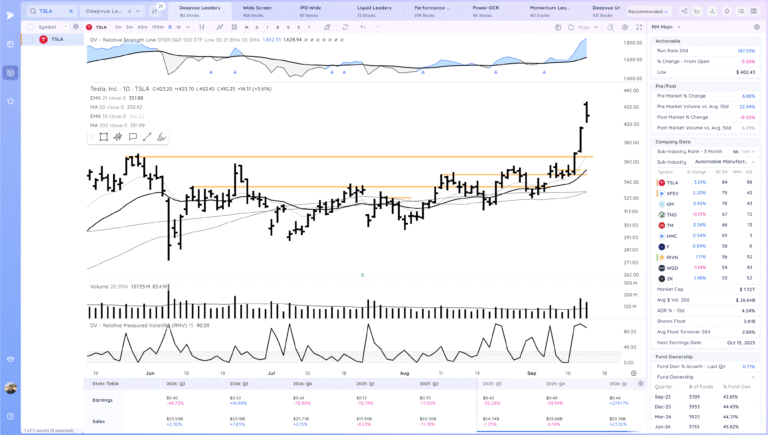

TSLA Gap Up on Elon Insider Buy. Continued Expansion

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 15, 2025

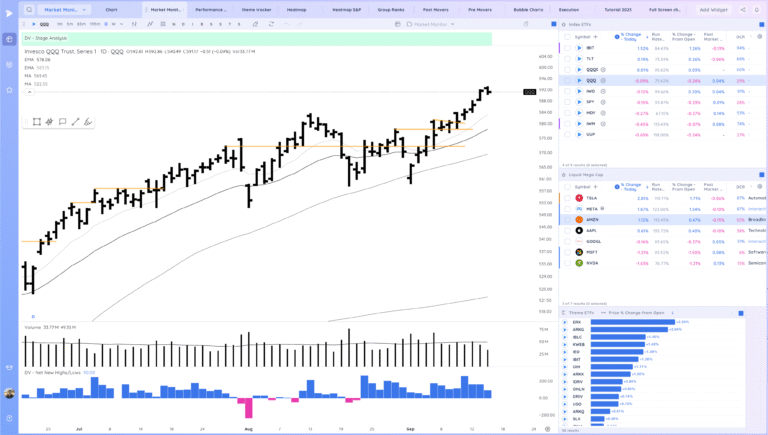

Market Action

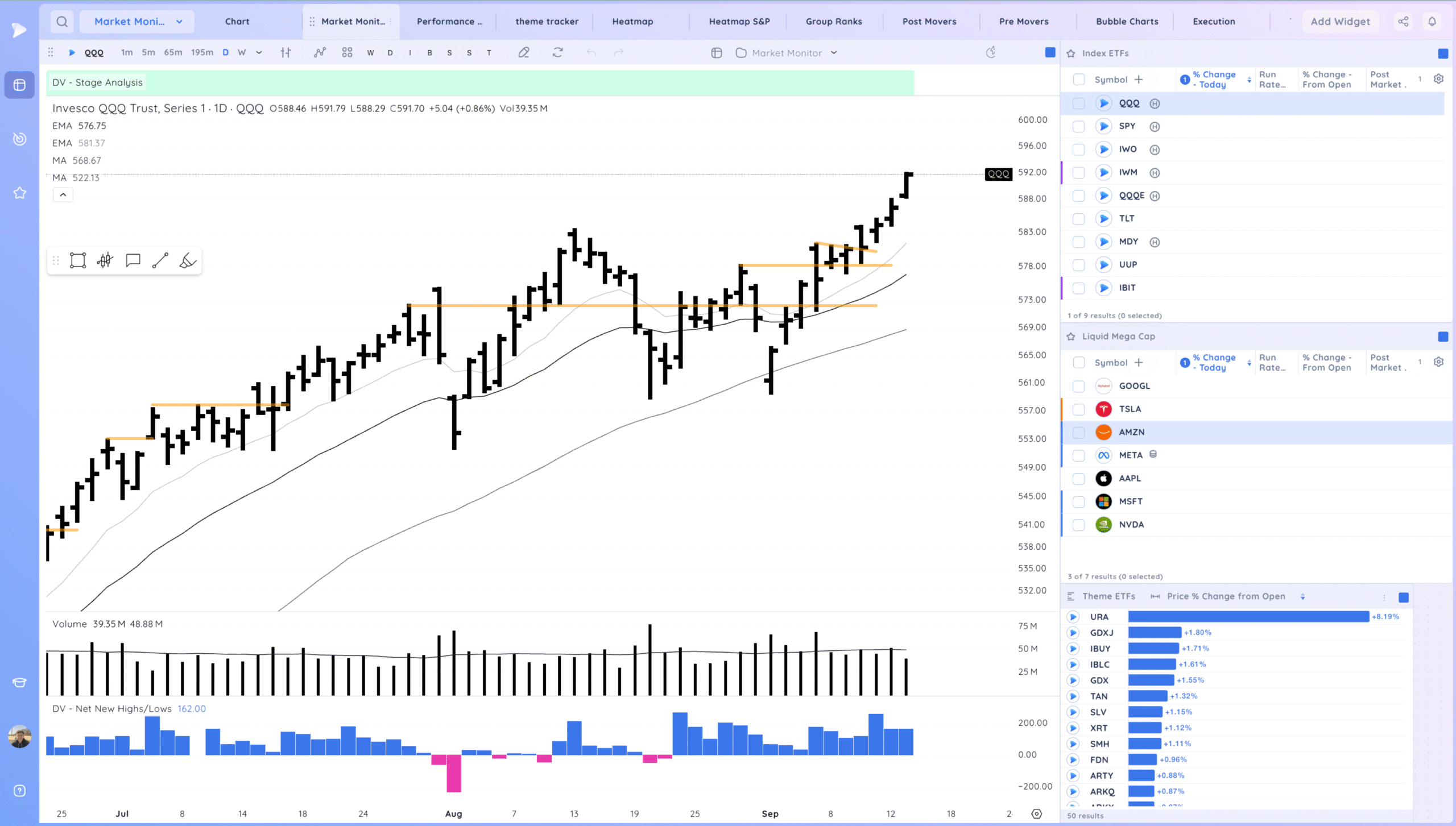

QQQ – Expansion higher and continued trend. Certainly getting a bit stretched in the short term but strong. Be ready for a stress test

Bulls want to see continued progress above the MAs

Bears want to see a sharp break lower with a negative close.

Daily Chart of the QQQ.

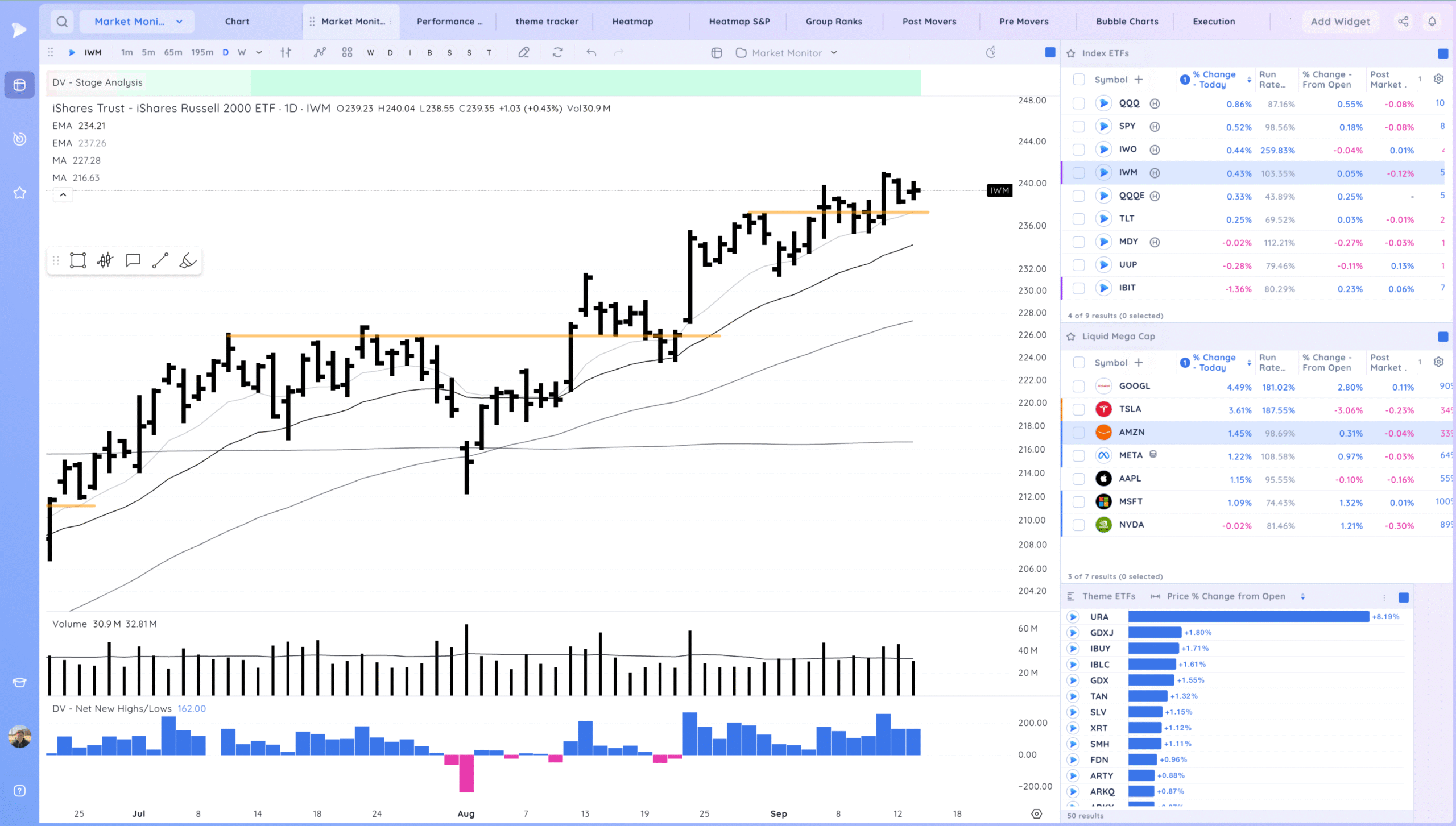

IWM – Building a range constructively

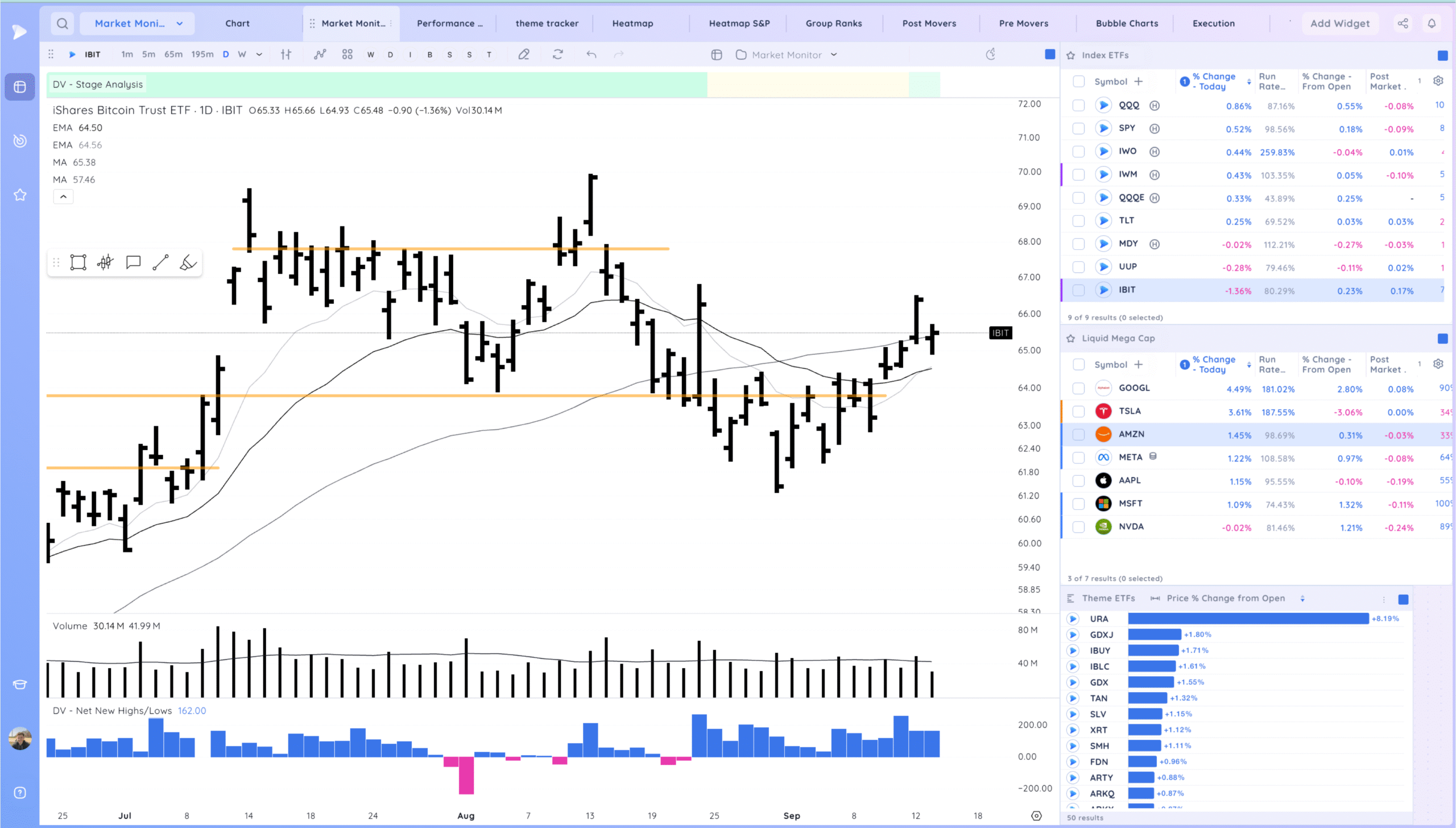

IBIT – Gap down and upside reversal. Watching for tightening action above the 21ema

