TSLA Downside Reversal

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

October 2, 2025

Market Action

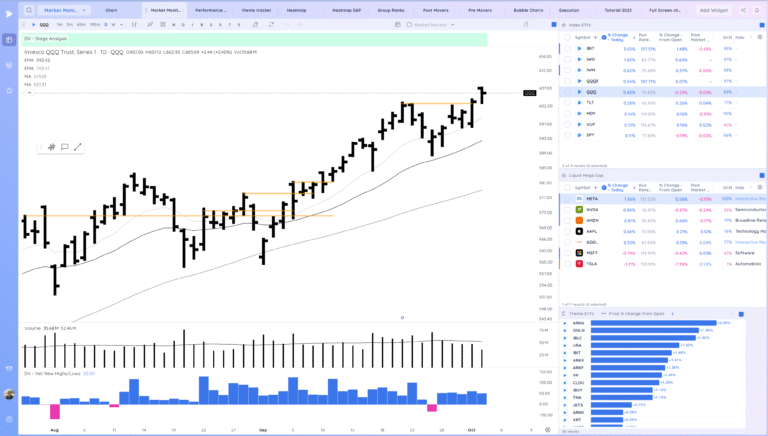

QQQ – Gap up, pull into the consolidation pivot and a decent close off lows. Continues to trend above the moving averages

Bulls want to see a continued trend higher / constructive sideways range building.

Bears want to see a sharp reversal down back towards the 10ema

Daily Chart of the QQQ.

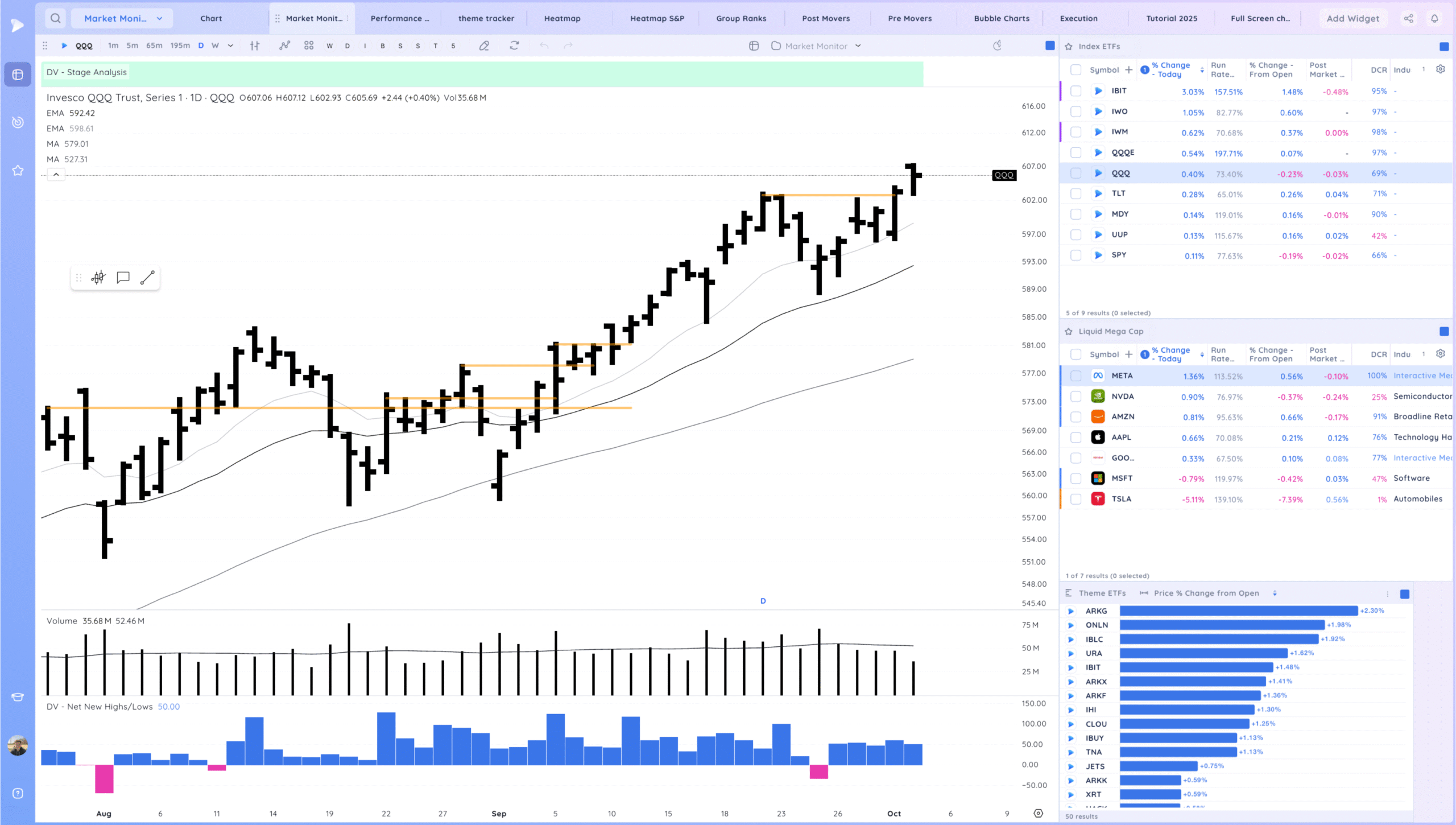

IWM – Strong close

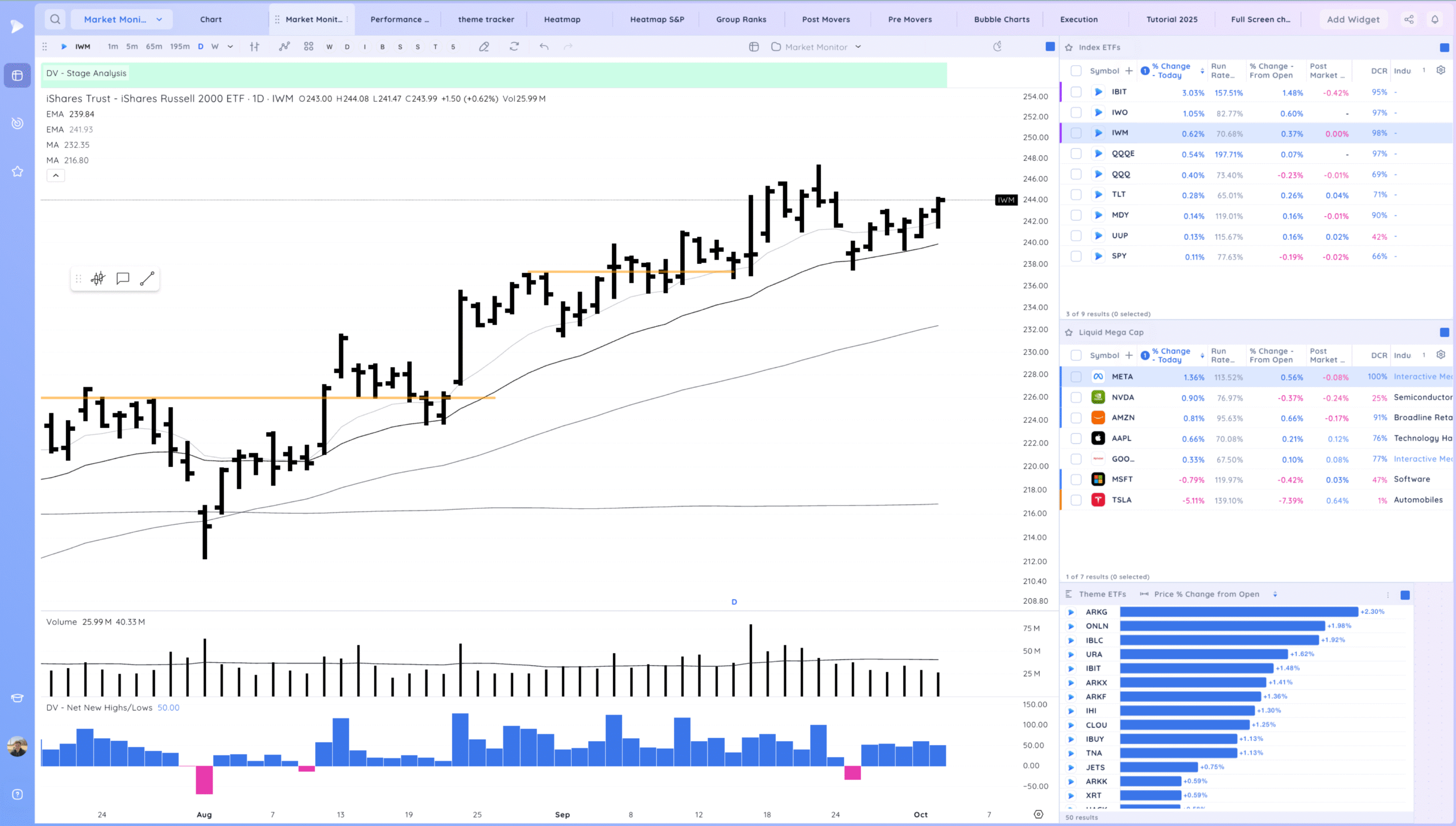

IBIT – More follow through and break above the 90% base level. Sharp move higher. Ideally contracts and builds a handle here.

COIN continues to push strongly up the right side. Crypto is a theme to be watching closely.

