Gap Down, Decent Close. Chop

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 14, 2025

Market Action

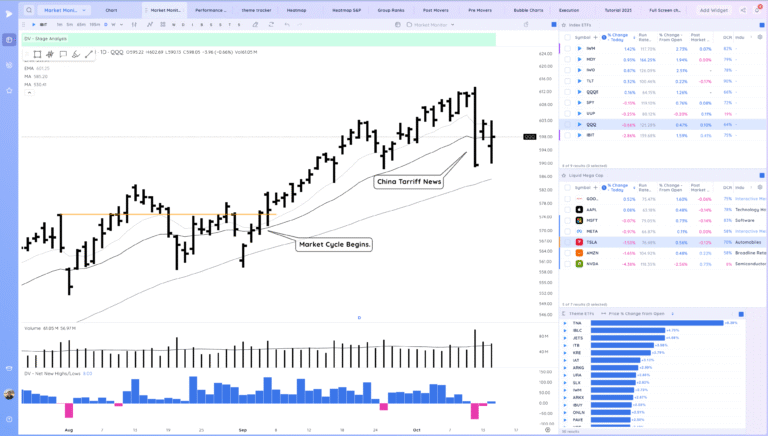

QQQ – Gap down as we continue to flirt with the 21ema. Choppy and news sensitive market currently. Volatility increase. Most names I’m watching had good responses to the gap down

Bulls want to see us hold above the 21ema at week end and continue trending

Bears want to see us reconfirm down, likely with additional negative news catalysts.

Daily Chart of the QQQ.

