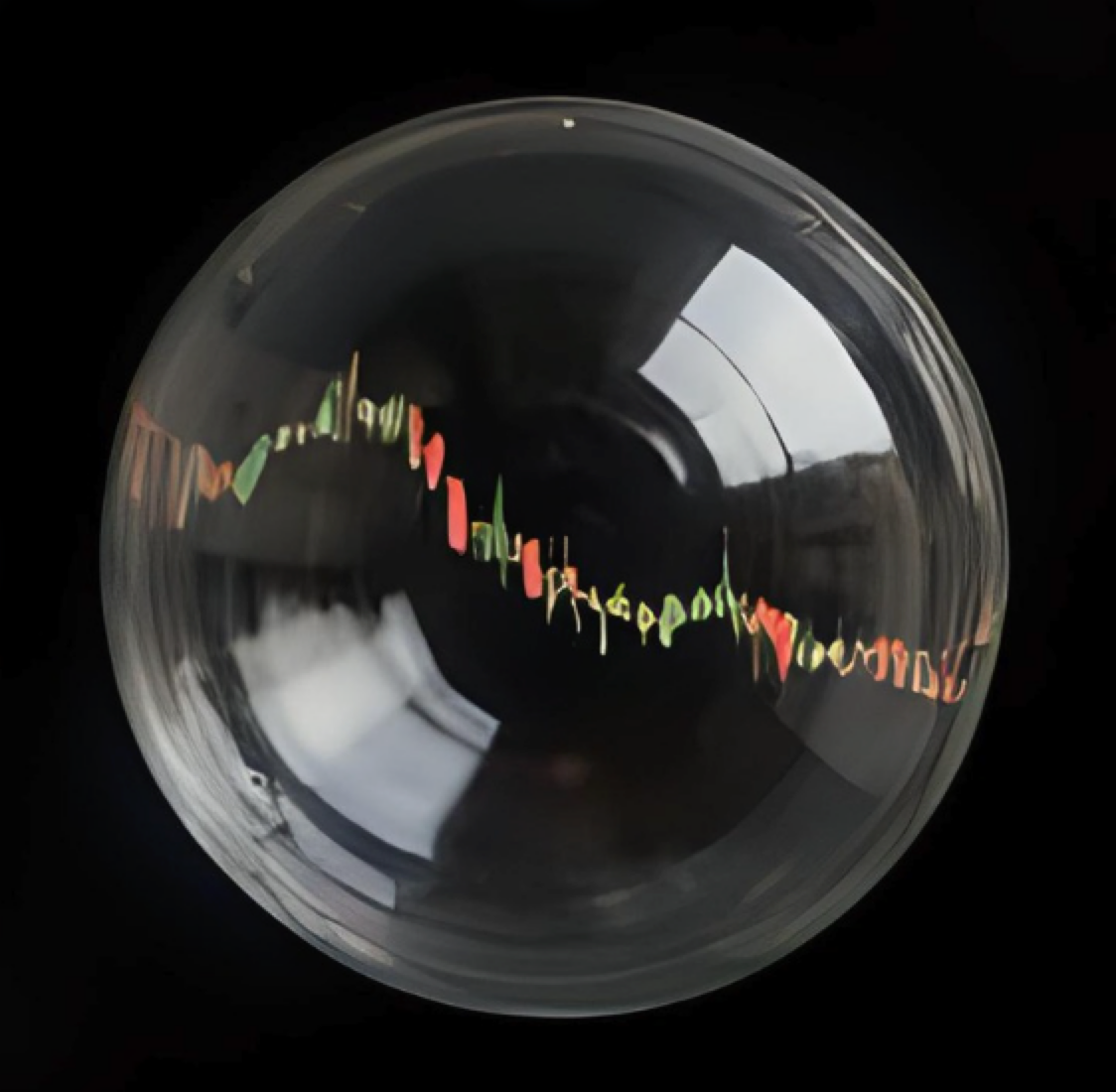

Lessons From the Dot-Com Bubble: Why the 1999–2000 Stock Market Mania Matters in 2025

Published: September 30, 2025

Studying the Dot-Com Bubble

The turn of the millennium might feel like ancient history in today’s fast-moving financial world, but the dot-com bubble of 1999–2000 still holds powerful lessons. And with current tech stocks once again reaching sky-high valuations, this time fueled by Artificial Intelligence (AI) hype, it’s a good time to revisit what went wrong back then.

In this post, we’ll walk through what happened during the dot-com bubble, what fueled it, how it collapsed, and what we can learn in 2025 as we navigate another potentially overheated market.

Why the Dot-Com Bubble Still Matters in 2025

Parallels between AI today and internet mania then

The stock market is beginning to feel and look a lot like it did in the late 1990s. This time, artificial intelligence is the buzzword just like the internet and “dot-com” was 25 years ago.

