TML Report October 13, 2025

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

October 13, 2025

Market Overview

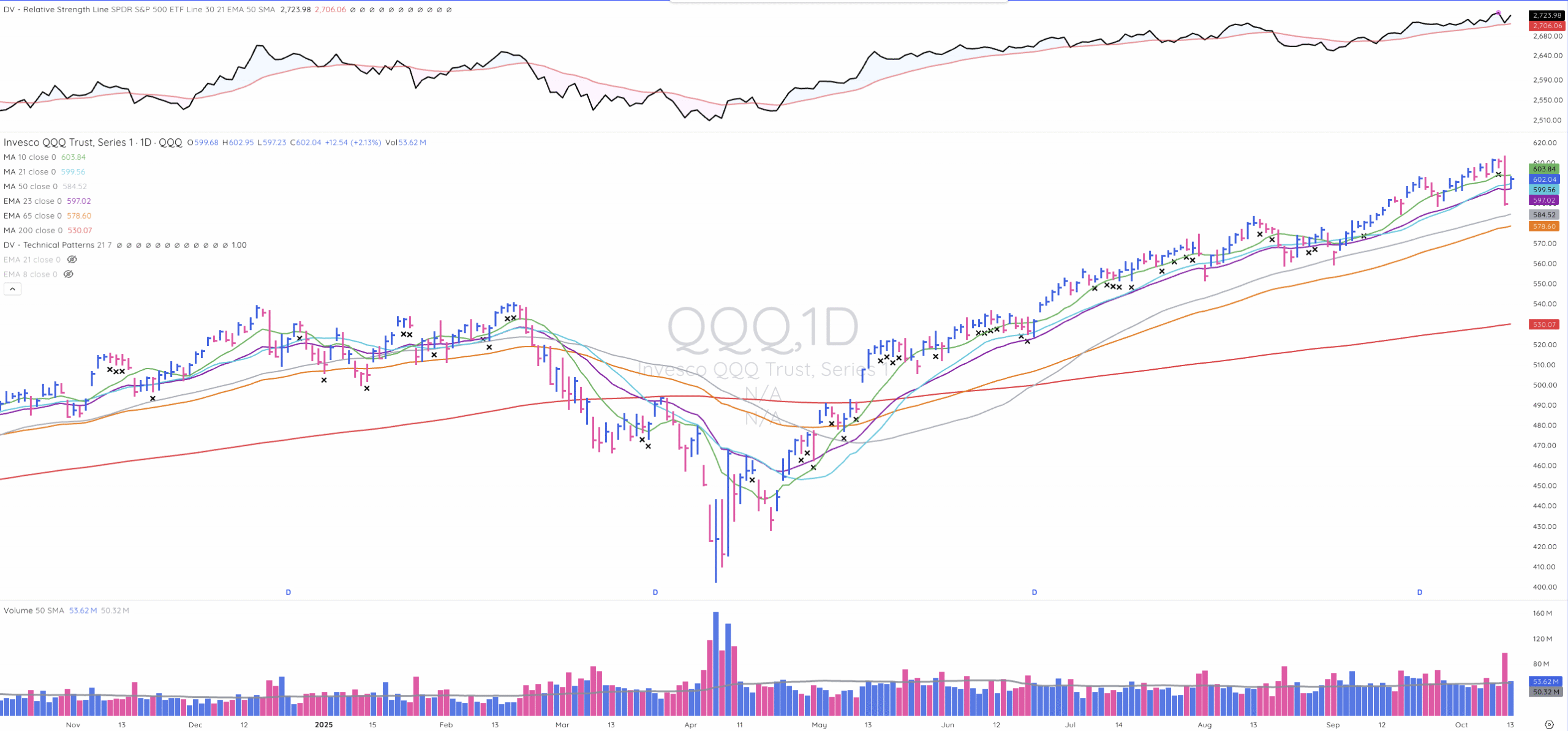

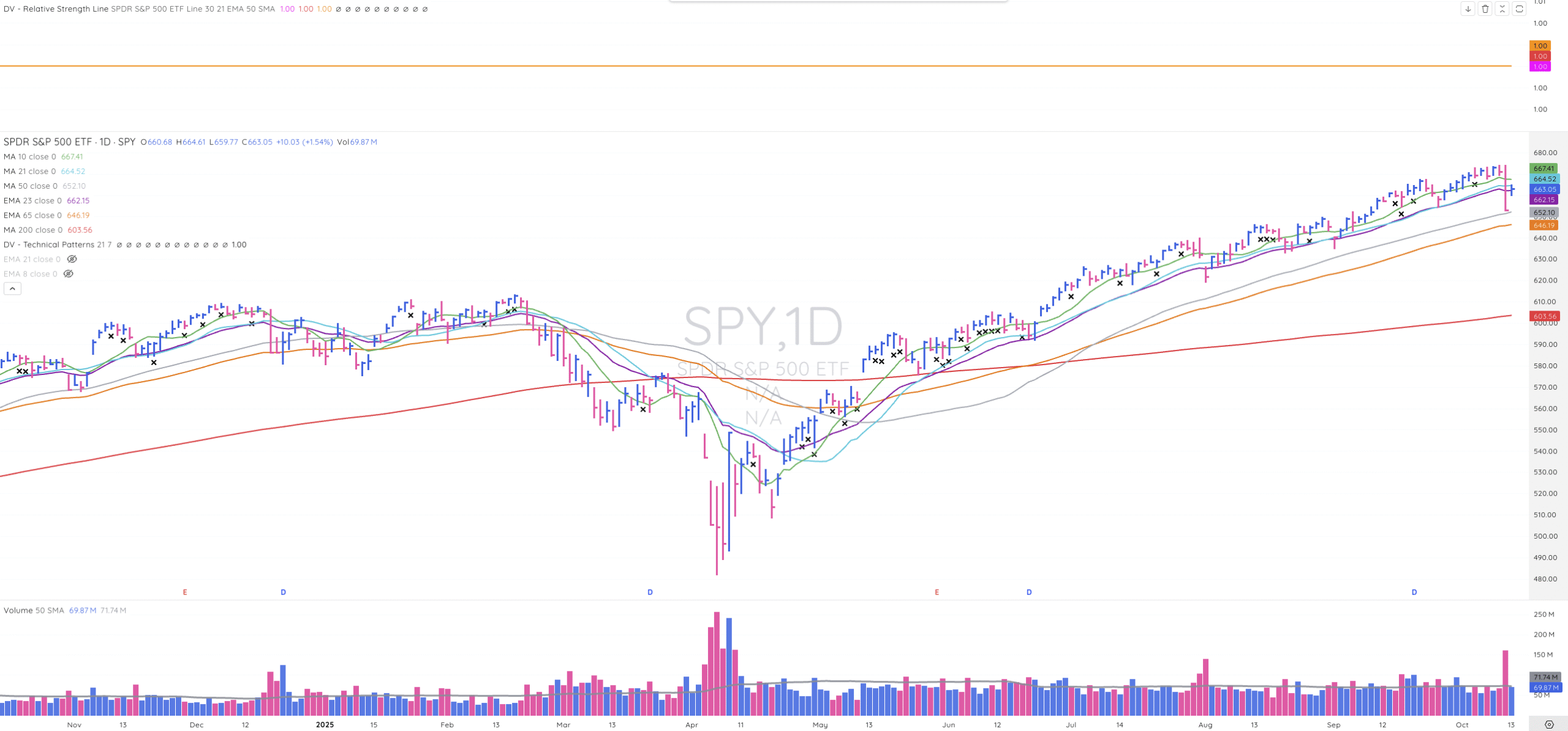

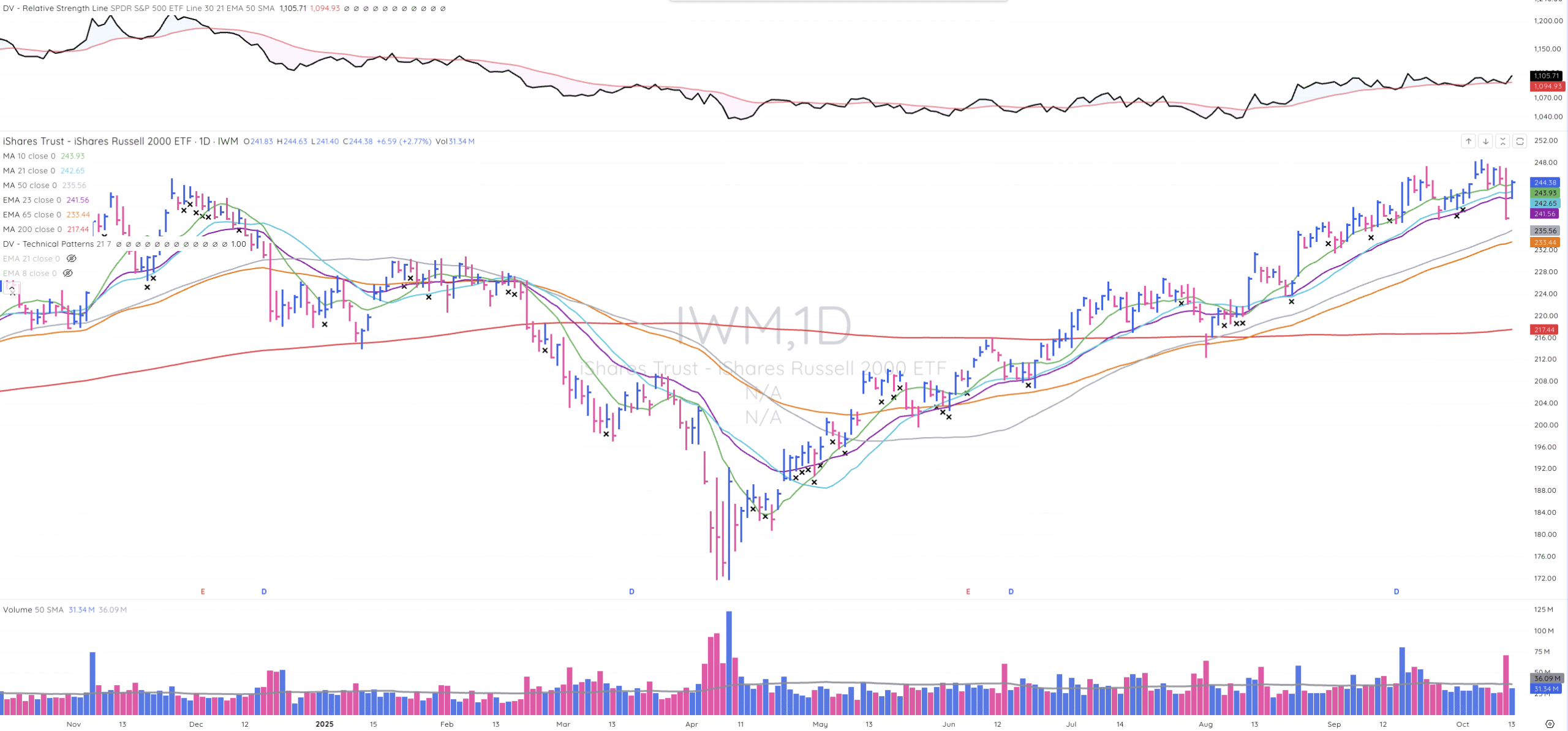

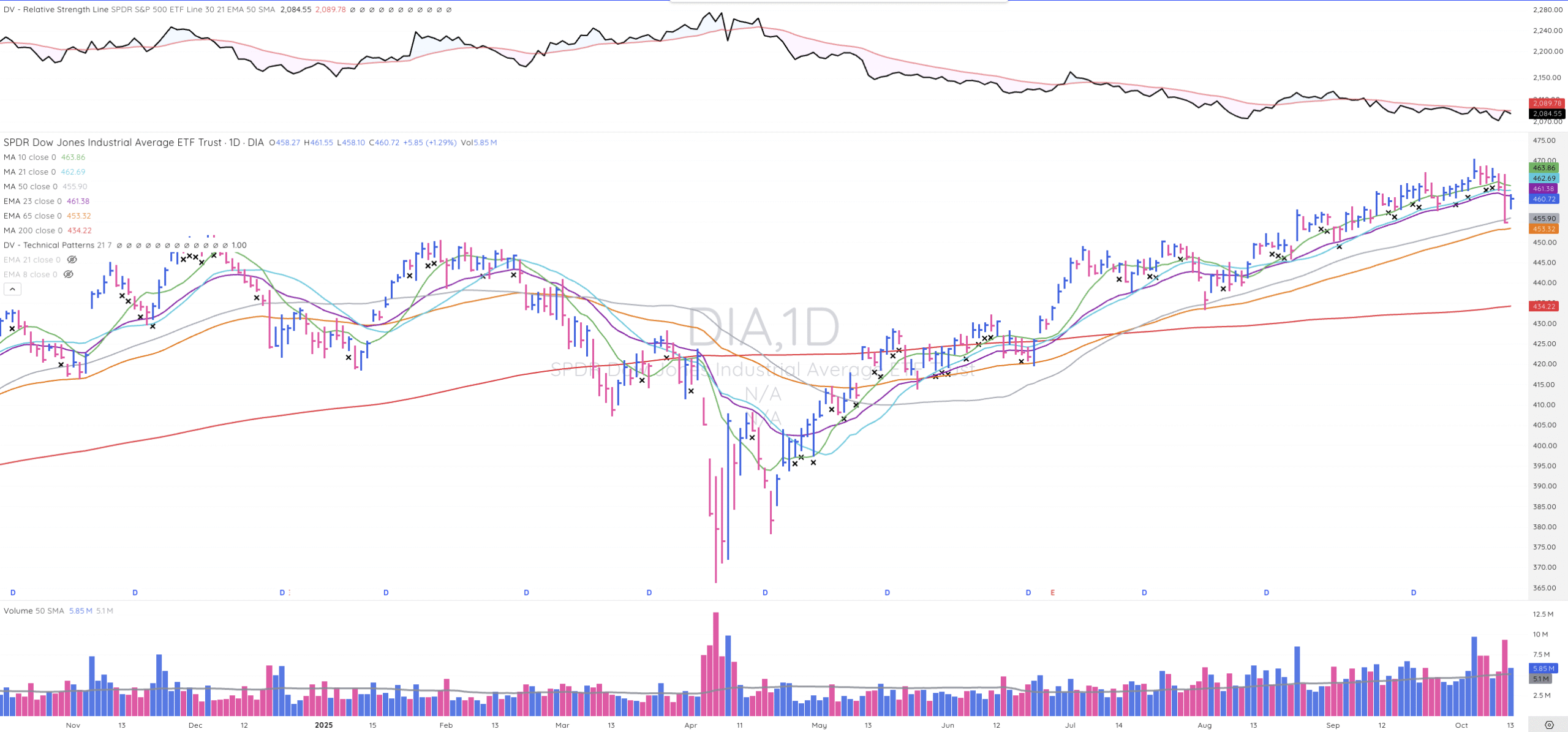