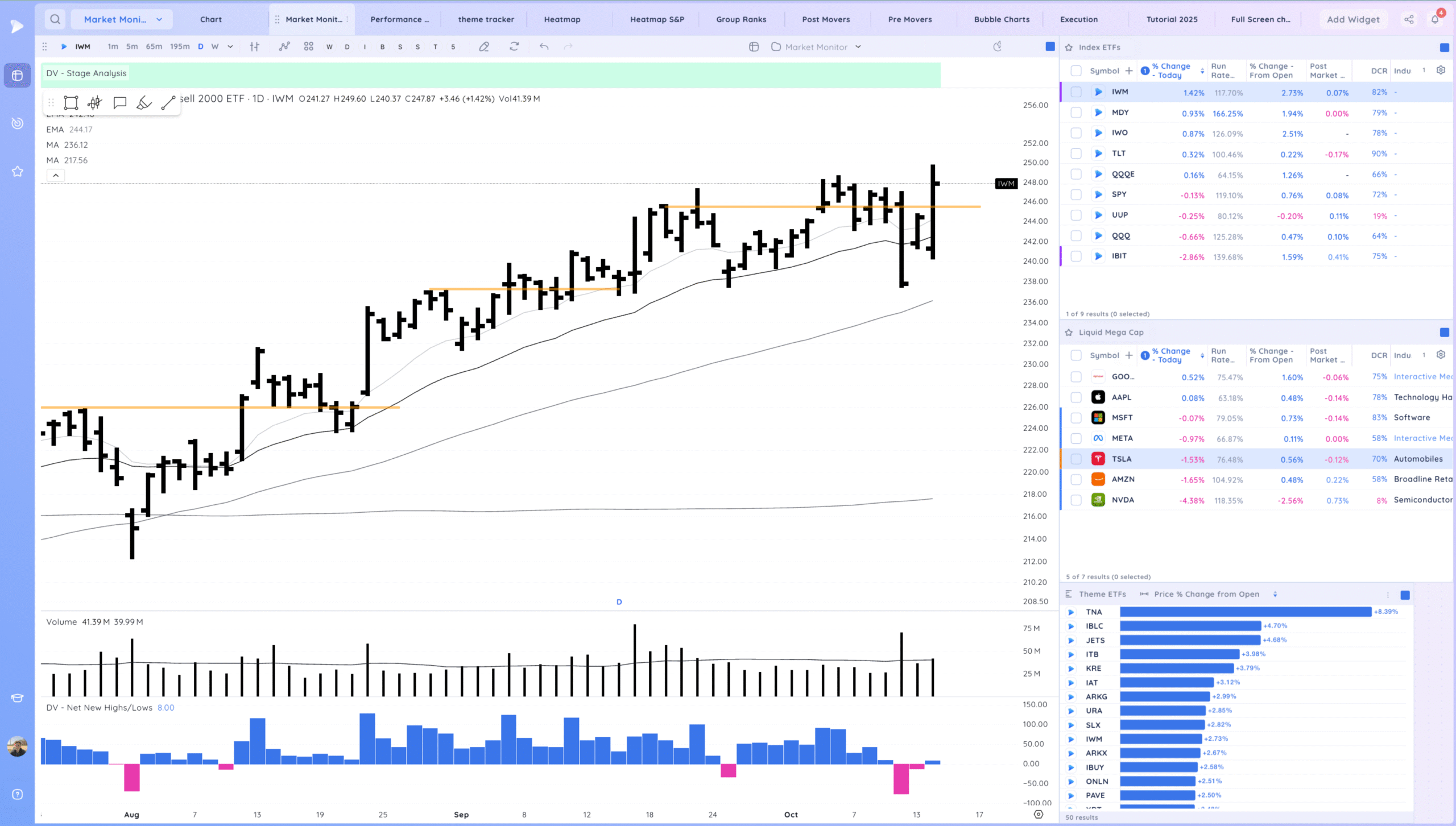

IWM – Strong positive outside day and range breakout

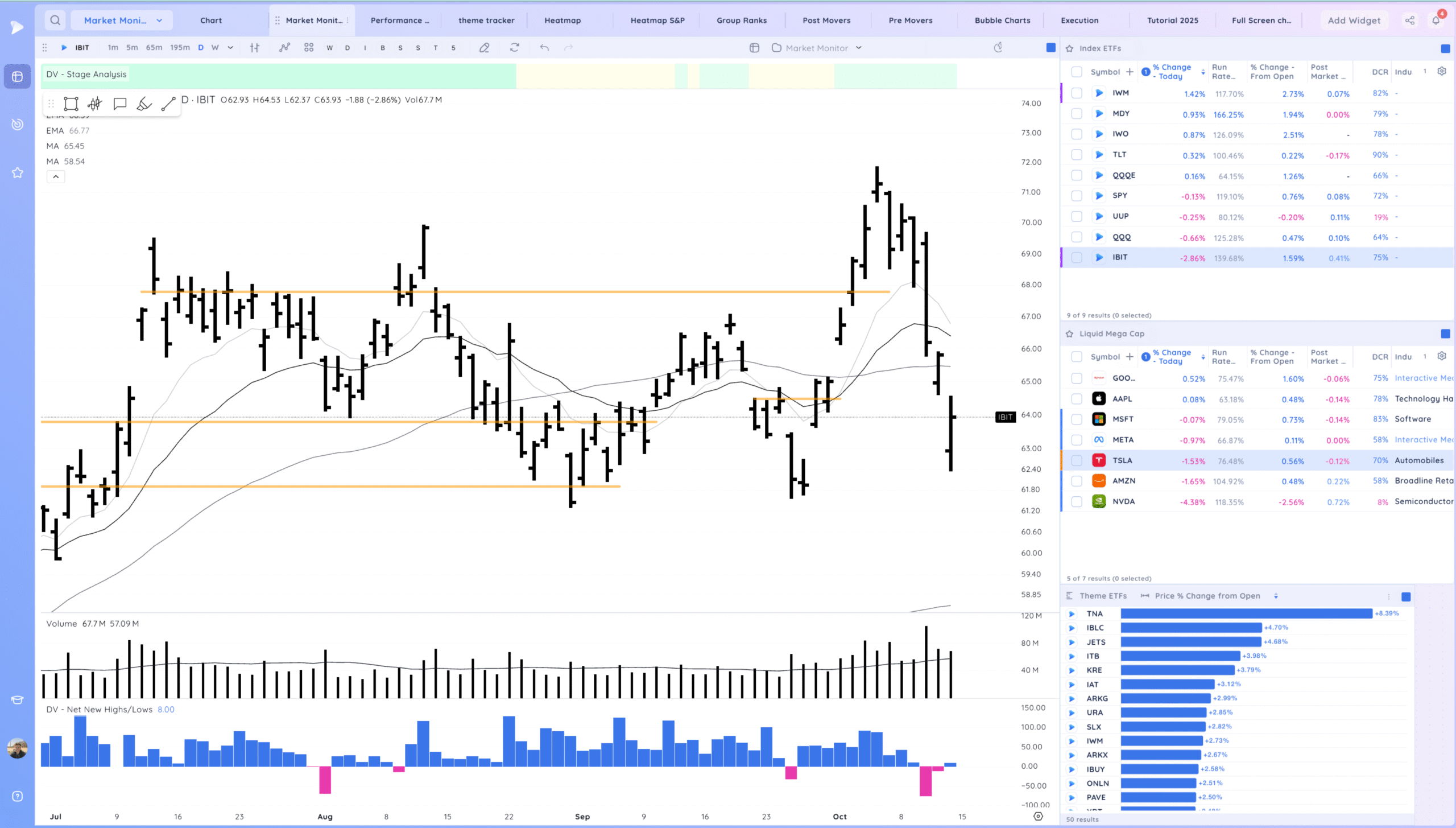

IBIT – More follow through down, but a push off day’s lows

Trends (3/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Below

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

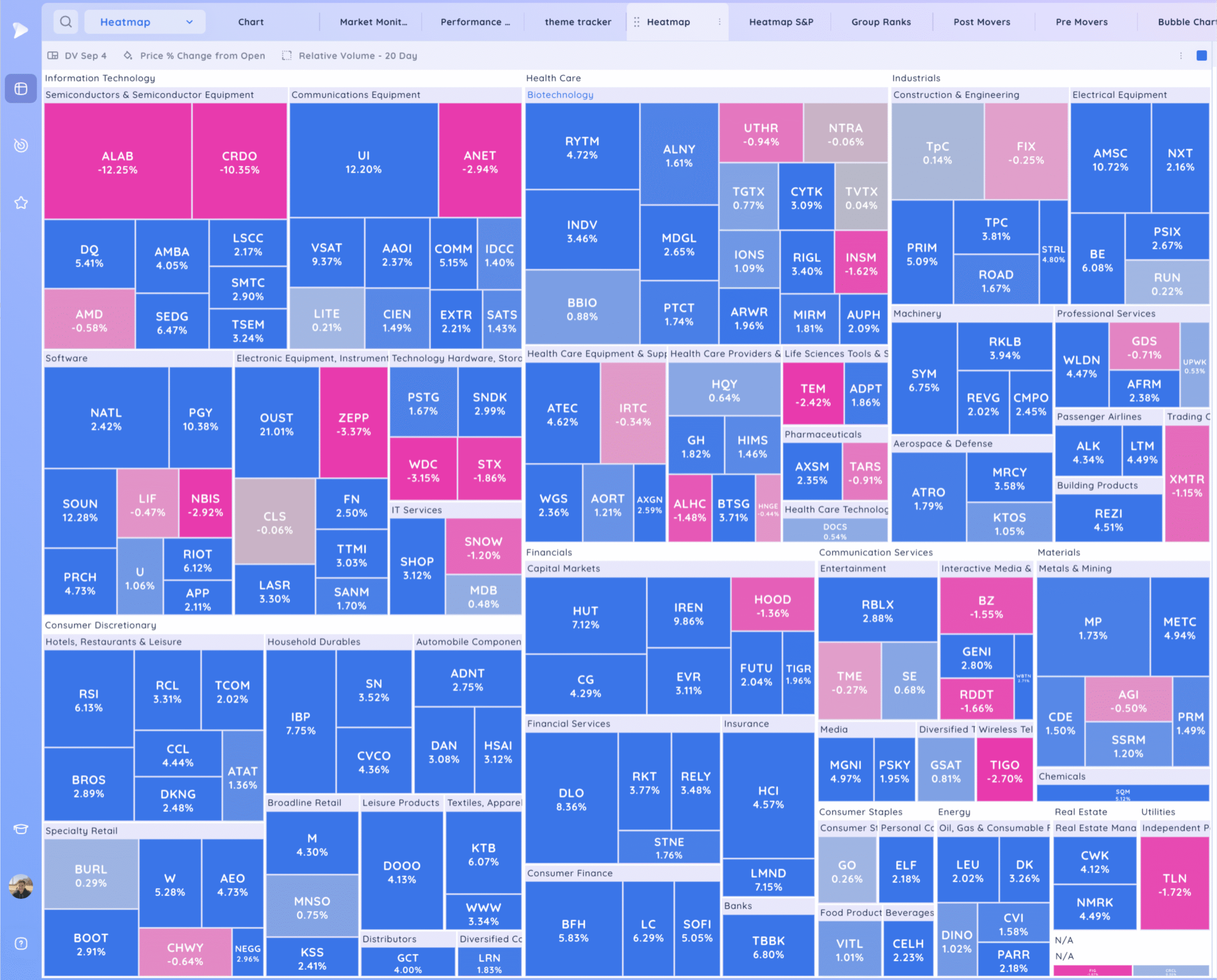

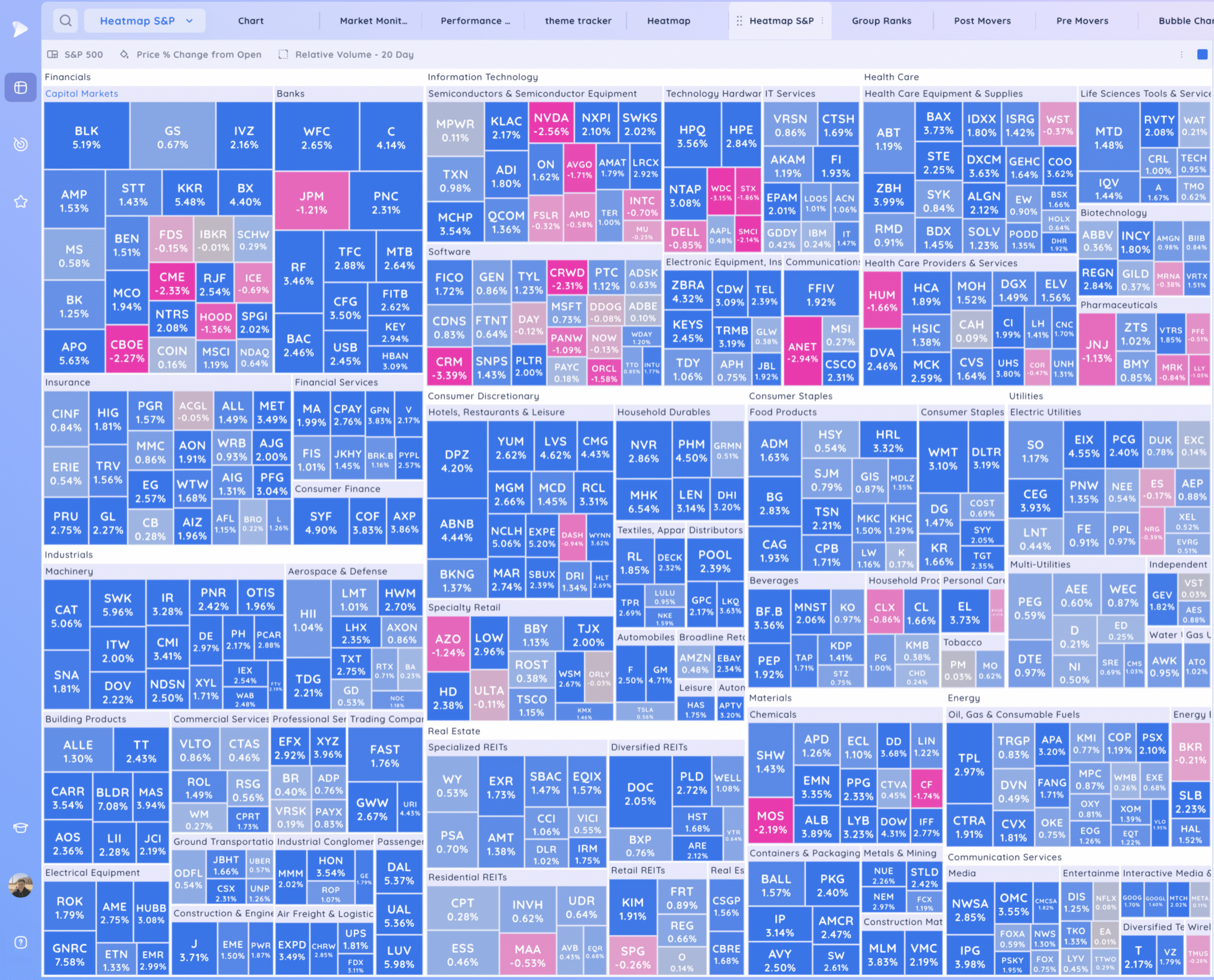

Groups/Sectors

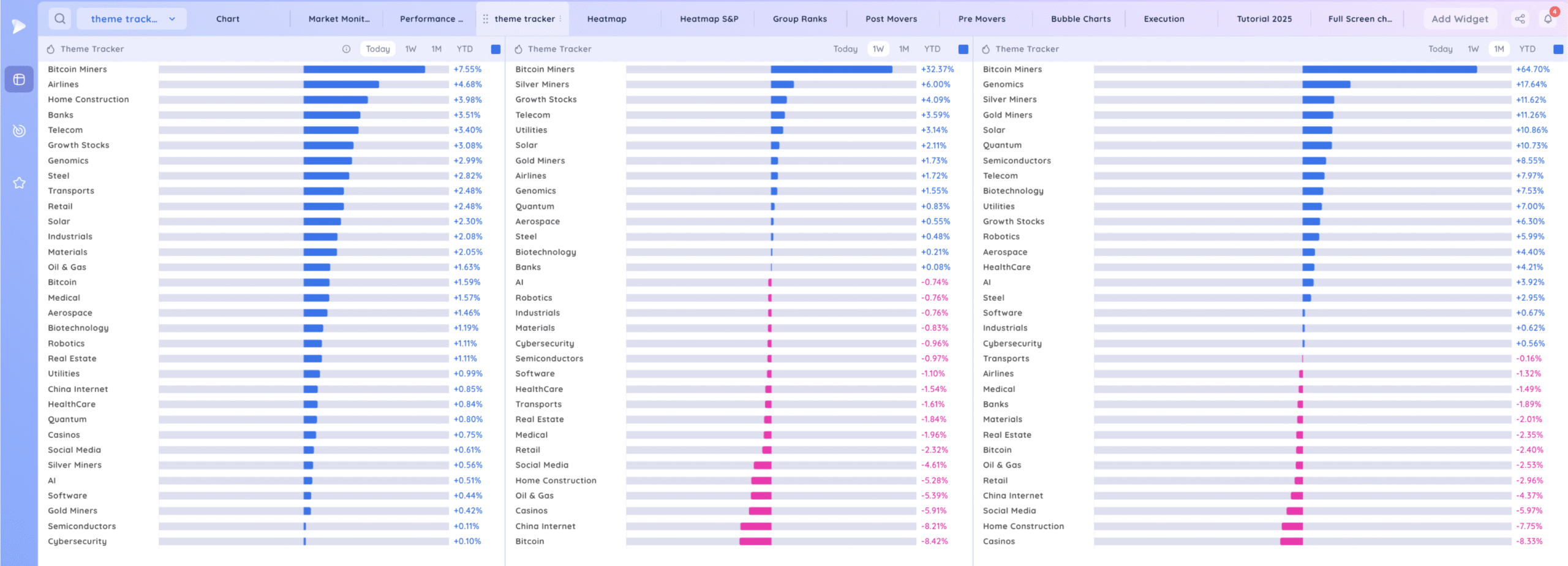

Deepvue Theme Tracker

Deepvue Leaders

S&P 500.

Leadership Stocks & Analysis

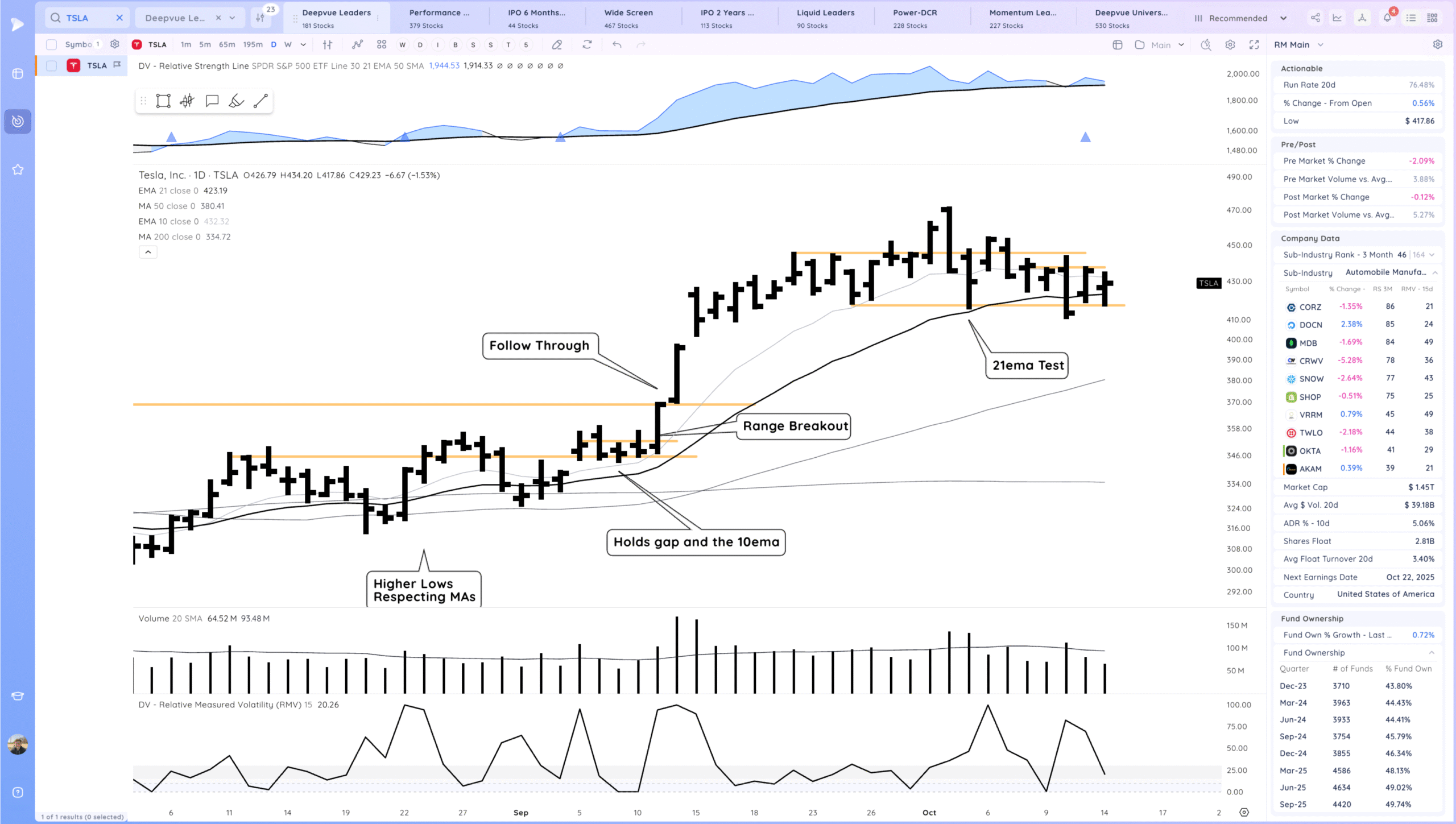

TSLA – Tightening again versus the range lows and the 21ema. Watching for a range breakout. Earnings starting to get closer

