TML Report October 1, 2025

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

October 2, 2025

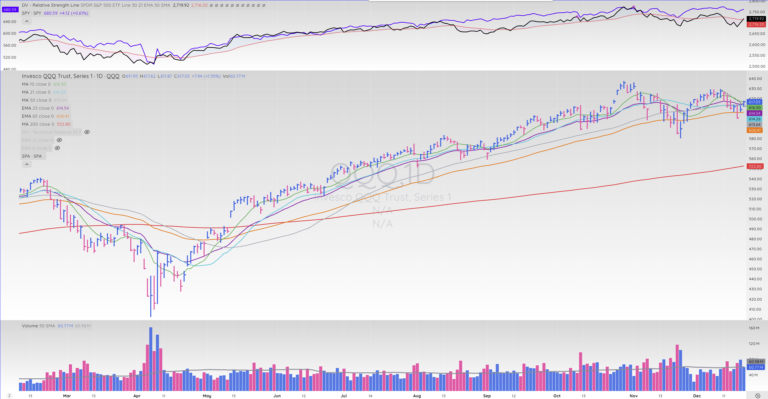

Market Overview

The major market indexes finished the session in good shape, leadership is broad, and the rotational process is healthy. Also, distribution is not an issue.

The health and breadth of the market’s leadership is always the key. Patience and selectivity when it comes to your entry make all the difference, especially when it comes to managing risk. So, watch the leaders, wait for sound setups to form, and most importantly, manage your risk.