Top performing hedge fund managers and CEOs of leading tech stocks are making the case that this Artificial Intelligence-fueled market may be in a bubble, comparing it directly to the dot-com crash. Growth stock traders and investors are also drawing clear lines between today’s AI boom and the dot-com era.

Never miss a post.

Sign up to get instant notifications when we publish a new post.

Back then, companies promised to “change everything” with the internet. Today, it’s the same story, just with AI. Stocks like Nvidia are climbing fast, even as some experts question long-term profitability.

Why Studying the Dot-Com Bubble is More Than Just Financial History

The hype-driven behavior is eerily familiar. In the dot-com era, startups raced to “get big fast.” Now it’s all about “scale AI or die.”

But there are key differences: today’s leading tech companies are actually profitable, unlike many dot-com startups that burned through invested money without ever making a dollar. Still, some experts say an AI crash could cause even more pain thanks to higher stock prices and broader retail investor participation.

What this shows is that bubbles aren’t just about tech. They’re about human psychology, easy money, and the fear of missing out (FOMO). And if you believe today’s AI valuations may already exceed the dot-com peak, this history lesson is more relevant than ever.

What Sparked the Dot-Com Bubble in the Late ’90s?

How the Internet Boom Set the Stage

The dot-com bubble started with the commercialization of the internet in 1995. Suddenly, it felt like anything was possible.

Startups popped up claiming they’d change how we shop, communicate, and work. This optimism drew in billions of dollars in venture capital, especially after Netscape’s explosive IPO in 1995.

Companies like Netscape Communications, Amazon, Ebay, and NVIDIA went public in the late ’90s, riding a wave of excitement and investor cash.

When Hype Replaced Fundamentals

Between 1998 and 2000, things got out of hand. Investors stopped caring about profits and focused on potential. If you had “.com” in your name, your stock soared even if your business model didn’t make sense.

Major milestones included:

- 1995–1998: Foundations laid. Netscape goes public. Amazon follows. Venture capitalists piled in.

- 1999: Peak mania. The NASDAQ surged 86% in one year. Big mergers like AOL-Time Warner marked the top.

- March 10, 2000: NASDAQ hit an intraday high of 5,132.52 – more than double in a year.

Media, hedge funds, and individual investors just kept buying every new thing. Even non-traders, like mail carriers and hairdressers, began talking about what stocks they were buying.

What Drove the Madness Behind the Bubble?

The Perfect Storm of Low Rates, Hype, and Easy Money

Several forces came together to inflate the dot-com bubble:

- Low interest rates in 1998–1999 made borrowing cheap

- The U.S. economy was booming, with low unemployment and inflation

- Speculation exploded, especially from retail investors

- Investment banks rushed to fund and bring new companies public with unproven business plans

- The media hyped the “new economy,” fueling FOMO

All of this created a feedback loop. As prices rose, more people jumped in, which pushed prices even higher.

How Media and Investor Psychology Fed the Frenzy

You couldn’t turn on the TV or open a newspaper without hearing about the Internet revolution. Financial networks breathlessly covered every new IPO.

This media buzz made regular people feel like they had to get in before it was too late. And because valuations were based on future potential, not profits, it became easy for startups to justify outrageous numbers.

How Valuations Got Totally Out of Control

When Revenue Didn’t Matter but Eyeballs Did

In the dot-com era, success wasn’t measured by profit – it was measured by page views or user traffic. If people were visiting your site, investors assumed you’d figure out how to make money later.

For example:

- In March 2000, the S&P 500 tech sector traded at 50x earnings

- Cisco reached massive heights – then lost 80% of its value

- Amazon soared despite years of losses

- Priceline (now Booking Holdings) traded at insane multiples with minimal revenue

Even strong players like Microsoft and IBM had price-to-earnings ratios of 30 – 40x, way above historical norms.

Extreme P/E Ratios and IPO Mania

IPOs were especially wild. Demand far outpaced supply, pushing stock prices through the roof. Most of these companies had no clear path to profit and many never made it.

The result? A house of cards built on hope, not numbers.

What Happened After the Crash Hit

The Brutal Wipeout of Unprofitable Startups

The fall came fast. Between March 2000 and October 2002, the NASDAQ dropped 75%, wiping out over $5 trillion in market value.

Hundreds of companies folded. Icons of the dot-com bubble, like Pets.com and Webvan, went bankrupt. Even the survivors took heavy hits:

- Microsoft took 17 years to fully recover its 2000 peak

- Cisco still hasn’t fully bounced back in inflation-adjusted terms

The Long Road to Recovery and Those Who Survived

The crash triggered new laws like Sarbanes-Oxley, designed to rein in accounting fraud and restore investor confidence. And it taught markets a hard lesson: profits matter.

