Trade Opportunity Case Study of the Week: INTC Post Gap Range Breakour – | Sep 28 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 28, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

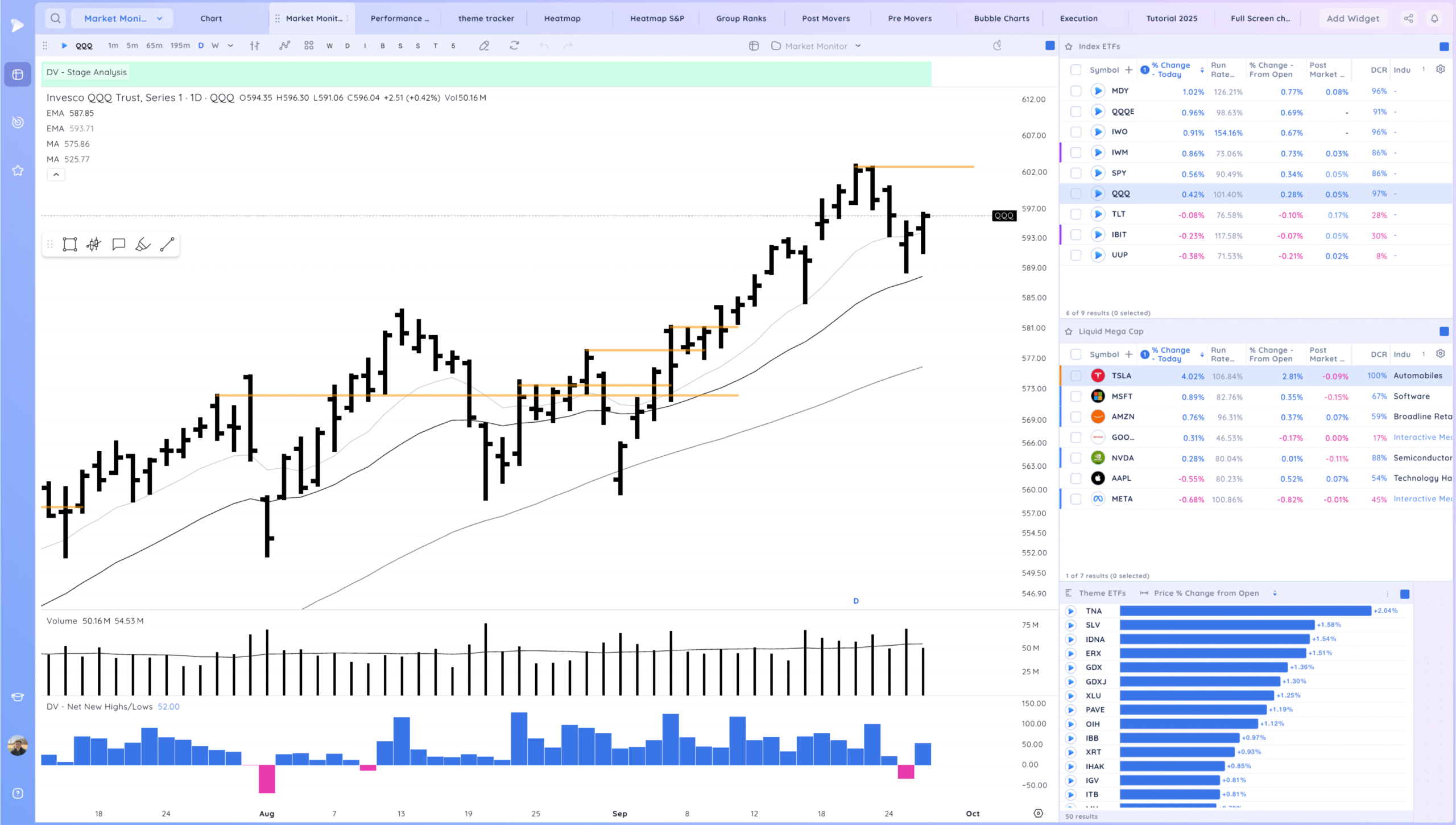

The market this week we overall pulled back into the 10ema. Good reversal action Thursday and friday.

