HOOD and APP Added to S&P 500

Richard Moglen

Stock Trader & Student of the Markets. I help traders improve their systems & performance at TraderLion & Deepvue

September 5, 2025

Market Action

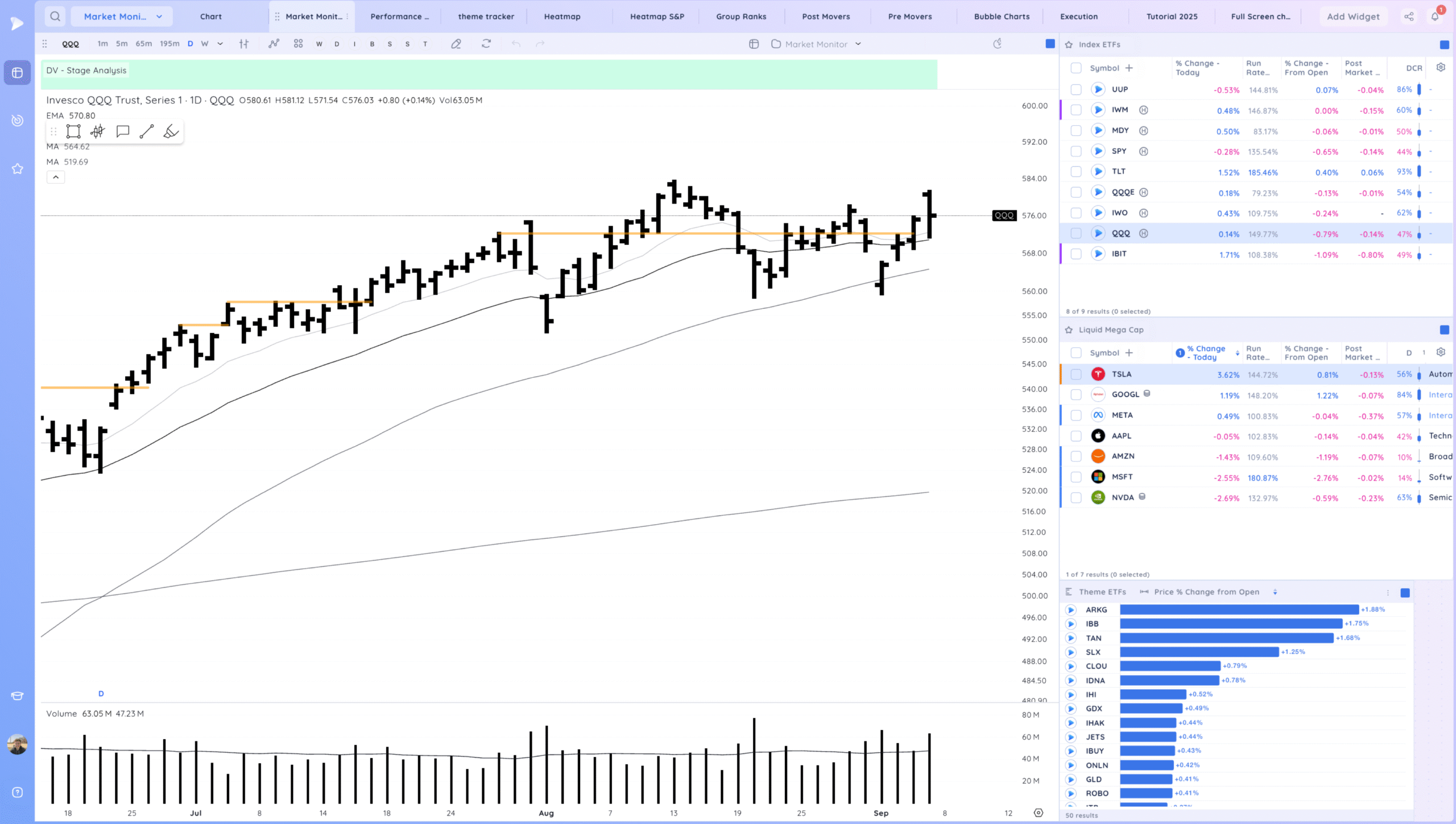

QQQ – Gap up and selloff, basing, then a gradual move off lows. Overall a strong week retaking the 21ema after the gap down Tuesday. In my view we’ve been consolidating for about 5 weeks now.

Bulls want to see a continued trend higher/constructive range sideways and move from this consolidation

Bears want to see a reversal lower breaking back below the 21ema

Daily Chart of the QQQ.

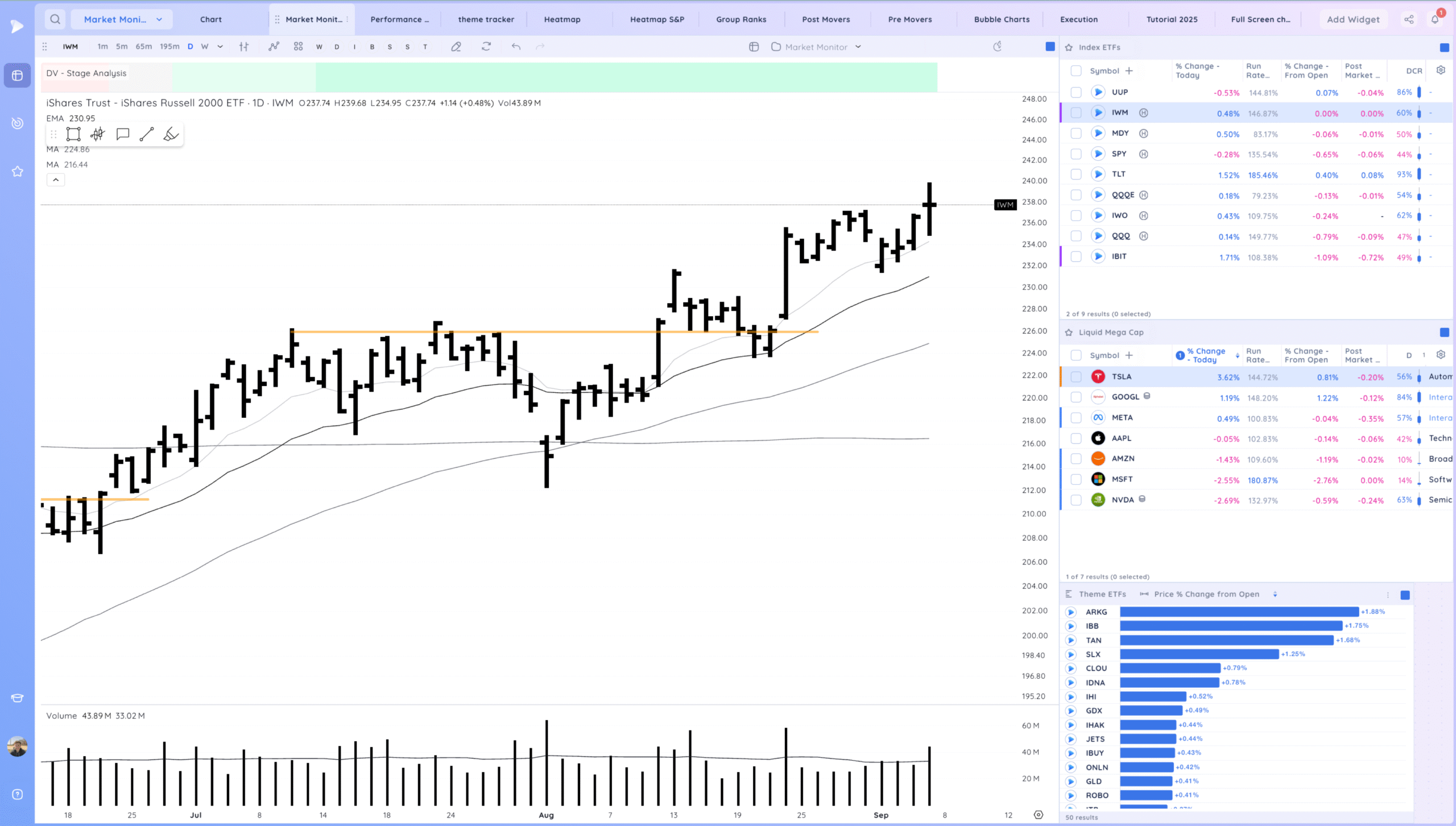

IWM – Wide range day with overall a close near the open, good push off lows

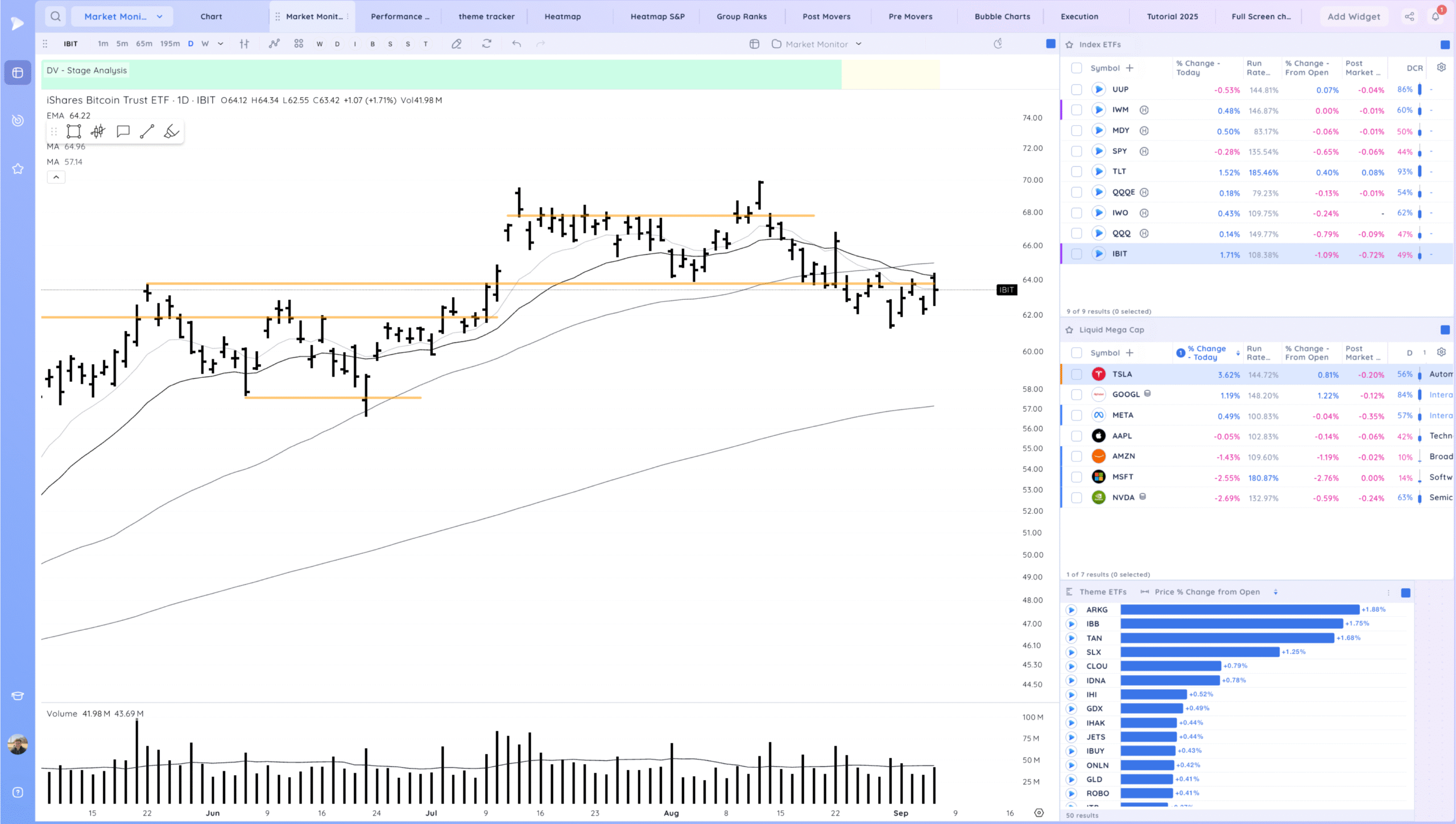

IBIT – Gap up above the key level, then rejected for now at the 21ema. Overall not much downside progress the past 2 weeks