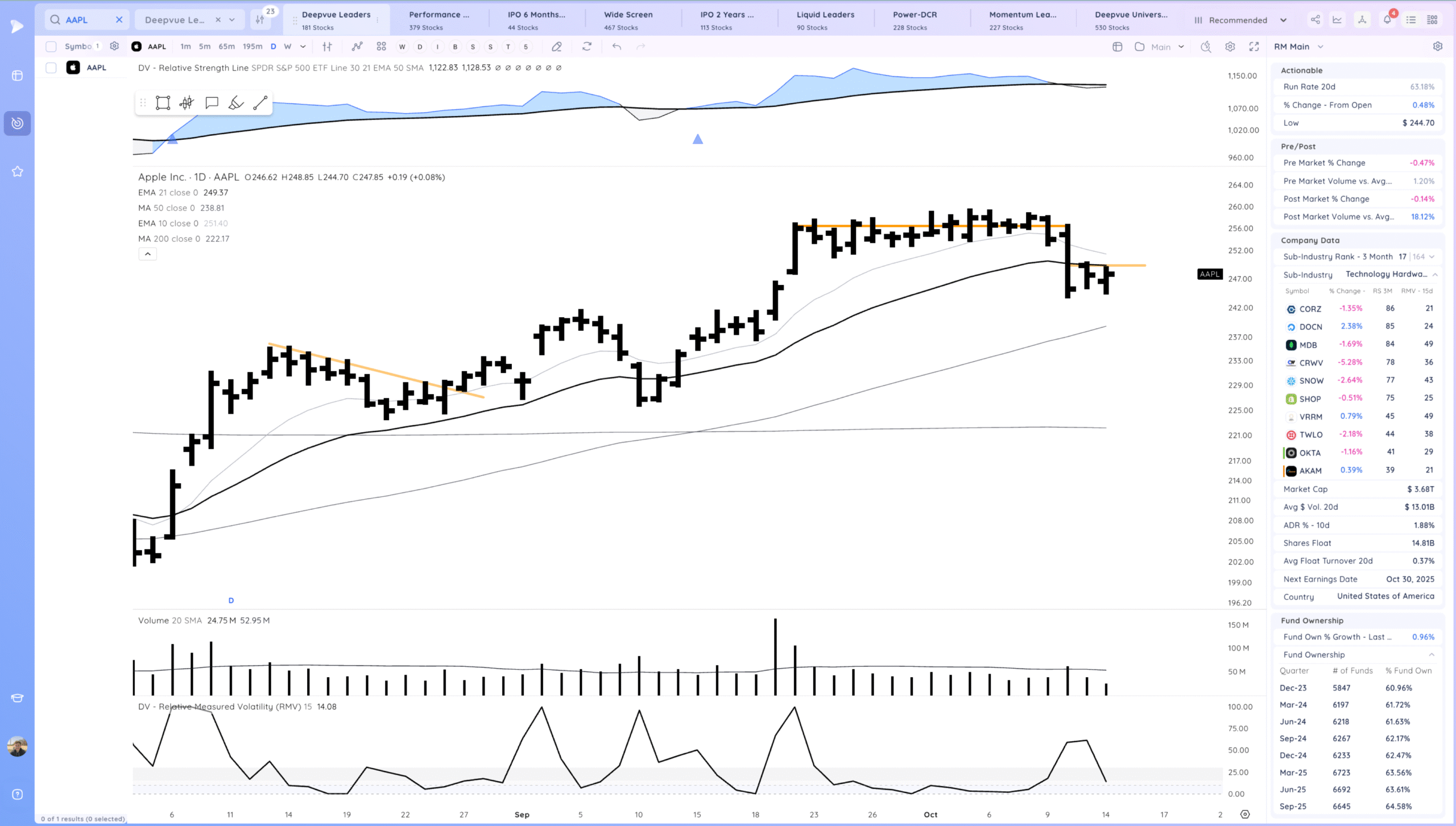

AAPL 2 tight days after the breakdown bar. Expecting expansion

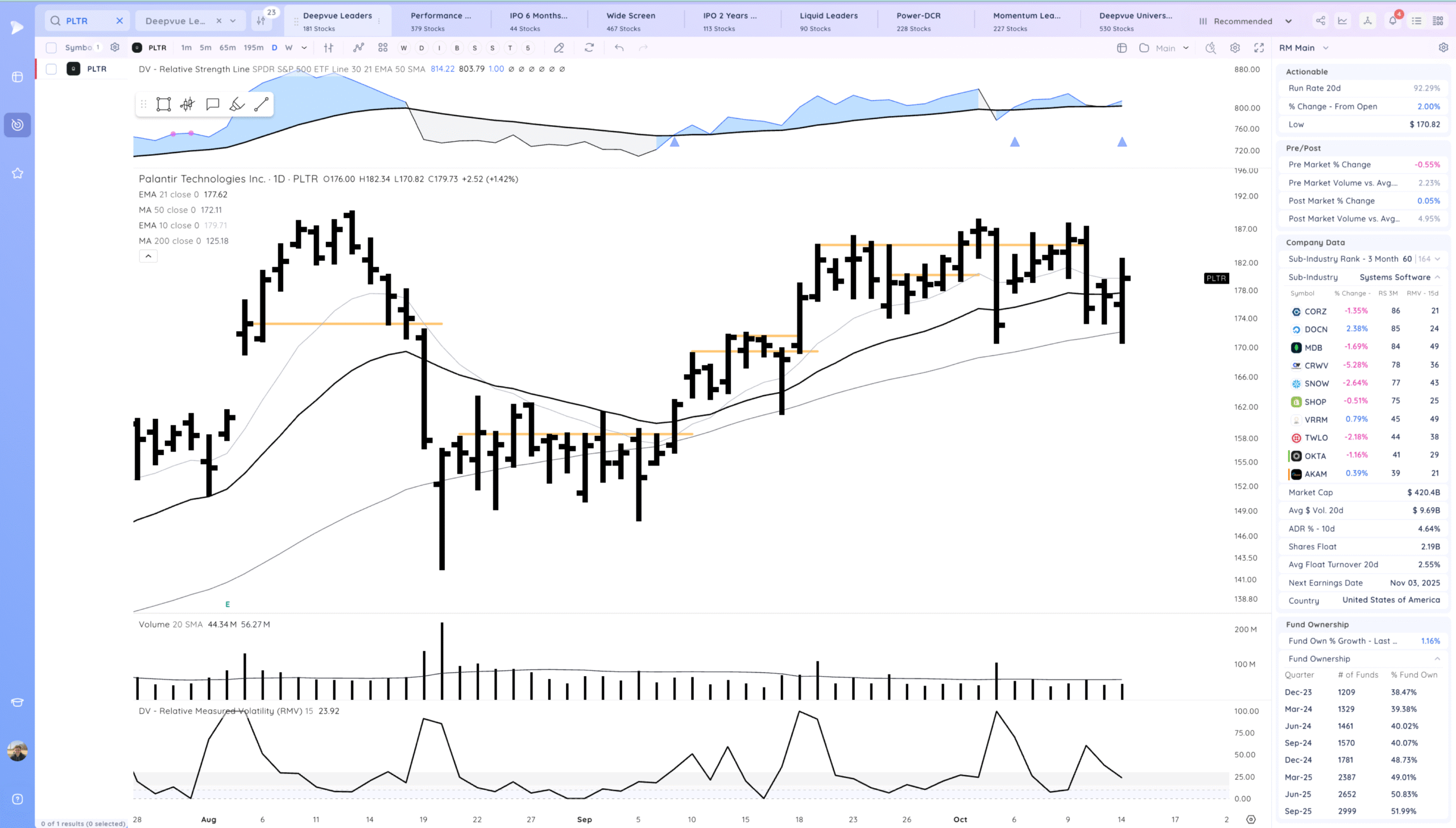

PLTR Positive outside day. Needs to follow through and break out of this range. Otherwise looks like churning action

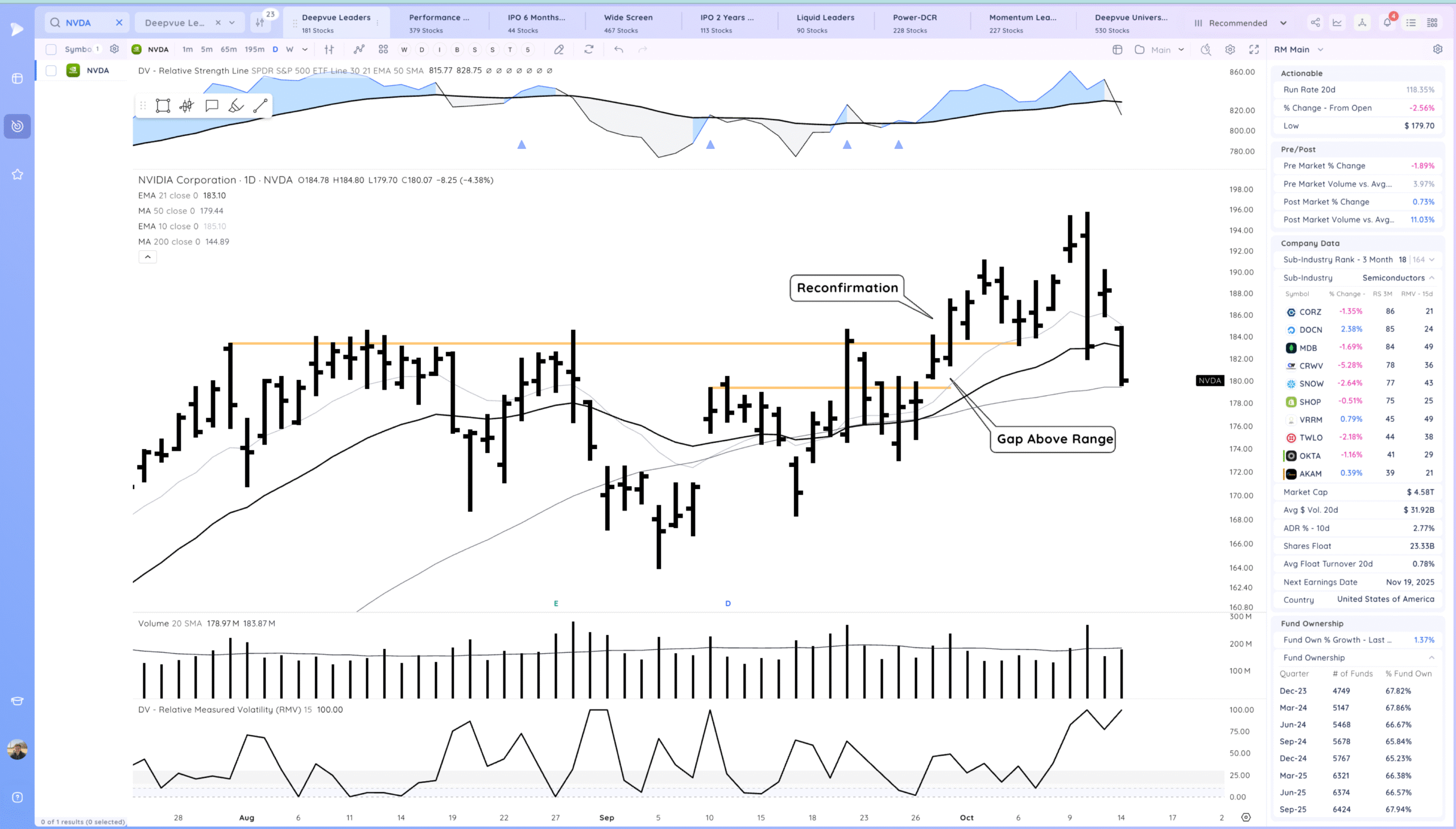

NVDA Reconfirmation down and failing the base breakout.