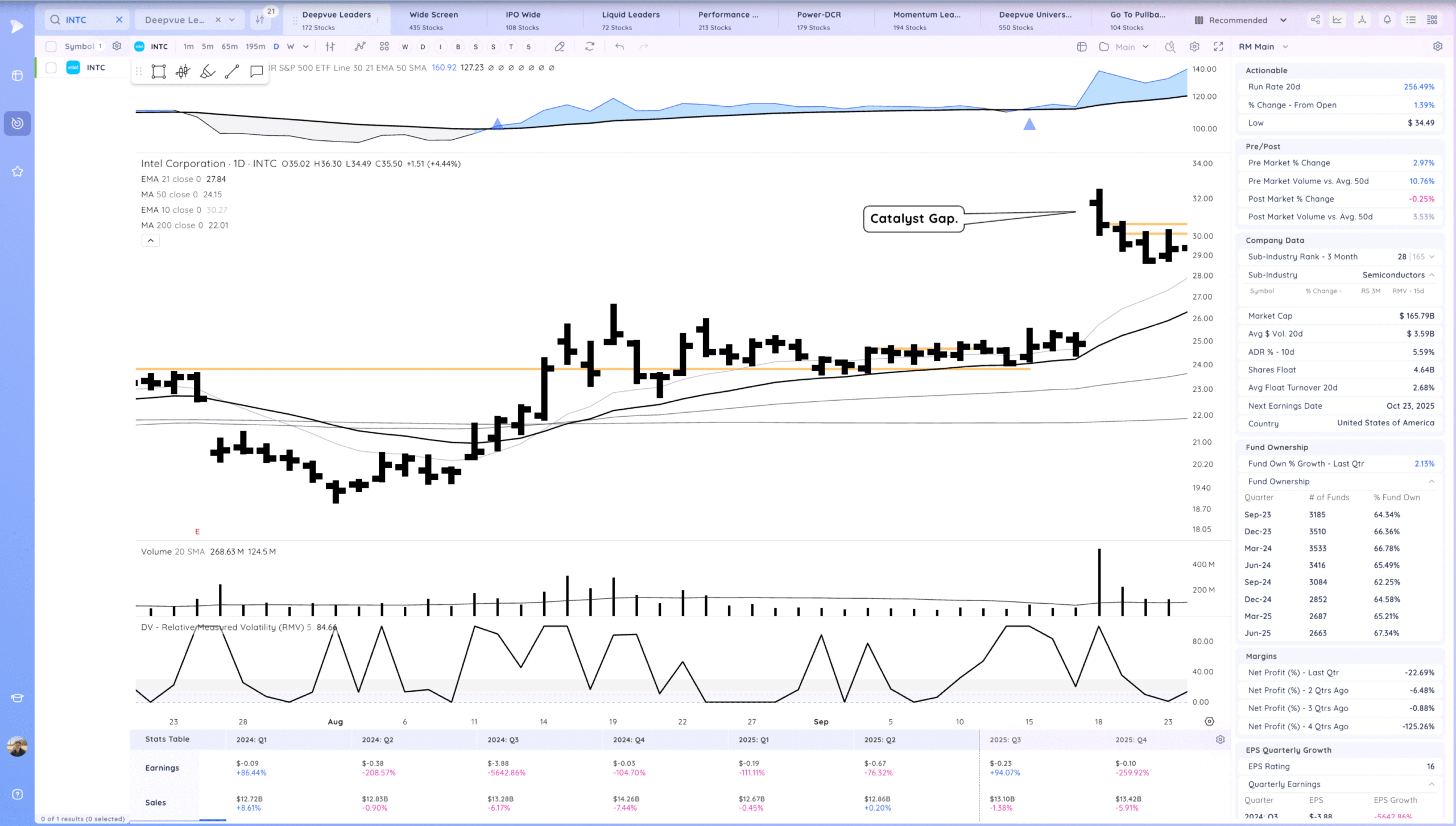

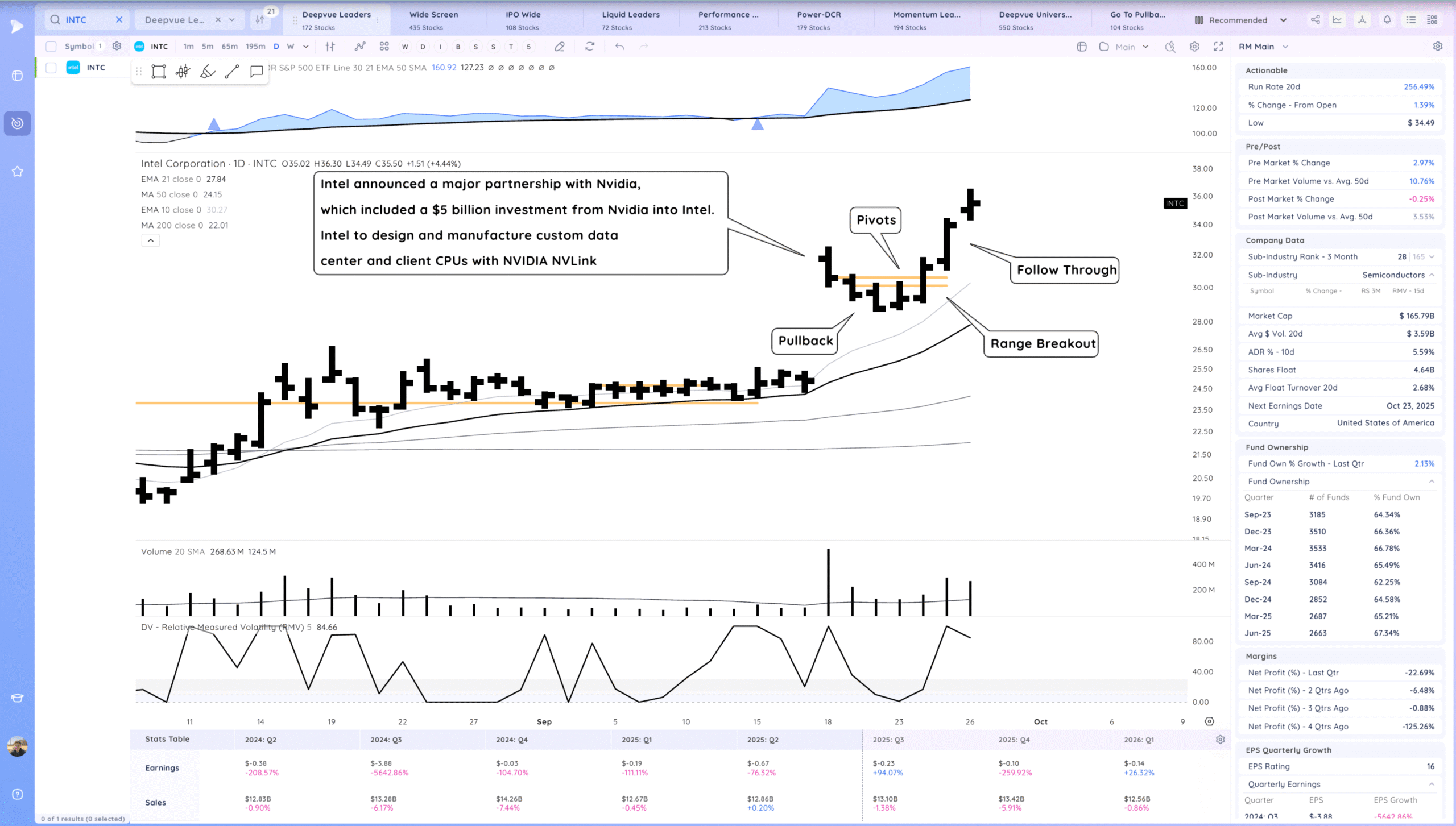

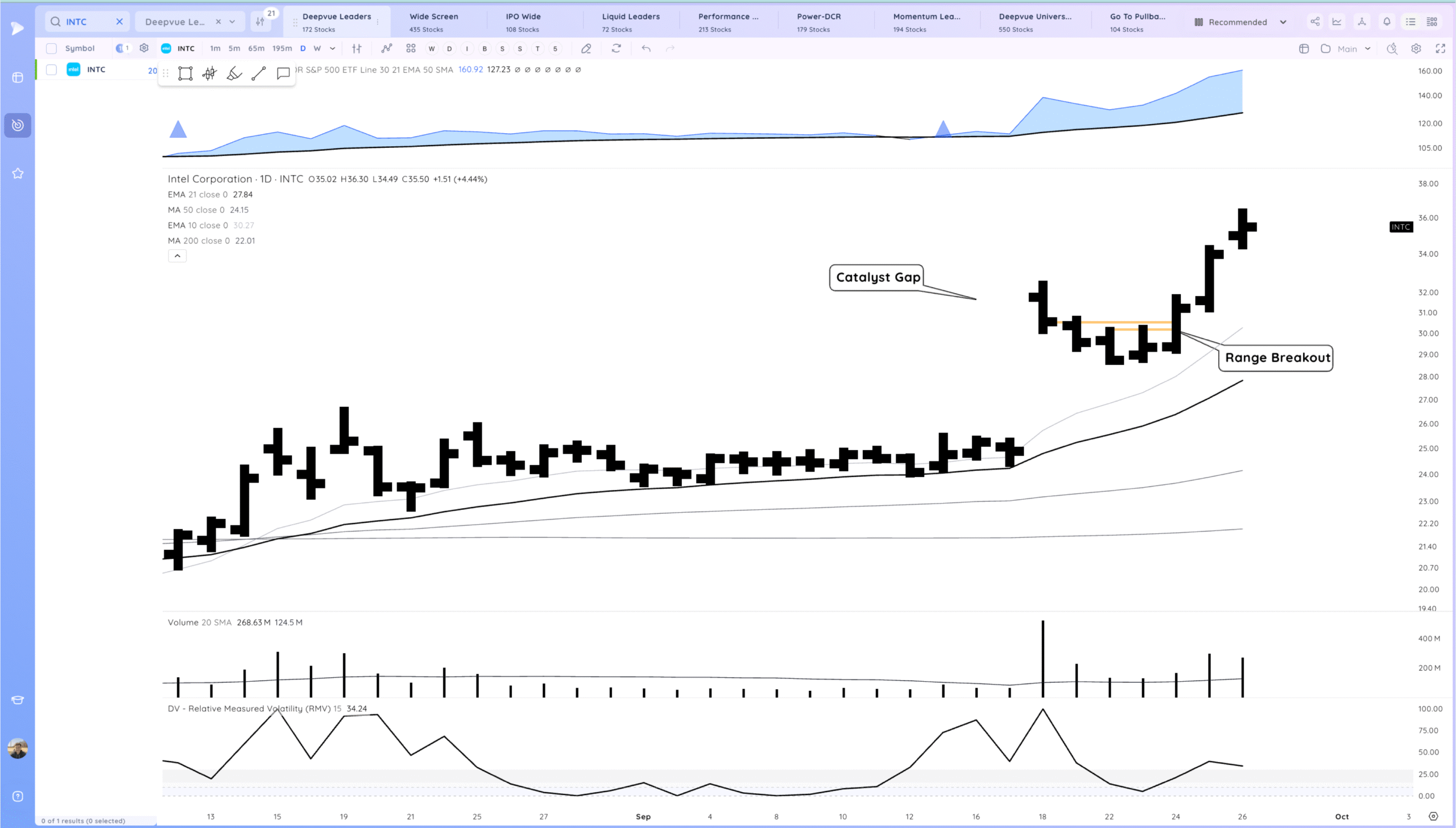

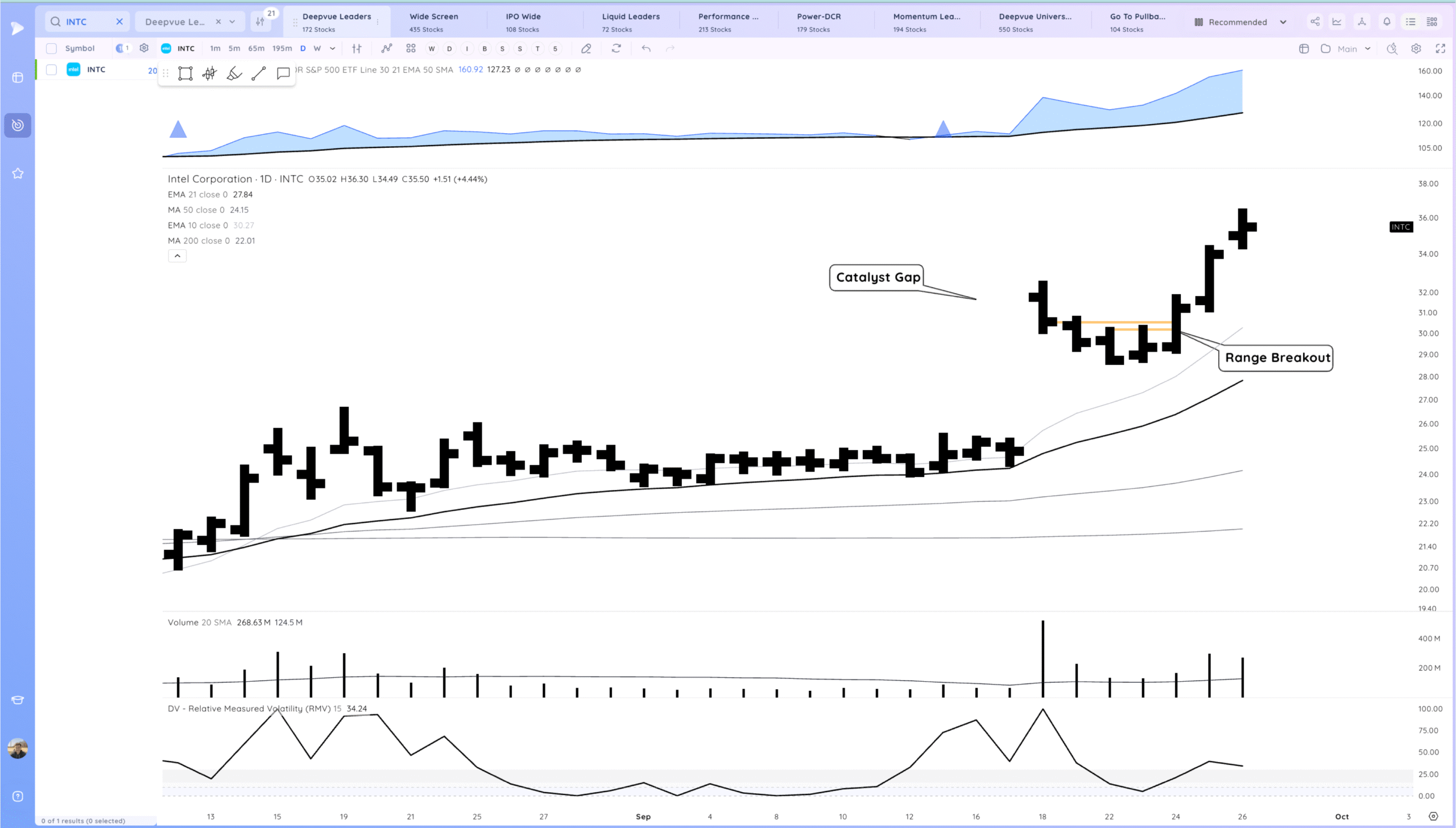

For this week we will be focusing on INTC which was a post-gap range breakout. Often you get u turns like after large gaps.

For years INTC has been a dog of a stock. What awakened this move was the partnership announcement with NVDA.

INTC Daily Chart:

Discovery – LEU

To catch strong moves you need to have processes in place to get names capable of them on your radar. Think of setting up a funnel system for each of your setups. Distill the characteristics you want it to exhibit and create screens that look for those.

