6 Proven Ways to Hold Winning Stocks Longer and Unlock Explosive Gains

Published: October 24, 2025

Hold Winning Stocks Longer

You’ve nailed the entry – The stock rockets higher, and for a moment, everything feels perfect. But then the voice kicks in: “Should I sell now? What if it pulls back?”

Most traders panic and cash out too early, leaving serious gains behind. The real secret to explosive returns?

Hold your winners longer and cut losers short. It’s one of the oldest rules in the book, and it’s how elite traders stay ahead.

In this guide, we’ll break down what “letting winners run” actually means, why it beats traditional buy-and-hold, and exactly how to do it.

Whether you’re a swing trader or trend follower, these 7 proven tactics will help you stay in longer and profit more.

Let’s get into it.

What Does Holding Winning Stocks Really Mean?

Holding winning stocks isn’t about clinging to hope or blindly riding out crashes – It’s a disciplined approach. You let strong stocks keep running, and you drop the weak ones fast.

One aspect of all professional traders is that they hold winners longer, cut losers short.

Winners are those setups that break out cleanly, show accelerating volume, and respect key support levels. They’re the stocks screaming “uptrend” with higher highs and higher lows.

Once they’re off to the races, your job isn’t to micromanage; it’s to give them space to compound.

On the flip side, losers show early warning signs – stalling momentum, breaks below moving averages, or failure to follow through on breakouts. Cut them fast, ideally at your predefined stop, to preserve capital for the next opportunity.

This simple formula, let winners run, cut losers short, creates asymmetry. One big winner can wipe out a bunch of small losses. That’s how you build real account growth.

Why Hold Winning Stocks Longer? The Math of Bigger Gains

Let’s be real: the huge money comes from holding longer. Short-term trades can work, but they rarely catch the full move.

Most traders treat stocks like a quick sprint buy and then sell high within days or weeks. But markets reward longer runners. By holding winners longer, you capture the full trend, turning 20% pops into 100%+ monsters.

Studies from trading legends like William O’Neil show that top-performing growth stocks often deliver 25-50% moves in their first leg up, with multi-month runs pushing gains to triple digits. Sell too early, and you’re leaving money on the table – Let them breathe, and you’re rewarded for your patience.

Here’s the math: If your average winner nets 10% but you cut losses at 5%, over time you will have net gains, only if you’re right on your trades 50% of the time.

Bring your average winner up to 50%? Not only are you winning bigger, but your win-to-loss ratio can be around 30% and you’re still making out.

Scale that across dozens of trades, and the win rate compounds.

Holding longer isn’t greedy – it’s strategic. It leverages trends and lets compounding work its magic.

How to Hold Winning Stocks Longer Without Getting Shaken Out

Knowing why you should hold winning stocks is just half the battle. The real challenge? Sticking with them when the market gets choppy, the gains feel “too good,” or fear creeps in.

Here are proven, practical tactics that help you hold winning stocks longer without getting shaken out by short-term noise or emotion.

1. Use Trailing Stops to Lock In Gains and Hold Winning Stocks

A trailing stop works like a moving safety net. It follows your stock upward, locking in profits while giving the trade enough room to breathe. It’s one of the simplest yet most powerful tools to help you hold winning stocks longer.

How to set it up:

- Start with your initial stop just below the breakout or key support.

- As the stock moves up, raise your stop to the most recent swing low or by a percentage.

- For volatile growth stocks, use a wider trailing stop (12–15%).

- For more stable names, tighten it to around 5–7%.

This strategy gives your trades room to run without letting big gains slip away. It’s ideal when you’re trying to hold winning stocks through inevitable pullbacks.

