Trade Opportunity Case Study of the Week: W Range Breakout – | Sep 6 2025

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 6, 2025

The Trade Opportunity

The purpose of this weekly article is to analyze the top trading opportunity of the week. To improve our identification and execution of high quality trade ideas that meet our setup requirements.

Each article will focus on a stock that meets one of three of the main categories of setups I trade:

- Range Breakout / VCP / tight area breakout

- Pullback to Support/ Key moving average

- Gapper / Post Gap Setup

These articles are like taking a step into the batting cage and loading up a historical at bat from a Ace pitcher in the world series – they will help you prepare and execute in future situations by studying important moments from the past.

The setups we cover will appear again and again in each market cycle

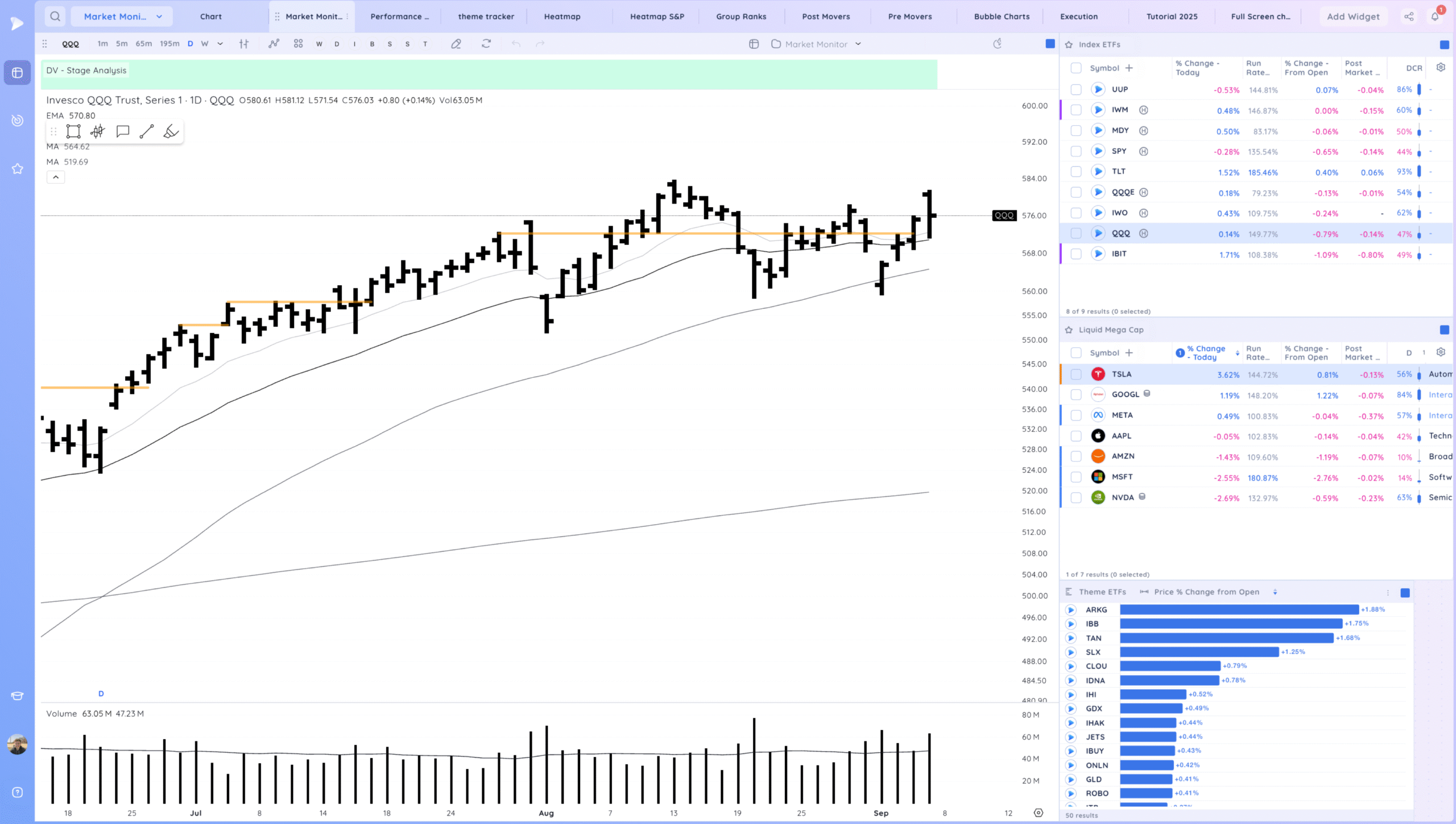

The Market this week gapped down on Tuesday and put in a strong upside reversal off the 50 sma. The momentum carried through the rest of the week.

