Weekly Digest – Edition 14

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: October 12, 2025

6 min read

Weekly Subscriber Digest

Key Trading Insights

Confluence of Support Creates A+ Opportunities

“When you have weakness to a confluence of IMPORTANT technical areas its A+ opportunity.”

Pullbacks to multiple major support levels simultaneously — like bottom of a long base AND a respected moving average — make odds much higher for it to hold.

Pullbacks to multiple major support levels simultaneously — like bottom of a long base AND a respected moving average — make odds much higher for it to hold.

Control Your Environment

Step away during stressful periods when you have cushion in positions and stops set on new names. If your rule is to wait until the close on names with cushion then it helps reduce emotional decision making.

Holding Through Earnings

“My rule for holding through earnings is if I have enough of a cushion.”

If cushion is larger than the implied earnings move, hold. Implied move I find on OptionSlam.com. Also consider qualitative factors like recent earnings reactions across the sector. May lighten up slightly if needed, but cushion is the primary decision factor.

If cushion is larger than the implied earnings move, hold. Implied move I find on OptionSlam.com. Also consider qualitative factors like recent earnings reactions across the sector. May lighten up slightly if needed, but cushion is the primary decision factor.

April Leaders Setting Up

When any group of stocks show early strength together, it often signals readiness for another leg

higher for the group. I consider April leaders to be a group in a similar way. My goal is to position in these leaders while they are completeing their multi-month bases.

Trade Activity

5 trades this week • 3 exits, 2 entries

| Ticker | Trade Notes |

|---|---|

| BULL | Sold Monday: Stopped out in morning for +9.5% gain. Attempted smaller rebuy but stopped again by close. |

| MDB | Bought Wednesday: Entered during tight 3-week consolidation near highs. Treated as swing position rather than core holding. |

| MDB | Sold Friday: Exited to reduce exposure. No reason to hold over weekend and can buy back if needed. |

| PLTR | Sold Add Friday: Sold recent add to reduce size significantly. Position still in top of base near breakout level – willing to watch and buy back if it pulls to base bottom. |

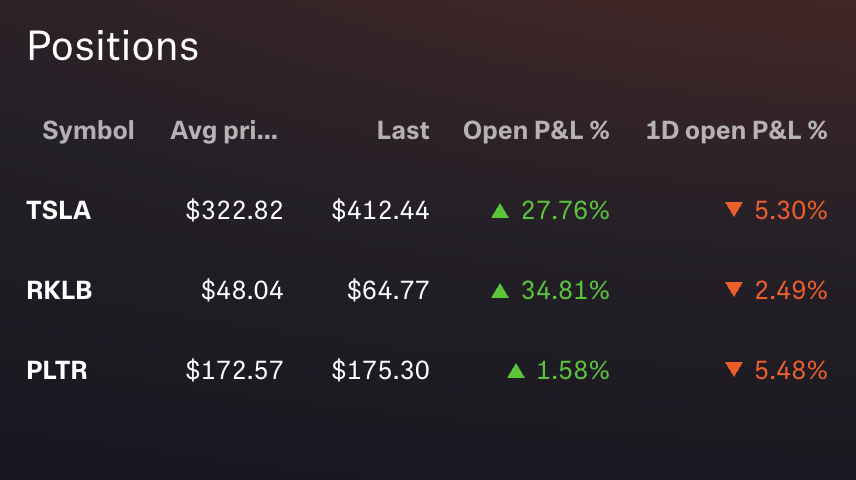

Current Holdings

3 core positions • Total exposure 121%

| Ticker | Status & Notes |

|---|---|

| TSLA | 91% of portfolio – #1 Focus. Fantastic action throughout the week. Using 10-week MA on closing basis as key support level. |

| PLTR | 16% of portfolio – #2 Focus. Reduced from 25% on Friday by selling add to manage exposure. Acting A+ but still in base near breakout. “Could pull back to bottom of base and still be fine… but I’d rather watch to buy back instead of riding both ways.” Ready to buy back on any pullback. |

| RKLB | 14% of portfolio. Using the 4-week on a closing basis. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | Beautiful day with nice momentum after stressful prior Friday. BULL stopped out for +9.5%, attempted rebuy but stopped again by close. Great action across $PLTR, $TSLA, $RKLB. “My favorite days are when things are fine and working and there isn’t much to think about.” Calmer environment welcomed after previous week’s stress. |

| Tuesday | Not the best close but nothing concerning. Nice action in $PLTR and $RKLB. $TSLA closed at low of day but held $430 level (highest volume price), providing comfort as long as closing above continues. |

| Wednesday | Strong momentum across the board. Added $MDB during tight consolidation. Not much movement in $TSLA or $PLTR but that’s fine – things don’t need to move every day or week. $RKLB push came with big volume, increasing likelihood the breakout sticks. |

| Thursday | Early strength in April leaders – $PLTR, $TSLA, $NFLX, $NVDA, $RKLB all showing coordinated power. $NFLX respecting 30-week MA providing confluence of support. Positioning ahead of what could be massive rally in these April leaders. |

| Friday | One of the most brutal daily readings for momentum breadth seen in a long time. Major structure is intact which makes me believe we will not see a major crash like earlier this year, but things can still pull back lower before snapping back. Reduced exposure by selling $PLTR add and $MDB. “If things do pull back more next week in my opinion it’s not a major top it will just offer much better opportunities in names to get long.” |

← Swipe to see more →