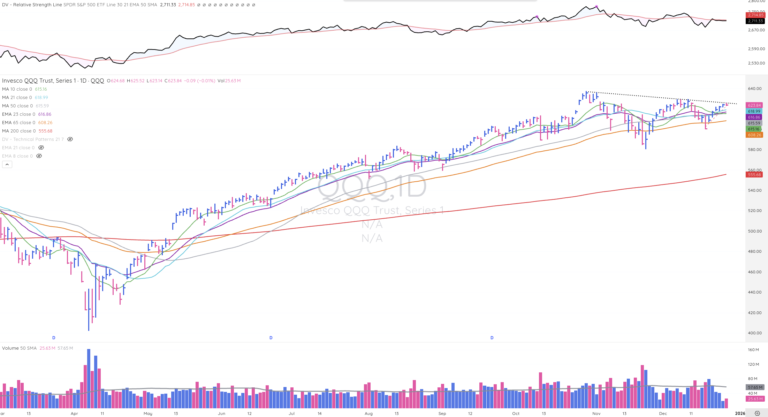

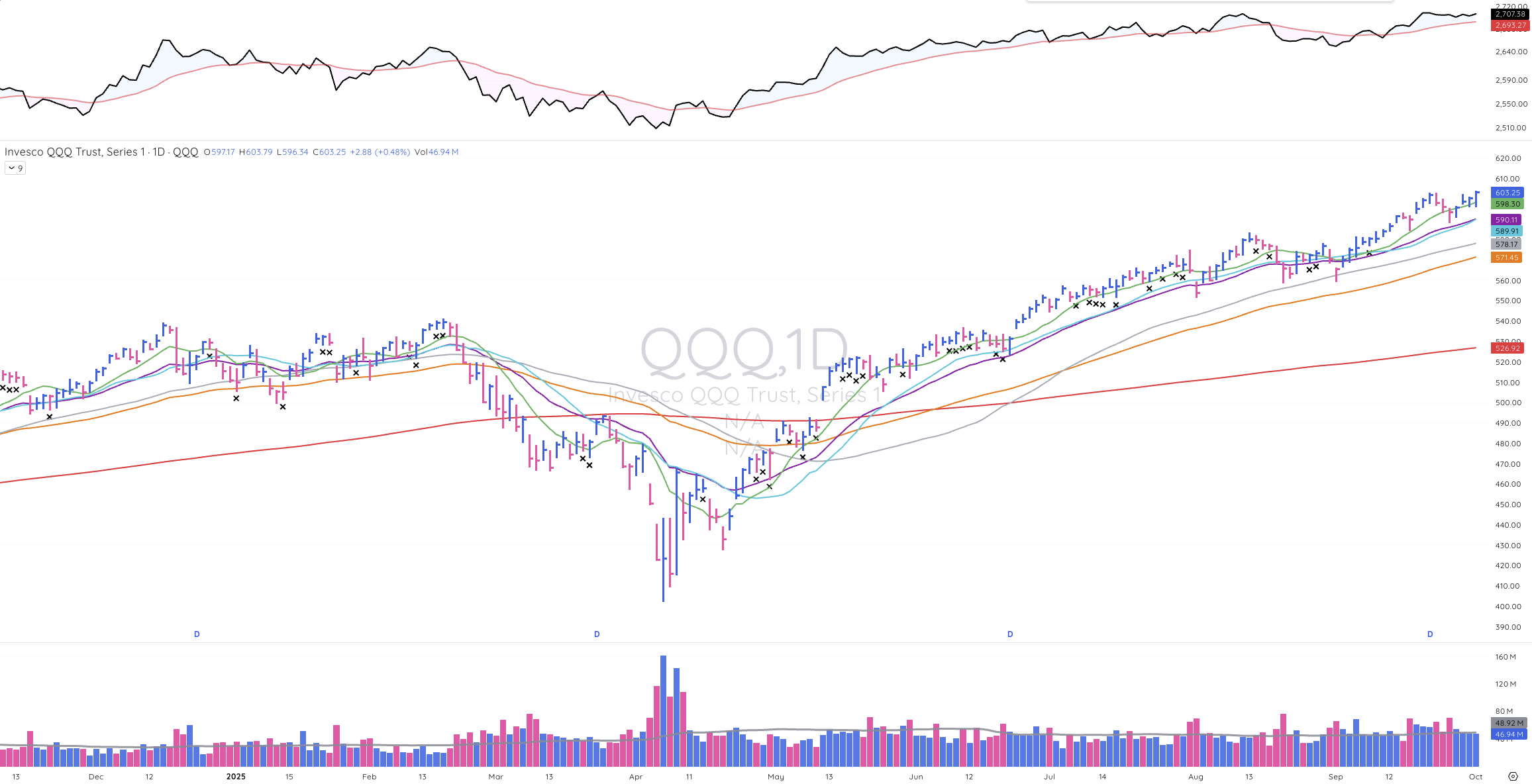

QQQ

The NASDAQ shook out slightly below its 10-SMA, but ultimately finished the day at a new all-time high.