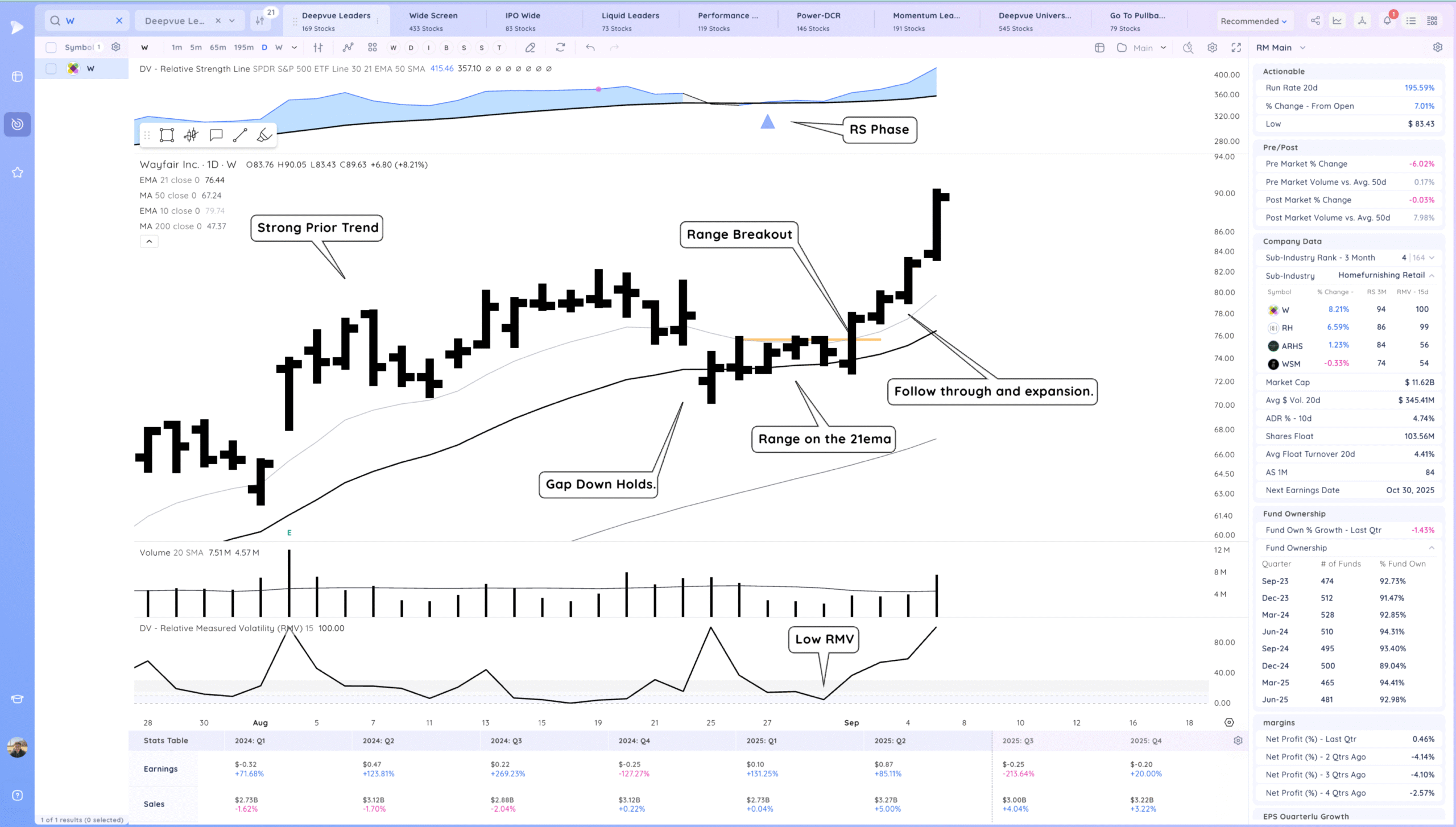

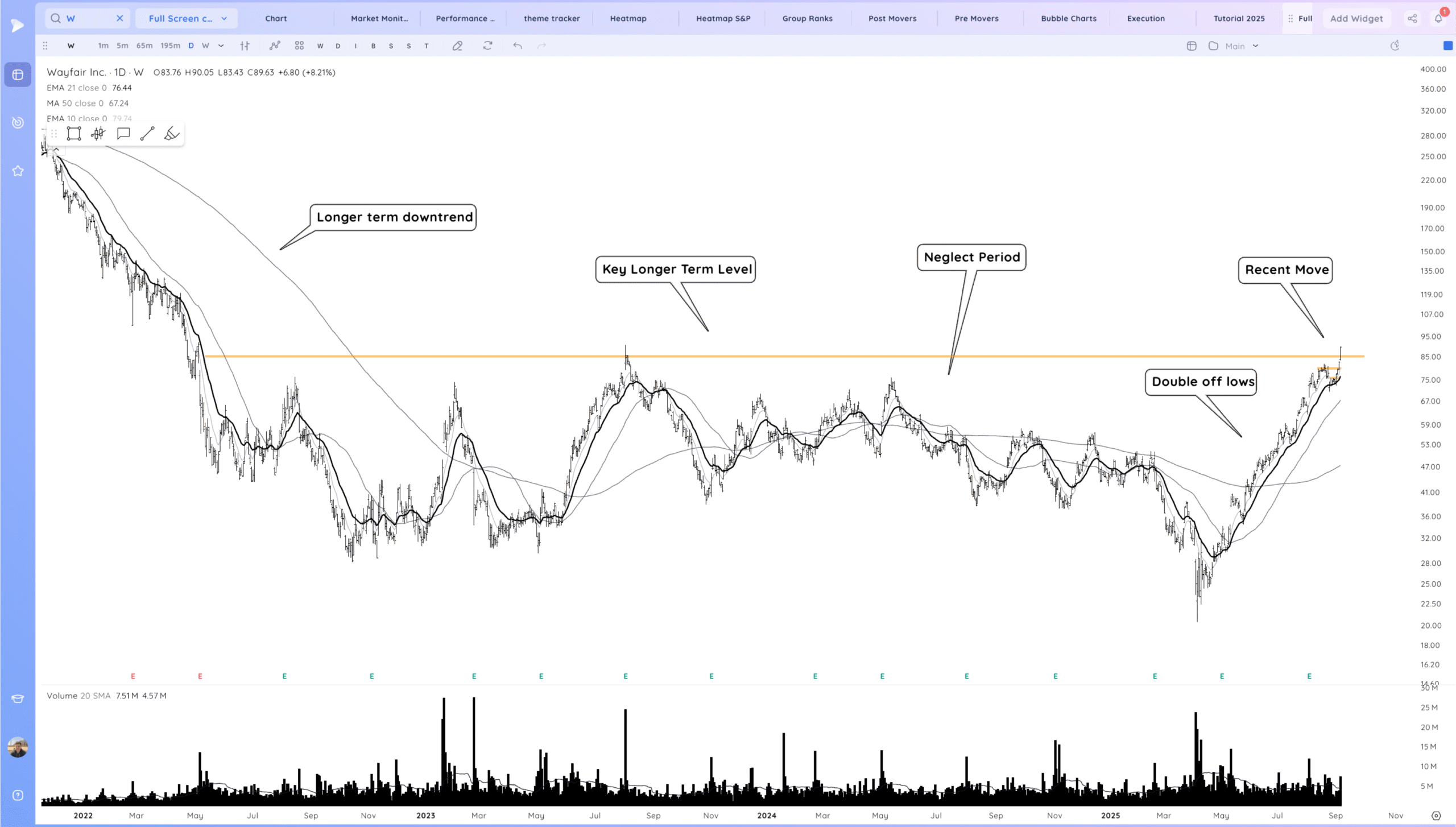

For this week we will be focusing on W’s range breakout.