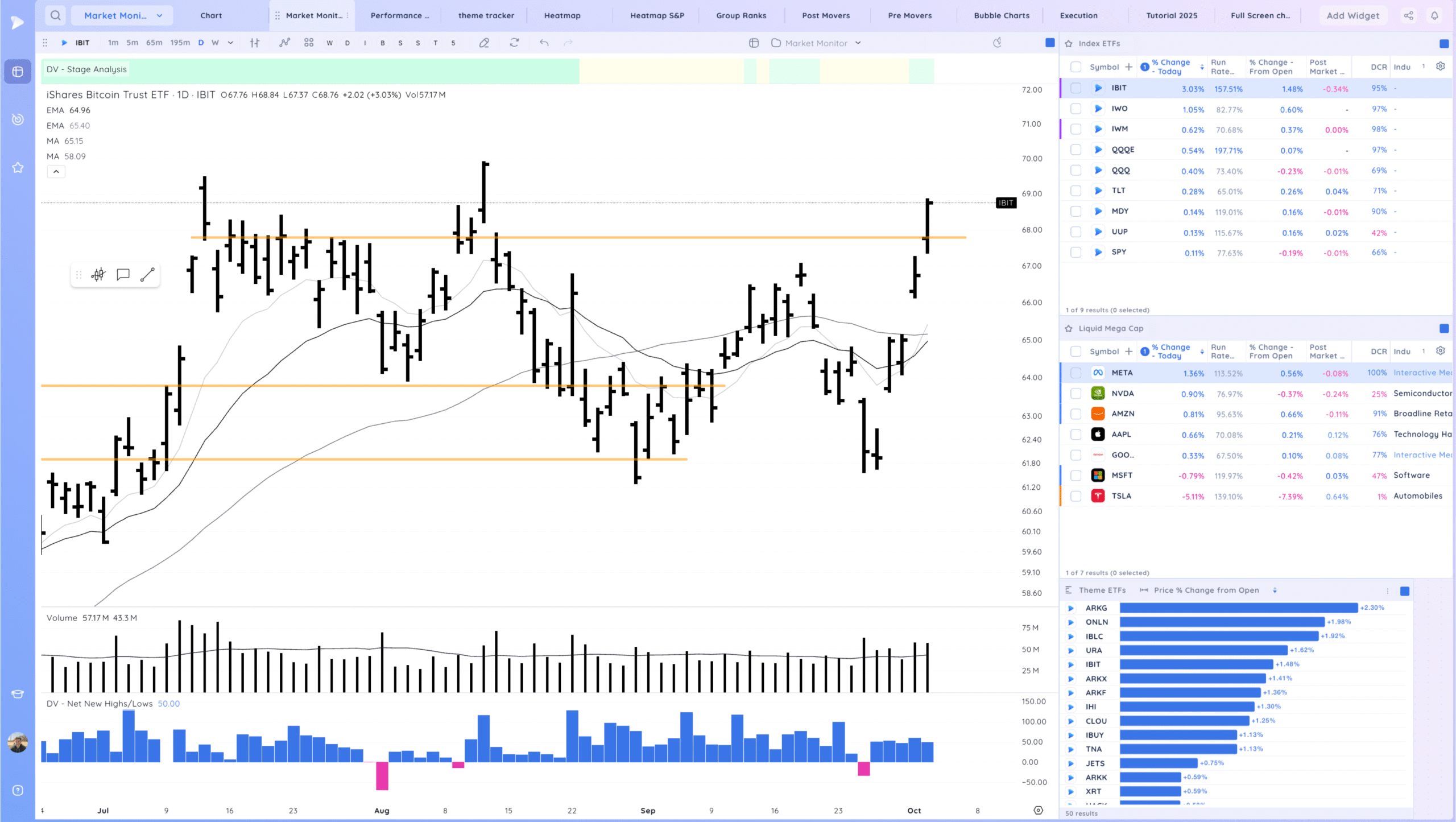

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

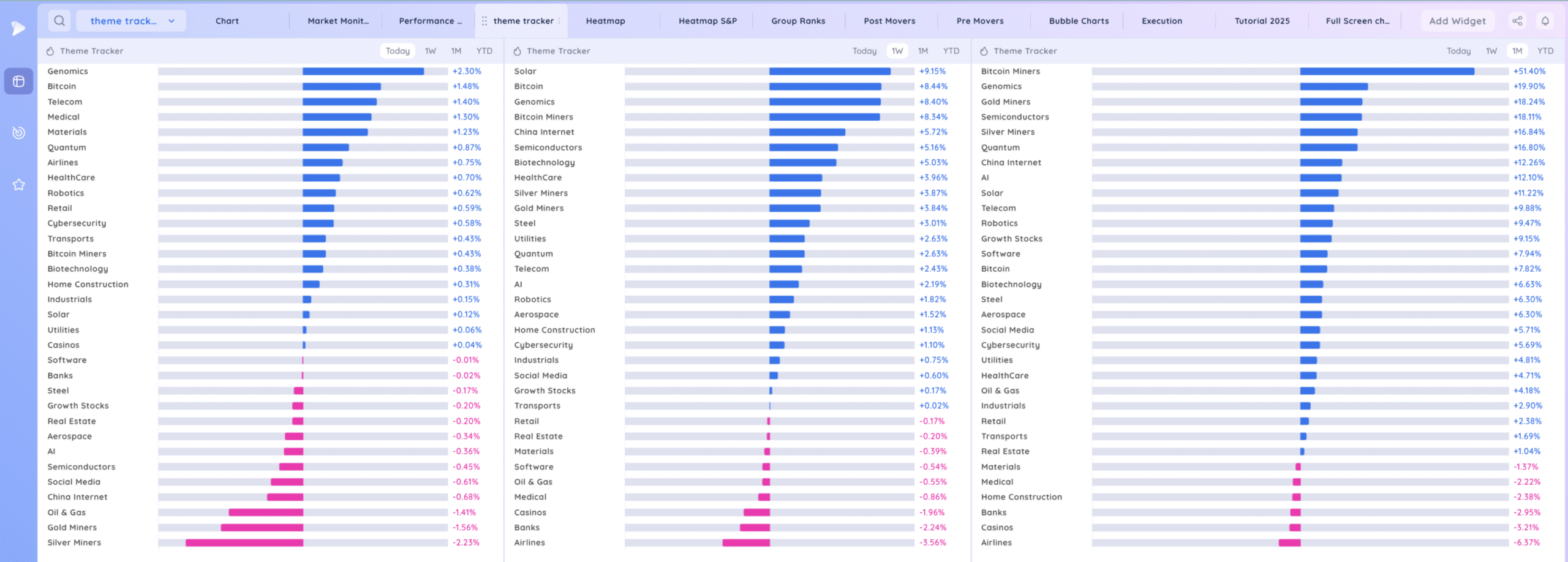

Groups/Sectors

Deepvue Theme Tracker

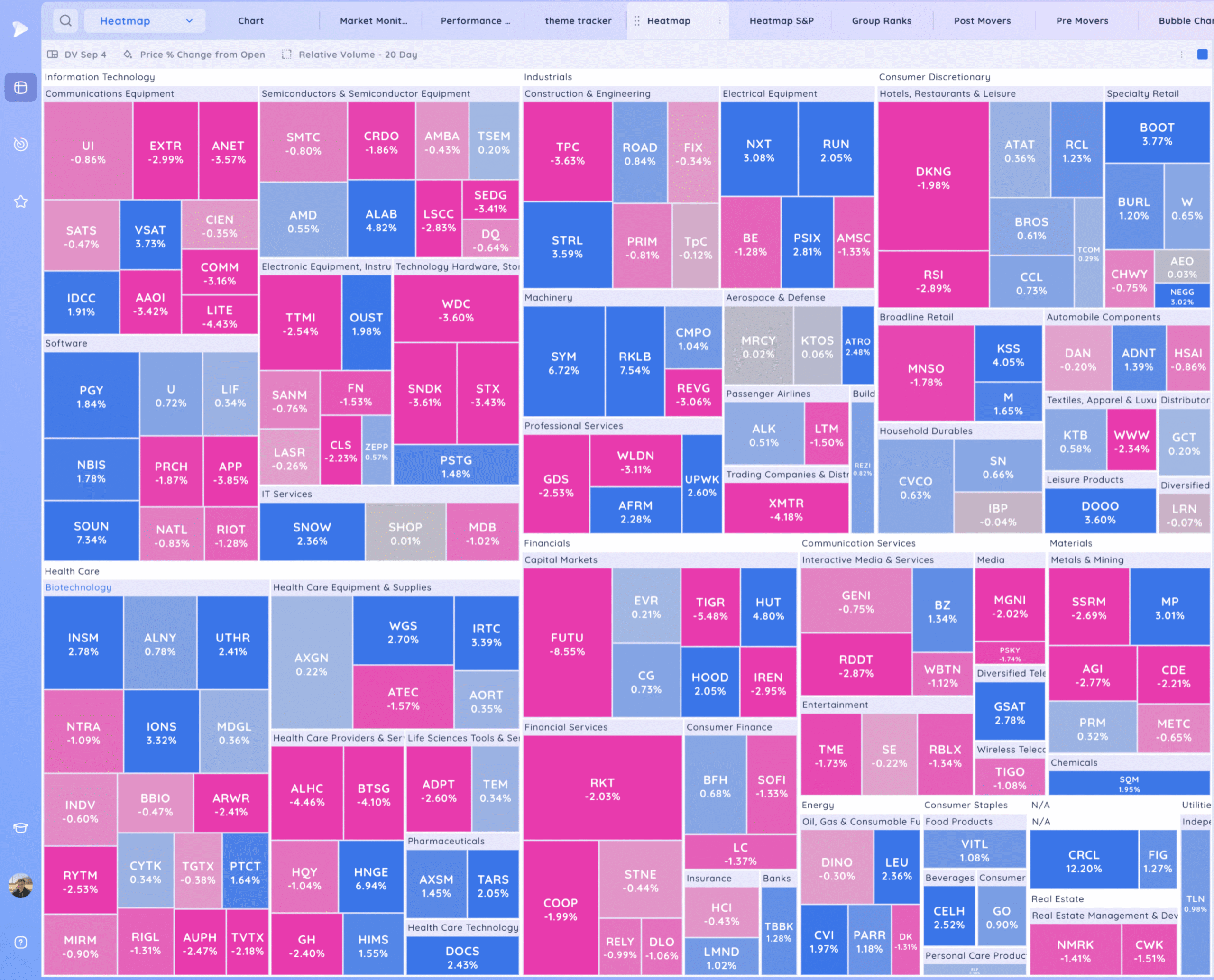

Deepvue Leaders

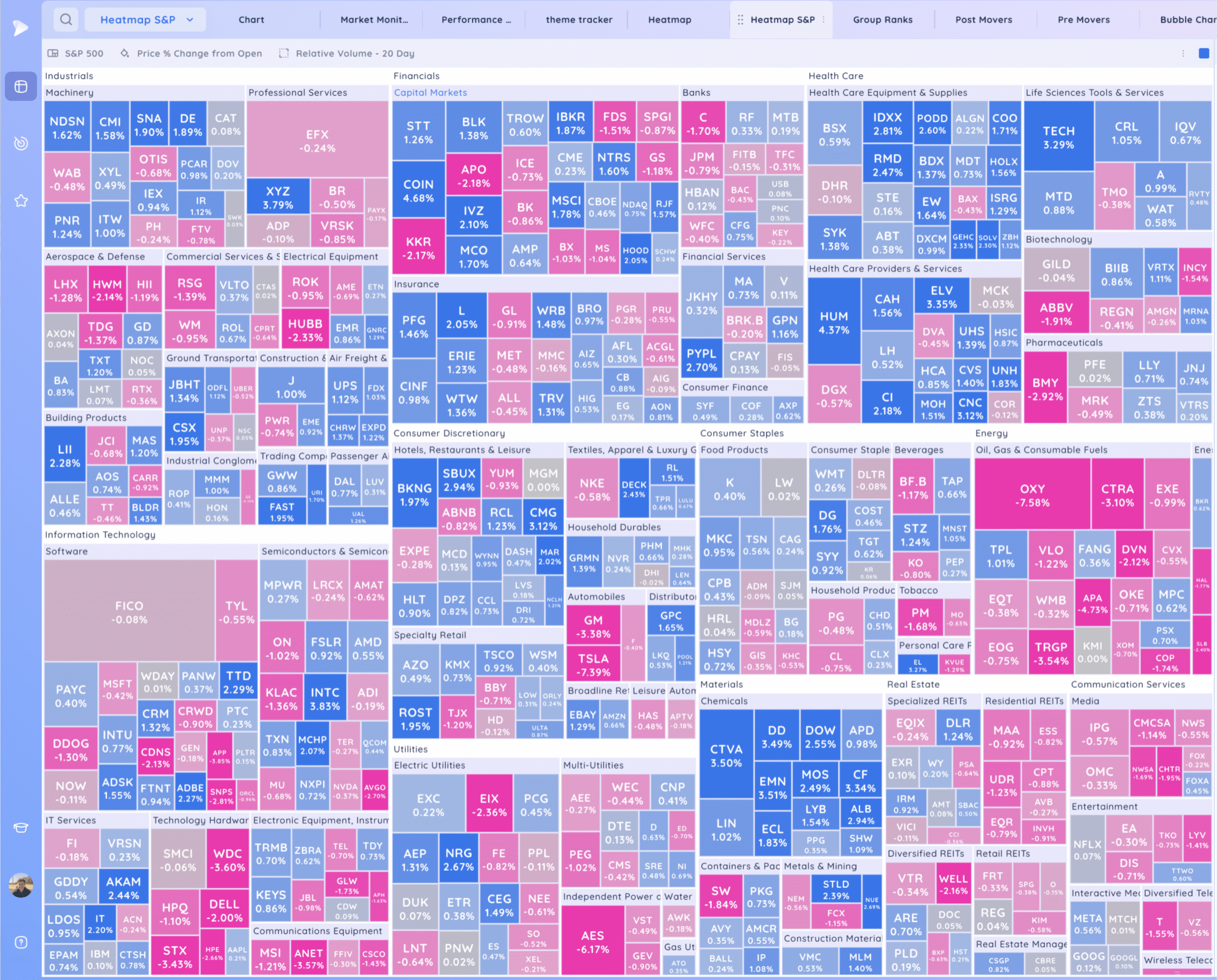

S&P 500.

Leadership Stocks & Analysis

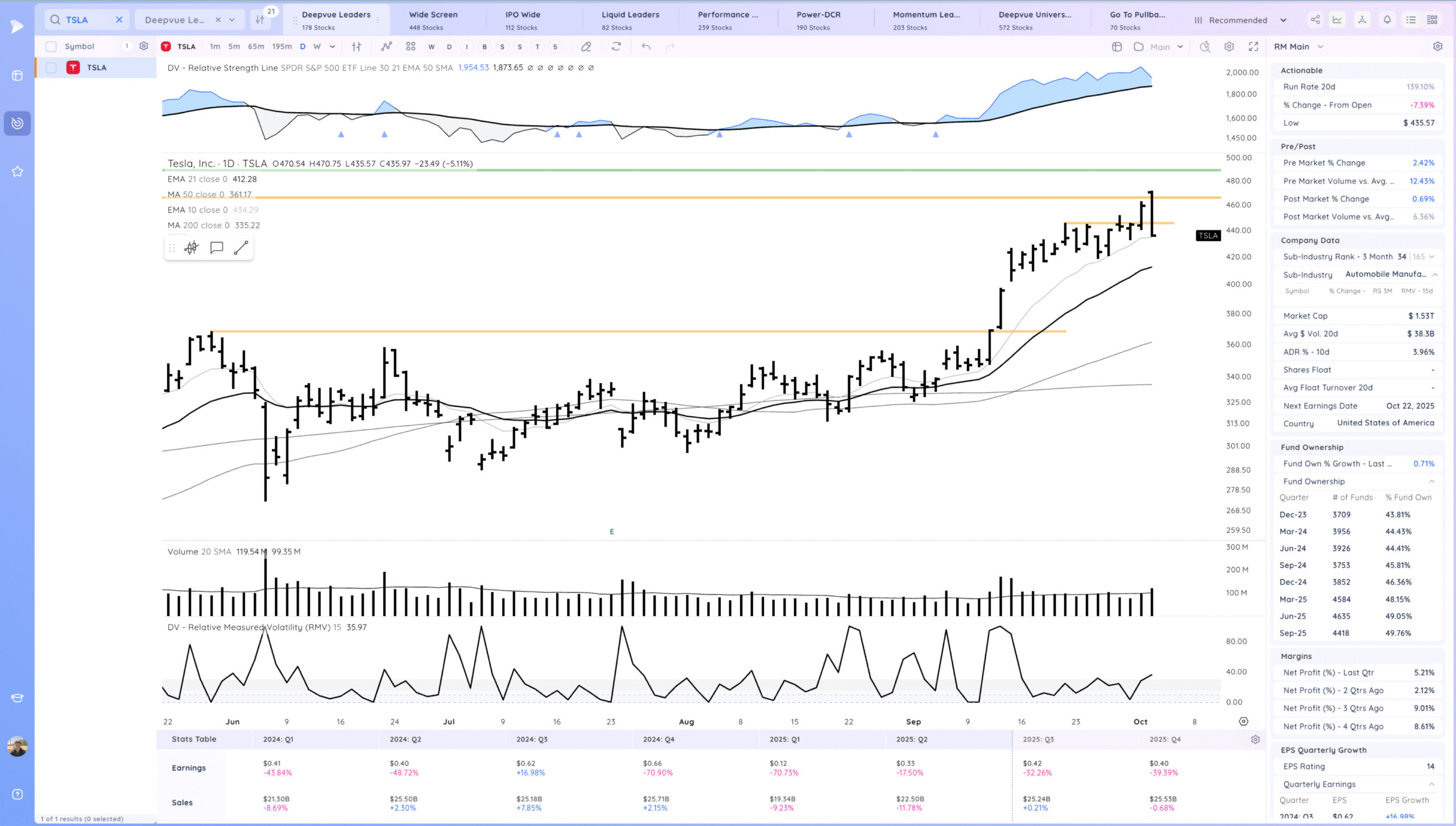

TSLA – Large downside reversal after positive deliveries numbers. high was around 30% from the breakout. Needs to snap back quickly or likely meets a rising 21ema.

