Trade Opportunity Case Studies of the Week: TSLA and ALAB Breakouts – | Sep 14 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 14, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

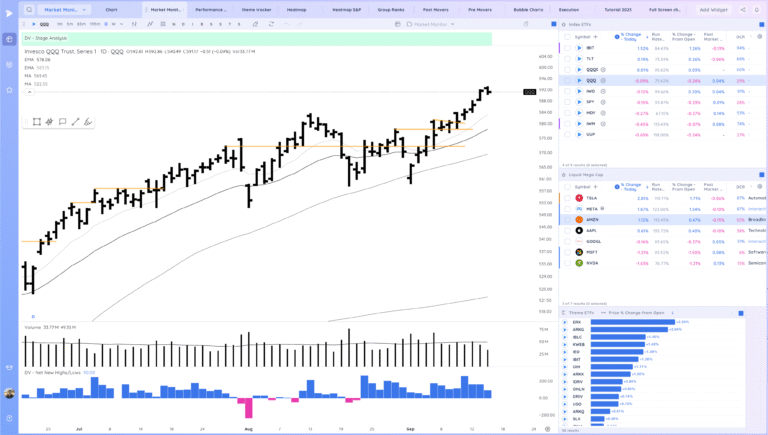

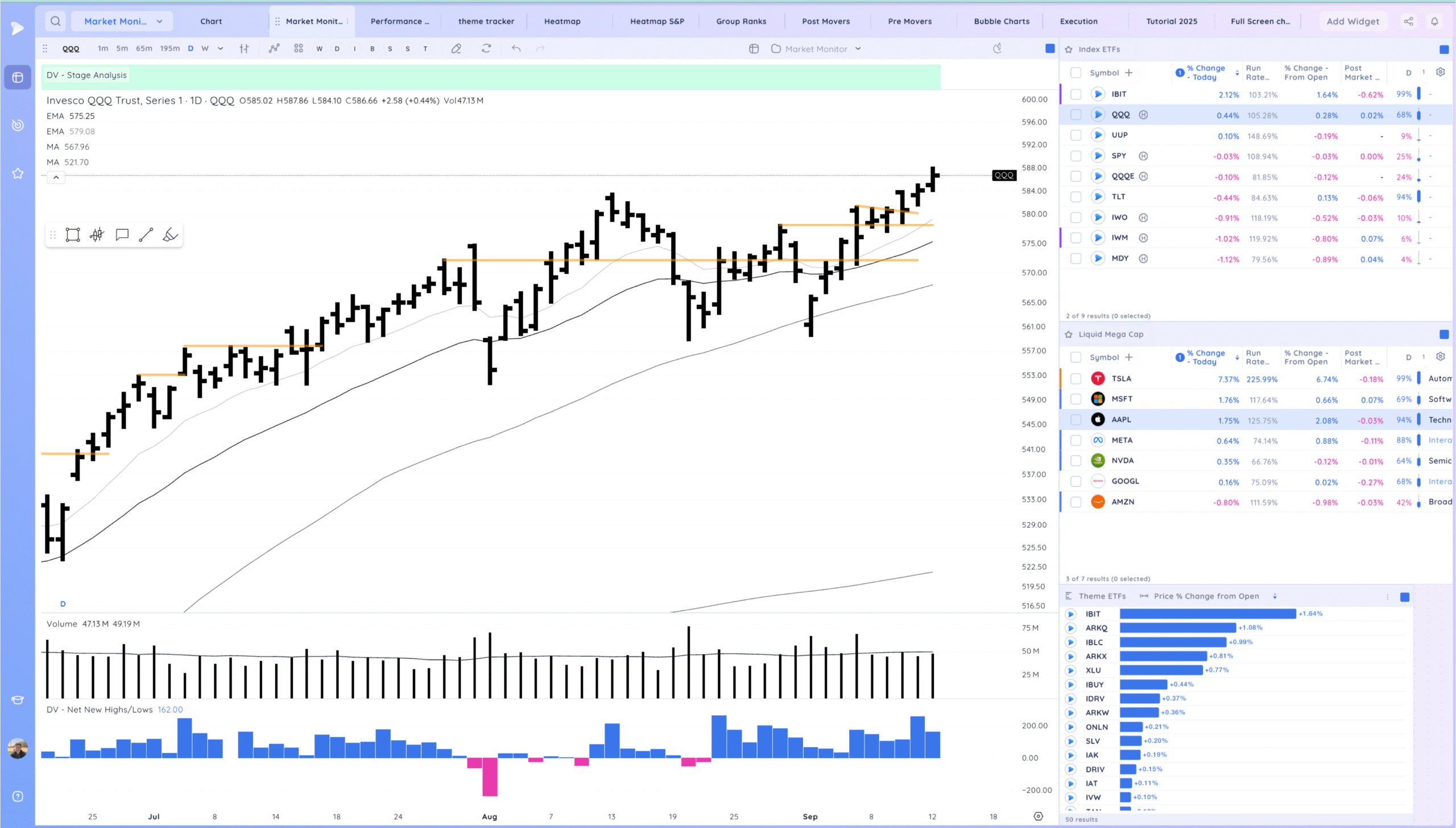

The market this week continued its strong move from the gap down reversal last week and made new highs.