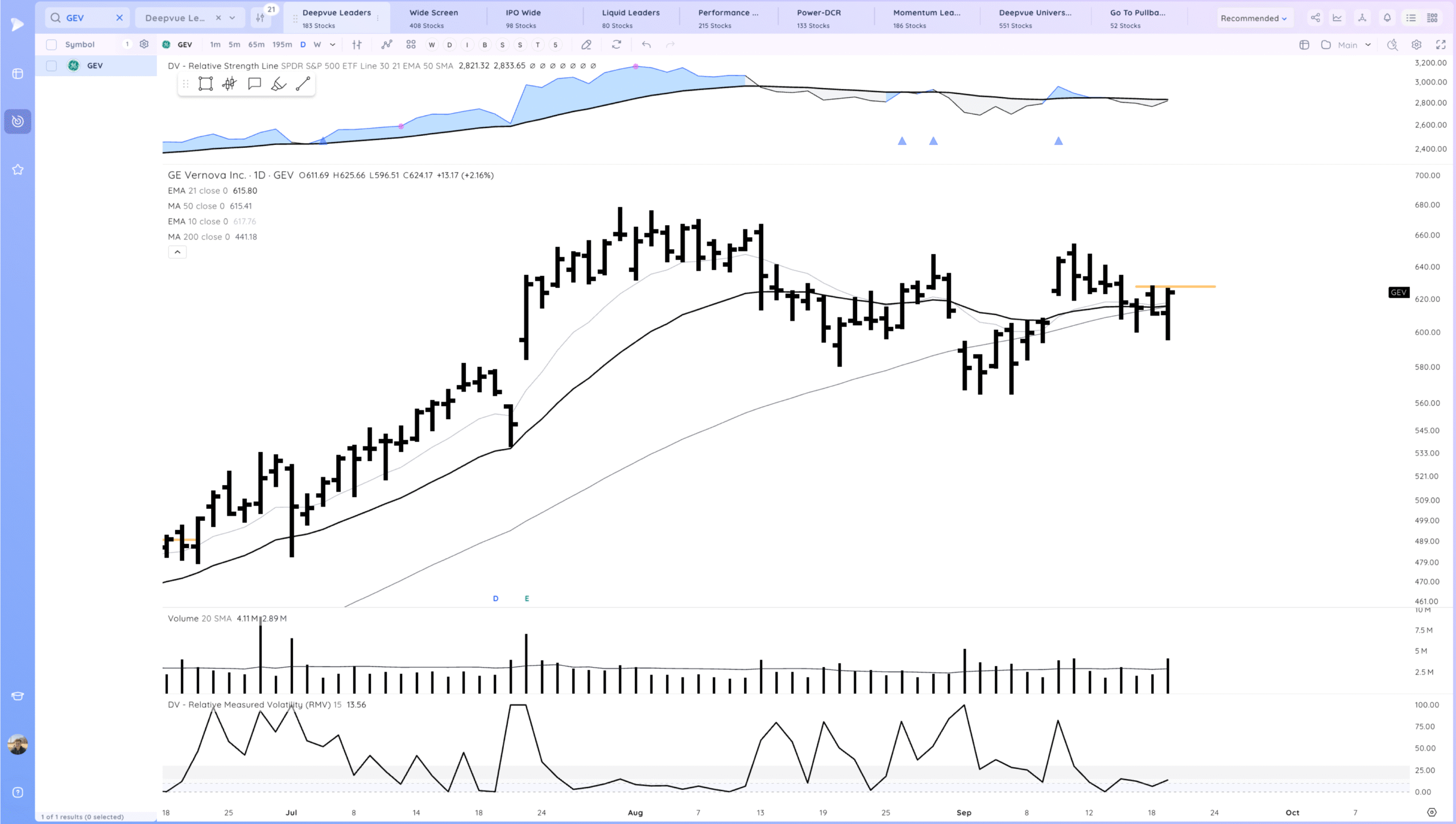

Daily Chart:

Discovery

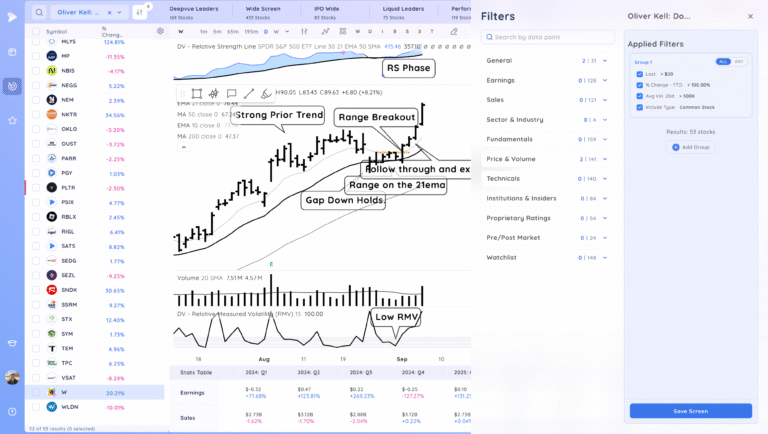

To get W on your radar you would want to focus on stocks in strong trends pulling back to their 21emas AND/OR stocks forming tight ranges.

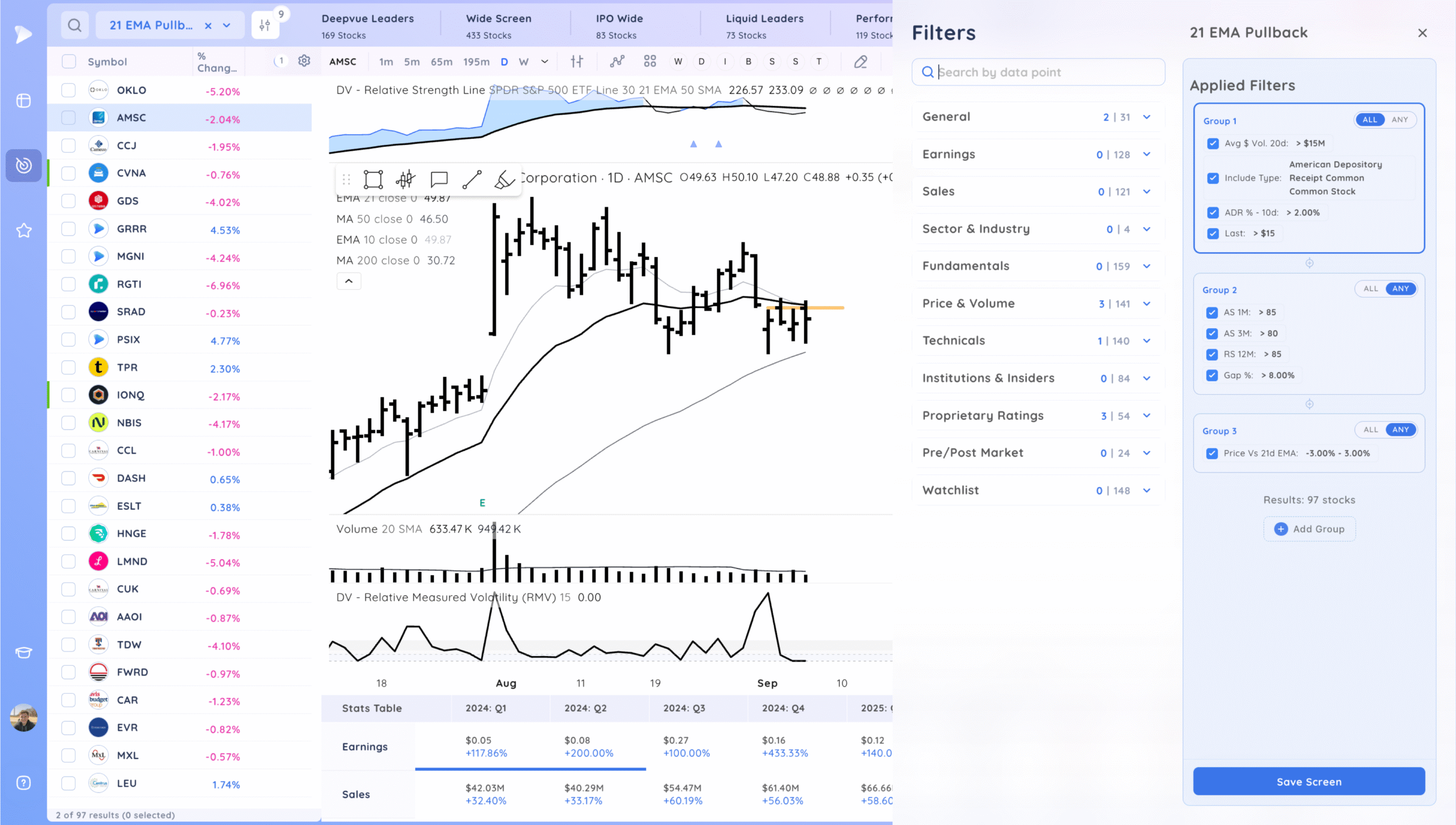

Here is a great screen you could use:

The Deepvue 21ema Pullback Preset.

This is one of my very favorite screens. It pulls up some great swing and position trade opportunities.

From this screen you are looking for a pullback that has a defined range and a stock that looks ready for follow through up. Choppier names should be avoided.

Setup and Execution

Once W is on your watchlist you would identify the setup and entry tactics you will use to trade it.

For trading ranges there are four main entry tactics

- Anticipation

- Accumulation versus Range Lows

- Standard Breakout

- Undercut and Rally

I prefer the Standard breakout and undercut and rally as they occur on the day where the stock is making the move.