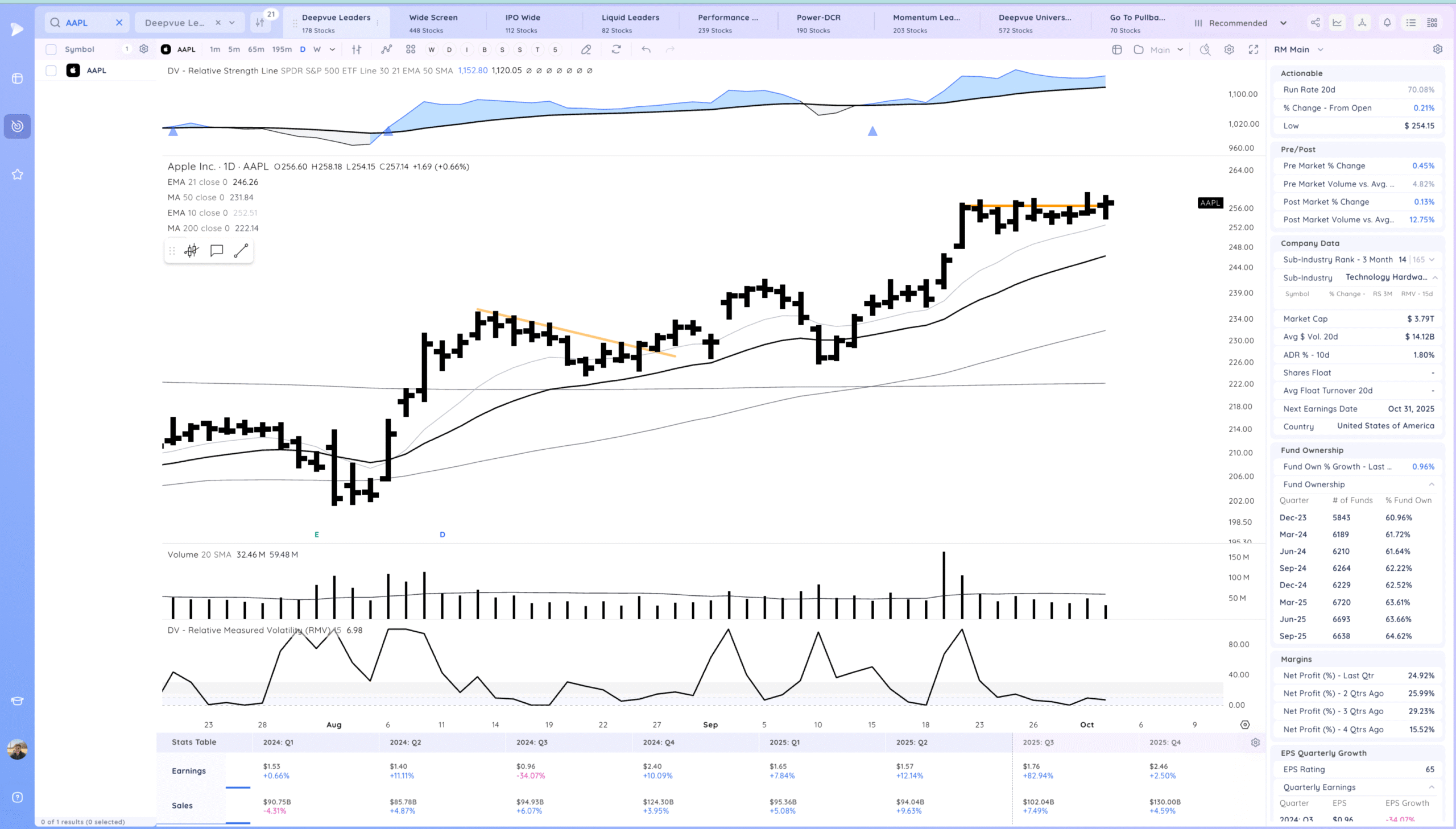

AAPL upside reversal at the pivot. Watching for follow through higher

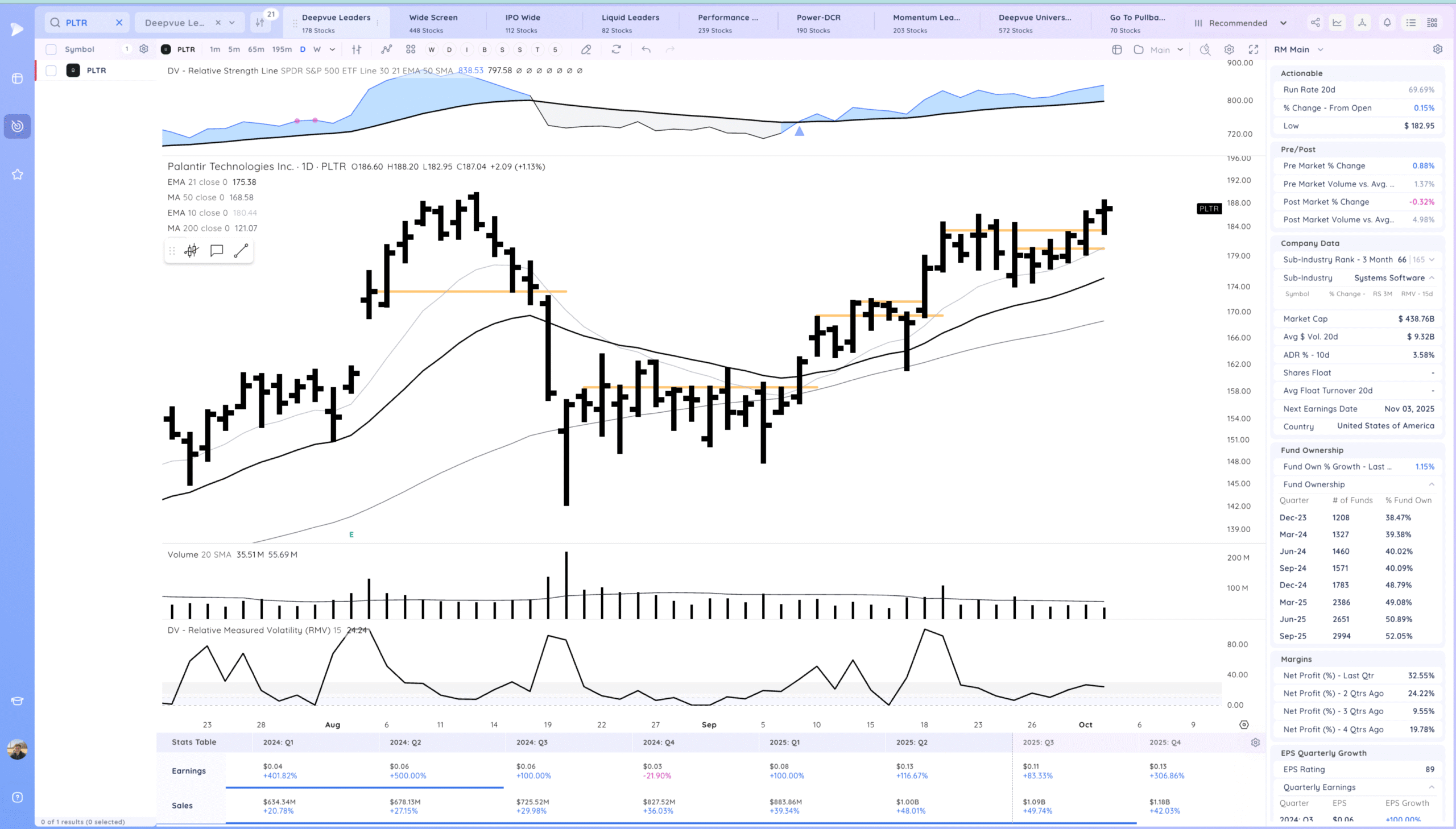

PLTR upside reversal. Good push off lows.