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

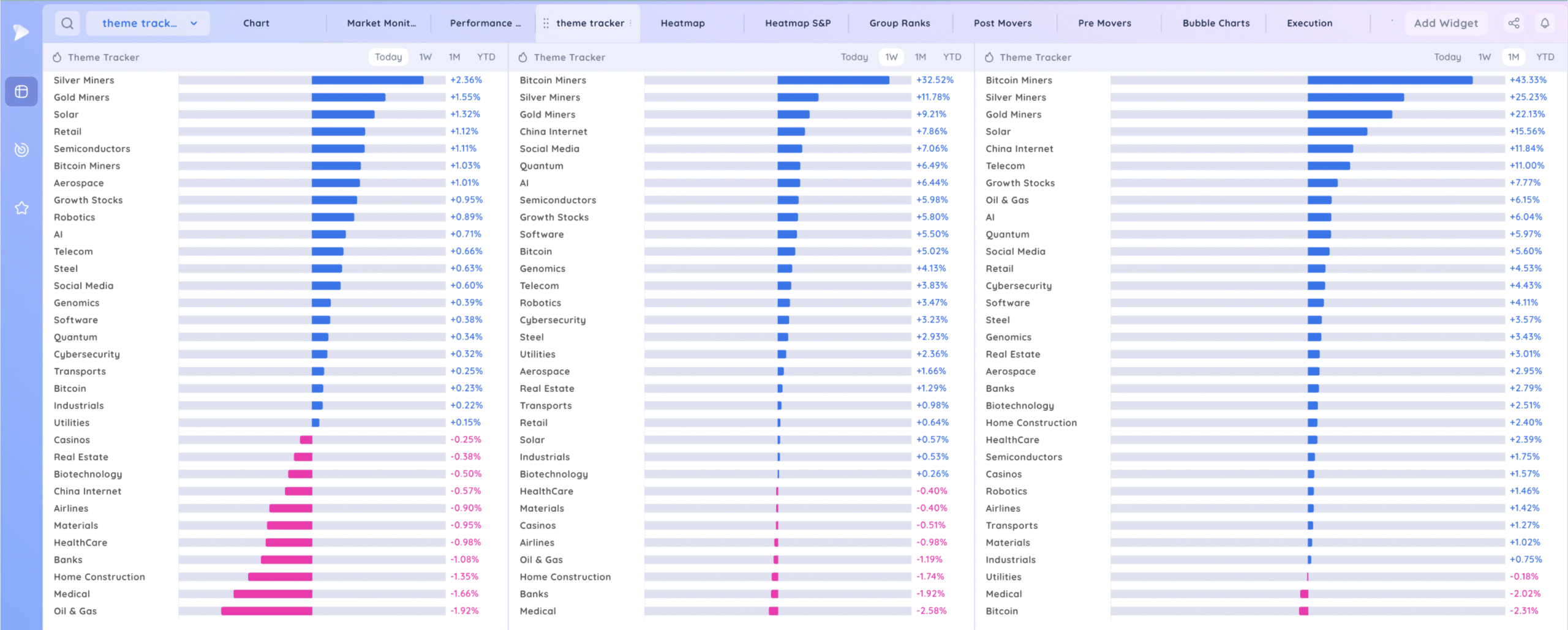

Deepvue Theme Tracker

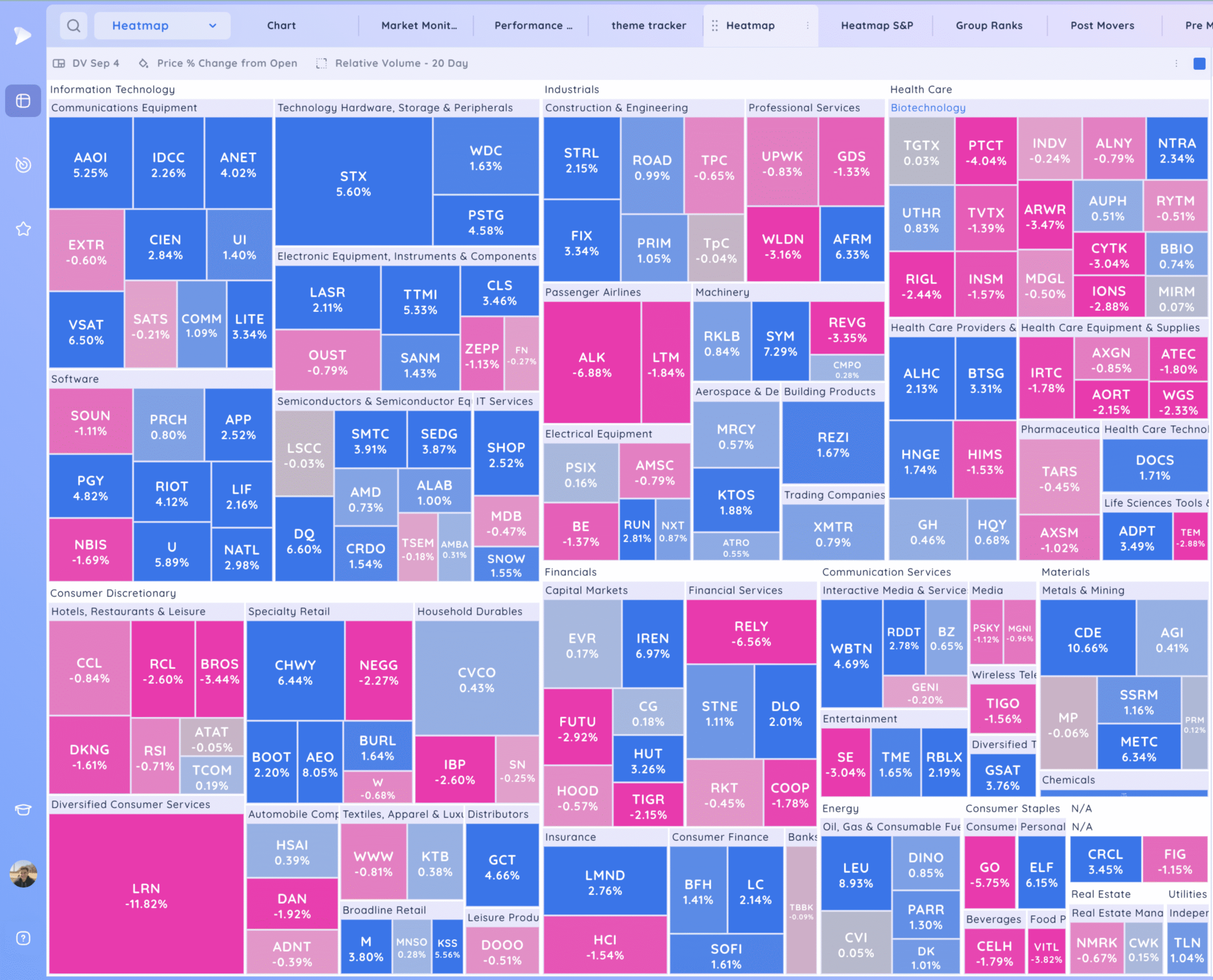

Deepvue Leaders

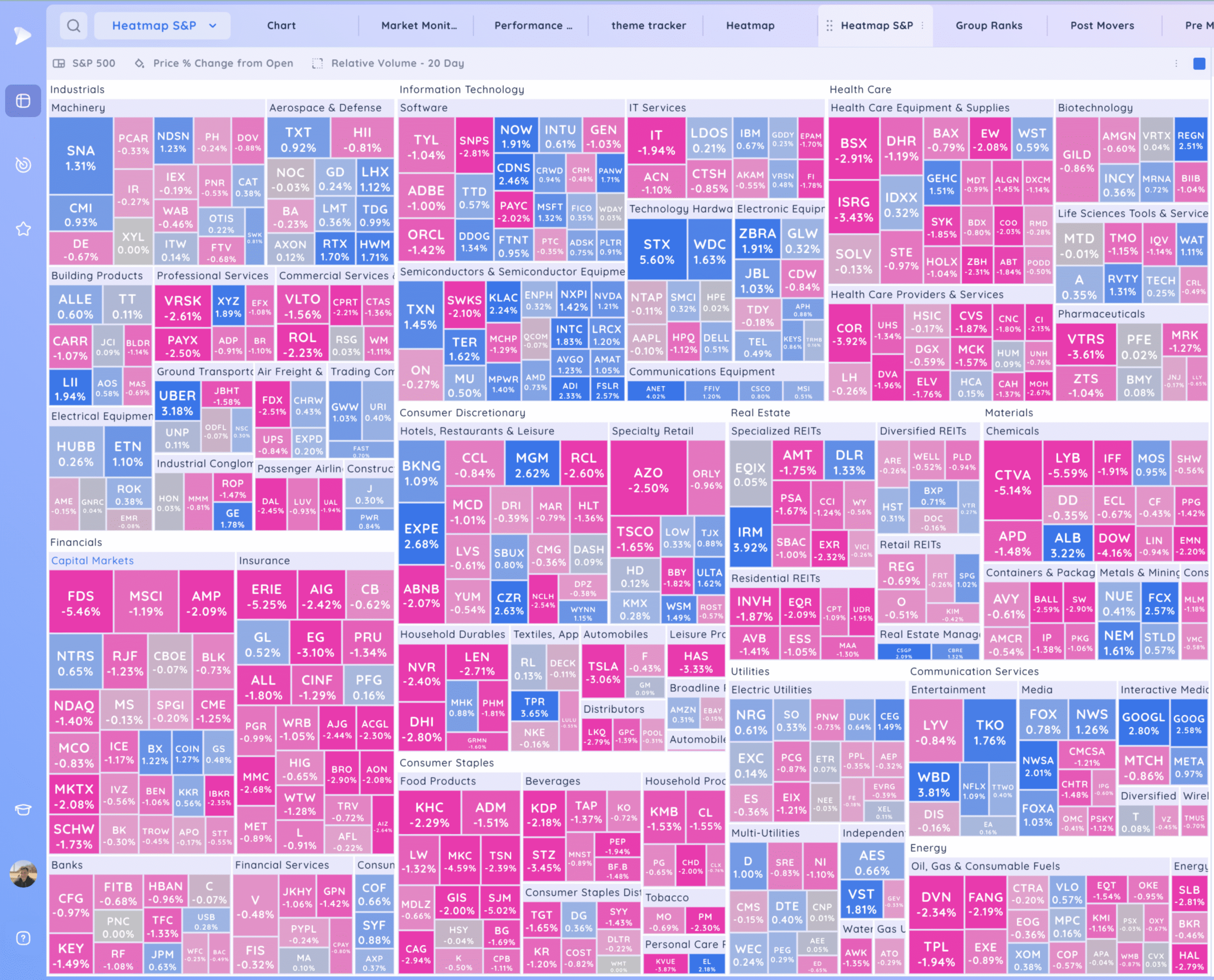

S&P 500.

Leadership Stocks & Analysis

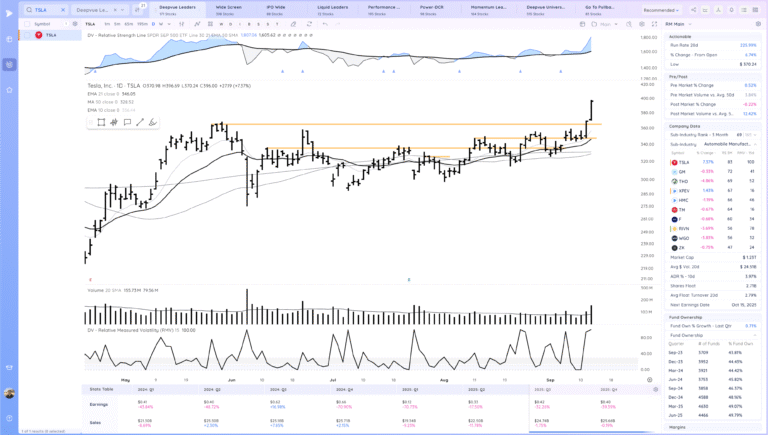

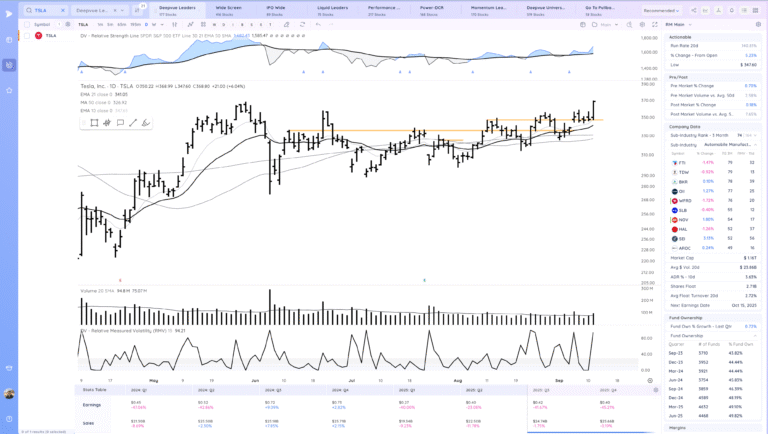

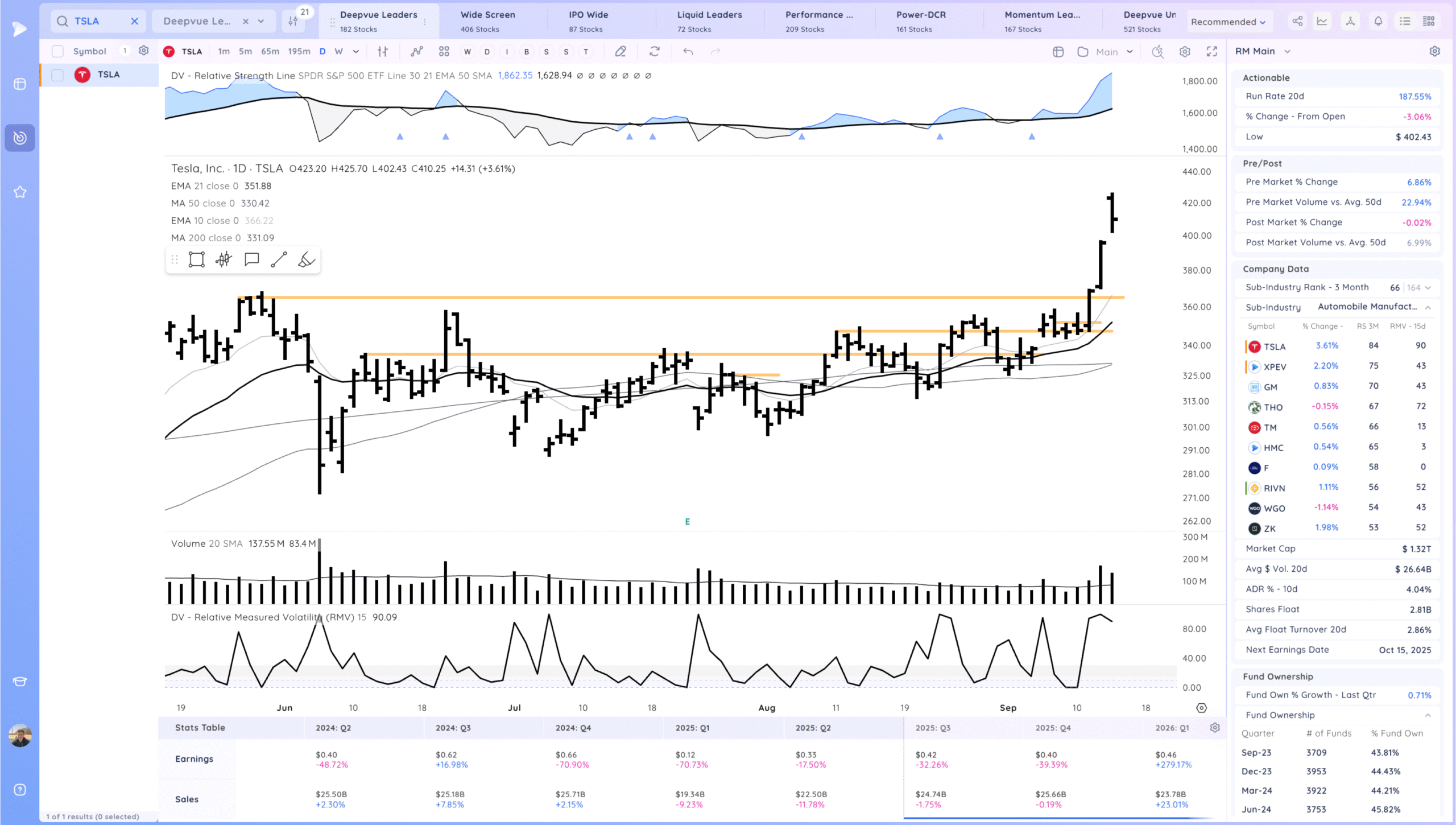

TSLA Gap up and sold a bit. Was and still is stretched short term. Watching for respect for the 10ema and stair step action. Elon insider buy caused FOMO.