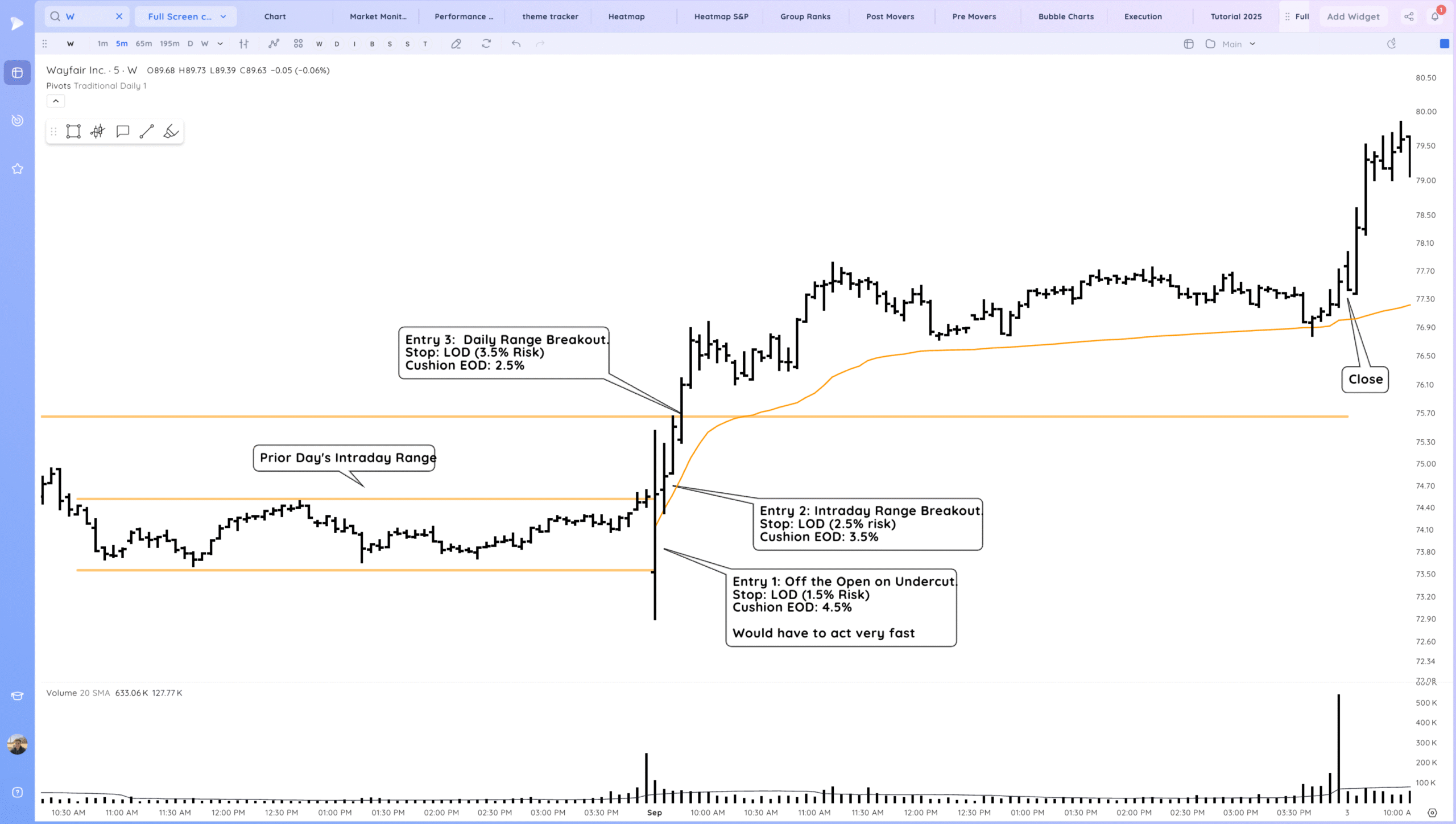

In the case of W it exhibited the undercut and rally entry tactic, my personal favorite.

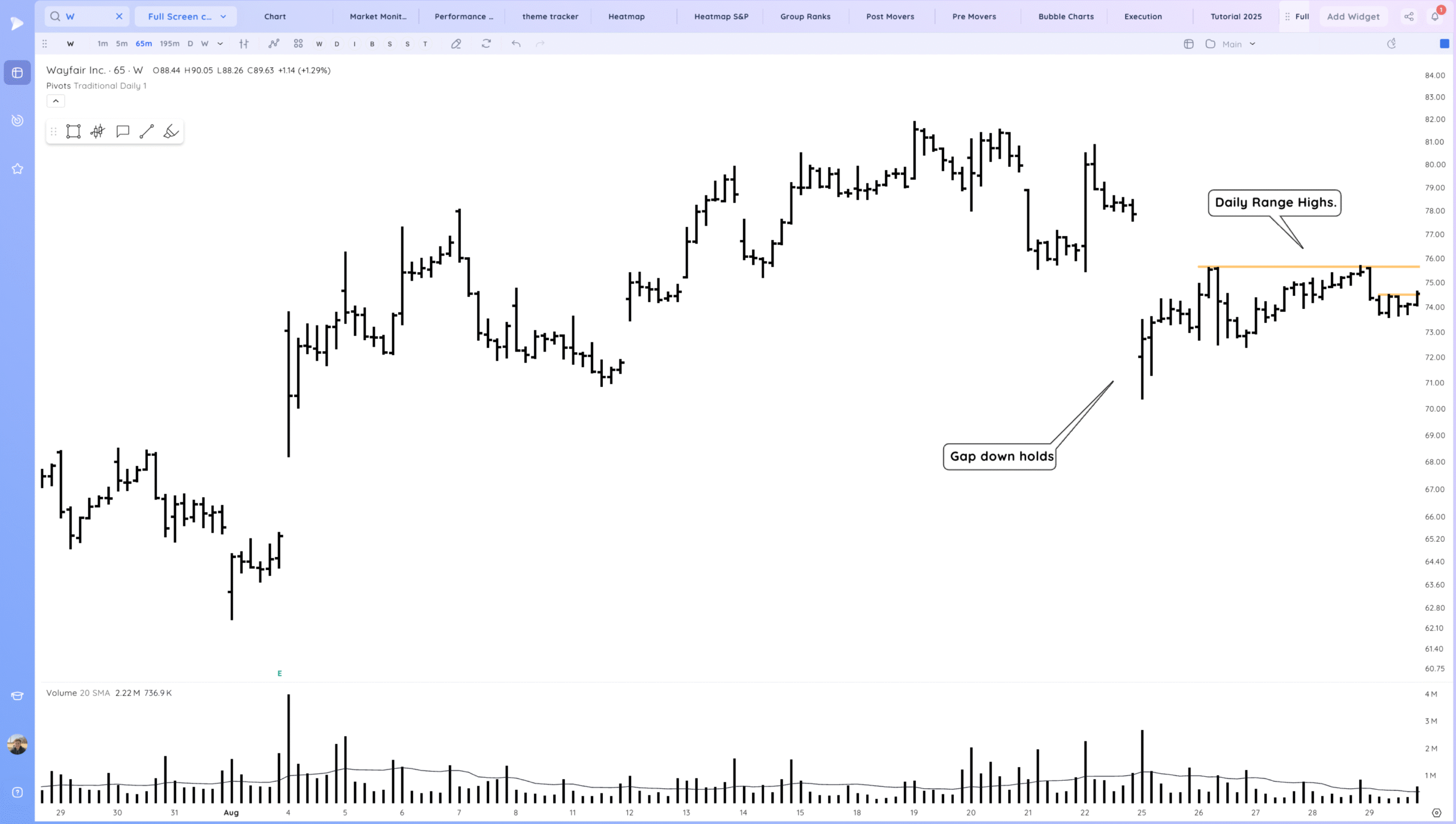

For ranges I typically like to go down to a 65 minute timeframe. This is AFTER I have identified the setup on a daily & weekly timeframe

Here is W on a 65 min before the undercut and rally.

