How To Use The Relative Strength Line To Find The Best True Market Leaders

Ross

Ross is a co-founder of TraderLion and Deepvue. He was mentored by William O’Neil, and co-authored The Model Book of Greatest Stock Market Winners at WON + Co.

Published: September 11, 2025

The relative strength line tells you how strong a stock is relative to every other stock on the market. It is a time-tested technical analysis indicator that has been effective for decades–its longevity means it can be trusted and used with confidence and conviction.

The relative strength line is often associated with the RS Rating 1-99, however this article focuses on the RS Line itself.

Never miss a new post from Ross Haber!

Stay in the loop by subscribing to the email list.

Relative Strength Line Calculation

The Basic Calculation

The calculation is simple; it is the price of the stock divided by the price of the S&P 500 at that time. Though deceivingly uncomplicated, the relative strength line is undoubtedly the key to finding the best-performing true market leaders, especially when the market is in a correction.

Key Insight: 80-90% of all new stock bases are formed while the market is in correction. The relative strength line is one of the most efficient and effective tools to find the strongest stocks among thousands to sort through.

For easy step-by-step instructions to plot the relative strength line on different platforms, use this guide.

Relative Strength Line Examples

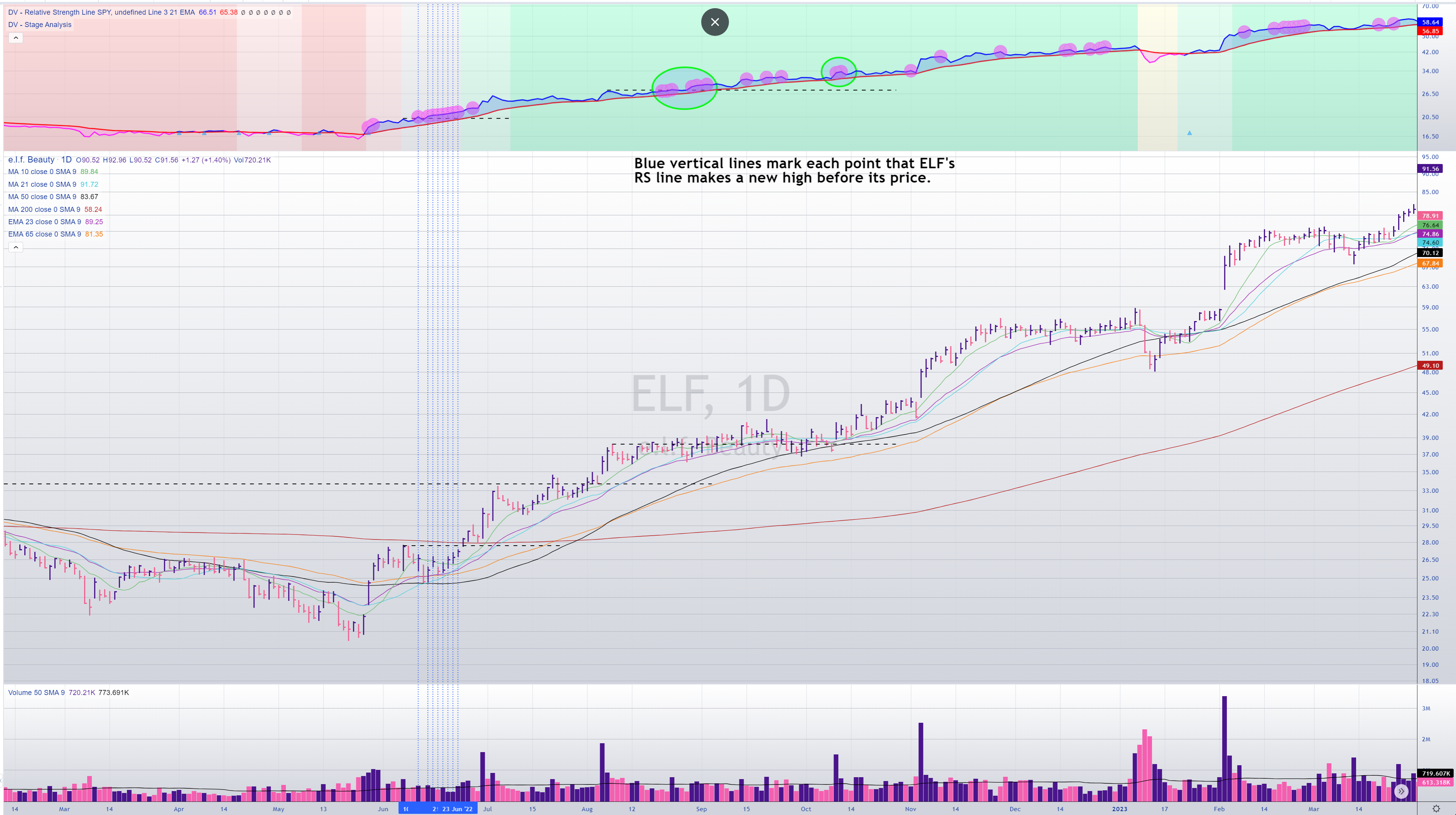

Let’s take a look at ELF and TSLA, two of our biggest winners from 2020. It was the RS line that put our eyes on these two stocks super early on. The charts below illustrate the functionality of this fairly simple indicator.

Relative Strength Line Considerations

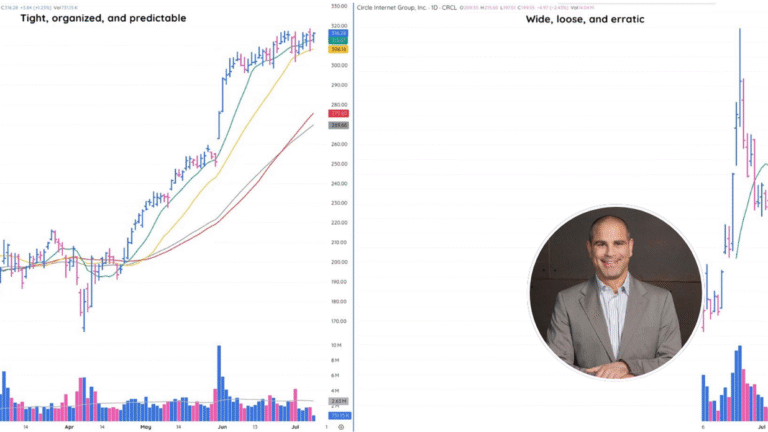