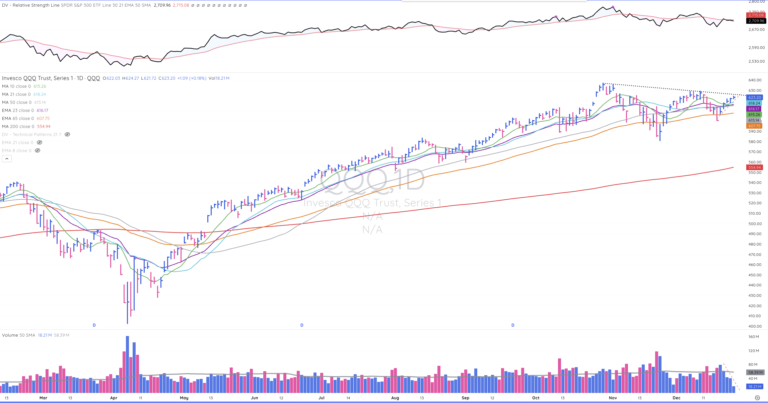

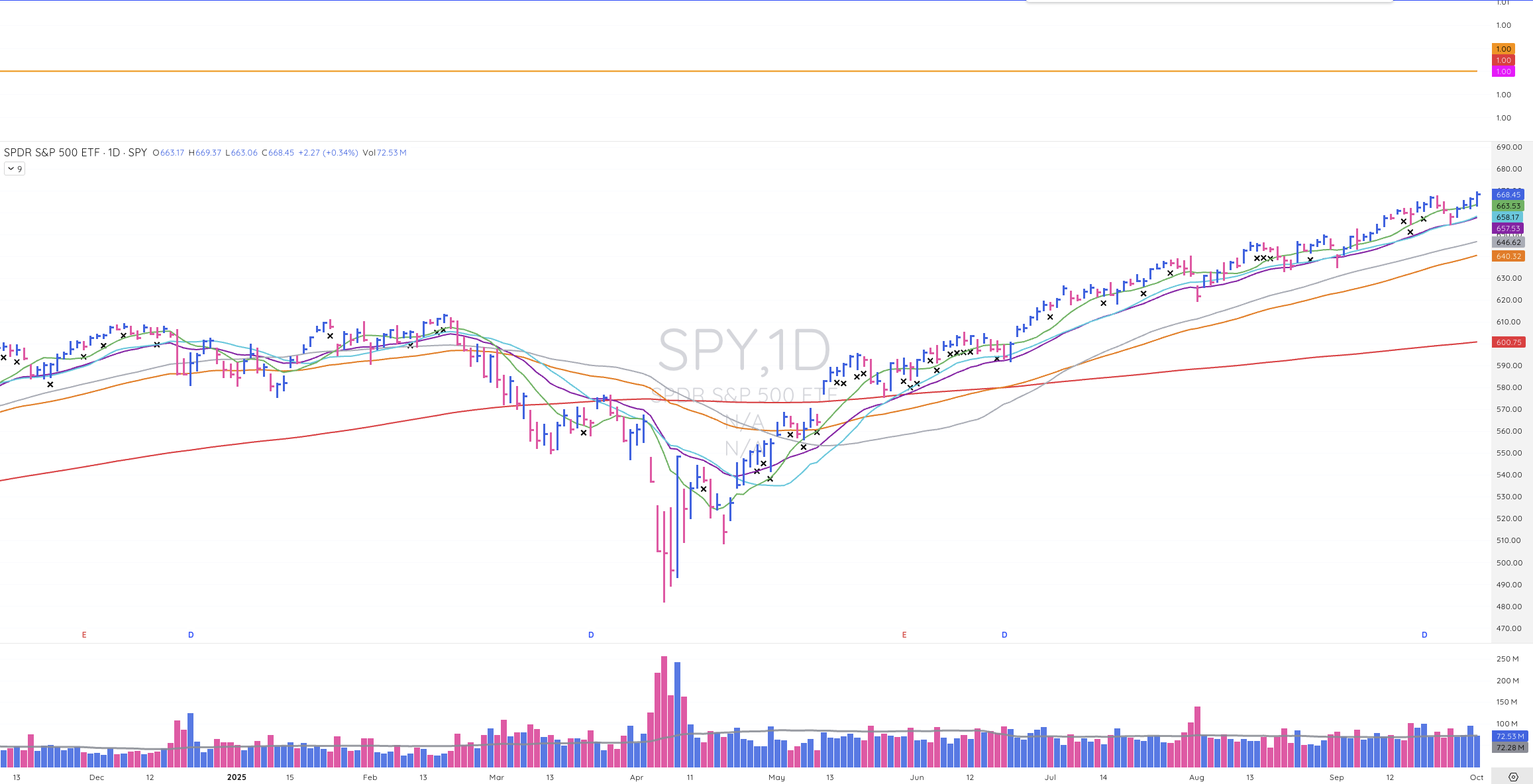

SPY

Just like the NASDAQ, the S&P 500 shook out slightly below its 10-SMA, but ultimately finished the day at a new all-time high.

IWM

The Russell 2000 has closed in a tight range over the past four days in and around its 10-SMA, just a short distance away from a new all-time high, confirming the new highs in the other three major indexes.