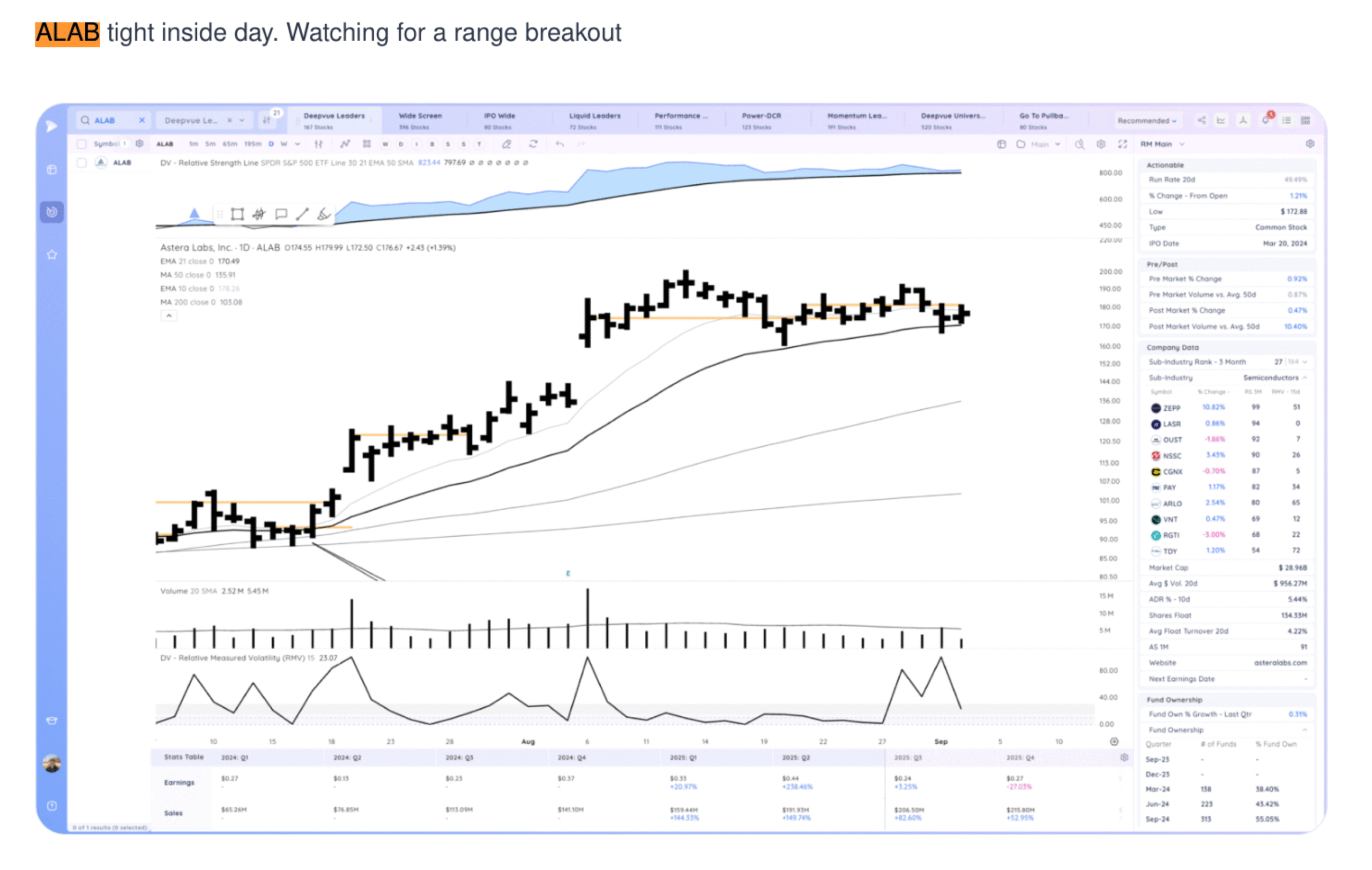

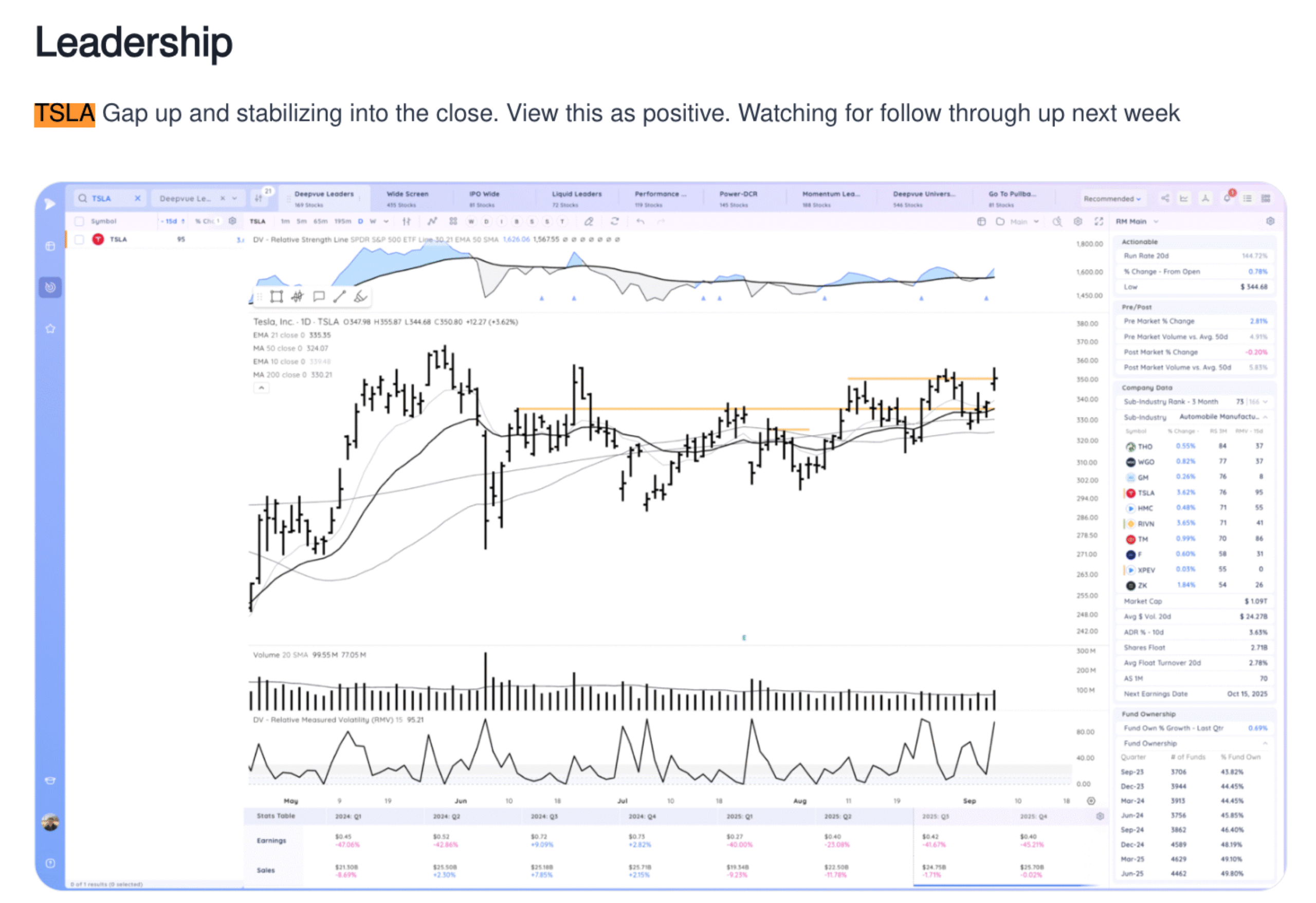

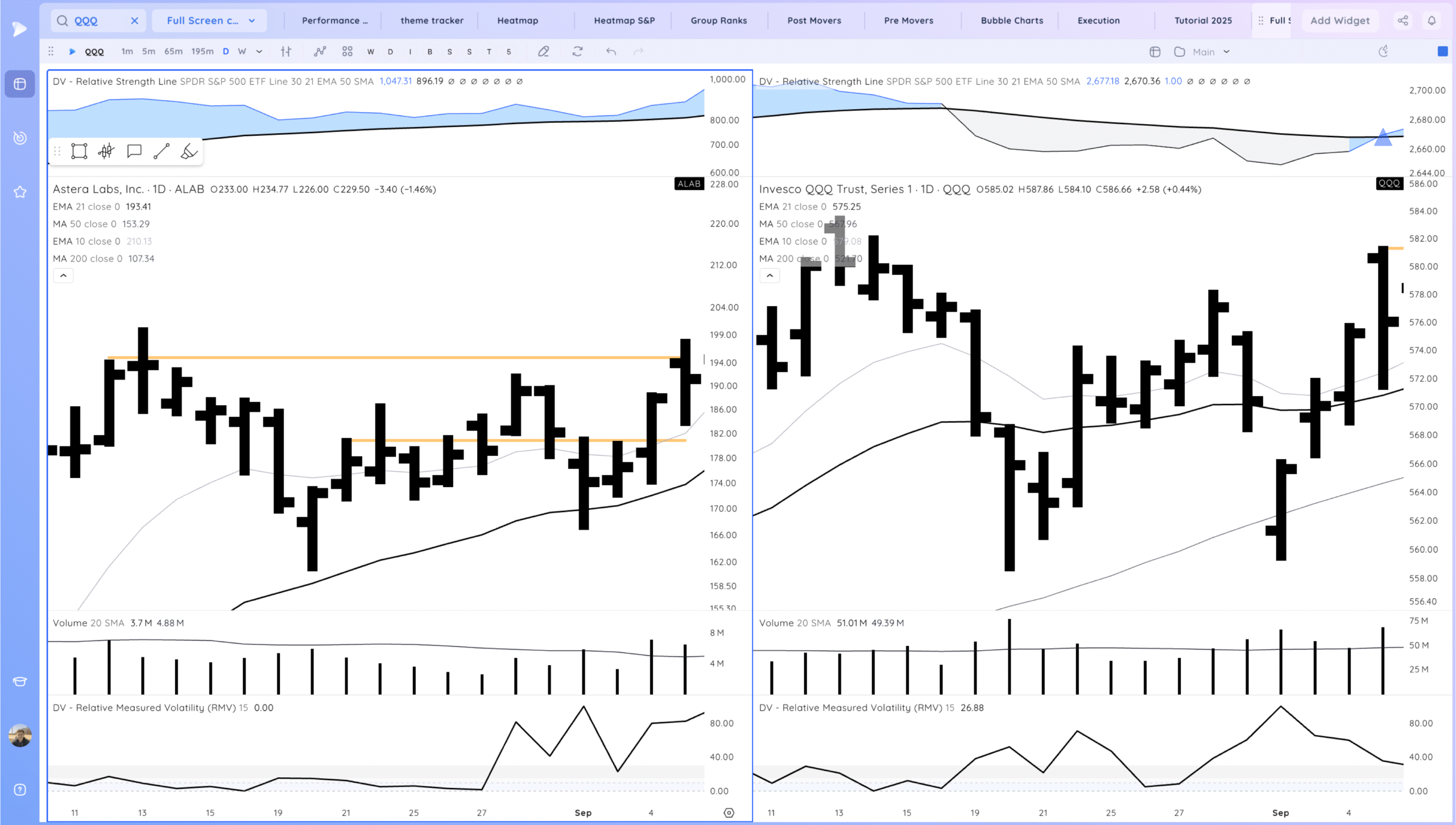

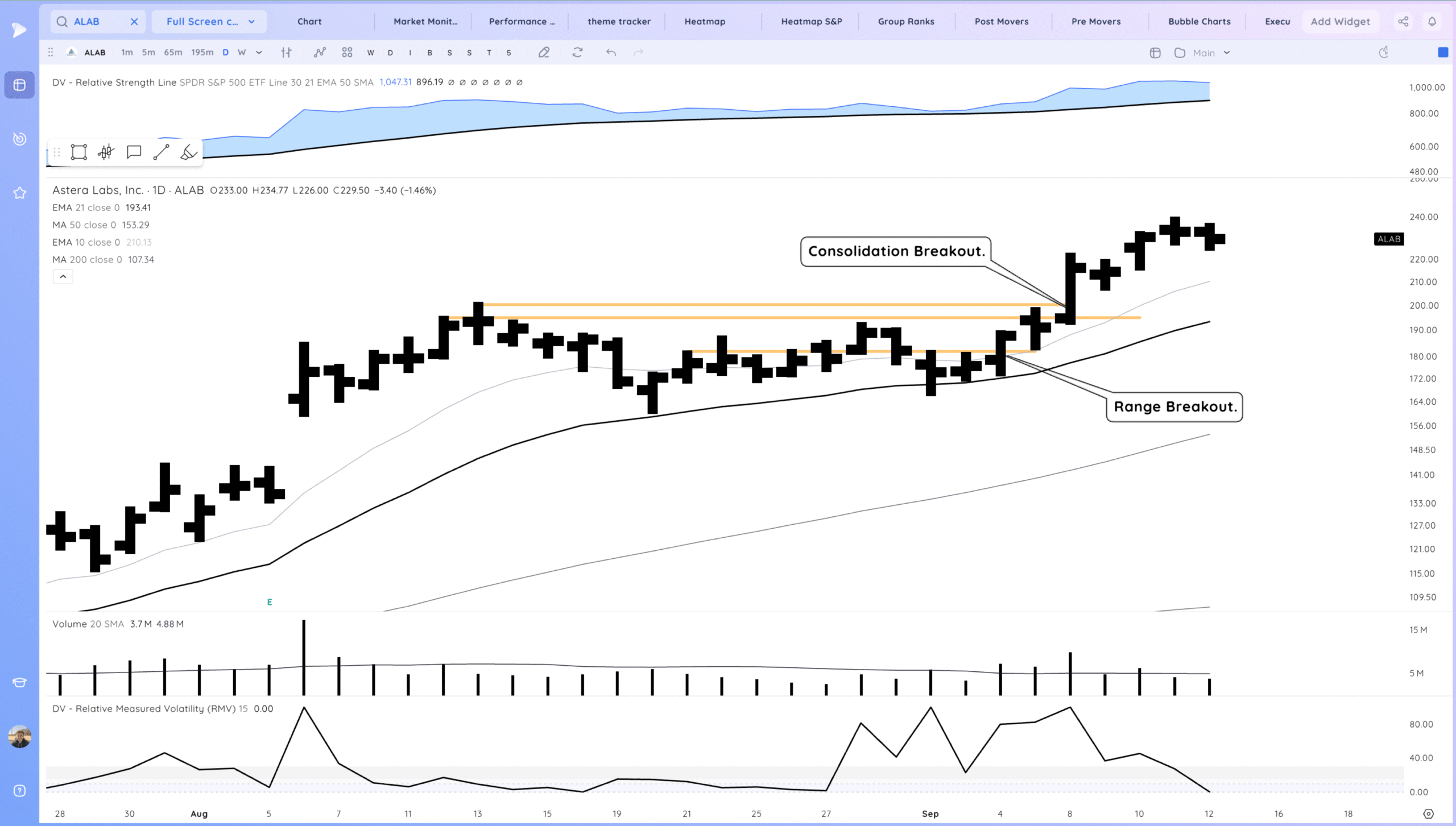

