Weekly Digest – Edition 12

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: September 28, 2025

7 min read

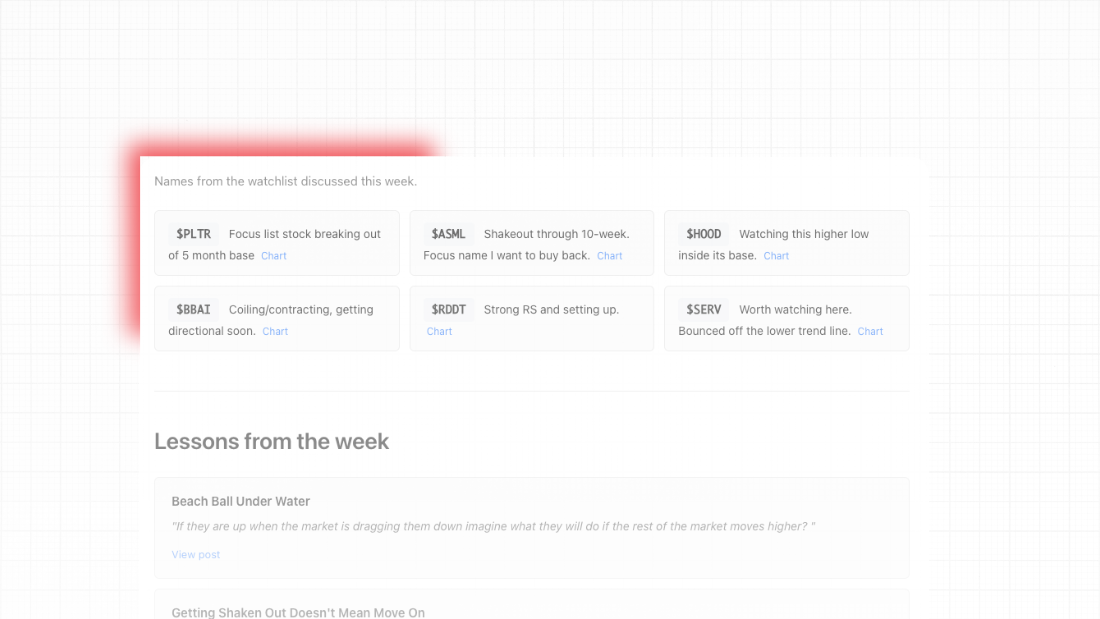

Weekly Subscriber Digest

“When you sell into weakness and focus on improving your worst case scenario you start to prefer stocks move

up slower than faster. The day to day to me is mostly irrelevant.”

Key Trading Insights

Three Weeks Sideways Turn Any Extended Name into Good Setup

“3 weeks sideways always turns any setup into something compelling.”

Discussion about RDDT being extended but would become priority if it had 3 weeks of sideways digestion to provide good risk/reward.

Discussion about RDDT being extended but would become priority if it had 3 weeks of sideways digestion to provide good risk/reward.

Minimize Screen Time During Volatility

“When the market gets volatile like today I intentionally try to minimize screen time to avoid making rash decisions!”

Days with high volatility are best handled by stepping away rather than watching every tick.

Days with high volatility are best handled by stepping away rather than watching every tick.

Flush Lows Often Lead to Strong Closes

“When a stock does take out the lows in the morning and does flush, it increases likelihood of a push into the close.”

A fade after a morning bounce that heads near lows is almost always going to take out the morning lows.

A fade after a morning bounce that heads near lows is almost always going to take out the morning lows.

April Leaders as Market Guide

“If the original market leaders begin to falter, and lower-priced, lower-quality, more-speculative stocks begin to move up, watch out!”

– William O’Neil

Tracking original April leaders (HOOD, MSTR, META, SPOT, PLTR, etc.) for cycle health indicators.

Tracking original April leaders (HOOD, MSTR, META, SPOT, PLTR, etc.) for cycle health indicators.

Portfolio Focus: 5 Names Max

“I like to hold no more than 5 stocks at once. When it becomes more than that my attention becomes spread and I don’t make the best decisions.”

Maintaining focus by limiting holdings for better decision-making.

Maintaining focus by limiting holdings for better decision-making.

Improving Worst Case Scenarios

Using the rising 10-week moving average as a guide for exits on TSLA. Last week at $344, now at

$357 and continuing to rise quickly, providing better risk management.

Trade Activity

2 trades this week • 1 exit, 1 new entry

| Ticker | Trade Notes |

|---|---|

| SPOT | Bought Tuesday: Started position on weakness as price contracted in base. Tighter chart with smaller ranges than RKLB. “This is a type of trade I would take 100 times over.” April leader showing constructive base action. |

| RKLB | Sold Thursday/Friday: Reduced size Thursday during volatility due to no cushion and high ADR. Fully exited Friday to simplify portfolio. “Still think it’s fine but just would rather revisit.” Stock became a headache despite strong space theme. |

Current Holdings

4 core positions • Total exposure: 138%

| Ticker | Status & Notes |

|---|---|

| TSLA | 94% of portfolio – Primary position. Showing crazy strength even when market is down. Faded off highs but day-to-day action irrelevant. Rising 10-week MA now at $357 providing improved risk management. “Already had a massive move out of prior base and deserves to rest.” |

| SPOT | 22% of portfolio – New position. April leader with tight VCPish base formation. Price contracting nicely, weakness staying inside last week’s candle making base even tighter. Better risk profile than RKLB with smaller trading ranges. |

| BULL | 14% of portfolio. Gapping up and potentially becoming bigger trade than anticipated. Not viewing as core position, will likely use 4-week MA instead of 10-week for management. |

| PLTR | 8% of portfolio. Perfect end to the week with handle forming as desired. I will likely look to add to my position next week. Showing constructive action. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | Strong close across the market. Many names extended but liquid leaders about to move out of long bases. NVDA attempting official breakout. |

| Tuesday | Slow day with Powell speaking at 12:35pm causing market hesitation. Small caps doing best. April leaders mostly lower but quietly inside bases. “Feels so far like a day that makes you want to do something out of boredom.” RKLB up 7% attempting base breakout but until it breaks out expecting it to fade as usual. |

| Wednesday | First volatile action in weeks with pressure across all names in morning. Started SPOT position on weakness. “Most stocks that took a hit today are still structurally fine. Bases are intact.” RKLB seeing pressure as expected given personality. |

| Thursday | Gap down open turning into wild volatility. Reduced RKLB position size due to no cushion and high ADR. |

| Friday | Volatile action again but mostly seems like digestion. Lots of leaders with inside weeks. Fully exited RKLB because of ugly close. Still think its fine but wanted to start with a clean slate. PLTR with perfect end to week, handle forming sets us up for a potential add next week. Final exposure 138%. “Weekly charts show not much happened despite the market this week feeling busy & stressful.” |

← Swipe to see more →