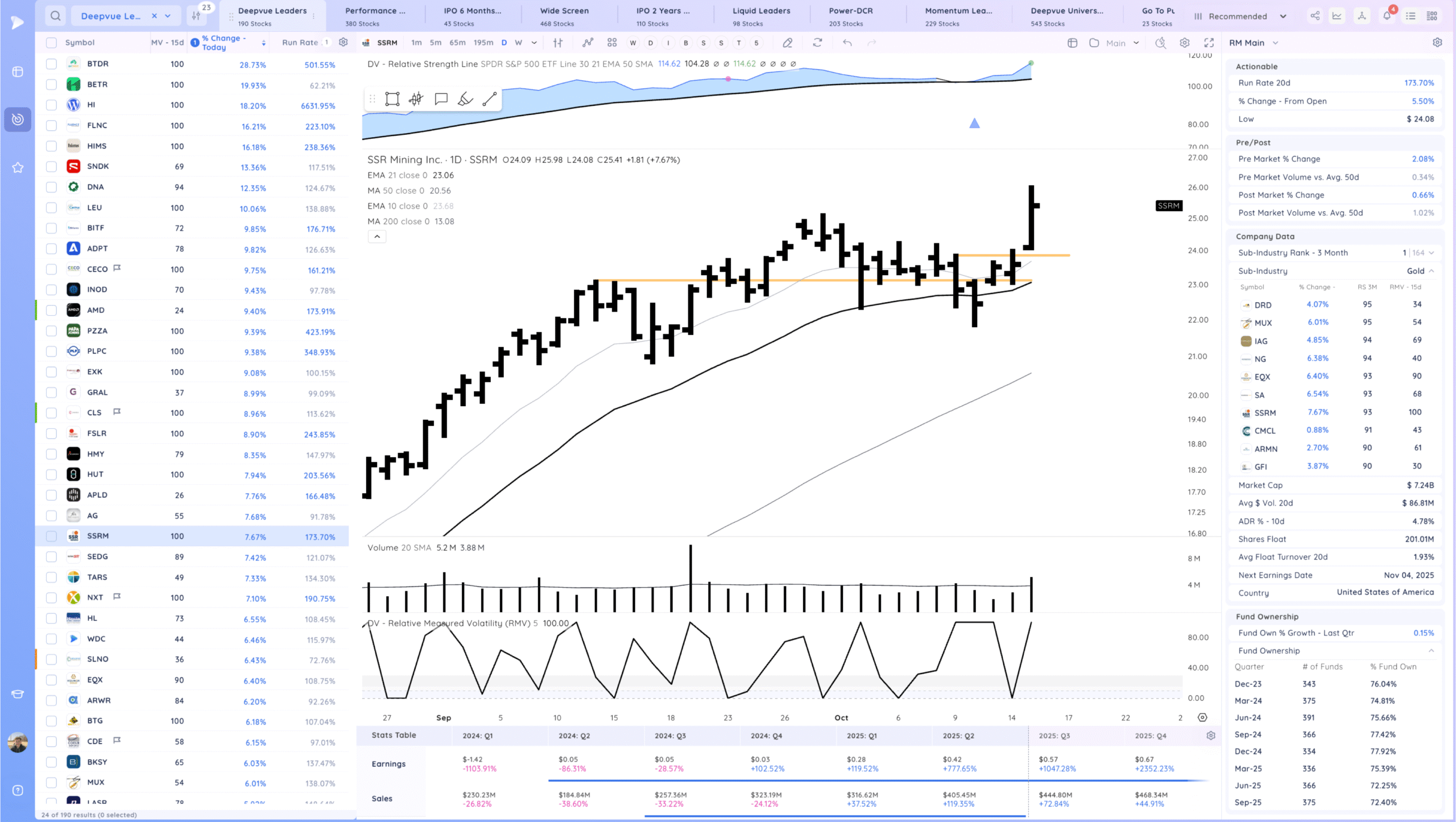

SSRM and TARS from the watchlist both strong today