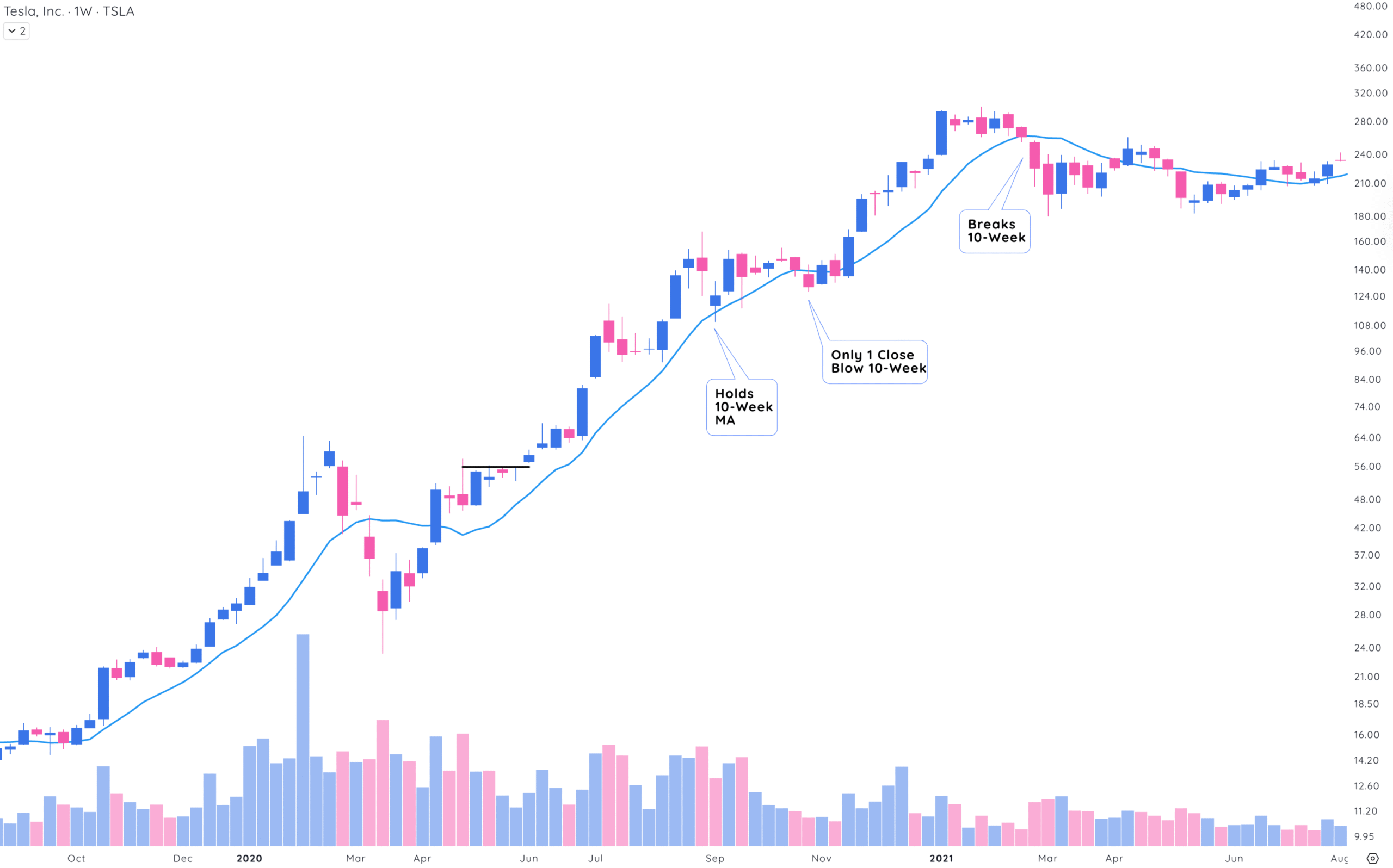

2. Follow Moving Averages to Stay in the Trend

Moving averages aren’t just indicators – they’re your guideposts for staying in the trade. They help you avoid getting spooked by normal pullbacks.

Short-term trades:

- Use the 10-day and 21-day exponential moving averages (EMAs).

- As long as the price stays above these lines, the trend is likely still intact.

Longer-term trends:

- Watch the 50-day simple moving average (SMA).

- Many strong stocks pull back to the 50-day before continuing higher.

- Don’t sell just because of one red day. Look for a confirmed close below the moving average before trimming or exiting.

By using MAs, you let the market tell you when a trend is over instead of guessing. And that’s how you successfully hold winning stocks through both calm and chaos.