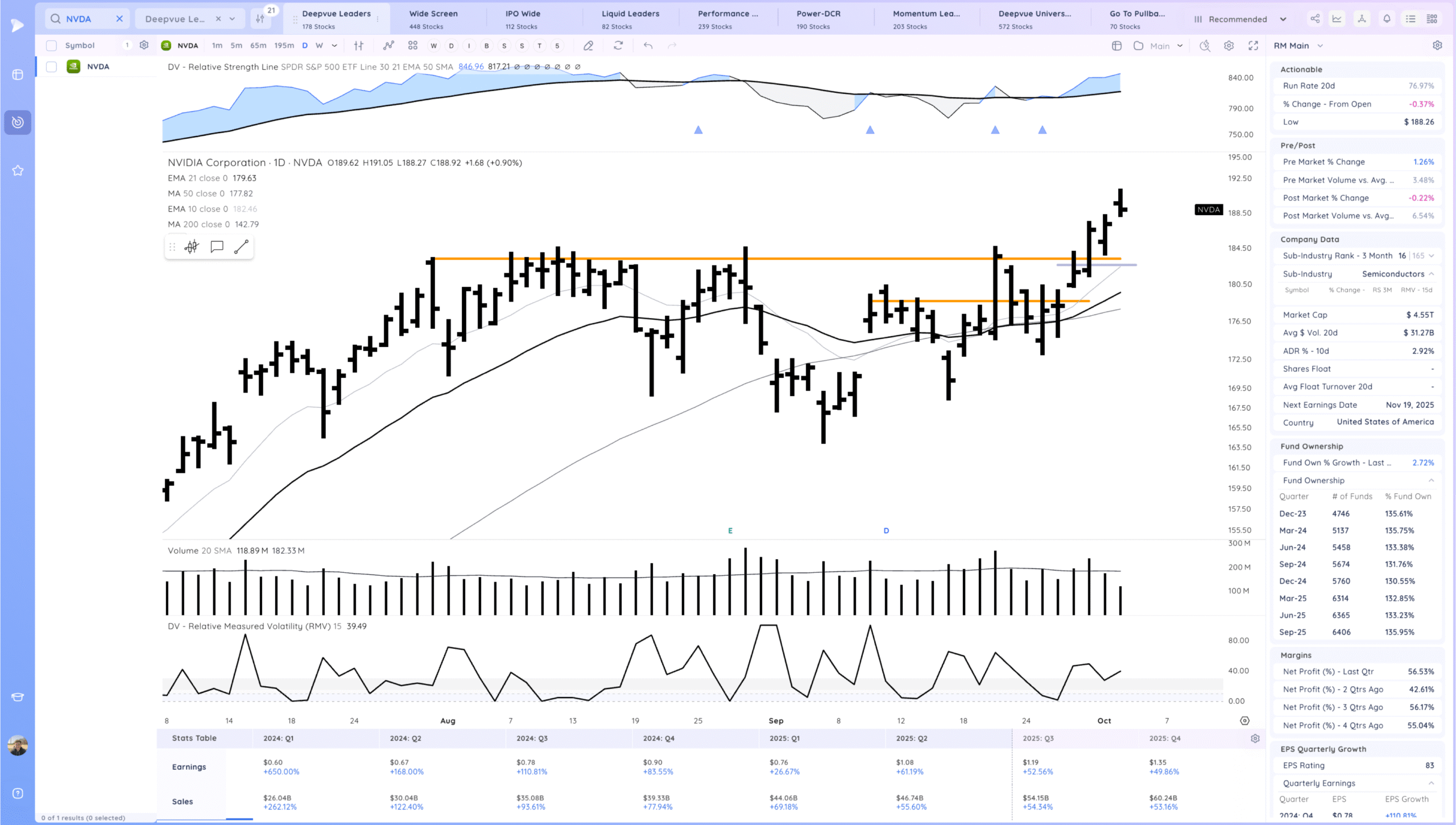

NVDA Gap up but weak close. watching for it to hold the 10ema on any pullback

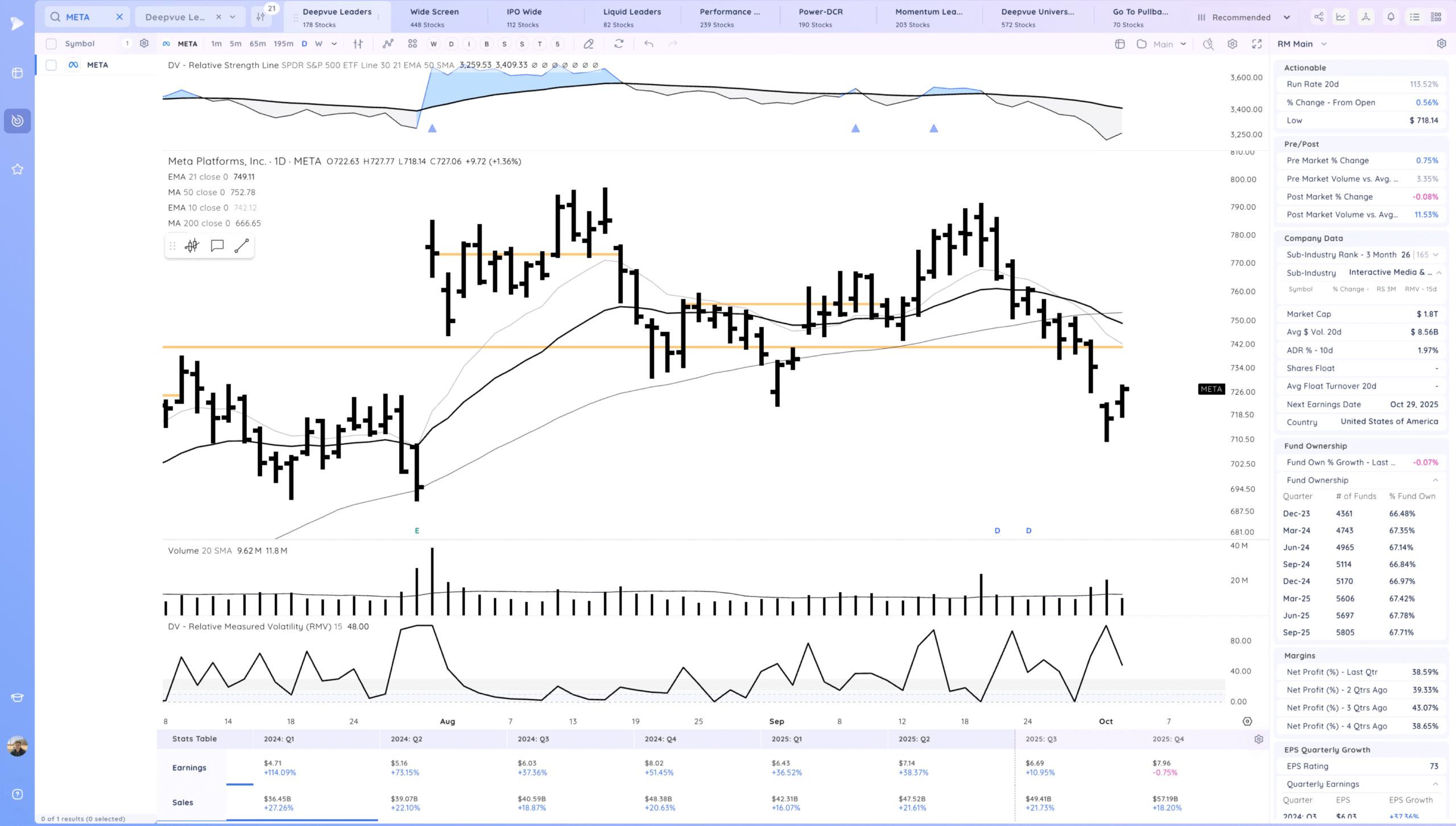

META slight follow through higher. Well below the MAs

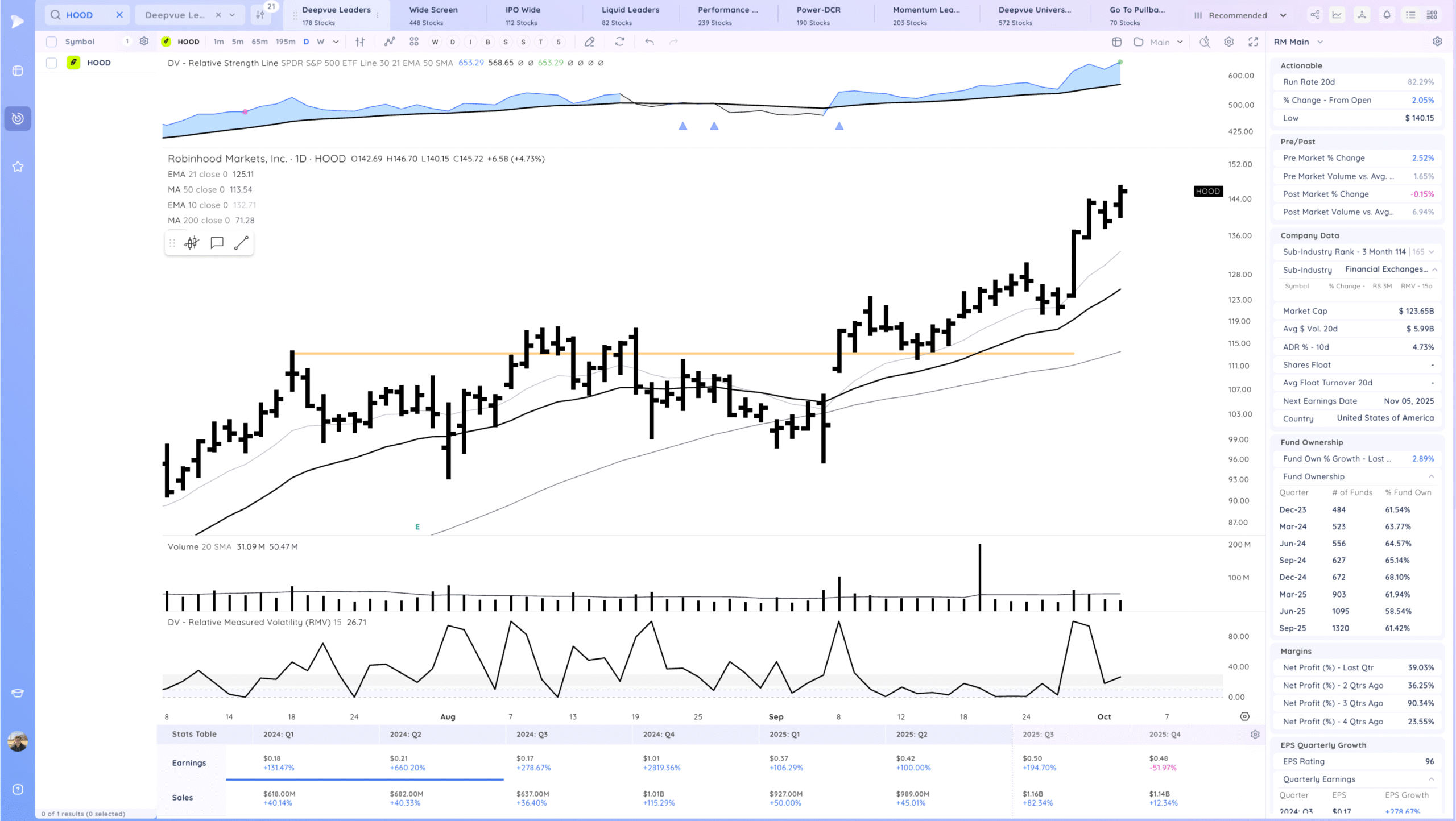

HOOD Trending

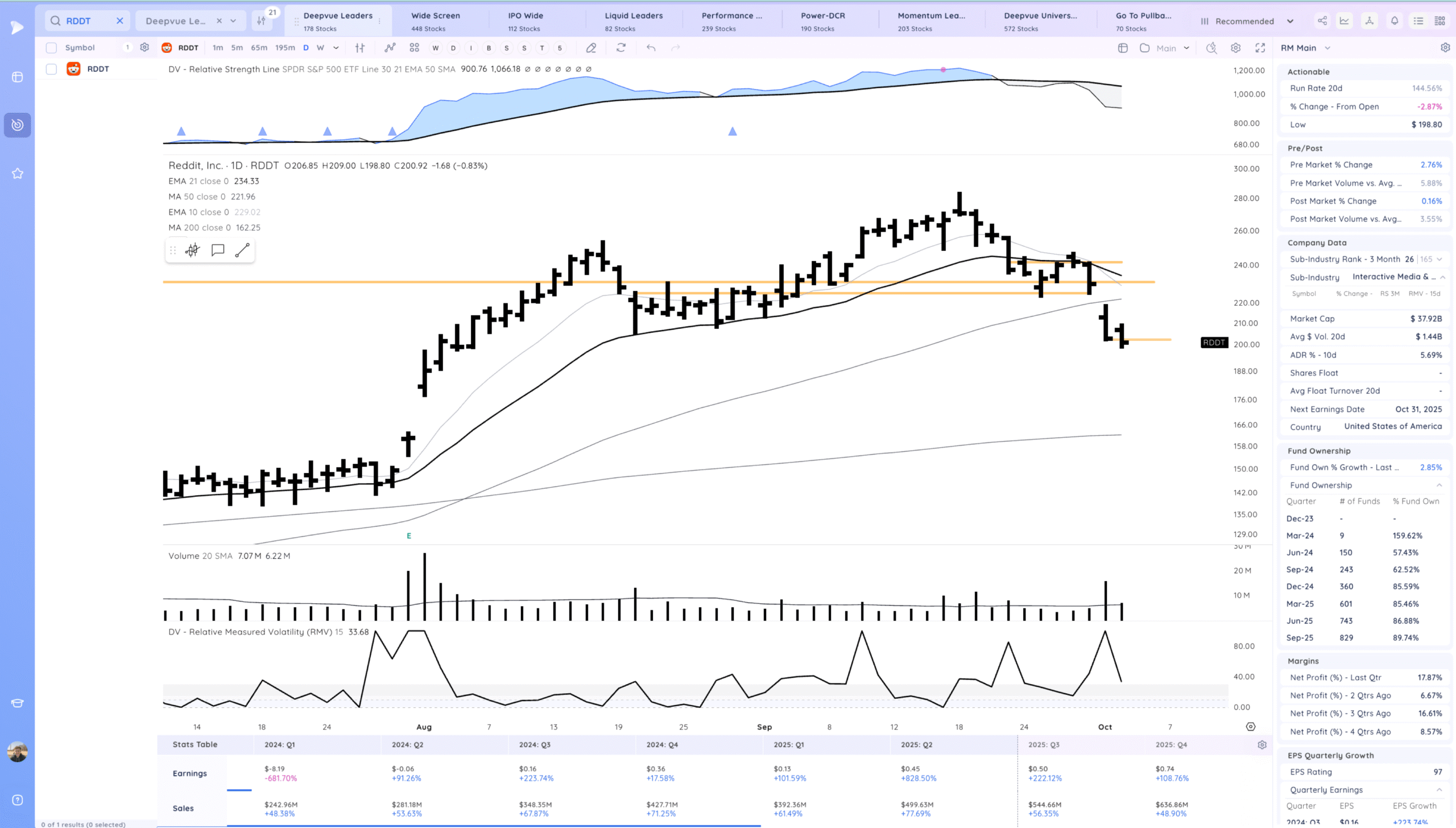

RDDT slight follow through down. Reversal traders would be watching for a turn up