Trends (4/4 Up) – Based on the QQQ

Shortest – 10 Day EMA – Above

Short-term – 21 ema – Above

Intermediate term – 50 sma – Above Rising

Longterm – 200 sma – Up – Above Rising

Groups/Sectors

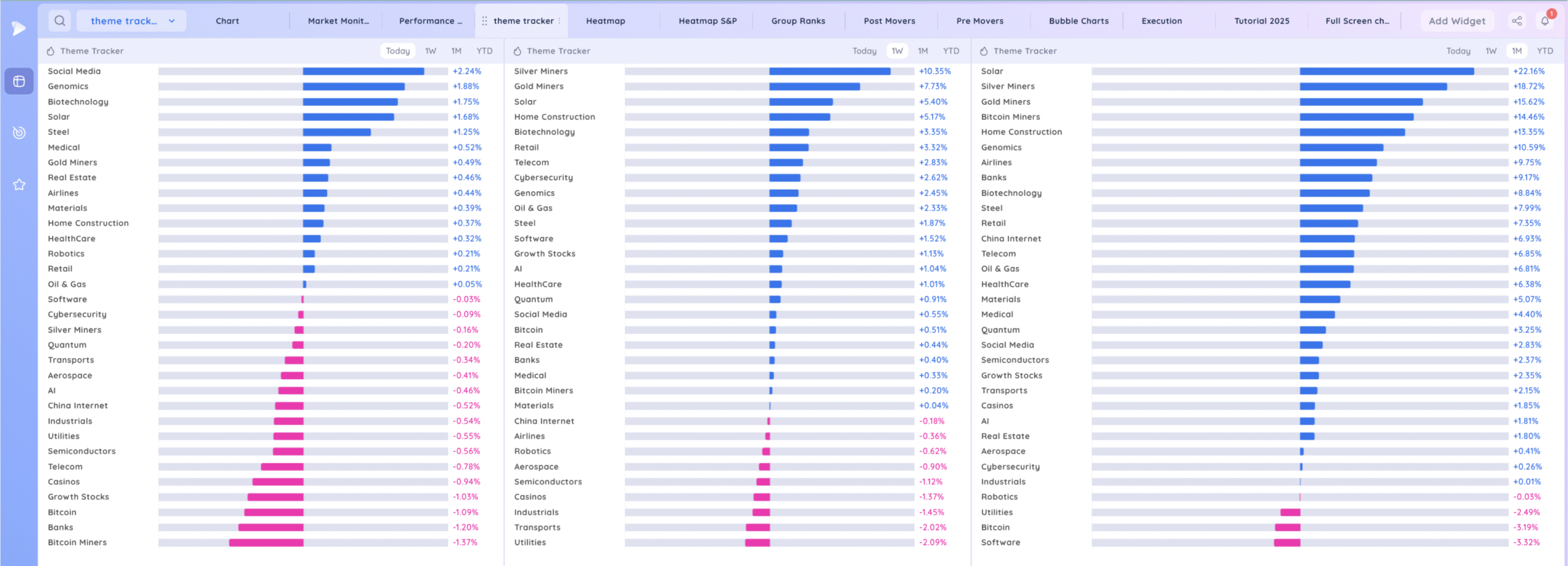

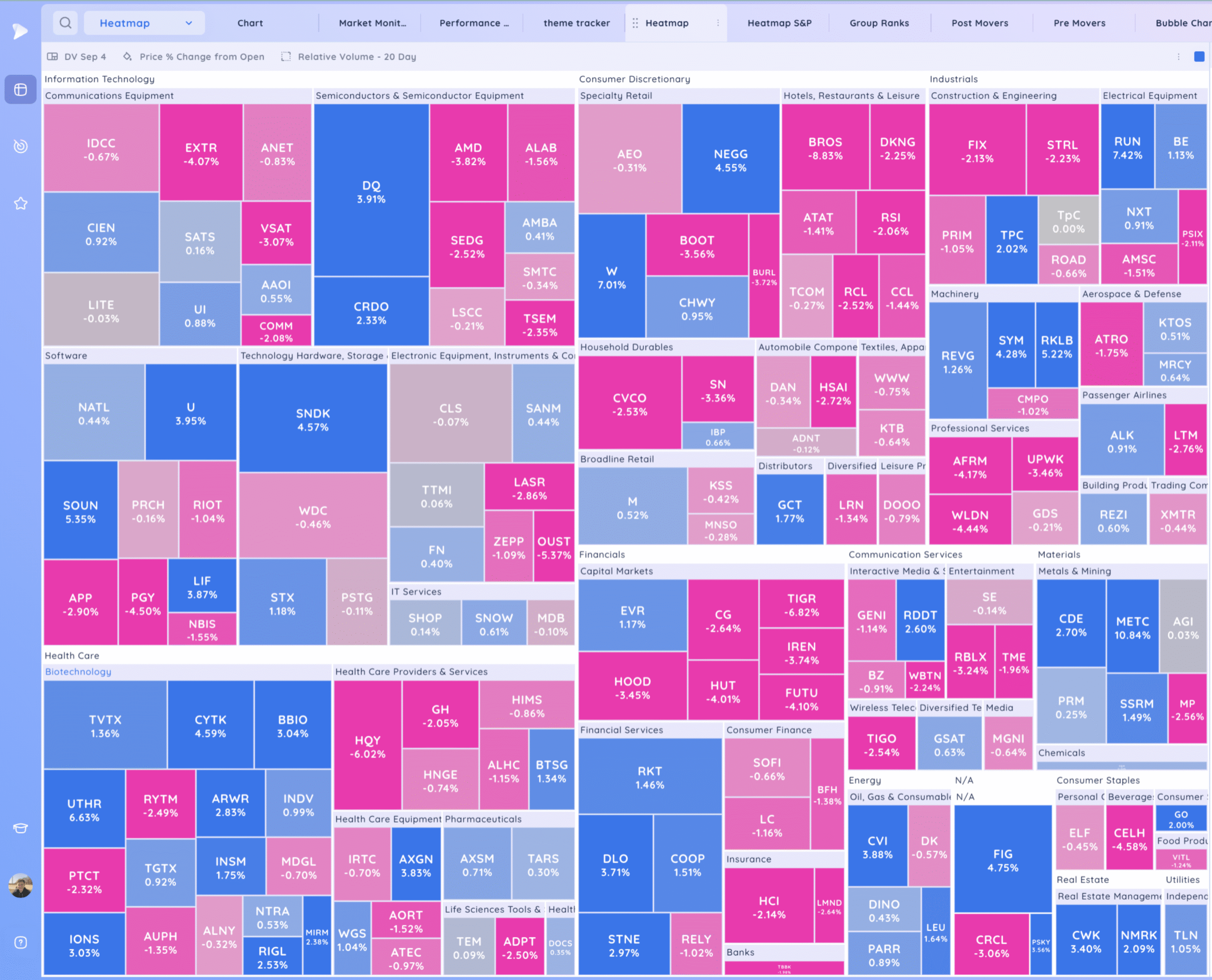

Deepvue Theme Tracker

Deepvue Leaders

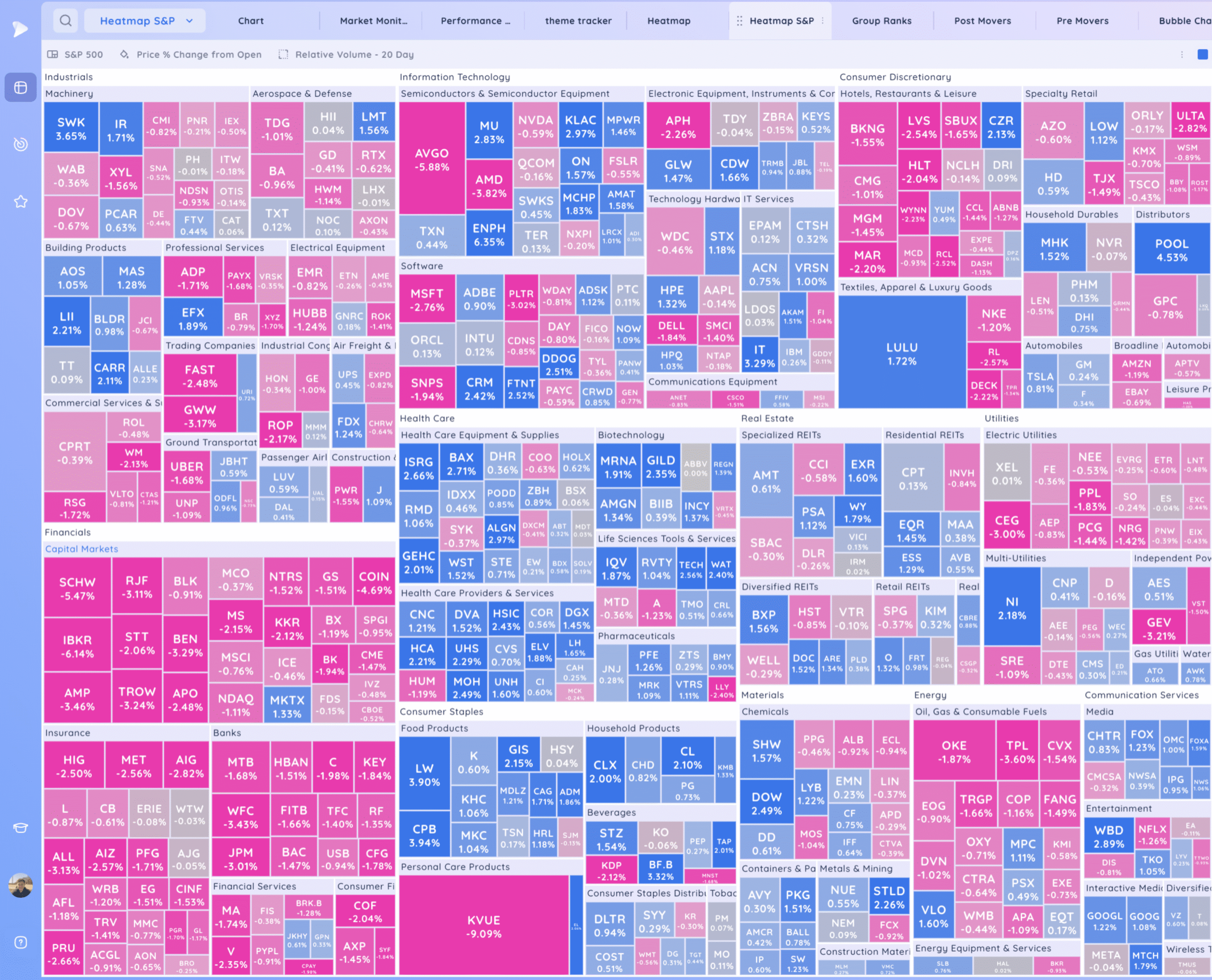

S&P 500.

Leadership

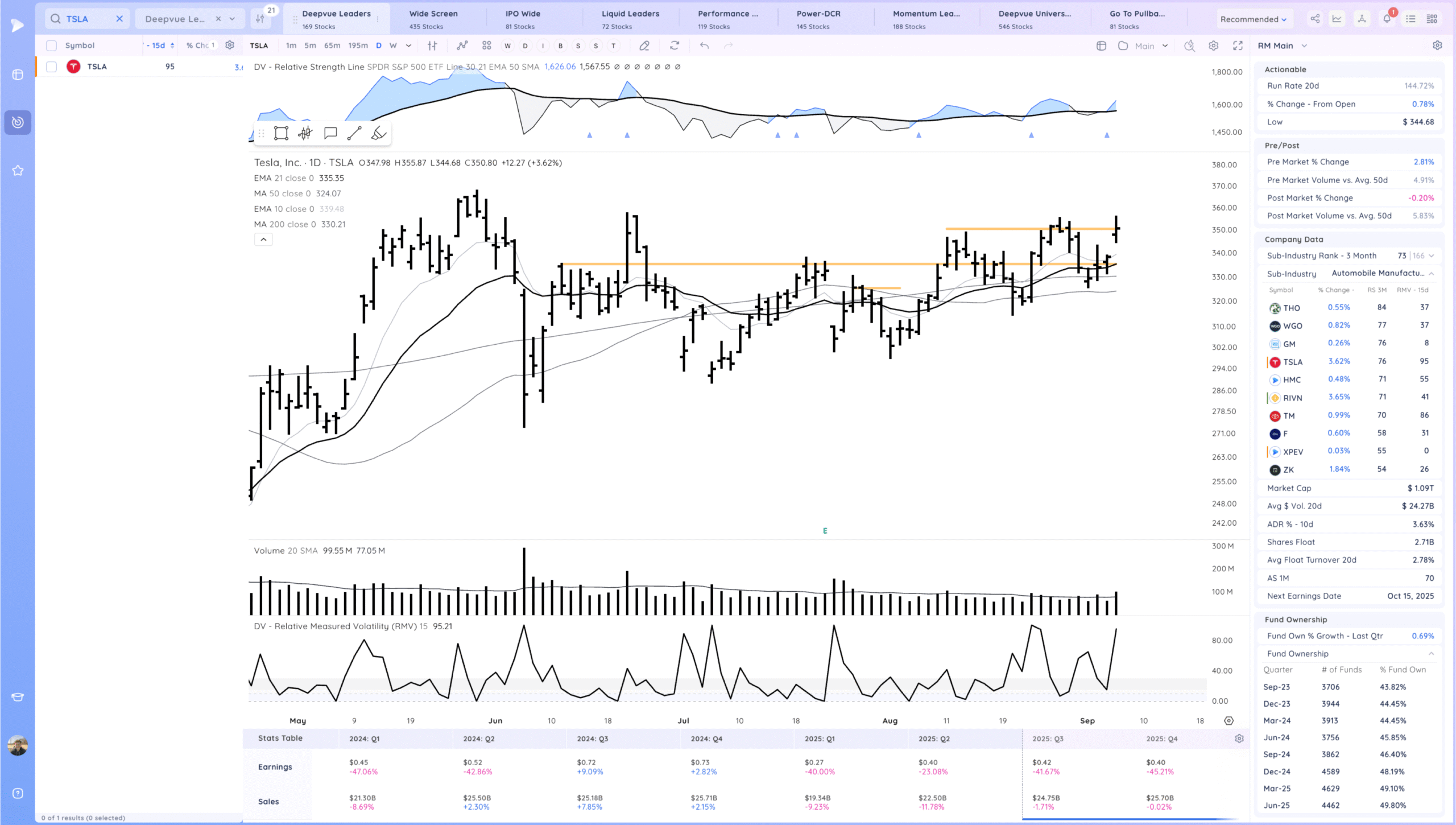

TSLA Gap up and stabilizing into the close. View this as positive. Watching for follow through up next week