3. Sell on Weakness, Not Strength

This is one of the biggest mindset shifts for traders: Don’t sell because a stock is going up – sell when it’s breaking down.

How to spot real weakness:

- The stock closes below key moving averages (like the 10-day or 21-day).

- You see heavy volume on down days – a sign big money might be exiting.

- The stock fails to bounce after a pullback or can’t reclaim key levels.

Selling on weakness helps you stay in trades longer and avoid panic exits.

It’s not about trying to sell at the exact top. It’s about responding to actual breakdown, not noise. This approach makes it much easier to hold winning stocks until the trend truly ends.

4. How Scaling Out Helps You Hold Your Core Position Longer

Scaling out means selling a portion of your position at predefined levels to lock in gains without closing the trade entirely. This strategy gives you both peace of mind and continued exposure to upside.

A simple plan:

- Sell 20–30% of your position when it hits your first profit target (like 1R or 10–15% gain).

- Sell another portion at your second target (say, 2R or 25–30% gain).

- Let the final portion run with a trailing stop.

This way, you’re banking profits while still riding the trend. It removes emotional pressure and makes it easier to hold winning stocks without second-guessing yourself every step of the way.

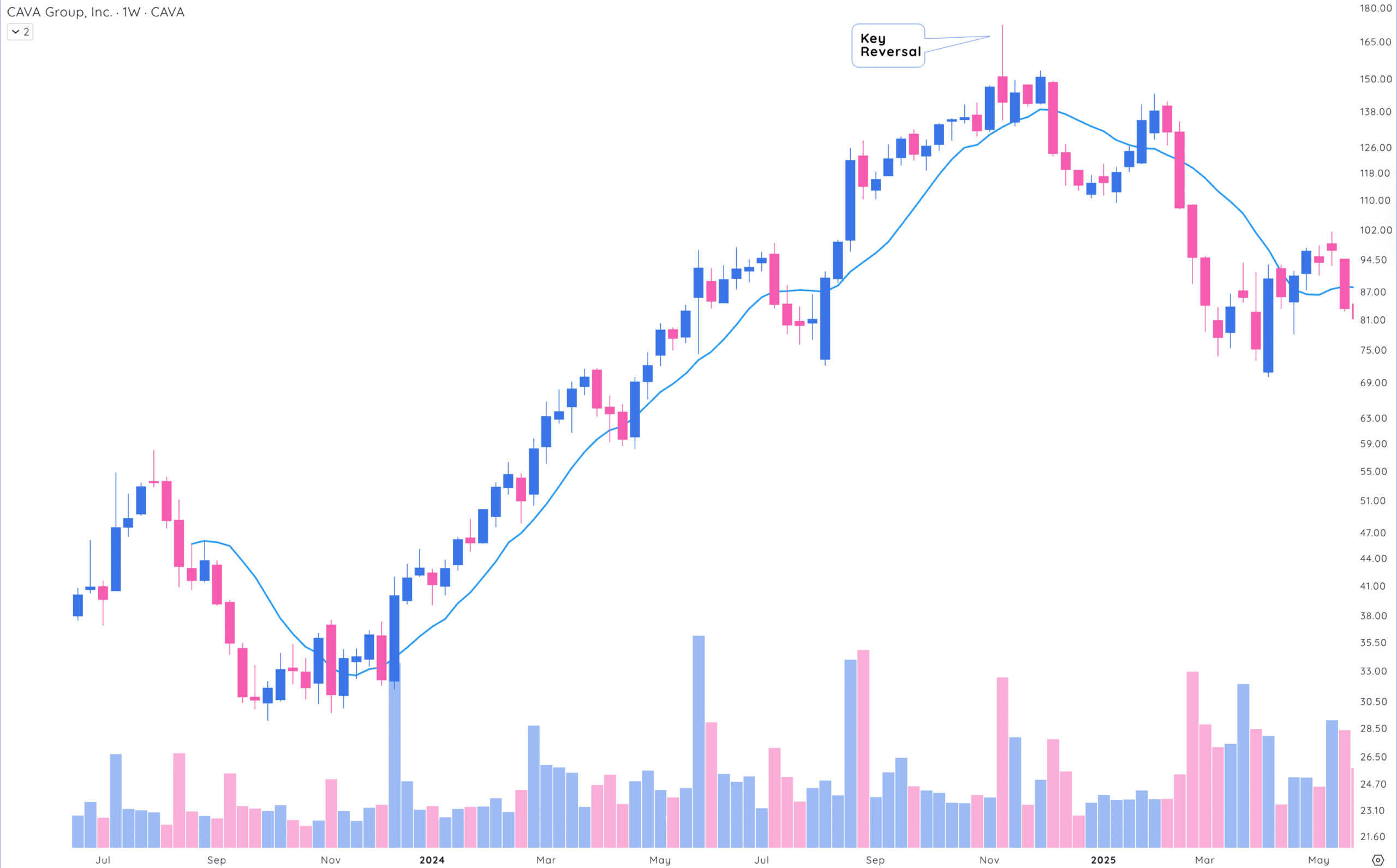

5. How to Use Key Reversal Bars to Time Partial Exits

Sometimes, price action will tell you when a short-term top might be forming. That’s where key reversal bars come in handy.

What to look for:

- A wide-range green candle with a long upper wick.

- The stock closes near the day’s low, on above-average volume.

This type of candle shows sellers stepping in after a strong run-up. It’s a great place to scale out some shares, especially if it lines up with a resistance level.

💡 Pro Tip: Keep the rest of your position with a stop below the 10-day EMA and let the remaining shares ride the next leg higher if the trend continues.

Spotting these reversal signals helps you stay disciplined and confident as you hold winning stocks through multiple phases.

6. How to Handle the Psychology of Letting Winners Run

This is the hardest part for most traders. Holding winners sounds easy until:

- Your stock pulls back 10–15%