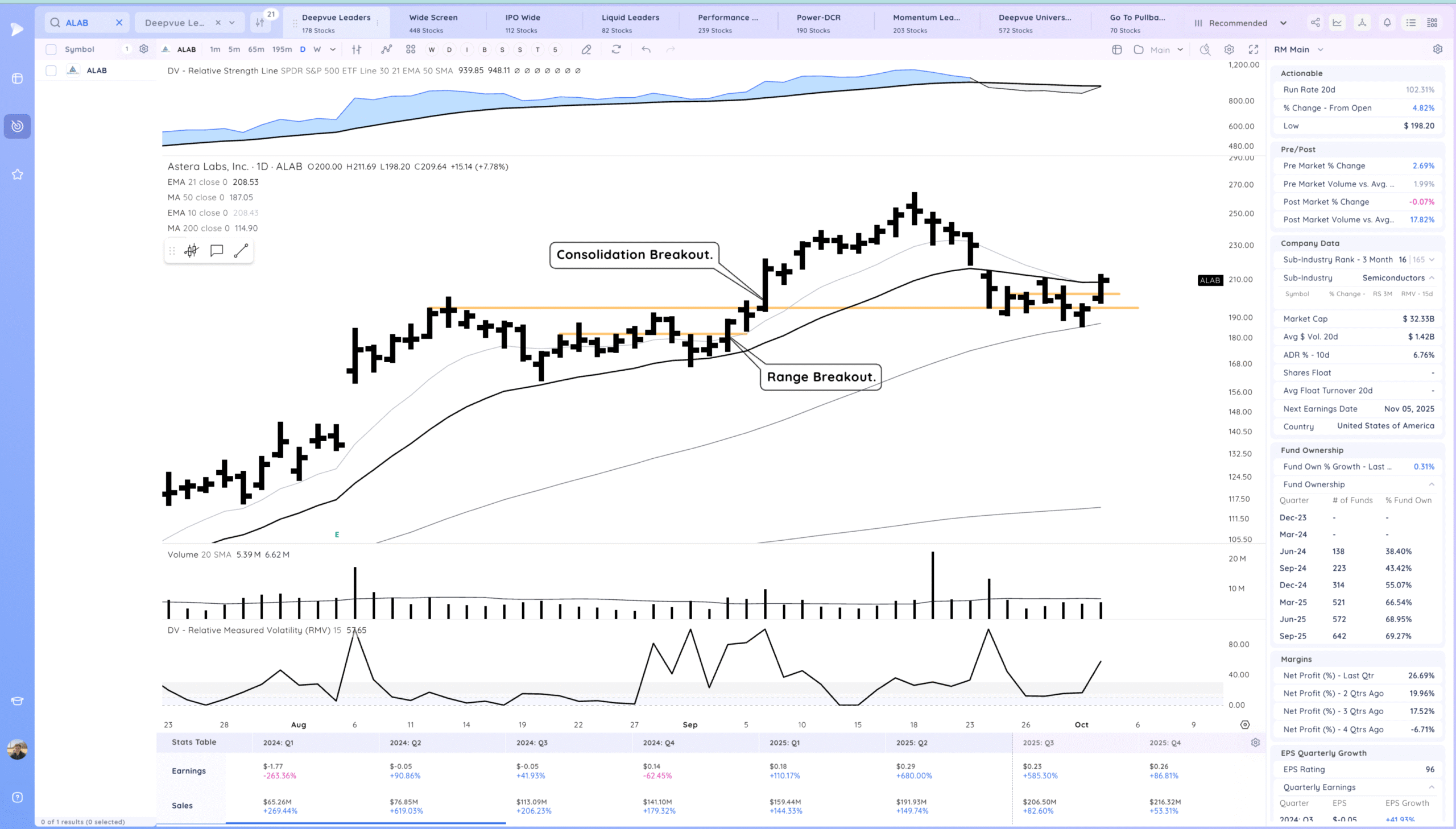

ALAB nice pop higher following through after the upside reversal

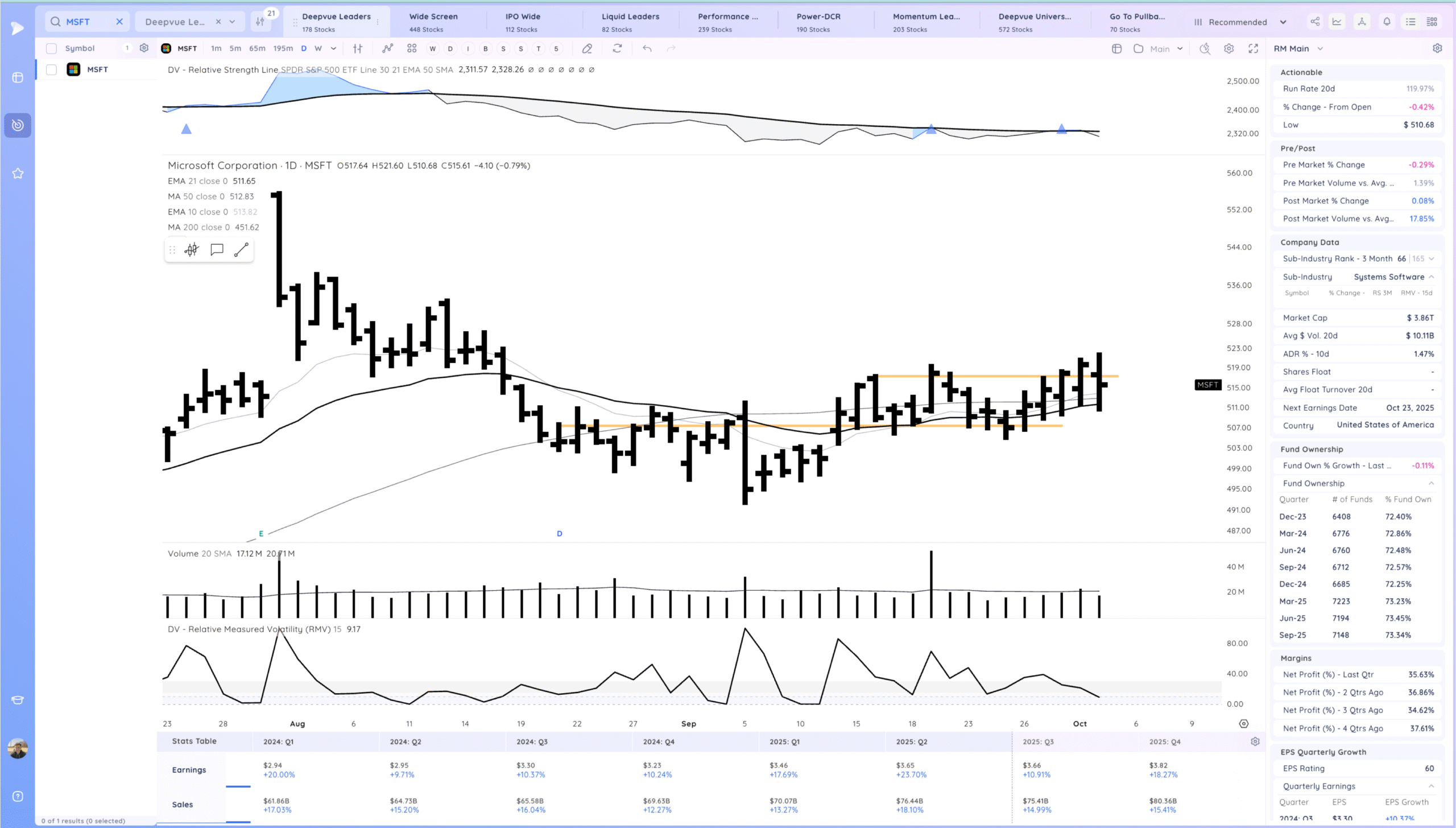

MSFT Continues to churn a bit as it tries to move up the right side

Key Moves

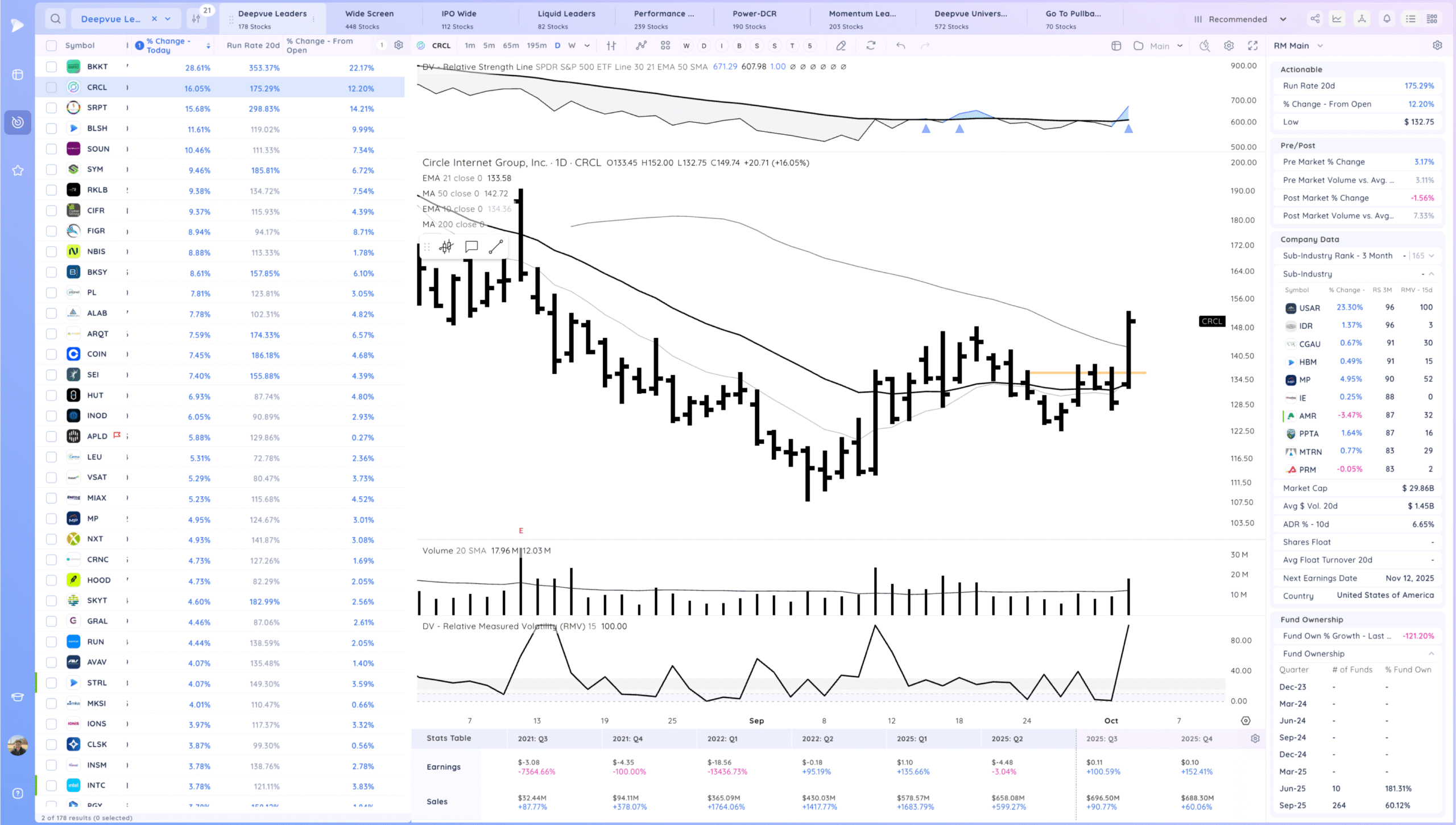

CRCL strong bottoming range breakout. From RMV 0

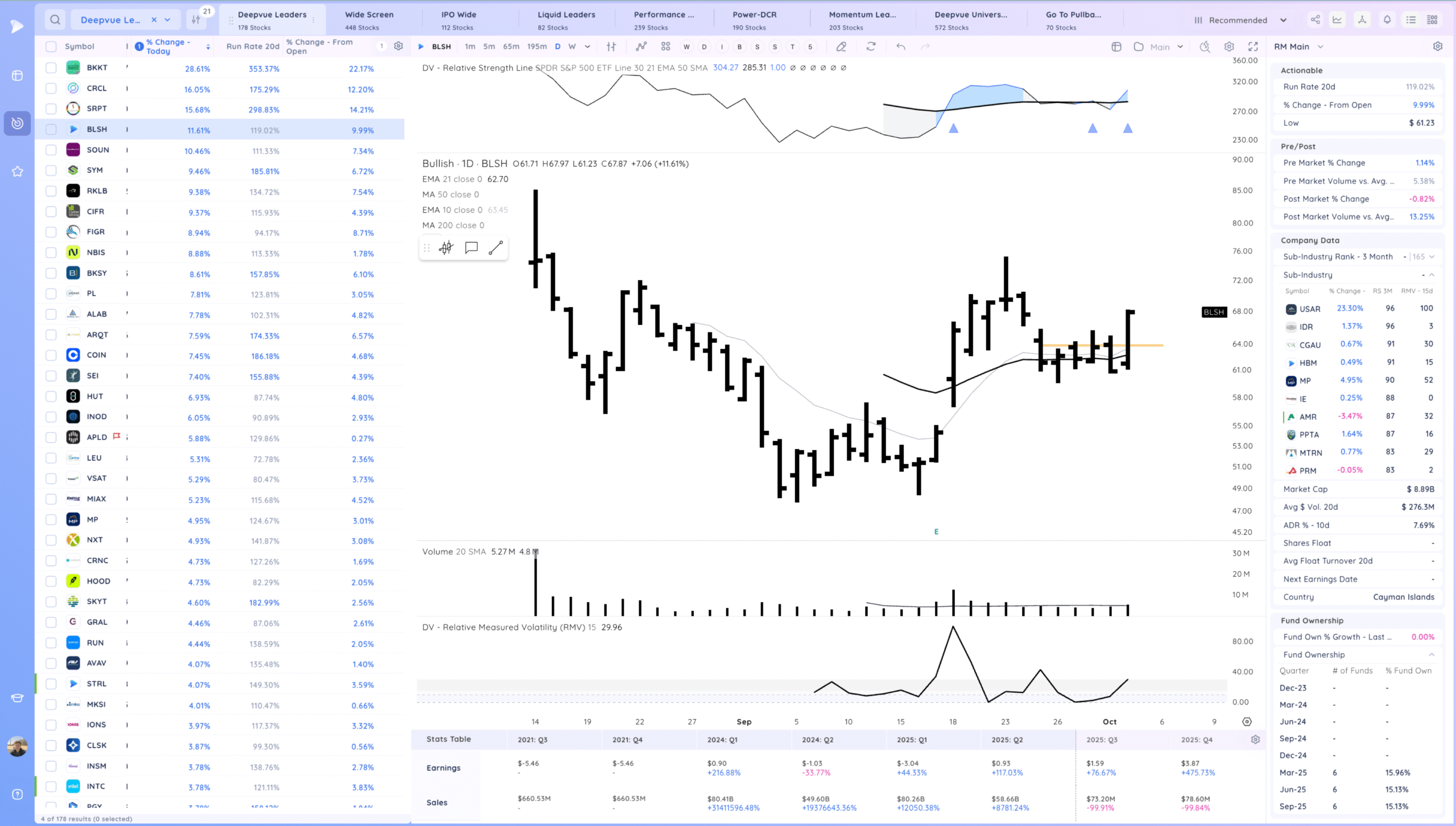

BLSH positive expectation breaker