Once you have found a name with an excellent relative strength line, it is important to remember that spotting clear, early relative strength like in the examples above is just the beginning of the process of finding a true market leader.

Beyond Relative Strength

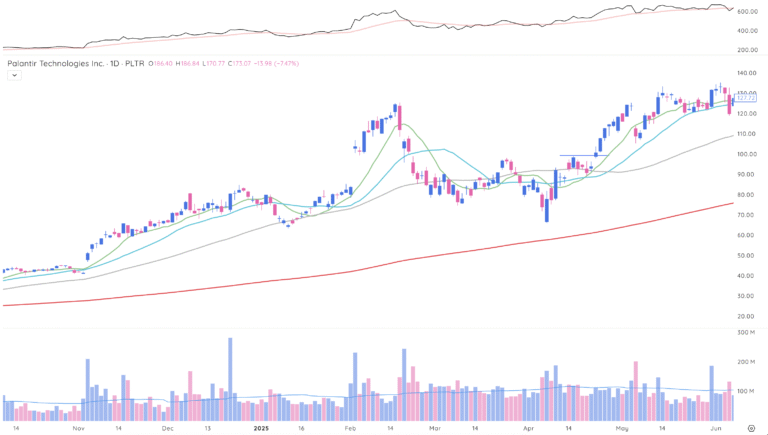

Next, I consider price and volume action. We must see healthy, constructive price and volume action accompany the early signs of strength in the stock.

Finally and most importantly, I consider all of the CANSLIM fundamentals. Never forget, the fundamentals are critical. The relative strength line alone will not get you very far.

However, with the relative strength line as your starting point and a skillful sequence of productive tools and techniques, you will be able to identify the most powerful and high-quality stocks, early on in the process with confidence.

Jump To: What is the bullish engulfing pattern?

Continue Your Trading Education

Understanding the relative strength line is just one piece of the puzzle when it comes to finding

true market leaders.

Successful trading requires a deep understanding of technical analysis, market psychology, and

proven strategies that work

across different market conditions.

If you’re serious about taking your trading to the next level and want to learn from seasoned professionals like Ross Haber who’ve

consistently found market leaders using these exact techniques, you’ll want to check out our weekly market analysis.

TML Talk provides in-depth market commentary, real-time stock analysis, and actionable insights that help you identify

the strongest stocks before they make their big moves. You’ll get the same analysis and thought process that has helped

us spot winners like ELF and TSLA early in their runs.