- It chops sideways for three weeks

- Your P&L whipsaws and plays tricks on your mind

But here’s the truth: Big gains often come with big emotional swings. Learning to sit through them is a skill and it can be developed.

How to manage the mental game:

- Journal your past trades. You’ll be surprised how many 2x gains came after 20–30% drawdowns.

- Reframe volatility. It’s not the enemy, it’s the cost of bigger rewards.

- Use simple affirmations. Even something like, “This is normal. Stick to the plan,” can prevent a panic sell.

- Trust your process. If you’re using moving averages or trailing stops, let them guide you. Don’t override them based on gut feelings.

And yes – stop checking your P&L every 10 minutes. Obsessing over numbers makes it nearly impossible to hold winning stocks with confidence.

How to Calculate Total Open Risk so You Can Sleep at Night

Even if you’re holding strong stocks, too much exposure can wreck your portfolio. That’s why you need to know your total open risk.

Here’s the formula:

Position Size × Distance to Stop (%) = Dollar Risk

Add up all your open trade risks and divide by your portfolio value:

Total Open Risk = (Sum of Dollar Risks) ÷ Total Portfolio Value

Example:

- Stock A: $20,000 position, 5% stop = $1,000 risk

- Stock B: $10,000 position, 4% stop = $400 risk

- Portfolio: $100,000

- Total Risk = ($1,000 + $400) / $100,000 = 1.4% open risk

Aim for under 6% total in normal markets. In uptrends, you can stretch to 8%. In choppy or bear markets, tighten up to 3–4%.

Use a simple spreadsheet and check it weekly. If your risk spikes due to a pullback, adjust your stops or scale out. This one habit could save your account.

Final Thoughts: Hold Winning Stocks Longer to Win Bigger

Holding winning stocks longer isn’t about wishful thinking. It’s about systems, strategy, and psychology.

From trailing stops to moving averages to scaling out and risk management – each tool is designed to help you stay in good trades longer and avoid the heartbreak of selling too soon.

Start small. Pick one strong stock this week and apply the 10-day or 21-day EMA rule. Let it ride a little longer than you normally would. Watch what happens.

The truth is: trading success comes from a few big winners, not dozens of tiny gains.

You’ve got the edge. Now let it run.