Setups and Watchlist

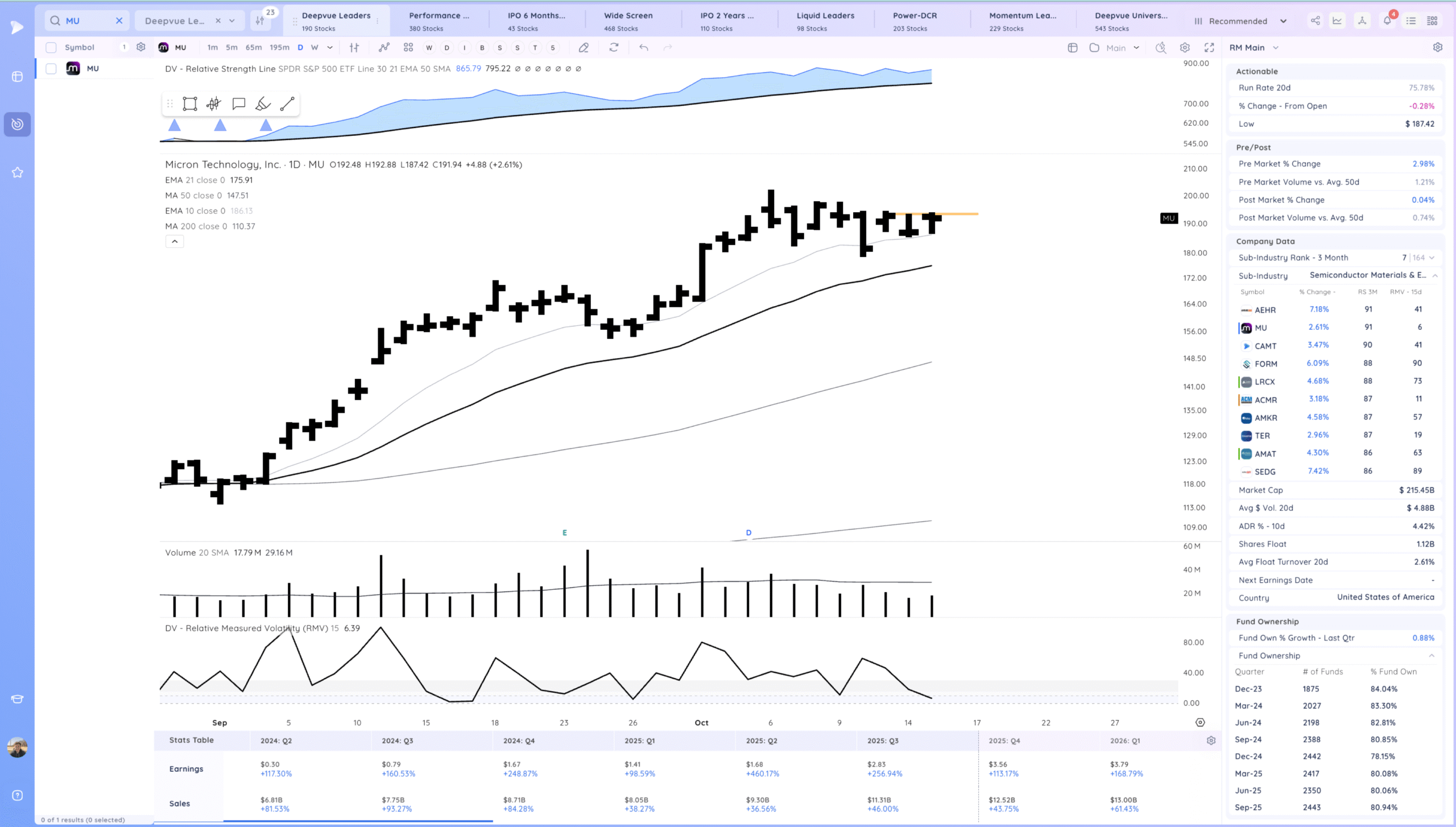

MU watching for a range breakout