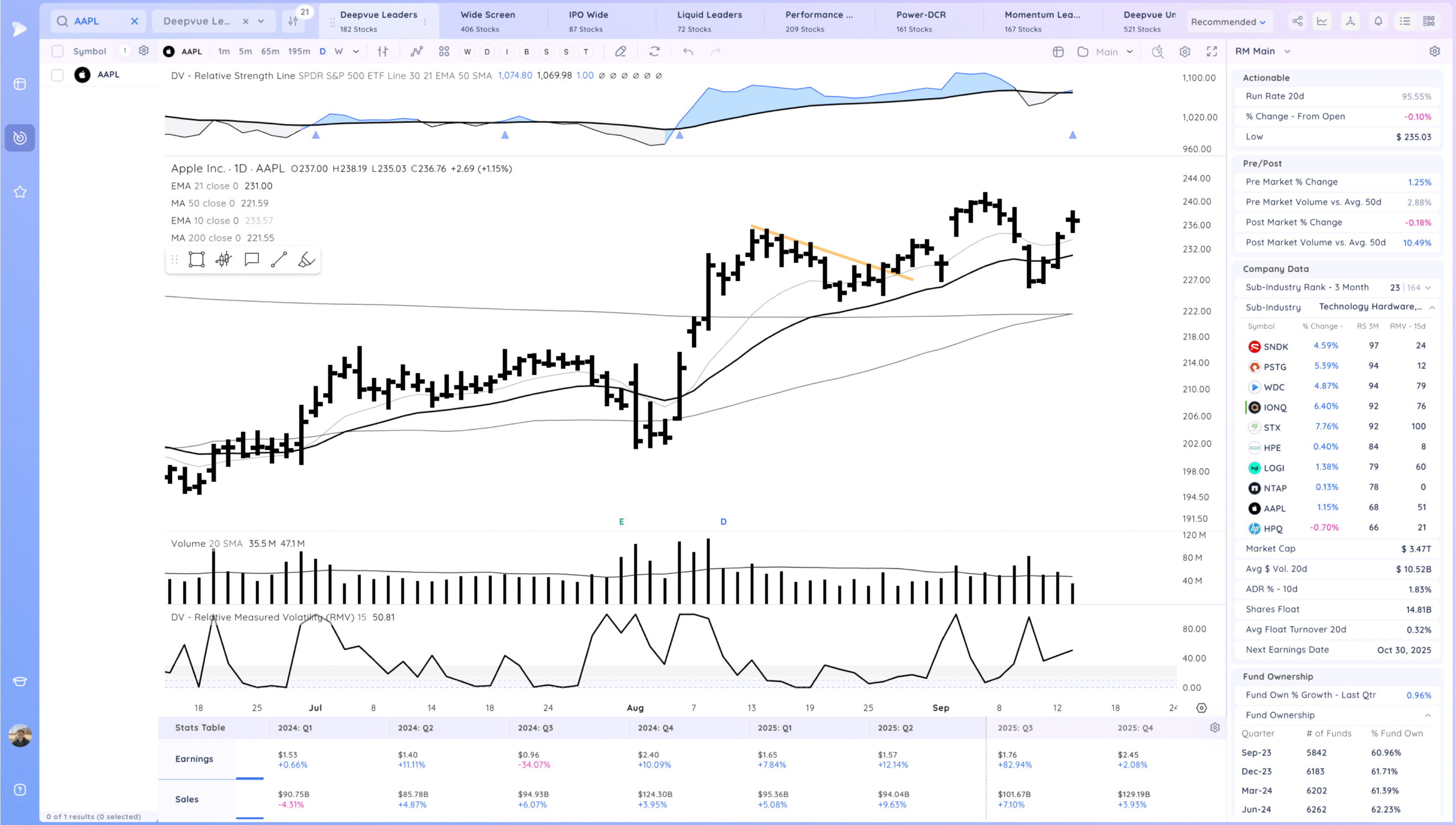

AAPL Gap up and tight day.

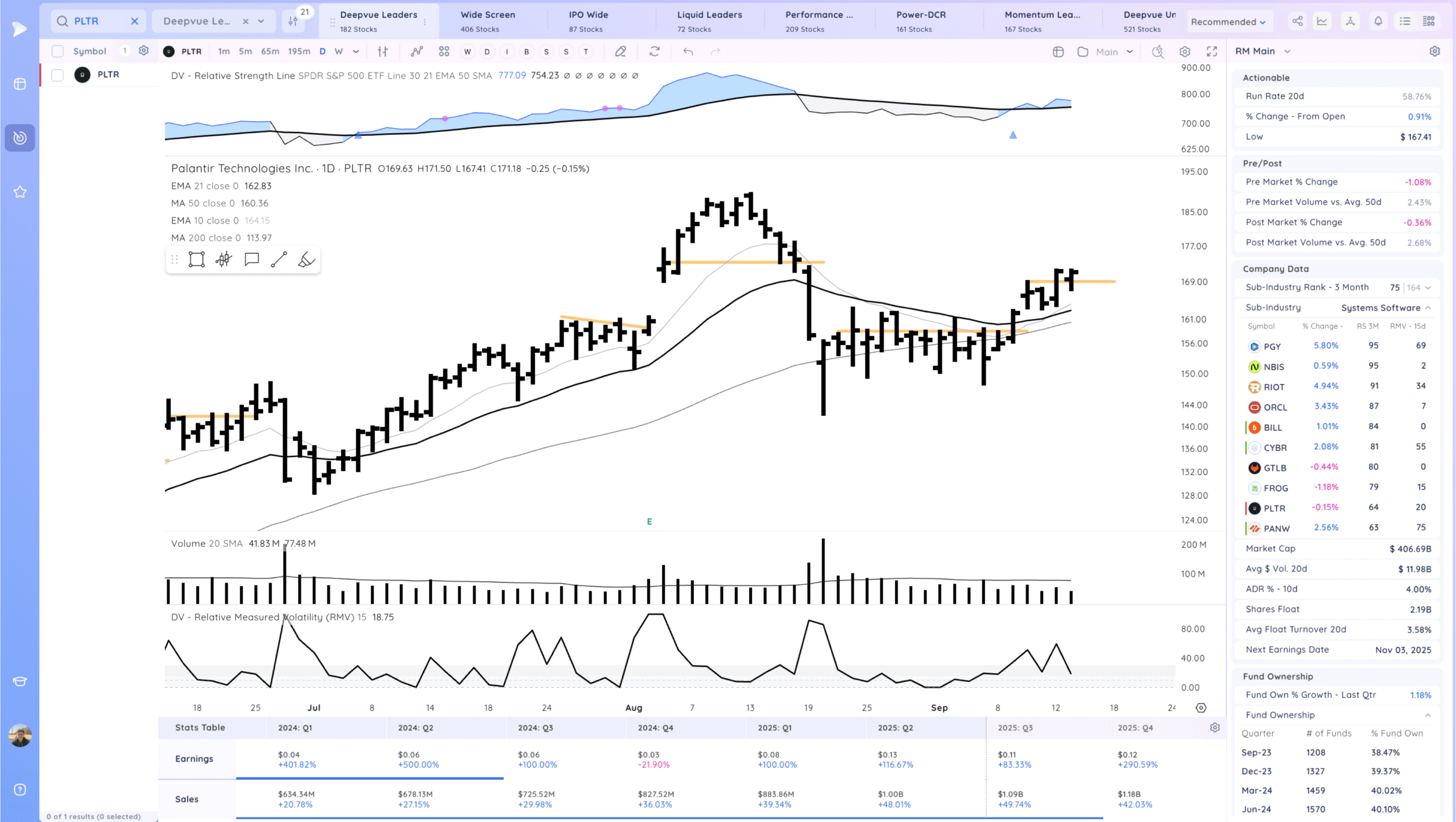

PLTR Tight inside day with a good close. Watching for continuation. I still feel like this base needs more time to develop