For this week we will be focusing on two of the best recent opportunities. The ALAB 21ema Range Breakout and Consolidation Breakout and the TSLA Breakout

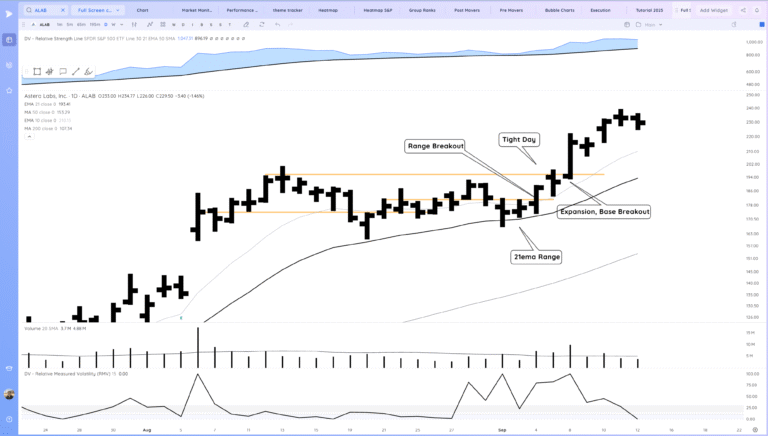

ALAB Daily Chart:

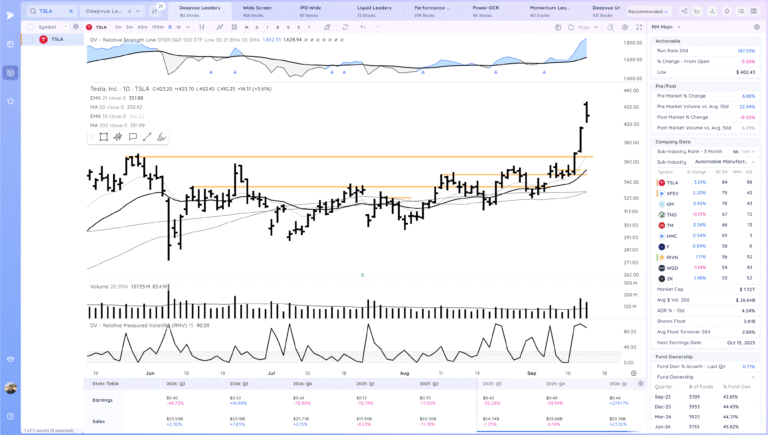

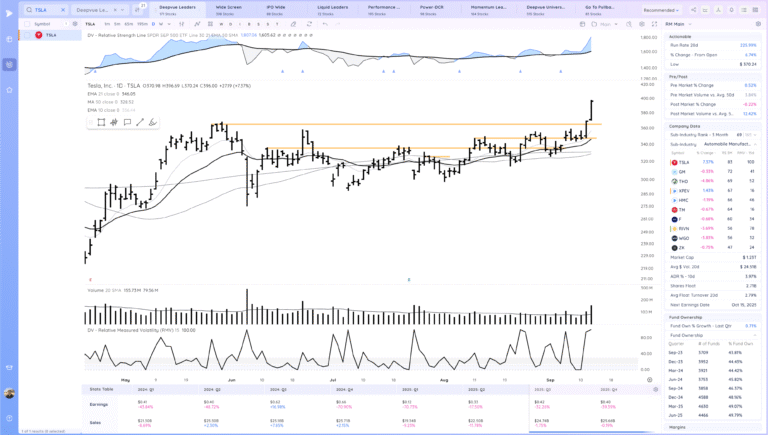

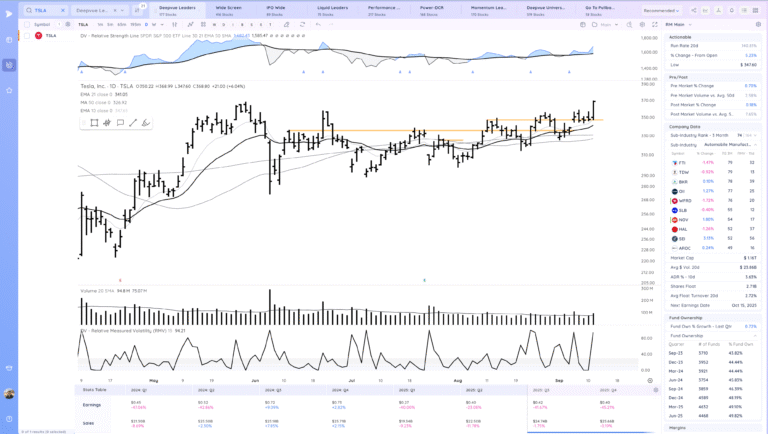

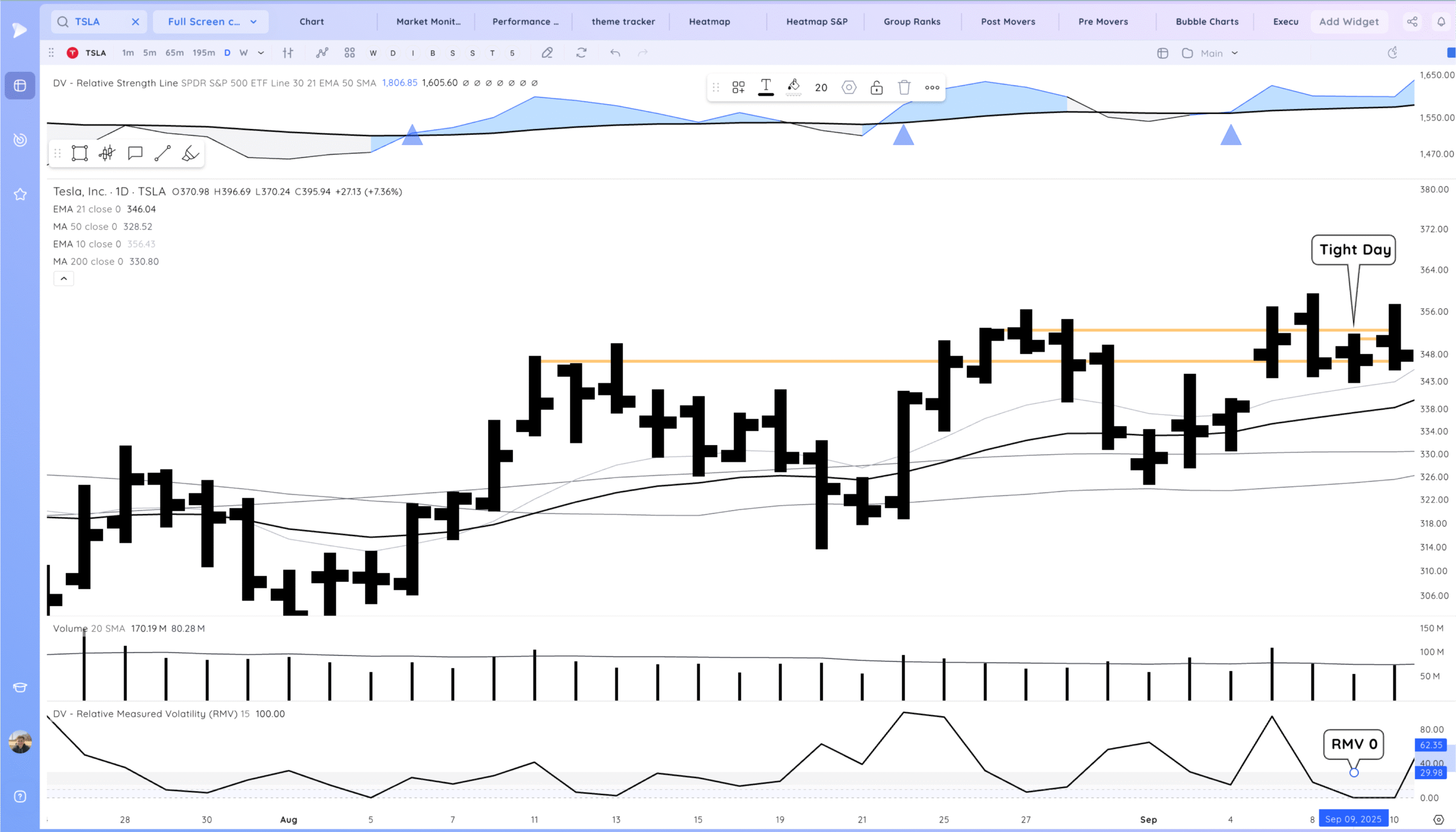

TSLA Daily Chart:

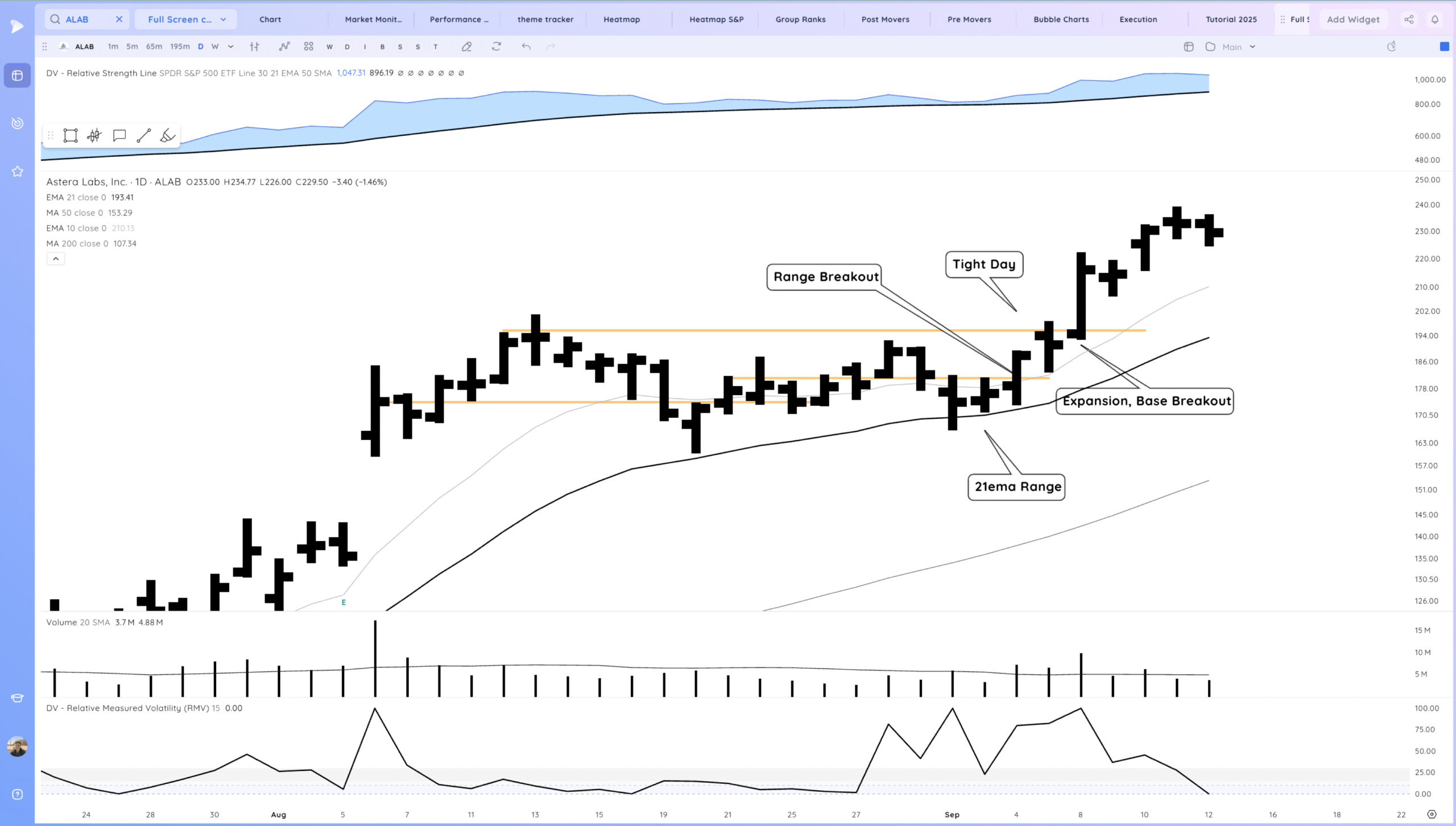

ALAB

Discovery – ALAB

To catch strong moves you need to have processes in place to get names capable of them on your radar. ALAB has been a focus for a while and it is one of the leaders I cover each report.

Whenever one of these leaders are setting up they are my priority for an entry. Here was my note on the day before the range breakout

Process:

- Create and curate a watchlist of Leaders

- Review them daily for your prefered setups/entry tactics.