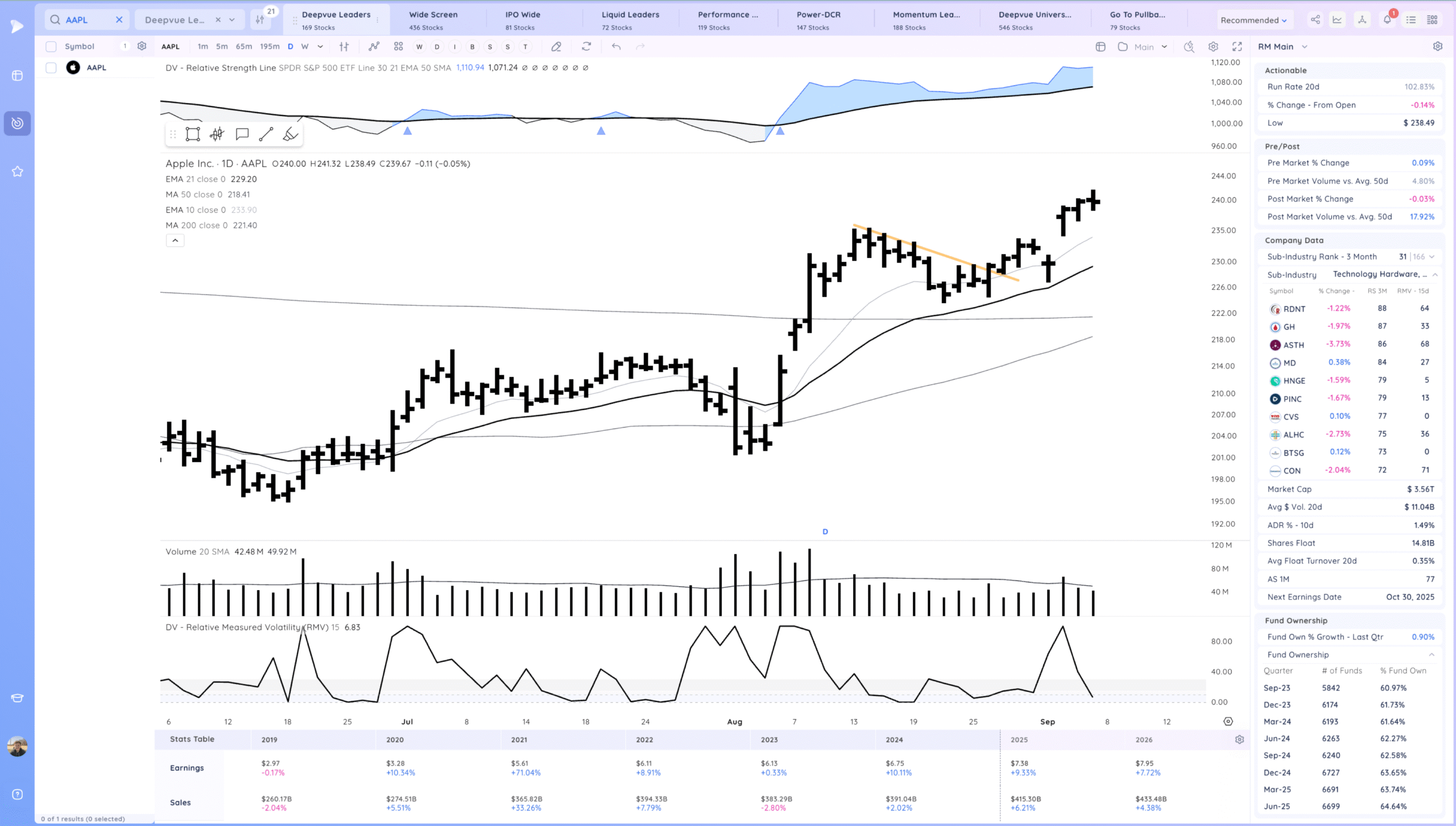

AAPL grinding higher

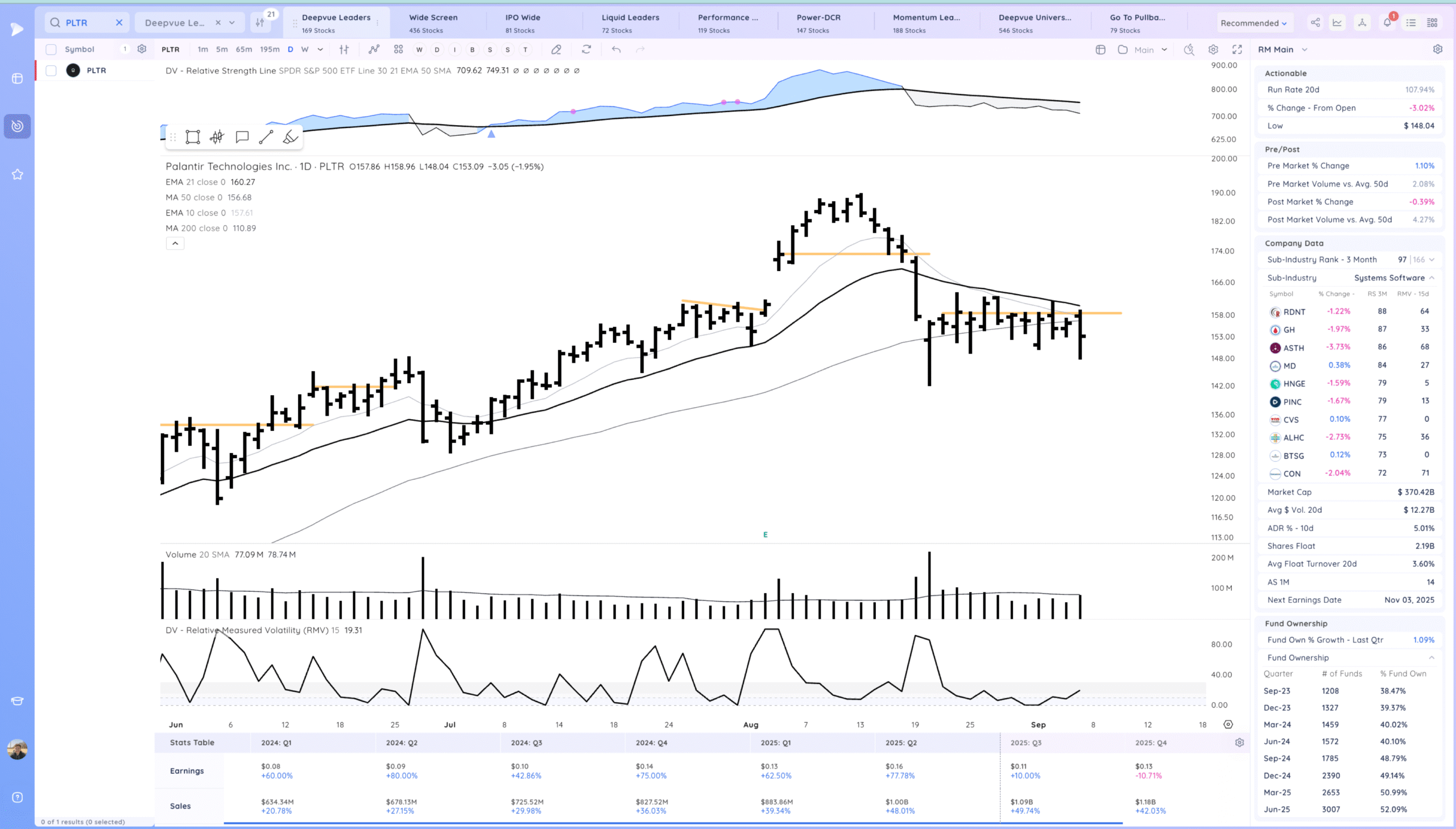

PLTR Continues to form out this range. big of a shakeout lower today. Watching for a pop through the moving averages

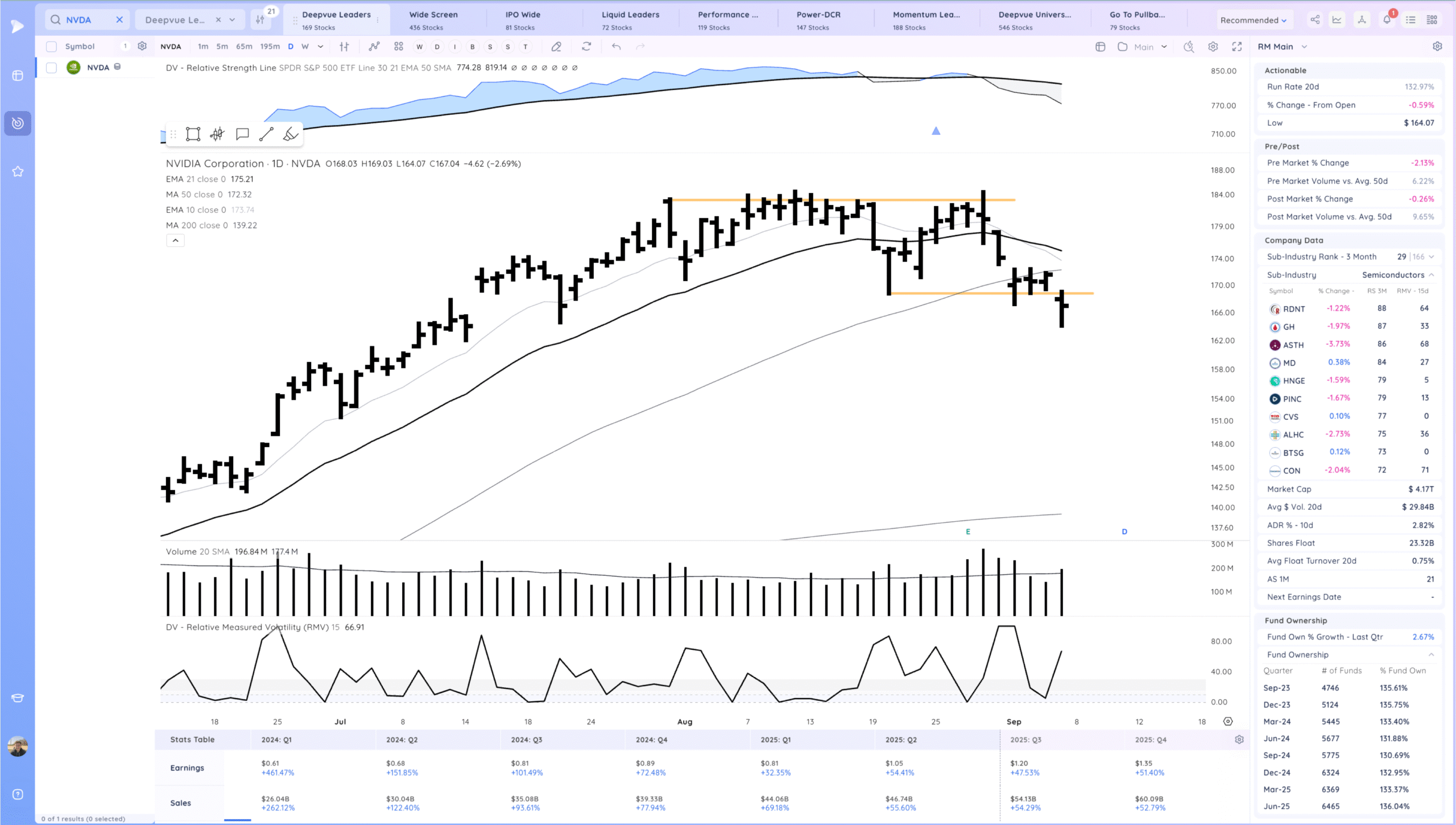

NVDA Expansion down but then a push off lows. Living below the 21ema for now. if it can follow through higher next week it would start a move up the right side of the base. Needs to reclaim the MAs