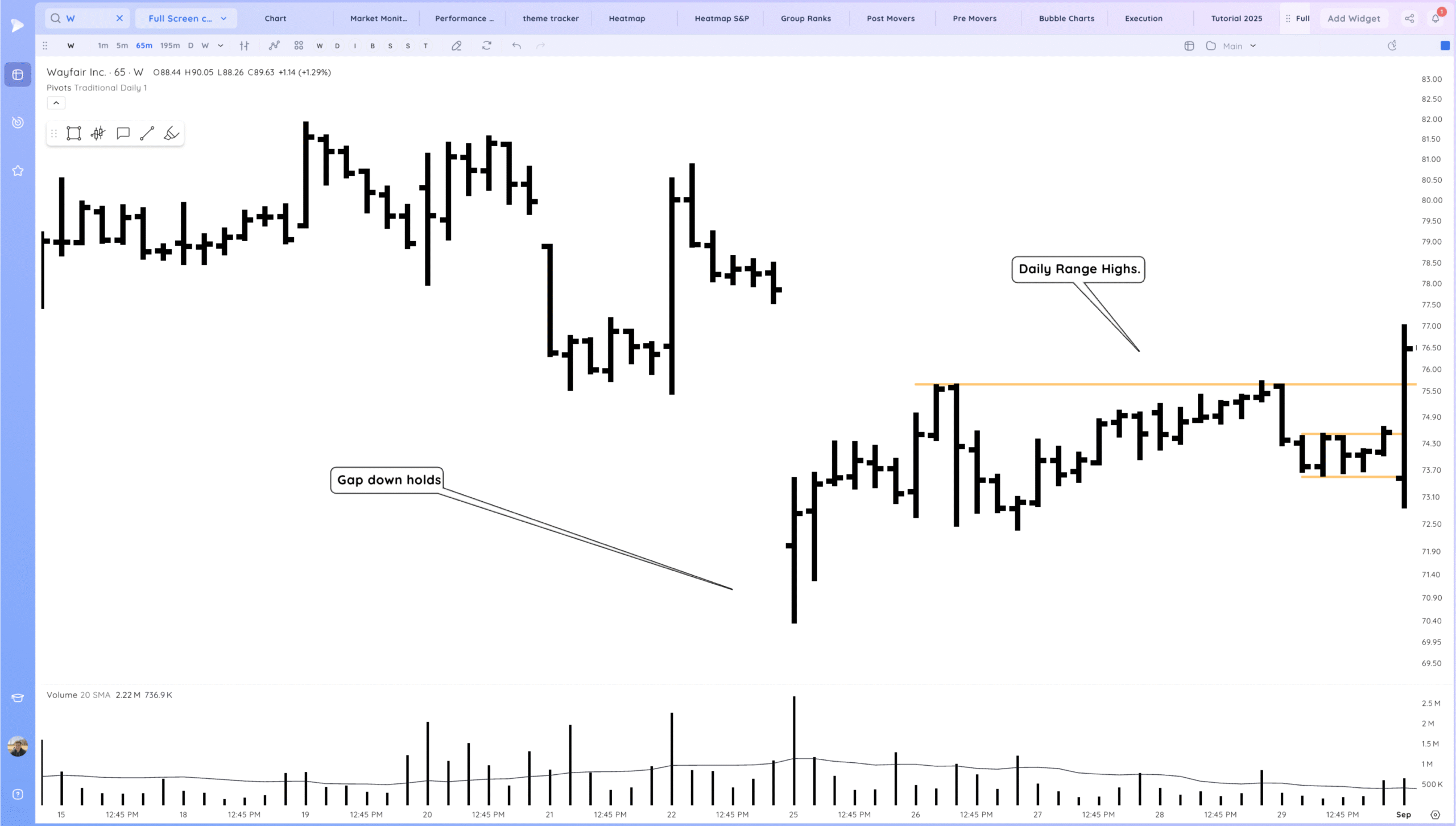

And here is the entry bar on a 65min timeframe.

What is really important here is the context of what the market was doing at the time.

This morning the market was gapping down. From this we could either rally off the open which would mean strong low risk spots with stops at LOD or we follow through down.

In this case we saw a strong rally off the open. allowing you to put some risk on to see if it sticks. The benefit of this type of entry is if the market fully rolls over we are stopped with only minimal losses (often less than 3% position stops)

Here were the potential entries for W. The Intraday Range Breakout is the most realistic.