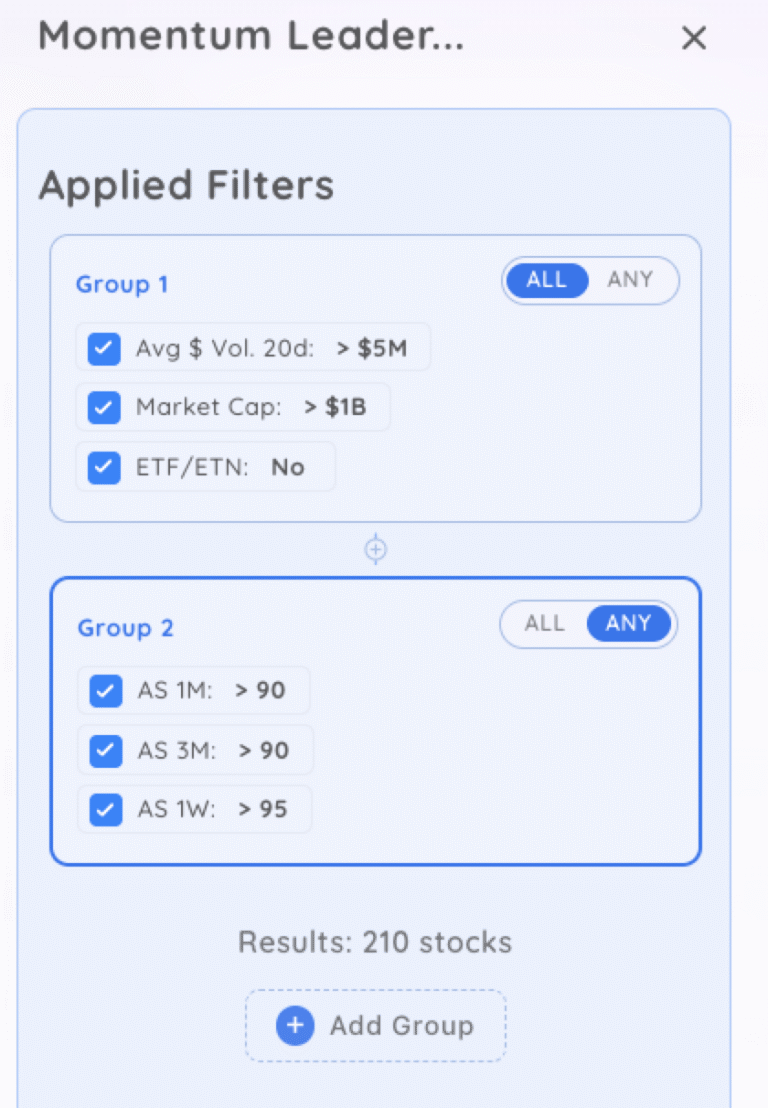

An alternate process would be to regularly review a top momentum movers screen or the Deepvue Leaders Screen for potential range breakouts. I have a screen that looks for the top 10% momentum stocks past 1,3 months or top 5% in the past week.

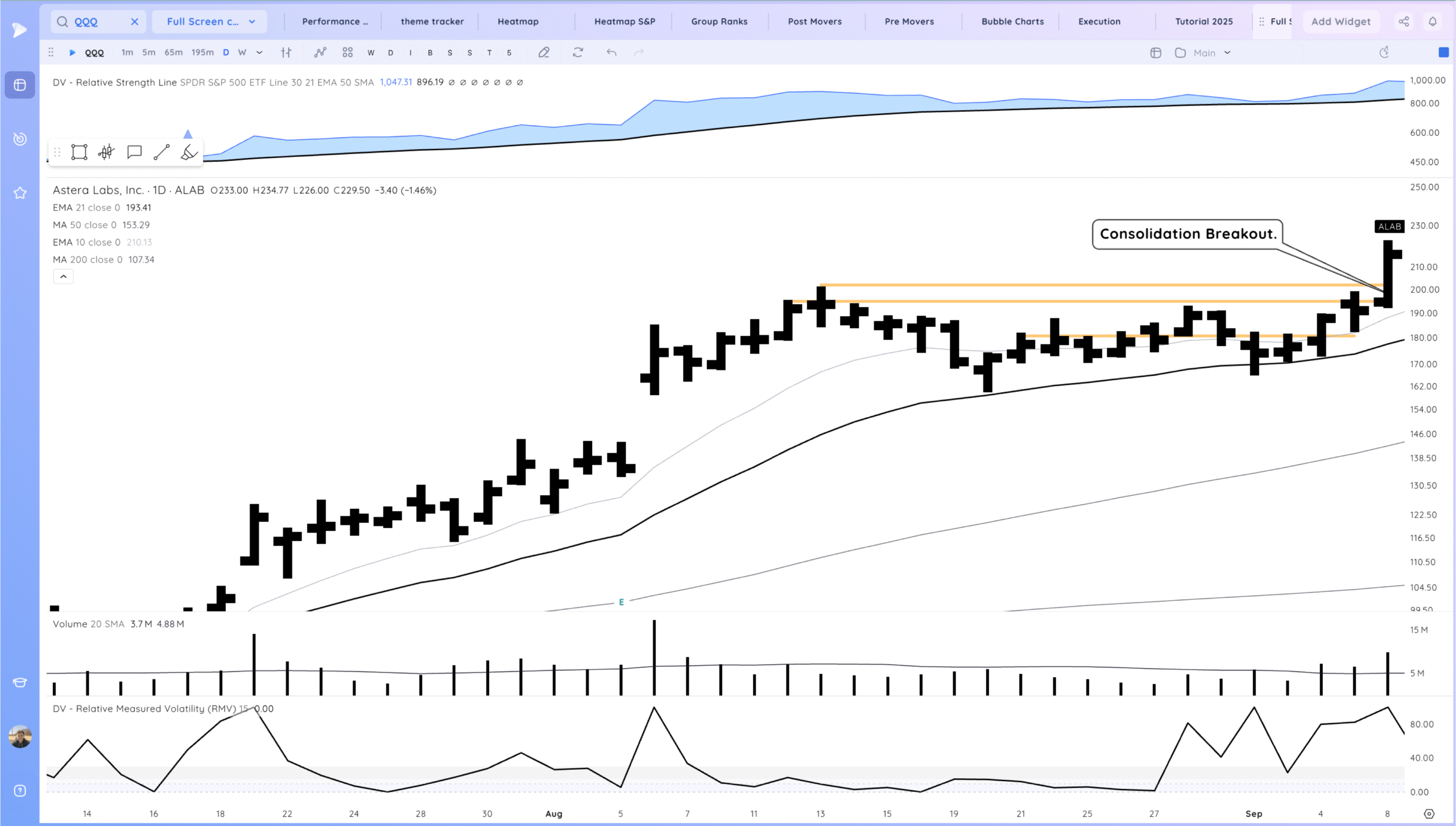

ALAB – Setup and Execution

For trading ranges there are four main entry tactics

- Anticipation

- Accumulation versus Range Lows

- Standard Breakout

- Undercut and Rally

I prefer the Standard breakout and undercut and rally as they occur on the day where the stock is making the move.