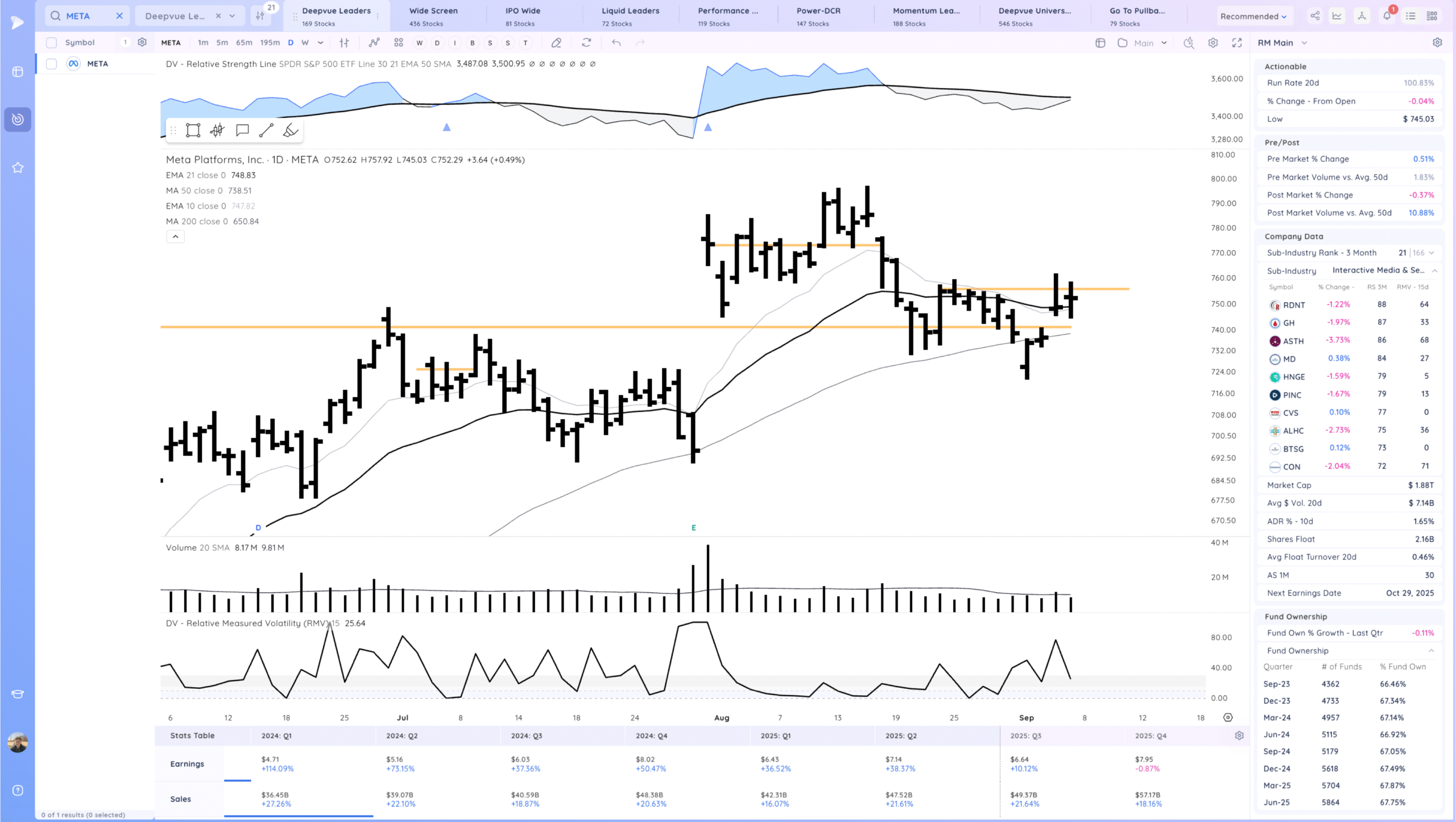

META Consolidation day after the gap up. Constructive

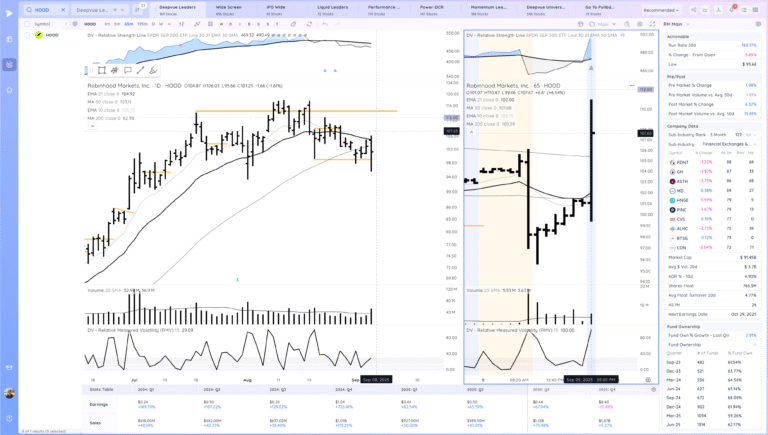

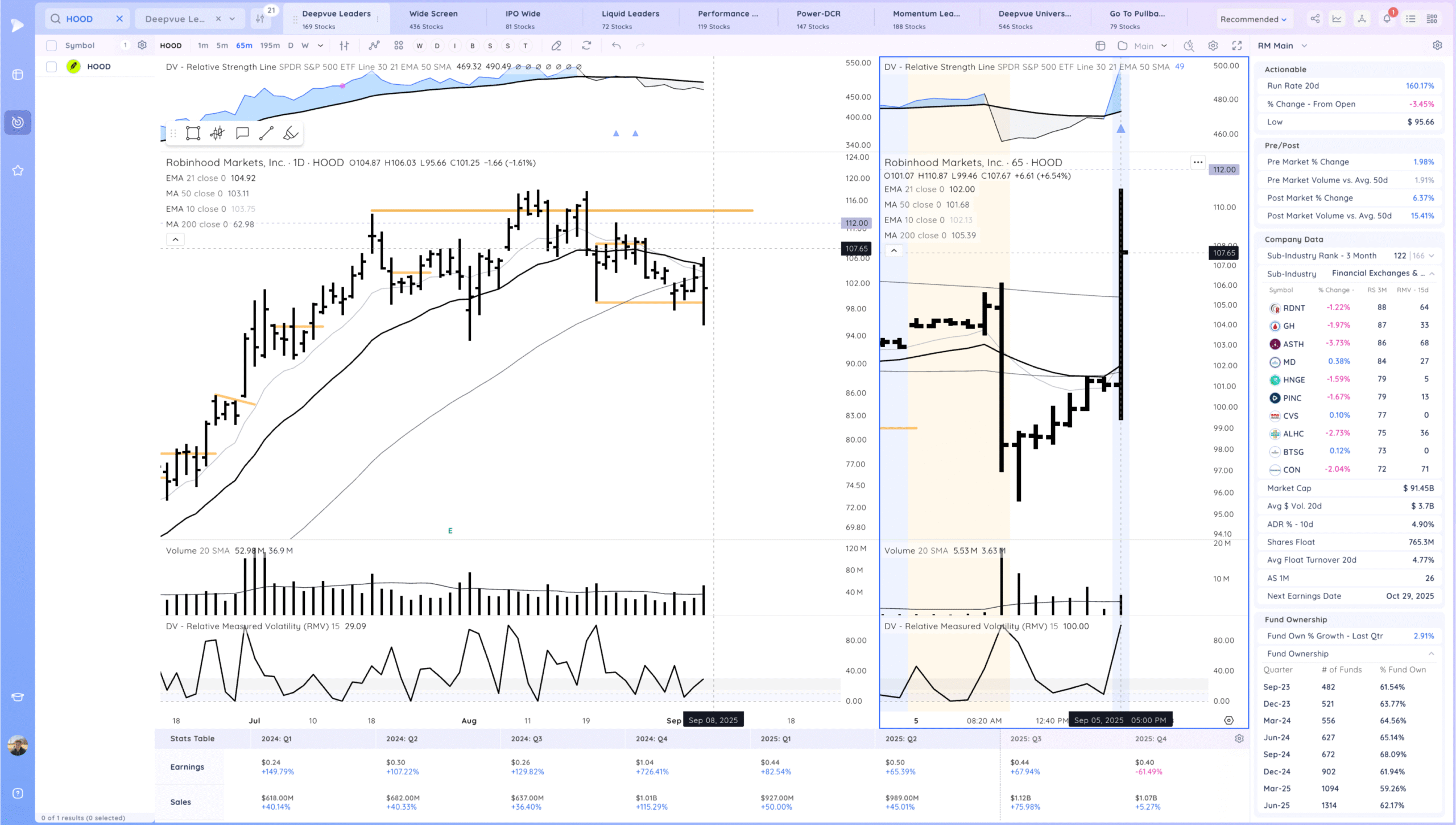

HOOD Gapping up after hours on S&P inclusion. On watch early next week. Popping above the MAs. APP also added

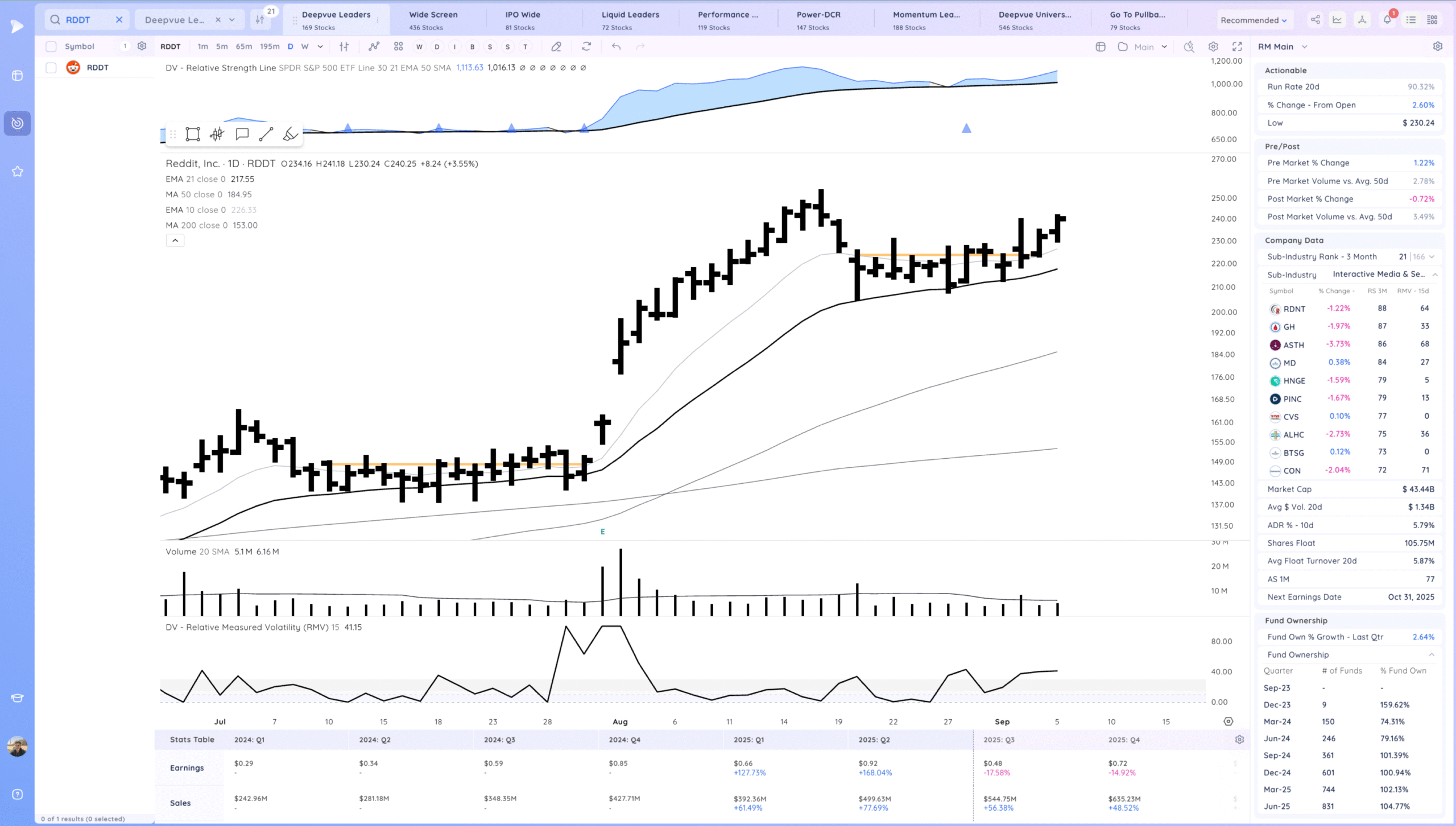

RDDT Some follow through up. Ideally pulls in slightly and tightens before re-confirming

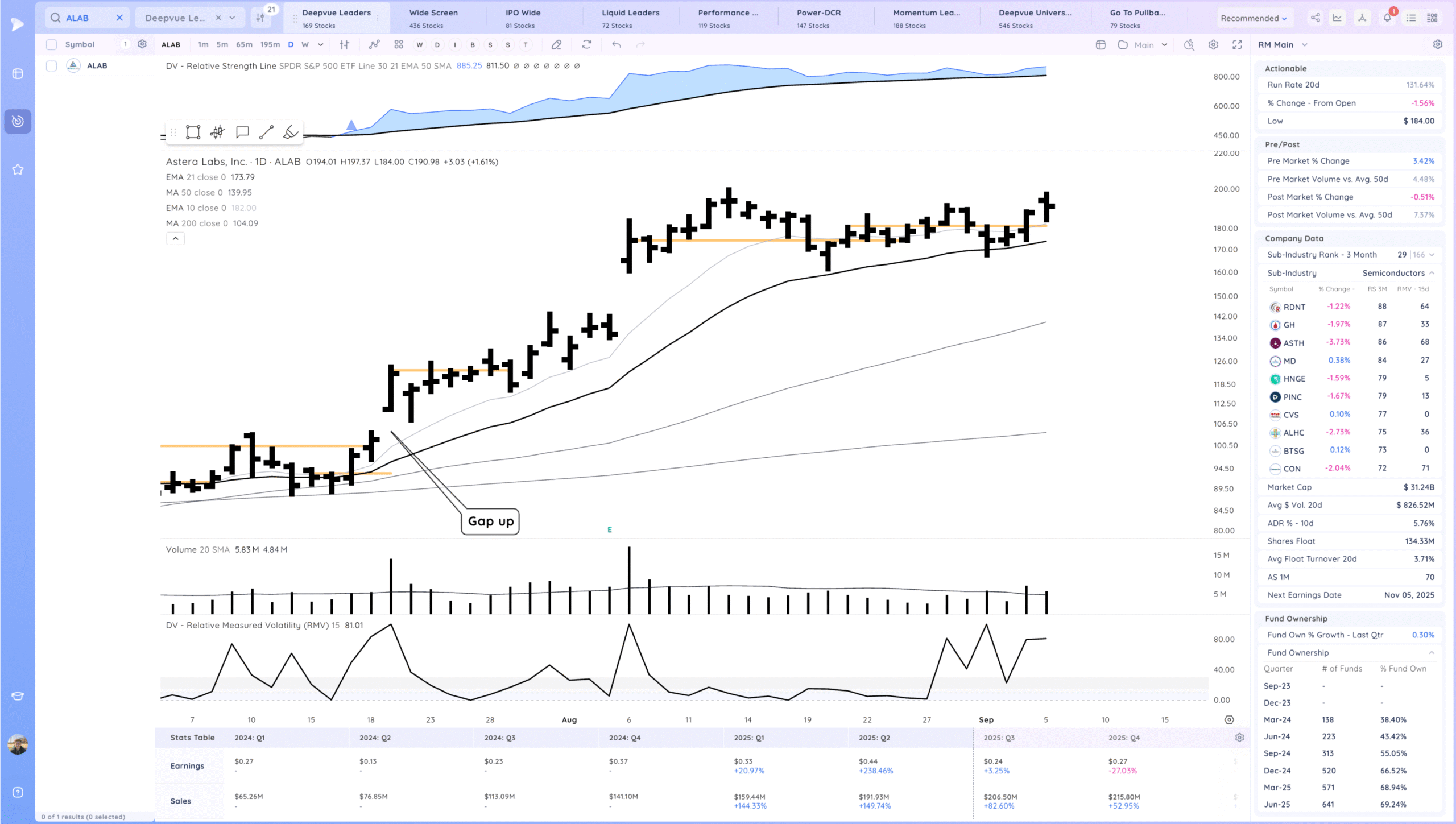

ALAB Follow through up and nice move off lows. If it tightens again will look to add.