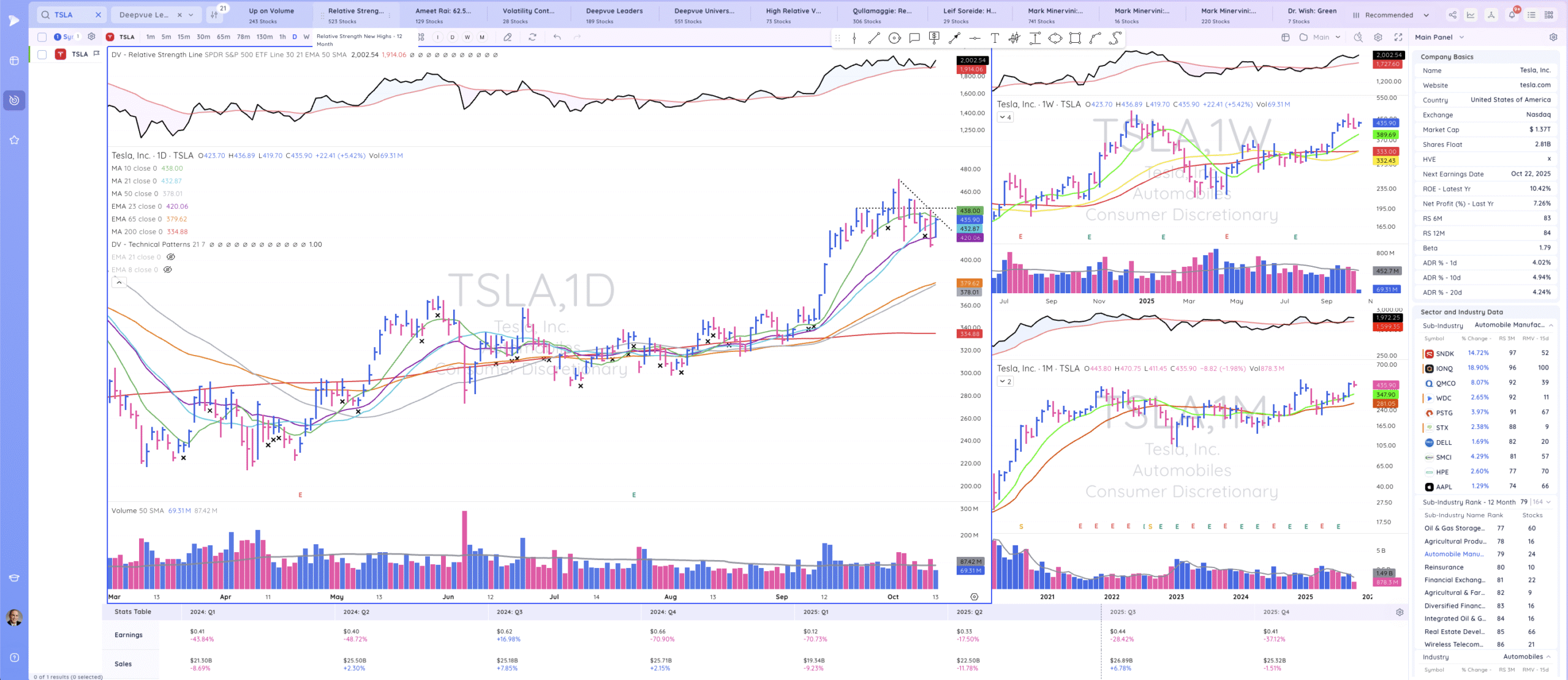

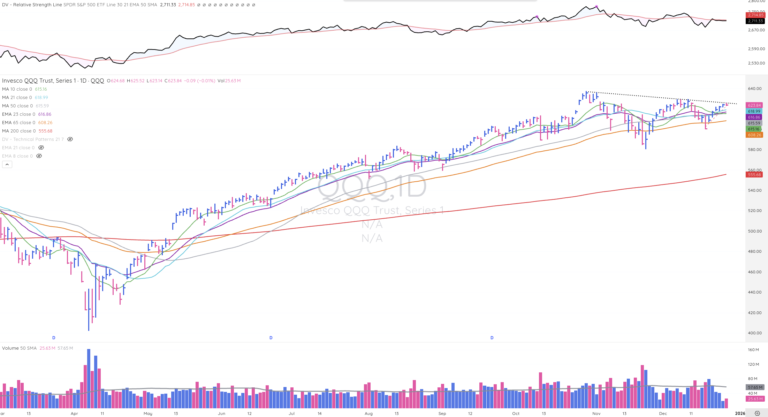

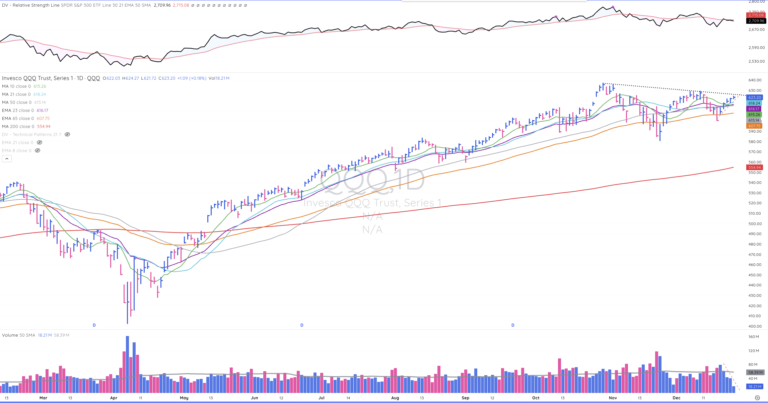

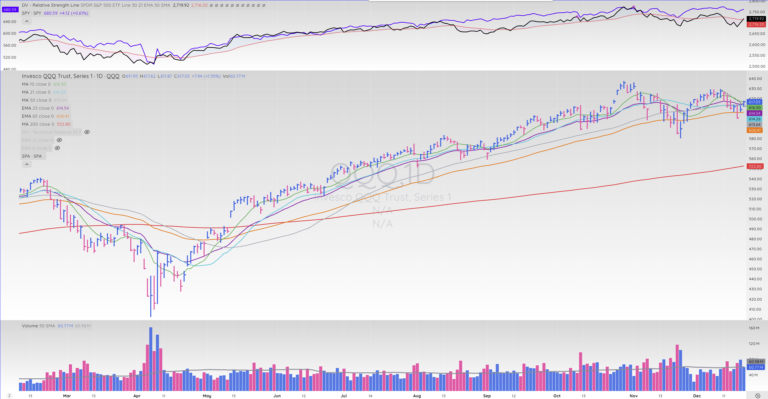

Tariff threats of 100% on China last Friday sent the market into a bit of a tailspin. The major indexes all closed near session lows on heavier volume. However, the NASDAQ opened above its 21-day SMA and held above throughout the session.

The health and breadth of the market’s leadership remain robust. Traditional growth names recovered and reclaimed key support along with the NASDAQ, many continuing to new all-time highs, including the high-flying quantum names, such as RGTI, QBTS, and IONQ. A glance at Deepvue’s daily theme tracker drives this point home.

Remember, patience and selectivity with our entries make all the difference, especially when it comes to managing risk. Like I always say, buying “right” is your best defense. So, watch the leaders, wait for sound setups to form, and most importantly, manage risk first, and the profits will follow.

Continue Reading This Week’s TML Report

Get expert CANSLIM analysis from Ross Haber, former William O’Neil portfolio manager, plus live Friday sessions and curated watchlists