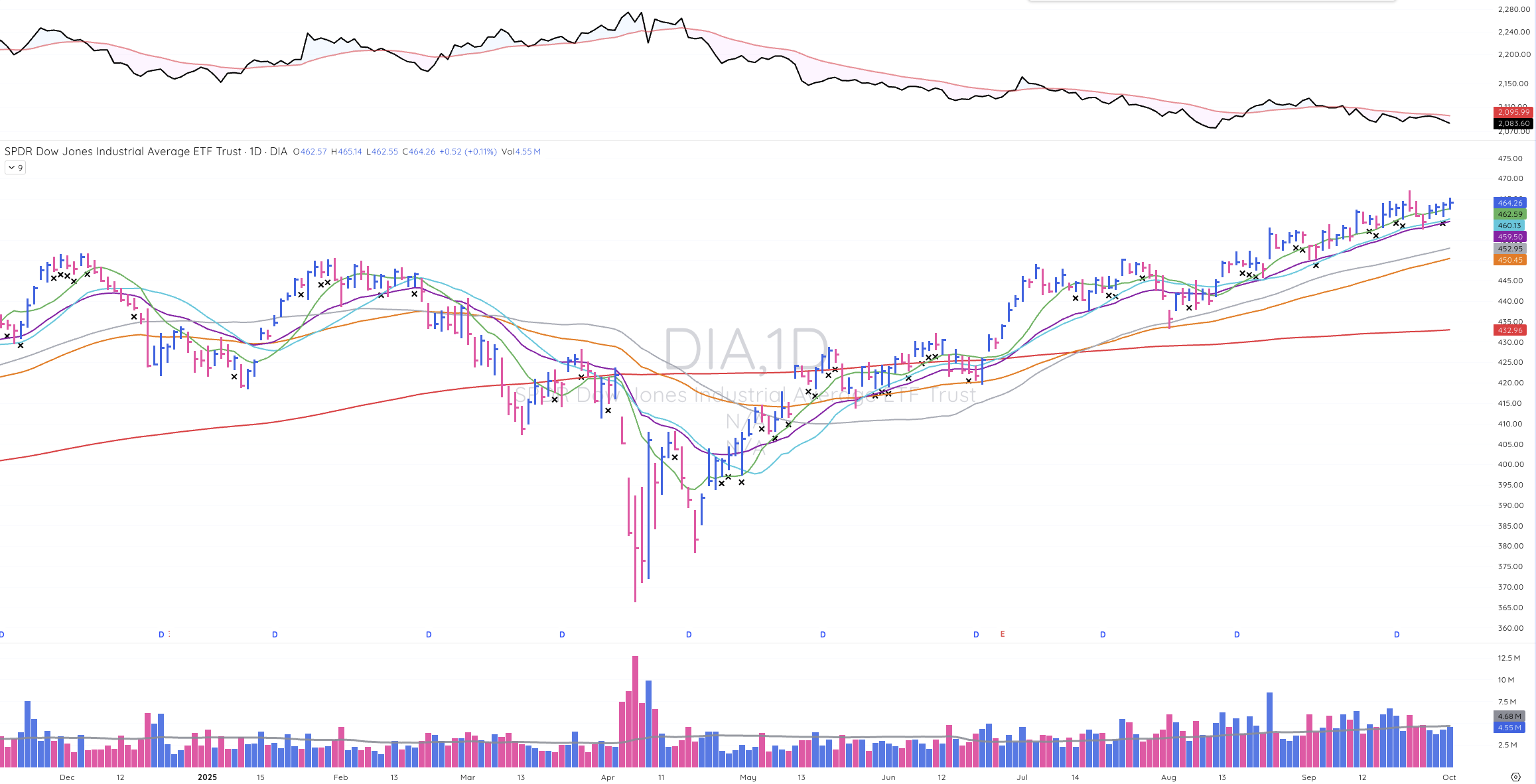

DIA

The Dow closed in a tight range above its 10-SMA over the past four days, but didn’t make a new high, unlike the NASDAQ and S&P 500.

Focus List

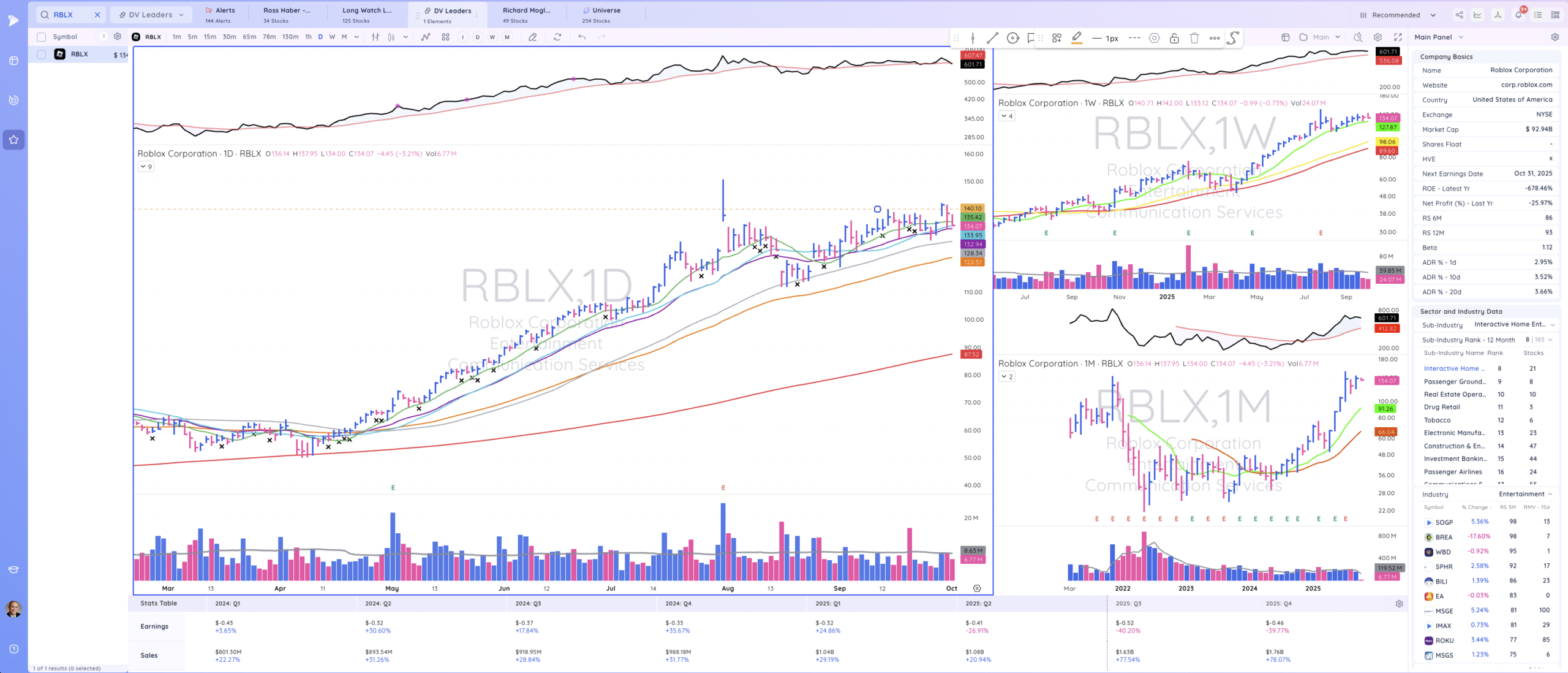

RBLX

RBLX backed and filled the gap from two days ago, which is less than ideal, but not out of character for the stock. It ultimately found support at its 21-SMA, and its base remains sound.