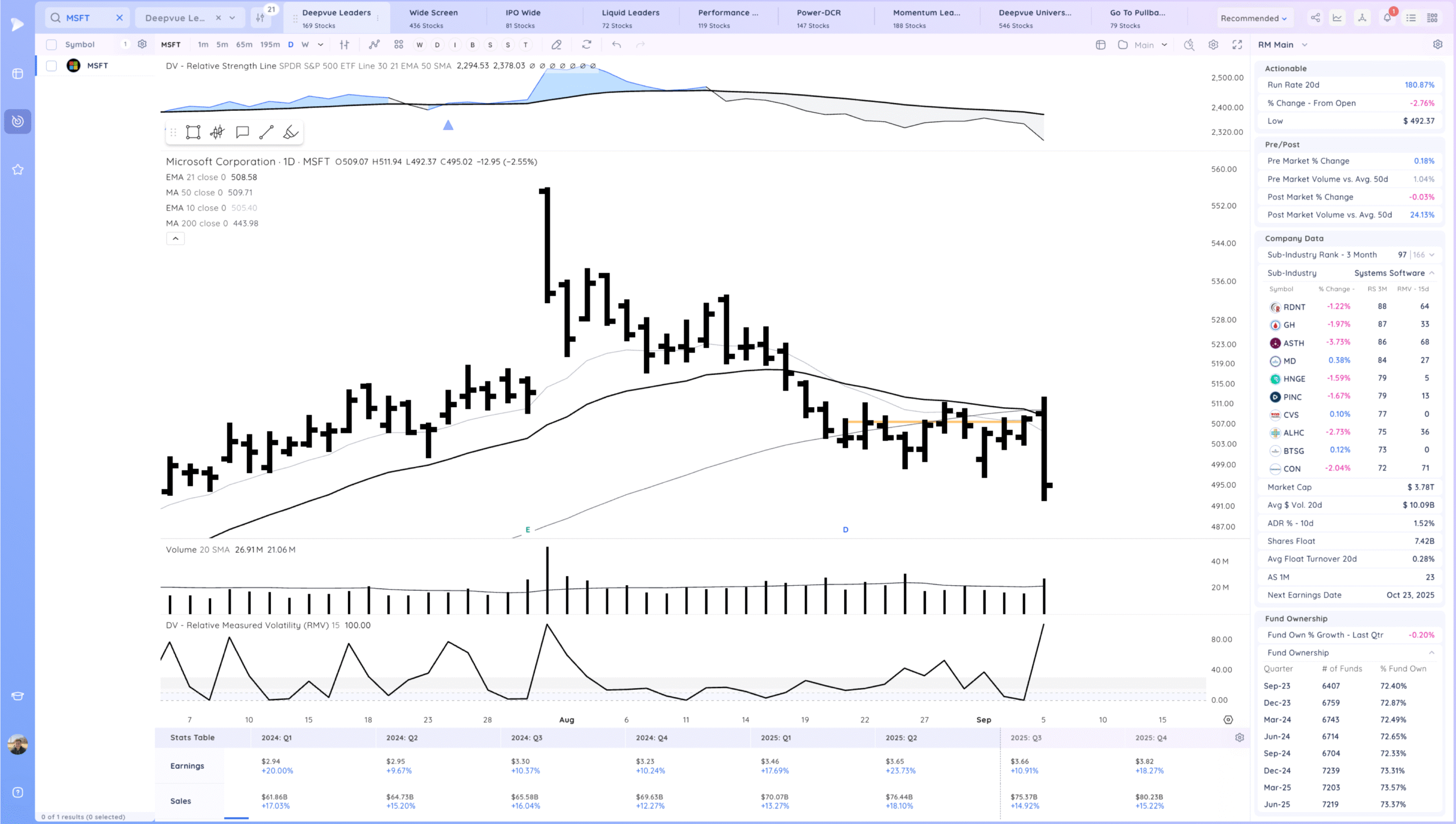

MSFT Large downside reversal failing at the MAs. Continues to be relatively weak

Key Moves

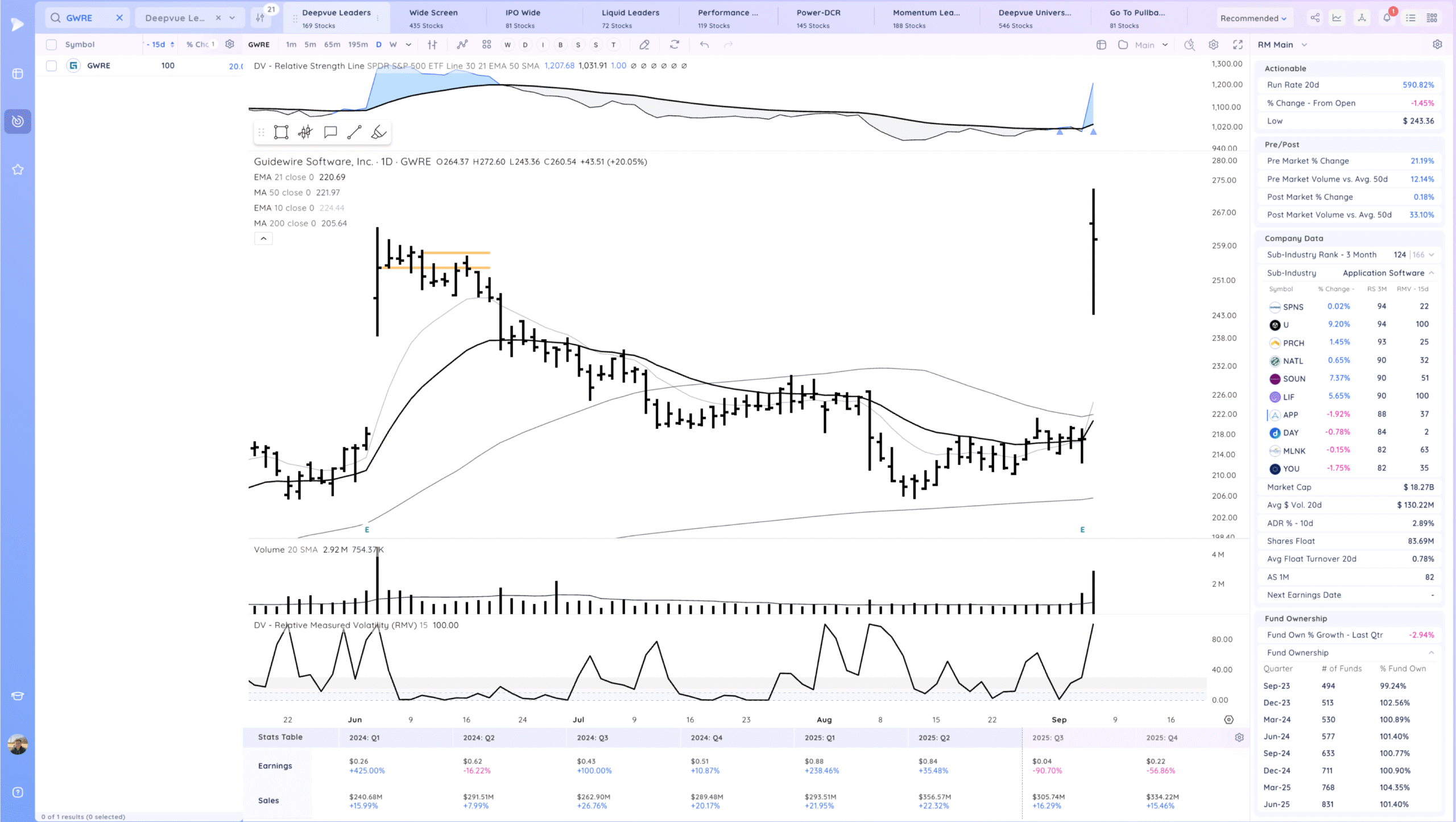

GWRE gap up and volatile day on earnings surprise

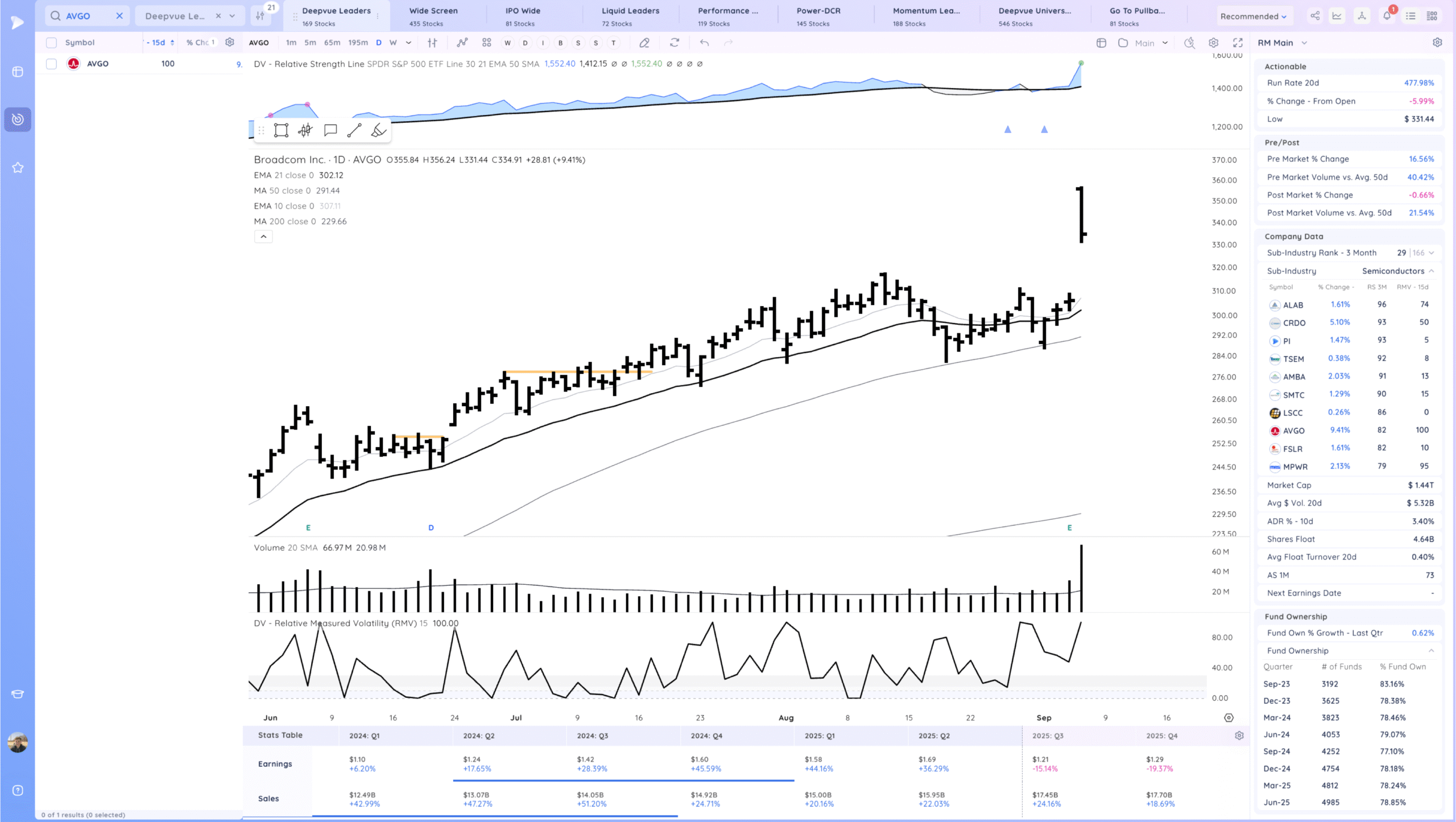

AVGO gap up but close near lows. Think ALAB CRDO strongest in the theme

Setups and Watchlist

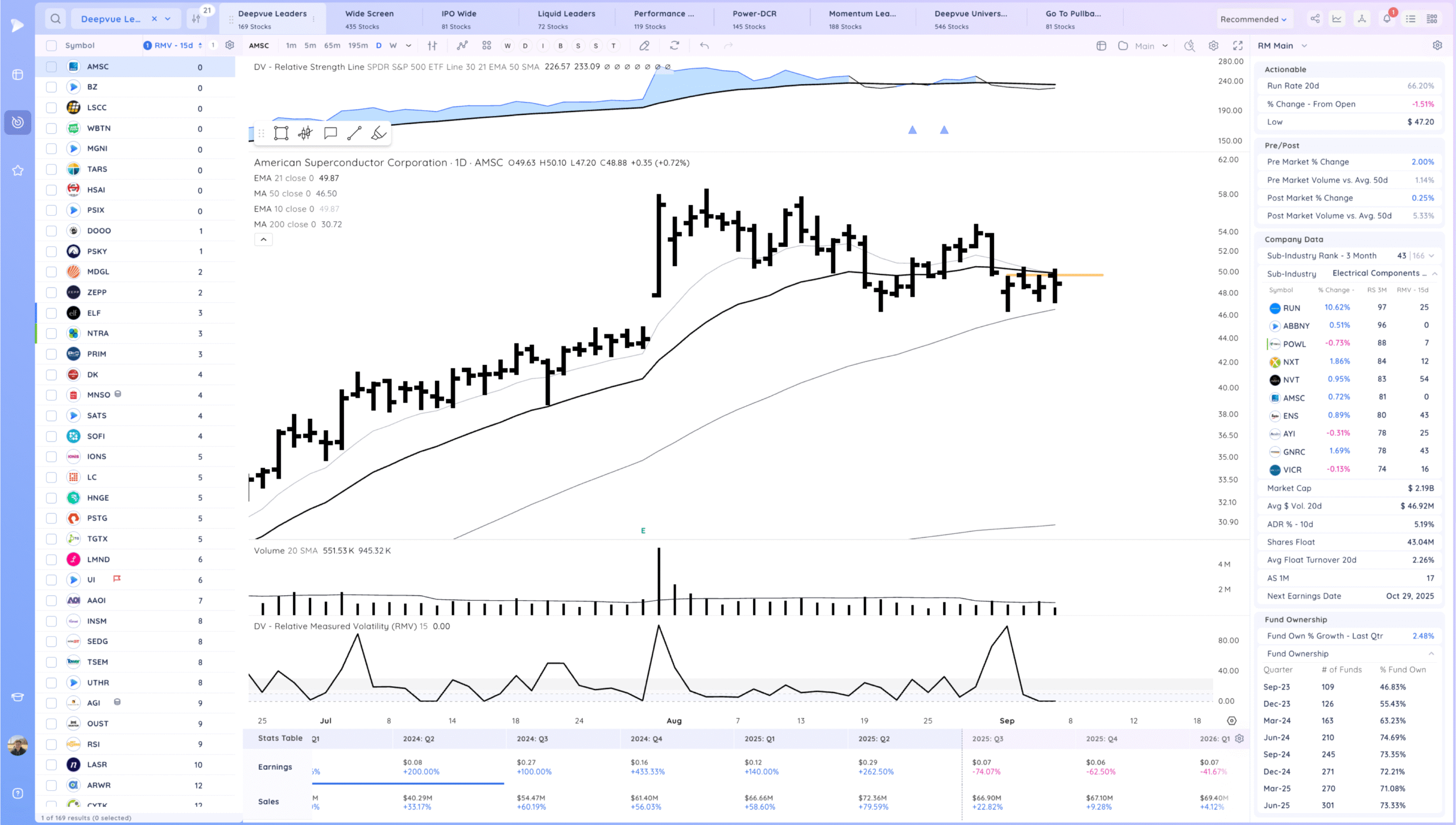

AMSC watching for a range breakout and pop through the 21ema

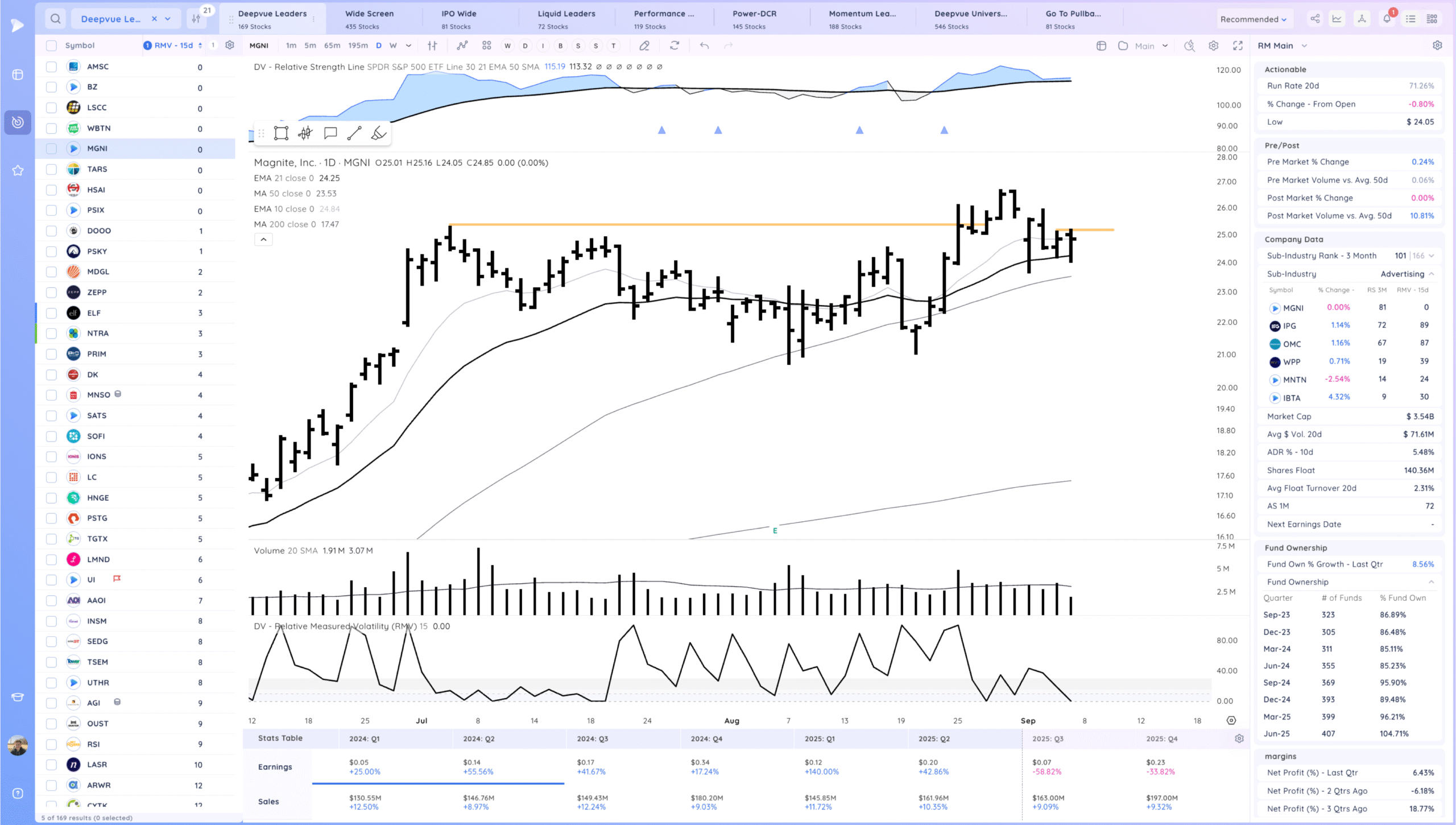

MGNI watching for a range breakout.