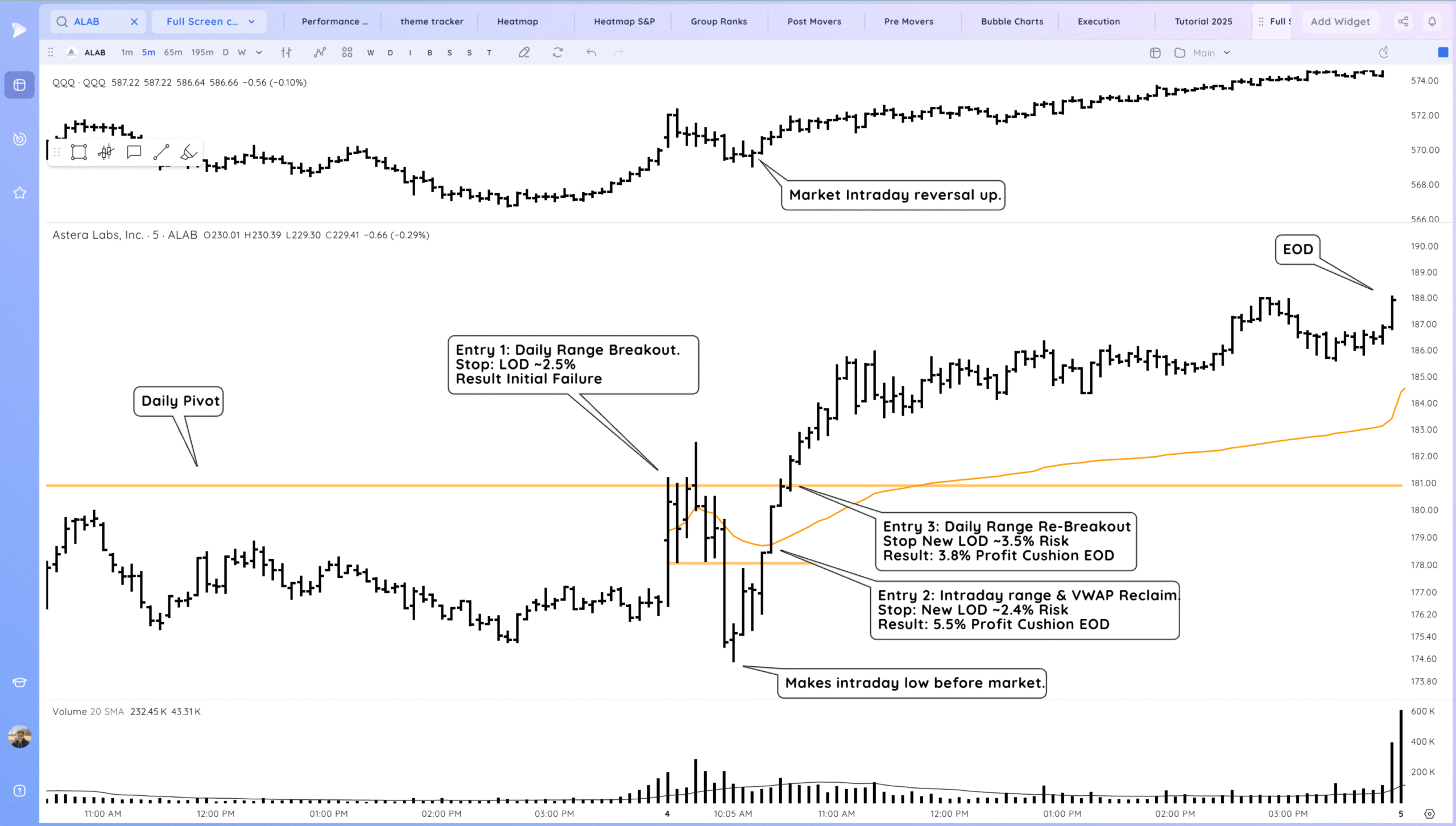

In the case of ALAB it exhibited the standard range breakout, however it wasn’t as easy as it seemed.

ALAB initially failed at the pivot and set a new LOD before recovering and breaking out. An Entry at #1 would have been a 2.5% loss. However note how ALAB made not further price progress down after the large sell bar which undercut key lows the prior day and then formed a new intraday low before the market.

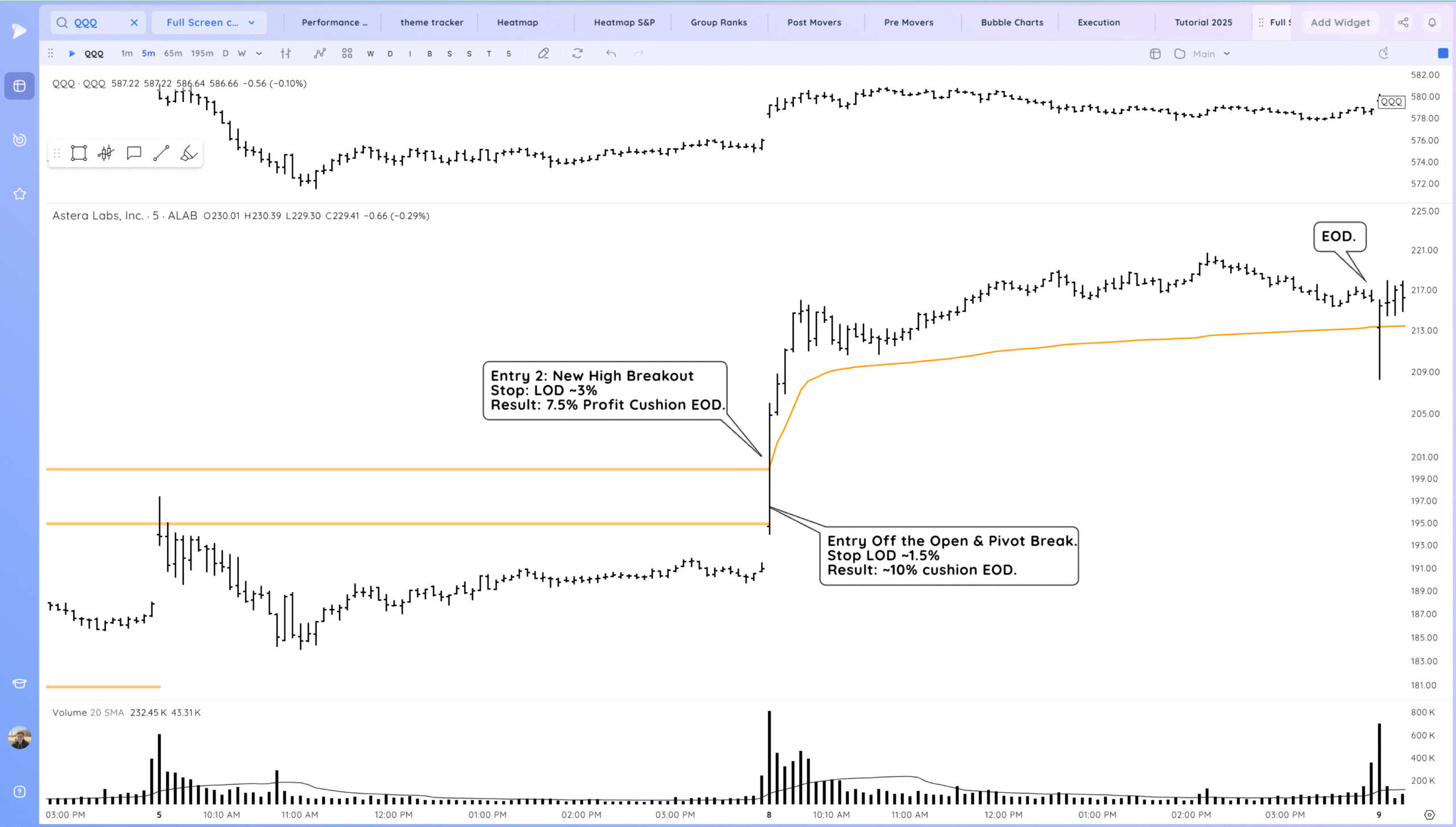

Here is ALAB on a 5 min

The next day we gapped up on the QQQ and put in a downside reversal. ALAB showed RS and put in a nice tight upside reversal follow on day.

It was then set up just under the next pivot and consolidation high.

From these type of tight days when a name like ALAB is at a larger timeframe key level we can get significant expansion.

That is exactly what happened as we opening slightly up and then powerfully broke out. This would have been the next low risk entry

Here is the action on the 5min. ALAB surged on the open and you would have to act fast to enter

Future thoughts

Since the entries ALAB has acted great, tightening and consolidating through time.

The Range breakout is up ~25%

The Consolidation Breakout is up ~15%

At this point stops should be well in the money and watching the 10ema as a guide for the trend. A sharp selloff bar down closing below that MA would signal a warning sign.