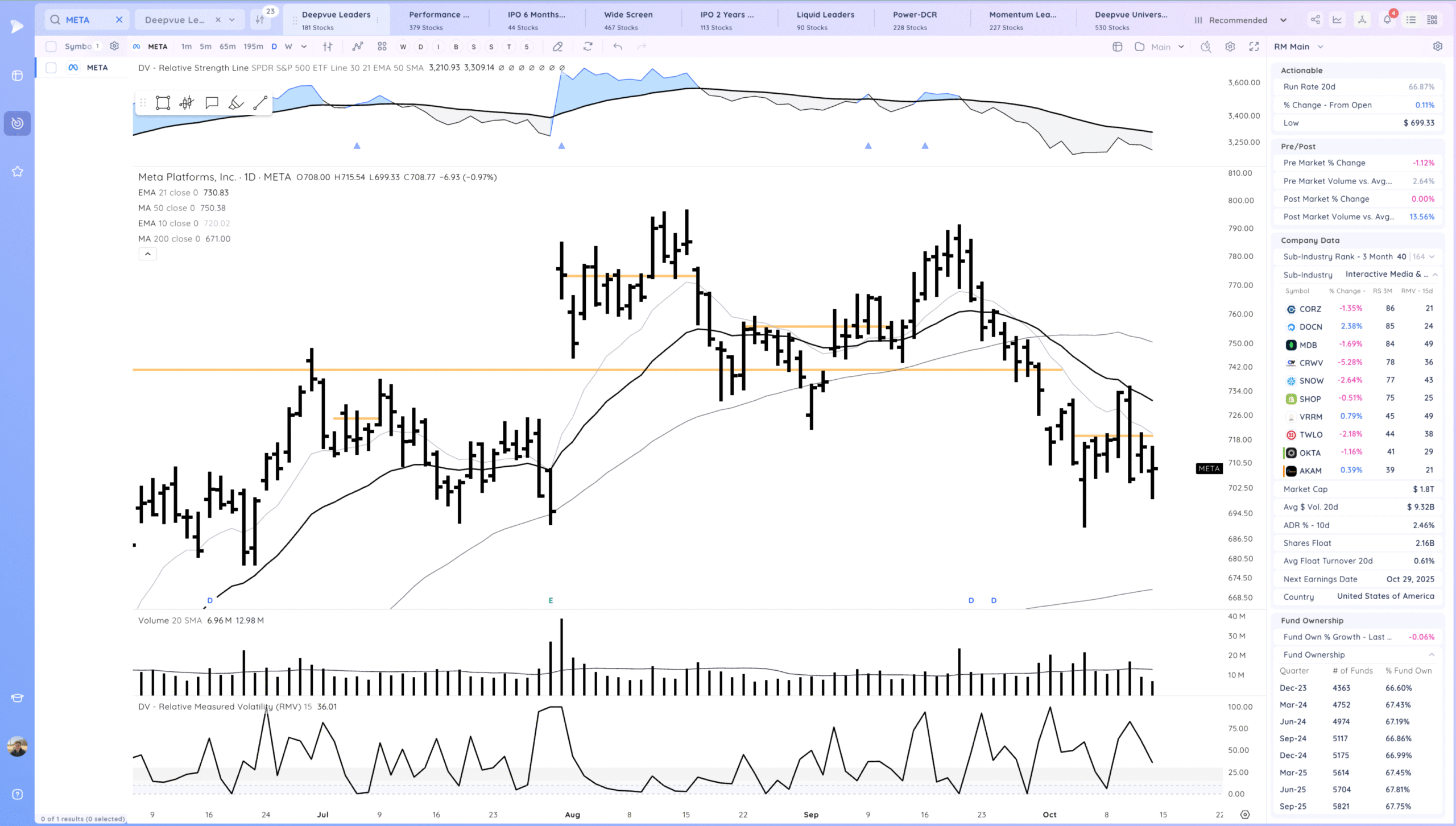

META forming this range below the MAs

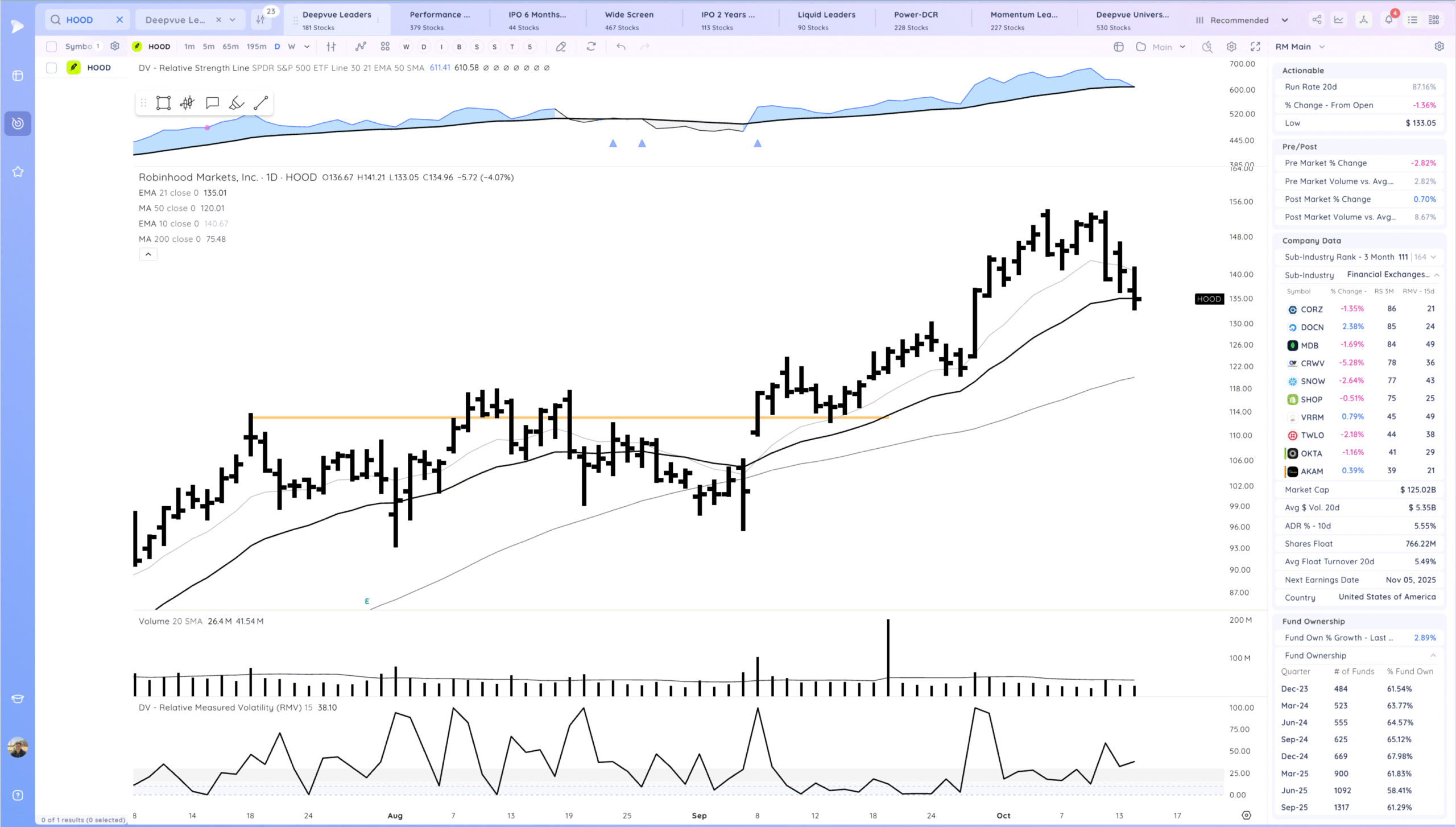

HOOD 21 ema pullback. Key Level

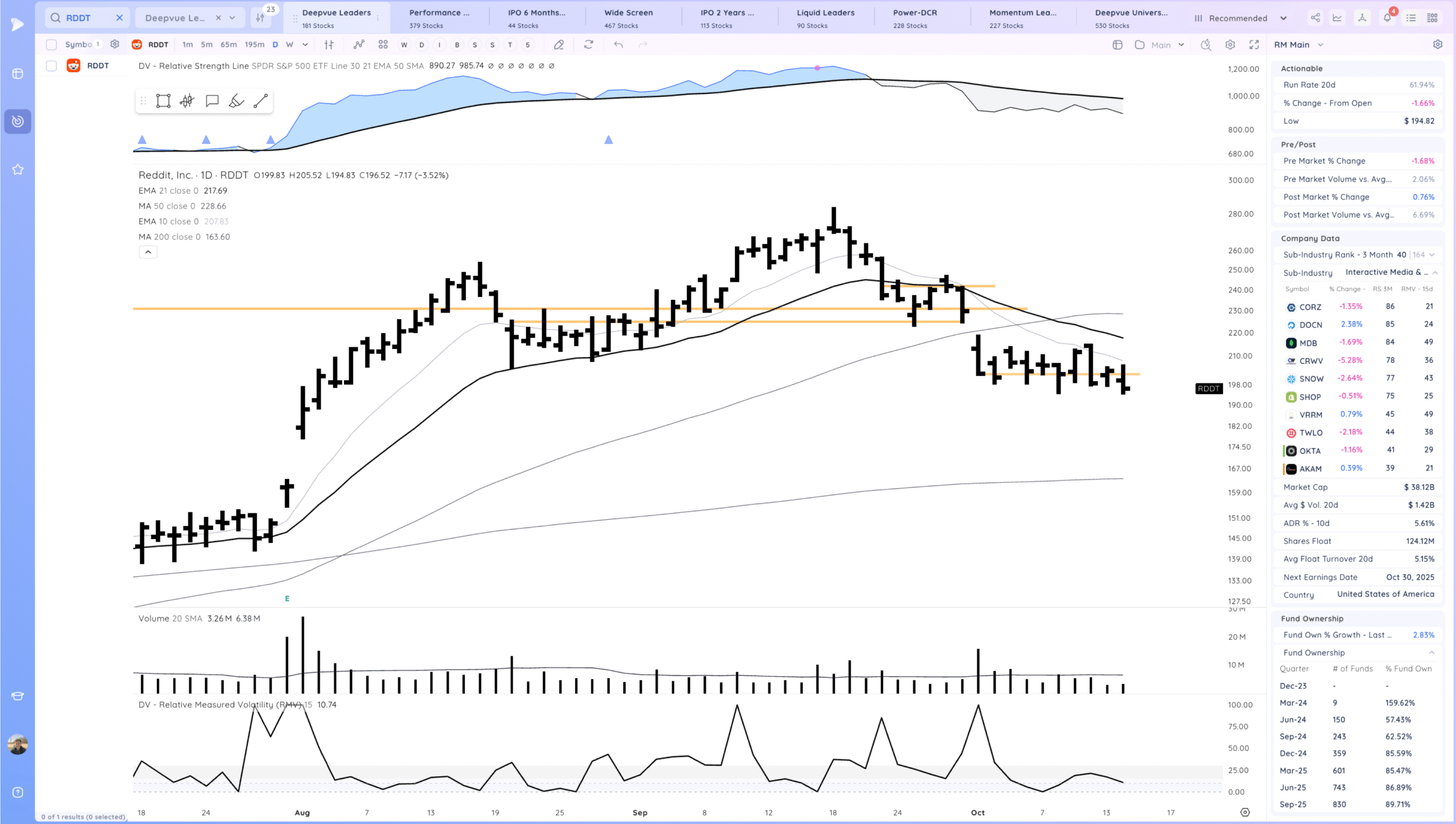

RDDT still in this range but looking vulnerable unless it can hold here. Unfilled gap above and in a downcycle