For post gap range breakouts my flow is

- Check for gaps ups and analyze the catalysts

- Track promising gaps in a watchlist

- Review daily for setups – range breakouts, HVC reclaims

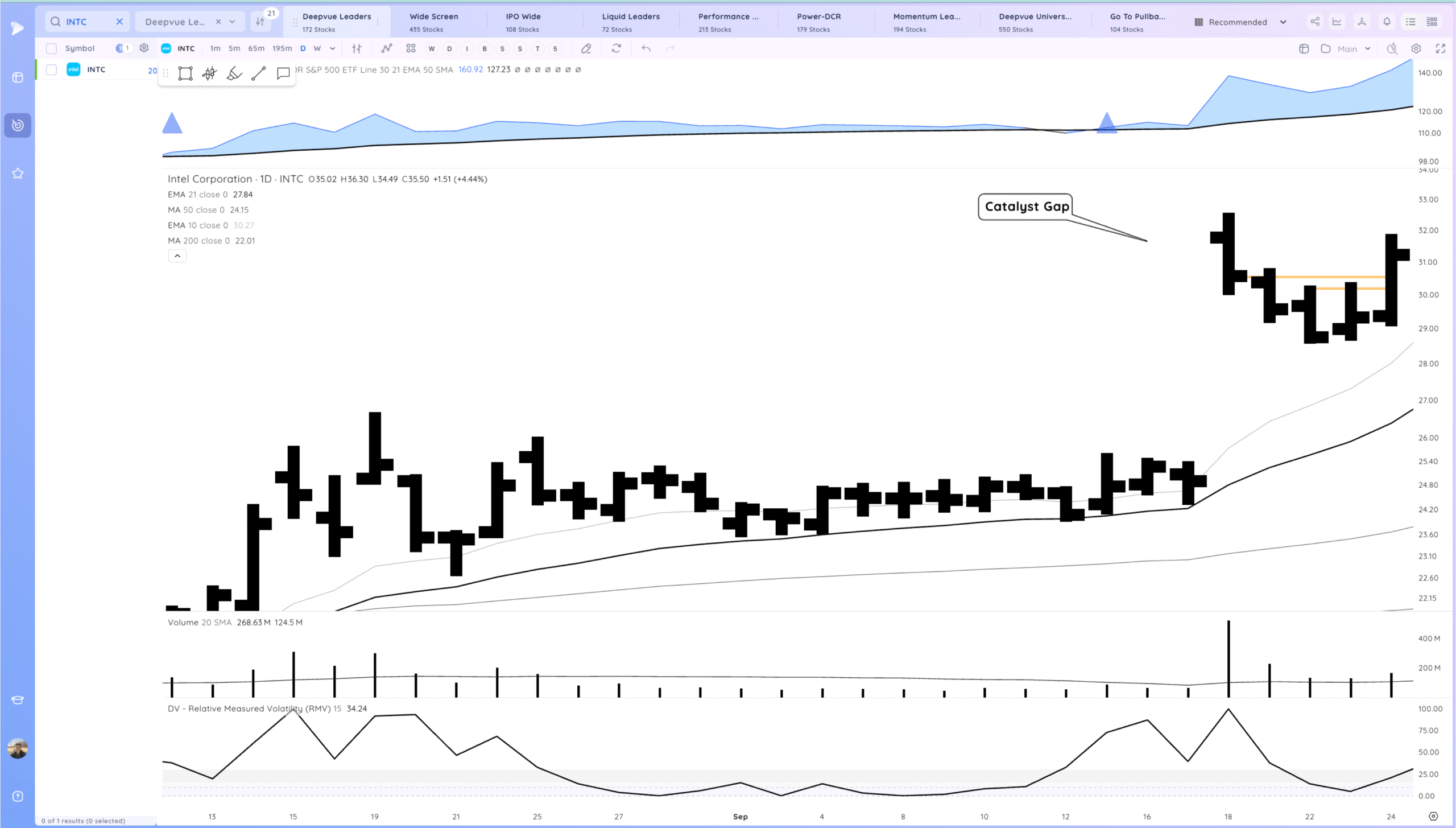

You could also have found INTC by looking for Low RMV names on Sep 23.

RMV 15 was under 5 and RMV 5 was 1.

Notcie how INTC had pulled back since the gap up, and on the 23rd formed a tight day where the downside momentum slowed. This is the type of setup for a potential u turn that we are looking for.

Setup and Execution

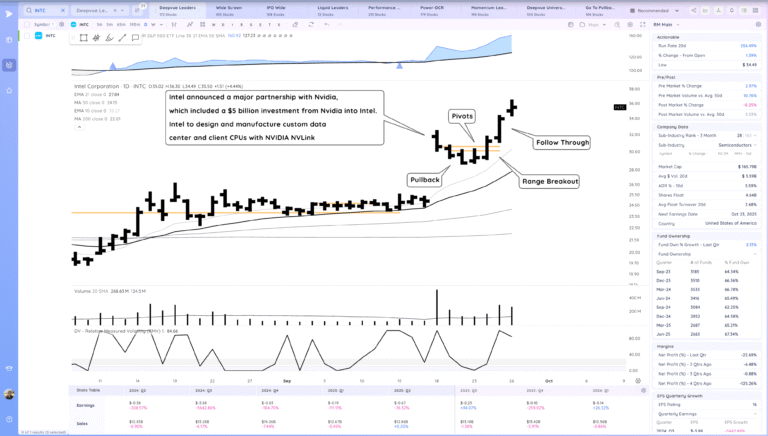

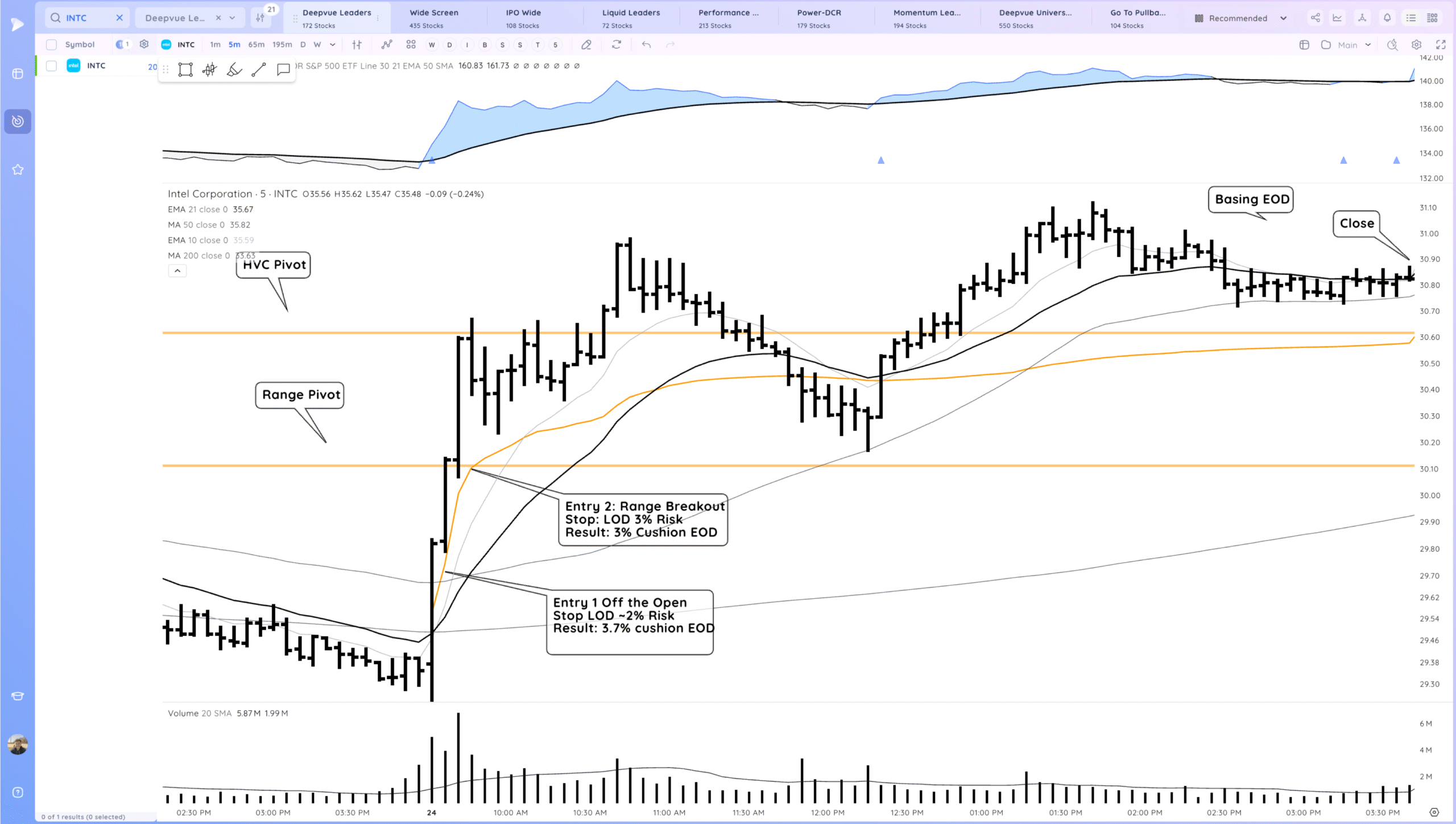

The key pivots on the daily chart for INTC were the HVC level (the close of the high volume, gap up day) and the range pivot. For high conviction trades what I am looking to place an order is strength right off the open heading up towards daily pivot levels where I can manage risk tightly,

With 2-3% individual stock risk you could size up to 20% (plenty in a high ADR name) and be risking less than 0.6% of your portfolio.