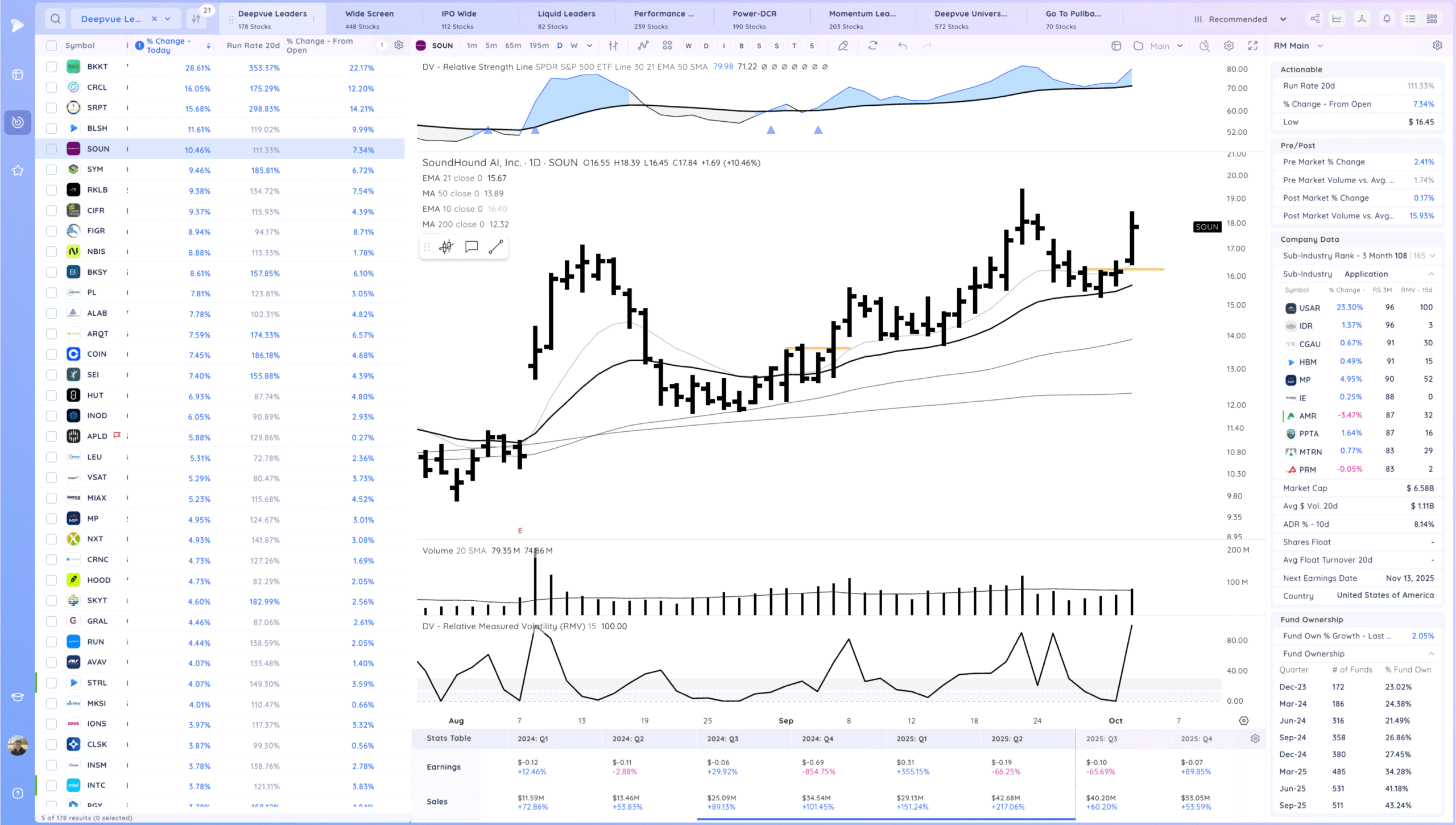

SOUN from the watchlist. Gap and go from the range breakout

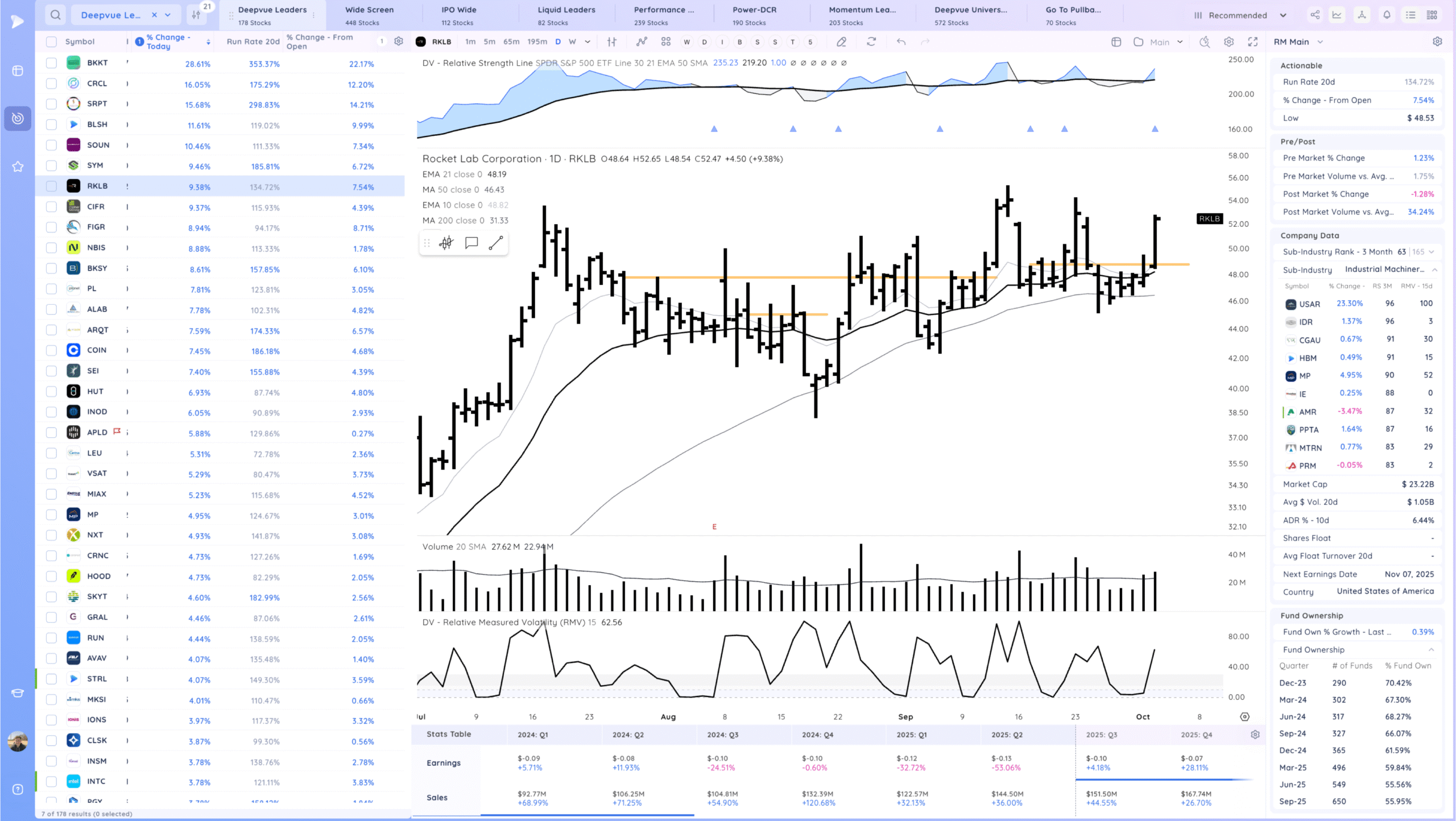

RKLB Strong range re-breakout

Setups and Watchlist

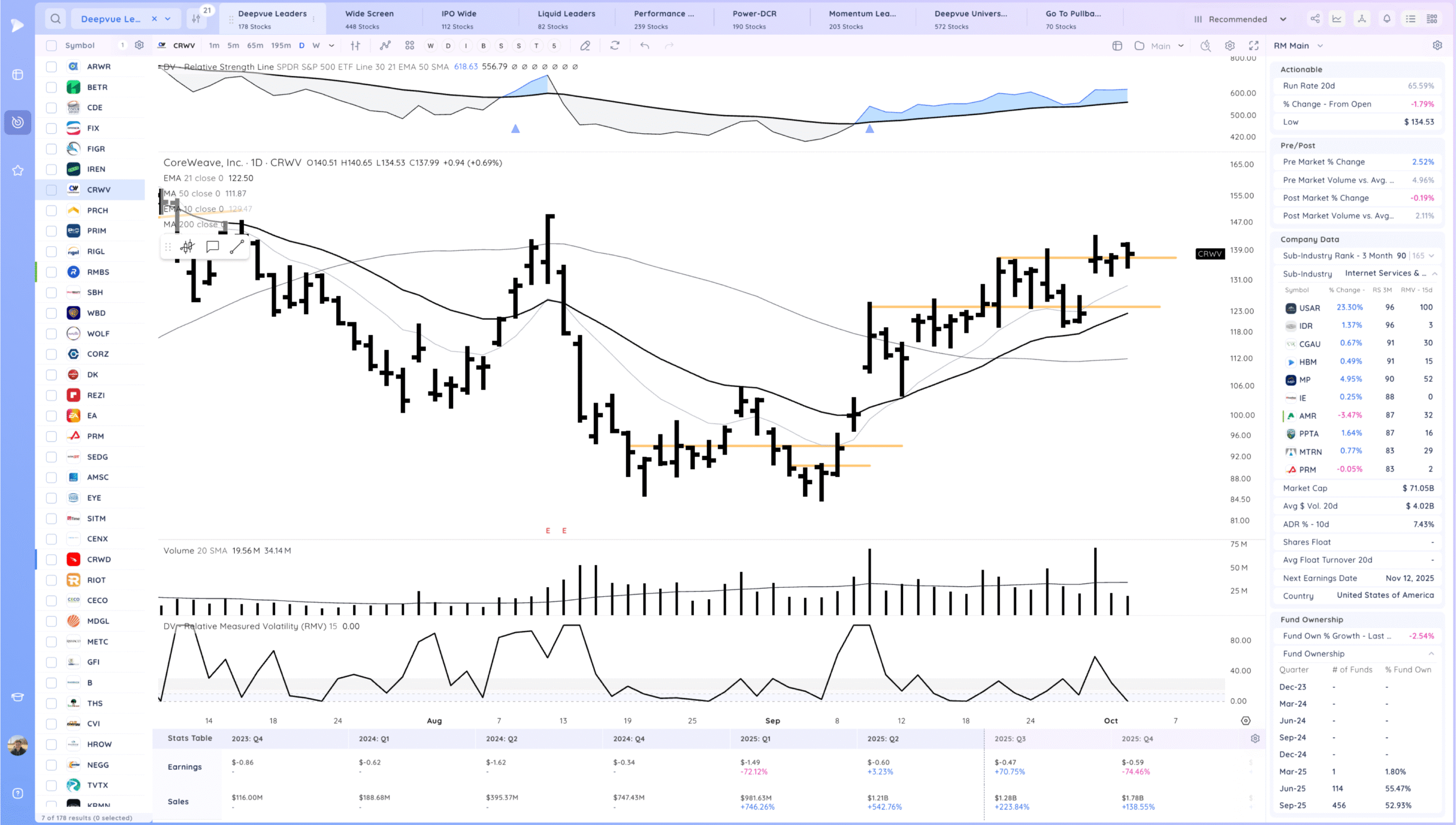

CRWV sitting on the pivot. Watching for a push higher off this level

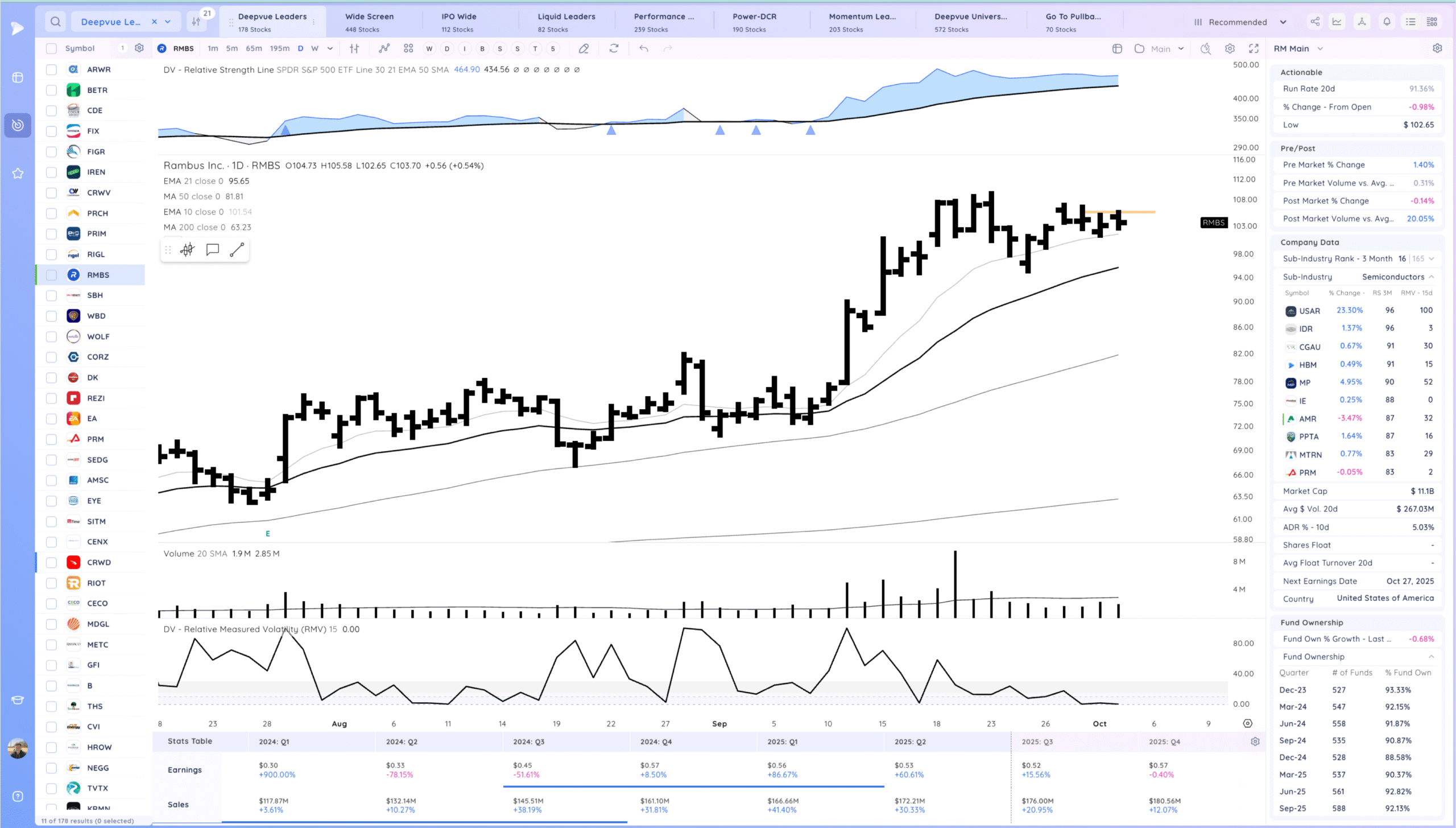