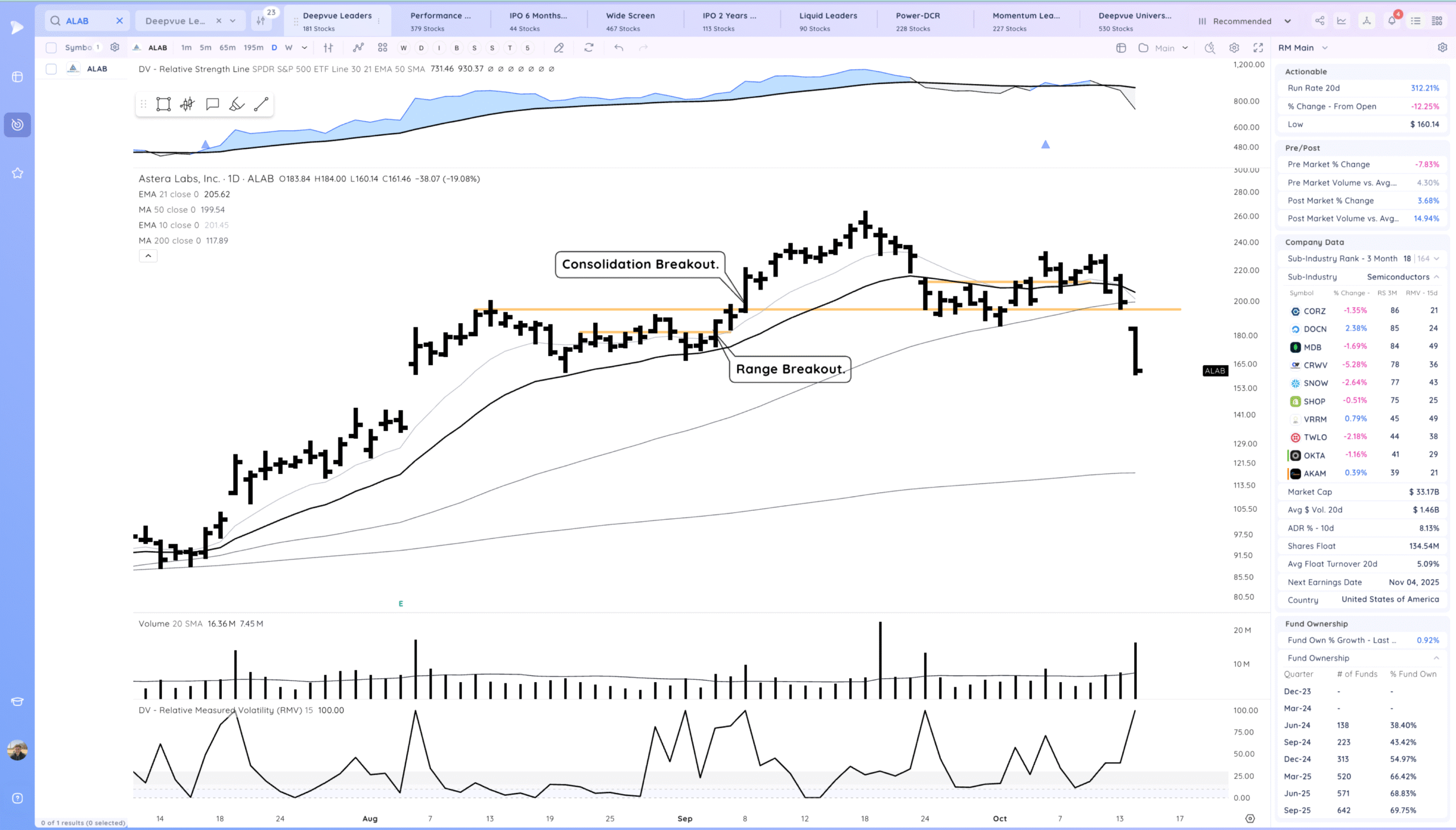

ALAB gap down and negative close.

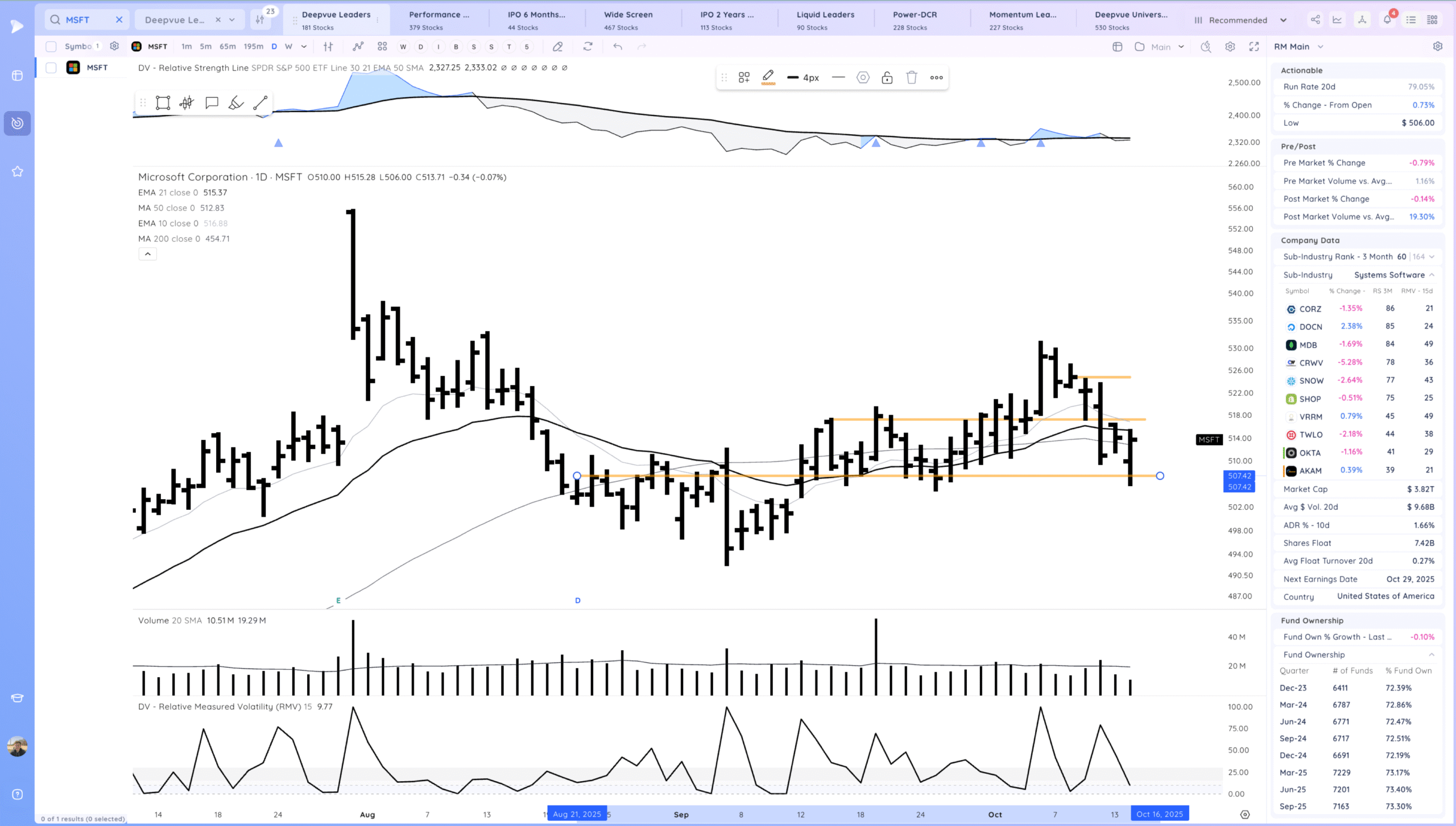

MSFT upside reversal off the prior range pivot

Key Moves

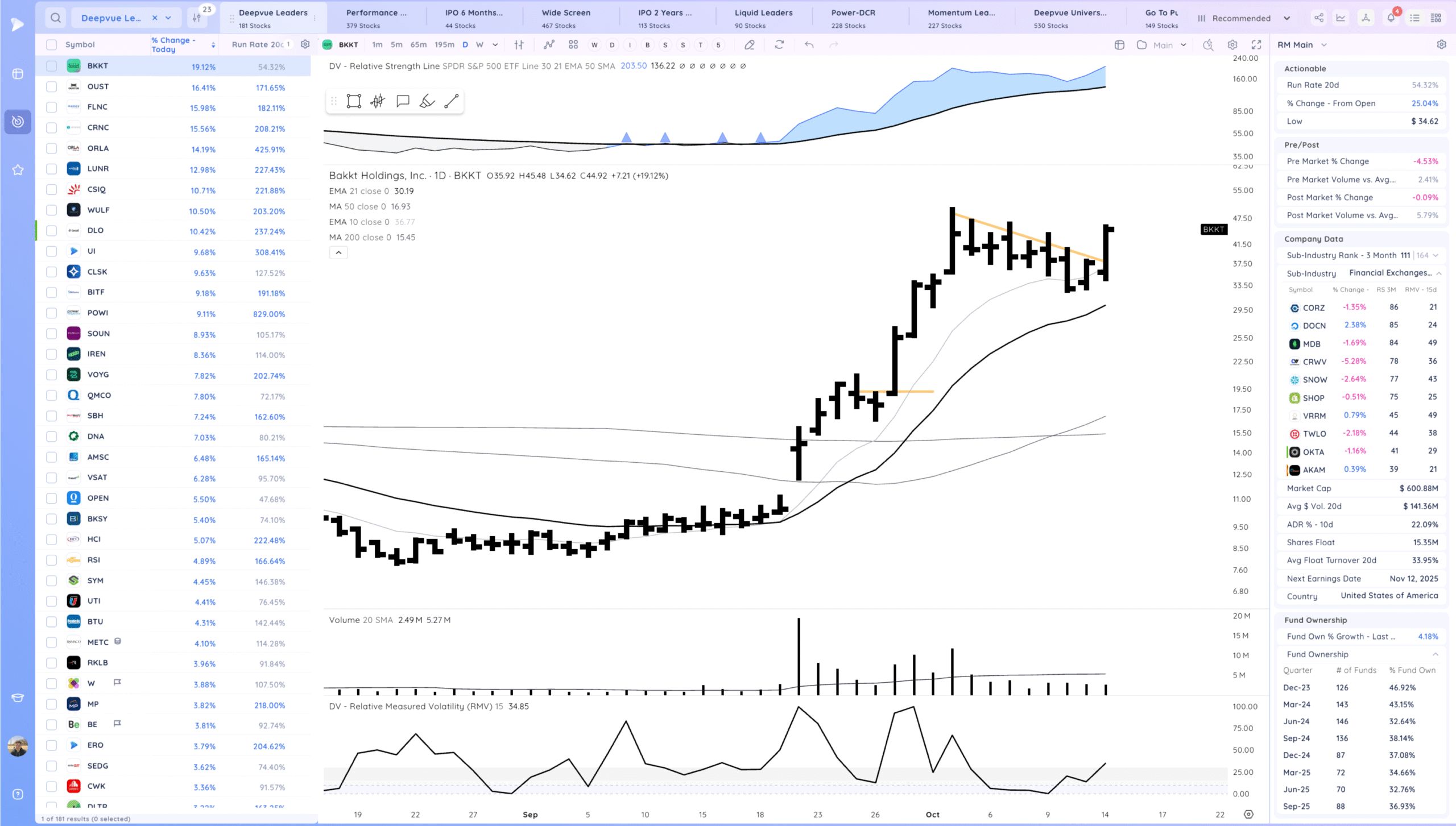

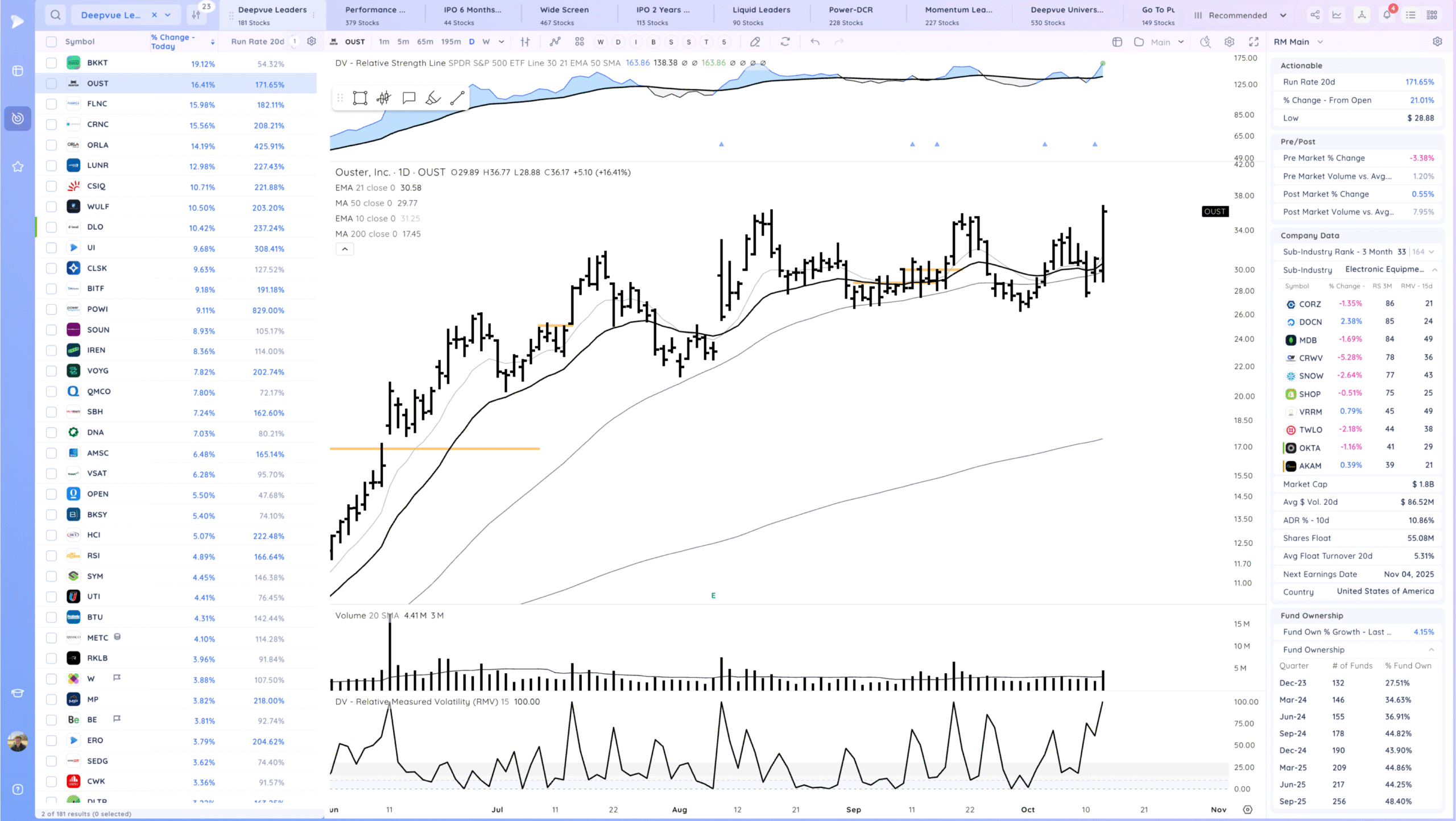

BKKT Flag breakout from the watchlist. Fast mover. Watching for follow through.