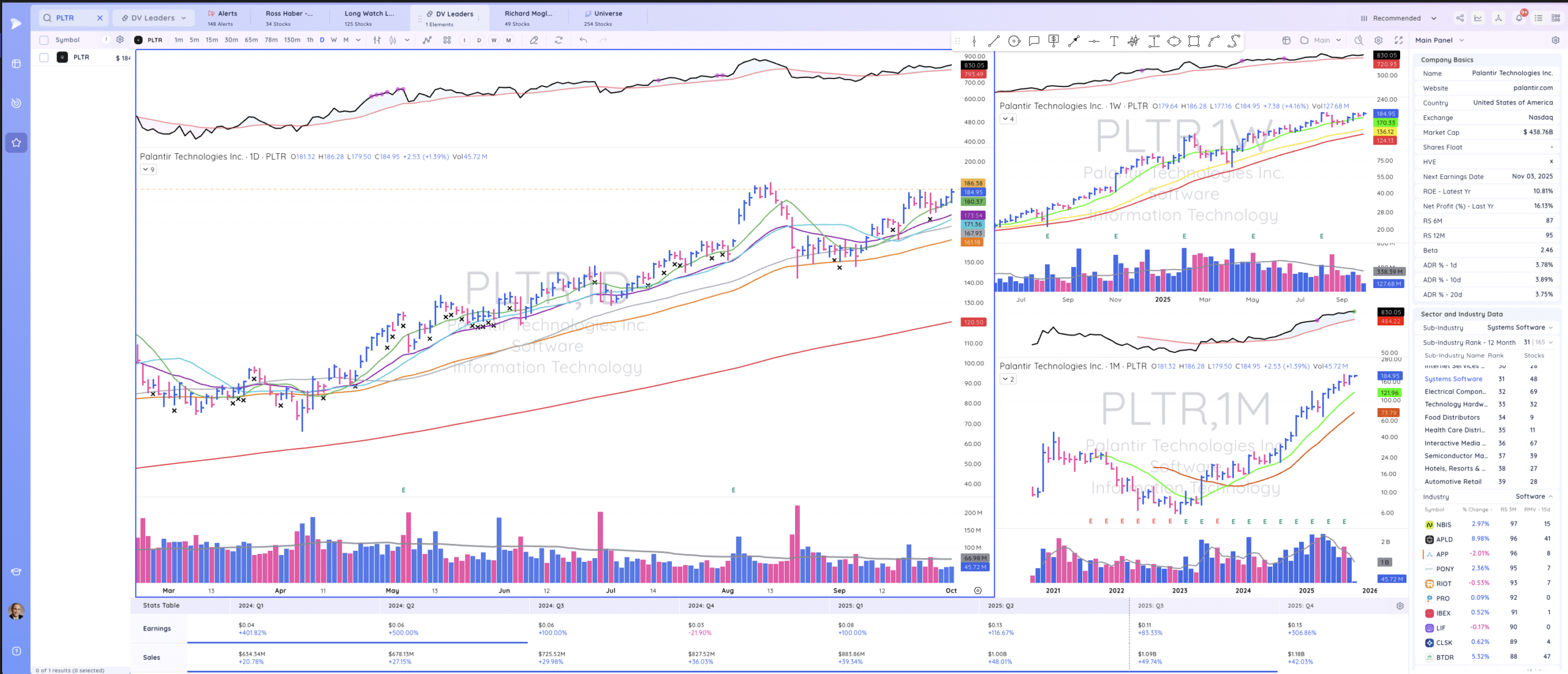

pLTR

PLTR has formed a sound cup with handle pattern that looks like it is getting ready to break out through the high of its handle.