RMBS watching for a range breakout. Swing trade idea

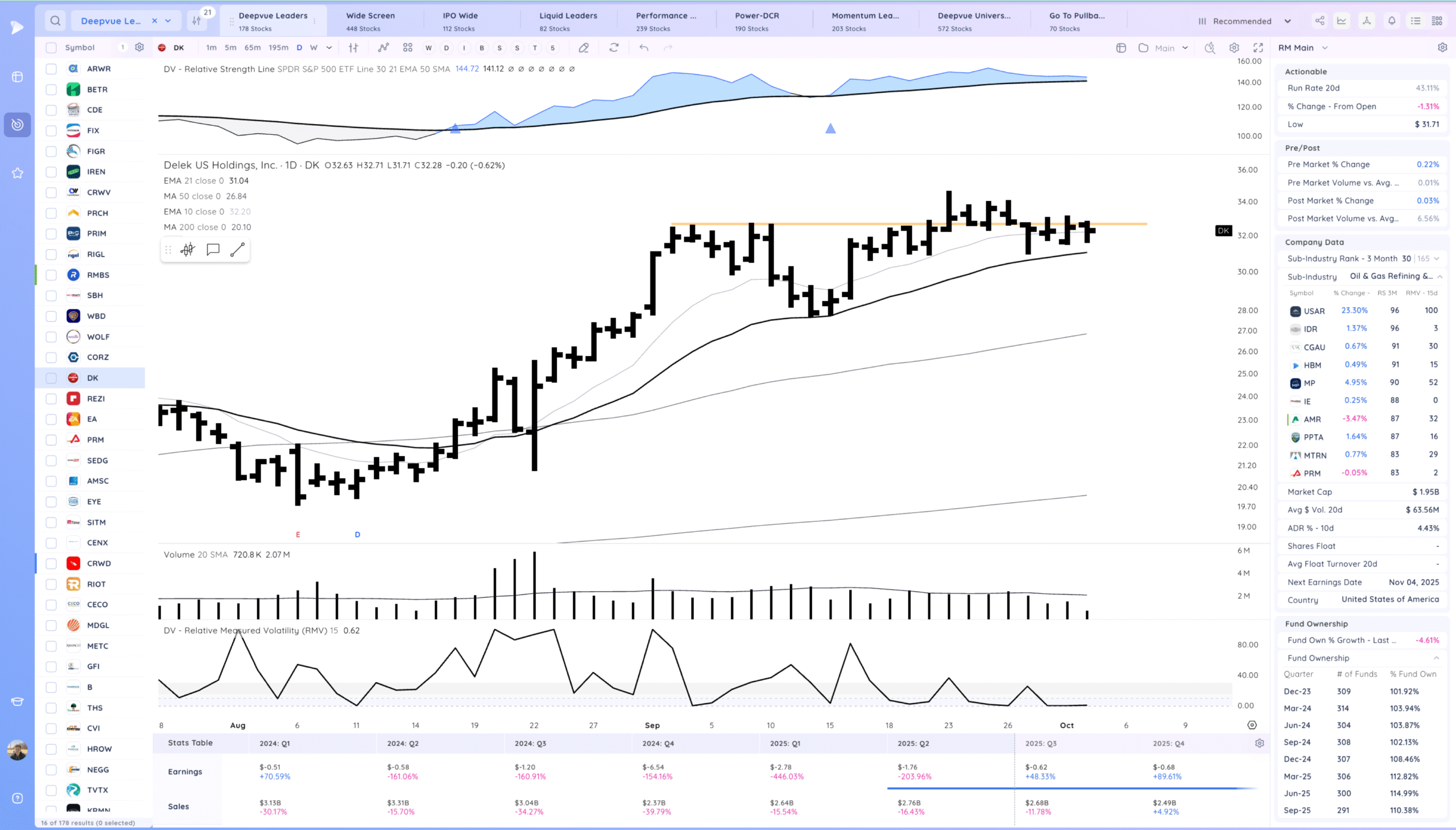

DK watching for a range breakout

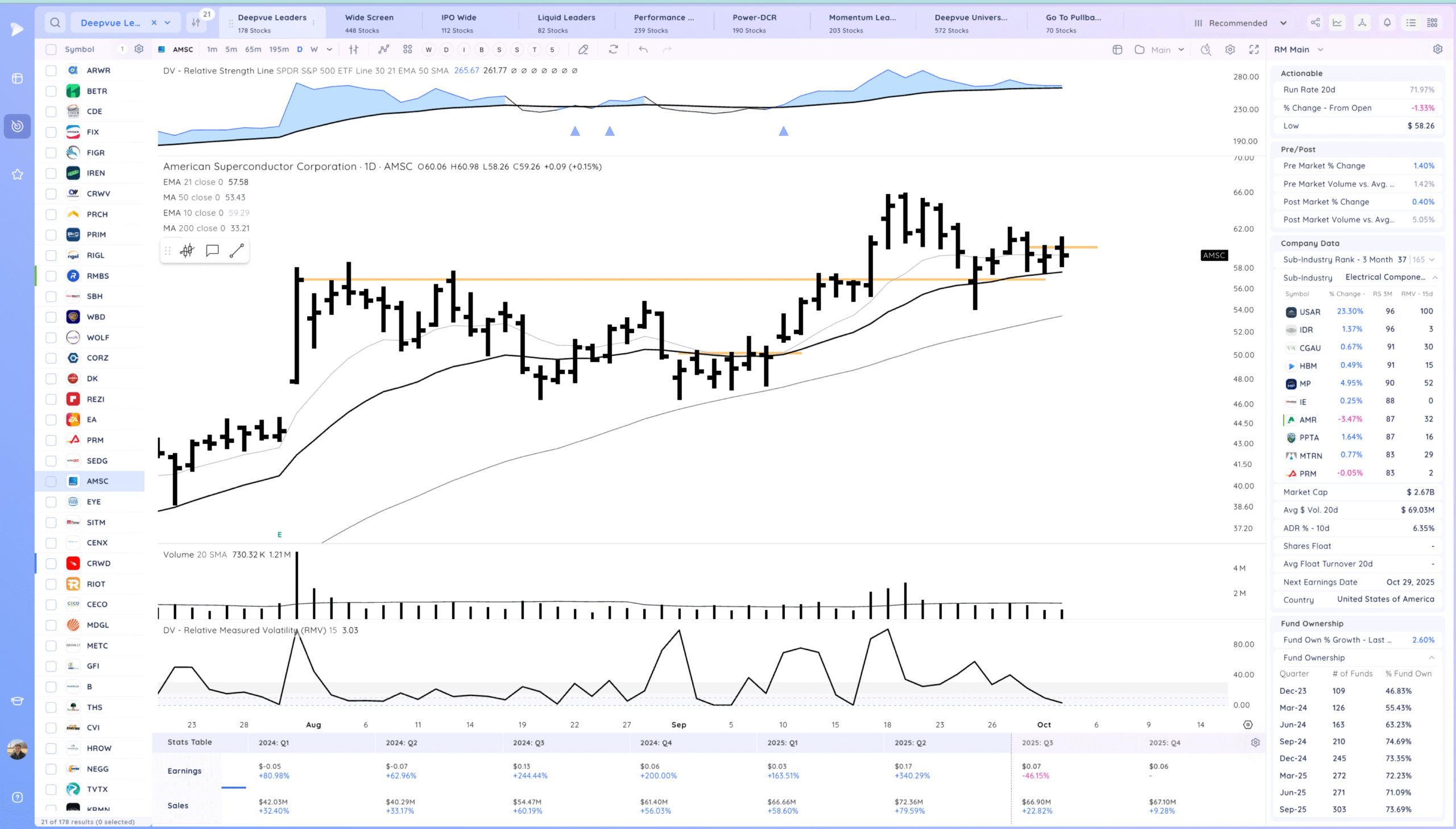

AMSC watching for a range re-breakout

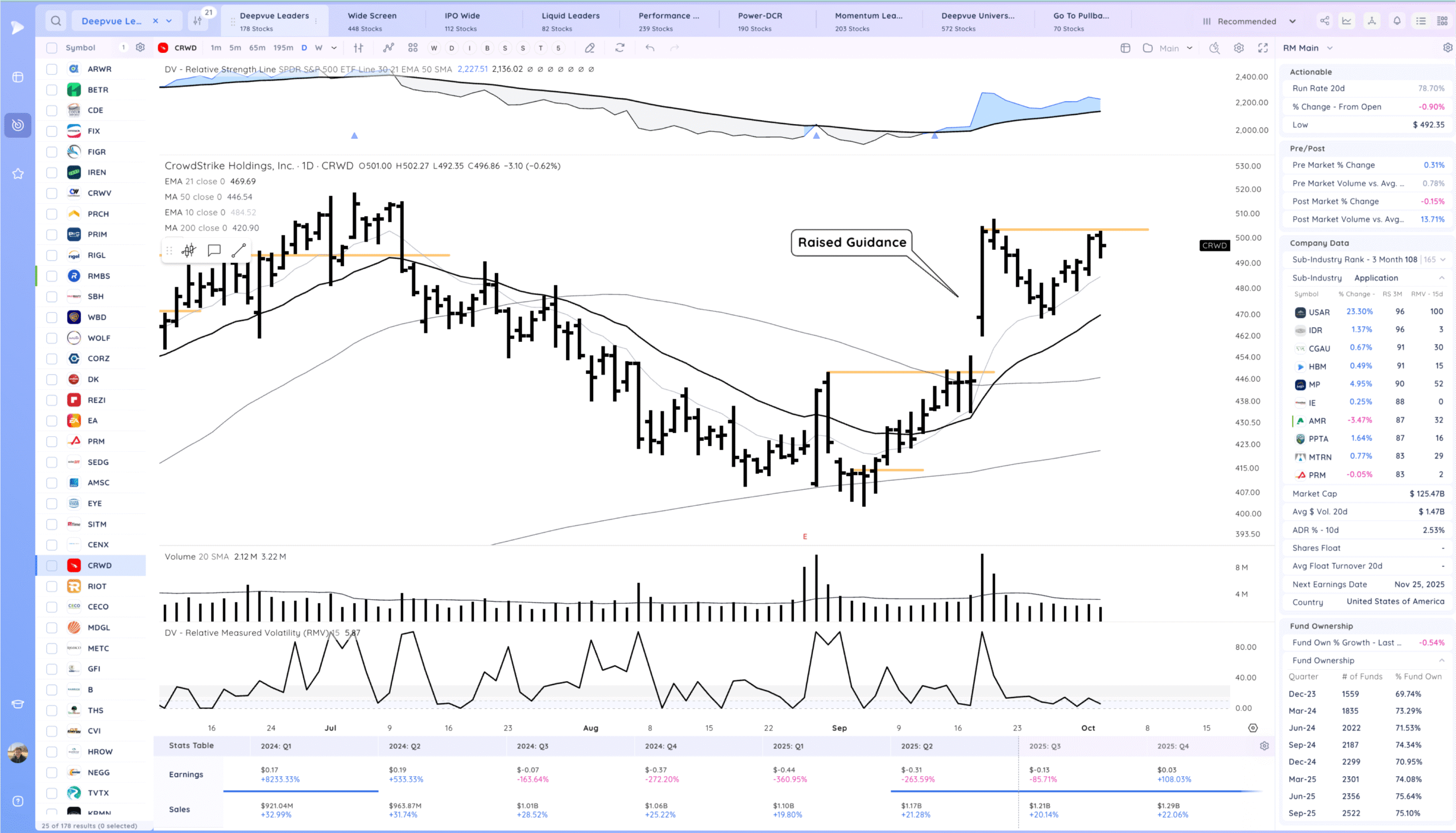

CRWD watching for a consolidation breakout.

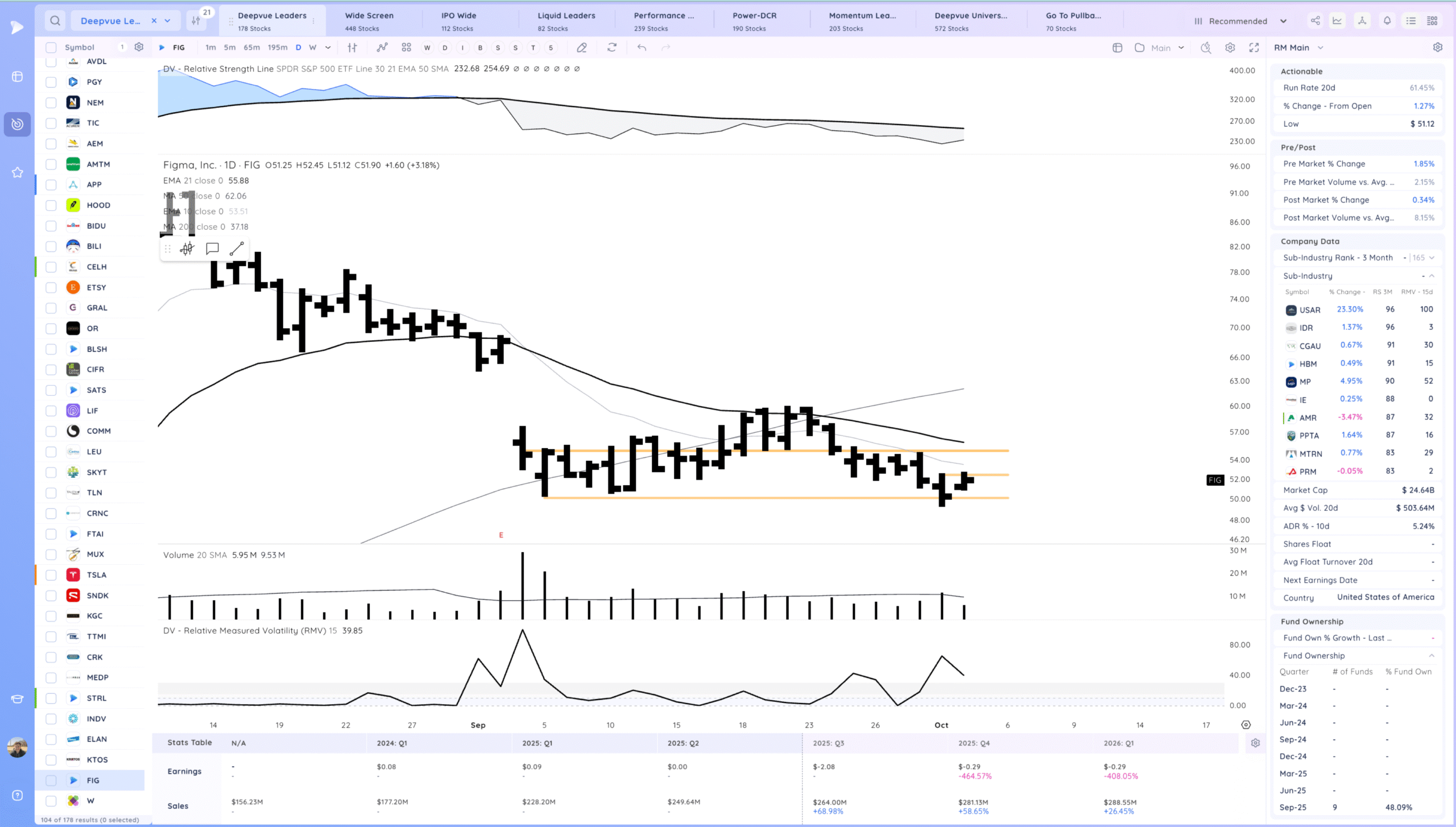

FIG watching for a range breakout from the tight day.