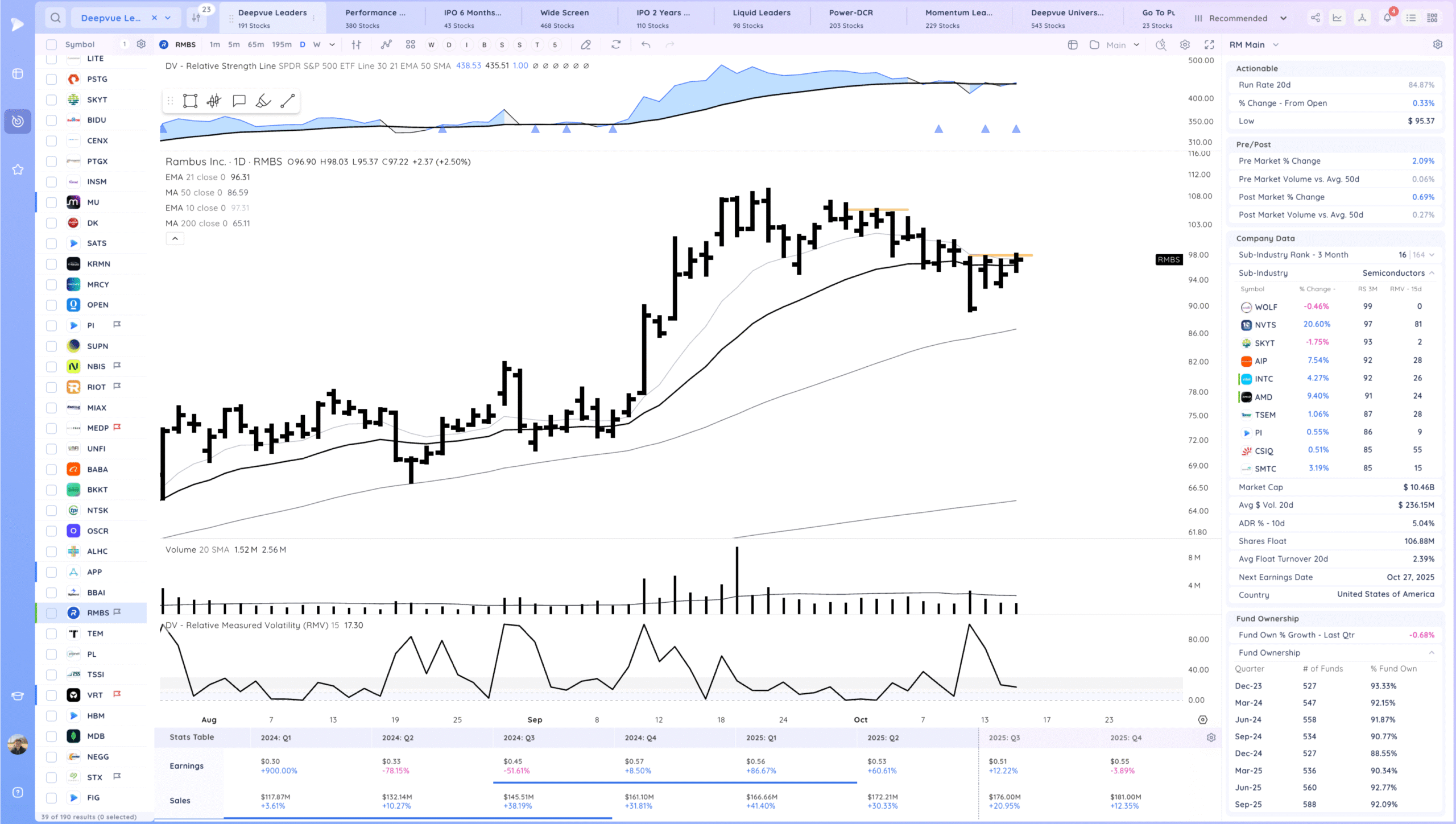

RMBS watching for a range breakout.