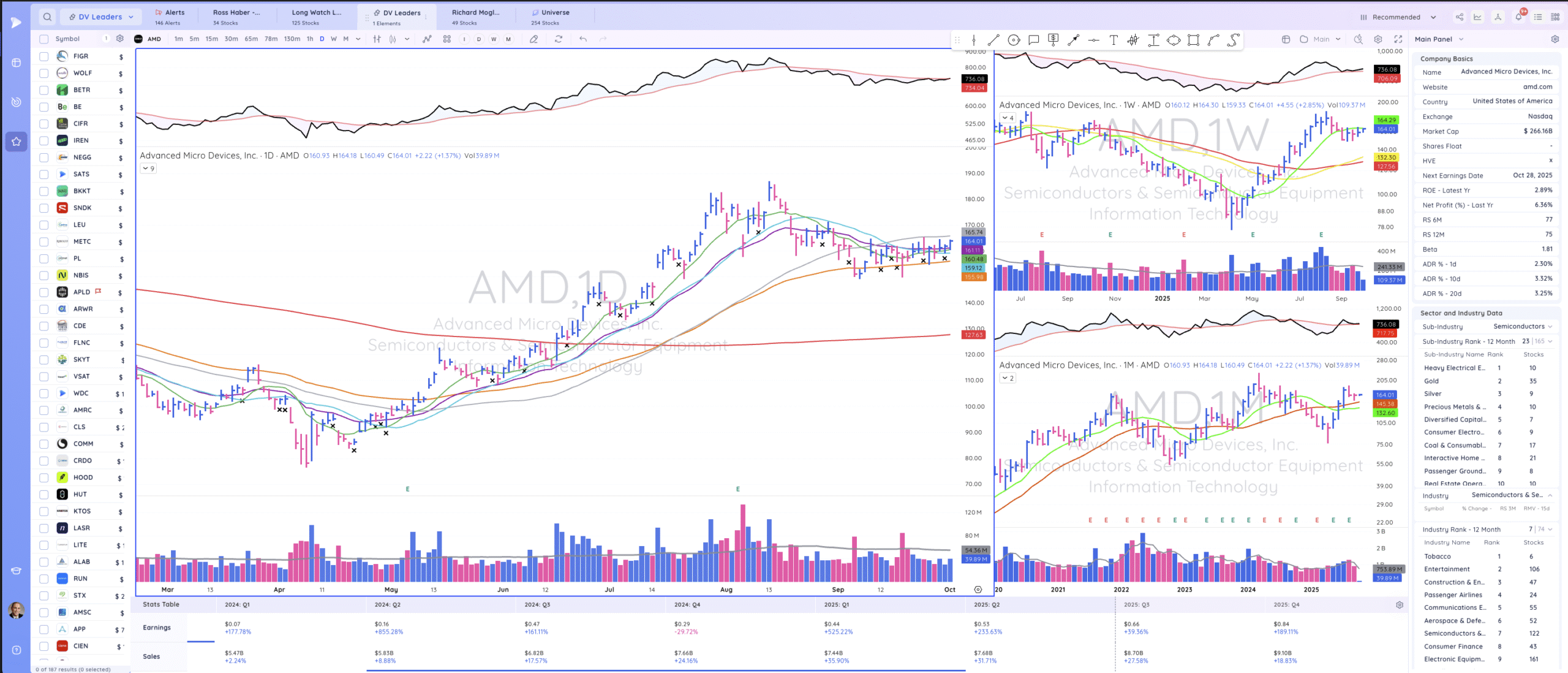

AMD

AMD has tightened up on low volume slightly below its 50-DMA, where it appears to be getting ready to reclaim this key moving average.