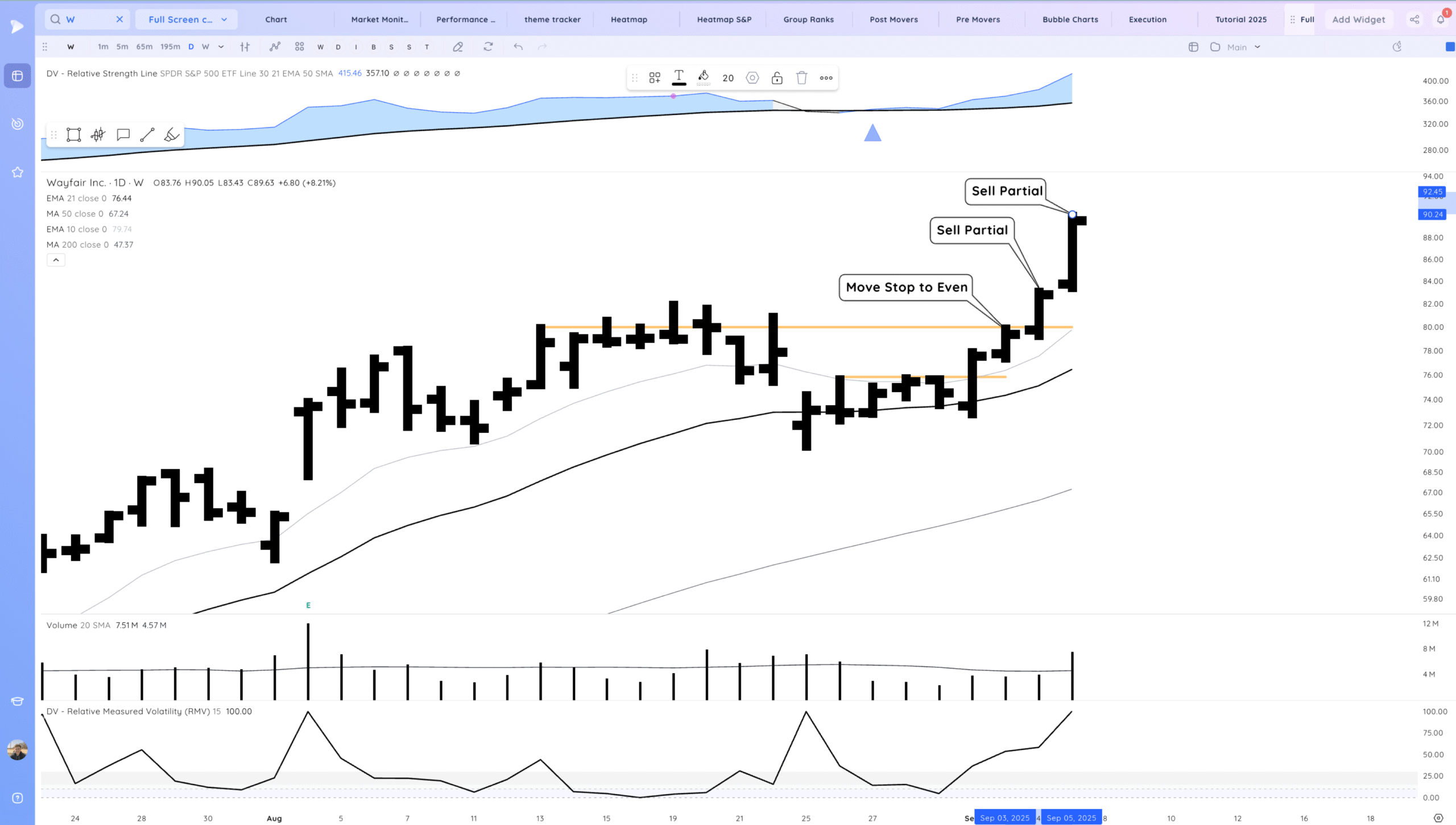

The next 3 days W followed through, allowing you to raise stops to breakeven and sell partials. Note how W started the move from a low RMV range.

Daily Chart:

Future thoughts

For a quick swing trader likely most should be sold already with the rest trailing at a short moving average like the 8 or 10ema.

For a position trader this was more of add opportunity but the 21ema is now above your cost so you could wait for 2 closes below that level.

This was a short stubby base but W is potentially starting a turnaround trend. We are at a key weekly/longer term level now.

Takeaways

W is a textbook undercut and rally range breakout.

I view it more as a tradable stock like CVNA that can make strong moves but is not the typical CANSLIM type name, more suited for swing trading.

However we will see if it can continue the current trend and start in earnest a longer term Stage 2 uptrend

Homework

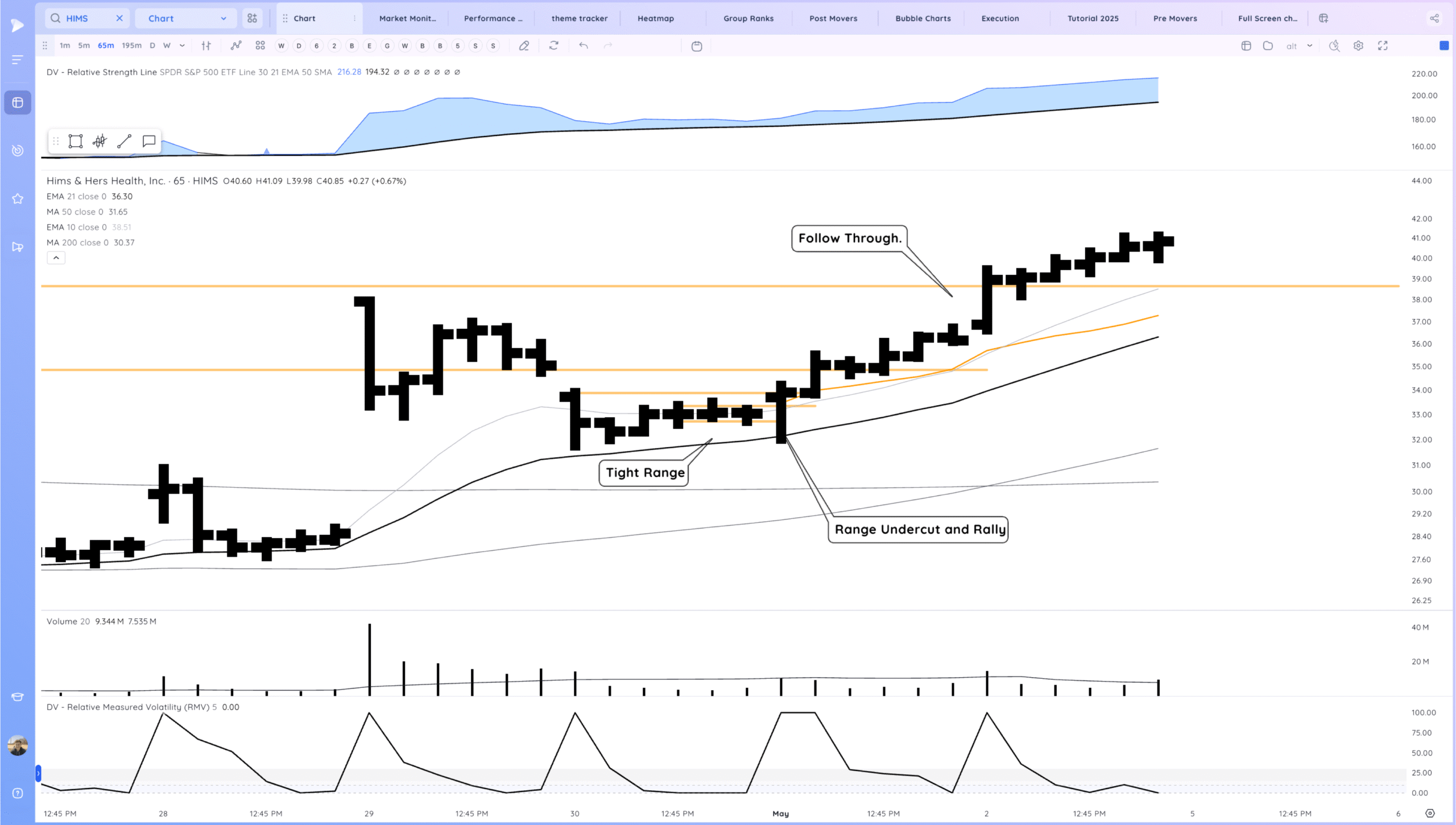

Here are a few other Range breakout undercut and rallies to study. I challenge you to find 2 more examples.