Ideally it pauses, lets the MAs catch up and reconfirms higher continuing the trend to new highs

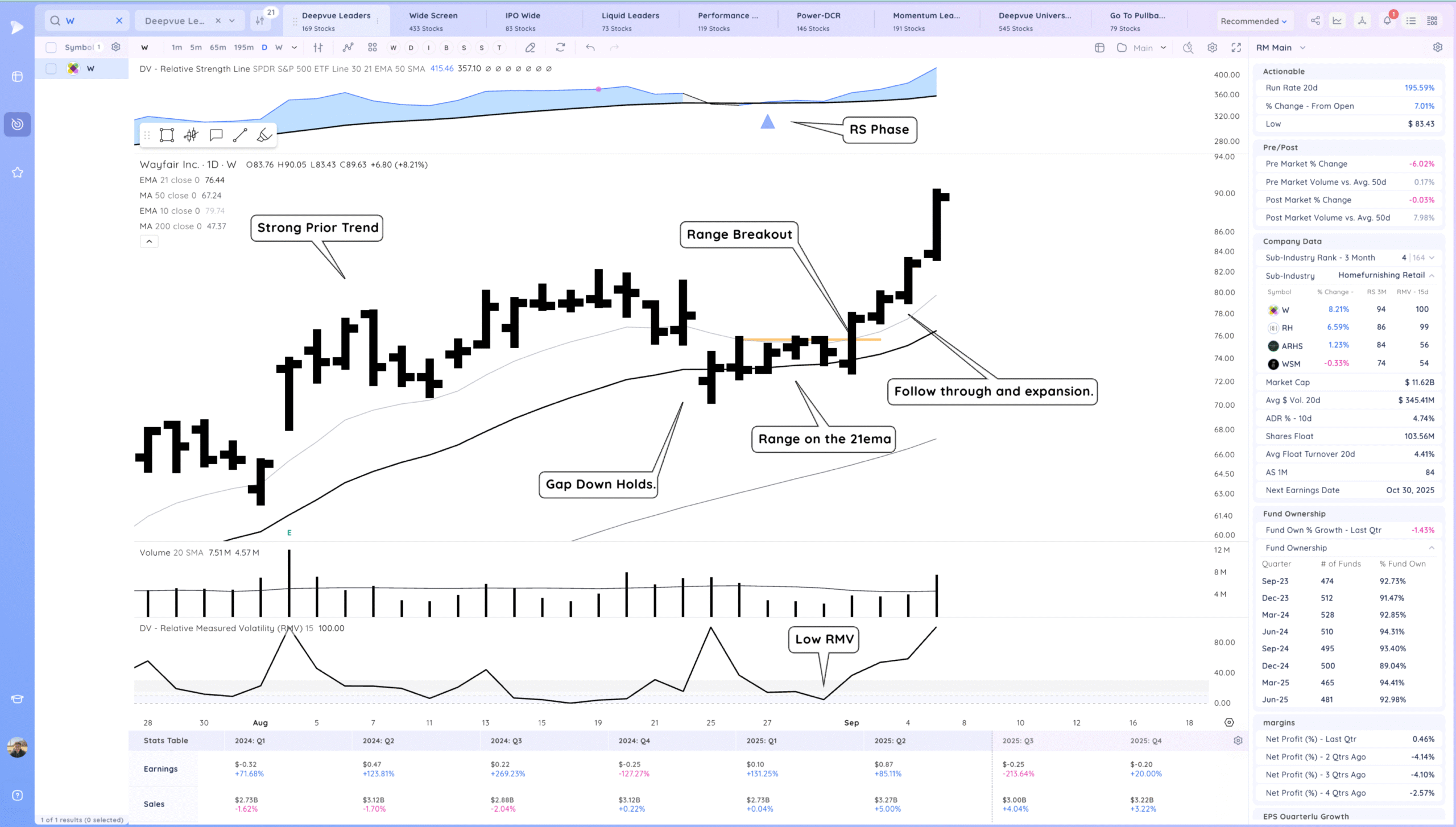

TSLA

Discovery – TSLA

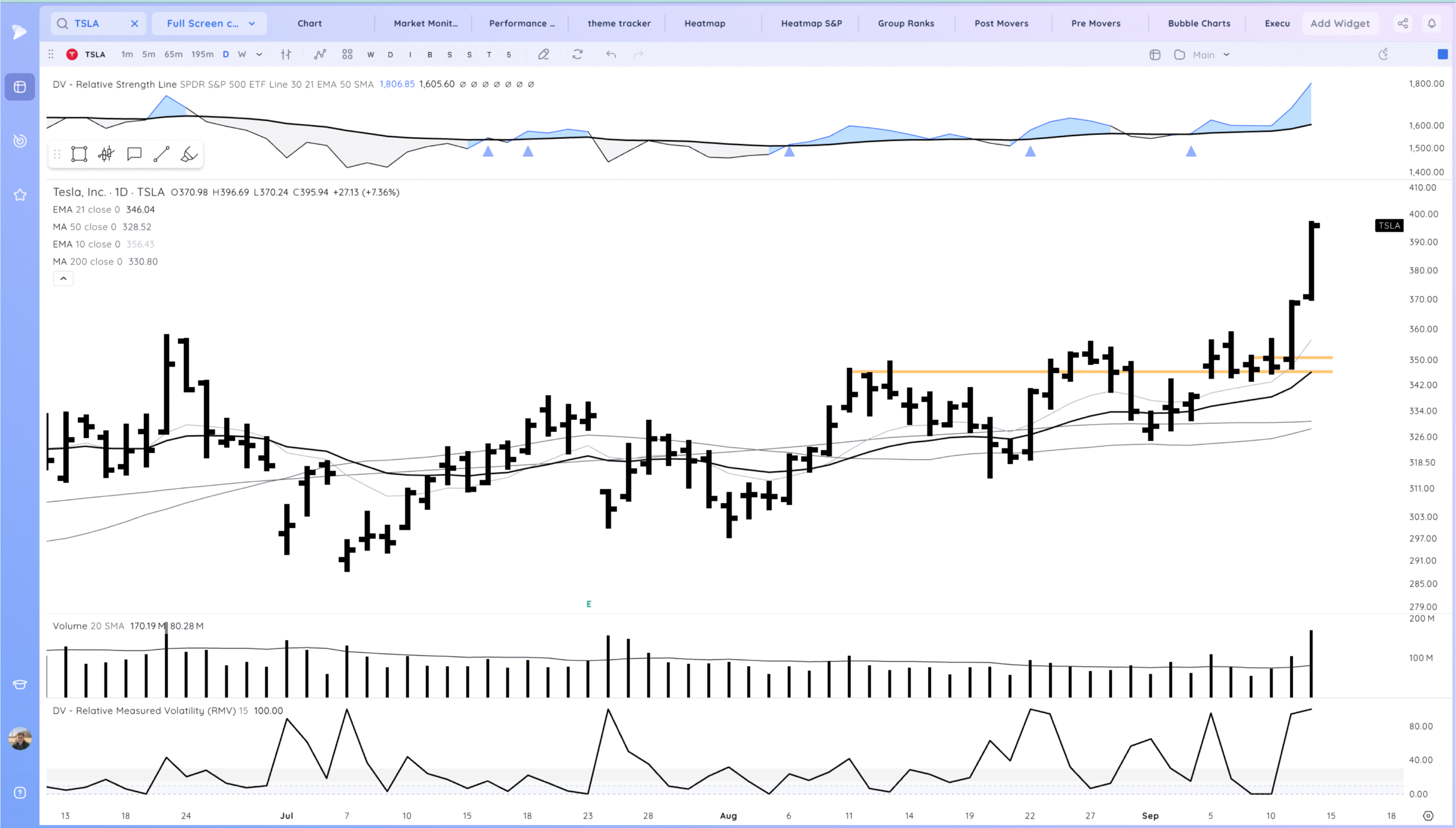

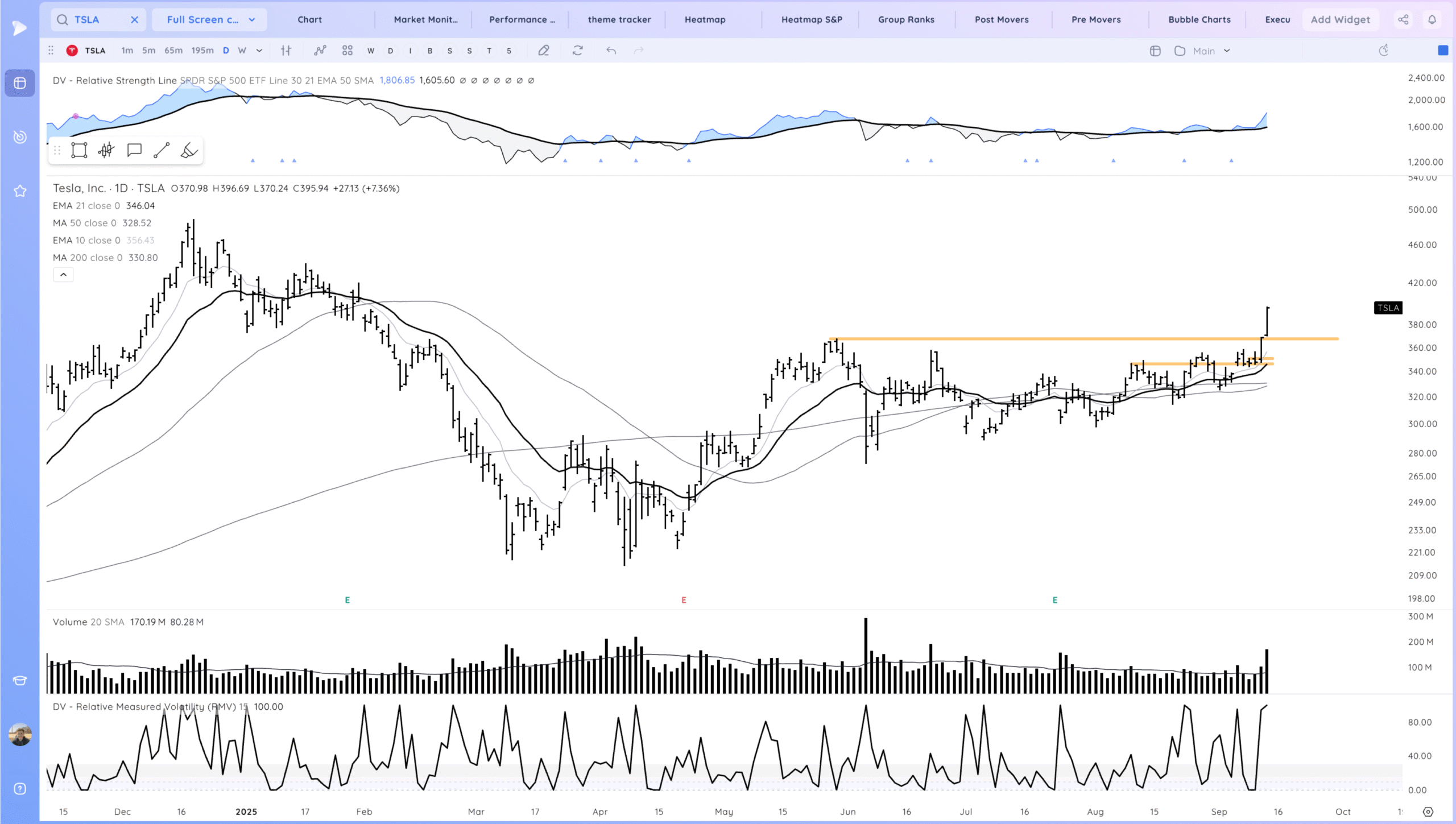

Similarly to ALAB TSLA should be a name you review regularly and look to trade when it sets up. You should have been watching this base form and the gap up should have gotten your attention.

TSLA – Setup and Execution

The larger setup for TSLA was a base breakout. With the gap up momentum was shifting. What you would be looking for is for TSLA to hold the gap and push higher.

Here is TSLA the day before the breakout. I highlighted it as first on my daily focus list along with RKLB and NBIS

The key daily pivots were as shown. The tight day high was the range breakout pivot and RMV had gone to 0.

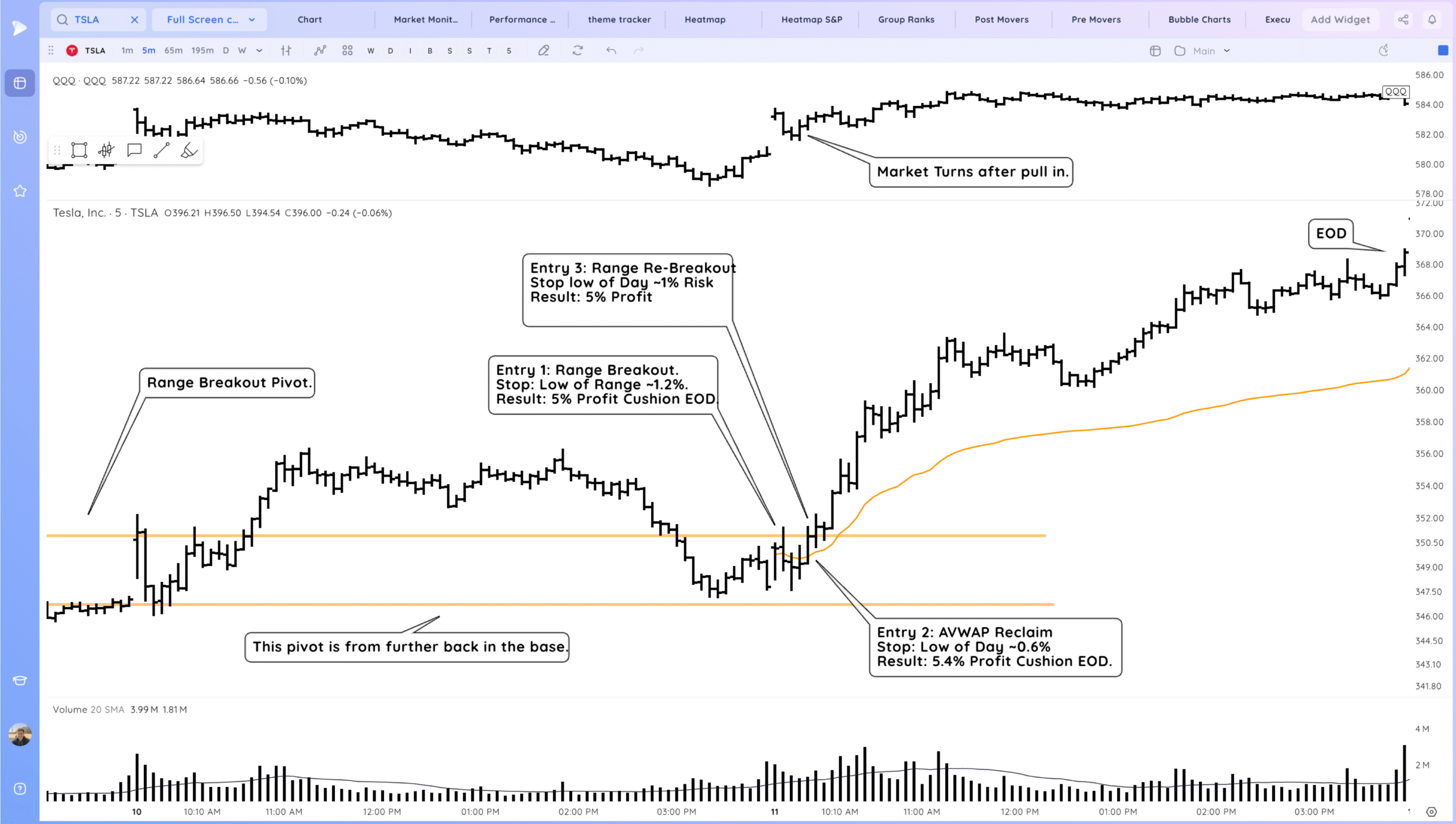

Here is the breakout day on a 5 minute.

For Entry 1 you may be stopped out depending on where your stop was. LOD was taken out. I have low of the range here because even that was below 1.5% risk since everything was so close. However even if stopped out using LOD TSLA gave you more chances as it u turned off the open.

TSLA closed at highs and followed through the next day up about 12% from the range breakout. Stops would be above breakeven.

Future thoughts

At this point TSLA is short term extended but you would expect it to stairstep higher with some pullbacks along the way. There is air to the 10ema which is the moving average of note. The shallowed natural reactions the stronger the move.

This is a breakout from a large base so position traders would want to give it the benefit of the doubt and trail at the 21ema. Swing traders may have sold a portion and be looking to add on a future MA bounce/flag

A sharp drop below the base pivot and penetrating too far at the close of the range breakout day would be a sign of caution.

Homework

The past 2 weeks there have been many opportunities. Go through this list and mark up potential entries and consider how you would have gotten them on your radar before the setup resolved.

HOOD MU SPHR RKLB AMSC GDS RMBS HIMS LEU NVMI AAOI STRL TEM

Continue Reading The Full Trade Lab Report

Get instant access to comprehensive market analysis that cuts through the noise and shows you exactly where the opportunities are