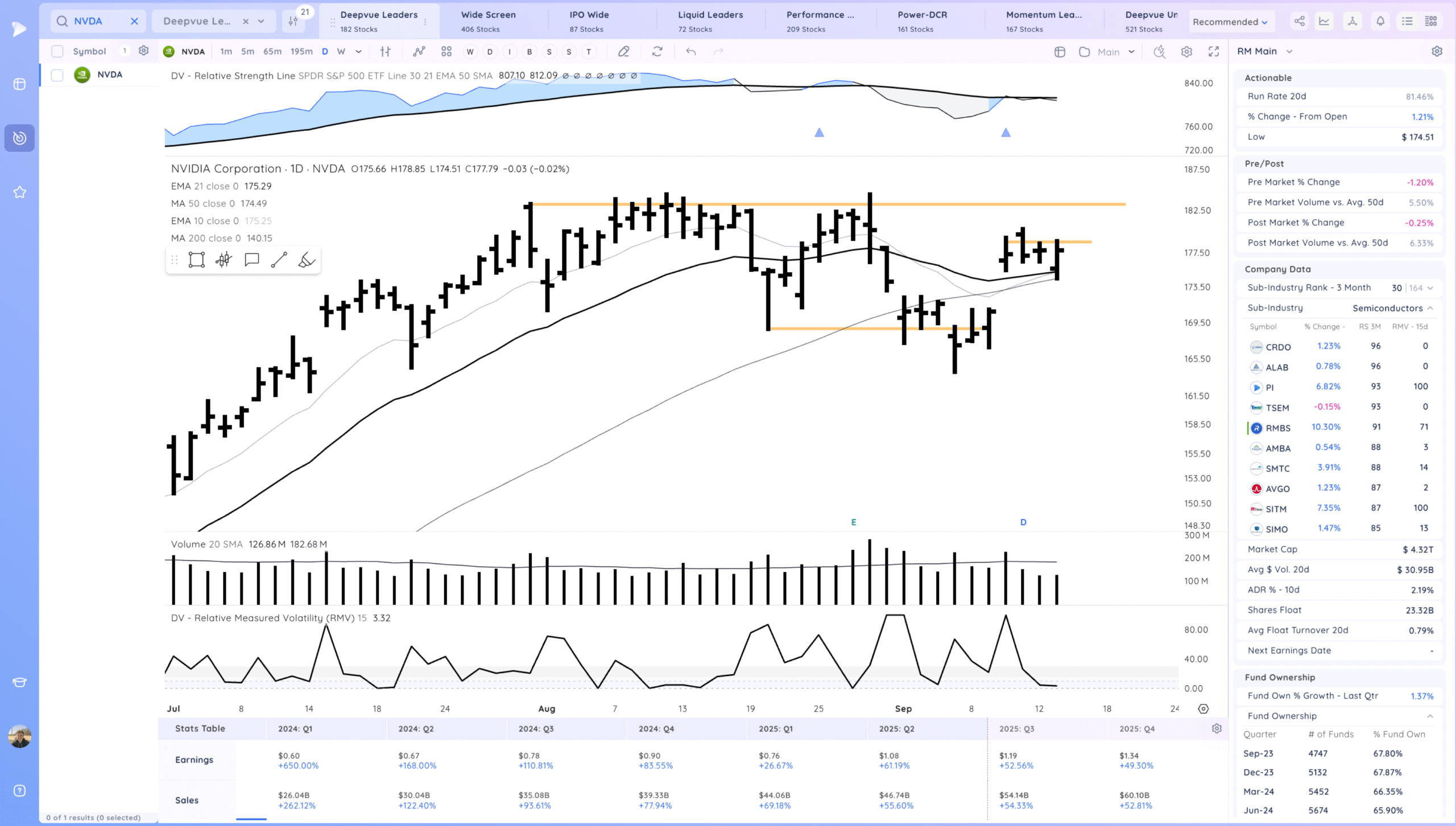

NVDA Strong upside reversal off the MA area. Primed for a range breakout attempt

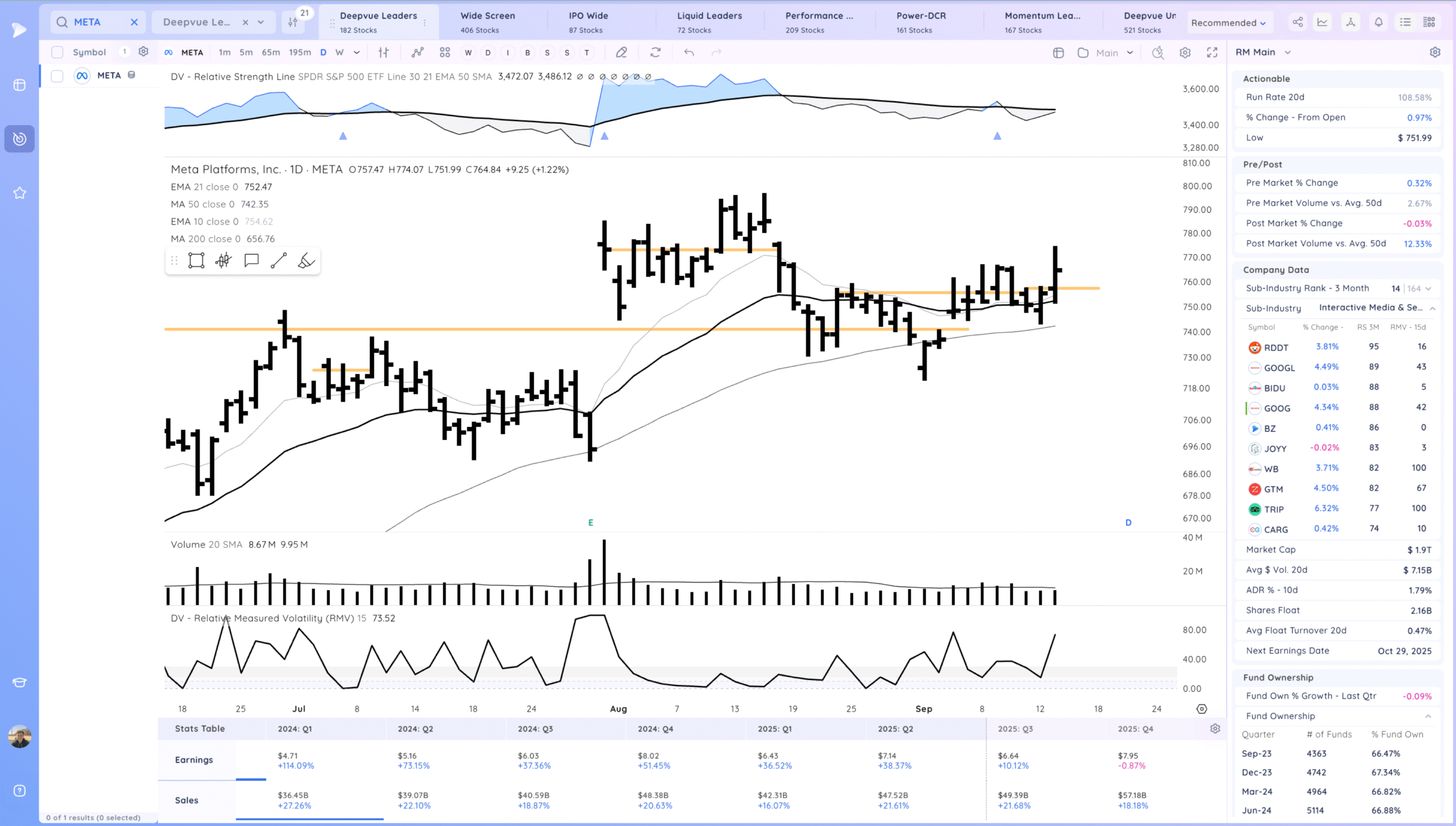

META follow through up. Some fade off highs

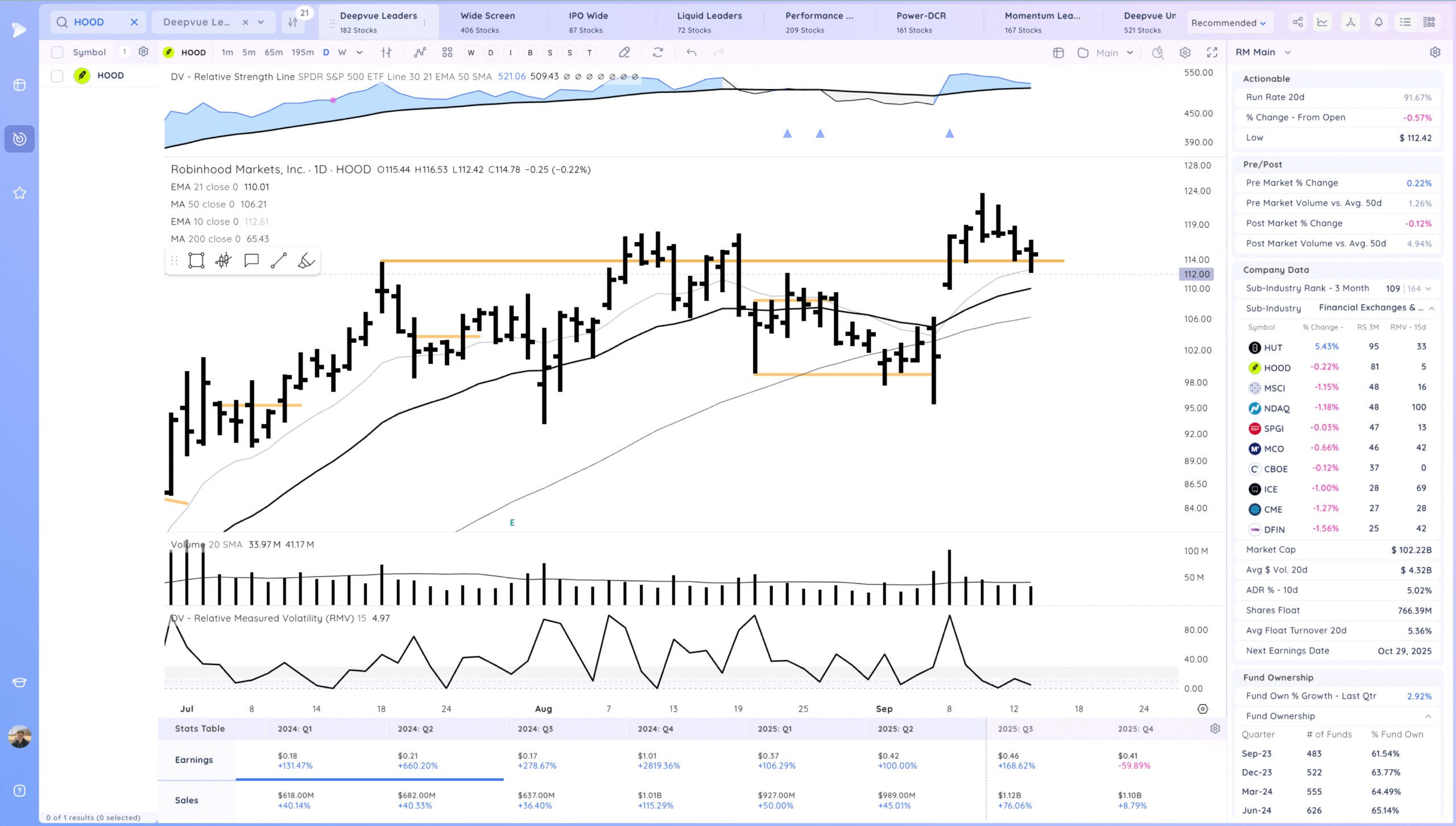

HOOD Upside reversal at the base pivot

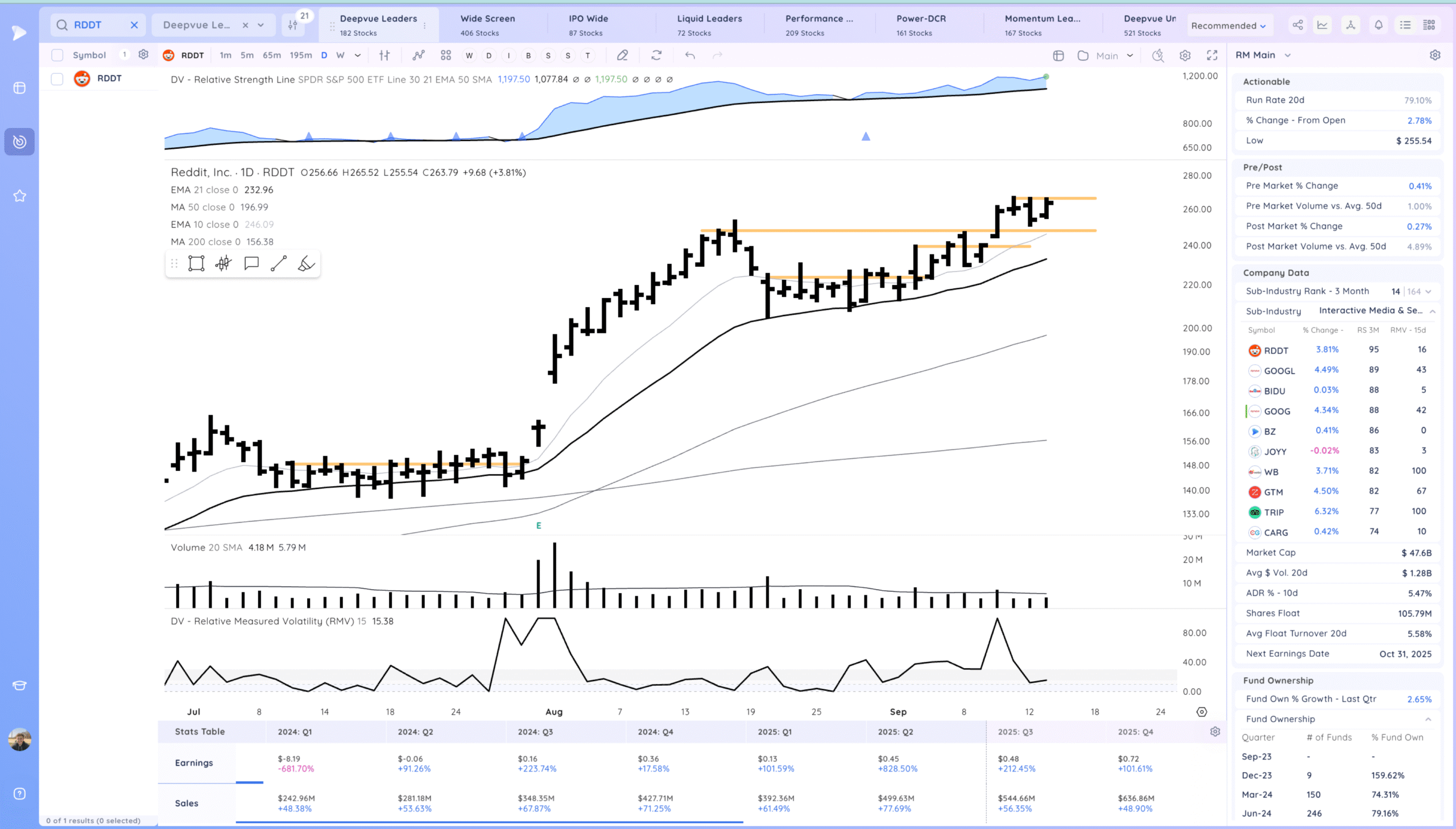

RDDT Inside day with good action. Watching for continuation

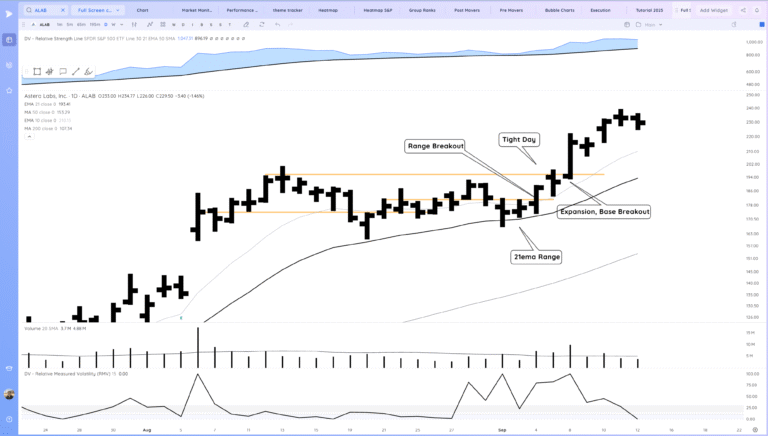

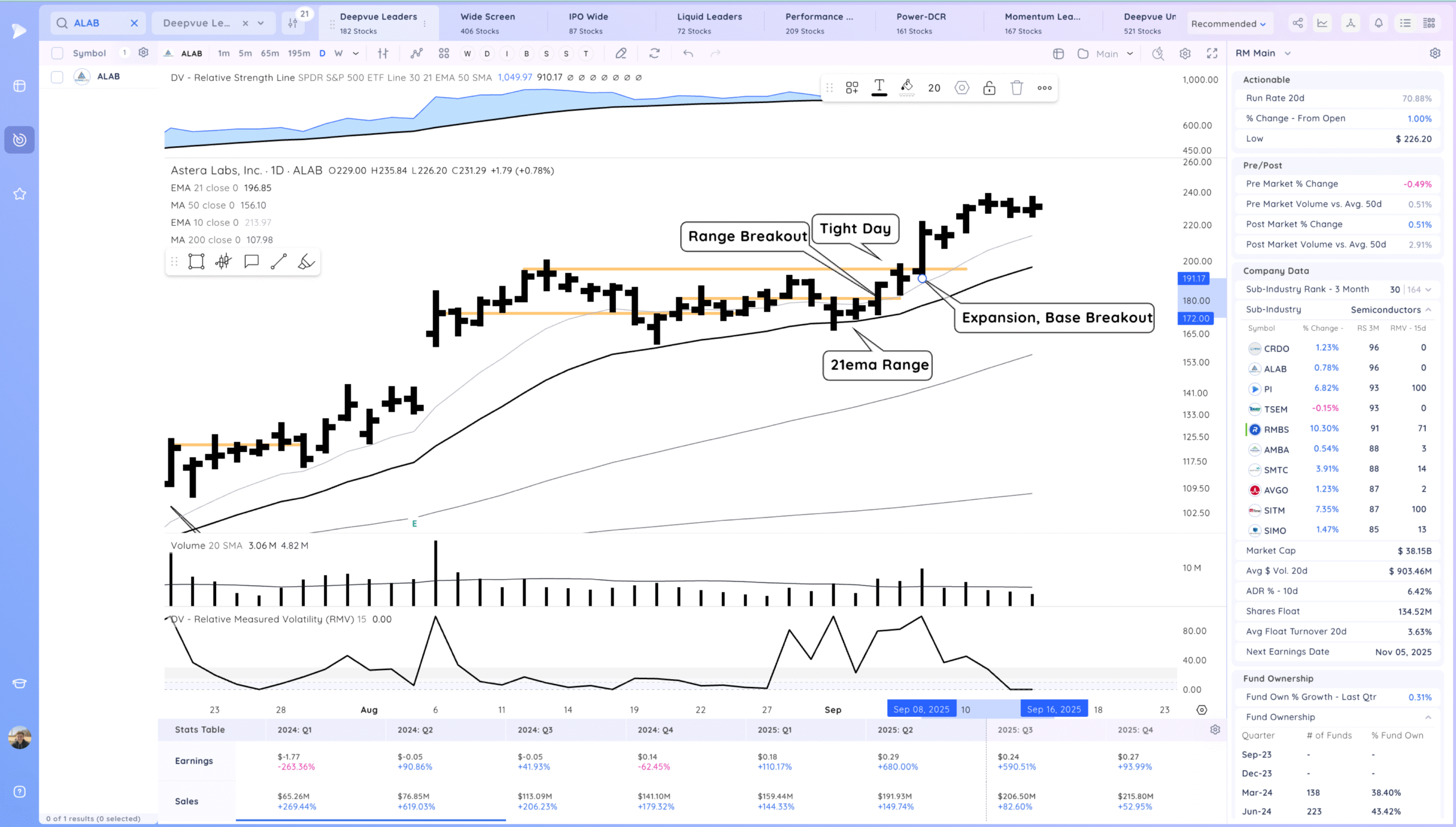

ALAB Constructive range building. Watching for continuation. Expecting it to respect the 10ema