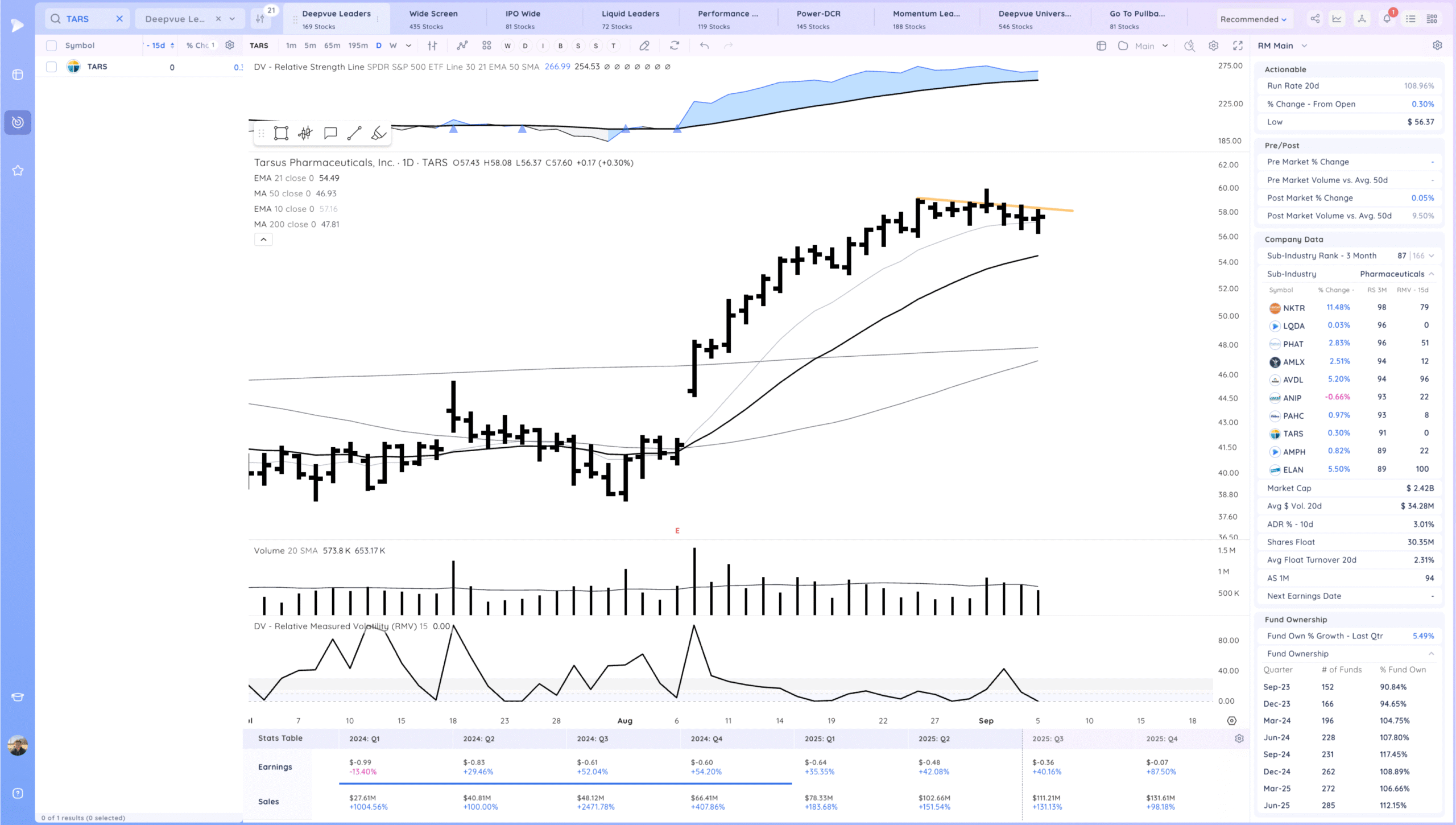

TARS 10ema pullback, watching for a flag breakout

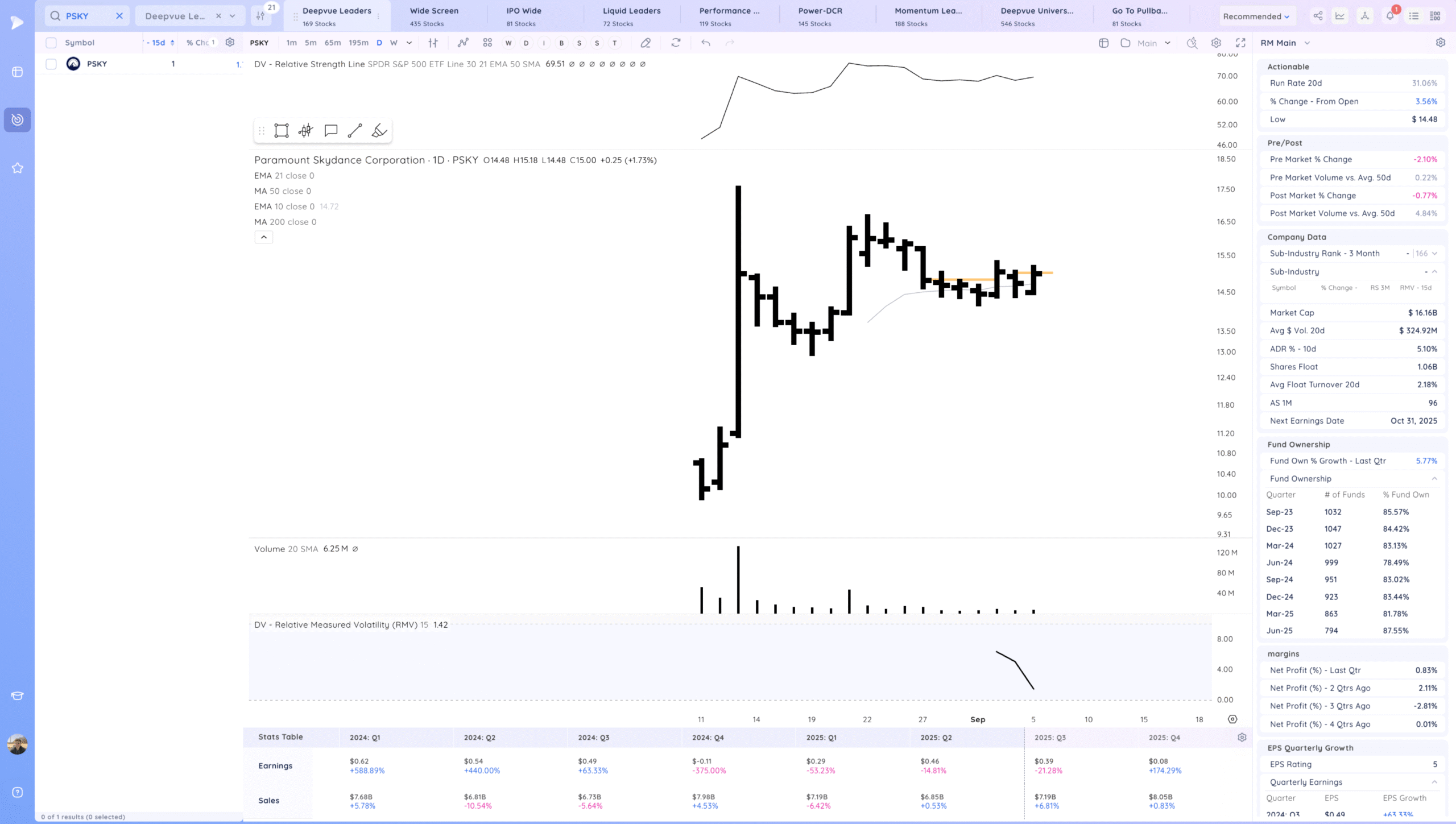

PSKY watching for a range breakout

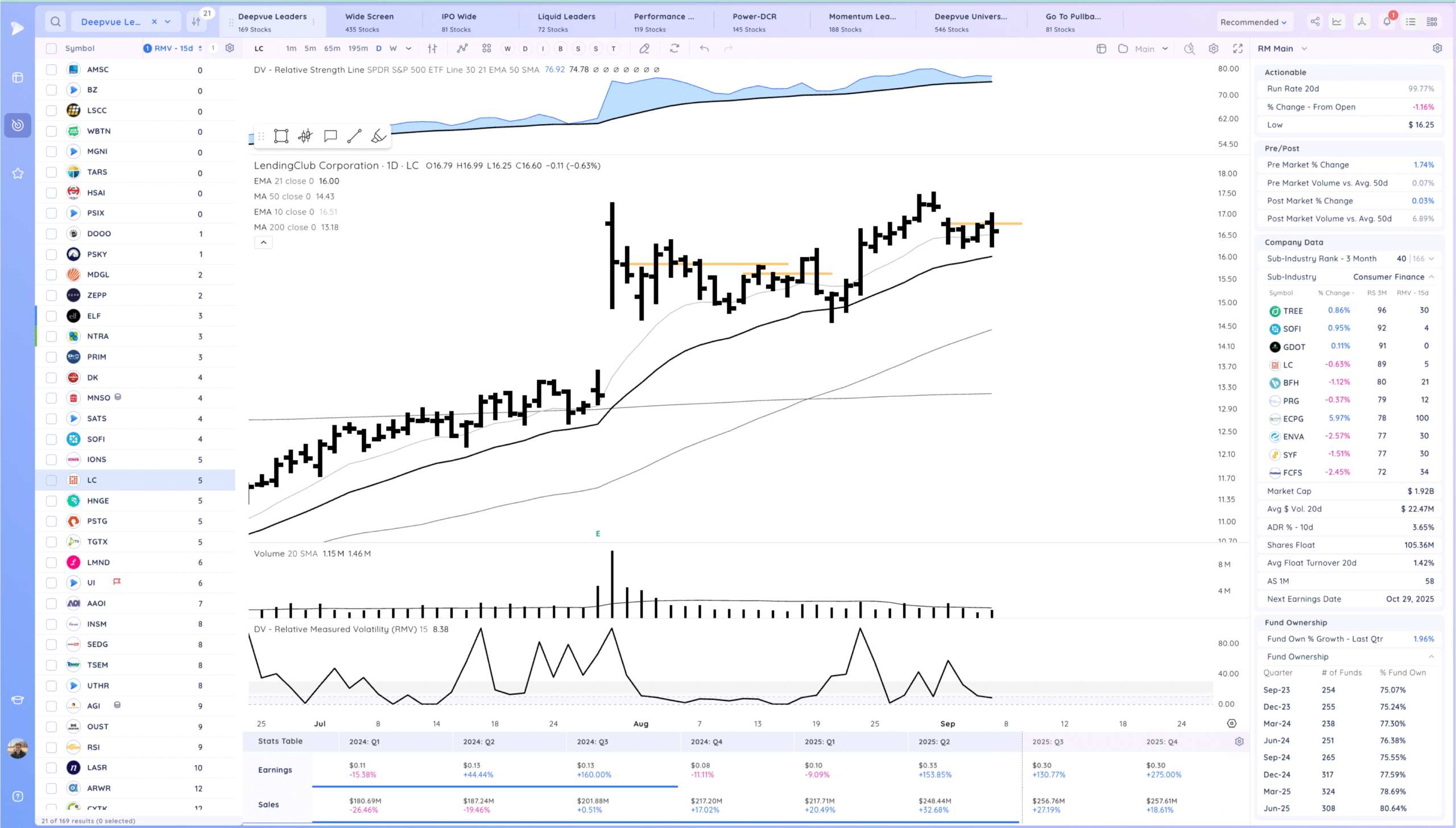

LC watching for a range breakout

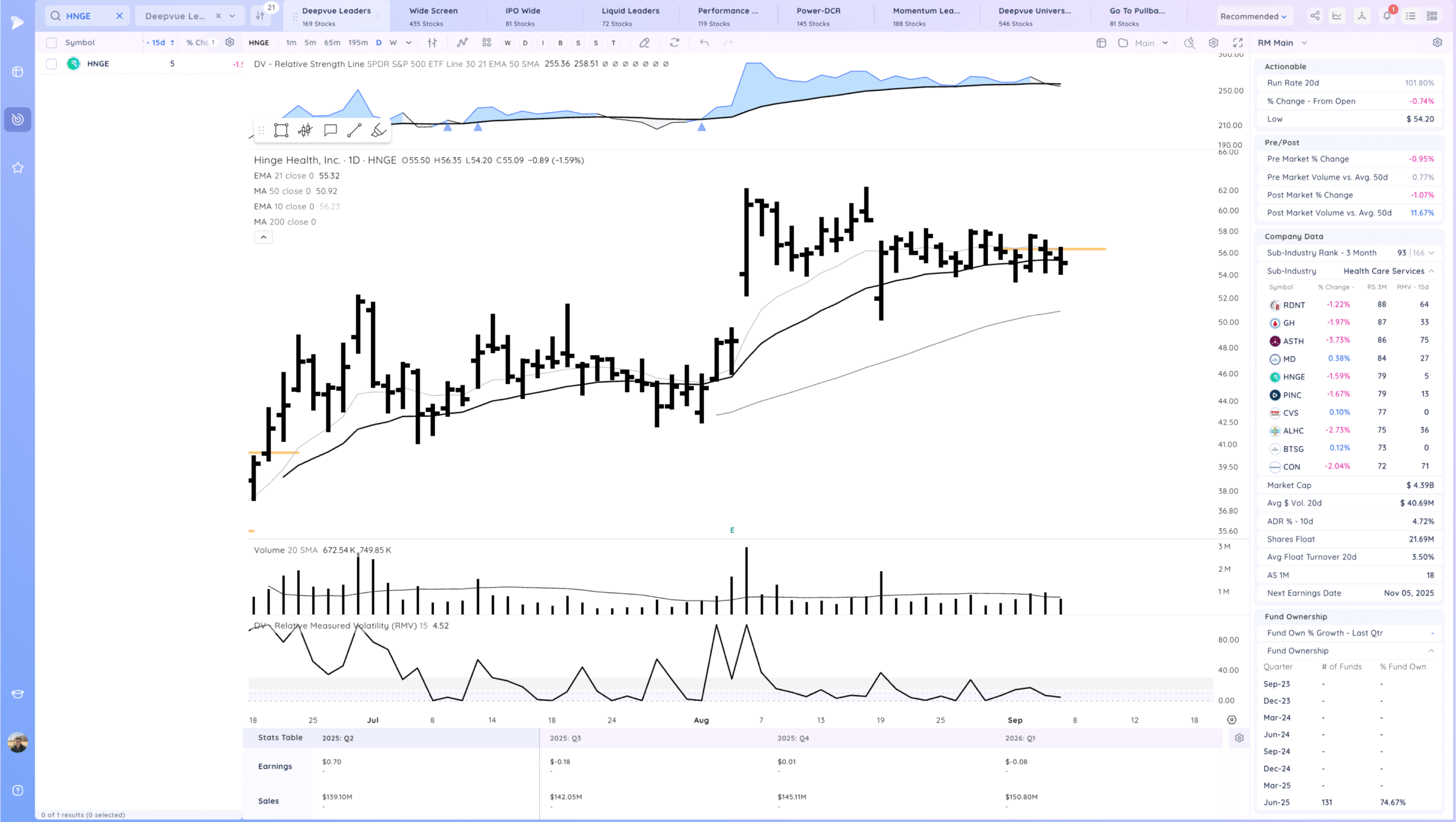

HNGE watching for a range breakout. Recent IPO

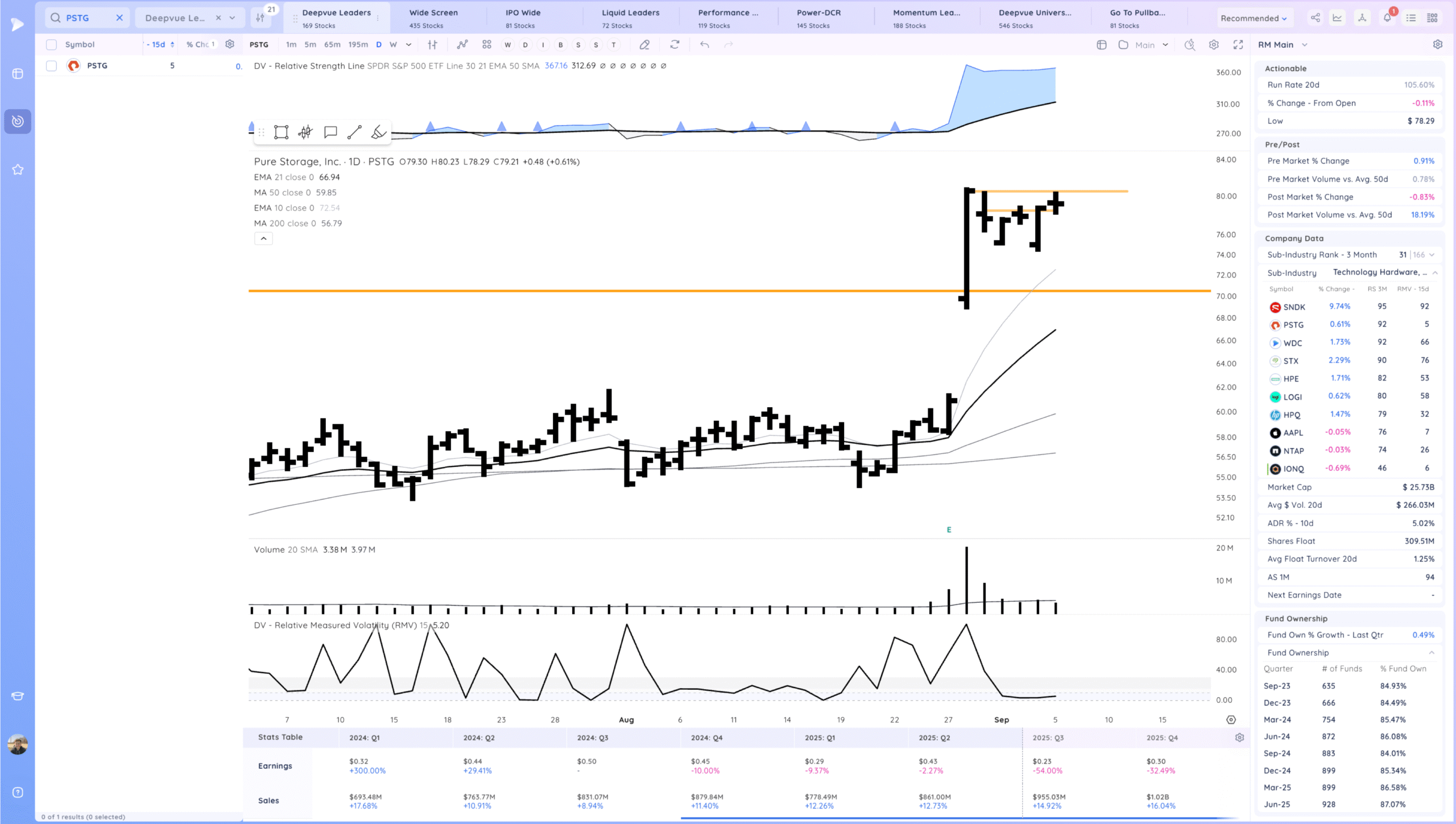

PSTG watching for a range breakout. Tight consolidation day, expecting expansion

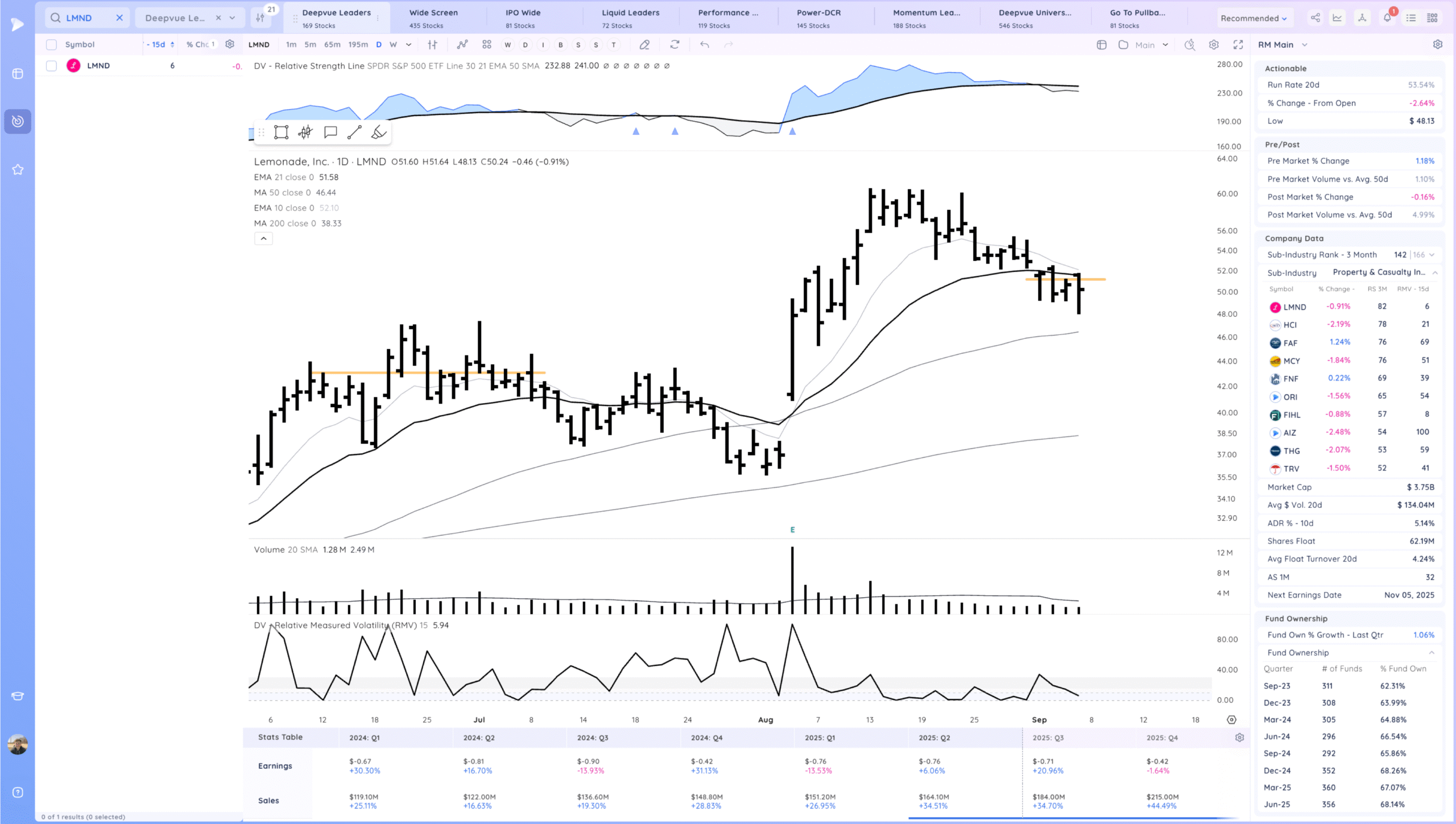