OUST range breakout from the inside day

Setups and Watchlist

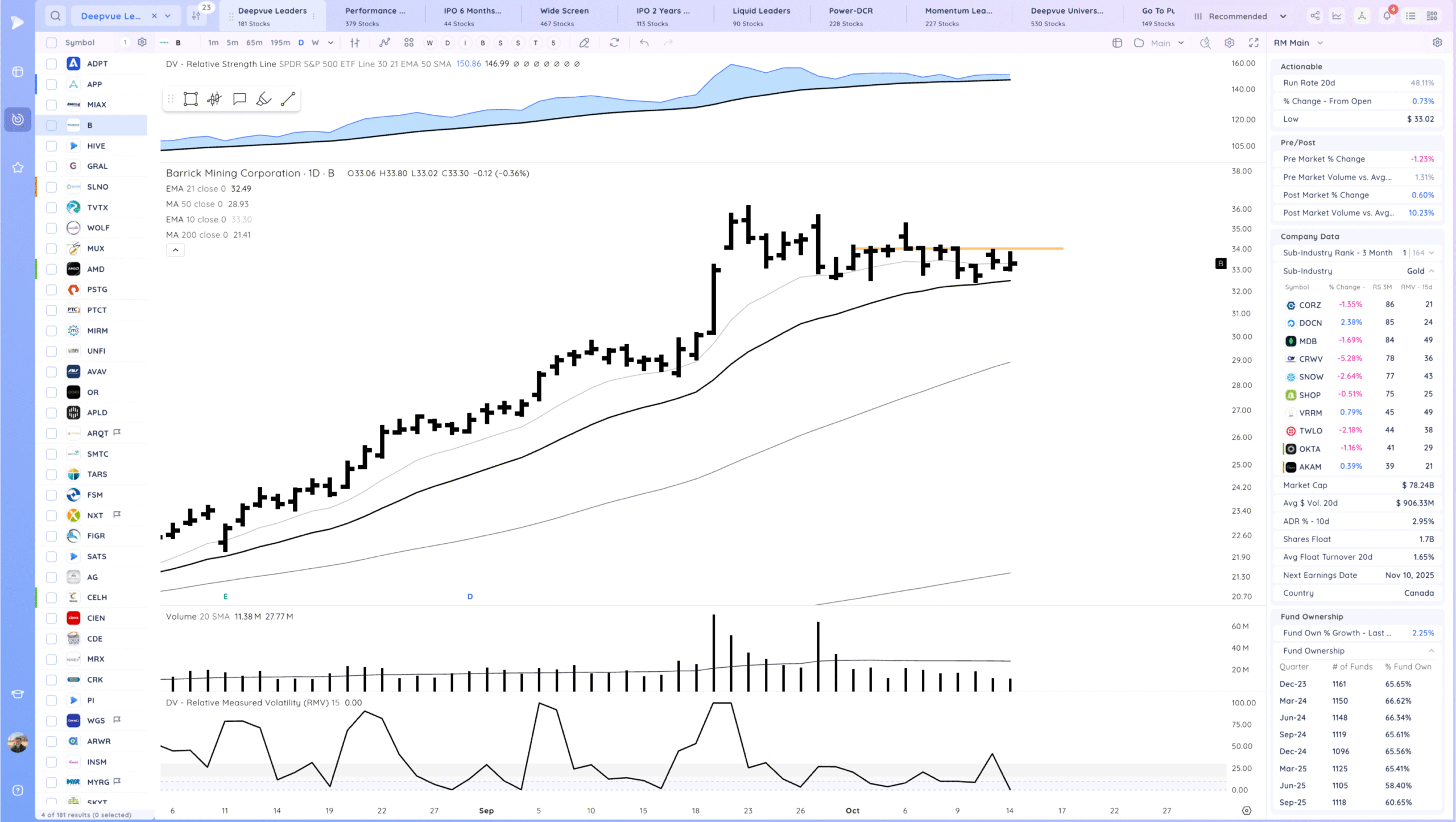

B watching for a range breakout if gold theme continues

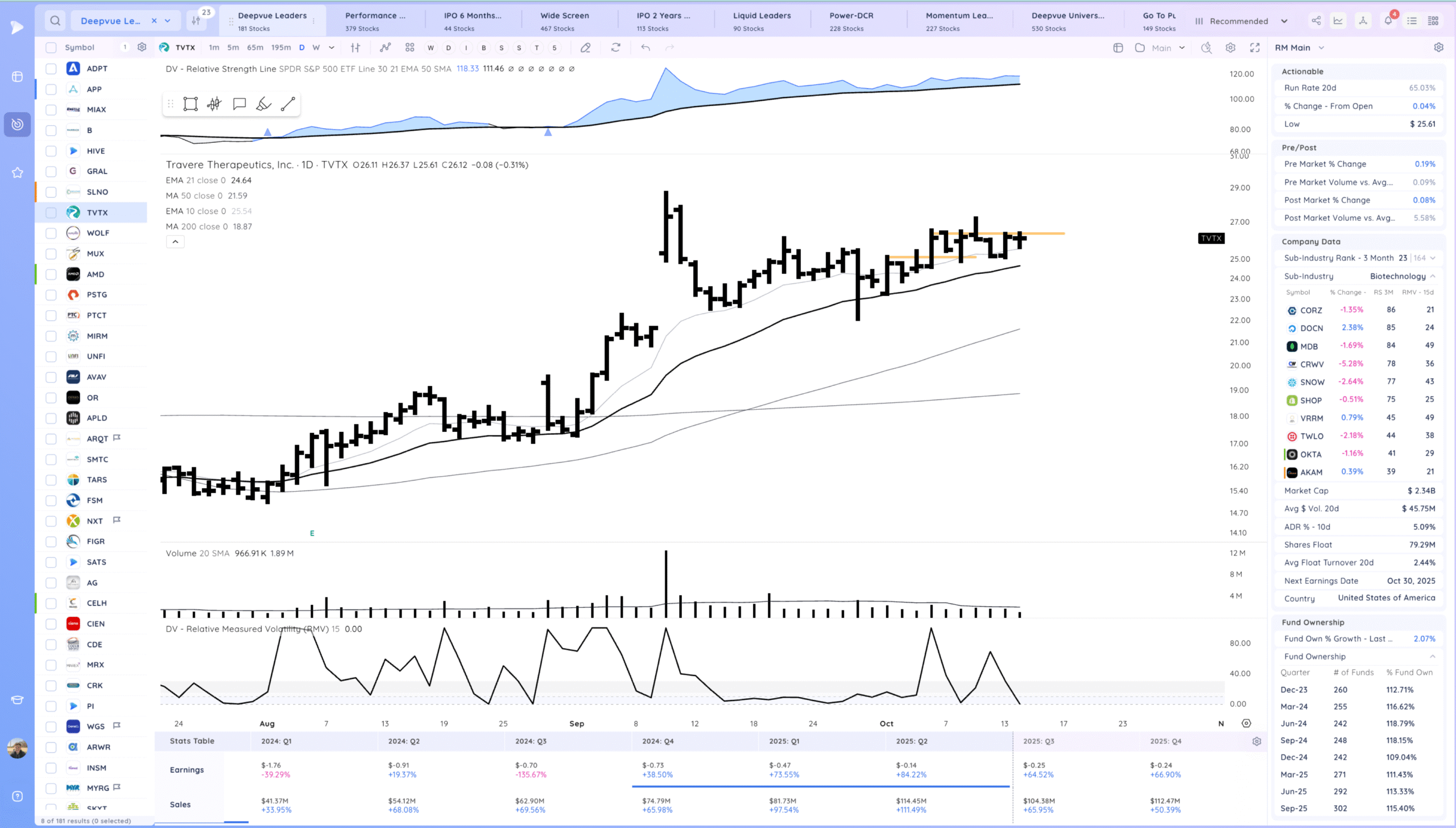

TVTX spec biotech watching for a range breakout.

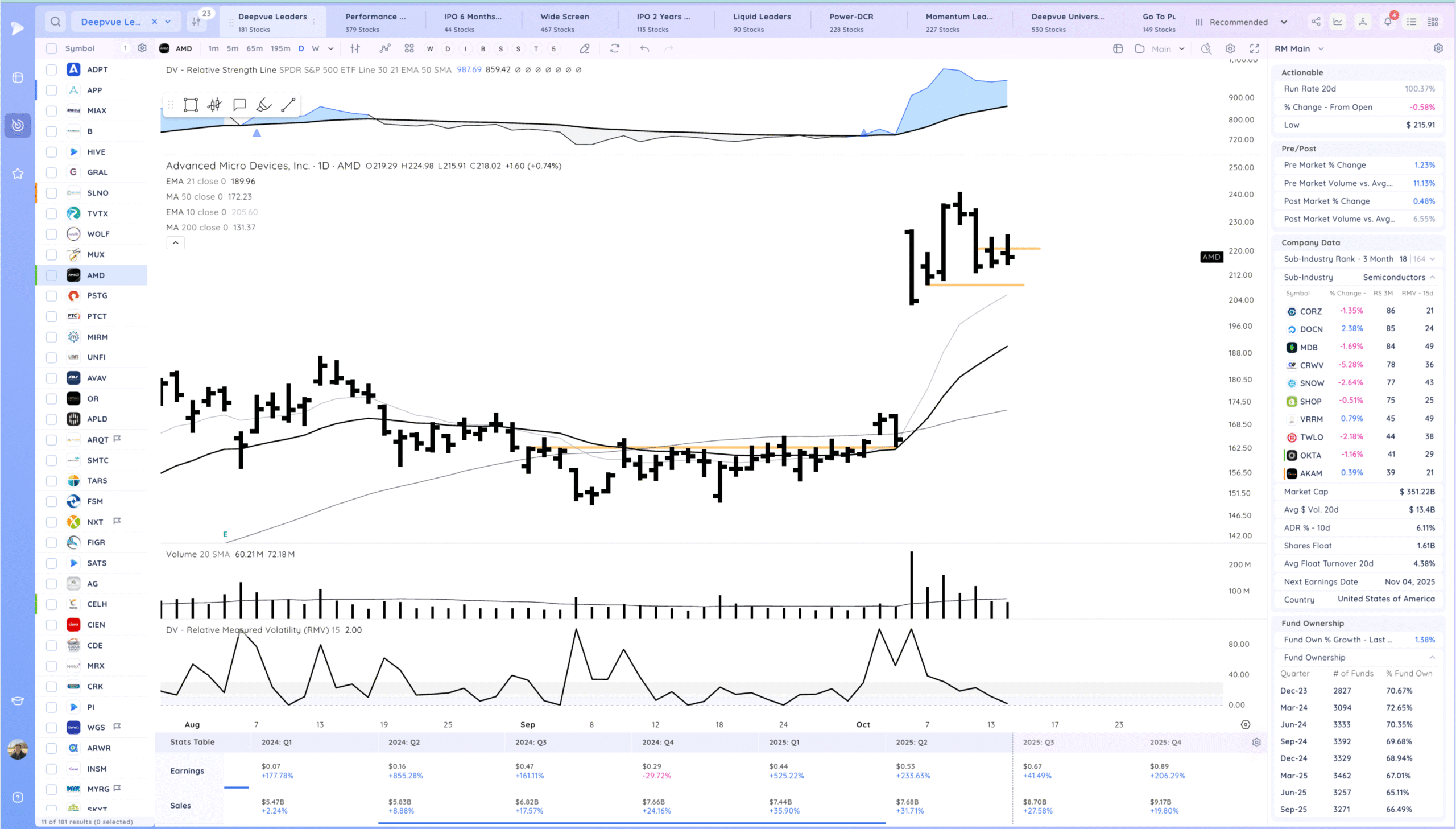

AMD watching for a range breakout. Could use more consolidation. NVDA weak which is a negative for the theme