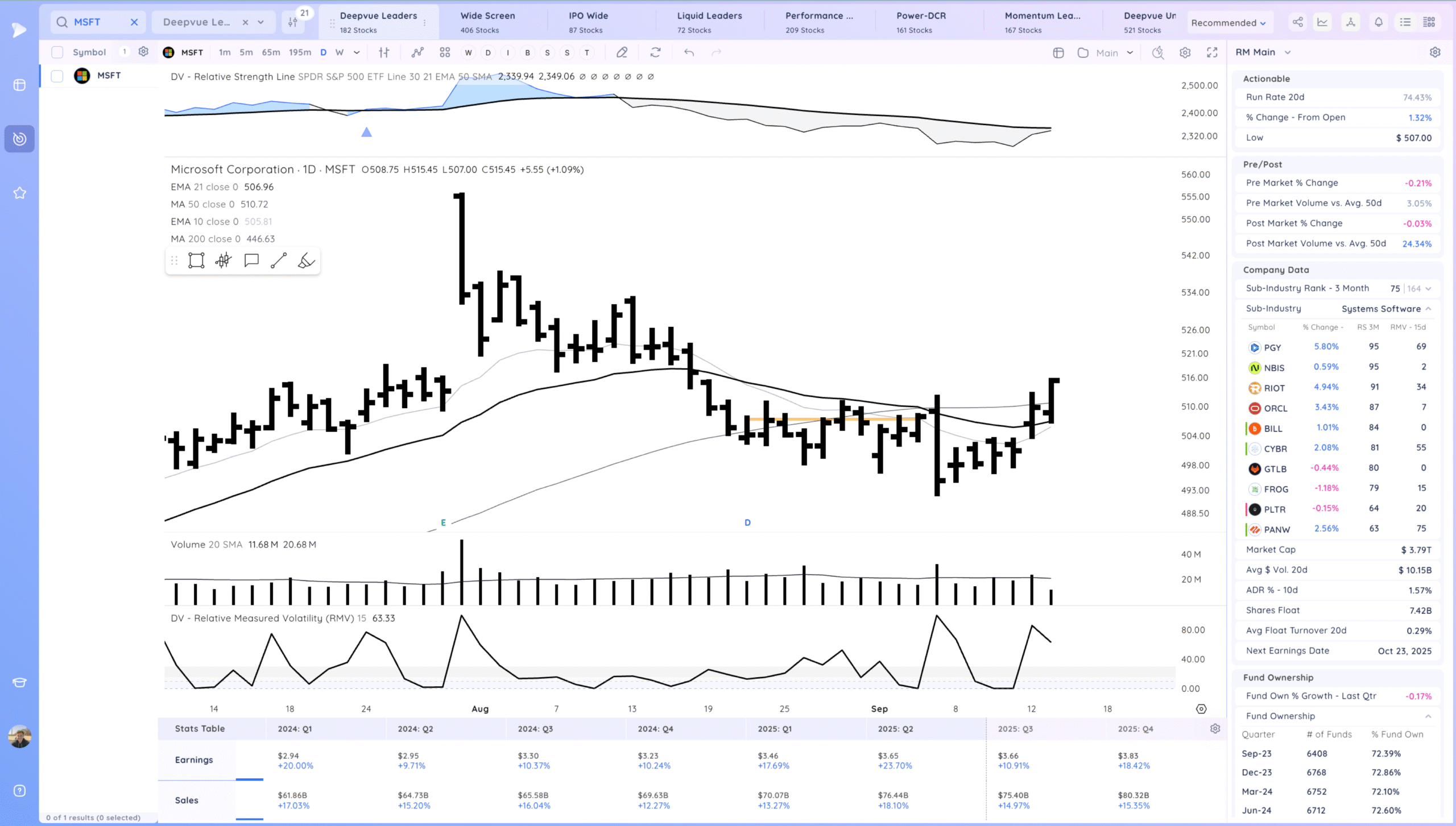

MSFT Good action pulling in and the pushing off the 21ema with a close at highs

Key Moves

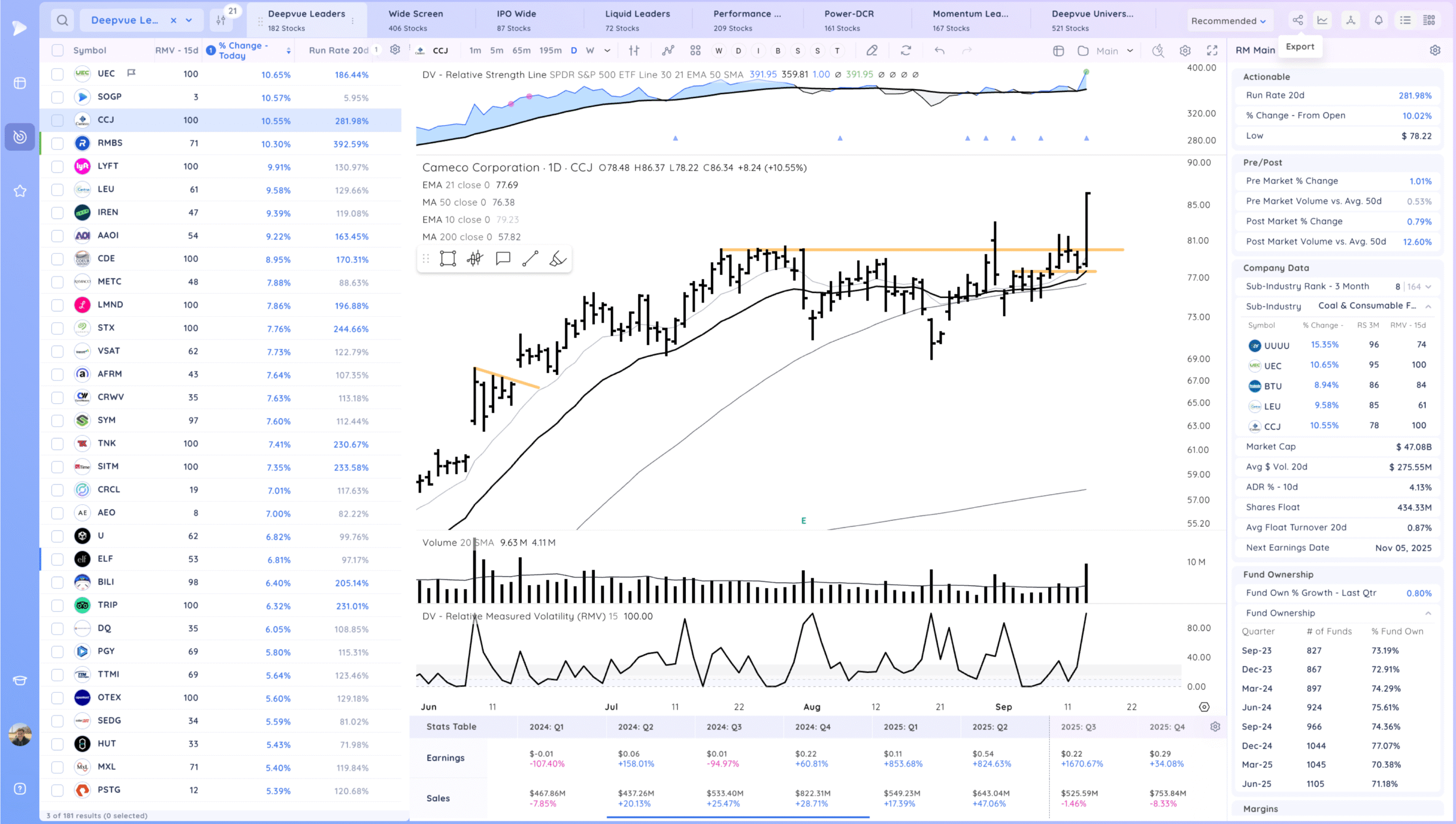

CCJ strong base breakout

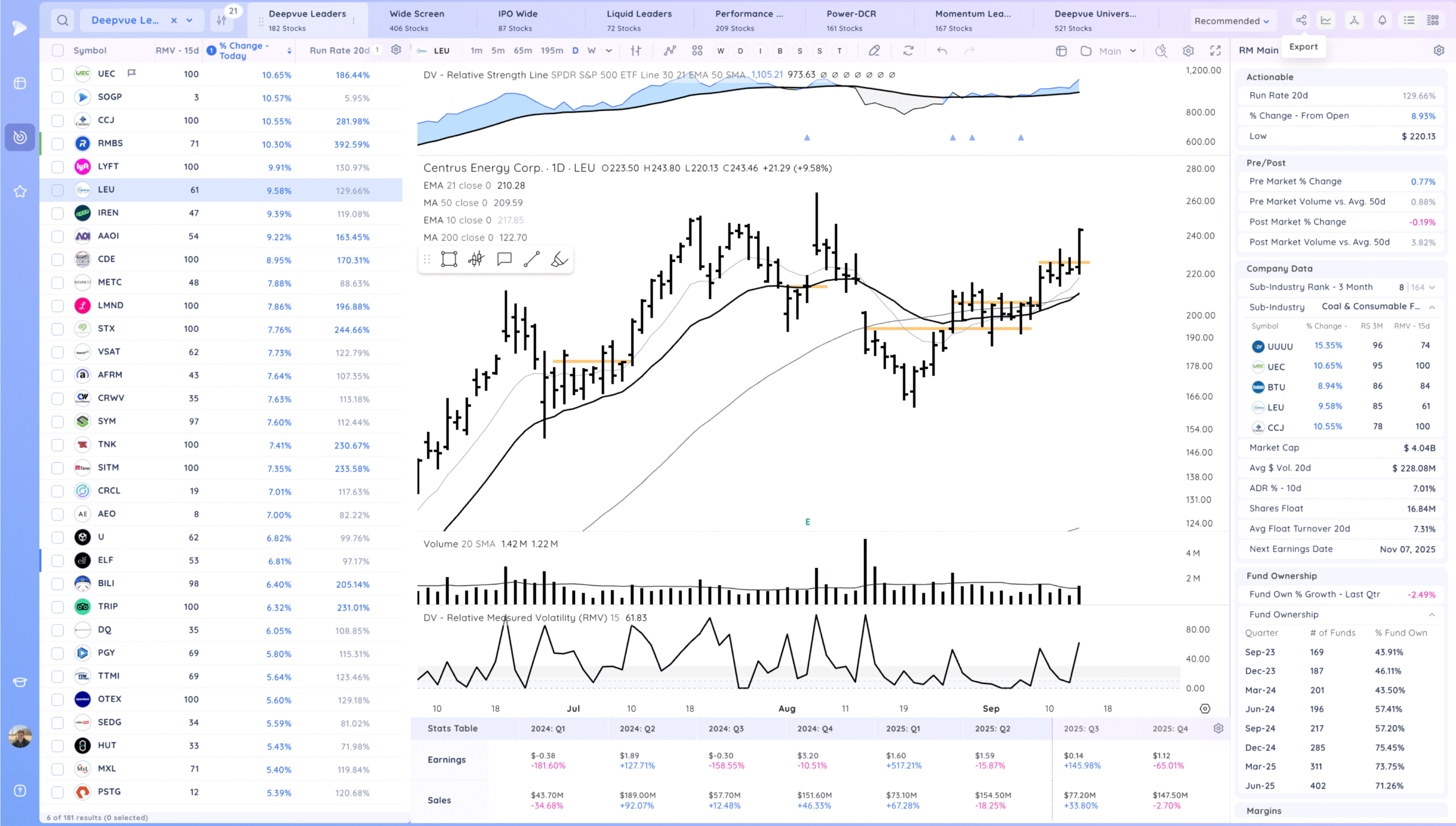

LEU strong re-confirmation

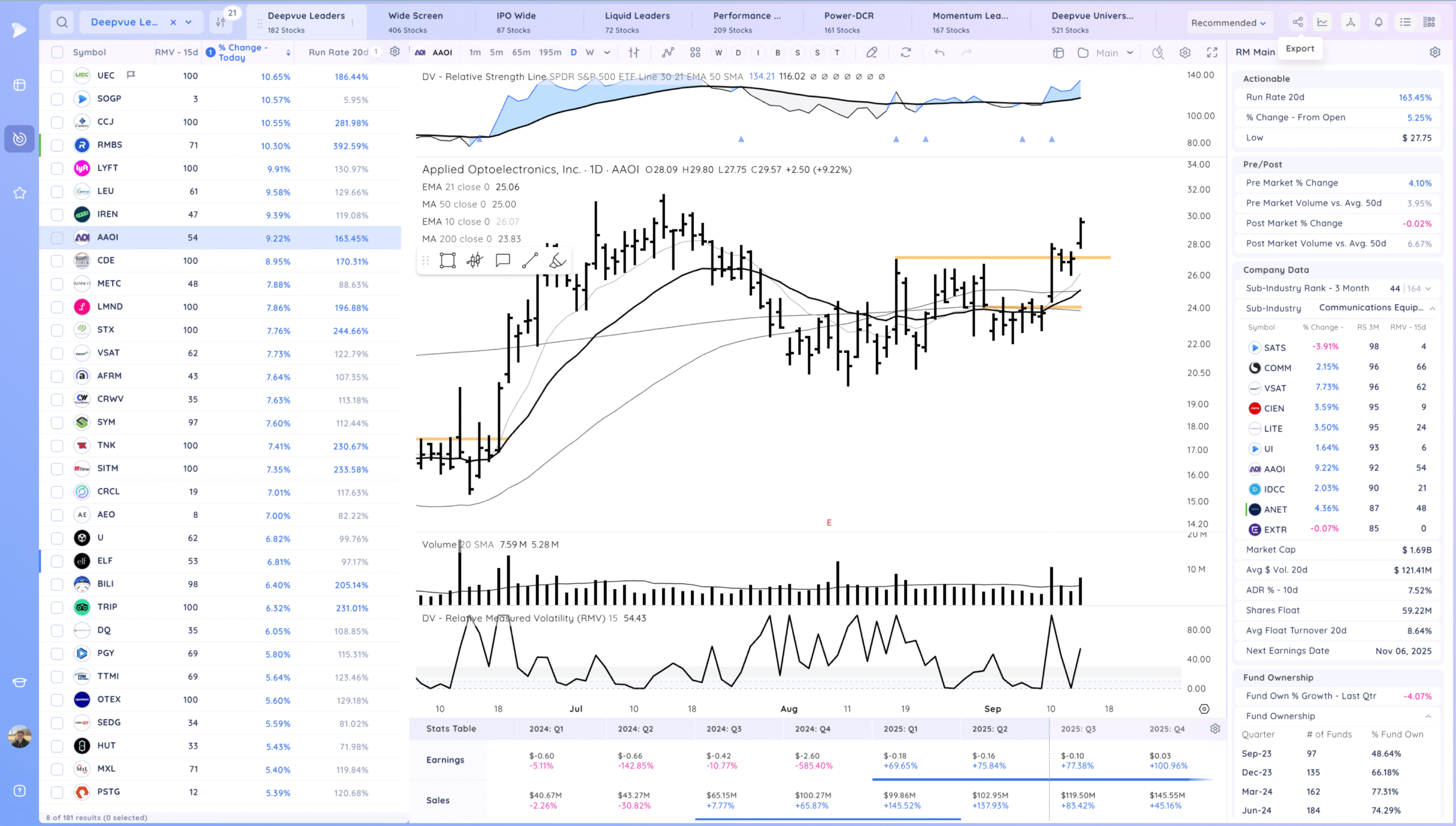