LMND watching for follow through up

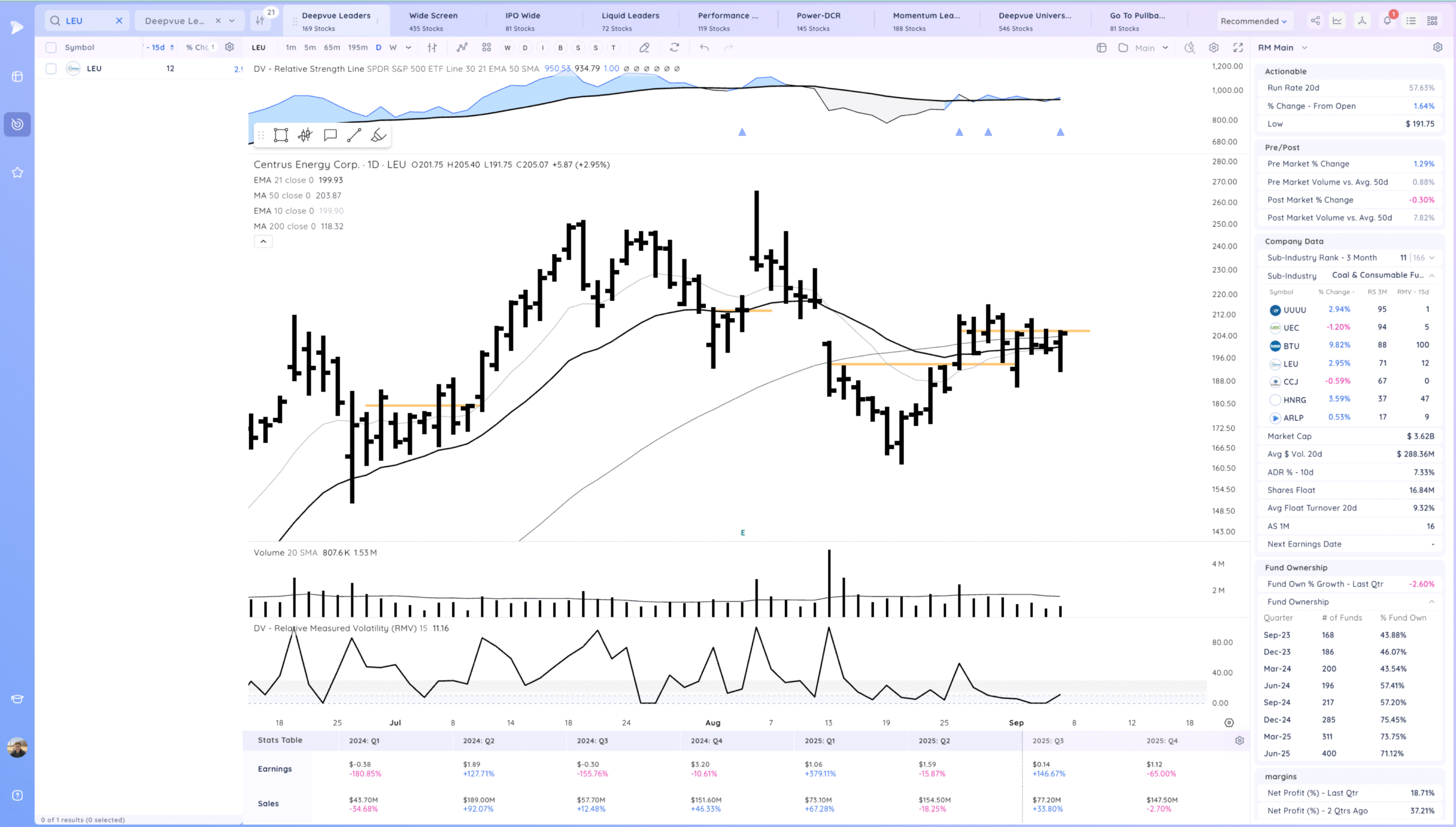

LEU watching for a range breakout

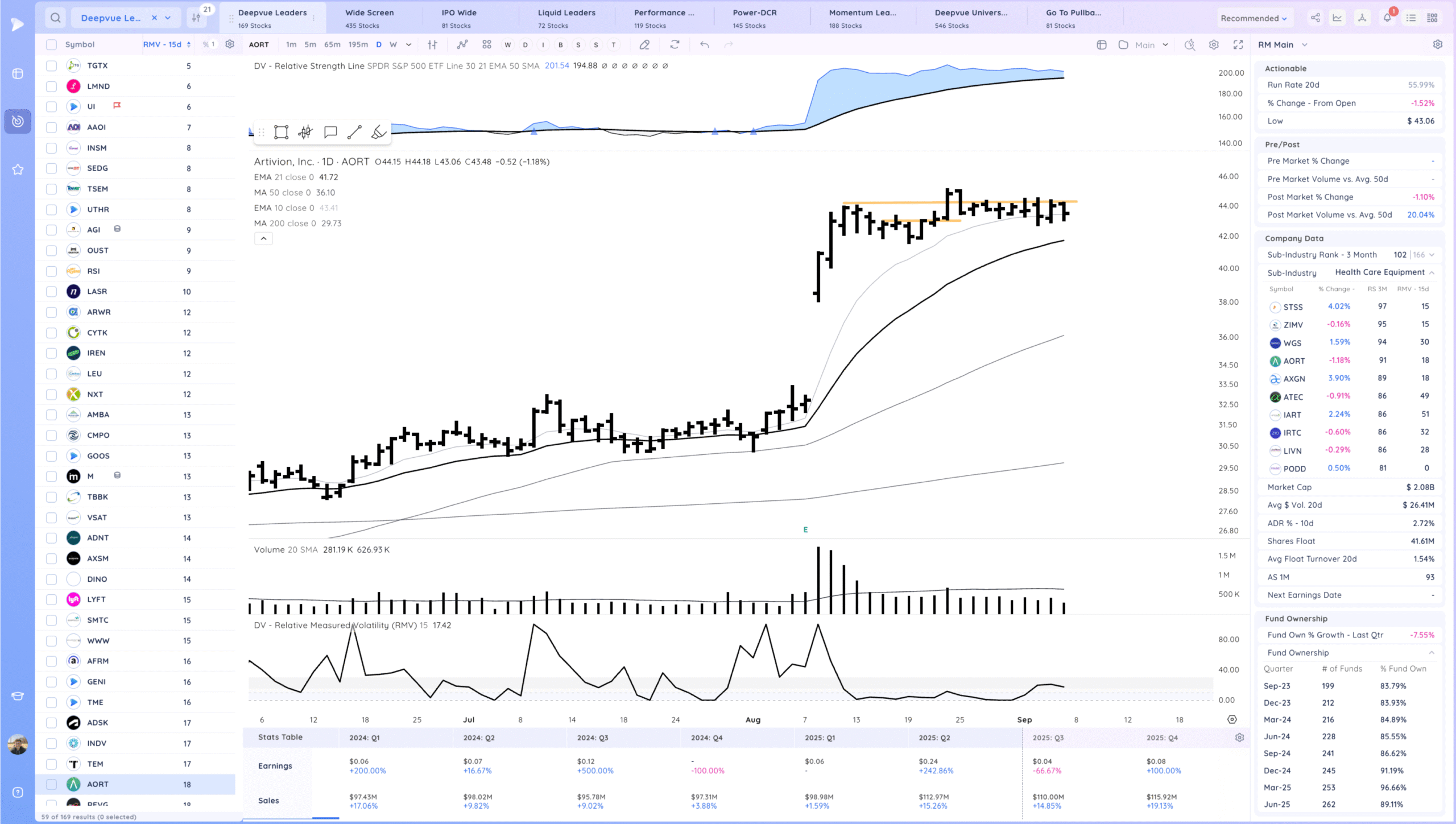

AORT watching for a range breakout

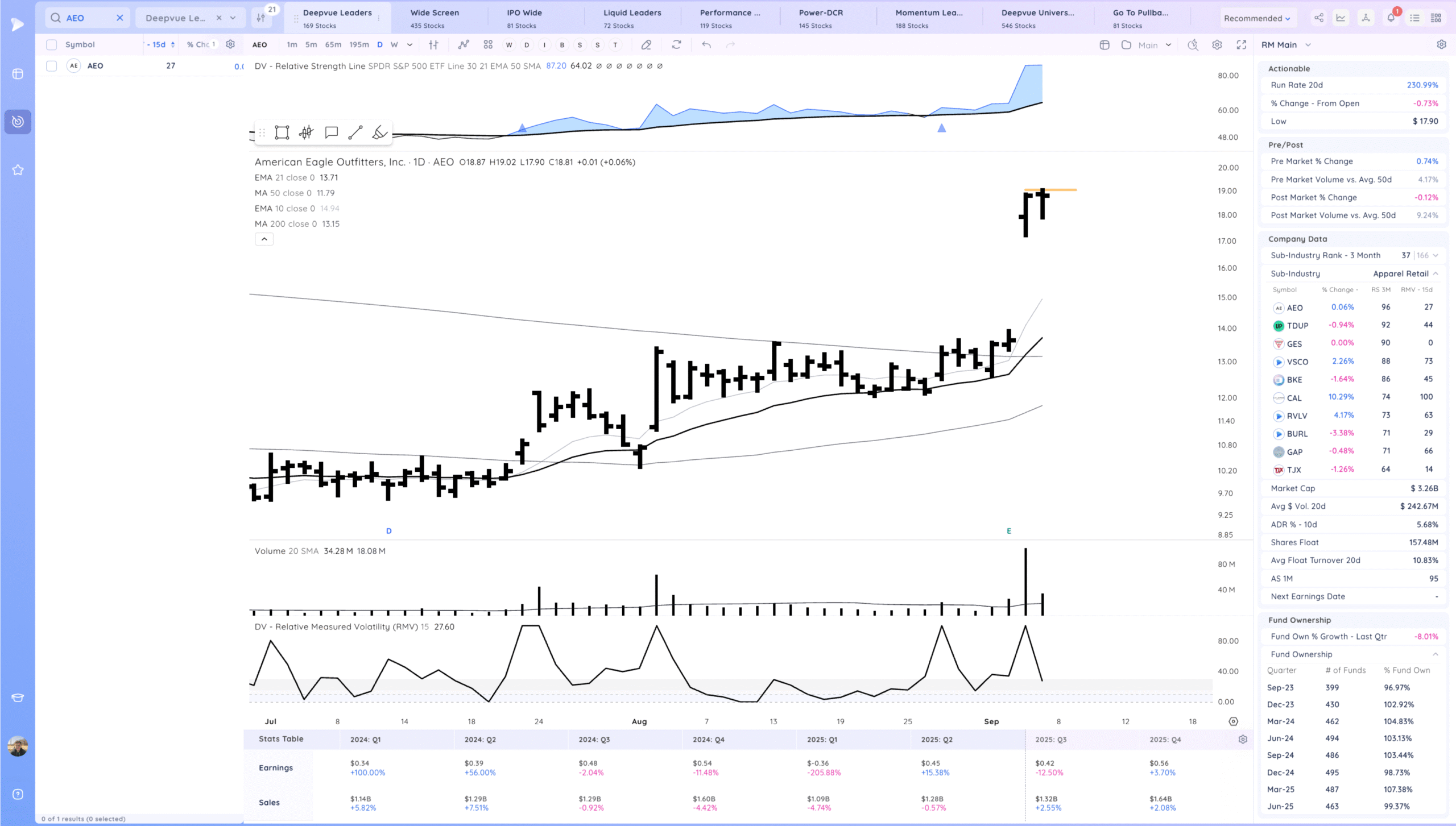

AEO watching for follow through up. ideally gap down open and push through HVC

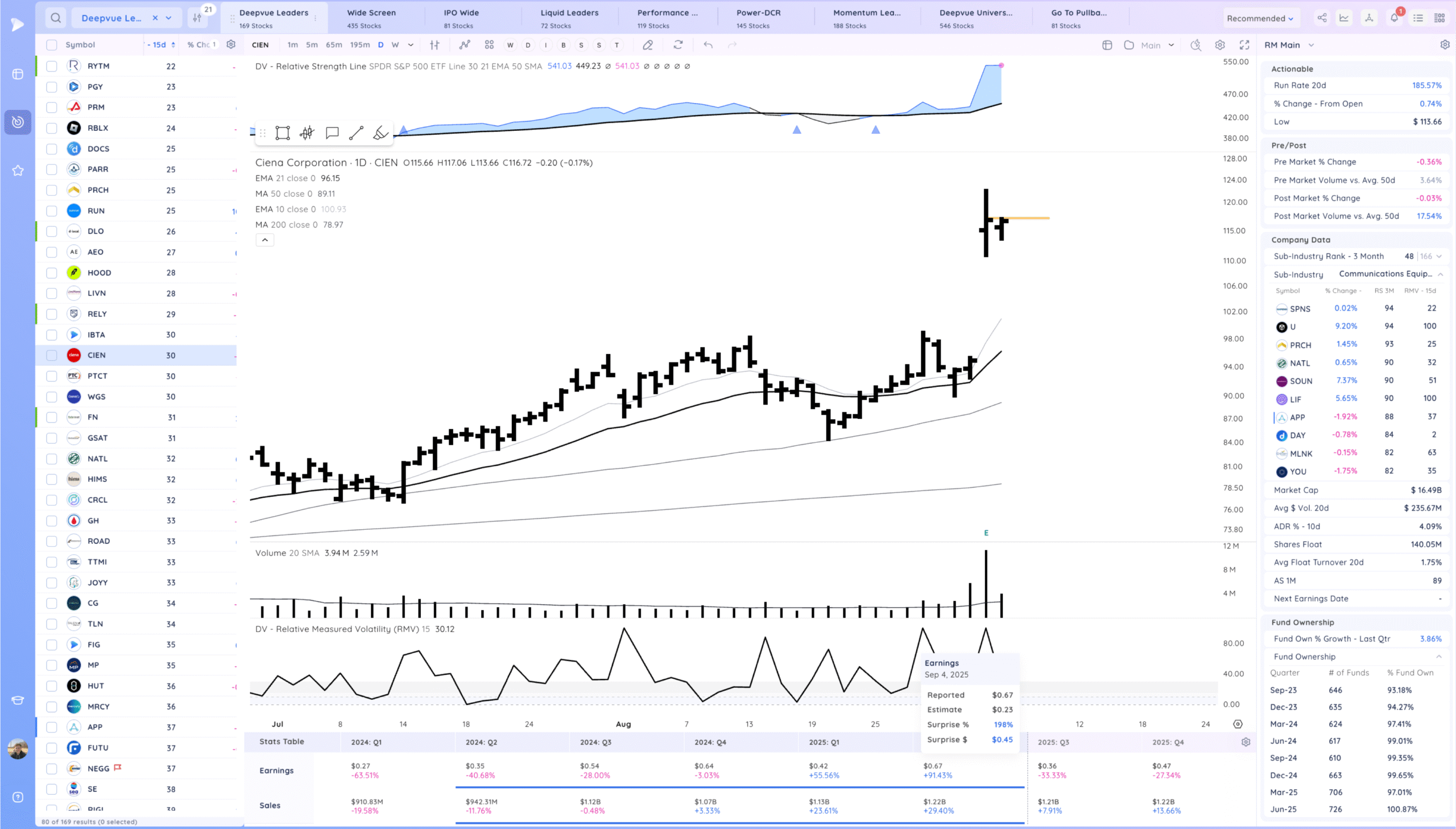

CIEN watching for a range breakout

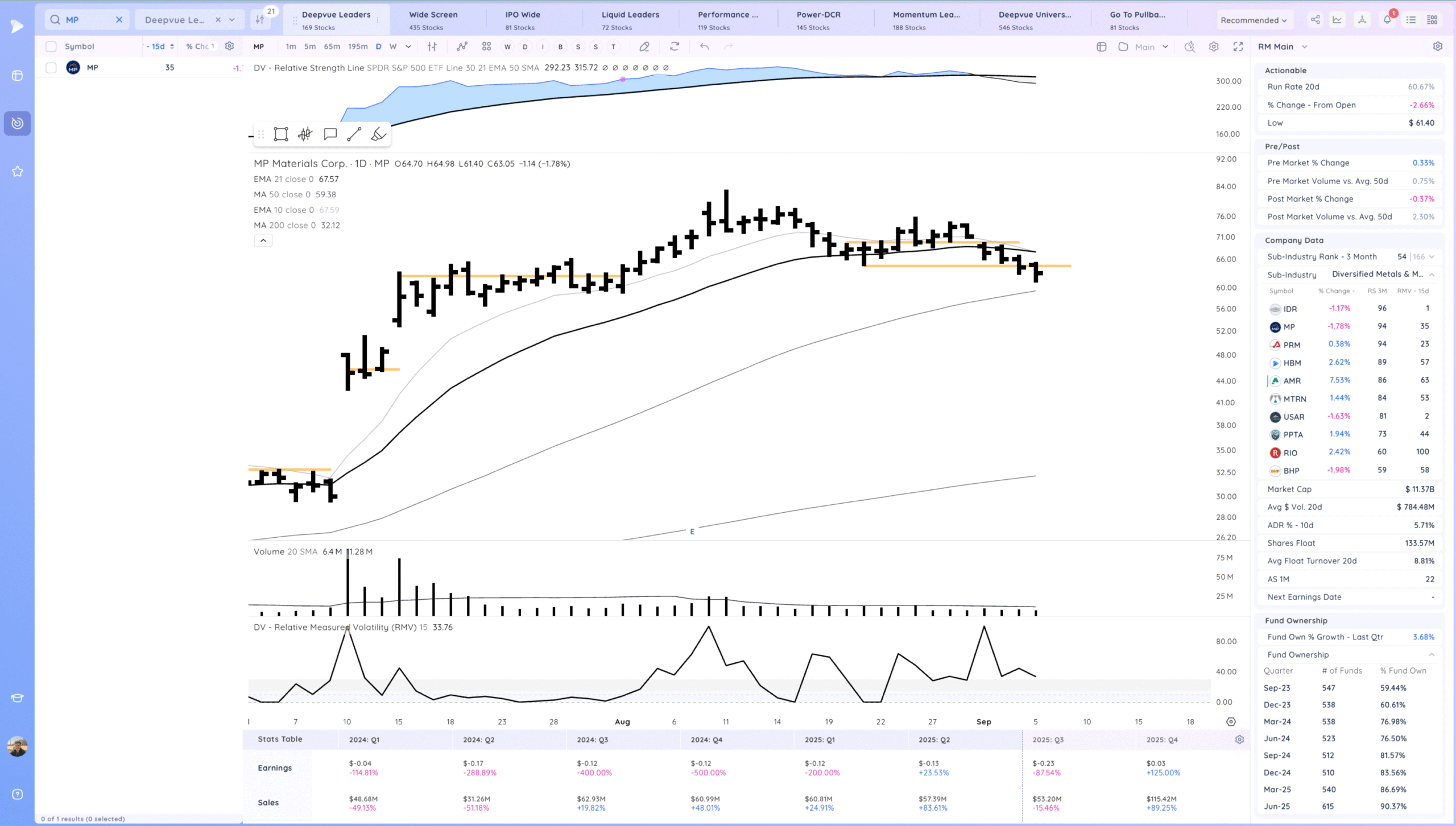

MP watching for level reclaim. Pulling into the prior range from a month ago

Today’s Watchlist in List form

Focus List Names

AMSC MGNI TARS PSKY LC HNGE PSTG LEU LMND AORT AEO CIEN MP HOOD TSLA

Focus:

HOOD TSLA LEU PSTG

Themes

Strongest Themes: Software, Crypto, Nuclear Power, Semis, Miners, Cruise Liners

Market Thoughts & Focus

See this as a good end to the week as we stabilized after the move lower from the gap. We’ve moved higher a few days now, some range building would be constructive and set up the next pivots.

Anything can happen, Day by Day – Managing risk along the way