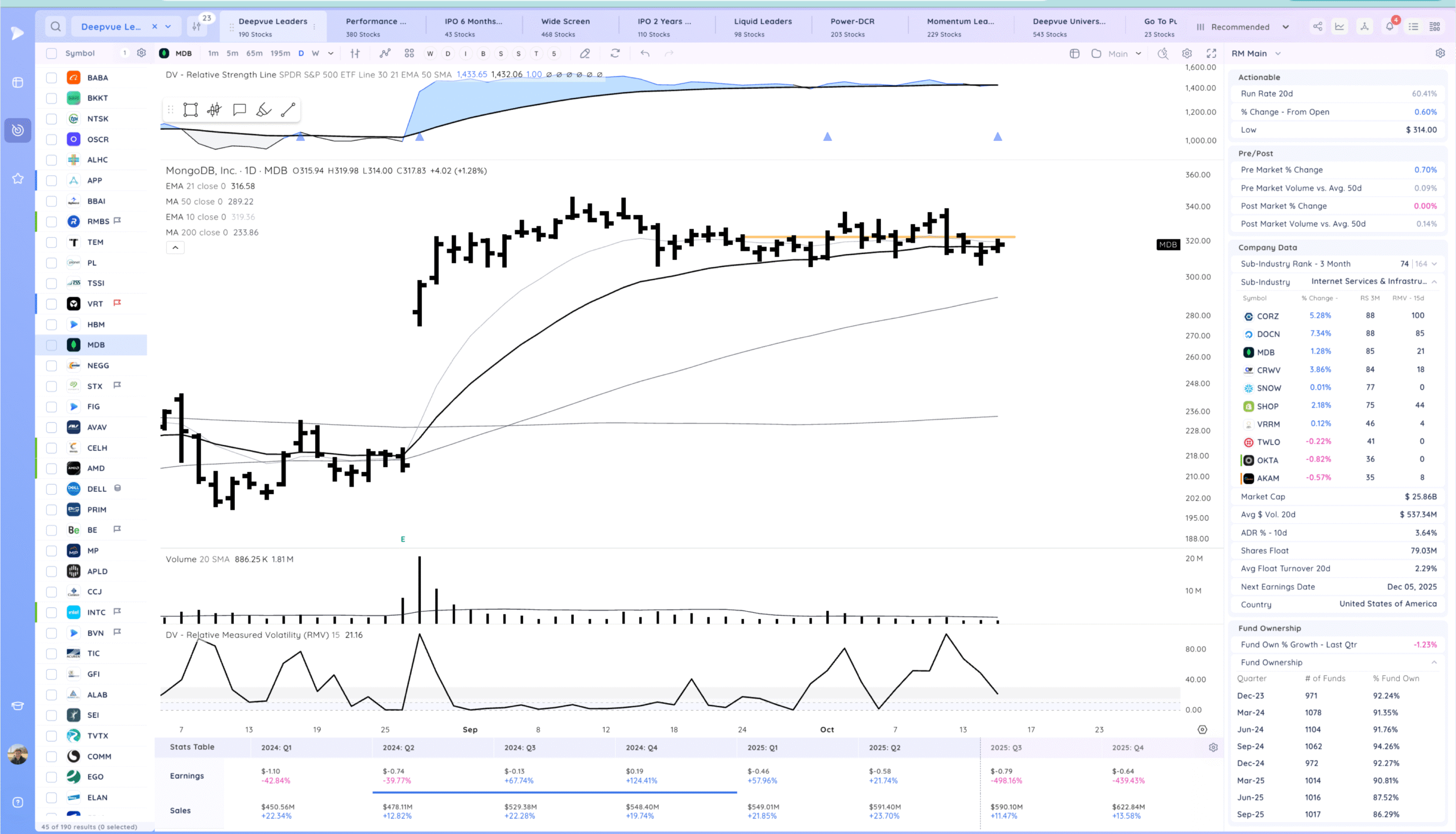

MDB watching for a range breakout

Today’s Watchlist in List form

Focus List Names

MU RMBS MDB TSLA HOOD

Focus:

TSLA HOOD MU

Themes

AI, AI Energy, rare metals, gold miners, biotech

Additional Thoughts

Indexes continue to chop around. Most names from the watchlist went today but not many new setups. Semis ripe for expansion one way or another.

Anything can happen, Day by Day – Managing risk along the way