AAOI gap and go

Setups and Watchlist

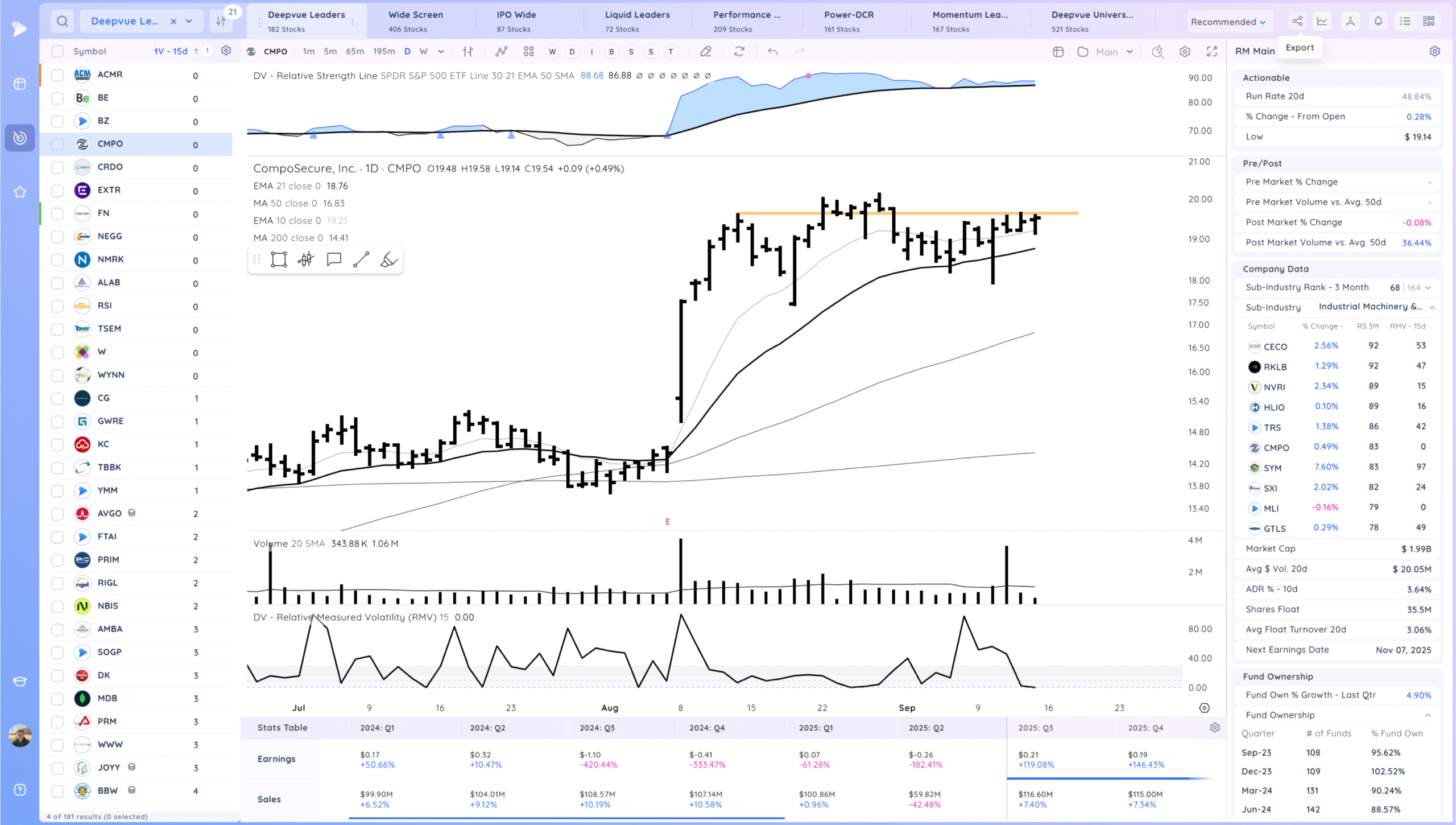

CMPO watching for a range breakout

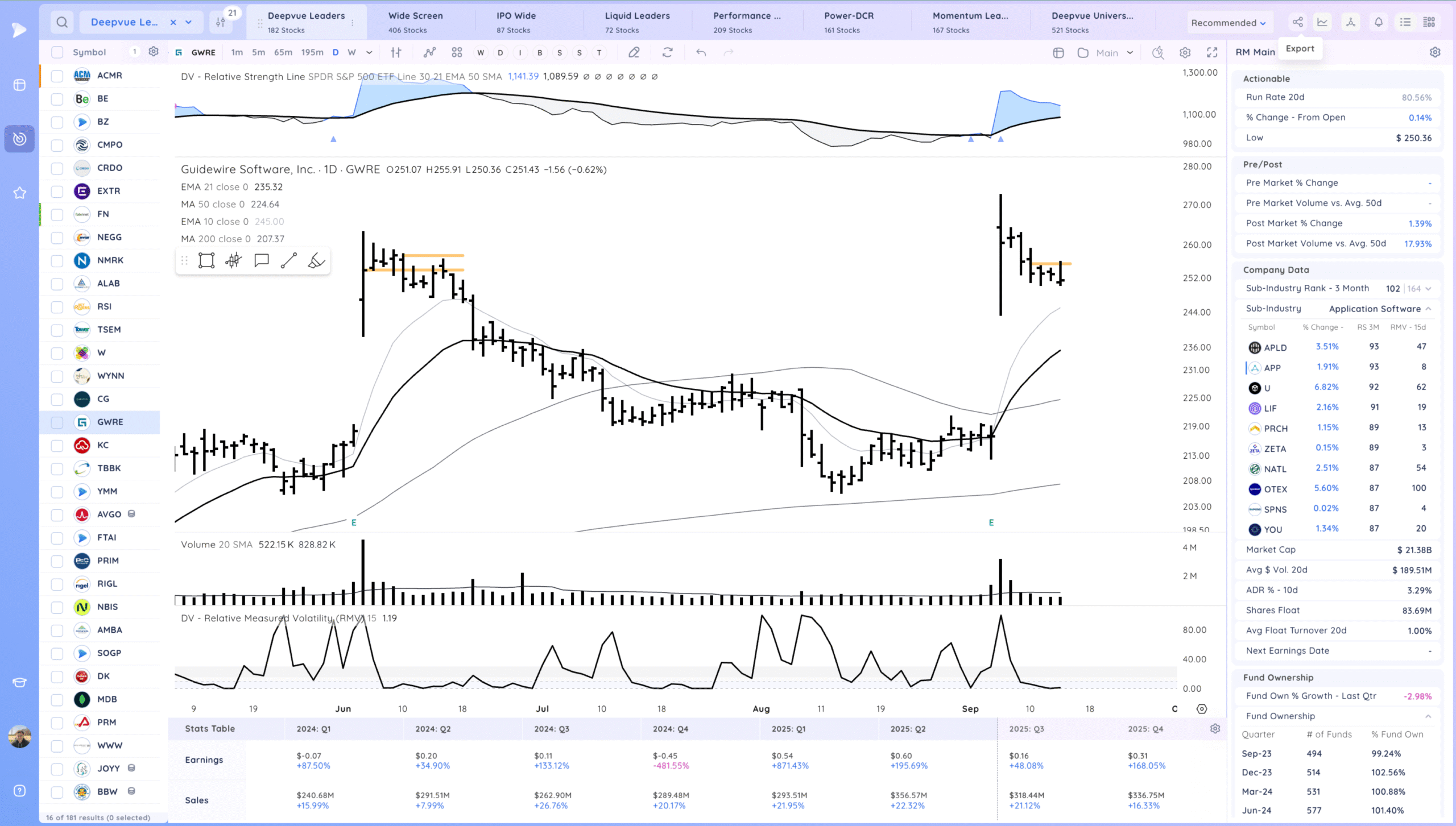

GWRE watching for a range re-breakout. Fade today

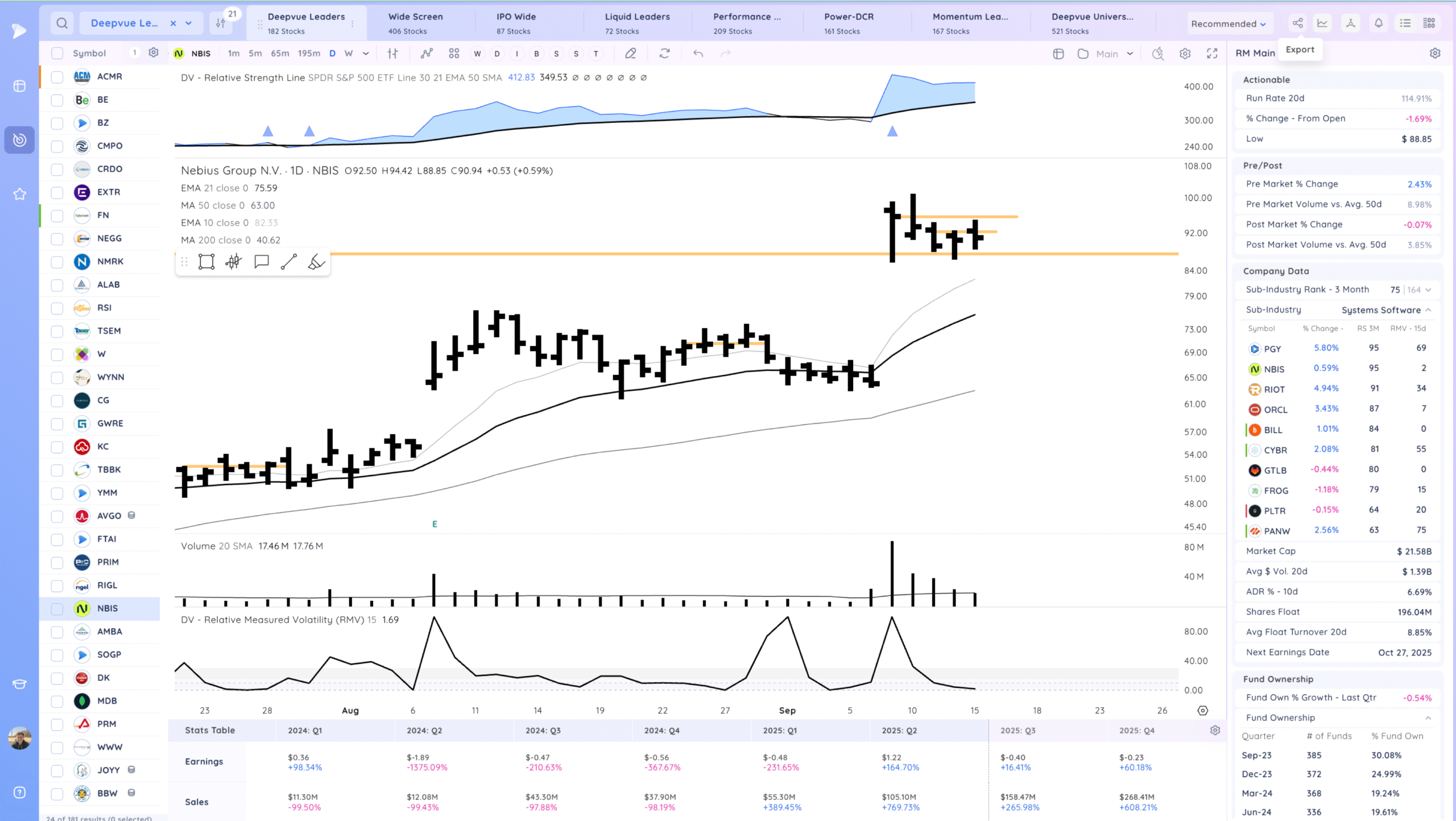

NBIS watching for range re-breakout through the upside reversal high.