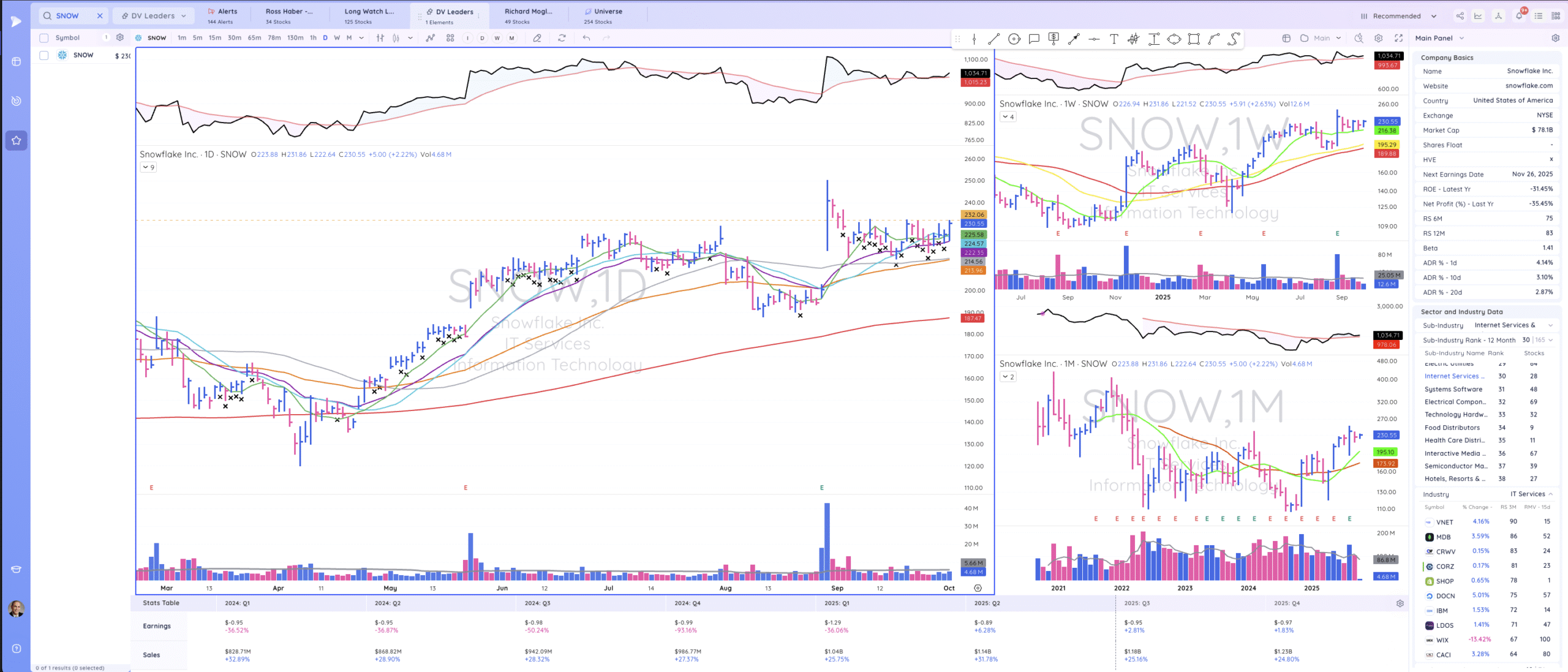

SNOW

SNOW has been tightening up above its key 50-SMA on light volume, where it looks about ready to break through resistance and head higher.