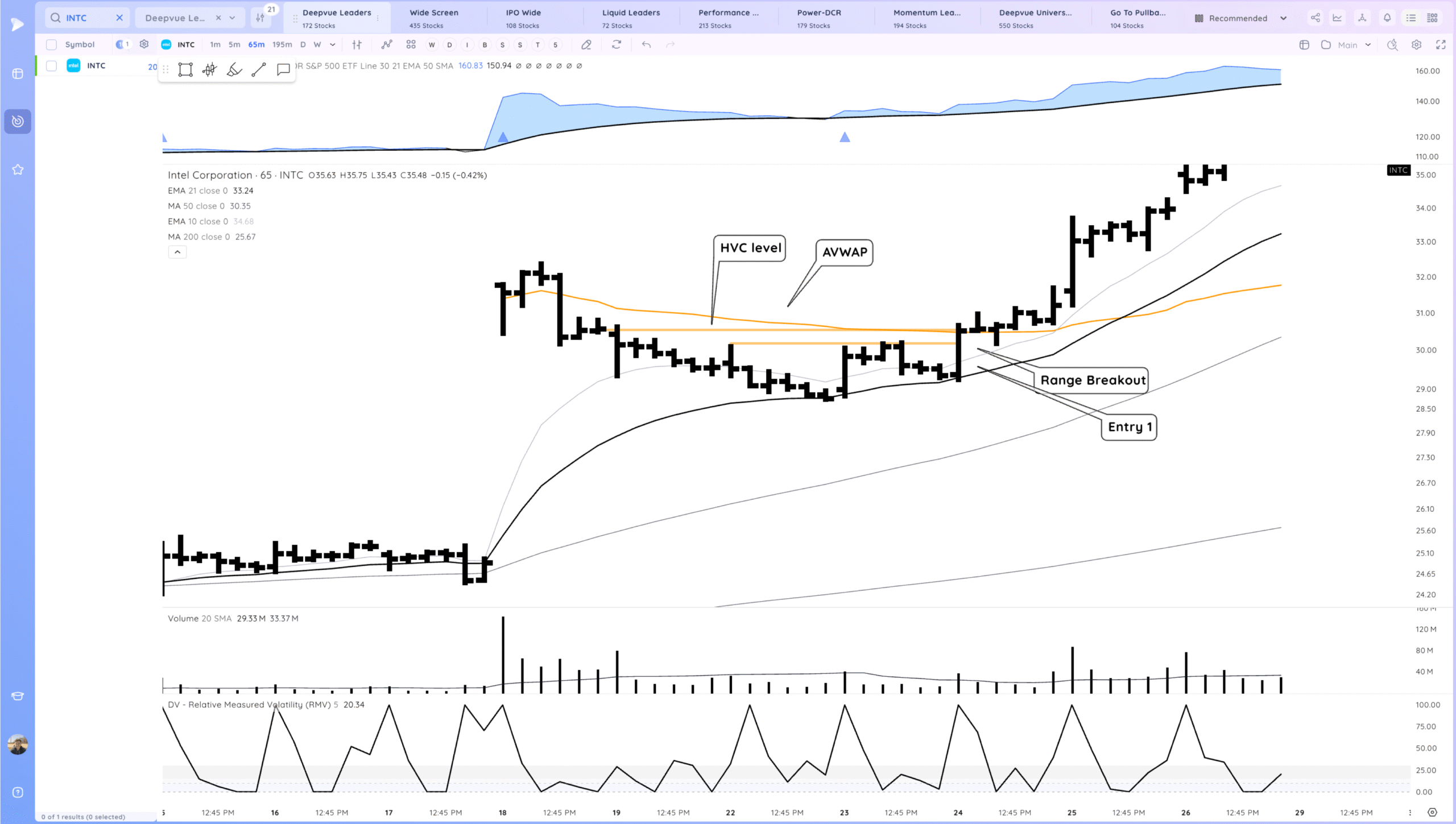

Here is INTC on a 5 min

INTC had a slight undercut before pushing strong early in the morning and breaking through the range. It then was more choppy and based around the HVC level to end the day. Both early entries worked well with little pressure.