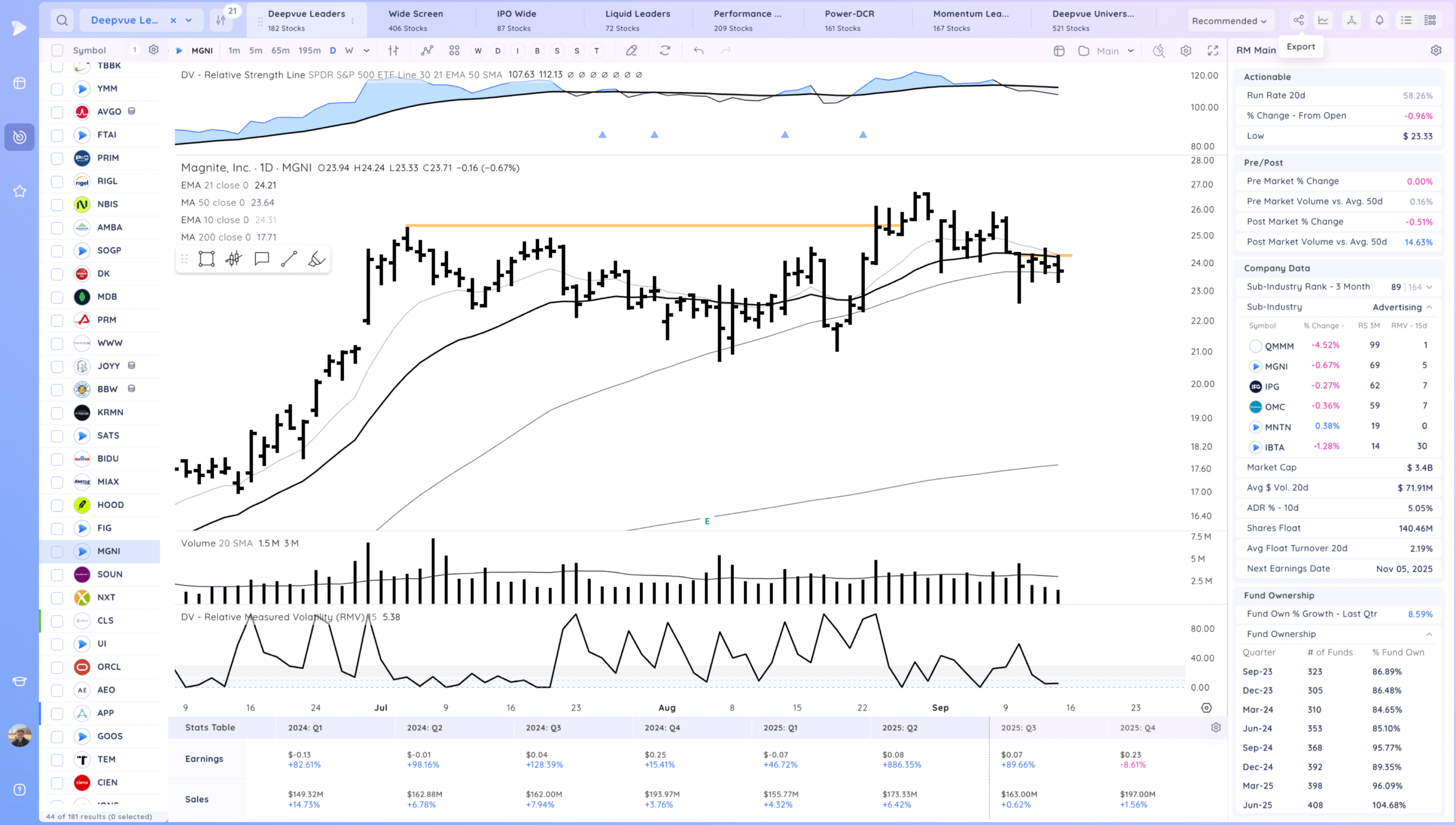

MGNI watching for a range breakout through the 21ema

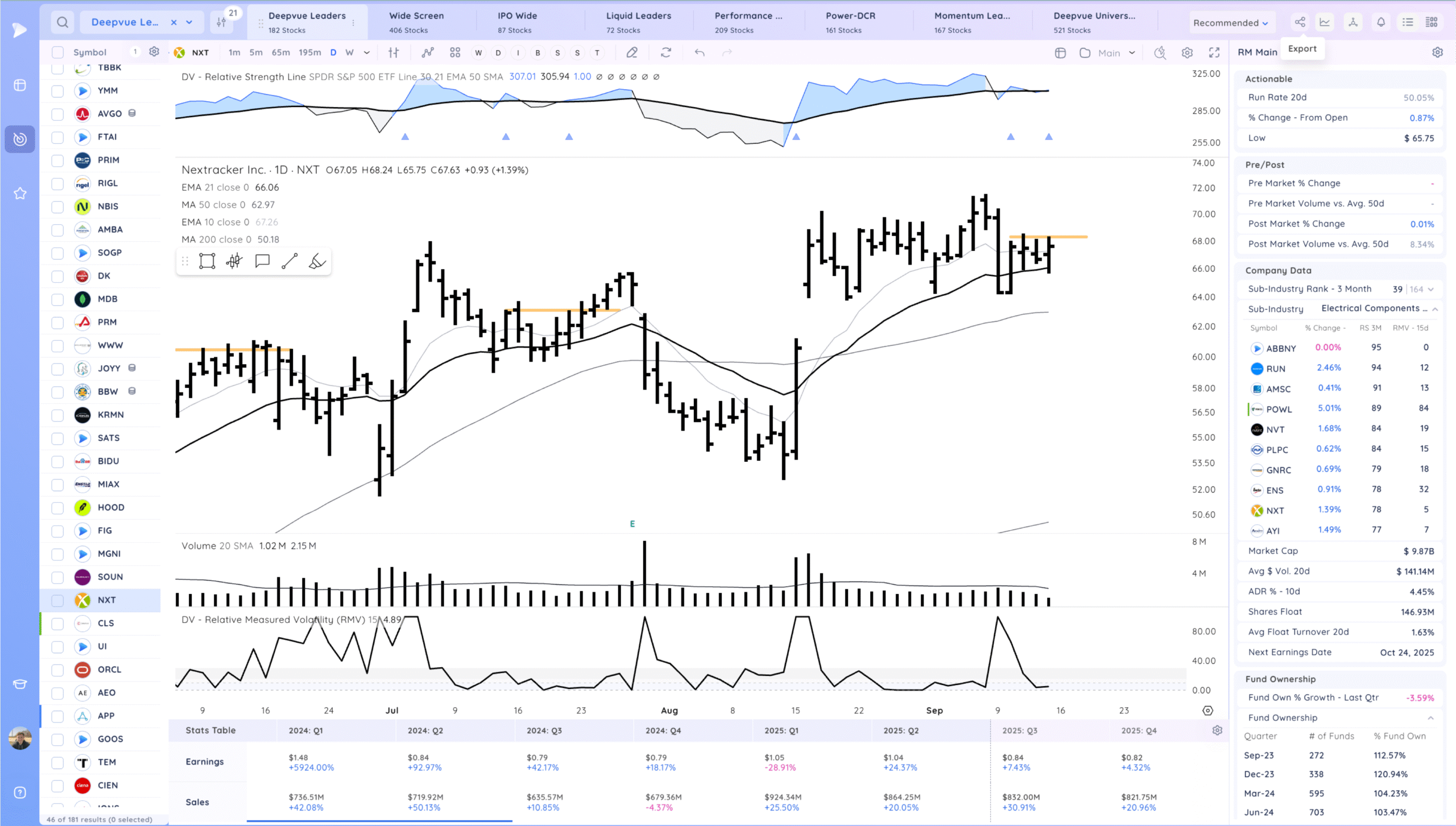

NXT watching for a range breakout

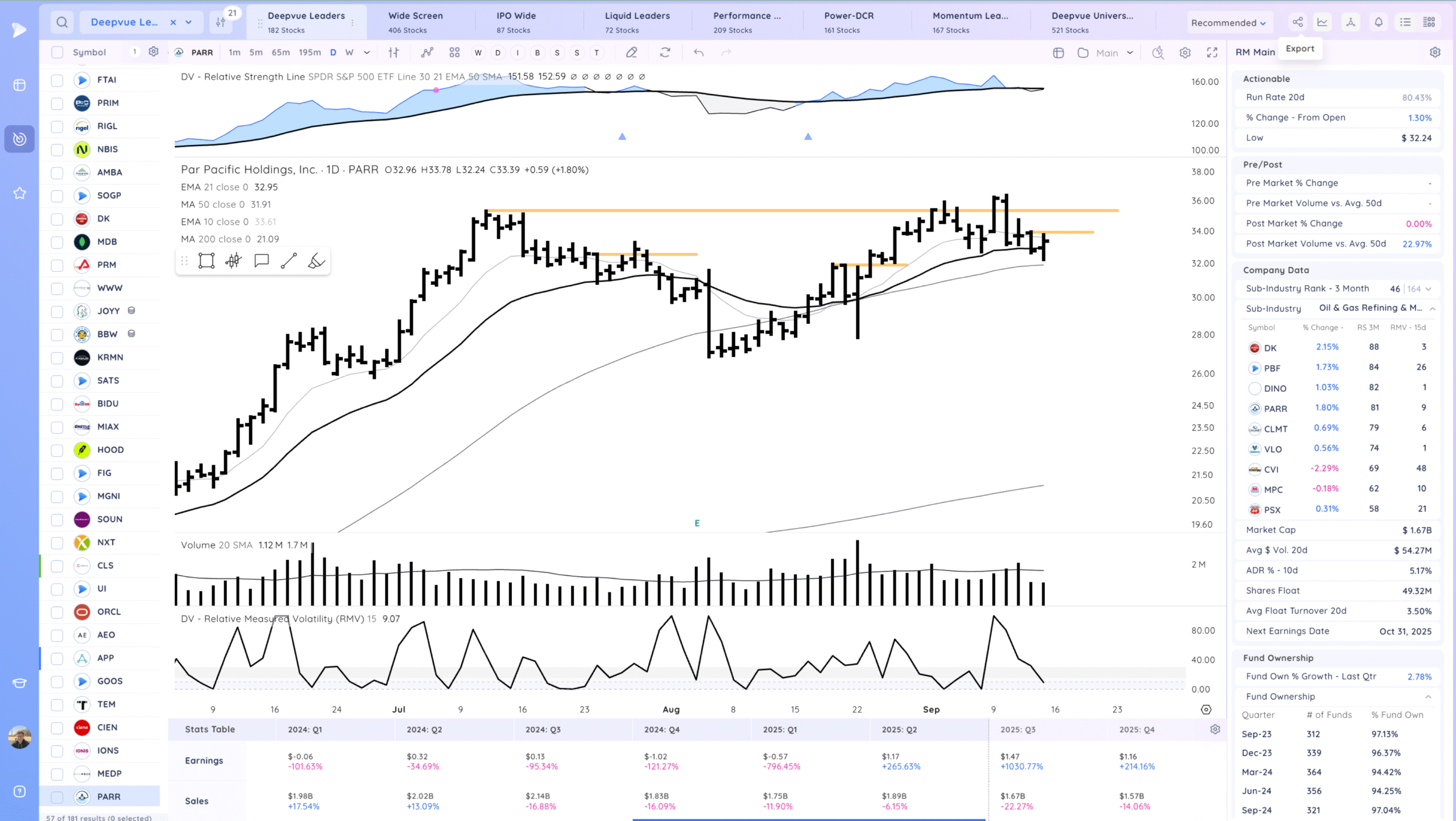

PARR watching for a range breakout/follow through up

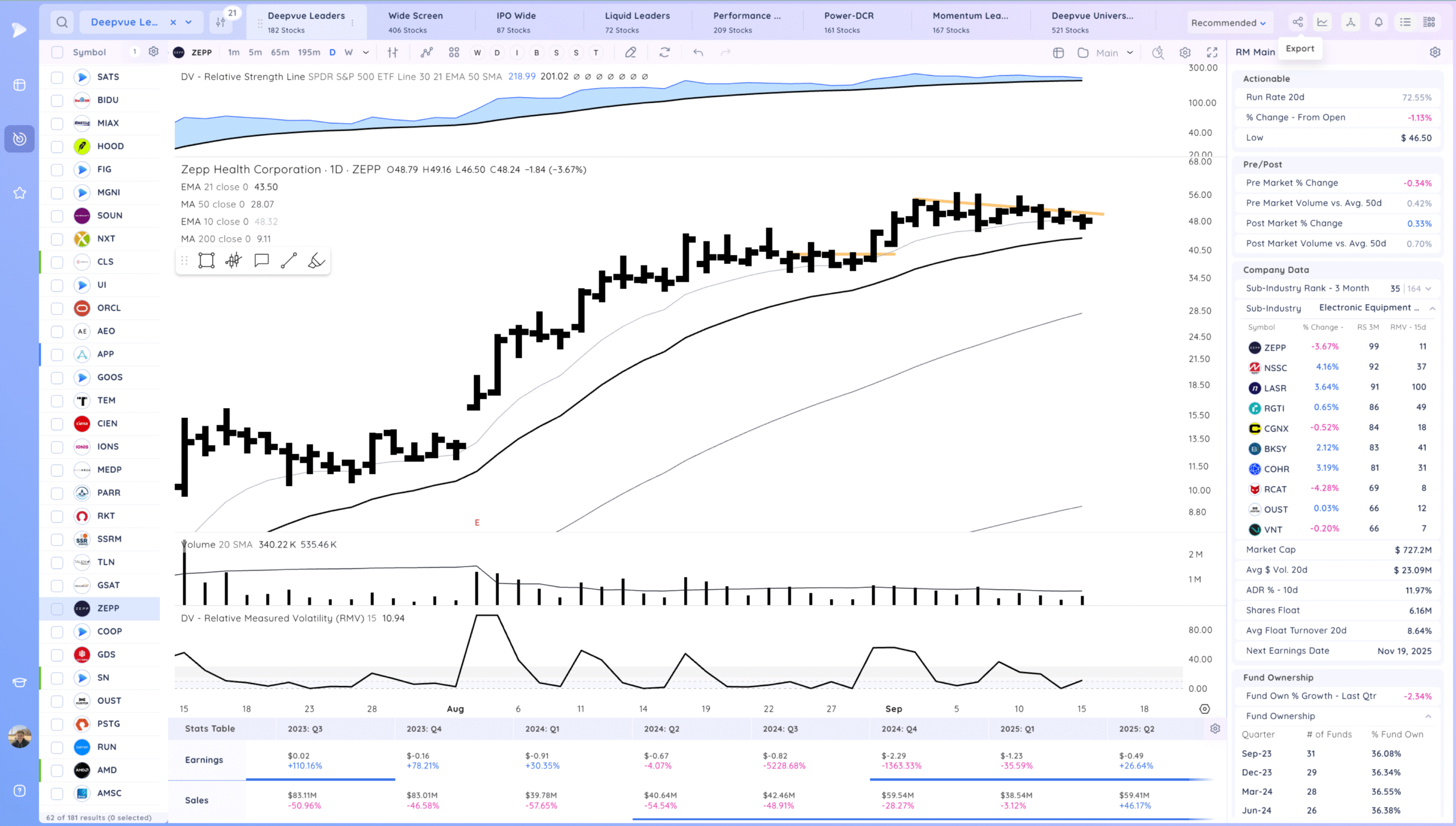

ZEPP watching for a flag breakout. Very fast mover

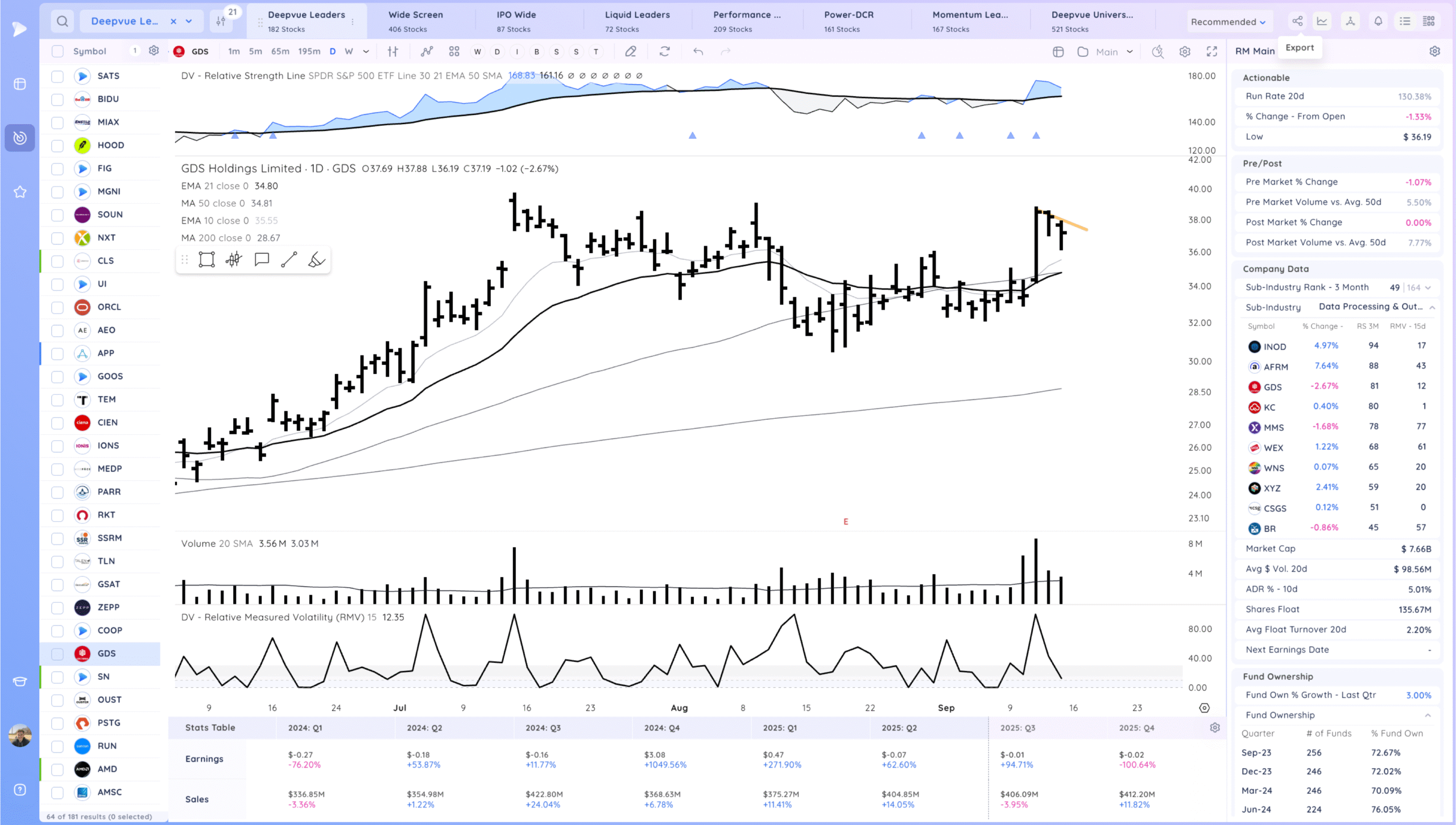

GDS fast mover, watching for a flag breakout

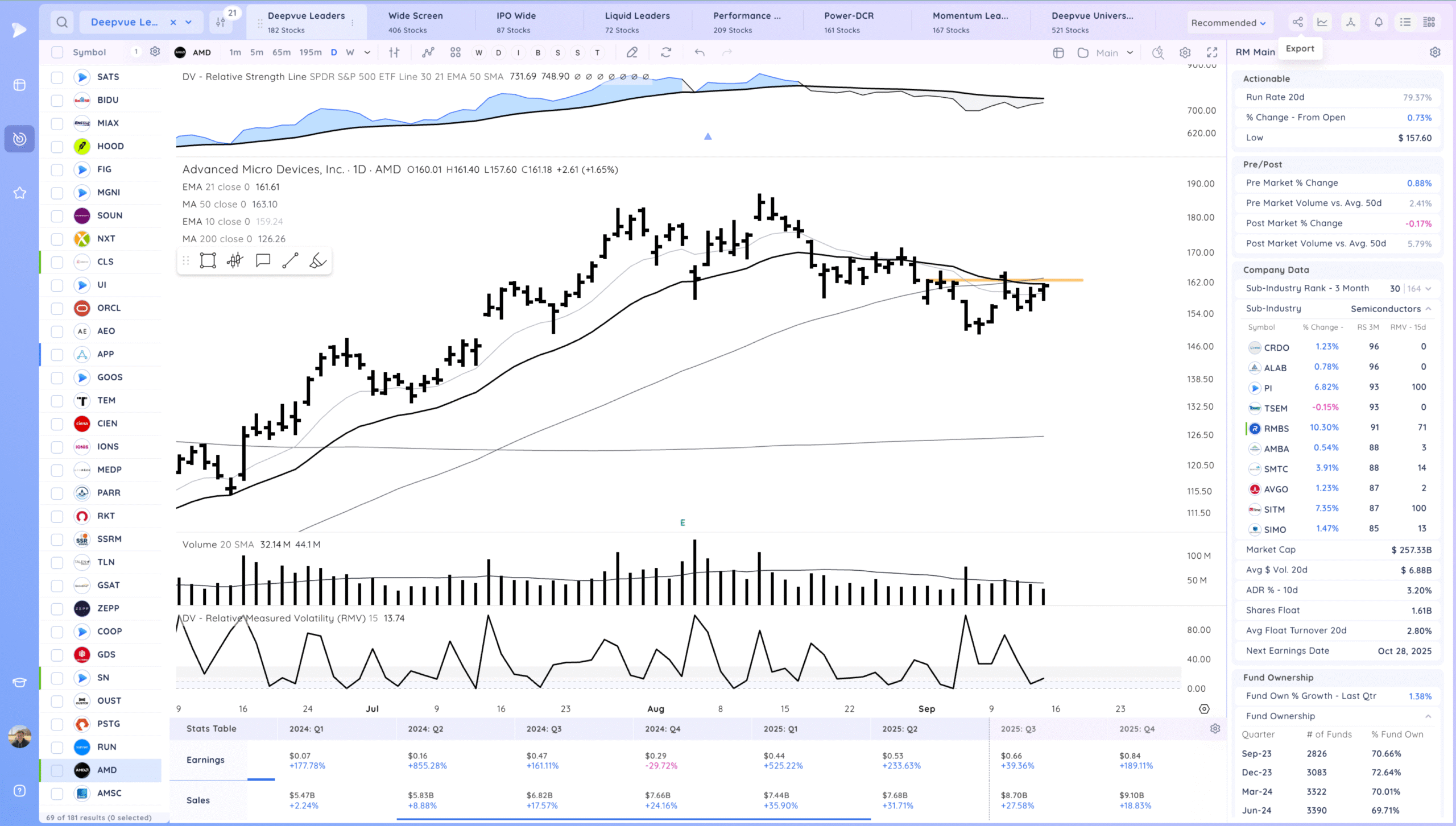

AMD watching for a pop through the 21ema

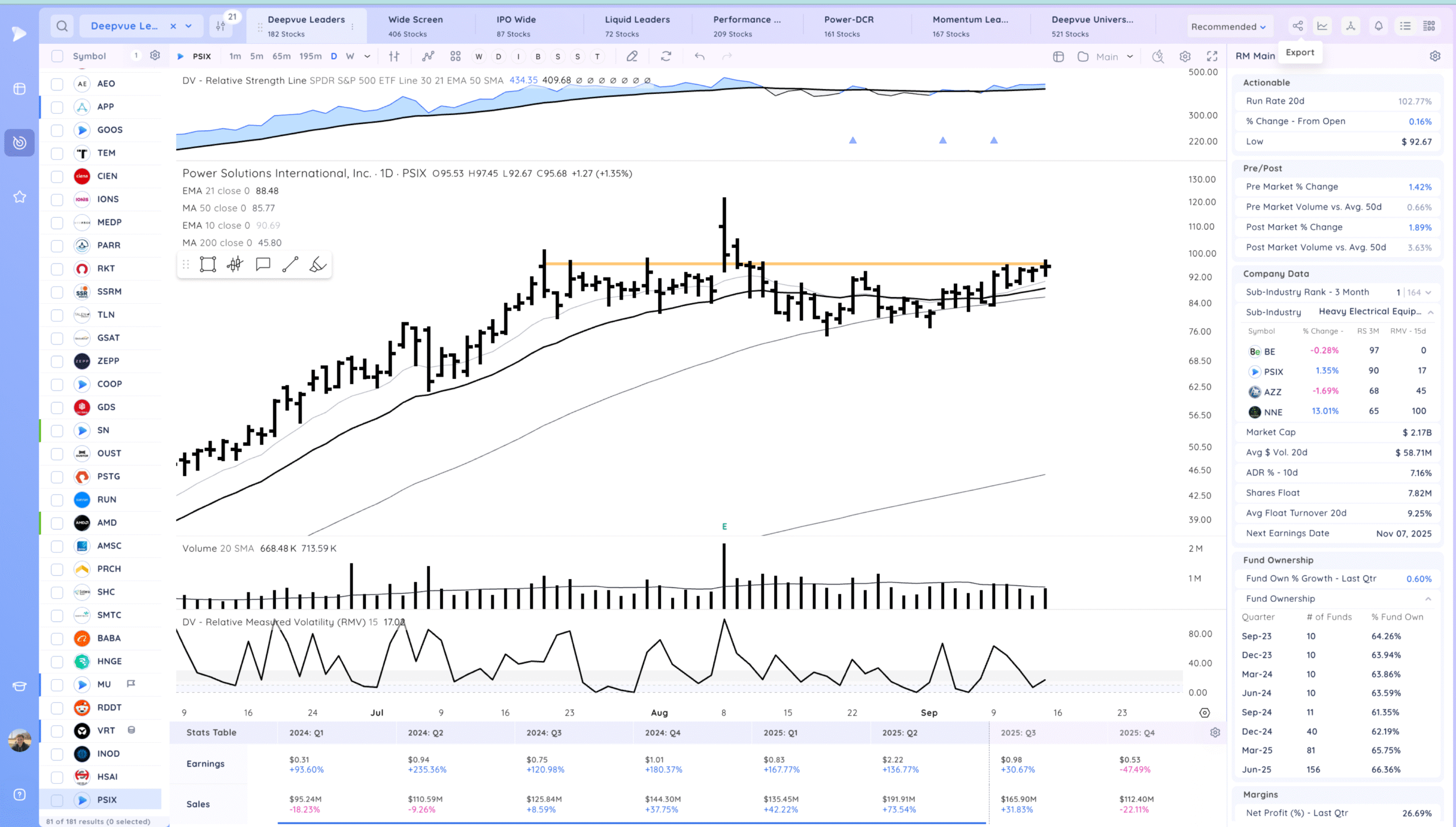

PSIX. watching for a range breakout

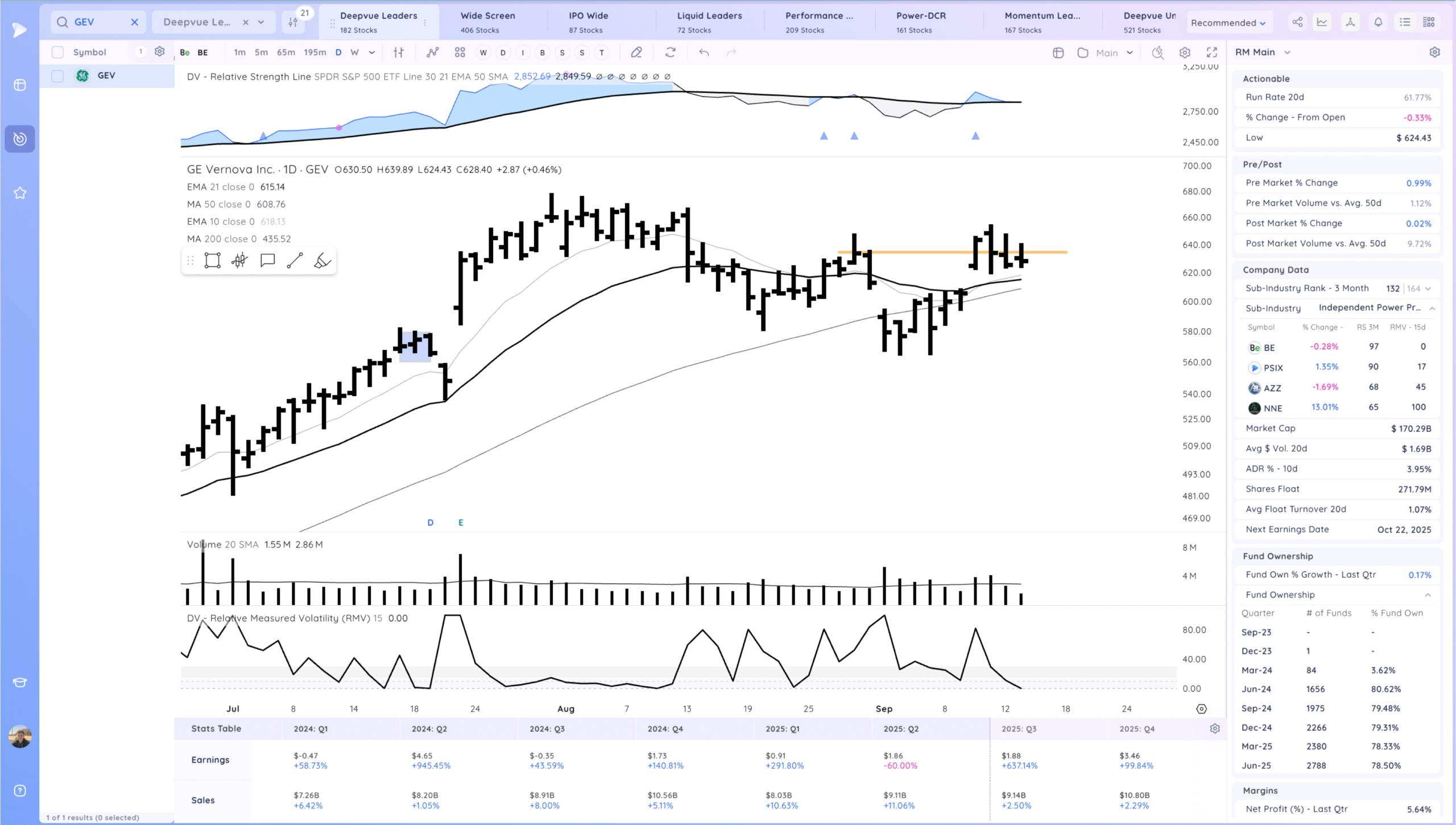

GEV watching for a range breakout

Today’s Watchlist in List form

Focus List Names

CMPO GWRE NBIS MGNI NXT PARR ZEPP GDS AMD PSIX HOOD NVDA GEV

Focus:

HOOD NVDA NBIS GEV

Themes

Strongest Themes: AI, Miners, Software, Energy

Market Thoughts & Focus

More strong action today. Remember to stay focused and centered. After strong expansion comes expansion and pullback, things don’t go up in a straight line. Expecting some stress tests. Be ready, know your plan for every position you have.

Anything can happen, Day by Day – Managing risk along the way

Continue Reading The Full Trade Lab Report

Get instant access to comprehensive market analysis that cuts through the noise and shows you exactly where the opportunities are