But the story isn’t all doom and gloom. Some companies like Amazon, eBay, and Nvidia emerged stronger. The technology was real. The problem was the timing and the excess exuberance of potential growth.

What Technical Indicators Signaled the End of the Dot-Com Bubble

Warning Signs From Charts, Momentum, and Sector Trends

From a technical analysis point of view, there were clear red flags before the dot-com bubble burst:

- The market was overbought on many market sentiment tools

- Price charts went parabolic, often a sign of unsustainable gains

- Market breadth narrowed, meaning fewer stocks were driving gains

- Momentum indicators diverged – stocks kept rising, but with less strength

Lessons From Market Mechanics That Still Apply Today

Other warning signs included:

- Liquidity and low interest rates encouraged margin buying

- Speculative feedback loops, where rising prices attracted more buyers

- Sector concentration, with tech dominating the indexes

- Rate hikes in 2000, which pricked the bubble

Technical tools, price charts, and sentiment measures warned investors, but many ignored them, as they were caught up in the hype.

Who Were the Biggest Winners During the Dot-Com Bubble

Stocks That Soared and What Happened After

Some companies saw once-in-a-lifetime gains during the bubble. But most came crashing down just as fast.

Here are a few standouts:

| Company | Dot-Com Era Peak Gain | Peak Price (Approx.) | Post-Crash Low | 2025 Status |

|---|---|---|---|---|

| Qualcomm (QCOM) | +2,619% in 1999 alone | $100 (Jan 2000) | $11.60 (Aug 2002) | Strong recovery. $168/share. Leader in 5G, AI, and wireless chips. Market cap $188B. |

| Amazon (AMZN) | +4,800% from 1997 IPO to 1999 peak | $107 (Dec 1999) | $6 (Sep 2001) | Iconic success. $228/share. E-commerce/cloud giant. Market cap $2.4T. |

| Cisco (CSCO) | +1,000% in late ’90s | $65 (Mar 2000) | $8 (Oct 2002) | Solid but never fully regained inflation-adjusted peak. $68/share. Networking leader. Market cap $266B. |

| Nvidia (NVDA) | +600% from 1999 IPO to 2000 peak | $3.90 (Mar 2000) | $0.33 (Oct 2002) | Explosive AI boom winner. $177/share. GPU/AI powerhouse. Market cap $4.3T. Magnificent Seven member. |

| Priceline (now Booking Holdings – BKNG) | +1,200% in 1999 (from IPO) | $165 (Late 1999) | $6 (Oct 2000) | Strong recovery. $5,510/share. Leader in online travel and booking services. Market cap $176.86B. |

| eToys.com | +320% from IPO | $84 (Oct 1999) | $0 (Mar 2001) | Bankrupt by 2001. Assets sold for pennies on the dollar. |

| Webvan | +100% from IPO | $30 (Nov 1999) | $0 (Jul 2001) | Promised 30-minute grocery delivery nationwide. Too early, too costly, logistics impossible at the time. |

| Pets.com | +27% | $14 (Feb 2000) | $0 (Nov 2000) | IPO in Feb 2000, soared briefly. Shut down within 9 months. Iconic bubble bust. |

| CMGI (later renamed ModusLink Global Solutions) | +1,300% | $163 (Mar 2000) | <$1 (2002) | Survived but irrelevant. Rebranded as ModusLink. Negligible market presence. |

| TheGlobe.com | +606% on IPO day (Nov 1998) | $97 (Early 1999) | $0.14 (2001) | Defunct by 2008. Delisted, assets sold for minimal value. No longer exists. |

| Excite@Home | +500% from 1997 | $135 (Apr 1999) | $0 (Sep 2001) | Bankrupt in Sep 2001. Assets sold off. No longer exists as an independent entity. |

| WorldCom | +1,000% from 1996 | $64 (Jun 1999) | $0 (Jul 2002) | Bankrupt in Jul 2002 due to massive accounting fraud. Reorganized as MCI, later acquired by Verizon. |

Infrastructure Plays vs. Consumer Hype

While flashy consumer websites got most of the attention, some of the biggest long-term winners were in infrastructure – companies building the plumbing of the internet, like routers and cloud tools.

Final Thoughts: What AI Investors Can Learn From the Dot-Com Bubble Era

The dot-com bubble was a mix of genius innovation and total insanity. It gave us the modern internet, but also wiped out fortunes.

As we watch the AI boom unfold in 2025, it’s worth remembering that bubbles always burst, but the technology often survives.

So what can you do?

- Stay grounded

- Don’t chase hype

- Diversify your investments

- Look for real earnings, not just exciting narratives

Although history never exactly repeats, it rhymes. By studying the past, we can look for opportunities to profit in the future.