Here is what it looked like at the close

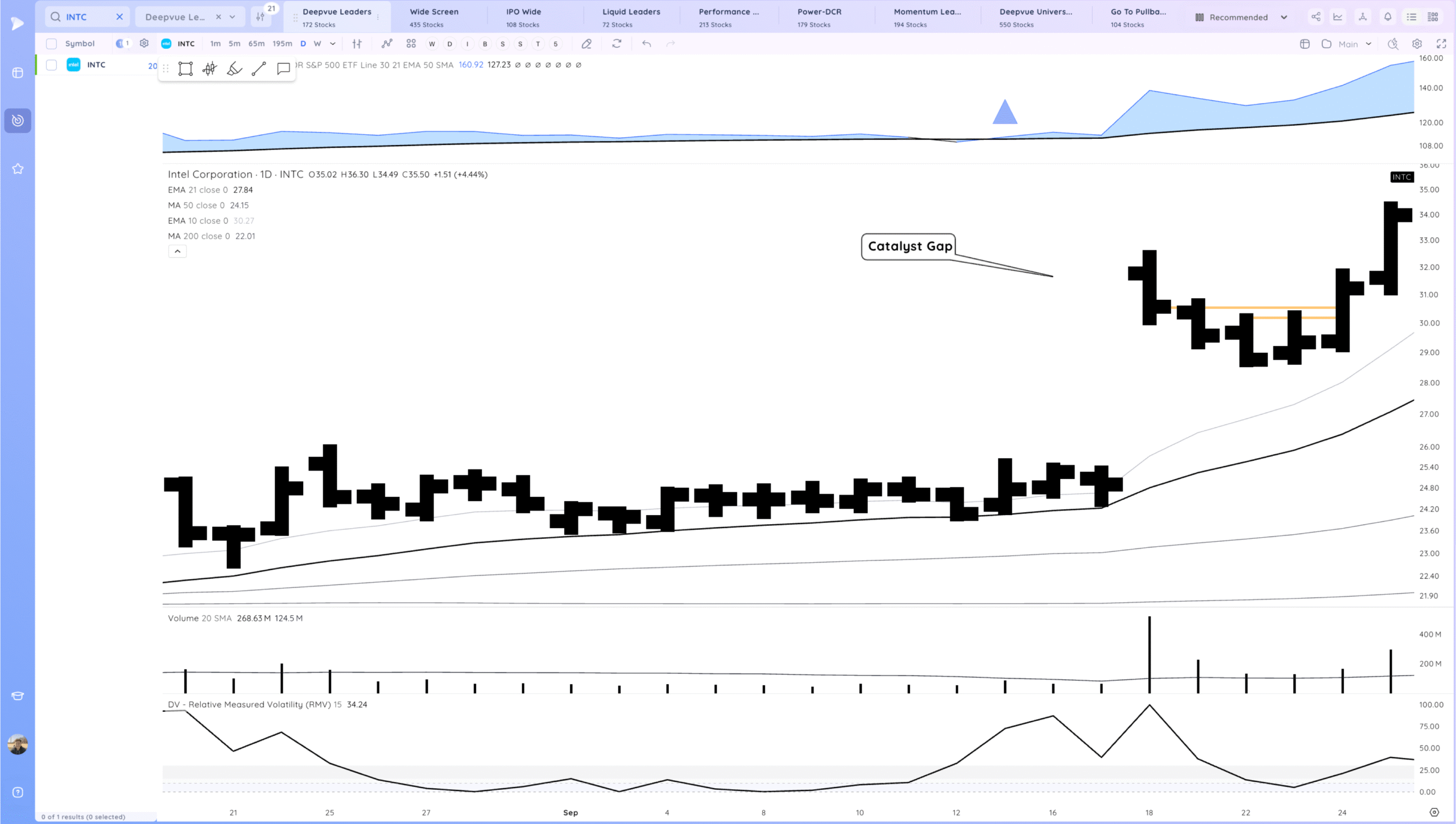

The next day INTC followed through strongly off the open breaking into new highs. At this point profit cushion would be above 10% and stops should be above breakeven and aggressive swing traders would likely take a portion off into strength.

INTC then gapped up and followed through more Friday up close to 20% from the first entry.