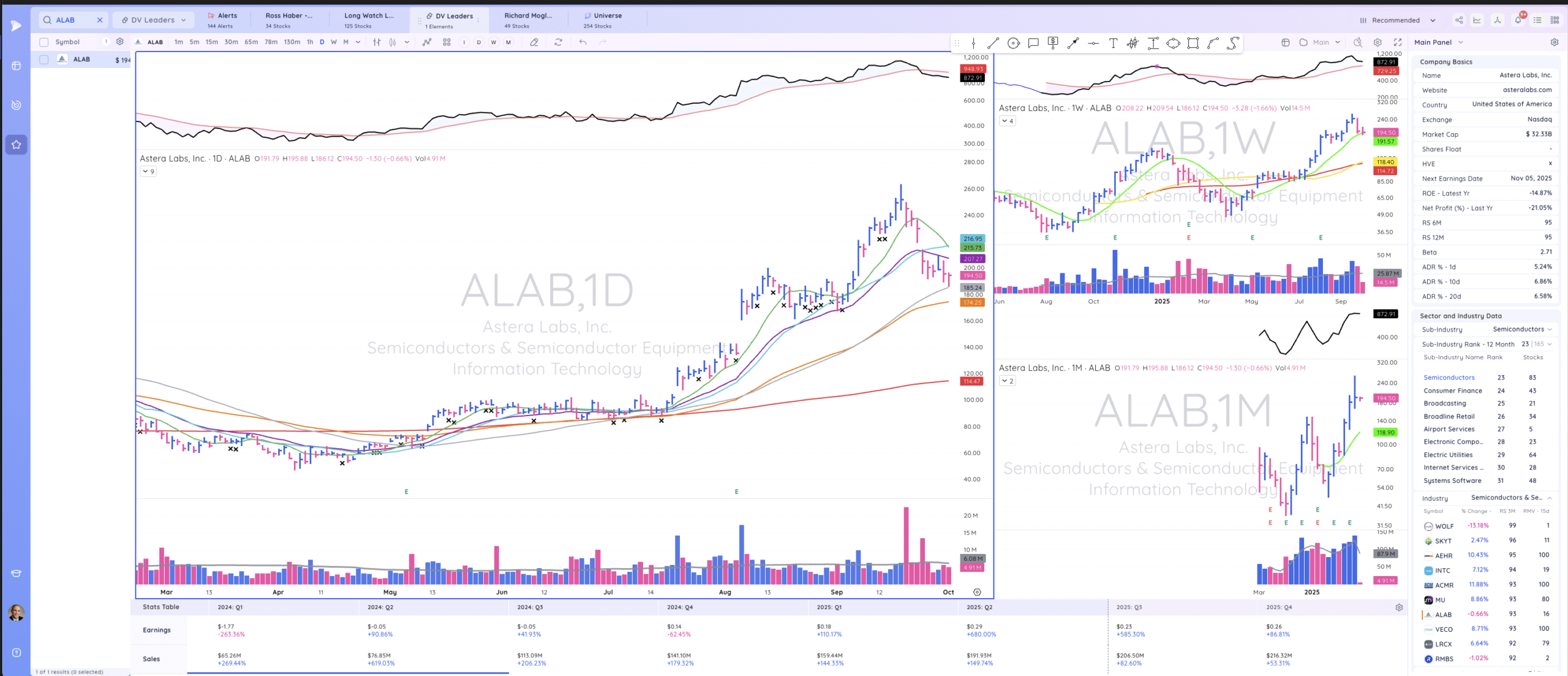

ALAB

ALAB pulled back to its 50-SMA and prior pivot, allowing traders to buy or add to this name using that average as a key support level to trade against.

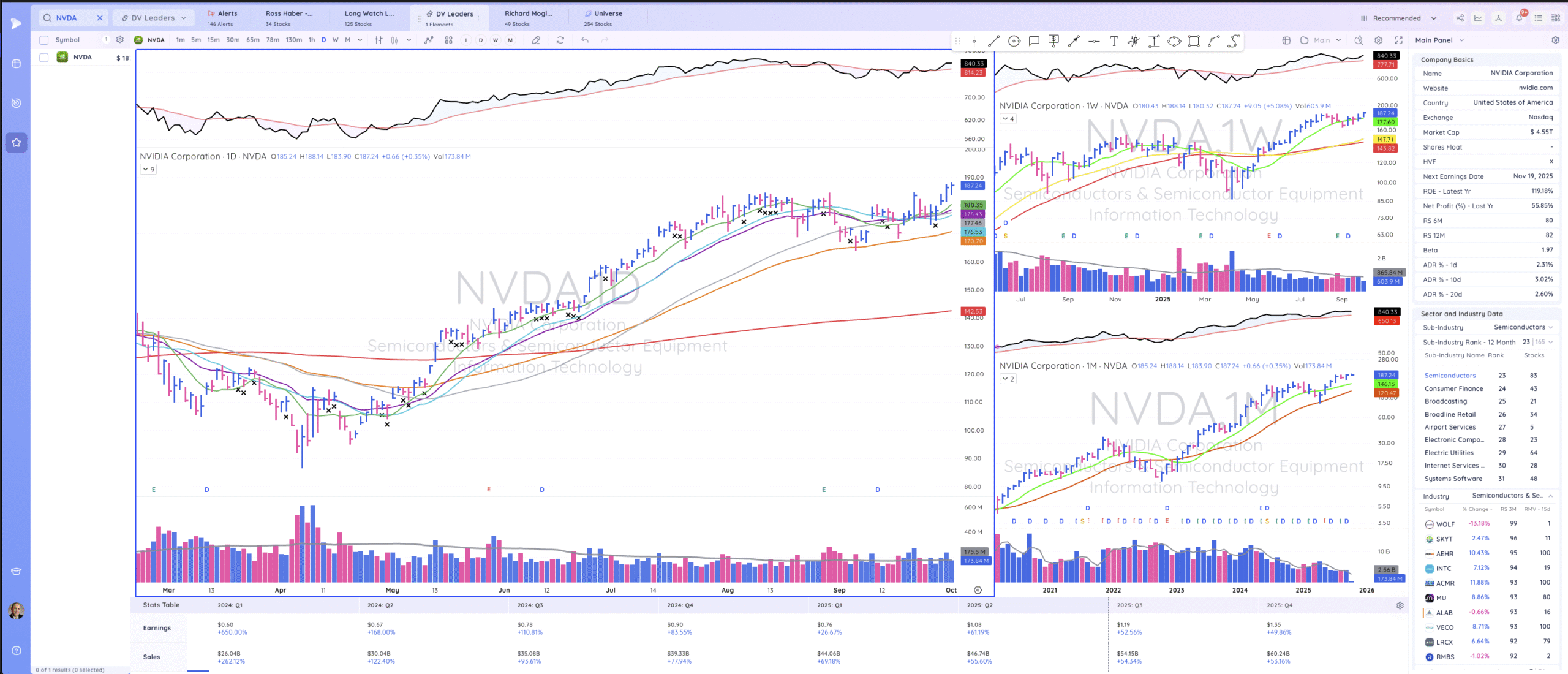

NVDA

NVDA broke out to new all-time highs on significant volume, which bodes well for the broader market. It is buyable on constructive weakness, versus its prior all-time high.