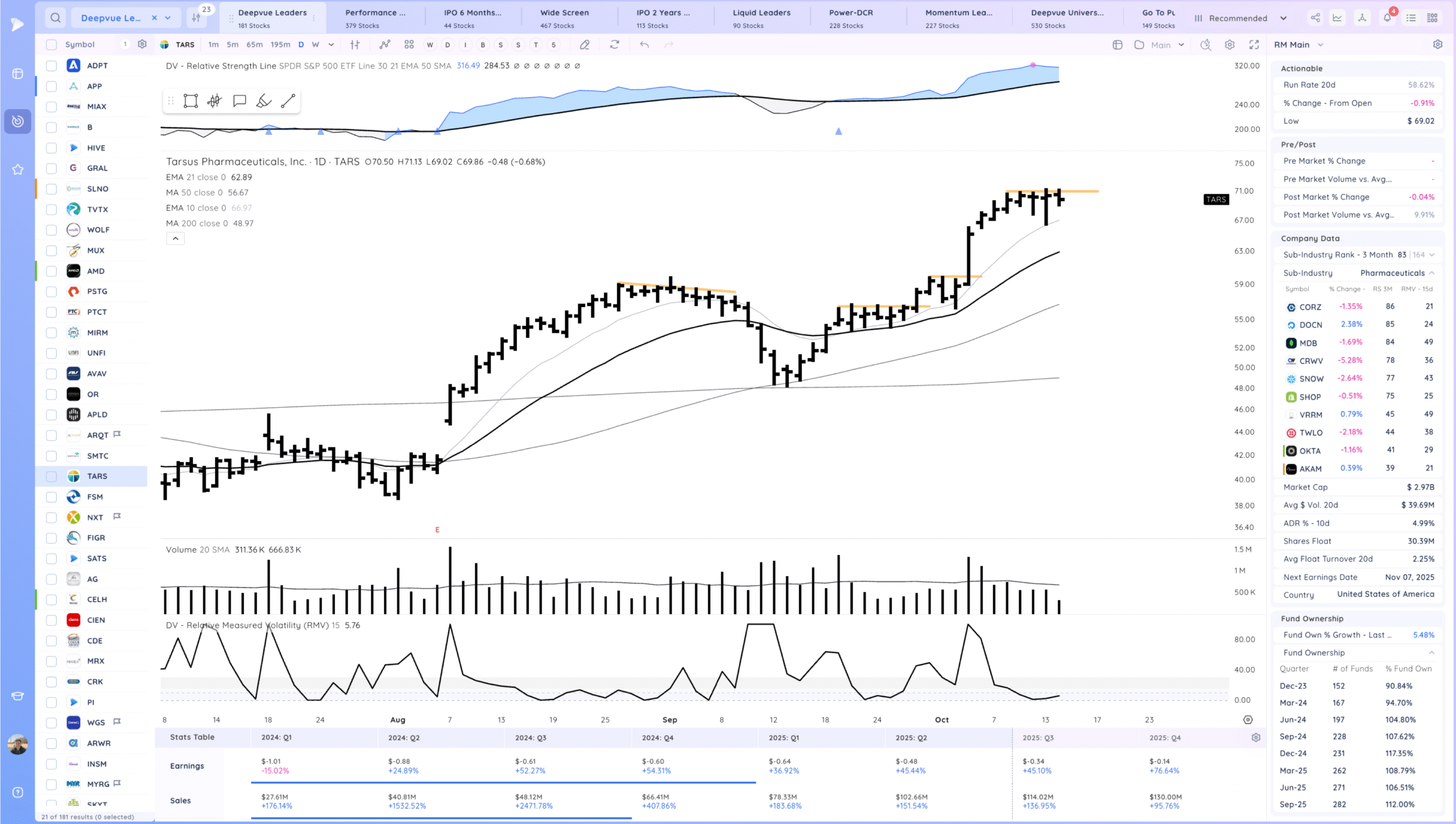

TARS watching for a range breakout

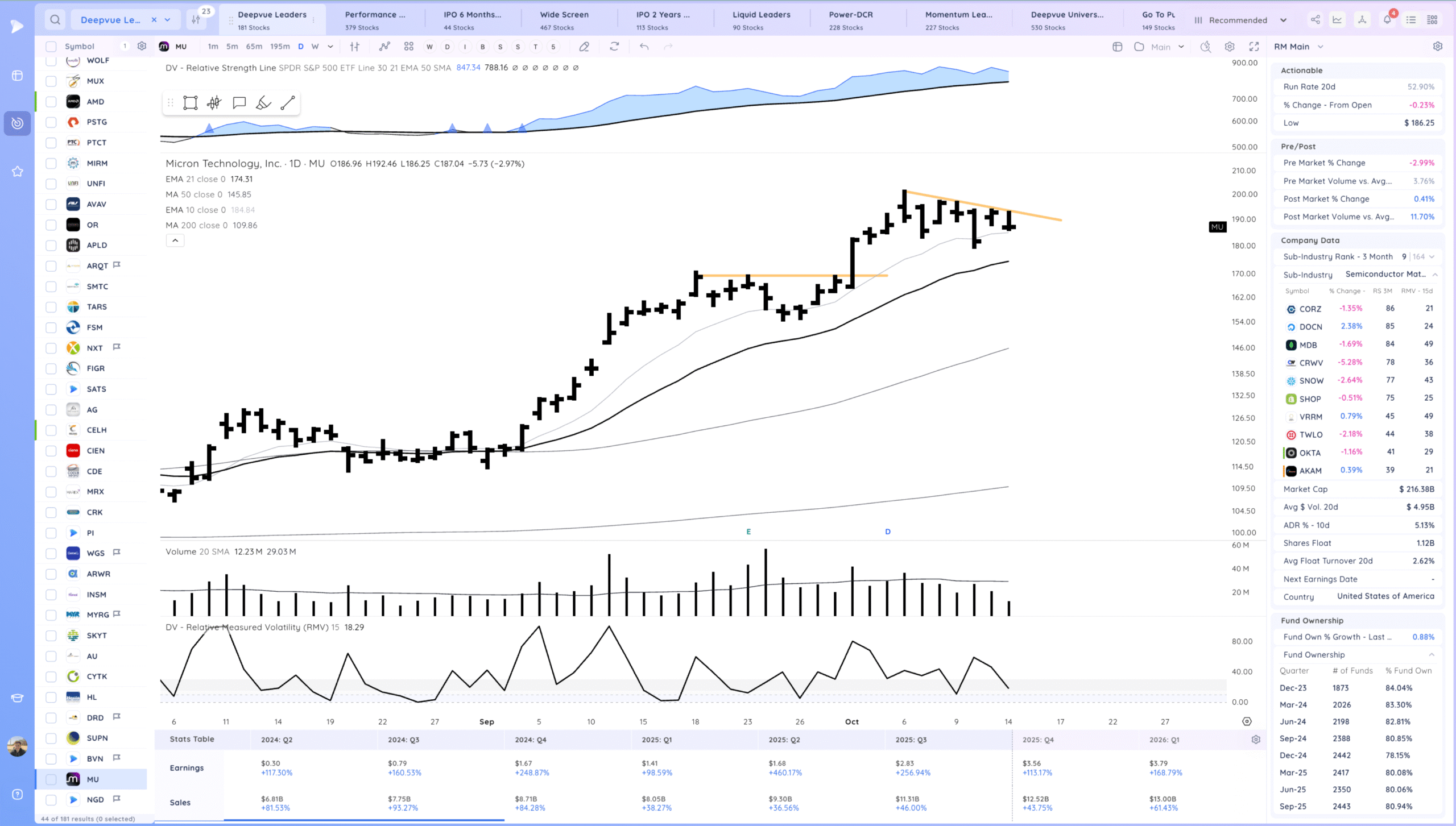

MU watching for a flag breakout. Best acting of semis. Still don’t like seeing NVDA acting weak