65 Minute Chart:

Daily Chart

Future thoughts

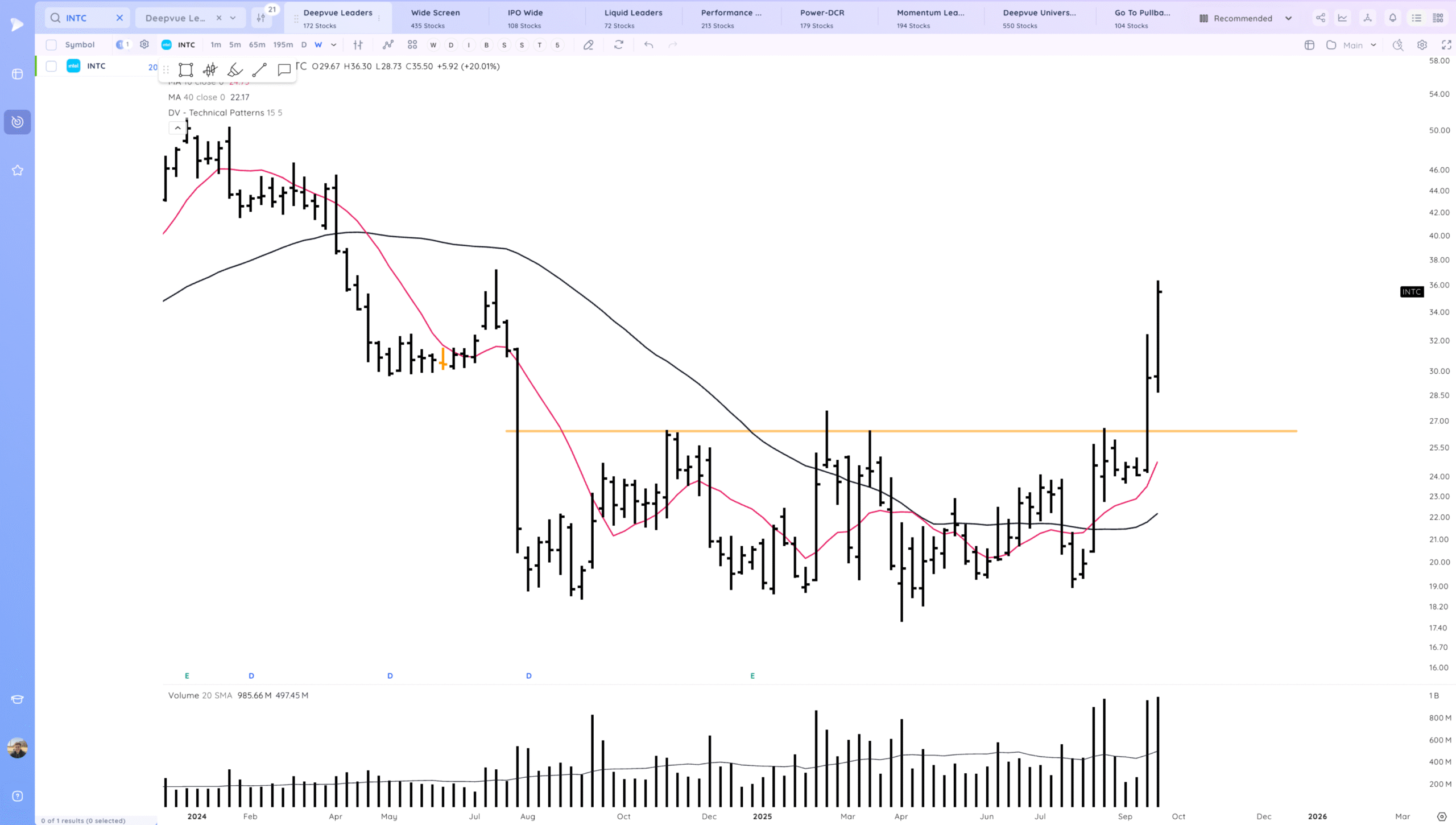

Short term odds of a pullback are strong given the powerful move, but likely a longer uptrend is just getting started for INTC.

Weekly chart:

Note how this is the start of a Stage 2 Uptrend and the average volume is increasing.

Some pullback the next few days would be expected, but you would not want it to retrace and break back below the HVC. You would want to see respect for the previous highs on a closing basis.

Homework

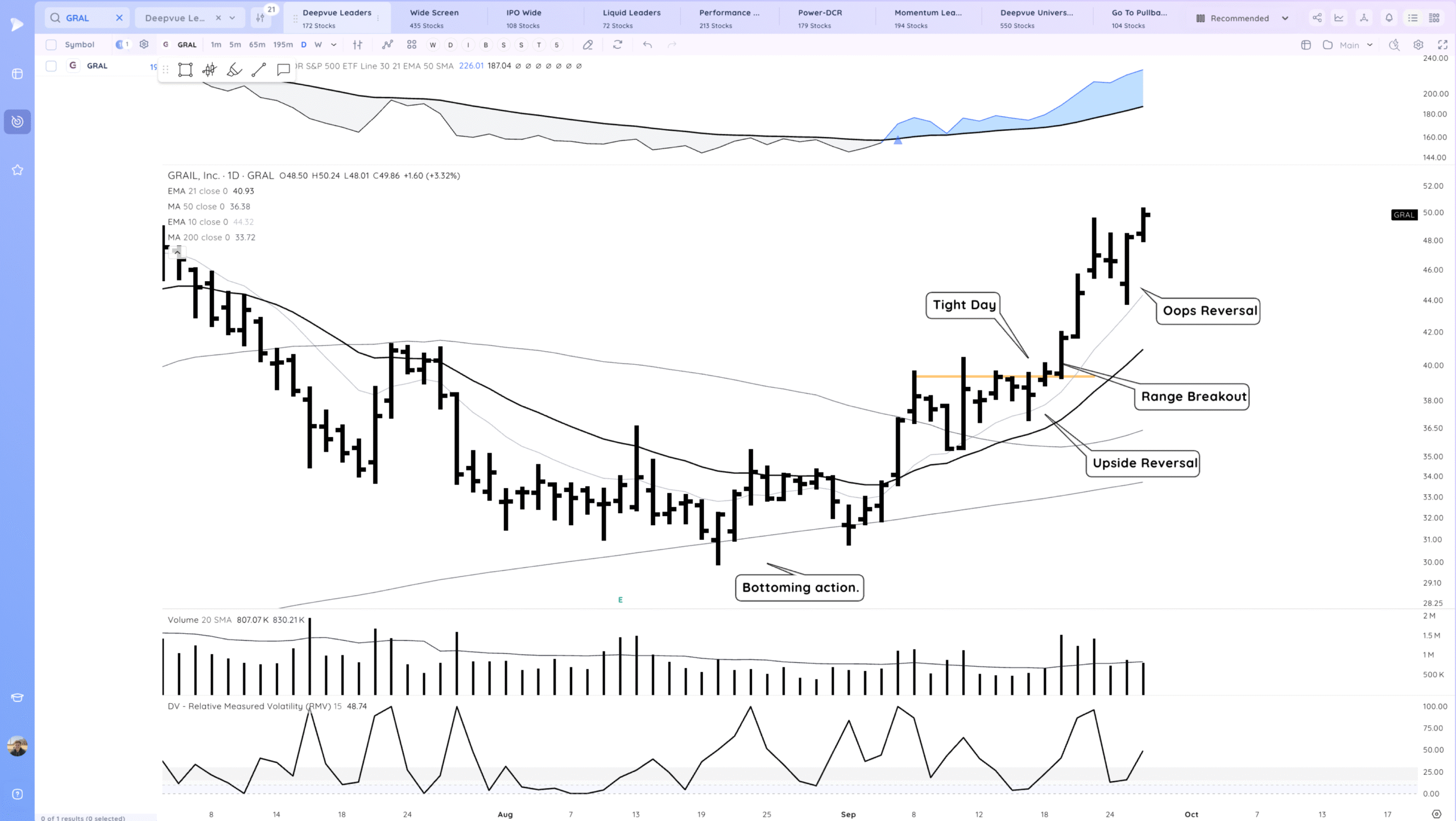

GRAL was another key opportunity over the last week+ Analyze the setup for yourself and think about processes to catch it.