HIMS undercut and rally after the April 29 2025 Gap up

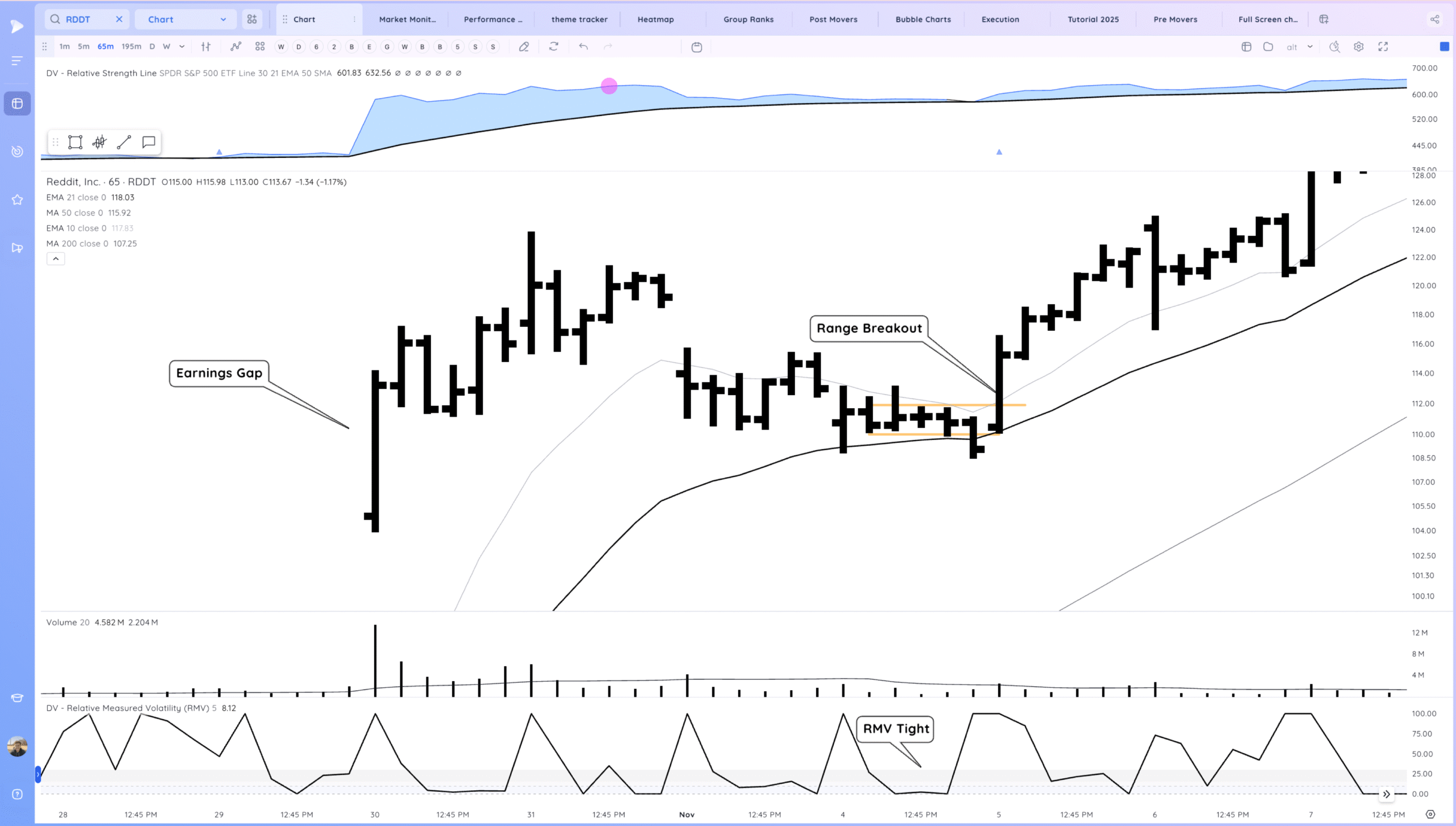

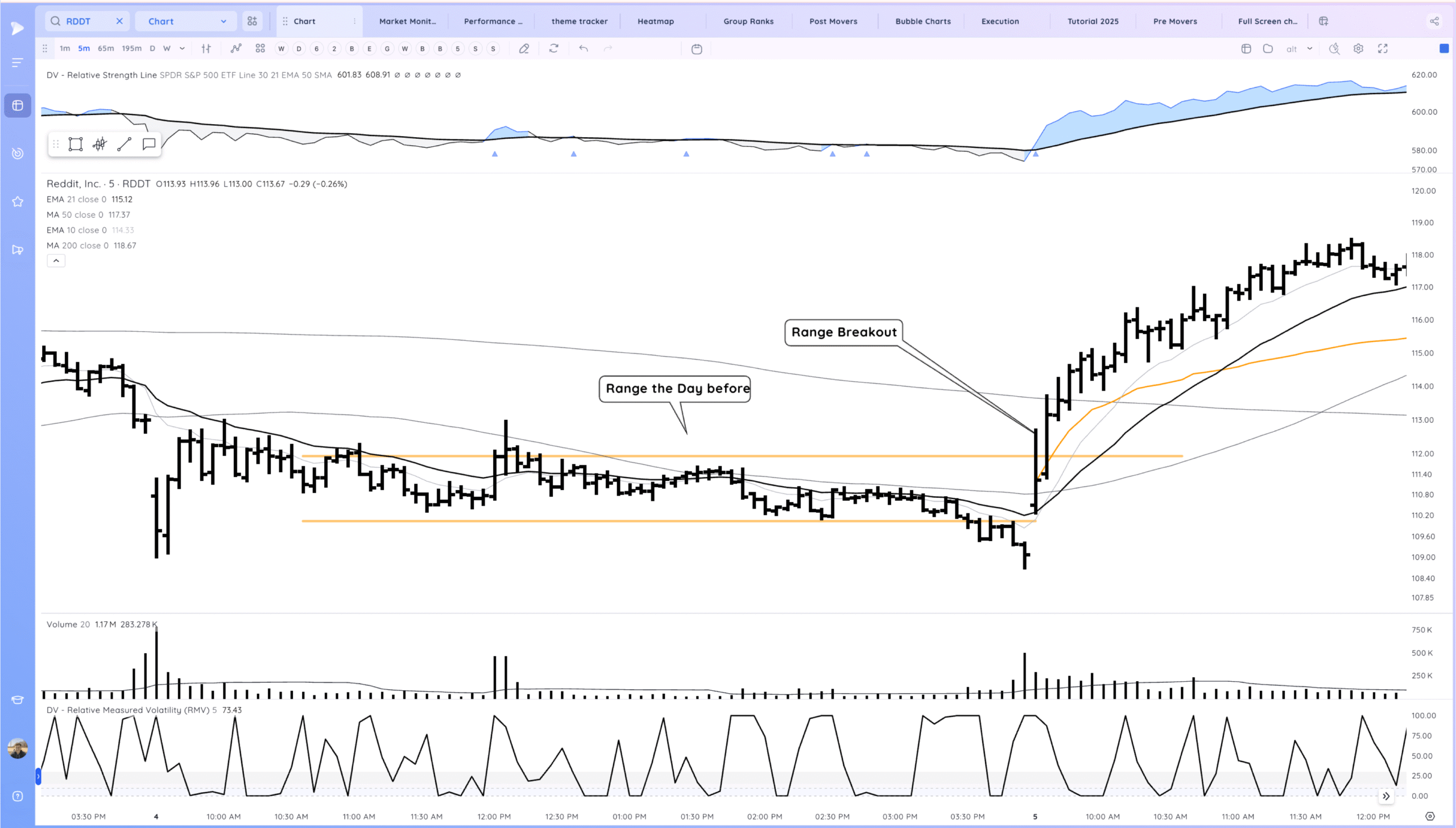

RDDT after its earnings gap is an example of a range breakout on the 65 min