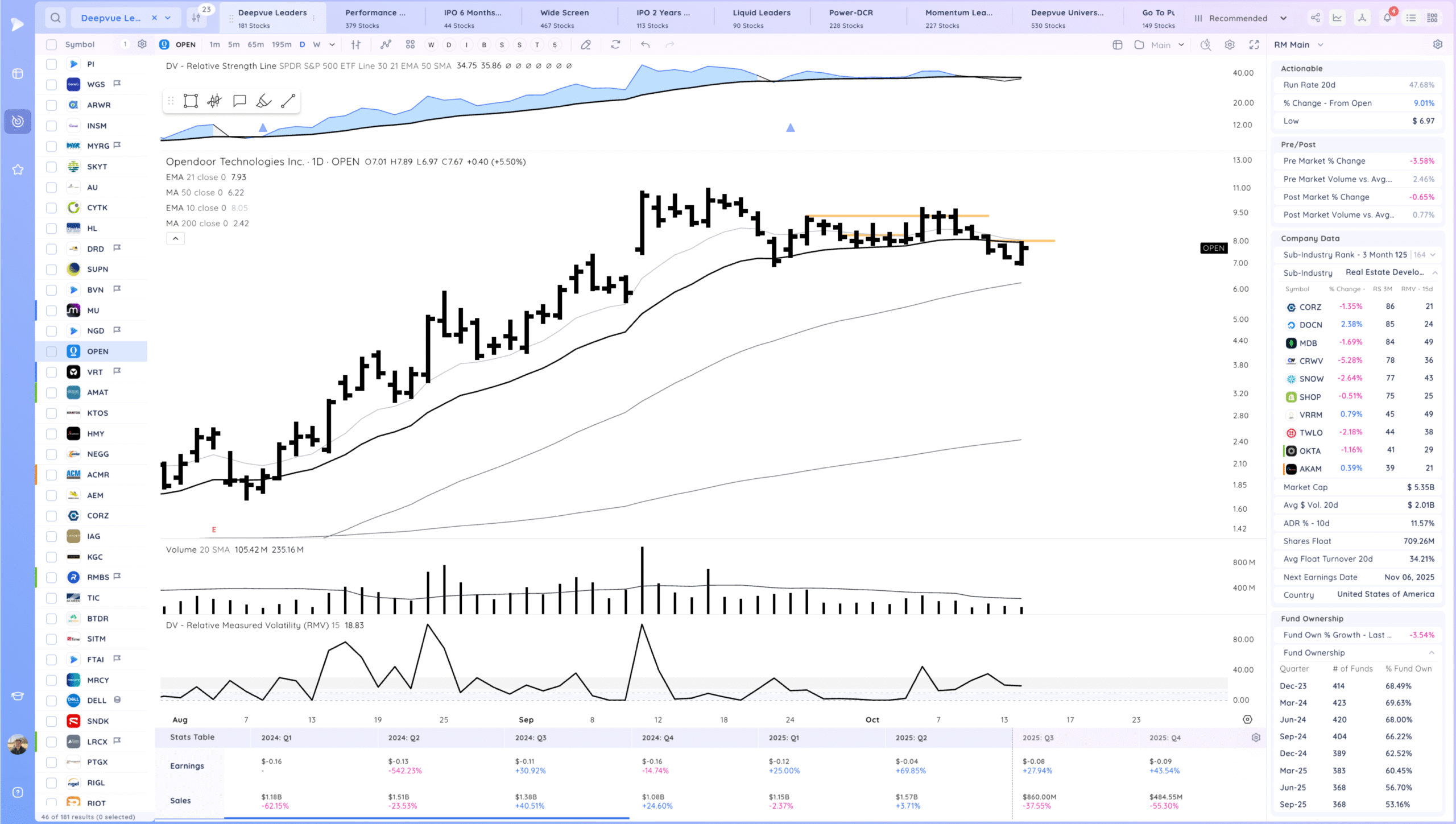

OPEN watching for a 21ema reclaim. fast mover would need to work right away

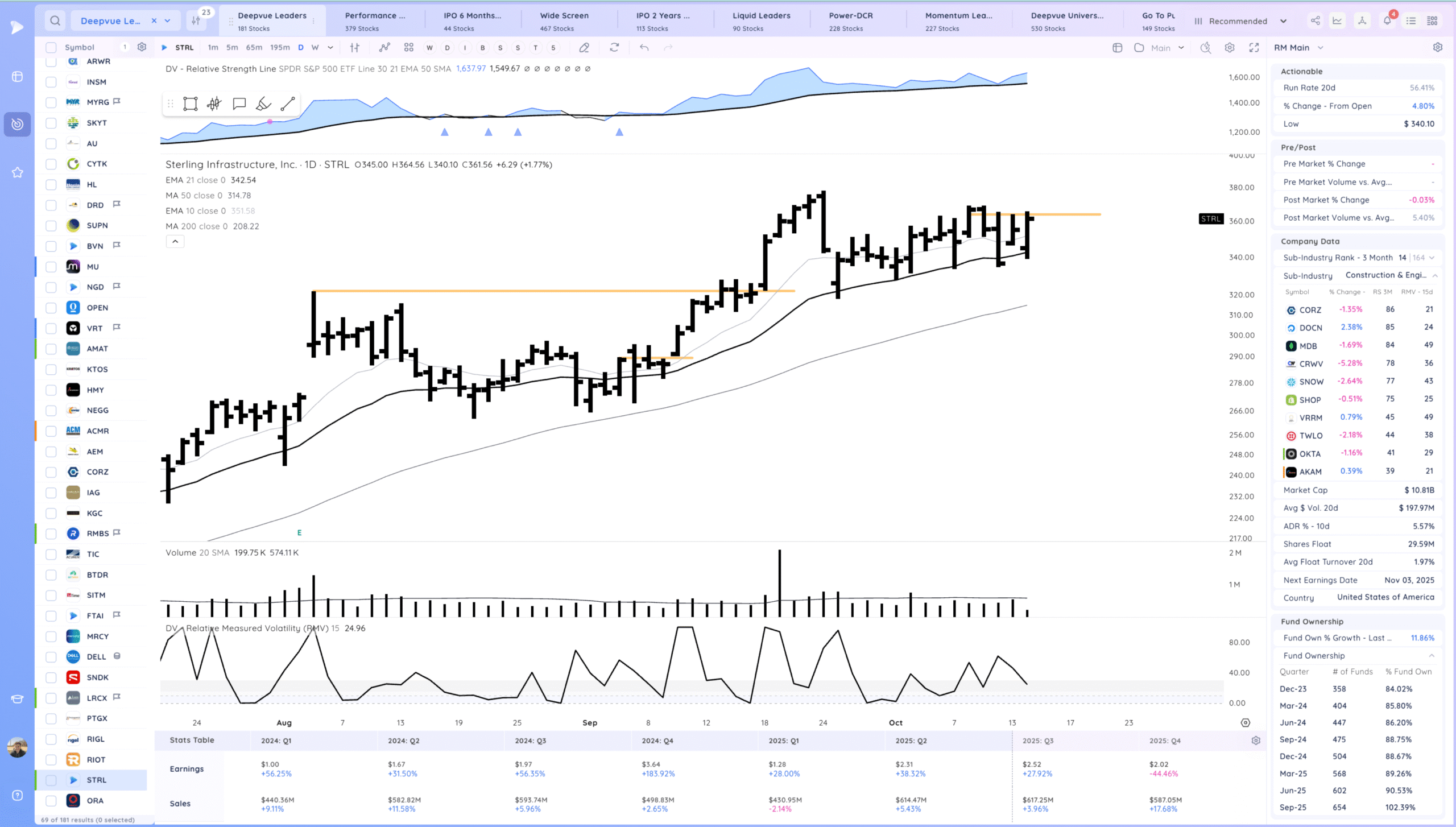

STRL watching for follow through up and range breakout

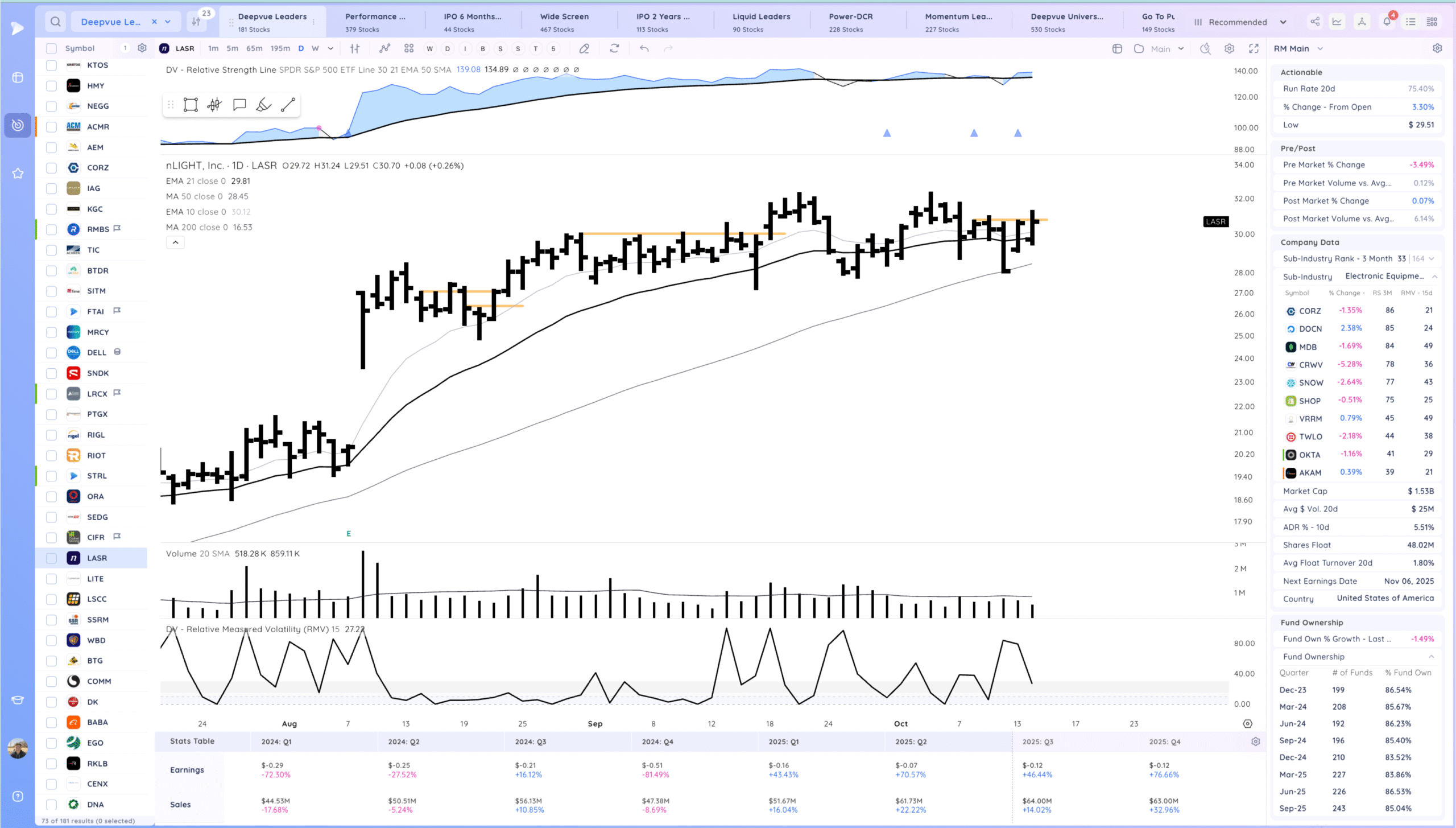

LASR watching for follow through up and range breakout

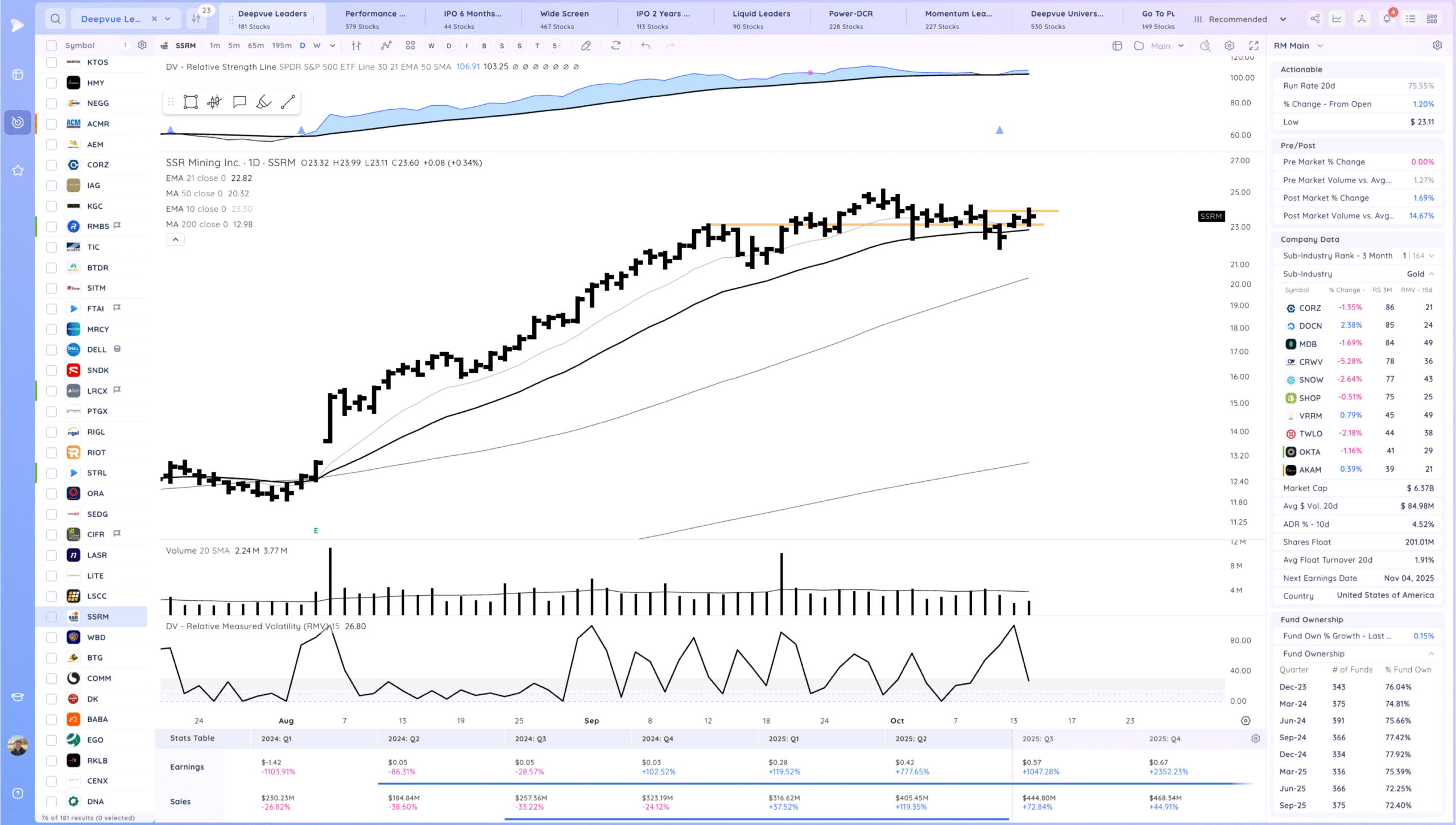

SSRM watching for follow through up and range breakout

Today’s Watchlist in List form

Focus List Names

B TVTX TARS AMD OPEN MU STRL LASR SSRM TSLA HOOD

Focus:

TSLA HOOD MU SSRM

Themes

AI, AI Energy, rare metals, gold miners, biotech

Additional Thoughts

It continues to be a choppy market that is news sensitive. NVDA being weak is a knock against the AI hardware theme but other semis are set up for expansion. I’m adopting more of a chop mindset currently. Being more selective and it needs to work. Recent trades are mixed.

Anything can happen, Day by Day – Managing risk along the way