Weekly Digest – Edition 11

Nick Schmidt

Nick Schmidt is a co-founder of TraderLion and Deepvue with over 10 years of market experience. Adopting a “less is more” philosophy, he focuses on weekly charts with an emphasis on price and volume.

Published: September 21, 2025

7 min read

Weekly Subscriber Digest

A good quote from William O’Neil that explains why I keep the leader list the same from April lows:

“If the original market leaders begin to falter, and lower-priced, lower-quality, more-speculative stocks begin to move up, watch out! … Laggards can’t lead the market higher.”

The key word here is original. New leaders emerge as the market moves and rotates and the original leaders are allowed to rest. But within the same cycle they shouldn’t crack.

“If the original market leaders begin to falter, and lower-priced, lower-quality, more-speculative stocks begin to move up, watch out! … Laggards can’t lead the market higher.”

The key word here is original. New leaders emerge as the market moves and rotates and the original leaders are allowed to rest. But within the same cycle they shouldn’t crack.

Key Trading Insights

Price Contraction Signals

When price action contracts with higher lows, it indicates controlled accumulation – a bullish signal worth monitoring closely.

“$RIVN price is contracting… higher lows… exactly like $TSLA. The tightening of price action like this is a sign of controlled accumulation and always something to pay attention to.”

“$RIVN price is contracting… higher lows… exactly like $TSLA. The tightening of price action like this is a sign of controlled accumulation and always something to pay attention to.”

Shakeouts vs. Retests Are Both Valid

“Both a retest / shakeout and recover of a level is good… one isn’t better than the other. If a level gets shaken out and recovered its still displaying structure.”

SNOW and LMND examples showed both clean retests and shakeout-recoveries can work equally well as valid entry patterns.

SNOW and LMND examples showed both clean retests and shakeout-recoveries can work equally well as valid entry patterns.

Big Bases = Bigger Conviction

“My conviction behind trades is mostly correlated with the length of the base. Bigger bases means that the move out of it can be much larger and more sustainable.”

Focus on multi-month or multi-year bases over short-term flags for better risk/reward.

Focus on multi-month or multi-year bases over short-term flags for better risk/reward.

AI Trade Continues to Lead

“The momentum since the open is lead by semis, software, quantum, genomics… Money is continuing to pump into groups that are around AI infrastructure and benefit from AI innovation.”

Potential Change in Environment

“If we close the week strong we are being led by liquid leaders for the first time in months that are done consolidating.”

First signs that breakouts may start working again vs. just weakness trades.

First signs that breakouts may start working again vs. just weakness trades.

April Leaders List as North Star

“The market won’t top with that list holding up… I treat it as my north star.”