Here it is on the 5 minute

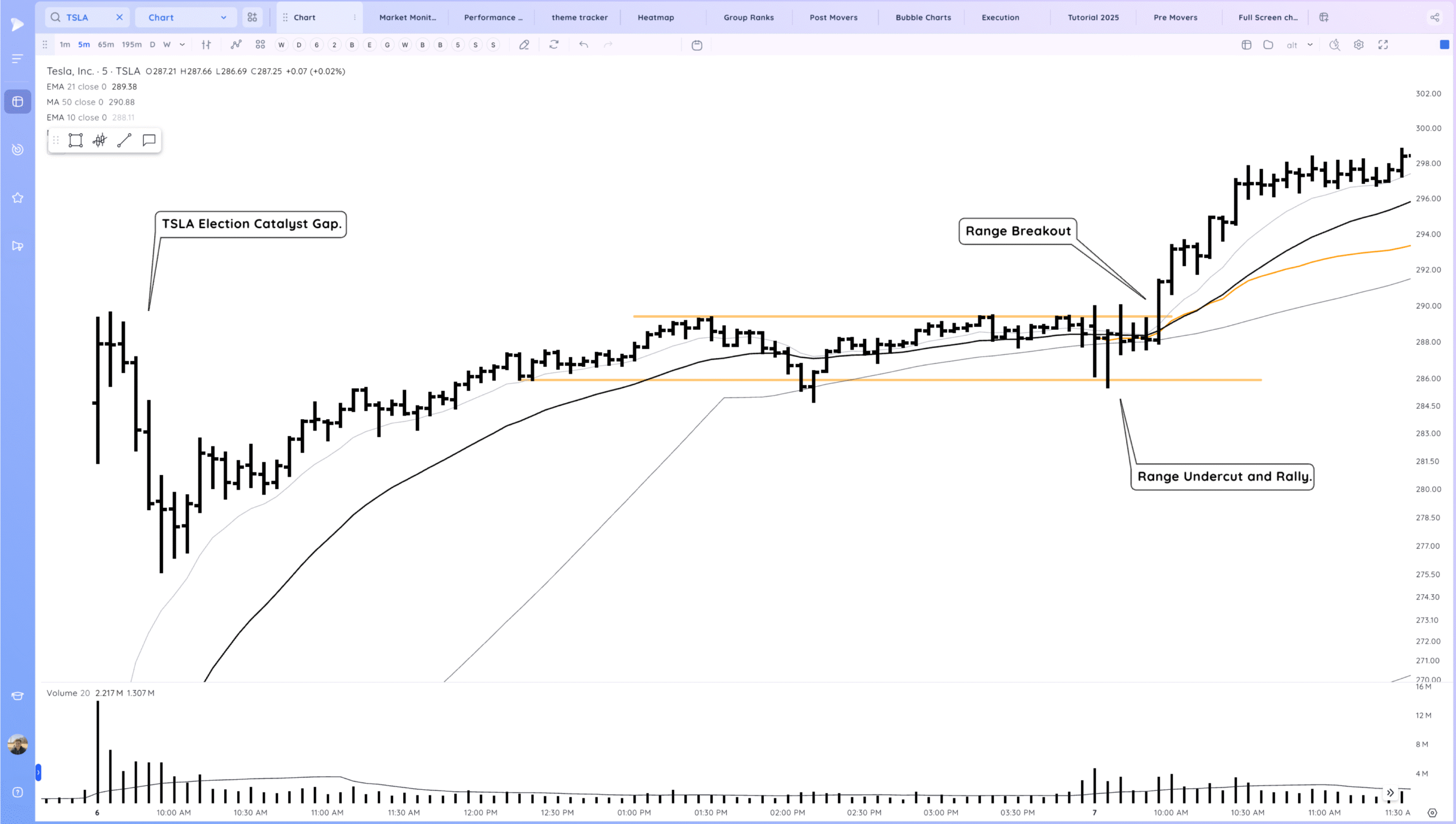

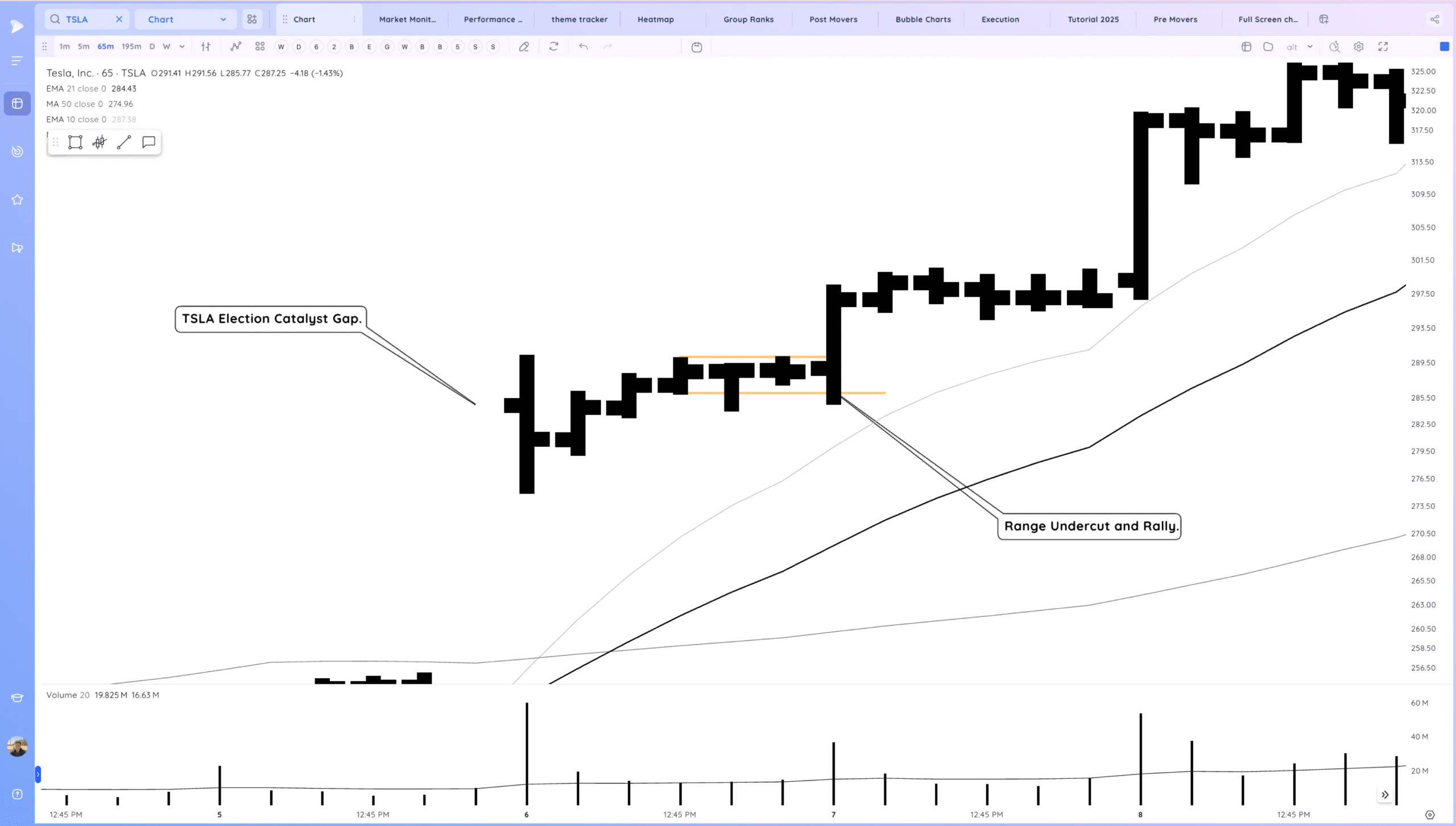

Here is TSLA after the election catalyst Nov 6 and 7 on the 65 minute TF

Here it is on the 5 minute