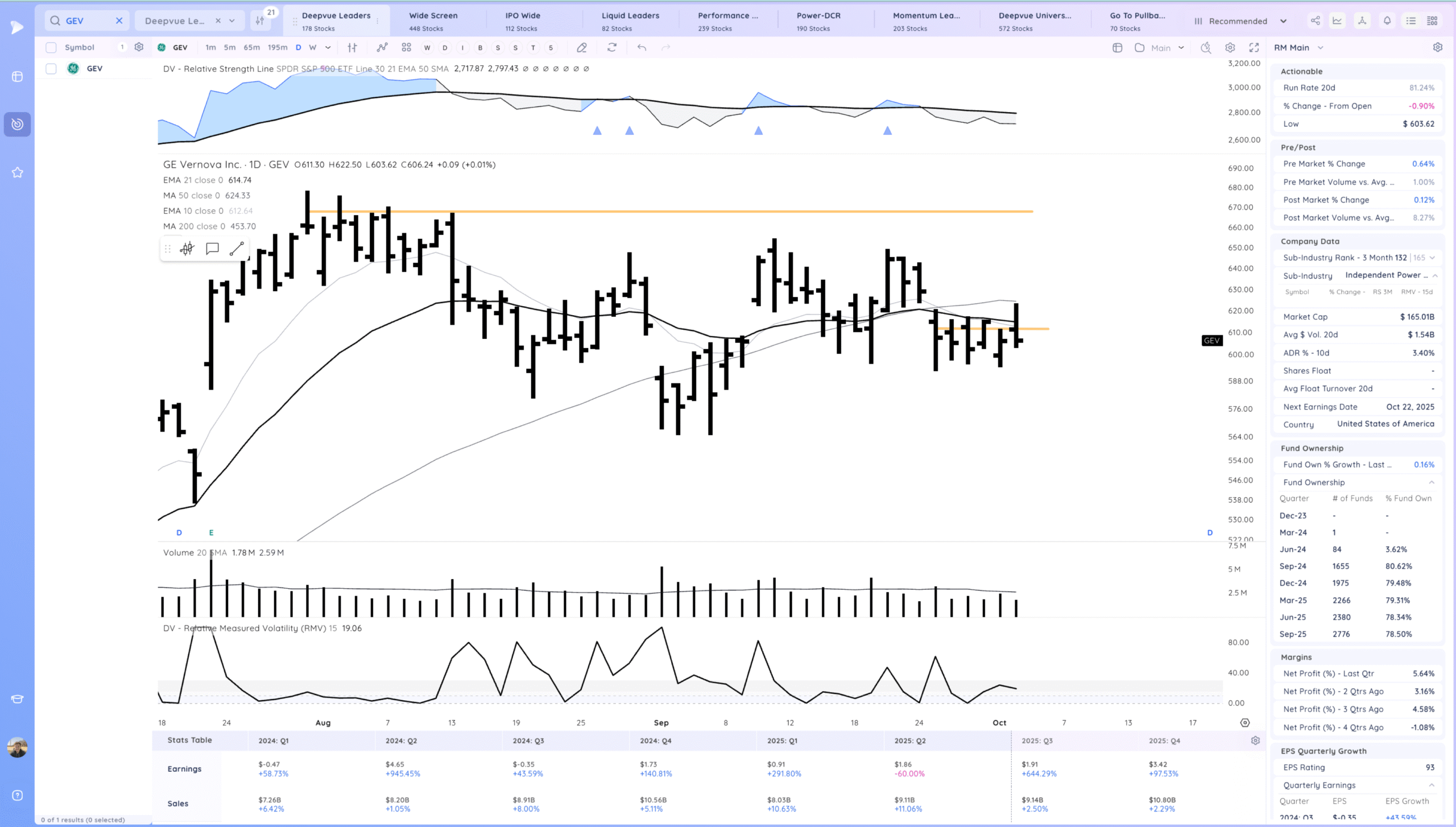

GEV watching for a range re-breakout.

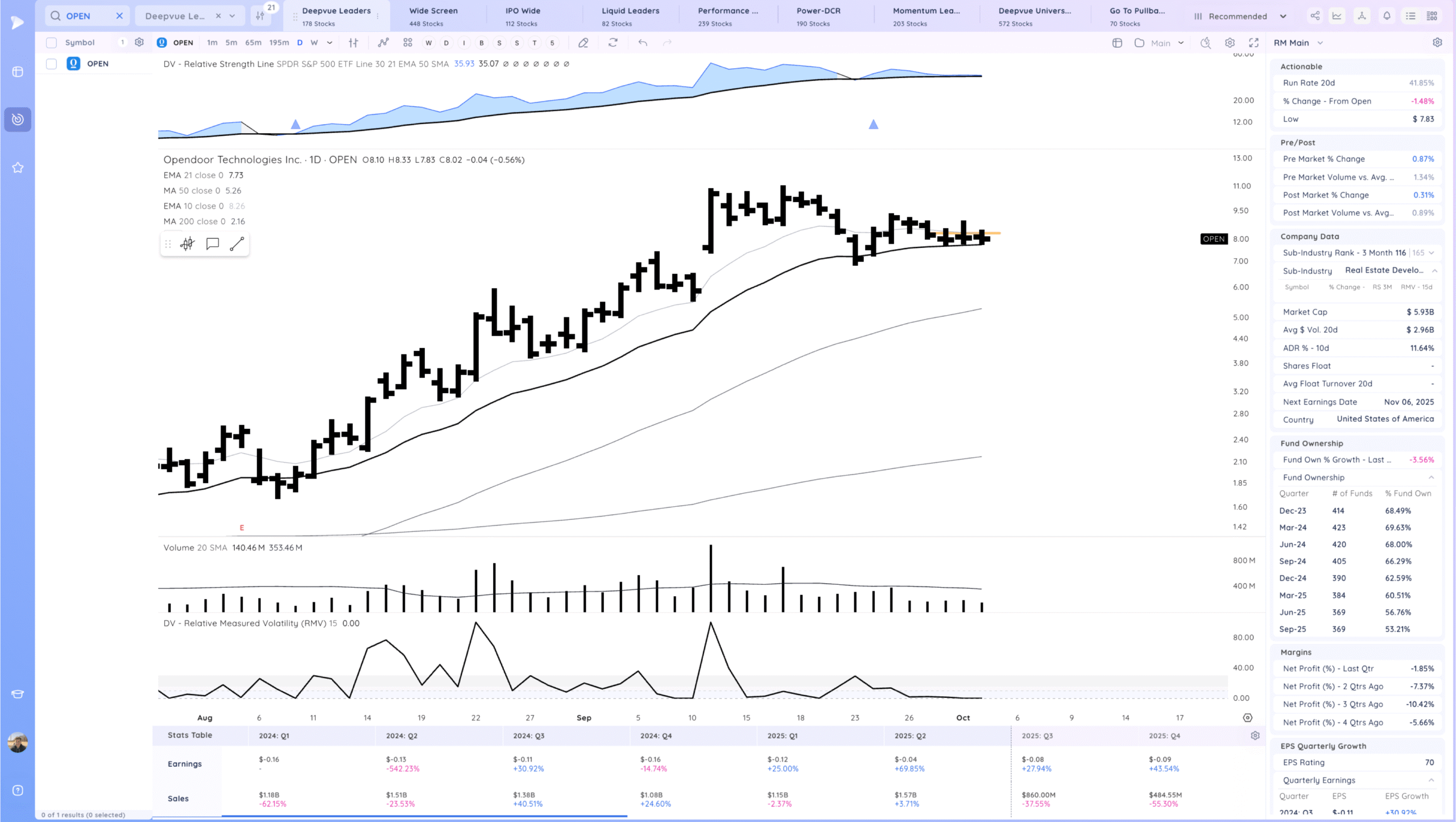

OPEN watching for a range breakout. Expecting expansion tomorrow

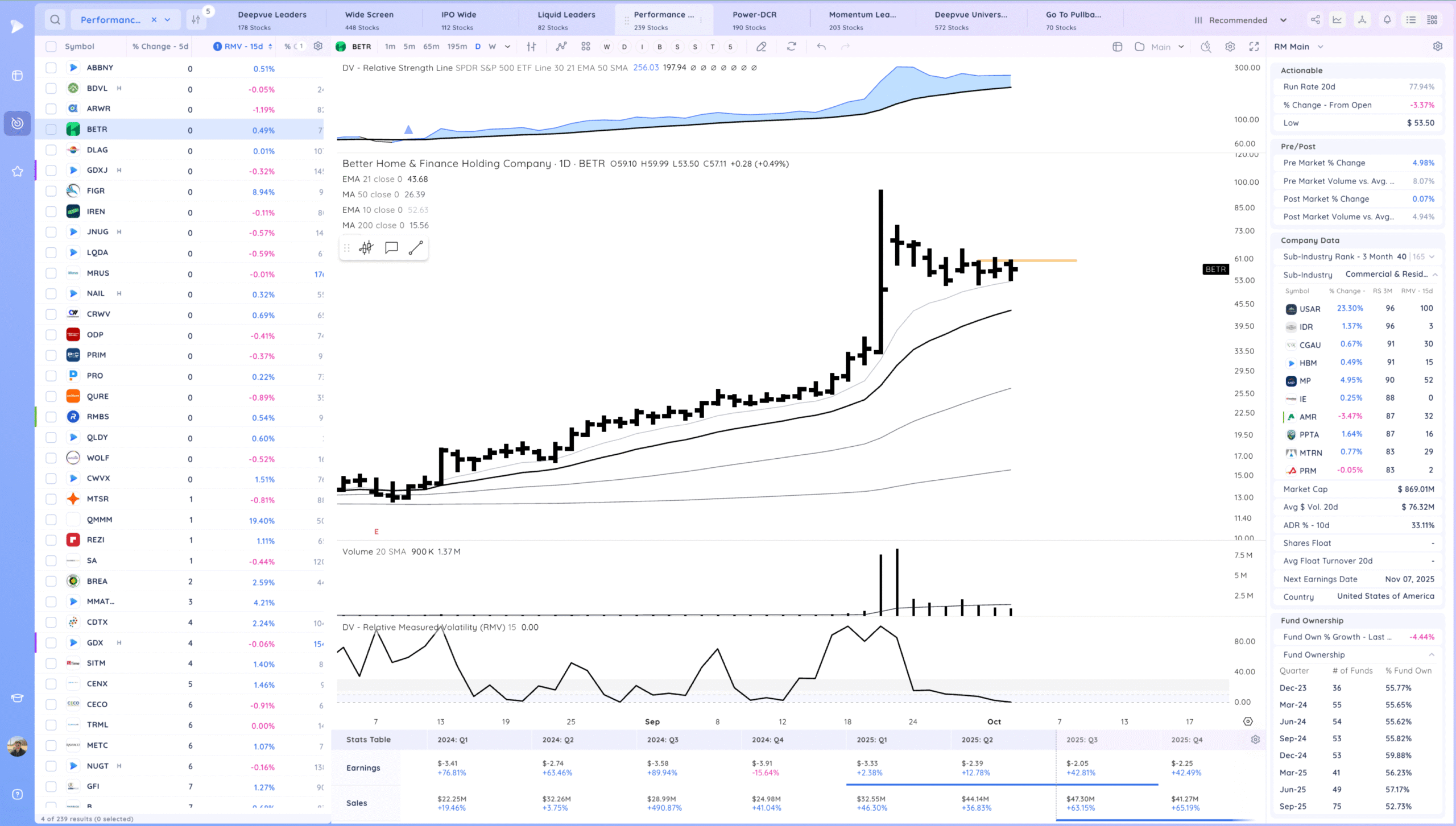

BETR same theme very fast mover. Watching for a range breakout.

Today’s Watchlist in List form

Focus List Names

CRWV RMBS DK AMSC CRWD FIG GEV OPEN BETR ALAB TSLA

Focus:

CRWV OPEN AMSC

Themes

Strongest Themes: AI, Metals/Miners, Energy, Crypto

Market Thoughts

Downside reversal in TSLA something to note if there is further weakness. I wouldn’t mind some sideways action to set new pivots.

Anything can happen, Day by Day – Managing risk along the way