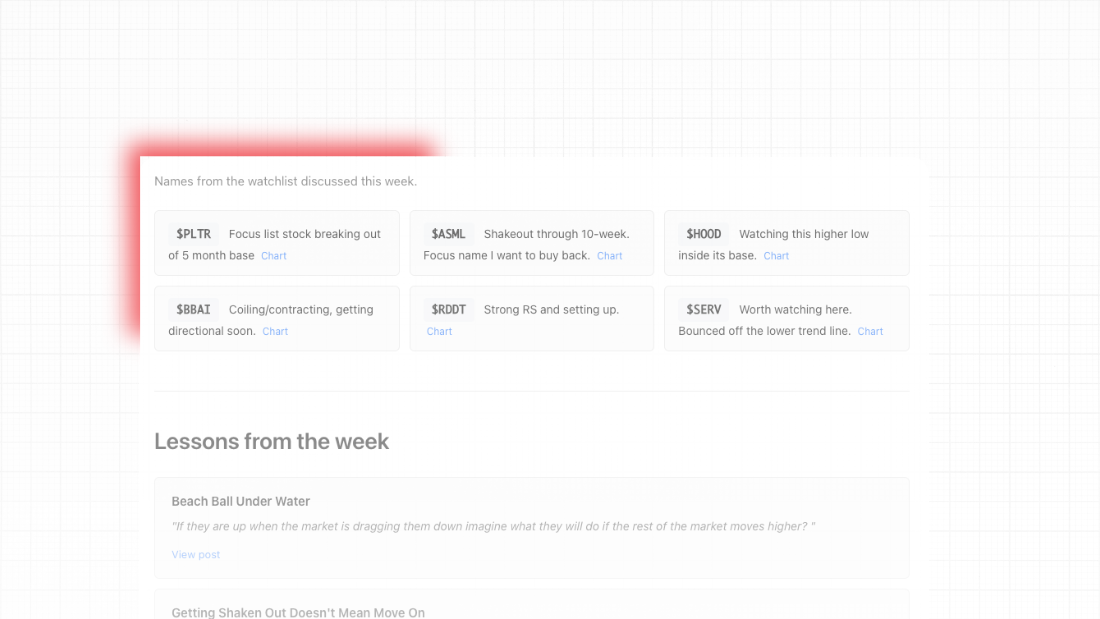

Key names: PLTR, DAVE, CRWD, DASH, META, SPOT, HOOD, NVDA, TSLA, MSTR, NFLX, UBER, RKLB.

Key names: PLTR, DAVE, CRWD, DASH, META, SPOT, HOOD, NVDA, TSLA, MSTR, NFLX, UBER, RKLB.

Trade Activity

5 trades this week • 2 exits, 3 new entries

| Ticker | Trade Notes |

|---|---|

| HOOD | Sold Exited position to be quicker shuffling positions when heavy on margin. Ended up selling low of day and the breakout worked by end of week. |

| SNOW | Bought Stopped Stopped out quickly on new position. |

| RKLB | Bought Thursday: Started position on weakness with tight stops since volume was light. I know the only way to get involved is on weakness. In a strong theme “Space” that I believe has a ton of potential is the market continues. |

| BULL |

Bought

Friday: Speculative trade anticipating potential higher low.

Video on why I bought → |

Current Holdings

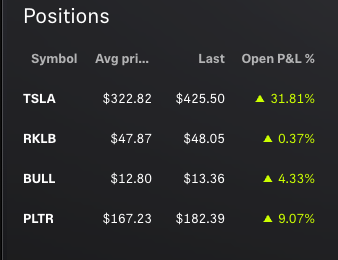

4 positions • 136% exposure

| Ticker | Status & Notes |

|---|---|

| TSLA | 94% of portfolio – Primary Focus. Successfully defended $410 monthly pivot multiple times. Strong close to the week. Currently holding monthly breakout level. |

| PLTR | 8% of portfolio – Small position maintained through the week. Part of the April leaders list showing potential fresh breakout characteristics. |

| RKLB | 20% of portfolio – Volatile name that’s been tough to hold in the base. I bought it again just because it gave an opportunity on weakness this week, along the 10-week, and the last few weeks have all had higher lows which makes me think it might be coming up the right side and almost ready. |

| BULL | 14% of portfolio – Speculative trade taken Friday. Loved the chart in July, attempting entry anticipating higher low formation. |

← Swipe to see more →

Weekly Market Observations

| Day | Key Observations |

|---|---|

| Monday | TSLA showing strength with close above $410. Failed breakouts like ANET aren’t failure of setup but product of current environment. |

| Tuesday | Difficult navigation continues. “Make no mistake even though the market is going up continuously, it still difficult trying to get positioned properly.” |

| Wednesday | Most leaders moving lower since open ahead of Fed decision. Choppy/volatile action expected until Fed. referred seeing weakness going into Fed rather than rallying into it. “The only data point that matters today is the close.” |

| Thursday | Strong day across the board. Leaders moving higher since open pushing highs. AI momentum dominating with semis, software, quantum leading. The market continues to be led by AI infrastructure or groups benefiting from AI. “Strong day across the board. Let’s see how we close the week.” |

| Friday | Strong week close. First time in months being led by liquid leaders done consolidating. April leaders list intact – treating as north star. Subtle environment shift the past 2 days with breakouts following through and more trades working. |

← Swipe to see more →